Crypto World

Why Amazon (AMZN) and Microsoft (MSFT) Stocks Just Crashed into Bear Market Territory

TLDR

- Amazon and Microsoft have entered bear market territory, both down over 20% from recent highs due to concerns about heavy AI spending without matching cloud revenue growth.

- The Magnificent Seven ETF has dropped nearly 11% from its October peak as investors rotate away from big tech stocks.

- Apple fell 5% on Thursday after reports emerged that its planned AI upgrade to Siri may face delays.

- Alphabet is down 6.4% over the past month, while Meta has given up all post-earnings gains and Tesla is down 7.3% year-to-date.

- UBS downgraded the U.S. technology sector to Neutral, citing concerns about AI capital expenditure outpacing current revenue generation.

The Magnificent Seven technology stocks are experiencing a downturn driven by investor concerns about artificial intelligence spending. The Roundhill Magnificent Seven ETF closed Thursday in correction territory, down nearly 11% from its late October high.

Amazon and Microsoft have been hit hardest among the group. Both companies have now entered bear market territory, meaning they are down more than 20% from their recent highs. Investors have penalized the two tech giants for ramping up AI infrastructure investments without delivering proportional cloud computing revenue growth.

The selloff has spread beyond the initial leaders. Alphabet, which received praise for its Gemini AI platform and cloud unit growth, has declined 6.4% over the past month. Meta Platforms erased all gains from its recent earnings report, which had highlighted AI-driven revenue growth.

Apple Faces Delay Concerns

Apple experienced its worst single-day performance since April 2025, falling 5% on Thursday. Reports indicated that the company’s planned AI upgrade to its digital assistant Siri may be delayed. The news raised questions about whether new AI features will drive the next iPhone upgrade cycle.

The company also faces headwinds from rising memory chip prices. These cost pressures come as investors wait for clearer signs of AI adoption in Apple’s product lineup.

Broader Market Rotation Underway

UBS recently downgraded the U.S. technology sector to Neutral from its previous rating. Mark Haefele, chief investment officer for global wealth management at UBS, recommended investors diversify across sectors and geographies. He noted that AI value creation is occurring beyond the information technology sector.

Mark Hawtin of Liontrust Asset Management highlighted the rising capital expenditure across the Magnificent Seven companies. He pointed to Amazon as an example, noting that much of the company’s expected cash flow this year could be absorbed by increased capital spending on AI infrastructure.

Other Magnificent Seven Members

Nvidia has traded in a range for several months without breaking out. The chip maker continues to face questions about sustaining its AI-driven growth trajectory. Tesla remains an outlier in the group, moving based on investor sentiment around CEO Elon Musk’s robotaxi and robot deployment plans rather than AI trends.

Tesla is down 7.3% year-to-date. Meta Platforms sits just above the threshold that would place it in bear market territory alongside Amazon and Microsoft.

The collective decline reflects a shift in investor sentiment toward the market’s most concentrated positions. The Magnificent Seven stocks have driven a large portion of market gains over the past two years. Weakness in these companies now weighs on broader market indexes.

Investors are not reacting to weak earnings reports. The concern centers on future growth prospects, specifically how quickly artificial intelligence investments will convert into profits. Companies across the group are spending heavily on AI infrastructure while current revenue from the technology remains limited compared to the capital outlays.

Wall Street analysts maintain that Microsoft has the most upside potential among the group. The average price target for Microsoft stock stands at $593.38 per share, implying 47.7% upside from current levels.

Crypto World

U.S. Grants General License to Reliance Industries to Buy Venezuelan Oil

TLDR

- The United States issued a general licence to Reliance Industries, allowing direct purchases of Venezuelan oil without breaching sanctions.

- The move follows Washington’s easing of sanctions on Venezuela’s energy sector after internal political changes.

- General licence permissions include buying, exporting, selling, and refining extracted Venezuelan crude.

- Reliance had previously stopped Venezuelan oil imports due to sanctions but now could resume direct purchases.

- The licence supports Reliance’s efforts to diversify crude sources and reduce reliance on higher‑cost alternatives.

The United States has issued a general license allowing India’s Reliance Industries Ltd to purchase Venezuelan oil directly. This development follows the U.S. capture of Venezuelan President Nicolas Maduro. The decision could streamline Venezuela’s oil exports while benefiting Reliance’s refining operations.

U.S. Eases Sanctions to Facilitate Venezuelan Oil Purchases

According to a Reuters report, the U.S. has eased sanctions on Venezuela’s energy sector, aiming to support a $2 billion oil deal with Washington. The sanction relief also complements the broader goal of aiding Venezuela’s oil industry reconstruction.

A general license now authorizes companies to buy and refine Venezuelan oil, bypassing previous restrictions. Reliance Industries applied for the license in January. As one of the world’s largest oil refiners, it operates an advanced refining complex.

The license will allow Reliance to resume buying Venezuelan oil directly. This could expedite the company’s plans to replace Russian oil supplies.

Reliance’s Oil Strategy and the Role of Venezuelan Imports

Reliance recently bought 2 million barrels of Venezuelan oil from Vitol, a major trader. The company is expected to continue seeking discounted Venezuelan crude, replacing Russian oil in its refineries.

Reliance’s purchase marks a shift from the company’s earlier reliance on Russian oil amid geopolitical tensions. The U.S. has granted specific licenses to traders like Vitol and Trafigura, enabling them to sell Venezuelan oil.

These traders now have the authority to market large quantities of oil from Venezuela. This move aims to reduce Reliance’s dependence on more expensive crude, thus lowering costs for its refining operations.

The Strategic Shift in Global Oil Supply Chains

Reliance’s refineries, with a combined capacity of 1.4 million barrels per day, stand to benefit from the cheaper Venezuelan oil. The company had ceased buying Venezuelan crude in 2025 due to U.S. sanctions but will now be able to resume direct purchases.

This shift will allow Reliance to diversify its oil sources amid the changing global oil market. The general license granted by the U.S. marks a key step in this transition.

By securing access to discounted Venezuelan oil, Reliance can maintain its competitive edge. This development could further align India’s energy interests with U.S. strategic goals in the region.

Crypto World

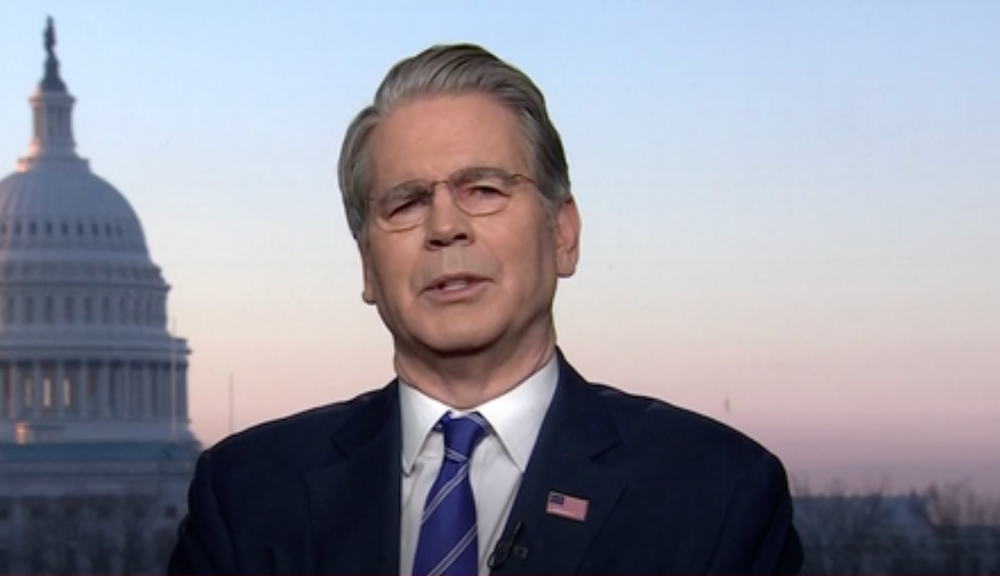

Passing CLARITY Act Will ‘Comfort’ Crypto Market Investors: Scott Bessent

Passing the CLARITY crypto structure bill could improve market sentiment amid the ongoing downturn, according to United States Treasury Secretary Scott Bessent.

The stalling of the CLARITY bill over concerns voiced by crypto industry executives has negatively impacted the industry, Bessent told CNBC on Friday. He said:

“In a time when we are having one of these historically volatile sell-offs, I think some clarity on the CLARITY bill would give great comfort to the market, and we could move forward from there.

I think if the Democrats were to take the House, which is far from my best case, then the prospects of getting a deal done will just fall apart,” Bessent continued.

He said that getting the bill passed “as soon as possible” and sent to US President Donald Trump for signature by spring, which occurs between late March and late June in the US, is important, given the potential shift in the balance of power in the 2026 midterm elections.

Related: White House officials met with crypto, banking reps to discuss stablecoins

The 2026 midterm elections could throw a wrench in Trump’s crypto agenda

The balance of power typically shifts in US midterm election years, Joe Doll, the former general counsel at non-fungible token (NFT) marketplace Magic Eden, told Cointelegraph.

“President Trump has a two-year unimpeded mandate that can be weakened greatly in the 2026 mid-term elections and reversed in the 2028 elections,” economist Ray Dalio said in January.

This potential political shift could reverse the Trump administration’s pro-crypto policies, if they are not codified into law, Dalio warned.

The Republican Party holds a slim four-seat majority in the US House of Representatives, with 218 seats compared to 214 seats held by the Democratic Party, according to data from the US House.

47% of traders on the prediction market Polymarket project that power will be split in the 2026 midterms, with each political party taking control of one chamber of Congress.

The Polymarket odds of a full sweep by the Democratic Party, meaning they claim a majority in both chambers, is 37% at the time of this writing.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Crypto World

Stock Futures Rise as Investors Weigh Up Key Economic Data

Stock futures were rising on Thursday, suggesting that investors still haven’t decided if the delayed January jobs report was a good or bad data point for the market.

Futures tracking the Dow Jones Industrial Average rose 139 points, or 0.3%. S&P 500 futures and contracts tied to the tech-heavy Nasdaq 100 also added 0.3%.

The Dow snapped a three-day winning streak on Wednesday, and the other major indexes also closed a touch lower. Stocks initially rose before giving up all of their gains after nonfarm payrolls data showed that the U.S. added 130,000 jobs in January, way above what economists were expecting.

Crypto World

5 leading crypto jurisdictions alternative to MiCA in 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

MiCA delivers certainty in Europe, but rising compliance costs are pushing many crypto firms to explore flexible offshore licensing in 2026.

Summary

- MiCA brings EU certainty, but firms eye mid-shore hubs for flexibility, tax efficiency, and faster crypto market entry.

- Dubai, Canada, and BVI have emerged as alternatives to MiCA, offering lower costs and specialized compliance paths.

- LegalBison helps crypto firms navigate global licensing as businesses diversify beyond single-jurisdiction MiCA models.

The implementation of the MiCA regulation has undeniably brought a high degree of certainty to the European market. However, for many Crypto Asset Service Providers (CASPs), the trade-off such as high capital requirements, strict physical substance rules, and intensive reporting can be a barrier to entry.

In 2026, the global landscape offers several “mid-shore” and offshore alternatives that provide agility, tax efficiency, and robust legal frameworks without the specific constraints of an EU crypto license.

Whether someone is looking for a rapid market entry, specialized activity-based rules, or a tax-neutral home for their treasury, these jurisdictions represent the strongest alternatives to MiCA compliance.

1. Dubai (VARA): The specialized global hub

For those looking for a jurisdiction that treats crypto as its primary focus rather than an add-on to traditional finance, the Dubai VARA crypto license is the premier choice for 2026.

Why Choose Dubai VARA?

- Activity-Specific Rulebooks: Unlike the broader MiCA framework, VARA provides tailored rulebooks for specific activities like custody, exchange, and broker-dealer services. This allows for more precise operational planning.

- Tax Neutrality: Dubai remains one of the most tax-efficient hubs in the world, offering 0% corporate tax for qualifying activities in many free zones.

- Speed and Innovation: The application process is generally more interactive and faster than the typical 12-month wait for an EU crypto license.

For firms targeting the MENA region and institutional capital, the Dubai VARA crypto license offers a level of prestige that rivals any European regulator.

2. Canada: The low-barrier gateway to North America

For startups that prioritize speed and cost-effectiveness, the Canada crypto license with MSB (Money Services Business) registration is often the fastest route to a reputable Western license.

The Canadian Advantage

- No Minimum Capital: Unlike MiCA, which requires up to €150,000 in Tier 1 capital, Canada has no fixed minimum capital requirement for MSB registration.

- Rapid Onboarding: Registration with FINTRAC can often be completed in 3 to 5 months, making it significantly faster than pursuing a Poland crypto license or CASP license in Malta.

- FMSB Option: Canada allows for “Foreign Money Services Business” status, enabling some firms to operate without a full-scale physical headquarters in the country.

3. The British Virgin Islands (BVI): The professional offshore choice

The BVI crypto license (under the VASP Act) has become the gold standard for token issuers and DeFi protocols that require a tax-neutral environment.

Why the BVI?

- Zero Tax: 0% corporate tax, 0% capital gains tax, and no withholding tax on dividends.

- Legal Stability: Based on English Common Law, the BVI offers a highly predictable legal environment that investors and VCs trust.

- Flexibility for Token Issuers: For those issuing a MiCA-compliant token, the BVI offers a compelling “Plan B” with far fewer restrictions on how token generation events (TGEs) are structured.

Asia’s Emerging Titans: Hong Kong and Singapore

For firms looking to tap into the world’s most active retail and institutional trading markets, securing a crypto license in Asia is a strategic necessity.

4. Hong Kong (SFC)

By 2026, Hong Kong has fully opened its doors to retail trading. It provides a stable, highly regulated environment that serves as the primary bridge to liquidity from Mainland China.

5. Singapore (MAS)

While the MAS is known for its rigorous standards, a Singaporean license is essentially a “seal of quality.” It is the preferred choice for major payment institutions (MPI) that want to combine crypto services with traditional fiat processing.

Strategic comparison: 2026 crypto licensing landscape

| Jurisdiction | Primary License | Timeline | Min. Capital | Tax Profile |

| Dubai | VARA License | 4-7 Months | ~$50k-$150k | 0% – 9% |

| Canada | MSB Registration | 3-5 Months | Varies | ~15% – 27% |

| BVI | VASP License | 4-6 Months | Varies | 0% |

| EU (e.g. CZ) | Czech Republic CASP license | 6-12 Months | €50k – €150k | 19% – 21% |

Global expansion with LegalBison

Choosing a jurisdiction is the most consequential decision a founder can make. LegalBison is a leading legal firm specializing in global company formation and crypto licensing.

By providing end-to-end support from initial feasibility studies to the final submission of an application; LegalBison ensures that a business is structurally sound and compliant with local regulators, whether it’s targeting the Middle East, the Americas, or Asia.

Diversification is the new compliance

In 2026, the most successful crypto businesses are rarely “single-jurisdiction” entities. While MiCA compliance provides a massive market, alternative hubs like Dubai, Canada, and the BVI offer specialized advantages that can significantly lower your operational burn rate.

By working with a dedicated partner like LegalBison, businesses can ensure that their choice of jurisdiction aligns with their long-term roadmap, whether that includes issuing a MiCA-compliant token or expanding footprint across the Asia-Pacific region.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Crypto Markets Rally After Softer-Than-Expected US Inflation Report

Total market value rose over 4% today, though risk appetite remains fragile.

Crypto markets caught some relief on Friday, Feb. 13, as investors digested a softer-than-expected U.S. inflation report.

Total crypto market capitalization surged almost 5% over the past 24 hours to $2.44 trillion, while most large-cap crypto assets saw moderate gains on the day.

Bitcoin (BTC) climbed back over 69,000, up 4.5% today and pushing its weekly price change into the green, up 1.7%.

Ethereum (ETH) rose over 7.5% to trade back above $2,000, bringing weekly gains to 4.4%.

Figure Heloc (FIGR_HELOC) waws the only top-10 assets in the red this morning, though it was down less than 1%. BNB saw subdued gains, up just 1.7% today.

Disciplined Leverage

Sentiment remains unstable despite the boost in prices. Analysts at glassnode noted in an X post on Thursday, Feb. 12, that Bitcoin’s net unrealized profit/loss has slipped back into the hope/fear regime at around 0.18, indicating thin profit cushions.

“This regime tends to be reactive,” glassnode said, adding that rallies often meet sell pressure while downside moves can extend as conviction fades.

Paul Howard, senior director at Wincent, a high-frequency crypto market maker, told The Defiant that markets are showing “a degree of fragility,” as traders remain worried about aftershocks after the Oct. 10 crash that wiped out nearly $20 billion in leveraged positions. Howard elaborated:

“Rumours surrounding the fallout from 10/10 — reportedly impacting at least one U.S.-based firm — have contributed to a more cautious tone in certain segments. This reinforces the importance of prudent risk management and disciplined use of leverage, particularly in an environment where liquidity can tighten quickly.”

The Crypto Fear & Greed Index remains deep in “extreme fear” territory, though it slightly improved after yesterday’s low.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Pi Network (PI) led gainers today, up 10%, followed by Midnight (NIGHT), up 9%.

On the downside, World Liberty Financial (WLFI) was today’s biggest loser among large-caps, though it’s down just 2.3%.

As for liquidations, according to CoinGlass data, roughly 90,640 traders were liquidated over the past 24 hours, with total losses nearing $260 million. Bitcoin accounted for $118.2 million and Ethereum for $56 million.

ETFs and Macro Conditions

On Thursday, Feb. 12, spot Bitcoin ETFs saw even heavier outflows than the day before, posting net outflows of $410.4 million, data from SoSoValue shows. Spot Ethereum ETFs, meanwhile, also recorded net outflows, losing $113.1 million.

In terms of macro dynamics, today the U.S. Bureau of Labor Statistics released its latest Consumer Price Index (CPI) report, showing prices rose 2.4% year-over-year in January, just below the 2.5% forecast by economists surveyed by Dow Jones. Core inflation, which excludes food and energy, matched expectations at 2.5%.

Crypto World

AAVE Price Still Under Duress Despite New Governance Model

Aave Labs has unveiled a fresh governance initiative that could redefine the future direction of one of the crypto sector’s leading lending protocols.

While on paper the developments appear to be a sound initiative, the AAVE price has failed to reflect due to investors’ behavior.

Sponsored

Sponsored

AAVE Launches New Governance Model

Dubbed “Aave Will Win,” the proposal calls on the Aave DAO to endorse a comprehensive roadmap centered on the forthcoming V4 upgrade. If approved, V4 would serve as the core infrastructure for the protocol’s next phase, establishing a framework where 100% of revenues from products developed by Aave Labs are allocated directly to the DAO.

AAVE price remains under pressure despite the rollout of its new governance model. The token is currently in oversold territory based on the Money Flow Index. Recent readings suggest macro-driven selling pressure may have peaked after several sessions of sustained outflows.

Historically, the AAVE price has rebounded after entering oversold conditions. Oversold signals often reflect selling saturation, where buyers gradually step in. However, broader crypto market weakness and cautious investor sentiment make this setup less straightforward than previous recovery cycles.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

Sponsored

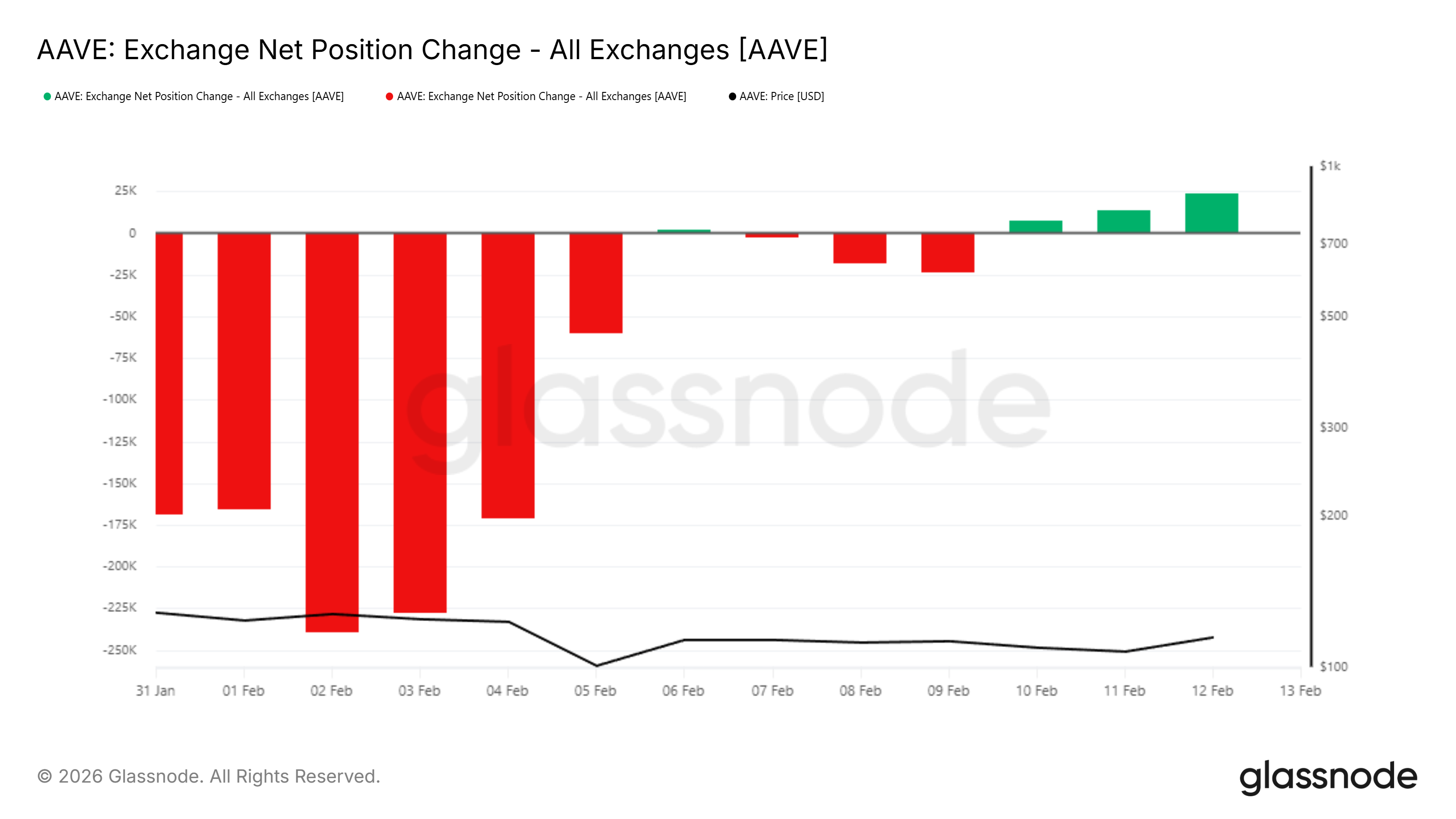

AAVE Holders Are Still Selling

Exchange net position change data shows that selling pressure continues to dominate. Net inflows to exchanges indicate that holders are moving AAVE to trading platforms. This behavior typically signals an intention to sell rather than accumulate.

Strengthening outflows and persistent exchange inflows may delay any potential rebound. Even positive protocol developments have failed to spark immediate upside momentum. Market participants appear focused on liquidity conditions and risk appetite rather than governance upgrades.

AAVE Price Is Holding Above Support

AAVE price trades at $111 at publication, holding above the 23.6% Fibonacci level at $109. This level is widely viewed as a bear market support floor. Maintaining this support is critical to prevent deeper structural weakness.

Mixed technical signals suggest AAVE may consolidate above $109 in the near term. Price could remain range-bound under the $119 resistance while momentum stabilizes. However, a confirmed break below $109 may expose AAVE to $100 or lower.

If selling pressure eases and investors regain confidence, AAVE could rebound from $109. A move above $119 would signal improving sentiment. Breaching $128 may open the path toward $136, invalidating the prevailing bearish outlook.

Crypto World

Ethereum price resembles adam and eve pattern, bottom forming?

Ethereum price is showing early signs of a potential macro bottom, with price action forming an Adam and Eve reversal pattern that could trigger a rally if key resistance is reclaimed.

Summary

- Adam and Eve reversal structure is developing, signaling bottom formation

- Point of control reclaim is required, to confirm the bullish reversal

- $2,450 resistance is the key upside target, if volume supports the breakout

Ethereum (ETH) price action is beginning to show characteristics commonly associated with bottoming formations as the market stabilizes after a prolonged corrective phase.

Following a sharp sell-off, ETH has produced a strong initial rebound and is now consolidating near key value levels. This behavior aligns closely with an Adam and Eve reversal pattern, a structure that often signals a transition from bearish control to early accumulation.

While the broader trend remains cautious, the developing structure suggests that downside momentum may be exhausting. If confirmed, this setup could mark the early stages of a trend reversal and open the door for a meaningful recovery toward higher resistance levels.

Ethereum price key technical points

- Adam and Eve bottoming pattern is developing, signaling a potential trend reversal

- Point of control acts as the activation level, required for confirmation

- Upside target sits near $2,450, aligned with high-timeframe resistance

The first phase of the Adam and Eve pattern, known as the “Adam” leg, is characterized by a sharp and impulsive move off the lows. Ethereum established a notable swing low around $1,740, followed by a strong rally that reflected aggressive short-covering and early-dip buying.

This sharp rebound typically indicates capitulation exhaustion rather than a sustainable trend continuation. In Adam and Eve structures, the Adam leg serves as the initial signal that selling pressure is beginning to fade, even if price has not yet transitioned into a full bullish trend.

Rounded base signals the ‘Eve’ Formation

Following the initial rebound, Ethereum has entered a slower, more rounded consolidation near the value area low. This price behavior forms the “Eve” portion of the pattern, where the market begins absorbing supply and building a base.

Unlike the sharp Adam leg, the Eve structure develops gradually, reflecting increasing balance between buyers and sellers. This phase is critical, as it allows the market to establish higher lows and build the foundation required for a sustainable move higher.

The fact that price is holding above the initial swing low suggests that sellers are losing dominance and that demand is beginning to stabilize near current levels.

Point of control is the key trigger

For the Adam and Eve pattern to be activated, Ethereum must reclaim the point of control on a closing basis. The point of control represents the price level with the highest traded volume and often acts as a pivot between bearish and bullish regimes.

A decisive reclaim of this level, particularly if backed by strong bullish volume, would confirm acceptance at higher prices and activate the reversal structure. Without this confirmation, the pattern remains speculative and vulnerable to further consolidation or downside retests.

Upside targets and reversal implications

If the pattern confirms, Ethereum’s next major upside objective sits near the $2,450 level, which aligns with high-timeframe resistance. A rally toward this region would represent a significant recovery from the recent lows and validate the broader bottoming thesis.

However, it is important to note that Adam and Eve reversals often unfold over time. Initial breakouts can be volatile, with pullbacks and retests common before sustained continuation occurs.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Ethereum appears to be in the early stages of a potential bottoming process. As long as price holds above the recent swing low near $1,740, the Adam and Eve pattern remains valid.

Confirmation will depend on Ethereum’s ability to reclaim the point of control with expanding bullish volume. If that occurs, a rotational move toward $2,450 becomes increasingly probable.

Crypto World

Anchorage Enables SOL Borrowing Without Moving Custody

Anchorage Digital has partnered with Kamino and Solana Company to roll out a structure that allows institutions to borrow against staked Solana without moving assets out of regulated custody, potentially addressing a key friction between traditional finance and decentralized lending markets.

In a Friday announcement, Anchorage said the initiative expands its Atlas collateral management platform by integrating with Kamino, a Solana-based decentralized lending protocol.

The effort is being carried out in collaboration with Solana Company, a publicly traded Solana (SOL) treasury created in partnership with Pantera Capital and Summer Capital.

Under the structure, institutions can use natively staked SOL as collateral for onchain borrowing while the assets remain held at Anchorage Digital Bank, a federally chartered crypto bank. That means investors can continue earning staking rewards while accessing liquidity through Kamino’s lending markets.

Anchorage acts as collateral manager, overseeing loan-to-value ratios, margin requirements and, if necessary, liquidations. Because the collateral remains in segregated custody, institutions do not need to move assets into smart contracts, a requirement that has historically limited participation by regulated entities.

Related: Solana treasuries sitting on over $1.5B in paper SOL losses

DeFi legislation hangs in the balance

The integration between Anchorage Digital, Kamino and Solana Company underscores growing institutional interest in decentralized finance. However, that momentum is unfolding against an uncertain regulatory backdrop in the United States, where lawmakers are still debating how to oversee digital assets and DeFi platforms.

At the center of the debate is the proposed CLARITY Act, which aims to establish clearer jurisdictional boundaries and regulatory standards for digital assets, including DeFi protocols.

While the bill is intended to reduce uncertainty for market participants, some DeFi advocates argue that it falls short of addressing how decentralized protocols, developers and governance structures should be treated under the law.

Industry groups have raised concerns that earlier draft language, including amendments introduced in January, does not sufficiently distinguish between centralized intermediaries and decentralized systems.

Amid the deadlock over the CLARITY Act’s future, the Trump administration convened a meeting with industry representatives earlier this month to break the impasse and gather feedback on outstanding provisions related to DeFi oversight and market structure.

Related: Who gets the yield? CLARITY Act becomes fight over onchain dollars

Crypto World

XRP ETFs Face $6.42M Outflow, Grayscale’s GXRP ETF Records Largest Loss

TLDR

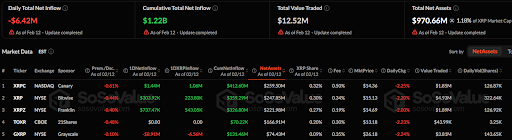

- XRP ETFs saw a daily outflow of $6.42 million, with cumulative inflows at $1.22 billion.

- XRPC ETF reported a $1.44M net inflow, but its market price declined by 2.25%.

- XRP ETF experienced a daily drop of 2.20% and a $303.92K net inflow.

- XRPZ ETF saw a 2.00% drop in market price, with $737.47K in daily inflows.

- The GXRP ETF recorded an $8.91M outflow, with a 2.24% drop in market price.

As of February 12, the daily total net inflow for XRP ETFs recorded a loss of $6.42 million. According to SoSoValue, the cumulative total net inflow remains positive at $1.22 billion. The total value traded stands at $12.52 million, showing a relatively low trading volume for the day. Total net assets for the XRP ETFs are valued at $970.66 million, representing 1.18% of the XRP market cap.

XRPC, XRPZ, and XRP ETFs Record Inflows

Among individual XRP ETFs, the XRPC ETF, listed on NASDAQ and sponsored by Canary, saw a slight 0.61% decline. It reported a 1-day net inflow of $1.44 million and a cumulative net inflow of $412.60 million. The ETF’s net assets stand at $259.50 million, with an XRP share of 0.32%. Its market price is $14.36, showing a 2.25% daily decline.

The XRP ETF, listed on the NYSE and sponsored by Bitwise, experienced a daily decrease of 2.20%. It saw a daily net inflow of $303.92 thousand and has a cumulative net inflow of $359.29 million. Its net assets stand at $247.85 million, representing 0.30% of XRP’s market share. The market price dropped to $15.13.

The XRPZ ETF, listed on the NYSE and sponsored by Franklin, experienced a 0.40% drop in value. It reported a daily inflow of $737.47 thousand with a cumulative net inflow of $326.80 million. Its net assets stand at $221.98 million, accounting for 0.27% of XRP’s market share. The ETF’s market price fell by 2.00% to $14.69.

GXRP Losses $8.91 as TOXR ETF Holds Stable

The TOXR ETF, listed on the CBOE and sponsored by 21Shares, saw a daily decline of 2.23%, with no changes in its flow for the day. It has net assets totaling $166.91 million, holding 0.20% of XRP’s market share.

Lastly, the GXRP ETF, listed on the NYSE and sponsored by Grayscale, recorded a 2.24% drop, with a daily net outflow of $8.91 million. This XRP ETF has net assets of $74.43 million, representing 0.09% of the XRP market. Its market price decreased to $26.18.

Crypto World

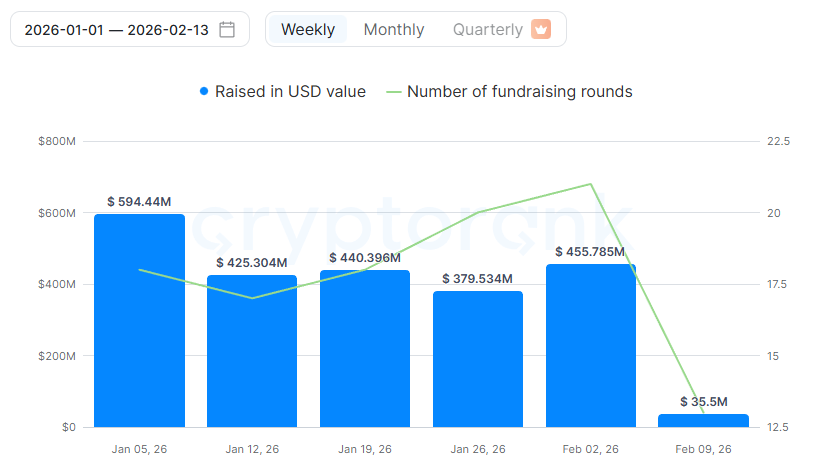

VCs Invest Over $2 Billion in Early 2026: Which Sectors Benefit?

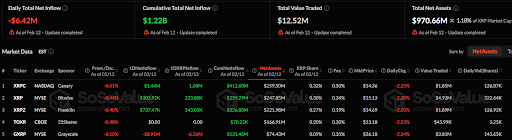

As capital flows sharply out of the crypto market in early 2026 and investor sentiment remains at extreme fear levels, venture capital allocation decisions have become a valuable signal. These moves help retail investors identify sectors that may still hold potential during a bear market.

Recent reports indicate that the crypto market environment has changed. The sectors attracting VC funding have shifted accordingly.

Sponsored

Sponsored

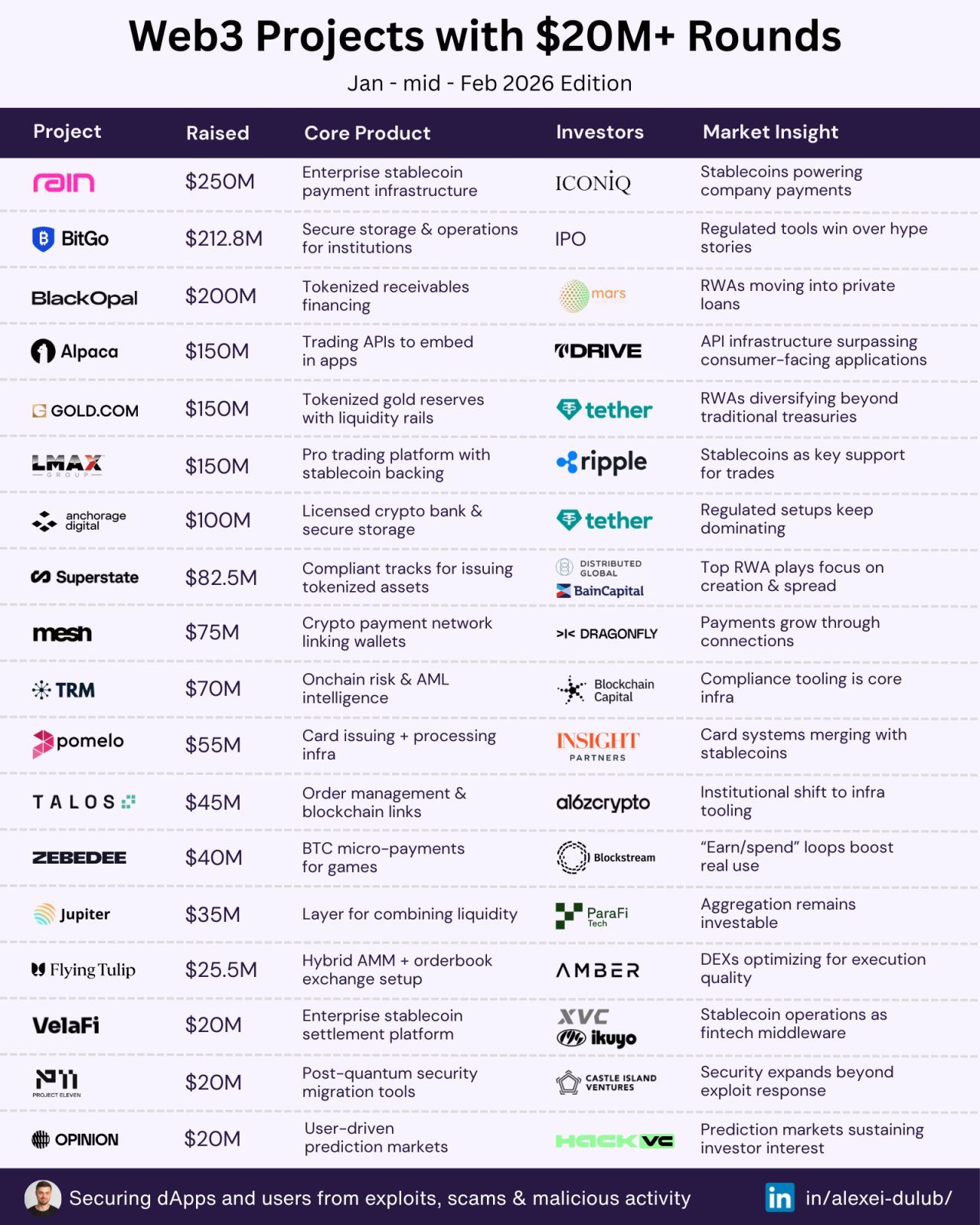

VCs Invest Over $2 Billion in Crypto in Early 2026

Data from CryptoRank shows that venture capital firms have invested more than $2 billion into crypto projects since the beginning of the year. On average, weekly inflows have exceeded $400 million.

Several large deals stand out. Rain raised $250 million to build enterprise-grade stablecoin payment infrastructure. BitGo secured $212.8 million through its IPO, reinforcing its role as a digital asset custodian and security provider for institutional clients.

BlackOpal also raised $200 million for its GemStone product, an investment-grade vehicle backed by tokenized Brazilian credit card receivables.

Beyond these deals, Ripple invested $150 million in trading platform LMAX. The move supports the integration of RLUSD as a core collateral asset within institutional trading infrastructure. Tether also made a $150 million strategic investment in Gold.com, expanding global access to both tokenized and physical gold.

Analyst Milk Road notes that capital is no longer flowing into Layer 1 blockchains, meme coins, or AI integrations. Instead, stablecoin infrastructure, custody solutions, and real-world asset (RWA) tokenization have emerged as the dominant investment themes.

Sponsored

Sponsored

Market data supports this shift. Since the start of the year, total crypto market capitalization has fallen by roughly $1 trillion. In contrast, stablecoin market capitalization has remained above $300 billion. The total value of tokenized RWAs has reached an all-time high of over $24 billion.

What Does the Shift in VC Appetite Signal?

Ryan Kim, founding partner at Hashed, argues that VC expectations have fundamentally changed. The shift reflects a new investment standard across the industry.

In 2021, investors focused on tokenomics, community growth, and narrative-driven projects. By 2026, VCs will prioritize real revenue, regulatory advantages, and institutional clients.

“Notice what’s absent? No L1s. No DEXs. No ‘community-driven’ anything. Every dollar went to infrastructure and compliance,” Ryan Kim stated.

The largest deals listed above involve infrastructure builders rather than token-driven projects designed to generate price speculation. As a result, the market lacks the elements that previously fueled hype cycles and FOMO.

“Not on speculation. Not on hype cycles. They’re looking at the pipes, rails, and compliance layers,” analyst Milk Road said.

However, analyst Lukas (Miya) presents a more pessimistic view. He argues that crypto venture capital is in a state of collapse, citing a sharp, sustained decline in limited partner commitments.

He points to several warning signs. High-profile firms such as Mechanism and Tangent have shifted away from crypto. Many firms are quietly unwinding their positions.

It may still be too early to declare the collapse of crypto VC, given that more than $2 billion has flowed into the sector since the start of the year. At a minimum, these changes suggest that crypto is integrating more deeply with the traditional financial system, a potential sign of long-term maturation.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video7 hours ago

Video7 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle