Politics

Palestine Action ban ‘disproportionate’ – but still banned for now

A High Court judge has ruled this morning, 13 February 2026, that the government’s ban on anti-genocide action group Palestine Action was “disproportionate” and breaches the human rights of UK people.

Palestine Action NOT a terrorist group (obviously)

However, the ‘proscription’ remains in place for at least another week while the government has a chance to prepare submissions on the court’s finding. It remains a criminal offence, for the time being, to express support for Palestine Action. Police should, of course, weigh whether it’s worth arresting people when no prosecutions are likely, but their record suggests they won’t.

Zack Polanski perhaps summed up the verdict the best:

A court has ruled that the government’s authoritarian ban on Palestine Action was unlawful.

Time to stop criminalising the people protesting a genocide – and start ending the UK’s complicity.

— Zack Polanski (@ZackPolanski) February 13, 2026

Meanwhile, on the ground, supporters of Palestine Action were jubilant.

The decision was made by a panel of judges who all have strong links to Israel, underscoring just how far the Starmer regime overstepped human rights legislation. It is almost certain to try to appeal, despite the exposed web of lies it created to try to justify the ban.

Outside the court, supporters were holding signs saying “I support Palestine Action”. These were the exact same ones that saw police people in their 1000s last year. Yet on 13 February, as far as the Canary team on the ground could tell no one was today:

The full judgment is available here.

Featured image via the Canary

Politics

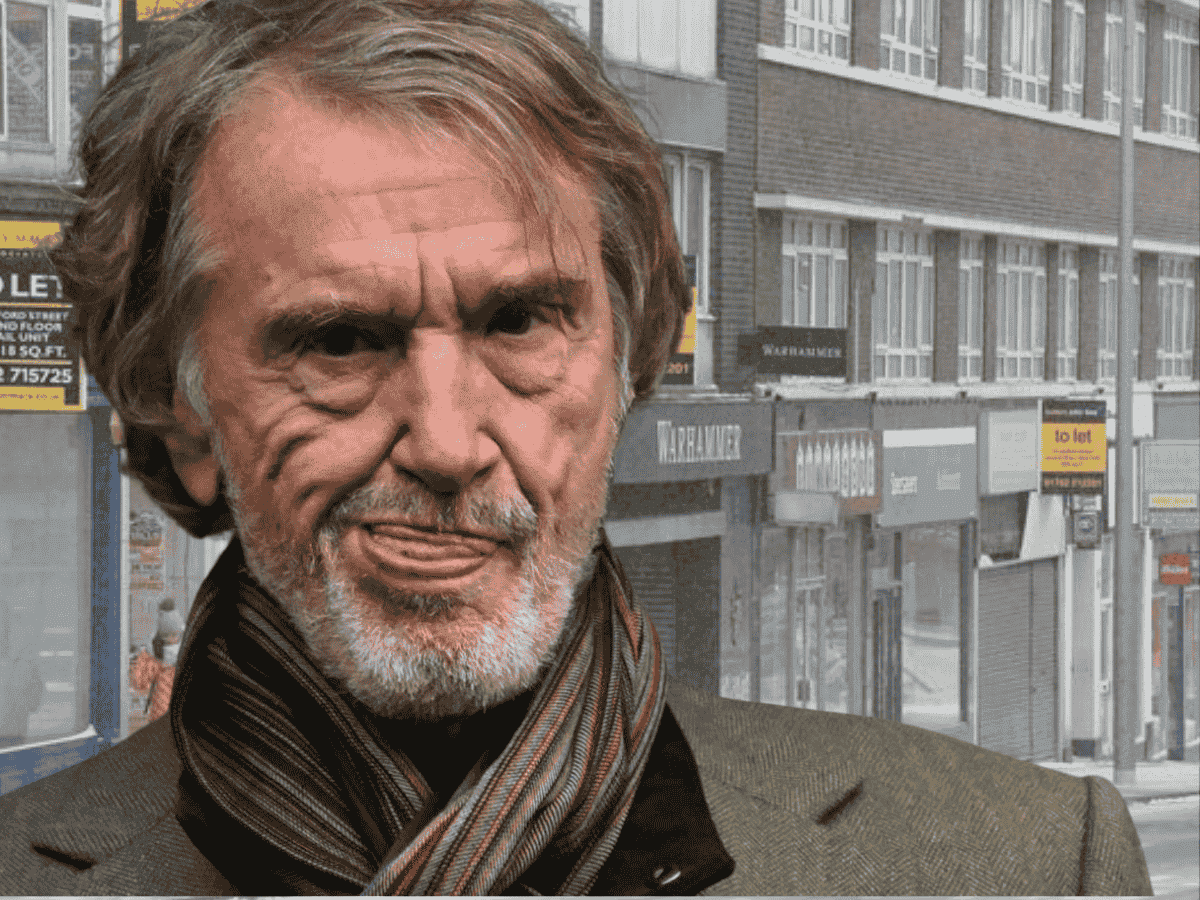

Ratcliffe is a tax-dodging hypocrite

Jim Ratcliffe is a rank hypocrite who abandoned the UK to stash billions offshore. The co-owner of Manchester United football club moved his tax residence to Monaco during the Covid pandemic to dodge an estimated £4bn in tax. He now lives as a tax exile whilst claiming the UK is ‘colonised’ by immigrants.

A billionaire who moved his tax residence to Monaco during the pandemic so he didn’t have to give his money to hospitals, schools, and public services?

Spare me. https://t.co/gN5KEckEPm

— Ash Sarkar (@AyoCaesar) February 11, 2026

Oi Ratcliffe – you can’t complain about a system you don’t pay into

Complaining about the 9 million people on benefits is a bit rich coming from a guy who enjoys the benefits of the UK system but doesn’t pay into it.

His move to the the French Riviera in September 2020 was heralded by his time screaming about the benefits of Brexit. He possibly moved because we forced him to pay £110m in tax in 2019.

You might be surprised to find out that Jim Ratcliffe was one of them.

Weird that, innit. pic.twitter.com/4hvrIm7yix— Simon Gosden. Esq. #fbpe 3.5% 🇪🇺🐟🇬🇧🏴☠️🦠💙 (@g_gosden) February 12, 2026

By moving his assets and his residency, the slimy knight of the realm ensured that his wealth stays in his pockets. Untold millions remain with one single man, rather than going back into the UK and funding essential services such as schools and hospitals. This didn’t stop Ratcliffe from telling Sky News that the UK is “costing too much money”.

Manchester United fans all over the UK have called out the club’s owner for being an absolute tool:

Millionaire, “I am not a racist BUT, wankers” living in Dubai to avoid tax, defending a billionaire wanker living in Monaco to avoid paying tax, and who is making numbers up to make racist comments

I am sorry @ManUtd but Ratcliffe’s comments shame our club. It’s not who we are pic.twitter.com/REyMKS5BHr

— Cantona & Best (@bestcanton7) February 12, 2026

The club has now distanced itself from Ratcliffe’s position:

BREAKING: Manchester United very politely chucking their owner under a large bus. https://t.co/6QzmFbZjm4

— Piers Morgan (@piersmorgan) February 12, 2026

Ratcliffe also claimed the UK population has surged to from 58 million to 70 million since 2020. This, he said, is due to immigration.

Ratcliffe is presumably better at counting his money than this.

His bizarre claim that the UK population grew by 12m between 2020 and 2025 is a fourfold exaggeration. His starting point, that our population was 58m in 2020 is out by 25 years. His claim that 9 million people are… pic.twitter.com/SYrJkCTvL5

— Dale Vince (@DaleVince) February 12, 2026

This is a blatant and racist lie. The Office for National Statistics confirms the population was 67.1 million in 2020. It had risen to 69.5 million by late 2025.

Pay up or shut up

Ratcliffe needs to concentrate less on immigration into the UK and more about his own shit. This man pays absolutely zero into the UK economy. He’s moved all of his cash offshore, so why is he commenting on the country costing too much?

Until he pays his share, he will continue to consciously deprive UK services such as the NHS of much needed money, driving people further into poverty for the sake of his own personal wealth.

It’s not immigrants that are the problem.

Featured image via The Canary

Politics

Desperate campaign seeks to smear Greens for opposing Zionism

The political and media establishment are clearly desperate to put a spanner in the Green Party’s massive surge since the election of current leader Zack Polanski. The part’s firm stance against Zionism has become central to this. And the establishment’s latest scramble to smear Greens for opposing Israel’s genocidal settler-colonial project in Palestine seems unlikely to be successful.

Green Party “Zionism is Racism” motion attracts smears

There have historically been different strains of Zionism — the Jewish nationalist movement behind the colonisation of Israel. But the dominant form today is a supremacist extremism that empowers racism, apartheid, and genocide. Zionism is not Judaism, no matter how much Israel’s leaders and cheerleaders want to blur the line.

Now, Green members are campaigning for a spring conference motion that seeks to acknowledge that “Zionism is Racism” and declare the party as “an Anti-Zionist Party.” They also seek a rejection of cynical attempts to “equate anti-Zionism with antisemitism” in order “to silence legitimate criticism” of Israel.

The motion is fundamentally about equality, freedom, and democracy. And if it passes, author Matt Kennard says:

This will be a watershed moment in British politics.

Israel’s genocide in the occupied Palestinian territory of Gaza has fuelled a growing movement to end the apartheid state’s crimes once and for all. And pro-Israel shills know full well that the Greens, under the leadership of a Jewish leader who stands in solidarity with Palestine, are helping to mainstream criticism of Israeli colonialism.

As a result, the smears are intensifying:

Green Party will likely vote to be first major UK political party that is anti-Zionist at its Spring Conference (Motion A105)

This will be a watershed moment in British politics

So the subversion steps up. This absurd article is the beginning

Anti-Zionism is anti-fascism pic.twitter.com/oP9PfM0X0L

— Matt Kennard (@kennardmatt) February 12, 2026

Thanks to strong progressive positions, the Green Party has quickly grown to over 190,000 members in recent months. And it has taken clear positions in support of Palestine under Polanski, like calling for the proscription of Israel’s occupation forces as a terrorist group.

But the party was previously more timid on Palestinian rights. And clearly there are some members still sympathetic to Israeli colonialism. Because one member has now told the historically racist Daily Mail (of all papers) that they reported fellow members to “counter-terrorism police” over the new motion on Zionism.

Green councillor Andrée Frieze, meanwhile, joined with others to criticise the “tone of, and language in, the motion“. But while pro-Israel voices might dislike it, it represents pretty basic progressive positions on Israeli colonialism:

Lubna Speitan—Palestinian Green Party member and a member of the Greens For Palestine Steering Group—has proposed this important motion for the Spring Conference.

I endorse all of it. It should all be Green Party policy. Basic stuff for a progressive party.

Motion A105:…

— Matt Kennard (@kennardmatt) January 26, 2026

Some observers believe this will be a real test for the Greens. But recent positions suggest that the majority of members will indeed lean into even stronger positions that meaningfully challenge Israeli war criminals and their cheerleaders.

Smears feed off timidity

Today, there are still attempts from pro-Israel propagandists to smear anti-genocide campaigners as antisemites. And such voices routinely claim that seeking accountability and consequences for Israel’s genocidal mass extermination of Gaza’s population is somehow “hateful”.

But the widespread pro-Israel smears against the left during Jeremy Corbyn’s leadership of the Labour Party were a learning moment. If you give propagandists an inch, they’ll take a mile. So the best way to challenge them is to call out their bullshit clearly and immediately.

No religious discrimination is ever acceptable. But that’s not what criticism of Israel is about. It’s political, not religious. And the vast majority of Green members have already shown their awareness of that, moving the party to strong positions on the Palestinian people’s right to existence, freedom, and democracy.

The smears will not end. But as long as Greens lean into unapologetic support for human rights and opposition to Zionist racism, the smears will fail. And when the smears fail, the chances of finally holding Israeli war criminals and their cheerleaders to account will increase.

Featured image via the Canary

Politics

Remigration by stealth? The government’s earned settlement proposals

James Bowes analyses the potential impact of the UK government’s proposed changes to its settlement schemes to both new migrants and migrants already in the UK.

The government’s consultation on its “earned settlement” proposals, which would make it much harder for immigrants resident here for long periods to get Indefinite Leave to Remain (ILR), also known as “settlement”, closed today. As written, and unlike previous immigration restrictions, these new rules won’t just affect new immigrants but will also affect over 2 million immigrants already living in the UK. These changes will force many legal immigrants to leave the country entirely.

What is changing?

Some changes will affect all applicants for ILR. The required English language level will increase from B1 to B2. The applicant will need to earn over £12,570 a year for at least three years. This latter change will make many people on a family visa or work dependant visa ineligible for ILR.

While the baseline period to qualify for ILR has been announced as 10 years, many people will face a wait much longer than this. People with a work visa for a job skilled below a graduate level face a 15-year wait for ILR and refugees face a 20-year wait. People who have entered the country illegally, overstayed their visa or entered on a visitor visa face an even longer 30-year wait. People who have claimed benefits may face an even longer wait.

The qualifying period will remain at 5 years for family of British nationals, BNO visa holders and people working in a graduate level job that either pays over £50,270 or is an eligible public sector job (e.g. doctors, nurses, teachers). It will be shortened to 3 years for people earning over £125,140. Qualifying periods remain unchanged for global talent and innovator founder visa holders.

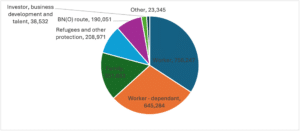

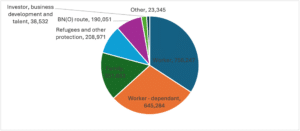

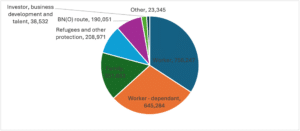

Who will be affected?

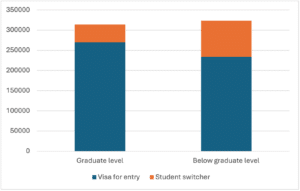

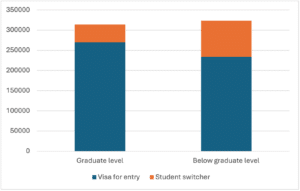

People with a settlement path visa living in the country at the end of 2024 by broad category

Roughly two thirds of people affected by the new rules will be here on a work visa or are the dependant of a work visa holder. Most of the others are on a family visa or are here for humanitarian reasons. Workers, their dependants and refugees will be most affected by the longer qualifying periods. However, everyone will be affected by the tougher language and salary rules.

What will the changes mean for work visa holders?

Skilled worker visa grants (including health and care) from 2021 to 2024 split by skill level, visa grants for entry and switchers from a student visa only

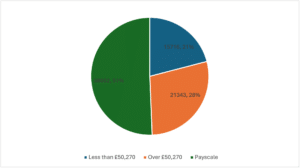

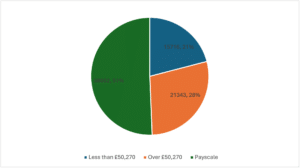

Skilled worker visa grants (including health and care) for graduate-level jobs for entry in 2023. Split by whether the job is on a public sector pay scale or if not, by whether the median salary for the occupation was above £50,270 in Year Ending June 2023.

About half of main applicant work visa holders face a 15-year wait as they are working in a job skilled below graduate level. Most work visa holders working in graduate level jobs will qualify for ILR in 5 years as they are either working in an eligible public sector job or a job paying over £50,270.

However, most dependants of even high-paid workers will face at least a 10-year wait. This is because the dependant themselves will have to earn over £50,270 or work in a public sector job to qualify in 5 years. Most dependants are likely to face a 15-year wait as they are accompanying workers in non-graduate jobs.

Will the changes mean people have to leave the country?

The new rules won’t simply mean a longer wait for ILR. They will mean many people don’t qualify for ILR at all and have to leave the country. Redundancy is much more likely during 15 years on a work visa than it is during 5 years.

Employers may be unwilling to pay the immigration skills charge for 15 years. People on a visa may be unable or unwilling to pay 15 years of visa fees and immigration health surcharge. Many care workers are graduates and so may not want to commit 15 years of their career to working in a care home.

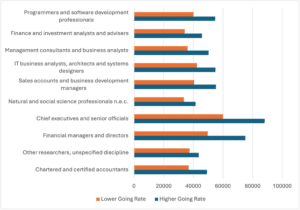

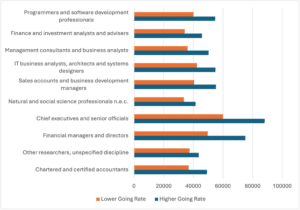

Lower and higher going rates for top 10 non-payscaled high-skilled jobs to illustrate how different the two rates are. NB: Sales accounts and business development managers may be downgraded to medium-skilled.

People who have had a skilled worker visa continuously since before April 2024 currently only have to meet a lower salary threshold and occupational going rate when they renew their visa or apply for ILR. However, these lower rates are currently scheduled to expire in April 2030.

This is a major challenge as both the higher salary threshold (£41,700 compared to £31,300) and the higher occupational going rates are much higher than the lower rates. This means many people, in both graduate and non-graduate jobs, will need a large pay rise to remain in the country, unless the government decide to extend the lower salary threshold and going rates beyond April 2030.

Another challenge for people renewing their visas will be the end of the Immigration Salary List from January 2027 (July 2028 for care workers), that allows a salary discount of 20% for shortage occupations. For visa renewals after this date, the discount to the salary threshold will only apply to visa renewals with the same employer and same occupation.

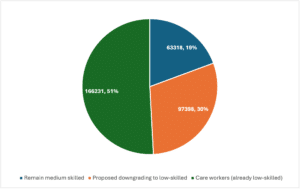

Skilled worker visa (including health and care) grants for entry and to student switchers 2021 to 2024 split by the skill level of the occupation if the proposed changes to skill classification in the Temporary Shortage List review are accepted. Jobs below graduate level only

When a medium-skilled occupation is reclassified as low-skilled, visa renewals are also only possible if they’re with the same employer and the same occupation. Visa renewal for the occupations downgraded to low-skilled in April 2024 will only be possible until April 2030.

Care workers are already considered a low-skilled occupation, only eligible for a visa due to their appearance on the soon to be abolished Immigration Salary List. A further 30 occupations may be reclassified as low-skilled following an updated evaluation of the skill level of jobs; it is unclear what transitional arrangements will exist for visa renewal in these occupations. If the changes are accepted, most people on the 15-year route to settlement would be working in jobs now considered low-skilled.

Unless the proposals are changed to address these challenges, many visa holders will be bound to one specific employer and occupation and only able to renew their visa if that employer is willing to pay a higher salary and visa fees. This will be a particular problem for people employed by exploitative or fraudulent employers. It may not even be possible to renew a visa for some low-skilled occupations.

Conclusion

Over 2 million people will face much tougher requirements to remain in the country than they expected when moving here. The majority are people who came to work. Over half of work visa holders and most dependants face a longer wait to be eligible for Indefinite Leave to Remain. During this time, they will face ongoing visa fees and other charges, and their immigration status will remain insecure. Many will be forced to leave the country entirely. The government claims that this is not the objective – if that is true, then it will need to introduce far-reaching transitional protections.

By James Bowes, Space Management Assistant, Strategic Planning and Analytics, University of Warwick.

Politics

Minister Calls Reform ‘Retirement Home For Failed Tories’

A Labour minister humiliated a Reform politician on BBC Question Time by describing the party as a “retirement home for failed Tories”.

Nadine Dorries – a former Conservative MP, ex-culture secretary and strong ally to Boris Johnson – defected to Reform last September, claiming the Tory Party was “dead”.

When discussing a question about climbing house prices in Bristol, Dorries acknowledged that the Conservatives had also failed to reach their housing targets when in office – and predicted Labour will also miss their 1.5 million new homes goal.

Dorries, now a Daily Mail columnist, claimed the problem was the “two main parties cannot lead the country”, adding: “That’s why I went to Reform.

“It’s time for a party that is going to be absolutely radical, that is going to bring forward change, that is going to change this, introduce growth, and change this housing.”

Defence minister Luke Pollard replied: “I don’t think you can have a new party when you’re just a retirement home for failed Tories.”

Amid widespread applause and laughter from the audience, he added: “That’s not a new party Nadine, it’s not.”

Dorries replied: “You can’t make that accusation without me coming back. Reform is the party of hundreds and thousands.

“That’s the difference between me and you. We’re a proper grassroots party of hundreds of thousands!”

Reform currently has eight MPs, with each one – including Nigel Farage – being a member of the Conservative Party at some point.

A total of 27 former Tory MPs have defected to join the rising right-wing party so far, including Dorries, ex-home secretary Suella Braverman and former Tory frontbencher Robert Jenrick.

According to Best for Britain’s tracker, Tory defections to Reform rose by 462% in 2025 compared to 2024 with 81 serving Reform councillors previously holding office for the Tories.

Politics

Bernard Argente: Badenoch needs to ask herself whether her MPs trust her or she distrusts her MPs

Bernard Argente writer, student, and parliamentary researcher who assisted Richard Tice and his staff.

What happens when a politician defects to another party? Or perhaps a more apt question to ask may be: does such a politician have a choice?

In the case of former Shadow Justice Secretary Robert Jenrick, he may have played the part of the Roman politician Brutus in the veritable play of this Parliament’s debacle.

After being sacked by Conservative leader Kemi Badenoch, Robert Jenrick defected to Reform UK last month, leaving the vast majority of Kemi’s cabinet with the sentiment: Et tu, Jenrick?

But did he orchestrate it, or did the morning sacking entail a predestined chain of events?

Oedipus Rex by Sophocles tells the story of an ill-fated protagonist, Oedipus, who unwittingly fulfils a prophecy, ergo killing his father. In our scenario, our central figure, Robert Jenrick, has rebelled against his leader, which may have been a response to the sacking, which functioned as a catalyst to a series of events which turned to realise Badenoch’s qualms.

Had the Leader of the Opposition not doubted her Secretary, Reform might not have received another heretic in its arsenal. It is imperative for the Conservative Party, with its policy of curtailing turncoats, not to ostracize suspected members as if it were a witch hunt.

The Conservative Party has flourished hitherto Benjamin Disraeli in its conglomerated and immovable community, in which it cannot be compartmentalized. Notwithstanding, the vitality of the Conservatives is indirectly proportional to Reform’s.

Members must not stay neutral, as it would be like when the angels of God who chose to remain neutral were banished to the Antechamber, as Dante’s Vergil put it: “These are individuals who refused to take a stand in life, choosing neither good nor evil.”

The Conservatives will never need Reform, even when it ostensibly seems that way. It is, however, Reform that needs the Conservatives! Just as in George Orwell’s Nineteen Eighty-Four the Ministry of Truth tried to change historical records and newspapers, Reform’s ex-Tory MPs will try to hide their past tweets lambasting Reform leader Nigel Farage, but the truth will remain static and the same.

“Britain is not broken”, wrote Kemi as a riposte to Jenrick’s statements. The leader of the Opposition has made this loss appear to be a victory akin to removing a parasite leeching off a host, but to Farage he has interpreted this as another man’s trash is another man’s treasure!

Whilst Badenoch had indeed been acting reflexively to ‘damning reports’ on Jenrick, it predicted a wave of other prominent Conservative MPs following Jenrick in kind, notably Andrew Rosindell, who defected to Reform UK primarily due to what he believes to be Chagos deal mismanagement and what he describes as the ‘surrender’ of British territory and Suella Braverman, who’d long been on the list of suspects.

The Conservative Party is believed to have identified several other MPs who may potentially defect to the Reform UK Party.

This list consists of several important names, Sir John Hayes, Esther McVey, Mark Francois, and Sir Desmond Swayne, and also entails nascent MPs such as Katie Lam and Bradley Thomas. This begs the question of whether Kemi has rooted out traitors upon traitors or if she has labelled them traitors, which is the role they must fulfil at the end of the play. Chekhov’s gun is a literary device derived from the Russian playwright. The device acts as a gun set in a play, and for it to be introduced, it must be fired. The Tory leader has cast herself a veritable gun in this play, and now that she has shot the villain, it signifies a posthumous warning to other MPs with the notion of treachery to not entertain those feelings.

But the question remains: Did Jenrick appoint himself the villain in Kemi’s story, or was it an unfortunate circumstance in which he had to play the cards he had been dealt? In the fullness of time, we may learn if this will have a domino effect on other MPs. But what is clear to Farage is that even if Kemi regards this situation as “Nigel Farage doing my spring cleaning”, Farage, on the other hand, thanks her for what he believes to be a late Christmas gift.

Badenoch must not follow the same philosophy Labour has with its divided branches, as it weakens the party to an attack from the outside. She must also understand the party’s ordeal to be analogous to a chess game—where her MPs are her pieces, and to sacrifice them blatantly or, worse, hand them to a rival party is blundering the game.

Kemi must ask her party the question: Is it the party not trusting her, or is it her not trusting her party?

Politics

Wicked Star Michelle Yeoh Reacts To Sequel’s Complete Oscars Snub

Despite the first film picking up a whopping 10 nods last year – including Best Picture and acting nods for its two leads – part two of the Broadway adaptation was completely overlooked by the Academy.

Michelle Yeoh, who plays the treacherous Madame Morrible in both films opposite Cynthia Erivo and Ariana Grande’s Elphaba and Glinda, has now shared her twopence on the snub.

“I am in shock! I really am,” she told Variety before speculating about why Wicked was overlooked this time round.

She offered: “I think sometimes the problem is that people think, ‘Oh, you already got so much with the first one, let other people have a chance’. But then it feels like, ‘No, come on!’

“It’s such a beautiful, well-made movie. Paul [Tazewell] for costume design, hair and makeup. If you compare it [with other contenders at the 2026 Oscars] it should be there.

“For Jon Chu, for [director of photography] Alice Brooks, for the set design. It’s not [a] replica of the first one. It’s more elaborate and there are many more new destinations in Wicked: For Good. So I was truly, truly very disappointed.”

While the first Wicked movie won critics over, the reception was more scattered for 2025’s follow-up, with some questioning whether director John M Chu’s decision to split the adaptation over two movies paid off.

That didn’t stop people from seeing it in their droves though, as Wicked: For Good beat its own box office record and became the biggest international opening for a stage musical adaptation.

Meanwhile, Michelle famously won the Best Actress Oscar back in 2023 for her role in Everything Everywhere All at Once, becoming the first Asian performer to scoop the award.

This year’s nominations fall heavily in favour of Sinners, with Ryan Coogler’s vampire horror making history as the most-nominated film ever thanks to an impressive 16 nods.

Politics

Why High Court Ruled Palestine Action’s Ban Unlawful

The High Court has just ruled that the government’s ban of Palestine Action under terrorism legislation is unlawful.

While the ban remains remains in place for now, it is a major victory to campaigners who have long opposed the decision.

MPs voted to proscribe Palestine Action as a terrorist organisation in July.

The drastic move came after the group targeted an Israeli defence company’s UK base and an RAF centre.

But the move to proscribe Palestine Action has sparked significant backlash from the left, especially amid Israel’s devastating ground offensive in Gaza.

Regional friction spiked when Palestinian militant group Hamas attacked and killed 1,200 people on Israeli soil on October 7, 2023, taking a further 251 hostage.

Israel then launched a military campaign in Gaza. The estimated death toll now exceeds 70,000 Palestinians, according to local health authorities.

While a ceasefire is currently in place, Gaza remains in a humanitarian crisis.

Thousands of people have been arrested since Palestine Action was proscribed last July for showing support for the proscribed group.

Here’s what you need to know.

What Is Palestine Action?

Palestine Action is a pro-Palestine organisation which describes itself as a “direct action movement committed to ending global participation in Israel’s genocidal and apartheid regime”.

It aims to target “corporate enablers of the Israeli military-industrial complex”.

The group’s main target is “Elbit Systems” which is reportedly Israel’s biggest weapons producer.

Its website says: “We do not appeal to politicians or anyone else to create the necessary changes, as we understand the depth of complicity within most global institutions.

“Rather than begging those who are complicit to gain a moral compass, we go straight to the source and shut down the production of Israeli weapons.”

It was set up a few years ago, before decades of tension between Israelis and Palestinians reached fever pitch in autumn 2023.

What Did Palestine Action Do?

The group has been accused of entering an RAF base, Brize Norton in Oxfordshire, on June 20, and spraying two aircrafts with red paint.

The action was condemned by Keir Starmer at the time as “disgraceful”.

Four people were subsequently arrested, and a security review was launched across the “whole defence estate”.

A further two people were arrested on suspicion of criminal damage on Tuesday, July 1, after Palestine Action claimed it had blocked Israeli defence firm’s UK site in Bristol.

Activists said they had covered it in red paint to “symbolise Palestinian bloodshed”.

The government had already put forward its proposals to proscribe Palestine Action by the time of the second incident.

MPs then decided to proscribe the group last summer, by 385 votes to 26.

What Does It Mean To Be Proscribed?

Once the proposal is passed into law, supporting the group will become a criminal offence.

Anyone who is a member or expresses support for the group could face up to 14 years in prison.

Security minister Dan Jarvis told MPs at the time that this will not stop protesters from expressing support for Palestine.

He said: “Palestine Action is not a legitimate protest group.

“People engaged in lawful protest don’t need weapons. People engaged in lawful protest do not throw smoke bombs and fire pyrotechnics around innocent members of the public.

“And people engaged in lawful protest do not cause millions of pounds of damage to national security infrastructure, including submarines and defence equipment for Nato.”

A Palestine Action spokesperson said last summer: “While the government is rushing through parliament absurd legislation to proscribe Palestine Action, the real terrorism is being committed in Gaza.

“Palestine Action affirms that direct action is necessary in the face of Israel’s ongoing crimes against humanity of genocide, apartheid, and occupation, and to end British facilitation of those crimes.”

Why Was There So Much Backlash By The Decision?

There were concerns that the legislation to proscribe Palestine Action was grouped together with two white supremacist groups – Maniacs Murder Cult and Russia Imperial Movement – to help it pass.

Some MPs warned that proscribing the group would undermine basic freedoms.

Ten-Labour MP Zarah Sultana, who is now a Your Party MP, slammed the government’s move, saying: “To equate a spray can of paint with a suicide bomb isn’t just absurd, it is grotesque.

“It is a deliberate distortion of the law to chill dissent, criminalise solidarity and suppress the truth.”

Other MPs pointed out that the vote in the Commons took place on the 97th anniversary of women being granted equal suffrage.

Labour’s Kim Johnson accused parliament for banning Palestine Action “for using tactics once seen in the Suffragette struggle”.

Meanwhile, the head of Human Rights Watch in the UK, Yasmine Ahmed, said proscribing the group was a “grave abuse of state power and a terrifying escalation in this government’s crusade to curtail protest rights”.

She added: “We expect this of authoritarian regimes like Russia or China, not a country like the UK that professes to believe in democratic freedoms.”

What Did The High Court Say?

The High Court ruled the ban of Palestine Action under terrorism legislation is unlawful, although it remains in place for now.

That means taking part in Palestine Action activities is still a serious offence.

Three senior judges said that while the group uses criminality to promote its goals, its activities have not crossed the very high bar to make it a terrorist organisation.

But, the judges decided the ban must stay in place until a further hearing later in February in case of a legal challenge.

What’s The Response To The Ruling?

The government said it will appeal the decision. Home secretary Shabana Mahmood said: “I am disappointed by the Court’s decision and disagree with the notion that banning this terrorist organisation is disproportionate.”

She said the government’s proscription “followed a rigorous and evidence-based decision-making process, endorsed by parliament”.

Palestine Action’s co-founder, Huda Ammori, said the ruling was a “monumental victory for both our fundamental freedoms in Britain and in the struggle for freedom for the Palestinian people”.

She said the ban will be remembered as “one of the most extreme attacks on free speech in recent British history”, adding that it would be “profoundly unjust” for the government to go ahead with its appeal.

Lib Dem Home Affairs spokesperson Max Wilkinson also slammed the government’s move.

The MP said: “The Liberal Democrats have argued all along that the proscription of Palestine Action was a grave misuse of terrorism laws.

“Placing Palestine Action in the same legal category as ISIS was disproportionate and risked undermining public trust and civil liberties.

“This ruling does not place anyone above the law. Any individual members of Palestine Action who are accused of serious offences such as vandalism and violent disorder should be investigated, prosecuted, and, if convicted, sentenced accordingly. But these are potential criminal acts and not comparable to the horrors of terrorism.”

Politics

Palestinians defy Israel’s media blackout

Israel continues to perpetrate war crimes against Palestinians in Gaza while denying access to foreign journalists.

Gaza’s media blackout persists

UN Commissioner‑General for Palestine Refugees (UNRWA), Philippe Lazzarini, condemned the “information blackout” and stressed that its lifting is long overdue. He warned that barring independent media fuels misinformation and obscures the truth. This situation remains critical for Gaza.

His statements thrust the issue of press freedoms into the limelight. The continued ban on foreign reporters is an old tactic the settler‑state has used to evade scrutiny. However, this ban is defective in an age of citizen journalism and social media proliferation.

Palestinian journalists, who continue to risk it all, are filling the void. Under these circumstances, social media has also become a crucial avenue for disseminating news. This includes official statements and announcements from Palestinian factions inside Gaza. It also includes mobile recordings documenting Israeli crimes. Indeed, Gaza remains at the core of global attention.

Citizen-journalists enter the fold

That said, when official sources diminish, information circulated on closed and anonymised social media platforms becomes difficult to verify, especially amidst conflicting narratives. The presence of foreign journalists helps document Israel’s violations, its use of illegal weapons, and casualty counting in Gaza.

More than 250 journalists and media personnel have been killed in Gaza since Israel waged its genocidal war in October 2023, according to press freedom groups. This makes it one of the deadliest conflicts for journalists in modern history. They were slain while on duty — carrying out a public service not only to their people but to the world. Calls for investigations into their deaths from international organisations have been relentless. Yet these calls are frequently ignored.

The price Palestinian journalists have paid is not to be taken lightly. They bear the brunt and risk their lives daily. They navigate dangerous conditions, never knowing if they’ll see their families again after a day in the field. Under international humanitarian law, journalists should be protected as noncombatants. And yet Israel continues to target them with impunity, wantonly…anyone surprised? Reporting from Gaza continues to highlight significant challenges.

Truth survives

Lazzarini’s statement reflects a growing concern that continues to be met with indifference, silence, and inaction from many governments and institutions. Additionally, the situation in Gaza remains alarming on the world stage.

Even so, the blackout Israel is desperate to maintain has not prevented the truth from reaching the world — but it does leave a population that continues to defy Israel’s genocide increasingly isolated. Despite this isolation, Gaza endures.

It is our responsibility at the Canary to pierce through the veil of silence and report what is happening behind the lines of fire. This commitment is especially vital in the context of Gaza’s ongoing genocide.

Featured image via the Canary

Politics

Bad Bunny’s Super Bowl Halftime Show Director Shares Story Behind Sweetest Moment

One of the most touching moments in Sunday night’s Super Bowl Halftime Show saw Bad Bunny sharing a moment with a young boy, before handing him his recently-won Grammy award.

And the directors behind the show have revealed there was a touching detail in this sequence that you might not have even realised.

During a recent interview with Variety, creative director Harriet Cuddeford explained: “The story behind that was Benito’s idea. He’d grown up watching his idols on TV getting awards. In his life now, he stands on stage and gets given awards by his idols.

“He knew the Grammys were coming up, and he was hoping to win something. And then obviously he won Best Album last weekend. And so, he really wanted to inspire the next generation.”

Cuddeford pointed out that the child actor was intended to represent Bad Bunny’s younger self, which is why he was dressed similarly to an old photo of the Puerto Rican singer and rapper as a boy.

“This is really representing a younger version of himself,” she added.

As for the actual award statuette, Cuddeford admitted that she’s not sure whether or not Bad Bunny bothered to get it back once the performance was over.

“Knowing him, he might have just left it with the kid, honestly,” she quipped.

Meanwhile, a widely-shared theory that the child in question was a five-year-old detained by federal immigration agents was debunked shortly after the Super Bowl.

In their joint Variety interview, Cuddeford and the performance’s director Hamish Hamilton have been taking fans behind the scenes of Bad Bunny’s show-stopping performance, lifting the lid on everything that went into making it happen.

Elsewhere in the interview, the duo admitted that not everything actually went to plan on the night, with a couple of mishaps taking place that – fortunately! – no one appeared to notice.

Politics

Reform flock to fellow racist Ratcliffe

Manchester United co-owner Jim Ratcliffe recently claimed that immigrants are “colonising” the UK. Critics – and anyone with a brain in their nut – quickly condemned the remarks as racist and deeply out of touch with Britain’s own colonial history.

Unsurprisingly, Reform MPs and figures on the far right quickly jumped on the bandwagon. While admitting Ratcliffe’s statistics were “mistaken,” Reform leader Nigel Farage maintained that the underlying argument holds up when judged against the dictionary definition of “colonise.”

Spoiler alert: No, it really fucking doesn’t.

Bro Farage literally just approved the term “colonised” to your face and you STILL softball him.

The mainstream media is complicit in the rise of the far right. https://t.co/iSGrPACvak

— JimmyTheGiant (@jimthegiant) February 13, 2026

Distraction tactics from the real ‘colonisers’

The Oxford Learners Dictionary definition of ‘colonise’ is:

to take control of an area or a country that is not your own, especially using force, and send people from your own country to live there.

It’s clear that immigrants have precious little control over their rights and freedoms in the UK, so it’s objectively clear that this statement is false. That’s even after disregarding the fake-news figures Ratcliffe and fellow racists are distributing.

Another mask falls as we hear #ManchesterUnited owner Jim #Ratcliffe showcasing his #racism. He has all that money and power and he still has to punch down. Too many on #socialwelfare too – by his reckoning. Too many rich #parasites by mine.

https://t.co/r5vWOgo0yy— Kevin Doyle (@kevidoyle) February 13, 2026

As the Canary reported yesterday:

Sir Jim Ratcliffe, co-owner of Manchester United, has come under heavy criticism for saying that immigrants are “colonising” the UK. He said:

“You can’t have an economy with nine million people on benefits and huge levels of immigrants coming in. I mean, the UK has been colonised. It’s costing too much money.

The UK has been colonised by immigrants, really, hasn’t it?”

The racist shithead also claimed that the UK’s population grew by 12 million people in 5 years. That’s bollocks too, as BBC Verify reported:

“it’s actually increased by 2.7 million.”

And, that statistic doesn’t take into account the economic benefit of immigrants doing all the shitty jobs white people don’t want. And that, in turn, doesn’t take into account that we’re talking about people – people who have a right to safety and welcome.

Rich racists: the actual ‘colonisers’

Reform MPs are, of course, eagerly amplifying what can only be described as barely veiled racism.

Man Utd boss Sir Jim Ratcliffe is right on immigration and UK is being ‘colonised,’ claims Reform UK’s Nadhim Zahawi https://t.co/0gPS34NQ0u

— LBC (@LBC) February 13, 2026

In January, we reported on Oxfam’s latest research, which identified a direct correlation between shrinking civil liberties and rising billionaire handouts aimed at buying political influence:

In the UK specifically, the wealthiest 56 individuals hoard more money than 27 million ordinary people. In fact, in the UK:

The UK’s billionaires have seen in the last year their average wealth grow five times faster than inflation-adjusted earnings.

56 people in the UK – all billionaires – have a combined wealth greater than 27 million other people, 39 per cent of the population. The average growth of a UK billionaire’s wealth was £231mn in the last year.

The average UK billionaire will gain more wealth than the value of the UK’s average annual salary in less time than it takes to watch a premier league football match

On average a person in the richest 1% in the UK owns 456 times more wealth than a person in the poorest 50%. The poorest half holds just 4.6% of the wealth, while the richest 1% own 21.3%. In 2024 the wealthiest 1% of UK adults had wealth of at least £2,317,452 […]

This year, the total wealth of the UK’s billionaires grew by 11bn, an average of £30.3 mn a day. Meanwhile one in five people in the UK live in poverty.

Yet the far-right rarely highlight who profits from soaring costs in food, defence, and healthcare – areas Advance UK Ben Habib argues are making life harder for ordinary people.

Nor do they acknowledge how increased defence spending often destabilises other countries. In turn, worsening conditions that force people to migrate in the first place:

‘@Sir_Ratcliffe in a 14 minute interview with @SkyNews explained how policies being pursued in the UK and EU are destroying our ability to feed ourselves, defend ourselves and medically treat ourselves.

He set out how western civilisation is killing itself.

On the other hand…

— Ben Habib (@benhabib6) February 12, 2026

Another Reform cheerleader and former Tory MP Nadine Dorries delighted in coming to Ratcliffe’s defence:

Nadine Dorries of Reform UK defends Jim Ratcliffe’s disgraceful immigration remarks.

His statistics were wrong, the substance was wrong and the language was wrong- but he was RIGHT.

Errrh?

Complete and utter gibberish. #bbcqt pic.twitter.com/BkBcRsM874

— Deirdre Heenan (@deirdreheenan) February 12, 2026

Thankfully, ordinary people are seeing right through it:

Can there be more of a traitor to the UK than Jim Ratcliffe? He offshored enough tax money to fund 120,000 nurses. People like him are the reason life has become so difficult for so many Brits.

— Robert M. (@3drm) February 13, 2026

Reform keep telling us immigrants are the problem and that billionaires are the good guys who create wealth.

Genuinely think this narrative was the plan Farage Sky & Ratcliffe intended to push and instead it’s exposed tax dodging billionaires as the parasite ruining the country— Sarah (@kokeshimum) February 12, 2026

What is it that first attracted you to billionaire, Jim Ratcliffe?

Reform UK – wealthy elites, cosplaying as working class, for the benefit of billionaires. https://t.co/iRtYHpZicp

— Don McGowan (@donmcgowan) February 12, 2026

If the UK is being ‘colonised’, it’s by super-rich billionaires who have bent politics to their will and are now cashing in on the consequences.

Featured image via Arne Musseler

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video2 hours ago

Video2 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’