Crypto World

Vitalik Buterin Proposes Hedging-Based Transformation for Prediction Markets

TLDR:

- Buterin warns prediction markets prioritize short-term betting over meaningful information discovery value

- Current platforms rely on naive traders with poor judgment, creating incentives for exploitative practices

- Hedging applications allow users to reduce risk exposure without extracting value from uninformed participants

- Personalized AI-driven prediction market baskets could replace traditional stablecoins and fiat currencies

Prediction markets face a critical juncture as Ethereum co-founder Vitalik Buterin expresses growing concerns about their current trajectory.

The platforms have achieved commercial success with substantial trading volumes. However, they increasingly focus on short-term cryptocurrency bets and sports wagering.

Buterin argues this shift toward immediate gratification undermines the technology’s potential for societal benefit. The current model prioritizes revenue over meaningful information discovery.

Buterin recently outlined an alternative vision centered on hedging applications that could reshape decentralized finance.

Current Market Dynamics and Sustainability Concerns

Prediction markets currently operate with two primary participant types. Smart traders provide market intelligence and generate profits through informed positions.

The counterparty must inevitably absorb losses to maintain market function. This structure creates fundamental questions about long-term viability.

Buterin identifies three categories of loss-absorbing participants in his analysis. Naive traders bet on incorrect outcomes based on flawed reasoning.

Information buyers fund automated market makers to extract valuable data. Hedgers accept negative expected value to reduce overall risk exposure.

The present ecosystem relies heavily on naive traders with poor judgment. Buterin acknowledges no inherent moral failing in this dynamic.

Nevertheless, he warns this dependency creates perverse incentives for platform operators. Companies feel pressure to attract and retain traders with weak analytical skills.

This approach pushes platforms toward what Buterin describes as activities with short-term appeal but lacking meaningful value. Teams justify these choices as survival tactics during challenging market conditions.

The business model rewards cultivating communities that embrace poor decision-making. Market participants chase dopamine-driven activities rather than meaningful information discovery.

Hedging Applications and Decentralized Stability Solutions

Buterin proposes hedging as a sustainable alternative for prediction market growth. The concept extends beyond traditional insurance into personalized risk management.

A biotech shareholder could bet against favorable political outcomes to balance portfolio exposure. This strategy reduces volatility without requiring zero-sum extraction from uninformed traders.

The most ambitious application targets stablecoin architecture itself. Current stablecoins depend on fiat-backed reserves that compromise decentralization principles.

Users seek price stability to meet future financial obligations. Different individuals face varying expense profiles across goods and services.

Buterin envisions eliminating traditional currency through prediction markets on diverse spending categories. Users would hold personalized baskets of market shares representing their expected expenses.

Local artificial intelligence systems would analyze individual spending patterns. The technology would recommend appropriate hedging positions for each user’s circumstances.

This framework requires markets denominated in productive assets like interest-bearing instruments or wrapped equities. Non-yielding currencies carry excessive opportunity costs that negate hedging benefits.

Both market sides achieve satisfaction when participants pursue genuine risk management. In his message, Buterin urges the industry to “build the next generation of finance, not corposlop.” Sophisticated capital flows naturally toward sustainable economic structures rather than exploitative models.

Crypto World

Pi Network Pioneers Celebrate PI’s 35% Daily Surge as Important Deadline Approaches

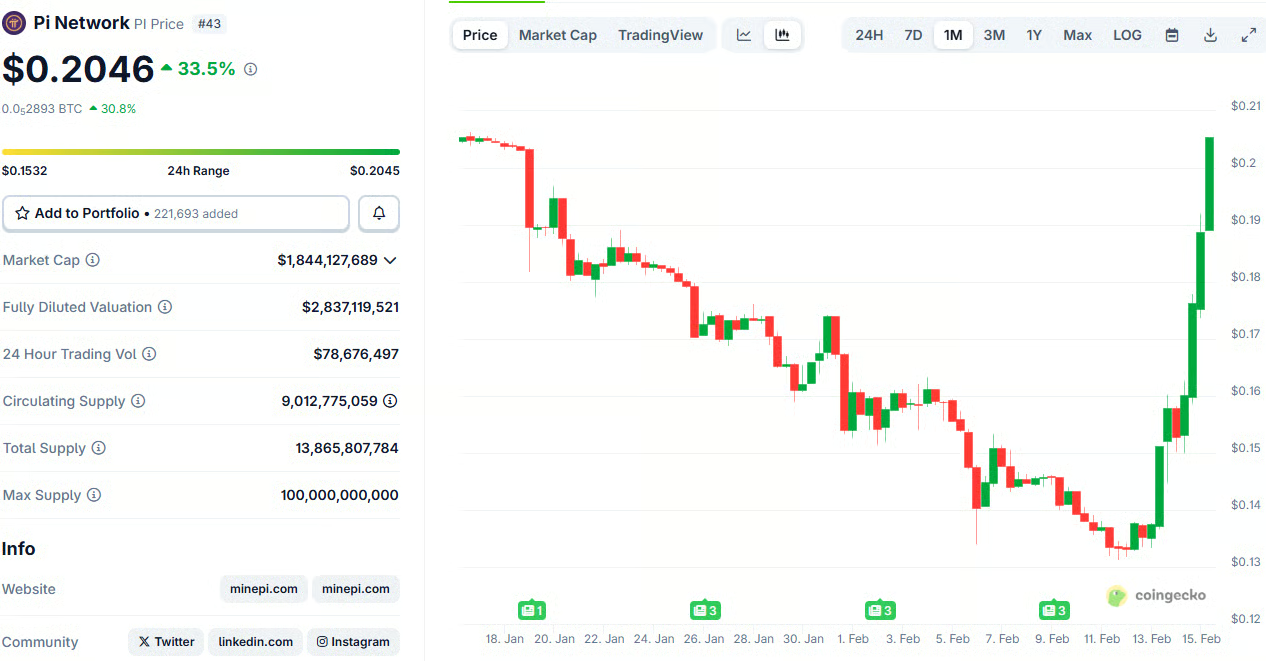

The PI token has become the most substantial gainer over the past 24 hours.

What a volatile ride it has been for Pi Network’s native token after the calmness experienced during the December holidays. The asset was charting severe losses for several consecutive weeks, but the past few days have been a lot more positive.

This resurgance comes after the team issued an important reminder about a deadline for today.

PI Rockets

As mentioned above, PI was consistently one of the worst performers in the cryptocurrency markets ever since the last correction began in mid-January. The asset marked consecutive all-time lows, with the latest being at $0.1312 on February 11. As the community was lashing out against the project behind it and there were calls for further decline, the trend reversed in the past few days.

PI’s price went on a wild run, gaining more than 30% in the past day alone, and over 55% since its all-time low seen just a few days ago. As such, it now trades above $0.20, which has prompted many Pioneers to celebrate the move and call for further gains.

“Huge congratulations to all Pioneers who recently DCA’d at the bottom around $0.13 – that decision is paying off nicely right now. A special shoutout and big thanks to PiBridge – a project that truly listens to the community and delivered one of the most useful features yet: USDT loans collateralized by PI. Thanks to this, anyone who urgently needed cash but didn’t want to sell their PI at the painful $0.13-$0.14 levels can now avoid massive regret,” commented Cryptoleakvn.

It’s worth noting that today’s surge comes just a day after a popular crypto analyst, Captain Faibik, said they added PI to their portfolio and predicted a massive 500% surge.

Deadline Approaches

Separately, but perhaps somehow related to the recent pump, is the deadline ending today that concerns Pi Network’s “4th role” – Pi Nodes. As reported earlier this week, the Pi Mainnet blockchain protocol is undergoing a series of upgrades, and the deadline for the first one is February 15.

It requires all Mainnet nodes to complete this important step to remain connected to the network. In this article, we reiterated the Core Team’s explanation that nodes must run on laptops or desktop computers, which would allow them to help power PI decentralization by validating transactions, strengthening network security, and supporting global consensus and trust.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Senators urge Bessent to probe $500M UAE stake in Trump-linked WLFI

Two US senators pressed the Treasury Department to examine a UAE-backed investment into World Liberty Financial (WLFI), citing potential national security and data privacy concerns. In a Friday letter to Treasury Secretary Scott Bessent, Elizabeth Warren and Andy Kim urged the Committee on Foreign Investment in the United States (CFIUS) to determine whether a formal review is warranted into a deal in which a UAE-backed investment vehicle would acquire about 49% of WLFI for roughly $500 million. The arrangement, disclosed days before Donald Trump’s inauguration, would make the foreign investor WLFI’s largest shareholder and its lone publicly known outside investor. The disclosures tie the funding to Sheikh Tahnoon bin Zayed Al Nahyan and include governance seats for executives linked to the technology firm G42, which has previously drawn scrutiny from U.S. intelligence agencies over potential ties to China.

Key takeaways

- The senators have asked Treasury Secretary Scott Bessent, who chairs CFIUS, to assess whether the foreign stake should trigger a formal CFIUS investigation, with a response deadline tied to March 5.

- The deal would grant a UAE-backed fund a 49% stake in WLFI for about $500 million, positioning the investor as WLFI’s largest shareholder and its only publicly disclosed non-U.S. investor, and it would involve two WLFI board seats held by executives connected to G42.

- Officials tied the investment to Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security adviser, raising concerns about foreign influence over a U.S. company handling financial and personal data.

- WLFI’s disclosed data practices include wallet addresses, IP addresses, device identifiers, approximate location data, and certain identity records through service providers—factors that intensify national-security considerations if a foreign government gains access or influence.

- Previous inquiries linked WLFI’s token sales to sanctioned or otherwise problematic actors, underscoring ongoing scrutiny of the firm’s governance and funding channels.

Tickers mentioned: $WLFI

Sentiment: Neutral

Market context: The episode sits within a broader regulatory backdrop in which U.S. authorities are closely examining foreign involvement in fintech, crypto, and data-centric companies, with CFIUS and other agencies increasingly scrutinizing deals that could expose Americans’ sensitive information to non-U.S. entities.

Why it matters

The inquiry highlights a growing tension between ambitious cross-border fintech investments and national-security safeguards. WLFI’s stake sale to a foreign investor—reportedly tied to a figure who serves as the UAE’s national security adviser—touches on questions about how foreign influence could translate into practical control over a U.S. company handling financial data and personal identifiers. The senators’ letter emphasizes that WLFI’s privacy disclosures include data types that could be valuable for both commercial and security purposes, including wallet addresses, IP addresses, device identifiers and location signals collected via service providers. If CFIUS were to determine that foreign access to this information poses a risk, it could lead to remedies ranging from structural changes to divestment or blocking the transaction.

The timing is notable. The deal’s trajectory reportedly unfolded in the period surrounding the transition into the early days of the Trump administration, a moment that further complicates oversight of foreign involvement in U.S. tech and financial platforms. The letter asks for a comprehensive, unbiased assessment, signaling that the matter could become a touchpoint in ongoing debates about foreign capital, data sovereignty, and the boundaries of U.S. national-security review in the digital era.

Meanwhile, WLFI’s governance and fundraising activity have drawn attention from lawmakers who previously raised concerns about the company’s token sales. In a separate thread, senators highlighted alleged connections between WLFI token economics and actors under sanctions or other sensitive watchlists, underscoring the potential for governance risks in a project that straddles traditional finance and blockchain-enabled remittance or exchange services. The convergence of crypto-oriented fundraising with established corporate governance raises practical questions about how future regulatory reviews will treat blended business models and cross-border capital flows.

What to watch next

- CFIUS response: Look for a formal reply from Bessent by the March 5 deadline and any indication of whether a full or targeted review will be initiated.

- Notifications and disclosures: Monitor whether WLFI or the UAE investor issues additional disclosures or amendments related to the stake, governance seats, or data handling practices.

- Governance dynamics: Track updates on WLFI’s board composition and whether the involvement of G42-linked executives persists or evolves in response to regulatory scrutiny.

- Regulatory actions: Observe any further actions from U.S. authorities regarding WLFI’s token sales or related governance tokens, and any comparable reviews of foreign investments in fintech platforms.

Sources & verification

- Letter to Bessent requesting CFIUS review (PDF): https://www.banking.senate.gov/imo/media/doc/letter_to_bessent_re_cfius_wlf.pdf

- Report on UAE-backed investment in WLFI and Trump-linked connections: https://cointelegraph.com/news/uae-backed-firm-buys-49-percent-trump-linked-world-liberty-wsj

- November 2023 inquiry into WLFI token sales and potential sanctions connections: https://cointelegraph.com/news/senators-trump-linked-wlfi-national-security-threat

- Trump denial of involvement in WLFI stake: https://cointelegraph.com/news/trump-denies-involvement-500m-uae-wlfi-stake

UAE-backed WLFI stake triggers CFIUS review over data access and security

A federal inquiry into a United Arab Emirates–backed investment in World Liberty Financial (WLFI) has surged into focus for U.S. national-security authorities. In a Friday letter to Treasury Secretary Scott Bessent, Senators Elizabeth Warren and Andy Kim request a formal assessment by the Committee on Foreign Investment in the United States (CFIUS) to determine whether the arrangement warrants a comprehensive review. The deal contemplates a UAE-backed investment vehicle acquiring roughly 49% of WLFI for about $500 million, a stake that would position the foreign fund as WLFI’s largest shareholder and sole outside investor currently disclosed. The outside investor’s ties to Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security adviser, and the allocation of two WLFI board seats to executives linked to the tech company G42, have attracted scrutiny from lawmakers who emphasize potential foreign influence over sensitive data streams and corporate governance.

The core concern centers on data control and access. WLFI’s disclosed privacy practices indicate that the company collects a spectrum of user data, including wallet addresses, IP addresses, device identifiers and approximate location data, as well as certain identity records obtained through service providers. Warren and Kim argue that such data, if controlled by a foreign government, could be leveraged to influence business decisions or gain strategic insight into American consumers’ financial behaviors. For CFIUS, this represents a classic national-security calculus: do the benefits of foreign investment outweigh the risk of sensitive information flowing beyond U.S. borders or under foreign influence?

The lawmakers’ letter notes that CFIUS’s remit includes evaluating foreign investments that could provide access to sensitive technologies or personal data belonging to U.S. citizens. They request a response by March 5 and advocate for a “comprehensive, thorough, and unbiased” review if warranted. The request follows a pattern of heightened scrutiny of foreign involvement in crypto and fintech ventures—a trend that has intensified as policymakers balance economic openness with the imperative to protect personal data and national security. The situation intertwines elements of geopolitical risk, data privacy, and the evolving regulatory framework governing digital assets and fintech platforms.

Earlier in the year, Warren and Reed also pressed authorities to investigate WLFI’s token sales amid allegations of connections to sanctioned actors, including claims that governance tokens were acquired by addresses associated with the Lazarus Group and other entities linked to Russia and Iran. While those claims remain contested and subject to ongoing debate, they underscore the broader context in which WLFI operates—where tokenization, remittance services, and crypto governance intersect with complex international exposure.

As WLFI and its backers navigate this regulatory landscape, the public record continues to evolve. President Trump, in separate remarks, has indicated that his family is handling the matter and that he does not have direct involvement in the investment. “My sons are handling that — my family is handling it,” he stated, adding that investments come from various individuals. The evolving narrative highlights how political dynamics can intersect with fintech ventures that straddle traditional financial services and blockchain-based offerings, raising questions about transparency, governance, and the safeguards that shield U.S. data from foreign influence.

Crypto World

Analysts Call for Another Big Move After 16% Surge

Ripple’s XRP broke the weekend silence with a massive double-digit surge to over $1.65.

Unlike the weekend at the start of the month, in which the cryptocurrency market was hit hard, and multiple assets suffered massive losses, the past 24 hours have benefited almost all digital assets.

Ripple’s cross-border token has emerged as one of the top gainers, having surged by 16% daily to its highest price levels since February 1 at over $1.65.

CryptoWZRD weighed in on XRP’s performance during the weekend, indicating that both charts, against the USD and BTC, closed bullish. The analyst added that “further upside from XRPBTC is very likely.”

Cobb, one of the most vocal XRP bulls on X who made some bold price predictions yesterday with double-digit targets, noted that the cross-border asset might have started to decouple from other larger-cap cryptocurrencies.

This claim has merit at least in the past day. Aside from DOGE, which has soared by over 20% since Saturday, XRP is the only other double-digit gainer from the top 20 alts.

ERGAG CRYPTO indicated that the current two-week candle, which is set to close later today, is “shaping into either a Hammer or a Dragonfly Doji.” The analyst explained that both options are classic reversal candles that appear after a severe downtrend.

XRP has indeed been in a downtrend for the past month and a half. The asset peaked at $2.40 on January 6 but was quickly halted there and pushed south to just over $1.10 on February 6. Nevertheless, it responded well to this calamity and now trades at $1.65, representing a near 50% surge from the local lows.

You may also like:

Consequently, ERGAG CRYPTO advised their followers to ignore the noise and focus on XRP’s structure, which “remains a bullish setup, until the market proves otherwise.”

#XRP – Descending Broadening Wedge (Update):

On the 2-week timeframe, the current candle (closing in ~16 hours) is shaping into either a Hammer ⚒️ or a Dragonfly 🐉Doji.

👉Both are classic reversal candles when they appear after a downtrend.

Add to that:

▫️ The Descending… https://t.co/zGhHHznrUo pic.twitter.com/JWXVOddqiy— EGRAG CRYPTO (@egragcrypto) February 15, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Altcoin Markets Show Recurring 120-Day Downtrend Cycle as Base Formation Begins

TLDR:

- Altcoin markets have experienced two identical 120-day downtrends since January 2024 during peak optimism phases.

- Total3 market cap shows rally-distribution-bleed-reset pattern rather than continuous upward bull cycle movement.

- Price has returned to major support zone while RSI sits at depressed levels after months of declining momentum.

- Historical pattern suggests capitulation windows occur when 120-day cycles repeat within same market structure.

Altcoin markets have consistently followed a 120-day downtrend pattern over the past two years, according to recent market analysis.

The cycle appears during periods of peak optimism and extends into full four-month corrections. Traders holding positions in recent drawdowns may find relief in understanding this recurring timeframe. The pattern suggests markets move in predictable blocks rather than continuous upward momentum.

Recurring Downtrend Structure in Altcoin Markets

Total3 market capitalization data reveals a consistent rhythm since January 2024. Markets experience sharp rallies followed by extended distribution phases.

The first quarter of 2024 saw altcoins surge before entering a 120-day decline. During these periods, bounces get sold, and sentiment turns negative.

Later cycles showed identical behavior. A fourth-quarter rally materialized before another 120-day correction pushed into early 2026. The duration matched previous patterns almost exactly. This repetition indicates structure rather than random volatility.

Market observers from Our Crypto Talk noted how most participants only recognize the rally phases. Successful traders track the reset periods with equal attention.

The current environment sits within another reset zone. These blocks follow a sequence: rally, distribution, slow decline, reset, then another rally.

Understanding this rhythm changes how traders approach positioning. Markets don’t move in straight lines during bull cycles.

Instead, they advance through predictable consolidation periods. Recognition of these phases helps separate short-term noise from longer-term trend development.

Technical Setup Points to Potential Base Formation

Current price action has returned to a major support band that previously acted as a floor. The market has repeatedly reacted around this zone in past cycles.

This area represents significant accumulation levels from earlier timeframes. Price behavior near established support often signals exhaustion of selling pressure.

Momentum indicators show complementary signals. RSI has trended downward for months and now sits at depressed levels.

While no single indicator guarantees reversals, compressed momentum after timed downtrends typically precedes shifts. Selling pressure appears to be reaching exhaustion points.

The convergence of time-based cycles and technical levels creates noteworthy conditions. When 120-day downtrends appear twice within the same cycle, they often mark capitulation windows.

Weak positions exit while value-focused buyers begin accumulating. This phase doesn’t guarantee immediate upside but shifts probability distributions.

Market structure suggests a transition from random downside to base building. Bitcoin’s stability could catalyze altcoin bid activity in coming weeks.

The panic phase appears complete based on historical cycle comparison. Patience becomes valuable during these periods as markets digest previous excesses and establish foundations for subsequent moves.

Crypto World

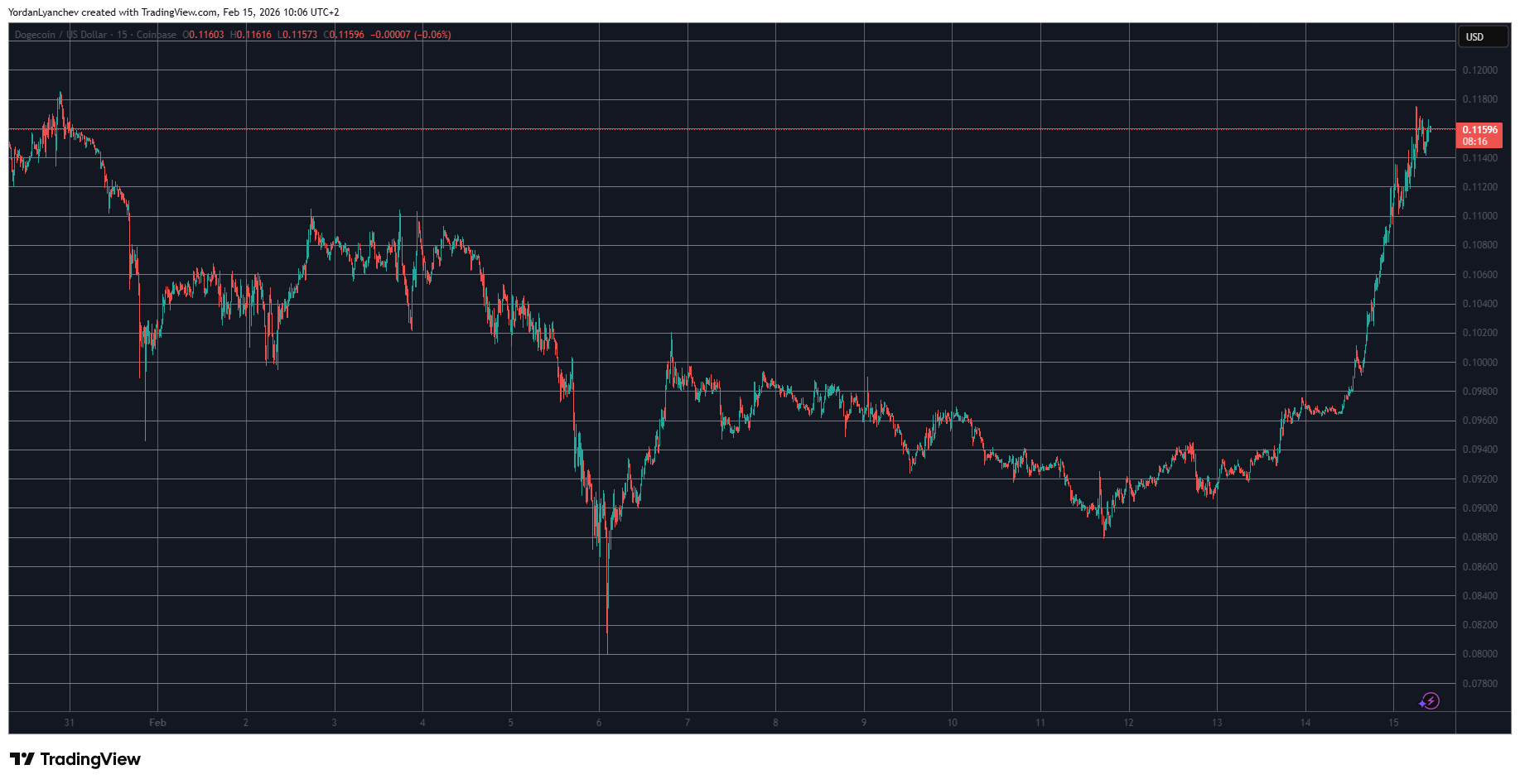

Is Elon Musk Behind Dogecoin’s Latest Double-Digit Surge?

DOGE and other meme coins are some of the most impressive gainers during the weekend.

Although most cryptocurrencies have charted notable gains over the past 36 hours or so, Dogecoin is among the top performers, having surged by double digits to over $0.11.

Perhaps the most evident reason behind this rally could be, once again, Elon Musk. This time, though, he hasn’t made a specific DOGE-focused statement as in the past, but rather a broader promise for the entire crypto industry.

In a recent video, the owner of X said the social media platform will allow users to trade stocks and digital assets directly from their timelines. They will be able to interact with ticker symbols in posts and complete trades within the app.

The beta platform is expected to launch within a month or two from X Money, the company’s in-house payments system. Nikita Bier, the firm’s head of product, explained that the goal is to turn the social media behemoth into an “everything app” that allows users to invest, send money, post, and message others.

Given Musk’s history with Dogecoin, it’s no wonder that the OG meme coin has gone on a tear ever since the announcement went live. The asset has consistently risen for the past few days, going from $0.095 to a two-week peak of over $0.115.

It’s worth noting, though, that the billionaire has been quite silent on the Dogecoin endorsement front in the past year or so after some controversial claims that led to lawsuits against him.

Other meme coins have also benefited from the recent market resurgance. PEPE has skyrocketed by 30% daily, while PIPPIN has solidified its spot in the top 100 alts after another 16% surge. Moreover, the asset has rocketed by 270% in the past week.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Solana Company Unveils First Digital Asset Treasury for Institutional Borrowing Against Staked SOL

TLDR:

- Solana Company introduces first tri-party custody model allowing borrowing against natively staked SOL tokens.

- Anchorage Digital’s Atlas system provides automated collateral management while assets remain in custody.

- Institutions earn 7% staking yields on SOL while accessing on-chain liquidity through Kamino’s platform.

- The scalable model serves as blueprint for future treasury companies and institutional DeFi participation.

Solana Company (NASDAQ: HSDT) announced a partnership with Anchorage Digital and Kamino on February 13, 2026.

The collaboration introduces the first digital asset treasury enabling borrowing against natively staked SOL in qualified custody.

The tri-party custody model allows institutional investors to earn staking rewards while accessing on-chain liquidity. This structure maintains custody, compliance, and operational control for institutional participants.

Tri-Party Custody Model Connects Institutional Capital to DeFi

The partnership brings institutional capital to Solana’s decentralized finance ecosystem through a novel custody arrangement.

Anchorage Digital serves as the collateral manager for natively-staked SOL held in segregated accounts. Institutions can earn staking rewards while simultaneously unlocking borrowing power through Kamino’s lending platform. All assets remain under qualified custody at Anchorage Digital Bank throughout the borrowing process.

Nathan McCauley, CEO and Co-Founder of Anchorage Digital, addressed the institutional demand for this infrastructure. “Institutions want access to the most efficient sources of on-chain liquidity, but they aren’t willing to compromise on custody, compliance, or operational control,” McCauley stated.

He noted that Atlas collateral management allows institutions to keep natively staked SOL with a qualified custodian while using it productively.

This approach brings institutional-grade risk management to Solana’s lending markets, according to the executive.

Anchorage Digital’s Atlas system provides automated oversight of loan-to-value ratios around the clock. The platform orchestrates margin and collateral movements based on predefined rules.

When necessary, the system executes liquidations to protect lenders and borrowers. These features give institutions familiar risk and compliance controls while enabling direct market participation.

Cheryl Chan, Head of Strategy at Kamino, commented on the partnership’s potential. “This collaboration unlocks meaningful institutional demand to borrow against assets held in qualified custody,” Chan explained.

By partnering with Anchorage Digital, Kamino enables institutions to access on-chain liquidity and yield on Solana. The arrangement allows institutions to custody assets within their existing regulated framework.

This removes a barrier that previously limited institutional participation in decentralized lending markets.

Blueprint for Future Treasury Operations and Network Growth

Cosmo Jiang, General Partner at Pantera Capital Management and Board Member at Solana Company, provided his perspective on the structure. “This structure demonstrates how institutional-grade infrastructure can unlock deeper participation on Solana,” Jiang said.

He described it as a strong example of how regulated custody and on-chain borrowing can work together. Jiang believes this scalable model is the blueprint other treasury companies will follow and institutional investors will demand.

The collaboration extends beyond the initial deployment. Other investors, venture firms, and protocols can replicate the structure.

This repeatability positions the model as a standard for institutional participation in protocol borrowing. The framework accommodates various collateral types, from standard digital assets to reward-bearing positions.

Solana has recorded strong network metrics across multiple dimensions. The blockchain processes more than 3,500 transactions per second. Daily active wallets average around 3.7 million users.

The network has surpassed 23 billion transactions year-to-date. SOL offers a native staking yield of approximately 7 percent.

Solana Company operates as an independent treasury company focused on supporting tokenized networks. The firm serves as a long-term holder of SOL tokens.

HSDT continues developing its neurotech and medical device operations alongside its digital asset treasury activities. The company’s mission centers on supporting the growth and security of blockchain networks.

Crypto World

Analysis Puts Bitcoin Price ‘Ultimate’ Bear Market Bottom Near $55,000

Bitcoin may not have hit true capitulation yet. On chain analytics firm CryptoQuant is warning that the real bear market floor could sit closer to $55,000. That is lower than many bulls want to admit.

If their data is right, the market still has some pain to process before a proper structural base forms. Weak hands may not be fully flushed. And until that final reset happens, calling this the ultimate bottom might be a bit premature.

Key Takeaways

- CryptoQuant data suggests the “ultimate” bear market bottom is near $55,000 based on realized price models.

- Bitcoin recently saw $5.4 billion in realized losses on Feb. 5, the highest since March 2023.

- Key valuation metrics like MVRV and NUPL have not yet reached historical capitulation zones.

Is The Selling Finally Over?

CryptoQuant says we are still in a normal bear phase, not the extreme panic zone that usually marks once in a cycle buying opportunities. In their view, bottoms are not single candles. They are long, messy processes that take time to build.

Meanwhile, price action keeps slipping. ETF outflows are stacking up and Bitcoin losing $66,000 has traders nervous. But according to the data, we still have not seen the kind of pain that typically resets the market.

Bitcoin price is trading more than 25% above its realized price, a level that has historically acted as strong support.

In past cycles like 2018 and the FTX collapse, Bitcoin bottomed 24% to 30% below realized price. If that pattern plays out again, the $55,000 area becomes the zone to watch.

Realized Losses And Valuation Metrics

The latest CryptoQuant data shows real damage under the surface.

On February 5, Bitcoin holders locked in $5.4 billion in daily losses as price slid 14% to $62,000. That was the biggest single day loss since March 2023.

But even with those numbers, key valuation metrics are not flashing full bottom yet.

The MVRV ratio has not dropped into the extreme undervalued zone that usually shows up at cycle lows. The NUPL metric also has not hit the deep unrealized loss levels that typically mark capitulation.

Long term holders tell a similar story. Right now, many are selling around breakeven. In past bear market bottoms, they were sitting on losses of 30% to 40%.

If history is any guide, the final phase of capitulation may require a deeper reset before a durable floor forms. Until then, patience may prove more valuable than premature bottom calls.

If Bitcoin Needs Another Reset, Bitcoin Hyper Does Not

When analysts start talking about “true capitulation,” it means one thing. Bitcoin could stay slow and heavy for longer than bulls expect.

That is not the environment for explosive base-layer moves.

Bitcoin Hyper ($HYPER) is built for momentum regardless of where BTC chops. This Bitcoin-focused Layer-2, powered by Solana technology, adds speed, lower fees, and real on-chain utility without touching Bitcoin core security.

Bitcoin Hyper is already gaining traction. The presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next increase, plus staking rewards up to 37%.

If Bitcoin needs more time to bottom, Bitcoin Hyper is positioned to move during the wait.

Visit the Official Bitcoin Hyper Website Here

The post Analysis Puts Bitcoin Price ‘Ultimate’ Bear Market Bottom Near $55,000 appeared first on Cryptonews.

Crypto World

Elon Musk’s X to Launch Smart Cashtags Enabling In-App Stock and Crypto Trading

Elon Musk’s social media platform X is preparing to roll out a feature that could transform the app from a discussion forum into a trading venue.

Key Takeaways:

- X plans to launch Smart Cashtags allowing users to trade stocks and cryptocurrencies directly in posts.

- The feature advances Musk’s vision of turning X into an all-in-one financial and social platform.

- It will roll out alongside X Money, a peer-to-peer payments system currently in beta testing.

Nikita Bier, X’s head of product, said the company plans to introduce “Smart Cashtags,” a tool that will allow users to buy and sell stocks and cryptocurrencies directly from their timelines.

The feature is expected to arrive within weeks, according to a post published Saturday.

X To Roll Out Smart Cashtags Enabling Stock And Crypto Trades From Posts

“We are launching a number of features in a couple of weeks, including Smart Cashtags that will enable you to trade stocks and crypto directly from the timeline,” Bier wrote.

Bier had previously hinted at the feature in January, sharing an image showing trading functionality embedded in posts, but the company had not confirmed the details at the time.

X previously experimented with financial features. In 2022, it added a basic Cashtag system that displayed price charts and market data for major assets such as Bitcoin and Ether.

Users could view market movements inside posts, though the feature only tracked prices and did not enable transactions. The earlier system was later discontinued.

The planned trading capability would mark a major shift for the platform, which already hosts a large share of online crypto conversation. Allowing direct transactions would move X beyond information sharing and into financial services.

The development aligns with Musk’s long-standing plan to turn X into an “everything app,” comparable to China’s WeChat, where messaging, payments and services operate in one place.

The trading feature comes alongside X Money, a peer-to-peer payments system. Speaking during a presentation at his artificial intelligence company xAI, Musk said the payment tool is currently in limited beta testing and could expand globally after the trial period.

“This is intended to be the place where all money is — the central source of monetary transactions,” Musk said.

According to Musk, the platform reaches roughly 600 million monthly users.

X Cracks Down on Crypto-Linked Engagement Apps

As reported, X has recently come under scrutiny after restricting API access for so-called InfoFi and engagement-reward projects, many of which were tied to crypto incentives.

The company said it would no longer allow apps that reward users for posting or interacting on X, citing concerns over AI-generated spam and manipulation.

Beyond crypto, X’s broader AI strategy has drawn regulatory attention, particularly in Europe, where authorities have raised concerns about Grok’s image-generation features.

The platform has since limited certain capabilities and introduced safeguards after investigations were launched.

X’s decision to clamp down on so-called InfoFi applications sent fresh shockwaves through the crypto market, dragging several tokens sharply lower and forcing a rethink across a niche that had grown tightly intertwined with the social media platform.

The immediate market reaction was led by KAITO, the token linked to the Kaito platform, which slid roughly 20% in a single day as investors digested what many saw as a structural threat rather than a short-term policy tweak.

The post Elon Musk’s X to Launch Smart Cashtags Enabling In-App Stock and Crypto Trading appeared first on Cryptonews.

Crypto World

Low Volume Breakouts: Why Markets Whisper Before They Roar

TLDR:

- Institutional buyers accumulate positions quietly before breakouts occur, absorbing supply inside bases

- Volume reduction before breakouts signals stored energy rather than weakness in underlying price trends

- Momentum funds and retail traders enter after performance becomes visible, creating delayed volume spikes

- Breakout timing context matters more than immediate volume confirmation for predicting trend sustainability

Low volume breakouts often face skepticism from traders who follow conventional technical analysis rules. The standard teaching suggests strong volume must accompany price breakouts for validation.

However, market history reveals a different pattern where volume frequently arrives after the breakout occurs. Technical analyst Aksel Kibar recently examined this phenomenon, noting that markets often move quietly before attracting broader participation.

This observation challenges widely accepted assumptions about volume requirements during breakout formations.

Institutional Accumulation Precedes Public Recognition

Market structure explains why breakouts occur without immediate volume expansion. Institutional investors typically build positions within consolidation ranges before prices break higher.

These buyers accumulate shares gradually when public interest remains low. Supply gets absorbed during this quiet phase, creating conditions for easier price movement.

Technical research supports the concept of volume reduction before breakouts. This pattern reflects stored energy rather than weakness in the underlying trend.

Price can advance with minimal participation because resistance has already been removed. The breakout itself represents recognition of a shift rather than the beginning of participation.

Early positioning by informed buyers means fewer shares remain available when prices break out. The lack of sellers allows price to move higher without requiring heavy volume.

This dynamic contradicts the traditional view that volume must confirm every breakout immediately. Markets can transition from accumulation to markup phase with relatively light trading activity.

The concept of “volume dry-up” before breakouts appears frequently in technical literature. Reduced trading activity can signal preparation for a move rather than disinterest.

When supply has been absorbed and sellers have exited, prices move freely on modest volume. This phase often precedes substantial trends that develop over subsequent weeks or months.

Market Stages Reveal Delayed Volume Patterns

Technical analyst Aksel Kibar noted on social media that breakout performance should consider context beyond the initial moment.

His analysis identifies three distinct stages in market behavior following consolidation patterns. The initial breakout stage often shows limited participation from retail traders and momentum investors.

Performance becomes visible as the trend develops and price gains become measurable. Momentum-focused funds enter positions after trends establish themselves through consistent price action.

Retail participation follows as media coverage expands and investment narratives gain traction. This sequence explains why volume peaks occur after breakouts rather than during them.

Studies examining breakout patterns reveal that timing matters more than immediate volume confirmation. Some quiet breakouts evolve into sustained trends while high-volume breakouts occasionally mark exhaustion points. The relationship between volume and price depends on market phase and participant behavior.

Recognition that volume confirms participation rather than initiating moves changes how traders evaluate breakouts. Markets demonstrate strength through sustained price advancement regardless of initial volume levels.

Historical patterns show that whisper-quiet beginnings can precede powerful trends. The sequence of accumulation, breakout, and expansion follows a logical progression that volume data reflects over time.

Crypto World

Why Multiple Resistance Tests Actually Increase Breakout Probability: Technical Analyst Reveals Market Truth

TLDR:

- Each resistance test removes sell liquidity, gradually weakening the barrier rather than strengthening it.

- Short positions accumulate above tested resistance, creating stop-loss clusters that fuel explosive breakouts.

- Horizontal resistance levels with three or more touches demonstrate institutional recognition and setup quality.

- Repeated price returns to resistance signal market acceptance and persistent demand, not rejection behavior.

Breakout probability increases with multiple tests at resistance levels, contrary to traditional technical analysis teachings.

Technical analyst Aksel Kibar challenges conventional market wisdom in a detailed explanation of modern market dynamics. The analysis focuses on liquidity pools, order flow, and auction theory.

Classical teachings suggest resistance strengthens with repeated failures. However, market behavior demonstrates the opposite trend through systematic liquidity depletion. Each test removes available sell orders and transfers inventory from sellers to buyers.

Liquidity Depletion Weakens Resistance Over Time

Resistance levels function as liquidity pools rather than solid barriers. Modern markets reveal these zones contain clusters of limit orders and resting sell liquidity.

Each price movement into resistance consumes available sell orders through transactions. This process gradually removes supply from the level.

The technical analyst compares resistance to ice being chipped away with each touch. Every test fills sell orders and reduces available supply at that price point.

Eventually, insufficient sellers remain to maintain the resistance level. This creates conditions favorable for eventual breakouts.

Buyers consistently absorb demand at these levels through repeated transactions. The inventory transfers from sellers to buyers during each test. This systematic reduction in available supply makes future breakouts structurally easier to achieve.

Short Positions Create Breakout Fuel Above Resistance

Market participants tend to initiate new short positions after repeated failures at resistance. Confidence in the level grows with each rejection, leading to tighter stop-loss clustering above. This accumulation of stops creates latent energy that fuels eventual breakouts.

When resistance finally breaks, short sellers must cover their positions simultaneously. Breakout traders and momentum participants enter the market at the same time. This combination creates a liquidity vacuum that accelerates price movement upward.

Aksel Kibar notes on his platform that strong breakouts frequently occur after multiple failed attempts. The concentration of stop-loss orders above well-tested levels amplifies the breakout move. This pattern explains why persistent testing often leads to decisive directional moves.

Horizontal Boundaries Signal Institutional Recognition

Horizontal levels carry particular significance in technical analysis, according to the analyst. These boundaries indicate institutional recognition and shared market memory across time periods. Multiple touches increase participant awareness and order clustering around these levels.

The analyst emphasizes mature chart patterns with a minimum of three touch points to pattern boundaries. This selection criterion improves signal quality and setup probability in trading decisions. Horizontal patterns from global exchanges demonstrate this principle consistently.

Markets operate as auction systems where repeated price returns signal ongoing negotiation. Persistence at specific levels indicates acceptance behavior rather than rejection.

Strong markets build bases through consolidation near resistance before continuation moves. This base-building process incorporates multiple tests as part of the natural market structure.

-

Politics7 days ago

Politics7 days agoWhy Israel is blocking foreign journalists from entering

-

Business7 days ago

Business7 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Tech6 hours ago

Tech6 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics7 days ago

Politics7 days agoThe Health Dangers Of Browning Your Food

-

Business7 days ago

Business7 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World1 day ago

Crypto World1 day agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle