Entertainment

LeBron James’ Wife Gets Real About Her ‘Love’ For Strip Clubs

There is no shame in Savannah James‘ game. During a recent episode of her “Everybody’s Crazy” podcast, Savannah, wife of NBA star LeBron James, opened up about her experiences with strip clubs, admitting she has a deep affinity for them.

This wouldn’t be the first time that someone from the famous James family has been candid with the public about their behind-the-scenes persona. In a 2025 episode, LeBron spoke openly with Savannah and others about their relationship and his fears about ending up single.

Article continues below advertisement

Savannah James Details Her ‘Love’ Of Strip Clubs

Speaking with her co-host, April McDaniel, Savannah opened up about how the strip club became one of her “favorite” pastimes.

“I love the strip club,” the mother of three said, calling it “one of my favorite” things to do to relax and separate from some of life’s biggest moments.

The conversation continued, with Savannah calling out some of her favorite establishments in Atlanta, Georgia, and Houston, Texas.

Article continues below advertisement

Social Media Reacts To Savannah James Speaking Freely About Strip Clubs

A clip of Savannah’s confession was shared on X, formerly Twitter, and garnered a range of responses from social media users who found the podcaster’s admission to be out of line.

“Women want to stand toe to toe with [men] so bad,” a user wrote. “They actually think this is normal.”

American sports columnist Jason Whitlock also commented, “Has a daughter,” which seemed to express his disapproval of Savannah’s leisure activities as well.

Other users, however, defended Savannah, with one writing, “So what if she has a daughter. Since she loves the strip club it’s gonna be bad on her daughter?”

Another wrote, “Wtf wrong [with] liking the strip club?? Y’all folks get lamer everyday!!”

Article continues below advertisement

LeBron Shares Interesting Message About Relationships Online After Savannah’s Confession

It’s unclear whether Savannah has ever visited a strip club with her superstar husband, but LeBron has been extremely candid in the past about navigating challenging times in his marriage.

Days after Savannah’s podcast episode aired, the Los Angeles Lakers star shared a message on his Instagram Stories about relationships.

“Behind every happy couple is the reality that a relationship isn’t 50/50,” the post read. “Some days, one person is struggling-whether it’s stress, grief, or exhaustion, and the other has to step up and hold steady. Happy couples don’t keep score.”

Article continues below advertisement

In 2025, LeBron spoke with media personality Speedy Morman on his “360” show about his marriage, according to an earlier report from The Blast. During their conversation, LeBron addressed the belief that his relationship with Savannah is “picture perfect,” denying the claims almost instantly.

“It’s not, man,” he said. “I’m gonna be honest. A relationship is never picture perfect.”

Article continues below advertisement

LeBron Talks Fighting Through Difficult Moments

As the conversation continued, LeBron, who has been with Savannah since the early 2000s, admitted that he has navigated difficult moments with his wife. For him, though, fighting for their union makes all of the hiccups worth it.

“… if you’re OK with working through the hardships and the adverse moments, then it will make it all worth it, man,” he said. “We’ve been together since high school, so sh-t ain’t always going to be a bed of roses, man — in any relationship, let alone someone you’ve been living with for 20 years.”

“I know I don’t want to be alone, that’s for d-mn sure,” LeBron said. “If I have to fight, crawl, scratch, bite, whatever to keep mine. I got to keep it. I gotta do what I gotta do. I don’t want to be alone. I’m [from] an only child, single-parent household.”

Article continues below advertisement

What’s The Secret Behind LeBron And Savannah’s Thriving Marriage?

Savannah has also admitted that things with LeBron haven’t always been a walk in the park.

According to The Blast, the socialite has acknowledged the “ebbs and flows” that come with being someone’s lifelong partner. However, those ups and downs have helped her become a better spouse by learning to “give grace.”

“You never know what people — or your significant other, for that matter — are going through. I appreciate that same sentiment,” she said. “You can’t depend on someone else for your happiness. You have to be happy.”

Entertainment

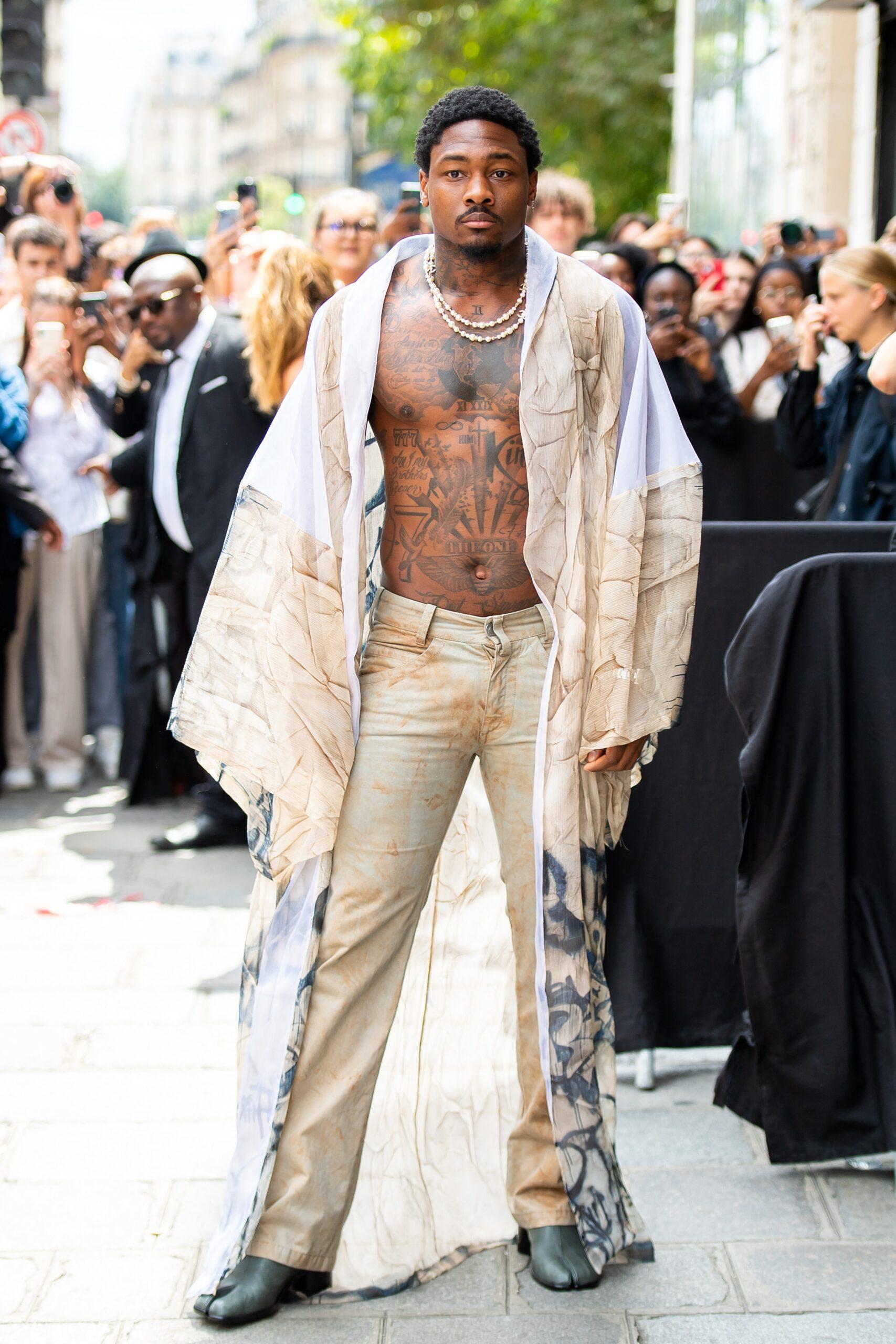

Jaden Smith abruptly walks off mid-interview after reporter mentions Ye

:max_bytes(150000):strip_icc():format(jpeg)/Jaden-Smith-Academy-Museum-Gala-021426-99feaf4bbd1d42a78d87cb5b3854832d.jpg)

The “Karate Kid” star has a complicated history with the artist formerly known as Kanye West.

Entertainment

Stefon Diggs Enters Not Guilty Plea In Chef Assault Case

On the heels of his Super Bowl 60 loss to the Seattle Seahawks, Diggs officially entered a plea in the case that could have him facing serious jail time if convicted.

Article continues below advertisement

Stefon Diggs Pleads Not Guilty On Assault Charges In Chef Incident

On Friday, February 13, Stefon Diggs appeared in Dedham District Court in Massachusetts for his arraignment on assault charges about an incident involving his former live-chef, according to TMZ.

Accompanied by his legal team, including attorney Mitchell Schuster, Diggs entered a not guilty plea to the December 2025 charges.

“We’re confident that after the facts and evidence are reviewed in this case, he will be completely exonerated,” Schuster told the media waiting outside the court.

Article continues below advertisement

Diggs Is Facing Felony And Assault Charges Over The Incident

His arraignment, initially set for January 23, was pushed back to accommodate the Super Bowl and was ultimately moved to February 13.

Per TMZ, the victim said via the incident report that she initially contacted authorities on December 16, 2025, noting that the alleged assault occurred just days prior on December 2.

In a detailed account, the victim explained that she was inside her bedroom in Diggs’ home with the door unlocked when the NFL star came inside to discuss the ongoing text messages sent between them due to a dispute over payment she said she had not received.

Article continues below advertisement

She continued, noting that Diggs became increasingly angry during the conversation before he allegedly slapped her in the face.

As she attempted to push Diggs away after being slapped, he allegedly “tried to choke her using the crook of his elbow around her neck.” The victim also said that Diggs then positioned himself behind her with his arm wrapped around her neck, which made it difficult to breathe.

At this point in the altercation, the victim said she thought she would black out, but when she tried to pull away, Diggs tightened his grip.

Towards the end of the incident, the victim alleged that Diggs threw her on the bed and said, “Thought so,” before exiting the bedroom.

Article continues below advertisement

Cardi B Previously Defended Him Against The Allegations Before Their Rumored Split

Cardi B and Stefon Diggs have likely broken up, after a tense Super Bowl weekend that ended with both of them unfollowing each other on Instagram.

However, weeks before, the Grammy winner defended the father of her infant son against the claims that he assaulted his former chef, and she also shut down claims that she told the victim to keep quiet about it.

Per Billboard, Cardi took to social media and posted an alleged text exchange between herself and the victim to prove that she was not involved, but she quickly deleted it.

Article continues below advertisement

“Not once has that woman said anything to me about being touched.. NOT ONCE!! Mind you, we were talking every single day until she left that house, and she JUST wrote me this,” she explained, after the woman also alleged that Cardi knew about what happened, but did not help her.

“But I’m gonna let the courts handle this sh-t and when it gets handled I want all yall talking sh-t on your f-cking knees with apologies just as loud as the way yall been harrassing over a lie.. and I put that on my two-month-old son in the name of the lord!! That’s how confident I am,” Cardi added.

Diggs Found Himself In Additional Legal Trouble Days Before The Super Bowl

On February 5, Stefon Diggs was mentioned in a lawsuit from a man who has alleged that the football star blamed him for a stolen Ferrari that was supposed to be transported from Miami to New York and then to its final destination in Houston, according to TMZ.

The luxury vehicle was stolen when it arrived in Houston, and an investigation “confirmed it was stolen by third parties in a sophisticated theft,” per the outlet.

The man alleges via the lawsuit that Diggs told those close to him that he was responsible for stealing the car despite never being arrested or charged regarding the theft.

He is suing Diggs for “shortage of patronage for his concierge and consulting business,” which he said he has suffered due to Diggs’ allegations.

Article continues below advertisement

Mounting Legal Issues Have Been Persistent For The Football Star

Diggs fired back and filed a libel lawsuit against Griffith, denying the allegations and stating they were fabricated in an attempt to air out personal grievances.

In early 2025, the Patriots star was sued by a former girlfriend, who alleged he physically assaulted her in a 2024 altercation, claims that he also denied.

Entertainment

Ari Fletcher Flexes Luxe Valentine’s Day Gift From Moneybagg Yo

Roomies… looks like Moneybagg Yo isn’t playing this Valentine’s Day. The rapper went all out for Ari Fletcher, gifting her a six-figure gift, and Ari made sure the timeline got every single angle. And you already know, Roomies… folks are in their feelings over this major Valentine’s Day flex.

RELATED: No Hard Feelings? Gabrielle “Gigi” Alayah Reposts Message About Having No Regrets After Kai Cenat Addresses Their Split

Ari Fletcher Shows Off Her Valentine’s Day Rolls Royce Flex

In a series of photos and videos posted to Ari’s social media, she’s seen standing in front of the luxury ride with a massive red bow on top and a sticker that says “SOLD.” She’s also holding a sign that reads, “SPECIAL DELIVERY EXCLUSIVELY FOR… Ms. Ari Fletcher,” serving all the bougie vibes. According to reports, the all-white Rolls Royce truck reportedly cost around to $500K, making this Valentine’s Day flex extra extravagant.

Ari’s look? An all-black matching fit that hugged every curve, a curly half-up, half-down hairstyle, flawless makeup, black sandals, and what appears to be a black Birkin bag — clearly out here living her best Valentine’s Day life. She also included the caption, “Thank you daddy ❤️,” and yes, Roomies… we know that wasn’t from her dad.

The Comment Section Is Clearly In Their Feelings

Fans ran straight to Ari’s Instagram comment section and laid their thoughts all the way down. Many were hyping her up, saying big mama is finally getting the love she deserves, while a few kept it simple with heart emojis. And you already know… some Roomies were hitting her with the “Ari, not today” energy, hinting at their own V-Day vibes, while a few tried to be slick and drop a casual “you’re welcome,” clearly pretending they were the ones who bought the truck.

One Instagram user @realstarrgyal said, “Them : 0 Ari: 100“

This Instagram user @badgyalshanshan added, “Come on 😍😍😍 you deserve it all honey 🍯”

And, Instagram user @trelittt shared, “You did say you wanted a new one 😍😍😍”

Meanwhile, Instagram user @badgirljanelle wrote, “He love him some YOUUUUU 😍😍😍 👏👏👏👏 We love to see it ❤️”

While Instagram user @bitchimfattrell said, “You’re welcome boo 🔥😘”

Finally, Instagram user @nejaweja commented, “Ari please not rn😭💔”

Just So You Know… Ari & Bagg Are Still Good

In case you were wondering, Ari Fletcher and Moneybagg Yo seem to still be going strong. The internet went wild after Ari posted a video showing her cruising with Bagg, all smiles as he drove. At one point, Moneybagg rapped along to the song playing, and Ari jumped in on the verse too, clearly having a blast together. Decked out in matching all-black fits and icy jewelry, the duo looked like a couple living their best life on a mini date night. The clips dropped right in the middle of the Lil Baby rumors, but Ari and Bagg are clearly unfazed, showing off their chemistry and proving they’re locked in, unbothered, and thriving together.

RELATED: Still Goin’ Strong?! Ari Fletcher Gives Peek Into Nightcap Vibes With Moneybagg Yo Following Rumors About Her & Lil Baby (VIDEO)

What Do You Think Roomies?

Entertainment

Lisa Rinna Teases Feud With Colton Underwood During ‘Traitors’ Reunion

Eagle-eyed social media sleuths couldn’t help but notice Underwood’s unfollowing Rinna on Instagram after filming on the reunion wrapped.

In a video shared online, Lisa Rinna teased an intense showdown with Colton Underwood, then referenced their biggest feud from earlier in the season.

Article continues below advertisement

Colton Underwood Appears To Have Unfollowed Lisa Rinna After ‘The Traitors’ Reunion

An X user flagged Underwood’s decision to unfollow Rinna just one day after the season 4 cast wrapped the “Traitors” reunion. “Omg mother Rinna clearly chewed his a** [at] the reunion!!! YAAAAS!!” the user captioned a screenshot of Underwood’s Instagram following list, proving Rinna’s account is no longer listed.

Rinna and Underwood bumped heads earlier in the season after Underwood correctly identified Rinna as one of the show’s titular characters. Rinna shared on camera that she found Underwood’s gameplay annoying because he kept telling others there was another side of Rinna that hadn’t been shown.

Article continues below advertisement

Lisa Rinna And Colton Underwood’s Feud Started Before The Reunion

While Rinna and Underwood’s feud on the show concluded after Rinna was eliminated, it continued off-camera and on social media, according to The Blast.

Weeks ago, another social media account captured a comment Rinna left on someone’s post: “Let’s talk about you being a stalker…” The comment was referring to Underwood’s ex-girlfriend’s claims that the former “Bachelor” star tracked her car and sent her harassing text messages.

Article continues below advertisement

Lisa Rinna Cleared The Air With Colton Underwood… But Things Have Clearly Changed

Rinna’s remark about Underwood’s past went viral, prompting the former “Real Housewives of Beverly Hills” star to clarify her stance on the father of one.

In her January 2026 video, Rinna said that despite her comment, she and Underwood were in a “great” place and that she enjoyed working with him on the show. “He was a great and is a great nemesis for me on the show in the game,” Rinna explained.

She then attempted to clarify why she made the initial comment about Underwood being an alleged stalker.

“Now, as you know, if you ask me to be a Housewife I’ll bring it to you, right? That’s what I was doing, all in the name of the game. But just so you know, I am totally great with Colton. I have been texting with him. We talk. Everything is great,” she said.

Article continues below advertisement

But how great can things really be? In an ominous TikTok, Rinna told her followers that “everything was taken care of” at the reunion.

Article continues below advertisement

Rinna Shares More About What Went Down At ‘The Traitors’ Reunion

Rinna further noted that she remained uncertain whether viewers would see the entirety of their fiery exchange, but assured followers that what “needed to be done was done.” She finished, “‘Cause you know, if you want a Housewife, I’ll give you a Housewife … honey.”

Rinna’s statements have sent some “Traitors” fans into a frenzy, praising her for going head-to-head with Underwood in front of the world.

“He thought he was going to see that side of Lisa. Ask and you shall receive,” someone wrote. “Go Lisa! Can’t wait for the rest of the reunion.”

Underwood Faced Backlash Over His Role On The Show

Although Underwood advanced deep into the competition, his run on “The Traitors” has been marked by controversy throughout.

In addition to his spat with Rinna, Underwood also went back-and-forth with Michael Rapaport, who fans branded “homophobic” following a questionable comment he made to Underwood during an earlier episode of the series.

According to The Blast, things have only gotten worse for Underwood, who shared in a recent interview that some watchers crossed a “few lines” and sent him threatening messages.

“… somebody told me to stick a gun up my a** and pull the trigger and called me the F word in it,” he said. “That’s crossing the line.”

Underwood also spoke about his relationship with Rinna pre-reunion, admitting he had a lot of “love” for the “Days of Our Lives” alum.

Article continues below advertisement

“I love Lisa, and I think it was such an honor to go against her. I know she said this too, we were perfect nemeses for each other,” he said. “… we’re there to entertain, and we get it; we’re gonna play heightened versions of ourselves. She said it, “You want a Housewife, I’ll give you a Housewife.” So I’m like, “Thank you! Let’s do this.”

Entertainment

“Love Boat” actor was warned not to talk to guest star Gene Kelly — here's what happened when he did

:max_bytes(150000):strip_icc():format(jpeg)/Gene-Kelly-1978-Ted-Lange-26th-Annual-NAACP-Theatre-Awards-2016-021026-5f0e9267d4984852a978d4aacd5687f9.jpg)

Ted Lange opens up about his surprising first encounter with Kelly when they filmed a 1984 episode of the beloved comedy series together.

Entertainment

Emmy Puts Her On Notice About G Herbo’s Gift

When it comes to Valentine’s Day surprises, sometimes the sweetest moments don’t come with a price tag. Apparently, they come with tiny voices and big opinions! And this time, it was Taina Williams and her baby girl Emmy giving the internet all the feels with a clip that had the timeline smiling from ear to ear.

RELATED: Oop! Emmy Shares How She REALLY Feels About Taina Williams & G Herbo’s Engagement (WATCH)

Emmy Claimed Her Valentine’s Day Spot Real Quick

In a video shared by Live Bitez, Emmy can be heard confidently telling her mom that the Valentine’s Day flowers from G Herbo were actually for both of them. As Taina questions her — “What are you doing… those are yours? Who bought you those?” — Emmy sweetly responds that “Daddy” got the bouquet for the two of them. In another clip, Taina showed handmade Valentine’s cards placed neatly on hers and Herbo’s pillows, seemingly crafted by Emmy. One of the adorable creations even featured openable hands that read “love you,” making it clear that Emmy understood the assignment when it came to spreading the love.

One Instagram user @ mzangelbaby said, “😂😂 Too cute 🥰! For both of us!! She’s definitely included 😂”

This Instagram user @kallion26_ added, “Man she look just like her daddy. 😂😍 crazy how genetics work.“

And, Instagram user @lakaysharedd commented, “Emmy said we both his Valentine’s 😂😂😂”

Meanwhile, Instagram user @leeee__saint_laurant wrote, “Too sweet 😍😍😍”

While Instagram user @keba.cas said, “god bless her beautiful personality“

Finally, Instagram user @crownedblvckqueen added, “She’s too cute😍”

Jealous… But Still Team Mommy & Daddy

What Do You Think Roomies?

Entertainment

5 Sexiest Movie Couples of All Time: From Neo and Trinity to Jack and Rose

Real-life love can’t ever be like the movies, but that’s what makes it so much fun to live vicariously through movie characters.

In the spirit of Valentine’s Day, we’re thinking about our favorite movie couples. But not just any movie couples: sexy movie couples. The ones whose chemistry makes you positively soon.

Watch With Us combed through all of movie history, and we picked out what we believe are five of the sexiest movie couples of all time.

From the black-and-white world of Casablanca to the sci-fi dystopia of The Matrix, these couples make us go crazy.

Neo and Trinity — ‘The Matrix’ Movies

Keanu Reeves and Carrie-Anne Moss in The Matrix Resurrections Warner Bros./Everett

Neo (Keanu Reeves) and Trinity (Carrie-Anne Moss) don’t actually have sex until the second Matrix movie, during which their lovemaking is juxtaposed against an infamous orgy sequence. But the two manage to make things feel hot and bothered while barely touching each other in the first of the Matrix trilogy — and when they finally do kiss, sparks literally fly.

It’s a combination of how objectively hot Reeves and Moss are, sure, but it’s also how passionate and pure their love is for each other, and how over the course of the franchise that undying devotion somehow endures in that crazy world. By The Matrix Resurrections, we understand they are fated to each other, they would die for each other, and it’s a beautiful thing.

Chiron and Kevin — ‘Moonlight’ (2016)

Though Chiron (Trevante Rhodes) and Kevin (André Holland) never actually become a couple, their lasting, aching connection makes their dynamic both powerful and heartrending. Moonlight follows Chiron from childhood to adulthood through three pivotal moments in his life, in which he comes to understand his identity as a gay man.

As a teenager, he had a sexual encounter with Kevin that they never explored further or spoke of until years later. As adults, they reconnect, now living two very different lives but forever touched by what the other one meant to them. The truth and tragedy of unrealized passion is sometimes more beautiful and more intimate than visualized intimacy.

Jack and Rose — ‘Titanic’ (1997)

Jack Dawson (Leonardo DiCaprio) and Rose Dewitt Bukater (Kate Winslet) may seem like the epitome of cringeworthy blockbuster melodrama, but if you just take three hours out of your day to actually watch Titanic, you’ll realize that “Paint me like one of your French girls” isn’t even really the sexiest moment between them.

The culmination of their patiently constructed romance is a deliriously erotic (if brief) scene in which Jack takes Rose in the back of a car in the ship’s cargo hold, whose windows fog up from how passionate and intense their lovemaking is. But that scene wouldn’t be what it is without the scintillating, slow-burn lead-up to their consummation — a culminating release felt by both the characters and the audience.

Elizabeth and Will — The ‘Pirates of the Caribbean’ Franchise

It’s crazy to think that one of the sexiest movie couples ever came from a Disney movie, but the Mouse House doesn’t really make movies like Pirates of the Caribbean anymore, either. At the time, Keira Knightley and Orlando Bloom were considered two of the hottest young actors in Hollywood, and putting them together for a romance anchored by emotional longing and a mutual transformation made for scintillating movie magic.

Will Turner is a blacksmith haunted by his father’s pirate ways, while Elizabeth is a governor’s daughter yearning to break free and harboring a lifelong fascination with pirates. In the end, Will basically becomes a pirate for her, and the two head off to have sexy little adventures together.

Rick and Ilsa — ‘Casablanca’ (1942)

“We’ll always have Paris” is one of the most emotionally ruinous lines of all time, from one of the classic movie couples that would never be. Humphrey Bogart once lit up screens with his weirdly sexy charm, and Ingrid Bergman was the woman everyone wanted (and wanted to be). Rick (Bogart) and Ilsa (Bergman) had a love affair that predated the events of Casablanca, but Ilsa reemerges in Rick’s life when she desperately needs his help.

Reconnecting, Rick and Ilsa find themselves not quite finished with one another, their love having never quite flamed out. But the fact that they can never really be together only makes their doomed affair more ardent, especially because Rick sacrifices their love for a greater cause. “Here’s looking at you, kid.” Cue swooning.

Entertainment

Starfleet Academy Stops Playing Around With Standout Episode Perfect For Actual Trekkies

By Chris Snellgrove

| Published

Starfleet Academy has proven divisive to fans in large part because it is a strange brew: great actors and top-notch special effects mixed with weird characterization and writing straight out of an early aughts boner comedy. Defenders of the show have maintained that everyone just needs to give the series more time to find its space legs, and the latest episode may have effectively proved them right. “Come, Let’s Away” drops the awkward, forced humor of earlier episodes to deliver a tale full of action, romance, and higher stakes than Starfleet Academy has ever had before.

Part of what makes this particular Starfleet Academy episode so effective is the misdirection baked directly into its plot. “Come, Let’s Away” starts out with scenes of our characters hooking up, and it wisely leverages the solid chemistry between Caleb and Tarima before jumping into the main plot: a joint training exercise where Academy and War College cadets must restart a derelict starship. But when those cadets are kidnapped by killer cannibals, Chancellor Ake must turn to her old nemesis, Nus Braka, for help in saving her students’ lives.

Somehow, Star Trek Returned

For Star Trek fans wanting Starfleet Academy to be more like the Golden Age of Star Trek, this is the episode you’ve been waiting for. First of all, it employs tropes and story beats very familiar to The Next Generation: for example, the cadets having to restart an old starship feels a lot like Riker having to get the USS Hathaway working for war games in “Peak Performance.” Speaking of Number One, “Come, Let’s Away” leans into Caleb and Tarima being the new Riker/Troi by giving them an Imzadi-esque mind link and having their shared romantic connection be a major key to resolving this plot.

While some Star Trek fans have enjoyed the show’s often lowbrow humor, I felt that this Starfleet Academy episode was much stronger for ditching the jokes and giving us an episode that plays out like a tense action thriller. From the moment they are captured, it is clear that our heroes are in mortal danger from bad guys (the Furies) who simply don’t play around. This is made abundantly clear when they partially eat a charismatic War College instructor (!) and then shoot his body out of the airlock to send a message to Starfleet.

The New Big Bad Is Finally Scary

The Furies are so dangerous that Chancellor Ake, at the urging of Admiral Vance, requests the help of Nus Braka, a notorious space pirate who has dealt with these foes before. This is definitely a stronger performance from Paul Giamatti than we saw in the first Starfleet Academy episode, and it helps that he is written much better. While his dialogue still has a few rough edges (like when he describes himself as “wanked” and “spanked”), he mostly comes off as genuinely dangerous, and his weirdly intimate interactions with Ake make him seem less like a Scooby-Doo villain and more like a flamboyant Hannibal Lecter.

Nus Braka is actually the personification of this episode’s greatest strengths: that it’s not afraid to raise the stakes by putting likable characters in mortal danger. In addition to offing the fun new War College instructor (and beware some major spoilers from here on out), they also kill B’avi, arguably the most likable of the War College cadets. Thanks to Nus Braka completely outwitting the Federation, his buddies were able to destroy a Starfleet vessel and ransack a starbase, giving this episode a shockingly high body count.

By Their Powers Combined

“Come, Let’s Away” is a far cry from the more carefree adventures of Starfleet Academy, but the grim subject matter also lends the show something it has desperately needed: some narrative weight. Previously, the show’s constant need to undercut tension robbed various episodes of their power, like filling the big, emotional Sisko episode with jokes about flatulence and genitalia. Also, it was tough to take SAM (a fairly solid character in her own right) very seriously in that Sisko episode because she spent most of her time onscreen talking and acting like a deranged TikTok skit come to life.

But SAM really shines in “Come, Let’s Away,” utilizing her powers in a logical way to restore power to a derelict vessel. Tarima uses her powers in a similarly logical way, and once she fully unleashes her abilities to pop some dude’s heads (Scanners-style!), we see how dangerous a Betazed warrior can be. Caleb also shines, both as Tarima’s partner in telepathic crime and as someone more resourceful than the average member of either the Academy or the War College.

The Ensemble Cast Finally Shines

While the plot involved sidelining some of the main characters (Darem and the Doctor mostly do little more than twiddle their thumbs), this episode of Starfleet Academy did a great job of highlighting most of the ensemble cast. The youngsters got to finally stop being quippy cadets and put their training to use in a life-and-death situation, and they all brought unique strengths to the table while working as a team. In this way, this is probably the most traditional Star Trek episode we have seen so far, and to my surprise, it really left me wanting more.

From the beginning, I have been one of Starfleet Academy’s harshest critics, but it’s not because I want the show to fail; the cast is talented, the SFX are beautiful, and the writers (especially Tawny Newsome) are passionate about the franchise. However, episodes are frequently hampered by bad comedy and low-stakes, teenage drama. To make matters worse, the show occasionally makes huge changes to the lore (like making most Klingons extinct in an offscreen event) that inevitably upset old-school Star Trek fans.

However, “Come, Let’s Away” ditches both the forced comedy and the teen drama, and we get to see these young characters deal with the most Star Trek situation of them all: an Away Team mission that goes catastrophically wrong. The characters are competent, the stakes are high, and the new villains are generally loathsome, adding to the show’s own lure rather than (ahem) cannibalizing older lore. Speaking of loathsome, Giamatti’s Nus Braka establishes himself as the guy you love to hate, and the combination of his master manipulation and his casual cruelty has made this former joke of a character as chilling as Gul Dukat ever was.

Is The New Star Trek Series Finally Worth Watching?

Only time will tell if Starfleet Academy can keep up the breathtaking momentum of this episode: Vance promises that capturing Braka is now Starfleet’s highest priority, and I can only imagine Chancellor Ake (who was uncharacteristically subdued for most of this episode) is itching for payback. This (plus Tarima being in critical condition) certainly implies that the rest of the season will be relatively serious, which is a relief to fans like me who have hated the hokey humor. Of course, the show has been wildly uneven from the beginning, so we may very well be back to goofy shenanigans in the very next episode.

Optimistically, though, I want to believe that Starfleet Academy writers have successfully pulled the rug on our expectations, pivoting the show from a goofy YA comedy fest to something more in line with the golden age of Star Trek. This would be a great way to thread the needle of appealing to older and younger fans, and it would even match the general arc of most YA stories (which inevitably pit their young protagonists against serious, seemingly unstoppable foes). If (and it’s admittedly a big if) that happens, Starfleet Academy could do what NuTrek has been failing to do for nearly a decade: bring generations of fans together in their love of the greatest sci-fi franchise ever made.

Entertainment

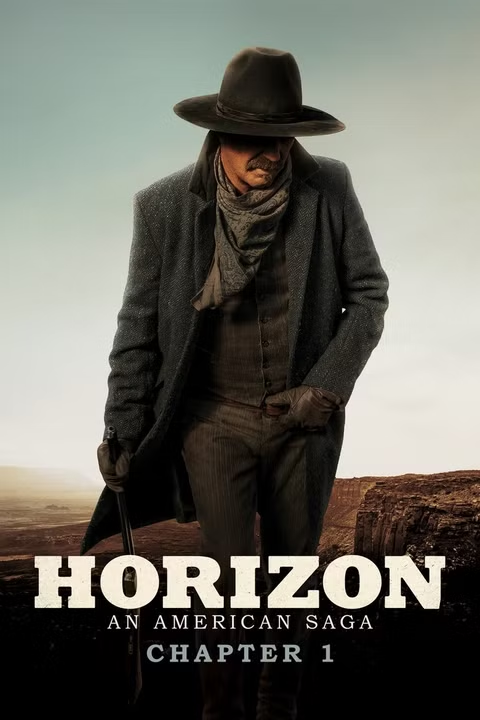

Kevin Costner’s Western Saga Faces Another Devastating Blow

Like salt and pepper or peanut butter and jelly, Kevin Costner and the West go together. Since the early days of his on-screen career, the actor has had an affinity for traveling back through time to the days when folks were attempting to claim property up to the Mississippi and beyond. His obsession with all things cowboys and pioneers was even the primary drive behind his jump from working in front of the camera to behind it when, in 1990, Costner gave filmmaking a shot for the very first time with his critically acclaimed epic Western, Dances With Wolves, in which he also starred. Since then, his love for cowboy hats and cattle wranglers has continued to grow tenfold and nowadays, it seems that every project he’s involved with has some sort of Western flair.

At the height of his Western fascination, Costner starred in the hit series Yellowstone, which saw him appear in the role of John Dutton — a family man, ranch owner, and cold-hearted killer — who will do anything to hold onto his power and ensure his family’s ranch reins supreme. During his tenure on the Taylor Sheridan-created production, the performer landed numerous nominations and wins on the awards season circuit, including a Golden Globe. But, eventually, he grew bored with the series and suffered a falling out with Sheridan, which sent him packing and onto the next thing.

As one could have seen coming a mile away, the next thing was a Western, but this time Costner wanted to play by his own rules. Returning to a position that he feels increasingly comfortable in, Costner set out to not only star in but also direct his passion project, a movie called Horizon: An American Saga, which is meant to span four movies in total. Unfortunately, the only one that managed to see the light of day (so far) is the first installment, which came out back in 2024. As elusive as the rest of the films in Costner’s costly film series, time is running out for audiences to stream the first part of Horizon, as it will soon ride off into the sunset and leave HBO Max in the dust on February 28.

Will ‘Horizon’ Ever Continue?

Set against the backdrop of the great American West, Horizon focuses its lens on a handful of different characters all fighting for survival during some of the country’s deadliest years. Despite having plenty of hope and sinking a massive amount of his funds into it, Costner’s first chapter in his hopeful franchise faltered at the box office. And, while the second movie is said to be completely done, it hasn’t yet been released. In the two years since the first installment galloped into cinemas, the director and his team have faced plenty of scrutiny and scandal. From financial troubles to allegations of sexual harassment, it seems like the wheels have completely fallen off this covered wagon.

Head over to HBO Max before February 28 to see Costner’s passion project come to life.

- Release Date

-

June 28, 2024

- Runtime

-

182 minutes

- Producers

-

Howard Kaplan, Mark Gillard

Entertainment

Rakai & Piper Rockelle Melt Hearts With Sweet Livestream Kiss

TeaMates, Rakai is deep in his feelings this Valentine’s Day! The popular streamer recently asked Piper Rockelle to be his Valentine during a live session, and even sealed the moment with a kiss.

Related: Deshae Frost & Rakai Respond After Kai Cenat’s Ex Gabrielle “Gigi” Alayah Airs Them Out Over Post-Breakup Shade (VIDEOS)

Rakai Pops The Question To Piper Rockelle On Livestream

On Friday Feb. 13, Rakai dedicated his livestream to asking a special someone to be his Valentine. Holding balloons and flowers, Rakai appeared nervous but excited as he popped the question to Pipe Rockelle, the 18-year-old social media star and former YouTube sensation. In clips now circulating online, Piper initially responded with a hesitant, “I mean, sure… yeah,” before confidently adding, “Yes, I want to be your Valentine.” Rakai then promised to take her out on Valentine’s Day and asked to seal the deal with a kiss, which she hesitantly agreed to, sending fans into a frenzy.

Social Media Reacts

As expected, social media wasted no time sharing opinions about the Valentine’s surprise over in The Shade Room teens comment section.

Instagram user @therealjenncarter wrote, “Rakai couldn’t wait for this 😂😂😂😂😂😂😂😂”

Another Instagram user @slvttbby wrote, “this so middle school but they cute tg 😂”

Instagram user @n.aiiyaa wrote, “Awww I miss being this young 😂😂🥺

Another Instagram user @mariieejaee wrote, “I like him with her 😭😍”

While Instagram user @marabear3 wrote, “A girl who’s really into you doesn’t act like this 😭”

Instagram user @untoldtalents wrote, “They both trolling 😂”

Another Instagram user @riahoney wrote, “normal teenage behavior this is literally so cute lol!!!”

While Instagram user @_shuntrell23 wrote, “She don’t like him, she like the attention & money that comes with being with him 😂💯”

Rakai & Piper Rockelle Popped Out At The Super Bowl

Rakai and Piper have appeared together on several livestreams, often flirting and joking with one another. However, fans began suspecting something more was going on when they popped out together at the Super Bowl Sunday. On Feb. 8, Piper shared a photo of herself and Rakai at the game, showing him with his arm around her as she rested her head on his shoulder. She captioned the post, “My first Super Bowl 🥹.”

Rakai later posted a similar photo on his own Instagram, fueling even more speculation. Things didn’t stop though, the pair also shared clips from a hotel room where they filmed TikTok videos together. Fans quickly noticed what appeared to be a tattoo of Rakai’s name on Piper’s ankle, sparking debate if the two are officially locked in.

Related: Social Media Debates Whether Rakai Was Supporting Or Trolling Kai Cenat With Dr. Seuss Reading On Live (VIDEO)

What Do You Think Roomies?

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business7 days ago

Business7 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World22 hours ago

Crypto World22 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?