Fashion

Claire’s Life: Front Row at Christian Siriano with Jackie Aina, Whoopi Goldberg, Monica, Althea Mink, and More!

I always kick off New York Fashion Week with the Christian Siriano show!

This season was all about volume and textures, witnessed by voluminous tops and dress, and gowns accented with sequins, feathers, chains, and more!

The front row was just as iconic as the designs on the runway!

I grabbed pix with Monique and Mia Rodriguez, Jackie Aina, Jerome Lamaar, and Patrice Taylor of Althea Mink, who made my fur look:

Backstage, I was juiced to grab a pic with Whoopi Goldberg and Monica, along with Christian himself!

Today is day 3 of New York Fashion Week…I’m just trying to keep up!

Keep it locked here for even more from New York Fashion Week!

Images; Salvatore DeMaio/Takii Nicole

Fashion

Top Crypto Games for New Players to Try

Crypto games now attract millions of players who want both entertainment and the chance to earn digital rewards. These games blend gaming and blockchain technology, allowing players to own items, trade assets, and take part in open economies that grow with active participation. This article helps newcomers find crypto games that are easy to start, fun to play, and worth their time.

Each featured title offers a different way to explore this fast-growing space. Some focus on strategy and competition, while others highlight creativity and collection. Together, they show how blockchain gaming continues to evolve and create new ways to play and earn.

Splinterlands

Splinterlands is a tactical trading card game built on blockchain technology. Players collect, trade, and battle with digital cards that represent different monsters and abilities. Each match uses strategy and quick decision-making to win rewards in cryptocurrency or NFTs.

New players can start with a low entry cost and earn cards through battles or marketplace trades. The game’s structure makes it easy to learn but hard to master, appealing to both casual and competitive players.

Those who enjoy crypto-based entertainment may also explore other digital gaming platforms that support cryptocurrency use. You can download JB casino and similar casinos that provide access to thousands of online games and fast crypto transactions, and then choose the one that is best for you.

Splinterlands continues to grow as one of the most active blockchain games, offering steady updates, new card sets, and community events that keep players engaged over time.

CryptoBlades

CryptoBlades is a web-based role-playing game built on blockchain technology. It lets players earn digital tokens called SKILL by defeating enemies and completing quests. The game runs on the Binance Smart Chain and uses NFTs to represent heroes, weapons, and other in-game assets.

Players start by creating a hero and forging a weapon. Each hero and weapon has unique traits that affect battle results. Success in combat grants experience points and token rewards, which can be used to upgrade characters or trade on the market.

The game’s design encourages strategy rather than luck. Players must match heroes and weapons to enemy types for better results. As a result, CryptoBlades offers both entertainment and the chance to earn crypto rewards through gameplay.

Illuvium

Illuvium is a 3D open-world role-playing game built on the Ethereum network. It blends exploration, creature collection, and strategic battles. Players explore a vast sci-fi world and capture creatures called Illuvials, each with unique traits and abilities.

The game features detailed graphics and a story that focuses on survival and discovery. Players gather resources, craft gear, and build teams to compete in battles for rewards.

Illuvium aims to combine traditional gaming with blockchain ownership. Each Illuvial exists as a digital asset that players can trade or sell. Therefore, progress in the game can have real-world value.

Its design appeals to both gamers and those new to blockchain games. With clear goals, strong visuals, and fair mechanics, it offers an accessible entry point for anyone curious about play-to-earn experiences.

Gods Unchained

Gods Unchained is a free-to-play card game that runs on blockchain technology. It lets players own digital cards as NFTs, giving them real control over their in-game assets. Each card has unique abilities that influence how matches unfold.

The game rewards players with tokens that they can trade or use to buy new cards. This system allows new players to start without spending money while still having a way to earn value through gameplay.

Matches depend on skill and strategy rather than luck or large investments. Players build decks, compete in ranked battles, and earn rewards based on performance.

Its mix of traditional card game mechanics and blockchain ownership makes it an appealing choice for those new to crypto gaming. The learning curve stays manageable, and the community offers plenty of support for beginners.

The Sandbox

The Sandbox allows players to create, own, and trade virtual assets built on blockchain. It gives users digital land plots that they can shape into games, art, or social spaces. Each creation can become an NFT that holds real value in the game’s economy.

Players can earn tokens by completing tasks or selling assets to others. This model attracts both gamers and creators who want to build and profit from their work. It also supports user-generated content, which keeps the world active and varied.

The game features simple tools that make building more accessible to new users. Its visual style and clear interface help beginners learn without needing advanced skills. As a result, The Sandbox stands out as an easy entry point for anyone curious about blockchain-based gaming.

Conclusion

The world of crypto games continues to expand as more players explore digital assets and blockchain-based rewards. These games offer a mix of entertainment and real ownership, which attracts both casual gamers and those curious about decentralized systems.

New players can start with titles that provide simple mechanics, clear reward systems, and active communities. This approach helps them learn how in-game tokens and NFTs work without facing steep learning curves.

Each game differs in gameplay style, earning model, and token use. Therefore, players should focus on games that match their interests and comfort levels before investing time or money.

As the market develops, crypto games will likely introduce fairer economies and better user experiences. Players who stay informed and approach these games with patience can find both enjoyment and opportunity in this evolving space.

Fashion

Runway Recap: Romeo Hunte Redefines Modern Menswear at New York Fashion Week

Romeo Hunte is revolutionizing menswear on a broader scale and his latest New York Fashion Week show was a testament of just how raw he is.

On Friday, the Brooklyn native presented his Fall/Winter 2026 show at the Gotham Hall in Manhattan’s garment district, and his designs were modern, distinctive, and progressive.

From polished, premium denim to impeccably executed outerwear, Romeo Hunte presented a multitude of well-constructed designs. Self-taught in sketching during his teenage years and later formally trained at FIT, Hunte has undeniably established himself as a designer to watch.

In addition to classic fabrics, we saw cultural and streetwear elements woven into his collection. Think graphic tops with the Mona Lisa imprinted, and models strutting down the runway with a tilted berets.

In addition to showcasing contemporary ready-to-wear, the collection also featured elevated evening wear, including printed silk suits with statement lapels and leather double-breasted blazers layered beneath leather capes.

Romeo’s show left a lasting impression during New York Fashion Week, and perhaps was nothing short of triumphant. He’s redefining what menswear looks like, and it’s always impressive when a designer can challenge the status quo.

Ahead, see more of Romeo Hunte’s incredible designs below!

HOT!

Photo Credit: Provided on behalf of Romeo Hunte

Fashion

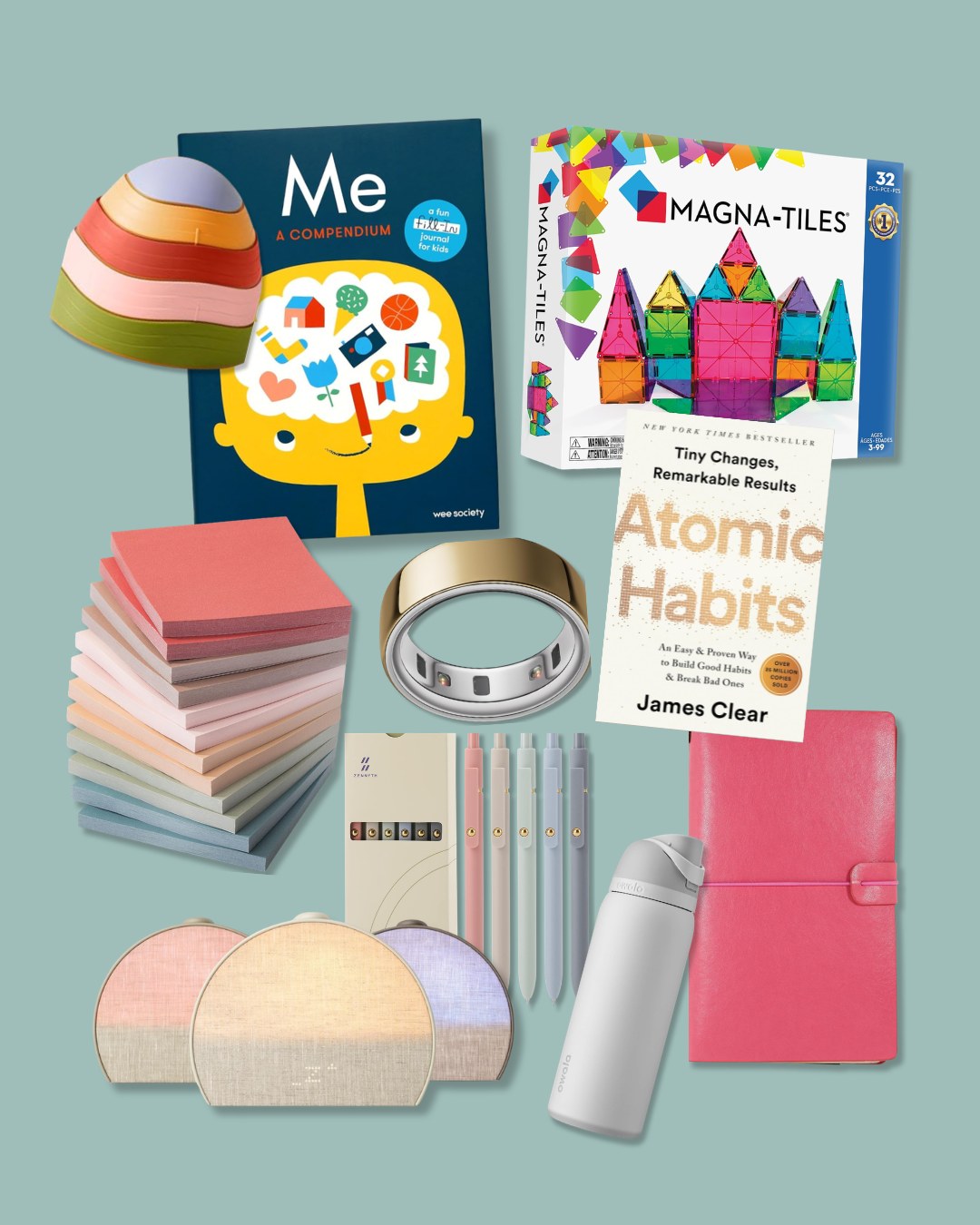

Amazon Sundays: Everyday Finds for Mindful Routines

This week’s Amazon edit highlights a small mix of everyday finds designed to support focus, routines, and organization for both kids and adults. The selection centers on reading and planning essentials, a few visual tools that help structure the day, and kid-friendly pieces that support focused play at home. Browse the full edit below, and explore more in our JB Amazon Shop and Amazon Storefront, refreshed weekly.

A Few Ways to Work These In

1. Create a cleaner work zone

Cable clips, a cork desk mat, quick-dry gel pens, and vintage sticky notes make daily tasks feel more contained. Small desk upgrades reduce visual clutter and make it easier to stay focused during work blocks.

2. Make the schedule visible

The Skylight digital wall calendar works best in a shared space like the kitchen or hallway. Seeing the week at a glance cuts down on reminders and keeps everyone aligned without constant phone check-ins.

3. Support sleep and steady routines

The Hatch Restore sunrise alarm clock helps ease mornings and evenings with light-based cues, while the Oura Ring offers insight into sleep and recovery patterns, useful for building more consistent rhythms.

4. Build habits through simple repetition

Atomic Habits, a lined notebook, or a daily journal keeps reflection practical. A short list, one tracked habit, or a few lines at night is enough to stay consistent without overcomplicating it.

Fashion

Color Trends in Prom Dresses and How to Wear Them Confidently

Prom dress colors shape the entire look of a prom outfit. They affect how your skin looks, how you photograph, and how confident you feel when you walk into the room. As a fashion blogger who styles shoots and creates content around formalwear, I have learned that color is never just a trend. It is […]

The post Color Trends in Prom Dresses and How to Wear Them Confidently appeared first on IFB.

Fashion

Sunset Tones: The Warm-Weather Color Edit

Rosie Assoulin Jacket, Guiliva Heritage Pants, Chanel Bag, Carolina Bucci Necklace

As spring approaches and travel plans start to take shape, sunset tones feel like the easiest way to refresh a warm-weather wardrobe. Soft yellows, spiced oranges, paste pinks. and sun-washed reds operate as modern neutrals, effortless to wear, easy to style, and naturally mixable. A fluid dress, a sheer top, or a woven accessory in these shades brings instant warmth to everyday staples, transitioning seamlessly from beach to dinner. Rather than one defining color, this edit lives in an ombré of glowing sunset hues meant to be layered, packed together, and worn on repeat.

Jacquard Scarf Tote

A vibrant jacquard-woven tote in warm, multicolored hues with a sculptural wooden top handle, perfect for adding a bold pop to any look.

Wedge Espadrilles

These green wedge espadrille with braided jute sole and ankle tie straps pick up warm sunset-inspired tones to elevate any seasonal outfit.

Fashion

Valentine’s Day 2026 Around the World: Travel, Food and New Ways to Celebrate Love

Valentine’s Day 2026: A Global Weekend of Love

Valentine’s Day 2026 falls on Saturday, February 14, turning the celebration into a long‑weekend opportunity for travel and special events. The day has evolved into a global phenomenon that now includes romantic partners, friendships and self‑care rituals, not just traditional couple dinners. Many cities are reporting spikes in themed events, from candlelit concerts to pop‑up markets, as people use the convenient Saturday date to extend celebrations across three days.

Travel Hotspots for Valentine’s Day 2026

Classic romantic capitals such as Paris and Venice remain top choices, with special hotel packages, Seine or gondola cruises, and candlelit dinners selling out early. Tropical escapes like Bora Bora and the Maldives are in demand for overwater villas, private beach dinners and bespoke “just us” experiences. Asian cities including Kyoto, with its traditional tea ceremonies and tranquil gardens, are drawing couples who prefer culture‑rich, reflective getaways over overt luxury.

In 2026, Valentine’s Day falling on a Saturday is also driving a domestic travel boom, especially in the United States, where couples are opting for close‑to‑home long‑weekend escapes. Emerging romantic hubs like Salt Lake City are promoting ski‑and‑city packages that combine mountain days with prix‑fixe Valentine dinners in urban hotels. Globally, curated hotel stays built around experiences—spa rituals, guided walks, and private tours—are winning out over purely room‑only deals.

Food‑Driven Romance: Dining as the Main Event

10 Hong Kong restaurants for a romantic Valentine’s Day 2026 …

Food‑centric travel is a defining trend of Valentine’s Day 2026, with a reported 43% year‑on‑year rise in bookings tied to culinary experiences. Cities such as Bangkok, Seoul and Tokyo are leading the list of romantic getaways chosen specifically for their street food, fine dining and immersive local cuisine. In Europe, Paris, Rome, Venice and Porto are marketing tasting menus, wine pairings and neighborhood food walks as key Valentine offerings.

Restaurants are also reshaping the Valentine’s menu itself, shifting from stiff multi‑course dinners toward shareable plates and flexible grazing experiences. Shared boards, small plates and dessert flights are being used to create a more interactive, conversational style of dining that many younger couples prefer. Menus increasingly feature travel‑inspired flavors, blending Italian, French and Japanese influences with bolder Latin American, Middle Eastern and Southeast Asian notes.

New Ways to Celebrate: Beyond Couples

When Is Valentine’s Day 2026 and How to Have a Sweet Celebration

Coverage of Valentine’s Day 2026 highlights how the celebration now embraces romantic love, platonic bonds and self‑love in equal measure. “Glow‑up” dates—joint spa visits, self‑care packages and wellness‑focused experiences—are trending as couples prioritize feeling good together over traditional gift boxes. Experience‑based gifts such as pottery classes, concert tickets and short trips are increasingly replacing typical chocolates and flowers.

At the same time, Galentine’s brunches and “family Valentine’s” activities are normalizing the idea that the day is for all kinds of relationships, not just partners. Social trends in 2026 also show a rise in solo celebrations, where individuals mark Valentine’s Day by taking themselves out, booking a mini‑break or finally buying a long‑desired personal treat. Across cultures, these shifts signal a broader move toward more inclusive, personalized, and experience‑driven ways of celebrating Valentine’s Day 2026.

For any questions/feedback regarding the above article, please do contact us anytime by clicking here

You may also like…

Fashion

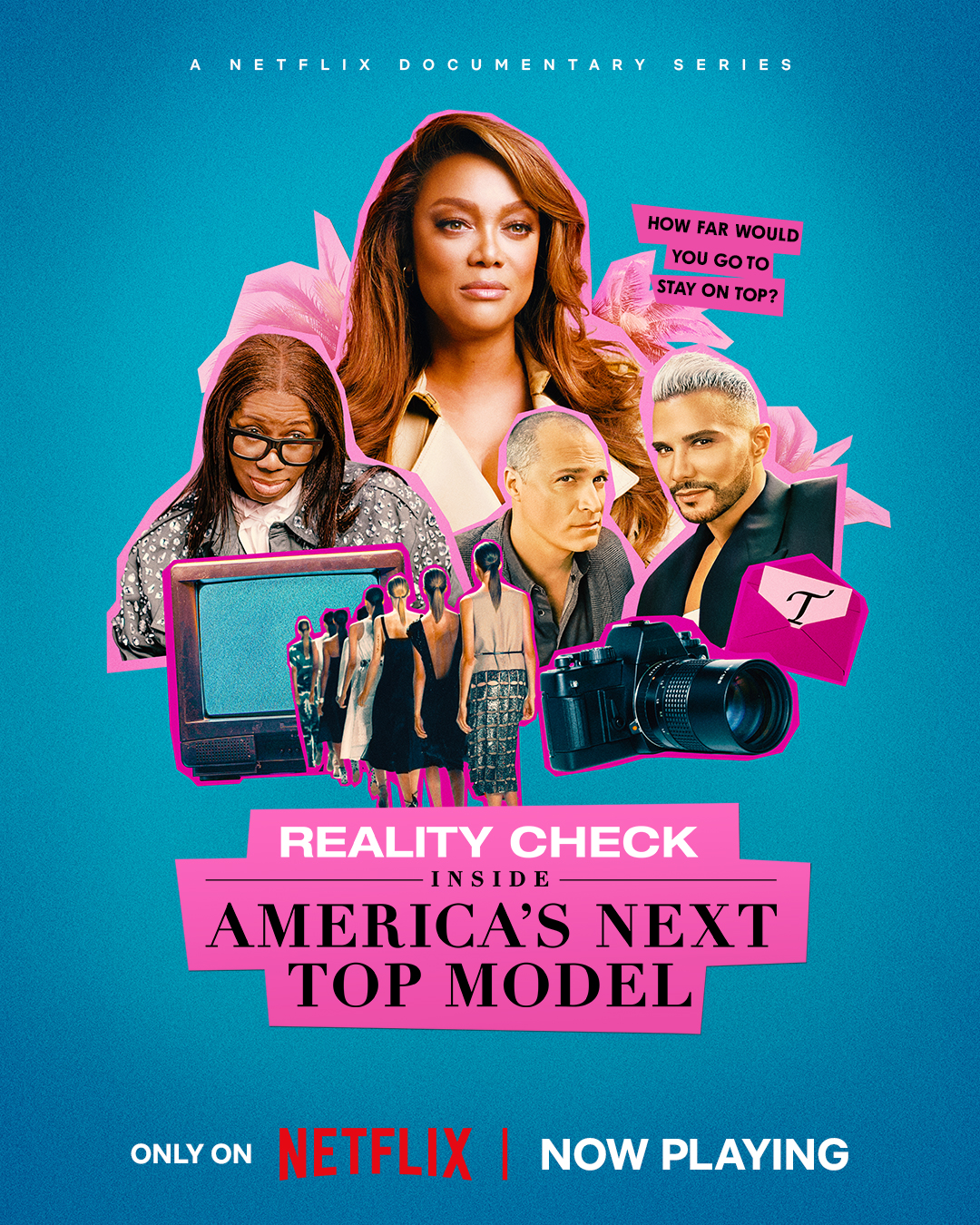

Reality Check: Inside America’s Next Top Model Drops Feb. 16 on Netflix and We Can’t Wait!

I can remember it like it was yesterday. Planning my entire schedule around Wednesday night’s for my must see TV: America’s Next Top Model. Me and my girls would gather around the television, and gag at all the crazy challenges the ladies would have to face (and how panelists like Ms. Jay, Mr. Jay, Tyra, and Nigel Barker would react)!

Now, over a decade later, Netflix is bringing all that good 2000’s nostalgia back with Reality Check: Inside America’s Next Top Model, premiering February 16th.

ANTM shaped an entire generation’s understanding of modeling. It gave us high fashion moments, iconic hairstyles, and popcorn worthy drama. While some things were obviously titillating and shocking, looking back, we now know that many many things (switching ethnicities, anyone?) simply wouldn’t fly in today’s cultural climate.

The new docuseries digs into the uncomfortable moments—the critiques that felt too harsh, the editing choices that reshaped narratives, the emotional toll the competition took on young women who were often just 18 or 19 years old. Former contestants speak candidly about body image pressures, controversial challenges, and the blurred line between mentorship and manufactured drama. Some participants embrace the reflection. Others have publicly criticized the project, questioning whether the industry has truly learned from its past.

What makes this documentary timely is not just nostalgia—it’s accountability. In 2003, reality TV was still the wild west. Social media didn’t exist the way it does now. There was no instant public discourse. Today, audiences demand transparency. They want to know what happened behind the scenes. They want context. They want growth.

At the same time, let’s not rewrite history without acknowledging impact. ANTM opened doors. It introduced viewers to diversity in modeling at a time when fashion magazines were far less inclusive. It put plus-size contestants, LGBTQ+ contestants, and women from different backgrounds on prime-time television. For many women watching, including myself, that visibility mattered.

Reality Check: Inside America’s Next Top Model feels less like a takedown and more like a reckoning—a moment to examine how far we’ve come in fashion, media, and representation, and how far we still need to go. Whether you were obsessed with the makeovers, lived for the runway challenges, or questioned the judging panel’s decisions every week, this series invites us to look back with a sharper lens.

And if there’s one thing fashion has always done well, it’s evolve. February 16th might just remind us that growth, even when messy, is still progress.

Fashion

Rihanna Attends the AWGE New York Fashion Week Show in a Black Monochromatic Look Alongside A$AP Rocky

We are officially in New York Fashion Week mode, and Rihanna made a special appearance at the AWGE fashion show yesterday in an all black look that was provocative.

AWGE is a creative agency founded by Ri’s beau A$AP Rocky, and acts as a in-house collective for fashion, music, and videos. A$AP first debuted his AWGE runway show during Paris Fashion Week in 2024, and it was refreshing to see him return to his hometown New York this season.

Rihanna sat front row, alongside the “A$AP Mob,” with a playful smize that exuded confidence. She wore a black leather coat that had fur trim, and layered it over a black lace bralette, blending delicacy with structure. She accessorized with black sheer footless stockings, and pointy toe stilettos, and her oversized black shades added a mysterious touch.

Back stage, “love was definitely on the brain,” as Rihana congratulated A$AP Rocky following a warm embrace. He seductively held on to her waist, with a grin that implied he just might be ready to make baby #4.

On our Fashion Bomb daily instagram page, one person commented, “Rocky imma need you to stay off my girl for a good 9 months; we need that album,” while another shared, “The way this man be loving on my girl should be studied!!! I want the for ALL MY GIRLS. “

A$AP Rocky is in his grove. Not only was he named the new House Ambassador for Chanel, but his latest album,”Don’t Be Dumb” reached #1 on the Billboard 200 chart, and his AWGE fashion show was a total success.

Rihanna has been in the spotlight for over two decades, and so it’s great to see her support her partner during this pivotal time, giving him the opportunity to shine.

What say you? Hot! Or Hmm…?

Photo Credit: @Hiphopnews, IG/Reproduction

Fashion

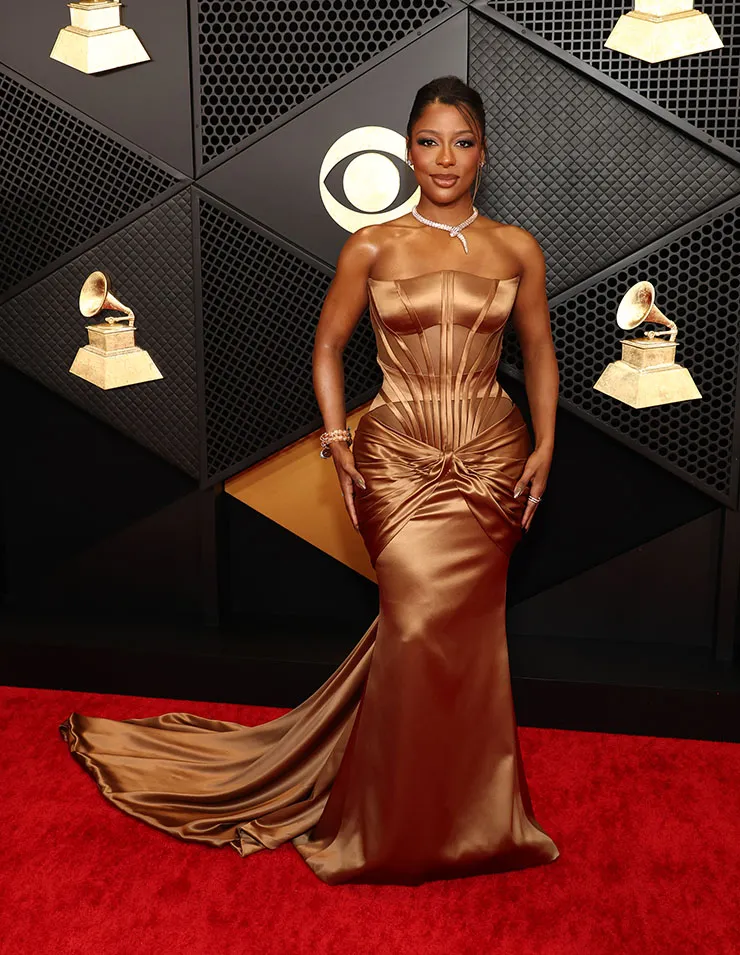

Show Review: Sergio Hudson Marks 10 Years with a Sculpted, Operatic Fall/Winter 2026 Collection at the New York Public Library

Sergio Hudson presented his Fall/Winter 2026 collection at the New York Public Library, celebrating ten years in business with a focused exploration of tailored stretch suiting, American sportswear, and sculpted silhouettes. The anniversary show drew inspiration from the grandeur of legendary Black opera singers such as Leontyne Price and the commanding stage presence of Aretha Franklin, channeling that sense of drama into a collection defined by heightened femininity and precision.

Texture anchored the lineup. Mohair, cashmere, suede, embossed croc, and snakeskin-embossed leather elevated classic tailoring, while silk charmeuse evening skirts, jewel-embellished bustiers, and black column gowns finished with cascading tulle introduced softness and movement.

Hudson’s signature structure remained intact, but the materials added depth and dimension.

This season signaled an evolution. Sculptural floral appliqués, plunging décolletage, and sharply tailored, figure-sculpting trousers demonstrated a refined approach to proportion and fabrication. Unexpected color pairings—mustard with teal, electric blue sequins offset by vivid pink—brought contrast and clarity while reinforcing the confidence of the collection.

A decade in, Hudson continues to refine his aesthetic while expanding its visual language. The Fall/Winter 2026 offering reflected both discipline and growth, underscoring his commitment to structure, glamour, and longevity.

Hot! Or Hmm..?

See more here:

Photo Credit: Kessler Studio

Fashion

Winter Olympics 2026 Results Today: Medal Table, Headlines and Star Performances

Winter Olympics 2026 Results Today

What to know about 2026 Winter Olympics opening ceremony

The Winter Olympics 2026 in Milan‑Cortina have reached a dramatic mid‑Games phase, with the medal table tightening at the top and several surprise champions emerging. Norway currently leads the overall medal count with 18 total medals, while host nation Italy has surged to 18 as well, delighting home fans across the Alpine venues. The United States and Japan are locked on 14 medals each, underlining the global spread of elite winter‑sports talent this year.

Norway’s strength in cross‑country skiing and biathlon has again proven decisive, keeping them on top despite strong challenges from Italy, the United States and France. Italy’s balance across alpine skiing, sliding sports and figure skating has turned the home Games into a festival of near‑daily podiums. Behind the leading pack, Austria, Germany and France remain firmly in contention, each already into double‑digit medal tallies with key events still to come.

Headline Golds in Figure Skating and Alpine

Figure skater Mikhail Shaidorov wins Kazakhstan’s first gold …

One of the defining stories of the Winter Olympics 2026 results so far has been Kazakhstan’s Mikhail Shaidorov, who stunned the field to win men’s figure skating gold and deliver his country’s first Olympic title in the sport. Shaidorov held on in the “leader’s chair” as favorites from Italy, France, Japan and the United States failed to overtake his personal‑best score in the free skate. Ilia Malinin, the two‑time world champion from the United States, struggled in the final and finished eighth after multiple errors, a shock outcome in an event many expected him to dominate.

In alpine skiing, the women’s events have produced dramatic finishes, with tight margins separating gold, silver and bronze on the steep Italian slopes. Technical specialists and speed racers have both found success in Milan‑Cortina, as changing snow conditions challenged even the most experienced athletes. The alpine program is far from over, meaning the current medal standings in skiing could shift again as the remaining downhill, super‑G and slalom races are contested.

Medal Table Snapshot after February 13

In photos: Winter Olympics 2026 kick off with opening …

A quick snapshot of the Winter Olympics 2026 results after the February 13 events shows how competitive the medal race has become. Norway and Italy are tied on 18 total medals, with the United States and Japan close behind on 14, and Austria rounding out the top five on 12. France, Sweden, Switzerland, the Netherlands and Canada complete a tightly packed top ten, all already on the board with multiple golds.

Smaller delegations have also made history, with Kazakhstan entering the table through Shaidorov’s figure skating gold and nations such as New Zealand and Slovenia securing rare Winter Olympic podiums. Great Britain, Latvia, Belgium and Finland have each claimed at least one medal, underscoring the breadth of global participation at these Games. As the second week continues, several disciplines with traditionally unpredictable outcomes, including snowboard halfpipe, freestyle skiing and short‑track speed skating, are poised to reshape the lower half of the medal standings.

What to Watch Next in Milan‑Cortina

Chloe Kim thrills in women’s snowboard halfpipe at 2026 Olympics

Looking ahead, fans following Winter Olympics 2026 results should focus on the remaining figure skating events, speed‑skating sprints and the final alpine races, all of which carry heavy medal implications. Speed skaters like American Jordan Stolz are chasing multiple podiums in the shorter distances, adding extra intrigue to the middle weekend of competition. In snowboarding, star names in the halfpipe and slopestyle events are set to defend their titles or chase breakthrough golds on the Italian ramps and rails.

With host‑nation Italy battling Norway, the United States and Japan at the top of the table, every final in the coming days will matter for national pride as well as individual glory. From the illuminated opening ceremony in Milan’s iconic stadium to the high‑drama contests in the Dolomites, Milan‑Cortina 2026 is shaping up as one of the most competitive Winter Games in recent memory.

For any questions/feedback regarding the above article, please do contact us anytime by clicking here

You may also like…

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech19 hours ago

Tech19 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 hours ago

NewsBeat5 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business3 days ago

Business3 days agoBarbeques Galore Enters Voluntary Administration