Crypto World

Anchorage, Kamino Let Firms Borrow Against SOL Without Moving Custody

Anchorage Digital, Kamino, and Solana Company are piloting a structure that could ease a longtime friction between traditional finance and DeFi: the ability to borrow against staked tokens without moving assets out of regulated custody. The collaboration expands Anchorage’s Atlas collateral management platform by integrating Kamino, a Solana-based decentralized lending protocol, with a framework that keeps collateral in custodial control. Solana (SOL) ((CRYPTO: SOL)) sits at the center of the arrangement, as the Solana Company treasury—an on-chain asset pool backed by Pantera Capital and Summer Capital—provides a tangible anchor for the program. The goal is to give financial institutions liquidity without forcing them to relinquish staking rewards or move assets into smart contracts that may carry higher regulatory or operational risk.

Key takeaways

- Atlas’s collateral management is being extended to support native staking positions, enabling lenders to use staked SOL as collateral while assets remain in Anchorage’s custody.

- Anchorage acts as collateral manager, setting loan-to-value ratios and margin requirements, and performing liquidation if necessary, removing the direct on-chain custody burden from regulated entities.

- The involved treasury, Solana Company, holds a large SOL position and participates in governance and risk disclosures through its custodial framework and public partnerships.

- The move unfolds amid a broader regulatory debate in the United States around DeFi, with the CLARITY Act aiming to clarify jurisdiction and standards for digital-asset activities.

- Industry groups warn that early draft language does not fully distinguish between centralized intermediaries and decentralized protocols, adding a layer of regulatory risk to institutional adoption.

Tickers mentioned: $SOL

Sentiment: Neutral

Market context: The development mirrors growing institutional interest in DeFi-enabled liquidity while regulators weigh how to apply traditional securities and banking rules to on-chain lending and custody models.

Why it matters

The Anchorage-Kamino-Solana Company arrangement represents a tangible path for institutions to engage with decentralized lending markets without altering their custody and compliance posture. By keeping the collateral in segregated, regulated custody at Anchorage Digital Bank, lenders can maintain certainty around asset segregation, reporting, and risk controls that are typically required for regulated entities. The model reduces a historical hurdle: moving assets into on-chain, non-custodial environments that can complicate lending approvals, risk management, and auditability for banks and asset managers.

From a risk-management perspective, Anchorage’s role as collateral manager—determining loan-to-value caps, margin calls, and potential liquidations—adds a familiar, governance-backed framework to on-chain lending. It gives institutions a governance layer that complements Kamino’s DeFi lending markets, potentially expanding the universe of assets that institutions are comfortable using as collateral. The custody-first approach aims to preserve staking rewards, which for SOL holders can mean ongoing yield while accessing liquidity. This is particularly salient for large treasuries such as Solana Company, which has built a sizable SOL position and participates in ecosystem funding and governance through its holdings.

Regulators, on the other hand, watch closely. The CLARITY Act, which seeks to establish clearer jurisdiction and regulatory standards for digital assets, has become a focal point in policy debates. While supporters argue the bill would reduce uncertainty for market participants, critics counter that it does not fully delineate how decentralized protocols, developers, and governance frameworks should be treated under the law. The tension is evident in industry discussions and public commentary, underscoring that even innovative custody-friendly DeFi solutions must operate within an evolving regulatory landscape. In this context, the Anchorage-Kamino-Solana Company collaboration can be seen as a practical test case: it demonstrates what regulated institutions are willing to try, and where policy gaps may need to be filled to broaden safe participation.

Solana Company’s position—reported to be one of the largest SOL-based treasuries—adds another layer of credibility to the experiment. Its holdings, and the associated disclosures, underscore the willingness of specialized treasury teams to explore on-chain lending as a liquidity tool, provided that custodial safeguards remain intact. The project’s public materials also point to Solana’s ecosystem ambitions and the role of strategic treasury management in supporting on-chain liquidity without destabilizing staking yields or governance processes.

The technical structure hinges on integrating Kamino’s lending protocol with Atlas’s collateral framework. Under the program, a loan would be issued against natively staked SOL, but the actual SOL remains in Anchorage’s segregated custody. That separation matters because it preserves the institution’s regulatory, accounting, and risk-management controls while granting access to liquidity through Kamino’s on-chain markets. Anchorage’s oversight includes monitoring collateral value relative to loan size, maintaining margin requirements, and triggering liquidations if risk thresholds are breached. This model avoids the conventional requirement for institutions to transfer assets into smart-contract-based vaults, a sticking point that has historically limited regulated participation in DeFi lending markets.

The integration was announced in a period when Solana’s ecosystem, including its treasury vehicles, has been under scrutiny for both performance and risk. The Solana ecosystem’s public-facing information notes that the Solana Company treasury holds a substantial stake in SOL, reinforcing the relevance of this development to how large on-chain holders think about liquidity and risk. This event aligns with broader industry interest in on-chain lending, especially where custody remains in regulated environments. For market participants, the arrangement signals a potential template for expanding institutional DeFi exposure without eroding the protections and oversight that banks and trust companies emphasize.

What to watch next

- Regulatory clarity progress on the CLARITY Act and related DeFi governance provisions, including any committee votes or amendments that clarify custody vs. on-chain lending.

- Milestones in the Atlas-Kamino integration, such as go-live dates, onboarding of initial institutional users, and risk-management enhancements.

- Solana Company’s ongoing SOL portfolio disclosures and any new risk disclosures tied to staking yields and on-chain liquidity use.

- Updates from Anchorage Digital Bank on custody controls, compliance reporting, and risk-management metrics as more institutions engage with the structure.

Sources & verification

- Anchorage Digital’s expansion of Atlas collateral management through Kamino integration with Solana Company’s treasury.

- Solana Company treasury data and public disclosures via CoinGecko.

- CLARITY Act overview and DeFi market-structure discussions.

- Public policy discussions and industry meetings surrounding DeFi oversight, including high-level regulatory engagement by the Trump administration.

Market reaction and key details

The collaboration between Anchorage Digital, Kamino, and Solana Company illustrates how institutions may bridge custody-grade risk controls with DeFi liquidity pools. By enabling native staking positions to serve as collateral without a custody transfer, the program could unlock new liquidity channels for regulated entities. The emphasis on collateral management, risk controls, and segregated custody is consistent with a broader trend: institutions seeking to participate in on-chain lending while preserving traditional compliance and reporting regimes. The Solana ecosystem’s treasury dynamics, including Solana Company’s substantial SOL holdings, will be watched closely to see how risk disclosures evolve as the program expands. For practitioners, the approach could inform future collaborations that pair regulated custody with decentralized markets, potentially shaping how banks, asset managers, and corporate treasuries view DeFi liquidity tools.

Key figures and next steps

The project’s practical implications hinge on governance, custody risk controls, and the speed at which regulated institutions feel comfortable expanding their DeFi participation. If the pilot proves scalable and appropriately regulated, it may pave the way for broader adoption of staking-backed liquidity facilities that keep assets under regulated custody while granting on-chain access to lending markets. Observers will be watching for formal go/no-go decisions from participating institutions, any changes to Atlas collateral parameters, and additional asset classes considered for similar custody-preserving lending structures.

Crypto World

Praetorian Group Scandal Echoes FTX Collapse

The US DOJ (Department of Justice) has secured a 20-year prison sentence against the founder of a sprawling crypto investment scheme.

According to prosecutors, this scheme had defrauded more than 90,000 investors worldwide of over $200 million.

Sponsored

Sponsored

DOJ Exposes and Dismantles $200 Million Bitcoin Ponzi as Founder Receives 20-Year Prison Term

In a statement released on Thursday, the DOJ confirmed that Ramil Ventura Palafox, 61, was sentenced after pleading guilty to wire fraud and money laundering charges.

Palafox was the founder, chairman, and CEO of Praetorian Group International (PGI), a multi-level marketing company that claimed to generate outsized returns through Bitcoin trading and crypto-related strategies.

According to court documents, PGI operated from December 2019 to October 2021, raising more than $201 million from investors worldwide. The company promised daily returns of 0.5% to 3%, marketed as profits from sophisticated Bitcoin arbitrage and trading activities.

In reality, investigators found PGI was not conducting trading at the scale required to generate such returns. Instead, it functioned as a classic Ponzi scheme, using funds from new investors to pay earlier participants.

Authorities said at least $30.2 million was invested in fiat currency, alongside 8,198 Bitcoin valued at approximately $171.5 million at the time of investment.

Confirmed losses reached at least $62.7 million, though prosecutors indicated the total financial harm could be significantly higher.

Lavish Lifestyle and Fabricated Profits: How Palafox Hid the Collapse Behind a Luxury Facade

To maintain the illusion of profitability, Palafox allegedly created and controlled an online investor portal that displayed fabricated account balances.

Sponsored

Sponsored

Between 2020 and 2021, the platform consistently misrepresented investment performance. It falsely showed steady gains and reinforced investor confidence even as the scheme unraveled behind the scenes.

Court filings detail how Palafox diverted substantial amounts of investor funds to finance a lavish personal lifestyle.

According to prosecutors, he spent roughly $3 million on 20 luxury vehicles. He also spent approximately $329,000 on penthouse accommodations at a luxury hotel chain and purchased four residential properties in Las Vegas and Los Angeles worth more than $6 million.

Additional expenditures included around $3 million on designer clothing, jewelry, watches, and home furnishings from high-end retailers.

Prosecutors further alleged that Palafox transferred at least $800,000 in fiat currency and 100 Bitcoin—then valued at approximately $3.3 million—to a family member.

The scheme began to collapse in mid-2021 after PGI’s website went offline and withdrawal requests mounted. Although Palafox resigned as CEO in September 2021, authorities said he initially retained control over company accounts.

Sponsored

Sponsored

Prosecutors described this case as one of the more significant crypto-related Ponzi schemes in recent years. The sentencing marks a decisive conclusion to a scheme that thrived on exaggerated crypto profits and global recruitment networks.

Parallels with FTX: How PGI Echoed a Larger Crypto Collapse

Despite differences in scale and sophistication, this case is similar in many ways to the FTX collapse and associated contagion. Both exploited the crypto boom, promising investors outsized, unrealistic returns:

- Palafox with daily Bitcoin gains of 0.5–3%,

- FTX through high-yield exchange products tied to Alameda Research.

Investor funds were misappropriated for lavish personal spending:

- Palafox on luxury cars, real estate, and designer goods

- SBF on Alameda’s risky bets, properties, and political donations.

Sponsored

Sponsored

Both schemes used deceptive methods to maintain investor confidence:

- PGI with a fake portal showing steady gains

- FTX with hidden liabilities and inflated valuations.

PGI defrauded over 90,000 investors with confirmed losses exceeding $62.7 million, while FTX affected millions and billions in missing funds.

Federal prosecutions followed, with Palafox sentenced to 20 years in February 2026 and SBF to 25 years in 2024.

All these highlight a trend among bad actors in crypto while also revealing the DOJ’s ongoing crackdown on crypto-related fraud.

Crypto World

Solana price breaks bearish structure, $95 target in focus

Solana price has broken its short-term bearish structure, signaling a potential momentum shift that could open the door for a bullish expansion toward the $95 resistance zone.

Summary

- Local bearish trend invalidated, signaling a shift in short-term momentum

- Holding above the value area low supports higher-low formation

- $95 high-timeframe resistance is the next target, if bullish structure persists

Solana (SOL) price action is showing a notable improvement in structure after breaking out of a local bearish downtrend that had controlled price movement for much of the week. This shift marks an important technical development, as Solana has now printed a new high, signalling a potential transition away from short-term bearish control.

While broader market conditions remain mixed, the change in local structure suggests that downside momentum is weakening. If Solana can continue to build acceptance above key value levels, the probability of a sustained move toward higher resistance increases.

Solana price key technical points

- Local bearish market structure has been broken, confirming a higher high

- Value area low remains intact, supporting higher-low formation

- $95 high-timeframe resistance is the next upside target, if momentum persists

The recent price action on Solana has produced a clear break in market structure on the lower timeframes. After a prolonged period of lower highs and lower lows, Solana has now pushed above prior resistance and established a new swing high. This move invalidates the immediate bearish trend and shifts short-term momentum back in favor of buyers.

Market structure breaks are often early signals of trend transitions, particularly when they follow extended consolidations or corrective phases. In Solana’s case, the breakout suggests that sellers are losing control, at least in the short term, and that buyers are becoming more aggressive at current levels.

Holding value area low is critical

Despite the bullish development, confirmation will depend on Solana holding above the value area low. This level represents the lower boundary of fair value within the current range and often serves as a key decision point for whether to continue or fail.

As long as price action remains above this level, Solana has the opportunity to establish a higher low. A higher low would further reinforce the bullish shift in structure and increase confidence that the breakout is sustainable rather than a short-lived reaction.

Failure to hold this level, however, would return Solana to balance and reopen the risk of renewed consolidation or downside rotation.

Higher highs and higher lows shift bias

If Solana continues to print higher highs while defending higher lows, the broader narrative within the current trading range will begin to shift. Multiple higher highs and higher lows would negate the prior bearish bias and suggest that the market is transitioning into a more constructive phase.

Such transitions often occur in stages, with initial breakouts followed by retests and consolidations before larger expansions take place. This underscores the importance of patience, as short-term pullbacks remain healthy within a developing bullish structure.

$95 resistance comes into focus

With the local bearish structure broken, attention now turns to the next major upside level. The $95 region represents a significant high-timeframe resistance area where price previously faced rejection. A move toward this level would align with typical follow-through behavior after a successful structure break.

Reaching $95 would also place Solana back into the upper portion of its broader trading range. How price behaves around this level will be critical in determining whether the rally extends further or transitions into another consolidation phase.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Solana is showing early signs of a bullish continuation. As long as price holds above the value area low and maintains the newly established higher high, the probability favors further upside exploration.

In the near term, traders should expect some volatility as the market digests the structure break. Controlled pullbacks that hold above support would strengthen the bullish case, while a loss of value could delay continuation.

For now, the evidence suggests that Solana’s recent breakout is meaningful. If momentum continues to build, the $95 resistance level stands out as the next key upside target in the current market phase.

Crypto World

Banks Should Embrace Stablecoin Yield in CLARITY Act: White House Adviser

Crypto companies and platforms that provide stablecoin rewards have become a major point of contention in the CLARITY crypto market structure bill.

The banking industry should not be threatened by crypto companies offering stablecoin yield to customers, and both sides must compromise on the issue, according to White House crypto adviser Patrick Witt.

Witt said it was “unfortunate” that the issue of stablecoin yield has become a major point of contention between the crypto industry and banks, adding that crypto service providers sharing yield with customers does not threaten the banking industry’s business model or market share. He told Yahoo Finance:

“They can also offer stablecoin products to their customers, just the same as crypto. This is not an unfair advantage in either way, and many banks are now applying for OCC bank charters themselves to start offering bank-like products to their customers.

In the future, I don’t think this is going to be an issue,” he continued, adding, “I think they’re going to find opportunities to use these products and leverage them and offer new products to their customers and expand their businesses.”

The ability of crypto service providers and platforms to offer rewards to customers who hold stablecoins has emerged as one of the most significant pain points for the industry, contributing to delays in passing the CLARITY market structure bill.

Related: White House crypto bill talks ‘productive,’ but no deal yet

Time is running out on passing the CLARITY Act, Witt and others warn

The proposed CLARITY Act establishes clear regulatory jurisdiction over crypto markets between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), and also creates an asset taxonomy for cryptocurrencies.

However, government officials and industry executives have warned that the looming 2026 US midterm elections could derail efforts to pass it into law and threaten to roll back crypto regulations established by the administration of US President Donald Trump.

“I think if the Democrats were to take the House, which is far from my best case, then the prospects of getting a deal done will just fall apart,” US Treasury Secretary Scott Bessent said on Friday.

“There’s a window here. The window is still open, but it is rapidly closing,” Witt said, adding that the White House Crypto Council is aiming to have the CLARITY Act signed into law before the midterms “take all of the oxygen out of the room.”

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Stocks Are Rising. S&P 500 Heads Back Toward Record High.

The S&P 500 mounted another early push toward its closing highs on Thursday.

The Dow Jones Industrial Average rose 180 points, or 0.4%. The S&P 500 was up 0.4%. The Nasdaq Composite was up 0.4%. The S&P was roughly 10 points away from its highest close on record.

The yield on the 2-year Treasury note fell to 3.52%. The 10-year yield dropped to 4.17%.

Crypto World

IREN Joins MSCI USA Index, Elevating Visibility for Institutional Investors

TLDR

- IREN has been included in the MSCI USA Index, enhancing its visibility among institutional investors and index-tracking funds.

- The inclusion is expected to trigger automatic buying by index-tracking entities, potentially boosting IREN’s stock in the short term.

- IREN has shifted focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech sector.

- CEO Daniel Roberts believes the MSCI inclusion will broaden institutional access as the company executes its AI Cloud strategy.

- Since the announcement, IREN’s stock has increased by around 7%, reflecting investor optimism despite concerns over recent financial results.

IREN, a company transitioning from a BTC mining operation to a dual-focus entity, has announced its inclusion in the prestigious MSCI USA Index. This move is set to elevate the company’s profile, attracting more institutional investors and index-tracking funds. It is expected to create a short-term surge in the stock price as automatic buying from these entities takes effect.

The inclusion in the MSCI USA Index provides IREN with enhanced visibility. Investors and funds that track the index will now automatically consider IREN as part of their portfolios. This may trigger a short-term surge in its stock value, supporting the company’s broader business goals.

Why MSCI USA Index Inclusion Matters for IREN

Daniel Roberts, Co-Founder and Co-CEO of IREN, expressed that being added to the MSCI USA Index is a sign of the company’s growth. “We believe this milestone will broaden institutional access to IREN as we continue to execute on our AI Cloud strategy,” he said. This inclusion comes as IREN shifts its focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech space.

As IREN pivots towards AI, the company’s shift in priorities is evident in its investments. It is spending more on AI-centric assets, such as data centers, than on traditional Bitcoin mining operations. This strategic move aims to capitalize on the growing demand for AI infrastructure, with plans to expand its power portfolio and attract long-term partnerships.

IREN’s Stock Response and Future Plans

Since the MSCI inclusion announcement, IREN’s stock has seen an upward movement. The company’s share price rose by approximately 7%, demonstrating investor optimism. However, concerns about the company’s financial performance remain, as recent quarterly results showed lower-than-expected revenues and widening losses.

Despite these concerns, IREN’s long-term outlook remains promising. The company is in talks for several major deals, including a multibillion-dollar contract that could further drive its growth. As the AI infrastructure market expands, IREN aims to leverage its secured power capacity to attract new contracts and raise its recurring revenue.

IREN continues to make progress with its energy initiatives, securing new data center campuses and large power agreements. These efforts position the company to meet the growing demand for energy from tech giants, ensuring a robust pipeline for future growth.

Crypto World

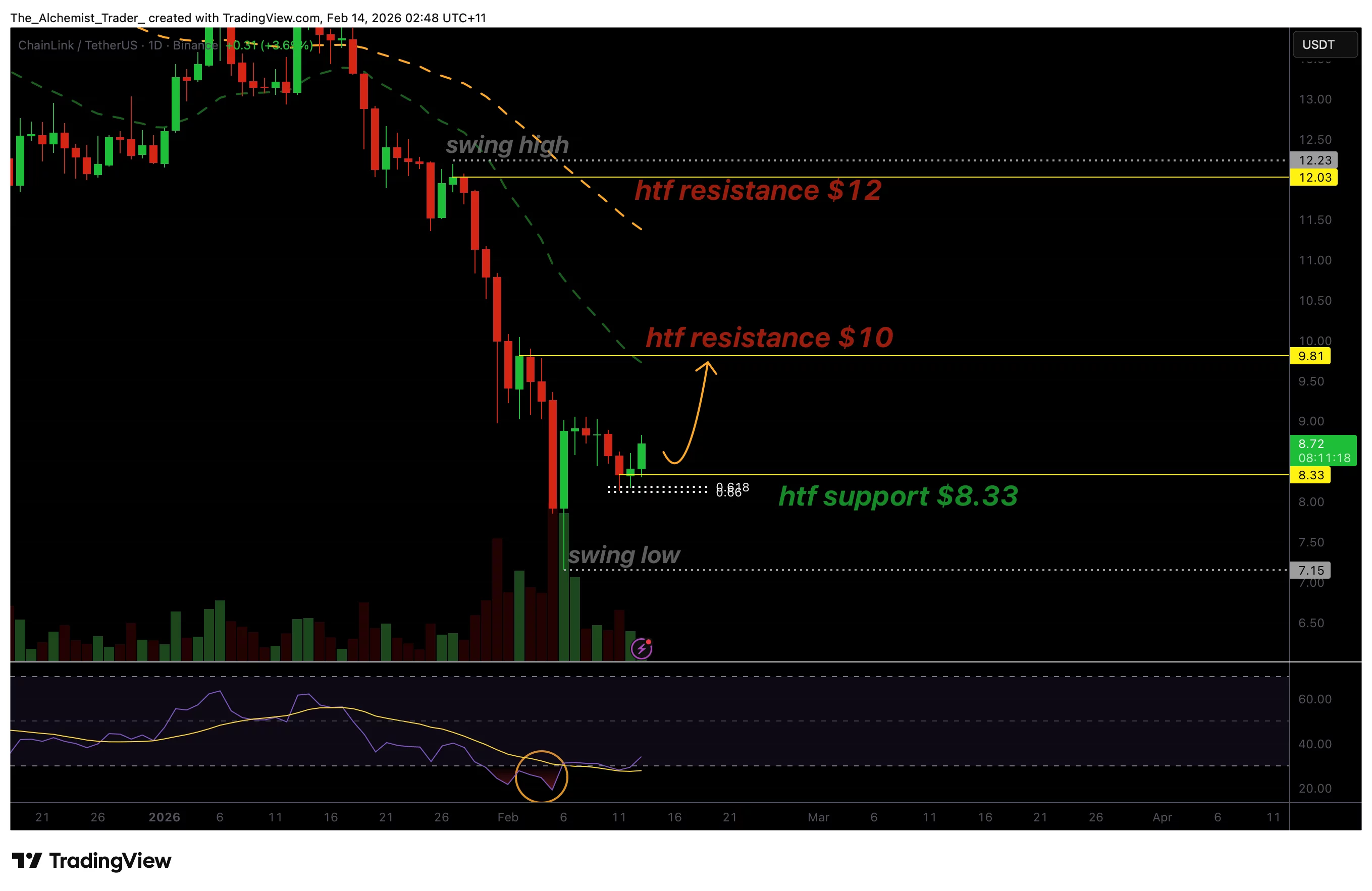

Why Chainlink price could rally to $10 as oversold RSI signals a bounce

Chainlink’s price is stabilizing at key Fibonacci support, with oversold RSI readings and improving momentum pointing toward a potential relief rally into the $10 resistance zone.

Summary

- $8.33 Fibonacci support is holding, confirming a short-term swing low

- RSI remains oversold, signaling selling pressure exhaustion

- Bullish momentum building, with $10 as the next key resistance

Chainlink (LINK) price action is beginning to show constructive signs after an extended period of downside pressure. Following weeks of aggressive selling, LINK has established a clear swing low and is now attempting to build a base above a technically significant support zone. This shift comes as momentum indicators flash oversold conditions, suggesting that bearish pressure may be exhausting.

As prices stabilize and buyers step in, the broader setup increasingly favors a corrective bounce rather than continued downside. With multiple technical factors aligning near current levels, Chainlink appears positioned for a potential rally toward higher resistance as momentum normalizes.

Chainlink price key technical points

- $8.33 support aligns with the 0.618 Fibonacci, reinforcing demand

- RSI remains in oversold territory, signaling momentum exhaustion

- Bullish follow-through opens a path toward $10 resistance, a key upside level

Chainlink has successfully established support around the $8.33 region, an area that carries notable technical importance. This level coincides with the 0.618 Fibonacci retracement, often referred to as the “golden ratio,” which frequently acts as a high-probability reaction zone in corrective moves.

The formation of a swing low at this level suggests that sellers are losing control and that demand is beginning to absorb supply. Price has since reacted positively from this area, confirming it as a short-term base and increasing confidence that a local bottom may be in place.

Holding above this support keeps the broader corrective structure constructive and limits immediate downside risk.

Oversold RSI signals momentum exhaustion

One of the most compelling elements supporting a potential rally is the Relative Strength Index (RSI), which remains in oversold territory. Oversold RSI conditions typically reflect excessive selling pressure and often precede relief rallies as momentum begins to revert toward neutral levels.

In Chainlink’s case, the oversold RSI is occurring after an extended downtrend, increasing the probability that the market is entering a mean-reversion phase. As price continues to stabilize and push higher, the RSI is likely to recover toward neutral territory, supporting further upside continuation.

Importantly, RSI recoveries do not require full trend reversals. Even within broader corrective structures, oversold conditions often produce sharp counter-trend moves as selling pressure fades.

Bullish influxes support the bounce

Recent price action suggests that the current rise is not purely mechanical. Bullish influxes are beginning to appear, indicating renewed buying activity. This shift in behavior is critical, as sustainable bounces require demand to return rather than relying solely on short covering.

As long as bullish participation continues and price maintains acceptance above support, the probability of a continuation move higher increases. The structure now favors a rotation toward the next major resistance rather than an immediate retest of lows.

$10 resistance comes into focus

If the current momentum persists, the next key upside target sits near the $10 level. This zone represents a significant resistance area where price previously faced rejection and where sellers may re-emerge. A move into this region would be consistent with a corrective rally driven by oversold conditions rather than a full trend reversal.

Reaching $10 would allow the RSI to normalize and provide the market with a clearer view of underlying demand strength. How price behaves around this resistance will be crucial in determining whether the rally can extend further or transition into consolidation.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Chainlink appears poised for a relief rally as long as the $8.33 support holds. Oversold RSI conditions, Fibonacci confluence, and improving bullish participation all support further upside.

In the near term, consolidation above support followed by higher lows would strengthen the bullish scenario. A $8.33 loss on a closing basis would weaken the setup and reintroduce downside risk.

Crypto World

U.S. Senate Clash Over Crypto Policy

Key Insights

- Warren questions SEC case dismissals, warning politics may be shaping crypto enforcement and investor protection.

- SEC Chair Atkins defends a shift away from lawsuits, prioritizing fraud prevention and clearer regulatory guidance.

- Senate clash highlights divide: clearer crypto laws vs stricter enforcement to protect markets and innovation.

Senate Hearing Turn Into a Crypto Flashpoint

A heated Capitol Hill hearing on February 12 thrust US crypto regulation into the spotlight as Senator Elizabeth Warren challenged Securities and Exchange Commission (SEC) Chair Paul Atkins over the agency’s recent enforcement decisions.

🚨 WARREN CALLS OUT TRUMP’S SEC OVER CRYPTO DONORS!

Sen. Elizabeth Warren ( @ewarren ) grilled SEC Chair Paul Atkins ( @SECPaulSAtkins ) over dropped cases against major crypto firms tied to Donald Trump’s ( @realDonaldTrump ) inauguration.

New data shows sharp declines in SEC… https://t.co/MAZx9QxpnA pic.twitter.com/PIbQvlzl4y

— BSCN (@BSCNews) February 13, 2026

Warren directly questioned why several investigations into major crypto firms were dropped, particularly those connected to companies that financially supported Donald Trump’s inauguration. She argued the timing raised serious concerns about political influence and investor protection.

Atkins rejected the allegations, saying the SEC is moving away from “regulation by enforcement” and back toward its core mandate: preventing fraud, protecting investors, and maintaining fair markets. He insisted previous leadership relied too heavily on lawsuits instead of clear guidance.

Is SEC Enforcement Really Declining?

Warren cited public statistics suggesting enforcement has slowed:

- Securities offering cases fell 10.64% from 2024 to 2025

- Investment adviser actions dropped 23.71%

- Broker-dealer cases declined 29.51%

Independent research also reported fewer settlements in fiscal 2025. However, Atkins countered that final annual data has not yet been released and argued the agency is prioritizing fraud over technical registration violations.

Supporters say the shift corrects regulatory overreach seen under former Chair Gary Gensler. Critics warn fewer actions could weaken accountability in the digital asset market.

Registration Violations or Innovation Barriers?

Central to the debate is whether unregistered token offerings automatically constitute misconduct. Crypto companies have long argued unclear securities definitions made compliance difficult.

Atkins supports legislation similar to the Digital Asset Market Clarity Act, which would divide oversight between the SEC and the Commodity Futures Trading Commission. He compared the past environment to innovators stuck between two competing regulators.

Warren disagreed, warning reduced oversight could usher in a “golden age of fraud.”

Could Politics Be Influencing Crypto Policy?

Warren highlighted dismissed cases involving major exchanges including Kraken, Coinbase, Gemini, and Binance, noting their financial ties to inauguration events. She also questioned dropped actions tied to executives who later received presidential clemency.

Atkins maintained pardons do not erase civil liability and emphasized that fraud investigations continue regardless of industry.

Conclusion

The battle discloses a larger policy divide: is a more explicit legislation more crucial in fostering innovativeness or is weaker enforcement more likely to hurt investors. The future of the United States regulation of digital assets may be determined by the final effect of Congress discussing crypto-market-structure legislation.

Crypto World

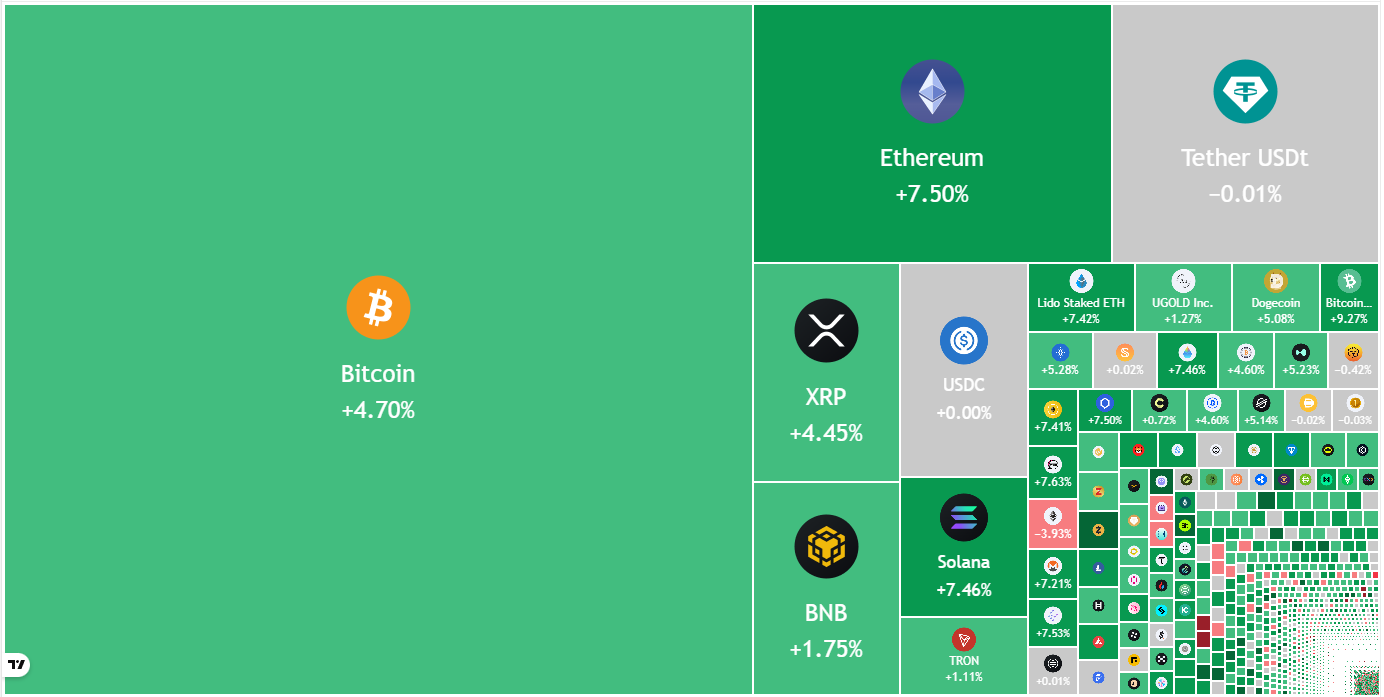

Bitcoin, Altcoin Relief Rally Aim To Restore Pre-crash Range Highs

Key points:

-

Bitcoin is attempting a comeback, which is expected to face stiff resistance at the breakdown level of $74,508.

-

Several major altcoins are attempting a recovery, signaling that lower levels are attracting buyers.

Bitcoin (BTC) has risen above $68,500, as buyers attempt to form a higher low near $65,000. According to Glassnode, BTC is stuck between the true market mean at $79,200 and the realized price near $55,000. The onchain data provider expects the range-bound action to continue until a major catalyst pushes the price either above or below the range.

Standard Chartered also had a muted forecast for BTC. It lowered BTC’s target to $100,000 from $150,000 for 2026. The bank expects BTC to fall to $50,000 over the next few months, followed by a recovery for the remainder of the year.

Several analysts also say that BTC has not yet bottomed out. Crypto analyst Tony Research said in a post on X that BTC will bottom in the $40,000 to $50,000 zone, possibly “between mid-September and late November 2026.”

Could BTC and the major altcoins start a recovery? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC turned up from $65,118 on Thursday, indicating demand at lower levels. The bulls will try to push the price to the breakdown level of $74,508.

If the Bitcoin price turns down sharply from the $74,508 level, it suggests that the bears remain active at higher levels. That may keep the BTC/USDT pair between $74,508 and $60,000 for a few days. On the downside, a break below the $60,000 support may sink the pair to $52,500.

Alternatively, if buyers thrust the price above $74,508, it suggests that the selling pressure is reducing. The pair may then rally to the 50-day simple moving average (SMA) ($85,046).

Ether price prediction

Buyers are attempting to push and maintain Ether (ETH) above the $2,000 level, but the bears have kept up the pressure.

If the price turns down from the current level or the $2,111 resistance, it suggests that the bears are aggressively defending the level. The Ether price may then retest the critical support at $1,750. If the level cracks, the ETH/USDT pair may extend the decline to the next major support at $1,537.

On the upside, buyers will have to swiftly push the price above the 20-day exponential moving average (EMA) ($2,297) to signal a comeback. If they manage to do that, the pair may ascend to the 50-day SMA ($2,800).

BNB price prediction

BNB (BNB) continues to gradually slide toward the strong support at $570, which is a vital level to watch out for.

If the BNB price plunges below the $570 support, it signals the start of the next leg of the downtrend toward the psychological level of $500.

However, the relative strength index (RSI) is in oversold territory, indicating that a relief rally is possible in the near term. If the price turns up from the current level, the bulls will attempt to push the BNB/USDT pair above the $669 level. If they can pull it off, the pair may march toward the 20-day EMA ($710).

XRP price prediction

XRP (XRP) has been clinging to the support line of the descending channel pattern, increasing the risk of a breakdown.

If that happens, the XRP price may drop to the $1.11 level. This is a critical level for the bulls to defend, as a break below it may resume the downtrend. The XRP/USDT pair may then fall to $1 and subsequently to $0.75.

Contrarily, if the price turns up from the current level and breaks above the20-day EMA ($1.55), it suggests that the pair may remain inside the channel for some more time. Buyers will have to achieve a close above the downtrend line to signal a potential trend change.

Solana price prediction

Solana (SOL) is trying to find support at the $77 level, but the bears are likely to sell on rallies.

The SOL/USDT pair may reach the breakdown level of $95, where the bears are expected to pose a strong challenge. If the price turns down sharply from the $95 level, it suggests that the bears have flipped the level into resistance. The Solana price may then plummet to the $67 level.

Conversely, if buyers push the price above the $95 level, the pair may rally to the 50-day SMA ($119). That suggests the break below the $95 level may have been a bear trap.

Dogecoin price prediction

Dogecoin (DOGE) is attempting to bounce off the $0.09 level, but the bears continue to sell on minor rallies.

If the Dogecoin price turns down and breaks below $0.09, the DOGE/USDT pair may drop to the $0.08 level. This is a crucial level for the bulls to defend, as a break below it may extend the downtrend to $0.06.

The first sign of strength will be a break and close above the 20-day EMA ($0.10). The pair may then rally to the breakdown level of $0.12, which is likely to act as stiff resistance. A break above the $0.12 level opens the doors for a rally to $0.16.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) broke below the $497 support on Thursday, but the bulls failed to sustain the lower levels.

The bulls are attempting to push the price above the 20-day EMA ($536) but are expected to face significant resistance from the bears. If the price turns down from the 20-day EMA and breaks below $493, the BCH/USDT pair may plunge toward the $443 level.

On the contrary, if the price breaks and closes above the 20-day EMA, it suggests demand at lower levels. The Bitcoin Cash price may then rally to the 50-day SMA ($581), where the bears are again expected to mount a strong defense.

Related: Bitcoin open interest hits lows not seen since 2024: Is TradFi abandoning BTC?

Hyperliquid price prediction

Hyperliquid (HYPE) has risen back above the 20-day EMA ($30.18) on Thursday, indicating buying on dips.

The flattish 20-day EMA and the RSI just above the midpoint suggest a balance between supply and demand. Buyers will have to propel the Hyperliquid price above the $35.50 level to indicate that the corrective phase may have ended. The HYPE/USDT pair may then ascend to $44.

Contrary to this assumption, if the price turns down and breaks below the 50-day SMA ($27.25), it signals that the bears have an edge. The pair may then slump to the $20.82 support.

Cardano price prediction

Cardano (ADA) remains inside the descending channel pattern, indicating that the bears remain in charge.

The bears will attempt to strengthen their position by pulling the price below the support line and the $0.22 level. If they manage to do that, the ADA/USDT pair may descend to $0.20 and later to $0.15.

Instead, if the Cardano price turns up from the current level and breaks above the 20-day EMA ($0.29), it signals that the pair may remain inside the channel for some more time. Buyers will seize control on a close above the channel.

Monero price prediction

Monero (XMR) is facing resistance at the breakdown level of $360, but the bulls have not ceded much ground to the bears.

That increases the likelihood of a break above $360. If that happens, the bears will again try to halt the recovery at the 20-day EMA ($385). However, buyers are likely to have other plans. They will try to pierce the 20-day EMA, clearing the path for a rally toward the 50-day SMA ($460).

This positive view will be negated in the near term if the Monero price continues lower and breaks below $309. The XMR/USDT pair may then plummet to $276, which is likely to attract buyers.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Ripple’s (XRP) Next Price Targets, Cardano (ADA) Whales on the Move, and More: Bits Recap Feb 13

Here’s everything most interesting around XRP, ADA, and BTC.

Ripple’s XRP has rebounded substantially from the crash on February 6, and now many analysts believe a further pump could be on the horizon.

Cardano’s (ADA) whales have been quite active in the past week, while an interesting development suggests that Bitcoin (BTC) may experience a new pullback in the short term.

What’s Next for XRP?

As of press time, Ripple’s cross-border token trades just below $1.40, representing a 3% increase on a weekly scale. As usual, it has been the subject of numerous price predictions in the past few days, and the majority seem to be optimistic ones.

The analyst who goes by the X moniker X Finance Bull recently claimed that the XRP bull catalyst “is loading,” based on the recent interview of Scott Bessent (US Secretary of the Treasury), who appeared on Fox News. The politician confirmed that the Clarity Act (a proposed legislative framework designed to regulate the crypto sector in America) needs to pass this spring.

X Finance Bull argued that Ripple has over 100 institutional partners waiting for the green light, forecasting that “once it’s signed, the rush to XRP begins.” CRYPTOWZRD also chipped in. The analyst assumed that a further bullish move is “very likely” for XRP, еmphasizing the importance of holding above the $1.3820 level.

Meanwhile, factors such as the declining number of coins held on Binance and the formation of certain technical patterns suggest that Ripple’s native cryptocurrency could indeed head north soon.

ADA Whales Make Moves

Cardano’s native token has also rebounded by roughly 3% over the past week; however, that move coincides with a selling spree by large investors, commonly known as whales. Ali Martinez revealed that these market participants have dumped almost 200 million tokens in the span of seven days, a stash with a current USD equivalent of around $50 million.

You may also like:

These actions are concerning since they could instill panic across the community and prompt smaller players to cash out as well. After all, whales are considered experienced investors whose buying or selling decisions may be based on potential inside information that most people lack.

Additionally, sell-offs increase the amount of ADA available on the open market, and fundamental economic principles suggest the price could decline if demand fails to keep pace.

Despite the bearish factor, some analysts remain optimistic that a revival could be on the way. X user Aman recently noted that ADA’s valuation dipped to the demand zone of $0.26, which in previous cases has sparked substantial revivals.

More Problems for BTC?

The primary cryptocurrency fell to roughly $60,000 last Friday, marking its lowest level since October 2024. As of this writing, it trades at around $67,000, but certain elements signal that a renewed downtrend could be on the horizon.

Just recently, an anonymous whale deposited 8,200 BTC into Binance. The analytics company Lookonchain disclosed that whenever they execute such transfers, the asset goes down. It is worth noting that BTC’s price hovered around $69,000 at the time of the deposit, but minutes later it dipped to as low as $65,000.

An analysis made by Alphractal showed another potential bearish signal. The platform revealed that BTC’s long-term Realized Cap Impulse (a metric that is used to assess whether new capital is entering the ecosystem) has turned negative after three years.

Alphractal explained that, historically, such developments have had major implications for the asset, coinciding with periods of significant corrections or prolonged bear markets.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Trump-linked Truth Social seeks SEC approval for two crypto ETFs

Yorkville America Equities, the asset manager behind a series of exchange-traded funds (ETFs) tied to U.S. President Donald Trump’s Truth Social brand, has filed registration documents for two new cryptocurrency ETFs, expanding its push into the digital asset market.

According to a filing with the U.S. Securities and Exchange Commission (SEC) submitted Friday, the firm is seeking approval for the Truth Social Bitcoin and Ether ETF, which would offer exposure to the two largest cryptocurrencies by market capitalization. Yorkville also filed for a second product, the Truth Social Cronos Yield Maximizer ETF, which would invest in and stake , the native token of Crypto.com’s Cronos blockchain.

While both ETFs remain subject to SEC approval, the filings mark an significant next step for the politically branded investment firm. If approved, the ETFs would be launched in partnership with Crypto.com, which is expected to serve as the digital asset custodian, liquidity provider, and staking services provider for the new funds.

The Cronos-focused ETF is especially notable for its inclusion of staking rewards, which are typically earned by helping to secure proof-of-stake networks like Cronos. That could position the fund as a yield-generating product in a space still largely dominated by passive spot ETFs.

Both funds would also be distributed through Foris Capital US LLC, the SEC-registered broker-dealer affiliated with Crypto.com.

Truth Social first signaled its crypto ambitions in June 2025, when it filed an S-1 registration statement for a spot bitcoin ETF under the same brand. That was followed by a Blue Chip Digital Asset ETF filing in July 2025, targeting a basket of large-cap altcoins. Neither product has yet launched.

President Trump, a primary owner of Trump Media & Technology Group that in turn owns Truth Social, has struggled politically with his personal business ties to the crypto sector. That relationship is currently among the primary sticking points for advancing the U.S. Senate’s Digital Asset Market Clarity Act that would govern the oversight of U.S. crypto markets.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video11 hours ago

Video11 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?