Business

F&O Talk | Nifty breaches 20 & 100-DMA amid 11% VIX spike; Sudeep Shah on Coforge, 5 other top weekly movers

After back-to-back correction, the setup for Nifty has turned relatively cautious, with the index slipping below its 20DMA for the first time in the past few sessions. The 50-stock index is now trading below the key support level of 25,500, suggesting a weak near-term bias.

Indian markets will look for fresh triggers with the earnings season ended this week.

With this, analyst Sudeep Shah, Vice President and Head of Technical & Derivatives Research at SBI Securities, interacted with ETMarkets regarding the outlook for the Nifty and Bank Nifty, as well as an index strategy for the upcoming week. The following are the edited excerpts from his chat:

Q: Nifty closed 0.8% lower this week largely hit by the debacle in IT stocks. What are the cues for traders and investors for next week’s trade?

Last week, the benchmark index Nifty once again failed to sustain above the psychologically 26,000 mark, triggering a sharp bout of profit booking. After touching a high of 26,009, the index corrected nearly 550 points in just the final two trading sessions of the week — a swift move that signals supply emerging at higher levels. While the fall may appear routine on the surface, the underlying drivers of this correction tell a far more compelling story.

The major drag during this phase came from the Nifty IT index, which plunged over 8% during the last week and is now down over 14% month-to-date, marking one of its sharpest recent declines. The sell-off was largely triggered by rising concerns over the rapid expansion of AI-driven start-ups, which are increasingly seen as disruptive to traditional IT service companies. The speed and intensity of the decline suggest that this may not be a simple pullback on the downside and that raises an important question about whether the worst is already priced in.

From a technical perspective, the IT pack continues to flash strong warning signals. All the constituents of the Nifty IT index are trading below their key moving averages, firmly placed in a falling trajectory. Momentum indicators remain entrenched in bearish territory, with no visible signs of reversal. In such a setup, attempting bottom fishing could prove premature — unless the charts begin to tell a different story in the coming sessions.

Coming back to Nifty, it has now slipped below its 20-day, 50-day and 100-day EMAs, indicating a clear deterioration in short and medium-term trend strength. More importantly, both the 20-day and 50-day EMAs have started to slope downward — a subtle yet powerful bearish signal. Adding to the caution, the daily RSI failed to reclaim the 60 mark during the recent pullback and has now slipped below its 9-day average, hinting that upside momentum may remain capped — at least for now.

Going ahead, the 25,350–25,300 zone is likely to act as immediate support for the index. A sustained move below 25,300 could accelerate the correction towards 25100, followed by the crucial 24,900 mark. On the upside, the 50-day EMA zone of 25,650–25,700 level stands as a formidable hurdle.

Q: What are important Nifty and Bank Nifty levels for next week’s trade?

Going ahead, for Nifty, the 25,350–25,300 zone is likely to act as immediate support for the index. A sustained move below 25,300 could accelerate the correction towards 25,100, followed by the crucial 24900 mark. On the upside, the 50-day EMA zone of 25,650–25,700 level stands as a formidable hurdle.

For Bank Nifty, the 20 day EMA zone of 60000–59900 will serve as the immediate support area. A sustained move below 59900 may trigger further downside towards the 50 day EMA, currently placed at 59467. On the upside, the 60600–60700 band is expected to act as a crucial hurdle, and only a decisive close above this range may pave the way for a fresh up-move.

Q: The view on IT stocks is mostly bearish though some analysts are taking a contra view on the sector, arguing in favour of long term promise and favourable-risk reward after the extended correction. Data suggests not a single stock has given positive returns over a two-year period. In light of this, what will be your advice to investors?

Nifty IT witnessed a sharp sell-off last week, tumbling more than 8%, and is now down over 14% month to date, marking one of its steepest recent declines. The index has also slipped below its key support zones, signalling a clear deterioration in trend strength. With moving averages turning lower and momentum indicators firmly in bearish territory, the overall structure suggests that selling pressure may persist in the near term.

All the constituents of the Nifty IT index are trading below their key moving averages, firmly placed in a falling trajectory. Momentum indicators remain entrenched in bearish territory, with no visible signs of reversal. In such a setup, attempting bottom fishing could prove premature — unless the charts begin to tell a different story in the coming sessions.

Q: PSU Bank stocks appear to be a much more safe option as there is no direct link of the trade deal with the sector. What is your assessment and do you have stock recommendations?

The PSU Bank index cracked nearly 6% on the budget day and slipped below its 50-day EMA, but the subsequent recovery has been very strong, with the index rebounding sharply and marking a fresh all-time high near 9295 on 12th Feb. Over the last one year, it has been the best performing index with gains of nearly 53%, which clearly highlights sustained sector leadership.

Technically, the index continues to trade above key short- and long-term moving averages, keeping the broader trend bullish. The PSU Bank / Nifty ratio chart has also hit a new high and remains in a rising trajectory, indicating continued relative outperformance versus the broader market. The 8970–8950 zone remains a crucial support zone. As long as the index holds above this area, the bullish trend structure is likely to remain intact.

At the stock level, Indian Bank and Union Bank of India are both consolidating in a defined range since mid-January after a strong prior upward move, suggesting a healthy pause. This kind of time correction typically sets up the next leg of the trend. A strong follow-through move and a decisive breakout above their respective consolidation ranges can lead to continuation of the upmove in both stocks.

Q: India VIX was up 11% this week which brings opportunity for day traders in cash and derivatives market. How can traders utilize this?

Since hitting 16.11 on the budget day, India VIX cooled nearly 35% over the next 10 sessions in line with the usual post-budget volatility drop, but historically volatility tends to rise again in the following weeks — in the last 15 budgets, VIX closed negative immediately after the event in 11 cases (avg −8.82%), yet turned positive in 8 of the following one-month periods with an average rise of 17%, and the current pattern looks similar.

For traders, a rising VIX environment means bigger intraday ranges and faster price swings, so cash market day traders can focus on high-beta leaders and breakout/breakdown setups with smaller position sizing and quicker profit booking, while derivatives traders should avoid large naked positions due to higher premium risk and instead prefer defined-risk structures like debit spreads (bull call or bear put spreads) and hedged directional trades, which allow participation in movement while controlling downside if volatility expands further.

Q: Which sectors or themes will be in your radar next week?

Nifty Consumer Durables, Nifty Auto, Nifty Infrastructure, Nifty Manufacturing and Nifty Financial Services will be on the radar next week as they are currently the strongest pockets on the charts and are positioned in the leading quadrant of the Relative Rotation Graph (RRG), indicating superior relative strength along with momentum.

Consumer Durables has staged a sharp pullback from the 33383 lows showing strong demand at lower levels, while Auto and Manufacturing have rebounded decisively from their 200-day EMA and moved up swiftly, signaling trend support and continuation potential. Infrastructure is showing clear relative outperformance with the Infra/Nifty ratio chart giving a downward sloping trendline breakout followed by solid follow-through and Financial Services continues to outperform with its ratio line versus Nifty trending higher, together suggesting leadership is likely to remain with these themes if the broader market remains stable.

Q: SCI, Kirloskar Oil and Engineers India were big gainers this week while Firstsource, eClerx and Coforge, top losers. What should investors do with them?

Post results, Shipping Corporation of India saw a sharp gap-up and strong follow-through but is currently hovering near the earlier swing high zone of 280–282, which is acting as a supply area — price behaviour around this band will be important to judge whether momentum expands or the stock spends more time consolidating.

Kirloskar Oil Engines continues to show a higher-high higher-low structure and trades above key moving averages after a strong rebound since late January, suggesting trend strength remains visible as long as it holds above its nearby support band of 1330–1320.

On the weaker side, Firstsource Solutions has corrected sharply and slipped below the 275–270 support zone, which may now behave as an overhead resistance area, so price acceptance back above or rejection near this band becomes the key monitorable.

eClerx Services has broken an upward sloping trendline and its 200-day EMA, indicating loss of medium-term structure, with 3950 acting as an important reference level for trend assessment.

Coforge has also seen a double-digit weekly correction amid broader IT sector pressure linked to AI disruption headlines, so from a tactical standpoint the space may be better approached after signs of stabilization and base formation rather than during active weakness.

(Disclaimer: The recommendations, suggestions, views, and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

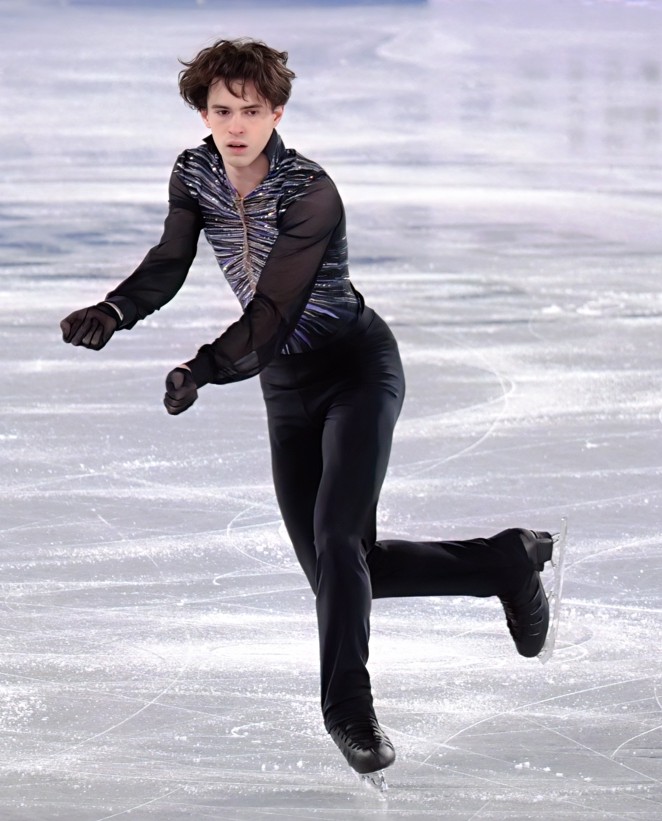

Kazakhstan’s Olympic Figure Skating Gold Medalist

Mikhail Shaidorov, the 21-year-old Kazakhstani figure skater, etched his name into Olympic history on February 13, 2026, by claiming gold in men’s singles at the Milano Cortina Winter Olympics. In a stunning upset, Shaidorov delivered the competition’s only clean free skate, landing five quadruple jumps to score a career-best 198.64 in the free program and 291.58 overall. This victory made him Kazakhstan’s first Olympic figure skating champion and the nation’s first Winter Olympic gold medalist since 1994.

The result shocked the figure skating world, as pre-event favorite Ilia Malinin faltered with falls and finished eighth. Japan’s Yuma Kagiyama took silver, and Shun Sato earned bronze. Shaidorov, who placed fifth after the short program (92.94 points), rose through the chaos of errors from top contenders to become a national hero.

Here are 10 essential things to know about Mikhail Shaidorov, updated as of February 14, 2026:

- Historic Olympic Gold in Milano Cortina 2026 Shaidorov’s triumph on February 13 at the Milano Ice Skating Arena marked Kazakhstan’s first Olympic gold in figure skating and only its second Winter Olympic gold ever (following cross-country skier Vladimir Smirnov in 1994). His flawless free skate featured five quads, earning him a total of 291.58 points—a season best and personal record. The performance came after a solid short program fifth-place finish, positioning him perfectly amid widespread falls and underrotations from rivals. Shaidorov’s stunned reaction in the kiss-and-cry area, as medals shifted from bronze to silver to gold, captured the moment’s drama. This debut Olympics delivered Kazakhstan’s breakthrough in a sport long dominated by powerhouses like Russia, the U.S. and Japan.

- Breakthrough 2024-25 Season Set the Stage Shaidorov exploded onto the elite scene in 2024-25, winning the Four Continents Championships title—the first ISU championship gold for a Kazakh skater in a decade—and silver at the World Championships. These results built his reputation as a technical innovator. He qualified for the Grand Prix Final and medaled multiple times on the circuit, showcasing consistency and ambition. Despite an up-and-down Olympic season with some inconsistencies, his pre-Games momentum positioned him as a dark horse rather than a favorite.

- Technical Pioneer with Groundbreaking Jump Combinations Shaidorov has pushed boundaries in men’s skating. He became the first to land a triple Axel-quadruple toe loop combination in competition (at the 2024 Grand Prix de France) and the first to perform a triple Axel-Euler-quadruple Salchow (at the 2024 Grand Prix Final). His programs emphasize high-difficulty quads early, with layouts designed for maximum technical element scores. At the Olympics, his five-quad free skate highlighted this prowess, earning a leading 114.68 technical score. Coaches credit his precision and risk-taking for elevating Kazakh skating.

- Born into a Skating Family in Almaty Born June 25, 2004, in Almaty, Kazakhstan, Shaidorov—known as Misha—grew up in a figure skating household. His father, Stanislav Shaidorov, a six-time Kazakh national champion, coaches and inspired his early start in 2010. Shaidorov trains at the Altynalmas club in Almaty and Sochi, Russia, under 1994 Olympic champion Alexei Urmanov and Ivan Righini. Standing 1.74 meters (5 feet 9 inches) and a student by profession, he balances academics with elite training. His humble beginnings at a local mall rink contrast with his global success.

- Five-Time Kazakh National Champion Shaidorov has dominated domestically, claiming five consecutive Kazakh Championships from 2019 to 2023 (with continued strength in recent years). These titles secured his international berths and allowed experimentation with programs. His national success echoes the legacy of late Kazakh legend Denis Ten, whose 2014 Olympic bronze long inspired Shaidorov. As Kazakhstan’s leading men’s skater post-Ten, he carries national expectations while advancing the sport locally.

- Multiple Grand Prix Medals and Challenger Success A four-time ISU Grand Prix medalist, Shaidorov earned silvers and bronzes across events like Skate America and Cup of China in recent seasons. He also secured three Challenger Series medals. These consistent podiums built his world ranking and experience against top competition. His 2024-25 Grand Prix performances, including innovative combos, qualified him for finals and honed his big-stage composure—key to his Olympic upset.

- Additional Honors: Asian Winter Games Bronze and More Shaidorov added continental hardware with bronze at the 2025 Asian Winter Games. His resume includes steady top finishes at major events, proving reliability under pressure. While not always the flashiest, his clean skating and growing artistry (program components in the 80s at Olympics) have earned praise for maturity beyond his years.

- Under-the-Radar Olympic Debut Turned Legendary Entering Milano Cortina as an underdog after mixed results, Shaidorov flew below expectations dominated by Malinin’s “Quad God” hype. His fifth in the short set up a free skate where he stayed composed while favorites crumbled. Media described him as shy and awkward off-ice, yet fierce on it. His gold proved “nothing is impossible,” as he noted post-event, inspiring underdogs worldwide.

- Legacy Tied to Denis Ten and Kazakh Skating Revival Shaidorov continues the path blazed by Denis Ten, Kazakhstan’s sole prior Olympic figure skating medalist (bronze 2014). Ten’s influence looms large; Shaidorov has cited him as motivation. His victory revives Kazakh pride in the sport, potentially boosting funding, rinks and youth participation in Almaty and beyond.

- Future Bright After Olympic Glory At 21, Shaidorov’s Olympic gold cements elite status with room for growth. His technical edge and composure suggest potential multi-Olympic contention. Post-victory, he becomes a national icon, with celebrations in Kazakhstan already underway. As figure skating evolves toward even greater difficulty, Shaidorov’s innovative jumps position him to lead. His story—from Almaty mall rink to Olympic podium—embodies perseverance and surprise.

Mikhail Shaidorov’s Milano Cortina triumph transcends sport, delivering historic joy to Kazakhstan and reminding the world that upsets define greatness. From dark horse to champion, his journey captivates and inspires.

Business

Hariri signals Future Movement’s return to Lebanon elections

Hariri signals Future Movement’s return to Lebanon elections

Business

100% In Stocks? Why Paying Off Debt Might Be Your First Move

Brett Ashcroft-Green, CFP® is a CERTIFIED FINANCIAL PLANNER™ , fee-only fiduciary, and the founder and owner of Ashcroft Green Advisors, a Nevada-based registered investment advisory firm.He has extensive experience working alongside high-net-worth and ultra-high-net-worth families, with a background in private credit and commercial real estate mezzanine financing as a business director at a large family office. His professional experience spans the U.S. and Asia, including several years living and working in China.Brett is fluent in Mandarin Chinese in both business and legal settings and previously served as a court interpreter. He has collaborated with leading commercial real estate developers including The Witkoff Group, Kushner Companies, The Durst Organization, and Fortress Investment Group.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY, BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information in this article is intended for general informational and educational purposes only and does not constitute financial, investment, tax, or legal advice. The views expressed are solely those of the author, based on independent research, analysis, and professional experience. Although the author is a CERTIFIED FINANCIAL PLANNER™ (CFP®) and owner of Ashcroft Green Advisors, a fee-only registered investment advisory firm, the content may not be suitable for your individual financial situation, objectives, or risk tolerance. Readers should consult with a qualified financial professional before making any decisions based on this material.

The author and/or clients of Ashcroft Green Advisors may hold positions in securities discussed in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Trump ally at the Fed gives advice to Kevin Warsh ahead of leadership change

White House Deputy Press Secretary and Special Assistant to the President Kush Desai praises a new jobs report and inflation statistics on ‘Kudlow.’

DALLAS – As Kevin Warsh prepares to take the reins at the Federal Reserve, a newly elevated Trump ally at the central bank is signaling how he believes the job should be done — and how the next chair should navigate a pivotal moment for monetary policy.

Speaking at the Dallas Federal Reserve, Governor Stephen Miran offered simple advice for Kevin Warsh, Trump’s nominee to replace Federal Reserve Chair Jerome Powell.

“Be forward-looking, not backward-looking,” Miran said. “If you’re going to be excessively backward-looking, you’re guaranteed to be behind the curve,” he added.

TRUMP NOMINATES KEVIN WARSH TO SUCCEED JEROME POWELL AS FEDERAL RESERVE CHAIR

Federal Reserve Governor Stephen Miran was nominated by President Donald Trump to join the central bank. (Victor J. Blue/Getty Images / Getty Images)

In Miran’s view, the current economic backdrop does not justify a strictly data-driven posture, diverging from the data-dependent approach that has defined the central bank under Powell.

“The time for data dependence is when you have enormous uncertainty. I don’t think we have enormous uncertainty.”

A LOOK AT THE UNFOLDING BATTLE BETWEEN TRUMP AND POWELL OVER FED POLICY

Jerome Powell, chairman of the U.S. Federal Reserve, is expected to complete his term in May. (Al Drago/Bloomberg/Getty Images / Getty Images)

Miran’s comments offer an early glimpse of how one of the Fed’s newest voices views the balance between anticipating economic shifts and reacting to incoming data.

President Donald Trump tapped Miran in August, shifting him from leading the White House’s Council of Economic Advisors to a seat at the world’s most powerful central bank. He joined the board amid mounting turmoil at the Fed, including a legal clash between the Trump administration and Governor Lisa Cook and a Justice Department investigation involving Powell.

Cook’s case is before the Supreme Court and Powell has not been charged with any wrongdoing.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Warsh’s path to the Fed chair could face delays amid Republican opposition tied to the probe into Powell. Sen. Thom Tillis, R-N.C., has said he will oppose consideration of Fed nominees until the administration concludes its investigation — a stance that carries weight given his seat on the Senate Banking Committee.

Kevin Warsh, former governor of the U.S. Federal Reserve, was widely considered for other roles within the previous Trump administration. (Tierney L. Cross/Bloomberg via Getty Images / Getty Images)

With Tillis placing a hold on Warsh’s nomination, forcing it out of committee would require a discharge vote on the Senate floor — a maneuver that needs 60 votes and appears unlikely in a closely divided chamber.

Regardless of the timing of Warsh’s confirmation, Miran’s early remarks signal how the Fed’s policymaking framework and its dynamic with the White House could shift in the months ahead.

Business

Palantir Is Executing Well — The Valuation Is The Problem

Palantir Is Executing Well — The Valuation Is The Problem

Business

Astronomers puzzle over ’inside out’ planetary system

Astronomers puzzle over ’inside out’ planetary system

Business

Rubio casts US, the ’child of Europe’, as critical friend to allies

Rubio casts US, the ’child of Europe’, as critical friend to allies

Business

SpaceX’s Starlink gets nod for satellite internet in Vietnam

SpaceX’s Starlink gets nod for satellite internet in Vietnam

Business

Son of Iran’s last shah urges US military intervention in Iran

Son of Iran’s last shah urges US military intervention in Iran

Business

Weekly Indicators: Calm On The Surface

Weekly Indicators: Calm On The Surface

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World12 hours ago

Crypto World12 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?