Crypto World

Metaplanet’s Bitcoin Bet Leads to $1.35 Billion Paper Loss

Tokyo-based Metaplanet released its fiscal year 2025 results, reporting a 738% year-over-year increase in revenue.

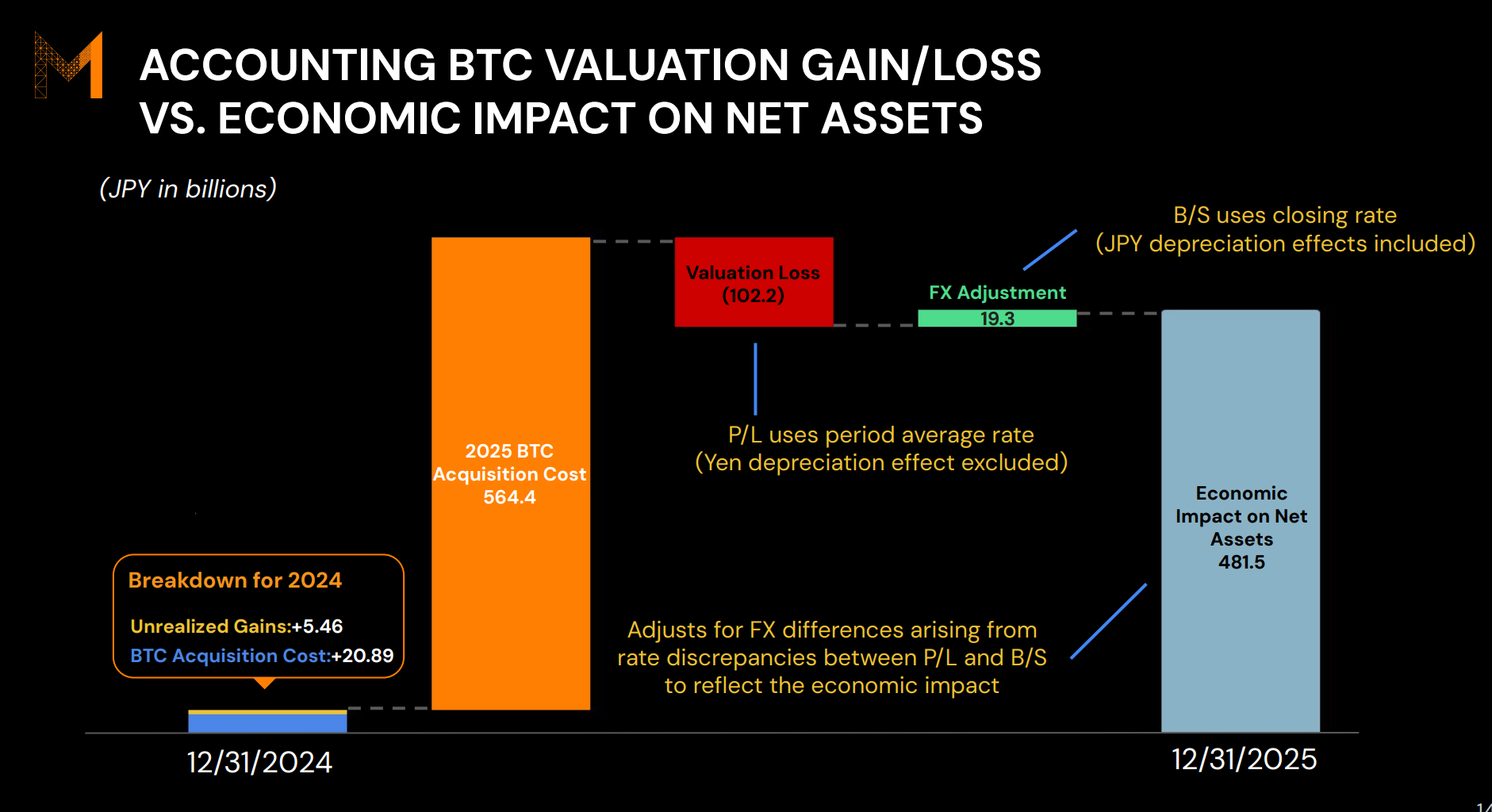

Despite the revenue surge, Bitcoin’s drawdown weighed heavily on the firm, as a non-cash valuation loss of 102.2 billion yen ($667.52 million) pushed the company into a net loss for the year.

Sponsored

Sponsored

Metaplanet’s FY2025 earnings report revealed revenue climbed to 8.9 billion yen ($58.12 million), up from 1.06 billion yen ($6.92 million) a year earlier. The company’s Bitcoin income business generated roughly 95% of total revenue.

“We launched the Bitcoin Income business in Q4 2024. Since then, this strategy has become our primary revenue source and is expected to remain a core driver of profit growth,” the report read.

Operating profit rose sharply to 6.28 billion yen ($41.01 million), marking a 1,694.5% increase year over year. Its shareholder base expanded significantly, growing from 47,200 at the end of 2024 to around 216,500 by the close of 2025.

Total assets also surged, rising from 30.3 billion yen ($197.89 million) to 505.3 billion yen ($3.30 billion) over the same period.

Despite the strong operational performance, the company posted a net loss of 95 billion yen ($620.17 million), after recording net income of 4.44 billion yen ($29.00 million) in 2024. The loss was primarily driven by valuation declines on its Bitcoin holdings.

Still, Metaplanet emphasized the strength of its balance sheet. The company said its liabilities and preferred stock would remain fully covered even in the event of an 86% drop in Bitcoin’s price, supported by an equity ratio of 90.7%.

Sponsored

Sponsored

The company also outlined its outlook for this year. Metaplanet expects revenue to reach 16 billion yen ($104.49 million) in FY2026, representing a 79.7% increase year over year. Operating profit is projected to rise to 11.4 billion yen ($74.45 million), up 81.3% from the previous year.

Japan’s Largest Corporate Bitcoin Holder Faces $1.35 Billion Unrealized Loss

According to the latest data, Metaplanet holds 35,102 BTC, a major increase from just 1,762 BTC at the end of 2024. The accumulation strategy has positioned the company as the largest corporate Bitcoin holder in Japan and the fourth-largest publicly listed corporate holder globally.

However, the rapid expansion of its Bitcoin treasury now comes with significant pressure. Metaplanet’s average acquisition cost stands at $107,716 per BTC, while Bitcoin is currently trading at $68,821.

Across its entire 35,102 BTC position, this translates into approximately $1.35 billion in unrealized losses. While these losses remain on paper and could reverse if Bitcoin recovers, they highlight the inherent volatility risk tied to corporate treasury strategies heavily concentrated in digital assets.

Metaplanet is not alone in facing valuation pressure. Bitcoin’s broader market drawdown has also pushed MicroStrategy’s holdings below its average acquisition price, leaving the US-based firm with unrealized losses exceeding $5.33 billion as of the latest data.

The impact extends beyond balance sheets. Metaplanet’s share price is down 28.63% year-to-date, reflecting how closely the company’s equity performance is now tied to Bitcoin’s price movements.

Crypto World

UK crypto rules moving too slowly to secure global hub status, says FCA-registered stablecoin Issuer Agant

The U.K.’s crypto regulatory framework is moving in the right direction, but not fast enough to support the country’s ambitions of becoming a global digital asset hub, Andrew MacKenzie, CEO of sterling stablecoin developer Agant, told CoinDesk.

The government has repeatedly pledged to position London as a center for global crypto and digital asset activity. However, comprehensive legislation governing stablecoins and wider crypto activity is expected to be approved by parliament only later this year and won’t come into force until 2027.

MacKenzie said this timeline contradicts the government’s goal of remaining globally competitive within the industry.

“I think the most damaging thing today has been the time that it’s taken to get to where we are just now,” MacKenzie said in an interview at Consensus Hong Kong. “People just want clarity … If there’s anything I’d like to see from the regulators, it’s just an acceleration in the pace with which we can do things.”

The London-based company recently joined the small group of cryptoasset businesses registered with the Financial Conduct Authority (FCA) under money laundering regulations, an approval process widely regarded as one of the most stringent globally. FCA registration is a prerequisite for operating certain cryptoasset activities in the U.K., and the process has earned a reputation for being both exacting and slow.

A hard-won regulatory milestone

For Agant, which plans to issue a fully backed pound sterling stablecoin called GBPA, the registration signals institutional intent rather than a retail crypto push. The company has positioned the token as infrastructure for institutional payments, settlement and tokenized assets.

The firm maintains active dialogues with the Treasury, the FCA and the Bank of England, MacKenzie said, describing engagement as constructive, but iterative.

“There are certain aspects that we don’t like, and we’re very vocal about them,” he said, referring in part to proposed limits within the Bank of England’s stablecoin framework.

Still, he said, regulators are listening.

“The most promising aspect when we speak to regulators is the fact that they’re willing to implement changes if there’s true justification there.”

Stablecoins as a tool, not a threat

When asked if he viewed European central banks’ and U.S. private banks’ opposition to stablecoins as a problem for the future of his project, MacKenzie dismissed their concerns over financial stability and unfair competition, saying stablecoins can strengthen sovereign monetary reach.

“When you see the penny drop with central bankers, you realize that this is actually an amazing way for them to export sovereign debt,” he said. By issuing a pound-pegged stablecoin, firms like Agant could distribute digital pounds globally, increasing exposure to sterling-denominated assets and potentially lowering funding costs. “We can go and sell pounds globally,” he said. “The cost of carry for the central bank is just reduced somewhat.”

Rather than eroding sovereignty, he said, properly structured stablecoins can extend it.

For commercial banks, the concern is that if consumers hold funds in stablecoins rather than depositing them, they could lose their ability to lend.

MacKenzie rejected that premise. “I don’t think it is a valid argument. What it really brings to the table is that banks need to become more competitive.”

Credit would not disappear, he added, but could shift toward alternative providers if incumbent banks fail to adapt. In that sense, stablecoins may increase competition in financial services rather than diminish credit availability.

UK banks shift from skepticism to acceleration

Bankers in the U.K. are paying closer attention to cryptocurrency projects, MacKenzie said. Conversations have escalated up the hierarchy.

“It’s now a C-suite conversation,” he said. “There’s an exponential acceleration to banks’ adoption of blockchain technology.”

Banks increasingly recognize efficiencies in programmable reconciliation, instant settlement and cross-border interoperability, he said. Even though the transition may take decades, as it did with the shift to digital banking, momentum is building.

“The banks themselves have expressed they see this as a 30-year transition.”

If the U.K. intends to compete with faster-moving jurisdictions in Europe, the Middle East, and Asia, time may prove the most critical variable.

Whether Britain can convert ambition into leadership may depend less on regulatory design and more on how quickly policymakers move.

“Zoom out and look at the macro,” MacKenzie said. “Nothing is set in stone.”

Crypto World

New Report Sends Monero (XMR) Price Soaring 10%

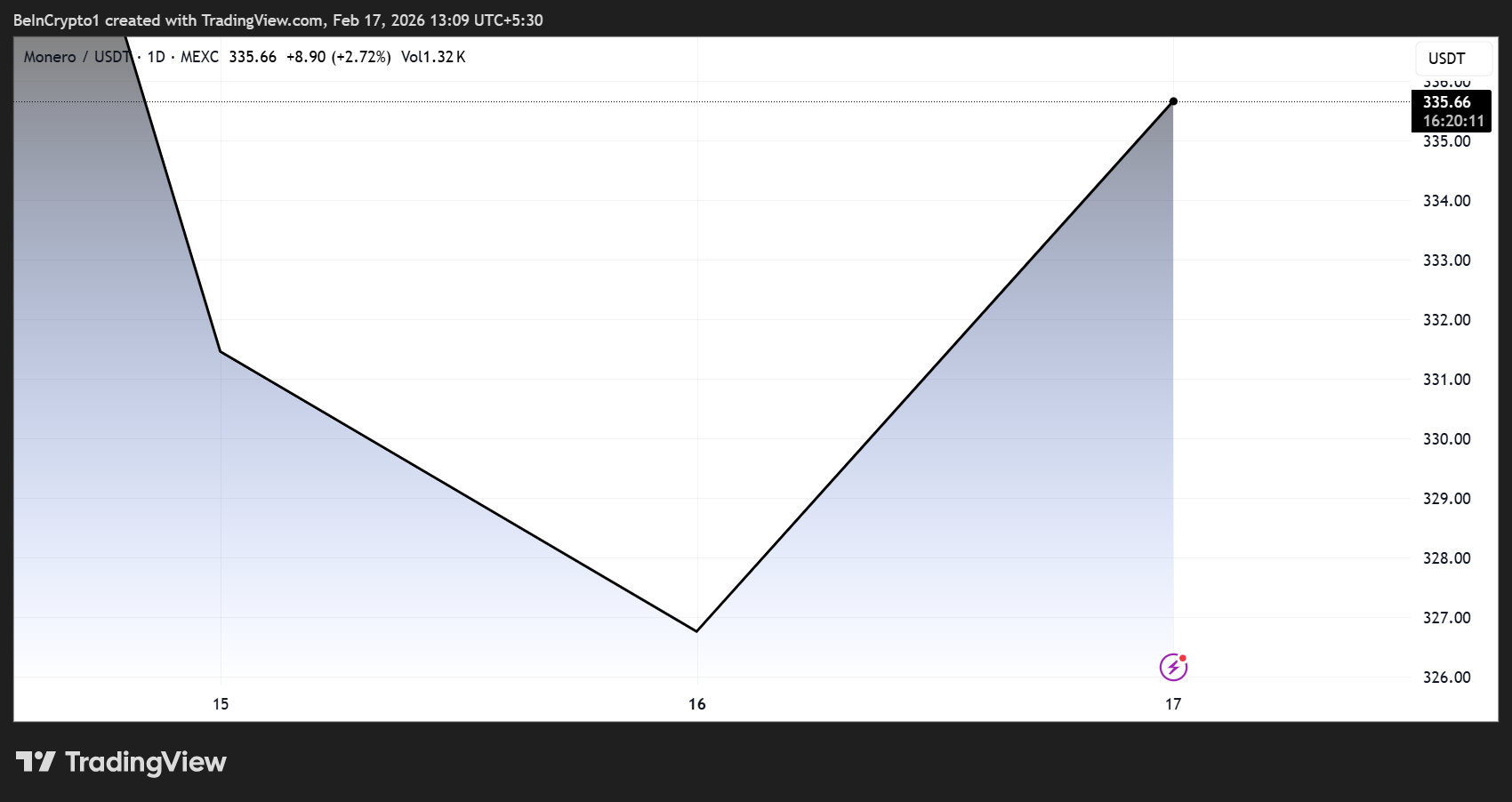

The XMR price climbed nearly 10% on Tuesday following the release of a new report by TRM Labs highlighting Monero’s resilience and growing adoption in privacy-focused markets despite delistings from major exchanges.

The research sheds light on the increasing use of Monero in high-risk environments, including darknet marketplaces, while also revealing subtle network-layer behaviors that could influence real-world privacy assumptions.

Monero’s Shadow Market Growth and Network Insights Drive XMR Price Surge

As of this writing, XMR was trading for $335.66, up by nearly 10% in the last 24 hours.

Sponsored

Sponsored

According to TRM Labs, Monero’s on-chain transaction activity remained broadly stable in 2024–2025 and consistently higher than pre-2022 levels.

This trend persisted despite restrictions from leading platforms such as Binance, Coinbase, Kraken, and Huobi, which have increasingly limited access to XMR due to regulatory and traceability concerns.

“Despite exchange delistings and enforcement pressure, XMR activity on Monero remains above pre-2022 levels,” TRM Labs noted.

According to the firm’s research:

- 48% of new darknet markets in 2025 were XMR-only.

- Most ransomware payments still occur in BTC — liquidity matters.

- 14–15% of Monero peers show non-standard network behavior.

Monero’s cryptography remains strong, but network-layer dynamics can influence real-world privacy assumptions.

The report emphasizes that Monero’s resilience is not primarily driven by casual retail trading. Instead, it reflects a core user base that actively seeks privacy-preserving transactions, even when faced with higher friction, fewer on-ramps, and reduced liquidity.

Sponsored

Sponsored

Transaction volumes in 2024 and 2025 were materially higher than in early 2020–2021, indicating sustained demand rather than sporadic, speculative spikes.

This stability is particularly notable given that, according to some reports, 73 exchanges delisted Monero in 2025 alone.

As a result, liquidity for XMR is increasingly concentrated on offshore or lower-compliance venues, which partially explains why most ransomware payments still occur in Bitcoin.

While actors frequently request Monero for its privacy features, Bitcoin remains easier to acquire, move, and convert at scale.

Sponsored

Sponsored

Monero Adoption on the Rise Among Darknet Markets

Meanwhile, the report also acknowledges that Monero’s adoption in darknet markets continues to grow.

TRM Labs data shows that 48% of newly launched darknet marketplaces in 2025 now support XMR exclusively, a sharp increase compared to previous years.

This trend is especially pronounced in Western-facing markets, reflecting a direct response to enhanced tracing capabilities on Bitcoin and US dollar-backed stablecoins.

It aligns with a recent BeInCrypto report, which cited the increasing use of XMR in illegal activities.

Sponsored

Sponsored

Network-Layer Insights With Privacy in Practice

Beyond market behavior, TRM Labs conducted empirical research into Monero’s peer-to-peer (P2P) network. The analysis found that 14–15% of reachable Monero peers displayed non-standard behavior, including:

- Irregular message timing

- Handshake patterns, and

- Infrastructure concentration.

While these anomalies do not indicate protocol failures or malicious activity, they highlight how network-layer dynamics can subtly affect theoretical anonymity models, even as Monero’s on-chain cryptography remains strong.

Monero occupies a unique position in the crypto ecosystem. While transparent networks and stablecoins have become increasingly traceable and regulated, Monero continues to offer privacy-preserving functionality that appeals to users operating in high-risk or privacy-conscious environments.

TRM Labs’ findings highlight both the strengths and nuances of Monero’s privacy design. It shows that real-world usage patterns and network behavior can affect the practical efficacy of anonymity protections.

Crypto World

SBI Holdings Targets Majority Stake in Singapore Exchange Coinhako

Japanese financial conglomerate SBI Holdings is moving to deepen its presence in the crypto sector, announcing plans to take a controlling position in Singapore-based exchange Coinhako.

In a Friday announcement, the Tokyo-listed firm said its wholly owned subsidiary, SBI Ventures Asset, has signed a letter of intent with Coinhako’s parent company, Holdbuild, to inject capital into the business and purchase shares from existing investors. If completed, the transaction would give SBI Holdings a majority stake and make Coinhako a consolidated subsidiary, subject to regulatory approval.

“Bringing Coinhako into the SBI Group as a consolidated subsidiary is not merely an investment in a single platform,” chairman and CEO Yoshitaka Kitao said, describing the acquisition as part of a broader effort to build international infrastructure for digital assets, including tokenized securities and stablecoins.

Financial terms and ownership details were not disclosed, and both the structure of the investment and share purchases remain under discussion, per the announcement. The nonbinding deal would give SBI a licensed base in Singapore, one of Asia’s key regulated crypto hubs.

Related: The future of crypto in the Asia-Middle East corridor lies in permissioned scale

Coinhako operates licensed crypto trading platform in Singapore

Founded in Singapore, Coinhako operates a regional digital asset trading platform and related services through Hako Technology, a Major Payment Institution (MPI) licensed by the Monetary Authority of Singapore (MAS). The group also runs Alpha Hako, a registered virtual asset service provider overseen by the British Virgin Islands Financial Services Commission.

In 2021, SBI Holdings invested in Coinhako through the SBI-Sygnum-Azimut Digital Asset Opportunity Fund, a joint vehicle with Switzerland’s Sygnum Bank.

Coinhako co-founder and CEO Yusho Liu said the new partnership would allow the exchange to scale institutional-grade systems and meet “surging demand for tokenized assets and stablecoins, ensuring Singapore remains at the heart of the world’s next-generation financial system.”

Cointelegraph reached out to SBI Holdings for comment, but had not received a response by publication.

Related: Singapore’s ‘finance-savvy’ crypto retail prefers trust over low fees: Survey

SBI Holdings expands blockchain footprint

SBI Holdings has been active in blockchain ventures for several years, investing in tokenization projects, payment networks and crypto-related businesses.

In December 2025, SBI partnered with Web3 infrastructure company Startale Group to develop a fully regulated Japanese yen-denominated stablecoin aimed at tokenized asset markets and cross-border settlement. The token is to be issued and redeemed by Shinsei Trust & Banking, a unit of SBI Shinsei Bank, while licensed crypto exchange SBI VC Trade will handle its circulation.

In August, SBI Group partnered with blockchain oracle network Chainlink to build digital asset tools for financial institutions in Japan and across the Asia-Pacific.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Crypto exchange Kraken vows to support “Trump Accounts” in Wyoming

Crypto exchange Kraken has vowed to support President Donald Trump’s “Trump Accounts” initiative in Wyoming.

Summary

- Kraken will sponsor Trump Accounts for every child born in Wyoming in 2026.

- The program grants eligible U.S. newborns a one-time Treasury contribution, with funds invested in market index funds.

- Wyoming Senator Cynthia Lummis has welcomed the move.

According to the official announcement from Kraken, the crypto exchange will sponsor Trump Accounts for every child born in Wyoming in 2026 by making a financial contribution to each eligible account as part of the federal program.

For those unaware, Trump Accounts are a new type of tax-advantaged retirement account that allows parents or legal guardians to open and contribute funds for children under 18.

Under a federal pilot program, every U.S. citizen newborn born between Jan. 1, 2025, and Dec. 31, 2028, is entitled to a one-time $1,000 seed contribution from the U.S. Treasury. These funds are invested in eligible market index funds and grow on a tax-deferred basis until the beneficiary reaches adulthood.

“By seeding accounts for every newborn in 2026, we are backing families from day one and reinforcing Wyoming’s role as America’s home for responsible crypto leadership,” Kraken Co-CEO Arjun Sethi said in a statement.

Pro-crypto Wyoming Senator Cynthia Lummis praised Kraken’s decision to sponsor Trump Accounts in the state, adding that the investment “will ensure children in Wyoming have a financial head start.”

“I’m grateful to Kraken for their commitment to Wyoming’s next generation and to the Cowboy State’s economic future,” she added.

Kraken has not disclosed how much it will contribute to this initiative, but said the decision was driven by Wyoming’s favorable regulatory climate, where it was able to become the nation’s first Special Purpose Depository Institution under the state’s crypto-specific banking framework.

“We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy,” co-CEO Dave Ripley wrote in an X post.

Kraken joins Coinbase and a slew of other financial giants like JPMorgan Chase that have publicly endorsed and supported the Trump Accounts initiative.

In a similar gesture toward community support, crypto-based prediction platform Polymarket opened a temporary free grocery store in New York City, offering food assistance and pledging millions of meals for local residents.

Crypto World

Crypto Funds See 4th Week of Outflows, but XRP and SOL Shine: CoinShares Report

Four consecutive weeks of crypto fund outflows hit $3.74 billion, but altcoins outperform as US investors retreat from the market.

Investment products linked to digital assets experienced their fourth consecutive week of outflows, recording $173 million and pushing cumulative losses over four weeks to $3.74 billion. Early in the week, inflows reached $575 million amidst brief optimism, but continued price weakness, which ended up triggering $853 million in outflows soon after.

Sentiment stabilized slightly on Friday following softer CPI data, as these investment vehicles witnessed $105 million of inflows. Trading activity also cooled significantly, and ETP volumes fell to $27 billion, less than half of the record $63 billion seen the week before.

Altcoin Appetite Surges

In the latest edition of the “Digital Asset Fund Flows Weekly Report,” CoinShares revealed Bitcoin continued to lag in terms of sentiment after seeing $133 million pulled from investment products tied to the asset. Short Bitcoin products also moved lower as combined losses reached $15.4 million over the past two weeks, a pattern frequently observed near cyclical lows, according to the asset manager.

Ethereum followed a similar path after seeing $85.1 million withdrawn, while Hyperliquid recorded $1 million in losses. Multi-asset strategies declined as well, with $14 million leaving the category. On the other hand, appetite remained strong for altcoin-focused investment products such as XRP, Solana, and Chainlink, which attracted $33.4 million, $31 million, and $1.1 million, respectively. Litecoin also gained a modest $0.4 million.

Regional sentiment showed a clear divide between the US and international markets. While the US experienced $403 million in outflows, other regions collectively saw $230 million in new capital. Germany led with $115 million, followed by Canada with $46.3 million and Switzerland with $36.8 million. Brazil added $14 million, Australia nearly $10 million, and Sweden $2.8 million during the same period.

Predictable Correction?

Bitcoin has shed almost 50% since its all-time high last October, prompting market analysts to predict the price could drop to as low as $50,000 before any meaningful recovery. Meanwhile, Hedy Wang, fintech veteran and founder of BlockStreet, believes that the current turbulence is a feature of a maturing market rather than a fundamental collapse. In a statement to CryptoPotato, Wang said,

“Unlike earlier speculative bubbles, the current Web3 ecosystem is supported by a more resilient and collaborative community ethos focused on long-term building. Therefore, an analytical view suggests the market is undergoing a natural, albeit volatile, evolutionary phase, with data pointing towards a repeating historical pattern rather than an unprecedented crisis.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why Traders Are Betting on $20,000 Gold

The gold price recently plunged in one of the sharpest one-day declines in decades after briefly topping $5,600 per ounce. Yet, traders continue to place aggressive bets that the metal could surge to $20,000 or more.

The divergence highlights a market driven by macroeconomic forces, speculation, geopolitical uncertainty, and shifting central bank behavior.

Sponsored

Sponsored

Massive Bullish Gold Bets Despite Volatility

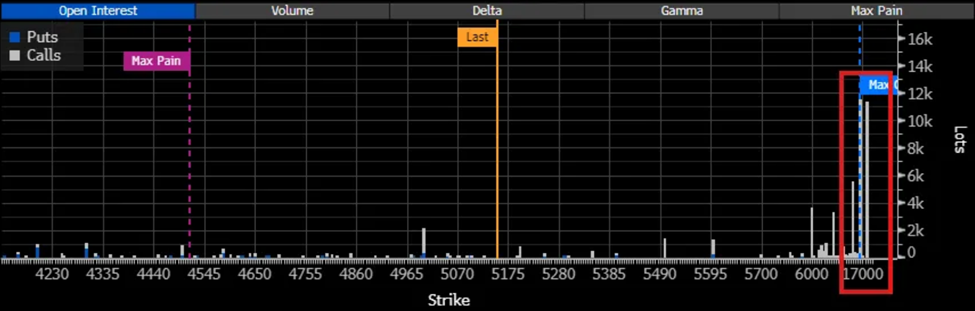

According to market commentary from traders and analysts, roughly 11,000 contracts tied to December $15,000/$20,000 gold call spreads have been accumulated.

“Gold $20,000 calls surge despite record selloff. Deep out-of-the-money bullish bets on gold are building even after a historic correction… The position has since grown to roughly 11,000 contracts, even with prices consolidating near $5,000,” commented Walter Bloomberg.

This optimism comes even as the XAU price consolidates near $5,000. The scale of these trades is striking, given the distance from current prices.

Such trades function as low-cost, high-upside wagers. For the spreads to expire in the money, gold would need to nearly triple by December, a scenario that would require a major macroeconomic or geopolitical shock.

Yet the presence of these bets has already affected market forces, pushing implied volatility (IV) higher in far-out-of-the-money calls and signaling demand for extreme upside exposure.

Against this backdrop, some analysts argue that gold’s broader trajectory remains intact despite recent turbulence.

Sponsored

Sponsored

“If you start zooming out on the macroeconomic factors, then it’s quite clear that the markets of Gold haven’t peaked at all. Yes, they can peak in the short term and have a 1-2 year consolidation period, but that doesn’t mean we aren’t in a larger bull market in Gold. As a matter of fact, I think we are. That’s why I’m buying Gold in the next 30-50% dip,” expressed Macro analyst Michael van de Poppe.

This perspective reflects a growing view among macro investors that gold’s rally is tied to structural shifts in the global financial system rather than purely cyclical factors.

Bull Market or Temporary Pause as Short-Term Constraints Remain?

Despite bullish long-term narratives, near-term volatility remains high. Commodities strategist Ole Hansen recently noted that gold rebounded above $5,000 after softer US inflation data pushed bond yields lower and revived expectations for interest-rate cuts.

Sponsored

Sponsored

This suggests that while macro tailwinds exist, trading activity and liquidity conditions, particularly in China, can significantly influence short-term price moves.

The bullish sentiment comes alongside a surge in speculative activity across metals markets. Trading volumes in Chinese aluminum, copper, nickel, and tin futures contracts have soared to levels far exceeding historical norms, driven in part by retail investors.

Exchanges have repeatedly tightened margin requirements and trading rules to curb excessive speculation, reflecting the scale of the frenzy.

Such conditions often amplify price swings, creating both rapid rallies and sharp corrections.

Sponsored

Sponsored

Another factor reinforcing the gold narrative is central-bank diversification. Economist Steve Hanke has pointed to China’s shift away from US Treasuries toward gold reserves, a trend widely interpreted as part of a broader move to reduce reliance on dollar-denominated assets.

This pattern has fueled speculation that gold could play a larger role in global reserves if geopolitical tensions or currency instability intensify.

However,not everyone is convinced the rally is sustainable. Commodity strategist Mike McGlone has cautioned that the metals sector may be overheating, drawing parallels to previous peaks where extreme positioning preceded corrections.

Stretched valuations, elevated volatility, and surging speculative flows could leave markets vulnerable to another sharp downturn if macro conditions shift.

Crypto World

BVNK Survey Finds 39% Receive Income in Stablecoins

A global survey commissioned by BVNK and conducted by YouGov found that 39% of crypto users and prospective users across 15 countries receive income in stablecoins, while 27% use them for everyday payments, citing lower fees and faster cross-border transfers as key drivers.

The survey of 4,658 respondents, conducted online in September and October 2025 among adults who currently hold or plan to acquire cryptocurrency, found that stablecoin users hold an average of about $200 in their wallets globally, though holdings in high-income economies average around $1,000.

It also found that 77% of respondents would open a stablecoin wallet with their primary bank or fintech provider if offered, and 71% expressed interest in using a linked debit card to spend stablecoins.

Those who receive income in stablecoins said the assets account for about 35% of their annual earnings on average, and those using them for cross-border transfers reported fee savings of about 40% compared with traditional remittance methods.

More than half of the crypto holders have made a purchase specifically because a merchant accepted stablecoins, increasing to 60% in emerging markets, while 42% said they want to use stablecoins for major or lifestyle purchases compared with 28% who currently do so.

Ownership was higher in middle- and lower-income economies, where 60% of respondents said they hold stablecoins, compared with 45% in high-income economies. Africa recorded the highest ownership rate at 79% and the strongest reported increase in holdings over the past year.

Multiple tokens preferred

A BVNK spokesperson told Cointelegraph that the study was designed to examine usage patterns among existing and prospective crypto users rather than measure broader population-level adoption.

They also said respondents tend to hold a range of dollar- and euro-pegged stablecoins rather than relying on a single issuer, suggesting users often maintain balances across multiple tokens.

When asked where they prefer to manage stablecoins, 46% of respondents selected exchange platforms, followed by payment apps with crypto features like PayPal or Venmo at 40%, and mobile crypto wallet apps at 39%. Only 13% said they would prefer to hold stablecoins in a hardware wallet.

BVNK is headquartered in London and was founded in 2021 as a stablecoin-focused payments infrastructure provider for enterprises. In June, it partnered with San Francisco-based Highnote to introduce stablecoin-based funding for the embedded finance platform’s card programs.

Related: When will crypto’s CLARITY Act framework pass in the US Senate?

Stablecoins move into regulated payroll systems

With the passage of the GENIUS Act in the United States and the implementation of Europe’s Markets in Crypto-Assets Regulation, stablecoins are increasingly being integrated into global payroll systems as companies expand digital asset settlement options for wages and cross-border payouts.

On Feb. 11, global payroll platform Deel said it will begin offering stablecoin salary payouts through a partnership with MoonPay, starting next month with workers in the United Kingdom and European Union before expanding to the US.

Under the arrangement, employees can opt to receive part or all of their wages in stablecoins to non-custodial wallets, with MoonPay handling conversion and onchain settlement while Deel continues to manage payroll and compliance.

Enterprise activity in the sector has also accelerated. Paystand recently acquired Bitwage, a platform focused on cross-border stablecoin payouts, expanding digital asset settlement and foreign exchange capabilities across Paystand’s B2B payments network, which has processed more than $20 billion in payment volume, according to the company.

Because stablecoins are typically pegged 1:1 to fiat currencies such as the US dollar or euro, they offer price stability that makes them better suited for payments than cryptocurrencies that can fluctuate sharply in value.

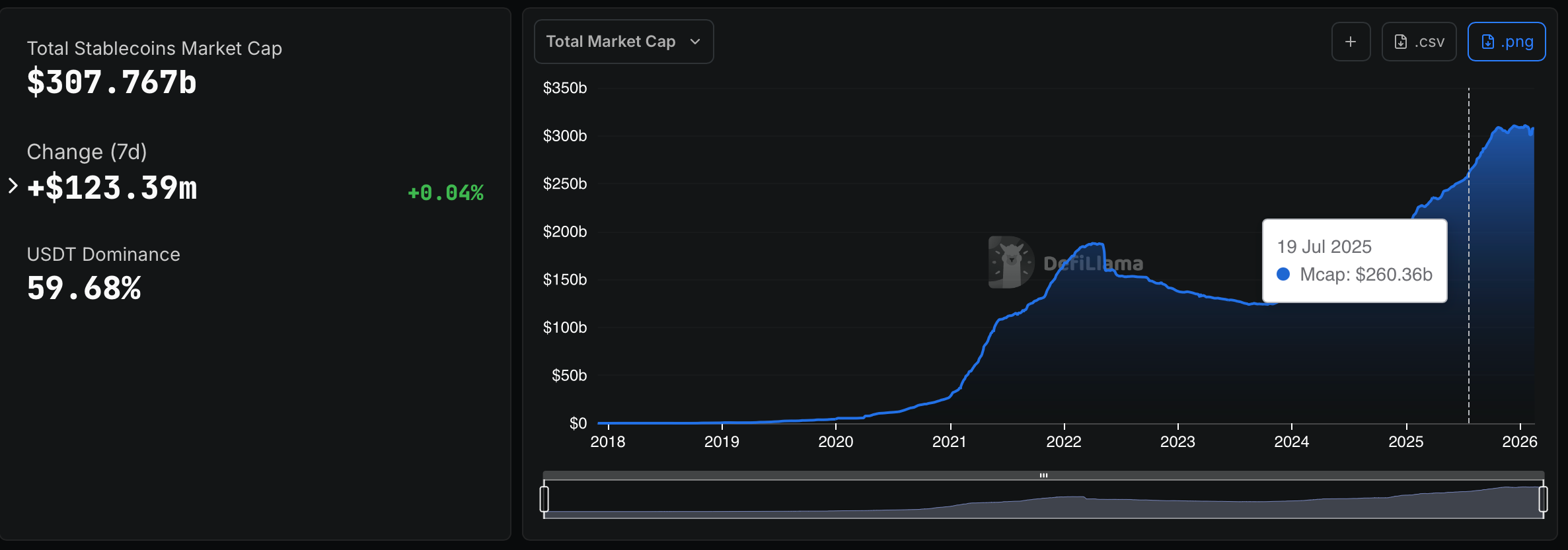

According to DefiLlama, the stablecoin market currently stands at $307.8 billion, up from $260.4 billion on July 19, around the time the US GENIUS Act was signed into law.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Kevin O’Leary Flags a Quantum Issue Few Bitcoin Investors See

Kevin O’Leary, Canadian businessman and Shark Tank investor, said that concerns over quantum computing are preventing institutions from increasing Bitcoin (BTC) allocations.

This latest statement comes as experts continue to raise alarms that the impact of quantum computing risks may already be starting to show, though not in the way many expected.

Sponsored

Sponsored

Quantum Risk Keeps Institutions From Expanding Bitcoin Exposure, O’Leary Warns

O’Leary described quantum computing as a “new concern floating around now.” According to him, the theoretical risk that a powerful quantum system could eventually compromise blockchain cryptography is enough to keep large investors cautious.

While he did not suggest the threat is imminent, O’Leary indicated that the possibility is influencing capital allocation decisions today. In his view, until the industry provides a clear and credible solution to address quantum vulnerabilities, institutional exposure to Bitcoin is unlikely to move meaningfully beyond the 3% range.

“Until that gets resolved, don’t expect them to go beyond a 3% allocation. They’ll stay cautious, they’ll stay disciplined, and they’ll wait for clarity. That’s the reality,” he said.

His comments suggest that institutions now view quantum risk as significant enough to justify defensive positioning. Meanwhile, some appear to be taking the potential risk even more seriously.

Christopher Wood, global head of equity strategy at Jefferies, removed a 10% allocation to Bitcoin from his model portfolio, citing concerns about quantum computing.

Wood argued that progress in the field would weaken the case for Bitcoin as a reliable store of value, particularly for pension-style long-duration investors. This comes as some analysts argue that growing fears around quantum computing are beginning to influence Bitcoin’s valuation.

Willy Woo recently suggested that quantum concerns may have contributed to Bitcoin breaking its 12-year outperformance trend against gold. Charles Edwards, founder of Capriole Investments, echoed a similar view.

Sponsored

Sponsored

He argued that interest in quantum computing intensified around the time Bitcoin reached its peak, prompting investors to reduce risk exposure, which in turn contributed to the subsequent price decline.

Developers Advance BIP 360 for Future Bitcoin Consideration

Amid mounting concerns, Bitcoin developers cleared a procedural milestone last week by merging Bitcoin Improvement Proposal 360 (BIP 360) into the official BIP GitHub repository.

This means the proposal is now formally listed and can be considered for future Bitcoin updates, though it has not been approved or scheduled for implementation.

BIP-360 proposes a new output type called Pay-to-Merkle-Root (P2MR) that reduces long exposure of public keys by removing Taproot’s key-path spend.

“Pay-to-Merkle-Root (P2MR) is a proposed new output type that commits to the root of a script tree. It operates with nearly the same functionality as P2TR (Pay-to-Taproot) outputs, but with the quantum vulnerable key path spend removed,” the proposal reads.

Traditional formats like P2PK directly expose public keys, and P2TR commits to a public key and can reveal it via key-path spends, creating a potential vulnerability to future quantum attacks. P2MR’s script-only design keeps public keys off-chain until the script must be revealed at spend time, thereby reducing that exposure.

Crypto World

DeFi protocol ZeroLend shuts down after 3 years, citing inactive chains and hacks

Decentralized lending protocol ZeroLEnd is winding down operations after three years, citing unsustainable economics amid inactive blockchains and rising security threats.

The protocol, which ran crypto lending markets across various blockchains, said sustained efforts couldn’t overcome challenges such as price data providers dropping support and shrinking liquidity on networks like Manta, Zircuit, and XLAYER. These issues and constant hacker threats have made it unsustainable.

“Combined with the inherently thin margins and high risk profile of lending protocols, this resulted in prolonged periods where the protocol operated at a loss,” the team stated in an official update.

Lending markets such as ZeroLend are blockchain platforms where users deposit their cryptocurrencies to earn interest (like a savings account), while others borrow those assets by putting up collateral. Think of it as peer-to-pool lending without banks.

Oracle providers provide real-time price data to lending markets such as ZeroLend. When they drop support, it breaks the lending markets, making them unreliable or impossible to run.

The shutdown underscores harsh realities: fleeting liquidity, persistent exploits, and dwindling investor interest in broader corners of the digital asset market continue to test DeFi protocols.

ZeroLend’s team said its top priority is ensuring that “users can safely withdraw their assets” from the protocol.

For assets stuck on low-liquidity chains such as Manta, Zircuit, and XLAYER, the team will update the smart contracts on a set schedule to free up as much as possible. Users need to withdraw quickly, as most markets have been set to a 0% loan-to-value ratio, which means no borrowing is allowed.

LBTC holders on Base get partial relief

Lombard Staked Bitcoin, or LBTC, a year-bearing version of bitcoin used in DeFi lending on ZeroLend’s markets on Coinbase’s Layer 2 network Base, experienced an exploit in February last year, The attacker used a forged LBTC as collateral to drain liquidity.

Users who deposited LBTC there will get partial refunds funded by the team’s LINEA drop allocation. The announcement called on affected users to contact moderators or file support tickets for the refund.

“We kindly ask all affected LBTC users to contact the moderators or submit a support ticket so we can maintain direct communication and coordinate the next steps. For token holders, this marks the conclusion of the ZeroLend journey,” the team said.

“Please withdraw any remaining assets and reach out through official support channels if you need assistance. Thank you for being part of ZeroLend,” it added.

Crypto World

The Old Stablecoin Playbook Doesn’t Apply Anymore: Here’s What Banks Need to Know Now

TLDR:

- Paxos says regulated stablecoins must meet strict reserve and capital standards to operate in the U.S. market.

- Stablecoins function as payment rails and settlement infrastructure, not as direct replacements for bank deposits.

- Global corporations are now using stablecoins to move millions of dollars in minutes instead of days across borders.

- Banks that issue or custody stablecoins can turn a perceived competitive threat into an entirely new revenue stream.

The old stablecoin playbook doesn’t apply anymore, and banks are beginning to take notice. The introduction of the GENIUS Act by the U.S. Congress has pushed financial institutions to reconsider long-held assumptions about stablecoins.

What was once dismissed as a crypto-trader tool has grown into a multi-trillion-dollar market. Banks that continue operating on outdated beliefs risk falling behind fintechs and blockchain-native competitors. The regulatory and commercial landscape has fundamentally shifted.

Outdated Assumptions About Regulation and Risk No Longer Hold

For years, banks treated stablecoins as unregulated, high-risk instruments sitting outside traditional finance. That view no longer reflects reality.

Jurisdictions including Singapore, the European Union, and the United States have established clear frameworks for stablecoin issuance and custody.

The GENIUS Act adds further structure, making regulated stablecoins the only viable path forward in the U.S. market.

Regulated issuers like Paxos already operate under strict reserve management standards and capital requirements. Consumer protections are built into these frameworks, reducing institutional risk considerably.

Banks can now engage with stablecoins knowing that legal guardrails are firmly in place. The compliance infrastructure that once seemed absent is now well established.

The old playbook also treated stablecoins as threats to financial stability. That assumption, too, has aged poorly. Paxos stated that “well-regulated stablecoins actually enhance financial stability by increasing transparency, speed and efficiency.”

On-chain stablecoin transactions are publicly auditable in real time, offering transparency that traditional interbank transfers cannot match.

Paxos further noted that “reserves held in short-term Treasuries are safer than many bank assets.” Banks clinging to outdated risk narratives are working from an incomplete picture.

Global regulatory bodies are aligning on oversight standards at a steady pace. Updating that picture is now a strategic necessity, not just an operational preference.

Banks That Rewrite the Playbook Stand to Gain the Most

The old stablecoin playbook also cast stablecoins as deposit killers threatening bank lending capacity. Paxos pushed back on that directly, stating that “stablecoins serve as rails for payments, settlement and capital efficiency in ways that deposit accounts cannot.”

Banks can issue or custody stablecoins themselves, turning a perceived competitive threat into a growth product. Just as electronic payments once seemed disruptive, stablecoins can expand balance sheets when embraced strategically.

Stablecoins now power cross-border remittances, tokenized asset settlement, and on-chain capital markets at scale. Global corporations are moving millions of dollars in minutes rather than days using stablecoin infrastructure.

Paxos confirmed that “asset managers use them as cash legs for tokenized assets and broker-dealers are leveraging them to create new revenue streams.”

These are not theoretical use cases — they are active, high-volume applications already reshaping global finance.

Paxos was direct in its assessment, saying that “financial institutions that deny this reality are ignoring the signals of market transformation.”

Banks that update their thinking can unlock faster settlement, improved liquidity management, and entirely new client offerings.

The old narrative that stablecoins were only for crypto exchanges has been overtaken by market reality. Those that don’t adapt may find competitors have already claimed that ground.

Paxos summed up the broader shift clearly: “Stablecoins are not a threat to banking — they are an evolution of money that can make banks more competitive.” The window to rewrite the playbook remains open, but it continues to narrow.

Banks that move now can help shape how stablecoins integrate with traditional financial infrastructure. Those that wait may find the terms of that integration have already been set by others.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video16 hours ago

Video16 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech4 hours ago

Tech4 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal