Crypto World

Powering the Future of Web3 Games

GameFi has moved beyond being a niche Web3 experiment. It is now a serious segment of the gaming industry where gameplay, finance, and digital ownership intersect. For enterprises, the opportunity is no longer theoretical.

GameFi platforms are generating real user engagement, real economies, and real revenue flows. But while many projects launch, only a few achieve scale and sustainability.

The difference?

Successful games in the GameFi sector are not just games, they are well-designed economic systems backed by strong technology and long-term strategy.

Before discussing how to build the next big one, let us look at what today’s top Web3 games are doing right.

Check Out the Top 5 Web3 Games in the GameFi Sector

Take a look at the top 5 Web3 games in the GameFi sector that have shown ecosystem impact, retention, and economic design, not hype.

1) Axie Infinity

One of the earliest GameFi successes, Axie Infinity proved that play-to-earn could drive global adoption.

Why it worked

- NFT-based ownership of characters

- Strong community culture

- Reward-driven gameplay loop

- Marketplace liquidity

Key lesson for enterprises

Ownership and community can drive growth. However, token inflation must be managed carefully for sustainability. With the help from professional service providers, enterprises can also build an NFT game like Axie Infinity to make a mark in the GameFi sector.

2) The Sandbox

The Sandbox positioned itself as a creator-driven metaverse where users build and monetize experiences.

Why it worked

- User-generated content model

- LAND-based digital real estate economy

- Major brand partnerships

- Creator monetization

Key lesson for enterprises

GameFi scales when both creators as well as just players get incentives.

3) Illuvium

Illuvium focuses on AAA-quality gameplay combined with blockchain mechanics.

Why it worked

- High production quality

- Strategic battle mechanics

- Strong token utility design

- Transparent development roadmap

Key lesson for enterprises

In web3 gaming, players still expect high-quality gameplay. Blockchain alone isn’t enough. Businesses can certainly take inspiration from Illuvium and develop an adventurous NFT game.

4) Star Atlas

A space-themed strategy game combining exploration, resource management, and NFTs.

Why it worked

- Deep in-game economy

- Long-term vision

- Asset ownership layers

- Multi-token structure

Key lesson for enterprises

Complex economies require careful modeling to remain stable.

5) Big Time

Big Time blends RPG gameplay with NFT cosmetics rather than pay-to-win mechanics.

Why it worked

- Focus on fun-first gameplay

- Cosmetic NFT monetization

- Reduced entry barriers

- Balanced economy

Key lesson for enterprises

GameFi succeeds when gameplay comes first, monetization second.

Common Success Patterns Across Top Web3 Games in the GameFi Sector

Across these examples, Several similar patterns emerge across the top web3 games in the GameFi sector

1. Gameplay First, Tokenomics Second

The most successful GameFi titles treat blockchain as an enabler, not the core product. Players stay for compelling gameplay, including progression, competition, exploration, or social interaction and not for token rewards alone.

When token incentives become the primary attraction, users behave like short-term extractors rather than long-term players. This leads to boom-and-bust cycles. Enterprises that win in the GameFi sector tend to design games where tokens enhance the experience rather than define it. The economy supports gameplay, not the other way around.

2. Sustainable Token Models

A GameFi economy behaves like a real economy. Unlimited token emissions without sinks create inflation, reducing value and user trust.

Sustainable models include:

- Controlled emission schedules

- Burning mechanisms

- Utility-driven demand

- Balanced reward pacing

Enterprises must think like central banks managing a currency, not just game studios issuing rewards. Strong tokenomics protects both player confidence and long-term platform stability.

3. Asset Utility

NFTs that exist only for speculation lose relevance within a short span of time. Assets must have in-game purpose, like access rights, upgrades, status, or gameplay advantages. Utility-driven NFTs create reasons to hold rather than flip. This stabilizes secondary markets and strengthens ecosystem value. For enterprises, this means designing assets as functional components of gameplay and community identity, not just collectibles.

4. Strong Community Loops

GameFi ecosystems grow when players feel involved, not just entertained. Guilds, DAO participation, social competitions, and collaborative events increase emotional investment.

Community-led growth reduces marketing spend and increases organic retention. When users recruit other users, acquisition becomes more efficient.

Enterprises that build social infrastructure into their games often see longer lifecycle value per player.

5. Long-Term Roadmaps

GameFi projects that succeed, rarely launch everything at once. They evolve in phases, such as alpha, beta, seasonal updates, expansions. A visible roadmap builds credibility and signals commitment. It reassures users that the platform is not a short-lived experiment.

Enterprises should consider GameFi platform development like live services, not one-time releases. Continuous development sustains engagement.

Want to Build Web3 Games in the GameFi Sector?

How Enterprises Can Build the Next Big GameFi Platform

GameFi platform development is not about copying mechanics. It’s all about designing an ecosystem.

1. Start with a Business Model, Not a Token

Many GameFi projects tend to fail because they start with token issuance instead of revenue logic. A token without a business model becomes speculation fuel.

Enterprises must define:

- How value enters the ecosystem

- How revenue is generated

- How players progress and spend

- How the platform sustains itself

Tokens should support these mechanics, not replace them. A clear model ensures predictability and investor confidence.

2. Design Sustainable Tokenomics

Tokenomics must be stress-tested against growth scenarios. What happens when users double? When rewards are farmed? When markets fluctuate?

Enterprises should simulate:

- Inflation pressure

- Liquidity demands

- User reward cycles

- Exit scenarios

This requires financial modeling expertise, not just blockchain development. Sustainable tokenomics prevents economic collapse.

3. Build for Scalability

GameFi platforms combine gaming infrastructure and financial systems. They must support:

- High user concurrency

- Secure transactions

- Marketplace activity

- Real-time gameplay

Poor scalability leads to slow transactions, high fees, and user frustration. Enterprises should architect systems for growth from day one rather than retrofitting later at higher costs.

4. Focus on Retention Mechanics

Retention is where GameFi profitability lives. Acquiring users is expensive; keeping them is valuable.

Retention tools include:

- Progression systems

- Time-limited events

- Competitive modes

- Social features

- Reward milestones

These mechanics give users reasons to return. Enterprises that master retention build predictable revenue streams.

5. Prioritize Security

GameFi platforms handle valuable assets. Exploits or breaches can erase user trust overnight.

Security must cover:

- Smart contract audits

- Anti-cheat systems

- Wallet safety

- Fraud detection

- Data integrity

Security cannot be considered as a feature, it’s foundational. Enterprises that underinvest here risk reputational and financial damage.

Why Enterprises Partner with a Professional GameFi Development Company

1. Multidisciplinary Expertise

GameFi sits at the intersection of gaming, finance, and blockchain. Few internal teams cover all three deeply. Therefore, the need for a trusted GameFi development company arises. A specialized partner brings cross-domain expertise, reducing trial-and-error risks.

2. Faster Time-to-Market

Experienced GameFi teams reuse proven frameworks, smart contract templates, and tested architectures. This accelerates development without compromising quality. Speed matters in competitive Web3 gaming markets.

3. Economic Design Support

Designing a stable in-game economy requires financial modeling skills. An experienced GameFi development company often includes tokenomics specialists who simulate economic behavior. This protects long-term viability.

4. Security & Compliance Readiness

Professional partners implement audit-ready systems and compliance-aware frameworks. This is critical as regulations tighten around digital assets.

5. LiveOps & Scaling Support

GameFi is not “launch and leave.” It requires updates, tuning, and monitoring. Development partners often support LiveOps, ensuring the ecosystem evolves safely.

Final Thoughts

The next big GameFi success won’t come from hype. It will come from solid design, strong economies, and real player value.

Antier, a vastly experienced GameFi development company, works with enterprises to design and build GameFi ecosystems that are scalable, secure, and retention-driven. Support from Antier includes:

- End-to-end GameFi platform development

- Tokenomics architecture

- NFT integration

- Smart contract development

- Marketplace and wallet systems

- LiveOps and scaling support

The goal isn’t just launching Web3 games,it is about building a sustainable digital economy. Enterprises that treat GameFi as a long-term platform opportunity and not as a short-term trend are the ones most likely to win. So, the real question is: Are you building a game, or building an economy? And your success lies within the answer itself.

Frequently Asked Questions

01. What is GameFi and how has it evolved in the gaming industry?

GameFi is a segment of the gaming industry where gameplay, finance, and digital ownership intersect, moving beyond a niche Web3 experiment to generate real user engagement, economies, and revenue flows.

02. What are the key factors that contribute to the success of GameFi projects?

Successful GameFi projects are well-designed economic systems supported by strong technology and long-term strategies, focusing on community, ownership, and sustainable token management.

03. Can you name some of the top Web3 games in the GameFi sector and their unique features?

Top Web3 games include Axie Infinity (NFT ownership and community culture), The Sandbox (user-generated content and monetization), Illuvium (AAA-quality gameplay), Star Atlas (deep in-game economy), and Big Time (fun-first gameplay with cosmetic NFTs).

Crypto World

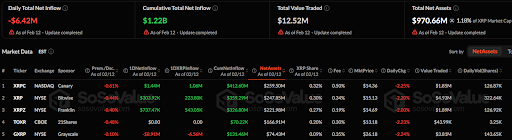

XRP ETFs Face $6.42M Outflow, Grayscale’s GXRP ETF Records Largest Loss

TLDR

- XRP ETFs saw a daily outflow of $6.42 million, with cumulative inflows at $1.22 billion.

- XRPC ETF reported a $1.44M net inflow, but its market price declined by 2.25%.

- XRP ETF experienced a daily drop of 2.20% and a $303.92K net inflow.

- XRPZ ETF saw a 2.00% drop in market price, with $737.47K in daily inflows.

- The GXRP ETF recorded an $8.91M outflow, with a 2.24% drop in market price.

As of February 12, the daily total net inflow for XRP ETFs recorded a loss of $6.42 million. According to SoSoValue, the cumulative total net inflow remains positive at $1.22 billion. The total value traded stands at $12.52 million, showing a relatively low trading volume for the day. Total net assets for the XRP ETFs are valued at $970.66 million, representing 1.18% of the XRP market cap.

XRPC, XRPZ, and XRP ETFs Record Inflows

Among individual XRP ETFs, the XRPC ETF, listed on NASDAQ and sponsored by Canary, saw a slight 0.61% decline. It reported a 1-day net inflow of $1.44 million and a cumulative net inflow of $412.60 million. The ETF’s net assets stand at $259.50 million, with an XRP share of 0.32%. Its market price is $14.36, showing a 2.25% daily decline.

The XRP ETF, listed on the NYSE and sponsored by Bitwise, experienced a daily decrease of 2.20%. It saw a daily net inflow of $303.92 thousand and has a cumulative net inflow of $359.29 million. Its net assets stand at $247.85 million, representing 0.30% of XRP’s market share. The market price dropped to $15.13.

The XRPZ ETF, listed on the NYSE and sponsored by Franklin, experienced a 0.40% drop in value. It reported a daily inflow of $737.47 thousand with a cumulative net inflow of $326.80 million. Its net assets stand at $221.98 million, accounting for 0.27% of XRP’s market share. The ETF’s market price fell by 2.00% to $14.69.

GXRP Losses $8.91 as TOXR ETF Holds Stable

The TOXR ETF, listed on the CBOE and sponsored by 21Shares, saw a daily decline of 2.23%, with no changes in its flow for the day. It has net assets totaling $166.91 million, holding 0.20% of XRP’s market share.

Lastly, the GXRP ETF, listed on the NYSE and sponsored by Grayscale, recorded a 2.24% drop, with a daily net outflow of $8.91 million. This XRP ETF has net assets of $74.43 million, representing 0.09% of the XRP market. Its market price decreased to $26.18.

Crypto World

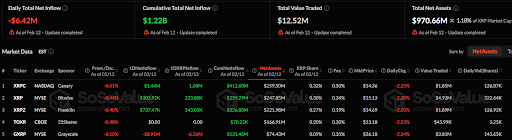

VCs Invest Over $2 Billion in Early 2026: Which Sectors Benefit?

As capital flows sharply out of the crypto market in early 2026 and investor sentiment remains at extreme fear levels, venture capital allocation decisions have become a valuable signal. These moves help retail investors identify sectors that may still hold potential during a bear market.

Recent reports indicate that the crypto market environment has changed. The sectors attracting VC funding have shifted accordingly.

Sponsored

Sponsored

VCs Invest Over $2 Billion in Crypto in Early 2026

Data from CryptoRank shows that venture capital firms have invested more than $2 billion into crypto projects since the beginning of the year. On average, weekly inflows have exceeded $400 million.

Several large deals stand out. Rain raised $250 million to build enterprise-grade stablecoin payment infrastructure. BitGo secured $212.8 million through its IPO, reinforcing its role as a digital asset custodian and security provider for institutional clients.

BlackOpal also raised $200 million for its GemStone product, an investment-grade vehicle backed by tokenized Brazilian credit card receivables.

Beyond these deals, Ripple invested $150 million in trading platform LMAX. The move supports the integration of RLUSD as a core collateral asset within institutional trading infrastructure. Tether also made a $150 million strategic investment in Gold.com, expanding global access to both tokenized and physical gold.

Analyst Milk Road notes that capital is no longer flowing into Layer 1 blockchains, meme coins, or AI integrations. Instead, stablecoin infrastructure, custody solutions, and real-world asset (RWA) tokenization have emerged as the dominant investment themes.

Sponsored

Sponsored

Market data supports this shift. Since the start of the year, total crypto market capitalization has fallen by roughly $1 trillion. In contrast, stablecoin market capitalization has remained above $300 billion. The total value of tokenized RWAs has reached an all-time high of over $24 billion.

What Does the Shift in VC Appetite Signal?

Ryan Kim, founding partner at Hashed, argues that VC expectations have fundamentally changed. The shift reflects a new investment standard across the industry.

In 2021, investors focused on tokenomics, community growth, and narrative-driven projects. By 2026, VCs will prioritize real revenue, regulatory advantages, and institutional clients.

“Notice what’s absent? No L1s. No DEXs. No ‘community-driven’ anything. Every dollar went to infrastructure and compliance,” Ryan Kim stated.

The largest deals listed above involve infrastructure builders rather than token-driven projects designed to generate price speculation. As a result, the market lacks the elements that previously fueled hype cycles and FOMO.

“Not on speculation. Not on hype cycles. They’re looking at the pipes, rails, and compliance layers,” analyst Milk Road said.

However, analyst Lukas (Miya) presents a more pessimistic view. He argues that crypto venture capital is in a state of collapse, citing a sharp, sustained decline in limited partner commitments.

He points to several warning signs. High-profile firms such as Mechanism and Tangent have shifted away from crypto. Many firms are quietly unwinding their positions.

It may still be too early to declare the collapse of crypto VC, given that more than $2 billion has flowed into the sector since the start of the year. At a minimum, these changes suggest that crypto is integrating more deeply with the traditional financial system, a potential sign of long-term maturation.

Crypto World

Coinbase stock jumps as top analysts maintain buy rating

Coinbase stock jumped by 5% on Friday, a day after the top crypto exchange reported weak financial results, including falling revenues and soaring losses.

Summary

- Coinbase share price bounced back after publishing its financial results.

- Its revenue declined, and its profits fell as expenses rose and crypto prices fell.

- Top Wall Street analysts maintained their bullish outlook while lowering their targets.

Coinbase shares jumped to $147, well above the year-to-date low of $140. It remains well below the all-time high of $445.

Top analysts maintained a buy rating on COIN stock

The rebound came after H.C. Wainwright maintained its buy rating on the company and set a $350 target. A move to that target would imply a 135% surge from the current level.

The company’s analysts noted that Coinbase had become a bargain after the recent crash, pushing it to its lowest level since 2024.

Additionally, they noted that the company would benefit from the CLARITY Act, which has been stuck in the Senate Banking Committee. A meeting between banks and companies in the crypto industry at the White House failed to resolve the key issue of allowing stablecoin rewards.

Other Wall Street companies maintained their buy rating on Coinbase stock even as they lowered their target price. Chris Brender of Rosenblatt Securities lowered the target price from $325 to $240, while Needham’s John Todaro slashed it from $290 to $230.

Benchmark’s Mark Palmer also slashed the target from $421 to $267. As a result, the average target among Wall Street analysts dropped to $303 from $400 three months ago.

Coinbase reported weak financial results on Thursday and blamed the ongoing crypto market crash. Its transaction revenue dropped to $982 million in the fourth quarter from $1.5 billion in Q4’24. This slowdown was offset by an increase in subscription and services revenue, which jumped to $727 million.

Coinbase reported significant quarterly losses after marking down its crypto assets like Bitcoin (BTC) and Ethereum (ETH). Its operating costs continued rising as it aims to become the “everything exchange”.

The company has invested in several key products, which it hopes will boost its revenue in the future. For example, it recently unveiled a prediction marketplace and aims to become a stockbroker by introducing tokenized stocks.

A major risk for Coinbase stock is that some analysts expect Bitcoin to remain under pressure in the near term. In a note on Thursday, analysts at Standard Chartered lowered their Bitcoin target to $100,000 and warned it could drop to $50,000.

Coinbase stock price technical analysis

The weekly chart shows that the COIN stock price has crashed in the past few months as Bitcoin and most altcoins have plunged. It dropped to a key support level, marking the lowest swings since September 2024.

The coin remains below all moving averages, while the Relative Strength Index has moved to the oversold level of 30, its lowest swing since 2023.

Therefore, the most likely scenario is where it resumes the downtrend, potentially to the key support level at $100.

Crypto World

Truth Social Files for Digital Asset ETFs

Truth Social Funds has filed with the SEC to launch two digital asset ETFs, aiming to integrate cryptocurrencies into traditional financial markets and attract new investors.

Truth Social Funds has filed a registration statement with the U.S. Securities and Exchange Commission (SEC) for two digital asset exchange-traded funds (ETFs) – the Truth Social Cronos Yield Maximizer ETF and the Truth Social Bitcoin and Ether ETF.

The Truth Social Cronos Yield Maximizer ETF will provide exposure to CRO, the native cryptocurrency of the Cronos ecosystem, while the Truth Social Bitcoin and Ether ETF will hold BTC and ETH. Both ETFs will also offer staking rewards.

The funds will be advised by Yorkville America Equities with a management fee of 0.95%.

“We are excited to launch our initial two Digital/Crypto offerings under Truth Social ETFs. In partnership with Crypto.com, we plan to provide an investment platform for investors covering multiple aspects of digital and crypto investing with both capital appreciation and income opportunities,” said Steve Neamtz, President of Yorkville America Equities.

According to the announcement, the introduction of these digital asset ETFs is expected to enhance market liquidity. It provides a more structured, regulated avenue for investing in cryptocurrencies, which is particularly appealing to those who have been hesitant due to volatility and regulatory uncertainty incrypto markets.

The move by Truth Social Funds is part of a broader trend in the financial industry, where traditional financial institutions are increasingly exploring the inclusion of digital assets.

This article was generated with the assistance of AI workflows.

Crypto World

BlackRock Increases Bitmine Stake to Over 9 Million Shares: What’s Next?

If you think the institutional appetite for crypto ended with the ETF approvals, look again. In a move that signals massive long-term conviction, the world’s biggest asset manager, BlackRock, has reportedly increased its stake in Bitmine to over 9 million shares, according to a recent 13H-FR filing surfaced on X.

While retail traders are distracted by red candles, the world’s largest asset manager is actively seizing more infrastructure.

This isn’t just a passive buy; it’s a statement. When Larry Fink’s firm moves millions of shares in a crypto-native company, it changes the liquidity map for everyone involved.

Context: The Wall Street Pivot Continues

This accumulation comes hot on the heels of BlackRock’s dominance in the spot ETF market.

Their iShares Bitcoin (BTC) Trust has already shattered growth records, surpassing $70 billion in assets faster than any ETF in history.

Now, by significantly increasing exposure to Bitmine, the world’s biggest asset manager is doubling down on the operational side of the blockchain ecosystem.

While headlines often focus on spot price, smart money follows the institutional hedging and whale positioning deeper in the stack.

BlackRock holding over 9 million shares suggests it sees mining and infrastructure not as a risky bet, but as a critical asset class worthy of its balance sheet.

Discover: The best new crypto on the market

BlackRock and Bitmine: Strategic Accumulation or Just a Hedge?

Why buy the miners when you already own the coin? This is the question savvy traders need to answer.

Owning equity in operations like Bitmine offers BlackRock a strategic leveraging of Bitcoin’s success without the custody fees associated with direct coin holding.

This stake increase indicates that BlackRock believes the sector is currently undervalued relative to its future cash flow potential.

Furthermore, this aligns with a broader trend of incumbents staking claims in the digital asset space. We are seeing similar aggressive moves elsewhere, such as Goldman Sachs revealing significant crypto holdings.

Wall Street is no longer dipping a toe in; they are buying the swimming pool.

What Traders Should Watch Next

If you are holding crypto-linked equities or spot BTC, this is a bullish signal for the medium term. Institutional accumulation usually precedes a supply squeeze.

Watch for two things in the coming weeks:

- Sector Correlation: Does Bitmine’s stock price begin to decouple from daily BTC movements due to this institutional support?

- Global Sentiment: This Western accumulation parallels bullish crypto sentiment emerging in Hong Kong, suggesting a coordinated global bid for crypto assets is forming.

Ignore the minute-by-minute candles and watch the whales. When BlackRock buys 9 million shares, they aren’t planning to sell next week.

Discover: The ultimate crypto for portfolio diversification

The post BlackRock Increases Bitmine Stake to Over 9 Million Shares: What’s Next? appeared first on Cryptonews.

Crypto World

Bitcoin Eyes $80K as Traders Expect A Short-term BTC Price Rebound.

Bitcoin (BTC) charged above $69,000 on Friday as US CPI data showed cooling inflation, leading traders to hope for a short-term BTC price recovery.

Key takeaways:

-

Traders favor a short-term BTC price relief rally, but bulls must first take out the resistance at $68,000 to $70,000.

-

Bitcoin market analysis forecasts a short squeeze toward $80,000 if bulls succeed in confirming the $65,000 level as support.

Bitcoin price must take out resistance at $68,000

Bitcoin attempted a breakout on Thursday but “got slammed back down at the $68K level,” said analyst Daan Crypto Trades in a Friday post on X, adding:

“That’s the area to watch if BTC wants to see another leg up at some point.”

An accompanying chart showed the BTC/USD pair consolidating within a falling wedge in the one-hour time frame.

Related: Bitcoin ETFs bleed $410M as Standard Chartered slashes BTC target

The pattern projected a short-term rally to $72,000 once the price breaks above the wedge’s upper trendline at $68,000.

Fellow Ted Pillows said that the “chances of a deeper correction would increase” if the $65,000-$66,000 support does not hold.

“To the upside, if Bitcoin reclaims the $70,000 level, it could rally 8%-10% really quickly.”

From a technical perspective, BTC’s price action has been forming a V-shaped recovery chart pattern on the four-hour chart, as shown below.

The BTC/USD pair is retesting a key area of resistance defined by the 20-period EMA at $67,500 and the 200-week exponential moving average (EMA) at $68,000.

Bulls need to push the price above this level to increase the chance of a rally to the pattern’s neckline at $72,000.

As Cointelegraph reported, if Bitcoin breaks $72,000, it will revive the hopes of a recovery toward the 20-day EMA at $76,000 and eventually, the 50-day simple moving average above $85,000, bringing the total gains to 26%.

Liquidation risk builds near $80,000

Exchange order-book liquidity data from CoinGlass showed Bitcoin’s price pinned below two walls of asks centered just below $75,000 and around $80,000.

“$BTC liquidations are stacking well above $72K, and around the area from $77K to $80K,” Bitcoin analyst ZordXBT said in his latest post on X.

Below the spot price, bid orders were lying down to $64,500, “where I have my limit orders placed,” the analyst said, adding:

“If the market holds itself here, it can very easily eat those liquidity bubbles.”

The chart above suggests that if the $72,000-$75,000 level is broken, it could spark a liquidation squeeze, forcing short sellers to close positions and driving prices toward $80,000, which is the next major liquidity cluster.

Zooming in, Ted Pillows highlighted significant bid clusters at $65,000 and ask orders around $68,000, saying that the price is likely to revisit these areas to wipe out the liquidity.

“I think a revisit of $65,000 and a pump to $68,000 will both happen soon.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

3 Altcoins To Watch This Weekend | February 14

Altcoins are showing sharply mixed signals this week, with explosive rallies colliding against deepening corrections across the market. While some tokens are capturing attention with a powerful breakout setup, others continue to struggle near fresh lows.

Thus, BeInCrypto has analysed three such altcoins which investors should keep an eye on over the weekend.

Sponsored

Sponsored

Pippin (PIPPIN)

PIPPIN ranks among the best-performing altcoins this week, surging 203% over seven days. The meme coin trades at $0.492 at publication, remaining below the $0.514 resistance level. Strong momentum has fueled speculative interest as traders monitor continuation signals.

Technically, PIPPIN is breaking out of a descending broadening wedge, a pattern projecting a 221% rally. A confirmed breakout requires flipping $0.600 into support. While the projected upside is significant, the practical target remains clearing the $0.720 all-time high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If bullish momentum fades or macro conditions weaken, downside risk increases. A drop below $0.449 support could send PIPPIN toward $0.372. Such a move would invalidate the bullish thesis and negate the wedge breakout structure.

Sponsored

Sponsored

Aptos (APT)

APT price has declined 12.6% over the past week, forming two new all-time lows during this period. The altcoin trades at $0.899 at publication, remaining below the $1.00 psychological level. Persistent weakness reflects continued bearish momentum across the broader crypto market.

The Money Flow Index currently sits below the 20.0 threshold, placing APT in the oversold zone. Such readings often signal selling saturation and potential accumulation. If the MFI rises above 20.0 and buying pressure strengthens, reclaiming $1.029 could confirm recovery momentum.

If bearish momentum persists, downside risk remains elevated. Continued selling pressure may push APT below current levels. A break lower could result in another all-time low near $0.800, reinforcing the prevailing negative trend.

Kite (KITE)

KITE is another altcoin to watch this weekend as it has emerged as a strong contrast to weaker altcoins, consistently forming new all-time highs this week. The token trades at $0.197 at publication, marking a 53% weekly gain. Sustained upside momentum reflects strong investor demand and improving crypto market sentiment.

KITE reached a fresh all-time high of $0.210 today, reinforcing bullish technical structure. Persistent capital inflows appear to be driving the rally. If buying pressure continues, the price could extend toward $0.231, supported by strong volume and positive short-term momentum.

However, overbought conditions could trigger profit-taking. If buying interest begins to fade, KITE may retrace toward the $0.163 support level. A decline to that zone would invalidate the bullish thesis and signal weakening upside momentum.

Crypto World

Is the Worst Over or Another Dead-Cat Bounce?

PI is the best-performing top 100 cryptocurrency today (February 13).

The cryptocurrency market made another move south in the past 24 hours, with most leading digital assets (including BTC) charting minor losses.

Somewhat surprisingly, Pi Network’s PI has defied the bearish environment, posting a daily gain of around 8%.

Finally in Green

Pi Network’s native cryptocurrency has been in a sharp decline over the past several months, disappointing its huge base of proponents and investors. Just a few days ago, its price dropped to a new all-time low of around $0.13, while its market cap plunged to around $1.1 billion.

Over the last 24 hours, though, the bulls stepped in, and PI reached almost $0.15. Its capitalization once again surpassed $1.3 billion, making it the 55th-largest cryptocurrency.

The notable resurgence comes shortly after the team behind the project provided an update on its Node infrastructure. The developers revealed that the Pi Mainnet blockchain protocol is undergoing a series of improvements and set a deadline of February 15 for the first upgrade.

The Core Team explained that it will run the consensus algorithm with Pioneers who have applied to become Nodes and have successfully installed all required blockchain software on their computers.

“While our hope is to include as many Pioneers as possible when defining the Node requirements, the availability and reliability of individual nodes in the network affect the safety and liveness of the network,” the official announcement reads.

PI’s price revival also coincides with a slowdown in token unlocks. Approximately 19 million coins are scheduled for release today (February 13), marking the record day for the next 30 days. Towards the end of the month, the daily unlocks are expected to drop below 5 million, which could reduce selling pressure and help stabilize the price.

You may also like:

The Recent Rumors

Earlier this month, some X users speculated that Kraken is preparing to allow trading services with PI. Such support from one of the leading crypto exchanges would likely have a positive price impact on the asset, as it would increase its liquidity and availability and improve its reputation.

Perhaps the biggest boost will be if Binance decides to embrace PI. The world’s largest crypto exchange was expected to do so last year and even held a community vote to determine whether its users wanted the token listed on the platform. Despite the overwhelming support, Binance has yet to honor their wish.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

The Mortgage Market’s Bitcoin Experiment Has Already Begun

A US-based structured-credit firm is pushing TradFi boundaries by integrating crypto into real-world lending. Newmarket Capital, managing nearly $3 billion in assets, is pioneering hybrid mortgage and commercial loans that leverage Bitcoin (BTC) alongside conventional real estate as collateral.

Its affiliate, Battery Finance, is leading the charge in creating financial structures that leverage digital assets to support credit without requiring borrowers to liquidate holdings.

Sponsored

Sponsored

Bitcoin to Reshape Mortgages and Real-World Lending

The initiative targets borrowers who are crypto-asset holders, including tech-savvy Millennials and Gen Z. It provides a path to financing that preserves investment upside while enabling access to traditional credit markets.

By combining income-producing real estate with Bitcoin, the firm seeks to mitigate volatility risk while offering borrowers a novel lending solution.

According to Andrew Hohns, Founder and CEO of Newmarket Capital and Battery Finance, the model involves income-producing properties, such as commercial real estate, paired with a portion of the borrower’s Bitcoin holdings as supplemental collateral.

Bitcoin is valued as part of the overall loan package, providing lenders with an asset that is liquid, divisible, and transparent, unlike real estate alone.

“We’re creating credit structures that produce income, but by integrating measured amounts of Bitcoin, these loans participate in appreciation over time, offering benefits traditional models don’t provide,” Hohns explained in a session on the Coin Stories Podcast.

Early deals demonstrate the concept, with Battery Finance refinancing a $12.5 million multifamily property using both the building itself and approximately 20 BTC as part of a hybrid collateral package.

Borrowers gain access to capital without triggering taxable events from selling crypto, while lenders gain additional downside protection.

Sponsored

Sponsored

Institutional-Grade Bitcoin Collateral

Unlike pure Bitcoin-backed loans, which remain experimental and niche, Newmarket’s model is institutional-grade:

- It is fully underwritten

- Income-focused, and

- Legally structured for US regulatory compliance.

Bitcoin in these structures is treated as a collateral complement rather than a standalone payment method; mortgage and loan repayments remain in USD.

“Bitcoin adds flexibility and transparency to traditional lending, but the foundation is still income-producing assets,” Hohns said. “It’s a bridge between digital scarcity and conventional credit risk frameworks.”

The approach builds on a broader trend of integrating real-world assets (RWA) with digital holdings. In June 2025, federal agencies like the FHFA signaled in mid-2025 that crypto could be considered for mortgage qualification,

Sponsored

Sponsored

However, private lenders like Newmarket Capital are moving faster, operationalizing hybrid collateral structures while adhering to existing regulatory frameworks.

Newmarket and Battery Finance’s work illustrates how Bitcoin and other cryptocurrencies can interface with TradFi as tools to unlock new forms of lending and credit.

Still, challenges exist. BeInCrypto reported that despite Fannie Mae and Freddie Mac’s plans to accept Bitcoin as mortgage collateral, there is a catch.

The Bitcoin must be held on regulated exchanges. Bitcoin in self-custody or private wallets won’t be recognized.

Sponsored

Sponsored

This raises concerns about financial sovereignty and centralized control. Policy limits Bitcoin’s use in mortgage lending to custodial, state-visible platforms, excluding decentralized storage.

“This isn’t about adoption vs. resistance. It’s about adoption with conditions. You can play— …but only if your Bitcoin plays by their rules. Rules designed for control…As adoption deepens, pressure will mount for lenders to recognize properly held Bitcoin—not just coins on an exchange…Eventually, the most secure form of money will unlock the most flexible capital,” one user remarked.

Nevertheless, while this innovation is not a solution to housing affordability, it represents a meaningful step toward mainstream adoption of crypto in real-world finance.

Crypto World

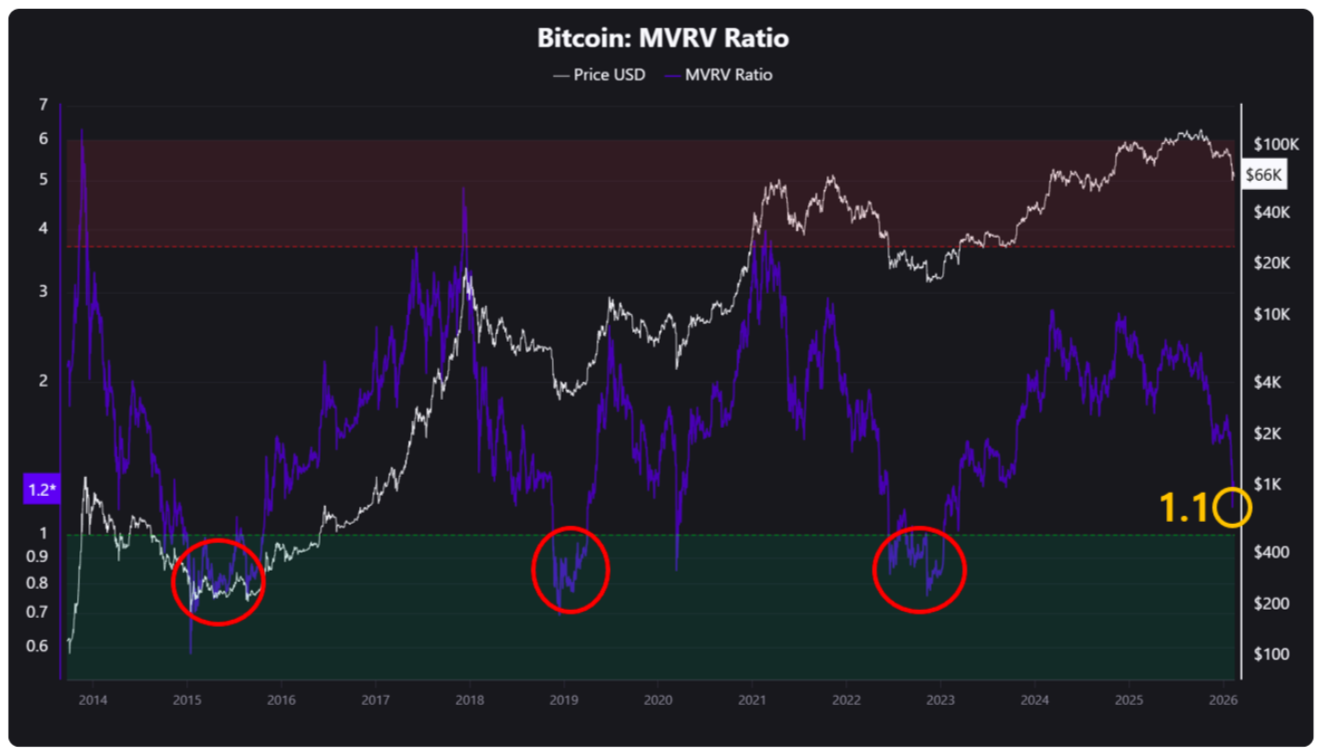

Bitcoin Price Metric Sees ‘Undervaluation’ As It Taps Three-Year Lows

Bitcoin (BTC) is approaching “undervalued” territory for the first time in three years as a classic indicator nears its inflection point.

Key points:

-

Bitcoin has not been so “undervalued” versus its market cap since March 2023, research shows.

-

The MVRV ratio is approaching its key breakeven level for the first time in over three years.

-

MVRV analysis sees Bitcoin in the process of reversing its downtrend.

Bitcoin value metric echoes $20,000 price

Research from onchain analytics platform CryptoQuant released on Friday reveals key developments on Bitcoin’s market value to realized value (MVRV) ratio metric.

A classic BTC price gauge, the MVRV ratio compares Bitcoin’s market cap to the price at which the supply last moved, also known as its “realized cap.”

Values below 1 imply that the supply is undervalued at current prices. Last week, as BTC/USD dropped below $60,000, MVRV hit 1.13 — its lowest reading since March 2023, when it traded at just $20,000.

“Following its all-time high in October 2025, Bitcoin has been in a downtrend for approximately four months and is now approaching what can be considered an undervalued zone,” CryptoQuant contributor Crypto Dan commented.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

MVRV last registered below 1 at the start of 2023. At the time of Bitcoin’s latest all-time high last October, the ratio peaked at 2.28.

Crypto Dan questioned the validity of Bitcoin’s 52% drop from all-time highs. Neither the top nor the bottom, he argued, was characteristic of typical MVRV behavior.

“However, unlike previous cycles, Bitcoin did not experience a sharp rise into a clearly overvalued zone during the recent bull cycle,” the research post continued.

“This distinction is important to recognize. As a result, the current decline may also differ from past market bottoms, and it appears necessary to respond with this possibility in mind.”

Bitcoin price bottom “being forged right now”

In January, Cointelegraph reported on early signs that BTC price action may be preparing a trend reversal.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto sentiment hits record low

On two-year rolling time frames, the Z-score of the MVRV ratio, which divides its readings by the standard deviation of market cap, recently fell to historic lows.

“The current Z-Score of $BTC is lower than during the bear market bottom in 2015, 2018, COVID crash 2020 and 2022,” crypto trader, analyst and entrepreneur Michaël van de Poppe observed at the time.

This week, CryptoQuant contributor GugaOnChain used another Z-score iteration to show that BTC/USD was in a “capitulation zone.”

“The indicator suggests that we are approaching the historical accumulation phase,” he wrote in an accompanying post.

“The statistical deviation of the Z-Score screams opportunity, signaling that the bottom of this downtrend is being forged right now.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video6 hours ago

Video6 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

(@SweatyKodi)

(@SweatyKodi)

![MORAD - NO MONEY [VIDEO OFICIAL]](https://wordupnews.com/wp-content/uploads/2026/02/1771006117_maxresdefault-80x80.jpg)