Crypto World

Cardano is Launching a New Stablecoin This Month

The Cardano blockchain ecosystem will integrate USDCx, a variant of Circle’s USDC stablecoin, by the end of February.

On February 15, Philip DiSaro, CEO of the smart contract development firm Anastasia Labs, confirmed that “USDCx” will go live on the network before the end of the month.

Sponsored

Sponsored

Cardano Targets Stablecoin Deficit With Upcoming USDCx Debut

USDCx is a dollar-denominated stablecoin backed 1:1 by USDC held through Circle’s xReserve infrastructure. Circle is the issuer of USDC, the second-largest stablecoin by market capitalization.

According to DiSaro, USDCx will function identically to native USDC for retail users, allowing for seamless transactions across decentralized applications.

However, he noted that the asset differs slightly in its redemption mechanics compared to USDC.

“USDCx is functionally identical to native USDC for retail users. The literal only difference in functionality is that USDC can be redeemed directly for USD in a bank account through Circle EXCLUSIVELY by institutional partners of Circle. That means this is not possible and doesn’t matter to retail users, or even DeFi power users because they are not able to do this with USDC either,” DiSaro stated.

Still, DiSaro emphasized that the new stablecoin retains full USDC utility for the broader Cardano ecosystem.

“USDCx is not scuffed USDC; it has all of the functionality that USDC has for retail. You can bridge USDCx to any CCTP enabled chain in a single transaction, which would be the same amount of transactions if we had native USDC. Anything that you can pay for with USDC in a transaction, you can pay for with USDCx in a transaction,” DiSaro explained.

Nonetheless, market observers have noted that the launch represents a critical infrastructure upgrade for Cardano.

Sponsored

Sponsored

Notably, the Charles Hoskinson-led blockchain has historically struggled to attract the deep, stablecoin liquidity seen on rival chains such as Ethereum and Solana.

Data from DeFiLlama shows it hosts less than $40 million in stablecoin supply, compared with the billions held on rivals such as Ethereum.

Previous attempts to bootstrap stablecoin liquidity on Cardano have largely failed to gain traction, leaving the network at a competitive disadvantage in the decentralized finance sector.

So, this move is designed to address the network’s long-standing liquidity fragmentation and bolster its decentralized finance capabilities.

Meanwhile, the initiative arrives as Cardano attempts to shed its reputation for isolation through an integration with LayerZero. This interoperability protocol facilitates communication between separate blockchains.

By leveraging LayerZero, Cardano applications can theoretically interact trustlessly with more than 50 other networks, including Ethereum and Solana.

However, investors have yet to react positively to these structural changes.

BeInCrypto’s data shows that the network’s native ADA token has declined more than 25% over the past month to a 2-year low of $0.24. It has recovered to $0.28 as of press time.

This price performance reflects the broader crypto market downtrend and skepticism about the chain’s ability to capture market share in an increasingly crowded crypto economy.

Crypto World

Crypto Flows to Human Trafficking Services Jump 85% to Hundreds of Millions in 2025

As Epstein-linked revelations emerged, new data show crypto payments to suspected trafficking services surged 85% globally in 2025.

As global attention remains fixed on the continued release and scrutiny of emails and documents tied to sex trafficker Jeffrey Epstein, attention has turned to how exploitation networks operate and move money.

Against this backdrop, a new report from Chainalysis disclosed that cryptocurrency flows to suspected human trafficking-related services surged sharply in 2025. Transaction volumes reached hundreds of millions of dollars, up 85% year-over-year. While the figures quantify financial activity, the report stressed that the true cost of these crimes is borne by victims, not balance sheets.

Trafficking-Linked Crypto Activity

The increase in crypto-linked trafficking activity has occurred alongside the expansion of Southeast Asia–based scam compounds, online gambling operations, and Chinese-language money laundering and guarantee networks, many of which operate openly on Telegram and form a tightly connected illicit ecosystem with global reach.

Unlike cash-based systems, blockchain transparency helps investigators to trace these flows, thereby creating opportunities to identify and disrupt networks that would otherwise remain hidden. Blockchain analytics company Chainalysis tracked four primary categories of suspected cryptocurrency-facilitated trafficking: Telegram-based “international escort” services suspected of trafficking people; “labor placement” agents linked to kidnapping and forced labor in scam compounds; prostitution networks; and vendors of child sexual abuse material (CSAM).

Payment behavior differs across categories. “International escort” services and prostitution networks rely almost entirely on stablecoins as they prioritize price stability and ease of conversion, but CSAM vendors have historically favored Bitcoin. However, its dominance is declining as alternative Layer 1 networks and privacy tools emerge.

Escort services were found to be deeply integrated with Chinese-language money laundering networks that rapidly convert stablecoins into local currencies and reduce exposure to asset freezes by centralized issuers. Transaction-size analysis points to professionalized operations as nearly 49% of “international escort” service transfers surpass $10,000, which is consistent with organized enterprises operating at scale.

Meanwhile, prostitution networks cluster in the $1,000-$10,000 range. These networks often use structured pricing and customer-service models, advertising standardized rates across major East Asian cities, which in turn produce identifiable on-chain patterns useful for detection.

You may also like:

CSAM Crypto Economy

CSAM operations reveal a different structure. It was found that roughly half of transactions are under $100, and there is a shift toward subscription-based models that generate predictable revenue streams. In 2025, Chainalysis observed growing use of Monero and instant exchangers to launder CSAM proceeds, in addition to an emerging overlap between CSAM networks and sadistic online extremism communities, where abuse material is monetized through cryptocurrency payments.

One major CSAM site identified in July 2025 alone used more than 5,800 crypto addresses and generated over $530,000 since 2022. The report also stated that trafficking-linked services leverage US-based infrastructure for scale and legitimacy, while operators often remain overseas to limit personal exposure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP Rally Fails as Traders Take Early Profit: What’s Next?

XRP price surged sharply, nearly posting an 18.7% intraday gain before surrendering half of that advance. The token now trades near $1.53 after closing with a 9% rise.

Premature profit-taking by holders capped momentum and may influence XRP price direction in the coming sessions.

Sponsored

Sponsored

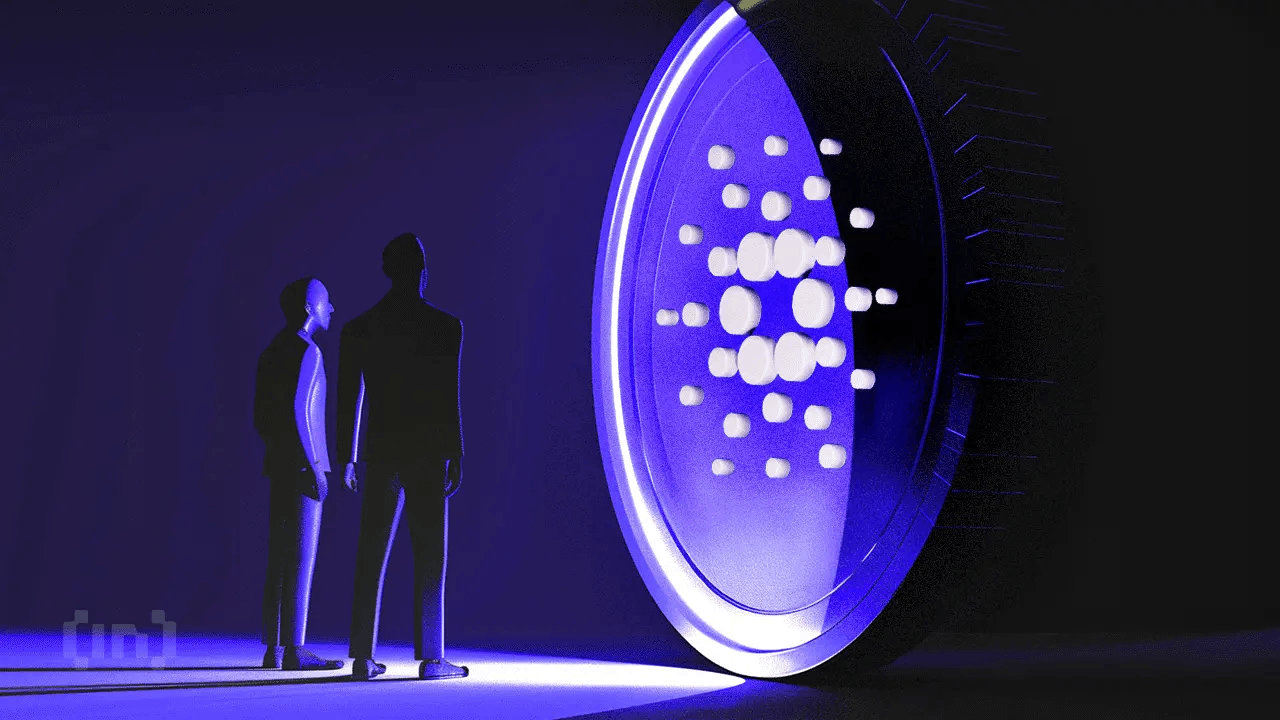

XRP Selling Continues

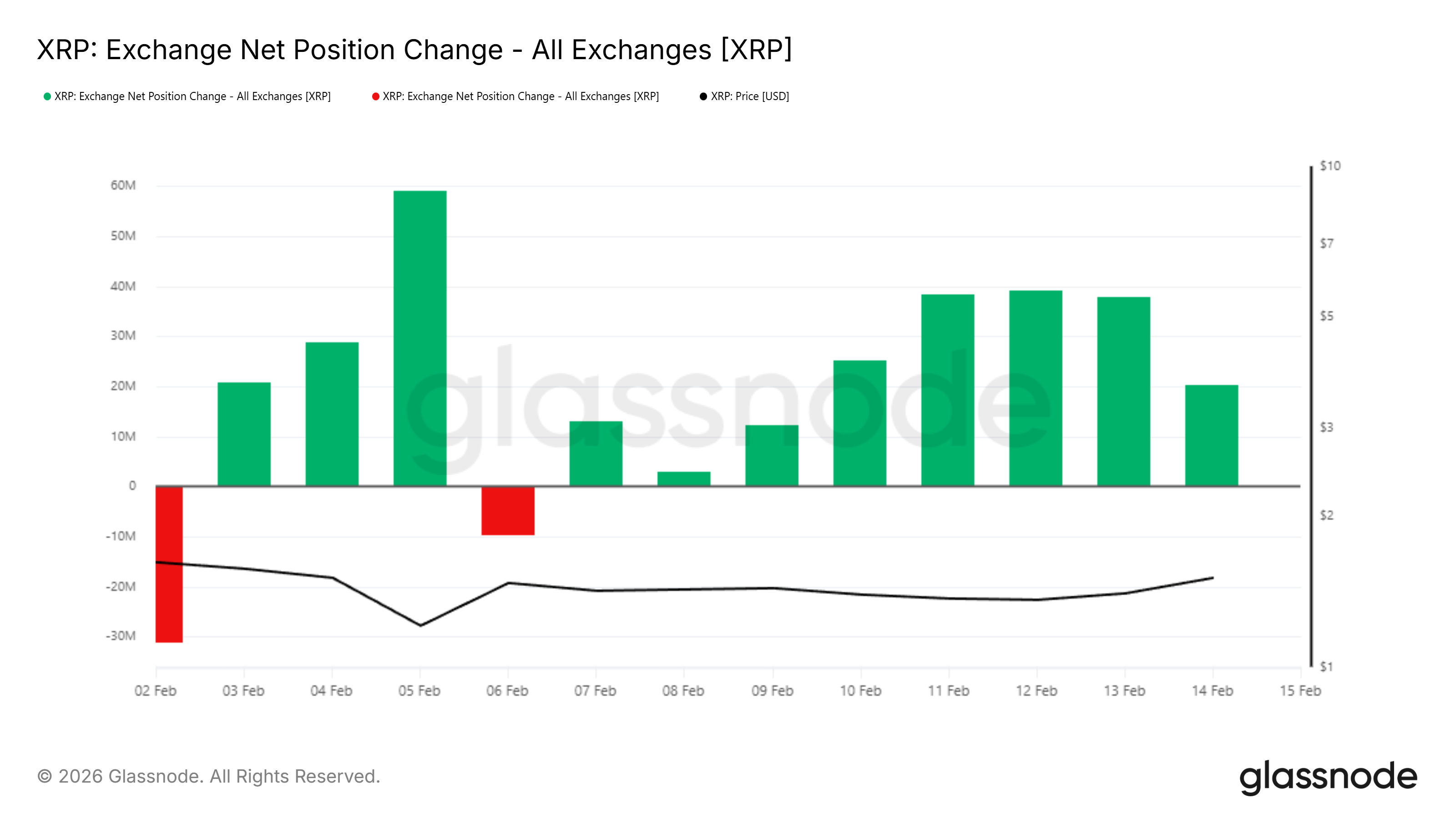

Exchange net position change data indicates that selling among XRP holders remains consistent. Green bars on the metric show continued inflows to exchanges, which typically signal intent to sell. This steady movement suggests holders are offloading XRP during price rallies.

Outflows continue to dominate net flows despite the recent surge. Investors appear eager to secure profits after weeks of volatility. Such behavior often suppresses sustained breakouts and reinforces consolidation near resistance levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

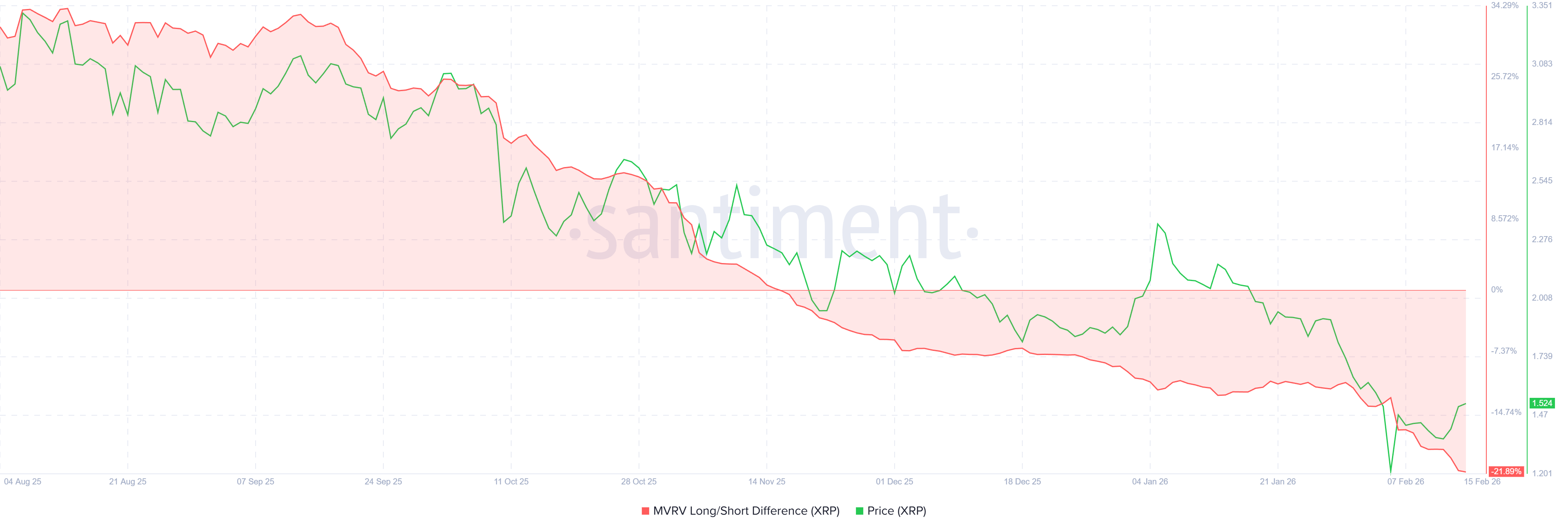

The MVRV Long/Short Difference highlights the dominance of XRP short-term holder profits. This metric measures the distribution of unrealized gains between long-term and short-term investors. Current low readings indicate that short-term holders hold a larger share of profits.

Short-term holders typically react quickly to price increases. Their tendency to sell at the first sign of gains likely contributed to the rally’s abrupt halt.

Sponsored

Sponsored

As long as STH profits dominate, upward momentum may encounter repeated resistance.

XRP Price May Face Some Resistance

XRP nearly recorded an 18.7% rise during the latest trading session before settling at a 9% gain. The long wick and rapid reduction in upside reflect early profit booking. Such behavior highlights fragile bullish conviction despite renewed interest.

The immediate objective is securing $1.51 as a support floor. XRP trades slightly above that level at $1.53.

Resistance near $1.62 may cap gains, and renewed selling from short-term holders could pull the price back toward $1.36.

If distribution slows and demand stabilizes, XRP could regain upward traction.

A decisive move above $1.62 would strengthen the technical structure. Sustained buying could drive the price toward $1.76, invalidating the bearish thesis and reinforcing recovery momentum.

Crypto World

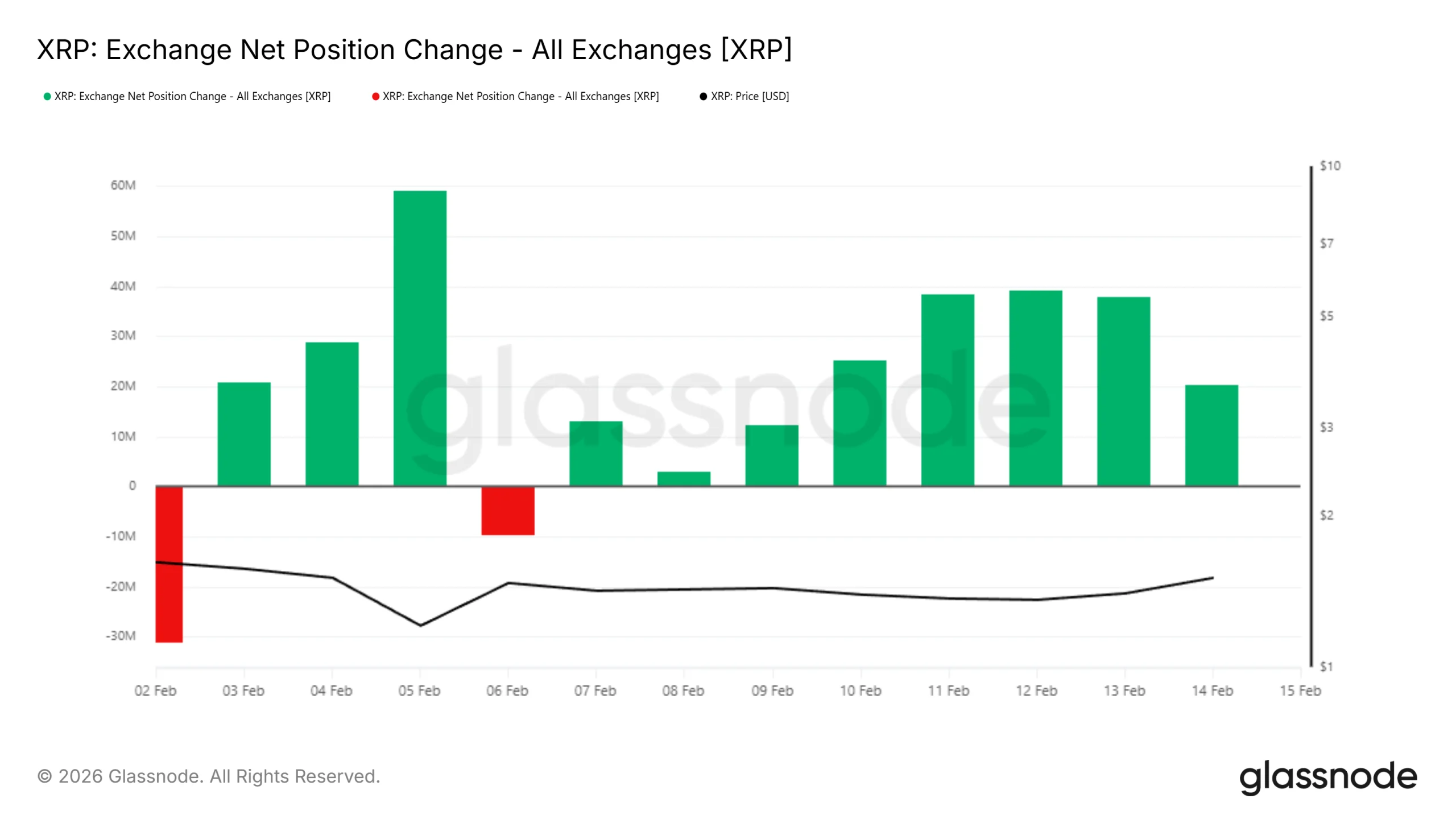

Crypto Needs Privacy To Scale in Payments: Binance Co-Founder CZ

The lack of privacy for onchain transactions is one of the biggest hurdles to the mass adoption of cryptocurrencies for payments and a medium of exchange, according to Changpeng Zhao, co-founder of the Binance cryptocurrency exchange.

The executive commonly known as “CZ” said the lack of privacy prevents businesses and institutions from paying expenses in crypto. He gave this example:

“Lack of Privacy may be the missing link for crypto payments adoption. Imagine a company pays employees in crypto onchain. With the current state of crypto, you can pretty much see how much everyone in the company is paid by clicking the ‘from’ address.”

In a previous conversation with investor and host of the All-In Podcast Chamath Palihapitiya, CZ also cited physical security concerns as a reason why onchain transparency is a risk to users. The comments follow a revival of privacy and the cypherpunk ethos in crypto.

Cypherpunk ideology is central to the birth of cryptocurrencies, peer-to-peer digital money that can be transferred without centralized intermediaries, and the encryption of online communication to shield messages from surveillance.

Related: ‘No privacy’ CBDCs will come, warns billionaire Ray Dalio

Encrypt everything: the rise of onchain privacy

Businesses and institutions will not embrace crypto, Web3 platforms, or blockchain if they cannot shield their transactions, Avidan Abitbol, the former Business Development Specialist for the Kaspa cryptocurrency project, told Cointelegraph.

Transaction data contains critical information about corporate workflows, trade secrets, business relationships and can provide clues about a company’s overall financial health to competitors, he said.

These issues can lead to corporate theft, negatively impact corporations during business negotiations and increase the threat of an institution being targeted by scammers, Abitbol added.

The continued technological development of AI systems will exacerbate this issue, according to Eran Barak, the former CEO of privacy company Shielded Technologies.

Centralized servers containing critical or valuable information will become increasingly attractive for AI-assisted hackers, he told Cointelegraph.

This means that onchain privacy technologies will become necessary to protect valuable online information as AI becomes more powerful and can assemble heuristic clues about a potential target and statistically model probable outcomes, he said.

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

Crypto World

Senators Demand CFIUS Probe Into $500M UAE Stake in Trump-Linked Crypto Firm

TLDR:

- UAE-backed entity acquires 49% stake in World Liberty Financial for reported $500 million investment

- Transaction directs $187 million to Trump family-linked entities just days before inauguration

- Platform collects wallet addresses, device identifiers, and location data from U.S. users

- Senators set March 5 deadline for Treasury confirmation on whether security review is proceeding

Two U.S. Senators have formally requested Treasury Secretary Scott Bessent to initiate a national security review of a foreign investment transaction.

The request centers on a reported $500 million stake purchase by a UAE-backed entity in World Liberty Financial, a cryptocurrency venture associated with the Trump family.

Senators Elizabeth Warren and Andy Kim raised concerns about potential foreign access to sensitive financial data through the transaction.

Foreign Investment Structure Raises Questions

The reported agreement grants the UAE-backed investment vehicle approximately 49 percent ownership in World Liberty Financial. This transaction occurred just four days before the presidential inauguration in January 2026.

According to reports, Sheikh Tahnoon bin Zayed Al Nahyan, who serves as the UAE’s national security adviser, backed the investment.

The Wall Street Journal characterized the transaction as unprecedented in American political history. The deal structure reportedly directs $187 million to entities linked to the Trump family.

These entities include DT Marks DEFI LLC and DT Marks SC LLC. The investment makes the foreign fund the largest shareholder in the cryptocurrency platform.

Under the reported terms, two of five board seats would go to executives who also hold positions at G42. This company, associated with Sheikh Tahnoon, has previously faced scrutiny from U.S. intelligence agencies. The dual roles have prompted questions about potential conflicts and foreign influence.

Data Collection Practices Draw Scrutiny

The Senators highlighted World Liberty Financial’s privacy policy in their correspondence. The platform acknowledges collecting wallet addresses, device identifiers, and IP addresses from users. Additionally, the company gathers approximate location data inferred from IP addresses.

Service providers working with World Liberty Financial may collect additional sensitive identifiers. These include driver’s license numbers and passport information. The platform may receive this information through its partnerships and operational activities.

Furthermore, World Liberty Financial has applied for a trust bank charter. The company has stated its goal of creating “a new financial system for the benefit of millions.”

This move could expand the company’s access to financial information from U.S. citizens. The combination of sensitive data collection and significant foreign ownership has triggered national security considerations.

CFIUS Review Process Under Examination

The Committee on Foreign Investment in the United States typically reviews transactions involving foreign control of U.S. businesses.

The committee also examines investments that could provide foreign entities access to sensitive personal data. Warren and Kim requested confirmation about whether the transaction received proper review.

The Senators set a March 5, 2026 deadline for Treasury’s response. Their letter includes six specific questions about the review process. These questions address whether the transaction qualified as a covered transaction requiring examination.

Reports noted the deal moved quickly and “granted swift paydays to entities affiliated with the Trumps.” The Senators seek clarity on whether the World Liberty Financial transaction received special treatment through a fast-track mechanism. The UAE reportedly lobbied for a pilot program that Treasury announced in May 2025.

Crypto World

Wall Street giant Apollo follows BlackRock in DeFi push with Morpho token deal

Apollo Global Management (APO) is moving deeper into crypto, striking a deal that could make the $938 billion asset manager a major token holder in a decentralized lending platform.

The firm signed a cooperation agreement with the Morpho Association, the French non-profit organization behind the Morpho protocol, that allows Apollo and its affiliates to buy up 90 million tokens tokens over the next four years.

The purchases may take place through open-market buys, over-the-counter transactions and other arrangements, and are subject to ownership caps and transfer restrictions. Galaxy Digital UK acted as exclusive financial adviser to Morpho, according to the document.

Beyond the token purchases, Apollo and Morpho said they will work together to support lending markets built on Morpho’s protocol. Morpho provides infrastructure for onchain lending markets and curator-managed vaults that allocate assets across them. The protocol is governed by holders of the MORPHO token. The 90 million token stake would translate to 9% of the protocol’s governance token’s total supply.

The agreement adds to Apollo’s expanding blockchain footprint. Last year, the firm made a “seven-figure” investment in blockchain project , which focuses on bringing traditional financial products onchain. Apollo’s credit strategies have already been tokenized via third parties. Tokenization specialist Securitize issues ACRED, a token that gives exposure to the Apollo Diversified Credit Fund, while Anemoy offers ACRDX, which tracks Apollo’s global private and public credit strategies.

The move comes as other asset managers test decentralized finance rails. Earlier this week, BlackRock, the world’s largest asset manager, said it will make shares of its tokenized U.S. Treasury fund, BUIDL, tradable on decentralized exchange Uniswap and purchased an undisclosed amount of the protocol’s governance token UNI .

Crypto World

Brazil Proposes Historic 1 Million Bitcoin Strategic Reserve Bill

TLDR:

- Brazil targets one million Bitcoin accumulation over five years through RESBit strategic reserve framework.

- Bill 4501/2024 permits Brazilian taxpayers to settle tax obligations directly using Bitcoin payments.

- Legislation prohibits sale of seized Bitcoins, retaining confiscated assets under public control.

- Brazil becomes first G20 nation to codify Bitcoin as sovereign reserve asset through formal legislation.

Brazil has reintroduced legislation to establish a strategic Bitcoin reserve targeting one million BTC over five years. Federal Deputy Luiz Gastão presented the expanded version of Bill 4501/2024 on February 13, 2026.

The proposal positions Brazil as the first G20 nation to codify cryptocurrency as a sovereign reserve asset. The bill creates RESBit, Brazil’s Strategic Sovereign Bitcoin Reserve, with funding potentially drawn from national foreign exchange holdings.

Legislative Framework and Reserve Target

The updated bill represents an expansion of earlier legislative efforts from late 2024. Federal Deputy Eros Biondini originally introduced the measure, which advanced through committee stages and public hearings in 2025. The reintroduced version carries substantially broader ambitions than its predecessor.

MartyParty, a crypto industry commentator, highlighted the development on X, stating “Brazil introduces 1m Bitcoin Strategic Reserve Bill – first G20 country to codify.”

The observation reflects growing institutional interest in cryptocurrency as a hedge against traditional financial risks.

Several nations have discussed similar measures, yet Brazil appears positioned to implement such policy first among major economies.

The target of one million Bitcoin represents approximately 5% of the total supply that will ever exist. Brazil’s foreign exchange reserves currently stand between $300 billion and $370 billion.

Earlier versions of the bill proposed capping allocations at 5% of reserves, though the expanded target suggests a larger commitment.

At prevailing Bitcoin prices between $66,000 and $70,000, the full reserve would cost approximately $66 billion to $70 billion.

However, the five-year implementation timeline spreads acquisition costs across multiple budget cycles. This phased approach aims to minimize market impact while building the reserve gradually through planned purchases.

Implementation Provisions and Strategic Goals

The bill establishes RESBit as the formal mechanism for managing Brazil’s Bitcoin holdings. The reserve structure includes several operational provisions beyond simple acquisition.

Seized Bitcoins from judicial and law enforcement actions would be retained rather than sold, keeping them under public control.

The legislation permits Brazilian taxpayers to settle obligations using Bitcoin. This provision could accelerate cryptocurrency adoption while providing another avenue for reserve accumulation.

The government would receive Bitcoin directly through tax payments rather than exclusively through open market purchases.

State-owned or state-supported Bitcoin mining operations receive encouragement under the proposal. Domestic mining would allow Brazil to acquire Bitcoin through production rather than purchase alone.

The bill also promotes federal custody standards and blockchain technology adoption across government operations.

The reserve aims to diversify Brazil’s monetary holdings beyond traditional assets like US dollars and gold. Currency risk reduction and inflation hedging represent core objectives.

By holding Bitcoin, Brazil seeks to protect against potential depreciation of conventional reserve assets while participating in the emerging digital asset economy.

The proposal awaits further legislative action before implementation. Congressional approval would mark a historic shift in sovereign asset management and cryptocurrency legitimacy within major economies.

Crypto World

Michael Saylor Signals Another Bitcoin Buy Amid Market Rout

Strategy, the Bitcoin treasury vehicle co-founded by Michael Saylor, extended its unbroken buying streak to week 12 as the broader crypto market faced renewed volatility. The company has kept up a publicly visible accumulation cadence, signaling a long-term conviction in Bitcoin as a treasury reserve. The latest activity underscores a pattern that has drawn attention across crypto markets, with Saylor using the firm’s accumulation chart on X to communicate pace and scale. The most recent purchase, executed in early February, adds to a balance sheet that already ranks among the largest publicly disclosed BTC reserves. Taken together, Strategy’s holdings have surged to a substantial level, with the firm noting its forthcoming 99th BTC transaction in public messaging, a milestone that has become a hallmark of the strategy’s capital deployment.

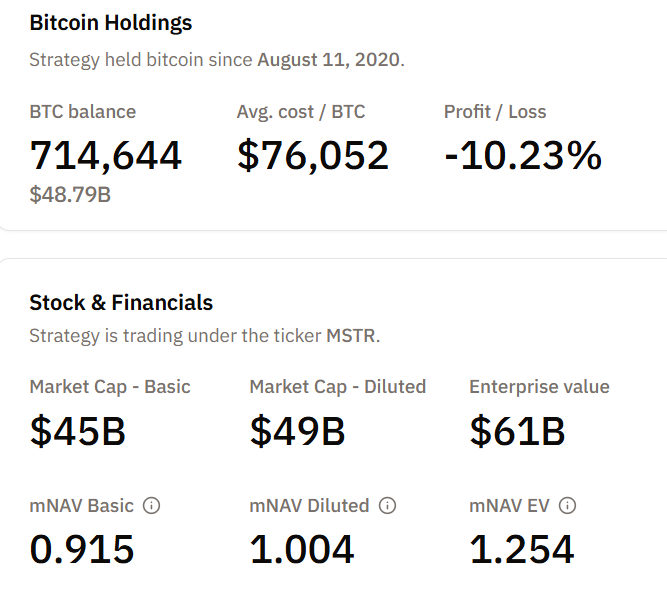

Bitcoin (CRYPTO: BTC) has weathered a bear market that began in 2022, and Strategy’s approach has remained steadfast through periods of drawdown. The company’s last publicly disclosed BTC purchase occurred on Feb. 9, when it acquired 1,142 BTC for more than $90 million. That trade lifted Strategy’s total BTC holdings to 714,644 coins, a sizable stake by any measure, with a reported market value in the vicinity of $49.3 billion based on prevailing prices at the time of publication. The accumulation pattern is publicly traceable through Saylor’s social posts and the company’s historical buy chart, which has become a proxy for the pace of Strategy’s purchases and its longer-term thesis around Bitcoin’s role in corporate treasuries. A visual history of these purchases is maintained at SaylorTracker, which aggregates the company’s transaction timeline.

The broader crypto sector, by contrast, has faced notable headwinds. An October flash crash sent BTC tumbling from its peak, along with a wave of selling that left investors wary. The selloff rekindled questions about liquidity, risk appetite, and the ability of large treasury-like entities to weather downturns. In this context, Strategy’s ongoing accumulation stands out as a counterpoint to headlines of market distress. The firm’s trajectory also intersects with debates about the sustainability of crypto treasury models, particularly as some market participants questioned whether large holders would pause or reverse acquisitions during adverse conditions.

Even as it presses forward, Strategy has not been immune to the sector’s broader strains. Earlier this month, the company disclosed a quarterly loss that contrasted with the heavy emphasis on reserve accumulation. The reported Q4 loss of $12.4 billion weighed on the stock, which traded around the mid-$130s after a period of volatility. In the background, traders and analysts watched for how the company would navigate financing and liquidity needs amid broader mNAV dynamics—the premium to net asset value that defines access to capital for crypto treasuries. By September 2025, the standard-bearer peers in the sector had reported mNAV readings below 1 in several cases, signaling heightened scrutiny of balance-sheet backing for crypto holdings. Strategy’s own mNAV movements have mirrored those dynamics, with reported readings dipping toward parity or below, underscoring the financing challenges that accompany a large BTC reserve.

Against this backdrop, Strategy’s strategy of disciplined accumulation continues to attract attention from investors and market observers who view Bitcoin as a long-duration asset class within a corporate treasury context. The company’s public timeline—the ongoing chart that has become a de facto barometer for its buying pace—offers a rare window into how one of the sector’s largest holders approaches accumulation on a sustained basis. The narrative remains particularly compelling given the scale: with more than 700,000 BTC under management, Strategy sits at a level that few corporate treasuries have publicly matched. The company’s public disclosures and the accompanying market commentary from Saylor and his supporters contribute to a broader debate about whether large, disciplined buyers can alter price dynamics or shape sentiment in a fragmented market.

Why it matters

The persistence of Strategy’s BTC purchases matters for multiple reasons. First, it demonstrates a long-term, conviction-driven approach to reserve management that diverges from the more reactive trading styles seen in other crypto market participants. By maintaining weekly or near-weekly additions, the firm effectively reduces the impact of short-term volatility on its decision-making, signaling a belief that Bitcoin can serve as a store of value and a growth driver for its balance sheet over time.

Second, the scale of Strategy’s holdings—together with the accompanying price signals from public buys—has implications for market structure and liquidity. While a single treasury buyer cannot dictate macro prices, a reserve of this magnitude contributes to market depth and acts as a counterbalance to episodes of panic selling. The ongoing accumulation thus interacts with investor sentiment, potentially supporting a slower, steadier price path rather than abrupt, large swings driven by speculative flows alone. This dynamic matters to traders, funds, and other corporations weighing their own treasury strategies in a sector characterized by volatility and evolving regulatory scrutiny.

Third, the broader mNAV narrative—highlighting how the market values crypto treasuries relative to their holdings—frames a conversation about access to financing and growth potential within the space. When mNAV readings stay under 1, financing becomes more expensive and equity issuance can become constrained, which in turn can influence future purchasing capacity. The sector’s health—reflected in earnings, balance-sheet metrics, and regulatory signals—must be weighed alongside performance and market cycles. Strategy’s experience, including its latest quarterly loss and the subsequent price movement, underscores that even a high-conviction accumulator is not immune to macro-driven stress or uneven investor appetite for risk assets.

What to watch next

- Strategy’s next BTC purchase and whether the company will confirm a new tranche on its public chart.

- Updates on the 99th BTC transaction and any changes to the accumulation cadence communicated by Saylor or Strategy executives.

- Monitoring mNAV movements across Strategy and peer treasuries to gauge financing conditions and potential impacts on future purchases.

- Reactions to Strategy’s Q4 results, including any strategic pivots, cost-management steps, or capital deployment plans disclosed in forthcoming statements.

- Regulatory developments and macro factors that could influence corporate treasury activity in crypto markets.

Sources & verification

- Strategy’s February 9 BTC acquisition: 1,142 BTC for more than $90 million, bringing total holdings to 714,644 BTC.

- Saylor’s accumulation chart posted on X, signaling ongoing purchases and the plan for the 99th BTC transaction.

- SaylorTracker chart history documenting Strategy’s Bitcoin purchases.

- Strategy’s Q4 reported loss of $12.4 billion and related market reaction, including the stock price movement.

- mNAV discussions and Standard Chartered Bank references to mNAV dynamics within the crypto-treasury sector.

Market reaction and key details

Crypto World

Silver Mining Stocks Poised for Growth as Precious Metals Stabilize at Record Highs

TLDR:

- Silver trading at $78 per ounce establishes new range between $70-$90 after climbing from $30 in 2025.

- Mining profit margins expand significantly with production costs at $15-$25/oz for silver, $1,500-$2,000/oz for gold.

- Aya Gold & Silver’s Boumadine project will increase output sixfold to 36 million silver-equivalent ounces by 2030.

- Silver X Mining plans to double production to 2 million ounces by 2027, with capacity for 6 million long-term.

Silver and gold prices remain at historically elevated levels, with silver trading near $78 per ounce and gold reaching $5,000 per ounce.

Market analysts are examining whether these price points represent a new stable range for precious metals. Investment focus has shifted toward mining companies that can expand production capacity at current valuations.

Financial observers note that mining stocks have not fully reflected the sustained higher commodity prices in their market capitalizations.

Mining Profitability Expands at Current Metal Valuations

Analysis from market commentator Wall Street Mav indicates silver has entered a consolidation phase following significant gains.

The metal climbed from $30 to $121 per ounce between June 2025 and January 2026. Current trading patterns suggest a new range between $70 and $90 per ounce may be forming.

Gold and silver miners are experiencing substantial profit margins at these price levels. Production costs for gold typically range from $1,500 to $2,000 per ounce, while silver mining costs average $15 to $25 per ounce.

The spread between production costs and market prices has created favorable conditions for mining operations.

Supply constraints continue to support precious metals pricing. Market observers point to evidence of silver supply shortages affecting industrial demand.

Demand destruction for silver is estimated to occur around $135 per ounce, where solar panel manufacturers would transition to copper-based alternatives.

The duration of elevated prices will determine mining company strategies. Extended periods at current levels enable debt reduction, stock buybacks, and dividend increases. Companies with the capacity to increase production stand to benefit most from the sustained price environment.

Production Growth Differentiates Mining Investment Opportunities

Aya Gold & Silver (AYASF) operates the Zgounder mine in Morocco, producing 6 million ounces of silver annually. Production costs at the facility run approximately $20 per ounce, generating gross profits exceeding $300 million yearly. Free cash flow is estimated at $250 million under current operations.

The company’s Boumadine project represents a significant expansion opportunity. This development will be six times larger than the existing Zgounder operation. Production is scheduled to begin by 2030, with output equivalent to 36 million ounces of silver annually.

Silver X Mining (AGXPF) operates in Peru, home to the world’s largest silver reserves. Current production stands at 1 million ounces per year. Management projects doubling output to 2 million ounces by 2027 through operational improvements.

Long-term development plans suggest Silver X could scale production to 6 million ounces annually. The company’s reserve base supports this expansion trajectory.

Geographic diversification remains a consideration for investors evaluating regional mining operations and associated operational risks.

Crypto World

AI Bubble Warning: Analyst Predicts 2026 Crisis as Industry Burns $400B Annually

TLDR:

- AI industry currently spends $400 billion per year while generating only $50-60 billion in revenue annually.

- Debt-based financing distinguishes current AI boom from dot-com bubble, creating potential systemic risks.

- Circular funding patterns keep revenue within AI ecosystem without generating actual profits for businesses.

- Power grid limitations delay data center construction, pushing revenue timelines further while debt payments remain due.

A cryptocurrency analyst has raised concerns about the artificial intelligence industry’s financial sustainability. Alex Mason, who claims to have accurately predicted market movements in 2022, posted warnings on X about what he describes as an impending AI bubble collapse.

His analysis points to a significant gap between industry spending and revenue generation. The timing of potential stress, according to Mason, aligns with 2026.

Revenue Gap and Circular Funding Raise Questions

The AI sector currently burns approximately $400 billion annually while generating between $50 billion and $60 billion in revenue.

Mason argues this disparity represents a structural problem rather than typical early-stage challenges. Major AI companies reportedly lose tens of billions each year. Meanwhile, most businesses implementing AI solutions see no meaningful returns on their investments.

Mason points to circular funding patterns within the industry. Large players fund each other through partnerships that appear substantial on paper.

However, much of the revenue remains within the ecosystem itself. This creates activity without generating actual profits, according to the analyst’s assessment.

The lack of a clear profitability timeline adds to concerns about the sector’s sustainability. Costs continue to rise while profit margins remain uncertain.

Many companies rely on the assumption that scaling operations will eventually resolve financial challenges. Mason also notes a shift toward government and defense contracts, which he interprets as a defensive move rather than genuine growth.

Infrastructure limitations present another obstacle to AI expansion. The power grid cannot support all planned data center construction.

This pushes potential revenue generation further into the future while debt obligations remain immediate. Companies must service their borrowings regardless of when profits materialize.

Debt Structure Creates Systemic Vulnerabilities

The current AI boom differs fundamentally from the dot-com bubble in its financing structure. The earlier tech bubble primarily involved equity investments.

When it burst, investors suffered losses but the broader financial system remained stable. Today’s AI expansion relies heavily on debt financing, with companies borrowing substantial amounts based on future profit expectations.

Private credit markets have already allocated hundreds of billions to technology-related loans. Insurance companies hold significant exposure to these investments.

Banks maintain connections through leverage arrangements and credit facilities. This interconnected web of obligations creates potential systemic risks if AI companies fail to achieve profitability.

Consumer financial stress compounds these concerns. Foreclosure rates are climbing across housing markets. Automobile repossessions have increased in recent months.

Student loan defaults continue to spread while credit card delinquency rates rise. These trends exist before any potential AI-related financial disruption.

Mason clarifies that he does not predict AI technology will disappear entirely. Instead, he suggests markets may be underestimating the pain associated with the industry’s path to profitability.

The analyst indicated he will publicly announce when he believes markets have bottomed and investment timing becomes favorable.

Crypto World

What Happens to Strategy If Bitcoin Drops Below $8,000?

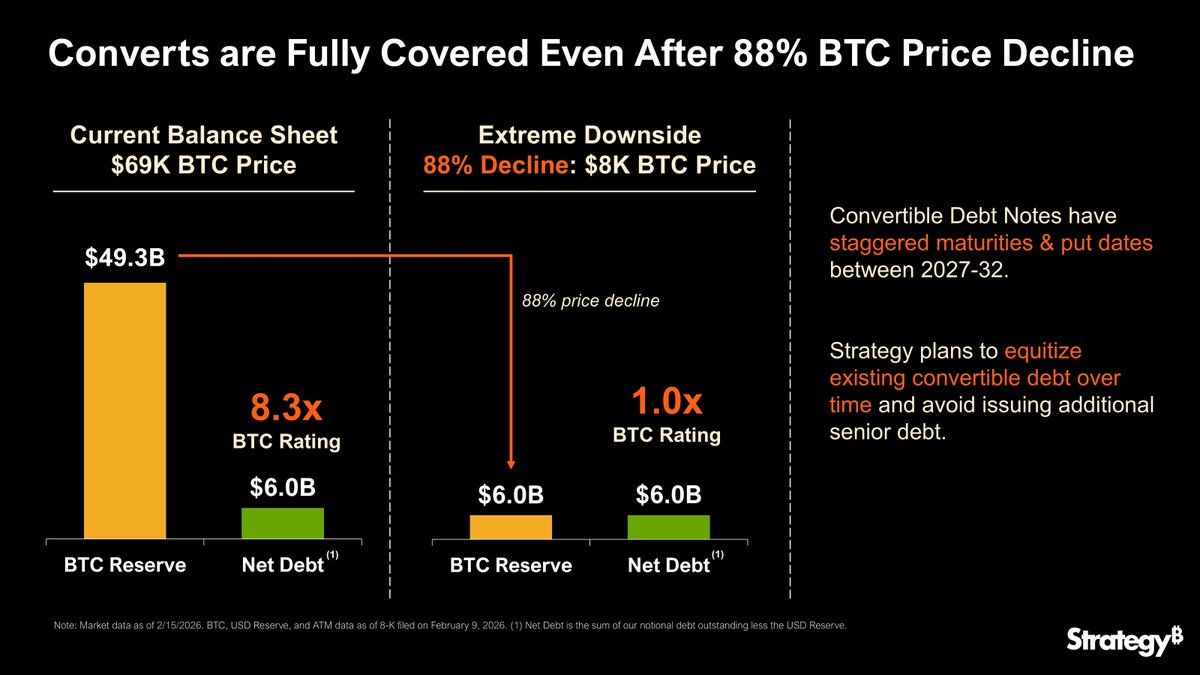

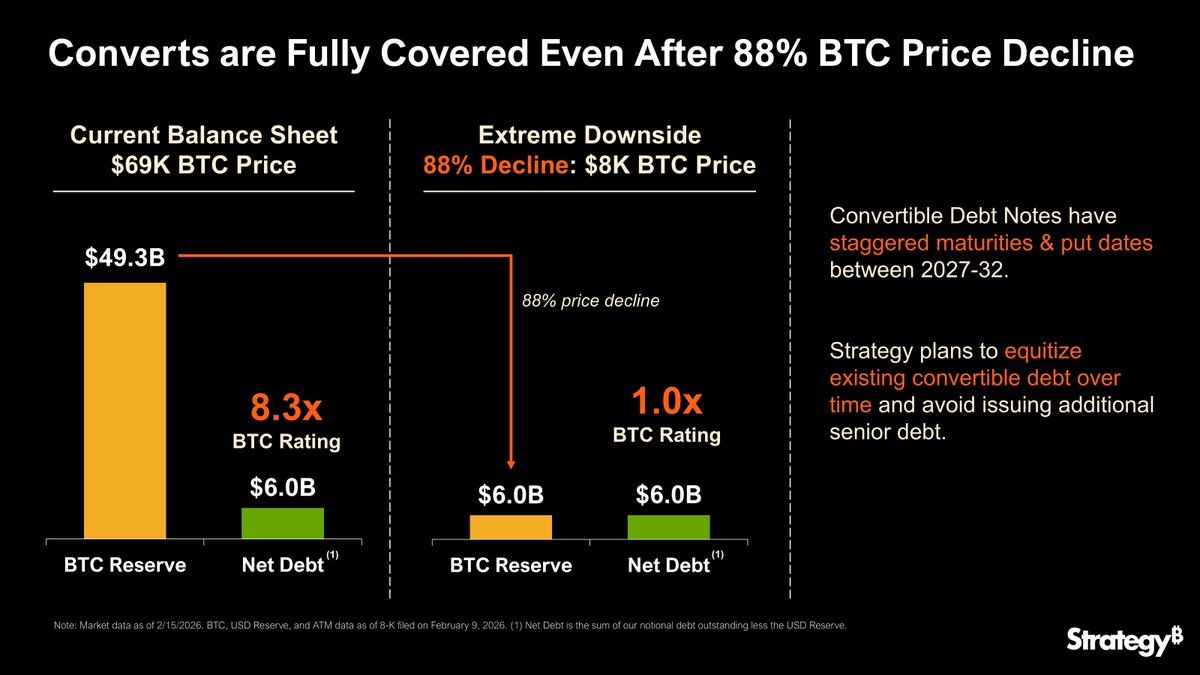

Strategy (MicroStrategy) today asserted it can fully cover its $6 billion debt even if Bitcoin falls 88% to $8,000. However, the bigger question is what happens if the Bitcoin price falls below that line?

The company’s post highlights its $49.3 billion Bitcoin reserves (at $69,000/BTC) and staggered convertible note maturities running through 2032, designed to avoid immediate liquidation.

Strategy Reiterates What Happens If Bitcoin Price Drops to $8,000

Only days after its earnings call, Strategy has reiterated the $8,000 prospective Bitcoin price and what would happen to the company in such an event for the second time.

Sponsored

Sponsored

“Strategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt,” the company stated.

At first glance, the announcement signals resilience in the face of extreme volatility. However, a deeper dive reveals that $8,000 may be more of a theoretical “stress floor” than a true shield against financial peril.

At $8,000, Strategy’s assets equal its liabilities. Equity is technically zero, but the firm can still honor debt obligations without selling Bitcoin.

“Why $8,000?: This is the price point where the total value of their Bitcoin holdings would roughly equal their net debt. If BTC stays at $8,000 long-term, its reserves would no longer cover its financial obligations through liquidation,” investor Giannis Andreou explained.

Convertible notes remain serviceable, and staggered maturities give management breathing room. The firm’s CEO, Phong Le, recently emphasized that even a 90% decline in BTC would unfold over several years, giving the firm time to restructure, issue new equity, or refinance debt.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price to $8,000, which is pretty hard to imagine, that is the point at which our BTC reserve equals our net debt and we’ll not be able to then pay off of our convertibles using our Bitcoin reserve and we’d either look at restructuring, issuing additional equity, issuing an additional debt. And let me remind you: this is over the next five years. Right, so I’m not really worried at this point in time, even with Bitcoin drops,” said Le.

Yet beneath this headline figure lies a network of financial pressures that could quickly intensify if Bitcoin drops further.

Sponsored

Sponsored

Below $8,000: Covenant and Margin Stress

The first cracks appear at roughly $7,000. Secured loans backed by BTC collateral breach LTV (Loan-to-Value ratio) covenants, triggering demands for additional collateral or partial repayment.

“In a severe market downturn, cash reserves would deplete rapidly without access to new capital. The loan-to-value ratio would exceed 140%, with total liabilities exceeding asset value. The company’s software business generates approximately $500 million annually in revenue—insufficient to service material debt obligations independently,” explained Capitalist Exploits.

If markets are illiquid, Strategy may be forced to sell Bitcoin to satisfy lenders. This reflexive loop could depress BTC prices further.

At this stage, the company is technically still solvent, but each forced sale magnifies market risk and raises the specter of a leverage unwind.

Insolvency Becomes Real at $6,000

A further slide to $6,000 transforms the scenario. Total assets fall well below total debt, and unsecured bondholders face likely losses.

Equity holders would see extreme compression, with value behaving like a deep out-of-the-money call option on a BTC recovery.

Sponsored

Sponsored

Restructuring becomes probable, even if operations continue. Management could deploy strategies such as:

- Debt-for-equity swaps

- Maturity extensions, or

- Partial haircuts to stabilize the balance sheet.

Below $5,000: The Liquidation Frontier Comes

A decline below $5,000 crosses a threshold where secured lenders may force collateral liquidation. Combined with thin market liquidity, this could create cascading BTC sell-offs and systemic ripple effects.

In this scenario:

- The company’s equity is likely wiped out

- Unsecured debt is deeply impaired, and

- Restructuring or bankruptcy becomes a real possibility.

“Nothing is impossible…Forced liquidation would only become a risk if the company could no longer service its debt, not from volatility alone,” commented Lark Davis.

Sponsored

Sponsored

Speed, Leverage, and Liquidity As The Real Danger

The critical insight is that $8,000 is not a binary death line. Survival depends on:

- Speed of BTC decline: Rapid drops amplify margin pressure and reflexive selling.

- Debt structure: Heavily secured or short-dated debt accelerates risk below $8,000.

- Liquidity access: Market closures or frozen credit exacerbate stress, potentially triggering liquidation spirals above the nominal floor.

What Would It Mean for the Market?

Strategy is a major BTC holder. Forced liquidations or margin-driven sales could ripple through broader crypto markets, impacting ETFs, miners, and leveraged traders.

Even if Strategy survives, equity holders face outsized volatility, and market sentiment could shift sharply in anticipation of stress events.

Therefore, while Strategy’s statement today suggests the firm’s confidence and balance-sheet planning, below $8,000, the interplay of leverage, covenants, and liquidity defines the real survival line beyond price alone.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech19 hours ago

Tech19 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 hours ago

NewsBeat5 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business3 days ago

Business3 days agoBarbeques Galore Enters Voluntary Administration