Crypto World

Epstein Files Reveal Crypto Talks With SEC’s Gary Gensler

The Epstein files show he discussed meeting Gary Gensler to talk about digital currencies, offering fresh insight into the financier’s efforts to engage with early crypto leaders and policy figures.

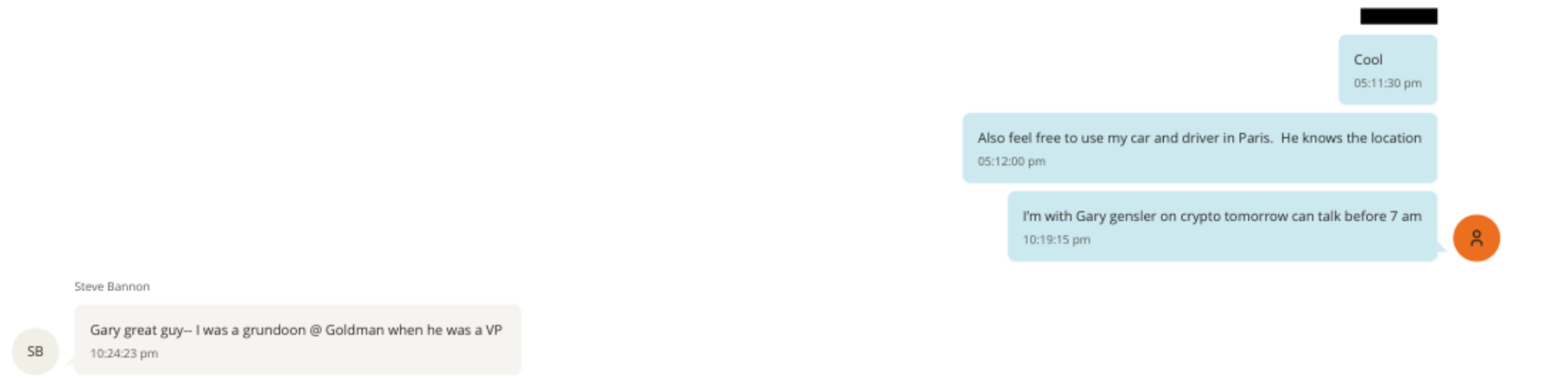

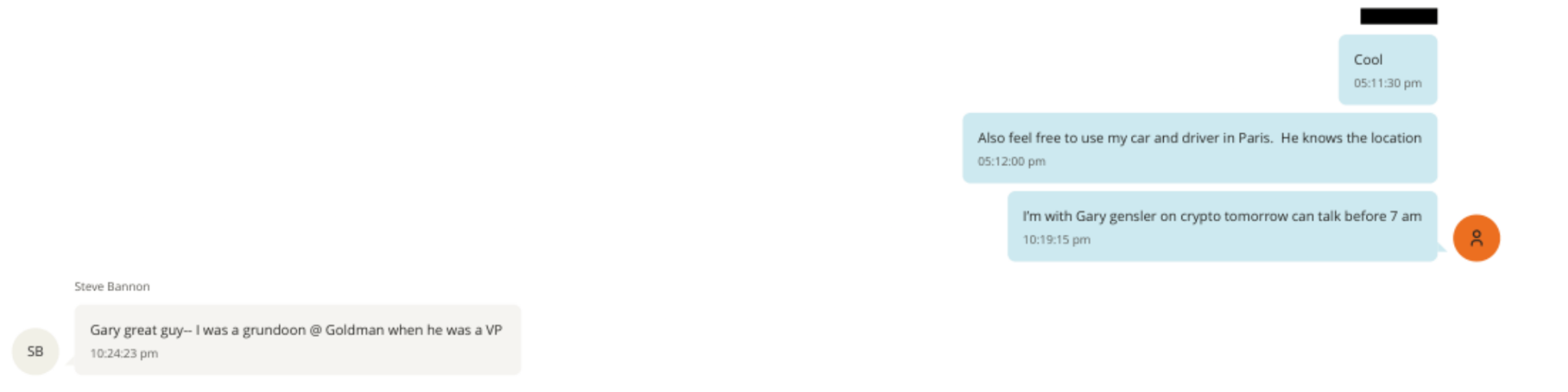

Emails from May 2018 show Epstein telling former Treasury Secretary Lawrence Summers that “Gary Gensler [is] coming earlier… wants to talk digital currencies.” Summers replied that he knew Gensler from government service and described him as “pretty smart.”

Sponsored

Sponsored

The exchange suggests Epstein expected Gensler to participate in discussions involving cryptocurrency.

Epstein Files Reveal More Crypto Stories

Separately, internal messages show Epstein referencing crypto-related meetings connected to MIT Media Lab leadership.

One message asked whether others “would be interested in Gary Gensler,” indicating Gensler’s involvement in crypto-focused academic or policy circles at the time.

In another message, Epstein wrote that he would be “with Gary Gensler on crypto tomorrow,” although the files do not independently confirm whether a direct meeting took place.

At the time, Gensler was a professor at MIT, where he taught blockchain and digital currencies.

Sponsored

Sponsored

He later became the SEC from 2021 to 2025, where he oversaw the most aggressive regulatory crackdown on crypto in US history.

The Gensler references appear alongside broader evidence of Epstein’s deep involvement in early cryptocurrency development and investment.

DOJ documents show Epstein donated hundreds of thousands of dollars to MIT’s Media Lab. This included funding the Digital Currency Initiative, which supported Bitcoin Core developers after the Bitcoin Foundation collapsed.

Developers funded through the initiative included key maintainers of Bitcoin’s open-source protocol.

In addition, financial records confirm Epstein invested $3 million in crypto exchange Coinbase in 2014.

He also invested in Bitcoin infrastructure firm Blockstream and corresponded with early Bitcoin developers, researchers, and venture capitalists.

Furthermore, emails show Epstein proposing a Sharia-compliant digital currency modeled on Bitcoin in 2016.

However, the files do not show any financial relationship between Epstein and Gensler. Nor do they confirm whether the two men met directly or collaborated on any crypto-related project.

Still, the documents highlight Epstein’s sustained efforts to engage with influential figures in crypto, academia, and financial policy.

Crypto World

Metaplanet’s Bitcoin Bet Leads to $1.35 Billion Paper Loss

Tokyo-based Metaplanet released its fiscal year 2025 results, reporting a 738% year-over-year increase in revenue.

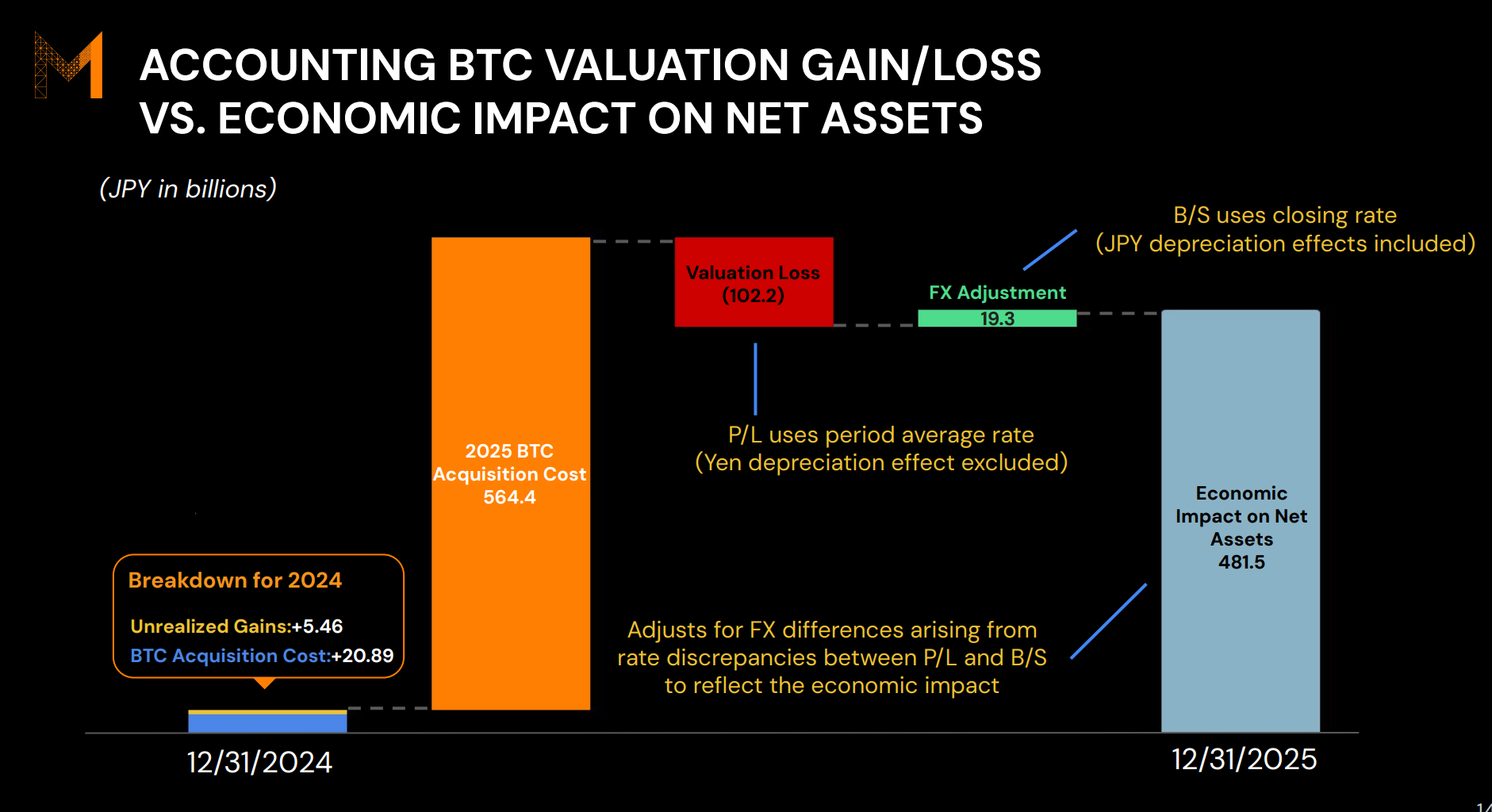

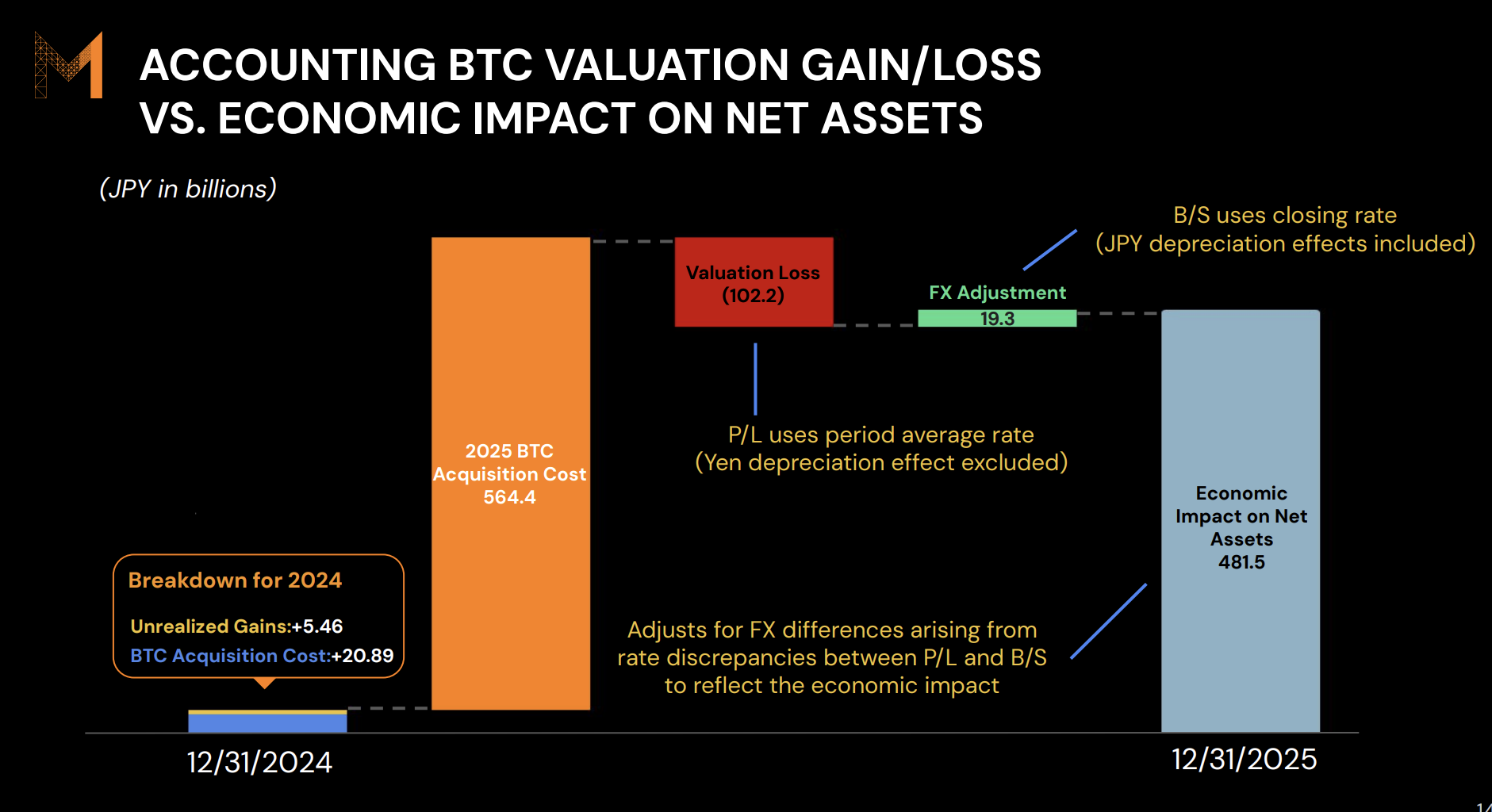

Despite the revenue surge, Bitcoin’s drawdown weighed heavily on the firm, as a non-cash valuation loss of 102.2 billion yen ($667.52 million) pushed the company into a net loss for the year.

Sponsored

Sponsored

Metaplanet’s FY2025 earnings report revealed revenue climbed to 8.9 billion yen ($58.12 million), up from 1.06 billion yen ($6.92 million) a year earlier. The company’s Bitcoin income business generated roughly 95% of total revenue.

“We launched the Bitcoin Income business in Q4 2024. Since then, this strategy has become our primary revenue source and is expected to remain a core driver of profit growth,” the report read.

Operating profit rose sharply to 6.28 billion yen ($41.01 million), marking a 1,694.5% increase year over year. Its shareholder base expanded significantly, growing from 47,200 at the end of 2024 to around 216,500 by the close of 2025.

Total assets also surged, rising from 30.3 billion yen ($197.89 million) to 505.3 billion yen ($3.30 billion) over the same period.

Despite the strong operational performance, the company posted a net loss of 95 billion yen ($620.17 million), after recording net income of 4.44 billion yen ($29.00 million) in 2024. The loss was primarily driven by valuation declines on its Bitcoin holdings.

Still, Metaplanet emphasized the strength of its balance sheet. The company said its liabilities and preferred stock would remain fully covered even in the event of an 86% drop in Bitcoin’s price, supported by an equity ratio of 90.7%.

Sponsored

Sponsored

The company also outlined its outlook for this year. Metaplanet expects revenue to reach 16 billion yen ($104.49 million) in FY2026, representing a 79.7% increase year over year. Operating profit is projected to rise to 11.4 billion yen ($74.45 million), up 81.3% from the previous year.

Japan’s Largest Corporate Bitcoin Holder Faces $1.35 Billion Unrealized Loss

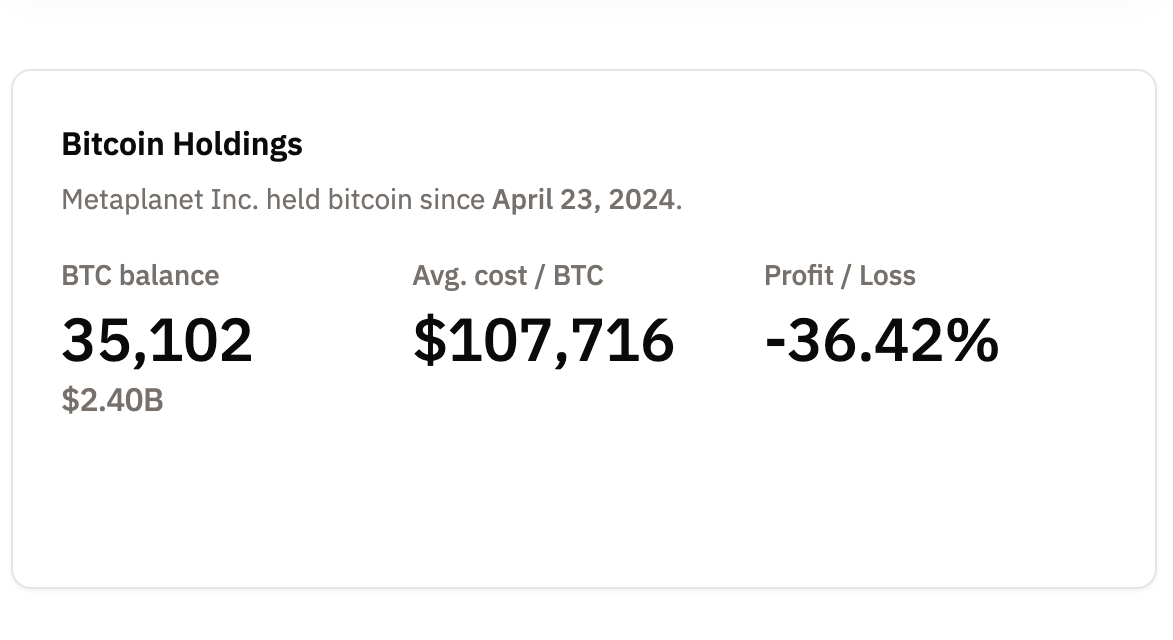

According to the latest data, Metaplanet holds 35,102 BTC, a major increase from just 1,762 BTC at the end of 2024. The accumulation strategy has positioned the company as the largest corporate Bitcoin holder in Japan and the fourth-largest publicly listed corporate holder globally.

However, the rapid expansion of its Bitcoin treasury now comes with significant pressure. Metaplanet’s average acquisition cost stands at $107,716 per BTC, while Bitcoin is currently trading at $68,821.

Across its entire 35,102 BTC position, this translates into approximately $1.35 billion in unrealized losses. While these losses remain on paper and could reverse if Bitcoin recovers, they highlight the inherent volatility risk tied to corporate treasury strategies heavily concentrated in digital assets.

Metaplanet is not alone in facing valuation pressure. Bitcoin’s broader market drawdown has also pushed MicroStrategy’s holdings below its average acquisition price, leaving the US-based firm with unrealized losses exceeding $5.33 billion as of the latest data.

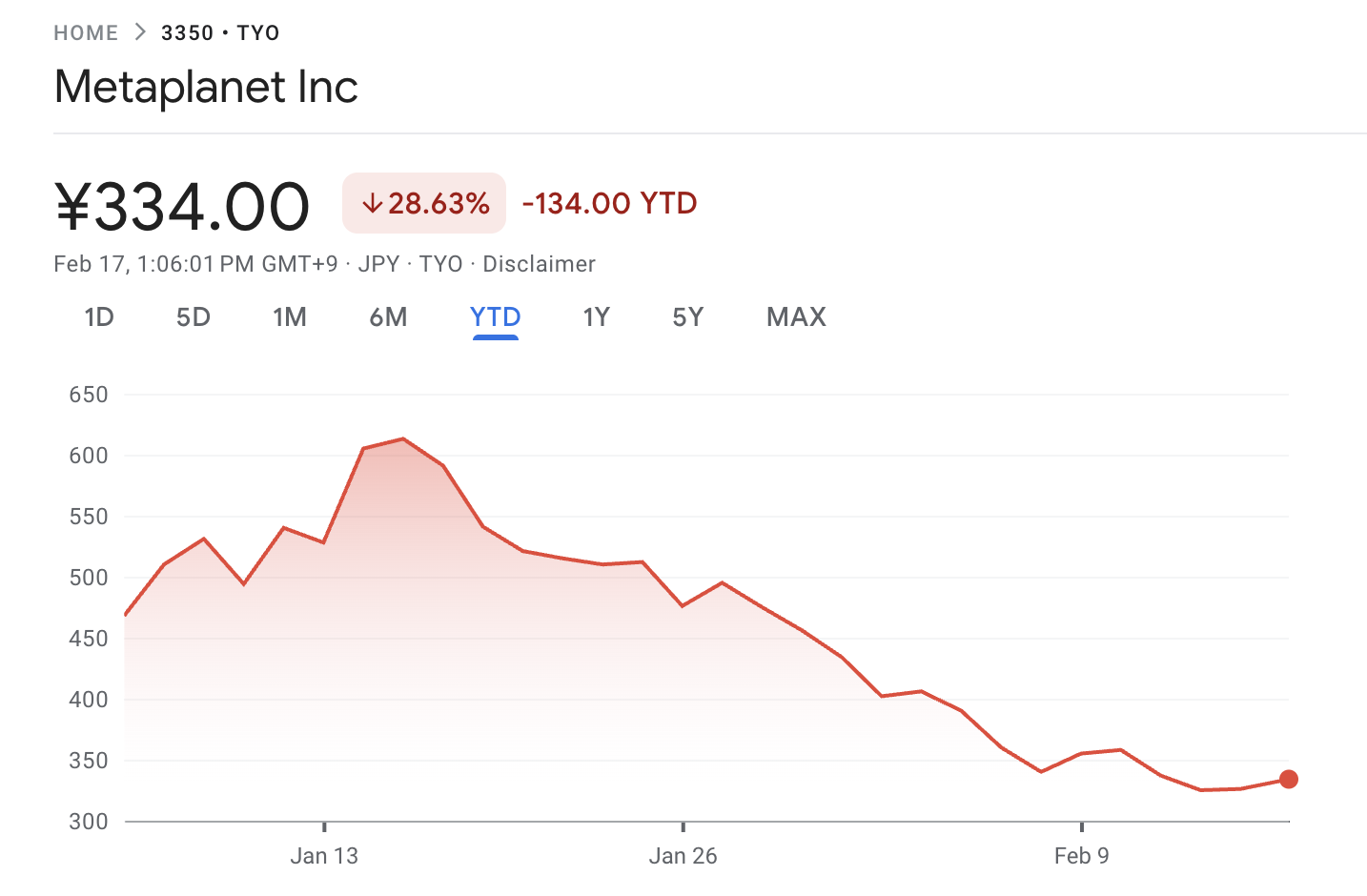

The impact extends beyond balance sheets. Metaplanet’s share price is down 28.63% year-to-date, reflecting how closely the company’s equity performance is now tied to Bitcoin’s price movements.

Crypto World

Zcash wallet Zashi rebrands to Zodl following team split

The mobile wallet Zashi has been rebranded to Zodl following a split from its former parent organization, as its development team moves forward under a new independent structure.

Summary

- Zashi wallet has rebranded to Zodl after its development team left Electric Coin Company to form an independent entity.

- The wallet’s functionality, security, and user data remain unchanged, with the update applied automatically.

- The team will continue focusing on privacy and long-term growth under independent management.

In a statement released on Feb. 16, the team said the upcoming app update will rename Zashi to Zodl without changing how the wallet works. Users will not need to download a new app, move funds, or update their recovery phrases.

The transition will take place automatically with the next software update. As per the announcement, the rebrand reflects “a new chapter” for the wallet, while keeping the same product, developers, and focus on privacy.

Transition to an independent structure

The change follows the departure of the full Zashi (ZEC) development team from Electric Coin Company in January 2026. The group, which helped build both the Zcash protocol and the Zashi wallet, resigned after internal disagreements over governance, funding, and autonomy.

After leaving, the team formed a new company called Zcash Open Development Lab, also known as ZODL. Under this entity, the wallet was renamed Zodl and placed fully under independent management.

The developers said the move was needed to support long-term growth without relying on the Zcash development fund. Since forming the new organization, the team has continued releasing updates and maintaining the wallet.

Zodl’s creators stressed that the rebrand does not affect security or compatibility. Wallet balances, transaction history, and seed phrases will continue to work as before, and the app will remain connected to the Zcash blockchain.

Over the coming days, the Zashi name will be replaced with Zodl across websites, support channels, and social platforms.

Transition to an independent structure

In its announcement, the team said its mission remains unchanged. Zodl will continue to focus on private transactions and expanding access to shielded ZEC.

“We envision a world without mass financial surveillance,” the statement said, adding that financial privacy is central to personal sovereignty. The developers said their goal is to make private digital payments accessible to a wider audience.

The rebrand comes as privacy-focused cryptocurrencies continue to gain attention. Due to a rise in the use of privacy features, shielded ZEC transactions now account for roughly 30% of the supply in circulation.

At the ecosystem level, the Zcash Foundation recently published its 2026 roadmap, outlining plans to improve wallet usability, developer tools, and network infrastructure. Many analysts view the Zodl transition as another example of the friction that can arise between non-profit governance bodies and independent development teams within the crypto space.

Similar splits have occurred in other technology and blockchain projects over funding and control. For now, Zodl’s team says users can continue using the wallet as usual, while future updates will focus on improving privacy tools and user experience.

Crypto World

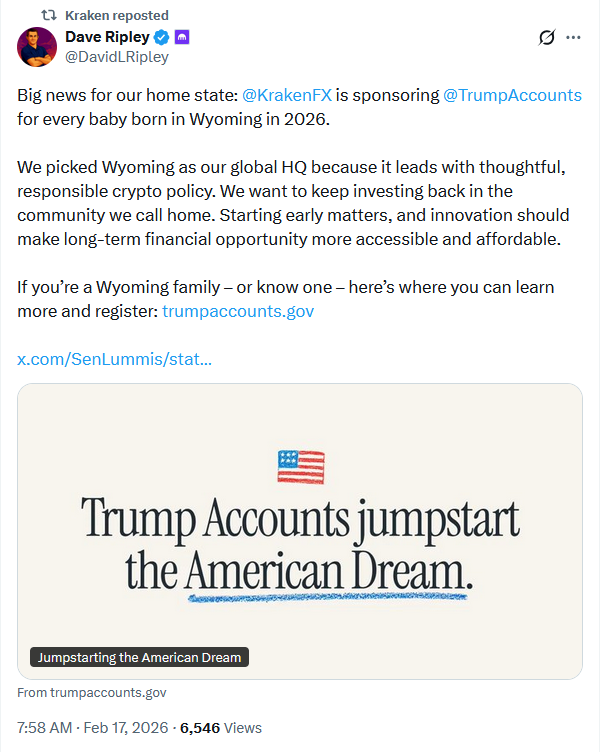

Kraken backs Trump accounts in Wyoming over crypto alignment

Kraken has joined a growing roster of crypto firms aligning with a White House-backed savings concept for American children, signaling how policy-friendly states can shape industry participation. The exchange is the latest to back the Trump Accounts program for children under 18, a pilot initiative that pairs public seed funding with private sector engagement. The move was publicly framed by Wyoming lawmakers as part of the state’s broader effort to cultivate a crypto-friendly climate from its governance to its regulatory environment. Kraken’s leadership said the decision reflects a broader philosophy: that early financial opportunity should be accessible and affordable, a sentiment echoed by Wyoming officials who tout a regulatory framework they deem thoughtful and responsible.

Key takeaways

- Wyoming Senator Cynthia Lummis publicly announced Kraken’s commitment to fund Trump Accounts created for newborns in Wyoming, highlighting the state’s role in the program.

- Kraken’s co-CEO Dave Ripley pointed to Wyoming’s “thoughtful, responsible crypto policy” as a key reason for establishing the firm’s global headquarters there.

- The Wyoming government’s support is linked to Kraken becoming the US’s first Special Purpose Depository Institution (SPDI) and its involvement with Frontier Stable Token.

- Trump Accounts represent a new type of retirement vehicle for minors, with a federal pilot seed of $1,000 per eligible newborn born between 2025 and 2028.

- Traditional banks such as JPMorgan, Bank of America, and Wells Fargo have publicly supported the Trump Accounts program, reflecting broad financial-system engagement beyond crypto-native firms.

Sentiment: Neutral

Market context: The development sits at the intersection of evolving crypto policy, state-level regulatory experimentation, and a broader push from traditional financial institutions to participate in innovative savings tools tied to the digital asset ecosystem. The Trump Accounts program, paired with Wyoming’s SPDI designation and Frontier Stable Token efforts, underscores how policy and geography can influence where crypto-related financial products take root.

Why it matters

The disclosure underscores Wyoming’s continuing appeal as a hub for crypto business. By positioning Kraken’s headquarters in a state that touts a long-running stance toward cryptocurrency policy, the firm signals that regulatory predictability is a meaningful competitive advantage in an industry prone to policy shifts. The combination of SPDI status and Frontier Stable Token development frames Wyoming as more than a duty-bound regulatory sandbox; it’s a launchpad for projects seeking stable, regulated rails for crypto-based savings and custody solutions.

From a consumer perspective, the Trump Accounts program could broaden access to long-term savings for families. If the federal seeds of $1,000 per newborn are distributed through a controlled, retirement-style vehicle, early access and compounding effects could have tangible effects on education and financial security for the next generation. However, the exact scope and funding mechanics of Kraken’s pledges—and how they will be allocated across eligible newborns—remain to be disclosed, leaving room for questions about total funding and administrative overhead.

Beyond crypto-native players, the involvement of major banks in supporting Trump Accounts suggests a broader commitment to integrating innovative savings vehicles into the mainstream financial system. The collaboration between public programs and private institutions could help normalize crypto-adjacent products in everyday financial planning, while also drawing scrutiny over governance, disclosure, and consumer protections. For observers, the evolving narrative raises questions about how such programs will balance public incentives with private sector risk, especially in markets that remain volatile and highly regulated.

The broader ecosystem has already seen crypto-adjacent firms extending benefits back to their home markets. In a related thread, Polymarket opened a free grocery store in New York City and pledged to donate millions of meals across the five boroughs, demonstrating a philanthropic approach to public-facing crypto initiatives. The move followed Kalshi’s fruitfully timed outreach, including a $50 grocery giveaway to residents in Manhattan, illustrating how prediction markets and related platforms are leveraging on-the-ground community support to build familiarity with their products.

Kraken’s blog post emphasizes the state’s role in enabling Silicon Valley–style innovation at a regional scale, with the Frontier Stable Token mentioned as a case study in Wyoming’s effort to expand stable, on-chain financial offerings. The combination of SPDI capabilities and state-backed support signals a model where government policy can align with corporate investment to create a more accessible crypto-enabled financial future, at least for a segment of the population.

As the sector weighs these developments, observers will be watching how the Trump Accounts pilot unfolds in practice, including how much funding is ultimately allocated by Kraken and other participants, how custodial arrangements are handled, and what guardrails are put in place to protect minors’ savings. The stakes extend beyond Wyoming’s borders: the outcome could influence how other states approach crypto policy, how Wall Street and fintechs collaborate on new savings vehicles, and how regulators assess the balance between innovation and consumer protection in youth-focused financial instruments.

Moreover, the narrative around corporate giving is evolving alongside regulatory signaling. The Trump Accounts initiative, backed by high-profile financial names, frames a broader movement where the private sector collaborates with federal and state programs to seed opportunities for younger generations. In this environment, Wyoming’s policy environment and Kraken’s leadership may serve as a proving ground for what a coordinated public-private approach to crypto savings can look like in the United States.

What to watch next

- Disclosure of Kraken’s per-child funding commitments and total pledged amount for Trump Accounts in Wyoming.

- Clarification of how Trump Accounts will be seeded by the federal program (Jan 1, 2025 to Dec 31, 2028 window) and the mechanics of ongoing contributions.

- Progress updates on Frontier Stable Token, including regulatory milestones and adoption by Wyoming residents or institutions.

- Additional corporate participants revealing commitments to Trump Accounts or similar state-led crypto savings initiatives.

- Regulatory developments in Wyoming and other states that could influence SPDI operations, crypto custody, and youth-focused financial products.

Sources & verification

- Kraken blog post Sponsoring Wyoming Trump Accounts detailing SPDI status and Frontier Stable Token context.

- Senator Cynthia Lummis X status announcing Kraken’s funding for newborn Trump Accounts in Wyoming.

- Dave Ripley’s X status confirming Kraken’s Wyoming HQ rationale and policy stance.

- Polymarket X status announces a free grocery store in New York City and a plan to donate 3 million meals across the five boroughs.

Kraken backs Trump Accounts in Wyoming as state-friendly policy draws crypto firms

Kraken has become the latest crypto company to align with a Trump administration initiative aimed at expanding savings opportunities for American children. The exchange joined a growing list of supporters after Wyoming’s senator Cynthia Lummis first flagged the development, stating that Kraken would fund all Trump Accounts created for Wyoming newborns as part of the pilot program. The public note from Lummis highlighted the state’s commitment to fostering a robust, future-oriented financial landscape for the next generation.

Kraken’s leadership framed the move within a broader strategic preference for Wyoming, emphasizing the state’s regulatory climate as the primary driver behind establishing the firm’s global headquarters there. Co-CEO Dave Ripley underscored that Wyoming’s policies are deliberate and responsible, aligning the company’s long-term ambitions with a governance framework designed to support innovation while protecting consumers. “We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy. We want to keep investing back in the community we call home. Starting early matters, and innovation should make long-term financial opportunity more accessible and affordable,” Ripley said in a post attributed to him on X.

Kraken’s published remarks also drew attention to the state’s role in enabling institutional frameworks such as the Special Purpose Depository Institution (SPDI) charter and the Frontier Stable Token. In a separate blog post, the exchange credited Wyoming officials with enabling its SPDI status and praised the state for helping advance frontier initiatives that blend traditional financial rails with digital assets. This alignment with SPDI and Frontier Stable Token signals a broader strategy to anchor crypto services in a jurisdiction perceived as stable and policy-forward.

Under the Trump Accounts framework, these vehicles are a novel form of retirement account designed for minors, financed in part by a federal seed of $1,000 for each child born between January 1, 2025, and December 31, 2028. The idea seeks to pair public funding with private-sector participation to create a foundation for long-term, tax-advantaged savings. While Kraken did not disclose the amount it intends to contribute per eligible newborn, the company confirmed its commitment to participate and noted that discussions with policymakers and state authorities are ongoing.

The broader financial ecosystem has shown varied enthusiasm for Trump Accounts. Prominent banks, including JPMorgan Chase, Bank of America, and Wells Fargo, have publicly supported the initiative to a degree, signaling a warming relationship between traditional finance and crypto-enabled savings products. The convergence of these players around a program meant to seed children’s savings illustrates a cross-industry willingness to experiment with governance structures, while raising questions about oversight, transparency, and the long-term performance of such accounts.

Beyond Kraken’s pledge, the broader crypto philanthropy wave has gained visibility in other corners of the market. Polymarket, a blockchain-powered prediction market, opened a temporary free grocery store in New York City, pledging to donate millions of meals across the five boroughs. The restaurant-like store operated for a few days before a coordinated food-donation event on a subsequent Monday, inviting residents to contribute to redistribution efforts. The move, paired with Kalshi’s $50 grocery giveaways to residents in Manhattan, underscores the industry’s willingness to blend community outreach with product education—a strategy aimed at normalizing crypto-enabled services in everyday life.

As Wyoming stands at the center of these developments, Kraken’s public involvement offers a concrete signal to the market: policy clarity, coupled with corporate participation, can accelerate the adoption of crypto-enabled savings tools. The SPDI framework and Frontier Stable Token provide a tangible context for how a state can serve as a testing ground for crypto custody, stability mechanisms, and youth-focused financial products. Investors and participants will be watching not only for the pledged funding totals but for how these initiatives translate into accessible financial opportunities for families across the region and beyond.

https://platform.twitter.com/widgets.js

Crypto World

The Right P2E Game Development Company is the Key to Success

The play-to-earn or P2E model has matured. It is no longer a novelty in Web3; it is an economic model capable of building real digital economies, attracting millions of users, and generating meaningful revenue for enterprises.

Yet the reality is uncomfortable. A number of P2E games tend to fail within a few months after launch. The reason behind the failure is not that the idea was weak or that the market lacks demand. It is due to the fact that the foundation wasn’t built to scale.

It is to be kept in mind that P2E games are not just entertainment. It is:

- A financial ecosystem

- A token economy

- A live service platform

- A community-driven marketplace

- A security-sensitive environment

Choosing the wrong P2E game development company does not just delay your project, it can result in collapsing the entire ecosystem. For enterprises, the real decision isn’t “Should we build a P2E game?” It’s “Who can build one that survives real-world scale?”

Why Scaling Breaks Most P2E Games

Early growth can hide structural weaknesses. Many P2E games look successful in the first few months because token rewards attract players very quickly. However, cracks tend to appear at the time when real activity begins, cracks appear.

1. Token Inflation Spiral

If rewards are not balanced, token supply floods the market, resulting in value dropping, players losing incentive, and speculators exit. A P2E game developer without tokenomics expertise often overlooks long-term supply dynamics.

2. Bot Exploitation

Reward systems attract bots. Without detection systems, automated farming drains value from real players and destabilizes the economy. Scaling securely requires anti-bot logic, behavioral analytics, and exploit monitoring.

3. Infrastructure Stress

P2E games involve constant transactions, such as claims, trades, staking, and marketplace activity. Poor backend planning leads to lag, failures, or downtime. A crash during growth damages credibility instantly.

4. Smart Contract Vulnerabilities

A single exploit can drain funds or freeze assets. Enterprises cannot afford trial-and-error blockchain coding. Security must be engineered from day one.

At the time when these issues come up, user trust disappears, and in GameFi, trust is everything. Thus, when trust breaks, game economies tend to crumble.

What “Scalable” Actually Means in P2E Game Development

A number of P2E game developers claim scalability. However, only a few define it properly. True scalability includes:

1. Sustainable Tokenomics

Sustainable tokenomics is not just token creation, but economic design that survives growth cycles, user behavior changes, and market fluctuations. It includes emission schedules, sinks, staking models, and value loops that keep demand alive.

2. Secure Smart Contract Frameworks

Contracts must be modular, auditable, and optimized. Security architecture must assume adversarial behavior. Enterprises need experienced developers who build for resilience, not just functionality.

3. Scalable Backend Systems

P2E combines gaming servers and financial systems. Infrastructure must support thousands and sometimes millions of concurrent actions. Cloud scalability, database design, and API efficiency are matters of immense importance in this regard.

4. Anti-Fraud & Anti-Exploit Mechanisms

Fraud detection systems must monitor unusual behaviors, repeated farming patterns, and suspicious wallet interactions. Without this, economies can be manipulated quite easily.

5. LiveOps & Economy Tuning

P2E is not static. Rewards, sinks, and incentives need constant balancing. Developers must support real-time adjustments. Scaling requires ongoing economic management.

WPlanning to Build a P2E Game That Succeeds and Scales?

Key Traits of a Reliable P2E Game Development Company

At the time of choosing a P2E game development company for your project, here are some of the key traits to watch out for to make the right selection.

1) Deep Tokenomics Expertise

Tokenomics is closer to financial engineering than game design. A strong P2E game development company:

- Models supply-demand dynamics

- Simulates user growth scenarios

- Designs burn and sink systems

- Balances rewards against inflation

They think like economists, not just developers.

2) Blockchain Security Maturity

A credible P2E game developer prioritizes:

- Contract audits

- Multi-layer security

- Wallet safety flows

- Compliance awareness

Security protects reputation and user confidence.

3) Architecture for Growth

Scaling is planned, not patched later. A mature developer designs:

- Load-ready backend systems

- Efficient indexing for transactions

- Modular architecture for upgrades

This, in turn, helps reduce long-term technical debt.

4) LiveOps Capability

P2E success depends on iteration. Events, reward cycles, and engagement mechanics must evolve. A capable P2E game developer supports:

- Economy monitoring

- Event design

- Seasonal content

- Reward recalibration

Without LiveOps, engagement tends to decline.

5) Proven Web3 Gaming Experience

Experience reduces risk. A P2E game development company that has shipped Web3 games understands pitfalls like inflation cycles and bot waves. Past execution matters more than promises.

Questions Enterprises Must Ask Before Hiring

Here are a few important questions to ask your chosen P2E game development company before finalizing the hiring process in order to avoid costly mistakes later.

- How do you simulate token economies?

- How do you prevent bot farming?

- What scalability architecture do you use?

- What is your smart contract audit process?

- How do you support LiveOps post-launch?

Once you get all the answers with clarity and evidence, finalize the hiring.

Why Enterprises Prefer Specialized P2E Game Development Companies

The P2E model sits at the intersection of: Gaming + Blockchain + Finance.

Only a few development partners master all three internally.

A specialized P2E game development company provides:

- Cross-domain expertise

- Pre-tested frameworks

- Faster development cycles

- Lower risk exposure

- Long-term ecosystem support

For enterprises, this translates into predictable outcomes.

Closing Thoughts

It is always to be kept in mind that in the P2E model, launching is easy, but sustaining is hard. Scaling is where winners are decided.

A real P2E game developer doesn’t just build gameplay; they engineer economies.

The real question for enterprises is simple: Are you building a short-term hype cycle, or a long-term digital economy? The right partner determines the answer.

Antier, an experienced P2E game development company, works with enterprises to build P2E ecosystems designed for sustainability. Support includes:

- Advanced tokenomics modeling

- Smart contract architecture

- Blockchain and wallet integration

- Scalable backend systems

- Security-first development

- LiveOps and ecosystem tuning

The objective isn’t just launch, it’s longevity. Let’s work on your next P2E project to make it successful.

Frequently Asked Questions

01. What is the play-to-earn (P2E) model in Web3?

The P2E model is an economic framework that allows users to earn real value through gameplay, creating digital economies that attract millions of users and generate revenue for enterprises.

02. Why do many P2E games fail shortly after launch?

Many P2E games fail due to a lack of scalable foundations, which leads to issues like token inflation, bot exploitation, infrastructure stress, and smart contract vulnerabilities.

03. What does true scalability mean in P2E game development?

True scalability in P2E game development refers to the ability to handle growth without compromising the game’s economy or user trust, ensuring robust systems for tokenomics, security, and infrastructure.

Crypto World

Binance Disputes Fortune Claims of Iranian Sanctions Breaches and Wrongful Terminations

TLDR:

- Binance conducted internal review and found no evidence of sanctions violations tied to Iranian transactions

- Exchange operates under Abu Dhabi Global Market regulation plus 21 local jurisdictions worldwide

- Company denies firing investigators for raising compliance concerns about alleged sanctions breaches

- Binance invested heavily in compliance infrastructure since 2023 regulatory settlement with authorities

Binance has formally disputed a Fortune investigation claiming the exchange processed over $1 billion in Iran-related transactions.

The cryptocurrency platform sent a detailed rebuttal letter on February 15, addressing allegations published two days earlier.

The company stated that a comprehensive internal review found no evidence of sanctions violations. Binance emphasized its commitment to regulatory compliance and cooperation with authorities.

Company Denies Evidence of Sanctions Violations

Fortune’s February 13 article alleged that internal investigators uncovered substantial transaction volumes tied to Iran.

The report suggested these transfers potentially violated international sanctions laws. Binance conducted a full internal review following the claims raised in the investigation.

The exchange stated it found no evidence supporting allegations of sanctions law breaches. This conclusion was reached after consultation with qualified legal counsel.

The company rejected assertions that violations were discovered and then suppressed. Binance characterized the Fortune report as containing material inaccuracies requiring correction.

The exchange operates under regulatory oversight from multiple jurisdictions worldwide. Binance holds authorization from the Abu Dhabi Global Market as its primary regulator.

The platform also maintains licenses and registrations across 21 different local jurisdictions. These regulatory relationships require ongoing compliance monitoring and reporting.

Chief Executive Officer Richard Teng addressed the allegations through the social media platform X. He stated that the record must be clear regarding the absence of sanctions violations.

Teng also denied that investigators were terminated for raising compliance concerns. The CEO requested corrections to what he described as inaccurate reporting.

Enhanced Compliance Framework Since 2023 Resolution

Binance referenced its 2023 regulatory settlement when addressing compliance capabilities. The company has invested substantially in its sanctions screening infrastructure since that resolution.

These investments included expanded staffing dedicated to compliance functions. The exchange allocated resources to anti-money laundering controls and transaction monitoring systems.

The platform described its compliance program as among the most robust in digital assets. Binance maintains internal standards that often exceed global regulatory requirements.

The company implements zero-tolerance policies on staff conduct violations and unauthorized data access. These policies extend to failures in observing internal compliance procedures.

The exchange questioned the sourcing and motivations behind the Fortune investigation. Binance noted the article relied heavily on anonymous sources while presenting speculation as fact.

The company emphasized that multiple legitimate channels exist for reporting compliance concerns. These include internal whistleblowing provisions and statutory protections for employees raising issues.

Binance requested that Fortune review its statements and correct misleading implications. The exchange offered to provide additional context for more accurate reporting.

The company stressed that accuracy is critical when publishing allegations related to sanctions compliance. Binance affirmed its continued cooperation in meeting monitorship obligations and regulatory commitments across all jurisdictions.

Crypto World

Wintermute adds tokenized gold to institutional OTC desk

Wintermute has rolled out institutional over-the-counter trading for tokenized gold, marking its entry into digital commodities amid rising interest in asset-backed tokens.

Summary

- Wintermute added tokenized gold to its OTC desk.

- Institutions can now trade and settle gold tokens on-chain.

- The market is forecast to reach $15 billion by 2026.

The firm said on Feb. 16 that its OTC desk now supports trading in Pax Gold and Tether Gold, the two largest gold-backed tokens by market value.

The service gives professional investors a way to gain exposure to physical gold through blockchain-based products, while keeping access to crypto-style settlement and liquidity. It comes in response to the increasing demand from institutions for transparent, stable assets that are easy to trade and settle fast.

Building on-chain access to gold markets

Wintermute will offer institutional clients algorithmically optimized spot execution as part of the new launch. Clients can settle trades in the way that suits them best. Transactions can be completed on-chain using major cryptocurrencies, stablecoins, or traditional fiat currencies.

This setup allows positions to be opened, adjusted, or closed instantly. It also helps move capital smoothly between markets while lowering settlement risk. For trading firms and investment funds, this structure makes it easier to manage liquidity and hedge exposure.

Instead of sticking to traditional choices like exchange-traded funds or buying physical gold bars and coins, more investors are starting to look at tokenized gold. These digital tokens are backed by real gold and allow investors to buy small fractions of it, making gold ownership more accessible.

They can also be traded easily, giving holders flexibility without the hassle of storing or transporting physical gold. That level of flexibility is hard to achieve in conventional markets.

Industry data shows that the total value of tokenized gold surged to around $5.4 billion by mid-February 2026, an increase of about 80% in just three months.

Growth outlook and institutional interest

Wintermute chief executive Evgeny Gaevoy said the tokenized gold market could reach $15 billion by the end of 2026, nearly three times its current size. He pointed to rising institutional participation and demand for asset-backed digital products as key factors behind the forecast.

Trading volumes have also increased. During the fourth quarter of 2025, tokenized gold products recorded over $126 billion in turnover, outpacing several major gold ETFs.

According to analysts, 24-hour trading and more transparent pricing are the main factors driving the growth. Prices are shown in real time, and investors are free to buy and sell whenever they want.

Despite the recent crypto market downturn, tokenized gold has remained popular among investors seeking stability and portfolio diversification. Wintermute’s most recent launch indicates a larger trend in the industry toward more reputable, institution-focused services.

Crypto World

Wallet Founder Warns of Coordinated Scam Targeting XRPL Users

XRPL users face coordinated scam surge, wallet founder says, as attackers deploy phishing, fake apps, and sign requests globally.

Xaman Wallet founder Wietse Wind has said that a “massive XRPL targeted scam effort” is underway, warning users about fake sign requests, phishing emails, and impersonation accounts.

His alert points to a rise in social engineering attacks aimed at crypto holders rather than flaws in the blockchain code.

A Multi-Pronged Attack on XRPL Users

Wind wrote on X on February 16 that he had spent the weekend adding new filters and alerts to Xaman Wallet after detecting coordinated attempts to trick users into signing malicious transactions.

He listed several methods seen in recent days, including scam NFTs that promise token swaps, fake desktop wallet apps, and direct messages posing as support staff. The official wallet account repeated the warning, telling users not to click links, respond to DMs, or connect wallets to unknown websites.

According to Wind, the attacks usually focus on manipulating users rather than breaching software, with the scammers expanding beyond social media and sending phishing emails even though Xaman does not store user email addresses, suggesting attackers are relying on leaked data from unrelated breaches.

The tricksters are also reportedly promoting fake “desktop wallets,” despite Xaman being a strictly mobile application. Some fraudulent projects are even promising free tokens in exchange for users’ secret keys.

Wind stressed that funds will stay safe if people avoid approving unknown transactions or sharing their keys.

You may also like:

“No matter the amount of warnings, detection, filtering, alerts in the app and here on social: no scammer can get you if you don’t willingly / unknowingly interact with them,” he advised. “Your funds are perfectly safe in Xaman Wallet: just don’t sign any transaction you don’t trust, and don’t interact with anyone promising you free tokens.”

Scams Moving Beyond DeFi Exploits

The XRPL scam wave reflects a troubling industry-wide trend, with a PeckShield report from earlier in the year revealing that crypto scams and hacks drained more than $4.04 billion in 2025.

Of that total, $1.37 billion came from scams alone, a 64% increase from 2024. The firm said attackers are shifting toward tailored phishing campaigns that target individuals with large holdings instead of relying only on technical exploits.

Furthermore, the PeckShield report also found that centralized platforms and companies accounted for about 75% of stolen funds last year, up from 46% in 2024.

These high-value thefts tied to deception extend beyond software wallets. On January 17, 2026, blockchain investigator ZachXBT reported that a victim lost about $282 million in Bitcoin (BTC) and Litecoin (LTC) through a hardware wallet scam. According to his findings, the attacker later moved the funds through THORChain and converted them to Monero (XMR).

Wind’s posts framed the latest campaign as a reminder that wallet security often depends on user decisions.

“This is a cat and mouse ‘game,’ and the scammers will not win,” he stated.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto.com Gets Certified on AI Amid Tech Rush

Crypto.com says it has become the first digital asset platform to receive an international certification for artificial intelligence systems management amid its continued expansion into the sector.

The company said on Monday that it received ISO/IEC 42001:2023 certification, an international standard governing the creation and implementation of an AI management system.

“Security and privacy continue to be a core focus for us, particularly as we scale our AI-driven infrastructure and services,” said Crypto.com information security chief Jason Lau, adding that the certification ensures “every AI system we develop and deploy is secure, transparent, and aligned with emerging regulatory expectations.”

Crypto.com co-founder and CEO, Kris Marszalek, said the certification was “an important step as we continue to leverage AI tools and technologies.”

Crypto.com recently leaned into offering AI services that tie in with its crypto offering, launching software development kits and tailored data services. It also recently launched the AI agent platform ai.com on Feb. 9, which it considers a core business.

The new website allows users to create AI agents that can perform everyday tasks such as trading and managing workflows.

Marszalek said the goal of the company was to accelerate the capabilities of AI “by building a decentralized network of autonomous, self-improving AI agents that perform real-world tasks for the good of humanity.”

Related: Do Super Bowl ads predict a bubble? Dot-coms, crypto and now AI

Crypto executives and users have been enamored with AI, with companies rushing to offer AI services to keep up with the hype surrounding the technology.

Crypto-focused AI agents, which can conduct transactions without human intervention, have grown in popularity as traders look to gain an edge in the always-on market.

Rival crypto exchange Coinbase has also begun to offer services tailored to AI, launching crypto wallet infrastructure on Feb. 11 that allows AI agents to spend, earn and trade crypto.

AI Eye: 9 weirdest AI stories from 2025

Crypto World

Kraken Will Sponsor Trump Accounts For All Wyoming Babies Born In 2026

Crypto exchange Kraken has become the latest company to heed calls from US President Donald Trump to support his “Trump Accounts,” a savings plan aimed at American children under the age of 18.

The move was first announced by Wyoming Senator Cynthia Lummis on Monday, with the Republican official stating that Kraken would provide funding toward all Trump Accounts created for newborns in the state of Wyoming.

“Grateful to Kraken for their commitment to Wyoming’s next generation and to the Cowboy State’s economic future,” she said.

Kraken’s co-CEO Dave Ripley said the firm chose to support Trump Accounts in Wyoming due to the positive regulatory climate in the state, home to the firm’s headquarters.

“We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy. We want to keep investing back in the community we call home. Starting early matters, and innovation should make long-term financial opportunity more accessible and affordable,” he said.

In a blog post, Kraken said that the Wyoming government enabled the firm to become the US’s first Special Purpose Depository Institution and praised it for its work on helping launch the Frontier Stable Token.

Trump Accounts are a new type of retirement account in the US that can be established by parents or legal guardians for children under 18. Under a pilot program, the federal government will seed Trump Accounts with $1,000 for any child born between Jan. 1, 2025, and Dec. 31, 2028.

So far, traditional finance heavyweights such as JPMorgan, Bank of America and Wells Fargo have all put support behind Trump Accounts in varying degrees, alongside several other well-known names.

Kraken did not share how much funding it would contribute to each eligible newborn. Cointelegraph has reached out to Kraken for comment.

Crypto firms give back amid state support

This isn’t the only crypto-related firm to give back to its home state this month.

Last week, blockchain-based prediction market platform Polymarket opened a free grocery store in New York City and said it would donate 3 million meals across the five boroughs.

Related: CFTC adds Coinbase, Ripple execs to 35-member advisory committee

The store was open from Thursday to Sunday last week, followed by a food donation day on Monday, when people could donate food to be redistributed across the city.

The move from Polymarket followed a similar move by prediction market competitor Kalshi, with the platform offering a $50 grocery giveaway to over 1,000 Manhattan residents on Feb. 3.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Crypto’s AI Pivot: Hype, Infrastructure, and a Two-Year Countdown

If Consensus Hong Kong 2026 had an unofficial theme, it wasn’t Bitcoin or regulation. It was artificial intelligence — and the scramble to figure out what it actually means for crypto.

AI surfaced in almost every context: main-stage keynotes, side-event panels, venture capital meetings, and even the post-conference mood. But the conversations weren’t uniform. They ranged from Hong Kong government officials endorsing the machine economy to venture capitalists declaring the AI hype cycle in crypto already over.

Enterprise AI Agents Are Already Deployed

At the Gate’s side event, Sophia Jin, Hong Kong Tech Director at Byteplus — ByteDance’s enterprise technology arm — revealed that multiple major crypto exchanges are already using the company’s AI agent products. She outlined three use cases in production: intelligent customer service that incorporates deep research and trading scenario matching; multi-agent research systems with parallel data collection; and AML workflow automation with human oversight at decision points.

The most notable detail was the safety architecture. Byteplus places guardrails outside the agent orchestration layer — a kill switch that can halt agents immediately if they breach defined boundaries. Jin projected that within two years, every exchange employee will have an enterprise-grade AI assistant, while onboarding new users will become dramatically easier through AI-powered personalized education.

Two Years Until AI Outthinks You

Ben Goertzel, CEO of decentralized AI marketplace SingularityNET, offered the conference’s most provocative timeline. He gave humans roughly two years before AI surpasses them in strategic thinking.

“The human brain is better at taking the imaginative leap to understand the unknown,” Goertzel said iat Consensus. It won’t last, though. “We should enjoy it for a couple more years.”

While his Quantium project can already predict short-term Bitcoin volatility with high accuracy, Goertzel noted that long-term strategic thinking remains uniquely human — for now. He described the current bear cycle as a “stress test” for infrastructure that will eventually host artificial general intelligence.

Bitget CEO Gracy Chen offered a more grounded view. On a panel about agentic trading, she compared current AI trading bots to interns — faster and cheaper but requiring supervision. Historical data-driven models have never encountered events like the 10/10 liquidations, she noted, making human intervention essential in unfamiliar conditions. But within three to five years, she projected, AI could replace many human roles.

Saad Naj, CEO of agentic trading startup PiP World, countered that humans may not be the right baseline. “As humans, we are too emotional. We can’t compete with AI solutions,” he said, noting that 90% of day traders lose money.

Building the Payment Layer for Agents

If the main stage provided the vision, side events tried to build the plumbing.

At the Stablecoin Odyssey event at Soho House, the panel “Building Payment Blockchains for the Agentic Economy” focused on what infrastructure AI agents actually need. Nellie Tan, Payment Head at Monad, introduced Coinbase’s X402 protocol — an HTTP-native on-chain payment standard — and argued that agentic payments would generate transactions “at the speed of data,” requiring throughput of thousands to millions per second.

Eddie, CEO of payment middleware AEON, framed the shift as an interface transition. When consumers interact through AI agents rather than apps, every commercial interaction funnels through a single point — and the last mile is always a payment. His company processes what he described as 80% of crypto payments through partnerships with OKX, Bybit, and others.

The question of which blockchain AI agents would choose remained open. Mate Tokay, CMO of OP_CAT Layer, noted that no one yet knows whether agents will select chains based on training data, experience, speed, or security. The answer likely depends on the transaction — large asset transfers prioritize security, while consumer purchases prioritize speed.

Crypto as Currency for AI — or Just Another Hype Cycle?

The most striking endorsement came from outside the industry. Hong Kong Financial Secretary Paul Chan Mo-po used his appearance to frame AI agents as an economic force that crypto is uniquely positioned to serve.

“As AI agents become capable of making and executing decisions independently, we may begin to see the early forms of what some call the machine economy, where AI agents can hold and transfer digital assets, pay for services and transact with one another onchain,” Chan said.

Binance CEO Richard Teng pushed it further. “If you think about the agentic AI, so the booking of hotels, flights, whatever purchases that you would make, how you think that those purchases will be made — it’ll be via crypto and stablecoins,” he said. “So, crypto is the currency for AI, if you think about it.”

But venture capitalists poured cold water on the broader “AI + crypto” narrative. Anand Iyer of Canonical Crypto described the moment as a trough. “We went through a frothy period. Now it’s about figuring out where the real strength lies,” he said. Both Iyer and Kelvin Koh of Spartan Group criticized overinvestment in GPU marketplaces and attempts to build decentralized alternatives to OpenAI or Anthropic — projects that require capital far beyond what crypto can muster.

Instead, both see potential in purpose-built solutions that start with a specific problem. Proprietary data, regulatory edges, or go-to-market advantages now matter more than technical novelty. Koh’s advice to founders was blunt: “Twelve months ago, it was enough to have a wrapper on ChatGPT. That’s no longer true.”

What’s Forming

Conversations among industry participants pointed toward a framework taking shape: stablecoins serving as value rails for agent transactions, prediction markets handling information pricing, AI systems executing trades and operations, and physical robotics extending the loop into the real world. It’s not a single project or protocol — it’s a thesis about where crypto and AI intersect productively, without relying on the speculative cycles that drove previous bull runs.

A parallel thread runs through decentralized AI. Current systems are centralized and opaque. The idea of transparent, verifiable, community-governed AI networks aligns with crypto’s founding principles — and Goertzel, among others, pointed to the growth of such projects at the event as evidence that convergence is underway.

The pure speculation cycle may not return. But at Consensus Hong Kong, the argument that AI gives crypto a reason to exist beyond trading was made simultaneously from the government podium, the exchange boardroom, and the venture capital meeting. That’s a different kind of consensus.

The post Crypto’s AI Pivot: Hype, Infrastructure, and a Two-Year Countdown appeared first on BeInCrypto.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video13 hours ago

Video13 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Tech1 hour ago

Tech1 hour agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show