Crypto World

Aave Founder Unveils $50 Trillion Solar Financing Vision Through Tokenized Infrastructure

TLDR:

- Aave could expand collateral by $1.5-5 trillion capturing just 10% of solar financing market share by 2050

- Global solar investment needs $10-50 trillion through 2050, with current annual investment at $420 billion

- Tokenized solar debt enables developers to borrow $70 million in minutes versus months with traditional finance

- Five percent bond market reallocation to solar would inject $6.5 trillion, advancing net zero by 10-15 years

Aave founder Stani Kulechov has published a comprehensive vision for onchain lending to capture a substantial portion of the global energy transition market.

The proposal centers on tokenizing solar energy infrastructure and battery storage projects as collateral. Kulechov estimates the total addressable market at $30 to $50 trillion between now and 2050.

The strategy positions decentralized finance protocols to compete directly with traditional infrastructure funds and development banks in financing renewable energy deployment.

Global Solar Investment Requirements Create DeFi Opportunity

Kulechov frames the opportunity in transformative terms, stating the industry is approaching “a 30 to 50 trillion dollar value capture market for Aave between now and 2050.”

Current solar energy investment stands at approximately $400 to $420 billion annually as of 2024. However, reaching net zero emissions by 2050 requires installing between 14,000 and 15,500 gigawatts of solar capacity.

With roughly 1,700 gigawatts currently deployed, the remaining gap demands $10 to $12 trillion in conservative scenarios.

More aggressive projections accounting for artificial intelligence growth and emerging market development push requirements to $15 to $20 trillion.

The Aave founder argues that energy abundance creates positive feedback loops rather than market saturation. As solar costs decline through economies of scale, cheaper energy stimulates additional economic activity. This increased activity drives higher electricity demand, requiring further solar deployment.

Traditional infrastructure capital currently comes from specialized funds managing $300 to $400 billion annually. Meanwhile, global bond markets exceed $130 trillion, and equity markets reach $110 trillion.

Even capturing five percent of bond capital allocation to solar would inject $6.5 trillion into the sector. This represents roughly 15 times current annual investment levels and could accelerate net zero timelines by 10 to 15 years.

Tokenization Addresses Illiquidity Premium in Infrastructure Assets

Solar projects typically structure with 30 percent equity and 70 percent senior debt components. Equity sponsors target 8 to 15 percent returns, while senior debt offers 5 to 8 percent yields in mature markets.

These cash flows come from power purchase agreements spanning 15 to 25 years with creditworthy counterparties. The predictability creates bond-like characteristics, yet infrastructure funds face illiquidity constraints that limit capital deployment.

Kulechov emphasizes that “every dollar invested in solar manufacturing drives costs down further through learning curves, making the next dollar more productive.”

Pension funds typically allocate only 3 to 5 percent to illiquid infrastructure despite potentially allocating 15 to 20 percent to liquid equivalents.

Tokenizing solar assets on blockchain networks enables continuous secondary market trading. An identical project might require 10 percent returns as an illiquid asset but only 6 percent when tokenized.

Aave Protocol can accept tokenized solar debt as collateral for stablecoin borrowing. A developer holding $100 million in tokenized project debt could borrow $70 million in stablecoins within minutes rather than months.

This capital velocity allows immediate redeployment into new projects. Simultaneously, Aave depositors gain access to diversified, geographically distributed yield backed by physical infrastructure rather than government debt or cryptocurrency volatility.

Market Share Projections Position Protocol as Major Financier

Kulechov projects that capturing just 10 percent of the solar financing market would expand Aave’s economic collateral by $1.5 to $5 trillion through 2050. A 25 percent market share scenario grows this to $3.75 to $12.5 trillion.

For context, JPMorgan manages $4.5 trillion in assets while BlackRock oversees $14 trillion. The abundance financing thesis positions decentralized protocols to compete at comparable scale with the largest traditional financial institutions.

The strategy extends beyond dollar-denominated markets. Solar farms exist across multiple jurisdictions, creating natural demand for euro, pound, and other local currency stablecoins.

Developers in Europe could tokenize euro-denominated senior debt and borrow in euros against that collateral. This solves persistent demand-side problems for non-dollar stablecoins while creating local currency yield opportunities.

Distribution channels include Aave App for retail users, Aave Pro for institutional participants, and Aave Kit for fintech integration. Kulechov declares that “funding energy transitions is by far the largest opportunity for Aave,” framing the approach as explicitly opinionated capital allocation.

Rather than offering neutral access to all asset classes, the protocol would prioritize future-proof abundance assets over legacy scarcity-based instruments like government bonds or mortgages.

Crypto World

Bitcoin Heads For Worst Quarter Since 2018 With 22% Drop

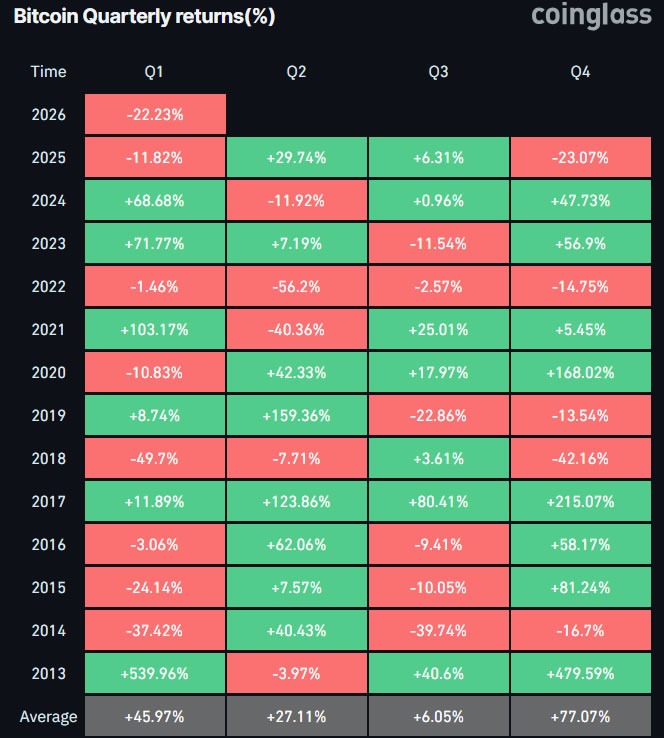

Bitcoin may be headed for its worst first quarter in eight years, with data showing Bitcoin is already down 22.3% since the start of the year.

The asset began the year trading around $87,700 and has declined by around $20,000 to current lows of around $68,000, putting it on track for its worst first quarter since the 2018 bear market — which fell almost 50%, according to CoinGlass.

Bitcoin (BTC) has declined in seven of the past thirteen Q1s, with the most recent being 2025 when it lost 11.8%, 2020 when it shed 10.8%, and the largest ever, 2018, when it dumped 49.7% in just three months.

“The first quarter of the year is known for its volatile nature,” observed analyst Daan Trades Crypto on Sunday.

“So it’s safe to say, whatever happens in Q1 does not generally translate over further down the line, according to the historical price action,” he added.

First-ever red Jan and Feb?

BTC has only ever seen two consecutive first quarters of losses in the bear market years of 2018 and 2022.

Comparatively, Ether (ETH) has only seen red in three of the past nine first quarters, with the current period shaping up to be its third-worst historically, with 34.3% losses so far.

Related: Bitcoin loses $2.3B in biggest crash since 2021 as capitulation intensifies: Analyst

Meanwhile, Bitcoin is also on track to see its first-ever consecutive January and February in the red. The asset lost 10.2% in January and is down 13.4% so far this month. It needs to reclaim $80,000 to prevent a red February.

Bitcoin is in a correctional phase

Nick Ruck, the director of LVRG Research, told Cointelegraph that the ongoing decline in BTC price amid persistent global economic uncertainty “reflects a regular correctional phase rather than a structural breakdown in the asset’s long-term trajectory.”

“While short-term pressures could intensify if macroeconomic headwinds persist, historical patterns show Bitcoin’s resilience often leads to strong recoveries in later months, particularly as institutional adoption and halving cycle dynamics continue to strengthen its potential,” he added.

Meanwhile, BTC has entered its fifth consecutive week of losses, falling 2.3% over the past 24 hours to $68,670 at the time of writing, according to CoinGecko.

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest

Crypto World

Bitcoin Price Bounce Triggers Crash Risk to $58,000?

BTC’s recent recovery may be hiding a dangerous signal. The Bitcoin price bounced nearly 9% between February 12 and February 15, giving the impression that the worst of the correction was over.

But the rebound is already weakening. Now, leverage data, momentum signals, and on-chain profit trends suggest the bounce may have increased crash risk instead of ending it.

Sponsored

Sponsored

Bitcoin’s 9% Bounce Drew Nearly $2 Billion in Long Bets

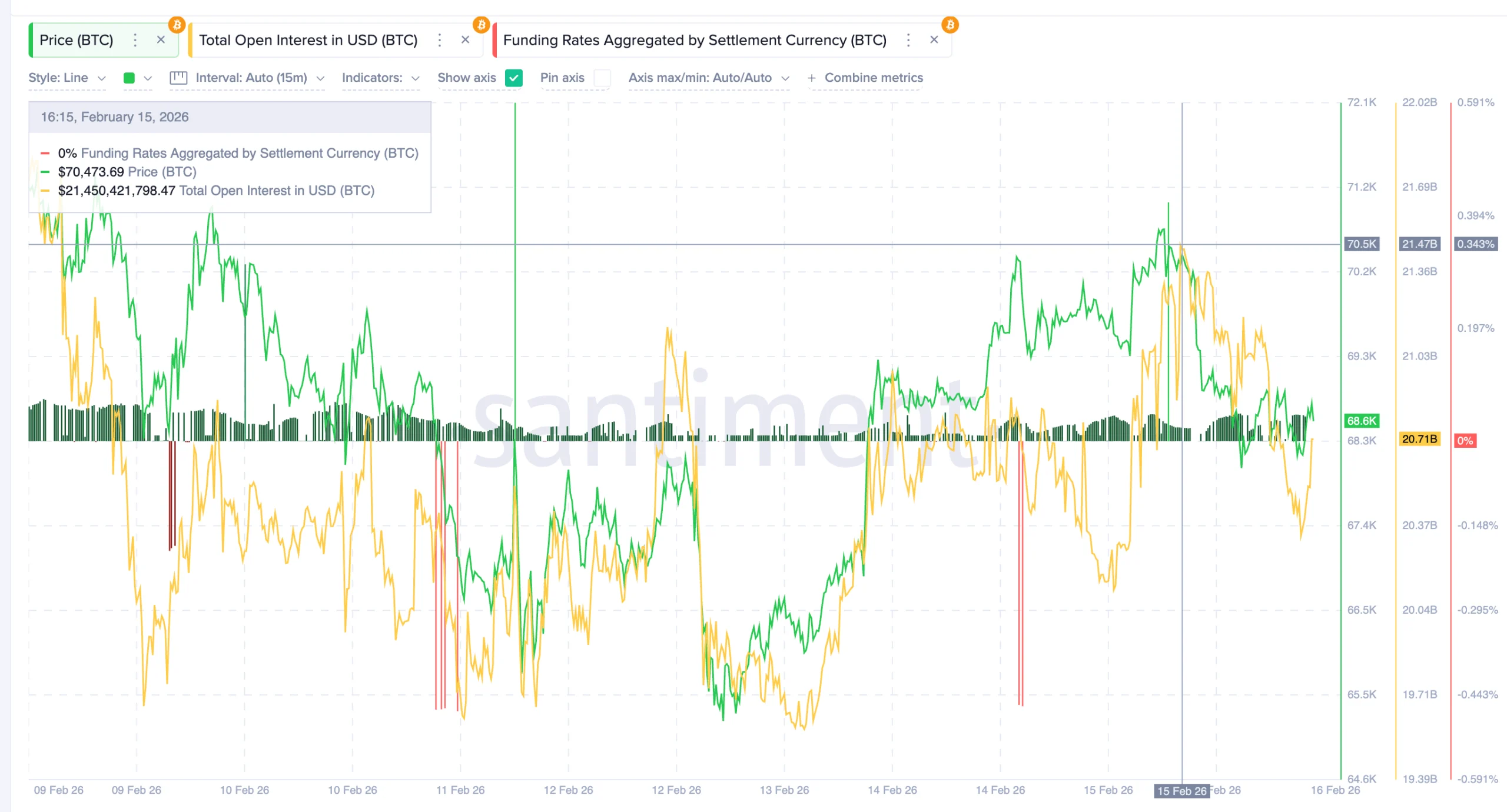

Between February 12 and February 15, Bitcoin climbed roughly 9%. At the same time, futures traders aggressively positioned for further upside. Total open interest, which tracks the total value of active futures contracts, rose from $19.59 billion to $21.47 billion. This was an increase of about $1.88 billion, or roughly 9.6%, between February 13 and February 15.

This increase did not happen in isolation. Funding rates also turned strongly positive, rising toward +0.34%. The funding rate is the fee paid between long and short traders. When it is positive, long traders pay short traders. This shows that most BTC traders were betting on prices rising.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Together, rising open interest and positive funding rates confirmed that the market was positioning for a larger recovery. But the larger chart structure reveals a critical problem.

This entire rebound happened inside a bear flag pattern. A bear flag forms when the price rises slowly after a sharp drop but remains inside a downward continuation structure. It often acts as a pause before another decline.

Sponsored

Sponsored

The recent rejection near the local peak and the ongoing pullback now show that Bitcoin is still trading inside this bearish pattern. Price is already drifting toward the lower boundary of the flag. If this lower support breaks, the next leg of the weakening Bitcoin price prediction could begin.

Hidden Bearish Divergence and 90% Profit Surge Show Sellers Are Returning

Momentum indicators are now starting to confirm this growing weakness. On the 12-hour chart, Bitcoin formed a hidden bearish divergence between February 6 and February 15.

During this period, the price formed a lower high, meaning the recovery was weaker than the previous peak. But the Relative Strength Index, or RSI, formed a higher high. RSI measures the strength of buying and selling momentum.

This combination is called hidden bearish divergence. It usually appears when buying momentum rises temporarily, but the overall trend remains weak. It signals that sellers are quietly regaining control. Shortly after this signal appeared, Bitcoin’s pullback began.

Sponsored

Sponsored

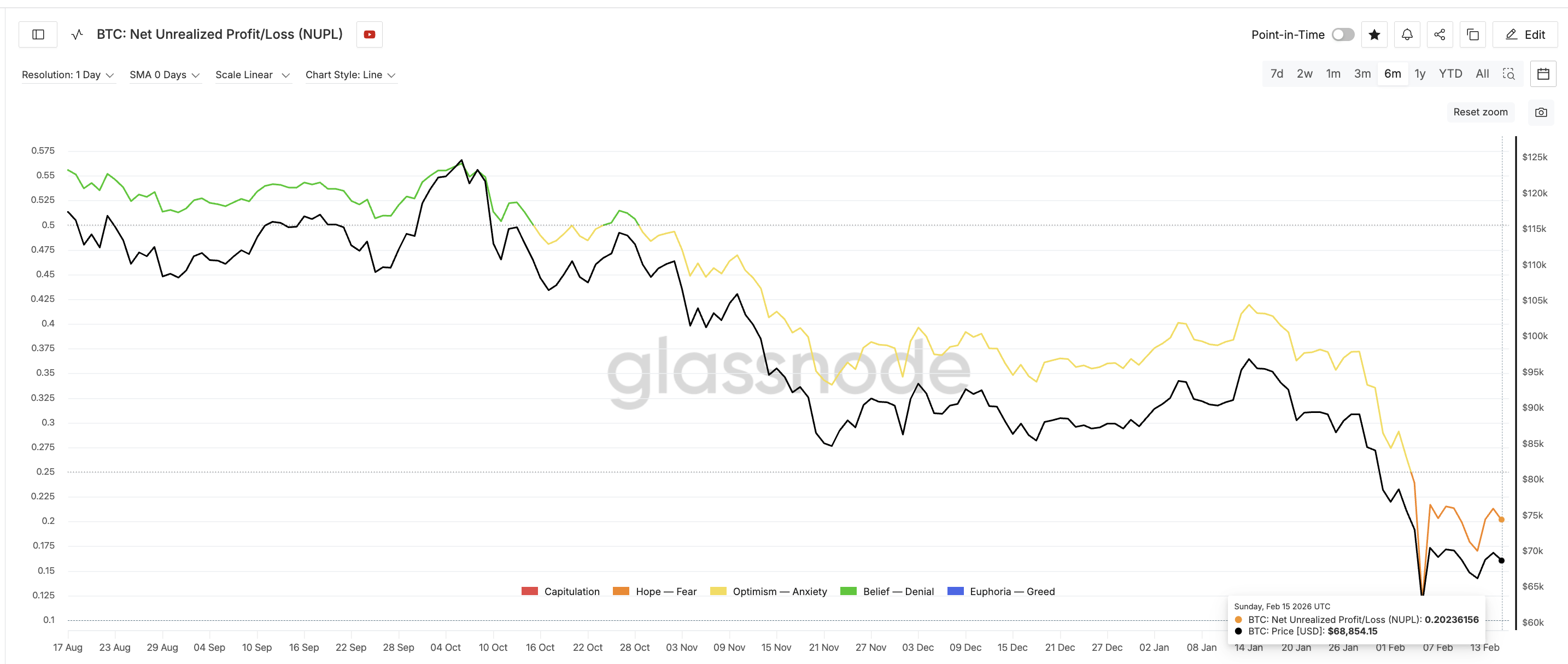

At the same time, on-chain profit data surged sharply, creating another warning sign. Bitcoin’s Net Unrealized Profit/Loss, or NUPL, rose from 0.11 on February 5 to 0.21 on February 14. This was an increase of about 90%. It is currently moving near the same zone, at press time.

NUPL measures the average unrealized profit across all Bitcoin holders. It shows how much profit investors are holding on paper. When NUPL rises sharply, it means many investors are suddenly back in profit, even if it is a small amount. This increases the risk of profit-taking.

The last time NUPL reached similar levels was on February 4. At that time, Bitcoin was trading near $73,000. Within one day, the price collapsed to around $62,800. That was a drop of nearly 14%. Now, the same profit structure has appeared again.

This creates a scary situation. Investors holding fresh profits may sell quickly if prices start falling. That selling can accelerate the correction. This aligns with the hidden bearish divergence already visible on the chart.

Sponsored

Sponsored

Together, these signals show that the recent bounce may have strengthened sellers instead of removing them.

Key Bitcoin Price Levels Show Breakdown Risk Toward $58,800

Bitcoin is now approaching the most important support zone in its current structure. The first critical level is $66,270. This level forms near the lower boundary of the bear flag pattern breaks.

If Bitcoin breaks below this Fib level, the bearish continuation pattern would activate. The next major downside target sits at $58,880 (the $58,000 zone). This level aligns with the 0.618 Fibonacci retracement level ( a structurally strong zone) and represents roughly a 14% decline from current prices.

If selling pressure accelerates further, Bitcoin could fall toward the $55,620 zone, which aligns with the deeper projection of the bear flag structure. On the upside, Bitcoin must reclaim $70,840 to stabilize in the short term.

A stronger breakout above $79,290 would fully invalidate the bearish structure. That would signal that buyers have regained control. Until then, the risk remains tilted to the downside. The recent bounce improved sentiment briefly. But rising leverage, hidden bearish divergence, and a 90% surge in unrealized profits now show that the Bitcoin price recovery may have created the conditions for another drop.

Crypto World

Why Bittensor (TAO) Is Today’s Best-Performing Crypto

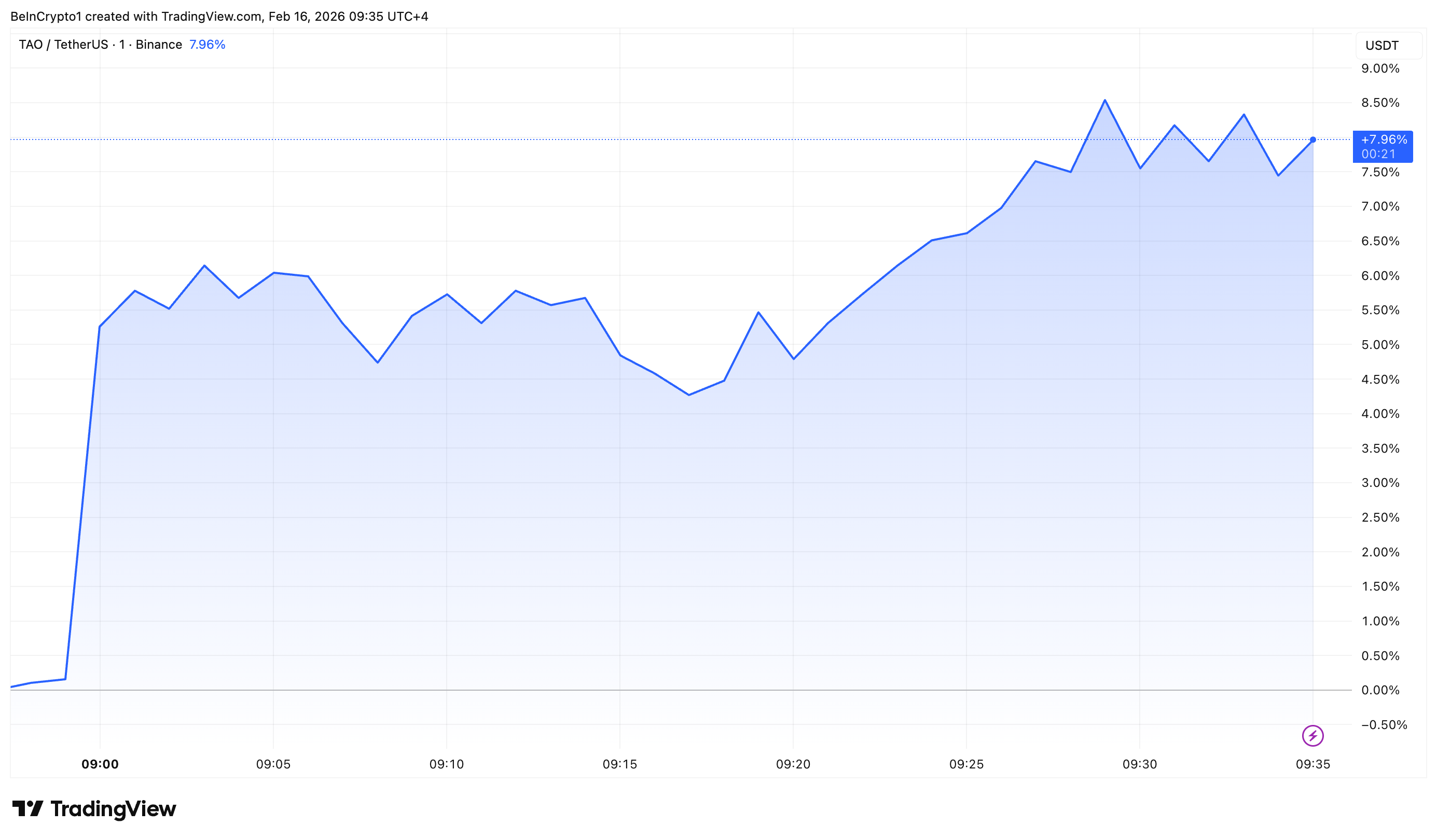

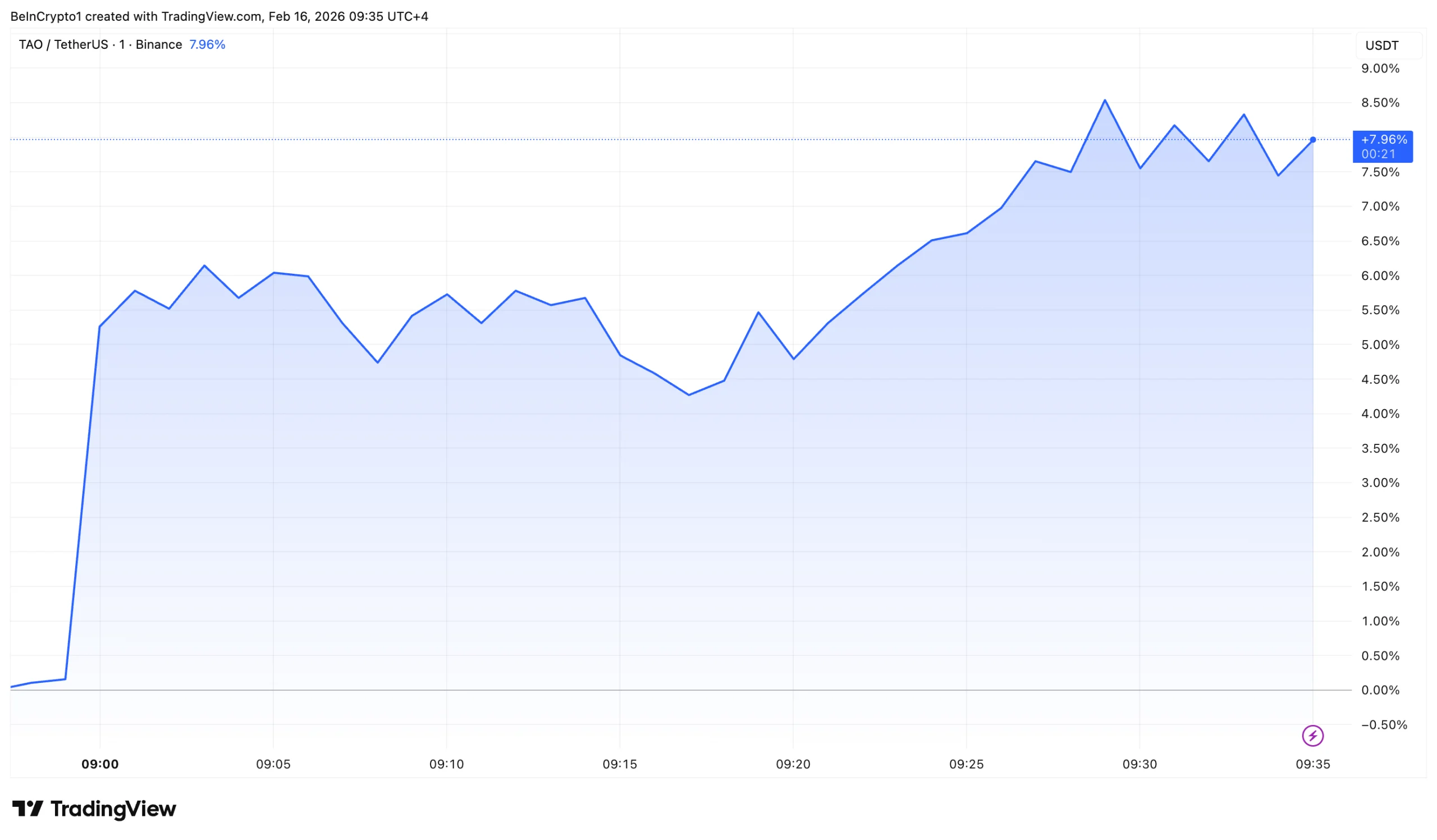

Bittensor’s TAO token climbed nearly 8% to become the top gainer after Upbit, South Korea’s largest cryptocurrency exchange, announced its listing.

The rally enabled TAO to outperform the broader crypto market, which remained under pressure as the total market capitalization declined 2.53% over the past 24 hours.

Sponsored

Sponsored

Upbit Introduces TAO Trading Pairs Amid Turbulent Market Conditions

Upbit confirmed that TAO will be available for trading against three trading pairs: Korean won (KRW), Bitcoin (BTC), and Tether (USDT). Trading is scheduled to begin on February 16 at 16:00 Korean Standard Time (KST). Furthermore, deposits and withdrawals will open within approximately 90 minutes of the announcement.

“Deposits and withdrawals are supported only through the specified network (TAO – Bittensor Network). Deposits and withdrawals via EVM networks are not supported. Please verify the network before depositing,” the notice read.

As is standard for new listings on the platform, Upbit will implement temporary trading safeguards at launch. The exchange will restrict buy orders for approximately five minutes after trading begins.

During that same window, it will block sell orders priced more than 10% below the previous day’s closing price. For roughly two hours after the listing, Upbit will permit only limit orders.

The listing triggered a price surge for TAO, reinforcing a pattern commonly observed when tokens secure new exchange support. Following the announcement, the token advanced nearly 8%.

At the time of writing, the altcoin was trading at $207.6. Moreover, TAO’s rise pushed it to become the largest gainer among the top 100 cryptocurrencies on CoinGecko.

Sponsored

Sponsored

The latest rally builds on the token’s recent momentum. TAO has gained more than 21% over the past week after trending predominantly downward since the beginning of the year.

TAO Price Prediction: What Comes Next?

Meanwhile, analysts remain optimistic about the artificial intelligence-focused blockchain. Analyst Michaël van de Poppe signaled a bullish outlook for Bittensor’s token. He projected at least a “mean reversion” toward approximately $300.

“I think that protocols working on AI <> Crypto are a must have in every portfolio and I’m glad I’ve added funds into this position. I think that we’re going to see more strength going forward from here,” Van de Poppe wrote.

Looking ahead, TAO’s short-term trajectory will likely depend on whether the listing-driven momentum converts into sustained trading volume and continued buyer interest. If broader sentiment stabilizes and participation remains elevated, the token could extend its recovery.

However, weakening momentum or renewed market pressure may temper gains. As exchange accessibility improves, overall crypto market conditions will also be a key factor.

Crypto World

Russia Sees $648M In Daily Crypto Transactions As Gov Pushes Regulation

Russia’s finance ministry and central bank are reportedly calling on the government to speed up the rollout of crypto market regulations amid booming adoption of digital assets, claiming citizens are spending almost 50 billion Russian rubles ($648 million) on crypto daily.

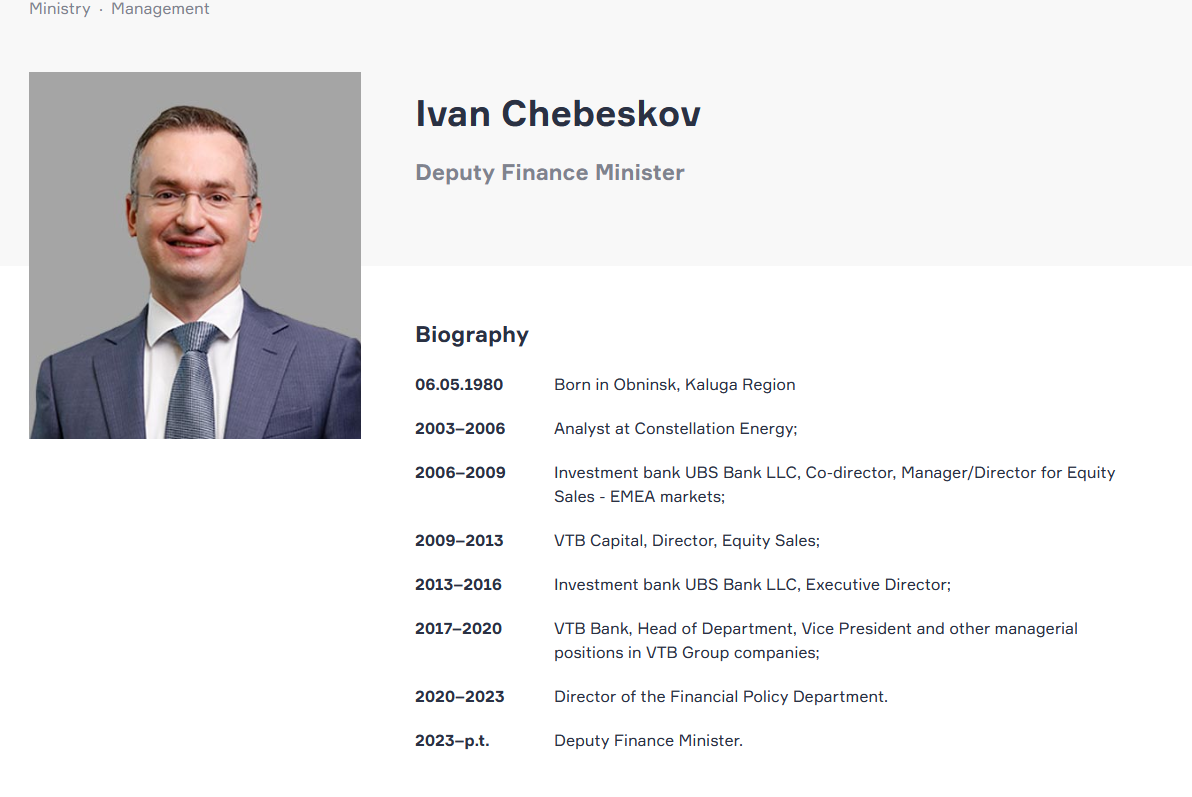

According to a report from Russian news outlet RBC on Thursday, Russia’s deputy finance minister, Ivan Chebeskov, emphasized the importance of regulating the market, as most crypto spending is happening primarily through unregulated channels.

“We have always said that millions of citizens are involved in this activity, these are trillions of rubles from the point of view of citizens in use, in savings,” he said as part of a panel discussion on digital assets at the Alfa Talk conference, adding:

“Also, for example, one of the figures, about 50 billion rubles per day is the turnover of crypto in our country. That is a turnover of more than 10 trillion rubles per year, which is now happening outside the regulated zone, outside our attention.”

The daily volume of 50 billion rubles cited by Chebeskov equates to roughly $648 million, with the yearly figure equating to $129.4 billion. It marks strong crypto adoption within the country as it tangles with economic sanctions slapped on the country by the US and Europe.

The European Union, in particular, has recently raised concerns over Russia’s use of crypto to bypass sanctions, and is pushing to “ban all cryptocurrency transactions with Russia” as part of a new sanctions package, according to a report from the Financial Times on Feb. 10.

In late December, Russia’s central bank released a policy proposal looking to enable both qualified and non-qualified investors to buy certain crypto assets, marking a stark contrast to its earlier push for an outright ban on crypto.

The proposal seeks to provide a strict limit on non-qualified investors, allowing them to hold up to 300,000 rubles ($3,834) worth of crypto a year, while allowing broad access to the market, excluding privacy coins, for qualified investors.

Related: Russia is blocking WhatsApp to push ‘surveillance’ app, company says

Speaking on the same panel as Chebeskov, the first deputy chairman of Russia’s central bank, Vladimir Chistyukhin, said he hopes to see crypto market regulation adopted by the government in the spring session of the State Duma, the first of two annual legislative periods in Russia.

“We would very much like the government to see the law adopted in the spring session. I hope that this is a possible consensus decision and this will provide an opportunity for a transition period for market participants to obtain the necessary licenses, to develop appropriate internal documents to start work, as I said, to legalize this segment of the market,” he said.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Zcash price tests resistance as shielded supply hits 30%

Zcash price is pressing against a key psychological level as privacy adoption quietly tightens supply.

Summary

- Zcash is testing a major psychological level at $300, with price structure showing recovery but momentum not yet fully bullish.

- Privacy adoption is accelerating, as 30% of total ZEC supply now sits in shielded addresses, potentially tightening circulating float.

- A breakout above $300 could trigger renewed upside, while failure at resistance may lead to short-term consolidation.

ZEC was trading around $287 at press time, down 11% in the past 24 hours. The short-term drop comes after a strong run. Over the last seven days, the price is up 23%. On a 30-day basis, gains stand at 29%.

Over the past year, Zcash (ZEC) has surged roughly 792%, making it one of the stronger performers of this cycle. The 7-day range between $223 and $327 reflects elevated volatility as the price coils beneath the $300 level.

Derivatives data show some cooling. According to CoinGlass data, trading volume fell 27% to $1.57 billion, while open interest dropped 13% to $406 million, a sign that some leveraged positions have been flushed out during the pullback.

Shielded supply growth tightens float

A Feb. 16 post on X by Delphi Digital noted that Zcash’s shielded pool now accounts for 30% of total supply, up from just 11% a year ago.

The firm described this dynamic as a “privacy flywheel.” As more coins move into the shielded pool, the anonymity set expands. A larger anonymity set improves privacy guarantees, which in turn attracts more users. That feedback loop, if sustained, could materially shift supply dynamics.

At the current pace, Delphi estimates that more than 50% of the supply could be shielded within 12 to 18 months.

Coins that enter the shielded pool are often held longer. Historically, shielded users show higher conviction and lower turnover. That reduces the immediately available supply on the market. When float tightens and demand rises, price reactions can become sharper.

Zcash’s November 2024 halving also changed the equation. Annual inflation dropped to around 4% and is projected to decline toward roughly 1% by 2028. After nearly a decade of proof-of-work mining, most of the supply is already distributed across a global miner base.

Zcash price technical analysis

ZEC is trading near $287 and testing resistance around $300. This is a psychological round number and sits close to the recent swing high in the current recovery leg. This zone is also where previous price rejections cluster.

The short-term bullish case would be reinforced by a verified break and close above $300. Immediate support is located close to $277, which serves as a dynamic support level and is in line with the middle Bollinger Band. Holding above it maintains the upward momentum.

Below that, the recent swing low and lower Bollinger Band, which is located close to $188, provides the next significant support. That level marked the base of the previous oversold bounce.

The Bollinger Bands are beginning to contract after a period of expansion. Volatility is cooling. Often, this type of compression precedes a stronger directional move.

At 47, the relative strength index has bounced back from oversold territory below 30, indicating that selling pressure has subsided. Any breakout attempt would gain conviction if it were to sustain a move above 50.

A higher low of $188 has been set for the near term. A constructive structure is indicated by the price’s current upward push into resistance. The next technical target is located around $366, close to the upper Bollinger Band, if $300 is broken.

But a decline toward $277 is likely if the price fails at $300. The $188 level, which would be crucial to defend if the larger bullish structure were to hold, could be exposed once more in a deeper correction.

Crypto World

Kevin O’Leary awarded $2.8M in defamation case against BitBoy Crypto

Kevin O’Leary, investor and Shark Tank star, has won a $2.8 million defamation judgment against crypto influencer Ben “BitBoy Crypto” Armstrong.

Summary

- Kevin O’Leary won a $2.8 million defamation judgment against crypto influencer Ben Armstrong after a Florida federal court entered a default ruling in his favor.

- The case stemmed from March 2025 social media posts in which Armstrong falsely accused O’Leary of murder and a cover-up tied to a 2019 boating accident.

- Judge Beth Bloom awarded $2,828,000 in damages, including $2 million in punitive damages, after Armstrong failed to respond or appear in court.

A federal judge in the U.S. District Court for the Southern District of Florida entered a default judgment in O’Leary’s favor after Armstrong failed to meaningfully defend against the lawsuit.

The case stemmed from a series of social media posts Armstrong made in March 2025, in which he falsely accused O’Leary of murder and claimed O’Leary paid to cover up involvement in a 2019 boating accident that killed two people. O’Leary was never charged in that incident, and his wife was later acquitted at trial.

Kevin O’Leary wins damages against BitBoy

Judge Beth Bloom presided over the case and awarded $2,828,000 in damages after an evidentiary hearing.

As Armstrong did not respond to the lawsuit or appear at the hearing, the court entered default judgment against him on the claims of defamation per se and publication of private facts. Armstrong’s later motion to set aside the default judgment was denied.

The damages awarded include:

- $78,000 for reputational harm,

- $750,000 for emotional distress, and

- $2 million in punitive damages intended to punish Armstrong for the false statements.

The posts at issue also included Armstrong posting O’Leary’s private phone number and urging followers to “call a real life murderer,” which contributed to harassment and increased security concerns for O’Leary.

Armstrong had attempted to argue that his failure to respond was due to mental health issues and incarceration, but the judge rejected those claims, noting Armstrong was served with the complaint and had ample opportunity to participate.

The ruling underscores legal accountability for defamatory conduct online, particularly when claims are made to large audiences on social media.

Crypto World

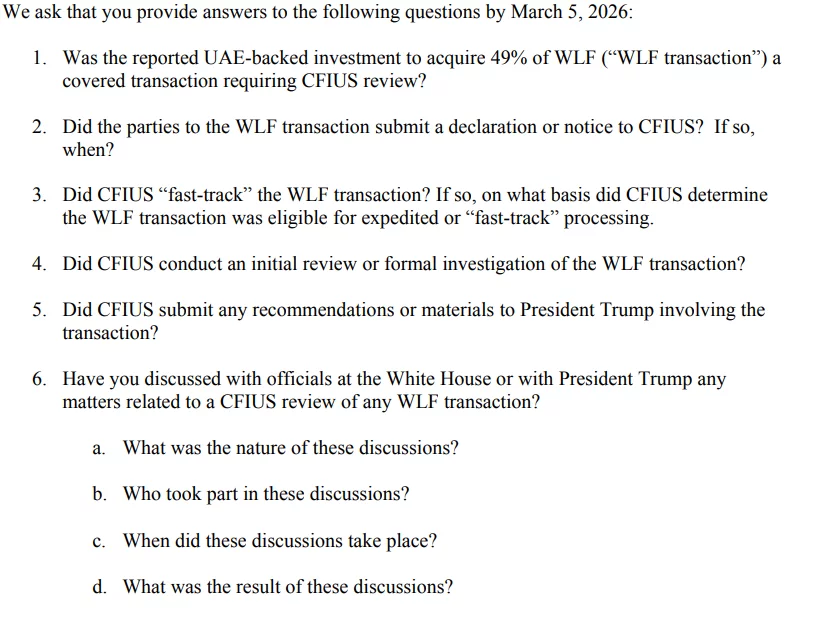

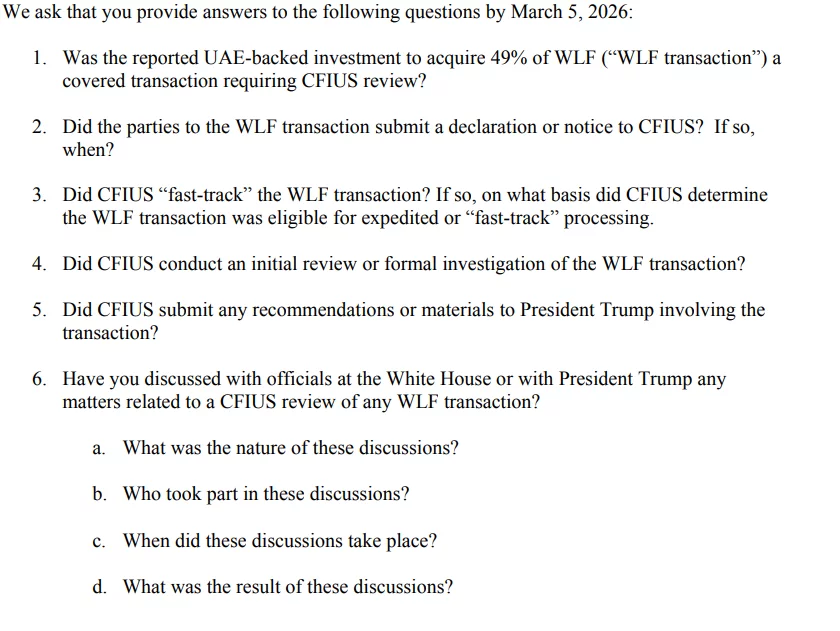

Senators urge CFIUS probe into UAE stake in Trump-linked World Liberty Financial

Democratic senators are calling for a national security review of a major foreign investment in World Liberty Financial, the crypto firm tied to Donald Trump and his family.

Summary

- Democratic senators urged the Committee on Foreign Investment in the United States to review a reported $500 million UAE-linked stake in World Liberty Financial, citing national security concerns.

- Sens. Elizabeth Warren and Andy Kim questioned whether the deal was formally reviewed and whether foreign investors could gain board influence or access to sensitive financial data.

- The investment is reportedly tied to Sheikh Tahnoon bin Zayed Al Nahyan, with links to G42, intensifying political scrutiny as Donald Trump denies knowledge of the transaction.

In a Feb. 13 letter to Treasury Secretary Scott Bessent, Senators Elizabeth Warren and Andy Kim urged the Committee on Foreign Investment in the United States to examine a reported $500 million stake linked to the United Arab Emirates.

The lawmakers said the investment could pose national security risks. They questioned whether CFIUS was notified. They also asked whether the deal was formally reviewed.

According to the letter, a UAE-backed entity acquired a large stake in World Liberty shortly before Trump’s January inauguration. The senators said the timing raises concerns. They warned that foreign ownership of a U.S. financial technology firm tied to a sitting president is unprecedented.

The letter sets a March deadline for answers from the Treasury.

Background and political fallout

The controversy centers on reports that an investment vehicle linked to Sheikh Tahnoon bin Zayed Al Nahyan purchased nearly half of World Liberty. Tahnoon is the UAE’s national security adviser. He is also linked to tech conglomerate G42, which has previously drawn scrutiny in Washington.

Lawmakers said the structure of the deal could give foreign actors board influence and access to sensitive financial data.

Trump has denied knowledge of the specific transaction. He said his sons manage the business. The White House has rejected claims of improper influence.

World Liberty has already faced a congressional probe over its foreign fundraising. The new letter intensifies pressure. It frames the issue as a national security matter, not just an ethics debate.

Treasury officials have not yet publicly responded.

Crypto World

Strategy Reveals Capacity to Withstand Bitcoin Price Collapse to $8,000

TLDR:

- Strategy can maintain full debt coverage even if Bitcoin price crashes 88% to $8,000 levels

- Michael Saylor plans to convert company’s convertible debt into equity over three to six years

- The announcement demonstrates Strategy’s confidence in its balance sheet and risk management approach

- Debt-to-equity conversion strategy aligns with Saylor’s long-term bullish outlook on Bitcoin

Strategy announced it can weather a Bitcoin price decline to $8,000 while maintaining sufficient assets to cover all outstanding debt obligations.

The bitcoin-focused company made the statement amid ongoing market volatility. Michael Saylor, the firm’s founder, simultaneously revealed plans to convert convertible debt into equity over a three to six-year period. The disclosure provides insight into the company’s risk management approach.

Financial Buffer Against Market Downturn

Strategy’s official statement indicates the company maintains substantial financial cushion despite aggressive bitcoin accumulation.

The company posted that it “can withstand a drawdown in BTC price to $8K and still have sufficient assets to fully cover our debt.” The $8,000 threshold represents an 88% decline from Bitcoin’s current trading levels.

Such a dramatic collapse would bring the cryptocurrency to prices last seen in early 2020. The company’s assertion demonstrates confidence in its balance sheet structure and asset management strategy. Strategy has positioned itself as a corporate bitcoin treasury company.

The firm holds one of the largest corporate bitcoin reserves globally. This financial resilience stems from the company’s debt-to-asset ratio and overall capital structure.

Strategy has raised billions through various financing mechanisms to fund bitcoin purchases. The company apparently structured these obligations with significant downside protection in mind.

Convertible Debt Transformation Timeline

Michael Saylor shared his vision for the company’s debt management through a post on X. Saylor stated: “Our plan is to equitize our convertible debt over the next 3–6 years.” This approach would transform debt obligations into equity stakes.

The conversion strategy aligns with Saylor’s long-term bullish outlook on bitcoin. Converting debt to equity reduces fixed obligations and interest expenses. It also provides flexibility as the company continues building its bitcoin position.

The timeline Saylor outlined suggests a gradual transition rather than immediate conversion. This measured approach allows the company to optimize conversion timing based on market conditions.

The strategy potentially reduces dilution risk for existing shareholders while maintaining operational flexibility. The combination of debt coverage capacity and conversion plans reflects Strategy’s evolving corporate structure.

Crypto World

Ray Dalio Warns of World Order Breakdown: Is Crypto at Risk?

Billionaire investor and Bridgewater Associates founder Ray Dalio says the global order established after World War II is breaking down. He argued that the world is entering what he calls “Stage 6” of the “Big Cycle.”

His warning has triggered renewed debate about geopolitical instability and its impact on cryptocurrency markets.

Sponsored

Ray Dalio Says We’re in “Stage 6” as World Order Breaks Down

Dalio frames the current moment through what he calls the “Big Cycle.” This is a pattern in which dominant empires rise, peak, and eventually decline. According to this model, the world is now in “Stage 6.”

“In my parlance, we are in the Stage 6 part of the Big Cycle in which there is great disorder arising from being in a period in which there are no rules, might is right, and there is a clash of great powers,” the post read.

Unlike domestic political systems, Dalio argues, international relations lack effective enforcement mechanisms such as binding laws or neutral arbitration. As a result, global affairs are ultimately governed by power rather than rules. When a dominant country weakens and a rival gains strength, tensions typically increase.

He identifies five types of conflict that tend to escalate in such periods: trade and economic wars, technology wars, capital wars involving sanctions and financial restrictions, geopolitical struggles over alliances and territory, and finally, military wars.

Most major conflicts, he argues, begin with economic and financial pressure long before bullets are fired. Dalio draws comparisons to the 1930s, when a global debt crisis, protectionist policies, political extremism, and rising nationalism preceded World War II.

He notes that before large-scale military conflict erupted, countries engaged in tariff battles, asset freezes, embargoes, and financial restrictions, tactics that resemble measures used today.

Sponsored

In his view, the most significant flashpoint in the current cycle is the strategic rivalry between the United States and China, particularly over Taiwan.

“The choice that opposing countries face—either fighting or backing down—is very hard to make. Both are costly—fighting in terms of lives and money, and backing down in terms of the loss of status, since it shows weakness, which leads to reduced support. When two competing entities each have the power to destroy the other, both must have extremely high trust that they won’t be unacceptably harmed or killed by the other. Managing the prisoner’s dilemma well, however, is extremely rare,” Dalio wrote.

However, warnings like this are not new. Dalio has issued similar cautions for years. This suggests his recent remarks are part of a consistent long-term thesis rather than a sudden shift.

Still, it’s worth noting that rather than making a direct prediction about military conflict, Dalio argues that the structural conditions historically associated with major power transitions are now in place.

Sponsored

Broader Implications for the Crypto Market

Dalio’s warning raises questions about how digital assets might perform. In periods marked by sanctions, asset freezes, and restrictions on cross-border finance, cryptocurrencies can attract attention as alternative settlement rails that operate outside traditional banking infrastructure.

Bitcoin, in particular, is often viewed as resistant to censorship and capital controls. These characteristics could become more relevant if financial fragmentation accelerates. At the same time, cryptocurrencies remain sensitive to global liquidity conditions.

Historically, geopolitical stress and policy tightening have triggered broad risk-off reactions across markets. This, in turn, may weigh on equities and high-beta assets alike.

Sponsored

If rising tensions lead to tighter financial conditions or reduced investor appetite for risk, crypto markets could experience heightened volatility in the short term.

“For stocks, this likely means higher volatility, lower valuations, and sharper swings as geopolitical risks rise. For crypto, weakening trust in traditional money could drive long-term interest, but short-term stress may still trigger severe price swings,” analyst Ted Pillows stated.

Another key factor is that heightened geopolitical tensions may push investors toward traditional safe-haven assets. Gold has historically benefited during periods of uncertainty, as capital seeks stability and long-standing stores of value.

In recent months, precious metals have surged to record highs, while cryptocurrencies struggled to recover following October’s tariff-driven market downturn. This divergence highlights that, despite Bitcoin’s “digital gold” narrative, many investors still treat gold as the primary hedge during acute geopolitical stress.

If tensions deepen, capital flows could continue favoring established defensive assets over more volatile alternatives. For crypto markets, that dynamic suggests a complex outlook: while long-term narratives around monetary debasement and financial fragmentation may strengthen, near-term price action could remain vulnerable to shifts in global risk sentiment.

Crypto World

Apollo to acquire Up to 90M MORPHO tokens in strategic deal

Apollo Global Management is moving to deepen its involvement in decentralized finance through a long-term collaboration with the Morpho Association.

Summary

- Apollo Global Management will acquire up to 90 million MORPHO tokens over 48 months.

- The partnership follows institutional integrations with Bitwise, which launched a USDC yield vault, and Flare, which enabled XRP-linked lending.

- The deal strengthens Morpho’s on-chain lending infrastructure and gives Apollo long-term governance influence.

The partnership was announced on Feb. 13, with the Morpho Association confirming that it had signed an agreement with Apollo affiliates.

Over the next 48 months, Apollo and its related entities will have the option to acquire up to 90 million Morpho (MORPHO) tokens.

Agreement outlines token purchase plan

These tokens may be obtained through a mix of open-market purchases, over-the-counter transactions, and other negotiated arrangements. To promote market stability, the agreement includes ownership caps as well as specific transfer and trading restrictions.

These safeguards were built into the structure of the deal to limit sudden supply increases and reduce the likelihood of sharp price swings.

If the full allocation is purchased, Apollo’s holdings would represent about 9% of Morpho’s total governance token supply.. At recent prices ranging between $1.19 and $1.37 per token in mid-February, the full cap would be valued at approximately $107 million to $115 million.

Galaxy Digital UK Limited acted as the exclusive financial adviser to Morpho during the negotiations. Morpho said the cooperation will support the development of lending markets, credit infrastructure, and curator-managed vaults across its protocol.

Agreement outlines token purchase plan

The Apollo deal follows several high-profile institutional partnerships that have helped Morpho strengthen its position in decentralized lending.

In late January 2026, Bitwise Asset Management introduced its first on-chain vault on Morpho, offering USDC deposits with yields of up to 6%. The launch marked Bitwise’s first move into non-custodial DeFi yield strategies.

Shortly after, in early February 2026, Morpho expanded its platform by integrating with the Flare blockchain. This integration made it possible for users to lend and borrow XRP-linked assets, such as FXRP. The rollout included vaults backed by FXRP, FLR, and USDT0, all accessible through the Mystic app.

Coinbase made major strides in 2025 when it integrated Morpho’s infrastructure to support its crypto-backed lending services. The integration supported over $960 million in active loans, $1.7 billion in collateral, primarily backed by Ethereum and Bitcoin, and over $450 million in USDC earning yield.

Morpho has been also able to reach a wider audience by offering lending, borrowing, and yield products to both individual and institutional customers through other partnerships with Bitget, Société Générale Forge, Gemini, and Crypto.com.

Ongoing protocol improvements have enabled this expansion. Morpho Vaults 1.1, which was released in 2025, improved risk management. In the meantime, the development of Morpho V2 is one of the main objectives for 2026. Future iterations will include fixed-rate and fixed-term loans with decentralized risk controls.

Market observers see the Apollo deal as evidence of growing institutional confidence in on-chain credit markets. Partnerships such as these are becoming more common as traditional asset managers look for more direct access to blockchain-based financial infrastructure.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat14 hours ago

NewsBeat14 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat15 hours ago

NewsBeat15 hours agoMan dies after entering floodwater during police pursuit

-

Politics5 days ago

Politics5 days agoWhy was a dog-humping paedo treated like a saint?