Crypto World

Bhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

Bhutan has sold another 100 Bitcoin worth approximately $6.7 million, according to blockchain analytics platform Arkham Intelligence, which flagged the transaction in a recent post.

Summary

- Bhutan sold another 100 BTC worth about $6.7 million, marking its third consecutive week of Bitcoin transfers, according to Arkham Intelligence.

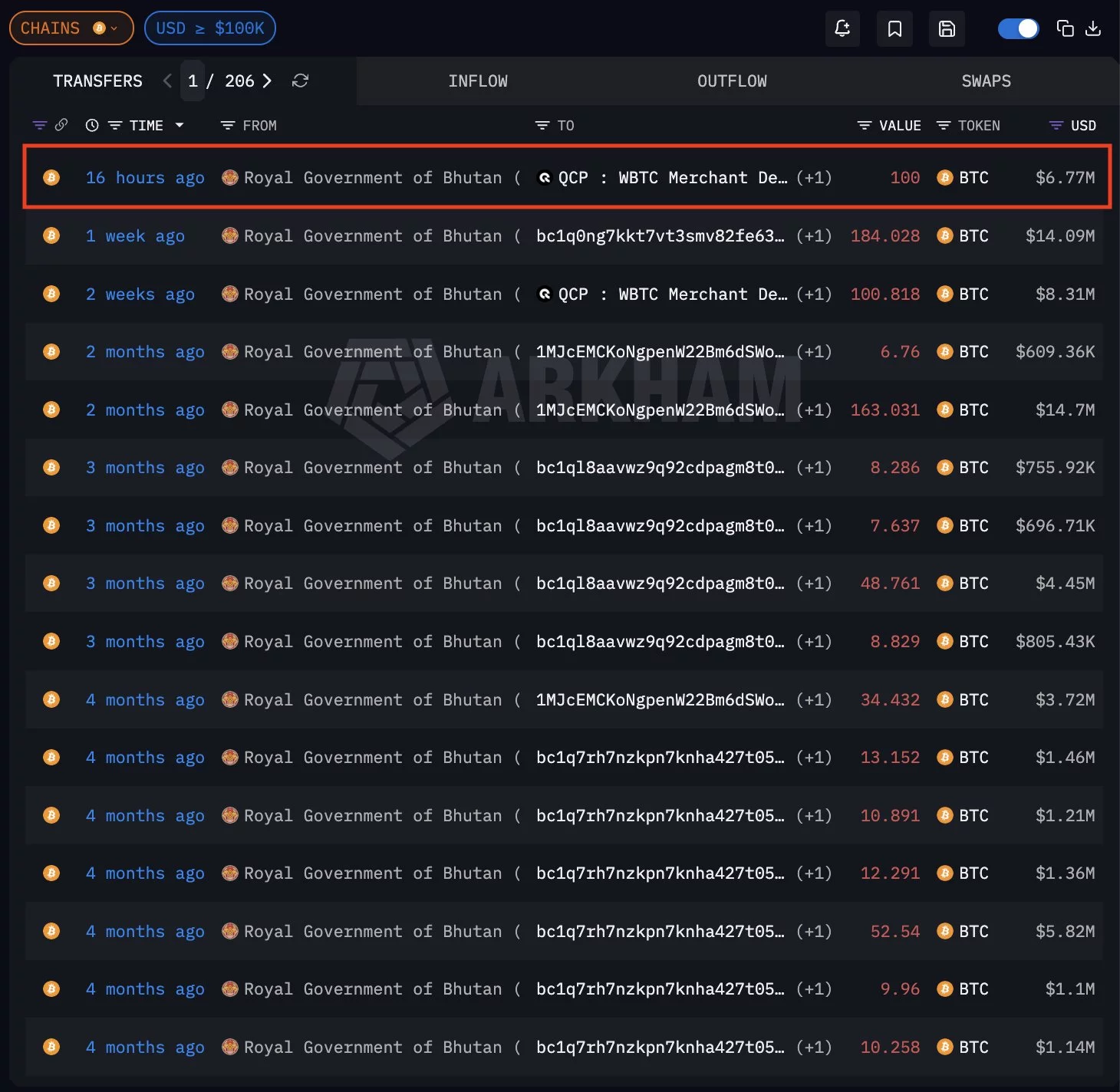

- On-chain data shows structured, repeated deposits to a QCP-linked WBTC merchant address, suggesting gradual treasury management rather than a single large liquidation.

- Despite ongoing sales, Bhutan still holds roughly 5,600 BTC valued at around $372 million, keeping it among the largest sovereign Bitcoin holders.

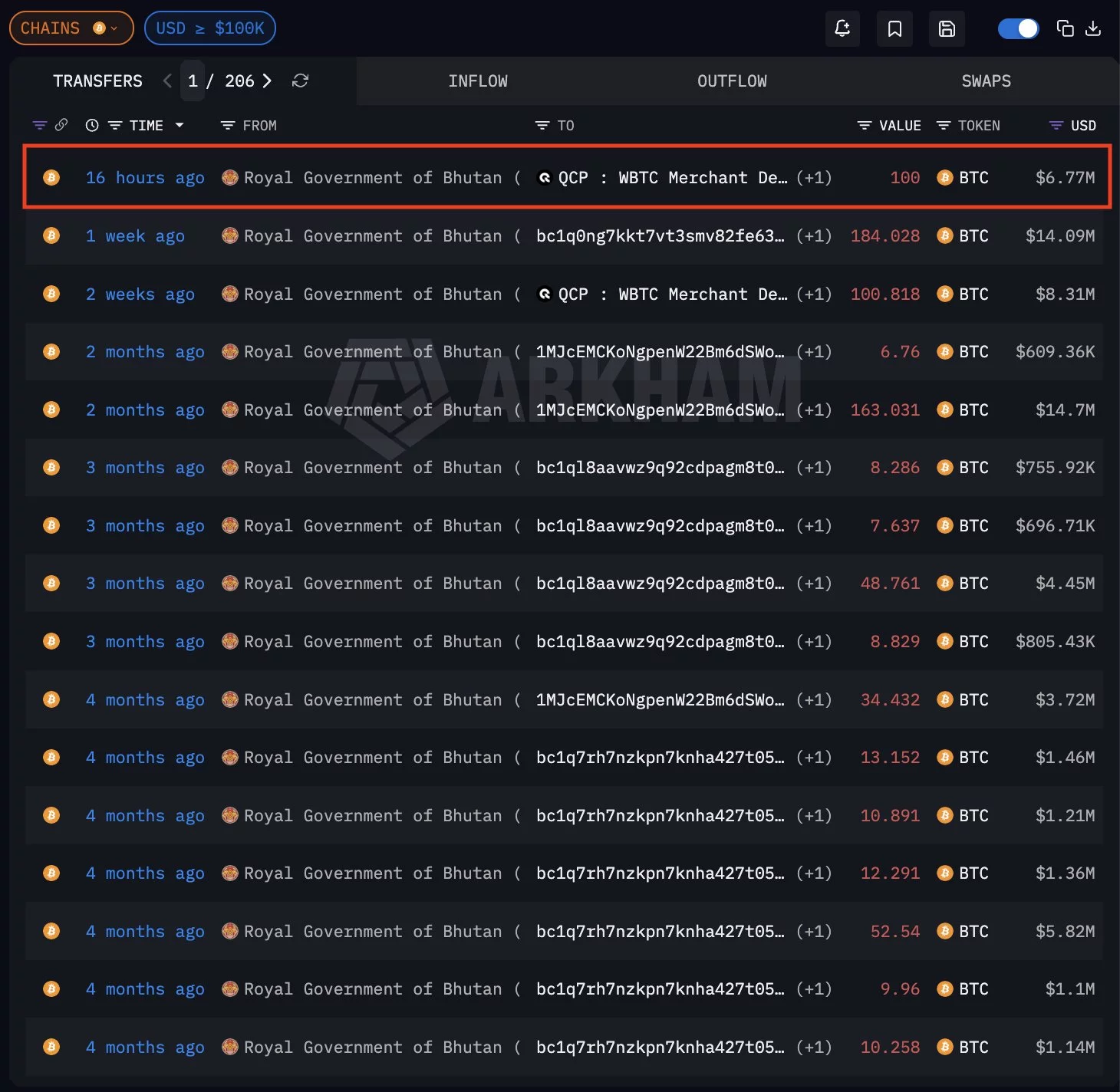

On-chain data shared by Arkham shows the transfer occurred roughly 16 hours prior to the alert, with 100 Bitcoin (BTC) moved from wallets labeled as belonging to the Royal Government of Bhutan to an external address identified as a QCP-linked WBTC merchant deposit.

The transaction is part of what Arkham describes as three consecutive weeks of Bitcoin selling activity.

Bhutan’s weekly Bitcoin selling activity continues

The data indicates Bhutan has been gradually offloading Bitcoin in recent weeks.

Transaction history visible in Arkham’s dashboard shows multiple BTC transfers over recent weeks, including movements of 184 BTC and 100 BTC batches. The consistent pattern of deposits suggests structured selling rather than a single large liquidation.

Moreover, Arkham previously reported that the country sold at least $100 million worth of BTC in September 2025, and the latest transaction suggests that the selling strategy is ongoing.

Bitcoin mining slows down after halving

Bhutan’s Bitcoin reserves are largely tied to its state-backed mining operations. The country had announced plans to scale its mining capacity to up to 600 megawatts in partnership with Bitdeer Technologies.

However, Arkham noted that on-chain mining inflows appear to have slowed following Bitcoin’s April 2024 halving event, which reduced block rewards and increased pressure on mining profitability.

The slowdown may be contributing to Bhutan’s gradual treasury sales.

Despite recent sales, Arkham data shows Bhutan still holds approximately 5,600 BTC, valued at around $372 million, across identified wallets. The holdings position Bhutan among the more significant sovereign Bitcoin holders globally.

While the transfers do not necessarily confirm immediate market selling, repeated exchange-linked deposits often signal liquidity preparation. Market participants will likely monitor whether Bhutan’s weekly BTC movements continue in the coming weeks.

Crypto World

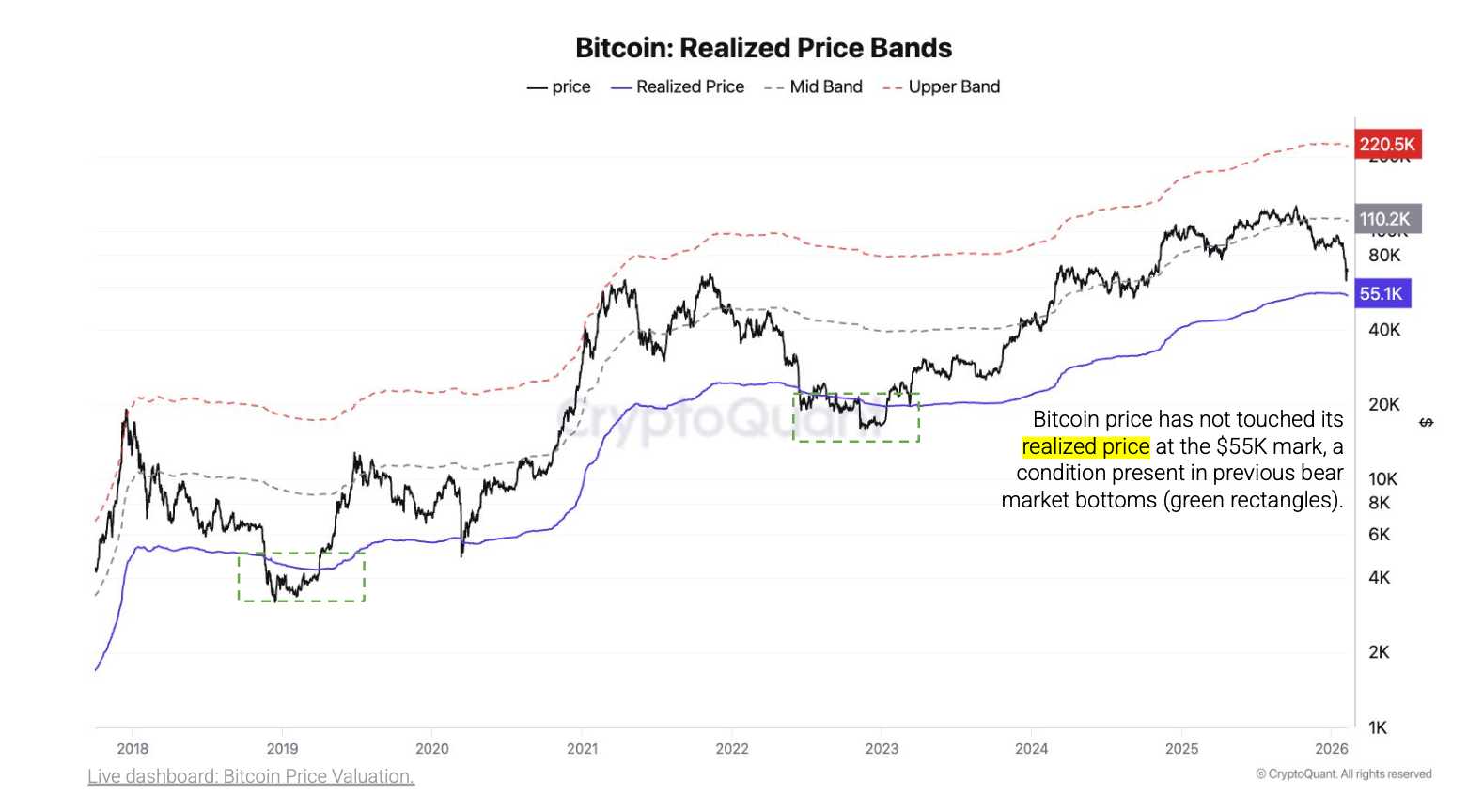

CryptoQuant Places Bitcoin Bear Market Bottom at $55,000 as Key Indicators Show Extended Correction Ahead

TLDR:

- Bitcoin trades 25% above its realized price of $55,000, which historically marks bear market bottoms

- February 5 sell-off triggered $5.4 billion in daily losses, the largest since March 2023’s $5.8 billion event

- Monthly realized losses at 0.3 million BTC remain far below 2022 bear market bottom of 1.1 million BTC

- Long-term holders selling near breakeven versus 30-40% losses typical at previous bear market cycle lows

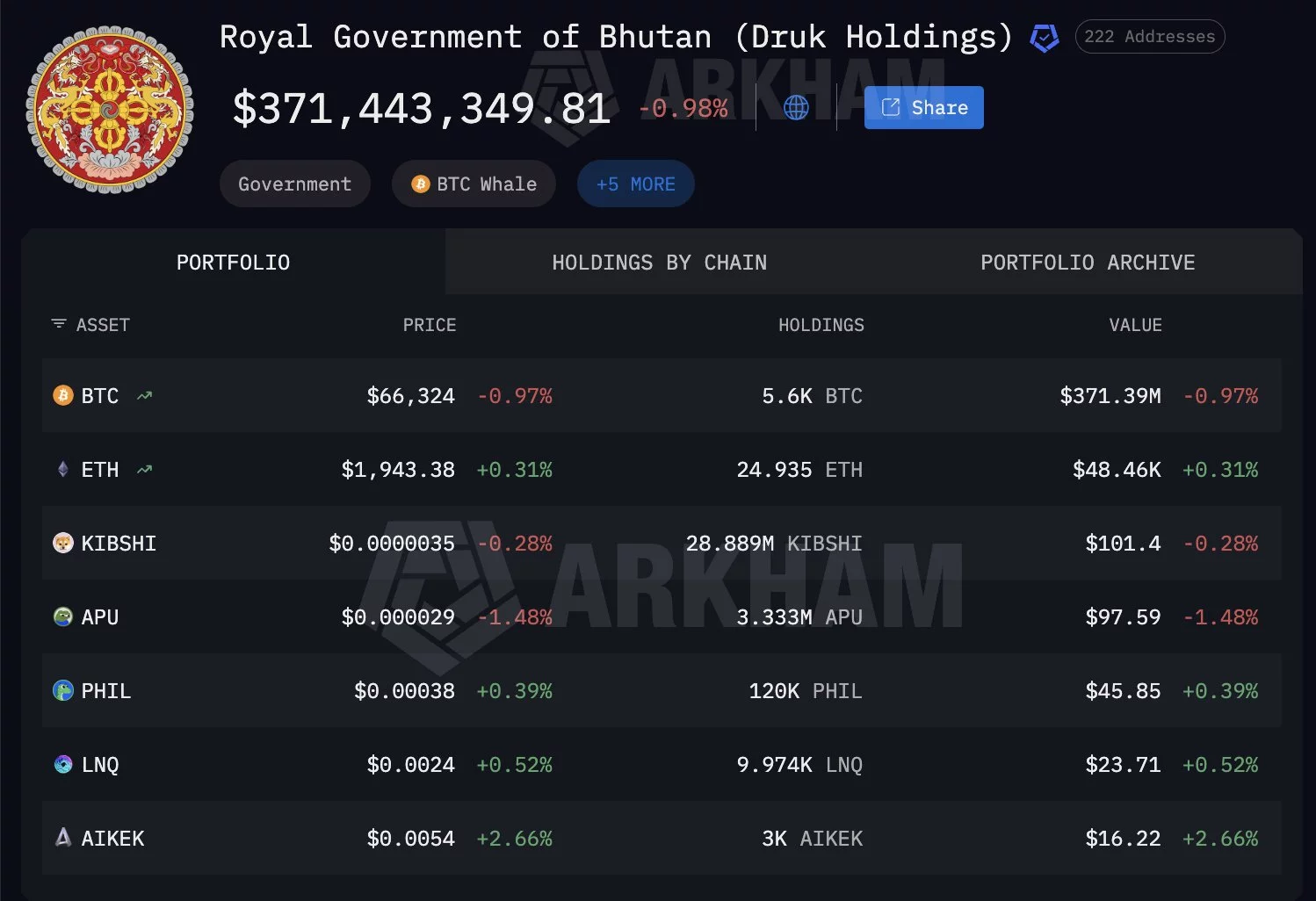

Bitcoin’s bear market floor sits around $55,000, according to blockchain analytics platform CryptoQuant. The firm’s latest assessment suggests the cryptocurrency remains more than 25% above this critical support level.

CryptoQuant analysts note that bear market bottoms require several months to establish rather than forming through sudden capitulation events.

This analysis comes as Bitcoin trades significantly higher than key historical support zones that marked previous cycle lows.

Realized Price Indicates Extended Bottoming Process

The realized price metric serves as CryptoQuant’s primary indicator for determining Bitcoin’s potential bottom. This measure calculates the average price at which all coins last moved on the blockchain.

Historical data shows this metric provided strong support during past bear markets. Current trading prices remain elevated compared to this threshold, suggesting additional downside potential exists.

Previous bear cycles demonstrated distinct patterns when Bitcoin approached these levels. During the 2018 downturn, prices dropped 30% below the realized price before stabilizing.

The FTX collapse in 2022 pushed Bitcoin 24% beneath this metric. After reaching these depths, the cryptocurrency spent between four and six months building a foundation before recovery began.

Recent market volatility has not yet pushed Bitcoin into the extreme zones that characterize true bottoms. On February 5, the asset experienced a 14% decline to $62,000, triggering $5.4 billion in realized losses.

This marked the largest single-day loss realization since March 2023, when holders crystallized $5.8 billion in losses. The figure also exceeded the $4.3 billion recorded shortly after the FTX exchange collapsed.

Despite these substantial losses, CryptoQuant maintains that a structural bottom has not materialized. Monthly cumulative realized losses currently stand at 0.3 million BTC, well below the 1.1 million BTC observed at the end of the 2022 bear market. This disparity suggests selling pressure has not reached the intensity associated with cycle lows.

Source: Cryptoquant

Multiple Indicators Show Market Remains Above Capitulation Levels

The MVRV ratio, which compares market value to realized value, has not entered extreme undervaluation territory. This metric historically signals bear market bottoms when reaching deeply depressed levels.

Current readings indicate Bitcoin trades above the ranges that marked previous cycle nadirs. Similarly, the Net Unrealized Profit and Loss metric has not declined to the 20% unrealized loss threshold observed at past bottoms.

Long-term holder behavior provides additional evidence that full capitulation has not occurred. These investors currently sell positions near breakeven prices.

During previous bear market conclusions, long-term holders typically absorbed losses between 30% and 40% before markets reversed. This behavioral difference suggests conviction remains higher than at historical turning points.

Approximately 55% of Bitcoin’s circulating supply remains profitable at current prices. This contrasts with the 45% to 50% range typically observed at cycle lows.

The elevated proportion of profitable holdings indicates many investors entered positions at lower prices and maintain paper gains. Bear market bottoms usually feature a higher percentage of underwater positions across the holder base.

CryptoQuant’s Bull-Bear Market Cycle Indicator remains in the Bear Phase rather than advancing to the Extreme Bear Phase. The latter designation historically marks the beginning of extended bottoming periods.

These extreme phases typically persist for several months, reinforcing the firm’s assessment that bear markets require time to resolve.

Standard Chartered recently adjusted its outlook, projecting Bitcoin could test $50,000 before recovering later this year.

Crypto World

How Espresso’s HotShot Consensus Addresses the Rollup Centralization and Fragmentation Crisis

TLDR:

- Espresso’s decentralized shared sequencer eliminates single points of failure in Rollup transaction ordering.

- HotShot consensus achieves two-second finality on devnet with plans for sub-second confirmation by 2026.

- Presto enables one-click cross-chain transactions without traditional bridging or additional gas fees.

- The network integrates with over 20 chains while preserving Rollup sovereignty through flexible participation.

The rapid proliferation of Layer 2 Rollups has created two fundamental problems that threaten ecosystem cohesion. Fragmentation prevents seamless interaction between chains, while centralized sequencers introduce censorship risks and single points of failure.

Espresso Systems addresses both challenges through a decentralized shared sequencer network powered by HotShot consensus.

The protocol raised $60 million from a16z and Coinbase Ventures to build infrastructure connecting over 20 chains with fast finality and cross-chain composability.

Cross-Chain Composability Addresses Rollup Fragmentation Crisis

The fragmentation dilemma emerged as rollups multiplied without standardized interoperability protocols. Applications and liquidity became isolated across separate Layer 2 ecosystems.

Users faced complex bridging processes and high costs when moving assets between chains. This fragmentation undermined the composability that makes Ethereum’s base layer valuable for developers.

Espresso tackles this problem through its confirmation layer architecture designed to achieve cross-chain composability.

According to the official website, the network provides reliable state views for other chains, bridges, and applications through real-time confirmation.

Smart contracts deployed on different Rollups can directly communicate without traditional bridging infrastructure. This restores the seamless interaction developers expect from integrated blockchain environments.

The Presto solution demonstrates practical fragmentation resolution through one-click cross-chain transactions. The system leverages Espresso’s fast finality to enable direct chain communication.

A partnership with Rarible showcased cross-chain NFT minting at the Devcon developer conference. The demonstration proved users could mint NFTs across chains without bridging or extra gas fees.

Technical performance supports these composability goals with measurable improvements. The current devnet achieves two-second finality with 5 MB/s throughput.

Official updates note this represents three times faster confirmation and five times higher capacity compared to mainnet. The development roadmap projects sub-second finality by 2026 as optimization continues.

Decentralized Sequencing Eliminates Centralization Vulnerabilities

Centralized sequencing represents the second critical vulnerability in current rollup architecture. Most Layer 2 networks rely on single sequencers controlled by project teams.

These operators possess unilateral power to order, delay, or exclude transactions from blocks. The arrangement creates censorship vectors and introduces catastrophic failure risks if operators go offline.

Espresso replaces centralized control with a distributed validator network operating globally. The shared sequencer accepts transaction blocks from connected Rollups for collective confirmation.

HotShot consensus serves as the Byzantine Fault Tolerance protocol ensuring distributed agreement among validator nodes. This architecture eliminates single points of failure while distributing censorship resistance across the entire network.

Protocol-level safeguards enforce decentralization guarantees for settlement on Ethereum’s base layer. The system ensures only blocks confirmed by Espresso validators can finalize on Layer 1.

This restriction prevents Rollup operators from bypassing consensus through direct submission. The mechanism guarantees all transactions undergo distributed validation before achieving finality.

The business model preserves Rollup sovereignty despite shared infrastructure. Official statements emphasize Rollups can freely choose to fully rely on the network, partially participate, or run independent sequencers.

This flexibility allows projects to access decentralization benefits without surrendering operational control. Partnerships with Arbitrum, Optimism, and Polygon demonstrate major ecosystem acceptance of the shared sequencing approach.

Crypto World

US Prosecutors Warn on Crypto Risks

U.S. prosecutors have warned of Valentine’s Day romance scams using crypto after cases cost victims millions.

Prosecutors in the U.S. state of Ohio have issued a public warning urging Americans to watch for romance scams tied to cryptocurrency as they celebrate Valentine’s Day.

The alert drew attention to a rise in emotionally driven fraud cases where victims are persuaded to send digital assets after forming online relationships.

Federal Warning Outlines Latest Tactics

The U.S. Attorney’s Office for the Northern District of Ohio said criminals often approach targets through dating apps, social platforms, or text messages, then build trust for weeks or months before requesting money for fabricated emergencies or investments.

According to U.S. Attorney David M. Toepfer, scammers “prey on trust and emotion,” and they “are not looking for love—they are looking for money.” He added that such criminals often focus on older adults and emotionally vulnerable individuals.

His office also cited recent prosecutions and investigations, including a December 2025 case where authorities charged Frederick Kumi, a Ghanaian national accused of helping run a romance fraud network that allegedly took more than $8 million from elderly victims since 2023. Per investigators, the group used AI tools to create false identities and maintain convincing conversations before requesting money. Kumi was arrested in Ghana and is facing charges including wire fraud conspiracy and money laundering conspiracy.

Another case involved an Ohio woman who lost about $663,000 after a stranger contacted her through a “wrong number” text. The fraudster later guided her through opening accounts on Crypto.com and Coinbase, then convinced her to transfer funds to a fake investment platform.

Fortunately, detectives from the FBI traced part of the stolen money to cryptocurrency wallets and seized more than $8.2 million in USDT with help from Tether.

You may also like:

Data Shows Wider Trend in Crypto-Linked Fraud

Recent industry research suggests these crimes fit a broader pattern, as shown in a January 2026 report from blockchain security firm PeckShield, which estimated that crypto scams and hacks cost users more than $4 billion in 2025, with about $1.37 billion tied to scams alone.

The company said losses from scams rose about 64% from the previous year, often involving personalized impersonation tactics aimed at high-value targets.

The Ohio prosecutors have recommended several ways that people can protect themselves from romance tricksters, including reverse image searches on profile photos, skepticism toward anyone who refuses to meet in person, and a hard rule against sending cryptocurrency, gift cards, or wire transfers to people met online.

They also advised victims to preserve all communications and financial records, then file reports with the FBI’s Internet Crime Complaint Center. Additionally, the National Elder Fraud Hotline operates daily to guide older adults through the reporting process.

According to the officials, for those who may have sent crypto, time matters, since law enforcement can freeze stolen assets, but only if wallets are identified before funds move through mixers or overseas exchanges.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

SEC chair warns some prediction markets may fall under securities laws

The head of the U.S. Securities and Exchange Commission says prediction markets are drawing serious legal and regulatory attention.

Summary

- U.S. Securities and Exchange Commission Chair Paul Atkins called prediction markets a “huge issue” as the sector faces growing legal and regulatory scrutiny.

- Atkins said some event-based contracts could fall under SEC jurisdiction if they meet the definition of a security.

- The SEC is coordinating with the Commodity Futures Trading Commission as questions mount over oversight, especially for platforms like Polymarket and Kalshi.

At a Senate Banking Committee hearing on February 12, SEC Chair Paul Atkins described rapidly-growing prediction markets as “a huge issue” for federal regulators.

Platforms such as Kalshi and Polymarket have expanded quickly since the 2024 election cycle. These markets let users speculate on outcomes from elections and sports to economic events.

Their growth, now measured in tens of billions of dollars, has pushed them into the spotlight of U.S. regulators.

Who regulates prediction markets?

Atkins said the legal status of prediction markets isn’t always clear. He noted that jurisdiction overlaps between the SEC and the Commodity Futures Trading Commission (CFTC).

“Prediction markets are exactly one thing where there’s overlapping jurisdiction potentially,” Atkins said.

Historically, the CFTC has been seen as the primary federal regulator for these markets. Atkins said the SEC may regulate some markets depending on how they’re structured, especially if contracts resemble securities.

“We have enough authority,” he told lawmakers, adding that a “security is a security regardless how it is and some of the nuance with prediction markets and the products depends on wording.”

SEC officials are reportedly meeting weekly with their counterparts at the CFTC.

CFTC Chair Michael Selig said regulators want a framework that protects market participants without pushing these platforms offshore.

Meanwhile, prediction markets also face state-level litigation, including claims that some offerings are illegal gambling under local laws.

Recent reports have noted insider trading concerns and legislative efforts to limit political event betting.

Crypto World

Bitcoin price outlook as $2.5B BTC options expire today

Bitcoin price trades near $68,000 as $2.5 billion in BTC options expire today, placing $74,000 max pain at the center of market focus.

Summary

- Bitcoin has been on a downtrend in February, falling nearly 50% from its all-time high.

- $2.5B in BTC options expire today with a put/call ratio of 0.72 and max pain at $74,000.

- RSI sits near 29 as volume and open interest decline across derivatives markets.

Bitcoin was trading at $68,280 at press time, down 1.1% over the last 24 hours. The asset has moved within a 7-day range of $64,760 to $71,450. Over the past 30 days, BTC is down 30%, and it now sits roughly 50% below its $126,080 all-time high set in October.

Spot activity has cooled. Bitcoin (BTC) logged $47 billion in 24-hour trading volume, a decline of 11% from the previous day. Derivatives markets are also easing.

As per Coinglass data, total futures volume stands at $63 billion, down 18%, while open interest has dipped 1.73% to $44 billion. That combination points to position trimming rather than aggressive new exposure.

$2.5B in options set to expire

According to Deribit data, $2.5 billion worth of Bitcoin options are set to expire at 8:00 a.m. UTC on Feb. 13. The put/call ratio stands at 0.72, indicating more call contracts than puts. The max pain price is $74,000, the level where the largest number of options would expire worthless.

At the same time, $420 million in Ethereum options will also expire, with a put/call ratio of 0.85 and a max pain level of $2,100.

Options expiry refers to the settlement of contracts that give traders the right, but not the obligation, to buy or sell Bitcoin at a specific price before a set date. As expiry approaches, market makers hedge their exposure by buying or selling spot and futures.

This can increase short-term volatility. In many cases, price gravitates toward the max pain level. In others, strong directional momentum overrides expiry-related flows.

With Bitcoin trading nearly $6,000 below $74,000, traders are watching to see whether the price gets pulled higher into settlement or continues lower.

Technical outlook: pressure remains below $74K

The daily structure is clearly bearish. Bitcoin has been printing lower highs and lower lows. It trades below the 50-day moving average near $75,000 and well under the 200-day moving average around $92,500. That alignment keeps momentum tilted to the downside.

Bollinger Bands are expanding, not compressing. Price recently touched the lower band, which often signals oversold conditions. In strong downtrends, however, assets can stay pinned near the lower band for longer than expected.

The relative strength index is around 29, deep in oversold territory. Yet there is no confirmed bullish divergence. Until RSI forms higher lows while price stabilizes, reversal signals remain limited.

Support sits at $65,000–$66,000, followed by the psychological $60,000 level. On the upside, $74,000–$76,000 is the key reclaim zone. A daily close above that area would ease pressure and open room toward $80,000.

For now, Bitcoin remains technically weak below $74,000. Options expiry may add volatility, but trend reversal requires structure to shift, not just a short-term bounce.

Crypto World

Solana price breaks below key $80 level as RSI sinks to 25

Solana price has slipped beneath a critical support level, with momentum indicators flashing deep oversold conditions as traders re-assess risk.

Summary

- Solana’s breakdown below a key psychological level reinforces its downtrend, with sellers still controlling structure.

- The memecoin-driven surge that fueled the previous rally has cooled.

- RSI has plunged to 25 as price breaks below $80, confirming strong bearish momentum.

Solana was trading at $78.33 at press time, down 2.7% over the past 24 hours. The token has dropped 45% in the last 30 days and is now roughly 73% below its January 2025 all-time high. Over the past week, the price has ranged between $76.81 and $89.28, with sellers maintaining control.

Trading activity has fallen. At $3.83 billion, Solana’s (SOL) 24-hour spot volume was down 15%. On the derivatives side, CoinGlass data shows that open interest dropped 3% to $4.91 billion, while volume dropped 12% to $10.28 billion.

The decline in open interest indicates that traders are closing positions rather than opening new aggressive bets. That kind of unwinding is common during the later stages of a correction. Still, it should not be mistaken for a confirmed bottom.

Why Solana has struggled

Solana’s weakness comes after a sharp pullback from its late 2024 and early 2025 rally. Memecoin activity, including tokens with political themes, attracted a lot of speculative capital to the ecosystem during that run. Leverage accumulated across derivatives markets as liquidity rapidly increased.

When that momentum cooled, the structure weakened. Long positions began to unwind, and stop-losses were triggered in succession.

Selling pressure increased as a result. Solana is a high-beta asset that often amplifies broader market movements. It tends to fall more when sentiment changes, but it can also outperform in high risk-on situations.

In periods of uncertainty, traders often prefer deeper liquidity, and that may favor Bitcoin and Ethereum. Compared to those markets, SOL’s thinner liquidity can amplify volatility during deleveraging.

Declining decentralized exchange volumes have also pressured the token. According to DefiLlama data, Solana’s January DEX volume was $117 billion. That was an improvement over the previous two months, but it was still less than the $155 billion that was recorded in October. Ecosystem-driven demand for SOL has weakened as speculative trading continues fade.

Although long-term projections are largely positive, pointing to the rise in stablecoin usage and micropayments, there haven’t been many short-term catalysts, making the price susceptible to technical pressure.

Solana price technical analysis

The break below $80 is technically significant. The level had acted as psychological support and formed the lower edge of a recent consolidation range. Once it gave way, the broader downtrend that began after the January peak near $150 was reinforced.

SOL now trades beneath both the 20-day and 50-day moving averages. Price is also positioned below the mid-point of the Bollinger Bands. Meanwhile, the bands themselves are widening, a sign that volatility is expanding.

When price continues to hug the lower band during that expansion phase, it usually reflects trend continuation rather than an immediate reversal.

Momentum indicators align with the weakness. Deep in oversold territory, the relative strength index has dropped to 25. Though no bullish divergence has yet to form, such readings may precede brief relief rallies. RSI remains below its signal average, which suggests sellers still dominate near-term flows.

SOL would need to firmly reclaim $80 with conviction in order for bullish momentum to resume. A sustained move toward $90 would be the next test. Beyond that, the $98–$100 region stands as a major resistance cluster.

On the downside, the $72–$70 area marks the next support zone. If that fails, attention shifts to the $65–$68 range, with stronger psychological support resting near $60.

The current setup reflects a market under pressure. Whether this evolves into capitulation or stabilizes into a base will depend on how the price behaves around the $70 region.

Crypto World

21Shares deepens BitGo ties to power ETF custody and staking

BitGo Holdings, Inc. and 21Shares have expanded their global partnership to support a growing lineup of crypto exchange-traded products (ETPs) and ETFs with enhanced staking and custody services.

Summary

- BitGo Holdings Inc. and 21Shares have expanded their global partnership to strengthen custody and staking support for crypto ETFs and ETPs across the U.S. and Europe.

- BitGo will provide qualified custody, trading, execution and integrated staking services, enabling 21Shares’ products to offer secure asset storage and potential staking yields.

- The move comes amid rising institutional demand for regulated crypto investment vehicles, with 21Shares managing roughly $5.7 billion in assets.

21Shares turns to BitGo for expanded custody

The new agreement covers both the United States and Europe, deepening cooperation between two major players in digital asset infrastructure and investment products.

Under the expanded partnership, BitGo will provide qualified custody, trading, execution and integrated staking services for 21Shares’ U.S.-listed ETFs and international ETP offerings.

These services include secure asset safekeeping, access to deep liquidity across electronic and over-the-counter markets, plus competitive staking rewards, all delivered within BitGo’s regulated and insured custody framework.

21Shares, a leading issuer of crypto investment products managing roughly $5.7 billion in assets, gains from BitGo’s infrastructure as it continues to expand its suite of digital asset offerings. The expanded pact supports both spot crypto products and instruments that enable holders to earn staking yields, a growing demand among institutional and regulated investors.

What this means for the market

The expanded collaboration comes at a time when institutional interest in regulated crypto products is rising globally. By pairing BitGo’s custody and staking capabilities with 21Shares’ broad ETP platform, both firms are positioning themselves to attract professional capital seeking secure, compliant exposure to digital assets.

Adam Sporn, Head of Prime Brokerage and Institutional Sales at BitGo, highlighted the importance of the partnership as 21Shares increases its ETF product range worldwide.

Andres Valencia, Head of Investment Management at 21Shares, noted that BitGo’s track record in security, regulatory compliance and governance made it an ideal partner for expanding staking and custody services.

This development builds on recent milestones for BitGo, including regulatory approvals and its NYSE listing, which enhance its ability to serve institutional clients with robust, compliant infrastructure. Meanwhile, 21Shares continues to grow its global ETF and ETP footprint, leveraging trusted partners like BitGo to scale securely.

Crypto World

Coinbase, Ripple, Solana execs join CFTC’s Innovation Advisory Committee

The Commodity and Futures Trading Commission expanded its Innovation Advisory Committee to a 35-member panel on Thursday with the addition of executives from leading crypto-facing entities like Coinbase and Ripple, among others.

Summary

- The CFTC has finalized a 35-member Innovation Advisory Committee to help modernize regulatory oversight.

- Executives from Coinbase, Ripple, Uniswap, and other crypto firms make up the majority of the panel.

- Chairman Michael Selig said the group will support the agency’s goal to “future-proof” U.S. financial markets.

An updated list with 23 new appointments, layered over the original 12 charter members that were designated at launch in late 2025, was published by the commission on Feb. 12.

The committee was formed to help guide the derivatives regulator so it can “future-proof its markets and develop clear rules of the road for the Golden Age of American Financial Markets,” Chairman Michael S. Selig explained.

The origins of the committee can be traced back to late 2025 under then‑Acting Chair Caroline Pham, who established the CEO Innovation Council to address the challenges of 24/7 trading, tokenized collateral, and prediction markets, goals that will remain on the agenda of the expanded Innovation Advisory Committee.

After Selig’s appointment as the permanent CFTC Chairman, he restructured and rebranded the council as the Innovation Advisory Committee, to officially replace the long-standing Technology Advisory Committee, and nominated the 12 original participants, such as Tyler Winklevoss from Gemini and Shayne Coplan from Polymarket, as charter members.

The majority of the 35-member committee now hails from digital asset firms. Notably, 20 members are directly involved with the crypto space.

Some of the new additions to the list include Crypto.com CEO Kris Marszalek, a16z crypto Managing Partner Chris Dixon, Ripple CEO Brad Garlinghouse, and Blockchain.com CEO Peter Smith, among others.

Meanwhile, executives at Grayscale, Anchorage Digital, Solana Labs, Paradigm, Kraken, Bullish, Chainlink Labs, Bitnomial, Etherealize, and Framework Ventures were also named to the committee.

At least five members are tied to prediction markets, including Kalshi CEO Tarek Mansour and DraftKings CEO Jason Robins.

Other members include executives at major financial institutions such as Nasdaq, CME Group, Cboe Global Markets, Intercontinental Exchange, and the Depository Trust and Clearing Corporation.

“By bringing together participants from every corner of the marketplace, the IAC will be a major asset for the Commission as we work to modernize our rules and regulations for the innovations of today and tomorrow,” Selig said.

Crypto World

Bitcoin Holders Are Being Tested as Inflation Fades, Pompliano

Bitcoin investors are rethinking the asset’s role as inflation cools, according to Bitcoin entrepreneur Anthony Pompliano. He told Fox Business that a softer inflation backdrop raises questions about Bitcoin’s value proposition as a finite-supply asset, especially if central banks continue to pursue accommodative policies. With January’s Consumer Price Index (CPI) cooling to 2.4% from 2.7%, the macro narrative is shifting and traders are weighing how long the inflation narrative can sustain crypto’s narrative as a hedge. The current price action mirrors a cautious mood within the market, as Bitcoin has retreated over the past month while sentiment remains subdued.

Key takeaways

- January CPI came in at 2.4% year over year, down from 2.7% in December, signaling a softer inflation backdrop.

- Bitcoin’s sentiment measure has slipped to multi-year lows, with the Crypto Fear & Greed Index signaling “Extreme Fear” at a recent reading.

- The flagship cryptocurrency is trading around the mid-to-upper $60 thousands, after a roughly 28% decline in the last 30 days.

- The U.S. dollar’s strength has cooled, with the dollar index down about 2.3% over the past month, reflecting shifting macro dynamics.

- Pompliano outlined a “monetary slingshot” thesis: as the dollar devalues and deflationary pressures surface in the near term, Bitcoin could gain longer-term value even if near-term volatility persists.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. Bitcoin’s price has fallen roughly 28% over the past month as macro concerns and sentiment weigh on risk assets.

Market context: In a broader macro context, inflation data and policy expectations continue to shape appetite for risk assets, including crypto. Traders are watching how central banks respond to evolving growth signals, while crypto-specific catalysts compete with traditional macro forces in steering flows and volatility.

Why it matters

The debate over Bitcoin’s role as a hedge against inflation has long hinged on the premise that a fixed supply will preserve value when fiat currencies are debased. Pompliano’s comments underscore the tension between theory and market reality: even as inflation data cools, the path of monetary policy remains uncertain, and investors are wary of premature conclusions about a lasting inflation retreat. In the near term, softer inflation can sap risk premium, potentially slowing the upside impulse for non-fiat stores of value like Bitcoin. Yet the longer-term case for supply-limited assets persists in the eyes of many bulls, particularly if policy makers persist with higher money growth or if inflation surprises to the upside later in the cycle.

The price action around Bitcoin during this period is a reminder that macro-driven volatility remains a defining feature of markets. The asset’s correlation with broader risk sentiment has intensified at times, even as proponents argue that the fixed supply and ever-closer approach to a 21 million cap provide a unique resilience during downturns. The current price backdrop—around $68,850 at publication and a 28% decline over 30 days—illustrates the tug-of-war between inflation awareness and liquidity conditions in crypto markets. The discussion around how monetary policy interacts with digital assets is likely to stay in focus as investors recalibrate what constitutes a hedge in a low-inflation regime that could be reinforced by policy shifts in the months ahead.

Additionally, the commentary around a potential “monetary slingshot” frames Bitcoin as part of a broader debate about how currency debasement and macro policy interact with a new generation of investors. If the dollar softens further in response to renewed expectations for money supply expansion or rate adjustments, Bitcoin could attract fresh inflows as an alternative store of value. That possibility exists alongside the reality that sentiment remains fragile and technicals are unsettled, making immediate directional bets more challenging for casual traders and even some long-term holders.

The impact of macro data on crypto markets is not isolated to Bitcoin. Broader market dynamics—ranging from ETF activity to sentiment gauges—continue to influence the pace and direction of capital into digital assets. Investors are weighing whether the inflation narrative can reassert itself or if structural shifts in the macro environment will redefine how crypto assets behave in risk-off cycles. In parallel, other macro indicators—like the strength or weakness of the U.S. dollar—will help determine whether BTC can sustain any upside or if it remains trapped within a wider risk-off regime.

For readers following the latest data points, the CPI figure and the Fed’s communications are central to the story. While the inflation print itself is a headline, the deeper question is whether the disinflationary trend proves durable or merely a snapshot in a more complex cycle. As Pompliano noted in his remarks, even if inflation cools on the surface, structural changes in policy and global liquidity conditions could continue to shape the narrative around Bitcoin’s long-term value proposition.

In parallel, the market’s mood as reflected by the Crypto Fear & Greed Index and the price movement of Bitcoin underscore a broader caution. The index’s “Extreme Fear” reading suggests that participants are reluctant to push risk assets higher, even when macro data offers a glimmer of relief. Traders will be watching next month’s inflation data, policy statements, and the evolving set of on-chain metrics to gauge whether the current sell-off represents a temporary pause or the onset of a new leg lower.

https://platform.twitter.com/widgets.js

Crypto World

Russia May Launch Its Stablecoin Amid Geopolitical Pressure

According to local reports, Russia’s central bank is re-examining its long-standing opposition to stablecoins. First Deputy Chairman Vladimir Chistyukhin said the Bank of Russia will conduct a study this year on the feasibility of creating a Russian stablecoin.

Previously, Russia had consistently opposed plans for a centralized stablecoin. However, Chistyukhin said foreign practice now warrants a renewed assessment of risks and prospects.

Sponsored

Sponsored

Moscow Reopens the Stablecoin Debate

The shift signals a strategic rethink rather than an immediate policy change. Still, the timing is notable.

Over the past year, the United States passed the GENIUS Act, establishing a federal framework for payment stablecoins.

The law formalized 1:1 dollar backing and reserve transparency requirements.

As a result, US-backed stablecoins have gained institutional legitimacy and expanded their footprint in cross-border payments and digital asset settlement.

At the same time, the European Union has accelerated work on a digital euro and MiCA-compliant euro stablecoins led by major banks.

Sponsored

Sponsored

European policymakers have framed these efforts as necessary to preserve monetary sovereignty and reduce dependence on foreign digital currencies.

Against that backdrop, Russia risks falling behind in the race to shape digital monetary infrastructure. Stablecoins now function as core liquidity rails in global crypto markets and, increasingly, in trade settlement.

If dollar and euro-backed tokens dominate cross-border flows, Russian entities could face deeper reliance on foreign-regulated instruments.

Sanctions Pressure and the Sovereignty Question

Moreover, sanctions and restrictions on Russia’s access to traditional payment networks add urgency.

A domestically controlled stablecoin could, in theory, provide an alternative settlement mechanism for international partners willing to transact outside Western systems.

Even exploring the concept signals that Moscow recognizes the geopolitical dimension of stablecoin infrastructure.

However, risks remain substantial. A Russian stablecoin would require credible reserves, legal clarity, and trust from counterparties. Without transparency and liquidity, adoption would be limited.

For now, the Bank of Russia is studying the issue, not endorsing it.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video18 hours ago

Video18 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn