Business

US Justice Department sends letter regarding Epstein files redactions to lawmakers, Politico reports

Business

Steel and Aluminum Stocks Fall, Automakers Gain After Reports of Tariff Pullback

Steel and Aluminum Stocks Fall, Automakers Gain After Reports of Tariff Pullback

Business

The 1-Minute Market Report, February 15, 2026 (NYSEARCA:SPY)

For 28 years, I was a professional trader, analyst & portfolio manager. I ran the equity trading desk at Northern Trust Co. in Chicago. Now I am a private investor, the founder of a nonprofit investor advocacy firm, and a private investing coach. My average annual return is 17.2%. The time period is from January 2009, when I first began publishing my stock picks, to the end of 2024. I publish my picks in newsletter format and send them directly to subscribers on a weekly basis. For my complete market outlook and model portfolio updates, visit zeninvestor.org.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AVGO, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

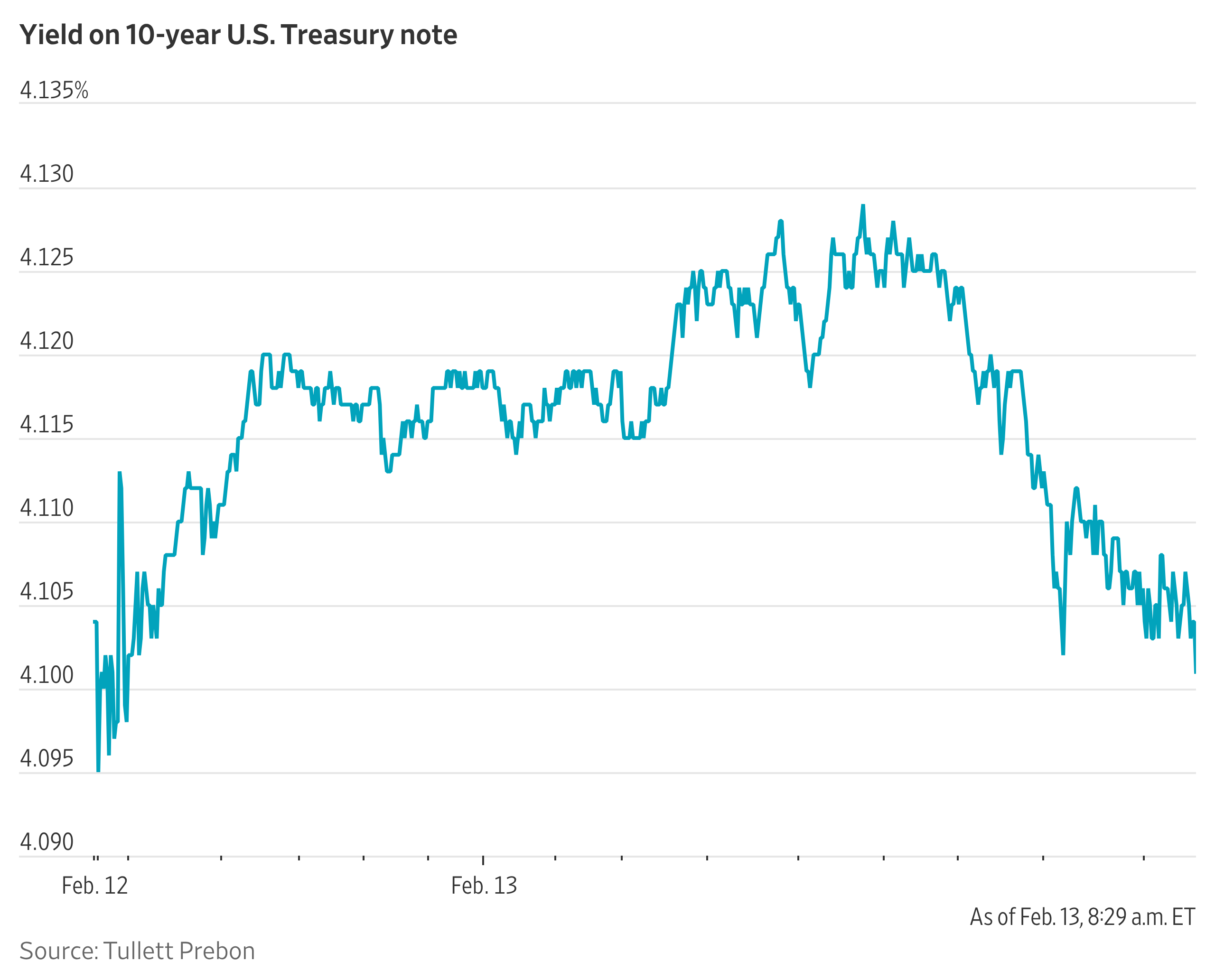

Treasury Yields Fall Further After Inflation Data

Treasury yields extended recent declines following cooler-than-expected inflation data.

Yields, which fall when bond prices rise, had already been sliding recently in response to some lackluster economic reports and volatility in the stock market, with investors turning to Treasurys as a safe haven.

The yield on the 10-year Treasury note settled at 4.055%, according to Tradeweb, the lowest closing level since Nov. 28.

Business

Globalstar Stock: Commercial Execution Is Heating Up With New Contracts (NASDAQ:GSAT)

I first entered investing in 2016 as an individual value investor. In 2022, I established the investment firm Libra Capital. I mostly write articles as part of my deep research into a company before I make an investment, whether long or short. For me, a ”hold” article means neutral; don’t touch the stock and exit a position if you have one. Sell is short it, or sell a long position, and vice versa for long.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GSAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Oil Settles Week Lower – WSJ

1528 ET – Crude oil futures settle the day slightly higher, but still finish the week losing ground. For the week, crude oil fell 1% to $62.89 a barrel. This afternoon’s Rig Count Report from Baker Hughes showed a slight decrease in U.S. oil rigs, although that was offset by an increase in gas rigs. News that OPEC+ intends to resume oil output increases, as well as headlines surrounding U.S. military operations versus Iran drove trading, says Robert Yawger of Mizuho Securities USA in a note. Brent crude prices rose 0.3% for the day to $67.75 a barrel, making it 0.4% Brent prices fell for the week. (kirk.maltais@wsj.com)

Oil Moves Lower As Market Weighs Geopolitical Risk

0950 ET – Oil futures are lower amid mixed sentiment around possible U.S. action in Iran. While more talks are planned over coming weeks, reports of a second U.S. aircraft carrier heading to the Middle East keep the specter of eventual military action in sight. More Russia-Ukraine peace talks for next week are also tempering risk. “Near-term global crude supplies remain ample and crude futures are likely holding a $5 to $7/barrel geopolitical premium,” BOK Financial’s Dennis Kissler says in a note. “Negotiations with Iran and Russia will be the near-term market movers.” WTI is down 0.6% at $62.47 a barrel and Brent is off 0.4% at $67.25.(anthony.harrup@wsj.com)

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Goldilocks Data Has Not Spurred a Stock Rally. Here’s Why.

Goldilocks Data Has Not Spurred a Stock Rally. Here’s Why.

Business

What to Watch Next Week

Investors face a holiday-shortened week featuring Federal Reserve speakers and economic data. Walmart earnings will provide insight into the health of the U.S. consumer. The market will parse a significant batch of data at the end of next week—including an advance look at fourth-quarter GDP and the personal-consumption expenditures price index—to gauge the economy’s momentum and inflation.

Presidents Day (U.S. markets closed)

Fed speeches: Federal Reserve Vice Chair Michelle Bowman will speak at a conference in Orlando, Fla.

Business

Pentagon threatens to cut off Anthropic in AI safeguards dispute, Axios reports

Pentagon threatens to cut off Anthropic in AI safeguards dispute, Axios reports

Business

Week’s Best: AI Slams Wealth Management Stocks

Week’s Best: AI Slams Wealth Management Stocks

Business

AI Was Proof of American Exceptionalism. Now It’s Undermining It.

AI Was Proof of American Exceptionalism. Now It’s Undermining It.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics7 days ago

Politics7 days agoThe Health Dangers Of Browning Your Food

-

Business7 days ago

Business7 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Tech1 hour ago

Tech1 hour agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

![Biggest Crypto News Happening Now!! [BlackRock + Joe Rogan + Ethereum]](https://wordupnews.com/wp-content/uploads/2026/02/1771127665_maxresdefault-80x80.jpg)