Business

Duroflex, Premier Industrial Corporation, 3 more companies get Sebi nod to launch IPO

In IPO parlance, Sebi’s ‘observation’ refers to the formal comments or clearance issued by the regulator on a company’s draft IPO documents.

Premier Industrial Corporation IPO

Premier Industrial Corporation’s IPO will be a mix of fresh issue and an offer for sale (OFS). The company received Sebi’s observation letter on February 10.

Under the issue, 2.79 crore equity shares will be offloaded by the company. In this, the fresh issue will be up to 2.25 crore while the OFS will be up to 54 lakh equity shares.

The selling shareholders are Arvind Chhotalal Morzaria, Dilip Chhotalal Morzaria, Subhash Chhotalal Morzaria, Lalit Navinchandra Morzaria and Nirmala Navinchandra Morzaria.

The company plans to utilise its net proceeds towards financing the capital expenditure requirements for setting up a new wire manufacturing facility in Raigad, Maharashtra, and for financing the capital expenditure required for the expansion of the existing manufacturing facility at the Wada Unit in Palghar, Maharashtra. A part of the proceeds will be be utilised for funding the working capital requirements of the company and for general corporate purposes.

Unistone Capital Private Limited is the sole Book Running Lead Manager (BRLM) to the issue.

Duroflex IPO

Duroflex IPO will be a mix of fresh issue and an offer for sale (OFS). The company received Sebi’s observation letter on February 12. The IPO consists of a fresh issue of equity shares aggregating up to Rs 184 and an offer for sale (OFS) of up to 2.25 crore equity shares by promoters and existing investors.

Duroflex Limited is a leading sleep and comfort solutions provider and is among the top three mattress companies in India by market share. It operates across mattresses, foam, furniture, pillows, accessories, and other bedding products under brands such as Duroflex, Sleepyhead, and Perfect Rest. As of June 30, 2025, Duroflex has established a broad network with 73 Company Owned Company Operated (COCO) stores, over 5,576 general trade stores, and a strong digital presence, serving a pan-India customer base.

Virupaksha Organics IPO

Virupaksha Organics IPO will entirely be a fresh issue worth Rs 740 crore according to the Draft Red Herring Prospectus (DRHP) filed by the company. The research-driven Indian pharmaceutical company received Sebi’s nod on Thursday, February 12.

The company is promoted by Chandra Mouliswar Reddy Gangavaram, Balasubba Reddy, Mamilla, Chandrasekhar Reddy Gangavaram, Vedavathi Gangavaram, Kondapalli Sandeep Reddy, Kotla SUuraj Redy, Mamilla Nagarjun Reddy, Gangavaram Sri Lakshmi and G Sri Vidya.

The BRLMs are Axis Capital Limited and SBI Capital Markets Limited while the registrar to the issue is Kfin Technologies Limited.

Hexagon Nutrition IPO

The public issue of Hexagon Nutrition will entirely be an OFS. The company received Sebi’s clearance on February 10. Under the OFS, promoters Arun Purushottam Kelkar, Subhash Purushottam Kelkar, Nutan Subhash Kelkar and Aditya Kelkar will together offload up to 30,859,704 equity shares.

The research-driven nutrition company is engaged in developing and manufacturing products across micronutrient premixes, branded wellness and clinical nutrition, therapeutic formulations, and ready-to-use foods.

The lead managers to the issue are Cumulative Capital Private Limited and Catalyst Capital Partners Private Limited while the registrar is Kfin Technologies.

Om Power Transmission IPO

The IPO will be a mix of fresh issue and an OFS. The company received the observation on today. Incorporated in 2011, Om Power Transmission is a power transmission infrastructure engineering, procurement, and construction (EPC) company with over 14 years of experience. The company’s expertise lies in the execution of high-voltage (HV) and extra-high voltage (EHV) transmission lines, substations and underground cabling projects delivered on a turnkey basis.

(Disclaimer: The recommendations, suggestions, views, and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

Gogoro Inc. 2025 Q4 – Results – Earnings Call Presentation (NASDAQ:GGR) 2026-02-13

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Leggett & Platt: This Cigar Butt Doesn't Offer Enough Puffs (Downgrade)

Leggett & Platt: This Cigar Butt Doesn't Offer Enough Puffs (Downgrade)

Business

Germany stocks higher at close of trade; DAX up 0.20%

Germany stocks higher at close of trade; DAX up 0.20%

Business

US allows oil majors to broadly operate in Venezuela, new energy investments

US allows oil majors to broadly operate in Venezuela, new energy investments

Business

DHC stock hits 52-week high at 6.54 USD

DHC stock hits 52-week high at 6.54 USD

Business

Osage Food Products introduces new color platform

New line features colors derived from plant-based sources.

Business

Form 13D/A TYSON FOODS For: 13 February

Form 13D/A TYSON FOODS For: 13 February

Business

Custom Flavors unveils leadership changes

Company names Scott Nadison president, elevates Alex Wendling to CEO.

Business

Head of DP World leaves company after Epstein links revealed

Sultan Ahmed bin Sulayem’s exit comes after files showed he appears to have exchanged hundreds of emails with Epstein.

Business

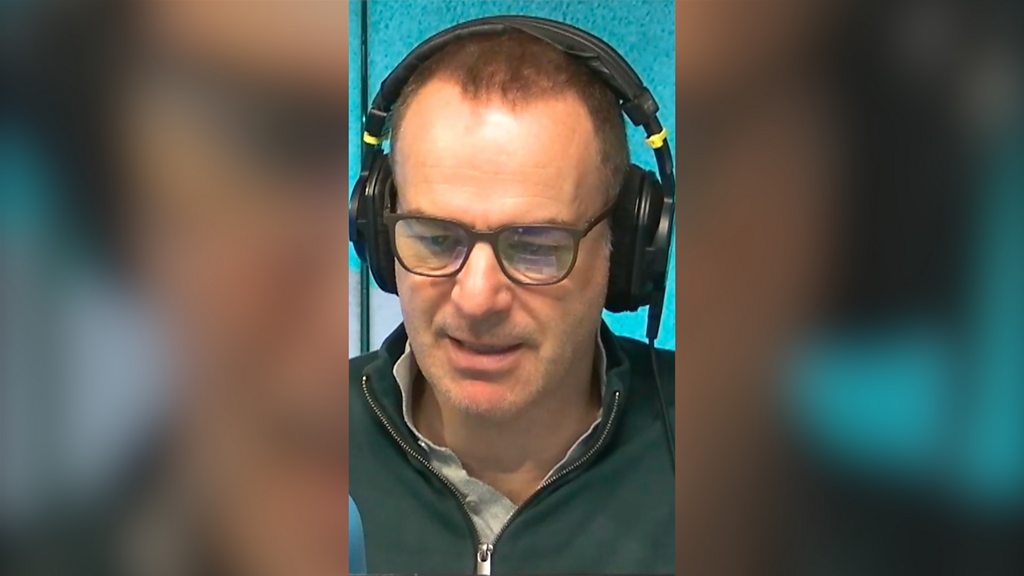

Why you should consider switching bank accounts

Martin Lewis explains why now might be a good time to think about changing your bank account.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video6 hours ago

Video6 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

![Who's your favorite girl in Digital Circus? [Money Money Green green meme] #shorts #trend](https://wordupnews.com/wp-content/uploads/2026/02/1771002718_maxresdefault-80x80.jpg)