Crypto World

SOL price prediction as Solana RWA Tokenization value breaks $1.66B record

Solana price is catching its breath after a ferocious multi‑month rally, slipping back toward the mid‑$80s as traders reassess how much upside is left in one of this cycle’s most aggressive beta plays. The pullback is sharp, but it is not disorderly; it looks like a market that simply ran too far, too fast.

Summary

- Solana price slips toward the mid-$80s after an aggressive multi-month run, with YCharts showing a near 56% drawdown from a year ago.

- Polymarket contracts still price meaningful odds of SOL above $160 and even new all-time highs by end-2026, highlighting a wide distribution of outcomes.

- Bitcoin and Ethereum prices frame Solana inside a broader macro risk-on tape, with high Solana volumes keeping liquidity conditions supportive.

Solana price cools, prediction markets stay bold

As of early U.S. trading, Solana (SOL) changes hands around $86.07, down 4.4% on the session, after trading near $90.03 24 hours ago. Perplexity Finance data show a 24‑hour range between roughly $84.41 and $86.57, with spot market cap hovering near $48.55B and volumes around $57.32M. YCharts puts Solana’s daily reference price at $85.94 for February 16, down from $88.16 yesterday and dramatically below roughly $194.43 a year ago, a drawdown of about 55.8%.

Despite that drawdown, prediction markets have not written Solana off. A Polymarket market asking whether Solana will hit a fresh all‑time high by December 31, 2026, prices that probability near 16%, while a separate contract on “What price will Solana hit in 2026?” shows traders assigning roughly 32% odds to SOL trading above $160 before year‑end 2026. In that market, downside brackets such as “↓ 60” and “↓ 40” still command substantial probability, underscoring that “the path to new highs is anything but linear.”

Macro risk lens and wider crypto tape

This recalibration comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $68,000–$69,000, with 24‑hour highs just above $69,000 and lows near $68,150, on roughly $37.8B in trading volume across major BTC/USD venues. Ethereum (ETH) changes hands close to $1,970–$1,975, after printing a 24‑hour high near $2,095.87 and a low around $1,933.97, with market cap near $237B. Solana (SOL) itself trades in the mid‑$80s, with Metamask data putting spot near $85.43 and 24‑hour volumes approaching $9.75B, a sign that “high 24h volume… improves liquidity and reduces slippage for traders.

Solana RWA tokenization efforts intensify

Solana’s RWA tokenization value smashing the 1.66 billion dollar mark reinforces the chain’s narrative as real financial infrastructure, not just a speculative L1, and that matters for SOL’s future pricing power. As more real-world assets settle and trade on Solana, fee revenue, demand for blockspace, and (crucially) the incentive to hold SOL for staking and governance all scale with it, giving fundamentals a chance to catch up with and eventually justify higher valuations in the next risk-on phase.

Crypto World

When Will The CLARITY Act Pass?

The crypto industry and investors are awaiting the completion of the US CLARITY Act, which has been delayed amid partisan politics and industry concerns.

The bill would rewrite the rules of the road for the crypto industry, from which agency oversees it to regulations for decentralized finance (DeFi).

Currently, lawmakers in the US Senate are hammering out the details, with significant points of contention. Democrats want a bipartisan bill with ethics provisions and a bailout prohibition that Republicans roundly rejected.

The crypto industry itself has taken issue with some of the provisions. Namely, Coinbase, the largest crypto exchange in the US, doesn’t want a bill that prevents it from offering stablecoin yields. The US bank lobby opposes such yields, saying they threaten deposits and the stability of the financial system.

The bill has gone through several iterations. Here’s a look at how far it’s come:

May 2025: CLARITY comes to Washington

House Committee on Financial Services Chairman French Hill first introduced the CLARITY Act on May 29, 2025.

The goal of the bill, according to the committee, was to establish “clear, functional requirements for digital asset market participants, prioritizing consumer protection while fostering innovation.”

The committee said the bill was needed for several reasons, mainly that digital assets represented the next step in digital financial innovation and that the regulatory status quo was stifling possibilities.

June-July 2025: House passes crypto bill

The House of Representatives moved with uncharacteristic speed on the CLARITY Act. In June, the bill moved through markup sessions in the House committees on agriculture and financial services and was placed on the calendar for a vote on the floor by June 23.

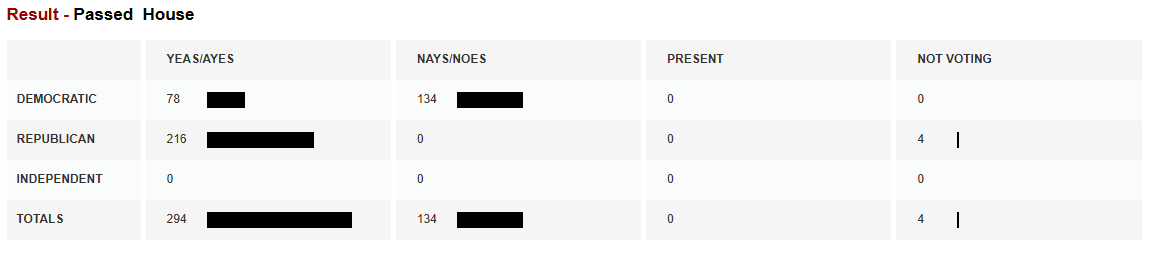

On July 17, the House of Representatives passed the bill, 294-134. The vote found more support among Republicans. Some 216 Republicans supported the bill, none opposed, while four abstained from voting.

There was some bipartisan support: 78 Democrats joined in voting “Yay,” while most of them, 134 Democratic Representatives, voted “Nay.” No Democrats abstained from voting.

With the vote, the bill moved to the upper house, the US Senate, where it has since been under debate.

July-September 2025: Senate starts work

The Senate quickly got underway with work on CLARITY. On July 22, Republican leaders on the US Senate Banking Committee released a draft version of the bill.

The discussion draft would “establish clear distinctions between digital asset securities and commodities, modernize our regulatory framework, and position the United States as the global leader in digital asset innovation.”

Senate Banking Committee Chair Tim Scott was optimistic about the Senate moving just as quickly as the House, giving an initial deadline of Sept. 30, 2025.

October-December 2025: Senators at odds during government shutdown

Democrats on the Senate Banking Committee, including noted cryptocurrency skeptic Senator Elizabeth Warren, were opposed to several parts of the discussion draft.

Warren took issue with how taxes would be treated under the law, saying in a statement that “proposals to clarify crypto’s tax treatment could ultimately give crypto an unfair advantage over other financial products.”

She also said that the proposals “make it harder to track what’s happening in crypto transactions if they are being used for illegal purposes.”

Senate Democrats also came up with their own proposals on how the bill would regulate DeFi. According to partners at Skadden Arps Slate Meagher & Flom, these DeFi rules sought to “leverage existing regulatory frameworks to create a crypto market structure and show Congress’ instinct to retrofit the current system rather than design one built for crypto.”

This was diametrically opposed to Republicans’ and the crypto industry’s vision, which was to create a new, bespoke system for the digital asset industry.

On Nov. 11, 2025, the Senate Agricultural Committee released its own discussion draft of CLARITY. The draft noted that lawmakers were still discussing the idea of which federal agency, the Commodity Futures Trading Commission (CFTC) or the Securities Exchange Commission (SEC), would regulate the industry.

Further hindering progress was the US federal government shutdown from Oct. 1 to Nov. 12 — the longest in history after the previous one that occurred in President Donald Trump’s first term. It only ended after a small group of Senate Democrats voted with Republicans to pass a resolution to temporarily fund the government.

December 2025-January 2026: Markup session, crypto industry gets impatient

Senator Cynthia Lummis predicted in the autumn that the crypto framework law would reach Trump’s desk by New Year’s Eve. As the year 2025 drew to a close, this seemed less likely.

On Dec. 19, the White House’s crypto and AI czar, David Sacks, said that, after a meeting with top senators working on CLARITY, there would be a markup session in January.

However, the planned markup session in the Senate Banking Committee was postponed amid substantive disagreements about the bill from the crypto industry lobby and the banking industry.

Coinbase CEO Brian Armstrong said they couldn’t support the bill due to its provisions banning interest-bearing stablecoins, as well as positioning the SEC as the main crypto industry regulator.

Related: US crypto market structure bill in limbo as industry pulls support

The move reportedly infuriated the White House, which was eager to complete work on the framework law.

Other financial bigwigs like David Solomon, CEO of Goldman Sachs, agreed with Armstrong, saying that the bill “has a long way to go.”

Work on the law did not stop completely. The Senate Agriculture Committee announced that it would have its own markup session on Jan. 27. Committee Democrats attempted to make amendments to the bill, including an ethics provision banning Congress from trading crypto, as well as ruling out any possibility of the government bailing out crypto.

These votes failed along party lines, and the Republican majority advanced the bill to the Senate floor.

February 2026: High-level talks at the White House, political maneuvers

Crypto industry executives, lawmakers and bankers are now meeting frequently at the White House and in the halls of Congress to figure out a solution to their differences. The Digital Chamber of Commerce said that a meeting on Feb. 3 focused on stablecoin yields.

These talks have continued. On Tuesday, more executives, including Ripple chief legal officer Stuart Alderoty, met for what was a “productive session.”

“Clear, bipartisan momentum remains behind sensible crypto market structure legislation. We should move now — while the window is still open,” he said.

Still, there’s been no deal. Delays have reportedly led to nearly $1 billion in outflows from the crypto market, according to data from CoinShares. Some observers believe that the delays are ultimately good in the long run, as it gives the industry a chance to bargain for more favorable terms.

Market analyst Michaël van de Poppe said, “I think if the bill were approved in its current form, it would have had a very bad impact on the markets in general. So, now, all the parties are aligned to continue the discussion. It reminds me a lot of the Markets in Crypto-Assets (MiCA) regulations in Europe.”

Many are eager to seal the deal before the midterm elections. The crypto lobby has been building its political machine through donations to political action committees (PACs). Both Republican and Democratic members of Congress are reportedly eager to pass something favorable before the 2026 campaign cycle begins and crypto PACs decide who to support.

Related: Crypto PACs secure massive war chests ahead of US midterms

Crypto’s strong support in the Republican Party could also prove a liability as the party loses popularity. Midterm elections historically go against the sitting president’s party, and in one year, the crypto lobby could be stuck with a lame-duck president and lukewarm support among a Democrat majority.

The success of CLARITY could end up being a race against the clock.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Metaplanet Revenue Surges 738% as Bitcoin Drives 95% of Sales

Metaplanet, a publicly listed Japanese company, has unveiled a sharp strategic pivot that centers Bitcoin income as the primary growth engine. In its fiscal year 2025 earnings release, the group disclosed revenue of 8.9 billion yen ($58 million), up 738% from 1.06 billion yen a year earlier, a surge driven by the launch of Bitcoin income operations in Q4 2024. The report also shows a dramatic shift in the business mix, with roughly 95% of total income now generated from BTC-related activities, largely through premium income from BTC options. By year-end 2025, the company reported holding 35,102 BTC, cementing its position as Japan’s largest corporate holder of Bitcoin. The transition, however, has introduced volatility into profits due to BTC price movements.

Key takeaways

- Revenue for FY2025 reached 8.9 billion yen (~$58 million), up 738% year over year from 1.06 billion yen.

- Bitcoin-related income accounted for about 95% of total revenue, with the BTC options premium driving a large portion of earnings.

- End-2025 Bitcoin holdings stood at 35,102 BTC, making Metaplanet the largest corporate Bitcoin holder in Japan.

- Operating profit was about $40 million, but the company posted a net loss of roughly $619 million due to impairment tied to Bitcoin valuation swings.

- The company plans to continue its Bitcoin treasury strategy, with a forecast for 2026 revenue around $104 million and operating profit near $74 million; overseas financing of up to $137 million was approved to grow holdings and reduce debt.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The report highlights a broader shift in corporate crypto strategies, where firms increasingly bundle treasury management with revenue from BTC-related activities. In a volatile BTC market, cash flow and profit reporting can hinge on mark-to-market valuations, prompting caution about earnings quality even as long-term holders pursue balance-sheet diversification.

Why it matters

Metaplanet’s pivot illustrates how traditional corporate structures can adapt to a changing crypto landscape. By treating Bitcoin (CRYPTO: BTC) as both a cash-flow engine and a treasury reserve, the company aims to hedge against fiat currency dilution while pursuing upside from long-term price appreciation. The 35,102 BTC position signals a deliberate shift toward crypto-native income streams and positions Metaplanet among Japan’s most visible crypto adopters in the corporate sector.

Investors should note the contrast between revenue growth and regulatory or accounting headwinds. While the BTC revenue line expanded dramatically, the year ended with a substantial impairment charge that wiped out operating income on a mark-to-market basis. That dynamic underscores how crypto volatility can impact reported profitability, even for firms pursuing a clear, long-term treasury thesis.

Leadership commentary reinforces the strategic orientation. In a post on X, CEO Simon Gerovich reaffirmed the commitment to a Bitcoin-focused approach, signaling that recent market volatility would not derail the plan. The capital-raising move, approved to raise as much as $137 million overseas, is aimed at expanding BTC holdings and reducing debt, reinforcing the scalability of Metaplanet’s treasury strategy across cycles.

What to watch next

- How the overseas capital raise of up to $137 million is deployed to expand BTC holdings and reduce leverage.

- Whether 2026 revenue and operating profit targets—roughly $104 million and $74 million—hold under shifting BTC prices and impairment dynamics.

- Any updates on impairment management or valuation adjustments tied to Bitcoin holdings in quarterly filings.

- Potential changes in the income mix or expansion of BTC-based income streams beyond options-related revenue.

Sources & verification

- Metaplanet FY2025 earnings report (PDF): https://contents.xj-storage.jp/xcontents/33500/950d7031/221a/4a55/a35b/03d8d22182fb/140120260216563315.pdf

- Bitcoin income strategy and treasury approach (earnings release notes).

- End-2025 BTC holdings figure (35,102 BTC) and related disclosures in the earnings report.

- Overseas capital raise approval (up to $137 million) to expand holdings and reduce debt (coverage referenced).

- 2026 revenue outlook and impairment context (coverage of the forecast and impairment). See: Metaplanet lifts 2026 revenue outlook despite $680M Bitcoin impairment.

Metaplanet’s market-facing narrative

Metaplanet’s 2025 results underscore a broader narrative about corporate experimentation with cryptocurrency as a core business driver rather than a mere balance-sheet asset. The company’s decision to anchor growth in Bitcoin-related income, especially via BTC options premium, signals a willingness to embrace sophisticated crypto-financial instruments as a standout revenue source. Yet the same assets that power growth also expose the company to the volatility that has redefined crypto markets in recent years. The impairment charge that accompanied the year’s performance is a concrete reminder that accounting marks tied to BTC valuations can overshadow operational success, particularly for firms with sizable holdings.

From a strategic perspective, Metaplanet’s ascent as Japan’s largest corporate Bitcoin holder is noteworthy. The 35,102 BTC tally reflects a deliberate long-horizon stance, described by management as a consolidation of a Bitcoin treasury strategy intended to hedge against fiat dilution and capture potential long-term appreciation. This is not merely a speculative play; it is a treasury management approach that seeks to align a company’s asset mix with a secular crypto thesis. The leadership’s insistence on maintaining and expanding this strategy, even as BTC prices have seen meaningful cycles, suggests confidence in the resilience of the underlying business model and a belief that the revenue stream will normalize as Bitcoin markets stabilize.

Looking ahead, the company’s forecast for 2026 signals ambition: a revenue run-rate of around $104 million with an operating profit near $74 million. If realized, this would mark a significant step up from the 2025 baseline, but it will require careful navigation of price volatility and the ongoing accounting implications of a large Bitcoin reserve. The overseas capital raise, approved to bolster the balance sheet and push the diversification of holdings, adds a layer of strategic financing that could help mitigate downside scenarios while supporting expansion in the BTC income category. In public statements, CEO Gerovich reiterated the commitment to a Bitcoin-centric path, arguing that short-term volatility should not override a long-run thesis that envisions BTC as a sustainable revenue and hedging instrument.

What to watch next

- Progress and deployment of the overseas capital raise (up to $137 million) and the impact on balance sheet strength and BTC acquisition capacity.

- Actual 2026 results versus forecast, with attention to how BTC price movements influence impairment and reported earnings.

- Any divergence in the BTC income mix, including potential expansion beyond BTC options into other Bitcoin-related revenue channels.

- Regulatory developments affecting corporate crypto treasury strategies and reporting standards in Japan and globally.

Crypto World

Hive, Riot earnings reports, FOMC minutes: Crypto Week Ahead

Hive Digital Technologies and Riot Platforms headline this week’s crypto-related earnings reports. The two data-center operators have expanded their operations, adding high-performance computing for AI applications to their bitcoin mining operations.

In macroeconomics, the Federal Reserve is likely to grab headlines, with minutes from the most recent Federal Open Market Committee meeting to be released on Wednesday. The committee kept rates steady in January, with two dissenting voices calling for a reduction.

The week also features a number of speeches from Fed officials, including Raphael Bostic, Michelle Bowman and Neel Kashkari.

What to Watch

(All times ET)

Crypto

- Feb. 17, 7 p.m.: Rocket Pool to implement its Saturn One upgrade.

- Feb. 18, 1 p.m.: Hedera to undergo a mainnet upgrade expected to take approximately 40 minutes to complete.

- Feb. 19, 8 a.m.: Zama to host a live presentation of its 2026 roadmap.

- Macro

- Feb. 16, 8:25 a.m.: U.S. Fed Bowman speech

- Feb. 17, 2:00 a.m.: U.K. unemployment rate for December est. 5.1% (Prev 5.1%)

- Feb. 17, 8:30 a.m.: Canada inflation rate YoY for January (Prev. 2.4%); Core rate YoY (Prev. 2.8%)

- Feb. 18, 2 a.m.: U.K. inflation rate YoY for January est. 3% (Prev. 3.4%); Core rate YoY est. 3.1% (Prev. 3.2%)

- Feb. 18, 2:00 p.m.: U.S. FOMC Minutes

- Feb. 18, 8:30 a.m.: U.S. durable goods orders MoM for December (Prev. 5.3%)

- Feb. 18, 9:15 a.m.: U.S. industrial production MoM for January est. 0.3% (Prev. 0.4%).

- Feb. 19: U.S. Fed Bostic, Bowman, and Kashkari speeches throughout the day

- Feb. 19, 8:30 a.m.: U.S. initial jobless claims for Feb. 14 est. 225K (Prev. 227K)

- Feb. 20. 8:30 a.m.: U.S. Core PCE price index MoM for December est. 0.4% (Prev. 0.2%); YoY est. 2.9% (Prev. 2.8%)

- Feb. 20, 8:30 a.m.: U.S. GDP growth rate QoQ Adv for Q4 est. 3. (Prev. 4.4%)

- Feb. 20, 9:45 a.m.: U.S. S&P Global manufacturing PMI flash for February est. 52.6 (Prev. 52.4).

- Feb. 20, 10 a.m.: U.S. Michigan consumer sentiment final for February est. 57.3 (Prev. 56.4)

- Earnings (Estimates based on FactSet data)

- Feb. 17: HIVE Digital Technologies (HIVE), pre-market, -$0.07

- Feb. 18: Figma (FIG), post-market, $0.45

- Feb. 19: Riot Platforms (RIOT), post-market, -$0.32

Governance votes & calls

- Feb. 17: Jito to host an X Spaces session with Hush Protocol.

- Feb. 18: VeChain to host its monthly VeChain Builders Space.

- Balancer is voting to swap a signer on the Emergency subDAO multisigs to improve operational responsiveness and security coverage. Voting ends Feb. 17.

- ENS DAO is voting to register the on.eth name and establish it as an onchain registry for blockchain metadata. Voting ends Feb. 19.

- Aavegotchi DAO is voting to consolidate assets from depleted wallets into the Liquidity wallet to simplify operations. Voting ends Feb. 22.

- Fluid DAO is voting to withdraw 1 million GHO and 1 million FLUID from the treasury to the Team Multisig to fund JupLend rewards and protocol incentives. Voting ends Feb. 22.

- GMX is voting on a proposal to implement tiered trading fee discounts for stakers and a staker-weighted trading leaderboard. Voting ends Feb. 22.

- Unlocks

- Feb. 16: Arbitrum to unlock 1.82% of its circulating supply worth $11.05 million.

- Feb. 17: to unlock 17.24% of its circulating supply worth $20.84 million.

- Feb. 20: to unlock 5.98% of its circulating supply worth $48.33 million.

- Feb. 20: to unlock 10.64% of its circulating supply worth $10.77 million.

- Token Launches

- Feb. 19: Resolv to complete rollout of updated USR/RLP yield distribution parameters

- Feb. 19: Injective to start INJ Community Buyback Round #226

Conferences

Crypto World

CryptoQuant flags $863M Nexo loans as confidence holds in pullback

CryptoQuant data shows Nexo users borrowed nearly 1 billion dollars in a year and over 30% returned, suggesting managed deleveraging as Bitcoin, Ethereum, and Solana retreat.

Summary

- CryptoQuant’s JA Maartun reports Nexo issued about 863 million dollars in credit, with users borrowing nearly 1 billion dollars from January 2025 to January 2026.

- Over 30% of Nexo users returned during the drawdown, a pattern analysts frame as risk being trimmed rather than a panic liquidation event.

- The flows come as Bitcoin, Ethereum, and Solana trade as high‑beta macro risk proxies, with crypto still closely tracking U.S. equity sentiment.

Crypto lending platform Nexo has quietly become a barometer of risk appetite in digital assets, even as markets digest a bruising pullback. In new on‑chain analysis published by CryptoQuant, researcher JA Maartun highlights that “data from Nexo shows: $863 million in total credit issued,” with users borrowing “nearly $1 billion” between January 2025 and January 2026. Crucially, “over 30% of users returned,” a dynamic Maartun frames as stability rather than stress during the drawdown. Full details are available in CryptoQuant’s “Stability During a Market Pullback>”

Market commentators argue those flows signal that leverage is being trimmed, not liquidated in panic. “Nearly $1B borrowed during a pullback says confidence didn’t fully leave the room,” Dutch outlet CryptoJournaal wrote, adding that “30% returning shows some deleveraging, but not a rush for the exits. Feels more like managed risk than stress.” That view echoes broader desks that describe crypto as the “purest expression of macro risk appetite,” with large‑caps still trading as high‑beta satellites to U.S. equities.

Broader crypto headwinds

It comes digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $68,700, with a 24‑hour range roughly between $68,000 and $70,500 and spot turnover near $37.5B. Ethereum (ETH) changes hands close to $1,985, after printing a 24‑hour high just above $2,000 and a low near $1,930, on about $24.5B in volume. Solana (SOL) trades in the mid‑$80s, last seen near $85–$86, down around 4% on the day with roughly $9–10B changing hands.

Nexo’s role in that ecosystem has grown since it launched what it called the world’s first crypto‑backed payment card with Mastercard, allowing users to spend against collateral without selling their holdings. At the same time, the lender remains under regulatory scrutiny, facing a recent fine in California over unlicensed lending practices. That mix of growth, leverage and oversight helps explain why on‑chain credit data from platforms like Nexo now sits at the center of every serious macro‑crypto conversation.

Crypto World

Warner Bros (WBD) Stock: Paramount Bid Gains Momentum as Netflix Deal Faces Antitrust Hurdles

TLDR

- Warner Bros. Discovery (WBD) may reopen negotiations with Paramount Skydance after the company enhanced its $78 billion offer with a $650 million quarterly ticking fee and breakup fee coverage.

- The current $82.7 billion Netflix deal faces regulatory challenges from Trump administration antitrust officials concerned about streaming market dominance.

- Paramount committed to cover WBD’s $2.8 billion Netflix breakup fee and up to $1.5 billion in debt refinancing costs to secure the deal.

- CEO David Zaslav is reportedly seeking Paramount to increase its $30 per share offer above $85 billion total to surpass Netflix’s $27.75 per share bid.

- Ancora Holdings opposes the Netflix deal with a $200 million stake, while only 42.3 million WBD shares have been tendered supporting Paramount’s offer.

Warner Bros. Discovery is weighing a critical decision between two competing billion-dollar offers. The media company’s board is considering whether to reopen talks with Paramount Skydance after rejecting its initial proposal.

Warner Bros. Discovery, Inc., WBD

Paramount enhanced its $78 billion all-cash offer on February 10. The company added a $650 million quarterly ticking fee if the deal extends past December 31.

The enhanced terms include coverage of WBD’s $2.8 billion breakup fee to Netflix. Paramount also committed up to $1.5 billion for debt refinancing costs.

These additions demonstrate Paramount’s determination to win the bidding war. The company believes it can secure regulatory approval faster than Netflix.

Netflix Deal Encounters Washington Roadblocks

Netflix and WBD signed an $82.7 billion agreement in December. That deal is now facing serious challenges from federal regulators.

Trump administration antitrust officials are examining Netflix’s position in the streaming market. A GOP operative familiar with the situation stated the Netflix deal is “going nowhere with the executive branch.”

The regulatory scrutiny centers on potential streaming monopoly concerns. Officials question whether combining Netflix with HBO Max creates excessive market concentration.

DOJ antitrust chief Gail Slater recently resigned under White House pressure. Her departure could extend the review timeline to six months or longer.

If the DOJ blocks the deal and Netflix litigates, the process could stretch another year. This uncertainty is pushing WBD to reconsider its options.

The Path Forward for WBD

WBD must notify Netflix before reopening talks with Paramount. Netflix would then receive an opportunity to match any improved Paramount offer.

CEO David Zaslav is hoping Paramount increases its $30 per share bid. Sources say he wants the total package to exceed $85 billion.

Netflix’s current $27.75 per share offer relies on selling WBD’s cable properties. The valuation of those assets remains uncertain in today’s media landscape.

Both bidders have indicated willingness to raise their offers. However, Netflix’s stock price declined during the bidding process, potentially limiting its flexibility.

WBD plans to announce its Q4 2025 earnings date this week. Investors are also awaiting the special shareholder vote date on the Netflix transaction.

Shareholder Response and Legal Pressure

Ancora Holdings accumulated a $200 million stake in WBD. The investment firm publicly opposes the Netflix deal.

Despite this opposition, only 42.3 million shares have been tendered supporting Paramount. That represents less than 2% of outstanding shares.

Paramount filed a lawsuit against WBD claiming the company favors Netflix due to personal relationships. The suit alleges CEO Zaslav’s friendship with Netflix co-CEO Ted Sarandos influenced the decision.

People close to Paramount say the company hadn’t heard from WBD about reopening talks as of Sunday night. Some observers believe WBD may be using media leaks to protect against litigation.

Analysts maintain a cautious outlook on Paramount Skydance. PSKY stock carries a Moderate Sell consensus rating on TipRanks based on zero Buys, one Hold, and three Sells.

The average price target of $12.33 suggests 19.5% upside from current levels. PSKY shares dropped 8.7% over the past year.

Crypto World

Gate Founder Dr. Lin Han on AI, Crypto, and TradFi’s Future

Gate has quietly become one of the largest cryptocurrency exchanges in the world. Founded in 2013 by Dr. Lin Han as a one-person project, the platform now serves over 49 million users, employs more than 2,000 people, and lists over 5,000 tokens alongside a growing suite of traditional financial products.

In an interview with BeInCrypto, Dr. Han discussed what drove that growth, why he believes the line between crypto and traditional assets is disappearing, and how artificial intelligence is about to reshape the way people trade.

From Solo Developer to Global Platform

Dr. Han started Gate — originally launched as Bter.com — by himself. Thirteen years later, the exchange offers more than 50 products and services. But he is quick to downplay the numbers.

“The number is not quite important. The most important thing is that when you build a product, you need to polish it very well. A score of 80 percent is not enough. You need 90% to 95% quality. You need to always be number one in the product,” he said.

That product-first philosophy extended to asset coverage early on. In 2013, Gate was among the first exchanges to aggressively list altcoins, offering over 100 at a time when most platforms stuck to a handful. “At that time, we were the only exchange that could do that,” Dr. Han recalled.

The next phase of growth, he says, will come from regulated markets. Gate now holds licenses across 80 jurisdictions, including 44 US states and coverage across more than 20 European countries under MiCA. The platform also holds licenses in Dubai, Japan, and Australia.

“We launched our platform for regulated areas last year, but this year we want to grow the users there,” Dr. Han said, acknowledging that competing with established local players in Europe and other regions remains a challenge. “In some areas, they have their own local players who have operated there for many years. We are the new player. We need to let more people know about us.”

Breaking Down the Wall Between Crypto and Traditional Finance

Gate has been expanding beyond crypto-native assets into what the industry broadly calls TradFi integration. The exchange now offers tokenized equities, gold, silver, commodities, and stock indices — all tradeable 24/7 on the same platform where users manage their crypto portfolios.

Dr. Han described two limitations of traditional markets that drove this move: regional restrictions that prevent users in many countries from opening US brokerage accounts, and the limited trading hours of conventional stock exchanges.

“With crypto, we can provide a system with very high accessibility. They can trade 24/7, anywhere, in any country. They have all kinds of crypto plus traditional assets together, managed in the same way. It’s much easier for them,” he said.

He also pointed to a practical benefit for portfolio construction. Crypto assets tend to be highly correlated — when Bitcoin drops, most altcoins follow. Adding uncorrelated traditional assets like gold or US equities gives users meaningful diversification for the first time within a single platform.

“Before, people could only trade crypto, and most of the assets are correlated. With traditional assets, they have another option. Gold is definitely not related to Bitcoin. You can choose silver, commodities, US stocks. There are a lot of options to manage your portfolio and lower your risk,” Dr. Han explained.

Looking further ahead, he sees the distinction between crypto and traditional assets fading entirely. “In the future, you don’t need to recognize which is crypto and which is a traditional asset. You can view them all as your asset. It will change the mindset of how users manage their portfolio.”

AI: From Interface to Infrastructure

The conversation shifted to artificial intelligence, where Dr. Han laid out what he calls “Intelligent Web3” — a vision where AI agents replace the complex interfaces that currently define crypto trading.

The problem, as he sees it, is straightforward: crypto products have become too complicated, especially for newcomers. “You see so many numbers, buttons — spot trading, futures trading, options, earnings. Which one should you use? How do you start? It’s too hard for people,” he said. “And Web3 is even more difficult. There are more than 10,000 DApps. Millions of tokens are launched each year. You cannot recognize which token to choose.”

Gate’s approach unfolds in two stages. The first, already live, uses AI agents to help users navigate existing interfaces — checking token information, explaining platform features, and suggesting trading strategies. The second stage is more ambitious: replacing the traditional interface entirely.

“They don’t need to use the old interface, the old tools anymore. They just tell the AI agent what they want. The AI agent does all the other work,” Dr. Han said. “If they want to buy Bitcoin, just say ‘help me buy Bitcoin.’ If they want to earn interest, tell AI ‘I want to put my Bitcoin to get interest.’ AI finds the best yield for you, and it’s done.”

He expects this transition to be visible within a year, and broadly transformative within two — a timeline he considers more realistic than the five-year horizon often cited in the industry.

“I don’t think it’s five years. Two years, at most,” he said.

Beyond user experience, Dr. Han sees AI reshaping how capital moves through markets. He argued that human-driven capital allocation is inherently inefficient — people hold assets idle while promising projects go unfunded. AI agents, operating around the clock and processing information at scale, could improve that flow.

“For one person, we cannot guarantee they can make money from that. But for the whole ecosystem, it will benefit for sure,” he said. “AI can do the labor work for you. You can put your energy in other areas. Use your real intelligence.”Gate has already begun applying AI internally. According to Dr. Han, nearly all front-end coding at the company is now handled by AI, with back-end development expected to follow soon.

Crypto World

Dollar Index (DXY) Stabilises After CPI Release

Late January proved exceptionally volatile in the currency markets, as reflected by the ATR indicator. However, following the rebound from the four-year low (B), price swings on the DXY chart have narrowed, suggesting a degree of market stabilisation.

Friday’s CPI release had the potential to trigger sharp moves in the US dollar index, yet no major surprises emerged. According to Forex Factory data, the actual figures were broadly in line with analysts’ forecasts (inflation eased slightly as expected), and market participants headed into the long weekend, with US financial markets closed on Monday for Presidents’ Day.

Technical Analysis of the DXY Chart

On 27 January, when analysing the Dollar Index (DXY) chart, we:

→ updated the descending channel (marked in red);

→ noted that DXY was trading near a long-term support zone from which price had rebounded twice in the second half of 2025;

→ suggested that the downward momentum could be losing strength.

However, the market had other plans. Although the rally towards peak C (the former support level) is a clear sign that bearish pressure is fading, it was preceded by a false downside breakout of the aforementioned support area.

Swing analysis also points to stabilisation, based on the proportional structure:

→ peak C formed within the 50%–61.8% retracement of the A→B impulse;

→ trough D developed within the 50%–61.8% retracement of the B→C move;

→ peak E emerged within the 50%–61.8% retracement of the C→D impulse.

The previously highlighted support zone is now acting as a range where supply and demand appear balanced.

While the descending channel remains technically valid, the confident trajectory (indicated by the arrow) from the B low suggests that bears may struggle to maintain the prevailing trend of recent months.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

XRP Price Outruns Bitcoin and Ether as Post-Crash Rotation Favors Ripple Token

XRP price is sprinting. Since the February 6 low, the token has ripped about 38% to $1.55. Meanwhile, Bitcoin and Ether are crawling with gains closer to 15%.

That kind of gap does not happen by accident.

After the recent liquidation wave shook the market, traders seem to be piling into XRP as the higher beta play. When momentum comes back, capital usually chases the coins that move the fastest. Right now, that coin is XRP.

Key Takeaways

- XRP has surged 38% to $1.55 since early Feb, outperforming BTC and ETH (15%).

- Binance reserves dropped by 192 million XRP, signaling distinct accumulation.

- Technical targets sit at $2.40 if the current supply shock narrative holds.

Is Smart Money Rotating? What Is Next For XRP Price

Bitcoin is sitting near $68,920. Ether is around $1,982. Solid recoveries, sure. But XRP has gone almost vertical, jumping more than 5% in the last 24 hours alone and racing to $1.55.

That kind of outperformance usually means money is rotating. With Bitcoin ETFs seeing outflows recently, traders are hunting for better upside elsewhere.

Bitcoin still looks hesitant, trying to confirm a real reversal. XRP, right now, has clear drivers behind it. Optimism around Ripple’s regulatory positioning. Growing ETF chatter. Strong narrative.

Supply Shock Signals to Watch

There is an interesting supply squeeze building. Data shows Binance XRP reserves dropped by about 192.37 million tokens between Feb. 7 and 9. That is roughly a 7% cut, bringing total holdings down to 2.553 billion. Levels we have not seen since early 2024.

When exchange balances fall that quickly, it usually means bigger players are pulling coins into cold storage. And we have seen this movie before. A similar wave of withdrawals came right before XRP ran from $0.60 to $2.40 in late 2024.

In the short term, traders are focused on the $1.91 resistance. If that level breaks cleanly, it opens a path toward prior cycle highs.

This week is a real stress test. Fed minutes are coming. Core PCE data too. Both can shake the entire market in seconds.

If macro sparks volatility, XRP will feel it. But the level that matters is $1.45. If price defends that zone while everything else is choppy, that is strength. And strength during chaos is what fuels the next leg higher.

A sustained hold above that area keeps the $2.40 target in play. Especially with options markets already pricing in a meaningful chance of that breakout this year.

The post XRP Price Outruns Bitcoin and Ether as Post-Crash Rotation Favors Ripple Token appeared first on Cryptonews.

Crypto World

XRP Fakeout to $1.65 Sparks Crash Fears: Gravestone Doji in Focus

The last time XRP printed a gravestone doji, it dumped by nearly 50% – will history repeat?

Ripple’s cross-border token stole the show yesterday, surging by double-digits to a multi-week peak of over $1.65. This prompted many analysts to speculate about another rally from the asset, perhaps to and beyond $2.00.

However, the following several hours showed that this was another fakeout as XRP tumbled to under $1.50, thus erasing almost all weekend gains.

According to a couple of prominent crypto analysts, the asset’s instant surge to $1.65 and its inability to close higher the weekly candle meant that it has printed a gravestone doji.

This is a technical term that suggests the formation of a bearish reversal candlestick pattern, indicating that the bullish momentum has faded. It’s often succeeded by a more profound price decline.

Ali Martinez, one of the analysts who spoke about the meaning of the gravestone doji, noted that the last time XRP had charted it, its price tumbled by 46% in just a few weeks. If something similar is to transpire now, XRP could lose the coveted $1.00 support and head toward $0.80.

The last time $XRP printed a gravestone doji was on the weekly chart, and the price dropped 46%. https://t.co/JcCuSzDd2k pic.twitter.com/IcxINjMCch

— Ali Charts (@alicharts) February 16, 2026

CryptoWZRD’s opinion was slightly different. They also acknowledged the gravestone doji close on the weekly chart, but added that “most of this move was a pullback from the earlier spike in a low-liquidity environment, which is healthy.”

You may also like:

ERGAG CRYPTO, a well-known XRP bull, retweeted a November 15, 2025, post, in which they asked why people are ignoring the fourth wave. They believe the asset is currently in this wave, which can “absolutely be irregular or expanded corrective.”

The analyst’s chart shows XRP’s price going to somewhere around $1.30 during the corrective fourth wave, before a potential reversal to new all-time highs.

#XRP – Rejecting Facts 🤔: WHY?

Honest and sincere question…

▫️Why are so many TA analysts rejecting this wave count, especially Wave 4?▫️Wave 4 can absolutely be irregular or expanded corrective, and in this structure we clearly need a close above Wave B to launch the 5th… pic.twitter.com/82esPLcvUa

— EGRAG CRYPTO (@egragcrypto) November 15, 2025

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Metaplanet’s operating profit jumps nearly 1,700% as bitcoin income generation pays off

Metaplanet (3350), the largest bitcoin treasury company in Japan, forecast full-year operating profit will rise 81% this year after premiums from writing options drove a 17-fold increase in 2025.

The company, which owns 35,102 BTC, earned 6.29 billion yen ($40.8 million) in operating profit last year. Premiums on writing options surged to 7.98 billion yen from 691 million in 2024. Total revenue rose 738% to 8.9 billion yen.

Still, as the price of bitcoin dropped from a near $125,000 all-time high to end the year below $90,000, Metaplanet recorded a non-cash valuation loss of 102.2 billion yen, dragging net income down to a loss of 95 billion yen ($605 million).

The Tokyo-based company still holds more than $2.4 billion worth of bitcoin and expects to generate nearly all of its 2026 revenue from these holdings.

It is currently sitting on around $1.2 billion in unrealized losses, given BTC’s price drop to $68,550.

The company said it expects full-year revenue to grow almost 80% in 2026 to 16 billion yen, with operating profit reaching 11.4 billion yen. The shares rose 0.31% to 326.0 yen on Monday.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat20 hours ago

NewsBeat20 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat22 hours ago

NewsBeat22 hours agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show