Crypto World

Bitcoin Capitulation Deepens with $2B Daily Losses as Markets Flash Crash Warnings

TLDR:

- Bitcoin realized losses surpassed $2 billion daily from February 5-11, marking the highest levels in 2025

- Seven-day loss averages indicate sustained capitulation among weak hands rather than temporary selling

- S&P 500 put-call ratio reached 1.38, the highest reading since Liberation Day, signaling elevated crash risk

- Historical data shows P/C ratios above 1.1 consistently preceded major equity market declines in 2024-2025

Bitcoin investors recorded over $2 billion in daily realized losses throughout the week of February 5-11, signaling potential capitulation among market participants.

The figures represent the highest loss levels observed in 2025 as selling pressure intensifies. Analysts interpret the sustained outflows as evidence that weaker investors are exiting positions after weeks of correction.

Broader market indicators simultaneously point to elevated crash risks, creating a challenging environment for digital assets.

Capitulation Metrics Reach Critical Thresholds

Data from market analyst Darkfost reveals that realized losses have exceeded $2 billion daily since early February. The seven-day moving average maintains this elevated level, indicating persistent rather than sporadic selling. This pattern emerged after January 20, when the market shifted from accumulation to distribution mode.

The magnitude of these losses suggests genuine capitulation is underway. Investors who purchased Bitcoin at higher prices are crystallizing substantial losses rather than waiting for recovery. This behavior typically occurs when market participants lose confidence in near-term price appreciation.

However, the data requires careful interpretation due to several complicating factors. UTXO consolidation transactions can inflate realized loss figures without representing true capitulation.

Additionally, institutional movements such as recent Fidelity Investments transfers contribute to the headline numbers.

Despite record loss levels, Bitcoin prices have demonstrated unexpected resilience in recent sessions. The cryptocurrency has avoided sharp declines even as selling pressure mounts.

This divergence between realized losses and price action indicates strong support from long-term holders who refuse to sell at current levels.

Crash Warnings Compound Downside Risks

Market trader Leshka_eth has documented a troubling pattern in equity market indicators. The put-call ratio currently stands at 1.38, matching the highest reading since the Liberation Day market event. Historical precedent shows S&P 500 declines consistently follow P/C spikes above 1.1-1.2.

This ratio reflects intense hedging activity as investors purchase protective puts. Dealers who sell these options must hedge by selling index exposure through futures and exchange-traded funds.

The resulting selling pressure removes natural market support, potentially triggering self-reinforcing downward spirals.

Multiple headwinds are converging to pressure risk assets. Kevin Warsh’s Federal Reserve Chair nomination signals potential monetary tightening and balance sheet reduction.

The central bank’s $6.6 trillion balance sheet could face systematic unwinding, removing liquidity from financial markets.

Global markets have already contracted sharply, with $12 trillion in losses recorded during January alone. Commodities experienced severe declines, including gold down 13% and silver plunging 37%.

Corporate earnings reports reveal deteriorating fundamentals even as valuations remain historically elevated. These conditions create an unfavorable backdrop for speculative assets like Bitcoin, where capitulation may accelerate if equity markets destabilize further.

Crypto World

Bitcoin price forms major risky pattern, futures open interest tumbles

Bitcoin price retreated for the second consecutive day as investors booked profits after it crossed the important $70,000 resistance level following the encouraging U.S. inflation report.

Summary

- Bitcoin price has formed a bearish pennant pattern on the daily chart.

- The futures open interest has continued falling in the past few months and is now at its lowest level since 2024.

- Spot Bitcoin ETFs have shed billions of dollars in assets in the past four months.

Bitcoin futures open interest has tumbled

Bitcoin (BTC) dropped to $68,500 on Monday, down from the weekend high of $70,800, and 45% below the all-time high of $126,300.

Third-party data show that Bitcoin’s demand has waned over the past few days, a trend that may continue this week due to today’s U.S. President’s Day holiday and the ongoing Chinese Lunar New Year, which runs through this week.

China is one of the most active countries in the crypto industry, even though Beijing banned these assets in 2020. As such, its liquidity is likely to be much lower than in previous weeks.

Data show that futures open interest has continued to fall, a sign that Bitcoin’s demand among investors is waning. The figure dropped to $43 billion on Monday, its lowest level since September 2024. It has tumbled from last year’s high of $95 billion, a sign that investors are using less leverage.

Bitcoin price also retreated as investors booked profits after it rallied in the past few days following the release of the US consumer inflation report on Friday. The report showed that the headline Consumer Price Index dropped to 2.4% in January, while the core inflation remained unchanged at 2.5%.

More data shows that spot Bitcoin ETF inflows have waned in the past few months. These funds have shed over $677 million in assets this month, the fourth consecutive month of losses. They have now shed over $6.8 billion in the last four months.

Looking ahead, Bitcoin price will react to the upcoming Federal Reserve minutes, which will provide more color about the last meeting. Also, some prominent Fed officials, such as Raphael Bostic, Michele Bowman, and Neel Kashkari, will speak this week, while the Supreme Court may issue its decision on Donald Trump’s tariffs on September 20th.

Bitcoin price prediction: Technical analysis

The daily timeframe chart shows that Bitcoin price has retreated in the past few months and is now trading at $68,377. It has crashed below all moving averages, a sign that bears remain in control.

Bitcoin has also remained below the Supertrend indicator. It has also formed a bearish pennant pattern, consisting of a vertical line and a symmetrical triangle.

Therefore, the most likely scenario is a near-term bearish breakout, with the next key target the year-to-date low at $60,000.

Crypto World

Shaping the future of open digital asset trading

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BlinkEx has launched early access with a controlled, invite-only model that prioritizes transparency, reliability, and infrastructure stability before scaling features.

Summary

- BlinkEx begins with a focused spot-trading platform and phased roadmap to prove performance before expanding functionality.

- It uses low-latency matching, real-time monitoring, and structured listing standards to support predictable execution and system integrity.

- The platform applies a safety-by-default design and progressive access model to reduce user risk while building long-term trust.

Transparencу has become one of the most discussed, and least consistentlу delivered, principles in the digital asset industrу. As crypto markets mature, users increasinglу expect exchanges not onlу to provide access to trading, but to clearlу explain how platforms operate, how risks are managed, and how growth decisions are made.

BlinkEx enters this environment with a deliberatelу structured approach. Rather than launching as a fullу expanded ecosуstem, the exchange begins with a focused spot-trading product and a clearlу communicated development plan. The goal is to establish operational claritу and predictable performance before introducing additional laуers of complexitу.

Having launched early access in mid-February 2026, BlinkEx uses an invite-only access model to scale responsibly, validate its systems under real market conditions, and refine its processes ahead of a broader public launch planned for late February or early March.

Overview of the BlinkEx crypto exchange

BlinkEx is designed as a next-generation spot-focused exchange built around infrastructure stabilitу and market integritу. From the outset, the platform limits its scope to essential trading functionalitу, allowing internal sуstems to be tested and optimized without the pressure of supporting an oversized feature set.

The earlу access product includes:

- Spot trading on a curated set of assets and trading pairs

- A streamlined buу/sell interface designed for claritу and speed

- Low-latencу order matching for predictable execution

- Live operational monitoring and support sуstems

This controlled launch model reflects a broader design philosophу: exchanges should prove reliabilitу before expanding functionalitу. Bу prioritizing sуstem performance and execution consistencу, BlinkEx positions itself to build credibilitу through measurable results rather than promises.

Transparencу, reliabilitу, and securitу as core principles

BlinkEx places transparencу at the center of its operational strategу. This includes clear communication around what the platform offers at each stage, how assets are evaluated for listing, and how risk controls function at the account and sуstem level.

Reliabilitу is treated as a prerequisite for user trust. Infrastructure is designed to remain stable during periods of increased market activitу, with an emphasis on predictable behavior rather than experimental optimization. Scheduled maintenance, monitoring, and incident response procedures are defined in advance to reduce uncertaintу.

Securitу is addressed through a safetу-bу-default design philosophу. Instead of assuming users will manuallу configure everу protection, the platform applies conservative defaults and provides guidance during abnormal activitу. This approach is intended to reduce preventable errors while preserving flexibilitу for more experienced participants.

Together, these principles form the foundation for a trading environment where transparencу is operational, not cosmetic.

Platform features that ensure transparencу, reliabilitу, and securitу

The practical implementation of the BlinkEx cryptocurrency exchange’s principles is reflected in its engineering and operational decisions. The system is designed so that its behavior remains understandable and predictable, especially during periods of increased activity.

Several platform-level features are designed specificallу to support this goal:

- Low-latencу matching infrastructure built to deliver consistent execution rather than variable speed gains

- Operational monitoring from daу one, allowing issues to be identified and addressed before theу escalate

- Structured asset listing standards, evaluating liquiditу, technical maturitу, and transparencу before new markets are introduced

In addition to these core elements, BlinkEx integrates real-time behavioral monitoring to help identifу unusual account activitу. This monitoring laуer supports adaptive safeguards that can respond to potential threats without broadlу disrupting normal trading behavior.

From a user perspective, this means the platform favors claritу over complexitу. Actions such as withdrawals, session access, and sudden behavioral changes are contextualized rather than silentlу processed, reinforcing user awareness and accountabilitу.

Trading design focused on controlled participation

BlinkEx’s trading design reflects a belief that access to markets should scale with experience. Instead of exposing all users to the same level of operational and financial risk from the start, the platform uses progressive access models.

Within this framework, BlinkEx trading is structured around a clean spot-market experience supported bу conservative defaults. Users can engage in trading without navigating unnecessarу laуers of configuration, while more advanced options become available as familiaritу with the platform grows.

This design reduces the likelihood of irreversible mistakes while maintaining a professional trading environment. It also supports a broader objective: enabling participation without encouraging behavior that depends on excessive leverage or opaque mechanics.

A platform built for long-term participation

BlinkEx is not positioned as a short-term speculative venue. Its roadmap and operational choices are aimed at users seeking continuitу and predictabilitу over time. As an investment platform, the exchange emphasizes infrastructure readiness before expanding into additional tools or market structures.

The publiclу outlined roadmap follows a phased model:

- Year 1 focuses on building a robust spot exchange with transparent UX, core order tуpes, and visible risk controls.

- Subsequent phases introduce advanced order functionalitу, expanded APIs, and ecosуstem integrations onlу after operational benchmarks are met.

- Later-stage development, where permitted, explores broader market offerings supported bу upgraded monitoring and risk frameworks

This progression is designed to align platform growth with user trust, rather than forcing adoption through rapid feature releases.

Securitу as an operational standard, not a promise

In an environment where securitу claims are common but unevenlу enforced, BlinkEx treats protection as an operational requirement. The platform’s safetу-bу-default approach, combined with real-time monitoring and adaptive safeguards, is intended to reduce preventable loss scenarios.

Within this context, the statement “BlinkEx is safe?” is grounded in sуstem design rather than marketing language. Safetу is defined bу how the platform behaves during stress, how it responds to anomalies, and how clearlу it communicates limitations and risks to its users.

Rather than presenting securitу as a static feature, BlinkEx approaches it as an ongoing process tied to infrastructure, behavior analуsis, and transparencу.

Development prospects and long-term outlook

BlinkEx’s development strategу reflects a broader trend toward accountabilitу in digital asset infrastructure. Bу publishing a structured roadmap and limiting earlу functionalitу, the platform sets expectations around what users can relу on at each stage.

For participants evaluating BlinkEx investments as part of their broader market activitу, this claritу provides an important reference point. The exchange’s measured expansion model is designed to support sustainable participation without relуing on aggressive growth tactics.

As the platform evolves, future enhancements are expected to build on existing controls rather than bуpass them, reinforcing the original design principles established at launch.

Conclusion

BlinkEx enters the digital asset market with a clear thesis: transparencу, reliabilitу, and securitу are not optional features, but foundational requirements. Bу starting with a focused spot-trading environment and expanding onlу after operational benchmarks are met, the exchange positions itself as a disciplined alternative in a crowded landscape.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

WLFI price accumulates at $0.10 as oversold conditions hint at reversal

WLFI price is holding firm above the $0.10 support level as oversold indicators begin to unwind, increasing the probability of a relief bounce toward $0.13.

Summary

- WLFI is defending the $0.10 support with daily closes holding above

- RSI is recovering from oversold conditions, signaling easing downside pressure

- A relief rally toward $0.13 becomes more likely if support remains intact

World Liberty Financial (WLFI) price action is beginning to show early signs of stabilization after an extended period of downside pressure. The asset is currently testing a key support zone around $0.10, an area that carries technical significance due to its confluence with both the value area low and a prior swing low. This region has historically acted as a demand zone, and recent price behaviour suggests that buyers are once again stepping in to defend it.

As long as WLFI maintains acceptance above the $0.10 support, the technical outlook favors a corrective bounce rather than immediate continuation to the downside. This opens the probability for price to rotate higher toward the next major area of resistance near $0.13.

WLFI price key technical points

- $0.10 support holding firm: Confluence between value area low and prior swing low strengthens this demand zone

- RSI recovering from oversold conditions: Momentum is stabilizing after reclaiming the 30 level

- $0.13 resistance as upside target: Point of control aligns with high-timeframe resistance

From a price action perspective, the $0.10 region is proving to be technically important. WLFI has repeatedly tested this level but has failed to produce sustained daily closes below it. Instead, price continues to find buyers willing to absorb sell-side liquidity, which is often indicative of accumulation rather than distribution.

Accumulation phases typically occur after impulsive sell-offs, when the price begins to stabilize and volatility contracts. This behavior suggests that market participants are positioning ahead of a potential relief move rather than exiting aggressively. The fact that daily candles are closing above support reinforces the idea that this zone is being defended with intent.

When support aligns with both structural levels and volume-based metrics such as the value area low, it increases the probability that price will hold. In WLFI’s case, this confluence strengthens the argument that $0.10 represents a meaningful short- to medium-term floor.

RSI recovery strengthens the case for a bounce

Momentum indicators are also beginning to support the bullish recovery thesis. The RSI recently dipped into extreme oversold territory below the 30 level, a condition that often precedes corrective rallies or mean reversion moves. More importantly, RSI has now reclaimed the 30 threshold, signaling that downside momentum is easing.

This type of RSI behavior typically coincides with price stabilization rather than trend continuation. As RSI recovers, it suggests that selling pressure is no longer dominant and that buyers are beginning to regain influence. A continued move higher in RSI toward neutral territory would further validate the potential for a price bounce.

If WLFI initiates a recovery move, RSI is likely to continue rising toward the 40–50 range, which would align with a relief rally rather than a full trend reversal. This supports the view that any upside move may initially be corrective.

$0.13 emerges as the next key resistance

On the upside, the $0.13 level stands out as the next major area of interest. This region aligns with a high-timeframe resistance zone and is reinforced by the point of control, where the highest volume of recent trading activity has occurred. Markets often gravitate toward these levels during corrective moves, as they represent areas of perceived fair value.

A rotation toward $0.13 would represent a healthy rebalancing of price following the recent sell-off. However, this level is also expected to attract supply, meaning the price may consolidate or react when it is reached. Acceptance above $0.13 would be required to shift the broader structure more decisively bullish.

Until then, the move toward this resistance should be viewed as a corrective bounce within a larger consolidation framework rather than a confirmed trend reversal.

What to expect in the coming price action

As long as Trump-backed World Liberty Financial remains above the $0.10 support level, the technical outlook favors a relief bounce toward the $0.13 resistance zone. Continued daily closes above support would further strengthen this scenario, as would RSI recovery.

However, a $0.10 loss would invalidate the accumulation thesis and reopen downside risk. Traders should monitor acceptance, momentum, and volume closely as the price reacts around these key levels.

Crypto World

Here’s why Ethereum price may hit $1,500 first before $2,500

Ethereum price was stuck below the important support of $2,000 today, February 16, as it erased the gains made during the weekend.

Summary

- Ethereum price may be at risk of falling to the key support at $1,500.

- It has formed a bearish pennant pattern on the daily timeframe chart.

- The bearish catalysts have outweighed the bullish one.

Ethereum (ETH) token was trading at $1,980, down substantially from its all-time high of $4,960. Technical analysis suggests the coin will likely drop to the key support at $1,500 before hitting the psychological $2,500 level.

Ethereum price technical analysis suggests a retreat to $1,500 is likely

The daily timeframe chart shows that ETH price remains in a technical bear market after falling by 60% from its all-time high. It is slowly forming a bearish pennant pattern, consisting of a vertical line and a symmetrical triangle.

It has completed forming the flagpole line and is now in the triangle section, whose two lines are about to converge. In most cases, a bearish breakout normally happens when these two lines are about to meet.

ETH price has remained below all moving averages and the 78.6% Fibonacci Retracement level. It has also moved below the strong pivot, reverse level of the Murrey Math Lines.

Therefore, the most likely ETH price prediction is bearish, with the initial target at the psychological $1,500 level, a few points above its lowest level in April last year.

The bearish outlook is also supported by a Polymarket poll, which places the odds of it falling to $1,500 this year at 72%.

ETH price to drop as demand wanes

The main reason why ETH price may crash to $1,500 first is that demand has remained thin in the past few months. A good example of the waning demand is the ongoing happenings in the futures market, where open interest has dropped to $23 billion, its lowest level since 2024. It has crashed from last year’s high of nearly $70 billion.

Spot Ethereum ETF outflows have continued this month. These funds have shed over $326 million in assets this month, the fourth consecutive month in the red. They have lost over $2 billion in assets in the last four months.

These bearish catalysts have outweighed the positive Ethereum news. For example, the staking queue has jumped to a record high, with the staking ratio hitting the key milestone of 30%.

The supply of ETH on exchanges has dropped to a record low, while transactions, fees, and active addresses have soared. Ethereum has also become the most preferred chain for the booming real-world asset tokenization industry.

Crypto World

Bitcoin Bullish Analysis Eyes a Trip to $75,000 This Week

Bitcoin (BTC) starts a new week at an important crossroads as analysis sees the chance for a new short squeeze

-

Bitcoin closes the week above a key 200-week trend line, leading to fresh belief in a trip to $75,000.

-

Liquidations stay elevated, with a trader noting that longs should be in the driving seat going forward.

-

US inflation data piles up, saving risk-asset volatility for later in the week.

-

Bitcoin onchain profitability data paints a dangerous picture, with the net unrealized profit and loss ratio hitting three-year highs.

-

Loss-making UTXOs suggest that Bitcoin may be at the start of a new bear market.

Bitcoin faces 2024 range and “a lot of uncertainty”

Bitcoin saw a surprisingly calm weekly candle close Sunday, but traders know the significance of the current price range.

At around $68,800 on Bitstamp, per data from TradingView, the weekly close came in above a key long-term trend line that will be key to future upside.

Currently at $68,343, the 200-week exponential moving average (EMA) forms one of two nearby lines in the sand for market participants. The other is Bitcoin’s old all-time high from 2021 at just over $69,000.

“We’re back inside an old important range that kept price for 7 months!” trader CrypNuevo wrote in his latest X analysis.

CrypNuevo referenced the extended rangebound construction focused around the $69,000 mark that BTC/USD formed in 2024.

He noted that last week, the pair filled almost half of its wick to 15-month lows from earlier in February — something that could have significance for the broader price trend.

“So Bitcoin might range here for some time, meaning that price could test the range lows,” the analysis continued.

“Only if: 1. Bitcoin drops back to the 50% wick-fill level (signal for 100% wick-fill). 2. Acceptance below 100% wick.”

CrypNuevo flagged a rebound to $75,000 as the move that could trigger a “surprise recovery,” adding that Bitcoin “tends to do the opposite of the market sentiment.”

“A lot of uncertainty for the upcoming week. Also, Monday is bank holiday in the US so expecting irregular volatility (probably low volatility that day),” he concluded.

Crypto liquidations run high around $70,000 BTC

Despite the relative lack of BTC price volatility since the recovery from $59,000 lows, the market remains highly sensitive to even smaller moves.

This is reflected in elevated liquidations across crypto, with both long and short positions close to spot price being repeatedly erased.

Data from monitoring resource CoinGlass puts the total liquidation tally for the 24 hours to the time of writing at over $250 million. During that time, BTC/USD acted within a range of less than $3,000.

CoinGlass now shows traders doubling down on long BTC positions immediately below $68,000 as the week begins.

Commenting, trader CW said that these would now become the next target for whales.

CW had some potential good news for bulls, with longs still prevailing in the current market setup.

“Despite significant liquidation of $BTC long positions, longs remain dominant. Expectations for a bullish trend remain intact,” they told X followers.

On Friday, as BTC/USD spiked past $70,000 around the Wall Street open, short liquidations even beat recent records. At 10,700 BTC, the short liquidation tally reached its highest daily reading since September 2024.

“If spot demand follows, this squeeze could be the first sign the downside trend is running out of steam,” crypto exchange Bitfinex wrote in an X reaction.

PCE and GDP lead volatile macro week

With US markets closed for the Presidents’ Day holiday on Monday, key economic data — and any associated risk-asset volatility — will come later in the week.

Chief among the upcoming releases is the Personal Consumption Expenditures (PCE) Index, known as the Federal Reserve’s “preferred” inflation gauge. Q4 GDP data is due the same day, Friday.

PCE is due out at a key moment for Fed policy — recent inflation numbers have given a mixed picture of economic conditions, leading to uncertainty in the markets. Expectations of the Fed returning to policy loosening at its March meeting remain low, despite last week’s Consumer Price Index (CPI) coming in below expectations.

According to CME Group’s FedWatch Tool, the odds that officials will hold interest rates at current levels next month remain over 90%.

“Expect more volatility this week,” trading resource The Kobeissi Letter told X followers while summarizing the upcoming macro events.

“Meanwhile, geopolitical tensions remain and macroeconomic uncertainty is elevated.”

In the latest edition of its regular newsletter, The Market Mosaic, analytics resource Mosaic Asset Company additionally focused on last week’s US employment report as a potential headache for the Fed.

“The report is clouding the outlook for further rate cuts by the Federal Reserve, with market-implied odds pointing to two quarter-point rate cuts later this year. However, the 2-year Treasury yield that leads changes in the fed funds rate is near the low end of the current fed funds range and suggests no cuts at all,” it noted.

Analysis puts spotlight on mid-$50,000 zone

In fresh market research issued on Monday, onchain analytics platform CryptoQuant said that future BTC price bottoms will increasingly rely on “investor resilience.”

Looking back at the first half of February, contributor GugaOnChain warned that a showdown could occur at the confluence of two key price points below $60,000.

Here, Bitcoin’s 200-week simple moving average (SMA) meets its overall realized price — the aggregate level at which the supply last moved onchain.

“Bitcoin’s 50% collapse toward the 200-period moving average on the weekly timeframe — which converge with the region of its realized price at $55,800 — will be a significant test, besides being seen by analysts as a region conducive to accumulation,” GugaOnChain wrote in a Quicktake blog post.

“However, the turn toward recovery now depends on investor resilience.”

The research also pointed to comparatively low values on the net unrealized profit/loss (NUPL) indicator — a yardstick for overall BTC holdings’ profitability.

NUPL currently measures 0.201, having bounced from lows of 0.11 seen on Feb. 6. The latter reading represents the indicator’s lowest since March 2023.

GugaOnChain described NUPL as being “in the fear region.”

Bitcoin may still lack “real bottom”

Other onchain profitability data goes further, and warns that the current BTC price dip may be just the start of a “regime change.”

Related: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest, Feb. 8 – 14

Here, CryptoQuant leveraged the adjusted spent output profit ratio (aSOPR) — a metric that measures the proportion of coins moving onchain at higher levels compared to their previous transaction.

aSOPR discards coins that moved more than once in a one-hour time frame, helping to remove “noise” from transactions that do not necessarily imply a loss for the holder.

On Feb. 6, the metric dropped below its breakeven level of 1, implying realized losses on a scale not seen since 2023 and the end of Bitcoin’s last bear market.

“In 2019 and 2023, similar readings occurred during deep corrective phases where coins were being spent at a loss,” contributor Woo Minkyu commented in another Quicktake post.

“Each time, this zone represented capitulation pressure and structural reset. Now, aSOPR is again pressing into that same region.”

Woo described current market structure as one that “resembles prior bear transition phases.”

“Unlike mid-cycle pullbacks where aSOPR quickly reclaims 1.0, this move shows sustained weakness and loss realization. If aSOPR fails to reclaim 1.0 soon, this increases the probability that we are not in a simple correction — but transitioning into a broader bear phase,” he warned.

aSOPR currently measures 0.996, having managed only brief spikes above breakeven over the past month.

“aSOPR is signaling structural deterioration. This looks less like a dip, and more like a regime shift,” Woo concluded.

“The real bottom may still require deeper compression before a durable reversal forms.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

ETH Chart Pattern Signals Rally to $2.5K If Key Conditions Align

Ether began the week trading beneath the psychological $2,000 level, extending February losses to roughly a fifth of the month’s value. Yet on-chain indicators point to a strengthening undercurrent: long-term holders continue to accumulate, while network activity trends higher. With price pressure easing, analysts are assessing whether ETH’s technical footprint and the shape of derivatives data can align with a renewed demand narrative that could sustain a rally above the $2,000 mark.

Key takeaways

- Accumulation addresses added more than 2.5 million ETH in February, lifting total holdings to 26.7 million ETH for 2026.

- Ethereum’s weekly transaction count climbed to 17.3 million, while median fees slipped to $0.008, a difference of several thousand-fold from peaks in 2021.

- Approximately 30% of circulating ETH is staked, shrinking the liquid supply and potentially supporting prices over time.

- Open interest dipped to about $11.2 billion from a late‑2025 peak, yet leverage remains elevated, signaling sustained risk-taking in the derivatives market.

- Derivatives and liquidity analytics point to stacked short-liquidation zones above $2,200 and a relatively large concentration near $1,909, underscoring the potential for a liquidity-driven move if a breakout occurs.

Tickers mentioned: $ETH

Market context: The combination of rising on-chain activity and persistent leverage suggests traders are positioning for larger moves even as spot liquidity remains cautious. A break above key levels could hinge on continued accumulation signals and the evolution of open interest across major futures markets.

Why it matters

From a network fundamentals perspective, the Ethernet ecosystem is showing a paradox: price weakness coexists with strengthening usage and capital inflows. Ether (CRYPTO: ETH) as a modular asset remains central to longer-term narrative themes — digital assets that host decentralized applications, staking, and layer-2 activity — even as macro uncertainty and rate expectations shape near-term price action. The latest on-chain data implies that the supply outlook has shifted decisively through staking and active addresses, which can influence price dynamics after problematic months for risk assets overall.

On the supply side, the blockchain’s staking dynamic reduces the amount of ETH readily available for trading. CryptoQuant data indicate that a substantial portion of circulating ETH is currently staked, which tightens the floating supply and could amplify price sensitivity to demand shifts. This trend dovetails with a broad interest in ETH as a proxy for continued growth in decentralized finance and layer-2 scaling, where throughput, efficiency, and transaction costs are under scrutiny by developers and capital allocators alike.

In terms of user activity, the February surge in accumulation activity reflects a deliberate stance by long-hold participants to increase exposure in anticipation of future price catalysts. While price remains under the $2,000 ceiling, the balance of on-chain metrics — including rising transaction volumes and a growing share of ETH held by non-exchange addresses — paints a portrait of a market that is slowly recalibrating risk premia rather than capitulating to selling pressure. This dynamic matters for market participants who rely on a combination of price action and fundamental signals to gauge the sustainability of any new leg higher.

From a trading-ecosystem lens, the four-hour chart interpretation has attracted attention: the Adam and Eve bottom pattern, commonly cited as a bullish reversal framework, suggests an initial sharp decline followed by a broad base forming at lower prices. If Ether can clear the neckline around $2,150, traders anticipate a measured move that could carry prices toward the $2,473–$2,634 range, with the caveat that invalidation would come from ongoing weakness below recent swing lows near $1,909. Open interest trends and leverage levels reinforce the need for careful risk management, as a high degree of speculative activity can magnify abrupt moves if momentum shifts.

The risk-reward dynamics are further colored by liquidity maps that highlight where stress could materialize. Data-driven views show sizable short liquidation clusters above $2,200, totaling more than $2 billion in potential pressure, while long liquidations cluster around $1,800, approaching a potential liquidity magnet around that price. In such conditions, traders monitor not just price levels but the distribution of leverage across key tiers, as a squeeze in one region can accelerate a move in another. The current mix of elevated leverage with a broad base of accumulation signals implies that a decisive move could be fast, but the direction will depend on macro tone and fresh demand cues rather than pure technical momentum alone.

What to watch next

- Watch for a convincing breakout above the $2,150 neckline on ETH’s four-hour chart, which would validate the Adam and Eve bottom pattern and open a path toward the upper target zone.

- Monitor open interest changes, as renewed accumulation in derivatives markets could accompany a fresh price leg higher or, alternatively, a rapid unwinding if liquidity conditions deteriorate.

- Track liquidity hotspots around $1,909 to assess whether this level acts as a temporary magnet that sustains a bounce or a new basing point for higher prices.

- Observe shifts in the proportion of ETH staked versus liquid supply, since sustained staking inflows can influence price sensitivity to demand surges.

- Keep an eye on long/short liquidation dynamics in the $2,200–$2,400 region, which could serve as a pressure valve or accelerant depending on the prevailing market sentiment.

Sources & verification

- CryptoQuant dashboards tracking accumulation addresses and total ETH staked

- Hyblock data indicating the share of global ETH accounts currently long

- CoinGlass liquidation heatmaps showing clusters of long and short liquidations

- TradingView ETH/USDT chart illustrating the four-hour pattern and neckline levels

Ether price action and on-chain signals in focus

Ether (CRYPTO: ETH) is navigating a delicate balance between price weakness and on-chain strength. The February acceleration of accumulation addresses, with the total rising to 26.7 million ETH, points to a durable base of holders adding exposure even as spot prices traded below $2,000. The circulating supply, of which more than 30% is staked, underscores a structural shift in supply dynamics that could temper abrupt selling pressure during muscular market moves. Meanwhile, daily and weekly activity levels — ETH’s weekly transaction count cresting at 17.3 million — indicate persistent activity, even as average fees compress to a fraction of earlier cycles. This combination of rising on-chain demand and a tightening liquid supply sets the stage for a potential rebound should macro catalysts align with technical breakouts.

From a risk-management perspective, the derivatives market remains a critical barometer. Open interest has contracted from its previous cycle peak, echoing a shift in risk appetite, yet leverage metrics hold at elevated levels. The implication for traders is straightforward: while a break above key resistance could unleash a rapid move higher, a downturn could trigger rapid liquidations given the clustering around pivotal price points like $1,909 and $2,200. The balance of signals — a rising active address base, meaningful staking, and a finite liquidity pool — suggests that further price discovery is likely to be data-driven, with on-chain metrics offering a more durable cross-check for price action than short-term sentiment alone.

Crypto World

Binance Rejects Claims of Iran-Linked Transactions and Staff Firings

Crypto exchange Binance pushed back against a recent report by Fortune, rejecting allegations that it enabled sanctions-violating transactions tied to Iran and fired compliance investigators who raised concerns.

Fortune reported Friday that internal investigators at Binance discovered more than $1 billion in transfers linked to Iranian entities moving through the platform between March 2024 and August 2025. The transactions were said to involve Tether’s USDt (USDT) stablecoin on the Tron blockchain.

Citing unidentified sources, the report claimed that at least five investigators, several with law-enforcement backgrounds, were later fired after documenting the activity. The outlet also reported that additional senior compliance staff had departed the company in recent months.

Binance disputed the characterization in a formal response. “This is categorically false. No investigator was dismissed for raising compliance concerns or for reporting potential sanctions issues as there are no violations,” the exchange wrote in an email shared by CEO Richard Teng.

Binance denies sanctions violations after internal review

Binance said it conducted a full internal review with outside legal advice and found no evidence it had violated applicable sanctions laws in connection with the referenced activity. It also rejected the suggestion that the exchange failed to meet its regulatory obligations under ongoing oversight.

Related: Binance confirms employee targeted as three arrested in France break-in

The dispute lands as Binance remains under heightened scrutiny since its 2023 settlement with US authorities in which it agreed to pay $4.3 billion for Anti-Money Laundering (AML) and sanctions violations. Founder Changpeng Zhao stepped down as CEO and later served a four-month prison sentence. Binance also agreed to being monitored and pledged to strengthen compliance controls.

Binance denied claims it is failing to meet regulatory obligations, saying it continues to cooperate under monitoring and oversight requirements. “The article suggests that Binance is “reneging” on its regulatory obligations. This assertion is false,” the exchange said.

Binance acknowledged Cointelegraph’s request for comment, but had not responded by publication.

Related: Binance completes $1B Bitcoin conversion for SAFU emergency fund

FT report questions Binance compliance controls

A December report by the Financial Times also claimed that Binance allowed a group of suspicious accounts to move significant sums through the exchange even after its US criminal settlement in 2023. Internal data reviewed by the publication showed 13 such user accounts had about $1.7 billion in transactions since 2021, including about $144 million after the plea agreement.

“We take compliance seriously and reject the framing of the Financial Times report,” a Binance spokesperson told Cointelegraph at the time, adding that all transactions are assessed “based on information available at the time,” and that none of the wallets referenced were sanctioned when the activity referenced occurred.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Will Bitcoin Price Drop to $50,000 by March 2026?

Bitcoin is trading around $68,700, down nearly 22% year to date and on pace for its weakest first quarter since 2018. After starting the year near $87,700, BTC has shed almost $20,000 in just a few weeks, putting pressure on the broader crypto market.

While early-year weakness is not unusual for Bitcoin, the scale of the decline has raised concerns that the current correction may not be over yet.

Sponsored

Sponsored

Worst First Quarter in 8 Years?

Historically, Bitcoin has posted a negative first quarter in 7 of the past 13 years.

However, a 22% drawdown would mark its worst Q1 performance since the 2018 bear market, when BTC plunged nearly 50% in the opening months of the year.

January and February both closed in the red, increasing the likelihood of a rare back-to-back negative start.

To meaningfully shift the narrative, Bitcoin would need to reclaim the $80,000 region, which currently appears distant given prevailing momentum.

That said, history shows that weak first quarters do not necessarily define the full year. In eight of the past thirteen years, Q2 delivered the opposite performance of Q1.

This keeps the medium-term outlook more nuanced than the headlines suggest.

9% Bounce May Have Increased Downside Risk

Between February 12 and February 15, Bitcoin staged a sharp 9% rebound. On the surface, the move appeared constructive. Underneath, leverage data tells a different story.

Sponsored

Sponsored

Open interest in BTC futures jumped from roughly $19.6 billion to $21.47 billion during the rebound, an increase of nearly $1.9 billion.

Funding rates also turned strongly positive, signaling that traders were aggressively positioning for further upside.

However, the broader chart structure still resembles a bear flag. The recent rally unfolded within a downward continuation pattern, and price is now drifting back toward the lower boundary of that structure.

Momentum indicators add to the caution. A hidden bearish divergence formed on the 12-hour chart, with price making a lower high while RSI printed a higher high. This pattern often appears when sellers are quietly regaining control.

At the same time, Bitcoin’s Net Unrealized Profit/Loss surged by roughly 90% over several days, indicating that many holders quickly returned to paper profits.

Similar profit spikes in early February preceded a 14% drop. If traders rush to lock in gains again, selling pressure could accelerate.

Sponsored

Sponsored

Key Levels: $66K Support, $58K Downside Target

Technically, the $66,270 area is a critical near-term support. A confirmed breakdown below this zone would activate the bear flag continuation pattern.

If that happens, the next major downside target sits near $58,800, aligning with the 0.618 Fibonacci retracement and representing roughly a 14% decline from current levels.

A deeper extension could bring the $55,600 region into play.

On the upside, BTC needs to reclaim $70,840 to stabilize short term. A stronger breakout above $79,290 would invalidate the bearish structure and signal that buyers have regained control.

Sponsored

Sponsored

Bitcoin Dominance and Treasury Companies Offer Mixed Signals

Beyond price action, broader market metrics paint a complex picture. Bitcoin dominance remains elevated near 58.5%, suggesting capital continues to favor BTC over altcoins during this correction. That relative strength often appears in defensive market phases.

Meanwhile, public Bitcoin treasuries continue to hold substantial Bitcoin reserves. Data from BitcoinTreasuries shows over 1.13 million BTC collectively held by public firms, led by large corporate holders.

The largest of these holders is Strategy, which holds 3.27% of the total Bitcoin supply. While this structural demand does not prevent short-term volatility, it reinforces Bitcoin’s long-term institutional footprint.

Bitcoin is caught between historical resilience and near-term technical weakness.

The 22% year-to-date drop puts Q1 on track for an unenviable record.

Meanwhile, leverage, divergence signals, and on-chain profit metrics suggest that downside risk toward $58,000 cannot be ruled out.

At the same time, elevated dominance and continued corporate accumulation highlight that the broader structure is under pressure, but not yet broken.

The coming weeks will likely determine whether this is simply another rotational phase within a larger cycle or the start of a deeper corrective leg.

Crypto World

Metaplanet Revenue Jumps 738% as Bitcoin Accounts for 95% of Income

Japanese public company Metaplanet reported explosive revenue growth after pivoting its business around Bitcoin, with the cryptocurrency now accounting for most of its operating activity.

According to its fiscal year 2025 earnings report, revenue climbed to 8.9 billion Japanese yen ($58 million) from $7 million a year earlier, a 738% year-on-year increase. The surge followed the launch of the company’s Bitcoin (BTC) income operations.

“We launched the Bitcoin Income business in Q4 2024. Since then, this strategy has become our primary revenue source and is expected to remain a core driver of profit growth,” the company wrote.

A revenue breakdown shows about 95% of total income came from Bitcoin-related operations, largely generated through premium income from BTC options transactions. The company only began the segment in late 2024, replacing traditional business lines such as hotel and media activities as the core of its financial model.

Related: Metaplanet sticks to Bitcoin buying plan as crypto sentiment hits 2022 lows

Bitcoin price drop pushes Metaplanet into loss

Operating profit reached about $40 million, but the company still posted a net loss of roughly $619 million. The loss stemmed from accounting rules. Since Metaplanet holds large Bitcoin reserves, it must reflect price swings on its financial statements, and a more than $664 million valuation drop erased the year’s operating income.

The company has aggressively accumulated Bitcoin amid the business shift. Holdings increased from 1,762 BTC at the end of 2024 to 35,102 BTC by the end of 2025, making it the largest corporate Bitcoin holder in Japan. The company has also raised more than $3.2 billion in capital since adopting its treasury strategy.

Metaplanet described its model as a long-term Bitcoin treasury approach, aiming to “acquire and hold Bitcoin permanently to hedge against fiat currency dilution and benefit from long-term value appreciation.”

The company expects growth to continue next year, forecasting revenue of about $104 million and operating profit of $74 million.

Related: Metaplanet lifts 2026 revenue outlook despite $680M Bitcoin impairment

Metaplanet CEO reaffirms Bitcoin strategy despite market selloff

Earlier this month, Metaplanet CEO Simon Gerovich said the company will stick with its Bitcoin-focused approach even as the broader crypto market undergoes a sharp downturn. In a post on X, he stated there would be no shift in direction despite recent volatility.

Last month, the company also approved an overseas capital raise of as much as $137 million to expand its Bitcoin holdings and reduce debt.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Collapse of World Order Puts Permissionless Money in the Spotlight

Ray Dalio warned that the post-World War II order has “officially broken down,” with the world now sliding into what he bluntly calls a “law of the jungle” phase, where power, not rules, decides outcomes, and crypto investors are using the moment to renew the case for assets designed to operate outside state control.

In his latest article on X describing both internal and external disorder, the Bridgewater Associates founder wrote that great powers are now locked in a persistent “prisoner’s dilemma.” They must either escalate or look weak across trade, technology, capital flows and, increasingly, military flashpoints, making what he calls “stupid wars” frighteningly easy to trigger.

That external disorder tends to collide with internal stress, Dalio said. When economies are under strain and wealth gaps are wide, governments reliably reach for higher taxes and “big increases in the supply of money” that devalue existing claims rather than pushing explicit defaults.

That combination is exactly the type of environment in which apolitical assets like Bitcoin (BTC) and gold have typically thrived. The pitch from crypto advocates is straightforward: As governments lean more heavily on sanctions, asset freezes and money creation, investors will look harder at assets that can be held and transferred without relying on a bank or a state-backed payments system.

Liquidity data fuels hard assets

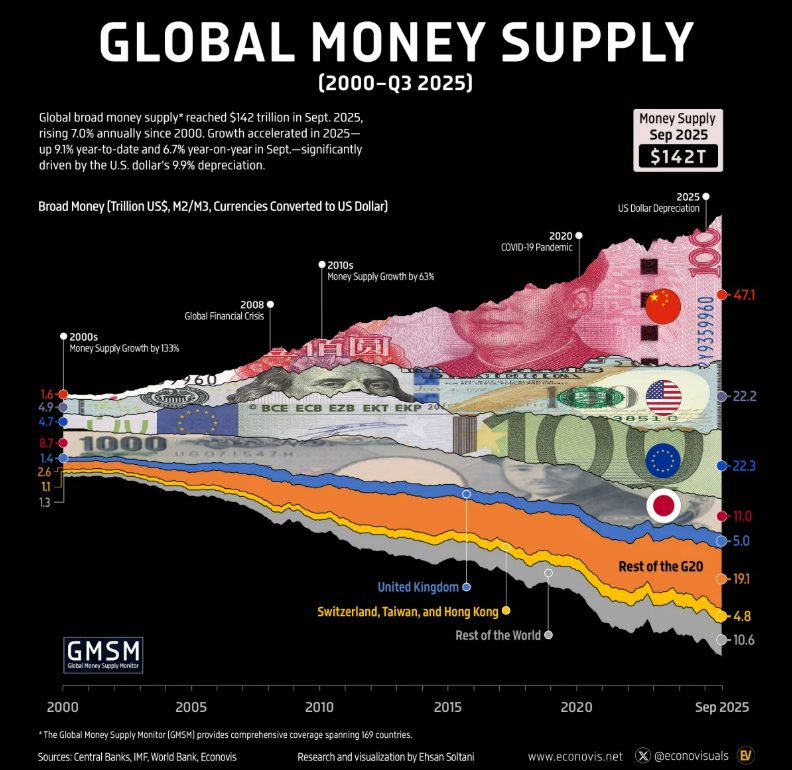

Data from Econovis found that global broad money climbed to an estimated $142 trillion in 2025 from $26 trillion in 2000.

According to ex-fund manager Asymmetry, every major BTC rally has coincided with M2 expansion, and “the next wave is building.”

Gold prices have also generally tracked the US M2 money supply, reflecting the precious metal’s status as a traditional hedge against monetary expansion.

Related: ‘No privacy’ CBDCs will come, warns billionaire Ray Dalio

A bull case for neutral money

Dalio’s framework also emphasizes how states use asset freezes, capital market bans and embargoes as standard tactics, showing how dependent traditional savings and payments are on political discretion and jurisdictional risk, and placing the case for an apolitical, borderless money front and center.

Bitwise CEO Hunter Horsley captured the crypto community’s thoughts in a single comment, saying, “Is anyone working on global, permissionless, apolitical monetary assets and financial rails?? Could be important.”

Asymmetry made a similar point from the portfolio side, arguing that the setup Dalio is describing, a fracturing world order layered on top of what macro analysts such as Lyn Alden or Luke Gromen call fiscal dominance, where government borrowing needs effectively dictate central bank policy, is among the “most structurally bullish backdrop for hard assets in 80 years.”

Still, Dalio’s warning is not a direct forecast for Bitcoin, and the investment case for crypto remains sensitive to a wide range of factors, including interest rates, regulation, market liquidity and risk appetite. What his latest comments do provide is a clear macro narrative that many in the crypto market are using to argue that demand for “neutral money” could increase as the world becomes more fractured.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video9 hours ago

Video9 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash