Crypto World

6 Predictions Reshaping Social Media

Let’s be honest: if your Web3 project isn’t on social media, do you even exist? The days of Discord-only communities and airdrop farming as a marketing strategy are numbered. In 2026, social media is where the real alpha is and the platforms are evolving faster than Layer 2 gas fees after a memecoin pump.

After analyzing trends across tens of thousands of global brands, here are six predictions that will shape social media strategy in 2026, with a crypto-native lens on what it means for our industry.

1. Short-Form Video + UGC Will Dominate (Yes, Even for DeFi)

Research shows 73% of marketers are prioritizing short-form video heading into 2026, with 47% specifically focusing on UGC video content. Translation: your community’s unboxing videos and tutorial clips are worth more than your polished explainer animations.

The crypto angle: Stop making 20-minute tokenomics deep-dives nobody watches. Start amplifying the 30-second clips of community members showing their first successful swap, their hardware wallet setup, or their reaction to actually understanding what a rollup is. Authenticity beats production value always has, but now the algorithms are enforcing it.

2. Paid Media Shifts to Video and AI Conversations

Budgets are moving to Instagram, YouTube, and TikTok platforms where video storytelling and social commerce thrive. But here’s the interesting part: conversational commerce is emerging as a new frontier.

Walmart’s ChatGPT integration lets users make purchases directly in chat. Think about that for a second: AI-powered shopping, inside a conversation.

The crypto angle: This is where it gets spicy. Imagine AI agents that don’t just recommend products they execute on-chain transactions. We’re not far from “Ask Claude to swap your ETH for that NFT you’ve been eyeing.” The ad format of the future might be a persuasive AI conversation, not a banner. Crypto-native brands should be experimenting with AI-commerce integrations now.

3. AI Moves From Experimentation to Infrastructure

By 2026, generative AI won’t be a “nice to have”; it’ll be embedded in the operating layer of marketing stacks. Agentic AI systems will draft copy, test creatives, and adjust ad spend mid-campaign, all in real-time.

Direct-to-consumer businesses already post six times more content than traditional retailers. The only way to compete is AI-augmented content creation.

The crypto angle: Web3 projects are uniquely positioned here. Many crypto teams are already AI-native in their workflows. The question is whether you’re using AI agents just for content, or building them into your entire community management stack from sentiment analysis to automated governance summaries to personalized engagement. Soon, teams won’t talk about using AI. They’ll just run on it.

4. Virtual Influencers Rise (With a Reality Check)

Earlier in 2025, nearly 60% of marketers planned to increase virtual influencer collaborations. Fast forward a few months, and partnerships with AI-only influencers dropped; audience fatigue and underperformance hit hard.

The crypto angle: We’ve been here before. Remember when every NFT project had a fictional founder? The lesson: virtual creators work as hybrid collaborators, not replacements for real voices. Use AI-generated characters for scalable storytelling and visual experimentation, but anchor campaigns in authentic community members. Transparency about AI’s role isn’t optional, it’s survival.

5. Burnout Prevention Becomes Survival Strategy

Most social teams have fewer than six people managing global brand presence. Nearly half report frequent burnout. With content demands rising and budgets tightening, automation isn’t a luxury; it’s triage.

The crypto angle: Crypto social managers have it worse. You’re running 24/7 Discord servers, managing global communities across multiple timezones, and expected to respond to FUD at 3am. In 2026, the projects that retain talent will be the ones treating automation as a force multiplier—AI handles scheduling, reporting, and routine engagement while humans focus on actual community building and creative strategy. Your community manager shouldn’t be burnt out; they should be empowered.

6. Social, Commerce, and Care Fully Converge

Two-thirds of marketers now collaborate closely with commerce and care teams. The lines between customer touchpoints are blurring into a seamless experience: a TikTok ad opens into a shopping cart, a DM uncovers an upsell opportunity, a chatbot drives recurring purchases.

The crypto angle: This is Web3’s moment to shine. Social tokens, wallet-connected experiences, on-chain loyalty programs—these aren’t future concepts, they’re here. Imagine a Discord message that triggers a token-gated discount, or a Twitter Space that unlocks exclusive NFT access. The brands that connect social engagement with on-chain commerce (without the friction) will transform community from a cost center into a revenue engine.

The future of social media is AI-powered, authenticity-driven, and increasingly commerce-enabled. For crypto-native brands, this isn’t about keeping pace, it’s about leading the charge.

The projects that treat AI as infrastructure, authenticity as strategy, and community as commerce will define the new standard in Web3 engagement.

The rest will be building on Solana and posting threads about it to 47 followers.

Crypto World

Here’s why Ethereum price may hit $1,500 first before $2,500

Ethereum price was stuck below the important support of $2,000 today, February 16, as it erased the gains made during the weekend.

Summary

- Ethereum price may be at risk of falling to the key support at $1,500.

- It has formed a bearish pennant pattern on the daily timeframe chart.

- The bearish catalysts have outweighed the bullish one.

Ethereum (ETH) token was trading at $1,980, down substantially from its all-time high of $4,960. Technical analysis suggests the coin will likely drop to the key support at $1,500 before hitting the psychological $2,500 level.

Ethereum price technical analysis suggests a retreat to $1,500 is likely

The daily timeframe chart shows that ETH price remains in a technical bear market after falling by 60% from its all-time high. It is slowly forming a bearish pennant pattern, consisting of a vertical line and a symmetrical triangle.

It has completed forming the flagpole line and is now in the triangle section, whose two lines are about to converge. In most cases, a bearish breakout normally happens when these two lines are about to meet.

ETH price has remained below all moving averages and the 78.6% Fibonacci Retracement level. It has also moved below the strong pivot, reverse level of the Murrey Math Lines.

Therefore, the most likely ETH price prediction is bearish, with the initial target at the psychological $1,500 level, a few points above its lowest level in April last year.

The bearish outlook is also supported by a Polymarket poll, which places the odds of it falling to $1,500 this year at 72%.

ETH price to drop as demand wanes

The main reason why ETH price may crash to $1,500 first is that demand has remained thin in the past few months. A good example of the waning demand is the ongoing happenings in the futures market, where open interest has dropped to $23 billion, its lowest level since 2024. It has crashed from last year’s high of nearly $70 billion.

Spot Ethereum ETF outflows have continued this month. These funds have shed over $326 million in assets this month, the fourth consecutive month in the red. They have lost over $2 billion in assets in the last four months.

These bearish catalysts have outweighed the positive Ethereum news. For example, the staking queue has jumped to a record high, with the staking ratio hitting the key milestone of 30%.

The supply of ETH on exchanges has dropped to a record low, while transactions, fees, and active addresses have soared. Ethereum has also become the most preferred chain for the booming real-world asset tokenization industry.

Crypto World

Bitcoin Bullish Analysis Eyes a Trip to $75,000 This Week

Bitcoin (BTC) starts a new week at an important crossroads as analysis sees the chance for a new short squeeze

-

Bitcoin closes the week above a key 200-week trend line, leading to fresh belief in a trip to $75,000.

-

Liquidations stay elevated, with a trader noting that longs should be in the driving seat going forward.

-

US inflation data piles up, saving risk-asset volatility for later in the week.

-

Bitcoin onchain profitability data paints a dangerous picture, with the net unrealized profit and loss ratio hitting three-year highs.

-

Loss-making UTXOs suggest that Bitcoin may be at the start of a new bear market.

Bitcoin faces 2024 range and “a lot of uncertainty”

Bitcoin saw a surprisingly calm weekly candle close Sunday, but traders know the significance of the current price range.

At around $68,800 on Bitstamp, per data from TradingView, the weekly close came in above a key long-term trend line that will be key to future upside.

Currently at $68,343, the 200-week exponential moving average (EMA) forms one of two nearby lines in the sand for market participants. The other is Bitcoin’s old all-time high from 2021 at just over $69,000.

“We’re back inside an old important range that kept price for 7 months!” trader CrypNuevo wrote in his latest X analysis.

CrypNuevo referenced the extended rangebound construction focused around the $69,000 mark that BTC/USD formed in 2024.

He noted that last week, the pair filled almost half of its wick to 15-month lows from earlier in February — something that could have significance for the broader price trend.

“So Bitcoin might range here for some time, meaning that price could test the range lows,” the analysis continued.

“Only if: 1. Bitcoin drops back to the 50% wick-fill level (signal for 100% wick-fill). 2. Acceptance below 100% wick.”

CrypNuevo flagged a rebound to $75,000 as the move that could trigger a “surprise recovery,” adding that Bitcoin “tends to do the opposite of the market sentiment.”

“A lot of uncertainty for the upcoming week. Also, Monday is bank holiday in the US so expecting irregular volatility (probably low volatility that day),” he concluded.

Crypto liquidations run high around $70,000 BTC

Despite the relative lack of BTC price volatility since the recovery from $59,000 lows, the market remains highly sensitive to even smaller moves.

This is reflected in elevated liquidations across crypto, with both long and short positions close to spot price being repeatedly erased.

Data from monitoring resource CoinGlass puts the total liquidation tally for the 24 hours to the time of writing at over $250 million. During that time, BTC/USD acted within a range of less than $3,000.

CoinGlass now shows traders doubling down on long BTC positions immediately below $68,000 as the week begins.

Commenting, trader CW said that these would now become the next target for whales.

CW had some potential good news for bulls, with longs still prevailing in the current market setup.

“Despite significant liquidation of $BTC long positions, longs remain dominant. Expectations for a bullish trend remain intact,” they told X followers.

On Friday, as BTC/USD spiked past $70,000 around the Wall Street open, short liquidations even beat recent records. At 10,700 BTC, the short liquidation tally reached its highest daily reading since September 2024.

“If spot demand follows, this squeeze could be the first sign the downside trend is running out of steam,” crypto exchange Bitfinex wrote in an X reaction.

PCE and GDP lead volatile macro week

With US markets closed for the Presidents’ Day holiday on Monday, key economic data — and any associated risk-asset volatility — will come later in the week.

Chief among the upcoming releases is the Personal Consumption Expenditures (PCE) Index, known as the Federal Reserve’s “preferred” inflation gauge. Q4 GDP data is due the same day, Friday.

PCE is due out at a key moment for Fed policy — recent inflation numbers have given a mixed picture of economic conditions, leading to uncertainty in the markets. Expectations of the Fed returning to policy loosening at its March meeting remain low, despite last week’s Consumer Price Index (CPI) coming in below expectations.

According to CME Group’s FedWatch Tool, the odds that officials will hold interest rates at current levels next month remain over 90%.

“Expect more volatility this week,” trading resource The Kobeissi Letter told X followers while summarizing the upcoming macro events.

“Meanwhile, geopolitical tensions remain and macroeconomic uncertainty is elevated.”

In the latest edition of its regular newsletter, The Market Mosaic, analytics resource Mosaic Asset Company additionally focused on last week’s US employment report as a potential headache for the Fed.

“The report is clouding the outlook for further rate cuts by the Federal Reserve, with market-implied odds pointing to two quarter-point rate cuts later this year. However, the 2-year Treasury yield that leads changes in the fed funds rate is near the low end of the current fed funds range and suggests no cuts at all,” it noted.

Analysis puts spotlight on mid-$50,000 zone

In fresh market research issued on Monday, onchain analytics platform CryptoQuant said that future BTC price bottoms will increasingly rely on “investor resilience.”

Looking back at the first half of February, contributor GugaOnChain warned that a showdown could occur at the confluence of two key price points below $60,000.

Here, Bitcoin’s 200-week simple moving average (SMA) meets its overall realized price — the aggregate level at which the supply last moved onchain.

“Bitcoin’s 50% collapse toward the 200-period moving average on the weekly timeframe — which converge with the region of its realized price at $55,800 — will be a significant test, besides being seen by analysts as a region conducive to accumulation,” GugaOnChain wrote in a Quicktake blog post.

“However, the turn toward recovery now depends on investor resilience.”

The research also pointed to comparatively low values on the net unrealized profit/loss (NUPL) indicator — a yardstick for overall BTC holdings’ profitability.

NUPL currently measures 0.201, having bounced from lows of 0.11 seen on Feb. 6. The latter reading represents the indicator’s lowest since March 2023.

GugaOnChain described NUPL as being “in the fear region.”

Bitcoin may still lack “real bottom”

Other onchain profitability data goes further, and warns that the current BTC price dip may be just the start of a “regime change.”

Related: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest, Feb. 8 – 14

Here, CryptoQuant leveraged the adjusted spent output profit ratio (aSOPR) — a metric that measures the proportion of coins moving onchain at higher levels compared to their previous transaction.

aSOPR discards coins that moved more than once in a one-hour time frame, helping to remove “noise” from transactions that do not necessarily imply a loss for the holder.

On Feb. 6, the metric dropped below its breakeven level of 1, implying realized losses on a scale not seen since 2023 and the end of Bitcoin’s last bear market.

“In 2019 and 2023, similar readings occurred during deep corrective phases where coins were being spent at a loss,” contributor Woo Minkyu commented in another Quicktake post.

“Each time, this zone represented capitulation pressure and structural reset. Now, aSOPR is again pressing into that same region.”

Woo described current market structure as one that “resembles prior bear transition phases.”

“Unlike mid-cycle pullbacks where aSOPR quickly reclaims 1.0, this move shows sustained weakness and loss realization. If aSOPR fails to reclaim 1.0 soon, this increases the probability that we are not in a simple correction — but transitioning into a broader bear phase,” he warned.

aSOPR currently measures 0.996, having managed only brief spikes above breakeven over the past month.

“aSOPR is signaling structural deterioration. This looks less like a dip, and more like a regime shift,” Woo concluded.

“The real bottom may still require deeper compression before a durable reversal forms.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

ETH Chart Pattern Signals Rally to $2.5K If Key Conditions Align

Ether began the week trading beneath the psychological $2,000 level, extending February losses to roughly a fifth of the month’s value. Yet on-chain indicators point to a strengthening undercurrent: long-term holders continue to accumulate, while network activity trends higher. With price pressure easing, analysts are assessing whether ETH’s technical footprint and the shape of derivatives data can align with a renewed demand narrative that could sustain a rally above the $2,000 mark.

Key takeaways

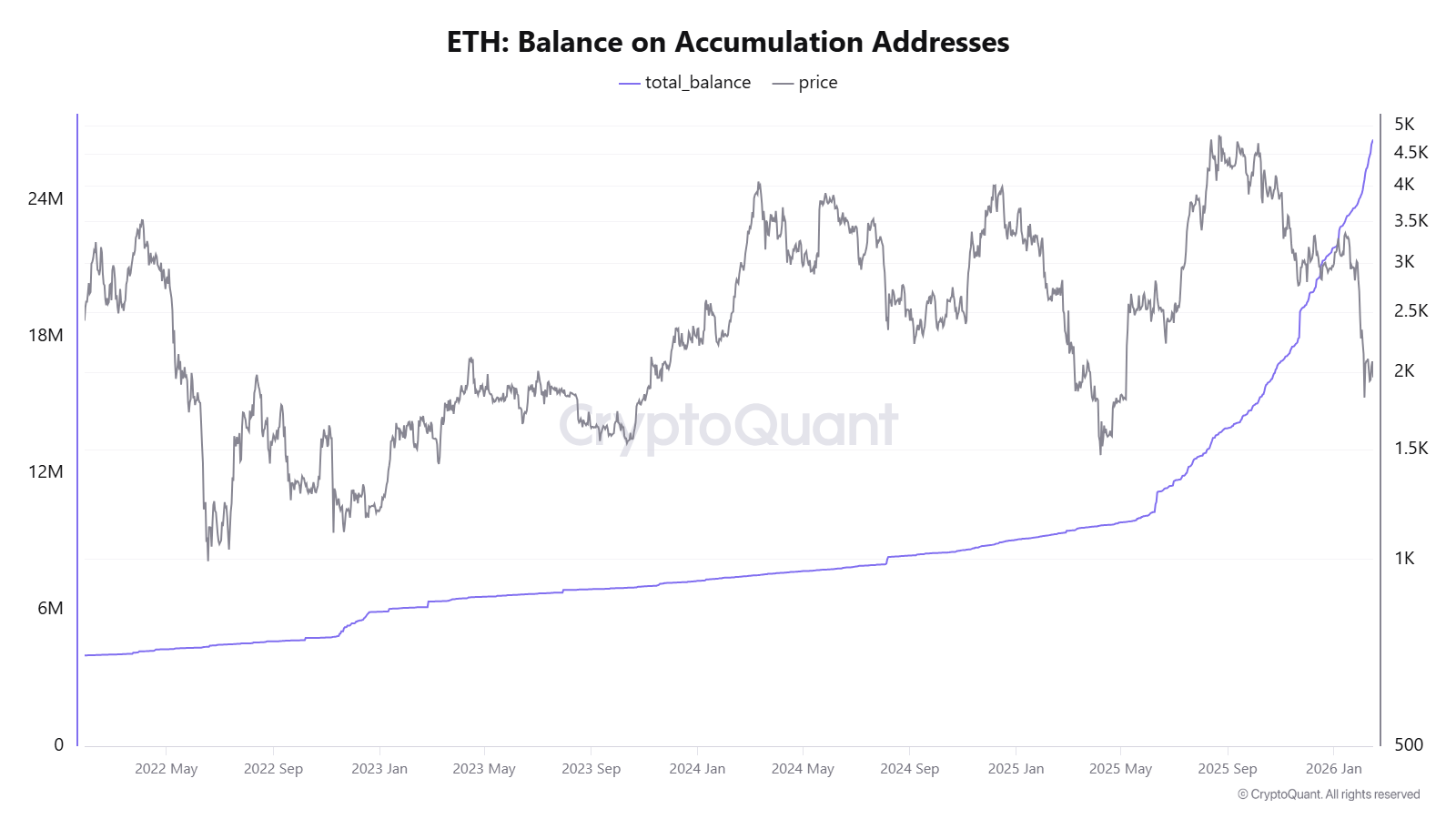

- Accumulation addresses added more than 2.5 million ETH in February, lifting total holdings to 26.7 million ETH for 2026.

- Ethereum’s weekly transaction count climbed to 17.3 million, while median fees slipped to $0.008, a difference of several thousand-fold from peaks in 2021.

- Approximately 30% of circulating ETH is staked, shrinking the liquid supply and potentially supporting prices over time.

- Open interest dipped to about $11.2 billion from a late‑2025 peak, yet leverage remains elevated, signaling sustained risk-taking in the derivatives market.

- Derivatives and liquidity analytics point to stacked short-liquidation zones above $2,200 and a relatively large concentration near $1,909, underscoring the potential for a liquidity-driven move if a breakout occurs.

Tickers mentioned: $ETH

Market context: The combination of rising on-chain activity and persistent leverage suggests traders are positioning for larger moves even as spot liquidity remains cautious. A break above key levels could hinge on continued accumulation signals and the evolution of open interest across major futures markets.

Why it matters

From a network fundamentals perspective, the Ethernet ecosystem is showing a paradox: price weakness coexists with strengthening usage and capital inflows. Ether (CRYPTO: ETH) as a modular asset remains central to longer-term narrative themes — digital assets that host decentralized applications, staking, and layer-2 activity — even as macro uncertainty and rate expectations shape near-term price action. The latest on-chain data implies that the supply outlook has shifted decisively through staking and active addresses, which can influence price dynamics after problematic months for risk assets overall.

On the supply side, the blockchain’s staking dynamic reduces the amount of ETH readily available for trading. CryptoQuant data indicate that a substantial portion of circulating ETH is currently staked, which tightens the floating supply and could amplify price sensitivity to demand shifts. This trend dovetails with a broad interest in ETH as a proxy for continued growth in decentralized finance and layer-2 scaling, where throughput, efficiency, and transaction costs are under scrutiny by developers and capital allocators alike.

In terms of user activity, the February surge in accumulation activity reflects a deliberate stance by long-hold participants to increase exposure in anticipation of future price catalysts. While price remains under the $2,000 ceiling, the balance of on-chain metrics — including rising transaction volumes and a growing share of ETH held by non-exchange addresses — paints a portrait of a market that is slowly recalibrating risk premia rather than capitulating to selling pressure. This dynamic matters for market participants who rely on a combination of price action and fundamental signals to gauge the sustainability of any new leg higher.

From a trading-ecosystem lens, the four-hour chart interpretation has attracted attention: the Adam and Eve bottom pattern, commonly cited as a bullish reversal framework, suggests an initial sharp decline followed by a broad base forming at lower prices. If Ether can clear the neckline around $2,150, traders anticipate a measured move that could carry prices toward the $2,473–$2,634 range, with the caveat that invalidation would come from ongoing weakness below recent swing lows near $1,909. Open interest trends and leverage levels reinforce the need for careful risk management, as a high degree of speculative activity can magnify abrupt moves if momentum shifts.

The risk-reward dynamics are further colored by liquidity maps that highlight where stress could materialize. Data-driven views show sizable short liquidation clusters above $2,200, totaling more than $2 billion in potential pressure, while long liquidations cluster around $1,800, approaching a potential liquidity magnet around that price. In such conditions, traders monitor not just price levels but the distribution of leverage across key tiers, as a squeeze in one region can accelerate a move in another. The current mix of elevated leverage with a broad base of accumulation signals implies that a decisive move could be fast, but the direction will depend on macro tone and fresh demand cues rather than pure technical momentum alone.

What to watch next

- Watch for a convincing breakout above the $2,150 neckline on ETH’s four-hour chart, which would validate the Adam and Eve bottom pattern and open a path toward the upper target zone.

- Monitor open interest changes, as renewed accumulation in derivatives markets could accompany a fresh price leg higher or, alternatively, a rapid unwinding if liquidity conditions deteriorate.

- Track liquidity hotspots around $1,909 to assess whether this level acts as a temporary magnet that sustains a bounce or a new basing point for higher prices.

- Observe shifts in the proportion of ETH staked versus liquid supply, since sustained staking inflows can influence price sensitivity to demand surges.

- Keep an eye on long/short liquidation dynamics in the $2,200–$2,400 region, which could serve as a pressure valve or accelerant depending on the prevailing market sentiment.

Sources & verification

- CryptoQuant dashboards tracking accumulation addresses and total ETH staked

- Hyblock data indicating the share of global ETH accounts currently long

- CoinGlass liquidation heatmaps showing clusters of long and short liquidations

- TradingView ETH/USDT chart illustrating the four-hour pattern and neckline levels

Ether price action and on-chain signals in focus

Ether (CRYPTO: ETH) is navigating a delicate balance between price weakness and on-chain strength. The February acceleration of accumulation addresses, with the total rising to 26.7 million ETH, points to a durable base of holders adding exposure even as spot prices traded below $2,000. The circulating supply, of which more than 30% is staked, underscores a structural shift in supply dynamics that could temper abrupt selling pressure during muscular market moves. Meanwhile, daily and weekly activity levels — ETH’s weekly transaction count cresting at 17.3 million — indicate persistent activity, even as average fees compress to a fraction of earlier cycles. This combination of rising on-chain demand and a tightening liquid supply sets the stage for a potential rebound should macro catalysts align with technical breakouts.

From a risk-management perspective, the derivatives market remains a critical barometer. Open interest has contracted from its previous cycle peak, echoing a shift in risk appetite, yet leverage metrics hold at elevated levels. The implication for traders is straightforward: while a break above key resistance could unleash a rapid move higher, a downturn could trigger rapid liquidations given the clustering around pivotal price points like $1,909 and $2,200. The balance of signals — a rising active address base, meaningful staking, and a finite liquidity pool — suggests that further price discovery is likely to be data-driven, with on-chain metrics offering a more durable cross-check for price action than short-term sentiment alone.

Crypto World

Binance Rejects Claims of Iran-Linked Transactions and Staff Firings

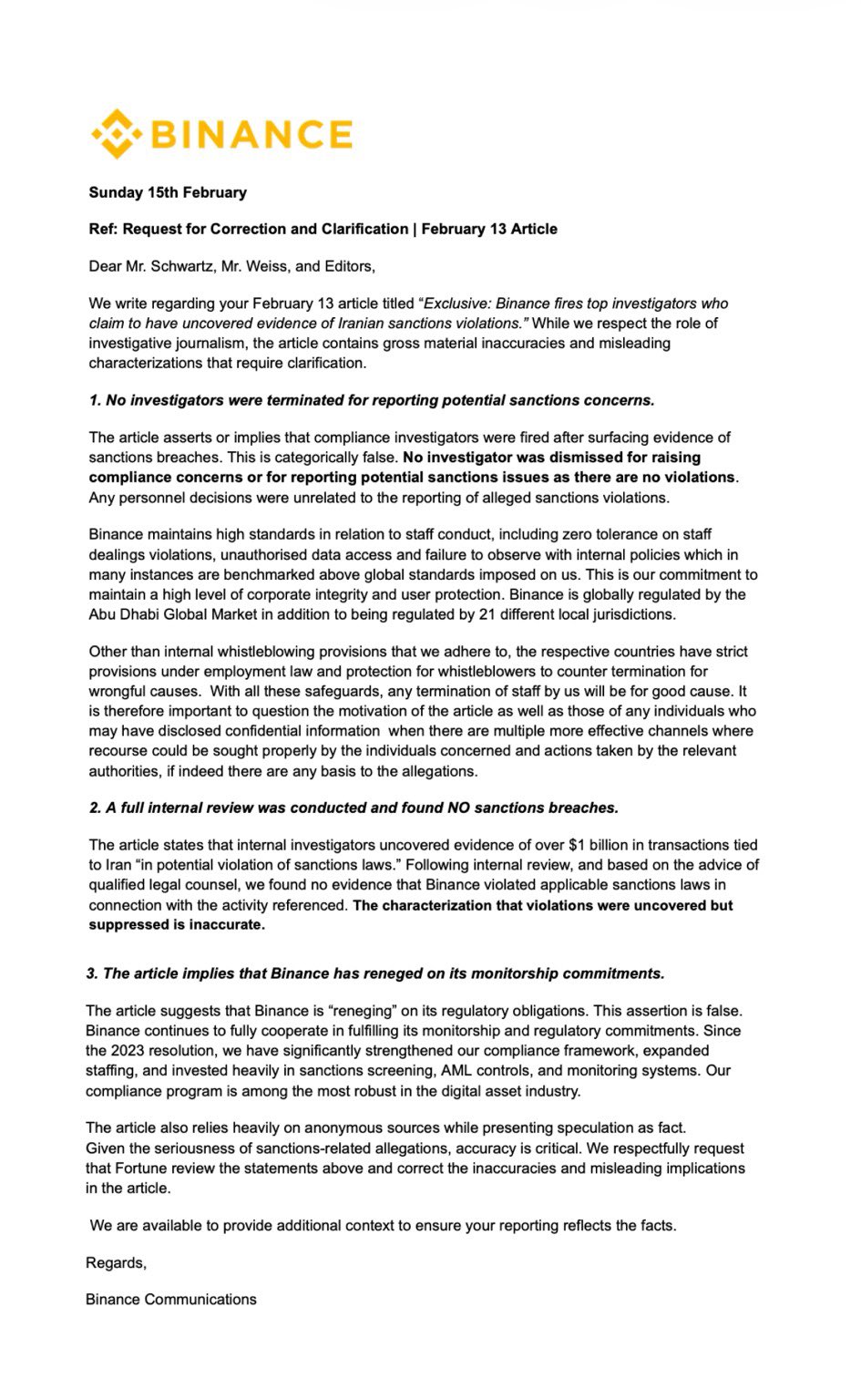

Crypto exchange Binance pushed back against a recent report by Fortune, rejecting allegations that it enabled sanctions-violating transactions tied to Iran and fired compliance investigators who raised concerns.

Fortune reported Friday that internal investigators at Binance discovered more than $1 billion in transfers linked to Iranian entities moving through the platform between March 2024 and August 2025. The transactions were said to involve Tether’s USDt (USDT) stablecoin on the Tron blockchain.

Citing unidentified sources, the report claimed that at least five investigators, several with law-enforcement backgrounds, were later fired after documenting the activity. The outlet also reported that additional senior compliance staff had departed the company in recent months.

Binance disputed the characterization in a formal response. “This is categorically false. No investigator was dismissed for raising compliance concerns or for reporting potential sanctions issues as there are no violations,” the exchange wrote in an email shared by CEO Richard Teng.

Binance denies sanctions violations after internal review

Binance said it conducted a full internal review with outside legal advice and found no evidence it had violated applicable sanctions laws in connection with the referenced activity. It also rejected the suggestion that the exchange failed to meet its regulatory obligations under ongoing oversight.

Related: Binance confirms employee targeted as three arrested in France break-in

The dispute lands as Binance remains under heightened scrutiny since its 2023 settlement with US authorities in which it agreed to pay $4.3 billion for Anti-Money Laundering (AML) and sanctions violations. Founder Changpeng Zhao stepped down as CEO and later served a four-month prison sentence. Binance also agreed to being monitored and pledged to strengthen compliance controls.

Binance denied claims it is failing to meet regulatory obligations, saying it continues to cooperate under monitoring and oversight requirements. “The article suggests that Binance is “reneging” on its regulatory obligations. This assertion is false,” the exchange said.

Binance acknowledged Cointelegraph’s request for comment, but had not responded by publication.

Related: Binance completes $1B Bitcoin conversion for SAFU emergency fund

FT report questions Binance compliance controls

A December report by the Financial Times also claimed that Binance allowed a group of suspicious accounts to move significant sums through the exchange even after its US criminal settlement in 2023. Internal data reviewed by the publication showed 13 such user accounts had about $1.7 billion in transactions since 2021, including about $144 million after the plea agreement.

“We take compliance seriously and reject the framing of the Financial Times report,” a Binance spokesperson told Cointelegraph at the time, adding that all transactions are assessed “based on information available at the time,” and that none of the wallets referenced were sanctioned when the activity referenced occurred.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Will Bitcoin Price Drop to $50,000 by March 2026?

Bitcoin is trading around $68,700, down nearly 22% year to date and on pace for its weakest first quarter since 2018. After starting the year near $87,700, BTC has shed almost $20,000 in just a few weeks, putting pressure on the broader crypto market.

While early-year weakness is not unusual for Bitcoin, the scale of the decline has raised concerns that the current correction may not be over yet.

Sponsored

Sponsored

Worst First Quarter in 8 Years?

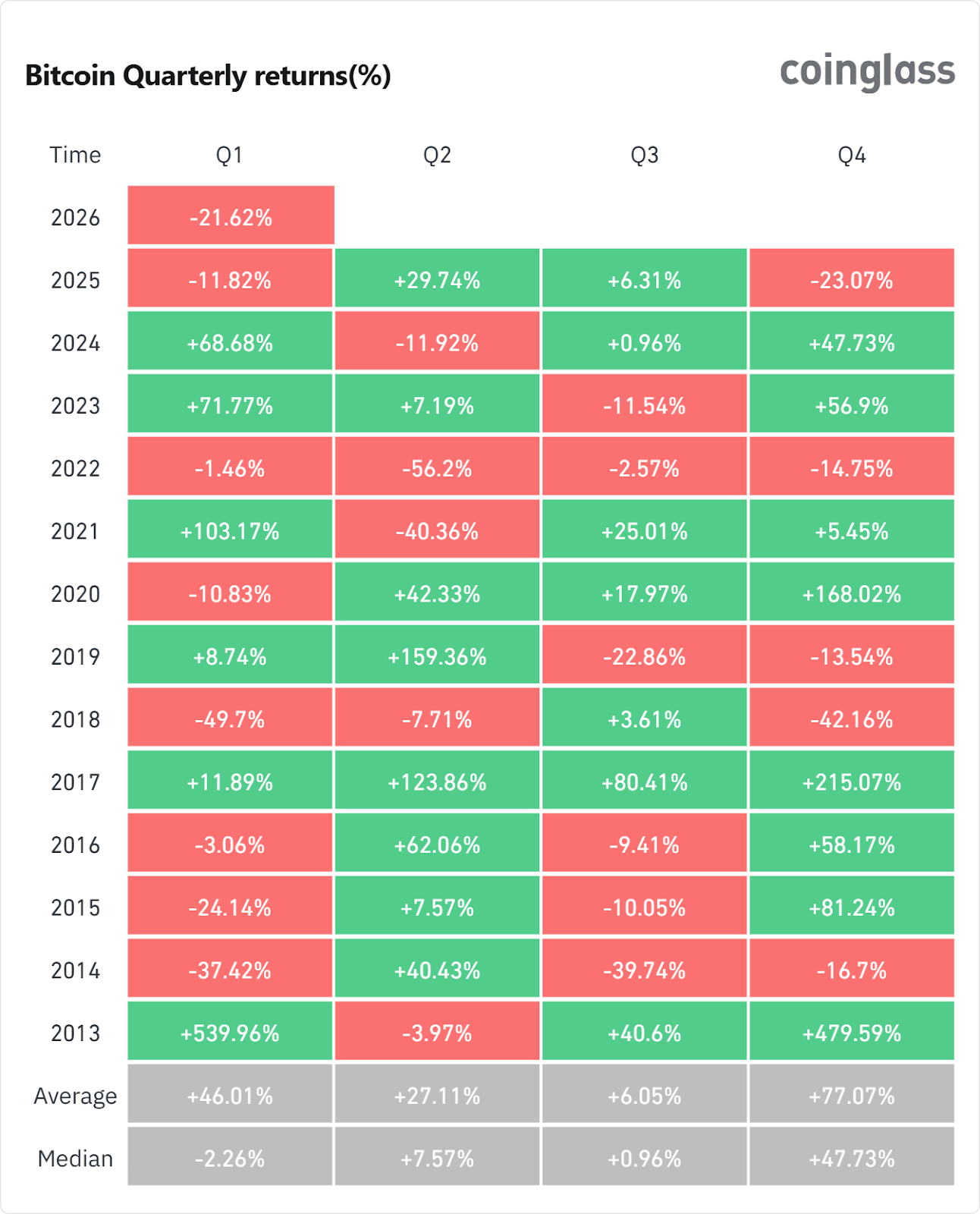

Historically, Bitcoin has posted a negative first quarter in 7 of the past 13 years.

However, a 22% drawdown would mark its worst Q1 performance since the 2018 bear market, when BTC plunged nearly 50% in the opening months of the year.

January and February both closed in the red, increasing the likelihood of a rare back-to-back negative start.

To meaningfully shift the narrative, Bitcoin would need to reclaim the $80,000 region, which currently appears distant given prevailing momentum.

That said, history shows that weak first quarters do not necessarily define the full year. In eight of the past thirteen years, Q2 delivered the opposite performance of Q1.

This keeps the medium-term outlook more nuanced than the headlines suggest.

9% Bounce May Have Increased Downside Risk

Between February 12 and February 15, Bitcoin staged a sharp 9% rebound. On the surface, the move appeared constructive. Underneath, leverage data tells a different story.

Sponsored

Sponsored

Open interest in BTC futures jumped from roughly $19.6 billion to $21.47 billion during the rebound, an increase of nearly $1.9 billion.

Funding rates also turned strongly positive, signaling that traders were aggressively positioning for further upside.

However, the broader chart structure still resembles a bear flag. The recent rally unfolded within a downward continuation pattern, and price is now drifting back toward the lower boundary of that structure.

Momentum indicators add to the caution. A hidden bearish divergence formed on the 12-hour chart, with price making a lower high while RSI printed a higher high. This pattern often appears when sellers are quietly regaining control.

At the same time, Bitcoin’s Net Unrealized Profit/Loss surged by roughly 90% over several days, indicating that many holders quickly returned to paper profits.

Similar profit spikes in early February preceded a 14% drop. If traders rush to lock in gains again, selling pressure could accelerate.

Sponsored

Sponsored

Key Levels: $66K Support, $58K Downside Target

Technically, the $66,270 area is a critical near-term support. A confirmed breakdown below this zone would activate the bear flag continuation pattern.

If that happens, the next major downside target sits near $58,800, aligning with the 0.618 Fibonacci retracement and representing roughly a 14% decline from current levels.

A deeper extension could bring the $55,600 region into play.

On the upside, BTC needs to reclaim $70,840 to stabilize short term. A stronger breakout above $79,290 would invalidate the bearish structure and signal that buyers have regained control.

Sponsored

Sponsored

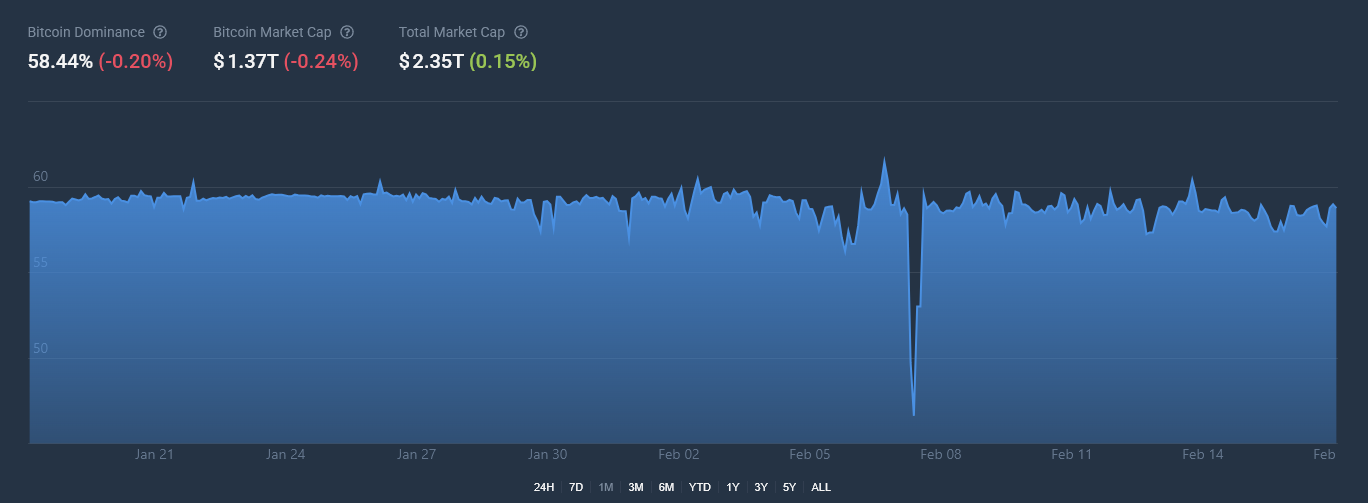

Bitcoin Dominance and Treasury Companies Offer Mixed Signals

Beyond price action, broader market metrics paint a complex picture. Bitcoin dominance remains elevated near 58.5%, suggesting capital continues to favor BTC over altcoins during this correction. That relative strength often appears in defensive market phases.

Meanwhile, public Bitcoin treasuries continue to hold substantial Bitcoin reserves. Data from BitcoinTreasuries shows over 1.13 million BTC collectively held by public firms, led by large corporate holders.

The largest of these holders is Strategy, which holds 3.27% of the total Bitcoin supply. While this structural demand does not prevent short-term volatility, it reinforces Bitcoin’s long-term institutional footprint.

Bitcoin is caught between historical resilience and near-term technical weakness.

The 22% year-to-date drop puts Q1 on track for an unenviable record.

Meanwhile, leverage, divergence signals, and on-chain profit metrics suggest that downside risk toward $58,000 cannot be ruled out.

At the same time, elevated dominance and continued corporate accumulation highlight that the broader structure is under pressure, but not yet broken.

The coming weeks will likely determine whether this is simply another rotational phase within a larger cycle or the start of a deeper corrective leg.

Crypto World

Metaplanet Revenue Jumps 738% as Bitcoin Accounts for 95% of Income

Japanese public company Metaplanet reported explosive revenue growth after pivoting its business around Bitcoin, with the cryptocurrency now accounting for most of its operating activity.

According to its fiscal year 2025 earnings report, revenue climbed to 8.9 billion Japanese yen ($58 million) from $7 million a year earlier, a 738% year-on-year increase. The surge followed the launch of the company’s Bitcoin (BTC) income operations.

“We launched the Bitcoin Income business in Q4 2024. Since then, this strategy has become our primary revenue source and is expected to remain a core driver of profit growth,” the company wrote.

A revenue breakdown shows about 95% of total income came from Bitcoin-related operations, largely generated through premium income from BTC options transactions. The company only began the segment in late 2024, replacing traditional business lines such as hotel and media activities as the core of its financial model.

Related: Metaplanet sticks to Bitcoin buying plan as crypto sentiment hits 2022 lows

Bitcoin price drop pushes Metaplanet into loss

Operating profit reached about $40 million, but the company still posted a net loss of roughly $619 million. The loss stemmed from accounting rules. Since Metaplanet holds large Bitcoin reserves, it must reflect price swings on its financial statements, and a more than $664 million valuation drop erased the year’s operating income.

The company has aggressively accumulated Bitcoin amid the business shift. Holdings increased from 1,762 BTC at the end of 2024 to 35,102 BTC by the end of 2025, making it the largest corporate Bitcoin holder in Japan. The company has also raised more than $3.2 billion in capital since adopting its treasury strategy.

Metaplanet described its model as a long-term Bitcoin treasury approach, aiming to “acquire and hold Bitcoin permanently to hedge against fiat currency dilution and benefit from long-term value appreciation.”

The company expects growth to continue next year, forecasting revenue of about $104 million and operating profit of $74 million.

Related: Metaplanet lifts 2026 revenue outlook despite $680M Bitcoin impairment

Metaplanet CEO reaffirms Bitcoin strategy despite market selloff

Earlier this month, Metaplanet CEO Simon Gerovich said the company will stick with its Bitcoin-focused approach even as the broader crypto market undergoes a sharp downturn. In a post on X, he stated there would be no shift in direction despite recent volatility.

Last month, the company also approved an overseas capital raise of as much as $137 million to expand its Bitcoin holdings and reduce debt.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Collapse of World Order Puts Permissionless Money in the Spotlight

Ray Dalio warned that the post-World War II order has “officially broken down,” with the world now sliding into what he bluntly calls a “law of the jungle” phase, where power, not rules, decides outcomes, and crypto investors are using the moment to renew the case for assets designed to operate outside state control.

In his latest article on X describing both internal and external disorder, the Bridgewater Associates founder wrote that great powers are now locked in a persistent “prisoner’s dilemma.” They must either escalate or look weak across trade, technology, capital flows and, increasingly, military flashpoints, making what he calls “stupid wars” frighteningly easy to trigger.

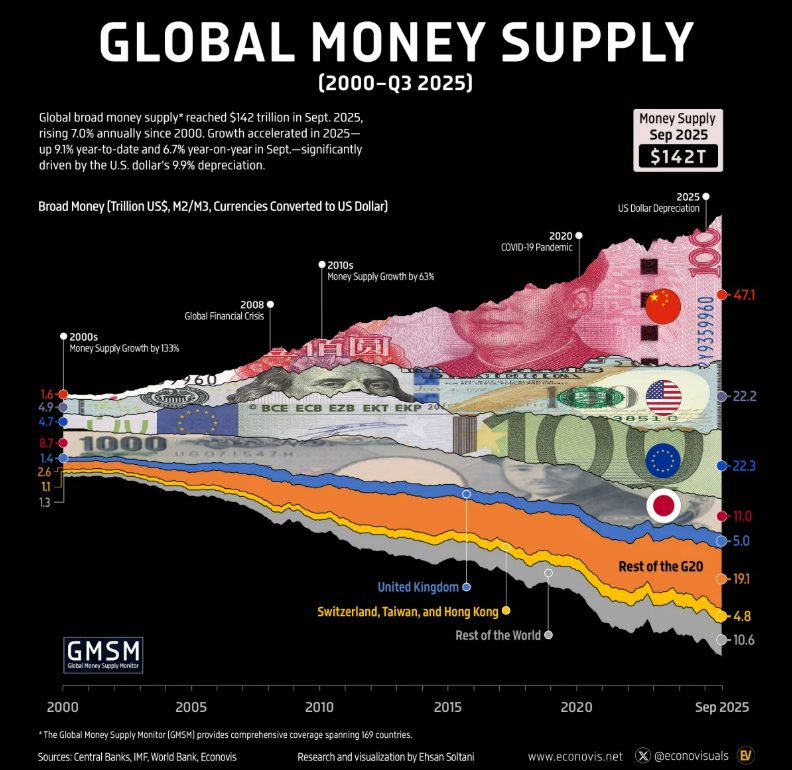

That external disorder tends to collide with internal stress, Dalio said. When economies are under strain and wealth gaps are wide, governments reliably reach for higher taxes and “big increases in the supply of money” that devalue existing claims rather than pushing explicit defaults.

That combination is exactly the type of environment in which apolitical assets like Bitcoin (BTC) and gold have typically thrived. The pitch from crypto advocates is straightforward: As governments lean more heavily on sanctions, asset freezes and money creation, investors will look harder at assets that can be held and transferred without relying on a bank or a state-backed payments system.

Liquidity data fuels hard assets

Data from Econovis found that global broad money climbed to an estimated $142 trillion in 2025 from $26 trillion in 2000.

According to ex-fund manager Asymmetry, every major BTC rally has coincided with M2 expansion, and “the next wave is building.”

Gold prices have also generally tracked the US M2 money supply, reflecting the precious metal’s status as a traditional hedge against monetary expansion.

Related: ‘No privacy’ CBDCs will come, warns billionaire Ray Dalio

A bull case for neutral money

Dalio’s framework also emphasizes how states use asset freezes, capital market bans and embargoes as standard tactics, showing how dependent traditional savings and payments are on political discretion and jurisdictional risk, and placing the case for an apolitical, borderless money front and center.

Bitwise CEO Hunter Horsley captured the crypto community’s thoughts in a single comment, saying, “Is anyone working on global, permissionless, apolitical monetary assets and financial rails?? Could be important.”

Asymmetry made a similar point from the portfolio side, arguing that the setup Dalio is describing, a fracturing world order layered on top of what macro analysts such as Lyn Alden or Luke Gromen call fiscal dominance, where government borrowing needs effectively dictate central bank policy, is among the “most structurally bullish backdrop for hard assets in 80 years.”

Still, Dalio’s warning is not a direct forecast for Bitcoin, and the investment case for crypto remains sensitive to a wide range of factors, including interest rates, regulation, market liquidity and risk appetite. What his latest comments do provide is a clear macro narrative that many in the crypto market are using to argue that demand for “neutral money” could increase as the world becomes more fractured.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?

Crypto World

Cardano price chart points to more downside as key ecosystem metrics plunge

Cardano price was stuck in a tight range on Monday, mirroring the performance of other cryptocurrencies.

Summary

- Cardano price continued its strong downward trend on Monday.

- Data shows that Cardano’s ecosystem growth has stalled.

- The team is now pegging its hope on the upcoming Midnight mainnet launch.

Cardano (ADA) was trading at $0.2815, stuck within a range it has been in for the past few days. It has dropped by nearly 80% from its highest point in November 2024.

Data compiled by DeFi Llama shows that Cardano’s ecosystem has continued to deteriorate over the past few weeks. Its decentralized finance ecosystem has continued to wane, with the total value locked falling by 26% in the last 30 days to $134 million.

Cardano has not added any new developers this year, even after securing a partnership with Pyth Network, one of the biggest oracles in the crypto industry. Pyth helps to bring off-chain data, such as price feeds, to the on-chain in an accurate way.

Adding more oracles to Cardano is one of the Pentad proposal’s top priorities, launched last year.

Cardano’s stablecoin ecosystem has also stalled. Its stablecoin supply stands at just $37 million, a tiny amount in an industry with over $300 billion in assets. The top stablecoins in the ecosystem are low-tier tokens like Moneta, Anzens, Djed, and iUSD.

Meanwhile, data compiled by CME show that the initial reception of the recently launched ADA futures has been weak, with the open interest being much lower than other tokens like Bitcoin and XRP.

Cardano is pegging its turnaround on Pentad and the upcoming Midnight mainnet launch, which will happen in the final week of March. Midnight will be a privacy-focused sidechain on Cardano, which is expected to attract more developers in the ecosystem.

Cardano price technical analysis

The daily timeframe chart shows that ADA price has been in a strong downward trend in the past few months, a move that has cost investors billions of dollars, with its market capitalization falling to over $10 billion.

Cardano has moved below the important support level at $0.3040, its lowest level in July and September 2024. It also remains below all moving averages, while the Percentage Price Oscillator remains below the zero line.

Therefore, the most likely Cardano price prediction is bearish, with the initial target being the year-to-date low of $0.2255. A drop below that level will indicate further downside toward the key support level at $0.200.

Crypto World

Fintech Company Secures Regulatory Approval in HK

The addition is the first crypto company to be licensed by the Securities and Futures Commission since June 2025, when the regulator approved Hong Kong BGE.

Hong Kong’s Securities and Futures Commission (SFC) has added another company to its list of formally licensed cryptocurrency trading platforms, according to a Friday announcement.

The SFC’s list of licensed virtual asset trading platforms includes Victory Fintech Company Limited as the latest of now 12 cryptocurrency and blockchain entities on the Hong Kong regulator’s website. The addition of Victory marked the first time since June 2025 that the SFC had approved a crypto trading platform in Hong Kong.

Although Hong Kong has been known for some time as a particularly strict jurisdiction in for crypto companies to operate in, authorities have been pursuing unlicensed virtual asset trading platforms as a criminal offense since June 2024. Many exchanges that had previously been operating in Hong Kong shut down, while others like OKX and Bybit withdrew their licensing applications.

Related: Crypto funds log fourth week of outflows at $173M as BTC dips below $70K

In January, Hong Kong’s Secretary for Financial Services and the Treasury, Christopher Hui, said regulators, including those at the SFC, were planning to submit a draft ordinance for providers offering crypto advisory services sometime in 2026. While a dozen companies are now licensed under the SFC, Hong Kong’s Monetary Authority listed no licensed stablecoin issuers as of Monday.

HK allows licensed companies to engage in crypto margin financing, perpetual trading

The addition of Victory Fintech came just a few days after Hong Kong’s SFC said it will allow licensed brokers to provide virtual asset margin financing. The securities regulator’s guidance only allows Bitcoin (BTC) and Ether (ETH) to be eligible as collateral, initially.

The SFC also outlined a framework for trading platforms to offer perpetual contracts to professional investors.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Ether May Retest $2.5K Soon If This Pattern Plays Out

Ether (ETH) opened the week with a drop below the psychological $2,000 level, placing the altcoin into a 20% loss for February. Still, onchain data shows long-term investors accumulating ETH and rising network usage.

Now, analysts are examining how ETH’s technical outlook and the derivatives data align with its emerging demand to determine if a prolonged rally above $2,000 is possible.

Key takeaways:

-

Over 2.5 million ETH flowed into accumulation addresses in February, lifting holdings to 26.7 million for 2026.

-

Ethereum weekly transactions hit 17.3 million as the median fees fell to $0.008, a 3,000x drop from 2021 peaks.

-

ETH open interest dropped to $11.2 billion, but leverage remains elevated, with liquidation clusters stacked near $1,909 and $2,200.

Ether accumulation grows despite price drop

Ether accumulation addresses added more than 2.5 million ETH in February, even as the price declined about 20%. Total holdings have risen to 26.7 million ETH, up from 22 million at the beginning of 2026.

MN Capital founder Michaël van de Poppe noted that ETH valued against silver is at its lowest level on record, arguing that such difficult market phases often present a long-term accumulation window.

The network demand is also improving alongside improving fundamentals. Over 30% of ETH’s circulating supply (37,228,911 ETH) is currently staked, reducing the liquid supply. At the same time, weekly transaction count reached an all-time high of 17.3 million, while median fees fell to $0.008.

In comparison, head of research at Lisk, Leon Waidmann, noted that the weekly transactions were near 21 million, but the median fees surged above $25 during the 2021 peak. The current structure reflects a higher usage at significantly lower cost.

Related: Harvard endowment reduces stake in Bitcoin ETF, adds Ether exposure

ETH compresses below $2,000 as leveraged traders brace for a breakout

On the four-hour chart, Ether appears to be forming an Adam and Eve bottom, a bullish reversal setup that begins with a sharp, V-shaped low (the “Adam”) followed by a slower, rounded base (the “Eve”).

The structure reflects an initial aggressive sell-off that quickly finds buyers, then a period of gradual accumulation as the volatility contracts.

A confirmed breakout above the $2,150 neckline validates the pattern and may open the door toward the $2,473–$2,634 region, based on the measured move projection from the base. The invalidation remains below recent higher lows, with $1,909 acting as a key short-term liquidity level.

Open interest has declined to $11.2 billion from a $30 billion cycle peak in August 2025. However, the estimated leverage ratio remains elevated at 0.7, only slightly down from 0.77 in January. This suggests leverage is still concentrated in the system, increasing the possibility of a sharp move.

Hyblock data shows that 73% of the global accounts are currently long on ETH. Liquidation heatmaps show more than $2 billion in short positions clustered above $2,200, compared with roughly $1 billion in long liquidations stacked near $1,800, highlighting a heavier squeeze risk to the upside.

Although the nearest dense cluster sits at $1,909, where $563 million in longs are vulnerable, which may act as a potential short-term liquidity magnet before the expected uptrend.

Related: Crypto funds log fourth week of outflows at $173M as BTC dips below $70K

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video9 hours ago

Video9 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash