Entertainment

Tia Mowry Leaves Fans Shook With Details About Her Last Kiss

Oh, Roomies… Tia Mowry is back at it again, and this time she’s serving full-on chaos and comedy that had fans clutching their pearls. The actress posted a new video this week that had everyone laughing, relating, and low-key questioning life choices all at once.

RELATED: Okay, Med School! Tia Mowry Flaunts Her Confidence While Lip-Syncing To Megan Thee Stallion’s Song ‘Her’ (WATCH)

Tia Mowry Has Fans Asking “What’s Tea?” After She Drops SPICY Details

In the clip, Tia Mowry does another skit, but this one hits different — with the song ‘FDO’ by Pooh Shiesty playing in the background. Text over the video reads, “Dress like the last dude you kissed,” while her caption says, “Now this is method acting” accompanied by a sideways laughing emoji. Tia’s look? A drawn-on mustache and goatee, a backwards black cap, blue oversized hoodie, dark cargo pants, and Timbaland boots — a fit that had fans joking, if this man was real, we’d be in his DMs.

Of course, the comment section did not disappoint, with one fan asking, “Tia! You had a YN girl?!” to which she responded, “Had?” — and now the timeline is in shambles, questions flying left and right.

One Instagram user @yourhomegirltye said, “It’s giving Pirates of the Caribbean turned YN 😂 love me some Johnny Depp ❤️”

This Instagram user @whoiskesha_ wrote, “She just be doing whatever I love it 😂😂😂”

And, Instagram user @scottidofficial shared, “😂😂😂 She funny A YN been through there“

Meanwhile, Instagram user @jay.ayee joked, “If this was on TikTok, we’d know exactly who it was by tomorrow 🤣”

While Instagram user @lolo_bangzz said, “Chile not Bone Studs and Harmony.. 😩😩🙏🏽”

Lastly, Instagram user @dmarie_roberts commented, “So yu kissed my man?? Hold up!! 😂😂😂😂”

Last Time Tia Had Us Wondering About A Man

The last time Tia had fans guessing about a man in her life, they nearly lost it. She posted a pic showing a tattooed hand on her neck, while sticking her tongue out to Lloyd’s ‘You,’ and naturally, fans went wild, convinced she had a new boo. But nope! After a little digging, the mystery hand belonged to her bomb makeup artist, Anton Khachaturian, proving once again that sometimes the hottest drama online is all about glam, not romance.

RELATED: No Way! Mystery Hand In Tia Mowry’s Pic Has Been Identified & Fans Are SHOOK At Who It Belongs To (PHOTOS)

What Do You Think Roomies?

Entertainment

What To Remember Before AMC’s Neo-Western Thriller Returns

Before Dark Winds returns to AMC with a thrilling fourth season, you may not have time to revisit Season 3 beforehand. Still, it’s been a year since our favorite tribal police officers were on active duty, making now the perfect time to read up on those events before we head back to Navajoland. So, what happened to Joe Leaphorn (Zahn McClarnon), Jim Chee (Kiowa Gordon), and Bernadette Manuelito (Jessica Matten) last season?

‘Dark Winds’ Season 3 Follows Leaphorn and Chee on the Trail of a Monstrous Killer

Like every season of Dark Winds, Season 3 adapts the works of author Tony Hillerman, namely the novels Dance Hall of the Dead and The Sinister Pig. Combining elements from both while splitting the main narrative into two, the season begins with Joe Leaphorn wrestling with the vision of a monster known as a “Ye’iitsoh.” As the creature stalks him in the wilderness, the season flashes back to earlier when he and Jim Chee (now officially a member of the Navajo Tribal Police after leaving the FBI and working the private sector for a while) are on the trail of two boys who have disappeared. While Ernesto Cata (Alonso Rappa) is killed, George Bowlegs (Bodhi Okuma Linton) gets away and hides in the wilderness as Leaphorn and Chee pursue him — and the monster who is hunting him.

So, who is this monster? Well, it turns out to be none other than a local archeologist, Dr. Reynolds (Christopher Heyerdahl), who was caught by the two boys by accident when they watched him plant archeological evidence at his dig site. After anthropologist Teddi Isaacs (Carly Roland) discovers the truth, she attempts to tell the officers about Reynolds’ plans for George, only to be killed by the doctor herself. At this point, Reynolds’ entire career is on the line, and the only way he can get out of this is by killing every witness who could identify him. So, with the help of Sheriff Lawrence “Gordo” Sena (A Martinez), Leaphorn and Chee plan to use George as bait to capture Reynolds at the train station, eventually leading to his death as Chee shoots Reynolds.

Having learned to embrace his Navajo heritage, Season 3 also pushes Jim Chee to come to terms with his troubled past. He eventually makes peace with his former rival, Shorty Bowlegs (Derek Hinkey), upon helping save his son George, and he realizes that he has finally found his place on the reservation. For everyone else, however, that lesson is a harder one to learn.

Bernadette Is Down at the U.S./Mexico Border in ‘Dark Winds’ Season 3

Elsewhere, Bernadette has joined the U.S. Border Patrol, where she discovers a drug-trafficking ring. Although nobody seems interested in pursuing her theory — namely, her boss, Senior Chief Ed Henry (Terry Serpico) — Bern begins an investigation of her own. This leads her to oilman Tom Spenser (Bruce Greenwood), who she believes is using his business as a cover to smuggle drugs (and the occasional person or two) into the country, all while paying off the entire Border Patrol department. This includes her roommate, Elenda Garza (Tonantzin Carmelo), who soon betrays her for a bigger payday. It’s here that Spenser’s enforcer, the villainous hitman, Roberto “Budge” de Baca (Raoul Max Trujillo), tries to bury Bern alive. Fortunately, he fails miserably.

But here’s where things get especially complicated for Bern. In the time she’s been stationed at the U.S.-Mexico border, she has fallen for her coworker Ivan Muños (Alex Meraz). However, Ivan has also taken Spenser’s money, and though he claims not to have spent any of it, she still can no longer trust him, despite their intimate encounters. Instead, Bern blows the lid off the whole operation, convincing Ivan to help her take Spenser down. While they succeed, Spenser gets away, and she and Ivan break up before Bern leaves the Border Patrol behind to return home to the Rez. Upon her return, sparks begin to fly once more between her and Chee.

Franka Potente joins the AMC series as Leaphorn’s deadliest threat yet.

‘Dark Winds’ Season 3 Ends With a Split for Joe and Emma Leaphorn

All of this aside, perhaps the biggest struggle of the third season exists in the Leaphorn home. After federal agent Sylvia Washington (Jenna Elfman) arrives on the Rez to investigate the death of B.J. Vines (John Diehl) — who Joe left for dead at the end of Season 2 — all the heat is put on our favorite Navajo lieutenant while he’s in the middle of an investigation. Of course, Emma (Deanna Allison) knows what Joe has done. Although her heart has been broken by his actions, and she believes he is no longer the man he once was, she lies to Washington about his whereabouts on the night in question. In the end, the case against Joe is dropped, and Washington returns home to, well, Washington, D.C.

But things aren’t left happy between Joe and Emma. The results of his lies and actions weigh heavily on Emma, who decides to leave the reservation (and Joe) for the time being. After discovering his deep-seated psychological issues and the guilt that plagues him, Joe Leaphorn must become a better man if he is going to win his wife back. While she still loves him, the season ends with the revelation that she is not sure that she can forgive him. With that, Dark Winds fans can expect Season 4 to pick up where we left off with the Leaphorns, Chee, and Manuelito.

Dark Winds Season 4 premieres February 15 on AMC and AMC+.

Entertainment

These 10 Great Sitcoms Were Cancelled Too Soon

Developing the perfect sitcom is what every writer dreams of doing. Given the legacy of the genre, getting your foot in the door can sometimes be a challenge in and of itself. But then, keeping it on the air is the battle. There have certainly been some wallops of flops over the years. Not just because you have a major name—Whoopi Goldberg, Bette Midler, even Emeril Lagasse—doesn’t mean it’s going to be a surefire hit.

But then there are the cases of really strong shows that, for reasons beyond our control, get axed well before their expiration date. Maybe it was low ratings, too much competition, a risky concept, or simply the timing; losing a beloved sitcom can be a gut punch for the creators, actors, and fans alike. It’s time to take a trip down memory lane and remember the sitcoms that got the axe before we were ready. Let’s raise a glass and give them one last hurrah as they live rent-free in our minds.

1

‘Rutherford Falls’ (2021–2022)

Being one of the first shows to help launch a streaming app is not an easy task. When Peacock first went live in 2020, it just so happened to be the same year as the COVID-19 pandemic. While we were all stuck at home, not everyone was eager to turn to something new. Especially a new streamer. Among some of the first titles to join Peacock was the severely underappreciated Rutherford Falls. Created by Ed Helms, Michael Schur, and Sierra Teller Ornelas, the series follows the unlikely friendship between history buff Nathan Rutherford (Helms) and Native American museum curator Reagan Wells (Jana Schmieding) in their quirky titular small town. A crisis of friendship is tested when the mayor (Dana L. Wilson) decides to move a statue of Nathan’s ancestor, the town founder, because drivers keep hitting it. Nathan embarks on an idealistic campaign to keep the statue in place. Reagan has to juggle loyalty to her friend and to her people, the Minishonka Nation. Using comedy and irony to highlight the biases that are present in today’s society surrounding Native Americans.

Rutherford Falls used a marginalized community and a white community to compare and contrast society’s views on their heritage and preservation throughout. It was praised for its authentic Native perspectives to mainstream comedy, focusing on community, identity, and everyday colonialism with heart and humor. But then, it was yanked. Despite critical praise, it was a battle between acclaim versus performance. Because of low viewership, the ultimate excuse was that Rutherford Falls was cancelled as a result of a cost-cutting measure. Ornelas attempted to shop the series around, but it didn’t pan out. The reality was that timing was everything. Perhaps if it had arrived a hair sooner or after lockdown was lifted and Peacock was more established, we’d be celebrating Rutherford Falls as a triumphant series.

2

‘The Ropers’ (1979–1980)

Spin-offs are hard. Not only do you have to live up to the hype of the original series, but you also have to expand upon it and make it even better. After the massive success of Three’s Company, ABC was desperate to capitalize on the series, and fast. After the first season, Norman Fell and Audra Lindley were asked whether they would move their characters, Stanley and Helen Roper, to their own series. They passed, but the network was persistent. With Fell fearful of the series flopping and thus being out of a job and an iconic role, it eventually took some convincing, and a guarantee that he could return to the main series, The Ropers was finally born.

At first, the show did well. Feeding off the new iteration of Three’s Company, now with Don Knotts as the new landlord, The Ropers put the married couple in a new light. Having sold their apartment building, they move to Cheviot Hills, where social climber Helen attempts to fit in with the community, as Stanley does little to acquiesce. And thus, the comedy of the series. Believing it was a surefire hit anywhere ABC put it, the show was moved from Tuesday nights to Saturdays, and it bombed. Somehow, believing the show would appeal to a younger demographic, it failed, and thus, The Ropers was cancelled. While Fell tried to return to Three’s Company, the popularity of Knott’s Ralph Furley essentially prevented Stanley from returning full-time. Though the Ropers made one final appearance, the two iconic characters were forced into retirement.

3

‘Happy Endings’ (2011–2013)

When your cancellation is deemed the “worst TV decision,” you know that’s worth something. Yet, that doesn’t soften the blow of having your series end before it should have. This is the story of the three-season hit Happy Endings. The series followed the antics of six best friends in Chicago: loving married couple, the overacheiver Brad (Damon Wayans Jr.) and perfectionist Jane (Eliza Coupe), ditzy Alex (Elisha Cuthbert), daydreamer Dave (Zachary Knighton), slacker Max (Adam Pally), and party animal Penny (Casey Wilson). As the dynamic shifts, the comedy remains. The 2010s response to Friends and How I Met Your Mother, Happy Endings was a tight relationship sitcom that still managed to be refreshing. But if there’s one type of refreshing that can kill a series, it’s when you refresh the weekly lineup.

Despite the third season earning critical acclaim, ABC took a drastic measure and moved the series from Wednesdays first to Tuesdays and then eventually the death spot of Friday night. Back in the ’90s, ABC triumphed with a Friday night block, but that heyday had been so far removed that attempting to revitalize the evening with a beloved show was simply just a risk. Even being applauded as an underrated and under-watched series, ratings are everything. As much as fans tried to get the show shopped and revived, it was of no use. Happy Endings was a great series gone too soon.

4

‘Better Off Ted’ (2009–2010)

With the rise of single-camera comedies taking over the ’00s, every network tried to capitalize on the new fad. But that also meant exploring an array of risky concepts. Not that satire is that brazen, but alas. Created by Victor Fresco, Better Off Ted followed the titular Ted Crisp (Jay Harrington), a single father and head of research and development at the soulless conglomerate of Veridian Dynamics. With the use of narration, Ted tends to break the fourth wall for comedic purposes. A witty approach to the workplace comedy, Better Off Ted lived in a similar realm to Arrested Development, and not just because Portia de Rossi was in the main ensemble.

Critics loved the concept, noting it as ahead of its time; but that didn’t translate into viewership. Audiences didn’t tune in enough. Fresco had felt that the series was not given fair promotion or enough time to build an audience, but the bigger problem was Better Off Ted was too smart for the time slot. ABC tended to place classic sitcoms in Better Off Ted‘s space, so audiences expecting a wholesome comedy instead found a surrealistic, rapid-fire show. Though the cast has reunited from time to time, the series lives on through its cult following.

5

‘Samantha Who?’ (2007–2009)

After making her name as a young actress on Married with Children, it was finally time for Christina Applegate to lead her own show. Proving that she could handle the pressure thanks to an array of guest spots, including her brilliant recurring role on Friends, she got her shot on ABC’s Samantha Who? The title went through a few name changes before settling on the final answer. The series followed Applegate as Samantha Newly, who develops retrograde amnesia after a hit-and-run. Upon awakening, she discovers that her old self was selfish and unlikeable, so she sets off on a mission to rectify her past, making amends with everyone in her life. A brilliant concept with a strong cast, which also included Melissa McCarthy and Jean Smart, Samantha Who? had all the makings of a hit, and it did. Until that pesky schedule change.

For the first season, Samantha Who? was the highest rated sitcom on television, surpassing Two and a Half Men, which had previously held the honor. As a Monday night series that had a strong lead-in with Dancing with the Stars, Samantha Who? was golden. Then, by Season 2, things changed. Moving the air slot, the series featured a new lead-in: the failed series In the Motherhood. While the ultimate excuse was the inability to slash its budget to warrant a third season, its move to Thursday destroyed the following it once had. A truly smart series with a wonderfully mature performance from Applegate, Samantha Who? deserved a longer journey on television.

6

‘Kevin Can F**k Himself’ (2021–2022)

Riding high off of the success of Schitt’s Creek, it was finally time for Annie Murphy to go solo. Created by Valerie Armstrong, AMC picked up a bold and incredibly risky series called Kevin Can F**k Himself. A riff off of the CBS sitcom Kevin Can Wait, which was criticized for how the lead character’s wife was written off the series, the AMC show took the incident as a jumping off point. The premise followed Allison McRoberts (Murphy), a woman struggling to redefine her life amid an unhappy marriage to her husband, Kevin (Eric Petersen), a narcissistic man-child whose treatment of Allison was borderline domestic abuse. The twist of the series was how the show was presented through contrasting perspectives. In one format, it was through a typical mutli-cam sitcom. The other, when Allison was navigating her personal struggles, was told through a dramatic single-camera approach.

By breaking television conventions, Kevin Can F**k Himself set itself apart from anything on TV. Especially what was on the network it was airing on. Perhaps the struggle was this was not the typical AMC show viewers watched on the cable channel. AMC made the decision to end the series after two seasons, similar to other series at the time. Further, it came down to a creative decision from Armstrong who felt, after Allison’s liberation, the story had concluded. Now, this did not bode well with the fans. Murphy’s star vehicle was exceptional, but in a self-contained world of television, some shows prefer not to overextend themselves to the dismay of its viewers.

7

‘Freaks and Geeks’ (1999–2000)

Surely you’ve heard of the mythical teen comedy Freaks and Geeks. Maybe you didn’t watch it, but the series has been discussed for decades thanks to the individuals involved who became some of Hollywood’s biggest names. Created by Paul Feig and executive produced by Judd Apatow, Freaks and Geeks was set in the fictional town of Chippewa, Michigan at a suburban Detroit high school at the start of the ’80s. Lindsay Weird (Linda Cardellini) and her younger brother, Sam (John Fracis Daley), attend the same school with different friend groups. Lindsay is part of the freaks, alongside Daniel Desario (James Franco), Ken Miller (Seth Rogen), Nick Andopolis (Jason Segel), and Kim Kelly (Busy Philipps). Sam’s friends are the geeks, comprised of Neal Schwieber (Samm Levine) and Bill Haverchuck (Martin Starr). And thus, the title Freaks and Geeks. Littered with nostalgia, Freaks and Geeks was the show that never had the chance to soar.

The series’ ability to lampoon adolescence was a major draw into the show’s success. Even with Emmy nominations and critical praise, if you’re a victim of erratic scheduling, there’s little hope of remaining on screen. Compared to the network’s massive hits like Frasier and Friends earning double the viewers, Freaks and Geeks was an easy target to give cancellation to. Further, having to compete with the juggernaut game show Who Wants To Be a Millionaire, it was near impossible to have any safety net. The direction of the series did not align between network and creator, so they cut the chord. While many sitcoms have come and gone, essentially being lost to time, the legacy lives on thanks to the success of the individuals involved. As Apatow put it, “Everything I’ve done, in a way, is revenge for the people who cancelled Freaks and Geeks.”

8

‘Two Guys and a Girl’ (1998–2001)

I like to believe I have an eye for talent because I was obsessed with Ryan Reynolds on Two Guys and a Girl, or Two Guys, a Girl, and a Pizza Place as it was originally titled. Unlike some titles on this list, Two Guys and a Girl did have a decently healthy run. However, when you end on a cliffhanger, the devoted fans will riot. I know I certainly did! Let’s back up to the premise. The original premise follows Pete (Richard Ruccolo), Berg (Reynolds), and Sharon (Traylor Howard), three friends in their twenties, as they navigate life, love, and careers in Boston. Starting at the pizza place they worked at during college, the series eventually expanded to focus on their post-collegiate lives, including the expansion of recurring characters, Johnny Donnelly (Nathan Fillion) and Ashley Walker (Suzanne Cryer).

Built upon the extraordinary chemistry of the lead trio, Two Guys and a Girl was a major hit during its run. But then, like other titles, ABC decided to move the series to the Friday night death spot, where it had a steep decline in ratings. After the shock result, the network tried to place it back to Wednesdays to restore its former glory, but it was too late. The series finale ended up being an episode called “The Internet Show.” It was an interactive show in which the fans of the show voted on the outcome online. The premise of the episode led to four different endings in whch each of the women believed they might be pregnant. The hope was to have the winner, who was Ashley, give birth by the end of Season 5. But that season never came to fruition as the show was canceled. It was a major blow, but that’s the business!

9

‘Pushing Daisies’ (2007–2009)

This one still stings. It’s time to discuss the uniquely whimsical Pushing Daisies. Created by Bryan Fuller, the series followed Ned (Lee Pace), a pie-maker with the ability to bring things back to life with his touch. Of course, this power came with a stipulation. Alongside his formerly deceased childhood crush Chuck (Anna Friel), co-worker Olive Snook (Kristin Chenoweth), and private investigator Emerson Cod (Chi McBride), Ned and co use his special ability to solve murders. With a cast that also featured Swoosie Kurtz as Lily, Chuck’s agoraphobic birth mother, and Ellen Greene as Vivian, Chuck’s aunt, the brilliant ensemble helped make the series wonderfully charming and aesthetically delightful. But after two seasons, Pushing Daisies died, and it was unable to be brought back to life by Ned.

Timing is everything, and because of the 2007–2008 writers’ strike, Pushing Daisies suffered from fully coming to fruition. With the first season being impacted, Fuller went on to focus on the ordered second season. But when ratings declined, presumably due to the aftermath of television limbo, ABC opted not to order additional episodes beyond the second season’s initial pick-up. With so many more stories to tell, Fuller had hoped to expand the series into other media, but it never happened. A quirky and distinct series, Pushing Daisies truly never had its time to blossom.

10

‘Sports Night’ (1998–2000)

One of the greatest entertainment writers of all time is Aaron Sorkin. If there is one thing he knows how to do, it’s write a story about the inner workings of a workplace. Before The West Wing or Studio 60 on the Sunset Strip or The Newsroom was Sports Night. Pulling the curtain back on a SportsCenter style show, Sorkin’s series focused on the professional and personal lives of the on and off-air staff producing a live nightly cable sports news show. Centering on anchor duo Casey McCall (Peter Krause) and Dan Rydell (Josh Charles) and executive producer Dana Whitaker (Felicity Huffman), Sports Night was notorious for Sorkin’s infamous “walk and talk,” as well as his fast-paced dialogue that captured the thematic elements of journalism ethics and the navigation of network pressure. A brilliant series that featured a dynamite ensemble that also included Joshua Malina and William H. Macy, it seemed as if ABC had a hit on its hands, but when the new millennium arrived, Sports Night departed.

Even through its smart writing, stellar cast, and unique direction, Sports Night struggled to find a devoted and dedicated audience. Because audiences expected a laugh riot and received something more in line with a dramedy, there was a disconnect. Perhaps it was ahead of its time or even on the right network. Sorkin did have the opportunity to move the series to another network, including Showtime; yet, he opted to dedicate all of his time to The West Wing on NBC. History tells us that it was the right decision, but the reality remains that Sports Night was one of Sorkin’s greatest projects.

Entertainment

Megan Thee Stallion Is ‘Overly Comfortable’ With Klay Thompson

Megan Thee Stallion is fully embracing her “Lover Girl” era courtesy of her relationship with NBA star Klay Thompson, as the two inch closer towards the one-year mark of being official.

In a new interview, Megan opens up about how her healing journey led her to finding her new love when she least expected it.

Article continues below advertisement

Megan Thee Stallion Says Boyfriend Klay Thompson Makes Her Feel ‘Overly Comfortable’

Speaking exclusively with PEOPLE, Megan Thee Stallion said she was blindsided by finding love with Klay Thompson, but due to her inner self-work, she knew she was ready.

“Well, I don’t never want to tell [anybody] to just jump in a relationship just because everybody else got one, and I’m not going to tell you to just jump in a relationship because you have to,” she said. “I didn’t even know I was going to be in my relationship, to be honest.”

“I think that because finally I started being in a better mind space about myself and my life, and I had already been doing a lot of work to heal me,” the Grammy winner shared. “I had been going to therapy, I had a bunch of activities that I started doing for myself, maybe God just opened up that space for me to have somebody that loved me right.”

Article continues below advertisement

The rapper told the outlet that the love between the two feels different than anything she has experienced before.

“This is one of the first times that I’ve ever been just overly comfortable,” Megan said. “I’m comfy, babe!”

She also offered advice to her fans, dubbed the “Hotties,” about letting love come to you instead of chasing it.

“I think people got to stop trying to be in love and trying to chase love,” Megan shared. “They just got to let it come to them. When it’s meant for you, it’s going to happen. God does not give you nothing that is not meant for you.”

Article continues below advertisement

Megan And Klay Initially Went Public With Their Romance In July 2025

After photos of the two made the rounds on social media last summer as they embarked on a luxurious baecation, Megan shared a risqué video of herself and Thompson that sent fans into overdrive.

A few days later, the couple made their official red carpet debut at Megan’s inaugural Pete & Thomas Foundation Gala in New York City.

Shortly after, she offered a bit of insight into the start of their relationship, describing it as “cute” and “like a f-cking movie.”

Megan also said that Thompson is the “nicest person I’ve ever met in my life,” adding that their relationship is the first time she’s “been with somebody who’s genuinely a nice person, and he makes me genuinely happy.”

Article continues below advertisement

Megan’s Social Media Activity Previously Sparked Rumors Of A Relationship Milestone

In October 2025, Megan posted a photo dump set to her track “Lover Girl,” but it wasn’t the music that had fans playing detective, it was what the photos could possibly mean.

The first photos were hands, likely those of Megan and Thompson, forming a heart shape with keys in the middle and a house blurred out in the background.

The image immediately led fans to assume that the couple were entering the next stage of their relationship and officially moving in together.

Additional photos included a look at various parts of the home, as well as Megan’s hand on Thompson’s face and neck.

“Y’all bought a house together??” one fan asked in the comments, while others offered congratulatory messages.

Article continues below advertisement

Klay Thompson Was In A Prior High-Profile Relationship

The Dallas Mavericks Star previously dated “Spider-Man” and “BlacKkKlansman” actress Laura Harrier. The former couple dated off-and-on from 2018 until early 2020.

Shortly after their appearance together at the 2020 Vanity Fair Oscar Party, allegations that Thompson was unfaithful emerged and the pair ultimately decided to call it quits.

Megan Thee Stallion Recently Revealed Her Partnership With Fanatics Sportsbook

Throughout the ad, Megan highlighted the FanCash earned on both winning and losing bets that can be redeemed for “authentic NBA merchandise and game tickets, collectibles, one-of-a-kind experiences, Bonus Bets, and more.”

Entertainment

The Greatest Cult Classic Anime That Redefined the Sci-Fi Genre Just Got Harder to Watch

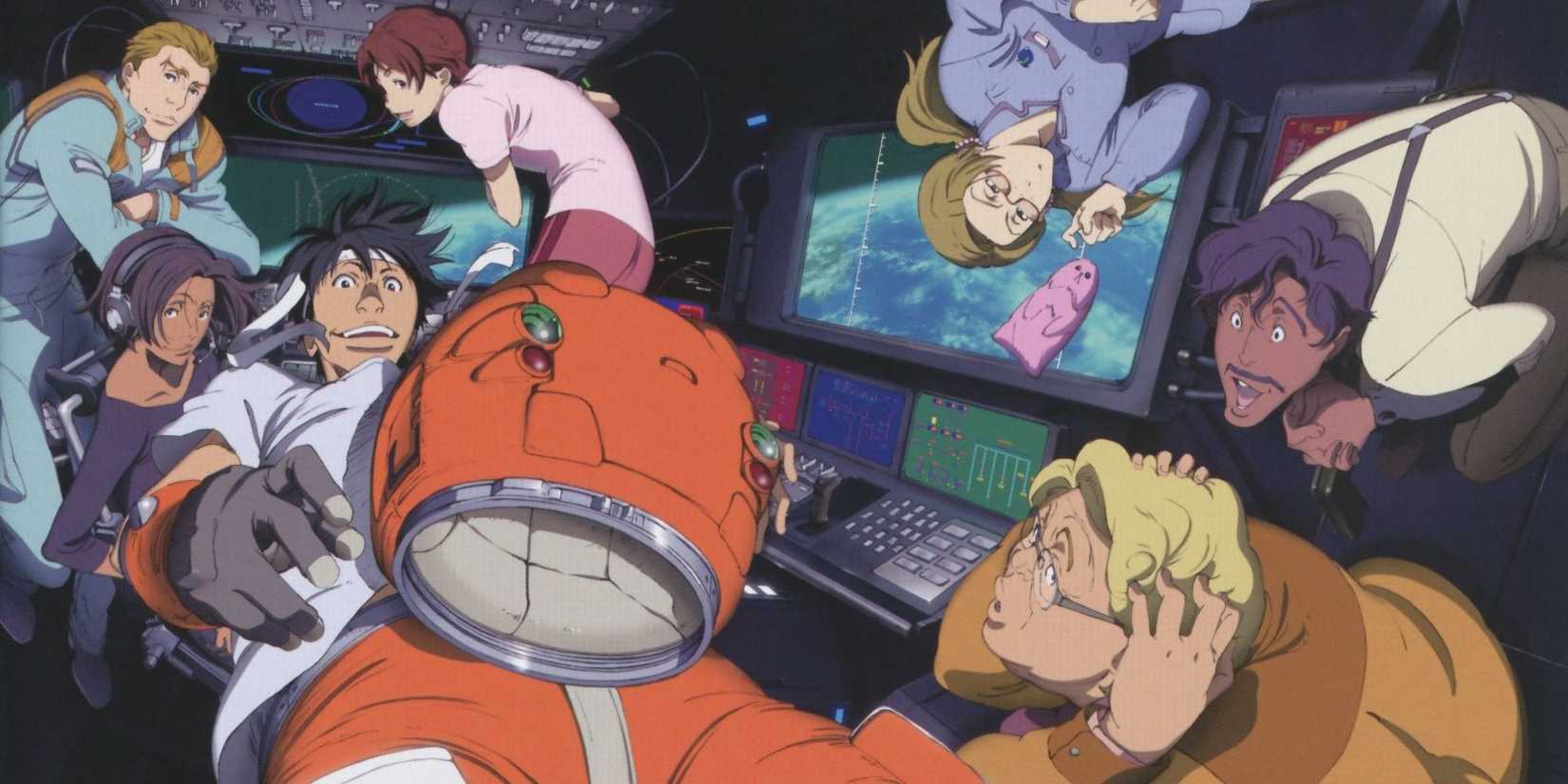

Sunrise is prominently known for iconic anime such as Cowboy Bebop and Gundam, but the studio is also acclaimed for producing one of the best-written sci-fi dramas of all time! While 2024 marked the first North American exposure and global release of Makoto Yukimura’s cult classic anime adaptation Planetes, Crunchyroll’s addition of science fiction to its library has sparked celebration and new attention to the forgotten show that redefined the space genre. In 2026, the series is still streaming on Crunchyroll (and via the Crunchyroll Amazon Channel), though it’s now locked behind a subscription after the free trial.

Unlike the typical narrative in space — often featuring larger-than-life battles or alien encounters — Planetes takes a grounded, realistic approach to the cosmos. Airing in 2003 and set in the year 2075, the series follows members of the “Debris Section” on DS-12 Toy Box as they carry out the dangerous, thankless task of clearing space junk orbiting Earth. The 26-episode anime has earned a devoted following over the years for tackling “blue-collar” themes with romance, humor, and psychological depth.

‘Planetes’ Is a Blue Collar Story of the Humanistic Lives of Space Debris Collectors

By focusing on the external and internal challenges that space poses for ordinary people, Yukimura’s Planetes holds a unique place in anime history. One of anime’s most defining features is its commitment to portraying space with the working class! In contrast to Vinland Saga‘s pacifist adventure, Planetes is set in 2075 and follows the lives of the “Debris Section” of the Technora Corporation. The team, often nicknamed “Half Section” due to its lack of funding and low status, is tasked with removing dangerous space debris from Earth’s orbit. Although it’s an unglamorous job, their work is essential to the safety of other space missions.

The plot centers on Ai Tanabe (Satsuki Yukino), a rookie recruit who believes in the power of love and teamwork, and Hachirota “Hachimaki” Hoshino (Kazunari Tanaka), a jaded and ambitious debris collector who dreams of owning his own spaceship. As they navigate the physical and emotional challenges of their job, they confront issues like loneliness, fear, and existential questions about their purpose in space. Other key characters include Fee Carmichael (Ai Orikasa), the chain-smoking section manager who cares deeply about environmental problems, and Yuri Mihairokov (Takehito Koyasu), a calm, thoughtful astronaut haunted by the loss of his wife in a space accident. Together, they deal with corporate bureaucracy and office romance, all while facing personal growth and the struggles that come with life in orbit.

Instead of centering on elite astronauts or daring explorers, Planetes puts the spotlight on an often-overlooked aspect of space: the maintenance workers. This focus on the blue-collar heroes of space offers a refreshing perspective that is rarely explored in the sci-fi genre. By depicting the lives of everyday workers, each character brings a unique perspective and motivation to the job, from Hachimaki’s dream of owning his own spaceship to Fee’s fierce dedication to her family and underappreciated job. Hachimaki, he is mostly driven by ambition and a desire to make a name for himself, yet his journey as a debris collector forces him to confront his worst fears. His arc, which includes a profound existential crisis, explores what it truly means to find direction in life.

Planetes doesn’t just ask what it takes to balance work and private life, but what triggers people to explore it! In doing so, the anime is given a slice-of-life feel rather than high-stakes heroics. Moreso, the show dazzles twice as brightly because of its interactive setting and forward-thinking art style.

‘Planetes’ Art Style Focuses on the Authenticity of a Space World in 2075

The visual style of Planetes further reinforces its realistic tone with an art style that prioritizes authenticity in an imaginary 2075. The designs of spacecraft, space suits, and stations are grounded in current technology, lending a sense of believability to the series’ depiction of space. The animators took care to represent the effects of zero gravity accurately, with characters floating, maneuvering carefully, and using handholds and tethers. This attention to technical detail adds to the show’s immersive quality, allowing the viewer to escape through the open society of Technora Corporation firsthand.

Directed by Gorō Taniguchi, author Yukimura’s imagination blooms in a full circle. What makes Planetes feel so alive is that it depicts a futuristic world where humans can be born and live on the moon (these types are called Lunarians), who operate like any ordinary person. The show backs up the possibility of this bizarre community by creatively showing space workers going about everyday business like shopping, hanging out at cafés, and even renting a motel for a private rendezvous. Just like the characters, the lived-in concept is well fleshed out to a convincing scale, which makes the show much more addictive.

Sound design also plays a crucial role in Planetes, with silent scenes capturing the eeriness of the vacuum of space and moments of intense quiet emphasizing the isolation the characters feel. Combined with the evocative music score composed by Kōtarō Nakagawa, this careful sound design brings a cinematic aesthetic to the series that can rival the allure of Cowboy Bebop‘s space background.

As a Cult Classic, ‘Planetes’ Also Tackles Environmental Issues and Corporate Exploitation

If you thought Planetes couldn’t get any deeper, think again. Sunrise’s underrated classic highlights the environmental impact of human activity. The duty of the Toy Box employees is a clear allegory for pollution on Earth, emphasizing humanity’s tendency to neglect ecological responsibility. By tackling this subject, Planetes calls for the need for eco-friendly practices even beyond our planet, reminding us that our actions have consequences, no matter where we go.

Planetes also examines issues of class disparity and corporate exploitation in space exploration. In the anime, space travel is largely controlled by powerful corporations and wealthy nations, leaving poorer countries and individuals at a disadvantage. This unequal distribution of resources is evident in the Debris Section’s limited funding and the dismissive attitude toward its workers. By exploring the socio-economic inequalities of its fictional workspace, Planetes offers a commentary on the real-world challenges of globalization and corporate power. These themes make the anime relevant, reflecting real concerns about opportunity in a future where space is the new frontier.

Most importantly, the critical success of Makoto Yukimura’s Planetes has become a beloved cult classic and a sci-fi darling rooted in love. Its realistic approach, focusing on blue-collar workers, and exploration of ethical and existential questions helped pave the way for other sci-fi works that emphasize the human condition. The anime demonstrates that stories set in space can instead find beauty and meaning in the everyday struggles and dreams of ordinary people. For fans of moving storytelling, Planetes is an incredible honor for such a heartwarming journey that redefined what science fiction anime can achieve.

- Release Date

-

2003 – 2004-00-00

-

Kazunari Tanaka

Hachirouta Hoshino

-

Planetes is available to stream on Crunchyroll now!

Entertainment

Kevin Smith’s Ultra Violent, R-Rated Comedy Horror On Netflix Is A Terrifying Transformation

By Robert Scucci

| Published

Long before I found my passion for digging up movies that play better than their critical reputations suggest, Kevin Smith made a little horror comedy in 2014 called Tusk that I completely wrote off and forgot about thanks to its 45 percent critical score on Rotten Tomatoes. Having since spent years reviewing movies with single-digit scores that I feel are better than some of their critically acclaimed counterparts, I finally decided to give this one a go. In my mind, 45 percent probably translates to at least a B minus based on how I personally rate films.

I’m admittedly a bit squeamish when it comes to body horror, though I’ll still check out films like Possessor and Stopmotion if the synopsis sounds compelling enough. And let me tell you something. Justin Long getting transformed into a walrus sounds pretty compelling for one very specific reason.

I used to hate Justin Long because he always plays a jerk. After watching movies like Barbarian and The Wave and thoroughly enjoying them for this exact reason, I’ve come to appreciate that this is where his talent really lies. Given how much fun he seems to have playing a jerk in nearly every project he’s in, I’ve started to believe he’s probably disproportionately nice in real life and living vicariously through his characters. Add Kevin Smith’s twisted sense of humor to the equation, and Tusk becomes essential viewing for anyone who loves violent and bizarre B-movie schlock.

Starts With A Podcast

Justin Long’s Wallace Bryton, sporting his best Anthony Kiedis mustache, is introduced through his offensive podcast, The Not-See Party, where he and his cohost Teddy Craft (Haley Joel Osment) roast viral videos. Following a lead about a Manitoba-based, katana swinging teenager known as the Kill Bill Kid, Wallace is disappointed to discover that the subject of the video committed suicide, meaning he traveled to Canada for nothing.

In an attempt to salvage his trip while still generating content, Wallace hears about a man named Howard Howe (Michael Parks), whose flyer claims travelers can live with him for free so long as they listen to stories about his life. Driving out to the middle of nowhere, Wallace prepares for what he believes will be the interview of a lifetime. Instead, he’s drugged and slowly stitched into a human sized walrus suit.

Meanwhile, Teddy and Wallace’s girlfriend Ally (Genesis Rodriguez), having not heard from him in days, receive an alarming voicemail detailing his current predicament. They enlist the help of former detective Guy LaPointe (Johnny Depp), who has been searching for Howard for as long as he can remember, under the suspicion that he’s responsible for countless missing persons cases just like Wallace’s. Determined to rescue their friend, the trio sets out to Howard’s last known address, completely unaware of the brutality waiting for them.

Production Values That Transcend Its Budget

Despite its meager, three million dollar production budget, the practical body horror effects in Tusk are more than solid. We get graphic closeups of Wallace during and after his transformation, and they’re absolutely nauseating in the best possible way. Justin Long’s look of bewildered distress really sells the entire ordeal. He starts the movie overly confident and smug, only to end up as a man trapped inside a walrus’s body.

Since I’ve personally never been sewn into a lifelike walrus suit made from scraps of my own amputated limbs against my will, I can’t say how I’d react in a similar situation. What I can say is that Long sells it convincingly, so credit where it’s due.

The best part of Tusk, though, is Johnny Depp. It feels like the role of Guy LaPointe was written specifically for him, even though reports suggest it was originally written for Quentin Tarantino, who passed on it. Depp is enthusiastic, eccentric, haunted by his past, and driven by his obsession with Howard. He carries himself like a flask-swigging, hard-boiled private detective who’s well past his prime.

While I enjoyed Tusk well enough before his arrival, Johnny Depp’s presence and ability to command every scene he’s in is what truly sealed the deal for me.

An interesting take on body horror mixed with comedy, Tusk isn’t for everyone, but I’m glad I finally got around to watching it. It has the same sick sense of humor you’d expect from Kevin Smith, but it’s focused squarely on this specific genre, showing his range in ways that characters like Jay and Silent Bob simply can’t. Once again haunted by the realization that I could have watched this movie over a decade ago and enjoyed it just as much, it’s another reminder of why you should always take what critics say with a grain of salt.

As of this writing, Tusk is streaming on Netflix.

Entertainment

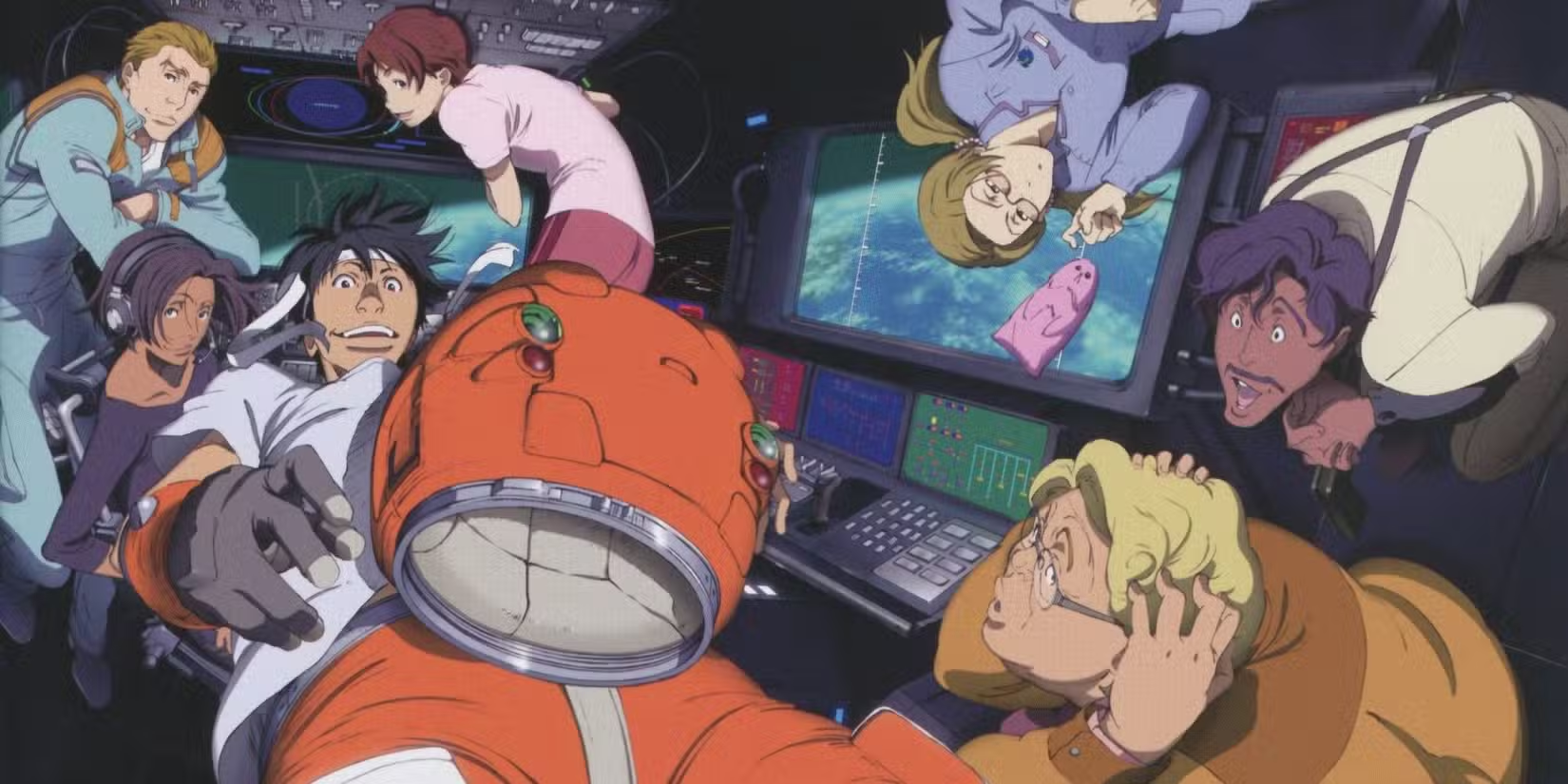

James Van Der Beek Bought $4.7M Texas Ranch 1 Month Prior To Death

James Van Der Beek

Bought Texas Ranch 1 Month Before Death

Published

James Van Der Beek helped his family lay down some serious roots in Texas before his death … he bought the ranch they’d been renting for years and sealed the deal just one month before he died amid a cancer battle.

The late “Dawson’s Creek” star bought the sprawling Spicewood ranch back on January 9 for $4.76 million … according to a new report from Realtor.com.

James moved to the ranch in 2020 with his wife and six children … they were renting it, fell in love with the place, and one of his last acts was buying it.

TMZ broke the story … James died died Wednesday morning after a battle with stage 3 colorectal cancer. He was diagnosed in mid-2023 and in November 2024 he publicly shared his fight.

Shutterstock

The ranch is a massive 36 acres with a 5,149-square-foot main house that features 5 bedrooms and three bathrooms. There’s also cabins and a pool on the ranch, plus sweeping views of the Pedernales River.

James’ widow started a GoFundMe after his death, saying the family exhausted all their funds in his cancer battle … and generous folks have already donated $2.37 million and counting.

Entertainment

One of the Greatest Shows of the 20th Century Just Sparked an AI Controversy

The Muppet Show recently made its grand return in the form of a Disney+ special, and by all accounts, it was a major success. In addition to bringing back fan-favorite Muppets like Kermit the Frog and Fozzie Bear, The Muppet Show also featured incredible guest stars like Sabrina Carpenter and Seth Rogen; it also skyrocketed in ratings, proving the Muppets still hold a place in people’s hearts and in pop culture. However, this praise is marred by controversy over Disney’s decision to use generative AI in an image promoting The Muppet Show.

The Muppet-themed podcast Kermitment was the first to notice the use of generative AI in Disney+’s header for The Muppet Showand posted a lengthy thread on Twitter breaking down inconsistencies, including Miss Piggy appearing without gloves. For any Muppet fan, that would set off warning bells, since it’s a large part of her character, and soon fans took to the internet to voice their displeasure. Disney would eventually remove the image, but the damage was done, and it points to a concerning trend in Hollywood that’s only beginning to grow.

‘The Muppet Show’ Works Because of Its Practical Effects, Not AI

The biggest draw of The Muppet Show, beyond speculating which movie could work if you replaced the actors with Muppets, is the creative energy that goes into bringing the characters to life. The late, great Jim Henson used a combination of puppetry and practical effects that made each Muppet feel like a distinct character; that creativity even extended to the voices, since his performance as Kermit influenced future performers. Henson’s signature style was a major influence on The Muppet Show director Alex Timbers, who discussed how he used the same tricks as the original Muppet Show to bring his special to life with the Los Angeles Times.

“If you’re dealing with a Muppet to Muppet scene, everything has to be in 3/4 scale. If there’s a human in the scene with the Muppet, it’s a 7/8 scale. There are all these little tricks to make sure that a mug feels the right size for Kermit and for that desk to feel the right height…The math of it is really challenging, but also really rewarding.”

By using generative AI in its marketing for The Muppet Show, Disney is either deliberately or unconsciously downplaying the effort that went into bringing the special to life. Given that previous shows on ABC and Disney+ were short-lived, and the classic MuppetVision 3D attraction at Walt Disney World was recently shut down, it’s looking more and more like the House of Mouse has no idea how to use the Muppets. The AI controversy isn’t helping, but it might not be the only time you hear “Muppets” and “AI” in the same sentence.

Disney Embracing AI Goes Against The Muppets’ Creative Vision

Disney recently made waves when it announced a $1 billion deal with OpenAI, allowing users to use OpenAI’s Sora platform to generate images of its characters. The idea of Kermit and friends being shoved through an AI generator feels unsettling, but that’s the least of Muppet fans’ worries. In an interview with Variety, Disney board chairman James Gorman revealed that newly minted chief creative officer Dana Walden plans to incorporate AI into future movies and TV. Combined with the revelation that newly hired CEO Josh D’Amaro also intends to push AI, it feels like Disney is going in the opposite direction from what makes the Muppets special. You can’t replicate the magical mix of puppetry and effects with AI, no matter how Silicon Valley might sell it.

The Muppet Show thrived for 50 years because of the hard work behind the scenes, and the only way it can continue thriving is for that work to continue. Instead of spending money on AI, Disney should market The Muppet Show as aggressively as possible.

- Release Date

-

February 4, 2026

- Director

-

Alex Timbers

- Writers

-

Albertina Rizzo, Kelly Younger, Jim Henson

- Producers

-

Matt Vogel, Seth Rogen, Alex McAtee, Eric Jacobson, Evan Goldberg, James Weaver, Sabrina Carpenter, Michael Steinbach, David Lightbody

Entertainment

Starfleet Academy’s Avery Brooks Tribute Makes No Sense, Proves Writers Didn’t Watch DS9 At All

By Chris Snellgrove

| Published

Recently, Starfleet Academy released an episode intended to celebrate Deep Space Nine legend Benjamin Sisko, complete with holographic character SAM taking a virtual trip through the Sisko Museum. The museum is filled with artifacts important to the Starfleet officer’s life, including the baseball that he always kept in his office on the station. One of those artifacts is the typewriter owned by Benny Russell, and while this is a great way to honor the episode “Far Beyond the Stars,” this particular tribute to the captain and Sisko actor Avery Brooks makes no sense whatsoever.

First, some context: in “Far Beyond the Stars,” Captain Sisko begins receiving strange visions from the Prophets in which he is a 1950s sci-fi writer named Benny Russell. The writer’s crowning achievement is a series of stories set on a space station named Deep Space Nine, but as a Black man, he is having trouble publishing these stories due to the rampant racism of the time period. His story is ultimately suppressed by the sci-fi magazine that he writes for because it features a Black man as its hero, and Benny collapses, only to pop up in an asylum in a later episode.

The Dreamer And The Dream

This vision had a profound impact on Benjamin Sisko: moved by the notion that he is “both the dreamer and the dream,” he is inspired to stay on Deep Space Nine and lead the fight against the Dominion. Because of this, you might think the presence of Benny Russell’s typewriter in the Sisko Museum would make perfect sense. But it’s actually crazy for many reasons, including the fact that, until a few years ago, there was no real Benny Russell in the Trek canon!

In Deep Space Nine, Benny only appeared to Sisko in visions, first by the Prophets and later by the Pah-Wraiths. We never see Sisko look up the historical Benny, implying that he doesn’t exist; in fact, the Star Trek Encyclopedia entry for Benny Russell claims that he “may have existed in an alternate reality, or perhaps only in certain reaches of Ben Sisko’s mind.” The fact that Benny didn’t previously exist is likely what Jake Sisko actor Cirroc Lofton was referring to in a recent TrekMovie interview, where he declared that the typewriter in the museum “technically…does not exist.”

The Dream Suddenly Became Real

However, Strange New Worlds retconned Benny Russell into existence by revealing that he wrote a book, The Kingdom of Elysian, that Dr. M’Benga liked to read to his daughter as a bedtime story. At the time, this was more of an Easter egg than anything else. The fictional tale had to be written by someone, so why not choose a beloved character known for writing sci-fi stories?

This brings us up to Benny’s typewriter appearing in Starfleet Academy, something that seems more impossible now than ever before. You see, it’s easy enough to accept that he was a real writer within the fictional canon of Star Trek. But how would Benjamin Sisko have gotten the actual typewriter from a failed writer who died centuries ago?

The Most Confusing Museum In The Galaxy

Of course, whether Benny failed as a writer is something of an open question. On Deep Space Nine, we see him as a man who goes crazy after his sci-fi masterpiece isn’t published, and he gets committed to a psychiatric hospital after a delusional breakdown. It’s never made clear exactly how he went from being someone who couldn’t publish his magnum opus to a published, respected writer whose works are still being enjoyed centuries in the future.

Even if you can accept that Benny Russell was real (like, did all of his friends actually look like the entire cast of Deep Space Nine?) and that he became famous and successful, there’s still one last question: how does anyone know about any kind of relationship between Sisko and this relatively obscure 20th-century writer? In DS9, it was implied that the only person he told about Benny Russell was his own father, Joseph Sisko; maybe he told Dr. Bashir, but this information would presumably been protected by doctor/patient confidentiality.

One More Thing About Sisko That Makes No Sense

It’s possible that Sisko filed a report about this to Starfleet, but that seems unlikely; after all, he would be admitting to having the equivalent of a mental breakdown while he was spearheading Starfleet’s war with the Dominion. That would be a bad look for anyone, and we know that Sisko doesn’t have a problem with keeping information from Starfleet. That’s one of the big lessons of “In the Pale Moonlight”: that he’s not afraid of omitting information, especially in the name of the greater good.

All of this adds up to the typewriter in Starfleet Academy being something of a paradox: longtime Star Trek fans understand its importance, but it’s unclear how Sisko would have obtained it, much less why the museum would have displayed it as one of his most prized possessions. Still, it makes for a fun Easter egg, one that continues to keep the fandom talking. Now, those fans are left with one final question: what else will we learn about Benny Russell that completely changes what we know about Star Trek?

Entertainment

Kai Cenat’s Ex Gigi Sparks Buzz With Message About “No Regrets”

Almost two months after her and Kai Cenat’s split, Gabrielle “Gigi” Alayah made a move that has fans talking again. Kai finally dropped a lengthy message on Instagram apologizing for not addressing their breakup. Now, fans think Gigi basically responded to his message without even saying a word.

RELATED: Open Book? Kai Cenat Breaks Silence & Mentions Gabrielle “Gigi” Alayah While Speaking On “Rumors” & “Speculations” Since Their Split

Gabrielle “Gigi” Alayah’s Latest Repost Has Fans Reading Between The Lines

Hours after Kai Cenat spoke about their breakup, Gigi reposted a message on her Instagram Story. It’s unclear whether she was directly responding to him, but fans were clocking the words heavy trying to connect the dots. No caption — just a message that read, “Never regret the love you give. It will always return to you in another time, in another person, or another place.” Right now, Kai hasn’t said any additional words, ad Gabrielle hasn’t revealed who or what her post is about. Even with all of that, the internet still thinks it all lines up.

Social Media Is Buzzing Over Gigi’s Low-Key Response

Over in The Shade Room Teens comment section, folks gave Gigi props, saying they would’ve crashed out a long time ago. Others added that it’s just a matter of time before she finds her prince charming.

Instagram user @famousdashja wrote, “She handled this so well cause I would’ve crashed out fr.”

Instagram user @jaee.renee wrote, “He responded a month later after she got dragged through the mud, she has every right to showcase that she’s healed and no longer bothered by it!”

While Instagram user @doseof.neaa wrote, “if i was her i would’ve posted an arm by now idk.”

Another Instagram user @iam.jadaaa wrote, “i love her and i wish she find THE ONE.”

Then Instagram user @_itsyagirlyanaa wrote, “y’all leave her alone and let her find peace😭 she’s human too.”

Instagram user @bdhk__serm wrote, “No literally, it sucks giving love and not receiving any back… but you always get it back one way or another.”

While another Instagram user @anti_social626 wrote, “Chile he gonna be sick af when she gets that breakup glow and really be outside 😭😭😭😭”

Lastly, Instagram user @adriyanaa.a wrote, “y’all owe this girl an apology frl.”

Here’s Why Fans Think Gigi’s Repost Might Be Directed To Kai

On Friday, February 13, Kai Cenat shocked fans again when he addressed rumors and assumptions surrounding his friends and Gabrielle. His message shook fans because it’s the first time he’s spoke about his breakup with GIgi since their split in December 2025. On his Instagram Story, Kai told his followers he knows it can get confusing when false news pops up about him. He added that since he’s always been open on social media, it’s hard to keep things private. He also addressed the rumors that surfaced after he stepped back from streaming. Kai apologized for not speaking sooner but admitted some things should’ve stayed private.

“There have been rumors, speculations, and comments made about my previous relationship and my friends. I want to apologize for not addressing things sooner, but I needed to take a step back from social media and process everything. People react to things in different ways, it is an emotional time and should have been handled PRIVATELY.”

Kai told fans that if something really needs his attention and deserves a response, he’s going to speak on it, no matter what it’s about. Then he shifted gears and addressed his breakup with Gigi. Rumors have been swirling since their split, and things seemingly escalated when Gigi hopped on YouTube sharing her side of the story. But Kai cleared the air on his end in his message writing, “I wish the best to Gabrielle and ask to please respect both sides,”

RELATED: Romantic Stream Sessions To Courtside Couple Goals: A Timeline Of Kai Cenat & Gabrielle “Gigi” Alayah’s Love Story (VIDEOS)

What Do You Think Roomies?

Entertainment

Amber Heard All Smiles as Johnny Depp Films Hollywood Return

Amber Heard

All Smiles In Spain As Johnny Films Hollywood Return

Published

Johnny Depp is happy to be working on a Hollywood movie set again, and Amber Heard looks happy to be living the lowkey mom life over in Europe.

Check out these photos of Amber on a walk with her kiddos over in Madrid … she’s all smiles on a Friday outing in the Spanish capital.

Amber looks content pushing a stroller … far from the glitz, glamour, and drama of Hollywood.

Meanwhile, Amber’s ex is getting back on the horse.

We saw Johnny a couple weeks ago in full costume and makeup as the Ghost of Christmas Future … he’s playing Ebenezer Scrooge in an upcoming adaption of “A Christmas Carol.”

Two very different paths for the former lovers turned legal foes … but at least they both look happy here.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video17 hours ago

Video17 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World2 hours ago

Crypto World2 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?