Crypto World

AVAX breaks key pattern as $9 turns into major supply zone

- The Avalanche (AVAX) token traded around $8.84 as sell-off pressure kept prices lower.

- Bulls have failed to reclaim the $10 mark and fresh declines may push AVAX to lows of $6.30.

- Sentiment across crypto is largely bearish.

Avalanche (AVAX) is facing mounting resistance just below the $9 mark, where persistent bearish pressure has stifled recent recovery attempts.

The altcoin’s bearish outlook aligns with broader cryptocurrency market vulnerability, and having recoiled off the resistance level, technicals suggest fresh losses are likely.

Avalanche price recap

AVAX has navigated a turbulent path over the past month, with prices falling since hitting highs near $15 on January 14, 2026.

The decline, currently putting the token 39% off its 30-day peak, has come amid significant macroeconomic headwinds and sector-wide profit-taking.

Bears have largely taken control despite Avalanche C-Chain’s recent network milestones, including throughput.

According to Ava Labs’ Martin Eckardt, the chain could hit over 4 million gas per second by next week.

Avalanche C-Chain is adding more throughput by the day. Goal is to hit 3.5m gas per second by the end of today and 4m by the end of next week. If everything goes smoothly we will keep pushing, since all the new supply is getting used immediately pic.twitter.com/NvKSn8nqfA

— Martin Eckardt 🔺 (@martin_eckardt) February 12, 2026

The dip to under $8.30 on February 5, 2026, intensified the sell-off pressure, and bulls find it difficult to break higher.

In the last 24 hours, the token fluctuated between a low of $8.64 and a high of $8.96, with trading volume dipping 7% to 254 million.

The past week’s performance tells a similar story of stalled momentum.

AVAX has seen two green days out of seven, with volatility under 1%, as bears defend the $9 threshold amid extreme fear readings on the Crypto Fear & Greed Index.

Avalanche price prediction: Technical picture

From a technical standpoint, AVAX has broken below a key weekly falling wedge pattern, with $9 acting as an immediate supply zone.

Further short-term bearish bias is from the weekly RSI at 30, with a move to oversold conditions hinting at a potential dip before another bounce on a volume uptick.

A notable leg down will rely on key support clusters at $8.50–$8.25, a zone reinforced by recent lows. If prices breach this defense line, bearish targets include lows of $7.50 and $.6.30.

On the other hand, upside catalysts will include a reclaim of $9.38 and a retest of the short-term max pain projection at the $13.90 resistance.

If indecisiveness resolves in favour of bulls, with the weekly MACD forming a bullish crossover, the next target will be the dynamic resistance mark coinciding with the 50-week moving average (at $19.42 as of writing).

The 200-day moving average is offering resistance at $23.69.

Avalanche’s lack of upside momentum mirrors Bitcoin’s struggle below $70,000. Crypto analysts see the overall market sentiment as still largely bearish, with forecasts for a potential dip to $50k for BTC.

Downside momentum will cascade across altcoins.

Crypto World

5 leading crypto jurisdictions alternative to MiCA in 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

MiCA delivers certainty in Europe, but rising compliance costs are pushing many crypto firms to explore flexible offshore licensing in 2026.

Summary

- MiCA brings EU certainty, but firms eye mid-shore hubs for flexibility, tax efficiency, and faster crypto market entry.

- Dubai, Canada, and BVI have emerged as alternatives to MiCA, offering lower costs and specialized compliance paths.

- LegalBison helps crypto firms navigate global licensing as businesses diversify beyond single-jurisdiction MiCA models.

The implementation of the MiCA regulation has undeniably brought a high degree of certainty to the European market. However, for many Crypto Asset Service Providers (CASPs), the trade-off such as high capital requirements, strict physical substance rules, and intensive reporting can be a barrier to entry.

In 2026, the global landscape offers several “mid-shore” and offshore alternatives that provide agility, tax efficiency, and robust legal frameworks without the specific constraints of an EU crypto license.

Whether someone is looking for a rapid market entry, specialized activity-based rules, or a tax-neutral home for their treasury, these jurisdictions represent the strongest alternatives to MiCA compliance.

1. Dubai (VARA): The specialized global hub

For those looking for a jurisdiction that treats crypto as its primary focus rather than an add-on to traditional finance, the Dubai VARA crypto license is the premier choice for 2026.

Why Choose Dubai VARA?

- Activity-Specific Rulebooks: Unlike the broader MiCA framework, VARA provides tailored rulebooks for specific activities like custody, exchange, and broker-dealer services. This allows for more precise operational planning.

- Tax Neutrality: Dubai remains one of the most tax-efficient hubs in the world, offering 0% corporate tax for qualifying activities in many free zones.

- Speed and Innovation: The application process is generally more interactive and faster than the typical 12-month wait for an EU crypto license.

For firms targeting the MENA region and institutional capital, the Dubai VARA crypto license offers a level of prestige that rivals any European regulator.

2. Canada: The low-barrier gateway to North America

For startups that prioritize speed and cost-effectiveness, the Canada crypto license with MSB (Money Services Business) registration is often the fastest route to a reputable Western license.

The Canadian Advantage

- No Minimum Capital: Unlike MiCA, which requires up to €150,000 in Tier 1 capital, Canada has no fixed minimum capital requirement for MSB registration.

- Rapid Onboarding: Registration with FINTRAC can often be completed in 3 to 5 months, making it significantly faster than pursuing a Poland crypto license or CASP license in Malta.

- FMSB Option: Canada allows for “Foreign Money Services Business” status, enabling some firms to operate without a full-scale physical headquarters in the country.

3. The British Virgin Islands (BVI): The professional offshore choice

The BVI crypto license (under the VASP Act) has become the gold standard for token issuers and DeFi protocols that require a tax-neutral environment.

Why the BVI?

- Zero Tax: 0% corporate tax, 0% capital gains tax, and no withholding tax on dividends.

- Legal Stability: Based on English Common Law, the BVI offers a highly predictable legal environment that investors and VCs trust.

- Flexibility for Token Issuers: For those issuing a MiCA-compliant token, the BVI offers a compelling “Plan B” with far fewer restrictions on how token generation events (TGEs) are structured.

Asia’s Emerging Titans: Hong Kong and Singapore

For firms looking to tap into the world’s most active retail and institutional trading markets, securing a crypto license in Asia is a strategic necessity.

4. Hong Kong (SFC)

By 2026, Hong Kong has fully opened its doors to retail trading. It provides a stable, highly regulated environment that serves as the primary bridge to liquidity from Mainland China.

5. Singapore (MAS)

While the MAS is known for its rigorous standards, a Singaporean license is essentially a “seal of quality.” It is the preferred choice for major payment institutions (MPI) that want to combine crypto services with traditional fiat processing.

Strategic comparison: 2026 crypto licensing landscape

| Jurisdiction | Primary License | Timeline | Min. Capital | Tax Profile |

| Dubai | VARA License | 4-7 Months | ~$50k-$150k | 0% – 9% |

| Canada | MSB Registration | 3-5 Months | Varies | ~15% – 27% |

| BVI | VASP License | 4-6 Months | Varies | 0% |

| EU (e.g. CZ) | Czech Republic CASP license | 6-12 Months | €50k – €150k | 19% – 21% |

Global expansion with LegalBison

Choosing a jurisdiction is the most consequential decision a founder can make. LegalBison is a leading legal firm specializing in global company formation and crypto licensing.

By providing end-to-end support from initial feasibility studies to the final submission of an application; LegalBison ensures that a business is structurally sound and compliant with local regulators, whether it’s targeting the Middle East, the Americas, or Asia.

Diversification is the new compliance

In 2026, the most successful crypto businesses are rarely “single-jurisdiction” entities. While MiCA compliance provides a massive market, alternative hubs like Dubai, Canada, and the BVI offer specialized advantages that can significantly lower your operational burn rate.

By working with a dedicated partner like LegalBison, businesses can ensure that their choice of jurisdiction aligns with their long-term roadmap, whether that includes issuing a MiCA-compliant token or expanding footprint across the Asia-Pacific region.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Crypto Markets Rally After Softer-Than-Expected US Inflation Report

Total market value rose over 4% today, though risk appetite remains fragile.

Crypto markets caught some relief on Friday, Feb. 13, as investors digested a softer-than-expected U.S. inflation report.

Total crypto market capitalization surged almost 5% over the past 24 hours to $2.44 trillion, while most large-cap crypto assets saw moderate gains on the day.

Bitcoin (BTC) climbed back over 69,000, up 4.5% today and pushing its weekly price change into the green, up 1.7%.

Ethereum (ETH) rose over 7.5% to trade back above $2,000, bringing weekly gains to 4.4%.

Figure Heloc (FIGR_HELOC) waws the only top-10 assets in the red this morning, though it was down less than 1%. BNB saw subdued gains, up just 1.7% today.

Disciplined Leverage

Sentiment remains unstable despite the boost in prices. Analysts at glassnode noted in an X post on Thursday, Feb. 12, that Bitcoin’s net unrealized profit/loss has slipped back into the hope/fear regime at around 0.18, indicating thin profit cushions.

“This regime tends to be reactive,” glassnode said, adding that rallies often meet sell pressure while downside moves can extend as conviction fades.

Paul Howard, senior director at Wincent, a high-frequency crypto market maker, told The Defiant that markets are showing “a degree of fragility,” as traders remain worried about aftershocks after the Oct. 10 crash that wiped out nearly $20 billion in leveraged positions. Howard elaborated:

“Rumours surrounding the fallout from 10/10 — reportedly impacting at least one U.S.-based firm — have contributed to a more cautious tone in certain segments. This reinforces the importance of prudent risk management and disciplined use of leverage, particularly in an environment where liquidity can tighten quickly.”

The Crypto Fear & Greed Index remains deep in “extreme fear” territory, though it slightly improved after yesterday’s low.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Pi Network (PI) led gainers today, up 10%, followed by Midnight (NIGHT), up 9%.

On the downside, World Liberty Financial (WLFI) was today’s biggest loser among large-caps, though it’s down just 2.3%.

As for liquidations, according to CoinGlass data, roughly 90,640 traders were liquidated over the past 24 hours, with total losses nearing $260 million. Bitcoin accounted for $118.2 million and Ethereum for $56 million.

ETFs and Macro Conditions

On Thursday, Feb. 12, spot Bitcoin ETFs saw even heavier outflows than the day before, posting net outflows of $410.4 million, data from SoSoValue shows. Spot Ethereum ETFs, meanwhile, also recorded net outflows, losing $113.1 million.

In terms of macro dynamics, today the U.S. Bureau of Labor Statistics released its latest Consumer Price Index (CPI) report, showing prices rose 2.4% year-over-year in January, just below the 2.5% forecast by economists surveyed by Dow Jones. Core inflation, which excludes food and energy, matched expectations at 2.5%.

Crypto World

AAVE Price Still Under Duress Despite New Governance Model

Aave Labs has unveiled a fresh governance initiative that could redefine the future direction of one of the crypto sector’s leading lending protocols.

While on paper the developments appear to be a sound initiative, the AAVE price has failed to reflect due to investors’ behavior.

Sponsored

Sponsored

AAVE Launches New Governance Model

Dubbed “Aave Will Win,” the proposal calls on the Aave DAO to endorse a comprehensive roadmap centered on the forthcoming V4 upgrade. If approved, V4 would serve as the core infrastructure for the protocol’s next phase, establishing a framework where 100% of revenues from products developed by Aave Labs are allocated directly to the DAO.

AAVE price remains under pressure despite the rollout of its new governance model. The token is currently in oversold territory based on the Money Flow Index. Recent readings suggest macro-driven selling pressure may have peaked after several sessions of sustained outflows.

Historically, the AAVE price has rebounded after entering oversold conditions. Oversold signals often reflect selling saturation, where buyers gradually step in. However, broader crypto market weakness and cautious investor sentiment make this setup less straightforward than previous recovery cycles.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

Sponsored

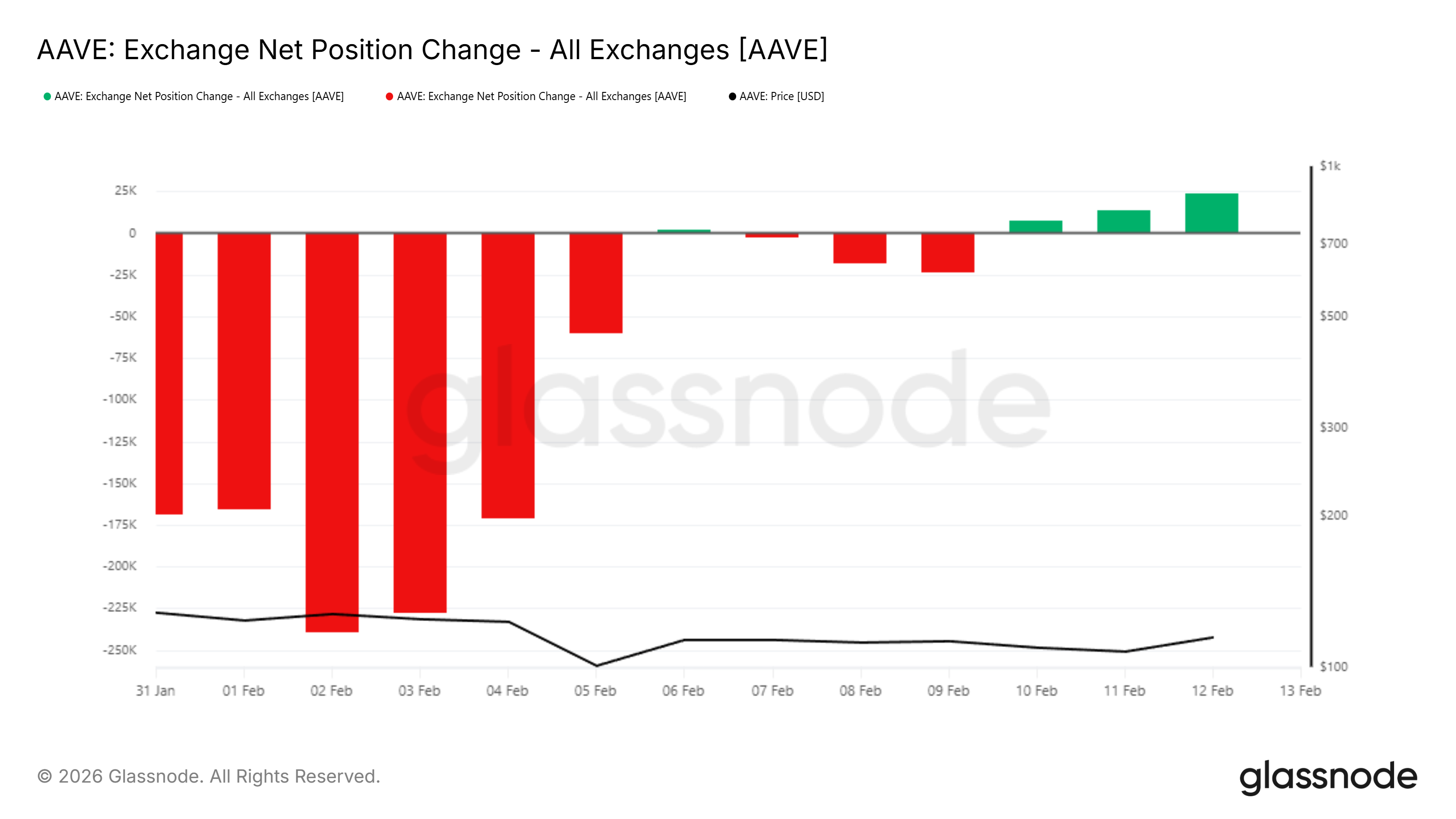

AAVE Holders Are Still Selling

Exchange net position change data shows that selling pressure continues to dominate. Net inflows to exchanges indicate that holders are moving AAVE to trading platforms. This behavior typically signals an intention to sell rather than accumulate.

Strengthening outflows and persistent exchange inflows may delay any potential rebound. Even positive protocol developments have failed to spark immediate upside momentum. Market participants appear focused on liquidity conditions and risk appetite rather than governance upgrades.

AAVE Price Is Holding Above Support

AAVE price trades at $111 at publication, holding above the 23.6% Fibonacci level at $109. This level is widely viewed as a bear market support floor. Maintaining this support is critical to prevent deeper structural weakness.

Mixed technical signals suggest AAVE may consolidate above $109 in the near term. Price could remain range-bound under the $119 resistance while momentum stabilizes. However, a confirmed break below $109 may expose AAVE to $100 or lower.

If selling pressure eases and investors regain confidence, AAVE could rebound from $109. A move above $119 would signal improving sentiment. Breaching $128 may open the path toward $136, invalidating the prevailing bearish outlook.

Crypto World

Ethereum price resembles adam and eve pattern, bottom forming?

Ethereum price is showing early signs of a potential macro bottom, with price action forming an Adam and Eve reversal pattern that could trigger a rally if key resistance is reclaimed.

Summary

- Adam and Eve reversal structure is developing, signaling bottom formation

- Point of control reclaim is required, to confirm the bullish reversal

- $2,450 resistance is the key upside target, if volume supports the breakout

Ethereum (ETH) price action is beginning to show characteristics commonly associated with bottoming formations as the market stabilizes after a prolonged corrective phase.

Following a sharp sell-off, ETH has produced a strong initial rebound and is now consolidating near key value levels. This behavior aligns closely with an Adam and Eve reversal pattern, a structure that often signals a transition from bearish control to early accumulation.

While the broader trend remains cautious, the developing structure suggests that downside momentum may be exhausting. If confirmed, this setup could mark the early stages of a trend reversal and open the door for a meaningful recovery toward higher resistance levels.

Ethereum price key technical points

- Adam and Eve bottoming pattern is developing, signaling a potential trend reversal

- Point of control acts as the activation level, required for confirmation

- Upside target sits near $2,450, aligned with high-timeframe resistance

The first phase of the Adam and Eve pattern, known as the “Adam” leg, is characterized by a sharp and impulsive move off the lows. Ethereum established a notable swing low around $1,740, followed by a strong rally that reflected aggressive short-covering and early-dip buying.

This sharp rebound typically indicates capitulation exhaustion rather than a sustainable trend continuation. In Adam and Eve structures, the Adam leg serves as the initial signal that selling pressure is beginning to fade, even if price has not yet transitioned into a full bullish trend.

Rounded base signals the ‘Eve’ Formation

Following the initial rebound, Ethereum has entered a slower, more rounded consolidation near the value area low. This price behavior forms the “Eve” portion of the pattern, where the market begins absorbing supply and building a base.

Unlike the sharp Adam leg, the Eve structure develops gradually, reflecting increasing balance between buyers and sellers. This phase is critical, as it allows the market to establish higher lows and build the foundation required for a sustainable move higher.

The fact that price is holding above the initial swing low suggests that sellers are losing dominance and that demand is beginning to stabilize near current levels.

Point of control is the key trigger

For the Adam and Eve pattern to be activated, Ethereum must reclaim the point of control on a closing basis. The point of control represents the price level with the highest traded volume and often acts as a pivot between bearish and bullish regimes.

A decisive reclaim of this level, particularly if backed by strong bullish volume, would confirm acceptance at higher prices and activate the reversal structure. Without this confirmation, the pattern remains speculative and vulnerable to further consolidation or downside retests.

Upside targets and reversal implications

If the pattern confirms, Ethereum’s next major upside objective sits near the $2,450 level, which aligns with high-timeframe resistance. A rally toward this region would represent a significant recovery from the recent lows and validate the broader bottoming thesis.

However, it is important to note that Adam and Eve reversals often unfold over time. Initial breakouts can be volatile, with pullbacks and retests common before sustained continuation occurs.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Ethereum appears to be in the early stages of a potential bottoming process. As long as price holds above the recent swing low near $1,740, the Adam and Eve pattern remains valid.

Confirmation will depend on Ethereum’s ability to reclaim the point of control with expanding bullish volume. If that occurs, a rotational move toward $2,450 becomes increasingly probable.

Crypto World

Anchorage Enables SOL Borrowing Without Moving Custody

Anchorage Digital has partnered with Kamino and Solana Company to roll out a structure that allows institutions to borrow against staked Solana without moving assets out of regulated custody, potentially addressing a key friction between traditional finance and decentralized lending markets.

In a Friday announcement, Anchorage said the initiative expands its Atlas collateral management platform by integrating with Kamino, a Solana-based decentralized lending protocol.

The effort is being carried out in collaboration with Solana Company, a publicly traded Solana (SOL) treasury created in partnership with Pantera Capital and Summer Capital.

Under the structure, institutions can use natively staked SOL as collateral for onchain borrowing while the assets remain held at Anchorage Digital Bank, a federally chartered crypto bank. That means investors can continue earning staking rewards while accessing liquidity through Kamino’s lending markets.

Anchorage acts as collateral manager, overseeing loan-to-value ratios, margin requirements and, if necessary, liquidations. Because the collateral remains in segregated custody, institutions do not need to move assets into smart contracts, a requirement that has historically limited participation by regulated entities.

Related: Solana treasuries sitting on over $1.5B in paper SOL losses

DeFi legislation hangs in the balance

The integration between Anchorage Digital, Kamino and Solana Company underscores growing institutional interest in decentralized finance. However, that momentum is unfolding against an uncertain regulatory backdrop in the United States, where lawmakers are still debating how to oversee digital assets and DeFi platforms.

At the center of the debate is the proposed CLARITY Act, which aims to establish clearer jurisdictional boundaries and regulatory standards for digital assets, including DeFi protocols.

While the bill is intended to reduce uncertainty for market participants, some DeFi advocates argue that it falls short of addressing how decentralized protocols, developers and governance structures should be treated under the law.

Industry groups have raised concerns that earlier draft language, including amendments introduced in January, does not sufficiently distinguish between centralized intermediaries and decentralized systems.

Amid the deadlock over the CLARITY Act’s future, the Trump administration convened a meeting with industry representatives earlier this month to break the impasse and gather feedback on outstanding provisions related to DeFi oversight and market structure.

Related: Who gets the yield? CLARITY Act becomes fight over onchain dollars

Crypto World

XRP ETFs Face $6.42M Outflow, Grayscale’s GXRP ETF Records Largest Loss

TLDR

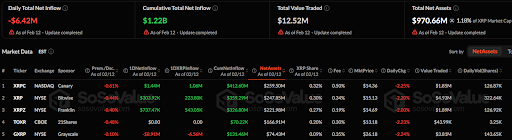

- XRP ETFs saw a daily outflow of $6.42 million, with cumulative inflows at $1.22 billion.

- XRPC ETF reported a $1.44M net inflow, but its market price declined by 2.25%.

- XRP ETF experienced a daily drop of 2.20% and a $303.92K net inflow.

- XRPZ ETF saw a 2.00% drop in market price, with $737.47K in daily inflows.

- The GXRP ETF recorded an $8.91M outflow, with a 2.24% drop in market price.

As of February 12, the daily total net inflow for XRP ETFs recorded a loss of $6.42 million. According to SoSoValue, the cumulative total net inflow remains positive at $1.22 billion. The total value traded stands at $12.52 million, showing a relatively low trading volume for the day. Total net assets for the XRP ETFs are valued at $970.66 million, representing 1.18% of the XRP market cap.

XRPC, XRPZ, and XRP ETFs Record Inflows

Among individual XRP ETFs, the XRPC ETF, listed on NASDAQ and sponsored by Canary, saw a slight 0.61% decline. It reported a 1-day net inflow of $1.44 million and a cumulative net inflow of $412.60 million. The ETF’s net assets stand at $259.50 million, with an XRP share of 0.32%. Its market price is $14.36, showing a 2.25% daily decline.

The XRP ETF, listed on the NYSE and sponsored by Bitwise, experienced a daily decrease of 2.20%. It saw a daily net inflow of $303.92 thousand and has a cumulative net inflow of $359.29 million. Its net assets stand at $247.85 million, representing 0.30% of XRP’s market share. The market price dropped to $15.13.

The XRPZ ETF, listed on the NYSE and sponsored by Franklin, experienced a 0.40% drop in value. It reported a daily inflow of $737.47 thousand with a cumulative net inflow of $326.80 million. Its net assets stand at $221.98 million, accounting for 0.27% of XRP’s market share. The ETF’s market price fell by 2.00% to $14.69.

GXRP Losses $8.91 as TOXR ETF Holds Stable

The TOXR ETF, listed on the CBOE and sponsored by 21Shares, saw a daily decline of 2.23%, with no changes in its flow for the day. It has net assets totaling $166.91 million, holding 0.20% of XRP’s market share.

Lastly, the GXRP ETF, listed on the NYSE and sponsored by Grayscale, recorded a 2.24% drop, with a daily net outflow of $8.91 million. This XRP ETF has net assets of $74.43 million, representing 0.09% of the XRP market. Its market price decreased to $26.18.

Crypto World

VCs Invest Over $2 Billion in Early 2026: Which Sectors Benefit?

As capital flows sharply out of the crypto market in early 2026 and investor sentiment remains at extreme fear levels, venture capital allocation decisions have become a valuable signal. These moves help retail investors identify sectors that may still hold potential during a bear market.

Recent reports indicate that the crypto market environment has changed. The sectors attracting VC funding have shifted accordingly.

Sponsored

Sponsored

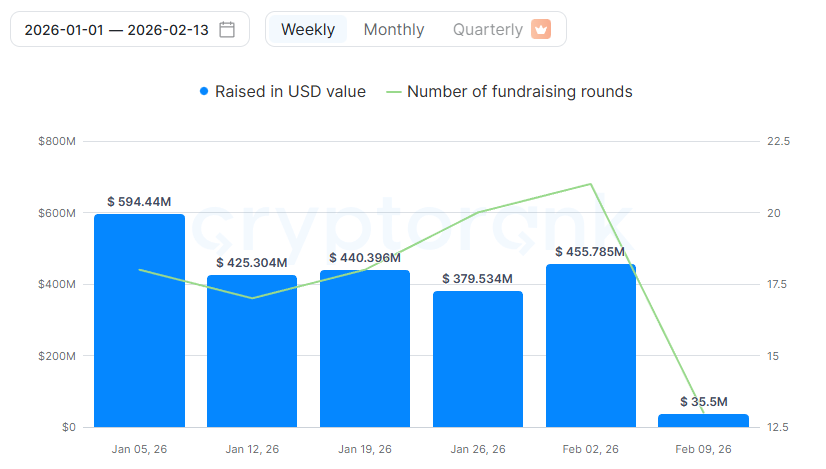

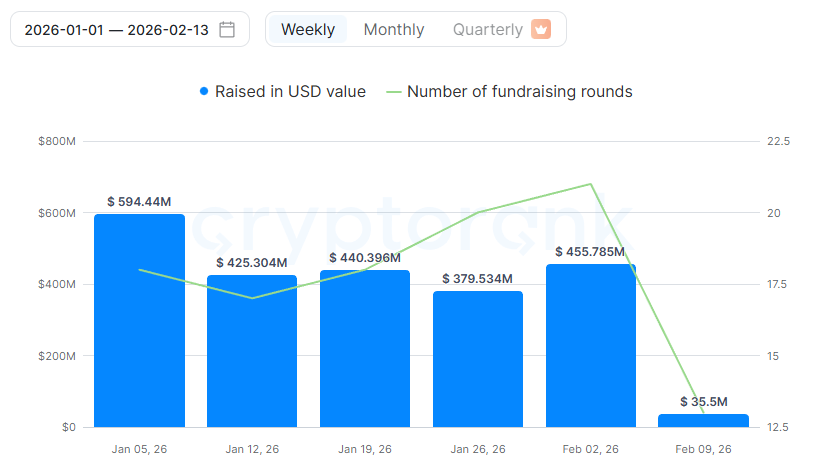

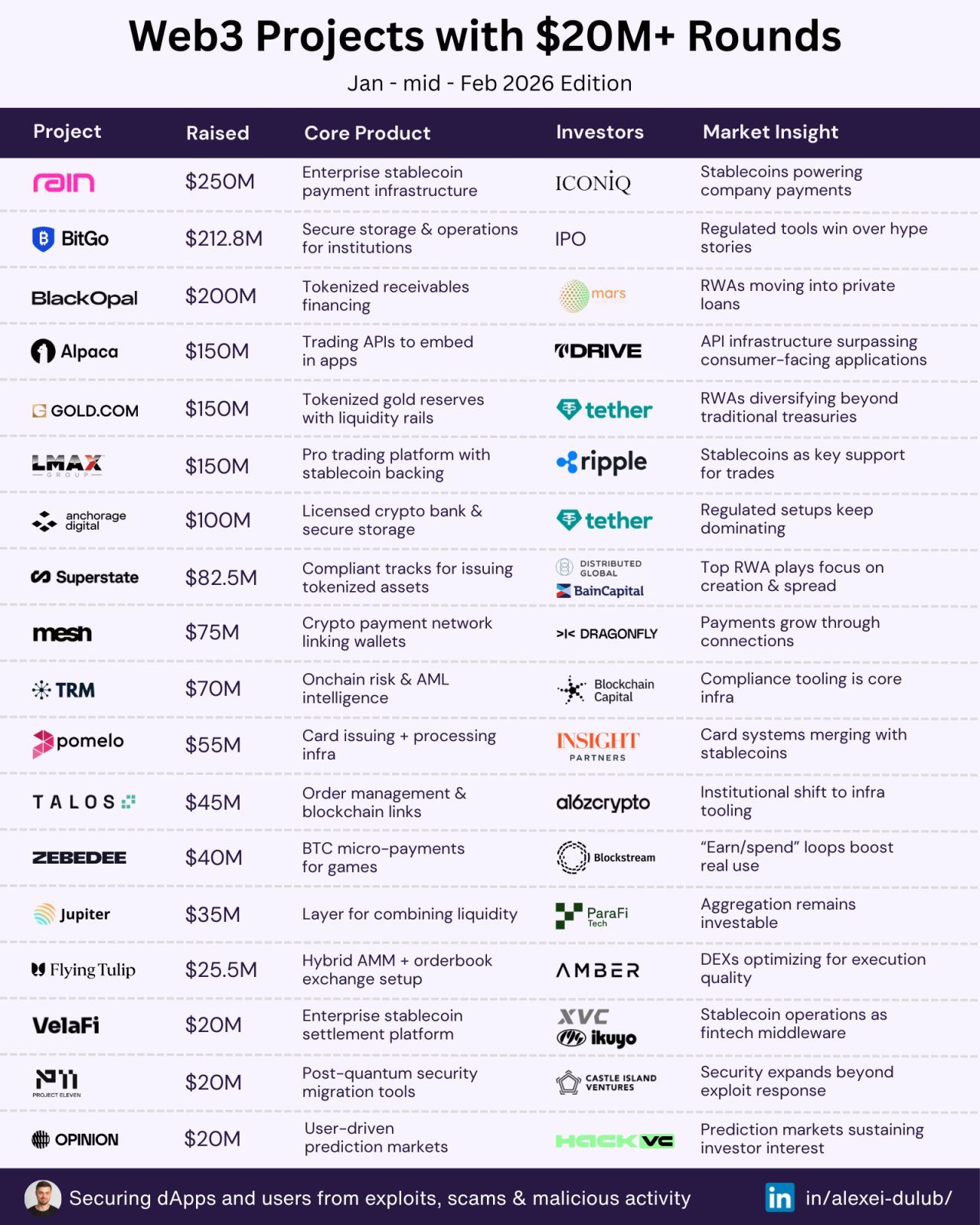

VCs Invest Over $2 Billion in Crypto in Early 2026

Data from CryptoRank shows that venture capital firms have invested more than $2 billion into crypto projects since the beginning of the year. On average, weekly inflows have exceeded $400 million.

Several large deals stand out. Rain raised $250 million to build enterprise-grade stablecoin payment infrastructure. BitGo secured $212.8 million through its IPO, reinforcing its role as a digital asset custodian and security provider for institutional clients.

BlackOpal also raised $200 million for its GemStone product, an investment-grade vehicle backed by tokenized Brazilian credit card receivables.

Beyond these deals, Ripple invested $150 million in trading platform LMAX. The move supports the integration of RLUSD as a core collateral asset within institutional trading infrastructure. Tether also made a $150 million strategic investment in Gold.com, expanding global access to both tokenized and physical gold.

Analyst Milk Road notes that capital is no longer flowing into Layer 1 blockchains, meme coins, or AI integrations. Instead, stablecoin infrastructure, custody solutions, and real-world asset (RWA) tokenization have emerged as the dominant investment themes.

Sponsored

Sponsored

Market data supports this shift. Since the start of the year, total crypto market capitalization has fallen by roughly $1 trillion. In contrast, stablecoin market capitalization has remained above $300 billion. The total value of tokenized RWAs has reached an all-time high of over $24 billion.

What Does the Shift in VC Appetite Signal?

Ryan Kim, founding partner at Hashed, argues that VC expectations have fundamentally changed. The shift reflects a new investment standard across the industry.

In 2021, investors focused on tokenomics, community growth, and narrative-driven projects. By 2026, VCs will prioritize real revenue, regulatory advantages, and institutional clients.

“Notice what’s absent? No L1s. No DEXs. No ‘community-driven’ anything. Every dollar went to infrastructure and compliance,” Ryan Kim stated.

The largest deals listed above involve infrastructure builders rather than token-driven projects designed to generate price speculation. As a result, the market lacks the elements that previously fueled hype cycles and FOMO.

“Not on speculation. Not on hype cycles. They’re looking at the pipes, rails, and compliance layers,” analyst Milk Road said.

However, analyst Lukas (Miya) presents a more pessimistic view. He argues that crypto venture capital is in a state of collapse, citing a sharp, sustained decline in limited partner commitments.

He points to several warning signs. High-profile firms such as Mechanism and Tangent have shifted away from crypto. Many firms are quietly unwinding their positions.

It may still be too early to declare the collapse of crypto VC, given that more than $2 billion has flowed into the sector since the start of the year. At a minimum, these changes suggest that crypto is integrating more deeply with the traditional financial system, a potential sign of long-term maturation.

Crypto World

Coinbase stock jumps as top analysts maintain buy rating

Coinbase stock jumped by 5% on Friday, a day after the top crypto exchange reported weak financial results, including falling revenues and soaring losses.

Summary

- Coinbase share price bounced back after publishing its financial results.

- Its revenue declined, and its profits fell as expenses rose and crypto prices fell.

- Top Wall Street analysts maintained their bullish outlook while lowering their targets.

Coinbase shares jumped to $147, well above the year-to-date low of $140. It remains well below the all-time high of $445.

Top analysts maintained a buy rating on COIN stock

The rebound came after H.C. Wainwright maintained its buy rating on the company and set a $350 target. A move to that target would imply a 135% surge from the current level.

The company’s analysts noted that Coinbase had become a bargain after the recent crash, pushing it to its lowest level since 2024.

Additionally, they noted that the company would benefit from the CLARITY Act, which has been stuck in the Senate Banking Committee. A meeting between banks and companies in the crypto industry at the White House failed to resolve the key issue of allowing stablecoin rewards.

Other Wall Street companies maintained their buy rating on Coinbase stock even as they lowered their target price. Chris Brender of Rosenblatt Securities lowered the target price from $325 to $240, while Needham’s John Todaro slashed it from $290 to $230.

Benchmark’s Mark Palmer also slashed the target from $421 to $267. As a result, the average target among Wall Street analysts dropped to $303 from $400 three months ago.

Coinbase reported weak financial results on Thursday and blamed the ongoing crypto market crash. Its transaction revenue dropped to $982 million in the fourth quarter from $1.5 billion in Q4’24. This slowdown was offset by an increase in subscription and services revenue, which jumped to $727 million.

Coinbase reported significant quarterly losses after marking down its crypto assets like Bitcoin (BTC) and Ethereum (ETH). Its operating costs continued rising as it aims to become the “everything exchange”.

The company has invested in several key products, which it hopes will boost its revenue in the future. For example, it recently unveiled a prediction marketplace and aims to become a stockbroker by introducing tokenized stocks.

A major risk for Coinbase stock is that some analysts expect Bitcoin to remain under pressure in the near term. In a note on Thursday, analysts at Standard Chartered lowered their Bitcoin target to $100,000 and warned it could drop to $50,000.

Coinbase stock price technical analysis

The weekly chart shows that the COIN stock price has crashed in the past few months as Bitcoin and most altcoins have plunged. It dropped to a key support level, marking the lowest swings since September 2024.

The coin remains below all moving averages, while the Relative Strength Index has moved to the oversold level of 30, its lowest swing since 2023.

Therefore, the most likely scenario is where it resumes the downtrend, potentially to the key support level at $100.

Crypto World

Truth Social Files for Digital Asset ETFs

Truth Social Funds has filed with the SEC to launch two digital asset ETFs, aiming to integrate cryptocurrencies into traditional financial markets and attract new investors.

Truth Social Funds has filed a registration statement with the U.S. Securities and Exchange Commission (SEC) for two digital asset exchange-traded funds (ETFs) – the Truth Social Cronos Yield Maximizer ETF and the Truth Social Bitcoin and Ether ETF.

The Truth Social Cronos Yield Maximizer ETF will provide exposure to CRO, the native cryptocurrency of the Cronos ecosystem, while the Truth Social Bitcoin and Ether ETF will hold BTC and ETH. Both ETFs will also offer staking rewards.

The funds will be advised by Yorkville America Equities with a management fee of 0.95%.

“We are excited to launch our initial two Digital/Crypto offerings under Truth Social ETFs. In partnership with Crypto.com, we plan to provide an investment platform for investors covering multiple aspects of digital and crypto investing with both capital appreciation and income opportunities,” said Steve Neamtz, President of Yorkville America Equities.

According to the announcement, the introduction of these digital asset ETFs is expected to enhance market liquidity. It provides a more structured, regulated avenue for investing in cryptocurrencies, which is particularly appealing to those who have been hesitant due to volatility and regulatory uncertainty incrypto markets.

The move by Truth Social Funds is part of a broader trend in the financial industry, where traditional financial institutions are increasingly exploring the inclusion of digital assets.

This article was generated with the assistance of AI workflows.

Crypto World

BlackRock Increases Bitmine Stake to Over 9 Million Shares: What’s Next?

If you think the institutional appetite for crypto ended with the ETF approvals, look again. In a move that signals massive long-term conviction, the world’s biggest asset manager, BlackRock, has reportedly increased its stake in Bitmine to over 9 million shares, according to a recent 13H-FR filing surfaced on X.

While retail traders are distracted by red candles, the world’s largest asset manager is actively seizing more infrastructure.

This isn’t just a passive buy; it’s a statement. When Larry Fink’s firm moves millions of shares in a crypto-native company, it changes the liquidity map for everyone involved.

Context: The Wall Street Pivot Continues

This accumulation comes hot on the heels of BlackRock’s dominance in the spot ETF market.

Their iShares Bitcoin (BTC) Trust has already shattered growth records, surpassing $70 billion in assets faster than any ETF in history.

Now, by significantly increasing exposure to Bitmine, the world’s biggest asset manager is doubling down on the operational side of the blockchain ecosystem.

While headlines often focus on spot price, smart money follows the institutional hedging and whale positioning deeper in the stack.

BlackRock holding over 9 million shares suggests it sees mining and infrastructure not as a risky bet, but as a critical asset class worthy of its balance sheet.

Discover: The best new crypto on the market

BlackRock and Bitmine: Strategic Accumulation or Just a Hedge?

Why buy the miners when you already own the coin? This is the question savvy traders need to answer.

Owning equity in operations like Bitmine offers BlackRock a strategic leveraging of Bitcoin’s success without the custody fees associated with direct coin holding.

This stake increase indicates that BlackRock believes the sector is currently undervalued relative to its future cash flow potential.

Furthermore, this aligns with a broader trend of incumbents staking claims in the digital asset space. We are seeing similar aggressive moves elsewhere, such as Goldman Sachs revealing significant crypto holdings.

Wall Street is no longer dipping a toe in; they are buying the swimming pool.

What Traders Should Watch Next

If you are holding crypto-linked equities or spot BTC, this is a bullish signal for the medium term. Institutional accumulation usually precedes a supply squeeze.

Watch for two things in the coming weeks:

- Sector Correlation: Does Bitmine’s stock price begin to decouple from daily BTC movements due to this institutional support?

- Global Sentiment: This Western accumulation parallels bullish crypto sentiment emerging in Hong Kong, suggesting a coordinated global bid for crypto assets is forming.

Ignore the minute-by-minute candles and watch the whales. When BlackRock buys 9 million shares, they aren’t planning to sell next week.

Discover: The ultimate crypto for portfolio diversification

The post BlackRock Increases Bitmine Stake to Over 9 Million Shares: What’s Next? appeared first on Cryptonews.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video7 hours ago

Video7 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

(@SweatyKodi)

(@SweatyKodi)