Business

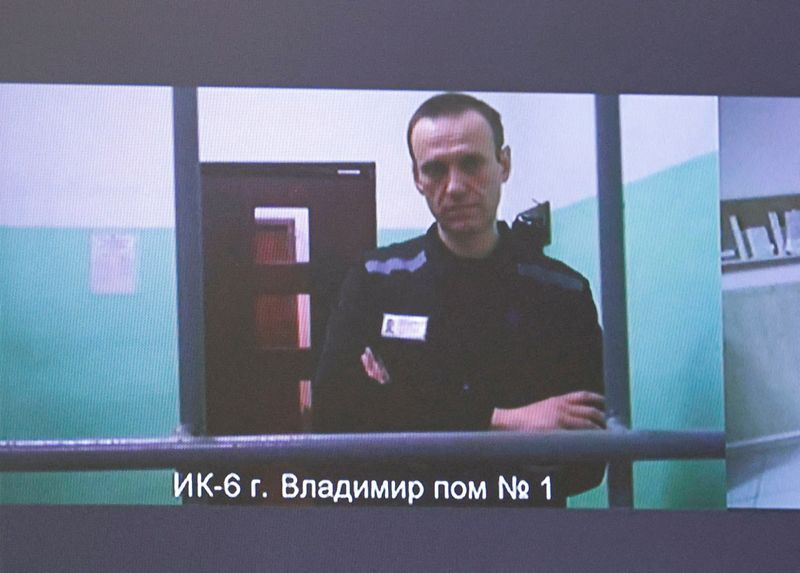

European allies say Navalny was poisoned by dart frog toxin; Russia rejects claims

Business

Never mind cod, it's tilapia and chips please

Two fish and chip shops in Fenland are trying lesser known varieties of fish as cod prices soar.

Business

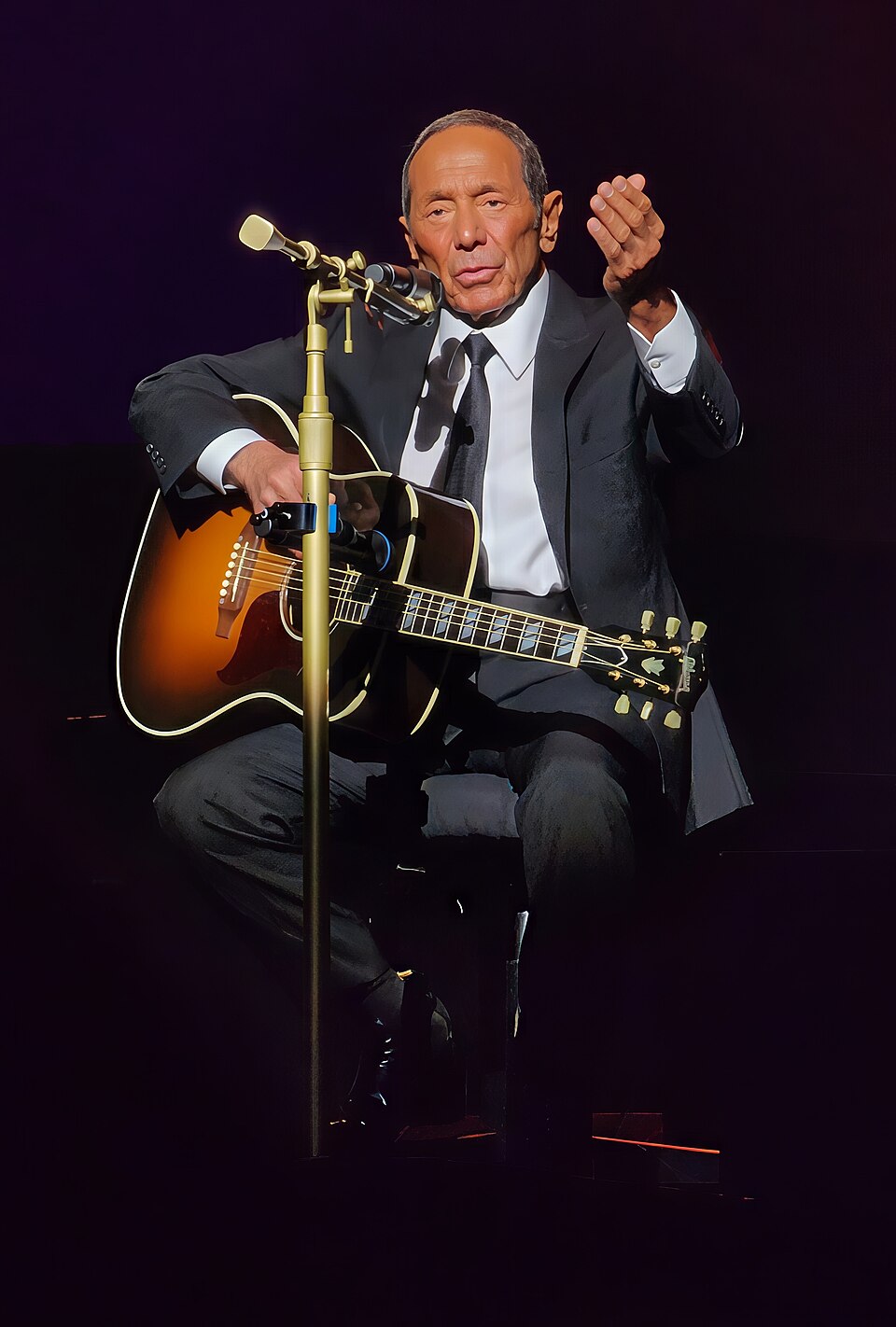

‘Inspirations of Life and Love’ Out Now

Legendary singer-songwriter Paul Anka, the enduring voice behind timeless hits like “My Way” and “Put Your Head on My Shoulder,” released his 30th studio album, Inspirations of Life and Love, on February 13, 2026, via Green Hill Music/Sun Label Group. The lushly orchestrated collection arrived perfectly timed for Valentine’s Day weekend, blending nine new original songs with two beloved classics to celebrate seven decades of his influential career.

The album, available on streaming platforms, CD, vinyl and in Dolby Atmos, follows Anka’s announcement in October 2025 and lead single “Anytime” drop. As of February 16, 2026, it has garnered early praise for its romantic themes, rich arrangements and Anka’s still-vibrant vocals at age 84.

Announcement and Build-Up Anka first teased the project on his official website and social media in mid-October 2025, describing it as a heartfelt reflection on love and life’s milestones. “It’s been an absolute joy to write and record these songs,” he posted on Facebook and Instagram. The lead track “Anytime” served as an instant grat, with a visualizer emphasizing its classic crooner style.

Pre-save campaigns on Spotify and other platforms built anticipation, with the album listed as arriving February 13. Rock Cellar Magazine previewed it in November 2025 as a celebration of Anka’s longevity, noting the inclusion of fresh material alongside re-recordings.

Album Details and Tracklist Inspirations of Life and Love runs approximately 43 minutes across 11 tracks. The record features Anka’s signature orchestral production, focusing on themes of romance, reflection and enduring emotion—ideal for the holiday release.

Key tracks include:

- “Anytime” (lead single, a new romantic ballad)

- “I Just Can’t Wait”

- “(All Of A Sudden) My Heart Sings”

- “That’s Life” (classic re-recording)

- “I Believe” (another nod to his catalog)

- “The Last Time I Saw You”

The album mixes original compositions with refreshed hits, showcasing Anka’s continued songwriting prowess. Green Hill Music highlighted the “lush orchestration” and “masterful” performances, positioning it as a mature, heartfelt addition to his discography of over 130 albums.

Media Coverage and Promotions The release coincided with high-profile interviews. CBS Sunday Morning aired a segment on February 15, 2026, where correspondent Lee Cowan profiled Anka’s 70-year career. Anka discussed adapting to industry changes, from teen idol days to writing for Frank Sinatra and embracing modern shifts like AI in music. He performed a spontaneous song about the show and emphasized discipline—daily olive oil with lemon, rigorous routine—to maintain his voice.

Deadline published an exclusive Q&A on February 13, where Anka reflected on Sinatra collaborations, Hollywood evolution and advice for creatives amid disruption. He expressed no immediate retirement plans, teasing his A Man and His Music Tour resuming March 4, 2026.

An HBO Max documentary, Paul Anka: His Way, streams alongside the album, chronicling his journey from 1957 teen sensation to enduring icon.

Reception and Cultural Impact Early listener reactions on social media and streaming platforms praise the album’s warmth and timeless appeal. Anka posted on Instagram February 14: “Happy Valentine’s Day, everybody 🌹 Let my new album be your soundtrack today.” Fans echoed sentiments, calling it a “perfect love collection” and lauding his enduring relevance.

Critics note the release reaffirms Anka’s status as one of pop music’s most consistent figures, with a Hot 100 presence across seven decades. The Valentine’s timing enhances its romantic draw, potentially boosting streams and sales in the holiday period.

Tour and Future Plans Anka’s A Man and His Music Tour resumes in March 2026, bringing the new material to live audiences. No retirement hints surfaced in recent interviews; he remains active, writing, recording and performing.

Inspirations of Life and Love arrives as a poignant milestone for Anka, blending nostalgia with fresh creativity. Available now on all platforms, it invites listeners to celebrate love through the lens of a music legend who shows no signs of slowing down.

Business

Uruguay will push ahead with pivot away from dollar debt, says Finance Minister

Uruguay will push ahead with pivot away from dollar debt, says Finance Minister

Business

Morning Bid: Japan’s economy could do with some Fire Horse energy

Morning Bid: Japan’s economy could do with some Fire Horse energy

Business

XP Inc.: Clearly Shifting Its Advisory Strategy, And Trades At 10/12x Earnings (XP)

Long-only investment, evaluating companies from an operational, buy-and-hold perspective.Quipus Capital does not focus on market-driven dynamics and future price action. Instead, our articles focus on operational aspects, understanding the long-term earnings power of companies, the competitive dynamics of the industries where they participate, and buying companies that we would like to hold independently of how the price moves in the future. Most QC calls will be holds, and that is by design. Only a very small fraction of companies should be a buy at any point in time. However, hold articles provide important information for future investors and a healthy dose of skepticism to a relatively bullish-biased market.Disclaimer: All of the author’s articles are written on an “as is” basis and without warranty. They represent the author’s opinion only and in no way constitute professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in any articles published.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Opinion: Gold the canary that doesn’t go ‘cheep’

OPINION: Some may be excited by the prospect of record gold prices, but the rush to the precious metal may be a portent of trouble to come.

Business

What Modern Betting Infrastructure Means for the Future of the UK Leisure Economy

The evolution of betting is undeniable. Whether it’s sports or the most common casino games, it’s clear there has been a very big shift when it comes to how individuals enjoy betting.

Of course, this has had a huge impact on the British Economy, as the leisure economy is no longer defined by physical or digital spaces, rather the adaptation of both spaces into a combined and shared space.

The central shift has been the evolution of the betting infrastructure, which has had the most impact on the British leisure economy, transforming back-room transactions into high-speed and data-driven actions personalized to every user.

From the best horse racing sites in the UK to the most common betting shops throughout the country, how much of an impact has the modern betting infrastructure had on the British leisure economy? How will it continue to evolve?

Welcome to Technological Leisure

If there’s one thing that defines the modern betting infrastructure, it must be its adaptation to the digital world. Betting has become universal, from enclosed standalone shops to ecosystems found throughout the internet, its evolution has drastically changed user consumption.

In great part it’s all thanks to innovative wagering technologies. What once was a long and boring process has turned into an easy one-click procedure that anyone can enjoy, promoting competitive socializing where individuals can wager whilst also enjoying the fun of getting to know other individuals with the same passion.

The integration of such systems has helped increase life in various cities, making it easier for individuals to enjoy betting. But it wouldn’t be possible if it wasn’t for the strong back-end systems these sites use, integrating real-time data and analyzing user activity to adapt its servers to the demand, especially at events with big crowds.

The Digital Multiplier

The economic impact of this digital infrastructure goes way beyond the immediate revenue of the gambling industry; it serves as a great example of how similar technological models can be implemented in other areas of the UK economy to favor economic growth. In a world where everyone demands high-speed connection, low latency streaming and stable servers, the systems implemented in the betting industry save as the pillars for the evolution of the UK economy.

In fact, some of these systems, first introduced in the betting industry, are being implemented in other areas of the economy that don’t involve activities like playing or gambling, with entertainment systems and streaming platforms exporting these systems and transforming them to their needs.

Whilst other sectors continue to evolve, the betting industry continues to implement new measures. In an era of financial responsibility where user protection is fundamental, the betting industry continues to create newer systems promoting user protection and security of payments, setting the first bricks for the future of data protection.

The Workforce Transformation

One of the biggest changes when it comes to physical betting shops must be the transformation of the role employees have. Traditionally, employees had to fulfill very simple tasks: if the employee was the bartender, he/she only had to serve drinks and the bookmaker was responsible for placing the bet.

But now, everything has changed, as these roles have mostly disappeared. Nowadays, employees are expected to serve as “tech-enabled hosts”. Every task they do must be fulfilled with a technological interaction in the process. A bartender has to pour out a pint whilst they trouble shoot a digital terminal whilst a bookmaker must have the required knowledge to navigate an integrated app and place the wager or the odds for a specific bet as fast as possible.

Now, employees are expected to be technological natives. They must be able to control and fix any technological problems that arise with ease, adapting to any role possible with the sole focus of providing the best service possible.

An Entertaining Future

As the betting industry continues to evolve, so does the British leisure economy. The fine line between “betting” and “gaming” will continue to blur whilst new measures first introduced on betting sites and games will be adapted and implemented on various areas of the British day-to-day life.

With new systems and innovations, the betting industry will continue to provide the whole UK economy with new ways to evolve, embracing faster and better entertainment focused on social responsibility and data protection.

Business

FPIs trim bearish bets, but no rush to buy yet

The Long-Short Ratio – number of traders betting on a rise in prices (long positions) to those betting on a fall (short)-of foreign portfolio investors‘ Nifty futures position stood at 19.4% on Friday, as against 7.5% seen exactly a month ago. Though the measure has fallen from 22.1% on Wednesday following the sell-off in the wake of the renewed AI-related concerns, showing foreigners have increased their bearish positions again, analysts are not concluding anything yet. The ratio made a lifetime low of 5.98% on September 30.

“FIIs have been on a bit of a rollercoaster lately,” said Vipin Kumar, AVP- derivatives and technical research at Globe Capital Market.

Agencies

AgenciesCHANGE IN MOOD Dip in FII Long-Short Ratio suggests ‘smart money’ is hedging its wagers as global worries over AI-driven volatility linger

Kumar said that after a brief period of optimism fuelled by the India-US trade statement, the Long-Short Ratio of FPIs’ Nifty positions is retreating once more, fuelled by a sharp sell-off in US tech, driven by growing anxieties over AI disruption.

“The recent dip in the FII Long-Short Ratio suggests that the ‘smart money’ is hedging its bets.”

After the announcement of the framework for the US-India trade deal earlier this month, bullish bets increased to 16-17% of total bets from only 11% a day ago.

However, the IT sell-off on Thursday and Friday soured some sentiment. The Nifty ended 1.3% lower at 25,471 on Friday, while the Nifty IT index fell 8.2% during the past week. Akshay Bhagwat, SVP- derivatives research at JM Financial Services, said that since budget day, foreign investors have covered their short bets and also bought index futures, roughly to the tune of Rs 9,400 crore till date.

“However, Nifty has lost its momentum lately, and the Long-Short Ratio has cooled off, back below 20% on profit booking of long bets,” he said.

NO BIG MOVES

After Friday’s decline, Nifty is expected to hold above the 24,850-25,000 zone, said Chandan Taparia, head of technical and derivatives research at Motilal Oswal Financial Services. “While the market has struggled to sustain momentum, it continues to form a higher base despite the STT hike, a weaker rupee, and geopolitical tensions,” he said. Taparia expects Nifty to oscillate between the budget-day lows of 24,500 and the highs of 26,300 seen after the US-India trade deal.

Kumar said that the cooling off of the Long-Short Ratio indicates any immediate upside for domestic markets remains capped as global headwinds outweigh local catalysts. “The short-term technical structure for the Nifty has shifted to a negative bias. Following the recent weakness, the index appears to be gravitating toward a price gap created during the February 3 rally, and the key support zone is placed around 25,200-25,000 spot levels,” he said.

Business

Global Launch Set for Late February 2026 Ahead of MWC

Xiaomi’s flagship Xiaomi 17 series, already a major success in China since its staggered 2025 launches, is on the verge of reaching international markets. As of February 15, 2026, reliable tipsters and leaks indicate the Xiaomi 17 (standard model) and Xiaomi 17 Ultra (premium flagship, including Leica Edition) will debut globally in late February 2026, just before the Mobile World Congress (MWC) 2026 kicks off March 2–5 in Barcelona.

Multiple sources, including Yogesh Brar, GSMArena, Gadgets 360, NotebookCheck, and Android Headlines, point to a European unveiling around February 28, with possible simultaneous or near-simultaneous reveals in other regions. Xiaomi has not issued an official announcement, but the consistent timeline across leaks suggests an imminent event—potentially a dedicated launch or press briefing in Europe. This early global rollout contrasts with past patterns where Xiaomi waited longer after China debuts.

China Launch Recap The Xiaomi 17 series launched in China in 2025: the standard Xiaomi 17 and Xiaomi 17 Pro (including Pro Max variant) on September 25, 2025, during founder Lei Jun’s annual speech, with availability starting September 27. The top-tier Xiaomi 17 Ultra followed on December 25, 2025, hitting shelves December 27. Powered by Qualcomm’s Snapdragon 8 Elite Gen 5 (or similar flagship chip), the lineup emphasized photography, battery endurance, and HyperOS 3 on Android 16.

The Xiaomi 17 features a compact design with a 6.36-inch LTPO AMOLED display, triple 50MP cameras, and up to 7,000mAh battery in China. The Ultra stands out with a 6.9-inch LTPO AMOLED, quad-camera setup including a 200MP periscope telephoto with continuous zoom, mechanical ring for controls, and 6,800mAh battery supporting 100W charging.

Global Rollout Timeline Leaks from early February 2026 confirm Xiaomi will bring only the Xiaomi 17 and Xiaomi 17 Ultra (Leica Edition) to global markets, skipping the Pro and Pro Max models which remain China-exclusive. Yogesh Brar reported on February 2 that the pair will launch “ahead of MWC,” with the Leica Edition Ultra targeted by February 28. GSMArena and NotebookCheck corroborated renders and specs for global variants, noting a European event likely in late February.

India availability is expected in early March 2026, per Brar and Abhishek Yadav, aligning with past Xiaomi patterns. European pricing leaks suggest the Xiaomi 17 starts at around €999 (12GB+512GB), while the Ultra could hit €1,499 (similar config). This positions them directly against Samsung’s Galaxy S26 series (expected March 2026) and Apple’s iPhone lineup.

Key Differences for Global Models Global versions may include adjustments for regional regulations and certifications. A notable change: the Xiaomi 17’s battery could drop to about 6,330mAh (roughly 10% smaller than China’s 7,000mAh), as reported by PhoneArena on February 6. This downgrade, common for Xiaomi flagships due to battery regs or component tweaks, may slightly impact endurance but retains fast charging. Other specs like display, processor, and cameras appear consistent.

The Ultra’s global variant retains its photography focus: 50MP main + 200MP periscope + 50MP ultra-wide, Leica co-engineering, and mechanical zoom ring. Both models emphasize HyperOS 3 features, AI enhancements, and premium builds.

Why the Early Global Push? Xiaomi aims to capitalize on flagship momentum before MWC, where rivals unveil devices. Launching ahead allows hands-on demos, reviews, and pre-orders to build hype. The decision to limit global offerings to two models streamlines distribution and focuses on high-demand variants: the compact Xiaomi 17 for everyday premium users and the Ultra for photography enthusiasts.

Specs Highlights

- Xiaomi 17 (Global expected): 6.36-inch LTPO AMOLED, Snapdragon 8 Elite Gen 5, 12GB+ RAM options, triple 50MP cameras, ~6,330mAh battery, HyperOS 3, IP68 rating.

- Xiaomi 17 Ultra: 6.9-inch LTPO AMOLED, same processor, up to 16GB RAM, quad cameras with 200MP periscope, 6,800mAh battery, 100W wired/50W wireless charging, Leica tuning.

Market Impact and CompetitionThe global Xiaomi 17 series enters a crowded premium segment. With aggressive pricing (under Samsung/Apple equivalents), strong cameras, and massive batteries, they challenge Galaxy S26 and iPhone 18 models. The Ultra’s Leica partnership and zoom prowess position it as a direct rival to Galaxy S Ultra and iPhone Pro Max in photography.

As MWC nears, expect official invites, teasers, or renders soon. Pre-orders could start immediately post-launch in select markets.

Xiaomi’s 17 series global debut in late February 2026 promises flagship performance at competitive prices. With leaks aligning on timing and specs, anticipation builds for what could be one of 2026’s strongest Android challengers.

Business

Corporate revenues jump most in six quarters on GST push

Buoyancy in these large-weighting sectors helped offset the one-time financial impact of India’s revamped labour codes on the $280-billion technology outsourcing and communications businesses that collectively have significant weights on the Nifty 50 – just after the financials.

Agencies

Agencies Momentum Seen in FY27

Analysts expect India’s corporate earnings to maintain their world-leading, double-digit growth rates in FY27 too, as bespoke trade deals on either side of the Atlantic seaboard buoy New Delhi’s export prospects in two of the world’s largest consuming blocs. In the third quarter, for a common sample of 3,723 companies considered by ETIG, revenue and net profit rose 9.8% and 13.5%, respectively. The growth rates were 8.1% for revenue and 14.5% for net profit in the second quarter ended September 2025.

“Earnings growth for the companies under coverage at 16% year-on-year was in line with our estimates, largely driven by metals, oil and gas, and banking and finance sectors,” said Gautam Duggad, institutional research head, Motilal Oswal Financial Services citing that Nifty 50 companies delivered 7% profit growth.

ETIG’s aggregate sample excludes the numbers of Tata Motors PV because the company had significant exceptional gains of Rs 82,616 crore in the September quarter due to the demerger of the commercial vehicles business.

This resulted in net profit of Rs 76,248 crore, forming 15% of the sample’s profit for the second quarter, thereby skewing the base. Including Tata Motors PV numbers to the total sample, net profit growth in the December 2025 quarter drops to 11.1% and that in the previous quarter jumps to 33.7%. Revenue growth, too, falls to 8.5% and 7.7%, in that order. According to Feroze Azeez, joint CEO, Anand Rathi Wealth, broader market profit growth was better than that of the benchmark Nifty 50 companies.

Size Doesn’t Matter

“This divergence suggests that earnings traction is shifting toward mid- and small-cap companies, supported by sectoral rotation, operating leverage benefits, and relatively lower base effects,” Azeez said. The sample’s operating margin contracted 60 basis points year-on-year to 17.8%. It remained flat at 15.4% after excluding banks and finance companies, reflecting that the lending sector continued to show pressure on net interest margins (NIM), or their core profitability.

One basis point is a hundredth of a percentage point. Azeez believes that India Inc’s margin outlook appears selectively constructive, with resilience in capital-intensive and financial sectors.

“Globally linked and consumption-driven segments may experience gradual normalisation rather than sharp expansion,” he added.

Sectorally, the performance was rather mixed. “The energy sector benefited from relatively low and stable crude oil prices, while better loan growth and stable asset quality underpinned the strength in financials,” said Antu Eapen Thomas, research analyst, Geojit Investments.

On the downside, communication services and consumer discretionary were the major laggards amid one-time provisions related to the new labour codes, Thomas said.

Better & Brighter

The outlook appears to be brighter.

Duggad believes that earnings momentum will strengthen further, supported by a low base in FY25 and improving business fundamentals. “The resolution of the India-US trade deal removes a significant overhang and positions India among the most competitive exporters relative to key emerging market peers,” he said.

According to Geojit’s Thomas, the GST rationalisation implemented in late 2025 has supported disposable income, providing an additional boost to consumption. “Nifty 50 earnings growth is projected at 5-6% for FY26, accelerating to 12-15% in FY27,” he said. Anand Rathi’s Azeez expects a meaningful recovery in FY27 following consolidation in FY26. “In the coming quarters, opportunities are expected to emerge in sectors such as capital expenditure and infrastructure, supported by sustained government spending and a revival in private capital expenditure,” he said.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat13 hours ago

NewsBeat13 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat15 hours ago

NewsBeat15 hours agoMan dies after entering floodwater during police pursuit

-

Politics5 days ago

Politics5 days agoWhy was a dog-humping paedo treated like a saint?