Crypto World

Ramil Ventura Palafox gets 20 years sentence over $200 million bitcoin Ponzi scheme

The CEO of Praetorian Group International (PGI) was sentenced to 20 years in prison in the U.S. for running a global Ponzi scheme that falsely claimed to invest in bitcoin and foreign exchange trading.

Ramil Ventura Palafox, 61, promised daily returns of up to 3%, misleading more than 90,000 investors and draining over $62.7 million in funds, according to a Thursday statement from the U.S. Attorney’s Office for the Eastern District of Virginia.

PGI collected more than $201 million from investors between late 2019 and 2021, including over 8,000 bitcoin , according to court records. Instead of investing the money, prosecutors said Palafox used new investor funds to pay old ones while siphoning millions for himself.

To keep the illusion going, Palafox built an online portal where investors could track their supposed profits, with numbers that were entirely fabricated.

In reality, Palafox was buying Lamborghinis, luxury homes in Las Vegas and Los Angeles and penthouse suites at high-end hotels. Prosecutors say he spent $3 million on luxury cars and another $3 million on designer clothing, watches, and jewelry.

The case was investigated by the FBI and IRS. Victims may be eligible for restitution. The SEC is pursuing civil penalties, and Palafox remains banned from handling securities.

Crypto World

A Complete Guide for DeFi Founders (2026)

If you are reading this, you are not looking for another surface-level article on stablecoins. You are here because you are making an important business and technical decision. You want to know whether your ETH-backed stablecoin can survive volatility, attract institutional capital, meet compliance standards, and scale without failure.

This guide is written for founders who want clarity before committing capital, resources, and reputation. You want to know whether your:

- The collateral model can handle market shocks

- The peg mechanism will remain stable

- Architecture meets institutional standards

- The revenue model is sustainable

- The system can pass audits and compliance reviews

This guide provides a practical, decision-ready framework for building an ETH-backed algorithmic stablecoin, backed by proven stablecoin development services and real-world implementation insights.

Why ETH-Backed Algorithmic Stablecoins Are Gaining Institutional Attention

Institutional capital does not follow hype. It follows liquidity, transparency, risk management, and infrastructure maturity. ETH-backed algorithmic stablecoins align with all four, making them increasingly attractive to serious DeFi founders and financial institutions.

Ethereum-backed models are preferred because they combine deep market liquidity, real-time on-chain collateral visibility, mature smart contract standards, and seamless integration with institutional systems supported by leading stablecoin development solutions providers.

- Strong Liquidity and Market Confidence

Ethereum remains one of the most liquid digital assets globally. In 2026, ETH continued to record high spot and derivatives volumes across major exchanges, ensuring efficient collateral liquidation during market stress. Institutional-grade custody solutions and regulated trading platforms support ETH natively, reducing onboarding friction for enterprises working with a professional stablecoin development company. High liquidity enables stablecoin systems to absorb volatility without extreme slippage, protecting peg stability.

- Real-Time On-Chain Collateral Transparency

ETH-backed stablecoins allow institutions to verify solvency directly on-chain. Leading protocols maintain:

- Collateral ratios between 130% and 180%

- Automated liquidation triggers

- Public reserve dashboards

This transparency minimizes counterparty risk and strengthens institutional trust.

- Mature Smart Contract and Oracle Infrastructure

Ethereum has one of the most battle-tested smart contract ecosystems in the industry. Billions in DeFi value have passed through audited protocols using advanced security practices. Redundant oracle networks and formal verification standards reduce systemic risk, making Ethereum-based systems more reliable than experimental networks. Institutional risk teams consistently favor platforms built with mature stablecoin development frameworks.

- Seamless Institutional Integration

Most major custodians, compliance platforms, and analytics providers already support Ethereum-based assets. This includes custody, AML monitoring, transaction reporting, and regulatory tooling. As a result, ETH-backed stablecoins can be integrated into enterprise workflows faster, lowering operational and compliance costs.

- Consistent Growth in TVL and Capital Efficiency

Recent DeFi analytics show that ETH-collateralized stablecoin protocols continue to grow in total value locked and user participation.

Key trends include:

- Higher resilience than unbacked algorithmic models

- Stronger capital retention during volatility

- Rising institutional wallet activity

Overcollateralized hybrid designs have demonstrated superior peg stability and liquidity durability, reinforcing long-term confidence among investors and enterprises.

Stress-Test Your ETH-Backed Stablecoin Strategy With Experts

What Founders Are Actually Searching For?

When a DeFi founder searches for ETH-backed algorithmic stablecoin development, they are usually trying to answer one of these critical questions:

- How do I design peg stability under volatility?

- How do I prevent liquidation cascades?

- How do I build something investors trust?

- How do I avoid becoming the next failed case study?

- Should we build internally or partner with a specialized stablecoin development team?

These queries reflect high-stakes decision-making, not casual research. Founders at this stage are evaluating long-term architecture, risk exposure, capital efficiency, regulatory readiness, and governance sustainability, often in consultation with a professional stablecoin development company. They are also assessing timelines, development costs, audit requirements, and post-launch operational responsibilities. This search intent is both technical and strategic, signaling readiness to invest in serious infrastructure rather than experimental prototypes.

The Core Architecture of an ETH-Backed Algorithmic Stablecoin

A resilient stablecoin protocol is built on six foundational layers.

1. Collateral Management Layer

- Dynamic collateral ratios

- Multi-source price feeds

- Automated margin monitoring

2. Stability Engine

- Peg maintenance algorithms

- Rebalancing mechanisms

- Market intervention logic

3. Oracle Infrastructure

- Redundant data providers

- Failover systems

- Manipulation-resistant feeds

4. Liquidity Framework

- AMM integration

- Cross-chain bridges

- Institutional liquidity channels

5. Governance System

- Risk parameter voting

- Emergency controls

- Protocol upgrade management

6. Security & Compliance Layer

- Continuous auditing

- Incident response systems

- Regulatory reporting modules

A professional stablecoin development company designs these layers as modular components to support scalability, seamless upgrades, and long-term protocol stability.

Why Most Algorithmic Stablecoins Fail

Historical analysis shows recurring failure patterns.

- Over-optimistic collateral assumptions

- Weak oracle resilience

- Incentives designed for growth but not sustainability

- Insufficient liquidity depth

- Lack of structured cryptocurrency development lifecycle management

When market volatility spikes, these weaknesses compound. Liquidation cascades begin. Confidence drops. The peg weakens. Capital exists. Founders who understand these systemic risks design countermeasures from day one.

Get Your Stablecoin Model Reviewed by Experts

Business Case: Turning Stability into Sustainable Revenue

Unlike speculative tokens that rely on short-term hype, stablecoin protocols generate value through continuous network usage, capital circulation, and enterprise integration. When supported by professional stablecoin development services, these systems evolve into core settlement and liquidity layers within the digital economy. Primary revenue drivers include:

- Stability Fees from Borrowers: Collected from users who mint or leverage the stablecoin, these fees represent a consistent income stream tied directly to protocol demand.

- Protocol Transaction Fees: Every on-chain transaction, swap, or settlement generates micro-fees that compound as network activity grows.

- Liquidity Pool Participation: By allocating treasury assets to decentralized liquidity pools, protocols earn trading fees while strengthening market depth.

- Institutional Settlement Services: Enterprise clients pay for high-volume settlement, reporting access, and customized infrastructure, creating premium revenue channels.

- Treasury Yield Optimization: Surplus collateral can be deployed into low-risk DeFi strategies, generating passive returns without exposing the peg to instability.

This ensures that revenue mechanisms remain sustainable across market cycles and do not introduce hidden risks that could weaken collateral backing or destabilize the peg.

In practice, the most successful stablecoin platforms treat monetization as a risk-managed engineering function rather than a marketing strategy. This disciplined approach is what transforms stablecoins into durable, institution-ready financial infrastructure.

Final Conclusion: Build Stability That Lasts

ETH-backed algorithmic stablecoins have evolved into core financial infrastructure in 2026. Success in this space now depends on strong collateral design, transparent risk management, secure smart contract architecture, regulatory readiness, and sustainable revenue models. Founders who approach stablecoin development with a long-term, institution-focused mindset are the ones building platforms that attract capital, retain users, and survive market cycles.

This is where Antier stands out as a trusted stablecoin development company. We help founders design secure, scalable, and future-ready stablecoin ecosystems. From architecture to compliance and post-launch support, we work as a strategic partner, not just a development vendor. Ready to Build with Confidence? Partner with Antier to launch an institutional-grade stablecoin built for performance, stability, and growth.

Frequently Asked Questions

01. What are the key factors to consider when developing an ETH-backed stablecoin?

Key factors include the collateral model’s ability to handle market shocks, the stability of the peg mechanism, compliance with institutional standards, sustainability of the revenue model, and the system’s capacity to pass audits and compliance reviews.

02. Why are ETH-backed algorithmic stablecoins gaining attention from institutional investors?

They attract institutional capital due to their strong liquidity, transparency, effective risk management, and mature infrastructure, which align with the needs of serious DeFi founders and financial institutions.

03. How does real-time on-chain collateral transparency benefit ETH-backed stablecoins?

It allows institutions to verify solvency directly on-chain, reducing counterparty risk and enhancing trust through maintained collateral ratios, automated liquidation triggers, and public reserve dashboards.

Crypto World

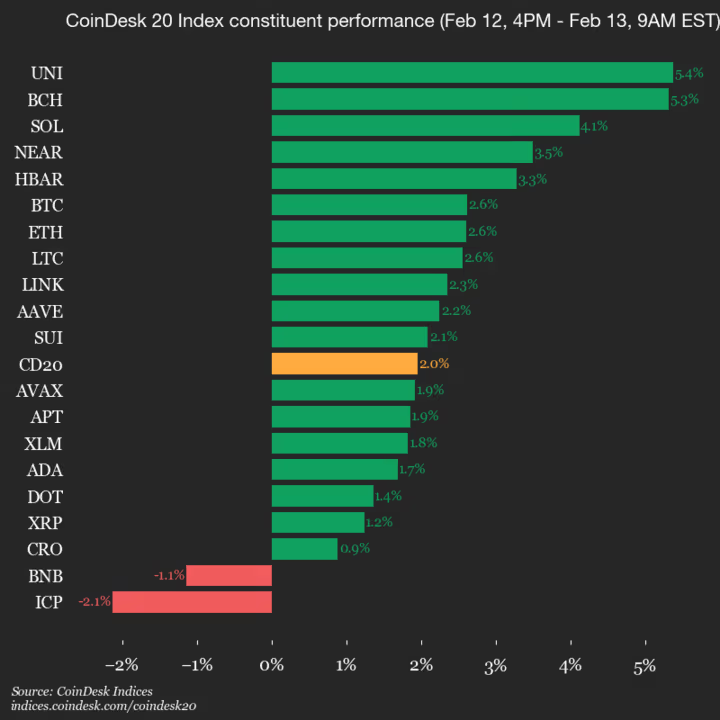

Uniswap (UNI) jumps 5.4%, leading index higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1920.47, up 2.0% (+36.77) since 4 p.m. ET on Thursday.

Eighteen of the 20 assets are trading higher.

Leaders: UNI (+5.4%) and BCH (+5.3%).

Laggards: ICP (-2.1%) and BNB (-1.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Binance Buys $1B in Bitcoin, US Inflation Lower-Than-Expected, but BTC Price Still Suffers: Weekly Crypto Recap

Bitcoin traded mostly sideways in the past week, but every breakout attempt was halted in its tracks.

Although bitcoin and most altcoins have recovered from the massive losses charted at the end of the previous business week, the past seven days weren’t exactly positive for the asset class, as it remains miles from the Q4 2025 peaks.

Before we examine the developments that took place in the past week, let’s quickly recap the latest crash that culminated on February 6 when BTC plunged to $60,000 for the first time in well over a year. Many altcoins collapsed by 20-30% daily, reaching new local lows.

Nevertheless, BTC bounced off on that day by $12,000 and tapped $72,000 in what became one of its most impressive single-day recovery attempts. However, the predominant bearish trend resumed rapidly, and BTC was stopped and driven down to $68,000 during the weekend.

It spent the next several days trading sideways between that lower boundary and $72,000. After the latest rejection at the upper boundary, the bears initiated another leg down, pushing the cryptocurrency south to $66,000 on Wednesday and $65,000 on Thursday.

The past few hours were slightly more positive for bitcoin, especially since the US CPI numbers for January came out and showed that inflation has actually cooled off. BTC jumped to $67,600 but was stopped there and now trades inches above $66,000. This means that BTC now sits at approximately the same spot as last week, but many alts have produced more substantial volatility.

On the one hand, XRP, BNB, HYPE, and SOL are deep in the red, but on the other, BCH, XMR, and HBAR have surged by up to 9.5%.

Market Data

Market Cap: $2.37T | 24H Vol: $110B | BTC Dominance: 56.7%

You may also like:

BTC: $67,200 (-0.06%) | ETH: $1,970 (+1%) | XRP: $1.38 (-3.7%)

This Week’s Crypto Headlines You Can’t Miss

Binance Completes $1B SAFU Fund Shift to Bitcoin. The most significant news in terms of BTC acquisition this week came from Binance as the exchange completed the conversion of its entire $1 billion SAFU fund to bitcoin. The company bought a total of 15,000 BTC in the span of just a few weeks.

BlackRock’s BUIDL Fund Hits Uniswap as UNI Jumped 40%. The largest decentralized exchange partnered with Securitize to make BlackRock’s USD Institutional Digital Liquidity Fund available for trading via UniswapX. The news sent shockwaves through the UNI community, with the token surging by up to 40% within minutes.

Banks Take Hard Line on Stablecoin Yields as White House Talks Stall. Although the March 1 deadline is approaching fast, the crypto industry and banks clashed again over stablecoin rewards without a clear agreement. No compromise was reached, said sources, but the session was described as “productive.”

Robinhood Enters Layer 2 Race With Public Testnet Launch of Robinhood Chain. The US-based trading platform noted earlier this week that it has launched the public testnet for Robinhood Chain, an Ethereum Layer 2 network built on Arbitrum, designed to accelerate the development of tokenized real-world and digital assets.

Miner Offloads $305M Bitcoin as Network Difficulty Sees Sharp Decline. The past few weeks have been tough on miners as well, especially in some regions due to severe weather. One of the larger entities in the field, Cango, disclosed that it had sold over $300 million worth of BTC amid rising pressure and falling profitability metrics.

Robert Kiyosaki Says Bitcoin Is a Better Investment Than Gold – Here’s Why. The best-selling author, who recently came under fire by the crypto community because of some controversial statements, believes bitcoin is a better investment than gold. Although he would rather hold both, if having to choose, he would opt for BTC due to its proven limited supply.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid – click here for the complete price analysis.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Stocks and crypto markets on edge as US inflation cools, Trump eyes steel tariff cuts

The stock and crypto markets remained on edge today, February 13, as participants reacted to the latest US consumer inflation report, which continued moving downwards in January.

Summary

- The stock and crypto markets retreated after the US published the latest US consumer inflation report.

- Data by the Bureau of Labor Statistics showed that the headline Consumer Price Index fell to 2.4%.

- Core inflation, which excludes the volatile food and energy prices, fell to 2.5%.

US stock indices retreated, with the futures tied to the Dow Jones. Nasdaq 100, and S&P 500 falling by over 35 basis points, continuing a trend that has continued on Thursday.

Similarly, crypto prices like Bitcoin (BTC) dropped to $66,000, while top altcoins like LayerZero (ZRO), Canton, Internet Computer, Uniswap, and Kaspa dropped by over 5% in the last 24 hours. The market capitalization of all tokens dropped to $2.29 trillion.

US consumer inflation retreated in January

A report released by the Bureau of Labor Statistics showed that the headline Consumer Price Index retreated from 2.7% in December to 2.4% in January, the lowest level in months. It retreated from 0.3% in December to 0.2% on a MoM basis.

The report showed that the core inflation, which excludes the volatile food and energy prices, dropped to 2.5% from the previous 2.6%. These numbers mean that US inflation has not surged as during President Donald Trump’s tariffs as most economists were expecting.

The report came a few hours after the Financial Times reported that Trump’s administration was considering tweaking his massive steel and aluminum tariffs, a move that will lead to lower prices in the long term

The data came two days after the BLS released strong non-farm payrolls data, which showed that the economy created 130k jobs in January, while the unemployment rate slipped to 4.3%.

Still, it is unclear whether the Federal Reserve will cut interest rates more times this year, even as inflation retreats. A Polymarket poll has the odds of no cuts in March at 93%. Another poll estimates that there will be just two cuts this year.

Stocks and crypto markets do well in periods of low interest rate

In theory, the stock and crypto markets do well when the Fed is cutting interest rates. A good example of this happened during the COVID-19 pandemic when these assets jumped as the Fed slashed rates to zero.

The assets then plunged in 2022, with Bitcoin moving below $16,000, as the Fed hiked interest rates to combat the elevated inflation.

However, the current Federal Reserve cycle has happened amid a divergence in the two assets. The stock market has soared to a record high, while Bitcoin and most altcoins are stuck in a bear market.

One reason for this is that the market has had some major moving parts in the past few months. The stock market has been driven be the ongoing AI boom, while the crypto market crash has happened because of the elevated risks, including on Iran.

Crypto World

How would Michael Saylor refinance Strategy’s $8.2B debt?

On a recent CNBC interview, Michael Saylor casually mentioned that if bitcoin (BTC) fell 90%, he would easily refinance his company’s debts. His company, Strategy (formerly MicroStrategy), owes creditors $8.2 billion.

Skeptics, however, were unconvinced that Saylor would be able to accomplish that feat so easily.

Although the company owns 714,644 BTC worth $47.4 billion at current prices, if it crashed 90%, Strategy holdings might only be worth $4.7 billion — far lower than its debt.

CNBC anchor Becky Quick, for example, was immediately unconvinced by Saylor’s flippant answer to her question about his plan for an extended bear market.

Crypto values have halved in four months, losing over $2 trillion since October 6. Maybe the worst is yet to come.

As Saylor was visibly laughing about how obvious it should be that Strategy would be able to refinance its debt after a 90% decline in the price of BTC, Quick asked a simple question.

“Refinance where, Michael?”

Saylor responded that he would “just roll it forward” to extend maturity dates on his principal repayments.

Unconvinced, Quick repeated her simple question. “You think banks would lend to you at that point?”

‘Just roll it forward’

Indeed, Saylor’s company isn’t particularly creditworthy by conventional metrics even today. S&P Global rates it at B-, which means that its bonds are speculative-grade, or colloquially, “junk bonds.”

If BTC were to decline 90%, the company would have far more debt than assets, and the company has a track record of losing money.

Indeed, its operating loss in its most recent quarter was $17.4 billion — a 16.4x increase year-over-year. Its “product support” and “other services” revenues also declined in Q4 2025 versus the prior year, as another sign of weakness.

Saylor’s confidence in his ability to roll-over his bonds is justifiable given the company’s current asset levels and his $2.2 billion in cash today, but if the price of BTC continues to collapse, those figures will deteriorate rapidly.

Read more: Michael Saylor’s Strategy sheds $6 billion in a day — again

Michael Saylor’s debt problem

With very little operating income to speak of relative to over $8 billion in bonds, hundreds of millions of dollars in annual dividend obligations, interest payments due to bondholders, salaries, and other operating expenses, Saylor might have a tough time convincing any lender to extend his credit during the depths of a bear market.

“I don’t think it’s going to $8,000,” Saylor retorted about BTC, without further explanation, at the end of that CNBC segment. “But the credit risk is de minimis at this point.”

While true, those beliefs do not answer the anchor’s question. How, exactly, does Michael Saylor plan to refinance $8 billion in debt if BTC crashes?

Again, and as many critics on social media have realized, he will not need to renegotiate the debt at all if BTC rallies. Only if BTC crashes will he need to renegotiate. At that point, it might have become impossible.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Top Trends Followed by Crypto-Friendly Neobanks in 2026

Why does sending money internationally still feel like mailing a letter in the age of instant messaging? A wire transfer takes three days, costs $45 in fees, and loses another chunk to unfavorable exchange rates.

Freelancers struggle to access basic banking services because traditional institutions can’t process cryptocurrency income. Small businesses watch profits evaporate in currency conversion fees while waiting for payments to clear.

These are not minor obstacles; they’re symptoms of a financial system built around outdated infrastructure. Banking currently moves more slowly than the digital world requires, while cryptocurrency systems are far too unpredictable for living, day-to-day lives. This disconnect can be filled by a crypto Neo bank development company having deep expertise in blockchain technology.

Now, let’s have a look at the statistics.

| According to Mordor Intelligence, the global Neobanking market is set for strong growth, rising from USD 7.38 trillion in 2025 to USD 8.18 trillion in 2026, and further accelerating to USD 13.67 trillion by 2031, at a CAGR of 10.82%. |

Crypto-friendly Neobanks do not symbolize incremental improvement; they symbolize the rebuilding of finance from scratch. Blockchain technology and bank stability are no longer topics of the future; they are happening right now, and the year 2026 will be the year of essential digital banking trends and not experimentation.

How Decentralized Banking is Reshaping Finance

Decentralized banking is the act of removing the old gatekeepers who managed our monetary systems for centuries. The simple question being asked is, why should anyone need permission to access their own money?

- Self-Custody Meets User-Friendly Design

Modern crypto banking solutions combine blockchain’s security with interfaces that feel familiar. Users maintain ownership of assets through private keys while navigating apps that look and function like traditional banking platforms. This removes the technical barriers that held mainstream acceptance at bay during the early days of crypto.

- Smart Contracts Enable Programmable Finance

Money becomes dynamic through smart contracts. Savings accounts can automatically invest surplus funds when balances exceed thresholds. Bills pay themselves on schedule. Emergency reserves are released only under predefined conditions. White label crypto Neo bank platform development is bringing these capabilities to regional providers who lack the resources to build proprietary systems.

- Geographic Borders Become Irrelevant

A user in Lagos accesses the same crypto-friendly Neobanks available in London or Los Angeles. This matters tremendously for the 1.4 billion unbanked adults worldwide. They are the people for whom traditional finance has systematically failed. The decentralized infrastructure is location-neutral and therefore allows financial services to become global for the first time.

6 Game-Changing Trends Defining Crypto Neo Banking in 2026

The landscape of crypto banking solutions is transforming rapidly. These six emerging trends are reshaping how a crypto Neo bank development company builds platforms and how users experience digital finance.

Trend #1: Agentic Banking & AI Financial Copilots

The role of artificial intelligence in crypto banking solutions is no longer limited to mere automation. Today, intelligent agents carry out complex financial maneuvers without any assistance. For instance, they analyze every spending situation and optimize every transaction.

- Transaction Routing Optimization

AI copilots evaluate gas fees, exchange rates, and settlement times in real-time. When paying an invoice in euros, the system automatically converts cryptocurrency at the optimal moment through the most cost-effective channel. No manual intervention required.

- Proactive Financial Management

A top crypto Neo bank development company uses Artificial Intelligence to forecast cash flow problems before they happen. The tools can help track forgotten subscriptions, make suggestions on how to revise the budget based on impending expenses, and flag questionable transactions, which may be evidence of fraud.

Trend #2: Embedded Finance Ecosystems

Banking is becoming integrated into systems that are frequented by the people daily. The shift represents a fundamental change in how crypto banking solutions reach users.

- Social Platform Integration

Restaurant bills get split in group chats with automatic currency conversion. Payments are routed via these kinds of messaging apps along with social networks without any detour to banking interfaces. This makes these apps popular among many people who fear accessing banking apps.

E-commerce sites integrate the crypto-friendly Neobanks directly into their payment systems. Consumers get instant stablecoin financing, rewards on pending orders, and payment options via multiple digital currencies without the need to leave the site. Those indulged in White label crypto Neo bank platform development enable this integration without merchants becoming licensed financial institutions.

Trend #3: Cross-Border Banking & Multi-Currency Wallets

International payments are finally catching up to the internet’s borderless nature. Modern crypto banking solutions treat geography as irrelevant.

Cross-border transactions are processed within minutes, not in days. A freelancer in Vietnam invoices a Canadian client and receives payment in the preferred currency before lunch ends. The three-day wire transfer is becoming as outdated as the fax machine.

- Intelligent Currency Management

In advanced wallets, assets are held in multiple denominations at any given time, allowing them to optimize based on spending patterns as well as market conditions. This means that they avoid any need for manual rebalancing while benefiting from optimal currency exchange rates.

Trend #4: Crypto-Fiat Hybrid Accounts

The distinction between cryptocurrency and traditional money is no longer absolute. Users want unified financial management, and a seasoned crypto Neo bank development company promises to deliver it without fail.

- Consolidated Financial Views

Modern platforms show traditional, crypto, and asset tokens in a singular screen or dashboard. Money is money, and the distinction between “crypto” and “fiat” matters less than how each serves specific financial needs.

Users can specify how they want their money allocated, for example, with 70% stablecoins, 20% bitcoin, 10% traditional currency, and accounts will regularly update as values shift. Similarly, portfolio management, which is only accessible to certain high-net-worth individuals, can now be found in new crypto-friendly Neobanks.

Trend #5: Mainstream Stablecoin & Tokenized Asset Integration

Stablecoins have shifted from experimental technology to financial infrastructure in 2026.

- Yield-Generating Transaction Accounts

Checking account balances earn competitive yields through stablecoin protocols. Money waiting to pay bills generates returns instead of sitting idle at zero percent interest. This represents a fundamental shift in digital banking trends, and transactional accounts are becoming productive assets.

- Fractional Asset Ownership

Tokenization enables ownership of real estate fractions, startup shares, or artwork portions, and everything is accessible through standard banking apps. White label crypto Neo bank platform development democratizes access to asset classes that once required significant wealth to enter.

Trend #6: Quantum-Safe Security & Invisible Biometrics

Security infrastructure in crypto banking solutions is evolving faster than threats emerge.

A forward-thinking crypto Neo Bank development company can employ quantum-proof algorithms, a process that is advantageous as upgrades will be done before a quantum threat actually occurs.

- Behavioral Authentication

Continuous verification is carried out through typing rhythms, device interactions, and walking gaits. Security works transparently in the background. Passphrase tension is done away with, and illegal activity is out of the question.

Develop A Compliant Neo Bank Platform Designed For Global Financial Markets

Why Regulation Will Make or Break Crypto Banking This Year

It is expected that the level of clarity that will be achieved by regulators in 2026 will be used to separate those who are viewed as legitimate crypto-friendly Neobanks from those who do business in gray areas. The framework emerging across jurisdictions will determine which platforms thrive and which disappear.

- Compliance Becomes Competitive Advantage

Clear regulations enable partnerships between crypto banking solutions and traditional financial institutions. Banks that previously avoided cryptocurrency due to uncertainty now actively pursue white label crypto Neo bank platform development partnerships to enter markets safely.

- Navigating Fragmented Requirements

The EU’s MiCA regulation, evolving US frameworks, and diverse Asian approaches create complex compliance landscapes. Successful crypto Neo bank development companies build flexible systems that adapt to multiple regulatory regimes simultaneously, turning fragmentation from an obstacle into a moat.

- License Acquisition Drives Consolidation

Multiple banking licenses and operational permissions enable broader market access. This advantage accelerates industry consolidation as smaller players either scale rapidly or face acquisition by larger licensed operators. Regulatory compliance infrastructure becomes as valuable as technical capabilities in determining which digital banking trends gain traction.

How to Create the Ultimate Digital Bank

The development of a successful crypto-friendly Neobank in 2026 demands this balance:

Different stakeholders, like cross-border workers, cryptocurrency traders who require fiat currency access, and businesses with multiple currency systems, require separate features. Serving all of these stakeholders makes the features less effective.

- Strategic Build-vs-Buy Decisions

Building proprietary systems offers maximum customization but demands enormous resources. White label crypto Neo bank platform development provides proven infrastructure and faster market entry. A successful crypto Neo bank development company adopts hybrid approaches, customizing white label platforms for specific market segments.

Architectural decisions are to be made about multi-signature wallets, hardware security modules, verification of smart contracts, and audit trails. It is a fact that security bolted onto existing systems creates vulnerabilities that sophisticated attacks will exploit. Every element of crypto banking solutions should consider security implications from the initial design.

Infrastructure should handle 100x the initial user base without architectural changes. Digital banking trends demonstrate that successful platforms grow exponentially. The appropriate selection of blockchain networks, putting in place effective scaling solutions, and designing flexible databases determines whether platforms can leverage growth opportunities or collapse under success.

Concluding Thoughts

The financial services market is split into two segments: those who adjust to change and those who formulate new paradigms of their own. Crypto-friendly Neobanks represent the convergence of blockchain’s potential with banking’s practical necessity.

AI financial copilots, quantum-safe security, embedded finance ecosystems, and tokenized assets aren’t isolated developments. They’re interconnected components of fundamental transformation in how people interact with money. Geographic Borders, banking hours, and even gatekeepers are becoming less relevant, whereas speed, transparency, and self-serve are becoming a minimum expectation.

The development of such infrastructure requires specialized expertise in blockchain technology, regulation, security configuration, and user experience. Not many teams have such a pool of expertise within their own organization, and partnerships with experts become important for success.

Ready to Launch a Neo Bank?

Antier holds expertise in white-label crypto neo-bank platform development, enabling faster market entry without compromising security and usability. As a quality crypto neo bank development company, we have successfully implemented crypto bank solutions across multiple continents.

Recognizing the rapid pace of digital banking trends and innovations, our team helps take that pace one step forward by implementing extensive crypto banking solutions that include smart contract development and highly scalable, compliant solutions.

Let’s partner together and make banking relevant for the way we live and work today.

Frequently Asked Questions

01. Why do international wire transfers take so long and cost so much?

International wire transfers can take up to three days and incur fees of around $45, along with losses from unfavorable exchange rates, due to outdated banking infrastructure that struggles to keep pace with modern digital demands.

02. What challenges do freelancers face with traditional banking systems?

Freelancers often struggle to access basic banking services because traditional institutions typically cannot process cryptocurrency income, limiting their financial options.

03. How are crypto-friendly Neobanks changing the financial landscape?

Crypto-friendly Neobanks are revolutionizing finance by combining blockchain technology with user-friendly interfaces, allowing users to maintain ownership of their assets while benefiting from features like smart contracts for automated financial management.

Crypto World

Is Aave Labs’ proposal ‘extractive’? DAO debate heats up

Since December, the DeFi sector’s largest protocol has been wrestling with an existential question, pitting Aave Labs against the DAO: who owns Aave?

What began as a discussion over swap fees rapidly escalated into an existential debate about ownership of the Aave brand, as well as the rights to monetize it.

Yesterday, Aave Labs published a “temperature check” entitled “Aave Will Win Framework” on the Aave governance forum.

Their headline is “100% of product revenue to the Aave DAO,” but the post, which runs to almost 4,000 words, doesn’t end there.

Read more: Aave brand dispute rumbles on as founder buys £22M London property

At a high level, the post proposes that all of Aave product revenue will be directed to the DAO. A foundation would also be set up to “assume responsibility for holding and stewarding” the Aave brand.

This addresses the DAO’s concerns around Labs’ potential brand capture on products including the front end, Aave’s app, card and institution-focused Horizon market.

These concessions are accompanied by a funding request for considerable sums, namely $25 million in stablecoins and 75,000 AAVE.

Further grants totaling $17.5 would be “payable upon specific product launches.”

The initial payment of stablecoins would be partially ($5 million) upfront, with the remainder streamed over the following year. AAVE tokens would unlock linearly over two years.

It clarifies “all funds will be spent on Aave-related efforts” such as “user acquisition, marketing, and ongoing development.”

Correct destination, but the route ‘needs work’

While DAO advocates generally see the proposal as directionally positive, concerns remain over the calculation of revenue. That, and the vast sum of tokens requested, both stables and AAVE.

Vocal DAO delegate Marc Zeller reacted harshly to begin with, calling Labs’ proposal “extractive” and a “gaslight.” He sees it as “raiding” DAO tokens “for zero actual enforceable commitment.”

A longer follow-up post was more positive, recognising “victory” for the DAO, while also recognizing that the move is essentially “four proposals in a trenchcoat.”

However, Zeller warns that, in calculating revenue, “deductions are at Aave Labs’ sole discretion. No independent audit. No cap. No DAO approval threshold.”

He also underlines that the $50 million worth of tokens requested represents “31.5% of the entire treasury. For a single service provider. In a single vote.”

Furthermore, the additional 75,000 AAVE tokens would further increase Labs dominance of DAO voting.

AAVE voting power

Aave Labs isn’t shy about flexing its muscles during sensitive votes.

In what was branded a “disgraceful” move, Labs triggered a surprise vote on contributor Ernesto Boado’s proposal over the Christmas holidays.

The proposal was voted down with 55% against, while the majority of DAO delegates abstained.

Additionally, Zeller suspects that today’s narrowly-rejected vote on “mandatory disclosures” was, ironically, heavily influenced by undisclosed Labs-linked wallets.

Forking over another 75,000 tokens would only increase Labs’ ability to swing future votes in its favor.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Three Arrested After Binance France Employee Home Break-In

Three suspects were arrested in France after a reported break-in targeting the home of a senior figure at Binance’s French unit, with the company confirming to Cointelegraph that one of its employees was the victim of a home invasion.

Local outlet RTL, citing anonymous police sources, reported that three hooded individuals attempted to enter an apartment in Val-de-Marne around 7:00 am CET Thursday and were carrying weapons.

RTL said the suspects first forced their way into the apartment of another resident, forcing them to direct them to the home of the head of Binance France. RTL reported the suspects searched the apartment and stole two mobile phones before fleeing.

Two hours later, the three suspects were reportedly arrested during a second home invasion attempt in Hauts-de-Seine after residents alerted authorities, RTL said. Authorities recovered the stolen phones and a vehicle that RTL said linked the suspects to the earlier break-in.

Related: 22 Bitcoin worth $1.5M vanish from Seoul police custody

Binance confirms a break into an employee’s home

Binance confirmed the incident to Cointelegraph but declined to identify the employee involved.

“We are aware of a home break-in involving one of our employees. There is an ongoing investigation with the local police,” a Binance spokesperson said. “The safety and well-being of our employees and their families is our absolute priority. We are working closely with law enforcement and further enhancing appropriate security measures.”

David Prinçay is the President of Binance France, but Cointelegraph was unable to independently verify the identity of the employee targeted in the break-in. Binance declined to provide further details, citing the ongoing investigation and safety concerns.

Related: Binance completes $1B Bitcoin conversion for SAFU emergency fund

Crypto wrench attacks rise 75% in 2025, as France sees most attacks

Physical attacks targeting cryptocurrency investors, also known as “wrench attacks,” have risen over the past year.

Wrench attacks increased by 75% during 2025, to 72 verified cases worldwide recorded last year alone, according to cybersecurity platform CertiK.

Wrench attacks accounted for at least $40.9 million in confirmed losses in 2025, but the value could be much larger due to unreported incidents, according to CertiK.

France recorded the largest number of attacks last year, with 19 confirmed incidents, while Europe accounted for about 40% of all attacks globally in 2025.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

How much does an RWA tokenization platform cost?

The acceleration of blockchain adoption in capital markets has transformed tokenization from a conceptual innovation into a strategic infrastructure decision. Enterprises, asset managers, and fintech startups are increasingly exploring tokenized securities, fractional ownership models, and programmable financial instruments. Yet before initiating development, a critical question arises: what is the true cost to build a tokenization platform?

Costs of developing the tokenization platform include far more than just the basic development time. The tokenization platform development cost are influenced by how complex the asset is, the depth of compliance required, how the product will be secured, how many integrations are required, and what level of scalable solutions will be required for the future. If the asset is a security or a tangible asset in the real world, the real-world asset tokenization cost will also include the costs associated with regulatory compliance, reporting requirements, and custodial obligations.

This blog covers the cost factors associated with tokenization and the various applications of tokenization platforms on several types of assets as well as the timelines of implementing a tokenization project. This guide will provide an extensive continuation of how an organization can effectively build compliant digital asset ecosystems, including some sample vendors (third party organizations) that have designed tokenization platforms.

What Is a Tokenization Platform and How Does It Work?

A tokenization platform development is a blockchain-enabled infrastructure that digitizes ownership rights and represents them as programmable tokens. These tokens can symbolize equity shares, debt instruments, real estate fractions, commodities, funds, or other regulated assets.

Unlike basic crypto token issuance, enterprise tokenization platforms operate within strict financial and legal frameworks. They combine blockchain immutability with compliance automation, investor management systems, and custody safeguards.

The foundational components of a tokenization platform include:

1. Blockchain Infrastructure

This serves as the ledger where token ownership and transactions are recorded. Organizations may choose:

- Public chains (Ethereum, Polygon) for liquidity and ecosystem access

- Private or permissioned chains for enhanced control and compliance

- Hybrid models for balancing transparency and confidentiality

Infrastructure decisions directly influence tokenization software development pricing, as private networks require node setup, governance models, and dedicated maintenance.

2. Smart Contract Engine

Smart contracts govern token issuance, transfer restrictions, dividend distribution, governance voting, and compliance checks. Advanced programmable securities increase the tokenization platform development cost, especially when they include:

- Lock-up periods

- Jurisdiction-based transfer rules

- Corporate action automation

- Automated yield calculations

3. Compliance & Identity Layer

This layer integrates KYC/AML providers, accreditation verification systems, and regulatory screening tools. Since regulated assets demand strict adherence, compliance modules significantly impact the overall real-world asset tokenization cost.

4. Custody & Wallet Systems

Institutional investors require bank-grade custody solutions, including:

- Multi-party computation (MPC) wallets

- Cold storage

- Key recovery systems

- Custodial integrations with regulated entities

Advanced custody frameworks elevate the RWA tokenization platform cost, particularly when insurance-backed storage is involved.

5. Investor Dashboard & Admin Controls

User interfaces manage onboarding, portfolio monitoring, dividend tracking, and reporting. Administrative dashboards handle asset issuance, investor approvals, and regulatory documentation.

Each of these modules contributes cumulatively to the total cost to build a tokenization platform.

Get a Detailed RWA Tokenization Platform Cost Estimate

Key Factors That Influence Tokenization Software Development Pricing

Tokenization software development pricing varies depending on several technical and operational factors:

1. Blockchain Selection

The blockchain framework determines performance, scalability, and cost structure.

- Public chains may reduce setup time but require gas optimization and scalability considerations.

- Enterprise blockchains demand custom node configurations and governance protocols.

- Cross-chain compatibility increases development complexity but improves liquidity access.

Selecting the appropriate blockchain architecture can significantly alter the tokenization platform development cost.

2. Smart Contract Complexity

Basic token contracts are relatively straightforward. However, security token standards with regulatory logic require deeper engineering and testing.

Complex smart contracts often include:

- Dividend automation

- Revenue-sharing logic

- Investor voting rights

- Automated cap table updates

- Compliance-based transfer gating

Extensive testing, formal verification, and third-party audits elevate the RWA tokenization platform cost, but they are essential for institutional trust.

3. Regulatory Framework & Jurisdiction

Compliance obligations differ across countries. Platforms targeting cross-border investors must integrate:

- Multi-jurisdictional accreditation rules

- Transfer restrictions

- Reporting frameworks

- Licensing requirements

Legal structuring often runs parallel to development, increasing the real-world asset tokenization cost. However, ignoring regulatory requirements can lead to costly revisions later.

4. Security Architecture

Security extends beyond smart contracts. It includes:

- API encryption

- Infrastructure firewalls

- DDoS mitigation

- Database protection

- Continuous monitoring tools

For institutional-grade deployments, third-party security audits are mandatory. These measures increase upfront costs but reduce long-term operational risk.

5. Integration Ecosystem

Tokenization platforms rarely operate in isolation. They require integration with:

- Payment gateways

- Banking APIs

- Identity verification providers

- Secondary trading platforms

- Reporting tools

Each integration expands development scope, influencing both the cost to build a tokenization platform and the overall deployment timeline.

How to Choose the Right RWA Tokenization Platform Development Company for Cost Efficiency ?

It is important to choose a qualified RWA tokenization platform development company when you’re considering the cost of developing a tokenization platform and ensuring its sustainability over time. Tokenizations take place at many intersections – Blockchain Engineering, Financial Regulations, Cybersecurity, and Enterprise Architecture.

Choosing a vendor who is not an expert in this area could expose you to compliance issues, security issues, budget overruns, and ultimately an increased total cost to create your RWA tokenization platform.

When making a decision on cost-effectiveness, do not focus so much on the lowest dollar option that you select a Vendor who cannot deliver an infrastructure that is secure, compliant, scalable, all without unnecessary rewriting/rework and/or hidden costs.

Evaluate Proven Domain Expertise

A qualified development partner should demonstrate experience in:

- Real-world asset structuring (real estate, private equity, debt instruments, funds)

- Securities token standards and regulatory mapping

- Smart contract security implementation

- Institutional-grade custody integrations

A vendor unfamiliar with regulated token issuance may underestimate compliance layers, leading to scope changes mid-project. This directly increases the cost to build a tokenization platform through extended development cycles and additional audit requirements.

Assess Technical Architecture Capability

A reliable partner should offer clear documentation on:

- Blockchain framework selection

- Node management architecture

- Scalability models

- Interoperability with exchanges and custodians

Cost efficiency is achieved when the technical foundation is designed for long-term scalability. Poor architecture decisions often require rebuilding components later, drastically inflating tokenization software development pricing.

Examine Security & Audit Readiness

Enterprise tokenization platforms must meet institutional security standards. The development company should have structured processes for:

- Smart contract audits

- Penetration testing

- Infrastructure hardening

- Secure key management

If audit readiness is not embedded in development from the beginning, remediation costs may exceed initial estimates, raising the total real-world asset tokenization cost.

Consider Post-Launch Support & Upgradeability

Tokenization ecosystems require ongoing updates due to:

- Regulatory changes

- Feature expansion

- Security enhancements

- Asset diversification

A development partner offering structured maintenance models reduces long-term uncertainty in tokenization platform development cost and prevents unexpected operational disruptions.

Analyze Transparency in Pricing Structure

An experienced RWA tokenization platform Development company will provide:

- Clear scope documentation

- Defined deliverables

- Milestone-based pricing

- Separate cost allocation for audits and integrations

Transparent pricing avoids ambiguity and stabilizes the projected RWA tokenization platform cost, ensuring alignment between business objectives and budget allocation.

Start Planning Your Tokenization Platform Today

What Is the Typical Tokenization Platform Development Timeline?

The tokenization platform development timeline depends on asset complexity, regulatory jurisdiction, customization level, and integration depth. While smaller MVPs may launch within a few months, institutional-grade ecosystems require structured, multi-phase execution to ensure compliance and scalability.

A realistic timeline typically ranges between 4 to 8 months, with enterprise-scale builds extending further depending on regulatory approvals.

Phase 1: Discovery, Feasibility & Regulatory Assessment (3–6 Weeks)

This foundational phase defines project viability. Activities include:

- Asset class feasibility evaluation

- Regulatory landscape mapping

- Legal structuring coordination

- Technical architecture planning

- Preliminary cost modeling

A well-structured discovery phase reduces scope ambiguity and creates clarity around the expected cost to build a tokenization platform. Skipping this stage often results in timeline extensions later.

Phase 2: Architecture Design & Compliance Framework (4–6 Weeks)

During this stage, the platform blueprint is finalized. Key deliverables include:

- Smart contract logic frameworks

- Compliance automation rules

- Custody integration planning

- Data security architecture

- UI/UX workflow designs

Proper planning at this stage prevents reengineering during development and helps control tokenization software development pricing.

Phase 3: Core Development & System Integration (8–16 Weeks)

This is the most resource-intensive phase. It involves:

- Smart contract coding and internal testing

- Backend system development

- API integration with payment, KYC, and custody providers

- Investor dashboard and admin panel development

Customization requirements significantly affect both the tokenization platform development cost and timeline. Multi-asset support, cross-chain functionality, or multi-jurisdiction compliance layers can extend this phase.

Phase 4: Security Audits & Quality Assurance (4–8 Weeks)

Institutional tokenization platforms require:

- Independent third-party smart contract audits

- Infrastructure penetration testing

- Load and performance testing

- Compliance validation

Audit timelines depend on contract complexity. While this stage adds to the overall real-world asset tokenization cost, it is essential for investor trust and regulatory approval.

Phase 5: Deployment, Launch & Optimization

Once audits are cleared:

- Mainnet deployment occurs

- Monitoring tools are activated

- Operational governance begins

- Performance metrics are analyzed

Post-launch support ensures smooth scaling and prevents unexpected increases in long-term RWA tokenization platform cost.

Building a Future-Ready Tokenization Ecosystem

Building a tokenization platform requires more than estimating the immediate cost to build a tokenization platform—it demands strategic planning for scalability, compliance, and long-term operational resilience. Organizations that prioritize modular architecture, automated regulatory controls, and secure custody frameworks are better positioned to manage evolving asset classes and investor growth without inflating future tokenization platform development cost.

A structured approach to the tokenization platform development timeline, combined with security-first engineering, ensures sustainable deployment and controlled RWA tokenization platform cost over time.

At Antier, as a trusted RWA tokenization platform Development company, the focus is on delivering compliant, scalable ecosystems while optimizing tokenization software development pricing and minimizing overall real-world asset tokenization cost. Through enterprise-grade architecture and regulatory alignment, Antier enables businesses to launch secure, future-ready tokenization platforms with confidence.

Frequently Asked Questions

01. What is a tokenization platform?

A tokenization platform is a blockchain-enabled infrastructure that digitizes ownership rights and represents them as programmable tokens, which can symbolize various assets like equity shares, debt instruments, or real estate fractions.

02. What factors influence the cost of developing a tokenization platform?

The cost of developing a tokenization platform is influenced by the complexity of the asset, compliance requirements, security measures, necessary integrations, and the scalability needed for future growth.

03. How do tokenization platforms ensure compliance and security?

Tokenization platforms ensure compliance and security by operating within strict financial and legal frameworks, utilizing blockchain immutability, automation for compliance, investor management systems, and custody safeguards.

Crypto World

JPMorgan (JPM) cuts Coinbase (COIN) target to $252 after 4Q miss, keeps overweight rating

Wall Street analysts from companies including JPMorgan (JPM) and Cannacord lowered their price targets for Coinbase (COIN) stock after the largest publicly traded crypto exchange missed fourth-quarter earnings estimates.

JPMorgan said weak crypto prices and trading activity weighed on volumes and fees. The bank maintained its overweight rating on the crypto exchange, but cut the price target to $252 from $290 in the Thursday report.

The stock, which is down about 40% so far this year, was priced around $150 at publication time in pre-market trading. It closed yesterday at $141.09.

Crypto-linked equities have had a choppy start to the year, broadly tracking the turbulent digital-asset market. Major companies such as Coinbase have seen share prices pressured as crypto trading volumes weakened and token prices slid. Bitcoin , the largest cryptocurrency, remains well below late-2025 peaks and is now down about 25% year-to-date.

JPMorgan analysts led by Kenneth Worthington said higher operating expenses, up 22% year over year, and a shift toward lower-fee Advanced trading and Coinbase One subscriptions pressured results.

The analysts lowered their forward take-rate assumptions and cited a softer volume and market cap outlook in trimming the price target. The take rate is the percentage of transaction volume the company keeps as revenue.

Coinbase’s scale and profitability stand out in a volatile crypto market, broker Canaccord said, maintaining its buy rating while cutting its price target to $300 from $400 after lowering near-term estimates following the results.

While tumbling spot prices have weighed on the broader industry, the broker said Coinbase remains solidly profitable and is taking incremental market share as it expands its product suite.

Analysts led by Joseph Vafi pointed to progress on the company’s “Everything Exchange,” growth in USDC commerce use cases and expanding decentralized finance (DeFi) applications on Base and Ethereum, in the report published Thursday.

Deribit, the derivatives exchange it bought during the year, was described as a strategic addition helping drive cross-sell activity outside the U.S. across spot and derivatives.

The analysts said global trading volume and market share are up roughly 100% from a year earlier, with recent records in notional volume supported by activity in gold and silver futures.

Canaccord expects a tougher first quarter for the industry, and sees Coinbase gaining market share and stepping up stock buybacks. It views the stock as near cyclical lows, with the new $300 target based on 22 times its 2027 Ebitda estimate.

Read more: Coinbase misses Q4 estimates as transaction revenue falls below $1 billion

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video3 hours ago

Video3 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’