Crypto World

MYX Finance Crashed 70% This Week, But Why?

MYX Finance has posted one of the steepest weekly drawdowns in the digital asset market. The token plunged 72% over the past seven days, underperforming most comparable altcoins. The sell-off erased months of gains and pushed MYX to a three-month low.

At first glance, such a collapse often signals protocol failure or declining utility. However, on-chain data and derivatives metrics tell a different story.

Sponsored

MYX Finance Is Still Doing Well In The DeFi Space

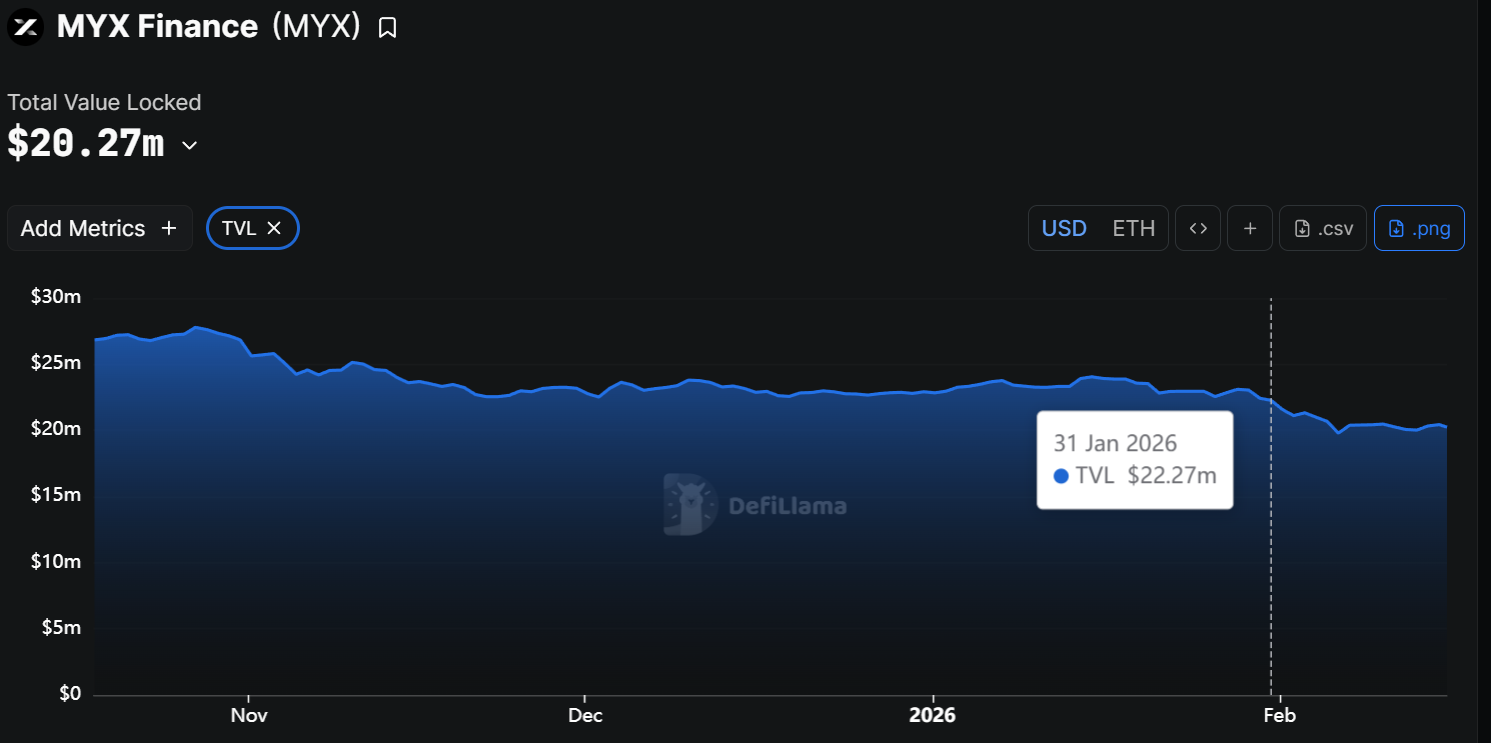

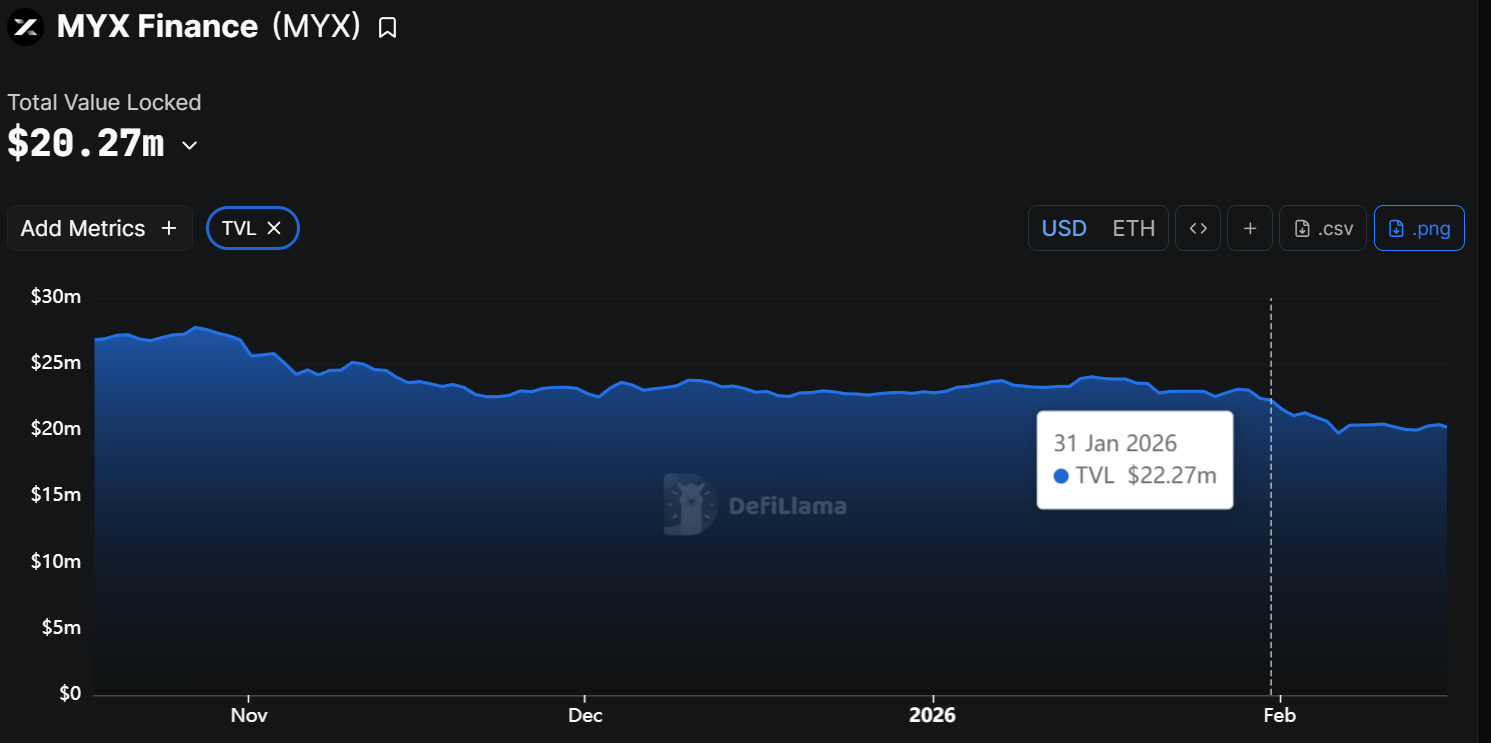

A sharp decline typically raises concerns about weakening demand or user migration. Investors often examine total value locked, or TVL, to assess platform health. In decentralized finance, TVL measures the amount of capital secured within a protocol’s smart contracts.

MYX Finance’s TVL declined by roughly $2 million since the start of the month. It fell from $22.27 million on January 31 to $20.27 million today. While the drop reflects some capital outflow, it does not indicate a systemic collapse. The reduction represents less than 10% of the total locked value.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This moderate contraction suggests that users have not exited en masse. Core utility appears intact. The data imply that the price crash was not driven by a dramatic fall in platform adoption.

Sponsored

Traders Are Pining For MYX Price Drop

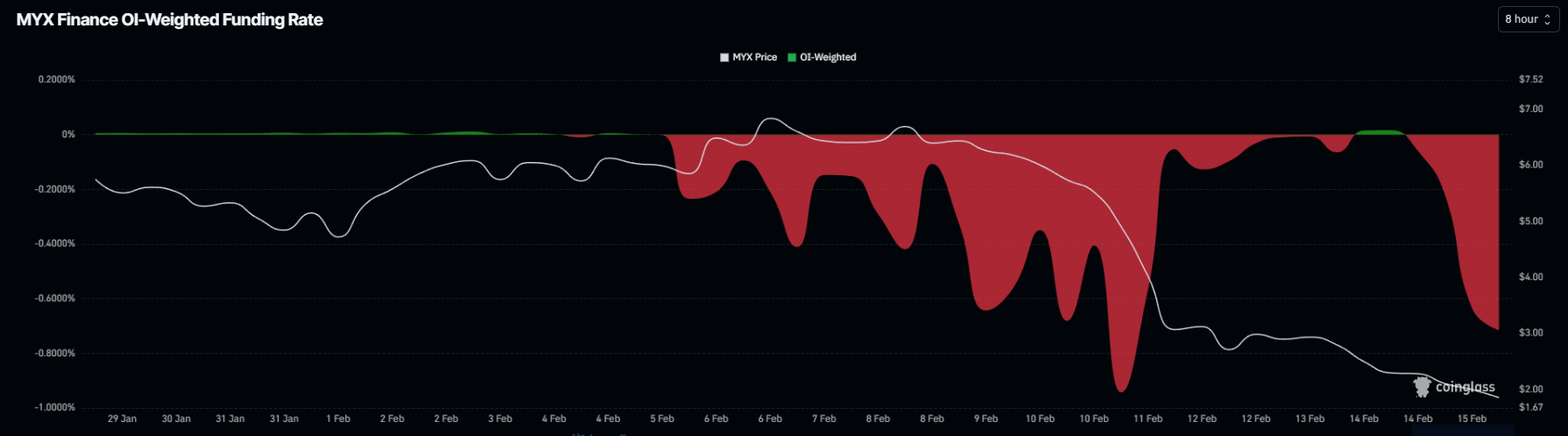

Derivatives data provides stronger insight into the recent volatility. Funding rates in perpetual futures markets reveal whether traders are leaning long or short. When funding turns deeply negative, short sellers dominate and pay fees to long holders.

MYX has experienced persistently negative funding rates, with spikes reflecting intense bearish pressure. This pattern shows traders have been aggressively opening short contracts. The imbalance suggests speculation on continued downside rather than a reaction to deteriorating fundamentals.

Such positioning can accelerate price movements. Heavy short exposure amplifies downward momentum during periods of fear. In MYX’s case, sustained negative funding indicates that sentiment, not utility loss, has driven much of the decline.

Sponsored

How Are MYX Holders Acting?

The Money Flow Index, or MFI, further supports this view. The MFI tracks capital inflows and outflows by combining price and volume. A move below the neutral 50 level signals strengthening selling pressure.

MYX’s MFI has fallen beneath that midpoint, confirming that MYX sellers currently control momentum. The shift reflects growing fear, uncertainty, and doubt among traders. As liquidity thins, price declines can intensify quickly.

Historical patterns offer additional context. The last time MYX’s MFI moved decisively from buying to selling pressure, the token dropped 50%. This time, the decline has already reached 72%. The trend may continue until the MFI approaches the oversold zone, where selling pressure typically begins to exhaust.

Sponsored

MYX Price Crashes

MYX is trading at $1.88 at the time of writing. The token broke below the psychological $2.00 level, marking its lowest price in three months. The 72% weekly decline reflects extreme short-term weakness and heightened volatility.

If MYX fails to hold the $1.68 support level, additional downside risk increases. A breakdown could push the token toward $1.43. Losing that support would expose the next critical level near $1.22, where buyers may attempt to stabilize price action.

Conversely, sentiment shifts can occur quickly in crypto markets. If investors view current levels as undervalued, accumulation could begin. A sustained move above $2.48 would signal improving strength. Reclaiming that level as support could invalidate the bearish outlook as MYX approaches the $3.00 mark.

Crypto World

USD1 Stablecoin Surges to $5 Billion Market Cap as Wall Street CEOs Schedule Florida Summit

TLDR:

- USD1 achieved over $5 billion market capitalization within initial phase, ranking among top stablecoins globally.

- Platform recorded $300 million total value locked with yields reaching 13% on USDC and 7% on USD1 holdings.

- Major financial CEOs from Goldman Sachs, Coinbase, Franklin Templeton attend February 18 Mar-a-Lago meeting.

- Developer plans target $9 trillion daily FX market, positioning USD1 as potential settlement infrastructure.

USD1 has reached a market capitalization exceeding $5 billion within its initial phase, positioning itself among the largest stablecoins in the global market.

The token, associated with World Liberty Financial, has attracted attention from traditional finance leaders ahead of a scheduled February 18 gathering at Mar-a-Lago.

Capital flows into the platform have accelerated despite broader market volatility, with early metrics showing substantial total value locked and competitive yield rates.

Platform Metrics Show Early Traction

The stablecoin recorded approximately $300 million in total value locked during its first month of operation. Users can access yield rates reaching around 13 percent on USDC deposits through the platform.

USD1 itself offers roughly 7 percent returns to holders, creating multiple entry points for yield-seeking investors.

A crypto analyst posting under the handle @Eljaboom noted the scale of the project on social media. “Everyone is watching BTC · $68,174.43. Meanwhile, a new dollar rail is quietly forming in Florida,” the analyst wrote. The commentary emphasized that USD1 had moved beyond early-stage development into operational scale.

The platform’s rapid accumulation of locked value demonstrates market appetite for alternative stablecoin infrastructure. Traditional stablecoin markets have been dominated by established players for years.

However, new entrants with institutional backing are now challenging existing market structures through competitive yield offerings and expanded functionality.

World Liberty Financial architect Zak Folkman has discussed plans extending into foreign exchange markets. The global FX market processes approximately $9 trillion in daily transactions, representing a substantial opportunity for blockchain-based settlement infrastructure. If USD1 transitions from a yield-generating token to a settlement layer, its utility could expand considerably.

Institutional Participation and Infrastructure Development

The February 18 event at Mar-a-Lago includes participation from several prominent financial executives. Coinbase CEO Brian Armstrong, Goldman Sachs CEO David Solomon, Franklin Templeton CEO Jenny Johnson, and Cantor Fitzgerald CEO Michael Selig are confirmed attendees.

This lineup reflects institutional curiosity about digital asset infrastructure rather than typical cryptocurrency community engagement.

The platform has outlined several development priorities on its public roadmap. A debit card product aims to bridge digital and traditional payment systems.

Mobile onboarding tools will expand accessibility beyond desktop users. Real-world asset integration could connect traditional financial instruments with blockchain rails.

The analyst’s post emphasized infrastructure over short-term price movements. “The token price is noise. The infrastructure is the story,” according to the social media commentary.

This perspective suggests that platform utility and adoption metrics matter more than speculative trading activity.

Capital allocation patterns indicate growing confidence in alternative stablecoin systems. Whether driven by yield opportunities or institutional partnerships, the flow of funds into newer platforms challenges the assumption that established stablecoins maintain permanent market dominance.

The development of payment rails and settlement infrastructure continues regardless of broader cryptocurrency market conditions.

Crypto World

Strategy Plans To Convert $6B Debt As Bitcoin Holdings Value Drops

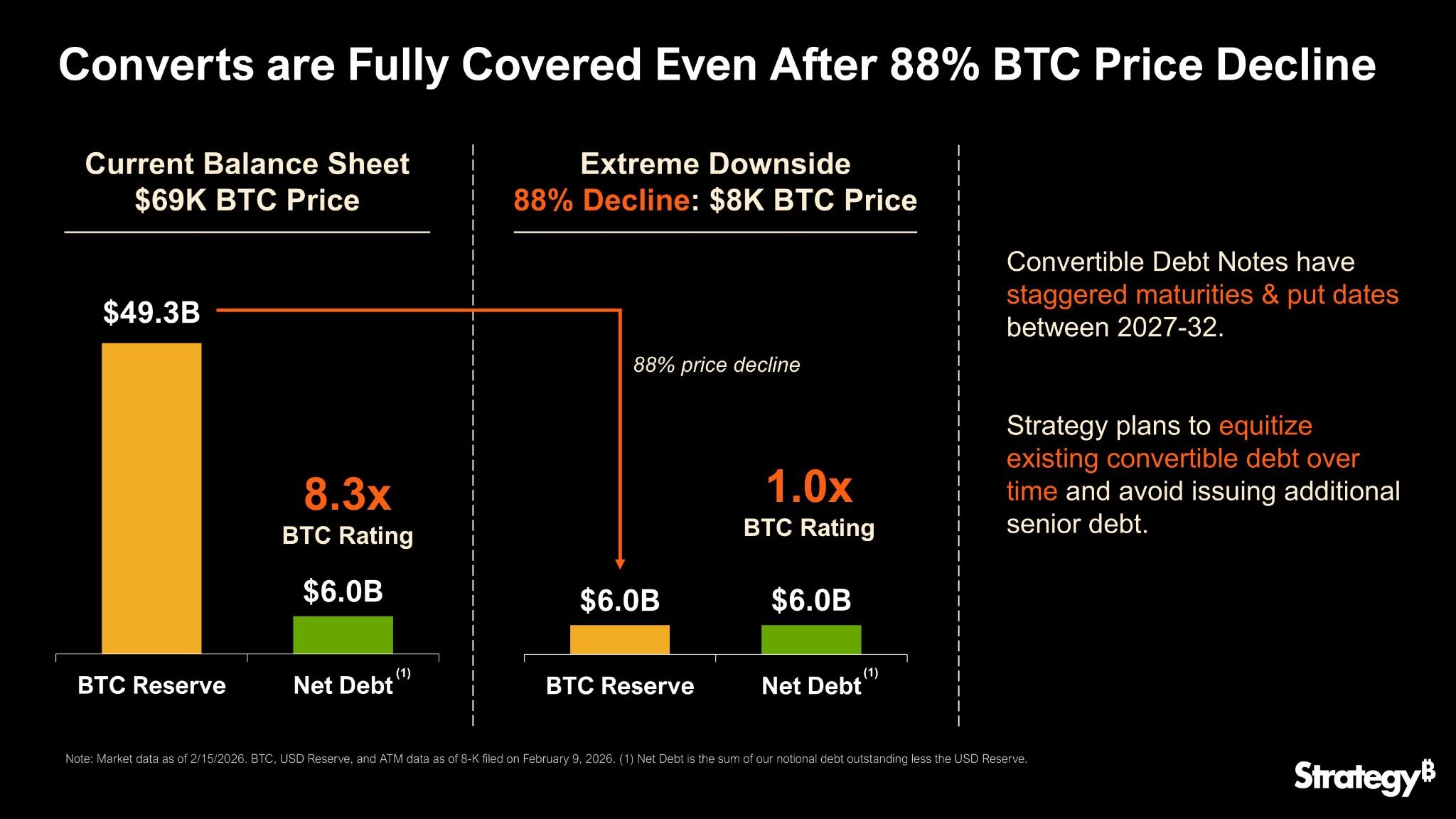

Strategy founder Michael Saylor has revealed the firm plans to convert its $6 billion in bond debt into equity — a move that reduces debt on the balance sheet.

“Strategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt,” stated the firm on X on Sunday, prompting Saylor’s response.

The Bitcoin (BTC) treasury company currently holds $49 billion in Bitcoin reserves with a stash of 714,644 BTC.

Its convertible debt is around $6 billion, so BTC would need to fall around 88% for the two to be equal, and it still has enough to cover the debt, the firm explained.

Equitizing convertible debt means converting the bond debt into equity as stock shares rather than repaying it in cash, essentially turning bondholders into shareholders.

The move would reduce debt pressure on the company, but it can also dilute existing shareholders because new stock is issued.

Strategy down 10% on average BTC purchase price

The average Bitcoin purchase price for Strategy is around $76,000, which means the firm is currently down around 10% on its investment with the asset trading at $68,400.

Related: Michael Saylor signals another Bitcoin buy amid market rout

Meanwhile, Saylor signaled another Bitcoin buy as he posted the Strategy accumulation chart on X on Sunday, a typical sign of a purchase.

The purchase would mark 12 consecutive weeks of buying as the company continues to accumulate despite a sharp decline in the underlying asset and its stock price.

Strategy stock down 70% from ATH

Strategy stock (MSTR) climbed 8.8% on Friday to end the week trading at $133.88, according to Google Finance.

The move came as Bitcoin recovered the $70,000 level again in late trading on Friday, but that recovery was short-lived as it lost some of those gains in early trading on Monday morning, falling to $68,400, according to CoinGecko.

Meanwhile, shares in the company are down 70% from their mid-July all-time high of $456, as BTC prices have fallen 50% from their peak in early October.

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest

Crypto World

Aave targets solar financing in long-term DeFi strategy

Aave is looking beyond traditional crypto lending as it explores a long-term strategy focused on financing solar energy and other real-world infrastructure.

Summary

- Aave founder Stani Kulechov says tokenized solar assets could unlock faster, cheaper funding for clean energy.

- Aave plans to use solar-backed tokens as collateral to improve liquidity and capital recycling.

- The move targets long-term growth beyond traditional crypto-based lending.

The shift was outlined in a recent post by founder Stani Kulechov, who argued that decentralized finance can play a major role in funding the global energy transition.

Kulechov said on-chain lending has already proven its technical strength with digital assets. The next step, in his view, is to bring productive, real-world assets such as solar farms into DeFi and turn them into usable collateral.

Turning solar projects into liquid assets

According to Kulechov, one of the main problems in solar and infrastructure financing is illiquidity. Most projects rely on long-term contracts that can last 20 years or more. Investors often accept lower flexibility in exchange for stable returns, but this also limits the amount of capital that can enter the sector.

Tokenization could change that. By turning solar projects into digital assets, investors would be able to trade and transfer their positions more easily. These tokenized assets could also be used as collateral on Aave (AAVE), allowing developers and financiers to borrow funds quickly instead of waiting months for traditional loans.

Kulechov said this could lower required returns and make projects more attractive. A solar asset that needs a 10% return in private markets might only need 6% if it becomes liquid and tradable. Over time, this could help recycle capital faster, letting the same money fund multiple projects instead of being locked up for decades.

He also pointed to the potential impact on stablecoins. Because solar farms are spread across many countries, their debt could be issued in different currencies. This could create new demand for euro- and pound-backed stablecoins, giving users more options beyond U.S. dollar lending.

Building a new model for DeFi growth

Lending against major cryptocurrencies has grown crowded and fiercely competitive, as per Kulechov. Similar products are currently offered by many DeFi platforms, which has decreased long-term growth potential and pushed down margins.

He argues that solar-backed lending presents an alternative. Aave might fund initiatives that produce actual cash flows and long-term value rather than depending on speculative assets. This would give depositors access to “green yield” while helping fund clean energy development.

He also stressed that most retail investors currently have limited access to solar investments. High minimums and complex structures keep many people out. On-chain products have the potential to reduce these obstacles and increase accessibility to infrastructure financing.

He believes that this strategy reflects a drastic change in the way that capital ought to be distributed. DeFi platforms should support assets that are productive and future-proof rather than concentrating on government debt or struggling industries.

Kulechov described this as an “opinionated” strategy. Users who choose solar-backed products are not just looking for returns, he said. They are choosing to fund creation over extraction and long-term growth over short-term fixes.

If the model works, it might result in a parallel financial system with real infrastructure and revenue supporting lending products and stablecoins.

“Aave Will Win,” Kulechov concluded, framing the shift as both a business strategy and a statement about the future of DeFI.

Crypto World

ZK-Proofs in Privacy-Preserving DeFi – Smart Liquidity Research

The tech that lets you prove you’re legit—without spilling your wallet’s secrets.

Decentralized finance was supposed to give us sovereignty. Instead, it gave us radical transparency. Every swap, every yield farm rotation, every panic sell at 3 a.m.—immortalized on-chain for anyone with a block explorer and curiosity.

Enter Zero-Knowledge Proofs (ZK-proofs): cryptography’s elegant solution to “trust me, bro”—but mathematically enforced.

What Are ZK-Proofs (Without the Math-Induced Migraine)?

A zero-knowledge proof lets one party prove a statement is true without revealing the underlying information.

In DeFi terms:

-

You can prove you have enough collateral without revealing your wallet balance.

-

You can prove you’re not on a sanctions list without revealing your identity.

-

You can prove a transaction is valid without exposing the sender, receiver, or amount.

It’s like showing the bouncer you’re over 18 without handing over your full life story.

Why DeFi Needs Privacy (Badly)

Most DeFi today runs on fully transparent blockchains like Ethereum.

Transparency is great for:

-

Verifiability

-

Auditing

-

Trust minimization

But it’s terrible for:

If hedge funds had to publish every trade in real time, markets would implode. Yet that’s essentially what DeFi asks of users.

ZK-proofs are the missing layer.

Core ZK Technologies in DeFi

1. zk-SNARKs

Succinct proofs. Small, fast to verify, but often require a trusted setup.

2. zk-STARKs

No trusted setup. More scalable, but proofs are larger.

Both are already being used to scale networks and enable privacy features.

Real Projects Building Privacy-Preserving DeFi

Let’s look at concrete implementations.

1. Aztec Network

Private DeFi on Ethereum

Aztec uses zk-rollups to enable programmable privacy. Users can:

-

Make private token transfers

-

Interact with DeFi applications privately

-

Shield balances and transactions

It combines Ethereum’s security with encrypted state transitions verified via zero-knowledge proofs.

Use case: A DAO treasury managing funds without publicly broadcasting every move.

2. Mina Protocol

The “Succinct” Blockchain

Mina keeps its entire blockchain at ~22KB using recursive ZK-proofs. While not purely DeFi-focused, its architecture enables:

-

Private smart contract logic

-

Verifiable off-chain computation

-

zkApps (zero-knowledge apps)

Use case: DeFi apps that verify external data or credentials without revealing the raw data.

3. Secret Network

Encrypted Smart Contracts

Secret Network allows private smart contracts where:

Use case: Confidential lending markets where positions aren’t publicly exposed.

4. Zcash

The OG zk-SNARK Pioneer

While not DeFi-native, Zcash introduced shielded transactions using zk-SNARKs. Its innovations laid the groundwork for privacy-preserving financial logic.

Lesson: Privacy and compliance can coexist through selective disclosure.

5. Polygon zkEVM

Scalable + Compatible

Polygon zkEVM uses ZK-proofs to validate batches of transactions while staying compatible with Ethereum’s tooling.

Though focused on scalability, this tech can integrate privacy layers into DeFi protocols operating on rollups.

Key Use Cases in Privacy-Preserving DeFi

🔒 Private Lending

Borrowers prove solvency without exposing full balance sheets.

🏦 Confidential Treasury Management

DAOs operate without leaking strategy.

🧾 Selective Compliance

Prove KYC status without revealing identity details.

📊 Strategy Protection

Traders shield positions from front-running bots.

The Regulatory Elephant in the Room

Privacy in crypto often triggers knee-jerk reactions from regulators. But ZK-proofs actually offer a middle path:

This is programmable compliance—arguably more precise than traditional finance reporting.

Institutions don’t want secrecy for crime. They want confidentiality for competitive advantage. ZK makes that distinction enforceable.

Challenges Ahead

Let’s not pretend it’s magic.

But, like early smart contracts in 2016, complexity fades as tooling matures.

The Big Picture

The first wave of DeFi was about composability.

The second wave was about scalability.

The third wave will be about privacy.

Because financial sovereignty without privacy is just transparent banking with extra steps.

ZK-proofs are turning DeFi from a public spreadsheet into programmable, selective, cryptographic confidentiality.

And when institutions finally move on-chain at scale, they won’t do it naked.

They’ll do it with zero knowledge.

REQUEST AN ARTICLE

Crypto World

Aave Founder Unveils $50 Trillion Solar Financing Vision Through Tokenized Infrastructure

TLDR:

- Aave could expand collateral by $1.5-5 trillion capturing just 10% of solar financing market share by 2050

- Global solar investment needs $10-50 trillion through 2050, with current annual investment at $420 billion

- Tokenized solar debt enables developers to borrow $70 million in minutes versus months with traditional finance

- Five percent bond market reallocation to solar would inject $6.5 trillion, advancing net zero by 10-15 years

Aave founder Stani Kulechov has published a comprehensive vision for onchain lending to capture a substantial portion of the global energy transition market.

The proposal centers on tokenizing solar energy infrastructure and battery storage projects as collateral. Kulechov estimates the total addressable market at $30 to $50 trillion between now and 2050.

The strategy positions decentralized finance protocols to compete directly with traditional infrastructure funds and development banks in financing renewable energy deployment.

Global Solar Investment Requirements Create DeFi Opportunity

Kulechov frames the opportunity in transformative terms, stating the industry is approaching “a 30 to 50 trillion dollar value capture market for Aave between now and 2050.”

Current solar energy investment stands at approximately $400 to $420 billion annually as of 2024. However, reaching net zero emissions by 2050 requires installing between 14,000 and 15,500 gigawatts of solar capacity.

With roughly 1,700 gigawatts currently deployed, the remaining gap demands $10 to $12 trillion in conservative scenarios.

More aggressive projections accounting for artificial intelligence growth and emerging market development push requirements to $15 to $20 trillion.

The Aave founder argues that energy abundance creates positive feedback loops rather than market saturation. As solar costs decline through economies of scale, cheaper energy stimulates additional economic activity. This increased activity drives higher electricity demand, requiring further solar deployment.

Traditional infrastructure capital currently comes from specialized funds managing $300 to $400 billion annually. Meanwhile, global bond markets exceed $130 trillion, and equity markets reach $110 trillion.

Even capturing five percent of bond capital allocation to solar would inject $6.5 trillion into the sector. This represents roughly 15 times current annual investment levels and could accelerate net zero timelines by 10 to 15 years.

Tokenization Addresses Illiquidity Premium in Infrastructure Assets

Solar projects typically structure with 30 percent equity and 70 percent senior debt components. Equity sponsors target 8 to 15 percent returns, while senior debt offers 5 to 8 percent yields in mature markets.

These cash flows come from power purchase agreements spanning 15 to 25 years with creditworthy counterparties. The predictability creates bond-like characteristics, yet infrastructure funds face illiquidity constraints that limit capital deployment.

Kulechov emphasizes that “every dollar invested in solar manufacturing drives costs down further through learning curves, making the next dollar more productive.”

Pension funds typically allocate only 3 to 5 percent to illiquid infrastructure despite potentially allocating 15 to 20 percent to liquid equivalents.

Tokenizing solar assets on blockchain networks enables continuous secondary market trading. An identical project might require 10 percent returns as an illiquid asset but only 6 percent when tokenized.

Aave Protocol can accept tokenized solar debt as collateral for stablecoin borrowing. A developer holding $100 million in tokenized project debt could borrow $70 million in stablecoins within minutes rather than months.

This capital velocity allows immediate redeployment into new projects. Simultaneously, Aave depositors gain access to diversified, geographically distributed yield backed by physical infrastructure rather than government debt or cryptocurrency volatility.

Market Share Projections Position Protocol as Major Financier

Kulechov projects that capturing just 10 percent of the solar financing market would expand Aave’s economic collateral by $1.5 to $5 trillion through 2050. A 25 percent market share scenario grows this to $3.75 to $12.5 trillion.

For context, JPMorgan manages $4.5 trillion in assets while BlackRock oversees $14 trillion. The abundance financing thesis positions decentralized protocols to compete at comparable scale with the largest traditional financial institutions.

The strategy extends beyond dollar-denominated markets. Solar farms exist across multiple jurisdictions, creating natural demand for euro, pound, and other local currency stablecoins.

Developers in Europe could tokenize euro-denominated senior debt and borrow in euros against that collateral. This solves persistent demand-side problems for non-dollar stablecoins while creating local currency yield opportunities.

Distribution channels include Aave App for retail users, Aave Pro for institutional participants, and Aave Kit for fintech integration. Kulechov declares that “funding energy transitions is by far the largest opportunity for Aave,” framing the approach as explicitly opinionated capital allocation.

Rather than offering neutral access to all asset classes, the protocol would prioritize future-proof abundance assets over legacy scarcity-based instruments like government bonds or mortgages.

Crypto World

How Intelligence Packages from Cybercrime Atlas Powered Operations Resulting in $97 Million Recovery

TLDR:

- Cybercrime Atlas produced 13 intelligence packages and 17,000 vetted data points for four major operations.

- Operations across 19 African countries resulted in 1,209 arrests and identified over 120,000 victims.

- Research-driven approach recovered $97 million and disrupted $678 million worth of criminal activities.

- Over 30 organizations collaborate using open-source intelligence to map criminal network choke points.

Cybercrime Atlas has successfully converted research intelligence into concrete law enforcement operations during 2024 and 2025.

The initiative produced 13 intelligence packages and vetted 17,000 actionable data points that powered four major cross-border campaigns.

These coordinated efforts resulted in 1,209 arrests and recovered $97 million from criminal activities. The research-driven approach enabled law enforcement to disrupt $678 million worth of illicit operations across multiple continents.

Intelligence Gathering Powers Multi-National Operations

The Cybercrime Atlas community developed a structured methodology to transform fragmented research into unified action.

Over 30 organizations contributed open-source intelligence that mapped cybercriminal networks and infrastructure. Each intelligence package underwent community vetting before reaching law enforcement partners.

This research directly supported INTERPOL’s Operations Serengeti and Serengeti 2.0 across 19 African countries. The intelligence identified critical infrastructure including malicious domains, crypto wallets, and physical equipment used by criminal networks. Law enforcement agencies used these mapped connections to coordinate simultaneous takedowns.

Binance announced the results through X, highlighting how structured collaboration helps identify criminal infrastructure.

The World Economic Forum launched the initiative in 2023 to bridge private sector research with public enforcement capabilities. Open-source intelligence allows cross-border data sharing without violating privacy or legal constraints.

Research Group Identifies Criminal Choke Points

The Cybercrime Atlas established a Research and Mapping Group in 2025 to enhance operational effectiveness. Banco Santander, Group-IB, Binance, and Orange Cyberdefense initially led the group. Mastercard, Recorded Future, SpyCloud, and TNO joined later to expand research capabilities.

This group focuses on identifying choke points within criminal ecosystems where disruption creates maximum impact. Researchers analyze digital traces across compromised domains, social accounts, and payment channels. Technical tools from Maltego, ShadowDragon, and Silent Push enable efficient data correlation and visualization.

The methodology connects seemingly unrelated digital evidence into coherent maps of criminal operations. Researchers track infrastructure patterns and financial flows to reveal network vulnerabilities.

This systematic approach allows law enforcement to target nodes that weaken entire criminal organizations rather than individual actors.

Operational Results Validate Research-Driven Approach

The intelligence-to-action model produced measurable outcomes across multiple jurisdictions during the reporting period. Operations identified more than 120,000 victims and neutralized key criminal infrastructure.

INTERPOL Cybercrime Director Neal Jetton acknowledged the effectiveness of this collaborative framework, stating that the initiative “creates a force multiplier against cybercrime,” turning intelligence insights into measurable results.

Binance’s security teams contributed foundational research, link analysis, and attribution insights for intelligence packages.

The company’s work focused on mapping criminal networks exploiting cryptocurrency infrastructure. Erin Fracolli, Binance’s Global Head of Intelligence and Investigations, emphasized the strategic value of collaborative frameworks in securing digital ecosystems.

“Partnerships like the Cybercrime Atlas are critical to securing the digital-asset space and the broader digital environment,” Fracolli noted.

The initiative also expanded into capacity building, training law enforcement personnel from over 40 countries. Programs in Bangkok and Panama taught investigators how to apply private-sector intelligence in active cases.

The Cybercrime Atlas partnership with STOP THE TRAFFIK now integrates human trafficking data into cybercrime mapping efforts.

Crypto World

Whales Coming to Rescue ADA?

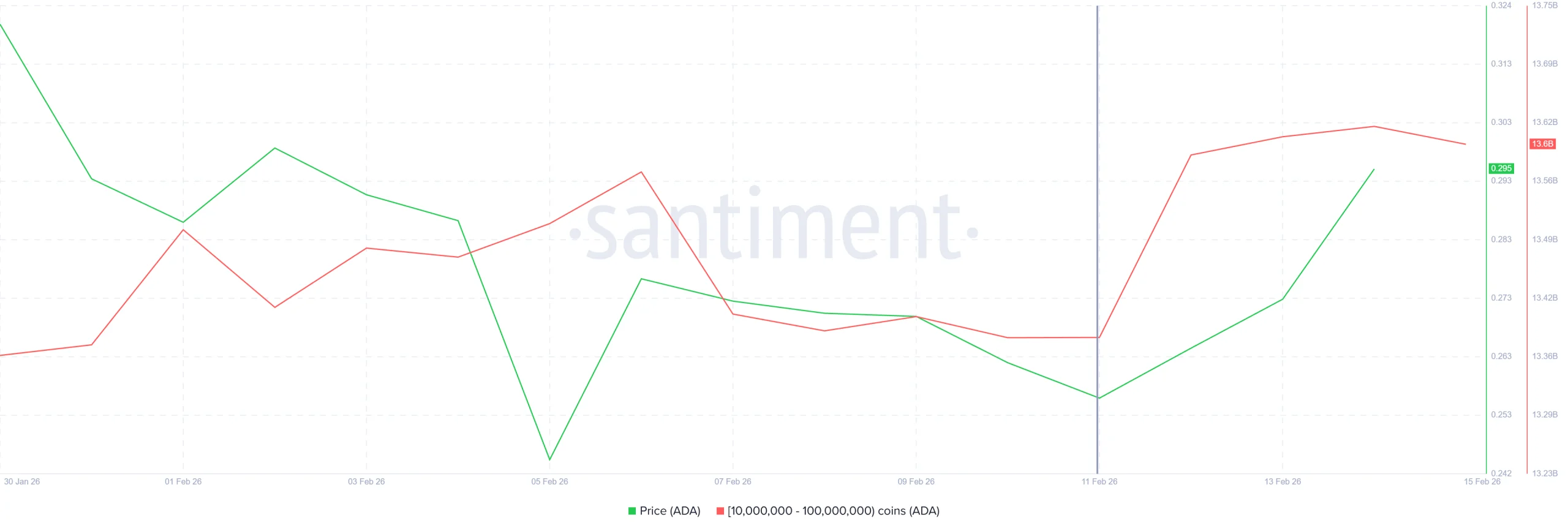

Cardano has shown early signs of stabilization after weeks of pressure. The ADA price is attempting a bounce from recent lows. Market data suggests the recovery is being supported by two key investor groups.

Large holders and long-term investors appear to be stepping in. Their activity is shaping short-term sentiment around the altcoin. As volatility persists across the crypto market, these cohorts may play a decisive role in ADA’s next move.

Sponsored

Sponsored

Cardano Holders Are Seemingly Bullish

On-chain data indicates that Cardano whales have been consistently supportive. Addresses holding between 10 million and 100 million ADA have accumulated heavily in recent days. These wallets added more than 220 million ADA, valued at over $61 million at the time of writing.

Such accumulation during price weakness often reflects strategic positioning. Whales likely took advantage of discounted prices. Their buying signals conviction in ADA’s recovery potential.

Large-scale accumulation can also reduce circulating supply, which may support price stability in the near term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Beyond whale activity, long-term holders are reinforcing confidence. The Mean Coin Age metric, which tracks the average age of circulating coins, has been steadily increasing. This indicator reflects whether older coins are moving or remaining dormant.

During bear markets, a decline in Mean Coin Age often signals transactions and potential selling. However, the current rise places the metric at a three-month high.

Sponsored

Sponsored

This suggests long-term holders are opting to HODL rather than liquidate positions. Sustained dormancy typically indicates expectations of future ADA price appreciation.

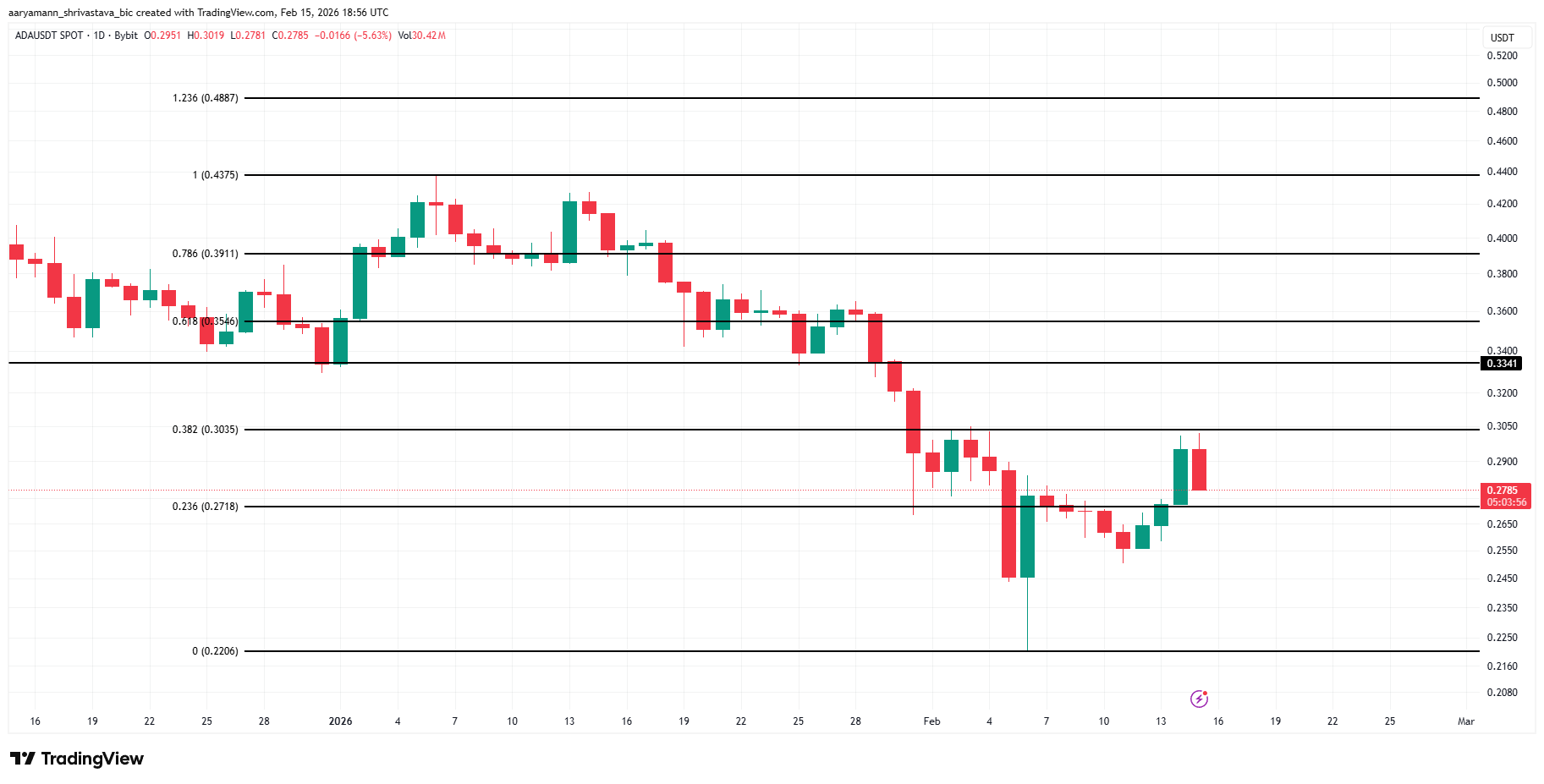

ADA Price Breach On The Cards

Cardano price is trading at $0.278 at the time of writing. The altcoin is attempting to secure the $0.271 level, which aligns with the 23.6% Fibonacci Retracement. Holding this support would strengthen the bullish structure. A confirmed rebound could open the path toward $0.303.

Whale accumulation combined with long-term holder conviction may inject needed stability. If buying pressure continues, ADA could extend gains beyond $0.303.

The next resistance stands near $0.354. A decisive move above that zone could push Cardano toward $0.391, reinforcing recovery momentum.

However, risks remain in volatile market conditions. If ADA fails to breach $0.303, sellers may regain control. Renewed pressure could force the price below the $0.271 support again.

A breakdown would likely expose $0.245 as the next downside target, invalidating the current bullish outlook.

Crypto World

Ethereum Tests Critical $1,943 Support: Analyst Projects $7,000 Target if Channel Holds

TLDR:

- Ethereum trades at $1,943, testing the lower boundary of an ascending channel established since 2020 lows.

- Technical analysis projects potential $7,000 target representing 260% upside if current support holds firm.

- Weekly close below $1,850 could invalidate the multi-year pattern and trigger decline toward $1,200-$1,500.

- Asymmetric risk-reward profile shows 20-30% downside risk versus 260% upside potential at channel boundary.

Ethereum is trading at a crucial support level near $1,943, according to recent technical analysis. Market observers are watching closely as the cryptocurrency tests the lower boundary of a multi-year ascending channel.

A successful bounce from this level could set the stage for a substantial rally. However, a breakdown below current support may trigger extended weakness across the market.

Channel Structure Points to Binary Outcome

The ascending channel pattern has guided Ethereum’s price action since 2020 when the asset traded around $80 to $100. This technical formation has demonstrated remarkable consistency over the past four years.

Traders have observed multiple respected touches of both upper and lower boundaries throughout this period. Each interaction with the channel’s lower trendline has historically presented buying opportunities.

Technical analyst Bitcoinsensus recently highlighted this setup on X, noting the critical nature of current price levels. The analysis emphasizes how Ethereum has formed a series of higher lows within the channel structure.

These formations confirm the pattern remains intact despite periodic volatility. The 2022 bear market brought a brutal test of the lower boundary, yet the channel held.

Current market conditions place Ethereum at the channel’s lower edge, creating what analysts describe as a high-conviction zone.

The price sits at approximately $1,943 as of writing, marking the last line of defense for the bullish macro structure. Trading volume and momentum indicators will prove essential in determining whether this support level holds firm.

The measured move methodology applied to this channel structure projects a potential target around $7,000. This represents roughly 260% upside from current trading levels.

Such projections rely on the assumption that the channel pattern continues to govern price behavior. Market participants are now weighing the probability of this outcome against alternative scenarios.

Path Forward Presents Asymmetric Risk Profile

Should Ethereum successfully defend current support levels, the projected path involves several intermediate milestones. An initial bounce would need to reclaim the $2,500 to $2,800 resistance zone that previously served as support.

Subsequently, breaking through the $3,500 to $4,000 range becomes necessary to confirm bullish momentum. The previous cycle high near $4,800 to $5,000 would then come into focus before any upper channel breakout.

The analysis notes what appears to be a recent “fakeout” below support levels, potentially representing a liquidity grab. Such price action often precedes genuine directional moves in cryptocurrency markets.

Volume profiles during any bounce will provide critical information about the strength of buying interest. Additionally, Ethereum rarely sustains independent rallies without corresponding Bitcoin strength.

Risk factors remain present despite the compelling technical setup currently in view. A weekly close below $1,850 would invalidate the multi-year channel pattern entirely.

Breakdown scenarios could push Ethereum toward the $1,200 to $1,500 range based on historical support zones. Broader macro conditions including recession fears or liquidity constraints could override technical considerations.

The risk-reward profile appears asymmetric at current levels according to proponents of this technical view. Downside risk to channel invalidation measures approximately 20% to 30% from present prices.

Conversely, upside potential to the projected target exceeds 260% should the pattern play out. This calculation assumes the channel structure maintains its historical validity and market conditions remain supportive of risk assets.

Crypto World

Bitcoin Fear and Greed Index Hits 8 as Whale Accumulation Signals Potential Market Bottom

TLDR:

- Fear and Greed Index drops to 8, matching extreme levels seen during 2018, 2020, and 2022 market bottoms

- Whale accumulation activity increases despite negative sentiment, creating divergence that preceded past rallies

- Behavioral finance principles show loss aversion and herd behavior drive extended sentiment recovery periods

- Major investors including MicroStrategy and ARK continue building positions during the extreme fear phase

The Fear and Greed Index for cryptocurrency markets has dropped to extreme fear territory, registering a reading of 8 according to recent market data.

This sentiment indicator, which tracks Bitcoin-centered market psychology through multiple metrics, has reached levels historically associated with major market bottoms.

The current reading reflects widespread investor caution and risk aversion across the digital asset space. Meanwhile, on-chain data suggests large holders continue to accumulate positions despite the prevailing negative sentiment.

Historical Patterns Point to Extended Bottom Formation

The Crypto Fear & Greed Index provided by Alternative.me combines several market factors to gauge investor sentiment.

These components include price volatility, trading volume, social media activity, Bitcoin dominance, and Google search trends. The index transforms these data points into a single metric that reflects overall market psychology.

Current extreme fear readings mirror conditions seen during previous major market stress events. The 2018 bear market bottom, the March 2020 pandemic crash, and the 2022 FTX collapse all displayed similar sentiment levels.

During each episode, the index fell below 10 as participants prioritized capital preservation over growth opportunities.

Cryptoquant researcher XWIN Research Japan notes that behavioral finance principles explain the current market state. Loss aversion drives investors to reduce exposure after experiencing portfolio declines.

Herd behavior reinforces this pattern as market participants collectively withdraw from risk assets. Consequently, sentiment typically recovers at a slower pace than price movements.

Source: Cryptoquant

The analysis emphasizes that extreme fear does not guarantee immediate market recovery. Historical data shows these conditions often mark the early stages of bottom formation rather than trend reversals.

Market confidence and capital inflows require time to rebuild after significant drawdowns. This suggests the current phase represents a psychological reset period for crypto markets.

Accumulation Activity Emerges Despite Negative Sentiment

Trader Kyle Chassé observed on social media that whale accumulation patterns have emerged alongside the extreme fear reading.

He noted that this divergence between sentiment and large holder behavior has preceded major Bitcoin bottoms in previous cycles. The combination of retail fear and institutional buying has historically signaled favorable risk-reward conditions.

Several prominent market participants have increased their cryptocurrency exposure recently. MicroStrategy’s Michael Saylor has publicly stated his intention to acquire additional Bitcoin.

Investment firm ARKd has purchased shares of cryptocurrency-related equities during the recent decline. Analyst Tom Lee indicated he would increase allocations if Ethereum reached specific lower price targets.

These accumulation patterns contrast sharply with the fearful sentiment reflected in the index. Large holders often build positions when retail investors exit the market.

This counter-cyclical behavior has characterized previous market bottoms across multiple asset classes. The current environment displays similar dynamics between different investor cohorts.

Market observers note that extreme sentiment readings alone do not determine timing for recovery. However, the combination of oversold conditions and whale accumulation has historically preceded bull market phases.

The cryptocurrency market remains in a consolidation period as prices stabilize and sentiment gradually improves.

Crypto World

Stablecoins as Shadow Banking – Smart Liquidity Research

Stablecoins were supposed to be the “boring” part of crypto. No volatility. No drama. Just digital dollars moving at internet speed.

Instead, they’ve quietly become one of the most important—and controversial—financial experiments of the decade.

Behind the scenes, stablecoins are starting to look a lot like shadow banks.

What Is Shadow Banking?

“Shadow banking” isn’t illegal banking. It refers to financial intermediaries that perform bank-like activities—without being regulated like traditional banks.

Think:

These institutions:

No deposit insurance.

No direct central bank backstop.

Plenty of systemic risk if something breaks.

Sound familiar?

How Stablecoins Mimic Banks

Take giants like:

Here’s what they do:

-

Accept dollars from users

-

Issue digital tokens pegged 1:1

-

Invest reserves into yield-bearing assets

(Treasuries, repo agreements, cash equivalents)

That’s deposit-taking and asset management—core banking functions.

The difference?

They aren’t chartered banks.

The Maturity Mismatch Problem

Traditional banks borrow short (deposits) and lend long (loans).

This creates liquidity risk.

Stablecoins claim to hold high-quality liquid assets—primarily short-term U.S. Treasuries. But if redemptions spike during panic, they face the same stress dynamic:

We saw shades of this during the 2022 depegging episodes—notably with algorithmic designs like TerraUSD, which collapsed spectacularly (though it lacked traditional backing).

Even asset-backed models face redemption pressure risk.

The Treasury Market Connection

Here’s where it gets interesting.

Stablecoin issuers are now among the largest buyers of short-term U.S. Treasuries. Some reports have placed Tether among the top global holders.

That means:

Crypto liquidity

→ flows into Treasuries

→ supports U.S. government financing

Stablecoins aren’t just crypto plumbing anymore.

They’re plugged into global macro finance.

If large-scale redemptions occur, forced Treasury sales could ripple into traditional markets.

That’s textbook shadow banking spillover risk.

Regulatory Gray Zone

Banks must:

Stablecoin issuers?

Regulation varies by jurisdiction. Oversight is patchwork. Some operate through money transmitter licenses rather than full banking charters.

Governments are now racing to respond. The U.S., EU, and Asia are all drafting or implementing frameworks to bring stablecoins closer to traditional prudential standards.

The debate is simple:

Are stablecoins payment tools?

Money market funds?

Narrow banks?

Or systemic shadow banks?

Why This Matters

Stablecoins power:

They solve real problems:

-

Faster settlement

-

Lower fees

-

Global accessibility

But scale changes everything.

When billions turn into hundreds of billions, stability becomes a public concern.

Shadow banking historically grows during financial innovation cycles—until a crisis exposes structural weaknesses.

Stablecoins may be early in that arc.

The Bull Case

Some argue stablecoins are safer than banks because:

-

Reserves are primarily short-term Treasuries

-

No risky lending books

-

Transparency reports are increasing

-

On-chain flows are auditable

In this view, stablecoins represent a leaner, programmable form of narrow banking.

The Bear Case

Critics warn:

If confidence breaks, digital bank runs happen faster than physical ones.

Panic spreads at blockchain speed.

The Future: Bank, Fund, or Something New?

Three possible paths:

-

Full Bank Model

Stablecoin issuers obtain banking licenses. -

Money Market Regulation Model

Treated like cash-equivalent funds. -

Hybrid Regulated Digital Cash Model

Custom framework recognizing blockchain-native design.

The decision will shape the next decade of digital finance.

Final Take

Stablecoins aren’t just a crypto convenience anymore.

They:

-

Warehouse billions in Treasuries

-

Provide dollar access globally

-

Operate outside traditional banking charters

-

Influence liquidity across markets

That’s not a niche experiment.

That’s shadow banking in digital form.

And history shows shadow banking only stays in the shadows—until it doesn’t.

REQUEST AN ARTICLE

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat11 hours ago

NewsBeat11 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World3 days ago

Crypto World3 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat13 hours ago

NewsBeat13 hours agoMan dies after entering floodwater during police pursuit