Politics

Inside Israel’s army of dual-nationals

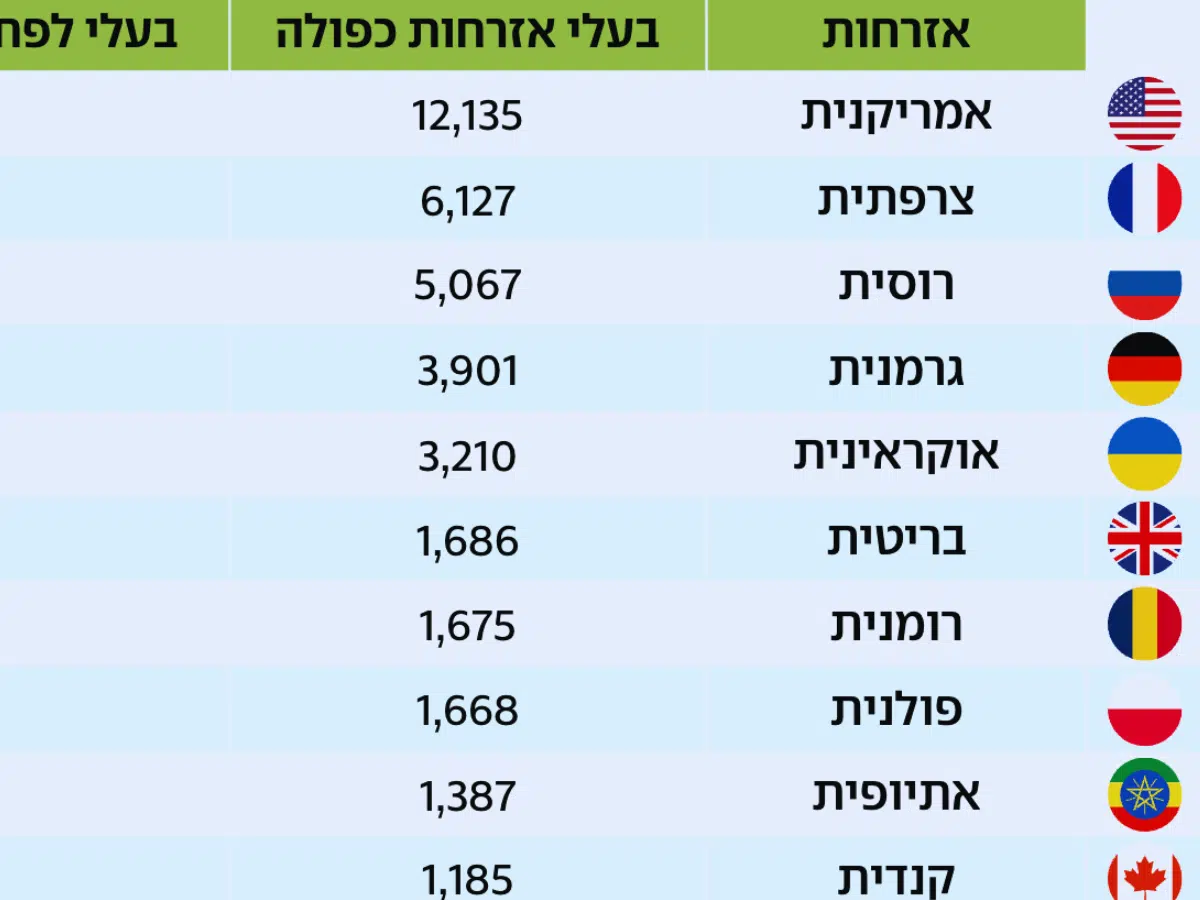

Data published by the Israeli army shows that 50,632 servicemen fighting in the ranks of the Israeli Defence Force (IDF) hold two or more nationalities (listed below).The data does not indicate how many were reservists versus active-duty soldiers — fighting for Israel.

As reported by the Canary’s Joe Glenton, the data was obtained by Declassified UK obtained through a Freedom of Information request.

Americans rank first (12,135), French second (6,100), and Russians third (5,000). Nationals from Germany, Ukraine, Britain, Romania, Poland, Canada, and Latin America also feature on the list. Of these, 4,440 soldiers hold two foreign nationalities, while 162 hold three or more — serving in military operations in Gaza, waged by Israel.

Less expected are Arab nationals from Yemen, Tunisia, Lebanon, Syria, and Algeria, who appear in the data — albeit in noticeably smaller numbers.

- United States: 12,135 soldiers

- France: 6,127 soldiers

- Russia: 5,067 soldiers

- Germany: 3,901 soldiers

- Ukraine: 3,210 soldiers

- Britain: 1,686 soldiers

- Romania: 1,675 soldiers

- Poland: 1,668 soldiers

- Ethiopia: 1,387 soldiers

- Canada: 1,185 soldiers

- Hungary: 885 soldiers

- Italy: 828 soldiers

- Argentina: 609 soldiers

- Netherlands: 559 soldiers

- Brazil: 505 soldiers

- Australia: 502 soldiers

- South Africa: 415 soldiers

- Belgium: 406 soldiers

- Austria: 390 soldiers

- Switzerland: 373 soldiers

- Spain: 372 soldiers

- Czech Republic: 309 soldiers

Conflicting jurisdictional obligations

The presence of dual-national IDF servicemen has raised questions about their legal obligations — in other words, when serving in Israel, whose laws are they answerable to.

These concerns have also culminated in criminal investigations into the conduct of soldiers deployed in Gaza since 2023.

In the UK, human rights groups collaborating with the Gaza-based Palestinian Centre for Human Rights submitted a report to the Metropolitan Police war crimes unit. Their findings highlight the participation of British nationals in Gaza and their possible involvement in suspected war crimes.

In June 2025, Canadian authorities, responding to complaints, launched preliminary investigations into Canadian nationals serving in the IDF suspected of war crimes.

Meanwhile, Belgium is investigating a Belgian soldier fighting for an elite IDF unit deployed in Gaza. That said, Belgium imposes no restrictions on dual nationals serving in foreign militaries.

Suspected Gaza war crimes

International organisations, including Human Rights Watch and Amnesty International, have long called for independent investigations to ensure that dual citizens are acting in compliance with international humanitarian law. A recent investigation by Al Jazeera Arabic found that six Israeli snipers hold dual nationalities and were implicated in attacks targeting civilians in Gaza.

According to local estimates, the war in Gaza, now in its third year, has resulted in more than 72,000 deaths and approximately 171,000 injuries. In addition, there has been widespread destruction of infrastructure, with humanitarian and legal repercussions extending far beyond the battlefield.

Featured image via the Canary

Politics

Green MP confronts Reform UK myths on immigration

Green MP Ellie Chowns challenged the thrust of Reform’s entire game on BBC Question Time.

“It’s inequality”

Chowns took apart the notion that immigration is to blame for the UK’s woes:

Reform UK, before it was the Brexit Party, before when it was UKIP, has been busy for many years fermenting this idea that immigration is the problem in this country. It’s completely untrue. Inequality is the problem in this country. The housing problems are… because we have had 40 years of governments not investing in housing. The health problems… are because we’ve had governments… failing to invest in our public services, presiding over decline. It’s inequality.

Ellie Chowns, “Reform UK, before it was the Brexit Party, before when it was UKIP, has been busy for many years fermenting this idea that immigration is the problem in this country”

“It’s completely untrue”

“Inequality is the problem in this country”

“The housing problems is… pic.twitter.com/XYVFIyibVJ

— Farrukh (@implausibleblog) February 12, 2026

Indeed, Oxfam found in 2023 that 1% of Britons have more wealth than 70% of the country.

It’s not foreign born people who are the issue — it’s the super rich migrating their finances to avoid tax and Labour — doing nothing to fix the issue. Tax doesn’t fund public spending but it can help control inflation through reducing the amount of pounds available.

Meanwhile, net zero immigration would actually contract the UK economy by 3.6%. Chowns’ is not wrong to diagnose inequality as the core issue — one compounded by the economic disparity such a contraction would cause. People cannot afford to have children, driving dependence on imported workers.

Another reason inequality is the core issue is that it literally caused the 2008 financial crash. That’s because people didn’t have enough money to keep up with inflated house prices. So banks gave them excessive credit — known as sub-prime mortgages — and house prices relative to income have worsened since. No wonder Chowns received such applause on BBC Question Time.

High inequality: low demand

We must also remember that inequality depresses demand for products and services. People currently living in poverty would spend more if they had the security of home ownership, while excess wealth at the top stagnates or inflates the value of assets.

£1 million sitting in a bank account would be spent by hundreds of less well off people, but if just one person has it no economic growth happens. It doesn’t necessarily mean everything should be entirely economically equal, but the level of disparity today is simply ridiculous. On top of that, immigration adds further demand for products and services, expanding the economy.

Reform’s whole mantra is completely wrong — economically and morally. Chowns got right to the heart of it on BBC Question Time and the audience thanked her for it.

Featured image via the Canary

Politics

Exercises That Help WIth Depression Symptoms Revealed

According to the leading mental health charity Mind, 1 in 5 people report experiencing a common mental health problem (like anxiety and depression) in any given week in England.

Additionally, the overall number of people reporting mental health problems has been rising in recent years. The number of people with common mental health problems went up by 45% between 1993 and 2023/24, in both men and women and suicide risk is at its highest for people in their 50′s.

Now, a new review by psycholologists from James Cook University has revealed that some exercises can be beneficial in tackling common mental health issues and the symptoms that come with them.

Exercises that help with anxiety and depression

Writing for The Conversation, the researchers said: “Exercise is effective at reducing both depression and anxiety. But there is some nuance. We found exercising had a high impact on depression symptoms, and a medium impact on anxiety, compared to staying inactive.

“The benefits were comparable to, and in some cases better than, more widely prescribed mental health treatments, including therapy and antidepressants. Importantly, we discovered who exercise helped most. Two groups showed the most improvement: adults aged 18 to 30 and women who had recently given birth.”

The researchers urge that all forms of exercise reduce symptoms but the most beneficial exercises for both anxiety and depression were aerobic exercises such as running, cycling or swimming.

“For depression, there were greater improvements when people exercised with others and were guided by a professional, such as a group fitness class.”

If exercise isn’t usually your kind of thing, the researchers assure that exercising once or twice a week had a similar effect on depression as exercising more frequently. And there didn’t seem to be a significant difference between exercising vigorously or at a low intensity – all were beneficial.

They add: “For people who are hesitant about medication, or facing long waits for therapy, supervised group exercise may be an effective alternative. It’s evidence-based, and you can start any time.”

Help and support:

- Mind, open Monday to Friday, 9am-6pm on 0300 123 3393.

- Samaritans offers a listening service which is open 24 hours a day, on 116 123 (UK and ROI – this number is FREE to call and will not appear on your phone bill).

- CALM (the Campaign Against Living Miserably) offer a helpline open 5pm-midnight, 365 days a year, on 0800 58 58 58, and a webchat service.

- The Mix is a free support service for people under 25. Call 0808 808 4994 or email help@themix.org.uk

- Rethink Mental Illness offers practical help through its advice line which can be reached on 0808 801 0525 (Monday to Friday 10am-4pm). More info can be found on rethink.org.

Politics

Epstein victims claim DoJ un-redacted their names to intimidate them

In an interview with NBC, victims of Jeffrey Epstein have accused attorney general Pam Bondi of foul play:

BREAKING: Multiple Epstein victims tell NBC News that Pam Bondi intentionally un-redacted their names and other victims’ names as a way to threaten them into silence!

“I think we all realize now that [the DOJ] really wanted to silence us, and [they] thought that [they] could… pic.twitter.com/c6zeiFFAvG

— Ed Krassenstein (@EdKrassen) February 12, 2026

“Intentional”

Ed Krassenstein wrote above:

BREAKING: Multiple Epstein victims tell NBC News that Pam Bondi intentionally un-redacted their names and other victims’ names as a way to threaten them into silence!

“I think we all realize now that [the DOJ] really wanted to silence us, and [they] thought that [they] could scare us by putting our names out there.”

“It had a list of victims, and one was redacted. That makes no sense. This is a list of victims. That is INTENTIONAL!”

This is an impeachable offense. Pam Bondi needs to be impeached immediately!

The women speaking in the video are the same group who stood behind Pam Bondi when she spoke before the Justice Department Oversight committee. The reason the women are raising their hands in the below image is because they were asked to indicate which of them have been ignored by Bondi’s Department of Justice (DoJ):

An image we won’t soon forget. Attorney General Pam Bondi refused to look at Epstein survivors pictured behind her on the Hill today. pic.twitter.com/KYCBQCXz3Y

— The Lincoln Project (@ProjectLincoln) February 11, 2026

Failed by the DOJ

Regarding coverage of victims, Maddison Wheeldon wrote for the Canary:

According to BBC News, on Friday 30th January two lawyers for Epstein’s victims insisted that a New York federal judge order the DOJ to remove the website holding the files. They stated that the negligent release was:

“the single most egregious violation of victim privacy in one day in United States history”.

At the Canary, we agree wholeheartedly.

This US-led failure to redact identifying images and names of victims has made the complete removal of such content the only viable response. Once again, women around the world are left feeling exposed and vulnerable, while so-called efforts to ‘protect women’ operate instead to shied powerful perpetrators of abuse. Yet again, a manipulative and abusive system has retraumatised the very women it was ostensibly meant to serve.

For more on the Epstein Files, please read:

Featured image via the Canary

Politics

Zarah Sultana slams Lib Dem duplicity on Palestine

On 13 February, the High Court ruled that the proscription of Palestine Action as a terrorist group was “disproportionate”. Since then, various politicians including Zarah Sultana have come forwards to voice their support for the ruling. The problem is that many of them didn’t speak up when it counted:

On the vote to proscribe Palestine Action, Liberal Democrat MPs abstained.

Stop gaslighting people.

When it mattered, you didn’t show up. https://t.co/nSd2SHcCWf

— Zarah Sultana MP (@zarahsultana) February 13, 2026

Suppression

Reporting on the ruling, Maddison Wheeldon wrote for the Canary:

The government’s choice to proscribe Palestine Action has been met by widespread public condemnation both at home and abroad. It has been viewed as an attempt to shut down solidarity that British people have shown with Palestinians through their legal right to protest.

Israel’s ongoing, horrific genocide against Palestine has been met with absolute impunity by Western leaders, resulting in mass protest and civil disobedience across the UK since October 2023. This proscription of direct-action group Palestine Action in the UK has widely been declared as an authoritarian and draconian overreach into the hard-fought civil liberties of British citizens.

Today’s ruling marks a positive step in the right direction.

In the video above, Davey says:

This High Court judgment shows prescribing Palestine action was a grave misuse of terrorism laws. Labour must accept its mistake, drop its appeal and stop wasting taxpayers’ money and suppressing civil liberties. Degrading counter-terror powers is a genuine threat to national security.

Davey isn’t wrong in what he’s saying. The problem is he’s showing he isn’t a leader — he’s a follower. And others have noticed too:

Ed Davey says banning Palestine Action was a grave misuse of terrorism laws.

Every single LibDem MP, including Ed Davey, abstained in the vote to ban them (66 had no vote recorded and 6 abstained by voting both for and against) pic.twitter.com/Y8qmDxO1pg

— Saul Staniforth (@SaulStaniforth) February 13, 2026

As Richard Burgon noted, only 22 MPs voted against the government:

I welcome the High Court ruling that the ban on Palestine Action is unlawful.

I was one of just 22 MPs who voted against proscribing Palestine Action and in my speech in Parliament I warned the Government of the consequences of its ban.

The Government must not seek an Appeal.

— Richard Burgon MP (@RichardBurgon) February 13, 2026

Only 22 MPs voted against proscribing Palestine Action as a terrorist organisation. They should be proud of themselves; the other 628 should be ashamed. pic.twitter.com/Z2507SzhI9

— Karl Hansen (@karl_fh) February 13, 2026

Labour MP Karl Turner at least had the decency to admit that he “bottled it”. Just like with Davey, though, this will come across to many as a face saving exercise:

This is true. I bottled it and voted with the government. But should have stood firm. I told them though. PM and Home Sec. https://t.co/b9rfxasDAN

— Karl Turner MP (@KarlTurnerMP) February 13, 2026

Turner also said that Starmer’s government pushed the ban on the basis that they ‘knew more’ than they could let on (something the court case has ultimately disproven):

Just because it’s this MP or that MP on the left of the party warning the powers that be shouldn’t mean the helpful advice is discounted. @johnmcdonnellMP and many others warned the government at the time and we were just pushed aside as not knowing what they knew. 🤷🏼♂️ https://t.co/KopDPl7g1d

— Karl Turner MP (@KarlTurnerMP) February 13, 2026

Draconianism

As we’ve reported, Starmer’s government have been a nightmare when it comes to civil liberties. At this point, it’s clear that Labour will kick the PM out before too long. Let’s hope Starmer’s successor learns from his constant failures.

Featured image via Parliament / Leicester Gazette (Flickr)

Politics

BBC removes Arabic service head, bowing to Israel lobby

The BBC is looking for a new head of its Arabic-language service to please Israel lobbyists. Mouthpieces for the occupation had complained it was too quick to blame Israel for its actions. The move is intended to force BBC Arabic to use the same dishonest framing as its English-language services.

The manufactured furore began in November 2025. Pro-Israel pressure groups complained that the BBC Arabic coverage of its ‘war’ in Gaza was “critically different” from English coverage. This meant that it was – this is not satire — “painting Israel as the aggressor” in Gaza.

BBC and the mirage of impartiality

Yes, genocidal Israel has murdered hundreds of thousands of civilians in Gaza along with hundreds of journalists and their families. It uses weapons that are illegal under humanitarian law on families in tents. But saying Israel is the aggressor is beyond the pale to the BBC. There was also criticism of BBC Arabic’s guests, because two of them had supported violence against Israelis.

Commenting on the BBC Arabic reshuffle, the Arabic-speaking Israeli ‘journalist’ Edy Cohen, welcomed the move:

https://x.com/EdyCohen/status/2019788772385177737

“Impartiality and editorial accuracy”? Right. But, as if this wasn’t hypocritical enough, Edy Cohen is no stranger to racist, inflammatory posts himself. In September 2024, in the midst of Israel’s genocide and talking to Israeli Channel 14 — the “pet channel of Likud and its far-right governing coalition partners” — he lumped the whole “Arab world” together into a mass that only responds to force and will attack Israel if it is “perceived as weak”:

In this world, the equation is simple: When Israel uses force and employs force – the Arab world and terrorist groups are afraid. When Israel hesitates and takes policy actions like containment or non-escalation, it’s perceived as weak, and invites further blows from terror organizations.

This was not an aberration for Cohen. He is so notorious for smears and ‘hasbara’ on behalf of Israel that he was the subject of an report titled:

Hashtags and hoaxes: How Edy Cohen engineers the Israeli disinformation machine on Twitter.

Stoking the fire

The report was published in August 2023, before Israel’s Gaza genocide began, so he didn’t just start after 7 October. It notes that:

Cohen deliberately – and strategically – tarnishes the reputation of Palestinians, Palestinian political factions, and the Palestinian resistance, specifically targeting them to discredit their stance.

It also points out that among Cohen’s most prominent hashtags are “#GloryToIsrael” and “#PalestineIsNotMyCause”.

According to the report, Cohen is helped in the circulation of his fake videos and inflammatory comment by a network of:

accounts bearing Arabic names that exclusively champion Israel and tout the “benefits” of normalization. He shares the posts from these accounts that, in turn, retweet his own posts.

Even though some of these tweets are attributed to real Arab figures who openly endorse normalization, many of them appear to be fake accounts, seemingly created with the specific intent to persuade Arab followers to embrace the concept of normalization.

It appears that Cohen is either formally a part of Israel’s ‘hasbara’ propaganda network, or functionally indistinguishable from those who are. The Misbar report concludes it’s the former:

In sum, Misbar’s comprehensive analysis concludes the Edy Cohen account is one of the many Israeli accounts present in the Arabic online sphere that systematically target Arab audiences, skillfully glossing over and whitewashing Israel’s image for them while concurrently distorting and casting a shadow over Palestinians. This calculated effort also appears designed to sow division within Arab nations and communities whenever the opportunity arises.

Cohen and others like him continue to lecture on ‘impartiality and editorial accuracy’ in BBC Arabic coverage — accusing them of ‘wrongly painting Israel as the aggressor’ in Gaza. Meanwhile, no mainstream UK media outlets will dare challenge this — amplifying the Israel lobby’s narrative instead.

Featured image via Barold/the Canary

Politics

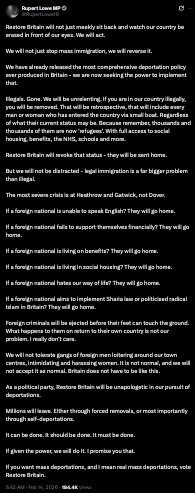

Rupert Lowe forms breakaway party, woos Tory fans

One of the biggest criticisms of Reform is that it’s just a rebrand of the Tory Party. Now, ex-Reform MP Rupert Lowe has created his own spinoff party, and it’s shaping up to be…a rebrand of a rebrand:

Ten years with the Conservatives and today I’m joining Restore Britain. I’ve always said it would take something genuinely compelling to make me defect, and this is it. https://t.co/eyeu9b2MIU

— Monika Užkalnytė🇻🇦 (@Monikablogs) February 13, 2026

And as Lowe himself has said, he’s open to attracting talent from the Tories, Reform, Advance — basically any reactionary party you can think of. Furthermore, Rupert Lowe seems intent on expanding his political circle.

Rupert Lowe: From Reform to Restore

The timeline of Lowe leaving Reform is messy. The TLDR is:

- Lowe began criticising Farage (seemingly in coordination with Elon Musk).

- Farage suggested Lowe wouldn’t be anywhere near office without Nigel’s cult of personality (a.k.a. Reform).

- Reform suspended Lowe and reported him to the police for ‘verbal threats’ and “serious bullying” of female staffers.

- Lowe described the accusations as “vexatious”.

- Several months of back and forth ensued.

With someone like Lowe, it’s better to have them on the inside pissing out than on the outside pissing in. Now, Farage is going to learn why that saying exists.

Lowe announced his new party in a SEVEN MINUTE LONG video on Twitter/X:

I am today launching Restore Britain as a national political party.

Join us.https://t.co/RMtEuHopgV pic.twitter.com/jQMAOjQJ5A

— Rupert Lowe MP (@RupertLowe10) February 13, 2026

We’re not watching all that, but we’re glad for him, or sorry that happened.

Remember when Twitter used to be about brevity? This is how long the average Rupert Lowe tweet is now:

By the way, we can’t ignore the fact that Lowe’s ‘Reform’ rival is going to be called ‘Restore’.

Does he not understand his main weakness is going to be voters literally just getting the names mixed up?

Some of what Lowe says in the announcement video is worth being aware of – particularly this section:

I’m now going to dedicate my life to finding, organising, funding and providing hundreds of qualified candidates to present to the British people at the next general election. This process has already started. with invitations being issued to patriots in aligned political parties: Reform, the Conservatives, the SDP, Advance, and more.

In local politics, we will work in partnership with localised political parties such as Great Yarmouth First that have the best interests of their residents at heart, combining our forces at the next general election.

The men and women standing for Restore in that election will not be politicians. I promise you that.

They will not be failed ministers.

They will not be tainted by failures of the past.

They will be from business, from the military, from science, from medicine, from education, from industry, representing real communities up and down the country. Every single one will be from well outside the existing political establishment and every single one will understand the difficult decisions that need to be taken.

While we can’t say who Restore will run for office, we can say the party is already attracting the dregs of British politics.

Rejects

Firstly, we should note it’s not just British dregs; the South Yank-frican billionaire Elon Musk is also behind the project:

Join Rupert Lowe in Restore Britain, because he is the only one who will actually do it! https://t.co/sa5VkSRWXD

— Elon Musk (@elonmusk) February 14, 2026

If you spend any time on Musk’s platform, you’ll know Lowe gets boosted six ways from Sunday on there. This, of course, is because Nigel Farage is not extreme enough for Musk, so instead he supports Lowe, Tommy Robinson, and Advance UK:

Advance UK will actually drive change.

Farage is weak sauce who will do nothing. https://t.co/Vnw2uTdRRi

— Elon Musk (@elonmusk) August 26, 2025

I have not met Rupert Lowe, but his statements online that I have read so far make a lot of sense https://t.co/bxHaigf3A1

— Elon Musk (@elonmusk) January 5, 2025

Notoriously, Lowe defended Musk after his site started generating deepfake imagery (what you might call ‘revenge pornography’):

The register of member interests shows that Rupert Lowe earned more than £46K from Twitter last year.

This self appointed champion of protecting women and girls has said precisely fuck all about Musk’s AI creating sexualised images of women & children.

Grifting charlatan. pic.twitter.com/gfrkCTiLL9

— Gyll King Post Skip Diplomacy (@GyllKing) January 9, 2026

Said deepfakes included Child Sexual Abuse Material (CSAM). And Musk spat his dummy out when governments of the world demanded that he turn off the paedophile taps. We thought they should have arrested him, but apparently if you’re the world’s richest man, you can facilitate the creation of CSAM without getting in trouble.

Another one supporting Lowe’s new party is the human migraine Katie Hopkins:

God bless you @elonmusk

I swear you were sent to help save us. https://t.co/ibILta4t9E

— Katie Hopkins (@KTHopkins) February 14, 2026

The less said about Hopkins the better, but she’s definitely someone who’s ‘tainted by the failures of the past‘. We’d say Lowe probably has the sense not to run her as a candidate, but he supported Musk despite all of the above, so who knows?

Carl Benjamin — a.k.a. ‘Sargon of Akkad’ — has also joined Restore.

It’s over before it’s even begun. All we need now is Nick Griffin and Are Tommeh https://t.co/8D1GArKNuo

— Manic Kieth Preachers KC (@wrb91) February 13, 2026

Benjamin got in trouble in 2019 because he couldn’t stop ‘joking’ about raping Jess Phillips. Here’s a picture of the guy covered in milkshake from the time he ran as a UKIP candidate:

Ukipper Carl Benjamin gets the milkshake he so richly deserves🥤 pic.twitter.com/OlOkw9Yf7l

— dave ❄️ 🥕 🧻 (@mrdavemacleod) May 19, 2019

A serious force?

Lowe’s supporters are claiming the party is off to a flying start. Nevertheless, Rupert Lowe has plenty of critics as well.

Over 5.1 million views on X alone within 12 hours of launching.

The reaction has been incredible, I have never seen anything like this in British politics.

So proud and grateful to be part of this really important movement. https://t.co/YxOSZ2wHyv

— Lewis Brackpool (@Lewis_Brackpool) February 14, 2026

While this isn’t hard confirmation, previous polling has shown there’s a potential voter base for Lowe — especially in his own constituency:

🚨NEW: New polling reveals that 9% of the public would vote for a party led by Rupert Lowe

[@FindoutnowUK] pic.twitter.com/36bn1q6cHj

— GB Politics (@GBPolitcs) January 15, 2026

📊 POLL | Voting intention in Great Yarmouth:

⚫️ GYF: 44% (+44)

🔴 LAB: 17% (-15)

➡️ REF: 16% (-19)

🔵 CON: 13% (-12)

🟢 GRN: 5% (+1)

🟠 LD: 5% (+2)GYF = Great Yarmouth First, Rupert Lowe’s party.

Via @FindoutnowUK, 2-4 Dec (+/- vs GE2024) pic.twitter.com/f3YG5G553B

— Stats for Lefties 🍉🏳️⚧️ (@LeftieStats) December 5, 2025

While it’s tempting to think Restore will split the Reform vote, there is another possibility. The spurned Lowe could use Restore as a weapon to damage Reform’s electability, and he could then use that to force Farage out and take control of both parties. This wouldn’t surprise us, as Lowe has already merged with Advance UK — a party formed by Ben Habib — i.e. another of the politicians Farage kicked out of Reform:

🚨BREAKING: Ben Habib has announced that the Advance UK Party will merge with Rupert Lowe’s Restore Britain

Advance UK currently has 40,000 members and dozens of councillors

— GB Politics (@GBPolitcs) February 14, 2026

Reform and Restore could also just enter into an electoral alliance. This shouldn’t be difficult, of course, because they already have the exact same name.

Featured image via Conservatives

Politics

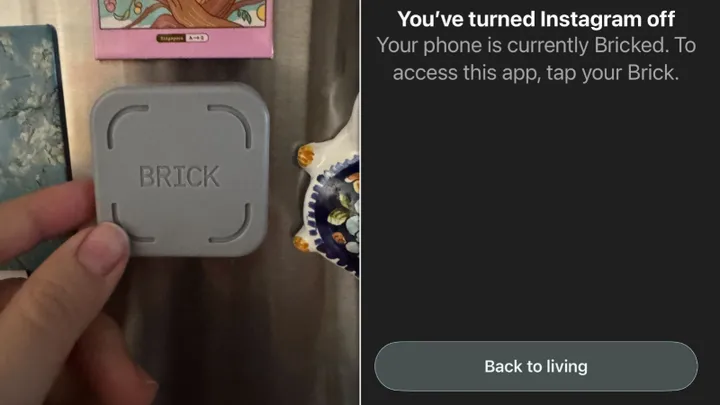

How Brick Helped Me Stop Wasting Time On Social Media

When this year started, I knew I had to make drastic changes… because my phone had taken over my life.

Screen time had skyrocketed. Humour circled around TikTok reactions. I found myself scrolling through waves of news horrors and memes before I was fully awake each day.

Enter the Brick, which has emerged as the go-to app for people looking to reset their relationships with their phones.

“Bricking” your phone has now become a verb for people to share the news that they are logging off and to tell others. I actually learned about “bricking” and “unbricking” myself through the loud declarations of other writers and influencers.

I was skeptical at first about whether an app blocker that costs over $50 could be worth it. But I had tried free ways of deleting social media apps and blocking them from my phone through features like Apple’s Screen Time or Android Digital Wellbeing, and they hadn’t worked because they are easy to bypass.

However, the Brick is a little square device that pairs with an app you download on your phone through a QR code. Once you connect your phone to your Brick, you can select which apps you need to block and for which hours of the day.

Then, the real test begins. You tap the physical Brick device with your phone to activate its app-blocking features – you need to touch the Brick again if you want to regain access to your blocked apps.

I was struck by how hard it was to leave the house for a whole day with a bricked phone. I even delayed using it at first because of this anxiety, which only strengthened my resolve that I probably needed to go through with this experiment.

So, after a day of too much scrolling, I put myself to the test and put my Brick on my fridge. Now, I would have to get up from the couch or get back home from work if I wanted to access that tantalising Reddit post.

I am happy to report that after more than a month of use, my brain feels different. I expected the strict enforcement of a Brick to change me – but even I was surprised by how much it did.

What you should know before you try a Brick

The Brick, available for iOS and Android, lets you set modes for “deep work” and “family time” hours, so bricking automatically happens during the natural rhythm of your day. It also keeps a running tally of how many hours you have been bricked each day, and on average, presumably to encourage you to stay strong and go a little longer without unbricking.

If you forget to use the Brick on your phone in your rush out the door, you can also Brick your device by pressing the Brick icon on the app’s homepage from where you are, but you will still need to go back to where your actual Brick is to unlock what you want to unlock.

What I loved about it

The first week I used it, I was surprised and embarrassed by how often my fingers would automatically tap the social media apps my Brick blocked me from accessing. My Brick bouncer would gently scold me whenever I tried to instinctively check Instagram or TikTok.

The app gives you five “emergency” unbricking workarounds if you really need to access an app you have blocked and you’re not near your Brick device, but I have yet to use one. Needing to use “emergency” unbricking to make an Instagram story about the Galentine’s party I attended really put into perspective what exactly I was doing with my one precious life.

The Brick challenged my belief that real-time social media feedback was necessary to stay connected with my friends or to be good at my job. In my opinion, this forced reflection is the Brick’s best benefit. I’ve missed a few direct messages from my friends, I’m not seeing as many funny TikTok memes anymore, and I’m out of the loop on some social media trends, but I feel more in control of what I am consuming. At the very least, I am paying more attention to how I spend my time on my phone.

What I think could be better — and why I’m sticking with my Brick

The Brick costs around $59 for one device. Though I find this little plastic box to be prohibitively expensive for what it is, I like that more than one person can use the same Brick, so you could theoretically get your roommate or partner to split the costs, too. I also like that once you buy it, you don’t need to pay a subscription fee to keep using it, unlike many other apps.

However, bricking yourself is not going to transform you completely.

Catherine Pearlman, a licensed clinical social worker and author of First Phone: A Child’s Guide to Digital Responsibility, Safety, and Etiquette, said the Brick is “a wonderful device,” but can’t be a long-term solution to endless social media scrolling on its own.

“Once you’re home [where your Brick is], the impulse still exists,” she told me. “So it doesn’t actually teach you how to work through that impulse to say…‘How do I really want to spend my time? How do I work through this emotion that I’m trying to avoid by scrolling?’”

Answering those questions is a bigger journey only you can answer. For Pearlman, it meant finding other ways to use her screen-free time.

“I knew I wasn’t going to stop using my phone, but I wanted to have an alternative,” she said as an example. “And then when the newspapers got too upsetting, I went to Kindle. So now I just read books in my Kindle, and I read eight books in January.”

If you want to get serious about blocking social media not just on your phone but on your computer as well (which your Brick cannot access), Pearlman suggested the free website blocker Cold Turkey.

As for me, I’m continuing to brick myself in the evenings, so that I can learn a new screen-free hobby of crochet. Just this past week, my phone screen time dropped 62% compared to the week before. Making loops of crochet rows with my hands feels more satisfying than the loops of TikToks I watched each night, but I don’t think I would have stuck with my new hobby without the Brick’s admonishments.

I’ve gone from my high of nine hours of daily screen time to a more reasonable five or six hours during a workday. I still have lapses where I will go a night without Bricking, but I feel much calmer when I do. When my head is not cluttered with the pulls of social media notifications and enticing Reels, I have time to figure out what I really want to do. And that’s a gift that I think is worth keeping.

Politics

The Cognitive Impacts Of Menopause Revealed In New Study

While menopause is a stage in every woman’s life, there is still so much we don’t know about the transitional period and the impacts it has on the body beyond the stereotypical symptoms such as hot flashes and mood swings.

In fact, there are 62 possible symptoms of menopause, which range from histamine sensitivities to hair loss and currently, 1 in 7 menopausal women are on Hormone Replacement Therapy (HRT) to mitigate these often debilitating symptoms, according to the pharmacy experts at Chemist 4 U.

Now, Barbara Jacquelyn Sahakian, a Professor of Clinical Neuropsychology, and Christelle Langley, a Postdoctoral Research Associate, Cognitive Neuroscience, both from the University of Cambridge have delved into just how cognitively impactful menopause can be for women and produced an eye-opening study.

The cognitive impacts of menopause

The researchers analysed data from nearly 125,000 women from the UK Biobank (a large database containing genetic and health data from about 500,000 people).

They placed participants into three groups: pre-menopausal, post-menopausal and post-menopausal with HRT. The average age of menopause was around 49 years old. Women who used HRT typically began treatment around the same age.

They found that menopause was associated with poorer sleep, increased mental health problems and even changes within the brain itself.

Writing for The Conversation, the researchers said: “Post-menopausal women were more likely than pre-menopausal women to report symptoms of anxiety and depression. They were also more likely to seek help from a GP or psychiatrist and to be prescribed antidepressants.

“Sleep disturbances were more common after menopause, as well. Post-menopausal women reported higher rates of insomnia, shorter sleep duration and increased fatigue.”

While HRT is the treatment prescribed for more difficult symptoms of menopause, the researchers believe that lifestyle changes could play a crucial role in improving symptoms.

“Our work and that of other research groups shows that a number of lifestyle habits can improve brain health, cognition and wellbeing, thereby reducing the risk of cognitive decline associated with ageing and dementia.

“This includes regular exercise, engaging in cognitively challenging activities (such as learning a new language or playing chess), having a nutritious and balanced diet, getting the right amount of good-quality sleep and having strong social connections.”

If you are struggling with menopause symptoms, speak to your GP.

Politics

The Church of England’s woke crusade is driving away the faithful

Who remembers Beilby Porteus? He doesn’t quite win the competition for Church of England cleric with the silliest name in history – the reverend Nutcombe Nutcombe, 19th-century chancellor of Exeter Cathedral, easily walks away with that prize. But Porteus was certainly one of the Church of England’s most outstanding campaigners for the abolition of slavery and, what we might call today, racial justice.

From the pulpit of St Mary-Le-Bow in 1783, he gave a seminal sermon. It condemned the inhumane treatment of slaves in the Caribbean, and in particular those on the Codrington Plantations – then owned by the Society for the Propagation of the Gospel in Foreign Parts, a Church of England body. Despite this fulminating critique of his own church, in 1787, Porteus was appointed as Bishop of London and thus also to the House of Lords, a position he used tirelessly to support William Wilberforce’s campaign to extirpate the slave trade. He was also committed to improving the lot of the poor, and making sure that as many people around the world had access to the Bible in their own languages.

Unfortunately, it seems that the Diocese of London has forgotten what it itself did to fight slavery. It is now engaged in a ‘Racial Justice Priority’ project. Clergy will be encouraged to promote ‘anti-racism in sermons’ in order to correct what the diocese claims is its own ‘systemic racism’. The project will also engage in ‘truth-telling’ to challenge the ‘historical heritage of slavery’, which, the Church of England seems to believe, haunts its every move. The cost of this project is £730,000 over three years, funded by the Church Commissioners – whose money, it is worth pointing out, was originally laid down for the support of poor clergy and cathedrals.

Who could possibly object to the Diocese of London acting against racism? It would be following not only in the footsteps of Porteus, but also the prompting of scripture itself, which reminds us that: ‘There is neither Jew nor Greek… for ye are all one in Christ Jesus.’ The problem is that such anti-racism initiatives are more apt to exacerbate racial division than to heal it, and to lead far beyond the bounds of what may be sanctioned by theology and scripture into the world of partisan political dogma.

Very far, in some cases. The racial-justice plan includes targets for percentages of ethnic-minoirty membership among clergy, administrative staff and even churchgoers. It also proposes ‘unconscious bias training’ for volunteers – something many of them will almost certainly view as the final straw after hours of safeguarding training and the day-to-day challenges of fundraising.

Perhaps more damaging than all of this is the ideological crusade inherent in the project. The previous Archbishop of Canterbury, Justin Welby, regularly insisted that the Church of England was ‘institutionally racist’. Nearly all of the evidence in support of this claim amounted to a reluctance of ethnic minorities to follow the norms of Anglicanism – something Welby chalked down to the ‘racism’ of the Church of England and its members. So it has drawn from scripture to justify an approach which effectively calls for the historic culture of the majority to adapt itself to the new minorities, rather than for minorities to assimilate.

This approach to scripture – based primarily on the most famous biblical lessons of loving one’s neighbour, the Good Samaritan and St Paul’s statement of there being neither Jew nor Greek – informs not only this Racial Justice Project within the Diocese of London, but also the approach of the Church of England at a higher level. It is from this that there is a general insistence on the good of open borders, a deep reluctance to speak out about any reasonable concerns people might have about wide-scale migration – even when its impact on the most vulnerable in society has been, as in the case of the rape gangs, at the deepest level of seriousness.

One of the practical impacts of this likely to be seen in London churches will be physical. An innocuous paragraph in the Racial Justice Strategy calls for ‘partnerships that can assist the Diocese of London in reviewing the legacy of statues and monuments exploring historical links and their relevance in today’s culture’. This refers to a desire expressed in the Church of England’s wider racial-justice reports for a move from ‘retaining and explaining’ monuments to a presumption that they should be removed if they have connections to slavery, despite any heritage or educational value they might have.

Another is in the idea of ‘truth telling’ to highlight ‘the historic injustices and the role played by the wider church’. The problem is that nowhere in the literature can one find calls to celebrate the courageous and world-leading actions of Porteus and his many Anglican colleagues to end the slave trade and help the disadvantaged. Everything is pointed towards calling for the majority in the church to lament their wickedness, but to forget anything good they might have done. This one-sided approach is hardly just or ‘truth telling’.

Congregations will be alienated by this injustice, but also they will know that this approach is not properly based on scripture. Christ calls for one to love the neighbour and the stranger, but the Bible, both in Old and New Testament, calls for the stranger and guest to be respectful to their hosts and society, respecting their customs and laws. One is hard-pressed to find, either in the CofE’s racial-justice documents, or in its public pronouncements, this huge part of scriptural guidance repeated. This absence is an unfortunate sign that the racial-justice agenda is driven more by politics than theology.

One injunction of scripture is ‘let us now praise famous men’. Perhaps if the Diocese of London spent more time honouring the legacies and examples of those like Porteus, rather than flagellating itself for imagined sins, they would be more likely to inspire its congregations to practical work against real racism and oppression, rather than driving them away in despair.

Bijan Omrani is the author of God is an Englishman: Christianity and the Creation of England.

Politics

Irish calls to boycott Israel in UEFA Nations League

Activists and politicians are urging the Football Association of Ireland (FAI) to boycott upcoming Nations League fixtures against the illegitimate settler-colony ‘Israel’. In a remarkable twist of fate, the Republic of Ireland has ended up in the same group as the land thieves for the 2026-2027 UEFA Nations League. This means Europe’s most pro-Palestine nation will potentially face-off against the world’s most anti-Palestine band of genocidal thugs.

Kosovo and Austria are the other teams in the group. Ireland are due to play Israel in September and October 2026.

However, the likes of the Ireland Palestine Solidarity Campaign (IPSC) have demanded things don’t even get that far. The pro-Palestine campaign group said:

The apartheid state should have been expelled from UEFA for its crimes against Palestinians, long before its genocidal war on Gaza. We demand that the FAI refuse to play these fixtures. We need a national sporting body to stand up and call the bluff of the governing organisations. Boycott apartheid Israel all day, every day until freedom for Palestine.

Boycott is the essential tool to prevent Zionist sportwashing

Unlike in the case of Russia, UEFA and FIFA — the administrative bodies for football in Europe and worldwide respectively — have pissed about endlessly when it comes to getting rid of the genocidaires squatting illegally on historic Palestine. They banned Russia almost immediately after Putin’s invasion of Ukraine. Yet nearly two and a half years into the world’s first live-streamed genocide, perpetrated by the Netanyahu regime, they have dodged removing ‘Israel’.

Richard Boyd Barrett of People Before Profit (PBP) also called for refusing to play the fixtures:

The Government should stop trying to normalise the Israeli regime. Israel is not a normal state, it is a regime based entirely on ethnic cleansing, apartheid and barbaric genocide of Palestinians. Like apartheid South Africa, boycott can help dismantle this cruel regime.

Sporting and cultural boycotts were indeed crucial to ostracising that racist regime. The likes of Eurovision and the Nations League are crucial to maintaining the Zionist charade of straddling two continents. ‘Israel’ is Schrödinger‘s Colony, existing in two (terror) states simultaneously: both a ‘nice, normal white European country’ just like us, as it supposedly shows by competing in the above contests. Yet we are asked to believe its inhabitants are indigenous to the land they’ve been stealing for the past 100 years, despite largely arriving from overseas to steal the territory from its rightful owners — the Palestinians.

Boyd Barrett was referring to comments from the pathetic Micheál Martin. The treacherous Taoiseach once again showed his fealty to Ireland’s masters by declaring:

It [the matches against ‘Israel’] should go ahead, and I think the FAI has taken the correct decision to fulfil the fixture.

RTE say Martin has said there is “no official boycott of Israel in Ireland”. The question is why, especially when the Palestinian-led Boycott, Divestment and Sanctions (BDS) movement is calling for it. There is no prospect of the Zionist entity changing of its own accord. It can only be shifted by external pressure and that means boycott — wreck its economy, and cut all ties with it culturally and in the sporting realm.

Others must join Ireland to force UEFA’s hand

Previous calls by activists to boycott athletic contests with the terrorist pseudo-state have been unsuccessful. Some members of the Irish women’s basketball team refused to travel for a fixture in Riga against the Zionist entity. Irish players then refused to shake hands with the land thieves on the other side. The match ultimately went ahead, however.

The FAI did pass a vote in November 2025 calling for the illegal settler-colony to be banned from international football. However, it seems the heads of Irish football are less keen when it actually comes to putting this into practice themselves. The FAI is adamant that the Nations League games will go ahead. They say they have consulted with UEFA, who are threatening disqualification if Ireland refuse to play.

The means of solving this problem is much like that faced by workers at their place of employment. If only one threatens to rebel, it’s trivial for the employer to say “fine, piss off — I’ll have no trouble replacing just you”. The task for the boss becomes much harder if everyone gets in a union and threatens to walk out.

That’s what’s needed here — with sufficient pressure from local activists in a country where the vast majority of people will oppose playing ‘Israel’, Ireland can provide the credible threat of withdrawal.

The trick will be working with other nations to get them to join this threat, forming a united front that the craven bosses at UEFA can’t ignore. If successful, it could be the beginning of the end for the Zionist fake-state’s continued sport-washing of its disgusting atrocities.

Featured image via the Canary

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World13 hours ago

Crypto World13 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?