Crypto World

Crypto Sentiment Set to Rise After CLARITY Act Passes

Passing the CLARITY crypto market structure bill could lift sentiment amid a broad downturn, according to United States Treasury Secretary Scott Bessent. In a CNBC interview, he described the bill’s stall as a drag on industry morale, noting that clarity on the framework would provide a much-needed anchor for investors and incumbents alike. He emphasized that moving the legislation forward quickly—ideally by spring, in the window between late March and late June—could set the tone for a more predictable regulatory environment as the political landscape shifts ahead of the 2026 midterm elections. Bessent warned that congressional dynamics, particularly the potential rebalancing of control in the House, will influence the odds of a deal becoming law.

“In a time when we are having one of these historically volatile sell-offs, I think some clarity on the CLARITY bill would give great comfort to the market, and we could move forward from there.”

In a time when we are having one of these historically volatile sell-offs, I think some clarity on the CLARITY bill would give great comfort to the market, and we could move forward from there.

I think if the Democrats were to take the House, which is far from my best case, then the prospects of getting a deal done will just fall apart,” Bessent continued. The Treasury secretary stressed that legislative motion on the bill should come “as soon as possible” and be sent to President Trump for signature within the spring window—an interval spanning roughly late March to late June—given the potential shift in political power during the 2026 midterms.

The broader discourse around the CLARITY Act has intersected with a series of policy conversations and industry concerns. White House officials had previously met with crypto and banking representatives to discuss stablecoins and market structure, signaling continued interest at the intersection of finance and regulation. The ongoing dialogue underscores the sensitivity of policy timing to electoral dynamics and the need for a credible legislative path to reduce uncertainty for participants across the ecosystem.

The 2026 midterm elections could throw a wrench in Trump’s crypto agenda

The balance of power in Washington often shifts during midterm years, a dynamic that former Magic Eden general counsel Joe Doll highlighted to Cointelegraph. The possibility that the House could tilt away from the current alignment injects additional risk into the policy calculus surrounding crypto-friendly reforms. Economic thinker Ray Dalio noted in January that a two-year window of political mandate could be undermined by a midterm verdict and the ensuing renegotiation of policy directions. If crypto-friendly principles are not codified into law, such political shifts could reverse the policy trajectories pursued during the administration. In the current landscape, the Republican Party holds a slim four-seat majority in the House (218-214), a distribution that means even narrow election outcomes could alter the calculus for reform.

Market watchers have also looked to prediction markets for a sense of how the midterms might unfold. Polymarket’s odds for the balance of power in 2026 project a split Congress as a plausible outcome (about 47%), with a Democratic sweep ranking at roughly 37% at the time of analysis. Those probabilities reflect the high degree of uncertainty that markets assign to policy continuity in crypto regulations, particularly if control of Congress remains contested. The numbers serve as a reminder that political risk remains a material variable for investors and firms navigating the regulatory landscape.

Sources and official references linked in coverage show that the policy conversation around the CLARITY Act is not happening in a vacuum. Reporting on the legislative posture, and the broader market implications, has drawn on remarks and analyses across major outlets and industry analyses, including coverage of the CLARITY Act’s political and market ramifications. The conversation also touches on the regulatory reception to stablecoins and market structure reforms, as seen in related reporting on White House discussions between regulators and industry participants.

As the discourse evolves, the question for market participants is how swiftly a clarified framework could be translated into enforceable rules and practical risk-management practices—without stifling innovation. A sooner movement toward clarity could reduce the anxiety that accompanies regulatory ambiguity, potentially supporting liquidity and risk appetite in a sector that has faced repeated bouts of volatility. But even with a clearer path to law, the degree to which the legislation aligns with the broader political project, and whether it endures through midterm shifts, will influence its effectiveness as a stabilizing force.

In this environment, the CLARITY bill stands out as a focal point where regulatory ambition meets political reality. The coming weeks and months will reveal whether the administration and lawmakers can reach a compromise that satisfies both investor protections and innovation-friendly constraints. The timing is tight: spring is traditionally the window for signature opportunities ahead of the new political cycle, and any delay could heighten the uncertainty that currently weighs on market sentiment.

The broader takeaway is that policy clarity matters more than ever when markets confront major volatility, and the next steps on the CLARITY Act could influence how the crypto sector allocates capital, builds infrastructure, and negotiates with traditional financial regulators. As the discussion continues, observers will be watching whether the administration can translate political will into a durable framework that supports both consumer protection and industry growth, while also accommodating the diverse interests that shape crypto policy in the United States.

What to watch next

- Progress of the CLARITY Act through congressional committees, with a focus on timing for floor action in the 2026 session.

- Any new White House statements or regulatory signals related to stablecoins and market structure reforms.

- Updates from key political actors as the 2026 midterms approach, including potential shifts in House control.

- Public commentary from major industry leaders and economists on the bill’s potential impact on liquidity and investor confidence.

- New polling or market-implied probabilities from prediction markets reflecting policy trajectory and election outcomes.

Sources & verification

- CNBC interview with Treasury Secretary Scott Bessent discussing the CLARITY bill and its potential impact (video, February 13, 2026).

- Crypto industry policy discussions and market structure debates referenced in Cointelegraph coverage on the CLARITY Act (Crypto industry split over clarity act).

- Cointelegraph reporting on White House discussions with crypto and banking reps about stablecoins and market structure (White House officials meeting market structure bill).

- Discussion of the 2026 US midterm balance of power and its implications for crypto policy (The balance of power typically shifts).

- Polymarket odds for the 2026 midterms and the likelihood of a split government (Polymarket: Balance of power 2026 midterms).

- US House data detailing party breakdown in the 118th Congress (data: pressgallery.house.gov).

Policy clarity could steer crypto markets through volatility ahead of 2026 midterms

The latest commentary from Treasury leadership underscores how regulatory clarity on the CLARITY Act is seen as a potential antidote to a period of heightened volatility in crypto markets. By framing a clear regulatory path, advocates argue it could ease caution among traders, reduce some of the overhang created by policy ambiguity, and possibly encourage more risk-taking in regulated venues. The argument is not merely about speed; it is about providing a stable, predictable framework that can accompany innovation rather than constrain it.

From a market dynamics standpoint, the timing is delicate. If the bill is advanced and signed into law ahead of the 2026 elections, industry participants hope for a period of relative policy continuity that could support capital formation and advanced product development. Conversely, a drawn-out process or a policy reversal in the wake of a midterm shift could reintroduce uncertainty, complicating executives’ investment theses and potentially altering capital flows across crypto markets and related financial instruments.

Ultimately, the CLARITY Act sits at the intersection of market structure discussions, consumer protection considerations, and the political calendar. The next steps will be telling: will policymakers align on a pragmatic framework that reduces risk without stifling innovation, or will partisan dynamics push reform onto a longer timeline? As observers weigh the odds of a spring signature, the industry remains focused on the broader trajectory of regulation, and on how that trajectory could influence liquidity, product development, and the appetite for regulated crypto ventures in a market that continues to grapple with volatility and regulatory ambiguity.

Crypto World

Dogecoin Dominates as Memecoins Surge Past Bitcoin in Risk-On Trading Frenzy

TLDR:

- Dogecoin recorded the highest trading volume among all memecoins during the recent rally phase.

- Memecoins outperformed Bitcoin significantly before entering correction while BTC remained stable.

- Historical cycles show Dogecoin surged 95x and 310x in past rallies with third cycle developing.

- The memecoin index tracks twelve tokens showing aggressive capital rotation into speculative assets.

Dogecoin spearheaded a speculative rally that pushed memecoins ahead of Bitcoin and other altcoins in recent days.

Trading volume for the leading memecoin exceeded all other tokens in its category. The surge reflects a clear shift toward higher-risk assets as market participants chase amplified returns.

Memecoins as a group delivered significant gains compared to Bitcoin’s steadier performance. The rally entered a correction phase over the weekend while Bitcoin maintained relative stability.

Trading Volume Surge Reflects Speculative Capital Shift

Dogecoin emerged as the standout performer among memecoins with the highest number of trades recorded. Market analytics platform Alphractal noted the exceptional trading activity in a weekend post.

The platform tracks a memecoin index composed of twelve tokens, including Dogecoin, Shiba Inu, Pepe, Dogwifhat, Floki, and Bonk. The index also monitors Ordinals, 1000SATS, Book of Meme, Meme, ConstitutionDAO, and Neiro.

The index showed clear outperformance against Bitcoin during the recent trading sessions. This performance gap illustrates how capital rotates aggressively into speculative assets during risk-on market phases.

Traders typically abandon conservative positions in favor of memecoins when seeking higher percentage gains.

Alphractal’s analysis highlighted that memecoins significantly outperformed Bitcoin and other altcoins over several days.

The rotation pattern matches behavior seen during previous speculative episodes in cryptocurrency markets. Retail investors often drive these movements as momentum builds around lower-priced tokens.

However, the memecoin rally showed signs of exhaustion as Sunday trading progressed. Memecoins started correcting while Bitcoin held steady at its current price levels. The divergence suggests profit-taking among traders who capitalized on the recent price spike.

Historical Patterns Suggest Extended Rally Potential

Market analyst Bitcoinsensus examined Dogecoin’s historical price cycles in recent commentary on the token. The analysis compared the current market environment to two previous bull cycles. During the first cycle, Dogecoin experienced a roughly 95-fold surge from consolidation levels.

The second cycle proved more explosive with a rally approaching 310 times the starting price. The third cycle remains in development without a clear peak forming yet.

Bitcoinsensus suggested Dogecoin could potentially reach the five-dollar zone if current patterns mirror past cycles.

Historical data shows Dogecoin performs best during strong risk-on environments across cryptocurrency markets. These rallies typically emerge after extended consolidation periods where the token trades sideways.

The breakout phase then attracts speculative capital as momentum traders enter positions.

The current market structure displays similarities to setup conditions observed before previous major rallies. Technical patterns and trading behavior show familiar characteristics from earlier cycles.

Market participants remain divided on whether historical performance will repeat given evolving market dynamics and regulatory landscapes.

Crypto World

Bitcoin Below $70K: Analyst Claims Derivatives Market Has Replaced On-Chain Price Discovery

TLDR:

- Bitcoin’s hard cap of 21 million coins no longer controls price due to unlimited synthetic derivatives exposure

- Single Bitcoin can back multiple financial instruments simultaneously, creating fractional-reserve dynamics

- Wall Street institutions manufacture inventory through cash-settled futures and perpetual swaps to control markets

- Price discovery shifted from blockchain fundamentals to derivative positioning and liquidation flow mechanisms

Bitcoin has dropped below $70,000, prompting renewed debate about the cryptocurrency’s price discovery mechanism.

A crypto analyst argues that the digital asset no longer trades on simple supply and demand principles. The market structure has fundamentally changed due to derivatives layering, according to the analysis.

This shift mirrors what happened to traditional commodities when Wall Street introduced complex financial instruments. The original Bitcoin thesis may be under pressure from synthetic supply creation.

Derivatives Disrupt Bitcoin’s Scarcity Model

Bitcoin’s value proposition rested on two core principles: a hard cap of 21 million coins and resistance to rehypothecation. These foundations have been challenged by the introduction of multiple derivative products.

Cash-settled futures, perpetual swaps, options, ETFs, and wrapped BTC now dominate trading volume. Prime broker lending and total return swaps add additional layers of synthetic exposure.

Crypto analyst Danny_Crypton posted on social media that price discovery has moved away from the blockchain. The on-chain supply remains fixed, but derivatives create unlimited synthetic exposure.

This dynamic has transformed Bitcoin into a market controlled by positioning and liquidation flows. Traditional supply and demand metrics no longer apply in the same way.

The shift parallels what occurred in gold, silver, oil, and equity markets. Once derivatives overtook spot trading in these assets, price behavior changed dramatically.

Physical scarcity became less relevant than paper positioning. The same pattern appears to be unfolding in cryptocurrency markets.

Wall Street institutions can now create multiple claims on a single Bitcoin. One coin might simultaneously back an ETF share, futures contract, perpetual swap, options position, broker loan, and structured note.

This fractional-reserve structure contradicts Bitcoin’s original design philosophy. The market has evolved into something different from what early adopters envisioned.

Synthetic Float Ratio Explains Current Dynamics

The analyst introduced a metric called the Synthetic Float Ratio to explain recent price action. This measurement tracks how synthetic supply compares to actual on-chain supply.

When synthetic supply overwhelms real supply, traditional demand cannot push prices higher. Hedging requirements and liquidation cascades become the dominant forces.

Market makers can trade against Bitcoin using these derivative instruments. The strategy involves creating unlimited paper BTC and shorting into rallies.

Forced liquidations allow covering positions at lower prices. This cycle repeats, creating downward pressure regardless of underlying demand.

The current drop below $70,000 reflects these structural dynamics rather than retail selling. Institutional players use derivatives to manufacture inventory and manage risk.

Their hedging activity creates price movements that appear disconnected from on-chain fundamentals. Traditional technical analysis may miss these underlying mechanics.

The analyst claims to have successfully predicted Bitcoin tops and bottoms for over a decade. His latest warning suggests that investors should understand these structural changes.

The cryptocurrency market has matured into a derivatives-dominated ecosystem. Whether this represents progress or deviation from Bitcoin’s original vision remains a contentious topic among market participants.

Crypto World

PGI CEO Sentenced to 20 Years in $200M Bitcoin Ponzi Scheme

PGI’s CEO spent millions on luxury cars, homes, hotels, designer clothing, jewelry, and watches using investor funds.

The US Department of Justice announced that Ramil Ventura Palafox, the CEO of Praetorian Group International (PGI), was sentenced to 20 years in prison.

Prosecutors stated that Palafox operated a $200 million Bitcoin-based Ponzi scheme that defrauded more than 90,000 investors across the world.

Bitcoin Fraud Case

According to court documents, Palafox, the 61-year-old dual citizen of the United States and the Philippines, owned and controlled PGI and served as its chairman, chief executive officer, and chief promoter. Prosecutors said Palafox falsely claimed that PGI was engaged in Bitcoin trading and marketed the firm as a multi-level marketing investment opportunity. He promised investors daily returns ranging from 0.5% to 3%.

In reality, PGI was not trading Bitcoin at a scale capable of generating those returns, and investor payouts were funded using victims’ own deposits or money from new investors. From December 2019 through October 2021, at least 90,000 investors invested more than $201 million in PGI, including approximately $30.3 million in fiat currency and at least 8,198 BTC, worth around $171.5 million at the time.

As a result of the scheme, investor losses rose to over $62 million. Court records reveal that Palafox created an online PGI portal that allowed investors to track what he represented as their investment performance. Between 2020 and 2021, the website consistently and fraudulently displayed gains, which led victims to believe their investments were profitable and secure.

Luxury Cars, Mansions, and Lies

Palafox spent roughly $3 million on 20 luxury vehicles, including models from Porsche, Lamborghini, McLaren, Ferrari, BMW, and Bentley. He also spent about $329,000 on penthouse suites at a luxury hotel chain and purchased four homes in Las Vegas and Los Angeles, estimated to be more than $6 million.

Additional spending included approximately $3 million on luxury clothing, watches, jewelry, and home furnishings from retailers such as Louboutin, Neiman Marcus, Gucci, Versace, Ferragamo, Valentino, Cartier, Rolex, and Hermès. Prosecutors said Palafox also transferred at least $800,000 in fiat currency and 100 BTC, which was then equivalent to $3.3 million, to a family member.

You may also like:

The Justice Department said PGI victims may be eligible for restitution.

Separately, PGI Global’s UK entity was shut down by the United Kingdom High Court back in 2022. In April 2025, the US Securities and Exchange Commission (SEC) charged Palafox with orchestrating the massive Ponzi scheme.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Virginia Crypto ATM Regulation Bill Awaits Governor’s Signature After Legislative Approval

TLDR:

- Virginia’s crypto kiosk bill passed both legislative chambers and now awaits the governor’s final signature.

- New regulations impose 48-hour holds for first-time users to prevent fraud and enable transaction reversals.

- Approximately 7% of crypto kiosk transactions involve fraud, prompting proactive regulatory intervention efforts.

- Operators cannot market crypto kiosks as ATMs under the bill, addressing widespread consumer confusion issues.

Virginia stands on the brink of implementing comprehensive cryptocurrency kiosk oversight as regulatory legislation reaches the governor’s desk.

Both the state Senate and House approved the measure, establishing licensing frameworks and consumer protections.

The bill now requires executive approval to become law. Industry operators would face new requirements including transaction limits and identification protocols. This regulatory approach positions Virginia among states taking definitive action on crypto kiosk oversight.

Comprehensive Regulatory Measures Target Kiosk Operations

The pending legislation establishes a statewide registration system for cryptocurrency kiosk operators across Virginia. Businesses must obtain licenses and comply with ongoing reporting standards under the proposed framework.

Transaction restrictions represent a cornerstone of the consumer protection approach. Users would encounter both daily and monthly caps on amounts processed through these terminals.

First-time kiosk users face a mandatory 48-hour waiting period before transactions complete. This hold mechanism creates an opportunity to reverse suspected fraudulent purchases.

All transactions require identity verification regardless of purchase amount. Operators must display prominent warning notices on every machine about potential fraud risks.

Marketing restrictions prevent operators from describing these devices as ATMs or using related language. Delegate Michelle Maldonado explained the reasoning behind this provision.

“The fact is, it’s kind of confusing to some people because they look like ATMs. They’re shaped like ATMs. But instead of taking money out, you’re sort of putting money in to purchase crypto that goes into a broader exchange,” the Manassas-area representative said.

The legislation requires fee caps and refund mechanisms for recoverable funds. Maldonado sponsored the House version after specific Virginia fraud cases came to light.

A Southwest Virginia resident lost $15,000 through a kiosk-based scam. Similar incidents occurred in Fairfax County, demonstrating statewide vulnerability to these schemes.

Bill Responds to Growing Fraud Concerns

Industry data indicates approximately 7% of crypto kiosk transactions currently involve fraudulent activity. Maldonado views this percentage as evidence for preventive regulatory action rather than evidence of minimal problems.

“That doesn’t mean that there’s no problem. It means that it’s in the beginning. And so this is the time to put the guardrails and the safeguards in place so that 7% doesn’t grow,” she explained.

Scammers use various deception tactics to direct victims toward crypto kiosks. Fake debt collection schemes claim immediate cryptocurrency payment resolves outstanding obligations.

Fraudsters warn targets of impending legal trouble unless they purchase digital currency quickly. Romance scams frequently exploit these terminals as well.

Blockchain technology makes cryptocurrency transactions effectively irreversible once completed. “The thing about crypto is that once it goes into the exchange, which is in the blockchain environment, there’s no way to trace it. There’s no way to get it back,” Maldonado noted.

Traditional banking systems offer dispute resolution and chargeback protections that cryptocurrency transactions lack.

The delegate emphasized the broader regulatory philosophy behind the legislation. “We really want to make sure that we are educating people, that we’re giving them the tools and that we’re holding industry accountable. And that means that the way they do business in the Commonwealth matters. And there’s got to be accountability,” she stated.

AARP Virginia strongly supports the awaiting legislation. The organization highlights increased targeting of older adults through kiosk-related fraud schemes.

Nationwide losses from similar scams have reached $250,000 in individual cases. Governor action will determine whether these safeguards take effect statewide.

Crypto World

Saylor Signals Week 12 of Consecutive Bitcoin Buys From Strategy

Michael Saylor, the co-founder of Bitcoin (BTC) treasury company Strategy, signaled that the company is acquiring more BTC amid the ongoing market dip, marking week 12 of a consecutive buying streak.

Saylor posted the Strategy BTC accumulation chart via the X social media platform on Sunday. The chart has become synonymous with BTC purchases made by the company, which is touting its upcoming 99th BTC transaction.

Strategy’s most recent BTC purchase occurred on Monday, when the company bought 1,142 BTC for more than $90 million, bringing its total holdings to 714,644 BTC, valued at about $49.3 billion using market prices at the time of publication.

Bitcoin and the broader crypto markets declined sharply following a flash crash in October that caused the price of BTC to decline by over 50% from the all-time high above $125,000 and below Strategy’s $76,000 cost basis, its average price of acquisition per BTC.

The company has continued to accumulate amid the market downturn, defying analyst suggestions that Strategy would dump its Bitcoin holdings or pause accumulation in the event of a market-wide downturn.

Related: Strategy CEO eyes more preferred stock to fund Bitcoin buys

Strategy continues to accumulate despite the collapse of crypto treasury companies

Even before October’s flash crash caused a market downturn, the crypto treasury sector was showing signs of collapse, with many treasury companies recording sharp declines in their stock prices and a collapse of mNAV, or multiple on net asset value, a critical metric for crypto treasury companies.

The multiple on net asset value, or the premium added to a company’s stock above its net asset holdings, fell below 1 for several leading crypto treasury companies by September 2025, Standard Chartered Bank warned.

Treasury companies with an mNAV above 1 have easier access to financing and stock issuance to buy more crypto.

Conversely, mNAV values below 1 signal potential trouble for these companies, as market participants price the company below the total assets it holds.

Strategy earlier this month reported a Q4 loss of $12.4 billion, sending the company’s stock price tumbling by about 17%. The shares have recovered some of that decline in recent days, closing on Friday at $133.88.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Hong Kong is trying to build up its crypto regulations: State of Crypto

Consensus Hong Kong wrapped up with a bang as policymakers announced new initiatives to grow the digital assets sector.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The narrative

Policymakers at Consensus Hong Kong announced a slew of initiatives aimed at strengthening the local digital asset ecosystem.

Why it matters

Philosophically speaking, the question of why we still care about this industry remains top of mind. Consensus showed that despite the sometimes ridiculous projects and unachievable hype cycles, companies still have a genuine use for the technology.

Breaking it down

Hong Kong’s regulators are trying to encourage growth in the local digital asset ecosystem, unveiling a framework for perpetual contracts and saying that stablecoin licenses will be announced in the coming month.

“That certainty of direction gives a lot of companies confidence to invest in Hong Kong and to build further,” said Jason Atkins, the chief commercial officer of crypto trading firm Auros.

While the Special Administrative Region of China is not yet close to approving all applicants and activities, the fact that regulators like the Securities & Futures Commission and the Hong Kong Monetary Authority are willing to engage and adapt their approaches to digital assets is still significant, he told CoinDesk. They’re asking companies what they need to do to encourage investment, he said.

“We’ve gone into the SFC a few times, spoken with the HKMA on think tanks and panels and groups where they literally are just trying to understand how our businesses operate and what we need to invest even more into the city, which is really positive,” he said.

The regulators have been positively engaged, trying to discern what companies need from them to operate in the region. This includes asking whether certain regulations need to be adjusted to address market needs, he said.

“So they think about ways they can loosen those or lighten them up for certain types of investor classes,” he said.

This fits with a broader trend of more traditional institutions wanting to get into crypto — or at least blockchain.

Multiple panelists, representing companies like Franklin Templeton and Swift, said they were using or exploring blockchain technology to streamline their operations. It’s reminiscent of the 2018 “blockchain, not Bitcoin” era, but these entities are actually executing, rather than just announcing pilots.

That an increasing number of traditional entities are moving into blockchain may be the story of 2026, said Edge & Node CEO Rodrigo Coelho.

Companies are “rushing to figure this out,” he told CoinDesk. “Companies are seeking out consulting and expertise.”

Shawn Chan, of Singapore Gulf Bank, described these types of rails as being superior for transferring value.

While international regulatory hurdles need to be worked out, he estimated that companies will increasingly adopt blockchain tooling within the next decade.

This week

- Congress and federal regulators are not holding any hearings tied to crypto this week.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Crypto World

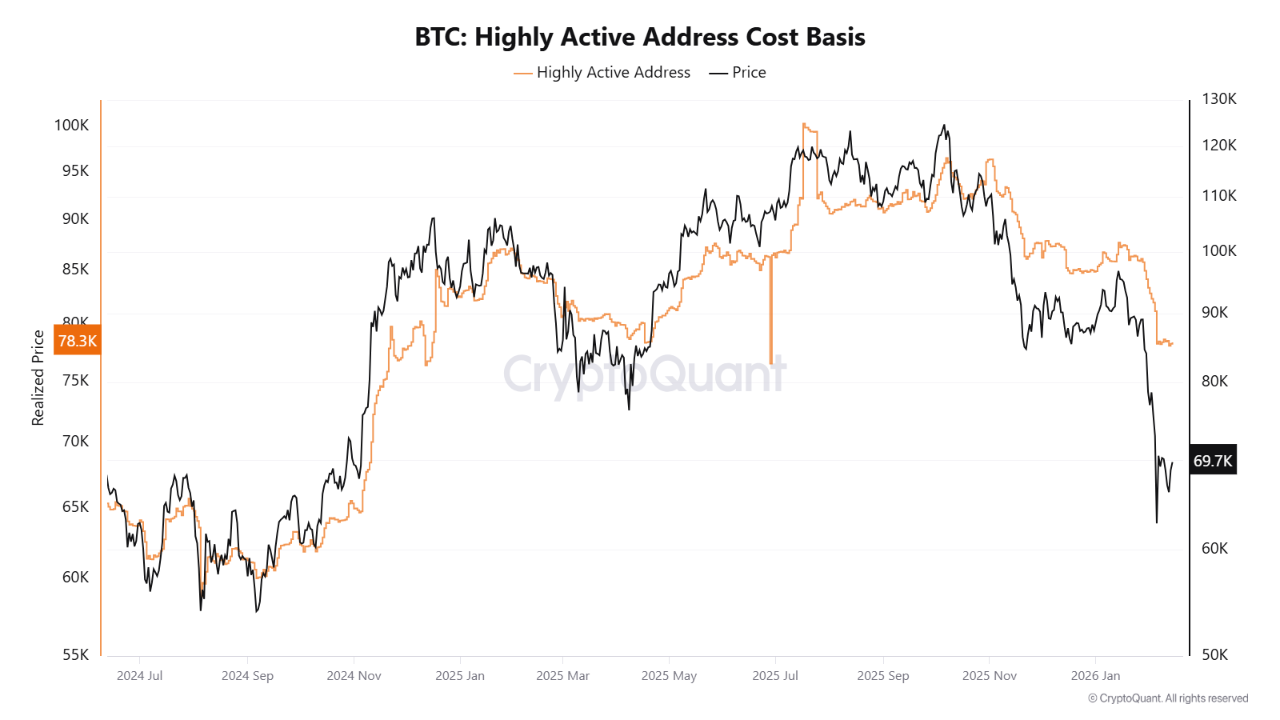

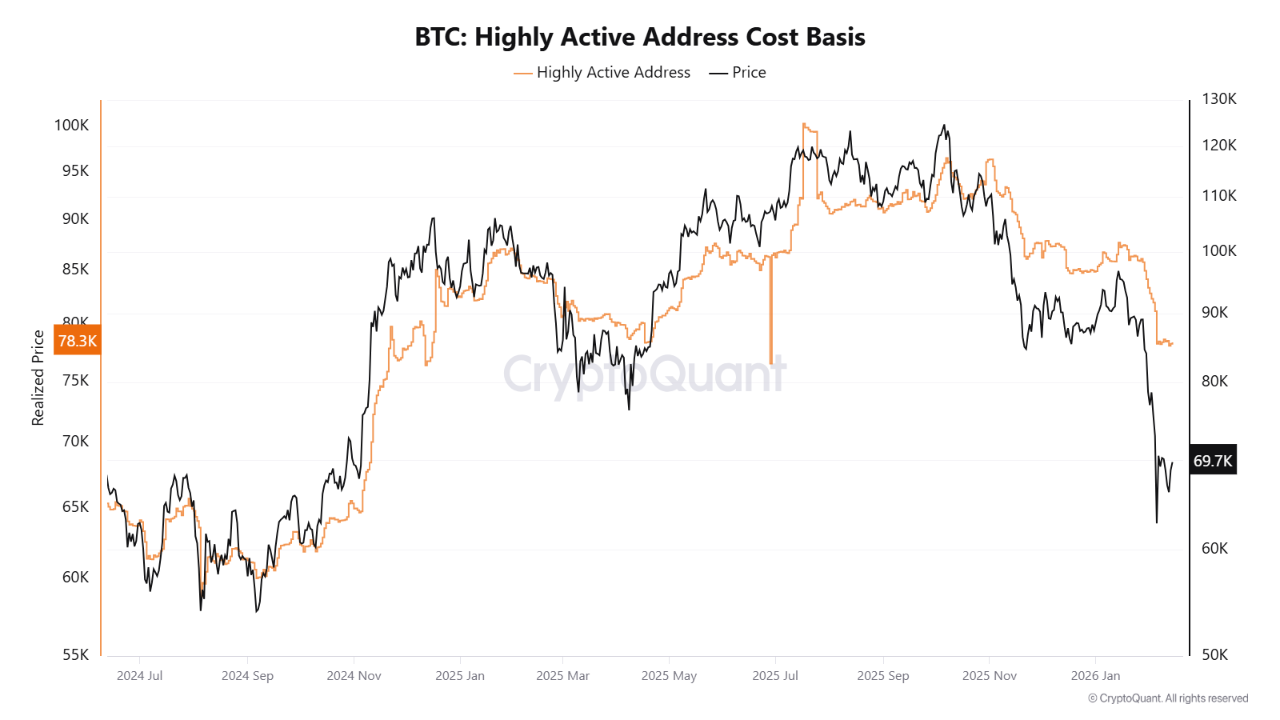

Bitcoin’s $78K Realized Price Emerges as Make-or-Break Level for Market Recovery

TLDR:

- Bitcoin currently trades below $78K, the realized price representing active addresses’ cost basis.

- Holding below this level places frequent traders underwater, shifting behavior from buying to selling.

- Sustained reclaim above $78K would return active participants to profit and reduce supply pressure.

- Failure to break resistance increases the probability of decline toward $50K long-term holder support zone.

Bitcoin trades below a structural threshold that could determine the market’s near-term direction. The cryptocurrency currently sits beneath $78,000, which represents the realized price of highly active addresses.

This level serves as a critical cost basis for participants who transact most frequently. Market observers note that price behavior around this zone will likely shape recovery prospects or signal further downside pressure.

The $78K Threshold as Market Divider

Bitcoin’s realized price for highly active addresses stands near $78,000 at present. This metric reflects the aggregate cost basis of market participants who respond quickly to changing conditions.

Unlike static technical levels, this threshold represents actual positioning and sentiment among active traders. The realized price functions as a behavioral marker rather than a simple chart reference.

Spot price currently trades below this realized level across major exchanges. This positioning places highly active addresses in unrealized losses on average.

Market structure shifts when participants hold underwater positions relative to their entry points. The change alters trading behavior from accumulation toward distribution as holders seek exits.

Trading below the $78K realized price historically increases overhead supply during rally attempts. Active addresses shift from absorbing sell pressure to contributing to it.

Source: Cryptoquant

Each move higher faces resistance from participants looking to reduce exposure near breakeven. The dynamic transforms what might otherwise serve as support into a supply zone.

The transition from support to resistance carries weight for short-term price action. Recovery attempts meet sellers who entered at higher levels and now seek liquidity.

This pattern reinforces the $78K zone as a divider between market phases. Acceptance below this level suggests continued pressure until equilibrium shifts.

Path Forward and Downside Risk

Market recovery requires the price to reclaim and hold above the $78K realized price. A successful breakout would return highly active addresses to profitability on average.

This shift reduces the incentive to distribute on strength and allows demand to stabilize. Sustained acceptance above this threshold validates the bullish case for continuation.

Reclaiming $78K would materially alter the market structure by removing a layer of supply. Profitable positions among active traders typically reduce selling pressure during subsequent advances.

The change allows price to build on higher ground without constant resistance. Recovery from above this level tends to show better follow-through than rallies from beneath it.

Repeated failures to break above $78K carry asymmetric downside risk for current holders. Each unsuccessful attempt reinforces the zone as distribution territory and weakens buyer conviction.

The pattern increases the probability that the price will seek the next major realized anchor. Technical structure deteriorates when key levels repel multiple breakout attempts.

The next dominant realized price sits near $50,000, corresponding to the long-term holder cost basis. This lower threshold represents participants with stronger conviction and lower propensity to sell.

Price typically finds more durable support at long-term holder levels due to reduced panic selling. A move toward $50K would mark deeper mean reversion before sustainable bottoming patterns can emerge.

Crypto World

Cardano is Launching a New Stablecoin This Month

The Cardano blockchain ecosystem will integrate USDCx, a variant of Circle’s USDC stablecoin, by the end of February.

On February 15, Philip DiSaro, CEO of the smart contract development firm Anastasia Labs, confirmed that “USDCx” will go live on the network before the end of the month.

Sponsored

Sponsored

Cardano Targets Stablecoin Deficit With Upcoming USDCx Debut

USDCx is a dollar-denominated stablecoin backed 1:1 by USDC held through Circle’s xReserve infrastructure. Circle is the issuer of USDC, the second-largest stablecoin by market capitalization.

According to DiSaro, USDCx will function identically to native USDC for retail users, allowing for seamless transactions across decentralized applications.

However, he noted that the asset differs slightly in its redemption mechanics compared to USDC.

“USDCx is functionally identical to native USDC for retail users. The literal only difference in functionality is that USDC can be redeemed directly for USD in a bank account through Circle EXCLUSIVELY by institutional partners of Circle. That means this is not possible and doesn’t matter to retail users, or even DeFi power users because they are not able to do this with USDC either,” DiSaro stated.

Still, DiSaro emphasized that the new stablecoin retains full USDC utility for the broader Cardano ecosystem.

“USDCx is not scuffed USDC; it has all of the functionality that USDC has for retail. You can bridge USDCx to any CCTP enabled chain in a single transaction, which would be the same amount of transactions if we had native USDC. Anything that you can pay for with USDC in a transaction, you can pay for with USDCx in a transaction,” DiSaro explained.

Nonetheless, market observers have noted that the launch represents a critical infrastructure upgrade for Cardano.

Sponsored

Sponsored

Notably, the Charles Hoskinson-led blockchain has historically struggled to attract the deep, stablecoin liquidity seen on rival chains such as Ethereum and Solana.

Data from DeFiLlama shows it hosts less than $40 million in stablecoin supply, compared with the billions held on rivals such as Ethereum.

Previous attempts to bootstrap stablecoin liquidity on Cardano have largely failed to gain traction, leaving the network at a competitive disadvantage in the decentralized finance sector.

So, this move is designed to address the network’s long-standing liquidity fragmentation and bolster its decentralized finance capabilities.

Meanwhile, the initiative arrives as Cardano attempts to shed its reputation for isolation through an integration with LayerZero. This interoperability protocol facilitates communication between separate blockchains.

By leveraging LayerZero, Cardano applications can theoretically interact trustlessly with more than 50 other networks, including Ethereum and Solana.

However, investors have yet to react positively to these structural changes.

BeInCrypto’s data shows that the network’s native ADA token has declined more than 25% over the past month to a 2-year low of $0.24. It has recovered to $0.28 as of press time.

This price performance reflects the broader crypto market downtrend and skepticism about the chain’s ability to capture market share in an increasingly crowded crypto economy.

Crypto World

Most Undervalued Since March 2023 at $20K, BTC Price Metric

Bitcoin (CRYPTO: BTC) is approaching what on-chain researchers describe as an undervalued zone for the first time in more than three years, according to CryptoQuant’s latest data. The market-value-to-realized-value (MVRV) ratio, a classic gauge of whether Bitcoin is fairly valued relative to the price at which the supply last moved, has moved toward a breakeven point after a months-long downtrend that followed an October 2025 all-time high. Last week’s price action saw BTC dip below $60,000, a level that has framed the market’s sentiment and testing of support in recent cycles. With the MVRV metric hovering near 1.1, analysts say the asset is edging into territory that historically accompanies accumulation and potential reversal, though they caution that no single indicator guarantees a bottom.

Key takeaways

- The MVRV ratio is approaching its key breakeven threshold for the first time in more than three years, signaling a potential move toward undervaluation.

- CryptoQuant data show the MVRV reading around 1.1, the lowest since March 2023 when Bitcoin was trading near $20,000.

- Analysts emphasize that when MVRV dips below 1, Bitcoin tends to be undervalued; the current reading sits above that level but within a range historically tied to bottoms or near-bottom conditions.

- The two-year rolling Z-score of the MVRV ratio has recently reached historic lows, a pattern some traders compare to prior bear-market bottoms, suggesting accumulation dynamics may be forming.

- Past commentary notes that the Downdraft since the October 2025 peak has not featured a rapid ascent into an overvalued zone, a nuance that could differentiate this cycle’s bottom formation from earlier ones.

Tickers mentioned: $BTC

Market context: On-chain signals come as Bitcoin experiences a multi-quarter consolidation after a new all-time high, with traders watching MVRV and Z-score metrics alongside price levels around $60,000. The combination of shifting on-chain signals and macro risk sentiment will likely influence whether the current downtrend resumes or a broader accumulation phase takes hold.

Why it matters

On-chain metrics like MVRV provide a lens into the psychological and behavioral underpinnings of Bitcoin’s price action. When the market value to realized value ratio approaches breakeven, commentators interpret it as a potential signal that the supply-weighted cost basis is, on average, becoming cheaper relative to current market prices. CryptoQuant contributors have highlighted that Bitcoin’s MVRV ratio hovered around 1.13 after Bitcoin’s dip below the $60,000 level last week—the lowest print since March 2023, when BTC traded near $20,000. That backdrop matters because it frames a broader narrative: the asset may be transitioning from a drawdown phase into a period where long-term holders could be stepping in at historically favorable levels.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

CryptoQuant’s analysis emphasizes that the current reading should be interpreted in the context of a four-month downtrend that followed Bitcoin’s October 2025 peak. The team notes that the market did not experience a sharp move into an obviously overvalued zone during the most recent bull cycle, a nuance that could influence how traders interpret the “bottom formation” narrative this time around. The research argues that such a structural difference could mean the eventual bottom may form gradually rather than through a sudden capitulation event—a scenario that has implications for long-term investors and risk teams evaluating exposure.

“The current Z-Score of $BTC is lower than during the bear market bottom in 2015, 2018, COVID crash 2020 and 2022,”

commented Michaël van de Poppe, a well-known trader and analyst, underscoring how the present configuration differs from prior cycles. In another update, CryptoQuant contributor GugaOnChain used a separate Z-score iteration to characterize BTC/USD as being in a “capitulation zone,” a reading that some interpret as an early stage of accumulation pressure forming behind the scenes. The analyst framed the takeaway as an invitation to consider the bottom could be forged in the current environment rather than simply waiting for a textbook capitulation event to materialize.

“The indicator suggests that we are approaching the historical accumulation phase,”

GugaOnChain wrote, adding that the statistical deviation captured by the Z-score points to opportunity rather than imminent disaster. While the language is nuanced, the consensus in these on-chain circles is that Bitcoin’s downside risk may be increasingly limited as long-term holders show willingness to accumulate near these levels.

What to watch next

- Track the MVRV ratio for a breakeven shift toward or below 1.0, which historically signals stronger undervaluation periods or a local bottom formation.

- Monitor the two-year rolling Z-score trajectory for a sustained move away from capitulation readings toward accumulation-style behavior.

- Observe Bitcoin price action around key support zones, particularly a continued hold above $60,000 and any subsequent retests that could validate the on-chain narrative.

- Look for corroborating on-chain signals, such as realized-cap data and transaction-flow metrics, that would reinforce a shift from distribution to accumulation.

Sources & verification

- CryptoQuant analysis on Bitcoin’s MVRV ratio and the “undervalued” zone hypothesis.

- CryptoQuant commentary on Z-score readings and capitulation-zone signals for BTC/USD.

- Cointelegraph coverage of Bitcoin’s price action, including the recent dip below $60,000 and prior bear-market analyses referenced in related on-chain pieces.

- Historical context from on-chain reporting on prior cycle bottoms (2015, 2018, 2020, 2022) and the 2023 regime when MVRV prints below 1.

Bitcoin’s on-chain signals point toward undervaluation and potential bottom formation

Bitcoin’s current on-chain narrative centers on a delicate balance between valuation signals and price action. The MVRV ratio, long used to gauge whether market prices are aligned with realized on-chain cost bases, has begun to test a breakeven threshold after a prolonged downtrend. The latest reads show MVRV around 1.1, a level that CryptoQuant contributors describe as edging into an undervaluation zone. This is especially notable given that the most recent weekly close saw BTC slip under the $60,000 mark, a psychological line that has acted as both a magnet and a ceiling in various market regimes. The juxtaposition of a price discipline around key levels with an MVRV metric that says, metaphorically, “value is being accumulated near the current prices,” fuels a nuanced debate on whether a lasting bottom is imminent or whether further consolidation is necessary before a durable uptrend can resume. (CRYPTO: BTC)

CryptoQuant researchers emphasize that when MVRV falls below 1, the signal is a cleaner undervaluation flag. While the current approximation sits around 1.1 rather than 1.0, the interpretation remains constructive: price levels could reflect a rising probability of longer-term value attraction. The last time MVRV explicitly dipped below 1 was at the start of 2023, when BTC traded around $20,000. The comparison underscores that the present cycle has delivered a different flavor of bottoming dynamics, one that may unfold more gradually than in prior cycles. The source notes that the peak-to-trough structure of the current drawdown did not send the market into a textbook overvalued regime, which broadens the set of possible scenarios around the eventual bottom and subsequent recovery.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

Beyond the MVRV signal, the market is attuned to the behavior of another metric set—the Z-scores that measure how far current values diverge from historical patterns. In two-year windows, the MVRV Z-score has dipped to an all-time low in several instances, a pattern analysts say mirrors the kinds of bottoming behavior seen in previous cycles. Michaël van de Poppe has highlighted that the current Z-score is lower than what was observed at major bear-market bottoms in 2015, 2018, 2020, and 2022, though no single metric guarantees an outcome. A different analyst, GugaOnChain, has used an alternate Z-score variant to characterize BTC/USD as being in a capitulation zone—an environment that often precedes accumulation-driven rebounds. The underlying message is that the bottom formation, if it is underway, could be a more drawn-out process than in some historical episodes, with on-chain dynamics providing nuance that price charts alone might miss.

These signals come at a time when the broader market is listening closely to on-chain data instead of relying solely on momentum-driven narratives. The combination of a price dip to sub-60k levels and a valuation framework that points toward undervaluation is generating renewed interest among long-term holders who recall similar cycles in which the real value of Bitcoin begins to assert itself well before a definitive price breakout appears on traditional charts. In this light, the discussion shifts from whether a bottom exists to how convincingly the current readings could translate into a sustainable reversal once the cycle completes its consolidation phase. The narrative remains contingent on a confluence of factors, including future price action, on-chain flows, and macro risks that continue to shape risk appetite across the crypto ecosystem.

The analysis, while nuanced, reinforces a cautious yet curious stance among observers: the market may be near a critical juncture where valuation signals begin to align with price stability and eventual demand. As ever, the caution remains that on-chain indicators offer probabilities, not certainties, and that a range of outcomes remains plausible depending on how external forces evolve in the weeks ahead.

Crypto World

Morgan Stanley Hiring Blockchain Engineers to Integrate Ethereum, Polygon, Canton, and Hyperledger

TLDR:

- The blockchain engineer role integrates Ethereum, Polygon, Hyperledger, and Canton.

- Multi-chain strategy balances public liquidity with enterprise-grade compliance.

- Role focuses on interoperability, secure APIs, and internal orchestration layers.

- Compensation reaches $150,000, reflecting strategic blockchain talent investment.

Morgan Stanley is building a multi-chain blockchain infrastructure integrating Ethereum, Polygon, Hyperledger, and Canton, with engineers earning up to $150,000.

Globally, top banks like ICBC ($6.7T assets) and JPMorgan Chase ($4T) are driving trading and investment growth. This highlights institutional focus on secure, real-time financial data and advanced blockchain solutions.

Role Overview and Multi-Chain Focus

In their post, Morgan Stanley noted that the blockchain engineer will lead projects integrating at least four blockchains. Ethereum offers a public ecosystem with deep liquidity and extensive developer tools.

Polygon complements Ethereum by providing lower fees and faster transactions while maintaining compatibility with Ethereum standards.

Hyperledger supports permissioned networks, channel-level privacy, and customizable consensus, making it suitable for internal banking workflows and consortium-based settlement systems.

Canton emphasizes privacy-preserving synchronization across networks, designed for regulated financial markets.

The combination indicates Morgan Stanley is targeting a hybrid approach. Public networks may handle secondary market activity and broader liquidity access.

Permissioned networks focus on issuance, compliance, and confidential processing. Engineers in this role will manage the integration across these systems to ensure consistent performance and interoperability.

This structure allows different layers of the platform to operate according to business needs. Developers will need to design abstraction layers, secure API gateways, and key management frameworks.

This ensures governance, observability, and DevOps controls remain uniform across networks.

Strategic Purpose and Talent Investment

Morgan Stanley’s posting highlights the institution’s intent to build multi-chain capabilities while reducing reliance on any single blockchain.

Ethereum and Polygon provide market access, while Hyperledger and Canton satisfy privacy and regulatory requirements.

By combining public and permissioned systems, the bank maintains flexibility for evolving regulatory landscapes. Banks are increasingly adopting hybrid systems to balance compliance with liquidity opportunities.

The posting lists compensation up to $150,000 per year, reflecting the strategic value of this role. The position signals that Morgan Stanley is not experimenting but actively investing in blockchain infrastructure.

Candidates are expected to deliver integration solutions that connect public networks with enterprise-grade permissioned systems.

Internal orchestration and platform-agnostic engineering will allow Morgan Stanley to select networks based on product requirements. Engineers will ensure secure transaction processing, consistent governance, and operational transparency.

This aligns the bank with global trends toward tokenized assets and programmable financial infrastructure.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech17 hours ago

Tech17 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 hours ago

NewsBeat3 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business3 days ago

Business3 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market