Business

Golfer’s Epic Comeback with LIV Adelaide Win

Anthony Kim, the former PGA Tour prodigy turned LIV Golf sensation, has captivated fans with his improbable return after a 12-year hiatus. His recent team debut and career resurgence highlight a story of triumph over adversity.

Prodigy Roots

Born June 19, 1985, in Los Angeles, Anthony Ha-Jin Kim burst onto the golf scene at the University of Oklahoma. He set the school’s scoring average record at 71.73 relative to par, earned three-time All-American honors, and was named 2004 NCAA Freshman of the Year.

Kim clashed with coaches over his intense lifestyle—practicing and partying at 150% effort—but his talent was undeniable as the top-ranked collegiate golfer.

PGA Tour Breakthrough

Kim turned pro in 2006, tying for second in his debut at the Valero Texas Open via sponsor exemption. He earned his 2007 PGA Tour card through Q-School, logging four top-10s as a rookie and breaking into the top 100 world rankings.

In 2008, he exploded with wins at the Wachovia Championship—shooting a tournament-record 16-under 272—and the AT&T National, hosted by Tiger Woods. These victories propelled him to No. 16 in the world.

Ryder Cup Heroics

Kim’s 2008 Ryder Cup performance at Valhalla was legendary, dominating Europe’s Sergio Garcia 4&3 in singles and helping the U.S. end a nine-year drought with a 16.5-11.5 win. He amassed 3.5 of 4 possible points.

The next year at the Presidents Cup, Kim went 3-1, including a 5&3 singles rout of Robert Allenby, aiding America’s 19.5-14.5 victory.

Masters Record Breaker

At the 2009 Masters, Kim torched Augusta National with a second-round 11 birdies, shattering the single-round record previously held by Nick Price’s 10. He finished T20 but etched his name in major lore.

His best major result came at the 2010 Masters with a T3 at 12-under, one stroke shy of runner-up Lee Westwood and four behind Phil Mickelson.

Injury and Vanishing Act

A ruptured Achilles tendon in 2012 sidelined Kim after the Wells Fargo Championship. He underwent surgery and vanished from golf amid rumors of addiction, mental health struggles, and off-course turmoil.

From 2012 to 2024, Kim played no competitive golf, living abroad and battling personal demons. Speculation swirled, but he stayed out of the spotlight.

LIV Golf Resurrection

Kim returned in 2024 with LIV Golf, signing a lucrative deal after years away. He competed independently before joining teams, showing flashes amid rust.

In November 2025, he fired a bogey-free 64 at the PIF Saudi International—his lowest round since 2011—finishing T5, his first top-10 in 14 years.

Adelaide Triumph

Kim’s crowning moment: winning the 2026 LIV Golf Adelaide at -23, three shots ahead of Jon Rahm’s -20. It marked his first pro victory in 16 years, a stunning comeback at age 40.

This triumph, just weeks ago, vaulted him into LIV headlines and boosted his Official World Golf Ranking from 4,221st to No. 847 over two years.

4Aces Team Switch

As of February 12, 2026, Kim replaced Patrick Reed full-time on Dustin Johnson’s 4Aces GC LIV team. In his debut, he tied for 22nd but expressed gratitude: “Blessed to be alive.”

LIV’s new world ranking points for top-10s position Kim for further climbs, especially after his T3 in the January 2026 LIV Promotions event earning his league spot.

Personal Battles Won

Kim has openly discussed college-era addiction and mental health issues that worsened post-injury. Now sober, married to Emily with daughter Bella, he credits family for his revival.

In emotional interviews, like with David Feherty, he detailed life’s spiral but embraced golf anew with “new priorities.”

Legacy and Future

Kim’s PGA stats: 122 starts, 84 cuts, three wins, $12.2 million earned, peaking with 22 top-25s. His 15 major starts yielded six top-25s, including three top-10s.

At 40, with LIV stability and rising form, Kim eyes more wins and majors eligibility. His story—from ghost to golf’s ultimate redemption arc—inspires as LIV grows.

Business

Lazard Enhanced Opportunities Portfolio Q4 2025 Commentary

Lazard Asset Management delivers world-class investment solutions and long-term value for their clients. When clients partner with Lazard, they gain a trusted advocate committed to championing their success and helping them achieve their unique ambitions. Note: This account is not managed or monitored by Lazard Asset Management, and any messages sent via Seeking Alpha will not receive a response. For inquiries or communication, please use Lazard Asset Management’s official channels.

Business

Diamond Hill Select Strategy Q4 2025 Portfolio Review

Diamond Hill Capital Management, Inc. is a wholly owned subsidiary of Diamond Hill Investment Group, Inc. Diamond Hill Investment Group is a publicly traded company, and its shares trade on the NASDAQ (Ticker: DHIL). Note: This account is not managed or monitored by Diamond Hill Capital Management, and any messages sent via Seeking Alpha will not receive a response. For inquiries or communication, please use Diamond Hill Capital Management’s official channels.

Business

Democrats willing to spend tens of millions to reshape Virginia voting maps, top lawmaker says

Democrats willing to spend tens of millions to reshape Virginia voting maps, top lawmaker says

Business

Nebius: AI Discount Bin

Nebius: AI Discount Bin

Business

Victory Sycamore Small Company Opportunity Fund Q4 2025 Commentary

Victory Sycamore Small Company Opportunity Fund Q4 2025 Commentary

Business

BlackRock Global Equity Market Neutral Fund Q4 2025 Commentary

BlackRock Global Equity Market Neutral Fund Q4 2025 Commentary

Business

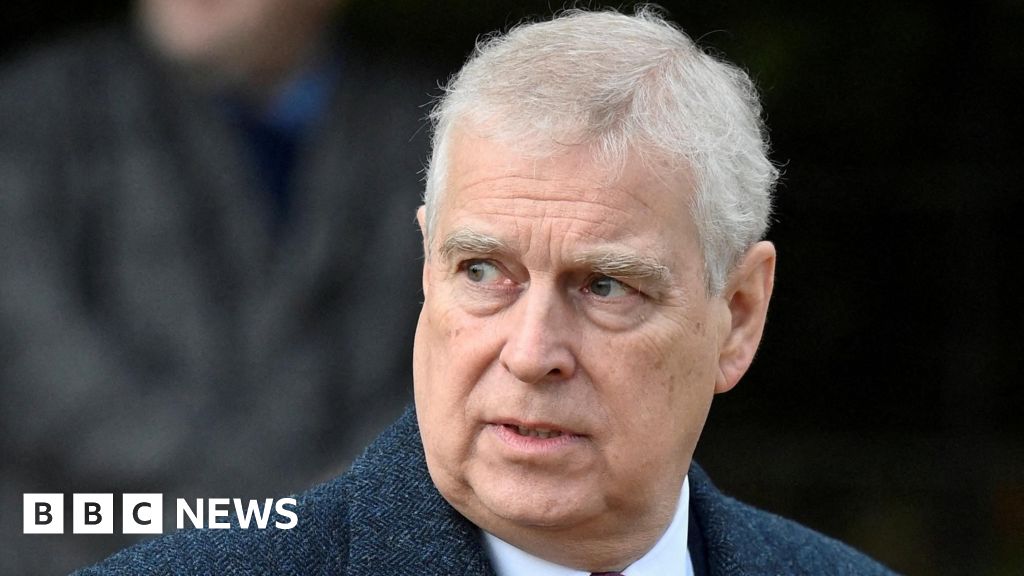

Andrew's time as trade envoy should be investigated, says Vince Cable

The former prince’s alleged actions were “totally unacceptable”, the ex-business secretary says.

Business

Trump told Netanyahu in December he would support Israeli strikes on Iran’s missile program, CBS News reports

Trump told Netanyahu in December he would support Israeli strikes on Iran’s missile program, CBS News reports

Business

Touchstone Dividend Equity Fund Q4 2025 Commentary

At Touchstone Investments, we recognize that not all mutual fund companies are created equal. Our commitment to being Distinctively Active means the employment of a fully integrated and rigorous process for identifying and partnering with asset managers who sub-advise our mutual funds and advocating a robust approach to portfolio construction that either uses standalone active strategies or serves as a complement to passive strategies. That is the power of Distinctively Active.

Touchstone Funds are offered nationally through intermediaries including broker-dealers, financial planners, registered investment advisors and institutions by Touchstone Securities, Inc. For more information please call 800.638.8194 or visit www.touchstoneinvestments.com

Specialties

Touchstone Investments helps investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific area of expertise.

Touchstone Securities Inc. is a registered broker-dealer and member FINRA and SIPC Note: This account is not managed or monitored by Touchstone Investments, and any messages sent via Seeking Alpha will not receive a response. For inquiries or communication, please use Touchstone Investments’s official channels.

Business

Wall Street Brunch: Walmart Weighs In As Q4 GDP Hits (undefined:WMT)

tupungato/iStock Editorial via Getty Images

Listen below or on the go via Apple Podcasts and Spotify

Walmart features in a holiday-shortened week with 57 S&P 500 reports. (0:17) Economists expect Q4 GDP growth near 2.8%. (1:10) Supreme Court could rule soon on Trump tariffs. (1:37)

The following is an abridged transcript:

It’s a holiday-shortened week for Wall Street, with markets closed Monday for Presidents’ Day — officially Washington’s Birthday, and observed as such by the NYSE.

But in the four trading days, there’s still plenty on the calendar, with 57 S&P 500 (SP500) companies reporting results.

Walmart (WMT) is the marquee name. The retail giant is expected to report fiscal Q4 EPS of $0.73 on revenue of $188.54B when it reports Thursday. Same-store sales are forecast to rise about 4.2%. Walmart also joined the $1T market-cap club last week.

Seeking Alpha analyst Grassroots Trading says Walmart is aggressively integrating AI — including “Sparky” — to drive efficiency and profitability, narrowing the gap with Amazon (AMZN). But they rate the stock a Strong Sell, arguing the valuation looks extreme, with limited margin of safety if multiples revert.

Also on the earnings calendar:

Palo Alto Networks (PANW) and Medtronic (MDT) report Tuesday, followed by DoorDash (DASH) and Occidental (OXY) on Wednesday.

On the economic front, the first look at Q4 GDP is due Friday, with economists expecting 2.8% annualized growth.

Wells Fargo says the underlying fundamentals still look solid — but estimates growth could run closer to 1.6% if you factor in the government shutdown’s drag on headline activity.

Also due Friday are the December income and spending figures, which include the core PCE price index — the Fed’s preferred inflation gauge. Core PCE is forecast to tick up to 3% year over year.

In Washington, a Supreme Court ruling on President Trump’s tariffs could come as soon as Friday. The court has flagged three opinion days: Feb. 20, Feb. 24, and Feb. 25.

Prediction markets indicate SCOUTS will rule against the tariffs. Kalshi implies about a 27% chance the court rules in favor, while Polymarket is around 26% as of today.

In the news this weekend, Nvidia (NVDA) says CEO Jensen Huang won’t attend the India AI Impact Summit in New Delhi “due to unforeseen circumstances.” But Nvidia said it remains “deeply committed” to the summit and to India’s rapidly advancing AI ecosystem.

The event runs Feb. 16 through Feb. 20, and is expected to draw heads of state — including French President Emmanuel Macron — along with top tech leaders such as Sundar Pichai of Alphabet (GOOG) (GOOGL) and Sam Altman of OpenAI (OPENAI).

For income investors, Chevron (CVX) goes ex-dividend Tuesday, paying out March 10.

ConocoPhillips (COP) and Hasbro (HAS) go ex-dividend Wednesday — ConocoPhillips pays out March 2, and Hasbro pays March 4.

And Microsoft (MSFT) goes ex-dividend Thursday, with a March 12 payout date.

And in the Wall Street Research Corner, Goldman Sachs has launched a software pair-trade basket — going long on names it sees as more insulated from AI disruption, and short on those it sees as more vulnerable.

On the long side are names such as Cloudflare (NET), CrowdStrike (CRWD), Palo Alto Networks (PANW), Oracle (ORCL), and Microsoft (MSFT).

On the short side, Goldman flagged Monday.com (MNDY), Salesforce (CRM), DocuSign (DOCU), Accenture (ACN) and Duolingo (DUOL).

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech17 hours ago

Tech17 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 hours ago

NewsBeat2 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business3 days ago

Business3 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market