Crypto World

The Mortgage Market’s Bitcoin Experiment Has Already Begun

A US-based structured-credit firm is pushing TradFi boundaries by integrating crypto into real-world lending. Newmarket Capital, managing nearly $3 billion in assets, is pioneering hybrid mortgage and commercial loans that leverage Bitcoin (BTC) alongside conventional real estate as collateral.

Its affiliate, Battery Finance, is leading the charge in creating financial structures that leverage digital assets to support credit without requiring borrowers to liquidate holdings.

Sponsored

Sponsored

Bitcoin to Reshape Mortgages and Real-World Lending

The initiative targets borrowers who are crypto-asset holders, including tech-savvy Millennials and Gen Z. It provides a path to financing that preserves investment upside while enabling access to traditional credit markets.

By combining income-producing real estate with Bitcoin, the firm seeks to mitigate volatility risk while offering borrowers a novel lending solution.

According to Andrew Hohns, Founder and CEO of Newmarket Capital and Battery Finance, the model involves income-producing properties, such as commercial real estate, paired with a portion of the borrower’s Bitcoin holdings as supplemental collateral.

Bitcoin is valued as part of the overall loan package, providing lenders with an asset that is liquid, divisible, and transparent, unlike real estate alone.

“We’re creating credit structures that produce income, but by integrating measured amounts of Bitcoin, these loans participate in appreciation over time, offering benefits traditional models don’t provide,” Hohns explained in a session on the Coin Stories Podcast.

Early deals demonstrate the concept, with Battery Finance refinancing a $12.5 million multifamily property using both the building itself and approximately 20 BTC as part of a hybrid collateral package.

Borrowers gain access to capital without triggering taxable events from selling crypto, while lenders gain additional downside protection.

Sponsored

Sponsored

Institutional-Grade Bitcoin Collateral

Unlike pure Bitcoin-backed loans, which remain experimental and niche, Newmarket’s model is institutional-grade:

- It is fully underwritten

- Income-focused, and

- Legally structured for US regulatory compliance.

Bitcoin in these structures is treated as a collateral complement rather than a standalone payment method; mortgage and loan repayments remain in USD.

“Bitcoin adds flexibility and transparency to traditional lending, but the foundation is still income-producing assets,” Hohns said. “It’s a bridge between digital scarcity and conventional credit risk frameworks.”

The approach builds on a broader trend of integrating real-world assets (RWA) with digital holdings. In June 2025, federal agencies like the FHFA signaled in mid-2025 that crypto could be considered for mortgage qualification,

Sponsored

Sponsored

However, private lenders like Newmarket Capital are moving faster, operationalizing hybrid collateral structures while adhering to existing regulatory frameworks.

Newmarket and Battery Finance’s work illustrates how Bitcoin and other cryptocurrencies can interface with TradFi as tools to unlock new forms of lending and credit.

Still, challenges exist. BeInCrypto reported that despite Fannie Mae and Freddie Mac’s plans to accept Bitcoin as mortgage collateral, there is a catch.

The Bitcoin must be held on regulated exchanges. Bitcoin in self-custody or private wallets won’t be recognized.

Sponsored

Sponsored

This raises concerns about financial sovereignty and centralized control. Policy limits Bitcoin’s use in mortgage lending to custodial, state-visible platforms, excluding decentralized storage.

“This isn’t about adoption vs. resistance. It’s about adoption with conditions. You can play— …but only if your Bitcoin plays by their rules. Rules designed for control…As adoption deepens, pressure will mount for lenders to recognize properly held Bitcoin—not just coins on an exchange…Eventually, the most secure form of money will unlock the most flexible capital,” one user remarked.

Nevertheless, while this innovation is not a solution to housing affordability, it represents a meaningful step toward mainstream adoption of crypto in real-world finance.

Crypto World

Netherlands Lower Chamber Passes 36% Tax Proposal Before Passing to Senate

The Netherlands’ House of Representatives advanced a legislative proposal on Thursday to introduce a 36% capital gains tax on savings and most liquid investments, including cryptocurrencies.

The legislation reached the 75-vote threshold required to advance, with 93 lawmakers voting in favor of it, according to the House tally.

Under the proposal, savings accounts, cryptocurrencies, most equity investments and gains made from interest-bearing financial instruments are subject to the tax, whether or not the assets are sold.

Critics say the bill will drive capital out of the Netherlands and into jurisdictions with more favorable tax laws, as investors seek a flight to safety from confiscatory taxation.

The Dutch Senate must also pass the bill before it is signed into law, which will take effect in the 2028 tax year, if it is passed, but many investors in the crypto community are already sounding the alarm and predicting capital flight from the country.

Related: European Commission calls on 12 countries to implement crypto tax rules

Investors say the tax is out of touch and will backfire

“France did this in 1997 and saw a massive exodus of entrepreneurs leaving the country,” Denis Payre, co-founder of logistics company Kiala said.

Crypto market analyst Michaël van de Poppe said the proposal is “the dumbest thing I’ve seen in a long time.”

“The number of people willing to flee the country is going to be bananas,” he added, echoing the calls of other industry analysts and executives.

An investor starting with 10,000 euros ($11,871) who contributes 1,000 euros per month over 40 years would end up with about 3,320,000 euros by the end of the 40 years, according to Investing Visuals.

However, the new 36% tax reduces the total amount after 40 years to about 1,885,000 euros, a difference of 1,435,000 euros, Investing Visuals said.

Crypto industry and tech executives in the United States voiced similar concerns about California’s proposed wealth tax on billionaires.

The proposal outlined a 5% tax on an individual’s net worth above the $1 billion threshold, igniting a torrent of backlash and tech entrepreneurs announcing that they were leaving the state of California.

Magazine: Best and worst countries for crypto taxes — plus crypto tax tips

Crypto World

CFTC Appoints Crypto Heavyweights to 35-Person Advisory Panel

CFTC forms 35-member advisory panel stacked with crypto leaders as regulator signals shift toward friendlier digital asset rules.

The U.S. Commodity Futures Trading Commission (CFTC) has selected several cryptocurrency executives to serve on its newly created Innovation Advisory Committee (IAC).

This development comes as the agency, led by Chair Michael S. Selig, continues to indicate that his administration plans to adopt a more permissive approach to regulating the digital asset industry.

IAC Appointee List Announced

Of the 35 members making up the panel, 20 are tied to companies involved in crypto, while at least five are involved in prediction markets. Among them are Crypto.com CEO Kris Marszalek, Gemini co-founder Tyler Winklevoss, Kalshi CEO Tarek Mansour, and Polymarket architect Shayne Coplan.

“Today marks an important and energizing moment at the CFTC as the Innovation Advisory Committee takes shape,” said Selig in a Thursday press release.

Additional members include Anchorage Digital’s top executive, Nathan McCauley, Grayscale’s Peter Mintzberg, Robinhood CEO Vladimir Tenev, Solana’s Anatoly Yakovenko, as well as Ripple chief Brad Garlinghouse, and Coinbase’s Brian Armstrong.

Executives at Paradigm, DraftKings, and the Depository Trust & Clearing Corporation (DTCC) were also included, together with representatives from traditional finance institutions such as Cboe, CME, Nasdaq, and the Options Clearing Corporation (OCC), among other firms.

Selig said the main aim is to ensure America remains the home to the most transparent and well-regulated financial markets in the world.

“By bringing together participants from every corner of the marketplace, the IAC will be a major asset for the Commission as we work to modernize our rules and regulations for the innovations of today and tomorrow,” he added.

Market Innovation and Crypto Regulation Streamlining

The IAC, launched in January, replaces the Technology Advisory Committee (TAC), which previously provided guidance on how emerging technologies were affecting derivatives markets.

You may also like:

The new body will serve as a resource on developments in derivatives and commodity markets, helping the Commission assess how innovations such as artificial intelligence (AI) and blockchain are reshaping financial systems and informing the development of adaptive regulatory frameworks.

The CFTC has also begun coordinating with the Securities and Exchange Commission (SEC) through a joint initiative known as “Project Crypto.”

The effort is aimed at harmonizing regulatory approaches to digital asset markets, reducing jurisdictional overlap between the agencies, and providing clearer and more predictable rules for cryptocurrency companies operating in America.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Lighter Enables Unified Collateral for Spot and Futures Trading

LIT surged 13% following a week of product updates.

LIT, the native token of decentralized perpetuals exchange Lighter, rose as much as 13% over the past 24 hours as the platform rolled out new trading features, including unified collateral accounts.

The token traded as high as $1.62, but has since retraced to $1.59, up just over 11% on the day, according to CoinGecko. However, LIT is still down around 50% from its launch price of above $3.

The price action follows a series of product updates from Lighter this week. On Thursday evening, the DEX launched new trading account types that let users switch to a unified collateral system for spot and perpetual futures trading.

The company explained in a post on X that this is the first phase in a set of upgrades aimed at allowing “arbitrary tokens” to be used as collateral on the platform. Lighter also added that the next step is the tokenization of LLP, the platform’s market-making vault.

Lighter currently has $925.8 million in total value locked (TVL) and ranks fourth among perpetual DEXs by daily trading volume, according to DeFiLlama. The platform has also accumulated more than 801,000 users and processed over 59 billion transactions, according to its explorer.

Earlier this week, Lighter also announced new markets, including Korean equity perpetual futures. The platform now offers contracts linked to Hyundai, Samsung, SK Hynix, and the Korean Composite index, with up to 10x leverage, according to a post on X.

The upgrades come as perpetual futures trading continues to heat up across decentralized finance (DeFi), with exchanges racing to capture market share. Competitors like Hyperliquid and Aster remain the largest players, with $5.1 billion and $1.86 billion in open interest (OI), according to DeFiLlama. As of Friday, Lighter’s OI stands at $782 million.

Crypto World

Crypto group counters Wall Street bankers with its own stablecoin principles for bill

The current impasse over stablecoin yields in the U.S. Senate’s crypto market structure bill is now in writing, and the crypto side is holding the line on needing some forms of rewards for stablecoin users.

A White House meeting between Wall Street bankers and crypto executives hit a wall this week, despite officials in President Donald Trump’s administration urging the sides to find a compromise. The banks held their line that no stablecoin yield or reward is acceptable, arguing that such yields threaten the depository activity at the heart of the U.S. banking system, explaining their position in a one-page paper entitled “Yield and Interest Prohibition Principles.”

The Digital Chamber has now penned its own set of principles and began circulating it on Friday, defending the need for the section in the Senate Banking Committee’s draft bill that outlines a range of situations in which rewards could be acceptable. The latest document, obtained by CoinDesk, also says that the bankers’ request for a two-year study on stablecoins’ effect on deposits is acceptable, as long as it doesn’t come with an automatic regulatory rulemaking in response.

“We want to make the case known for policymakers that we do think this is a compromise,” said Digital Chamber CEO Cody Carbone, in an interview on Friday. With this document, the industry group is putting in writing that it’s willing to give up ground on anything that looks like an interest payment for static holdings of stablecoins, which would most closely resemble a bank savings account.

While the crypto sector has been pursuing stablecoin products allowed under last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, the bankers are trying to dial back that law with edits included in this pending Digital Asset Market Clarity Act. But the GENIUS Act represents the current law of the land, so Carbone suggested that his industry’s willingness to scrap rewards on stablecoin holdings is a significant concession, and the crypto companies should still be able to offer rewards when customers engage in transactions and other activity. Bankers should return to the table to talk again, he said.

“if they don’t negotiate, then the status quo is that just rewards continue as-is,” said Carbone, who suggested that his group’s wide membership — which includes banking members — can put it closer to the middle of the discussion. “If they do nothing and they continue to say, ‘We just want a blanket prohibition,’ this goes nowhere.”

He hopes the Digital Chamber’s new position paper can reset the negotiations that have halted progress on the legislation since an 11th-hour disagreement derailed a hearing on the bill in the banking panel a month ago.

“Hopefully we can be the voice or the middle man who helps drive this conversation once again, because we are the one trade that represents both sides,” Carbone said.

The Digital Chamber’s principles on Friday highlighted two particular reward scenarios it wanted protected – those tied to providing liquidity and those fostering ecosystem participation. The group argued those two provisions of the draft bill’s Section 404 are especially important in decentralized finance (DeFi).

The White House is said to have called for a compromise by the end of this month. So far, the bank side hasn’t seemed to budge in repeated meetings, though Trump crypto adviser Patrick Witt said in a Friday interview with Yahoo Finance that another gathering may be scheduled for next week.

“We’re working hard to address the issues that were raised,” Witt told Yahoo Finance, saying he’s encouraged both sides to bend on the details.

“It’s unfortunate that this has become such a big issue,” he said, because the Clarity Act isn’t really about stablecoins, which was more appropriately the business of the already-passed GENIUS Act. “Let’s use a scalpel here to address this narrow issue of idle yield,” he added.

The Senate Agriculture Committee has already passed its own version of the Clarity Act, which focused on the commodities side of the ledger, while the Senate Banking Committee’s version is more about securities. If the banking panel follows its agriculture counterparts, it’ll advance the bill along partisan lines. But if a final bill is to eventually be approved in the entire Senate, it’ll need a lot of Democratic support to clear the chamber’s 60-vote margin.

Crypto World

Bitcoin Pushes Above $69K as Retail Bulls Show Intent

Bitcoin (BTC) rallied to $69,482 on Friday, and the rally coincided with data showing steady accumulation from smaller-sized holders in February.

Analysts say the breakout may evolve into a broader bullish trend, although other data suggest that a longer period of price consolidation will underlie the emerging bull trend.

Key takeaways:

-

BTC broke above the $69,000 resistance and its descending channel, triggering $92 million in short liquidations within four hours.

-

Small wallets added $613 million in February, while the whale wallets stalled with $4.5B billion in outflows.

-

Short-term holder profit-ratio indicator hit its lowest level since November 2022, underscoring weak sentiment over the past few weeks.

Will the Bitcoin relief rally last?

Bitcoin has pushed above the upper boundary of its descending channel and retested $69,000. The move marks a potential bullish break of structure (BOS), if BTC holds above $68,000.

If BTC holds above this reclaimed level, the next internal liquidity zones sit near $71,500 and $74,000. The 50 and 100-period exponential moving averages (EMAs) are now compressing beneath the price on the one-hour chart, reinforcing the possibility of the short-term momentum continuing.

The latest price surge triggered roughly $96 million in futures liquidations over the past four hours, with nearly $92 million coming from short positions, signaling a short squeeze on bearish traders.

BTC liquidations were primarily concentrated on Bybit (22.5%), Hyperliquid (22%), and Gate (15%), suggesting these platforms account for a significant share of active leveraged positioning in the market.

Related: Multi-day negative Bitcoin funding signals ‘overcrowded’ short trade: Reversal coming?

BTC retail investor demand backs the breakout

The breakout is supported by the steady buying from the smaller-sized investors. Order flow data from Hyblock shows that the small wallets ($0–$10,000) have accumulated roughly $613 million in cumulative volume delta (CVD) in February, consistently bidding during the price correction.

The mid-sized wallets ($10,000–$100,000) remain around -$216 million for the month, but the cohort added roughly $300 million since BTC fell below $60,000, suggesting selective accumulation during discounted periods.

Whale wallets ($100,000 and above) saw their CVD bottom near -$5.8 billion earlier in February and have since moved sideways. This stabilization implies that the aggressive distribution has paused, though a clear accumulation trend from the large holders has yet to emerge.

For the rally to continue, whale buying may need to return, and the short-term holder spent output profit ratio (SOPR) may need to move back above 1, signaling that the recent buyers are no longer selling at a loss.

Notably, the short-term holder SOPR recently fell to its lowest level since November 2022, indicating that many recent buyers have been realizing losses, a sign that conviction may remain fragile despite the rebound.

Related: Bitcoin passes $69K on slower US CPI print, but Fed rate-cut odds stay low

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Team That Flagged $1B Iran USDT Fired?

Binance has fired at least five members of its compliance investigations team after they internally flagged more than $1 billion in transactions allegedly tied to Iranian entities, according to Fortune.

The transactions reportedly took place between March 2024 and August 2025. As reported, they were routed using Tether’s USDT stablecoin on the Tron blockchain.

USDT on Tron: A Familiar Pattern For Iran?

The firings allegedly began in late 2025. Several of the dismissed staff had law enforcement backgrounds and held senior investigative roles.

Sponsored

Sponsored

Fortune reported that at least four additional senior compliance staff have also left or been pushed out in recent months.

The reported $1 billion in flows were denominated in USDT and moved across the Tron network. That combination has repeatedly appeared in recent sanctions enforcement actions involving Iran-linked activity.

Earlier this month, the US Treasury’s Office of Foreign Assets Control (OFAC) sanctioned two UK-registered crypto exchanges, Zedcex and Zedxion. It’s alleged that the exchanges processed nearly $1 billion in transactions tied to Iran’s Islamic Revolutionary Guard Corps (IRGC).

According to OFAC and blockchain analytics reporting cited by TRM Labs and Chainalysis, much of that activity also involved USDT on Tron.

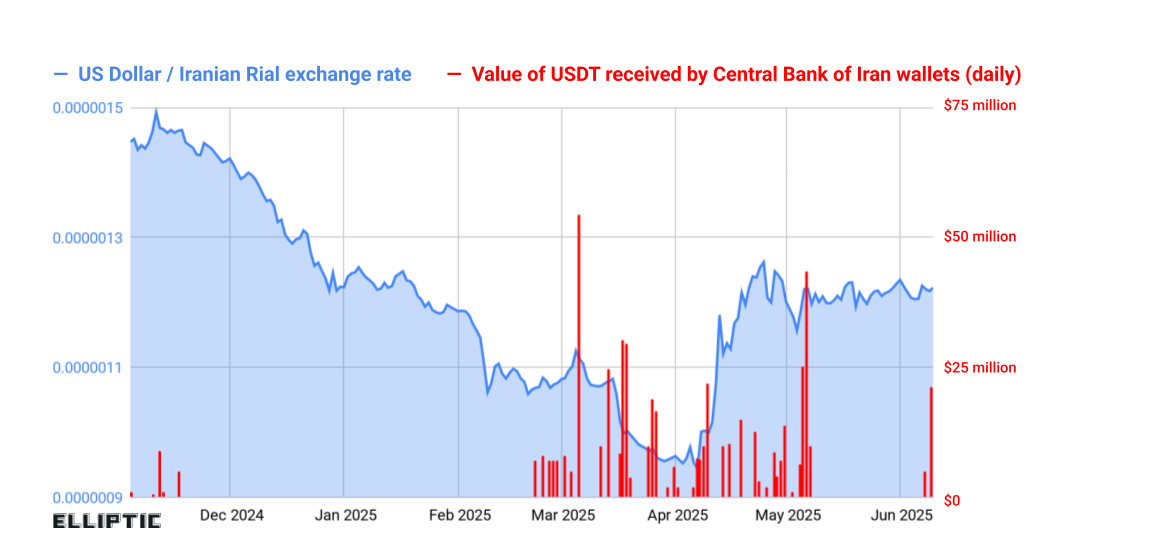

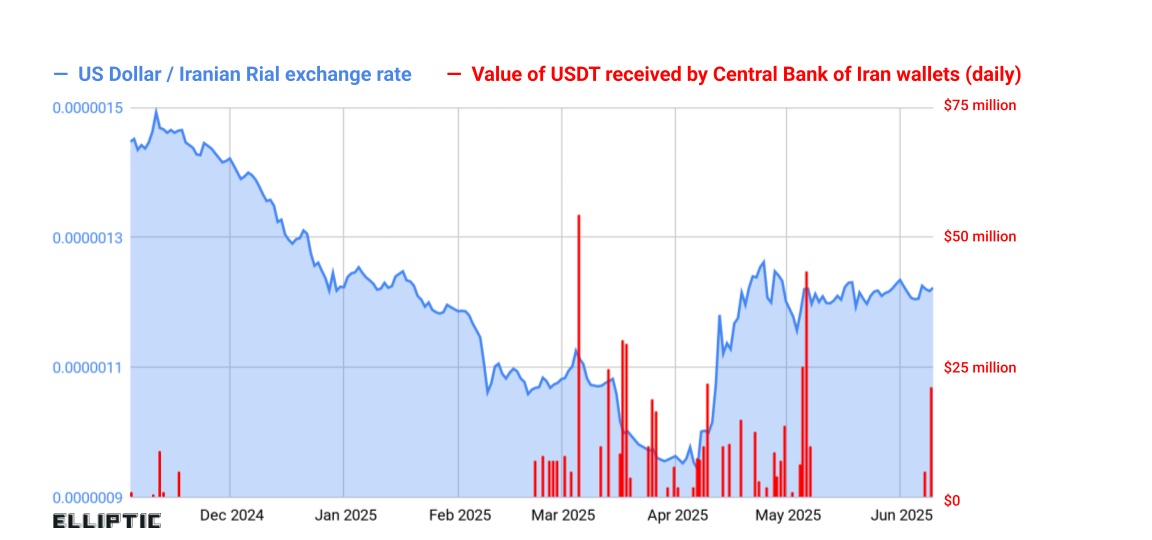

Separately, BeinCrypto reported in January that Iran’s central bank accumulated more than $500 million in USDT amid pressure on the Iranian rial. Blockchain analytics firm Elliptic said the purchases likely aimed to secure hard-currency liquidity outside the traditional banking system, effectively creating a parallel dollar reserve.

Taken together, these cases show how stablecoins—particularly USDT—have become central to Iran-linked cross-border financial flows.

Binance has not publicly confirmed that the alleged Iran-linked transactions violated sanctions laws, nor has any regulator announced new enforcement action against the company related to this reporting.

However, the episode unfolds amid broader scrutiny of stablecoin infrastructure and the role of exchanges in geopolitical sanctions regimes.

Crypto World

Binance’s France chief targeted by armed men looking for crypto

David Princay, the president of Binance’s France arm, was targeted by armed robbers on Thursday just hours before the same gang attacked an unnamed crypto entrepreneur at their home.

According to local media, three men broke into Pincay’s Val-de-Marne apartment, eventually fleeing with two mobile phones.

The robbers reportedly tried to continue their spree hours later, this time targeting a home in the commune of Vaucresson that belonged to a crypto entrepreneur.

After gaining access to the house, they beat the entrepreneur with their guns before fleeing.

Police were able to track the stolen phones to this second address and discovered that the attackers had used the same vehicle used in the Princay raid in their other escapades.

The three were subsequently tracked to the city of Lyon, where they were arrested.

The attacks appear to have been poorly planned as, during the raid on Princay’s home, the robbers had to force other residents living in the same building to point them towards his apartment.

Also, during the second raid, a woman reportedly overheard the robbers questioning their own directions, saying, “The address isn’t right,” and “Stéphane lives at number 41.”

Since the attacks, Binance CEO Richard Teng has confirmed that the “[French colleague] and his family are safe and working closely with law enforcement.”

Read more: French government gives crypto entrepreneurs priority police line

Binance’s Princay joins list of crypto victims in France

France has become known for crypto-specific robberies in which criminals rush wealthy investors and physically intimidate them into giving up their crypto.

A French tax agent who passed the details of crypto entrepreneurs and other authoritative individuals to criminal gangs saw her prison appeal rejected last month.

In that same month, another victim was tied up by three masked men who were looking for her partner’s USB stick, which contained access to his cryptocurrency.

Last year, the alleged ringleader of a series of crypto-related kidnappings in France was arrested in Morocco. They’re suspected of orchestrating the kidnapping of Ledger CEO David Balland.

Read more: French crypto tax firm targeted in ShinyHunters extortion attempt

After months of kidnappings, France’s Interior Minister Bruno Retailleau promised the industry that it would have priority access to emergency police services, amongst other security measures.

Retailleau said, “These repeated kidnappings of professionals in the crypto sector will be fought with specific tools, both immediate and short-term, to prevent, dissuade and hinder in order to protect the industry.”

Web3 Operational Security researcher Pablo Sabbatella warned crypto investors that they shouldn’t have “direct access” to their funds.

He said, “If you just have a Ledger with millions sitting in it, you are eventually gonna lose it all,” adding that “Multisigs, Shamir, time delays, geographic distribution and other systems will protect your assets.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Bitcoin Tops $69K as CPI Slows, Fed Rate-Cut Odds Stay Low

Bitcoin (CRYPTO: BTC) kicked off Friday’s session with a modest smile, boosted by a softer-than-expected January CPI print that renewed appetite for risk assets. Traders priced in cooler inflation while keeping a wary eye on the path of policy, with the largest cryptocurrency carving a path toward notable resistance as the CPI data circulated. At one point, BTC rose by as much as 4% intraday, with the benchmark token trading near the $69,000 region on Bitstamp as traders assessed how the inflation backdrop could shape Federal Reserve expectations in the near term.

Key takeaways

- Bitcoin surged on the back of a January CPI print that cooled beyond expectations, lifting BTC/USD toward the $69,000 level on Bitstamp and signaling renewed momentum in the short run.

- Core CPI matched estimates at 2.5% while the overall CPI printed 2.4%, both softer than anticipated, fueling a broad risk-on swing across macro assets.

- Market odds of aggressive Fed easing remained limited, with CME FedWatch showing slim chances of a rate cut at the March meeting, complicating the path for a sustained breakout.

- Analysts highlighted a confluence of technical references around the 68,000–69,000 area, including the old 2021 all-time high and the 200-week EMA, as a potential higher-low anchor for BTC.

- Gold climbed toward a symbolic milestone while the US dollar index attempted a recovery after the CPI release, underscoring a mixed but constructive macro backdrop for risk assets.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Positive. The CPI surprise propelled Bitcoin higher, with daily gains peaking near 4% and the price testing the $69,000 vicinity on major venues such as Bitstamp.

Market context: The inflation print fed into a broader narrative where macro assets showed a tempered response to cooling inflation, even as rate-cut expectations remained guarded and positioned around the mid-year horizon. Traders watched for durably slowing inflation signals to justify an acceleration in risk-taking, while acknowledging that policymakers may still stride cautiously given a resilient labor market and evolving growth dynamics.

Why it matters

The January CPI outcome reinforces a delicate balance in which inflation is trending lower, but policymakers are unlikely to rush the rate-cut cycle. The data echo a pattern observed in recent weeks: inflation metrics are trending toward multi-year lows, yet the Federal Reserve’s reaction function remains data-dependent. For BTC and the broader crypto market, softer inflation can translate into improved liquidity and a more forgiving risk environment, which historically tends to favor speculative assets and risk-sensitive sectors.

From a technical standpoint, traders are watching key price zones that have previously served as turning points. The 68,000–69,000 zone is notable because it intersects with the 2021 all-time high and the 200-week exponential moving average (EMA), a level analysts have cited as an anchor for potential higher-lows in the near term. Several market participants described BTC as consolidating in a potential falling-wedge pattern, a setup that could precede another leg higher if momentum builds. A recent update from a prominent trader noted that an initial breakout attempt at around the 68,000 level faced resistance, reinforcing the idea that the next meaningful move would likely be defined by how the market handles that zone.

Beyond BTC, macro gold also flirted with significant levels, highlighting a broader risk-on mood among non-crypto assets as the CPI narrative evolved. The U.S. dollar index found some footing after the initial CPI dip, a dynamic that can influence risk appetite across asset classes, including digital assets. In this environment, BTC’s performance could act as a barometer for market demand for risk assets and for investors seeking hedges or diversifiers amid evolving macro signals.

One notable thread in the commentary around the CPI release was the consideration of future Fed policy moves. While some market observers argued that a rate cut could become more plausible if inflation continues to ease, others cautioned that a single data print does not alter the central bank’s reaction function overnight. A widely cited dashboard showed that probability of a March rate cut remained in the minority, underscoring the challenge for crypto bulls to sustain a sustained breakout without clearer signs of easing monetary policy. In a related thread, a market observer referenced a lower-bound view on policy shifts, suggesting that the inflation trajectory would need to demonstrate sustained deceleration before a meaningful shift in rate expectations could be priced in. Investors also weighed a perspective opposing the surprise: that a temporary CPI softness might simply reflect statistical quirks rather than a durable downward trend.

For traders who have been watching the narrative unfold, the CPI surprise did not fully resolve the tug-of-war between risk-on optimism and the structural caution that has characterized crypto markets for much of the past year. While BTC’s intraday rally underscored renewed enthusiasm, many participants stressed that the long-term trajectory would hinge on the Fed’s path and on the sequencing of economic data in the coming weeks. A closing thought from a market commentator who tracks inflation data and policy expectations noted that, even with a favorable inflation print, the real test lies in whether inflation can stay on a downward trajectory long enough to alter policy expectations meaningfully.

The CPI data’s impact on the market narrative can be glimpsed through the lens of the related coverage around inflation dynamics and policy. For readers seeking concrete context, the CPI release is documented by the U.S. Bureau of Labor Statistics and the associated commentary on how core and headline readings evolved. The market’s reaction to the data is also shaped by how traders interpret the probability of future rate actions, as reflected in tools that gauge Fed expectations. Additionally, analysts cited external inflation trackers and independent assessments to illustrate the nuanced view of inflation risk in the current environment. For a broader sense of sentiment, the community’s discussions surrounding the CPI data and Fed policy provide a snapshot of how this turning point is perceived by traders and researchers alike, including conversations that reference alternative inflation metrics as a lens to evaluate CPI outcomes.

The narrative also includes perspectives from traders active in social channels, where analysts often cross-reference inflation data with on-chain signals and technical indicators. A notable thread tied to the CPI release highlighted the idea that the CPI decline, while supportive, is not a decisive turn; rather, it is part of a broader sequence that could unfold across the next several weeks as the market calibrates its expectations for policy, liquidity, and macro risk appetite. The ongoing dialogue among market participants underscores the importance of keeping a close watch on how the inflation data evolves and how policy guidance evolves in response, as those dynamics will continue to influence BTC’s trajectory and the crypto market more broadly.

For readers who want to explore the underlying data themselves, the CPI release and the market’s interpretation of it are widely covered in real-time feeds and official releases. The Bureau of Labor Statistics provides the primary figures, while market data platforms and analysis from research shops offer additional context on how these numbers translate into rate expectations, liquidity, and risk sentiment. In the eyes of many traders, the CPI print is less a singular event than a datapoint in an ongoing process—one that will shape the tempo and nature of crypto market movements in the weeks to come.

TradingView BTCUSD chart shows the intraday velocity, while the CPI context remains anchored by the U.S. CPI release from the Bureau of Labor Statistics. As a contemporaneous note, a widely circulated tweet from market analyst Andre Dragosch referenced Truflation’s sub-1% CPI readings as supporting evidence for a less aggressive inflation profile than some conventional measures imply. The exchange between traditional data and alternative inflation metrics continues to shape expectations around rate moves and cross-asset correlations.

In sum, the CPI surprise injected a tactical lift for Bitcoin, but the broader path remains a function of policy expectations, liquidity conditions, and the ongoing assessment of inflation trends. As the market digests the data, traders will be watching for a softening CPI to translate into a more explicit willingness to price in rate cuts—and with that, a more durable upside for BTC and the broader crypto complex.

Earlier coverage noted the delicate balance between momentum and resistance around the $68,000–$69,000 zone, a region that has historically defined the near-term tempo of BTC price action. The narrative continues to evolve as macro conditions, policy signals, and on-chain fundamentals interact in real time.

For additional context and data points discussed during the CPI reaction, see the related notes and coverage linked throughout this timeline, including references to the FedWatch tool and broader market commentary that has tracked the shifting probability of rate cuts in the March horizon.

//platform.twitter.com/widgets.js

Crypto World

Anchorage, Kamino Let Firms Borrow Against SOL Without Moving Custody

Anchorage Digital, Kamino, and Solana Company are piloting a structure that could ease a longtime friction between traditional finance and DeFi: the ability to borrow against staked tokens without moving assets out of regulated custody. The collaboration expands Anchorage’s Atlas collateral management platform by integrating Kamino, a Solana-based decentralized lending protocol, with a framework that keeps collateral in custodial control. Solana (SOL) ((CRYPTO: SOL)) sits at the center of the arrangement, as the Solana Company treasury—an on-chain asset pool backed by Pantera Capital and Summer Capital—provides a tangible anchor for the program. The goal is to give financial institutions liquidity without forcing them to relinquish staking rewards or move assets into smart contracts that may carry higher regulatory or operational risk.

Key takeaways

- Atlas’s collateral management is being extended to support native staking positions, enabling lenders to use staked SOL as collateral while assets remain in Anchorage’s custody.

- Anchorage acts as collateral manager, setting loan-to-value ratios and margin requirements, and performing liquidation if necessary, removing the direct on-chain custody burden from regulated entities.

- The involved treasury, Solana Company, holds a large SOL position and participates in governance and risk disclosures through its custodial framework and public partnerships.

- The move unfolds amid a broader regulatory debate in the United States around DeFi, with the CLARITY Act aiming to clarify jurisdiction and standards for digital-asset activities.

- Industry groups warn that early draft language does not fully distinguish between centralized intermediaries and decentralized protocols, adding a layer of regulatory risk to institutional adoption.

Tickers mentioned: $SOL

Sentiment: Neutral

Market context: The development mirrors growing institutional interest in DeFi-enabled liquidity while regulators weigh how to apply traditional securities and banking rules to on-chain lending and custody models.

Why it matters

The Anchorage-Kamino-Solana Company arrangement represents a tangible path for institutions to engage with decentralized lending markets without altering their custody and compliance posture. By keeping the collateral in segregated, regulated custody at Anchorage Digital Bank, lenders can maintain certainty around asset segregation, reporting, and risk controls that are typically required for regulated entities. The model reduces a historical hurdle: moving assets into on-chain, non-custodial environments that can complicate lending approvals, risk management, and auditability for banks and asset managers.

From a risk-management perspective, Anchorage’s role as collateral manager—determining loan-to-value caps, margin calls, and potential liquidations—adds a familiar, governance-backed framework to on-chain lending. It gives institutions a governance layer that complements Kamino’s DeFi lending markets, potentially expanding the universe of assets that institutions are comfortable using as collateral. The custody-first approach aims to preserve staking rewards, which for SOL holders can mean ongoing yield while accessing liquidity. This is particularly salient for large treasuries such as Solana Company, which has built a sizable SOL position and participates in ecosystem funding and governance through its holdings.

Regulators, on the other hand, watch closely. The CLARITY Act, which seeks to establish clearer jurisdiction and regulatory standards for digital assets, has become a focal point in policy debates. While supporters argue the bill would reduce uncertainty for market participants, critics counter that it does not fully delineate how decentralized protocols, developers, and governance frameworks should be treated under the law. The tension is evident in industry discussions and public commentary, underscoring that even innovative custody-friendly DeFi solutions must operate within an evolving regulatory landscape. In this context, the Anchorage-Kamino-Solana Company collaboration can be seen as a practical test case: it demonstrates what regulated institutions are willing to try, and where policy gaps may need to be filled to broaden safe participation.

Solana Company’s position—reported to be one of the largest SOL-based treasuries—adds another layer of credibility to the experiment. Its holdings, and the associated disclosures, underscore the willingness of specialized treasury teams to explore on-chain lending as a liquidity tool, provided that custodial safeguards remain intact. The project’s public materials also point to Solana’s ecosystem ambitions and the role of strategic treasury management in supporting on-chain liquidity without destabilizing staking yields or governance processes.

The technical structure hinges on integrating Kamino’s lending protocol with Atlas’s collateral framework. Under the program, a loan would be issued against natively staked SOL, but the actual SOL remains in Anchorage’s segregated custody. That separation matters because it preserves the institution’s regulatory, accounting, and risk-management controls while granting access to liquidity through Kamino’s on-chain markets. Anchorage’s oversight includes monitoring collateral value relative to loan size, maintaining margin requirements, and triggering liquidations if risk thresholds are breached. This model avoids the conventional requirement for institutions to transfer assets into smart-contract-based vaults, a sticking point that has historically limited regulated participation in DeFi lending markets.

The integration was announced in a period when Solana’s ecosystem, including its treasury vehicles, has been under scrutiny for both performance and risk. The Solana ecosystem’s public-facing information notes that the Solana Company treasury holds a substantial stake in SOL, reinforcing the relevance of this development to how large on-chain holders think about liquidity and risk. This event aligns with broader industry interest in on-chain lending, especially where custody remains in regulated environments. For market participants, the arrangement signals a potential template for expanding institutional DeFi exposure without eroding the protections and oversight that banks and trust companies emphasize.

What to watch next

- Regulatory clarity progress on the CLARITY Act and related DeFi governance provisions, including any committee votes or amendments that clarify custody vs. on-chain lending.

- Milestones in the Atlas-Kamino integration, such as go-live dates, onboarding of initial institutional users, and risk-management enhancements.

- Solana Company’s ongoing SOL portfolio disclosures and any new risk disclosures tied to staking yields and on-chain liquidity use.

- Updates from Anchorage Digital Bank on custody controls, compliance reporting, and risk-management metrics as more institutions engage with the structure.

Sources & verification

- Anchorage Digital’s expansion of Atlas collateral management through Kamino integration with Solana Company’s treasury.

- Solana Company treasury data and public disclosures via CoinGecko.

- CLARITY Act overview and DeFi market-structure discussions.

- Public policy discussions and industry meetings surrounding DeFi oversight, including high-level regulatory engagement by the Trump administration.

Market reaction and key details

The collaboration between Anchorage Digital, Kamino, and Solana Company illustrates how institutions may bridge custody-grade risk controls with DeFi liquidity pools. By enabling native staking positions to serve as collateral without a custody transfer, the program could unlock new liquidity channels for regulated entities. The emphasis on collateral management, risk controls, and segregated custody is consistent with a broader trend: institutions seeking to participate in on-chain lending while preserving traditional compliance and reporting regimes. The Solana ecosystem’s treasury dynamics, including Solana Company’s substantial SOL holdings, will be watched closely to see how risk disclosures evolve as the program expands. For practitioners, the approach could inform future collaborations that pair regulated custody with decentralized markets, potentially shaping how banks, asset managers, and corporate treasuries view DeFi liquidity tools.

Key figures and next steps

The project’s practical implications hinge on governance, custody risk controls, and the speed at which regulated institutions feel comfortable expanding their DeFi participation. If the pilot proves scalable and appropriately regulated, it may pave the way for broader adoption of staking-backed liquidity facilities that keep assets under regulated custody while granting on-chain access to lending markets. Observers will be watching for formal go/no-go decisions from participating institutions, any changes to Atlas collateral parameters, and additional asset classes considered for similar custody-preserving lending structures.

Crypto World

U.S. Grants General License to Reliance Industries to Buy Venezuelan Oil

TLDR

- The United States issued a general licence to Reliance Industries, allowing direct purchases of Venezuelan oil without breaching sanctions.

- The move follows Washington’s easing of sanctions on Venezuela’s energy sector after internal political changes.

- General licence permissions include buying, exporting, selling, and refining extracted Venezuelan crude.

- Reliance had previously stopped Venezuelan oil imports due to sanctions but now could resume direct purchases.

- The licence supports Reliance’s efforts to diversify crude sources and reduce reliance on higher‑cost alternatives.

The United States has issued a general license allowing India’s Reliance Industries Ltd to purchase Venezuelan oil directly. This development follows the U.S. capture of Venezuelan President Nicolas Maduro. The decision could streamline Venezuela’s oil exports while benefiting Reliance’s refining operations.

U.S. Eases Sanctions to Facilitate Venezuelan Oil Purchases

According to a Reuters report, the U.S. has eased sanctions on Venezuela’s energy sector, aiming to support a $2 billion oil deal with Washington. The sanction relief also complements the broader goal of aiding Venezuela’s oil industry reconstruction.

A general license now authorizes companies to buy and refine Venezuelan oil, bypassing previous restrictions. Reliance Industries applied for the license in January. As one of the world’s largest oil refiners, it operates an advanced refining complex.

The license will allow Reliance to resume buying Venezuelan oil directly. This could expedite the company’s plans to replace Russian oil supplies.

Reliance’s Oil Strategy and the Role of Venezuelan Imports

Reliance recently bought 2 million barrels of Venezuelan oil from Vitol, a major trader. The company is expected to continue seeking discounted Venezuelan crude, replacing Russian oil in its refineries.

Reliance’s purchase marks a shift from the company’s earlier reliance on Russian oil amid geopolitical tensions. The U.S. has granted specific licenses to traders like Vitol and Trafigura, enabling them to sell Venezuelan oil.

These traders now have the authority to market large quantities of oil from Venezuela. This move aims to reduce Reliance’s dependence on more expensive crude, thus lowering costs for its refining operations.

The Strategic Shift in Global Oil Supply Chains

Reliance’s refineries, with a combined capacity of 1.4 million barrels per day, stand to benefit from the cheaper Venezuelan oil. The company had ceased buying Venezuelan crude in 2025 due to U.S. sanctions but will now be able to resume direct purchases.

This shift will allow Reliance to diversify its oil sources amid the changing global oil market. The general license granted by the U.S. marks a key step in this transition.

By securing access to discounted Venezuelan oil, Reliance can maintain its competitive edge. This development could further align India’s energy interests with U.S. strategic goals in the region.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video8 hours ago

Video8 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle