Crypto World

Bitcoin faces quantum scrutiny as leveraged shorts eye liquidation risk zone

Bitcoin faces quantum computing scrutiny and heavy leveraged short positioning, with SOPR stabilization, ETF inflows and CME gap levels shaping whether a 10% move triggers a cascade of liquidations.

Summary

- Quantum computing risks are drawing institutional attention, raising governance and upgrade questions as ETF-driven ownership concentrates capital.

- CoinGlass maps show clustered short liquidations near 10% above spot, while CME gap zones and weekend liquidity amplify the risk of sharp squeezes.

- SOPR signals show short-term selling pressure easing and ETF flows flipping positive, hinting at a potential rebound if key trigger levels break.

Bitcoin’s potential vulnerability to quantum computing threats has drawn attention from institutional investors, while derivatives markets show concentrated short positions vulnerable to liquidation on a 10% price rally, according to market data and industry observers.

Venture capitalist Nic Carter stated that large institutional holders could pressure Bitcoin developers if potential quantum computing threats are not addressed, according to reports from Coin Bureau. The comments come as institutional exposure to Bitcoin has expanded through spot exchange-traded funds and custodial products.

Liquidation data analyzed over the weekend indicated that a significant volume of short positions would face unwinding on a 10% upside move, while substantial long positions remained exposed to liquidation on an equivalent decline, according to trader Ted Pillows, who shared the analysis on social media platform X.

Pillows’ figures showed that leveraged short positions outweighed vulnerable long positions, creating conditions where an upward price movement could trigger rapid buybacks. The analysis identified specific trigger levels that could open a path toward higher price zones, while noting a nearby area tied to a Chicago Mercantile Exchange futures gap.

CoinGlass liquidation maps reflected elevated leverage across derivatives venues, with open interest clustering around round-number strikes. The positioning followed weekend momentum periods, when reduced liquidity often amplifies price movements.

On-chain analyst miracleyoon observed that the Short-Term Holder Spent Output Profit Ratio moved below the 0.95 capitulation zone before recovering toward 1.0. The metric measures whether short-term holders sell at a profit or loss and often signals shifts in local trend behavior, according to the analyst.

The analyst stated that sustained positioning above 1.0 would imply absorbed selling pressure and could extend a technical rebound, while failure to hold that threshold would reopen range-bound conditions. The recent drawdown lacked the intensity seen on August 5, 2024, when the ratio fell toward 0.9, according to the analysis.

CryptoQuant contributor Amr Taha compared retail flows on cryptocurrency exchange Binance with institutional exchange-traded fund activity. On February 6, retail-driven sell pressure exceeded 28,000 Bitcoin, coinciding with a price drop, according to Taha’s data. A second wave on February 13 surpassed 12,000 Bitcoin, even as prices attempted stabilization.

Spot Bitcoin exchange-traded funds posted their first positive net flow day since January on February 6, according to the same analysis. BlackRock’s iShares Bitcoin Trust led with notable inflows, followed by Fidelity’s Wise Origin Bitcoin Fund, suggesting institutions accumulated holdings during periods of retail selling.

Carter framed the quantum computing issue as governance pressure rather than an immediate technical flaw, arguing that capital concentration alters power dynamics within open-source systems, according to Coin Bureau’s report. The discussions have resurfaced as more corporate treasuries and asset managers have allocated capital through regulated investment vehicles.

Analyst Teddy Bitcoins stated that the current market structure mirrored the 2022 price decline, projecting a potential substantial decline in 2026 based on chart symmetry. The thesis relied on cyclical behavior patterns rather than immediate catalysts, according to the analyst’s commentary.

The quantum risk discussion intersects with leverage imbalances and on-chain stabilization signals, reflecting different time horizons from short-term liquidations to multi-year structural considerations. Markets have absorbed these factors simultaneously, adjusting exposure across spot and derivatives venues.

Traders are monitoring whether Bitcoin prices can sustain momentum above key trigger levels to force short covering, while failure to defend nearby support levels could revive gap-fill scenarios. Developers face renewed debate over cryptographic upgrade paths as institutional ownership increases, though immediate price movements appear more likely to emerge from leveraged positioning dynamics.

Crypto World

Bitcoin Sentiment Hits Lows Amid Oversold Signals

Crypto market sentiment has fallen to extreme lows and could lead to a “durable bottom” that exhausts selling pressure, according to analysts at crypto financial services firm Matrixport.

“Sentiment has fallen to extremely depressed levels, reflecting broad pessimism across the market,” said Matrixport in a note on Tuesday.

Matrixport’s own Bitcoin (BTC) “fear and greed index” suggests that “durable bottoms” form when the 21-day moving average drops below zero and reverses higher, which is currently the case.

“This transition signals that selling pressure is becoming exhausted and that market conditions are beginning to stabilize.”

However, Matrixport cautioned that prices could still fall further in the near term. Historically, these deeply negative sentiment readings have offered attractive entry points, they said.

“Given the cyclical relationship between sentiment and Bitcoin price action, the latest reading suggests the market may be approaching another inflection point,” it stated.

Crypto market sentiment at four-year lows

Previous periods when the Matrixport sentiment metric was this low were around June 2024 and November 2025, following periods of steep market declines.

Alternative.me’s “Fear and Greed Index” is also around its lowest level since June 2022, with a reading of 10 out of 100 indicating “extreme fear.”

Related: Bitcoin down 22%, could it be the worst Q1 since 2018?

If Bitcoin closes February in the red, it will print five straight monthly losses in the longest streak since 2018, and one of the steepest sustained sell-offs in history.

Bitcoin is at historic oversold levels

Frank Holmes, chairman of Bitcoin mining firm Hive, said on Monday that Bitcoin is now roughly two standard deviations below its 20-day trading norm. “This is a level we’ve seen only three times in the past five years,” he said.

“Historically, such extremes have favored short-term bounces over the subsequent 20 trading days,” he explained.

“Despite the ongoing market jitters, I remain bullish in the long term because the fundamentals still look strong.”

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest

Crypto World

Harvard Flips the Script: Trims Bitcoin by 20%, Enters Ethereum Market With $86.8M Buy in Q4 2025

TLDR:

- Harvard Management Company trimmed nearly 1.5 million Bitcoin ETF shares, reducing its position by roughly 21 percent in Q4 2025.

- HMC purchased nearly 4 million Ethereum ETF shares worth $86.8 million, marking its first-ever exposure to the asset class.

- Bitcoin fell from $126,000 to $88,429 while Ethereum lost 28 percent of its value during Harvard’s repositioning quarter.

- Finance professors from UCLA and University of Washington criticized Harvard’s crypto strategy, questioning valuations and portfolio risk management.

Harvard Management Company sold approximately 20 percent of its Bitcoin holdings while placing an $86.8 million bet on Ethereum during the fourth quarter of fiscal year 2025.

The endowment trimmed nearly 1.5 million shares of the iShares Bitcoin Trust yet opened a fresh position in an Ethereum exchange-traded fund.

Securities and Exchange Commission filings released Friday confirmed the moves. Bitcoin remains Harvard’s largest publicly disclosed holding, valued at over $265 million despite the reduction.

Harvard Shifts Crypto Strategy with Ethereum Entry

Harvard Management Company’s $86.8 million Ethereum purchase marked the endowment’s first exposure to the asset.

The fund acquired nearly 4 million shares of an Ethereum ETF, a cryptocurrency Harvard had never previously held.

This move came as Bitcoin was trimmed by roughly 1.5 million shares, reflecting a broader repositioning within the digital asset space.

The quarter proved turbulent for both cryptocurrencies. Bitcoin peaked near $126,000 in October 2025 before sliding to $88,429 by quarter’s end.

Ethereum fared worse, shedding approximately 28 percent of its value over the same period. Harvard’s entry into Ethereum during this price decline suggests the fund saw longer-term opportunity despite short-term losses.

Finance experts, however, raised questions about both moves. Andrew F. Siegel, an emeritus professor of finance at the University of Washington, called the Bitcoin investment outright “risky.”

He pointed to a steep year-to-date decline and challenged the asset’s ability to hold value over time.

“It is down 22.8% year-to-date,” Siegel wrote. “It can be argued that the risk of Bitcoin is partly due to its lack of intrinsic value.”

His remarks cast doubt on whether the endowment’s crypto exposure aligns with its long-term financial responsibilities.

Harvard Exits Key Holdings, Reshuffles Tech Exposure

Avanidhar Subrahmanyam, a finance professor at UCLA, extended his criticism to Harvard’s new Ethereum position as well.

He had previously questioned the Bitcoin investment and noted that his concerns had since proven accurate. His latest remarks were equally pointed about the Ethereum bet.

“In my view, any underdiversified position in something as speculative as crypto does not make sense for HMC,” Subrahmanyam wrote. “If I were to ask them how they value BTC or Ethereum, I doubt I would get a cogent and precise answer.”

He added that he again questioned the wisdom of the Ethereum investment after raising earlier alarms about Bitcoin.

Outside of cryptocurrency, Harvard Management Company made several notable portfolio changes. The endowment opened a $141 million stake in Union Pacific Corporation following the railroad’s announced merger with Norfolk Southern.

Subrahmanyam acknowledged this particular move, saying the Union Pacific investment “may prove valuable” for the university given the proposed transcontinental railroad network it would create.

Harvard also exited two positions entirely, liquidating its full 1.1 million-share stake in Light & Wonder, Inc. and its 92,000-share position in Maze Therapeutics Inc.

On the technology front, Broadcom surged 222 percent within the portfolio while Google and Taiwan Semiconductor rose 25 percent and 45 percent respectively.

Amazon, Microsoft, and Nvidia each saw reductions of 36 percent, 21 percent, and 30 percent. Siegel noted that “the market is generally nervous right now with AI being so new and so expensive to train and deploy,” a factor he said likely drove some of those cuts.

Harvard’s directly held public equity portfolio declined by roughly $25,000 from the prior quarter, representing only a fraction of the university’s $56.9 billion endowment.

Crypto World

How to Sell Cryptocurrency Across Different Platforms and Market Conditions?

The crypto market operates across multiple environments, each shaped by different liquidity levels, user behavior, and technical structures. As a result, selling strategies must adapt to both platform choice and broader market conditions.

One of the first distinctions sellers encounter is between centralized, peer-to-peer, and decentralized platforms. Centralized exchanges emphasize speed and automation, often offering deep liquidity but limited flexibility.

Peer-to-peer environments prioritize user control and payment diversity, while decentralized protocols rely on smart contracts and on-chain execution. Knowing how these systems differ is a critical step in understanding how to sell cryptocurrency without unnecessary compromise.

Market conditions play an equally important role. During periods of high volatility, prices can shift rapidly within minutes, affecting execution quality.

In such environments, sellers must decide whether to prioritize immediate execution or price control. Understanding how to sell cryptocurrency during volatile phases often involves balancing urgency against the risk of unfavorable pricing.

Liquidity fragmentation further complicates selling decisions. While major assets may trade actively across multiple platforms, less common tokens often suffer from shallow order books.

Selling large amounts in low-liquidity markets can cause price slippage, reducing overall returns. Strategic sellers who understand how to sell cryptocurrency assess liquidity conditions before initiating transactions and adjust order size or timing accordingly.

Liquidity and Order Types in Crypto Selling

Order mechanics also influence outcomes. Market orders offer speed but limited control, while limit orders allow sellers to define acceptable pricing levels.

Order mechanics also influence outcomes. Market orders offer speed but limited control, while limit orders allow sellers to define acceptable pricing levels.

Stop orders and conditional triggers add another layer of risk management. Mastering these tools is essential for anyone aiming to learn how to sell cryptocurrency in a structured and disciplined manner.

Regulation, Security and Psychological Factors in Selling

Security considerations extend beyond platform reputation. Wallet management, transaction verification, and withdrawal procedures all affect the safety of a sale. Sellers must ensure that destination accounts are correctly configured and that transfers are confirmed properly.

A thorough approach to how to sell crypto includes protecting assets throughout the entire transaction lifecycle, not just at the point of execution.

Settlement and payment logistics deserve equal attention. Fiat withdrawals may involve banking delays, currency conversion fees, or regional processing limits.

In peer-based transactions, payment confirmation and release timing can vary. These operational details are often overlooked but are central to understanding how to sell cryptocurrency efficiently and predictably.

Regulatory frameworks add another layer of complexity. Selling cryptocurrency may trigger reporting obligations, capital gains taxes, or documentation requirements, depending on jurisdiction.

Sellers who fail to account for these factors risk legal and financial consequences. Responsible participation in digital asset markets requires understanding how to sell cryptocurrency in compliance with local regulations.

Psychology, Technology and Portfolio Goals in Crypto Selling

User behaviour and psychology also influence selling outcomes. Emotional responses to market movements can lead to rushed decisions or missed opportunities.

User behaviour and psychology also influence selling outcomes. Emotional responses to market movements can lead to rushed decisions or missed opportunities.

Experienced sellers rely on predefined exit strategies, profit targets, and loss limits rather than reacting impulsively. Developing this mindset is an essential part of learning how to sell cryptocurrency consistently over time.

Technological reliability should not be underestimated. Platform outages, network congestion, and system delays can interfere with execution during critical moments.

Diversifying access across multiple platforms and maintaining contingency plans helps mitigate these risks. A comprehensive understanding of how to sell cryptocurrency includes preparation for technical disruptions as well as market ones.

Another important consideration is portfolio impact. Selling decisions should align with broader financial objectives, whether rebalancing holdings, securing profits, or reducing exposure.

Viewing each sale in isolation can lead to fragmented decision-making. Strategic sellers understand how to sell cryptocurrency as part of an integrated portfolio strategy.

In conclusion, selling digital assets is a complex process shaped by platform choice, market conditions, and individual objectives. Knowing how to sell cryptocurrency requires a holistic approach that combines technical skills, risk awareness, and disciplined execution.

As the crypto ecosystem continues to evolve, sellers who adapt their strategies thoughtfully are better positioned to protect value and navigate change with confidence.

Crypto World

Real-World Assets: DeFi’s New Power Move

If you’ve been watching DeFi lately and thinking, “Where did all the noise go?” — good. The noise is being replaced by something far more dangerous (in a good way): real finance moving on-chain.

The most powerful trend in DeFi today isn’t another meme token or short-lived yield farm. It’s the explosive growth of Real-World Asset (RWA) tokenization — and it’s quietly reshaping the entire ecosystem.

The Shift: From Speculation to Structured Finance

For years, DeFi was largely circular—crypto collateral backing crypto loans to farm more crypto. Fun? Absolutely. Sustainable? Debatable.

Now we’re seeing capital rotate into RWAs — tokenized U.S. Treasuries, bonds, credit markets, and even real estate — plugged directly into DeFi rails.

This matters because:

-

It introduces a yield backed by real economic activity

-

It attracts institutional liquidity

-

It stabilizes TVL with less volatility than purely crypto-native assets

In short, DeFi is starting to behave like actual finance instead of a casino with better UI.

Legacy Protocols Aren’t Dead — They’re Evolving

While RWAs are booming, core lending protocols remain critical infrastructure.

Take Aave — still one of the most important liquidity engines in DeFi. Lending and borrowing markets are the backbone of capital efficiency, and Aave continues expanding across chains while integrating more stable and institutional-friendly assets.

What’s interesting isn’t just price movement — it’s positioning.

Aave and similar protocols are becoming the rails through which RWAs plug into DeFi. Imagine borrowing against tokenized Treasury bonds instead of volatile altcoins. That’s not theory anymore — it’s happening.

And when DeFi protocols become credit markets instead of speculation machines? That’s when institutions stop laughing and start allocating.

High-Speed Chains Are Fueling Liquidity

Infrastructure matters. Speed matters. Fees matter.

That’s where ecosystems like Solana are gaining traction. Faster finality and lower costs make it easier for tokenized assets and structured products to scale without suffocating under gas fees.

Even communities surrounding assets like XRP continue pushing narratives around cross-border settlement and institutional liquidity integration.

Whether or not every ecosystem wins long-term, one thing is clear: DeFi is competing to become the settlement layer for global finance.

That’s not a small ambition.

Why RWAs Are Winning Right Now

Here’s the strategic reality:

-

Pure DeFi yields fluctuate wildly.

-

Traditional finance yields are steady but slow.

-

RWAs merge both worlds.

Tokenized Treasuries offering predictable returns inside decentralized systems? That’s catnip for serious capital.

Instead of relying solely on volatile collateral like ETH or governance tokens, protocols can now plug into real bonds and credit instruments. That reduces systemic fragility and increases long-term sustainability.

And sustainability is what separates a cycle from a structural shift.

The Bigger Picture: DeFi Growing Up

This moment feels different from previous hype waves.

-

It’s less about memes.

-

Less about 10,000% APY farms.

-

More about tokenized funds, structured credit, and compliance-friendly infrastructure.

DeFi isn’t abandoning decentralization — it’s layering maturity on top of it.

We’re witnessing the transformation from:

“Number go up” culture

to

“Capital efficiency and global settlement infrastructure.”

That’s a glow-up.

What This Means for Builders and Investors

If you’re building:

Focus on infrastructure, compliance bridges, custody solutions, and RWA integration tooling.

If you’re investing:

Watch protocols that connect traditional assets to decentralized liquidity markets.

If you’re trading:

Narratives shift before prices do. RWAs are no longer a niche subcategory — they’re becoming a dominant vertical.

Final Thoughts

DeFi isn’t fading. It’s evolving.

Real-World Assets moving on-chain represent the strongest signal yet that decentralized finance is entering its next phase — one defined by stability, institutional participation, and real economic backing.

Speculation built the arena.

RWAs are bringing in the banks.

And this time, they’re playing by DeFi’s rules.

REQUEST AN ARTICLE

Crypto World

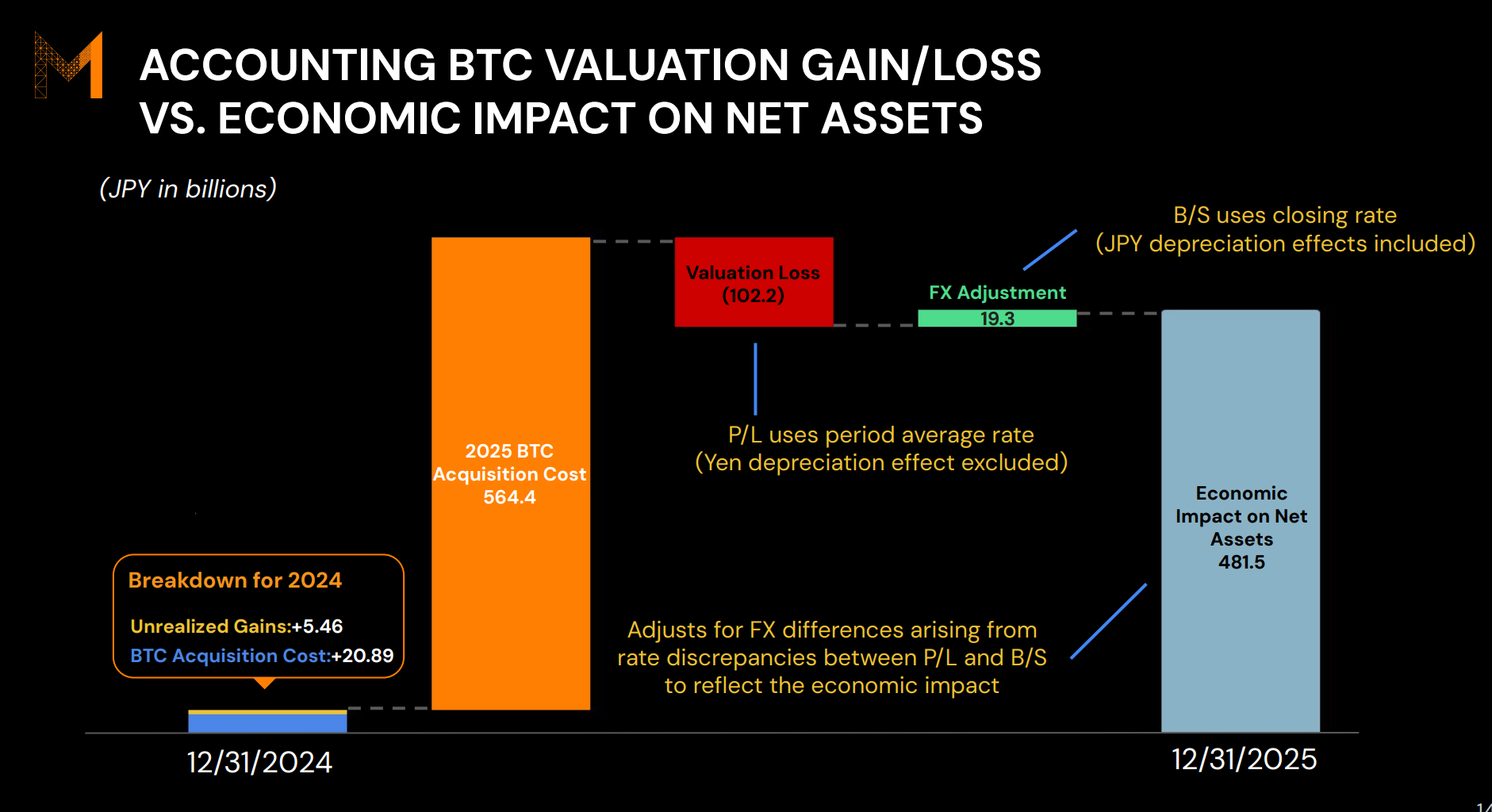

Metaplanet’s Bitcoin Bet Leads to $1.35 Billion Paper Loss

Tokyo-based Metaplanet released its fiscal year 2025 results, reporting a 738% year-over-year increase in revenue.

Despite the revenue surge, Bitcoin’s drawdown weighed heavily on the firm, as a non-cash valuation loss of 102.2 billion yen ($667.52 million) pushed the company into a net loss for the year.

Sponsored

Sponsored

Metaplanet’s FY2025 earnings report revealed revenue climbed to 8.9 billion yen ($58.12 million), up from 1.06 billion yen ($6.92 million) a year earlier. The company’s Bitcoin income business generated roughly 95% of total revenue.

“We launched the Bitcoin Income business in Q4 2024. Since then, this strategy has become our primary revenue source and is expected to remain a core driver of profit growth,” the report read.

Operating profit rose sharply to 6.28 billion yen ($41.01 million), marking a 1,694.5% increase year over year. Its shareholder base expanded significantly, growing from 47,200 at the end of 2024 to around 216,500 by the close of 2025.

Total assets also surged, rising from 30.3 billion yen ($197.89 million) to 505.3 billion yen ($3.30 billion) over the same period.

Despite the strong operational performance, the company posted a net loss of 95 billion yen ($620.17 million), after recording net income of 4.44 billion yen ($29.00 million) in 2024. The loss was primarily driven by valuation declines on its Bitcoin holdings.

Still, Metaplanet emphasized the strength of its balance sheet. The company said its liabilities and preferred stock would remain fully covered even in the event of an 86% drop in Bitcoin’s price, supported by an equity ratio of 90.7%.

Sponsored

Sponsored

The company also outlined its outlook for this year. Metaplanet expects revenue to reach 16 billion yen ($104.49 million) in FY2026, representing a 79.7% increase year over year. Operating profit is projected to rise to 11.4 billion yen ($74.45 million), up 81.3% from the previous year.

Japan’s Largest Corporate Bitcoin Holder Faces $1.35 Billion Unrealized Loss

According to the latest data, Metaplanet holds 35,102 BTC, a major increase from just 1,762 BTC at the end of 2024. The accumulation strategy has positioned the company as the largest corporate Bitcoin holder in Japan and the fourth-largest publicly listed corporate holder globally.

However, the rapid expansion of its Bitcoin treasury now comes with significant pressure. Metaplanet’s average acquisition cost stands at $107,716 per BTC, while Bitcoin is currently trading at $68,821.

Across its entire 35,102 BTC position, this translates into approximately $1.35 billion in unrealized losses. While these losses remain on paper and could reverse if Bitcoin recovers, they highlight the inherent volatility risk tied to corporate treasury strategies heavily concentrated in digital assets.

Metaplanet is not alone in facing valuation pressure. Bitcoin’s broader market drawdown has also pushed MicroStrategy’s holdings below its average acquisition price, leaving the US-based firm with unrealized losses exceeding $5.33 billion as of the latest data.

The impact extends beyond balance sheets. Metaplanet’s share price is down 28.63% year-to-date, reflecting how closely the company’s equity performance is now tied to Bitcoin’s price movements.

Crypto World

Zcash wallet Zashi rebrands to Zodl following team split

The mobile wallet Zashi has been rebranded to Zodl following a split from its former parent organization, as its development team moves forward under a new independent structure.

Summary

- Zashi wallet has rebranded to Zodl after its development team left Electric Coin Company to form an independent entity.

- The wallet’s functionality, security, and user data remain unchanged, with the update applied automatically.

- The team will continue focusing on privacy and long-term growth under independent management.

In a statement released on Feb. 16, the team said the upcoming app update will rename Zashi to Zodl without changing how the wallet works. Users will not need to download a new app, move funds, or update their recovery phrases.

The transition will take place automatically with the next software update. As per the announcement, the rebrand reflects “a new chapter” for the wallet, while keeping the same product, developers, and focus on privacy.

Transition to an independent structure

The change follows the departure of the full Zashi (ZEC) development team from Electric Coin Company in January 2026. The group, which helped build both the Zcash protocol and the Zashi wallet, resigned after internal disagreements over governance, funding, and autonomy.

After leaving, the team formed a new company called Zcash Open Development Lab, also known as ZODL. Under this entity, the wallet was renamed Zodl and placed fully under independent management.

The developers said the move was needed to support long-term growth without relying on the Zcash development fund. Since forming the new organization, the team has continued releasing updates and maintaining the wallet.

Zodl’s creators stressed that the rebrand does not affect security or compatibility. Wallet balances, transaction history, and seed phrases will continue to work as before, and the app will remain connected to the Zcash blockchain.

Over the coming days, the Zashi name will be replaced with Zodl across websites, support channels, and social platforms.

Transition to an independent structure

In its announcement, the team said its mission remains unchanged. Zodl will continue to focus on private transactions and expanding access to shielded ZEC.

“We envision a world without mass financial surveillance,” the statement said, adding that financial privacy is central to personal sovereignty. The developers said their goal is to make private digital payments accessible to a wider audience.

The rebrand comes as privacy-focused cryptocurrencies continue to gain attention. Due to a rise in the use of privacy features, shielded ZEC transactions now account for roughly 30% of the supply in circulation.

At the ecosystem level, the Zcash Foundation recently published its 2026 roadmap, outlining plans to improve wallet usability, developer tools, and network infrastructure. Many analysts view the Zodl transition as another example of the friction that can arise between non-profit governance bodies and independent development teams within the crypto space.

Similar splits have occurred in other technology and blockchain projects over funding and control. For now, Zodl’s team says users can continue using the wallet as usual, while future updates will focus on improving privacy tools and user experience.

Crypto World

Kraken backs Trump accounts in Wyoming over crypto alignment

Kraken has joined a growing roster of crypto firms aligning with a White House-backed savings concept for American children, signaling how policy-friendly states can shape industry participation. The exchange is the latest to back the Trump Accounts program for children under 18, a pilot initiative that pairs public seed funding with private sector engagement. The move was publicly framed by Wyoming lawmakers as part of the state’s broader effort to cultivate a crypto-friendly climate from its governance to its regulatory environment. Kraken’s leadership said the decision reflects a broader philosophy: that early financial opportunity should be accessible and affordable, a sentiment echoed by Wyoming officials who tout a regulatory framework they deem thoughtful and responsible.

Key takeaways

- Wyoming Senator Cynthia Lummis publicly announced Kraken’s commitment to fund Trump Accounts created for newborns in Wyoming, highlighting the state’s role in the program.

- Kraken’s co-CEO Dave Ripley pointed to Wyoming’s “thoughtful, responsible crypto policy” as a key reason for establishing the firm’s global headquarters there.

- The Wyoming government’s support is linked to Kraken becoming the US’s first Special Purpose Depository Institution (SPDI) and its involvement with Frontier Stable Token.

- Trump Accounts represent a new type of retirement vehicle for minors, with a federal pilot seed of $1,000 per eligible newborn born between 2025 and 2028.

- Traditional banks such as JPMorgan, Bank of America, and Wells Fargo have publicly supported the Trump Accounts program, reflecting broad financial-system engagement beyond crypto-native firms.

Sentiment: Neutral

Market context: The development sits at the intersection of evolving crypto policy, state-level regulatory experimentation, and a broader push from traditional financial institutions to participate in innovative savings tools tied to the digital asset ecosystem. The Trump Accounts program, paired with Wyoming’s SPDI designation and Frontier Stable Token efforts, underscores how policy and geography can influence where crypto-related financial products take root.

Why it matters

The disclosure underscores Wyoming’s continuing appeal as a hub for crypto business. By positioning Kraken’s headquarters in a state that touts a long-running stance toward cryptocurrency policy, the firm signals that regulatory predictability is a meaningful competitive advantage in an industry prone to policy shifts. The combination of SPDI status and Frontier Stable Token development frames Wyoming as more than a duty-bound regulatory sandbox; it’s a launchpad for projects seeking stable, regulated rails for crypto-based savings and custody solutions.

From a consumer perspective, the Trump Accounts program could broaden access to long-term savings for families. If the federal seeds of $1,000 per newborn are distributed through a controlled, retirement-style vehicle, early access and compounding effects could have tangible effects on education and financial security for the next generation. However, the exact scope and funding mechanics of Kraken’s pledges—and how they will be allocated across eligible newborns—remain to be disclosed, leaving room for questions about total funding and administrative overhead.

Beyond crypto-native players, the involvement of major banks in supporting Trump Accounts suggests a broader commitment to integrating innovative savings vehicles into the mainstream financial system. The collaboration between public programs and private institutions could help normalize crypto-adjacent products in everyday financial planning, while also drawing scrutiny over governance, disclosure, and consumer protections. For observers, the evolving narrative raises questions about how such programs will balance public incentives with private sector risk, especially in markets that remain volatile and highly regulated.

The broader ecosystem has already seen crypto-adjacent firms extending benefits back to their home markets. In a related thread, Polymarket opened a free grocery store in New York City and pledged to donate millions of meals across the five boroughs, demonstrating a philanthropic approach to public-facing crypto initiatives. The move followed Kalshi’s fruitfully timed outreach, including a $50 grocery giveaway to residents in Manhattan, illustrating how prediction markets and related platforms are leveraging on-the-ground community support to build familiarity with their products.

Kraken’s blog post emphasizes the state’s role in enabling Silicon Valley–style innovation at a regional scale, with the Frontier Stable Token mentioned as a case study in Wyoming’s effort to expand stable, on-chain financial offerings. The combination of SPDI capabilities and state-backed support signals a model where government policy can align with corporate investment to create a more accessible crypto-enabled financial future, at least for a segment of the population.

As the sector weighs these developments, observers will be watching how the Trump Accounts pilot unfolds in practice, including how much funding is ultimately allocated by Kraken and other participants, how custodial arrangements are handled, and what guardrails are put in place to protect minors’ savings. The stakes extend beyond Wyoming’s borders: the outcome could influence how other states approach crypto policy, how Wall Street and fintechs collaborate on new savings vehicles, and how regulators assess the balance between innovation and consumer protection in youth-focused financial instruments.

Moreover, the narrative around corporate giving is evolving alongside regulatory signaling. The Trump Accounts initiative, backed by high-profile financial names, frames a broader movement where the private sector collaborates with federal and state programs to seed opportunities for younger generations. In this environment, Wyoming’s policy environment and Kraken’s leadership may serve as a proving ground for what a coordinated public-private approach to crypto savings can look like in the United States.

What to watch next

- Disclosure of Kraken’s per-child funding commitments and total pledged amount for Trump Accounts in Wyoming.

- Clarification of how Trump Accounts will be seeded by the federal program (Jan 1, 2025 to Dec 31, 2028 window) and the mechanics of ongoing contributions.

- Progress updates on Frontier Stable Token, including regulatory milestones and adoption by Wyoming residents or institutions.

- Additional corporate participants revealing commitments to Trump Accounts or similar state-led crypto savings initiatives.

- Regulatory developments in Wyoming and other states that could influence SPDI operations, crypto custody, and youth-focused financial products.

Sources & verification

- Kraken blog post Sponsoring Wyoming Trump Accounts detailing SPDI status and Frontier Stable Token context.

- Senator Cynthia Lummis X status announcing Kraken’s funding for newborn Trump Accounts in Wyoming.

- Dave Ripley’s X status confirming Kraken’s Wyoming HQ rationale and policy stance.

- Polymarket X status announces a free grocery store in New York City and a plan to donate 3 million meals across the five boroughs.

Kraken backs Trump Accounts in Wyoming as state-friendly policy draws crypto firms

Kraken has become the latest crypto company to align with a Trump administration initiative aimed at expanding savings opportunities for American children. The exchange joined a growing list of supporters after Wyoming’s senator Cynthia Lummis first flagged the development, stating that Kraken would fund all Trump Accounts created for Wyoming newborns as part of the pilot program. The public note from Lummis highlighted the state’s commitment to fostering a robust, future-oriented financial landscape for the next generation.

Kraken’s leadership framed the move within a broader strategic preference for Wyoming, emphasizing the state’s regulatory climate as the primary driver behind establishing the firm’s global headquarters there. Co-CEO Dave Ripley underscored that Wyoming’s policies are deliberate and responsible, aligning the company’s long-term ambitions with a governance framework designed to support innovation while protecting consumers. “We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy. We want to keep investing back in the community we call home. Starting early matters, and innovation should make long-term financial opportunity more accessible and affordable,” Ripley said in a post attributed to him on X.

Kraken’s published remarks also drew attention to the state’s role in enabling institutional frameworks such as the Special Purpose Depository Institution (SPDI) charter and the Frontier Stable Token. In a separate blog post, the exchange credited Wyoming officials with enabling its SPDI status and praised the state for helping advance frontier initiatives that blend traditional financial rails with digital assets. This alignment with SPDI and Frontier Stable Token signals a broader strategy to anchor crypto services in a jurisdiction perceived as stable and policy-forward.

Under the Trump Accounts framework, these vehicles are a novel form of retirement account designed for minors, financed in part by a federal seed of $1,000 for each child born between January 1, 2025, and December 31, 2028. The idea seeks to pair public funding with private-sector participation to create a foundation for long-term, tax-advantaged savings. While Kraken did not disclose the amount it intends to contribute per eligible newborn, the company confirmed its commitment to participate and noted that discussions with policymakers and state authorities are ongoing.

The broader financial ecosystem has shown varied enthusiasm for Trump Accounts. Prominent banks, including JPMorgan Chase, Bank of America, and Wells Fargo, have publicly supported the initiative to a degree, signaling a warming relationship between traditional finance and crypto-enabled savings products. The convergence of these players around a program meant to seed children’s savings illustrates a cross-industry willingness to experiment with governance structures, while raising questions about oversight, transparency, and the long-term performance of such accounts.

Beyond Kraken’s pledge, the broader crypto philanthropy wave has gained visibility in other corners of the market. Polymarket, a blockchain-powered prediction market, opened a temporary free grocery store in New York City, pledging to donate millions of meals across the five boroughs. The restaurant-like store operated for a few days before a coordinated food-donation event on a subsequent Monday, inviting residents to contribute to redistribution efforts. The move, paired with Kalshi’s $50 grocery giveaways to residents in Manhattan, underscores the industry’s willingness to blend community outreach with product education—a strategy aimed at normalizing crypto-enabled services in everyday life.

As Wyoming stands at the center of these developments, Kraken’s public involvement offers a concrete signal to the market: policy clarity, coupled with corporate participation, can accelerate the adoption of crypto-enabled savings tools. The SPDI framework and Frontier Stable Token provide a tangible context for how a state can serve as a testing ground for crypto custody, stability mechanisms, and youth-focused financial products. Investors and participants will be watching not only for the pledged funding totals but for how these initiatives translate into accessible financial opportunities for families across the region and beyond.

https://platform.twitter.com/widgets.js

Crypto World

The Right P2E Game Development Company is the Key to Success

The play-to-earn or P2E model has matured. It is no longer a novelty in Web3; it is an economic model capable of building real digital economies, attracting millions of users, and generating meaningful revenue for enterprises.

Yet the reality is uncomfortable. A number of P2E games tend to fail within a few months after launch. The reason behind the failure is not that the idea was weak or that the market lacks demand. It is due to the fact that the foundation wasn’t built to scale.

It is to be kept in mind that P2E games are not just entertainment. It is:

- A financial ecosystem

- A token economy

- A live service platform

- A community-driven marketplace

- A security-sensitive environment

Choosing the wrong P2E game development company does not just delay your project, it can result in collapsing the entire ecosystem. For enterprises, the real decision isn’t “Should we build a P2E game?” It’s “Who can build one that survives real-world scale?”

Why Scaling Breaks Most P2E Games

Early growth can hide structural weaknesses. Many P2E games look successful in the first few months because token rewards attract players very quickly. However, cracks tend to appear at the time when real activity begins, cracks appear.

1. Token Inflation Spiral

If rewards are not balanced, token supply floods the market, resulting in value dropping, players losing incentive, and speculators exit. A P2E game developer without tokenomics expertise often overlooks long-term supply dynamics.

2. Bot Exploitation

Reward systems attract bots. Without detection systems, automated farming drains value from real players and destabilizes the economy. Scaling securely requires anti-bot logic, behavioral analytics, and exploit monitoring.

3. Infrastructure Stress

P2E games involve constant transactions, such as claims, trades, staking, and marketplace activity. Poor backend planning leads to lag, failures, or downtime. A crash during growth damages credibility instantly.

4. Smart Contract Vulnerabilities

A single exploit can drain funds or freeze assets. Enterprises cannot afford trial-and-error blockchain coding. Security must be engineered from day one.

At the time when these issues come up, user trust disappears, and in GameFi, trust is everything. Thus, when trust breaks, game economies tend to crumble.

What “Scalable” Actually Means in P2E Game Development

A number of P2E game developers claim scalability. However, only a few define it properly. True scalability includes:

1. Sustainable Tokenomics

Sustainable tokenomics is not just token creation, but economic design that survives growth cycles, user behavior changes, and market fluctuations. It includes emission schedules, sinks, staking models, and value loops that keep demand alive.

2. Secure Smart Contract Frameworks

Contracts must be modular, auditable, and optimized. Security architecture must assume adversarial behavior. Enterprises need experienced developers who build for resilience, not just functionality.

3. Scalable Backend Systems

P2E combines gaming servers and financial systems. Infrastructure must support thousands and sometimes millions of concurrent actions. Cloud scalability, database design, and API efficiency are matters of immense importance in this regard.

4. Anti-Fraud & Anti-Exploit Mechanisms

Fraud detection systems must monitor unusual behaviors, repeated farming patterns, and suspicious wallet interactions. Without this, economies can be manipulated quite easily.

5. LiveOps & Economy Tuning

P2E is not static. Rewards, sinks, and incentives need constant balancing. Developers must support real-time adjustments. Scaling requires ongoing economic management.

WPlanning to Build a P2E Game That Succeeds and Scales?

Key Traits of a Reliable P2E Game Development Company

At the time of choosing a P2E game development company for your project, here are some of the key traits to watch out for to make the right selection.

1) Deep Tokenomics Expertise

Tokenomics is closer to financial engineering than game design. A strong P2E game development company:

- Models supply-demand dynamics

- Simulates user growth scenarios

- Designs burn and sink systems

- Balances rewards against inflation

They think like economists, not just developers.

2) Blockchain Security Maturity

A credible P2E game developer prioritizes:

- Contract audits

- Multi-layer security

- Wallet safety flows

- Compliance awareness

Security protects reputation and user confidence.

3) Architecture for Growth

Scaling is planned, not patched later. A mature developer designs:

- Load-ready backend systems

- Efficient indexing for transactions

- Modular architecture for upgrades

This, in turn, helps reduce long-term technical debt.

4) LiveOps Capability

P2E success depends on iteration. Events, reward cycles, and engagement mechanics must evolve. A capable P2E game developer supports:

- Economy monitoring

- Event design

- Seasonal content

- Reward recalibration

Without LiveOps, engagement tends to decline.

5) Proven Web3 Gaming Experience

Experience reduces risk. A P2E game development company that has shipped Web3 games understands pitfalls like inflation cycles and bot waves. Past execution matters more than promises.

Questions Enterprises Must Ask Before Hiring

Here are a few important questions to ask your chosen P2E game development company before finalizing the hiring process in order to avoid costly mistakes later.

- How do you simulate token economies?

- How do you prevent bot farming?

- What scalability architecture do you use?

- What is your smart contract audit process?

- How do you support LiveOps post-launch?

Once you get all the answers with clarity and evidence, finalize the hiring.

Why Enterprises Prefer Specialized P2E Game Development Companies

The P2E model sits at the intersection of: Gaming + Blockchain + Finance.

Only a few development partners master all three internally.

A specialized P2E game development company provides:

- Cross-domain expertise

- Pre-tested frameworks

- Faster development cycles

- Lower risk exposure

- Long-term ecosystem support

For enterprises, this translates into predictable outcomes.

Closing Thoughts

It is always to be kept in mind that in the P2E model, launching is easy, but sustaining is hard. Scaling is where winners are decided.

A real P2E game developer doesn’t just build gameplay; they engineer economies.

The real question for enterprises is simple: Are you building a short-term hype cycle, or a long-term digital economy? The right partner determines the answer.

Antier, an experienced P2E game development company, works with enterprises to build P2E ecosystems designed for sustainability. Support includes:

- Advanced tokenomics modeling

- Smart contract architecture

- Blockchain and wallet integration

- Scalable backend systems

- Security-first development

- LiveOps and ecosystem tuning

The objective isn’t just launch, it’s longevity. Let’s work on your next P2E project to make it successful.

Frequently Asked Questions

01. What is the play-to-earn (P2E) model in Web3?

The P2E model is an economic framework that allows users to earn real value through gameplay, creating digital economies that attract millions of users and generate revenue for enterprises.

02. Why do many P2E games fail shortly after launch?

Many P2E games fail due to a lack of scalable foundations, which leads to issues like token inflation, bot exploitation, infrastructure stress, and smart contract vulnerabilities.

03. What does true scalability mean in P2E game development?

True scalability in P2E game development refers to the ability to handle growth without compromising the game’s economy or user trust, ensuring robust systems for tokenomics, security, and infrastructure.

Crypto World

Binance Disputes Fortune Claims of Iranian Sanctions Breaches and Wrongful Terminations

TLDR:

- Binance conducted internal review and found no evidence of sanctions violations tied to Iranian transactions

- Exchange operates under Abu Dhabi Global Market regulation plus 21 local jurisdictions worldwide

- Company denies firing investigators for raising compliance concerns about alleged sanctions breaches

- Binance invested heavily in compliance infrastructure since 2023 regulatory settlement with authorities

Binance has formally disputed a Fortune investigation claiming the exchange processed over $1 billion in Iran-related transactions.

The cryptocurrency platform sent a detailed rebuttal letter on February 15, addressing allegations published two days earlier.

The company stated that a comprehensive internal review found no evidence of sanctions violations. Binance emphasized its commitment to regulatory compliance and cooperation with authorities.

Company Denies Evidence of Sanctions Violations

Fortune’s February 13 article alleged that internal investigators uncovered substantial transaction volumes tied to Iran.

The report suggested these transfers potentially violated international sanctions laws. Binance conducted a full internal review following the claims raised in the investigation.

The exchange stated it found no evidence supporting allegations of sanctions law breaches. This conclusion was reached after consultation with qualified legal counsel.

The company rejected assertions that violations were discovered and then suppressed. Binance characterized the Fortune report as containing material inaccuracies requiring correction.

The exchange operates under regulatory oversight from multiple jurisdictions worldwide. Binance holds authorization from the Abu Dhabi Global Market as its primary regulator.

The platform also maintains licenses and registrations across 21 different local jurisdictions. These regulatory relationships require ongoing compliance monitoring and reporting.

Chief Executive Officer Richard Teng addressed the allegations through the social media platform X. He stated that the record must be clear regarding the absence of sanctions violations.

Teng also denied that investigators were terminated for raising compliance concerns. The CEO requested corrections to what he described as inaccurate reporting.

Enhanced Compliance Framework Since 2023 Resolution

Binance referenced its 2023 regulatory settlement when addressing compliance capabilities. The company has invested substantially in its sanctions screening infrastructure since that resolution.

These investments included expanded staffing dedicated to compliance functions. The exchange allocated resources to anti-money laundering controls and transaction monitoring systems.

The platform described its compliance program as among the most robust in digital assets. Binance maintains internal standards that often exceed global regulatory requirements.

The company implements zero-tolerance policies on staff conduct violations and unauthorized data access. These policies extend to failures in observing internal compliance procedures.

The exchange questioned the sourcing and motivations behind the Fortune investigation. Binance noted the article relied heavily on anonymous sources while presenting speculation as fact.

The company emphasized that multiple legitimate channels exist for reporting compliance concerns. These include internal whistleblowing provisions and statutory protections for employees raising issues.

Binance requested that Fortune review its statements and correct misleading implications. The exchange offered to provide additional context for more accurate reporting.

The company stressed that accuracy is critical when publishing allegations related to sanctions compliance. Binance affirmed its continued cooperation in meeting monitorship obligations and regulatory commitments across all jurisdictions.

Crypto World

Wintermute adds tokenized gold to institutional OTC desk

Wintermute has rolled out institutional over-the-counter trading for tokenized gold, marking its entry into digital commodities amid rising interest in asset-backed tokens.

Summary

- Wintermute added tokenized gold to its OTC desk.

- Institutions can now trade and settle gold tokens on-chain.

- The market is forecast to reach $15 billion by 2026.

The firm said on Feb. 16 that its OTC desk now supports trading in Pax Gold and Tether Gold, the two largest gold-backed tokens by market value.

The service gives professional investors a way to gain exposure to physical gold through blockchain-based products, while keeping access to crypto-style settlement and liquidity. It comes in response to the increasing demand from institutions for transparent, stable assets that are easy to trade and settle fast.

Building on-chain access to gold markets

Wintermute will offer institutional clients algorithmically optimized spot execution as part of the new launch. Clients can settle trades in the way that suits them best. Transactions can be completed on-chain using major cryptocurrencies, stablecoins, or traditional fiat currencies.

This setup allows positions to be opened, adjusted, or closed instantly. It also helps move capital smoothly between markets while lowering settlement risk. For trading firms and investment funds, this structure makes it easier to manage liquidity and hedge exposure.

Instead of sticking to traditional choices like exchange-traded funds or buying physical gold bars and coins, more investors are starting to look at tokenized gold. These digital tokens are backed by real gold and allow investors to buy small fractions of it, making gold ownership more accessible.

They can also be traded easily, giving holders flexibility without the hassle of storing or transporting physical gold. That level of flexibility is hard to achieve in conventional markets.

Industry data shows that the total value of tokenized gold surged to around $5.4 billion by mid-February 2026, an increase of about 80% in just three months.

Growth outlook and institutional interest

Wintermute chief executive Evgeny Gaevoy said the tokenized gold market could reach $15 billion by the end of 2026, nearly three times its current size. He pointed to rising institutional participation and demand for asset-backed digital products as key factors behind the forecast.

Trading volumes have also increased. During the fourth quarter of 2025, tokenized gold products recorded over $126 billion in turnover, outpacing several major gold ETFs.

According to analysts, 24-hour trading and more transparent pricing are the main factors driving the growth. Prices are shown in real time, and investors are free to buy and sell whenever they want.

Despite the recent crypto market downturn, tokenized gold has remained popular among investors seeking stability and portfolio diversification. Wintermute’s most recent launch indicates a larger trend in the industry toward more reputable, institution-focused services.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video13 hours ago

Video13 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 hours ago

Tech2 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show