Crypto World

US Prosecutors Warn on Crypto Risks

U.S. prosecutors have warned of Valentine’s Day romance scams using crypto after cases cost victims millions.

Prosecutors in the U.S. state of Ohio have issued a public warning urging Americans to watch for romance scams tied to cryptocurrency as they celebrate Valentine’s Day.

The alert drew attention to a rise in emotionally driven fraud cases where victims are persuaded to send digital assets after forming online relationships.

Federal Warning Outlines Latest Tactics

The U.S. Attorney’s Office for the Northern District of Ohio said criminals often approach targets through dating apps, social platforms, or text messages, then build trust for weeks or months before requesting money for fabricated emergencies or investments.

According to U.S. Attorney David M. Toepfer, scammers “prey on trust and emotion,” and they “are not looking for love—they are looking for money.” He added that such criminals often focus on older adults and emotionally vulnerable individuals.

His office also cited recent prosecutions and investigations, including a December 2025 case where authorities charged Frederick Kumi, a Ghanaian national accused of helping run a romance fraud network that allegedly took more than $8 million from elderly victims since 2023. Per investigators, the group used AI tools to create false identities and maintain convincing conversations before requesting money. Kumi was arrested in Ghana and is facing charges including wire fraud conspiracy and money laundering conspiracy.

Another case involved an Ohio woman who lost about $663,000 after a stranger contacted her through a “wrong number” text. The fraudster later guided her through opening accounts on Crypto.com and Coinbase, then convinced her to transfer funds to a fake investment platform.

Fortunately, detectives from the FBI traced part of the stolen money to cryptocurrency wallets and seized more than $8.2 million in USDT with help from Tether.

You may also like:

Data Shows Wider Trend in Crypto-Linked Fraud

Recent industry research suggests these crimes fit a broader pattern, as shown in a January 2026 report from blockchain security firm PeckShield, which estimated that crypto scams and hacks cost users more than $4 billion in 2025, with about $1.37 billion tied to scams alone.

The company said losses from scams rose about 64% from the previous year, often involving personalized impersonation tactics aimed at high-value targets.

The Ohio prosecutors have recommended several ways that people can protect themselves from romance tricksters, including reverse image searches on profile photos, skepticism toward anyone who refuses to meet in person, and a hard rule against sending cryptocurrency, gift cards, or wire transfers to people met online.

They also advised victims to preserve all communications and financial records, then file reports with the FBI’s Internet Crime Complaint Center. Additionally, the National Elder Fraud Hotline operates daily to guide older adults through the reporting process.

According to the officials, for those who may have sent crypto, time matters, since law enforcement can freeze stolen assets, but only if wallets are identified before funds move through mixers or overseas exchanges.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Treasury’s Bessent Says Crypto Clarity Act Could Calm Markets

The cryptocurrency market has swung sharply in recent weeks, with both Bitcoin and Ethereum trading well below the record levels they reached last year.

Key Takeaways:

- Bessent says the proposed Clarity Act could reduce uncertainty and stabilize crypto markets.

- He attributes part of Bitcoin’s recent drop to industry resistance to regulation.

- The bill faces political hurdles and opposition from some firms despite a 62% passage outlook.

However, US Treasury Secretary Scott Bessent believes a pending regulatory framework could help steady sentiment.

Speaking to CNBC on Friday, Bessent said passage of the proposed Clarity Act, a market structure bill aimed at defining oversight of digital assets, would ease uncertainty among investors.

Bessent Urges Swift Passage of Crypto Clarity Bill This Spring

“Some clarity on the Clarity bill would give great comfort to the market,” he said, adding that lawmakers should move quickly to place the legislation on the president’s desk this spring.

Bessent described part of the recent downturn as avoidable. Bitcoin has fallen more than 29% over the past month, a decline he characterized as partly driven by industry resistance to regulation.

“There is a group of Democrats who want to work with Republicans on getting a market structure bill,” he said.

“But there are a group of crypto firms who have been blocking it… that doesn’t seem to have been good for the overall crypto community.”

His latest comments were more measured than earlier criticisms directed at companies opposing the proposal.

In recent interviews, Bessent labeled dissenting firms “recalcitrant actors” and argued that participants unwilling to operate under a regulatory framework could relocate elsewhere.

US-based exchange Coinbase withdrew support over provisions restricting companies from offering yield on stablecoins to retail users.

Chief executive Brian Armstrong said at the time the firm would prefer no legislation over one it considers flawed.

Political dynamics could also shape the bill’s prospects. Bessent warned that a shift in congressional control following upcoming midterm elections might halt negotiations entirely.

He also pointed to prior regulatory pressure on the sector, saying policies during the previous administration came close to an “extinction event” for parts of the industry.

Prediction market Polymarket currently assigns roughly a 62% probability that the Clarity Act becomes law by the end of 2026.

Gold Rally, Clarity Act Uncertainty a Turning Point for Crypto

As reported, Bitwise Chief Investment Officer Matt Hougan has said that gold’s surge past $5,000 an ounce and mounting uncertainty around US crypto legislation are shaping a critical moment for digital asset markets.

Hougan said the combination of rising demand for assets outside government control and fading confidence in near-term regulatory clarity could influence both crypto adoption and price action in the months ahead.

He also flagged growing uncertainty around the Clarity Act, legislation aimed at cementing a pro-crypto regulatory framework in the US.

Political and geopolitical factors are adding further uncertainty. Internal divisions at the Fed, combined with leadership questions and rising tensions following a US naval deployment toward Iran, have pushed investors toward traditional havens.

“This flight to safety is bypassing Bitcoin entirely in favor of tangible commodities. Until the geopolitical dust settles or the Fed turns the liquidity taps back on, Bitcoin remains a high-risk play in a world looking for a bunker.

The post Treasury’s Bessent Says Crypto Clarity Act Could Calm Markets appeared first on Cryptonews.

Crypto World

Cathie Wood: AI and Market Volatility Create Long-Term Opportunities

TLDR:

- Cathie Wood sees AI as the largest investment opportunity for tech companies today.

- Algorithmic trading drives volatility but creates opportunities for well-researched investors.

- Inflation is easing, with monetary velocity stabilizing and unit labor costs contained.

- Bitcoin underperforms gold short-term, yet long-term supply dynamics remain favorable.

Cathie Wood ARK Invest market outlook is drawing attention as volatility intensifies across equities and digital assets.

The ARK Invest founder attributes recent swings to algorithmic trading and maintains that disciplined research during fearful periods can uncover long-term opportunities.

Volatility, AI Spending, and Market Structure

In a recent post on X, ARK Invest wrote, “Fear is high. Volatility is elevated.” The firm added that Cathie Wood would explain why such periods may create long-term opportunities in its “In The Know” segment.

Wood stated that much of the current turbulence is driven by algorithmically generated trading. “This kind of volatility tends to create opportunities for those who are doing deep research,” she said.

She argued that automated strategies are accelerating short-term market swings.

She compared the present backdrop to earlier stress events, including tariff-related turmoil. Wood noted that investors who sold in panic during those episodes later regretted their decisions. “Markets climb a wall of worry in strong bull markets,” she said, describing the current phase.

Wood contrasted today’s climate with the late-1990s tech and telecom bubble. She said the market is less forgiving of spending without productivity gains.

However, she maintained that Google, Meta, Microsoft, and Amazon “should be investing aggressively in AI,” calling it “the biggest opportunity of our lifetime.”

Inflation Trends, Dollar Outlook, and Bitcoin

Wood also addressed fiscal dynamics and productivity. She said the US budget deficit could shift toward surplus by the end of the current presidential term due to stronger-than-expected productivity growth. Citing Palantir, she pointed to data-driven efficiencies supporting that view.

On trade, Wood said concerns about the deficit overlook capital inflows. “We have a capital surplus that offsets the trade deficit,” she stated. She added that a dollar turnaround would be “a powerful anti-inflationary force.”

Turning to inflation metrics, Wood referenced the relationship between CPI and M2. She said inflation “is breaking down,” adding that monetary velocity is likely to flatten or decline. She also noted that unit labor costs are not rising as they did in the 1970s.

Addressing digital assets, Wood discussed Bitcoin and its recent underperformance against gold. She attributed the move to “risk-off sentiment and algorithmic selling.” Despite short-term pressure, she reiterated a long-term constructive outlook on Bitcoin supply dynamics and encouraged investors to consider self-custody.

Crypto World

Trump Media Files Bitcoin, Ether and Cronos Crypto ETFs with SEC

US President Donald Trump’s media conglomerate, Trump Media & Technology Group, has filed paperwork with the United States Securities and Exchange Commission (SEC) for two new exchange-traded funds (ETFs) linked to major cryptocurrencies.

According to a Friday announcement by its Truth Social Funds arm, the company plans to launch the Truth Social Bitcoin (BTC) and Ether (ETH) ETF alongside the Truth Social Cronos (CRO) Yield Maximizer ETF. The filing has not yet taken effect and remains subject to SEC review.

“We plan to provide an investment platform for investors covering multiple aspects of digital and crypto investing with both capital appreciation and income opportunities,” Steve Neamtz, president of Yorkville America Equities, which will act as investment adviser for both funds, said.

The funds would be developed in partnership with crypto exchange Crypto.com, which is expected to provide custody, liquidity and staking services if regulators approve the products. Investors would access the ETFs through the exchange’s broker-dealer, Foris Capital US LLC. Each product is expected to charge a 0.95% management fee.

Related: ETH ETF holders in ‘worse position’ than BTC ETF peers as crypto market looks for bottom

Proposed ETFs to track BTC, ETH and CRO with staking rewards

The Bitcoin and Ether fund aims to track the combined performance of the two largest cryptocurrencies by market capitalization, while also capturing staking rewards generated by Ether. The Cronos Yield Maximizer ETF, meanwhile, is designed to follow the performance of CRO, the native token of Crypto.com’s Cronos blockchain, and include staking income.

Trump Media, best known for operating the Truth Social social network, has increasingly explored cryptocurrency initiatives.

In April last year, Trump Media announced a deal with Crypto.com and Yorkville America Digital to launch a set of “Made in America” ETFs combining digital assets and traditional securities, including sectors such as energy.

In September, the firm also reached a deal with Crypto.com to create a joint treasury entity centered on accumulating the CRO token, beginning with an initial purchase of about 684.4 million CRO worth roughly $105 million through a mix of stock and cash.

Related: Spot Bitcoin ETFs add $167M, nearly erase last week’s outflows

Spot Bitcoin ETFs see weeks of consecutive outflows

Spot Bitcoin ETFs have seen four consecutive weeks of net outflows, with the latest weekly figure showing $360 million in withdrawals, according to data from SoSoValue.

The data also shows volatile but net-negative flows across late January and early February. The largest recent withdrawals included $817.87 million on Jan. 29, $509.70 million on Jan. 30 and $544.94 million on Feb. 4. Positive sessions were smaller, such as inflows of $561.89 million on Feb. 2, $371.15 million on Feb. 6, $166.56 million on Feb. 10 and $145.00 million on Feb. 9, with only $15.20 million entering on Friday.

Big questions: Would Bitcoin survive a 10-year power outage?

Crypto World

Ripple or Cardano Will Hold Up Better?

ChatGPT picked a clear winner in all categories.

Needless to say, the cryptocurrency industry has seen better days, with the prices of countless assets collapsing by 50% or more in the past several months. This has propelled analysts to speculate that this is no longer a bull market correction; instead, the majority believes the bear phase has begun.

If that’s the case, then let’s see which altcoins between two of the most popular ones – XRP and ADA – can cope better under times of uncertainty, fear, and sell-offs.

Narrative and Market Structure

To gain further perspective on the matter from an unbiased analysis, we decided to touch upon perhaps the most widely utilized AI chatbot solution – ChatGPT. It began by acknowledging the fact that the narrative in crypto has shifted from “how high can this asset go” to “which altcoin is likely to lose less.”

When it came to comparing the two altcoins in question, the AI platform outlined several categories in which either one can outshine the other. In market structure and liquidity, it noted that XRP typically benefits from deep exchange liquidity, high derivatives activity, and strong global trading presence.

Although ADA also has strong liquidity, it has historically shown higher volatility during drawdowns and has been more aggressively sold by retail investors. As such, this point went for Ripple’s cross-border token, which actually took the second win as well, dubbed “narrative resilience.”

ChatGPT noted that XRP’s value proposition revolves around cross-border payments, institutional rails, and regulatory positioning, while ADA’s thesis centers on smart contracts, ecosystem development, and long-term infrastructure growth.

“During bear cycles, institutional and regulatory narratives often carry more defensive weight than ecosystem growth promises, especially when speculative activity declines,” it added.

Community and Historical Performance

The last two categories mentioned in the subheading above also had the same winner. ChatGPT said ADA has historically experienced more extreme percentage declines from cycle tops, while XRP “tends to consolidate in tighter ranges during late-stage bear phases.”

You may also like:

In terms of community and holder behavior, ChatGPT’s answer was less obvious. It admitted that both have strong and vocal communities, but “ADA’s retail-heavy base can amplify panic selling.”

In contrast, XRP’s holder base has historically shown “stronger long-term holding behavior during legal and regulatory uncertainty periods.”

Consequently, OpenAI’s platform determined the following in a confirmed bear market:

- XRP is slightly more likely to show resilience

- ADA could face deeper volatility and sharper pecentage drawdowns

However, it warned that if BTC continues to trend lower, neither of the aforementioned altcoins is immune to additional double-digit percentage declines.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum ETFs Turn Positive as ETH Reclaims $2K

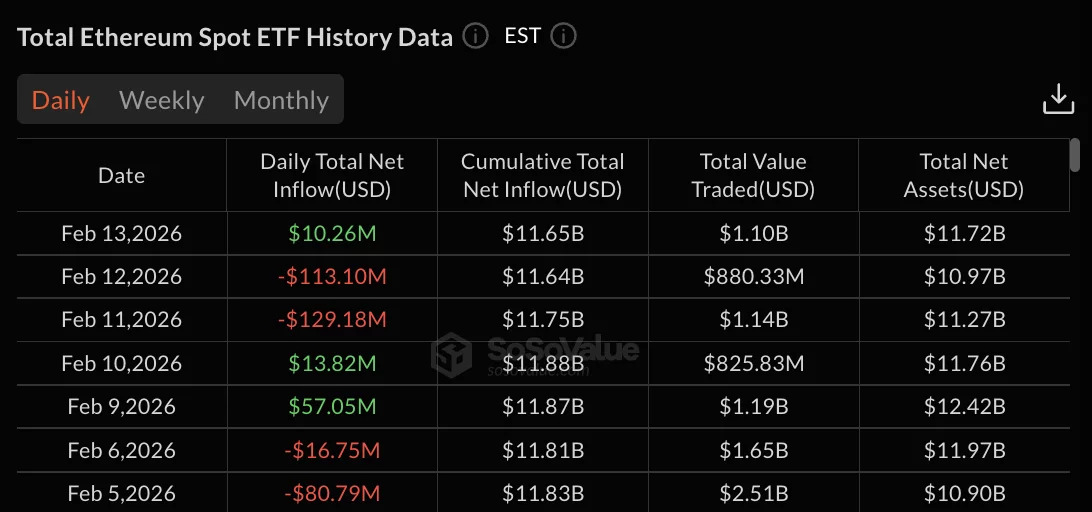

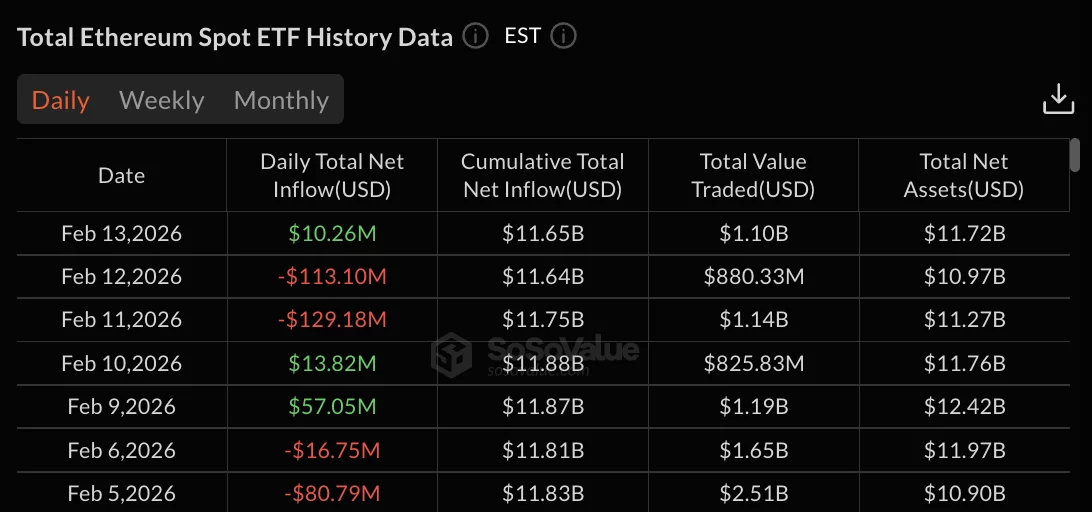

Ethereum spot ETFs recorded $10.26 million in net inflows on February 13, breaking a two-day outflow streak that saw $242.28 million in redemptions.

Summary

- Ethereum ETFs added $10M as ETH price reclaimed $2,000.

- Bitcoin ETFs saw modest $15M inflows after prior outflows.

- Weekly ETH ETF flows remain negative despite rebound.

Grayscale’s mini ETH trust led flows with $14.51 million, followed by VanEck’s ETHV at $3.00 million and Fidelity’s FETH at $2.04 million.

Ethereum (ETH) price gained 5.8% over 24 hours to reclaim the $2,000 level, trading in a range of $1,926.66 to $2,067.44.

The recovery follows sharp declines across longer timeframes: down 1.2% over seven days, 23.7% over 14 days, 37.5% over 30 days, and 24.4% over one year.

Weekly Ethereum outflows persist at $161 million

Ethereum ETFs recorded $161.15 million in weekly net outflows for the period ending February 13 despite the final day’s positive flow.

February 11 posted the week’s largest single-day withdrawal at $129.18 million, followed by February 12’s $113.10 million in redemptions.

February 9-10 briefly interrupted selling with $70.87 million in combined inflows. February 9 saw $57.05 million in positive flows while February 10 added $13.82 million.

The week ending February 6 posted $165.82 million in outflows, while the week ending January 30 recorded $326.93 million in redemptions.

The week ending January 23 marked the peak with $611.17 million in withdrawals as Ethereum fell from above $3,000 to below $2,000.

Total value traded reached $1.10 billion on February 13, down from $880.33 million the previous day.

Bitcoin posts modest $15 million inflow with mixed fund flows

Bitcoin spot ETFs recorded $15.20 million in net inflows on February 13, led by Fidelity’s FBTC with $11.99 million.

Grayscale’s mini BTC trust added $6.99 million while VanEck’s HODL contributed $1.95 million and WisdomTree’s BTCW posted $3.64 million.

BlackRock’s IBIT recorded $9.36 million in outflows and was its third withdrawal in four trading days.

February 11-12 saw Bitcoin ETFs post $686.67 million in combined outflows before February 13’s reversal.

Ethereum’s 5.8% daily gain allowed it to reclaim the $2,000 level after dipping below $1,930 earlier in the session.

Crypto World

Memecoins’ Silence Could Signal a Comeback: Santiment

A reversal in memecoins could come sooner than traders expect, even amid choppy conditions across the broader crypto market, if history is any indication, according to crypto sentiment platform Santiment.

“There is a growing narrative of “nostalgia” regarding memecoins, with many traders treating the sector as if it is permanently dead,” Santiment said in a report published on Friday.

“This collective acceptance of the ‘end of the meme era’ is a classic capitulation signal,” Santiment said, explaining that when a sector of the market is completely written off, it is often the “contrarian time” to start paying attention.

“Watch sectors that the crowd has left for dead; max pain often marks the bottom,” Santiment said.

Memecoin market cap falls amid market decline

The total memecoin market capitalization has fallen 34.04% to $31.02 billion over the past 30 days amid a wider crypto market decline that saw Bitcoin (BTC) fall near $60,000 on Feb. 3, the lowest point the asset’s price has been since October 2024, according to CoinMarketCap.

Among the top 100 cryptocurrencies, memecoin gains over the past seven days were mostly modest, except for outlier Pippin (PIPPIN), which surged 243.17%. The next best performers were Official Trump (TRUMP), up 1.37%, and Shiba Inu (SHIB), up 1.11%.

In previous cycles, market participants often expected Bitcoin to reach new all-time highs first, followed by a rotation of capital into Ethereum (ETH) and then into higher-risk altcoins.

However, as Bitcoin matures and institutional interest grows, some analysts are now questioning whether the familiar rotation pattern will play out the same way.

Altcoin season may not be “rising tide raises all ships”

Others have suggested that, unlike previous altcoin seasons where gains were broadly spread across the market, the next altcoin season may be far more selective, with only certain cryptocurrencies seeing upside.

Craig Cobb, the founder of The Grow Me, told Magazine in August 2025 that the next altcoin season will not be “the rising tide raises all ships.”

Related: Bitcoin holders are being tested as inflation eases: Pompliano

Santiment pointed to a growing fear on the crypto market on social media, with significantly more bearish than bullish comments, which may also be a sign that a market rebound is underway.

“Historically, markets move against the crowd’s expectations. This lingering disbelief, even during a price pump, is a healthy sign for a potential sustained recovery,” Santiment said.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

BTC ETH BNB XRP SOL DOGE BCH HYPE ADA XMR

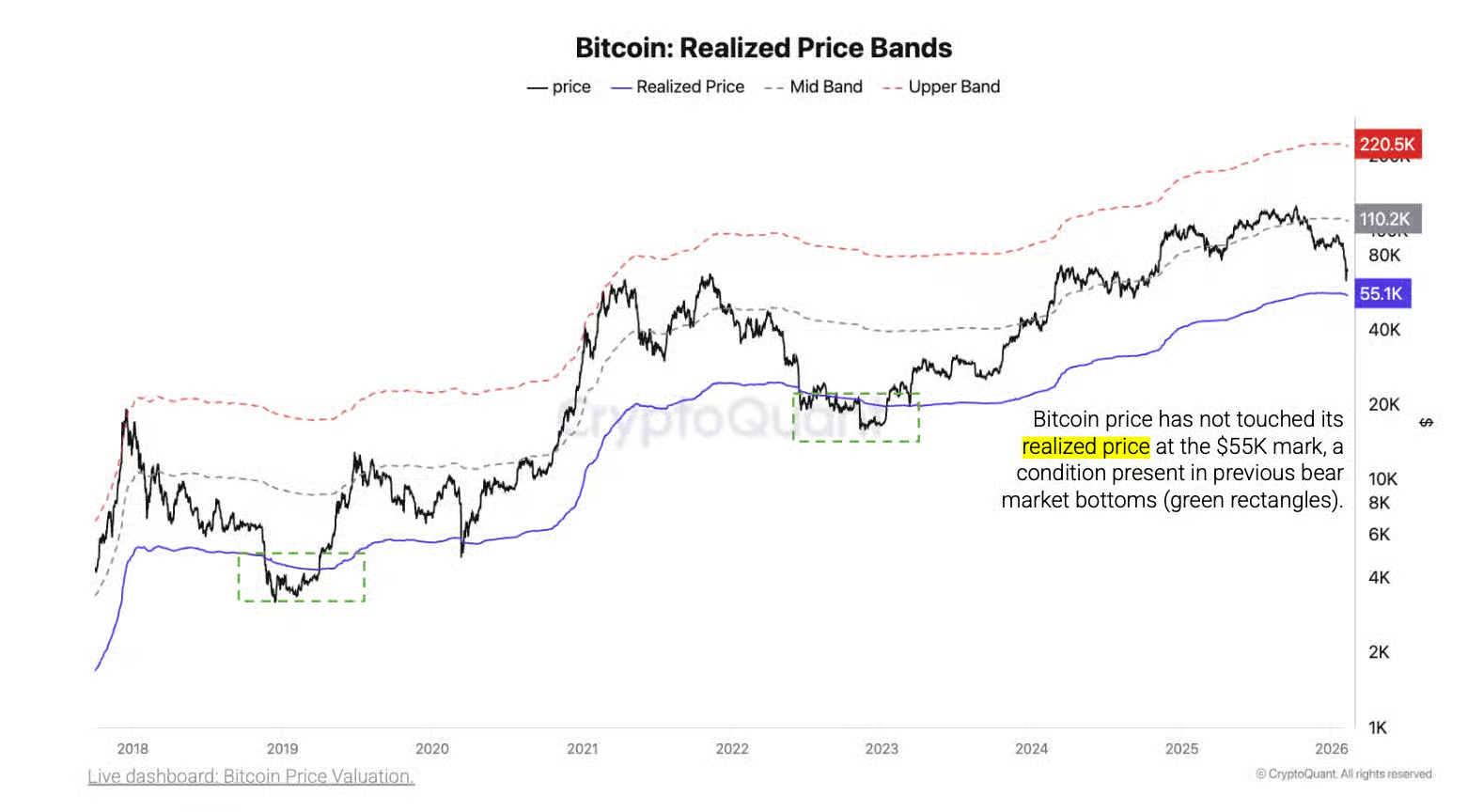

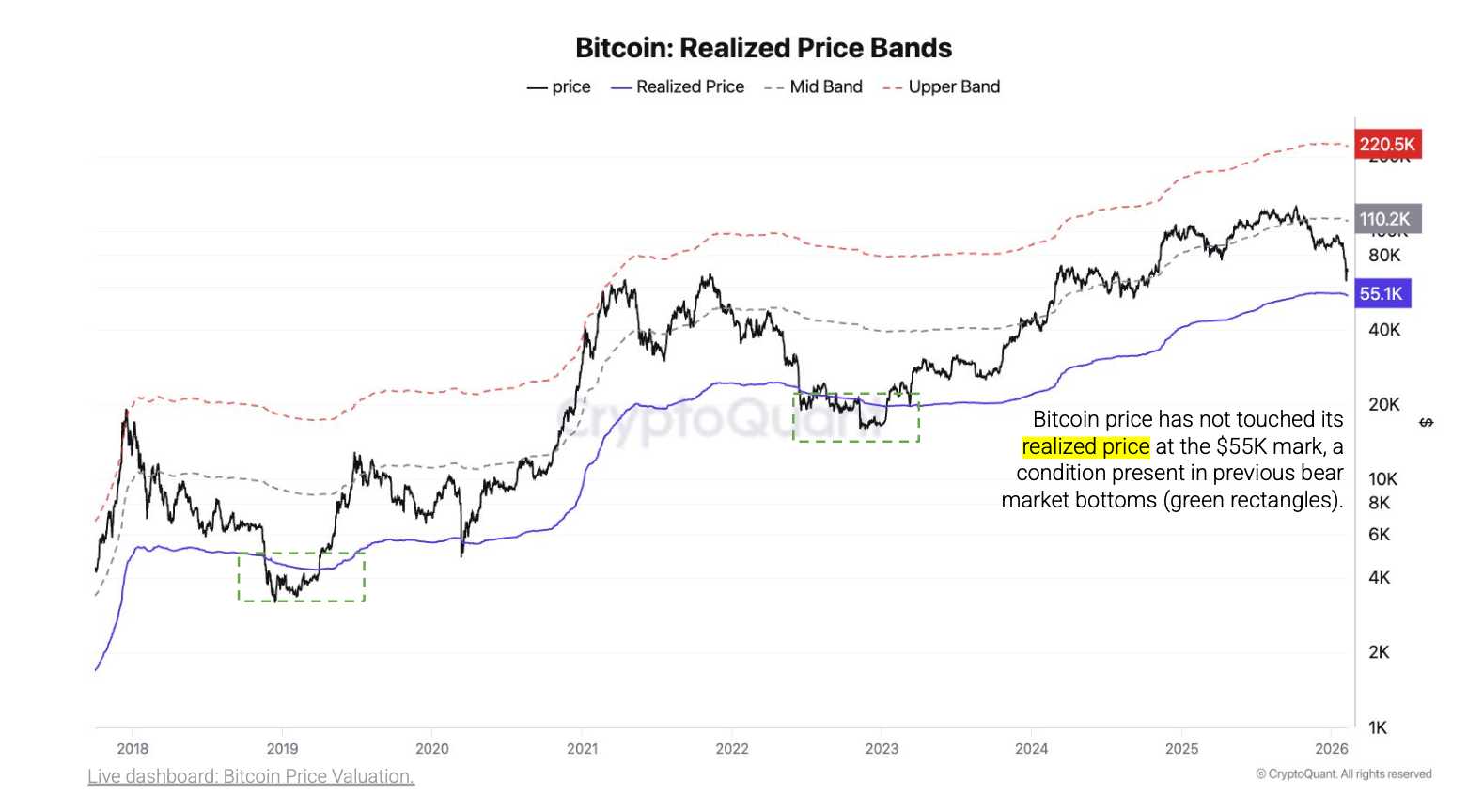

Bitcoin’s latest price action shows buyers attempting to extend a modest relief, with the benchmark crypto eclipsing the $68,500 mark as they seek to form a higher low around $65,000. On-chain analytics place BTC in a broad consolidation corridor, sandwiched between a true market mean near $79,200 and a realized price around $55,000. Analysts caution that this range-bound dynamic could persist until a tangible catalyst breaks the stalemate, sending prices either toward the upper boundary or back toward support levels. The current landscape reflects a delicate balance between demand at lower levels and selling pressure at nearby resistance, underscoring a market waiting for a clearer directional cue.

Key takeaways

- Bitcoin has moved above 68,500 but faces stiff resistance near 74,508, where a breakout would signal renewed bullish momentum and a potential shift in the range.

- On-chain data from Glassnode places BTC within a broad corridor, with the true market mean around 79,200 and the realized price near 55,000, implying accumulation could intensify only on a decisive breakout.

- Standard Chartered trimmed its BTC price target for 2026 to 100,000 from 150,000 and subsequently projected a dip to 50,000 in the near term before a late-year recovery, highlighting a cautious institutional stance.

- Several market observers still argue that BTC has not yet printed a definitive bottom; a notable forecast puts a bottom in the 40,000–50,000 range between September and November 2026.

- Altcoins show pockets of resilience, with selective recoveries across ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, and XMR as traders scan for early signs of a broader reversal.

Tickers mentioned: $BTC, $ETH, $BNB, $XRP, $SOL, $DOGE, $BCH, $HYPE, $ADA, $XMR

Market context: The broader market remains in a cautious stance as liquidity shifts and risk sentiment weigh on near-term moves. BTC’s current trajectory sits within a defined range, with analysts awaiting a decisive catalyst to push prices beyond resistance at 74,508 or to test critical supports. Institutional views add a layer of caution: Standard Chartered’s revised targets underscore a more conservative path for BTC in 2026, while analysts like Tony Research have outlined a potential bottoming window that could extend into late 2026. The immediate narrative centers on whether buyers can sustain pressure to invalidate the prevailing consolidation and ignite a broader rally.

Why it matters

The immediate importance of the current price structure lies in its impact on risk appetite and portfolio strategy. A sustained break above the 74,508 resistance level would not only shift the technical landscape for Bitcoin but could also rekindle momentum across the market, potentially drawing fresh capital into the space and facilitating a fuller altcoin recovery. Conversely, a breakdown below significant support could reinforce a risk-off mood, prompting a retracement toward the lower end of the range and testing the resilience of major support zones.

On-chain metrics provide context for traders weighing opportunity versus risk. The gap between the true market mean and the realized price implies participants are mindful of the distance between where BTC traded historically and where it is currently priced on a realized basis. This creates a framework in which bulls must prove durability by pushing beyond key technical thresholds, while bears still cling to the possibility of renewed downside if sellers re-enter with vigor. The evolving dialogue between on-chain signals and price action continues to shape sentiment, particularly as institutions reassess their longer-term exposure given mixed forecasts for the asset class.

For market participants, the current setup also matters for liquidity access and risk management. A confirmed breakout could unlock fresh liquidity pools and spur risk-taking in related sectors, whereas a protracted consolidation may incentivize traders to adopt range-bound strategies, await catalysts, or reallocate to alternative opportunities within and outside the crypto market. The evolving narrative across BTC and the major altcoins sets a backdrop for how exchanges, custodians, and developers approach scaling, risk controls, and product launches in the coming quarters.

What to watch next

- Bitcoin: Monitor a clear move above 74,508 to validate a bullish breakout, or a break below 60,000 to suggest renewed downside pressure and a potential retest of lower supports.

- Ether: A sustained push above 2,111 would signal renewed demand, while a breach of 1,750 could invite a deeper correction toward 1,537 or lower.

- XRP: The pair remains within a descending-channel pattern; a daily close above the 1.55 level and the downtrend line would be a bullish cue, while a drop below 1.11 could accelerate losses toward 1.00.

- Solana: The 95 level stands as a bear fault line; a move above could target the 50-day SMA near 119, whereas a failure near 95 might push toward 77 and test support.

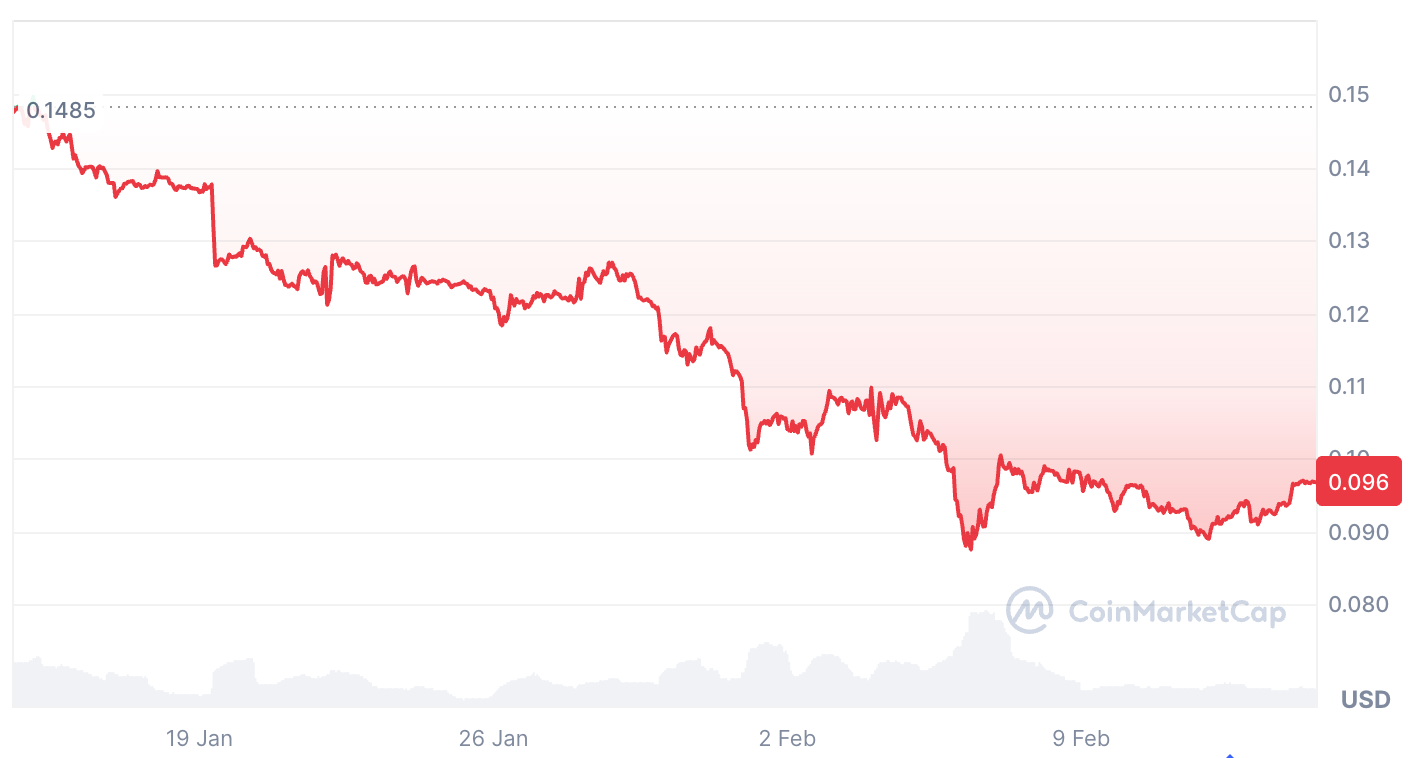

- Dogecoin: Bulls need a breakout above 0.12 to signal progress, with 0.09 acting as a critical support; a break below 0.09 raises the risk of a slide toward 0.08 and beyond.

Sources & verification

- Bitcoin price action around 68,500 with a key resistance near 74,508 and the concept of a higher low near 65,000 to frame the near-term setup.

- Glassnode on-chain metrics showing BTC trading between a true market mean of ~79,200 and a realized price near ~55,000.

- Standard Chartered’s revised BTC targets: 100,000 for 2026 with a potential move down to 50,000 in the near term.

- Analyst commentary placing BTC bottom prospects in the 40,000–50,000 range during Sept–Nov 2026.

- TradingView-based charts and top-10 asset analyses used to illustrate price action across BTC and major altcoins.

Market reaction and key figures shaping the crypto chart landscape

Bitcoin (CRYPTO: BTC) has managed a cautious uptick, clearing the 68,500 mark as buyers push for a higher low near 65,000. The price action sits within a defined corridor: a ceiling at 74,508 and a floor supported by the psychological and technical baselines around 60,000. The trajectory suggests traders are weighing a potential breakout against the risk of renewed downside, a dichotomy that mirrors the broader market’s struggle to find a durable directional impulse.

In the broader market, major alts are attempting to carve out their own narratives. Ether (CRYPTO: ETH) is fighting to sustain a foothold above 2,000, with resistance sketched at 2,111. A decisive breach above that threshold could catalyze a broader recovery, while a retreat could backtest 1,750 and possibly lower. Binance Coin (CRYPTO: BNB) has seen price pressure as well, edging toward a critical support level around 570—an area that could determine whether bulls gain ground to push toward the 669-plateau and the 20-day moving average near 710. XRP (CRYPTO: XRP) continues to navigate within a descending channel; a breakout above the 1.55 level on a sustained basis could deflate the pessimism around the pattern, whereas a failure to hold could accelerate a slide toward 1.11 and beyond.

Solana (CRYPTO: SOL) traders are closely watching $77 as a support pivot, with a failure to hold that level potentially steering the price toward 67–95. Conversely, a break above 95 could open the door to a test of the 50-day moving average around 119, suggesting a bear trap could be in play. Dogecoin (CRYPTO: DOGE) remains sensitive to micro rallies but faces ongoing selling pressure on rallies; a break above 0.12 would be noteworthy, while a drop below 0.09 reinforces the risk of a slide toward 0.08.

Bitcoin Cash (CRYPTO: BCH) has shown weakness below the 497 level, yet bulls are contesting the 20-day EMA around 536. A sustained move above the EMA would indicate demand at lower levels and could target the 50-day moving average near 581, while a failure could leave BCH exposed to a decline toward 443. Across the spectrum, Hyperliquid (CRYPTO: HYPE) has regained footing above the 20-day EMA, signaling buying on dips; a decisive move beyond 35.50 could spur a rally toward 44, while a break below 27.25 risks a drop toward 20.82. Cardano (CRYPTO: ADA) remains locked in a descending channel, with a break above the 20-day EMA at 0.29 needed to extend the range in a more constructive fashion. Monero (CRYPTO: XMR) is testing the 360 barrier, with a potential breakout to challenge the 385 and 460 levels if buying pressure intensifies, though a fall below 309 could invite a push toward 276 as a potential buyer magnet.

Crypto World

CryptoQuant Places Bitcoin Bear Market Bottom at $55,000 as Key Indicators Show Extended Correction Ahead

TLDR:

- Bitcoin trades 25% above its realized price of $55,000, which historically marks bear market bottoms

- February 5 sell-off triggered $5.4 billion in daily losses, the largest since March 2023’s $5.8 billion event

- Monthly realized losses at 0.3 million BTC remain far below 2022 bear market bottom of 1.1 million BTC

- Long-term holders selling near breakeven versus 30-40% losses typical at previous bear market cycle lows

Bitcoin’s bear market floor sits around $55,000, according to blockchain analytics platform CryptoQuant. The firm’s latest assessment suggests the cryptocurrency remains more than 25% above this critical support level.

CryptoQuant analysts note that bear market bottoms require several months to establish rather than forming through sudden capitulation events.

This analysis comes as Bitcoin trades significantly higher than key historical support zones that marked previous cycle lows.

Realized Price Indicates Extended Bottoming Process

The realized price metric serves as CryptoQuant’s primary indicator for determining Bitcoin’s potential bottom. This measure calculates the average price at which all coins last moved on the blockchain.

Historical data shows this metric provided strong support during past bear markets. Current trading prices remain elevated compared to this threshold, suggesting additional downside potential exists.

Previous bear cycles demonstrated distinct patterns when Bitcoin approached these levels. During the 2018 downturn, prices dropped 30% below the realized price before stabilizing.

The FTX collapse in 2022 pushed Bitcoin 24% beneath this metric. After reaching these depths, the cryptocurrency spent between four and six months building a foundation before recovery began.

Recent market volatility has not yet pushed Bitcoin into the extreme zones that characterize true bottoms. On February 5, the asset experienced a 14% decline to $62,000, triggering $5.4 billion in realized losses.

This marked the largest single-day loss realization since March 2023, when holders crystallized $5.8 billion in losses. The figure also exceeded the $4.3 billion recorded shortly after the FTX exchange collapsed.

Despite these substantial losses, CryptoQuant maintains that a structural bottom has not materialized. Monthly cumulative realized losses currently stand at 0.3 million BTC, well below the 1.1 million BTC observed at the end of the 2022 bear market. This disparity suggests selling pressure has not reached the intensity associated with cycle lows.

Source: Cryptoquant

Multiple Indicators Show Market Remains Above Capitulation Levels

The MVRV ratio, which compares market value to realized value, has not entered extreme undervaluation territory. This metric historically signals bear market bottoms when reaching deeply depressed levels.

Current readings indicate Bitcoin trades above the ranges that marked previous cycle nadirs. Similarly, the Net Unrealized Profit and Loss metric has not declined to the 20% unrealized loss threshold observed at past bottoms.

Long-term holder behavior provides additional evidence that full capitulation has not occurred. These investors currently sell positions near breakeven prices.

During previous bear market conclusions, long-term holders typically absorbed losses between 30% and 40% before markets reversed. This behavioral difference suggests conviction remains higher than at historical turning points.

Approximately 55% of Bitcoin’s circulating supply remains profitable at current prices. This contrasts with the 45% to 50% range typically observed at cycle lows.

The elevated proportion of profitable holdings indicates many investors entered positions at lower prices and maintain paper gains. Bear market bottoms usually feature a higher percentage of underwater positions across the holder base.

CryptoQuant’s Bull-Bear Market Cycle Indicator remains in the Bear Phase rather than advancing to the Extreme Bear Phase. The latter designation historically marks the beginning of extended bottoming periods.

These extreme phases typically persist for several months, reinforcing the firm’s assessment that bear markets require time to resolve.

Standard Chartered recently adjusted its outlook, projecting Bitcoin could test $50,000 before recovering later this year.

Crypto World

How Espresso’s HotShot Consensus Addresses the Rollup Centralization and Fragmentation Crisis

TLDR:

- Espresso’s decentralized shared sequencer eliminates single points of failure in Rollup transaction ordering.

- HotShot consensus achieves two-second finality on devnet with plans for sub-second confirmation by 2026.

- Presto enables one-click cross-chain transactions without traditional bridging or additional gas fees.

- The network integrates with over 20 chains while preserving Rollup sovereignty through flexible participation.

The rapid proliferation of Layer 2 Rollups has created two fundamental problems that threaten ecosystem cohesion. Fragmentation prevents seamless interaction between chains, while centralized sequencers introduce censorship risks and single points of failure.

Espresso Systems addresses both challenges through a decentralized shared sequencer network powered by HotShot consensus.

The protocol raised $60 million from a16z and Coinbase Ventures to build infrastructure connecting over 20 chains with fast finality and cross-chain composability.

Cross-Chain Composability Addresses Rollup Fragmentation Crisis

The fragmentation dilemma emerged as rollups multiplied without standardized interoperability protocols. Applications and liquidity became isolated across separate Layer 2 ecosystems.

Users faced complex bridging processes and high costs when moving assets between chains. This fragmentation undermined the composability that makes Ethereum’s base layer valuable for developers.

Espresso tackles this problem through its confirmation layer architecture designed to achieve cross-chain composability.

According to the official website, the network provides reliable state views for other chains, bridges, and applications through real-time confirmation.

Smart contracts deployed on different Rollups can directly communicate without traditional bridging infrastructure. This restores the seamless interaction developers expect from integrated blockchain environments.

The Presto solution demonstrates practical fragmentation resolution through one-click cross-chain transactions. The system leverages Espresso’s fast finality to enable direct chain communication.

A partnership with Rarible showcased cross-chain NFT minting at the Devcon developer conference. The demonstration proved users could mint NFTs across chains without bridging or extra gas fees.

Technical performance supports these composability goals with measurable improvements. The current devnet achieves two-second finality with 5 MB/s throughput.

Official updates note this represents three times faster confirmation and five times higher capacity compared to mainnet. The development roadmap projects sub-second finality by 2026 as optimization continues.

Decentralized Sequencing Eliminates Centralization Vulnerabilities

Centralized sequencing represents the second critical vulnerability in current rollup architecture. Most Layer 2 networks rely on single sequencers controlled by project teams.

These operators possess unilateral power to order, delay, or exclude transactions from blocks. The arrangement creates censorship vectors and introduces catastrophic failure risks if operators go offline.

Espresso replaces centralized control with a distributed validator network operating globally. The shared sequencer accepts transaction blocks from connected Rollups for collective confirmation.

HotShot consensus serves as the Byzantine Fault Tolerance protocol ensuring distributed agreement among validator nodes. This architecture eliminates single points of failure while distributing censorship resistance across the entire network.

Protocol-level safeguards enforce decentralization guarantees for settlement on Ethereum’s base layer. The system ensures only blocks confirmed by Espresso validators can finalize on Layer 1.

This restriction prevents Rollup operators from bypassing consensus through direct submission. The mechanism guarantees all transactions undergo distributed validation before achieving finality.

The business model preserves Rollup sovereignty despite shared infrastructure. Official statements emphasize Rollups can freely choose to fully rely on the network, partially participate, or run independent sequencers.

This flexibility allows projects to access decentralization benefits without surrendering operational control. Partnerships with Arbitrum, Optimism, and Polygon demonstrate major ecosystem acceptance of the shared sequencing approach.

Crypto World

SEC chair warns some prediction markets may fall under securities laws

The head of the U.S. Securities and Exchange Commission says prediction markets are drawing serious legal and regulatory attention.

Summary

- U.S. Securities and Exchange Commission Chair Paul Atkins called prediction markets a “huge issue” as the sector faces growing legal and regulatory scrutiny.

- Atkins said some event-based contracts could fall under SEC jurisdiction if they meet the definition of a security.

- The SEC is coordinating with the Commodity Futures Trading Commission as questions mount over oversight, especially for platforms like Polymarket and Kalshi.

At a Senate Banking Committee hearing on February 12, SEC Chair Paul Atkins described rapidly-growing prediction markets as “a huge issue” for federal regulators.

Platforms such as Kalshi and Polymarket have expanded quickly since the 2024 election cycle. These markets let users speculate on outcomes from elections and sports to economic events.

Their growth, now measured in tens of billions of dollars, has pushed them into the spotlight of U.S. regulators.

Who regulates prediction markets?

Atkins said the legal status of prediction markets isn’t always clear. He noted that jurisdiction overlaps between the SEC and the Commodity Futures Trading Commission (CFTC).

“Prediction markets are exactly one thing where there’s overlapping jurisdiction potentially,” Atkins said.

Historically, the CFTC has been seen as the primary federal regulator for these markets. Atkins said the SEC may regulate some markets depending on how they’re structured, especially if contracts resemble securities.

“We have enough authority,” he told lawmakers, adding that a “security is a security regardless how it is and some of the nuance with prediction markets and the products depends on wording.”

SEC officials are reportedly meeting weekly with their counterparts at the CFTC.

CFTC Chair Michael Selig said regulators want a framework that protects market participants without pushing these platforms offshore.

Meanwhile, prediction markets also face state-level litigation, including claims that some offerings are illegal gambling under local laws.

Recent reports have noted insider trading concerns and legislative efforts to limit political event betting.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video20 hours ago

Video20 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 hours ago

Crypto World5 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle