Crypto World

How Paid Hype Pumps Tokens and Silences Critics

Crypto news stories are vanishing without a trace. Articles questioning the influence of paid press releases have quietly disappeared from major crypto websites, leaving little evidence they were ever published.

At the same time, thousands of promotional announcements continue to flood the industry, shaping narratives, moving markets, and blurring the line between journalism and advertising.

The Shadow Pipeline That Fuels FOMO

Chainstory analyzed 2,893 press releases distributed between June 16 and November 1, 2025. Using AI-driven sentiment tagging and risk classification, cross-referenced with blacklists like CryptoLegal.uk, Trustpilot, and scam alert feeds, the report found that:

- 62% originated from high-risk (35.6%) or confirmed scam projects (26.9%).

- Low-risk issuers accounted for only 27% of releases.

- In certain niches, such as cloud mining, scam, or high-risk content, dominated ~90% of releases.

The tone of the content was heavily promotional:

Sponsored

Sponsored

- Neutral: 10%

- Overstated: 54%

- Overtly promotional: 19%

Content type breakdown further highlighted the triviality of much coverage:

- Product tweaks or minor feature updates: 49%

- Exchange listing announcements (spam): 24%

- Substantive corporate events (funding, M&A): 2% (58 releases)

Based on this, the researchers concluded that these dynamics create a “manufactured legitimacy loop.” Dubious projects buy guaranteed placements across dozens of outlets, including mainstream financial portals, sidebars, and niche crypto aggregators.

Placement allows these projects to populate “As Seen On” sections, leveraging recognition to drive retail FOMO.

Headlines are deliberately loaded with marketing buzzwords like “AI-Powered Revolution,” “RWA Game-Changer,” terms editorial desks would likely reject if scrutinized.

PR Dollars Speak Louder Than Facts

The ecosystem echoes TradFi abuses. SEC data shows press releases fueled 73% of OTC penny-stock pump-and-dump schemes from 2002–2015.

In crypto, the effect is amplified, with algorithmic trading bots that scrape keywords such as “partnership” or “listing,” automatically triggering buy orders.

The result is a short-term price pump, often followed by unexpected declines once the underlying project fails to meet expectations.

Complicating matters, FTC rules for native advertising require clear disclosure. In practice, many crypto “Press Release” sections appear neutral, erasing the sponsored stigma and conferring the illusion of independent validation.

Retail investors often interpret the placement of content on recognized domains as evidence of legitimacy.

Sponsored

Sponsored

Who Pulls the Strings Behind Crypto Coverage?

Chainstory’s findings initially gained traction across crypto media, with coverage appearing on TradingView, KuCoin, MEXC, and other outlets. Yet, key articles disappeared without explanation on several outlets.

- Investing.com – formerly titled “Crypto press releases dominated by high-risk projects, Chainstory study finds.”

- CryptoPotato, which had described wire services turning placement into a “paid commodity.”

There were no 404 errors or notices. Posts were simply erased from search and archive.

As seen by BeInCrypto via email, sources indicate that an executive from a company implicated in the pay-to-play ecosystem contacted these outlets, citing alleged data faults or bias.

Some editorial teams complied, suggesting a broader vulnerability: advertiser leverage over editorial independence.

It is imperative to note that most crypto outlets rely heavily on PR distribution revenue, particularly during bear markets or when ad budgets are tight.

Therefore, it may be safe to assume that critical reports threatening that revenue stream can prompt quiet removals or editorial self-censorship.

“I’m not involved in the day-to-day of the site/ editorial. I need to ask about this,” CryptoPotato’s Yuval Gov responded to BeInCrypto’s request for comments.

Sponsored

Sponsored

The Man at the Center: Nadav Dakner and Chainwire

At the core of the paid-PR ecosystem is Nadav Dakner, co-founder and CEO of Chainwire (MediaFuse Ltd.), which markets “guaranteed coverage” across crypto and TradFi sites.

“Broadcast your crypto & blockchain news with guaranteed coverage, in industry-leading publications,” read an excerpt on the Chainwire website.

A source close to the matter told BeInCrypto that Nadav is the force behind the article takedowns.

Chainwire mirrors the practices highlighted by Chainstory: syndication to dozens of outlets in exchange for visibility, often leveraged to influence retail behavior.

Despite scrutiny, Chainwire remains influential:

- Named “Best PR Wire” at the 2026 CoinGape Awards (February 2, 2026).

- Maintains strong G2 ratings for 2025 campaigns.

Meanwhile, Dakner’s past ventures provide further context. He co-founded MarketAcross and InboundJunction and was involved in the 2017 Gladius Network ICO, which raised approximately $12.7 million in ETH.

Sponsored

Sponsored

The SEC settled with Gladius in February 2019 for unregistered securities violations, requiring refunds and registration, but no fines due to self-reporting.

Gladius dissolved later that year without full compliance, leaving investors uncompensated.

Court documents from Gladius v. Krypton Blockchain Holdings (2018) describe Dakner introducing Gladius to Krypton Capital (founded by Ilan Tzorya). InboundJunction appeared in the whitepaper as a marketing/PR partner.

Some reports frame Dakner as the de facto CMO and investor. Investigative reporting by FinTelegram and CryptoTicker (October 2025) notes proximity to funding conduits linked to broader fraud networks involving figures such as Gery Shalon, Vladimir Smirnov, and Gal Barak.

Importantly, these connections are indirect, as no charges were filed against Dakner.

Chainwire also faced separate 2025 allegations of exploitative practices, including unpaid “test” campaigns and ghosting publishers.

Notably, no direct link exists between Dakner or Chainwire and Chainstory takedowns.

However, overlap in ecosystems and timing raises questions about whether commercial relationships suppress critical reporting.

The Quiet Amplifiers That Shape Crypto Markets

Chainstory’s research exposes a market where credibility can be bought, manipulated, or quietly erased. When critical reports vanish from archives, it reinforces the opacity and manufactured legitimacy that fueled the original concerns.

For retail participants within crypto’s hype-driven environment, skepticism is essential. Verification via on-chain data, independent sources, and awareness of PR revenue dependence is crucial to avoid falling prey to the pay-to-play cycle.

In crypto’s ongoing information wars, the quietest edits—deleted posts, altered archives, and erased analysis—may speak loudest, revealing the subtle levers that shape perception, sentiment, and ultimately, market outcomes.

Chainwire did not immediately respond to BeInCrypto’s request for comment.

Crypto World

Bitcoin’s 50% Drop Tests Markets as Retail Investors Continue Dip Buying

Retail investors on Coinbase continued buying dips through market volatility, even as warnings of a severe crypto winter emerged.

Since reaching a record high last October, Bitcoin has shed nearly half its value. As it continues to struggle below $70,000, the weakness is fueling fears of another crypto winter.

But despite the ongoing volatility in the market, retail activity on Coinbase has remained steady, according to Brian Armstrong.

Post-October Slump

In a recent tweet, the Coinbase chief executive said that the platform data shows retail users have continued buying despite price dips as native unit holdings across Bitcoin and Ethereum increased. Armstrong added that a majority of retail customers held balances in February that were equal to or higher than their December levels, as participation from smaller investors on Coinbase remained steady.

While retail activity appears resilient, market commentator Mippo warned that the broader market outlook remains fragile. Mippo said current conditions point to the onset of a “full-on crypto winter,” which has the potential to match the severity of the 2022 bear market or even the downturn seen in 2019. He attributed the near-term pressure to the “air gap” created by previously unsustainable valuations alongside an evolving regulatory environment.

He stated that historical crypto valuations were largely driven by speculative capital flows rather than business fundamentals, as regulatory uncertainty made it difficult for projects to generate compliant revenue or cash flows. Prices were often set by how much capital chased a limited supply of tokens tied to the most popular narratives at the time, and higher-risk themes commanded higher valuations.

According to Mippo, this framework is now breaking down as regulatory pathways for crypto projects become clearer, beginning with stablecoins and expected to extend to a broader range of tokens.

While he characterized this regulatory change as positive over the long term, Mippo said it creates challenges for projects whose valuations were built primarily on speculation. As compliant revenue generation becomes possible, he explained that market participants are increasingly focused on cash flows, which has led to a reassessment of token prices that were set too high under earlier assumptions. This helps explain why on-chain activity and fundamental usage may be growing even as token prices continue to decline, he added.

You may also like:

AI Dominance Pressures Crypto

Mippo also said crypto is being “absolutely mogged by AI,” while adding that the frenzy around meme coin speculation is catching up with the industry, and that crypto failed to build useful products during that period.

As such, he estimated the reset in valuations could continue for another nine to eighteen months before broader market conditions begin to improve.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Animoca Brands Wins Dubai Crypto License Expands Middle East Services

Animoca Brands has secured a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA), enabling a broader, regulated footprint for crypto activities within the emirate. The license authorizes broker-dealer services and investment management related to virtual assets in Dubai, excluding the Dubai International Financial Centre, and targets institutional and qualified investors. The public record shows the license was issued on Feb. 5, reinforcing Dubai’s ongoing push to formalize digital-asset operations under a clear governance framework. Animoca says the license strengthens its ability to engage with Web3 foundations and global institutions within a well-defined regulatory environment. The move comes as Dubai continues to position itself as a regional hub for regulated crypto activity.

Key takeaways

- Animoca Brands obtains a VARA VASP license to offer broker-dealer services and asset-management activities related to virtual assets in Dubai, focused on institutional and qualified investors.

- The license excludes the Dubai International Financial Centre, signaling a mainland-and-free-zone approach to oversight under VARA.

- The development aligns with Animoca’s broader strategy in Web3, including support for projects such as The Sandbox, Open Campus, and Moca Network, while expanding its investor access in the region.

- Dubai has a growing roster of licensed crypto operators, underscoring a deliberate shift toward a regulated, institution-friendly crypto ecosystem in the emirate.

- Animoca’s recent activity includes the January acquisition of Somo, integrating playable and tradable digital collectibles into its portfolio.

Market context: Dubai’s VARA framework is part of a broader regional trend toward regulated digital-asset markets within the UAE, with enforcement actions signaling a clear stance against unlicensed activity and marketing breaches. The emirate’s approach contrasts with looser regimes elsewhere, drawing institutional participants seeking compliant environments and predictable governance.

Why it matters

The VARA license marks a meaningful expansion point for Animoca Brands in a market that has openly courted Web3 and blockchain-driven enterprise. By enabling broker-dealer functions and asset-management capabilities under VARA’s oversight, Animoca gains a regulated on-ramp for institutional and qualified investors, potentially accelerating large-scale partnerships and liquidity channels for its portfolio companies. This is particularly relevant as the company maintains a diversified portfolio—encompassing The Sandbox, Open Campus, and Moca Network—while continuing to back early-stage projects that align with its long-term strategy in decentralized ecosystems.

For Dubai, the approval reinforces a deliberate effort to attract structured capital and sophisticated investment strategies into digital-asset ventures. The license depiction in VARA’s public register confirms a formal recognition of Animoca’s operations within the emirate and suggests a framework under which the company can collaborate with Web3 foundations and other international players—an important signal for both developers and financiers looking for regulated access to Dubai’s growing crypto infrastructure.

On the corporate side, the move dovetails with Animoca’s ongoing efforts to broaden its influence in the blockchain space. The company has been expanding its reach through portfolio expansion, strategic acquisitions, and partnerships that blend gaming, digital collectibles, and interoperable ecosystems. The Somo acquisition in January, which added playable and tradable digital collectibles to Animoca’s repertoire, underscores a strategy to combine asset-backed experiences with a regulated, institution-facing platform. This combination could help the firm monetize digital assets through more formalized channels while maintaining its emphasis on creator economies and user-owned ecosystems.

Altogether, the Dubai license positions Animoca at the intersection of regulated finance and Web3 innovation—a space that investors and builders have increasingly prioritized as crypto markets mature. The licensing choice also aligns with a broader UAE narrative of modernization and regulatory clarity, where oversight is paired with a deliberate openness to institutional participation in digital-asset markets.

What to watch next

- VARA’s ongoing oversight of licensed entities: continued monitoring of market conduct and compliance expectations for broker-dealer activities in the emirate.

- Expansion of Animoca’s regional activities: potential collaborations with Dubai-based institutions and Web3 foundations, and integration of Somo and other assets into regulated product offerings.

- Further licensing activity in Dubai: follow-on approvals for additional asset classes or service models, signaling the pace of institutional crypto adoption in the region.

- Regulatory alignment within the UAE: broader moves to harmonize crypto frameworks across Dubai and Abu Dhabi, and among allied Gulf markets.

Sources & verification

- VARA public register entry for Animoca Brands Middle East Advisory FZCO (license issued Feb. 5)

- Animoca Brands announcement: Animoca Brands secures VASP licence from Dubai’s VARA

- Animoca Brands expands portfolio with Somo acquisition

- BitGo awarded VARA broker-dealer license for its Middle East and North Africa unit

Dubai license expands Animoca’s Web3 footprint

Dubai’s VARA granted Animoca Brands a virtual-asset service provider license that unlocks broker-dealer and investment-management capabilities for virtual assets within the emirate, excluding the Dubai International Financial Centre. The license, officially issued on Feb. 5 and logged in VARA’s public register, opens the door for Animoca to serve institutional and qualified investors under VARA’s supervision. The registry entry confirms the formal scope of permitted activities and marks a notable milestone for a company whose portfolio spans The Sandbox, Open Campus, and Moca Network, along with a broad set of early-stage projects in the blockchain and gaming landscape. In comments accompanying the license, Omar Elassar, Animoca’s managing director for the Middle East and head of global strategic partnerships, described the move as a way to deepen partnerships with Web3 foundations and global institutions within a well-regulated framework.

The Dubai license is part of a broader pattern in which the emirate has actively cultivated regulated pathways for digital assets to foster institutional participation while maintaining oversight. VARA, established in 2022 to regulate asset issuance, trading, and related services across Dubai’s mainland and its free zones, has signaled a firm stance against unregistered activity. The regulator has also been active in enforcement, including financial penalties assessed against entities for unlicensed operations and marketing violations, underscoring the balance Dubai seeks between encouraging innovation and ensuring consumer protection and market integrity.

Animoca Brands’ footprint in the region extends beyond licenses. The company has built a diversified Web3 platform ecosystem that includes The Sandbox, a leading virtual world, along with Open Campus and the Moca Network. These projects are designed to integrate user-generated content, creator economies, and interoperable assets across multiple experiences. The company has also been expanding its investment thesis in digital collectibles and blockchain-based entertainment, backing a wide array of initiatives across the ecosystem.

In January, Animoca expanded its strategic capabilities by acquiring Somo, a gaming and digital-collectibles company, which brought playable and tradable collectibles into Animoca’s asset mix. The acquisition aligns with Animoca’s broader strategy of combining interactive experiences with a regulated, institution-facing platform, potentially enabling new revenue models and liquidity channels for Web3 projects within Dubai’s regulatory framework. While Somo’s integration is ongoing, the deal illustrates how Animoca intends to leverage regulatory access in Dubai to accelerate growth and broaden its reach in the Middle East’s burgeoning crypto market.

As Dubai continues to refine its regulatory approach and attract more institutional players, Animoca’s VARA license stands as a tangible signal of the emirate’s commitment to structured, compliant innovation in digital assets. For industry observers, the development highlights how major Web3 builders are moving toward regulated environments that can support scalable, investor-grade activity while preserving the decentralized and creator-centric ethos at the core of the sector.

Crypto World

Metaplanet Reports $605 Million Loss After Billions Spent on Bitcoin

TLDR

- Metaplanet posted a $605 million loss due to the decline in Bitcoin’s value.

- The company spent $3.8 billion on Bitcoin, purchasing the asset at an average price of $107,000 per coin.

- Metaplanet’s Bitcoin holdings are currently down by 37%, reflecting an unrealized loss of $1.4 billion.

- Despite the losses, the company saw an 81% increase in operating profit from its options business.

- Metaplanet continued purchasing Bitcoin even when the price exceeded $100,000, making its largest purchases in September and October.

Metaplanet, a Japanese firm that heavily invested in Bitcoin, has revealed a significant financial setback. The company announced a loss of ¥95 billion, or $605 million, for the past year. This decline follows the cryptocurrency’s steep drop in price from its all-time highs in October.

Metaplanet’s Losses Stem from Falling Bitcoin Value

The primary reason behind Metaplanet’s financial struggles lies in the falling value of its Bitcoin holdings. The firm’s 35,100 Bitcoin, which was worth $2.4 billion, has seen a dramatic decline in value. Since the company began accumulating Bitcoin 21 months ago, it has spent approximately $3.8 billion, acquiring the digital asset at an average price of $107,000 per Bitcoin.

At the current market value, Metaplanet’s Bitcoin holdings are down by about 37%, reflecting an unrealized loss of $1.4 billion. In the last quarter, ending December 31, the company’s Bitcoin stash lost ¥102 billion, or $664 million, in value. Despite these losses, Metaplanet’s stock price saw a minor increase to ¥326 on Monday.

Revenue from Premiums Amid the Losses

Metaplanet’s revenue model remains largely dependent on premiums from writing options. Over the course of the year, the company’s option premiums increased substantially, rising to ¥7.9 billion, or $51 million. This marks a sharp contrast to the previous ¥691 million, or $4.5 million, recorded in the prior year.

The firm has projected an 81% increase in operating profit, which it expects to come from its options business. While Metaplanet’s Bitcoin holdings have significantly decreased in value, this shift in focus toward its options business aims to provide some financial stability.

Bitcoin Purchases Amid the Decline

Metaplanet has continued to invest in Bitcoin even as its value fluctuated. The company made some of its largest purchases when Bitcoin was trading above $100,000. In September, Metaplanet acquired $630 million worth of Bitcoin when the price was around $106,000, followed by another purchase of $615 million in October.

In total, Metaplanet has been purchasing Bitcoin through a combination of common stock issuance and preferred shares. The company’s strategy mirrors that of Michael Saylor’s firm, Strategy, which has also invested heavily in Bitcoin. However, unlike Strategy, Metaplanet has introduced products like MERCURY and MARS to help mitigate market risks.

Crypto World

Altcoins See Selective Strength Amid $173 Million Crypto Outflows

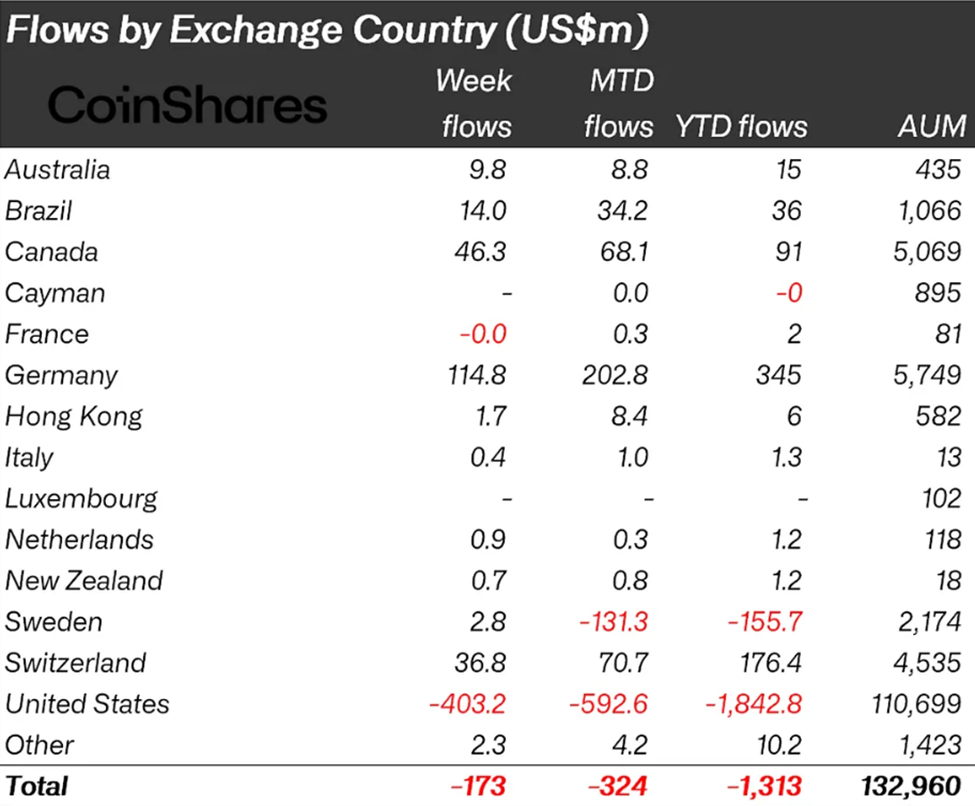

Crypto funds recorded a fourth consecutive week of net outflows, shedding $173 million, as investor caution persisted across major digital assets.

However, the pace of withdrawals has slowed markedly from the heavy selling seen in late January and early February, while select altcoins have continued to attract fresh capital.

Sponsored

Sponsored

Crypto Outflows Persist but Slow from January Peaks

According to the latest weekly fund flows report from CoinShares, cumulative outflows over the past four weeks have reached $3.74 billion, reflecting sustained weak sentiment following earlier market volatility.

While outflows continued, last week’s figure was broadly in line with the previous week’s $187 million decline, suggesting the sharp liquidation phase may be easing.

Earlier in the cycle, digital asset funds experienced much steeper withdrawals, including roughly $1.7 billion in each of the final weeks of January.

Market activity also cooled significantly, with ETF trading volumes dropping to $27 billion, down sharply from the record $63 billion reported the week before.

The decline in turnover suggests investors may be stepping back from aggressive repositioning, even as broader uncertainty persists.

Despite the overall negative flows, sentiment improved slightly toward the end of the week. Softer-than-expected US inflation data helped spark $105 million in inflows on Friday.

“Sentiment improved slightly on Friday following weaker-than-expected CPI data,” wrote James Butterfill, head of research at CoinShares.

This suggests macroeconomic signals continue to play a decisive role in shaping short-term crypto demand.

Sponsored

Sponsored

Regional Divergence Becomes More Pronounced as Bitcoin and Ethereum Lead Withdrawals

One of the most notable trends in the latest data was a widening regional divide. The US accounted for $403 million in outflows. This made it the primary driver of the global decline.

While US investors remain cautious, potentially reflecting macro uncertainty and positioning shifts, institutions in other markets may be viewing the recent price weakness as an opportunity to accumulate.

Meanwhile, the largest digital assets continued to bear the brunt of negative sentiment. Bitcoin investment products saw $133 million in outflows, the weakest performance among major assets.

Sponsored

Sponsored

Interestingly, short Bitcoin products also recorded outflows totaling $15.4 million over the past two weeks.

Historically, declines in demand for bearish positions have sometimes coincided with periods of market capitulation. Therefore, it may signal that the worst of the selling pressure could be nearing exhaustion.

Ethereum funds also struggled, posting $85.1 million in outflows as investors reduced exposure to the second-largest crypto. Smaller products were not immune either, with Hyperliquid seeing modest withdrawals of around $1 million.

Altcoins Show Signs of Rotation

In contrast to the broader trend, several altcoins continued to attract capital. XRP led inflows at $33.4 million, followed closely by Solana at $31 million, while Chainlink added $1.1 million.

Sponsored

Sponsored

These inflows point to a selective rotation rather than a wholesale exit from the crypto sector. Investors appear to be reallocating toward assets perceived to have stronger narratives or relative momentum, even as exposure to larger-cap tokens declines.

Taken together, the latest data paints a picture of a market still under pressure but stabilizing compared with the intense selling seen earlier in the year.

Crypto outflows remain persistent, yet their reduced scale, coupled with regional inflows and continued interest in certain altcoins, suggests investors are adjusting portfolios rather than abandoning the asset class outright.

Crypto World

YZi Labs Files for Board Expansion at CEA Industries Amid BNB Treasury Dispute

TLDR

- YZi Labs has filed a revised preliminary consent statement with the SEC to expand the board at CEA Industries.

- The expansion aims to place nominees who align with YZi Labs’ vision for the company’s future.

- YZi Labs raised $500 million in a private placement to build the world’s largest corporate BNB treasury.

- The company accused CEA Industries’ asset managers of attempting to shift from a BNB-only strategy to include other cryptocurrencies.

- The fallout from the treasury dispute caused CEA Industries’ stock to drop by 87%.

YZi Labs has formally filed a revised preliminary consent statement with the SEC, aiming to expand the Board of Directors at CEA Industries Inc. The expansion seeks to add new members who align with YZi Labs’ vision for the company. This move follows mounting tensions over the company’s digital asset strategy, particularly its management of the BNB treasury.

YZi Labs Pushes for Board Expansion

YZi Labs is looking to place nominees in new positions on the CEA Industries board. This move comes after a series of disagreements regarding the company’s asset management. The group has made it clear that its goal is to influence the direction of CEA Industries by installing directors who support their vision.

The push for expansion comes after a private placement raised $500 million for the company in July 2025. The capital was initially intended to build the world’s largest corporate BNB treasury. However, by the end of 2025, YZi Labs accused CEA Industries’ asset managers of trying to diversify away from a BNB-only strategy, which led to disputes within the company.

BNB Treasury Controversy Prompts Action

YZi Labs’ dispute with CEA Industries revolves around its BNB treasury management. The company had amassed over 515,000 BNB, worth $465 million in August 2025, to serve as its main reserve. However, tensions escalated in December 2025 when YZi Labs accused 10X Capital and BNC management of secretly adding other cryptocurrencies, such as Solana, into the strategy.

This shift away from a strict BNB-focused approach led to an 87% drop in CEA Industries’ stock from its post-announcement highs. The rift over the treasury strategy has now evolved into a power struggle, with YZi Labs pushing to control the company’s future by expanding the board.

SEC Review Delays Shareholder Vote

YZi Labs filed its revised preliminary consent statement with the SEC to initiate the board expansion. The filing is currently under review to ensure compliance with legal requirements for soliciting shareholder consents. Shareholders are unable to vote or submit consent forms until the SEC finishes its review process.

Once the SEC approves the filing, YZi Labs will distribute a white consent card to shareholders. This will allow shareholders to officially vote for or against the expansion of the board and the proposed new nominees.

Crypto World

Bitcoin Capitulation Deepens with $2B Daily Losses as Markets Flash Crash Warnings

TLDR:

- Bitcoin realized losses surpassed $2 billion daily from February 5-11, marking the highest levels in 2025

- Seven-day loss averages indicate sustained capitulation among weak hands rather than temporary selling

- S&P 500 put-call ratio reached 1.38, the highest reading since Liberation Day, signaling elevated crash risk

- Historical data shows P/C ratios above 1.1 consistently preceded major equity market declines in 2024-2025

Bitcoin investors recorded over $2 billion in daily realized losses throughout the week of February 5-11, signaling potential capitulation among market participants.

The figures represent the highest loss levels observed in 2025 as selling pressure intensifies. Analysts interpret the sustained outflows as evidence that weaker investors are exiting positions after weeks of correction.

Broader market indicators simultaneously point to elevated crash risks, creating a challenging environment for digital assets.

Capitulation Metrics Reach Critical Thresholds

Data from market analyst Darkfost reveals that realized losses have exceeded $2 billion daily since early February. The seven-day moving average maintains this elevated level, indicating persistent rather than sporadic selling. This pattern emerged after January 20, when the market shifted from accumulation to distribution mode.

The magnitude of these losses suggests genuine capitulation is underway. Investors who purchased Bitcoin at higher prices are crystallizing substantial losses rather than waiting for recovery. This behavior typically occurs when market participants lose confidence in near-term price appreciation.

However, the data requires careful interpretation due to several complicating factors. UTXO consolidation transactions can inflate realized loss figures without representing true capitulation.

Additionally, institutional movements such as recent Fidelity Investments transfers contribute to the headline numbers.

Despite record loss levels, Bitcoin prices have demonstrated unexpected resilience in recent sessions. The cryptocurrency has avoided sharp declines even as selling pressure mounts.

This divergence between realized losses and price action indicates strong support from long-term holders who refuse to sell at current levels.

Crash Warnings Compound Downside Risks

Market trader Leshka_eth has documented a troubling pattern in equity market indicators. The put-call ratio currently stands at 1.38, matching the highest reading since the Liberation Day market event. Historical precedent shows S&P 500 declines consistently follow P/C spikes above 1.1-1.2.

This ratio reflects intense hedging activity as investors purchase protective puts. Dealers who sell these options must hedge by selling index exposure through futures and exchange-traded funds.

The resulting selling pressure removes natural market support, potentially triggering self-reinforcing downward spirals.

Multiple headwinds are converging to pressure risk assets. Kevin Warsh’s Federal Reserve Chair nomination signals potential monetary tightening and balance sheet reduction.

The central bank’s $6.6 trillion balance sheet could face systematic unwinding, removing liquidity from financial markets.

Global markets have already contracted sharply, with $12 trillion in losses recorded during January alone. Commodities experienced severe declines, including gold down 13% and silver plunging 37%.

Corporate earnings reports reveal deteriorating fundamentals even as valuations remain historically elevated. These conditions create an unfavorable backdrop for speculative assets like Bitcoin, where capitulation may accelerate if equity markets destabilize further.

Crypto World

Inside the sanctioned stablecoin issuer A7A5’s race to build a crypto giant

HONG KONG — Oleg Ogienko, A7A5’s director for Regulatory and Overseas Affairs, is looking to debate anyone who accuses him of breaking any compliance laws through his stablecoin company.

Speaking to CoinDesk during Consensus Hong Kong, the public face of the Ruble-denominated stablecoin issuer A7A5 — which grew faster last year than USDT or USDC — stressed that, like any stablecoin issuer, compliance with the laws of where it is incorporated is key (in this case, Kyrgyzstan), and criminals are not welcome on the platform.

“We are fully compliant with the regulations of Kyrgyzstan. We do not do illegal things,” he said, emphasizing the issuer’s regular audits. “We have KYC procedures, and we have AML mechanisms embedded into our infrastructure. We do not violate any Financial Action Task Force principles.”

But here is the catch: A7A5’s issuing and affiliated entities, Old Vector LLC and A7 LLC, and the bank that holds the reserves, Promsvyazbank (PSB), are sanctioned by the U.S. Department of the Treasury, barring the U.S. dollar-denominated financial world from interacting with them.

So while the company’s affiliates are restricted by the U.S (whose laws underpin a majority of the global trade), being used by Russian companies to avoid sanctions is not a crime in Kyrgyzstan (where A7A5 is based) or in Russia.

A7A5 facilitates cross-border payments for Russian users facing banking restrictions, while also providing a route into USDT liquidity, the market leader, through decentralized finance (DeFi) protocols without holding dollar stablecoins directly.

In fact, the restriction became one of the driving forces behind the stablecoin’s surprising growth. It added almost $90 billion in circulating supply last year, outpacing USDT, which added $49 billion, and Circle’s USDC, which added about $31 billion, according to data from Artemis.

Going beyond sanctions

Ogienko admitted that life under sanctions puts pressure on people and limits access to some Western goods and services.

However, he argued that it has not stopped business activity or cross-border trade, describing the restrictions as an obstacle rather than an economic dead end and creating a market where A7A5 is in demand.

Ogienko said A7A5’s primary demand comes from businesses in Asia, Africa, and South America that trade with Russian exporters and importers and need cross-border payment mechanisms.

Right now, liquidity is limited because centralized exchanges won’t list the token due to the risk of secondary sanctions. DeFi liquidity pools exist where A7A5 can be swapped for USDT, though A7A5’s own dashboard says only around USDT 50,000 is available.

Ogienko says he was on the ground in Hong Kong trying to fix that, using the trip to Consensus to meet with exchanges and other blockchains — declining to name specifics — to build partnerships.

“We’ve been deployed on Tron and Ethereum, and now we are thinking about deploying on some other blockchains … we’re here to do cooperation with them,” he said.

While the firm wasn’t a sponsor at Consensus, having a U.S.-sanctioned entity at any conference could make organizers and sponsors nervous, even when its sponsorships are technically legal in some regions. This played out at Token2049 in Singapore — where A7A5 was a sponsor, organized by Hong Kong-registered BOB Group — a jurisdiction with no sanctions on Russia. BOB, however, later scrubbed references to A7A5 from the lists, after worries emerged from other sponsors.

Still, the sanctions and the politics surrounding the restrictions don’t bother Ogienko’s ambition to grow his business.

“We think that we can make the trade volumes settled in A7A5 grow … we hope that we can do more than 20% of Russia’s trade settlements with different countries in A7A5,” he said.

However, A7A5 still can’t be used in Russia, as lawmakers are still drafting stablecoin regulations.

Ogienko said that he is in contact with authorities in the country, describing the relationship as consultative and focused on blockchain regulation and financial infrastructure rather than direct government control.

“We’re not politicians. We are traders. We are businessmen,” he said, emphasizing neutrality. “We’re open for business cooperation with any country.”

Read more: Most Influential: Oleg Ogienko

Crypto World

6 Predictions Reshaping Social Media

Let’s be honest: if your Web3 project isn’t on social media, do you even exist? The days of Discord-only communities and airdrop farming as a marketing strategy are numbered. In 2026, social media is where the real alpha is and the platforms are evolving faster than Layer 2 gas fees after a memecoin pump.

After analyzing trends across tens of thousands of global brands, here are six predictions that will shape social media strategy in 2026, with a crypto-native lens on what it means for our industry.

1. Short-Form Video + UGC Will Dominate (Yes, Even for DeFi)

Research shows 73% of marketers are prioritizing short-form video heading into 2026, with 47% specifically focusing on UGC video content. Translation: your community’s unboxing videos and tutorial clips are worth more than your polished explainer animations.

The crypto angle: Stop making 20-minute tokenomics deep-dives nobody watches. Start amplifying the 30-second clips of community members showing their first successful swap, their hardware wallet setup, or their reaction to actually understanding what a rollup is. Authenticity beats production value always has, but now the algorithms are enforcing it.

2. Paid Media Shifts to Video and AI Conversations

Budgets are moving to Instagram, YouTube, and TikTok platforms where video storytelling and social commerce thrive. But here’s the interesting part: conversational commerce is emerging as a new frontier.

Walmart’s ChatGPT integration lets users make purchases directly in chat. Think about that for a second: AI-powered shopping, inside a conversation.

The crypto angle: This is where it gets spicy. Imagine AI agents that don’t just recommend products they execute on-chain transactions. We’re not far from “Ask Claude to swap your ETH for that NFT you’ve been eyeing.” The ad format of the future might be a persuasive AI conversation, not a banner. Crypto-native brands should be experimenting with AI-commerce integrations now.

3. AI Moves From Experimentation to Infrastructure

By 2026, generative AI won’t be a “nice to have”; it’ll be embedded in the operating layer of marketing stacks. Agentic AI systems will draft copy, test creatives, and adjust ad spend mid-campaign, all in real-time.

Direct-to-consumer businesses already post six times more content than traditional retailers. The only way to compete is AI-augmented content creation.

The crypto angle: Web3 projects are uniquely positioned here. Many crypto teams are already AI-native in their workflows. The question is whether you’re using AI agents just for content, or building them into your entire community management stack from sentiment analysis to automated governance summaries to personalized engagement. Soon, teams won’t talk about using AI. They’ll just run on it.

4. Virtual Influencers Rise (With a Reality Check)

Earlier in 2025, nearly 60% of marketers planned to increase virtual influencer collaborations. Fast forward a few months, and partnerships with AI-only influencers dropped; audience fatigue and underperformance hit hard.

The crypto angle: We’ve been here before. Remember when every NFT project had a fictional founder? The lesson: virtual creators work as hybrid collaborators, not replacements for real voices. Use AI-generated characters for scalable storytelling and visual experimentation, but anchor campaigns in authentic community members. Transparency about AI’s role isn’t optional, it’s survival.

5. Burnout Prevention Becomes Survival Strategy

Most social teams have fewer than six people managing global brand presence. Nearly half report frequent burnout. With content demands rising and budgets tightening, automation isn’t a luxury; it’s triage.

The crypto angle: Crypto social managers have it worse. You’re running 24/7 Discord servers, managing global communities across multiple timezones, and expected to respond to FUD at 3am. In 2026, the projects that retain talent will be the ones treating automation as a force multiplier—AI handles scheduling, reporting, and routine engagement while humans focus on actual community building and creative strategy. Your community manager shouldn’t be burnt out; they should be empowered.

6. Social, Commerce, and Care Fully Converge

Two-thirds of marketers now collaborate closely with commerce and care teams. The lines between customer touchpoints are blurring into a seamless experience: a TikTok ad opens into a shopping cart, a DM uncovers an upsell opportunity, a chatbot drives recurring purchases.

The crypto angle: This is Web3’s moment to shine. Social tokens, wallet-connected experiences, on-chain loyalty programs—these aren’t future concepts, they’re here. Imagine a Discord message that triggers a token-gated discount, or a Twitter Space that unlocks exclusive NFT access. The brands that connect social engagement with on-chain commerce (without the friction) will transform community from a cost center into a revenue engine.

The future of social media is AI-powered, authenticity-driven, and increasingly commerce-enabled. For crypto-native brands, this isn’t about keeping pace, it’s about leading the charge.

The projects that treat AI as infrastructure, authenticity as strategy, and community as commerce will define the new standard in Web3 engagement.

The rest will be building on Solana and posting threads about it to 47 followers.

Crypto World

Binance, Franklin Templeton Launch Off-Exchange Collateral Program

Editor’s note: The collaboration between Binance and Franklin Templeton highlights a pivotal step toward institutional-grade efficiency in digital markets. By enabling tokenized real-world assets to function as off-exchange collateral, the partnership aims to combine regulated custody with flexible yield opportunities, reducing counterparty risk for traders and asset managers. As institutions seek safer, more scalable models for on-chain activity, this program demonstrates how traditional finance instruments can operate within crypto rails while preserving safeguards. Crypto Breaking News will monitor the rollout and its implications for liquidity, risk management, and custody standards.

Key points

- Tokenized Benji fund shares used as off-exchange collateral on Binance.

- Assets stay off-exchange in regulated custody; value mirrored in Binance.

- Reduces counterparty risk while enabling yield for institutional participants.

- Custody and settlement backed by Ceffu.

Why this matters

By enabling tokenized real-world assets to settle on-chain with off-exchange collateral, the program strengthens risk controls and liquidity for institutions, illustrating a practical path to integrate traditional instruments into digital markets while preserving custody protections.

What to watch next

- More institutions participate in off-exchange collateral programs.

- Expansion of tokenized real-world assets available on Binance for collateral settlement.

- Ongoing collaboration between Franklin Templeton and Binance expands the network of program partners.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Binance and Franklin Templeton Advance Strategic Collaboration with Institutional Collateral Program

JOHANNESBURG, South Africa, February 16, 2026/ — Franklin Templeton, a global investment leader and Binance (www.Binance.com), the world’s leading cryptocurrency exchange by trading volume and users, announced a new institutional off-exchange collateral program, making digital markets more secure and capital-efficient. Now live, eligible clients can use tokenized money market fund shares issued through Franklin Templeton’s Benji Technology Platform as off-exchange collateral when trading on Binance.

The program alleviates a long-standing pain point for institutional traders by allowing them to use traditional regulated, yield-bearing money market fund assets in digital markets without parking those assets on an exchange. Instead, the value of Benji-issued fund shares is mirrored within Binance’s trading environment, while the tokenized assets themselves remain securely held off-exchange in regulated custody. This reduces counterparty risk, letting institutional participants earn yield and support their trading activity without hedging on custody, liquidity, or regulatory protections.

“Since partnering in 2025, our work with Binance has focused on making digital finance actually work for institutions,” said Roger Bayston, Head of Digital Assets at Franklin Templeton. “Our off-exchange collateral program is just that: letting clients easily put their assets to work in regulated custody while safely earning yield in new ways. That’s the future Benji was designed for, and working with partners like Binance allows us to deliver it at scale.”

“Partnering with Franklin Templeton to offer tokenized real-world assets for off-exchange collateral settlement is a natural next step in our mission to bring digital assets and traditional finance closer together,” said Catherine Chen, Head of VIP & Institutional at Binance. “Innovating ways to use traditional financial instruments on-chain opens up new opportunities for investors and shows just how blockchain technology can make markets more efficient.”

Assets participating in the program remain held off-exchange in a regulated custody environment, with tokenized money market fund shares pledged as collateral for trading on Binance. Custody and settlement infrastructure is supported by Ceffu, Binance’s institutional crypto-native custody partner.

“Institutions increasingly require trading models that prioritize risk management without sacrificing capital efficiency,” said Ian Loh, CEO of Ceffu. “This program demonstrates how off-exchange collateral can support institutional participation in digital markets while maintaining strong custody and control.”

Launching the institutional off-exchange collateral program expands on both Franklin Templeton’s and Binance’s growing networks of off-exchange program partners and represents another effort since announcing Franklin Templeton and Binance’s strategic collaboration in September 2025.

By using Benji to bridge tokenized money market funds, Franklin Templeton is taking trusted investment products and making them work in modern markets—allowing institutions to trade, manage risk, and move capital more efficiently as digital finance becomes an everyday part of the financial system.

Offering more tokenized real-world assets on Binance meets the increasing institutional demand for stable, yield-bearing collateral that can settle 24/7. This gives investors greater choice and enhances their trading experience on the world’s largest regulated digital asset exchange.

Franklin Templeton is a pioneer in digital asset investing and blockchain innovation, combining tokenomics research, data science, and technical expertise to deliver cutting-edge solutions since 2018. Learn more at Franklin Templeton Digital Assets.

About Binance

Binance is a leading global blockchain ecosystem behind the world’s largest cryptocurrency exchange by trading volume and registered users. Binance is trusted by more than 300 million people in 100+ countries for its industry-leading security, transparency, trading engine speed, protections for investors, and unmatched portfolio of digital asset products and offerings from trading and finance to education, research, social good, payments, institutional services, and Web3 features. Binance is devoted to building an inclusive crypto ecosystem to increase the freedom of money and financial access for people around the world with crypto as the fundamental means. For more information, visit: http://www.Binance.com

About Ceffu

Ceffu is an institutional-grade custody platform offering custody and liquidity solutions that are ISO 27001 & 27701 certified and SOC2 Type 2 attested. Our multi-party computation (MPC) technology, combined with a customizable multi-approval scheme, provides bespoke solutions allowing institutional clients to safely store and manage their virtual assets.

For the purposes of this program, custody services for Benji-issued tokenized money market fund shares are provided by Ceffu Custody FZE, a virtual asset custodian licensed and supervised in Dubai.

About Franklin Templeton

Franklin Templeton is a trusted investment partner, delivering tailored solutions that align with clients’ strategic goals. With deep portfolio management expertise across public and private markets, we combine investment excellence with cutting-edge technology. Since our founding in 1947, we have empowered clients through strategic partnerships, forward-looking insights, and continuous innovations – providing the tools and resources to navigate change and capture opportunity.

With more than $1.7 trillion in assets under management as of January 31, 2026, Franklin Templeton operates globally in more than 35 countries.

To learn more, visit http://www.FranklinTempleton.com

Franklin Resources, Inc. [NYSE:BEN]

All investments, including money funds, involve risk, including loss of principal. There are risks associated with the issuance, redemption, transfer, custody, and record keeping of shares maintained and recorded primarily on a blockchain. For example, shares that are issued using blockchain technology would be subject to risks, including the following: blockchain is a rapidly-evolving regulatory landscape, which might result in security, privacy or other regulatory concerns that could require changes to the way transactions in the shares are recorded.

Crypto World

Anthropic Expands Its AI Business in India with Strong Enterprise Uptake

TLDR

- Anthropic has doubled its revenue run rate in India in just four months.

- Developer adoption of Anthropic’s Claude Code has been a key driver of growth in India.

- The company has opened an office in Bengaluru to support its expanding operations.

- Anthropic has formed strategic partnerships to expand its AI solutions in the public sector.

- Air India is using Claude Code to improve software development and reduce costs.

AI startup Anthropic has seen rapid revenue growth in India, with its AI tools gaining traction across various sectors. The company’s revenue run rate has doubled in just four months, driven by high demand from developers and early government deployments. Anthropic has also expanded its presence in the country by opening an office in Bengaluru.

Strong Developer Adoption in India Drives Revenue Growth

Anthropic’s revenue growth in India is largely due to high adoption rates among developers. The company’s Claude Code has seen increased use in India, a country known for its large pool of tech talent. Developers are leveraging the tool to enhance productivity and speed up software development processes. According to Dario Amodei, CEO of Anthropic, India’s developer-centric culture has accelerated the company’s growth. Amodei noted, “Since my last trip here, the company has doubled its run rate revenue in India.”

The speed at which developers are adopting AI tools in India is a key factor in Anthropic’s success. Unlike other countries where casual consumers also use AI, India’s AI adoption is concentrated in the professional sector. This intense use by developers reflects the country’s focus on productivity and rapid experimentation. In India, AI adoption is characterized by a culture of quickly testing new ideas and moving forward with adjustments if necessary.

Anthropic Expands Partnerships to Support Public Sector Growth

In addition to its success in the developer market, Anthropic has formed several strategic partnerships in India. These partnerships will help expand its AI solutions into the public sector, including education, healthcare, and judicial services. The company’s India team will also provide applied AI expertise to startups and enterprises, assisting them in building and scaling AI-driven solutions.

One of the key enterprise clients, Air India, has adopted Claude Code to improve its software development speed. By integrating AI into its operations, the airline aims to reduce costs and increase efficiency. This collaboration reflects the growing interest in AI-powered tools across industries, as businesses recognize their potential to drive productivity improvements.

Government agencies in India have also shown interest in using AI technology, further accelerating Anthropic’s growth in the country. The Ministry of Statistics, for example, is working on an AI-powered server for economic data and statistics. Anthropic’s CEO highlighted that such efforts are progressing much faster than similar projects in other countries. He credited India’s entrepreneurial spirit and technical expertise for the rapid pace of adoption.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video7 hours ago

Video7 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash