Entertainment

Ryan Murphy’s 88 RT% Crime Miniseries Convinced Stephen King To Adapt His Favorite Horror Story

Stephen King is one of the most well-known and acclaimed authors of all time — so much so, in fact, that he’s been deemed the King of Horror on more than one occasion. His novels have been adapted into some of the horror genre’s most influential films, such as Carrie, The Shining, and Misery. His novels are still being adapted today, whether it be for movies or television, but there was one story in particular that he held onto for years, and that’s Lisey’s Story. But the time finally came when King felt ready to adapt the novel, and it was due in part to Ryan Murphy.

What Is ‘Lisey’s Story’ About?

Lisey’s Story was published in 2006, but it wasn’t until 2021 that the novel finally earned an adaptation — though not from a lack of interest, as King has repeatedly said that it is his personal favorite of the novels he has written, and even expressed interest in Lisey’s Story being adapted into a TV series back in 2017. The story follows Lisey Landon (Julianne Moore), the widow of a novelist, who is plagued by repressed memories that connect back to her husband’s death.

King previously divulged that the idea for Lisey’s Story came to him after a bad case of pneumonia sent him to the hospital. While he was there, his wife, Tabitha King, decided to redecorate his office. When he came home and saw all his books and other belongings in boxes, he had a startling vision of what his office would look like upon his death.

Mike Flanagan Is Turning Another Stephen King Favorite Into a TV Series

Get the corn syrup and red dye ready.

Stephen King Credits Ryan Murphy as the Reason ‘Lisey’s Story’ Became a TV Show

Given that Lisey’s Story is King’s personal favorite novel, that love made it difficult for him to agree to let anyone adapt it for the screen. In an interview with Entertainment Weekly, the author revealed that he was actually inspired by the second season of Ryan Murphy’s American Crime Story anthology series, The Assassination of Gianni Versace:

“I saw this thing on FX that was about the fashion designer Versace and about the man who killed him. And I had not really thought about getting involved with Lisey at that point or tackling it as a TV project, but I looked at that thing, and I said to myself, my goodness, this guy, Tom Rob Smith, wrote the whole thing. He wrote all eight or nine episodes, and I thought, well, if he could do that and bring it home and do such a great job, what about Lisey? And I sat down, and I started, and I showed the scripts to Ben Stephenson at Bad Robot one by one, and he was very encouraging. So the scripts got done, and everything else followed from that.”

According to King, something else that inspired him to tackle his own small-screen adaptation of Lisey’s Story was the changes introduced by streaming TV. “You have a chance to do more,” he said. “You can be a little more graphic with language and with sexual situations and with length, just the chance to do something that has that kind of spread, texture, and a little more nuance. For guys like me, it’s been great.”

Alongside the possibility of a longer format with multiple episodes (anyone who has read the author knows how long-winded he can be, so it’s no wonder that TV held appeal), King admitted he was able to make some necessary updates to Lisey’s Story, looking at the book through different eyes after 15 years, which enabled him to streamline the plot or cut characters that were unnecessary for the screen version. A Stephen King adaptation is always exciting, but Lisey’s Story was one that fans had been especially eager to see brought to life. So, thanks, Ryan Murphy (and American Crime Story), Stephen King might not have done it without you.

Entertainment

Where are the “America's Next Top Model” judges now? Inside their abrupt exit from the series

:max_bytes(150000):strip_icc():format(jpeg)/reality-check-antm-021326-e73fd4f2c5dd4f18836b2b17481b073d.jpg)

Jay Manuel, Miss J. Alexander, and Nigel Barker all departed the reality series following its 18th cycle.

Entertainment

Will Arnett had tense audition with Kevin Costner day after being hospitalized: 'This could go really bad right now'

:max_bytes(150000):strip_icc():format(jpeg)/Will-Arnett-Kevin-Costner-013026-bdeb9498577f4062ae19cb5858775ee2.jpg)

“I was meeting Kevin Costner and I legitimately was worried about crapping my pants,” Arnett recalled while eating some spicy wings on “Hot Ones.”

Entertainment

Nicole Curtis Faces Backlash at Her Kid’s School After N-Word Controversy

Nicole Curtis’ Slur Controversy

Parents at Kid’s School Unglued About Her Volunteering

Published

Some parents at a SoCal school where Nicole Curtis volunteers as a room parent to her son’s class have serious concerns on the heels of her N-word controversy… and at least one has gone to leadership demanding answers, TMZ has learned.

Here’s the deal … the HGTV star has been in hot water since a 2022 video leaked of her using the N-word while filming her popular show, “Rehab Addicts.” She’s was fired — and has issued an apology.

But TMZ has heard from multiple concerned parents at her kid’s school … who tell us they’re super uncomfortable with her working in the classroom as a volunteer — and they think the school should at the very least address the situation with parents.

One parent pointed out there are children of color who attend the school … and they’re shocked leadership has been mum on what happened — and the headline-making fallout.

Another parent told us they, along with others, voiced their concerns to the school administration … who allegedly told them it was not a “school-wide issue,” so there’s not much to be done.

Nicole has been at the school since the 2022 leak … and one parent told us it would be wise for her to read the room — and take some time off to let emotions cool.

Nicole declined to comment.

We’ve reached out to the administration for comment … so far, no word back.

Entertainment

Paris Hilton’s Hottest Shots Ever! Happy 46th Birthday!

Paris Hilton‘s big 46th has us sayin’ one thing and one thing only, “THAT’S HOT!”

The blonde bombshell — now married and a mama of two — kicked off her iconic ways back in the early 2000s, and she’s aging like a fine wine!

How well do you know Paris?! Here’s some trivia for ya’:

Entertainment

Hulu’s Hit Series Tell Me Lies Is Officially Ending After Season 3

Tell Me Lies will not be coming back for more episodes after its third season.

Creator Meaghan Oppenheimer confirmed on Monday, February 16, that the hit Hulu series would be concluding its run, writing via Instagram, “After three amazing seasons of Tell Me Lies, tonight’s episode will be the series finale. This was always the ending my writing team and I had in mind, and we are insanely proud of it. Your incredible response to this season inspired us to explore whether there was another organic way to continue the story, but ultimately we felt it had reached its natural conclusion.”

She concluded: “My main goal has always been to protect the quality of the show and give you the best experience I can give you. And so, while it is bittersweet to leave something that has been such a happy experience, I am very grateful that we are able to tell a complete story with an intentional ending — a privilege very few shows get. Thank you for loving our show. We are excited to bring you more stories in the near future.”

The season 3 finale scheduled to be released on Tuesday, February 17, will now be considered a series finale as well. Oppenheimer previously broke her silence on the assumption that season 3 of Tell Me Lies is the show’s last.

“In terms of future seasons, it’s impossible to really know at this point,” Oppenheimer exclusively told Us Weekly in January. “I certainly had always thought this was always more or less the ending I’d had in mind.”

Oppenheimer didn’t rule out a return, adding, “But you never know what’s going to happen in the future. But there’s definitely a sense where I didn’t want to leave anything hanging this season. Basically, I wanted to satisfy everyone.”

Based on Carola Lovering’s novel of the same name, Tell Me Lies follows the messy relationship between college students Lucy (Grace Van Patten) and Stephen (Jackson White). Their problematic on-and-off romance ends up lasting eight years — and everyone around them is affected by Lucy and Stephen’s ups and downs.

Season 3, which returned in January, raised the stakes with a surprise romance involving Bree (Cat Missal) and Wrigley (Spencer House), which complicated the present timeline. Bree’s wedding to Evan (Branden Cook) seemingly went off without a hitch despite her still having feelings for Wrigley — and previously learning that her now-husband hooked up with Lucy in college.

Off screen, Oppenheimer spoke to Us about how the writers’ room juggles the story lines that happen across two timelines.

“I always had a sense of where they are in 2015 and what their dynamic is and what secrets everyone is holding. Once you at least know what people know and what they don’t know, that gives you a lot of space to play,” she noted in 2024. “But the way that we constructed it is we definitely did the 2008 story line first in the room. We kind of mapped out the whole season and then we did 2015 as its own thing.”

Oppenheimer continued: “I knew where I wanted to end the season, though, in 2015. I knew where it needed to get to.”

After Tell Me Lies was renewed for a third season, Oppenheimer signed an overall deal with 20th Television, which is a part of Disney Television Studios.

“Meaghan has shepherded Tell Me Lies for two intensely addictive seasons that fueled an incredible wave of obsessive fan and social conversation,” president of 20th Television Karey Burke said in a December 2024 statement. “We are thrilled to have her officially in the studio fold and at the helm of another dramatic season.”

The final episode of Tell Me Lies airs Tuesday, February 17, on Hulu.

Entertainment

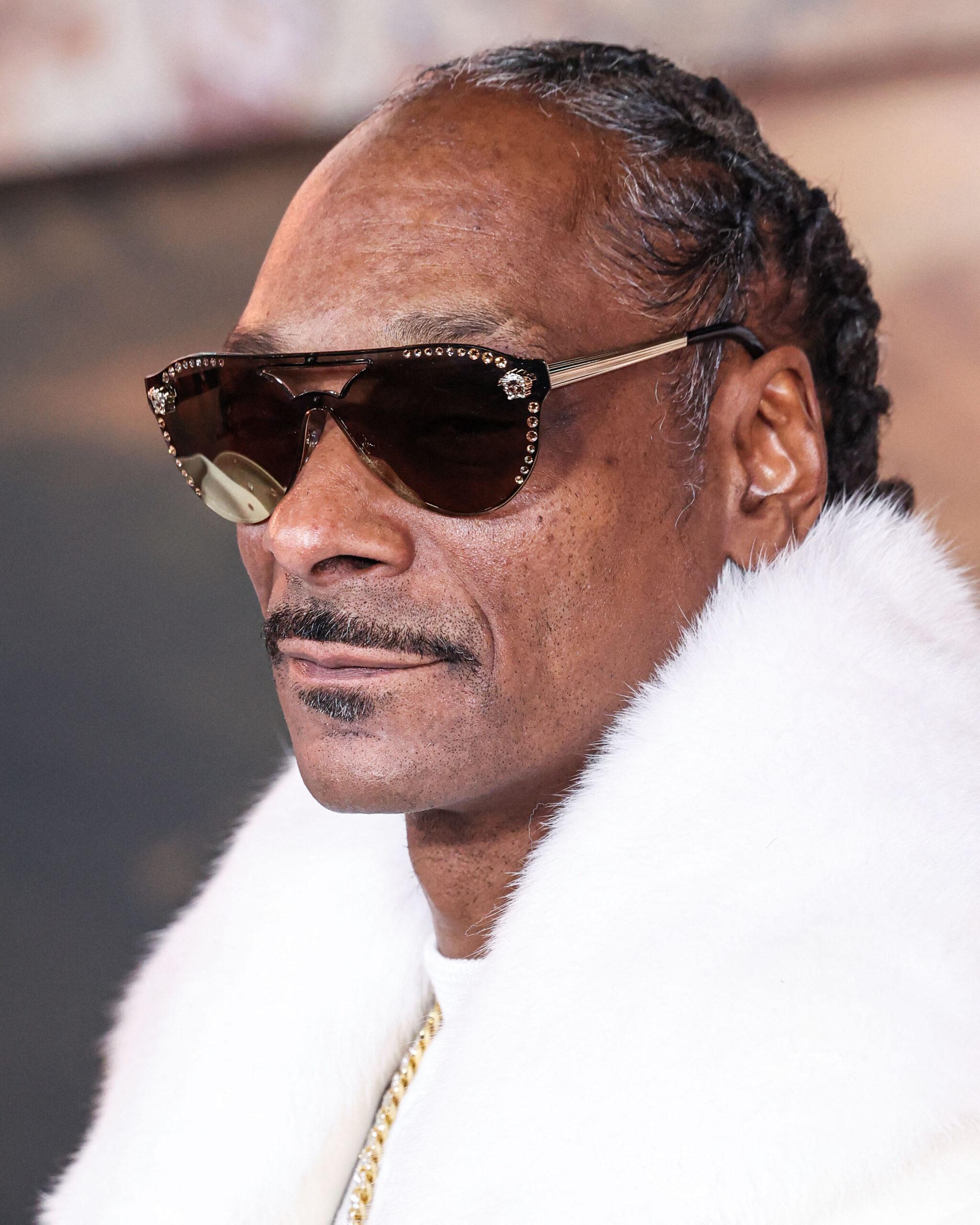

Snoop Dogg Turns Around Embarrassing Fail at Winter Olympics

Snoop Dogg is proving he never forgets a good deed.

One day, after the “Drop It Like It’s Hot” hitmaker faced an awkward moment when his card was declined at a restaurant in Livigno during the Winter Olympics, he responded with a surprise that no one saw coming.

The hip-hop legend had been making appearances throughout the games as an NBC correspondent and honorary Team USA coach for the Milan-Cortina Games, keeping fans entertained both on and off the snow.

Article continues below advertisement

How Snoop Dogg Cleared His Bill With Snowboard Finals Ticket

Although the restaurant owners appeared to waive off the legendary rapper’s bills, he didn’t let their generosity go unnoticed. The children of the family who own Cronox, the bar Dogg visited, recounted the story to Reuters in a video later shared on Instagram.

“Snoop Dogg ordered a cheeseburger, chicken wings, chicken nuggets, and French fries at Cronox, the bar of my parents,” one of the kids, Sofia Valmdre, said in the clip.

She continued explaining that the rapper had sent his staff to receive the food, but they were unable to pay as it “wasn’t going [through].”

Valmadre added that her mother had consented to his taking the food without paying, only for them to receive a gift from him after. “Today, he sent us five tickets to see the final,” Valamdre shared excitedly. “Grazie, Snoop!”

Article continues below advertisement

Snoop Dogg Makes Several Appearances During The Olympic Games

Before Dogg’s embarrassing card decline, Snoop had already been lighting up the Games with his trademark charisma. In one viral moment, The Blast reported, the 54-year-old rapper took to the slopes with a GoPro strapped on, attempting to glide through the snow.

Midway down, he shouted, “Oh sh-t!” as he wobbled precariously, fighting to stay upright. When the ride finally ended, Snoop collapsed onto the snow, lying flat on his back, seemingly in relief.

In another moment, Dogg was seen as the biggest American cheerleader. He proudly rocked a custom shirt featuring Team USA’s Korey Dropkin and Cory Thiesse, cheering alongside Dropkin’s mom as the duo improved to 4-0 at the Games.

Article continues below advertisement

Snoop Dogg’s Daughter Mourns The Loss Of Her Child

Amid Dogg bringing the cheer to the Olympics, his family was recently hit with a tragedy as his daughter Cori Broadus’s child passed away.

According to The Blast, Broadus announced the death of her 11-month-old Codi Dreaux, whom she shared with her fiancé Wayne Deuce, on February 1. The tragic loss comes 20 days after the infant left the neonatal intensive care unit, a milestone which Broadus celebrated.

The little girl was born three months premature in February 2025, from the very beginning, her life was marked by extraordinary challenges, spending months in the NICU as doctors closely monitored her fragile condition.

Article continues below advertisement

Broadus has since expressed heartbreak about the loss in a series of emotional posts on Instagram, per The Blast. In one post, she shared an image of herself lying in bed beside Codi Dreaux, writing in the caption: “I want to join you badly.”

She followed with another photo of the two together, declaring that her daughter was meant to outlive her, not the other way around.

Article continues below advertisement

Snoop Dogg’s Courtside Commentary Steals the Show

Beyond the Olympics, Snoop has continued to shine in the sports world. Last month, The Blast reported NBC welcomed Dogg as a guest analyst for the Los Angeles Clippers-Golden State Warriors matchup, and he delivered a brilliant commentary, switching between reporter and analyst roles.

Joining Terry Gannon and Reggie Miller in the booth, Dogg rolled in remarkable one-liners. After Jimmy Butler snagged a steal, Snoop quipped, “Cookies and cream! They opened up a cookie shop on him!”

Later, when Brook Lopez held his ground in the paint, Snoop delivered another gem: “Small fries tryin’ to run up on a Big Mac.”

Fans Recall Snoop Dogg’s 2024 Paris Olympic Moment

Dogg’s basketball highlights soon reminded fans of his first run with the Olympics in 2024.

While watching equestrian dressage, Snoop weighed in on a horse’s slick footwork and lost it. “The horse is crip-walking! You see that? That’s sick,” he exclaimed on air.

“This horse is off the chain! I gotta get this motherf-cker in a video,” he added, prompting his co-host Kevin Hart into a fit of laughter.

Entertainment

Virgin River Timeline Explained: How Much Time Has Passed Since Season 1?

While Virgin River is Netflix’s longest-running scripted series, viewers have been left confused about how much time has actually passed on the show.

Based on Robyn Carr’s book series, Virgin River follows the lives of residents living in a small town in Northern California, including Mel (Alexandra Breckenridge) and Jack (Martin Henderson). The hit series, which premiered in 2019, also stars Colin Lawrence, Annette O’Toole, Tim Matheson, Benjamin Hollingsworth, Sarah Dugdale, Zibby Allen, Marco Grazzini, Mark Ghanimé and Kai Bradbury.

Netflix’s hit series is seven seasons in – but it seems like way less time has passed for the residents of Virgin River. Mel signed one-year contract with Doc (Matheson) that is somehow not up yet while Charmaine’s pregnancy lasted five seasons of the show.

“I’m like, ‘You guys, eventually, you’re gonna have to do a time jump because we’re just aging way too fast for a five-month span,’” Allen, who plays Brie, joked to Today in 2022. “But yeah, I think that the pregnancy thing was one of the first sort of tells because even I, when I was watching the show before I was on, was like, ‘Oh, this covers way more time in the story.’ And it really doesn’t.”

With some of Us still confused how long each season has covered, keep scrolling for a breakdown.

Season 1 (One Month)

The debut season covered Mel’s initial arrival in the early spring but it seemed to only last four weeks maximum.

Season 2 (Four to Six Weeks)

Barely any time went by so season 2 stretched across a little over one month.

Season 3 (One Month)

Following Jack’s shooting, there was a time jump of three weeks before seasons 2 and 3. The rest of the events lasted another four weeks before Mel realized she was pregnant.

Season 4 (Four to Six Weeks)

The fourth season picked up around one to two weeks after season 3. This allowed Mel to continue to remain in the first trimester for the rest of season 4.

Season 5 (Three to Four Months)

Based on the holidays that took place on screen – from Labor Day to Christmas — season 5 was the longest to date with at least three months passing. There was a small time jump between parts 1 and 2 though, which allowed for the timeline to expand.

Season 6 (One Month)

The buildup to Mel and Jack’s wedding led to a timeline of three to four weeks maximum. Season 4 notably picked up in the spring, which meant there was a large time jump since the third season wrapped at Christmastime.

Entertainment

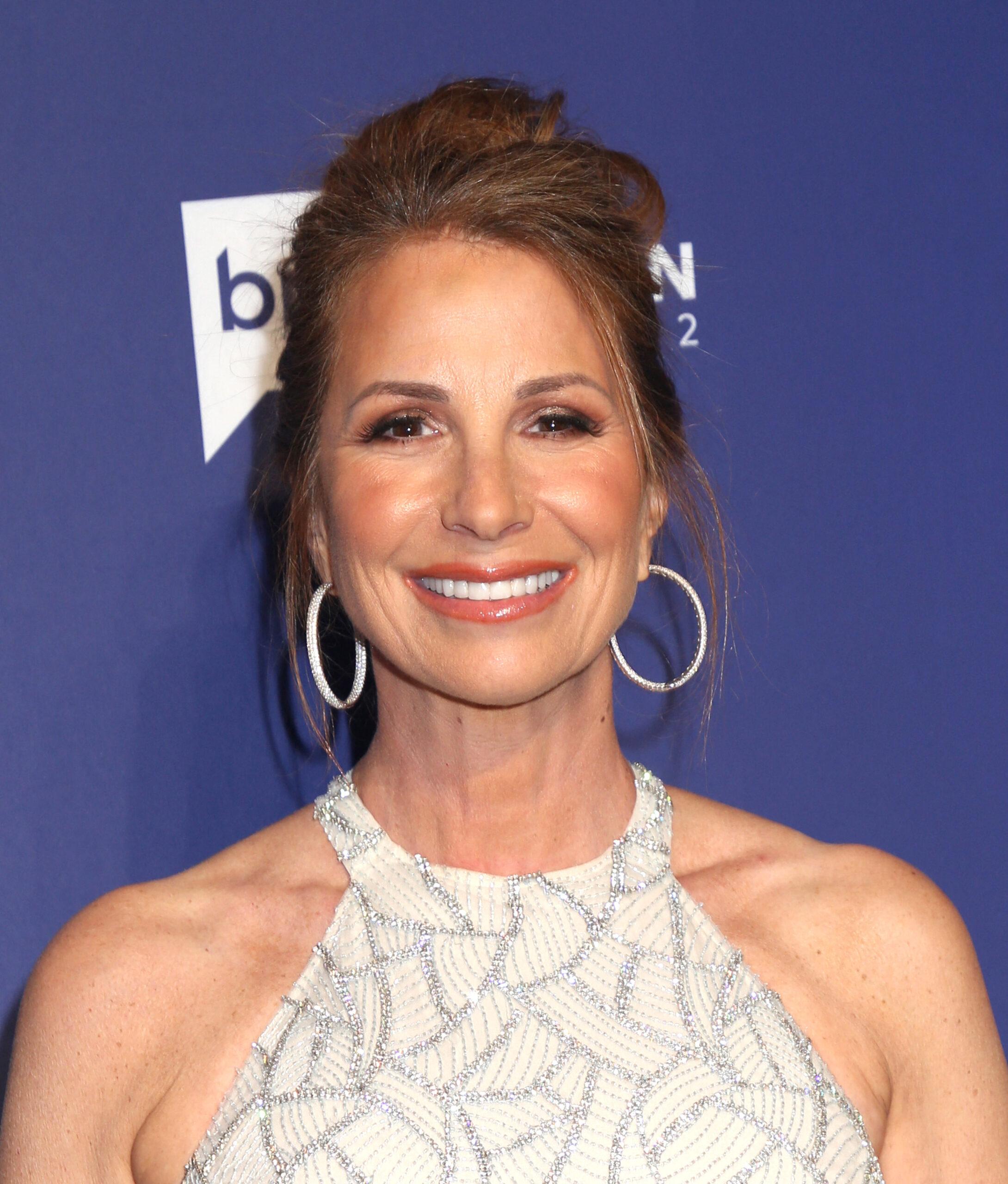

Jill Zarin Gets Another ‘Real Housewives’ Support

Jill Zarin is not facing these trying times alone, as her pals are rallying behind her.

The “Real Housewives” alum has some of her former fellow on-screen stars rising to her defense publicly after she was kicked off the “Real Housewives of New York” reboot show, before the cameras started rolling.

Jill Zarin ignited the controversy when she made a social media statement lauding her opinions about Bad Bunny’s performance at the Super Bowl Halftime show.

Article continues below advertisement

Aviva Drescher Does Not Think Jill Zarin Is Racist

Zarin’s former castmate, Aviva Drescher, is addressing the comments made about her following the release of her now-deleted Instagram video about Bad Bunny’s performance.

Backlash downpoured as fans reacted, calling Zarin a racist. Drescher’s statement is in response to this claim, and she insists her former castmate is not racist even though her commentary came off that way.

Drescher addressed the media sensation’s ordeal on “Miss Understood with Rachel Uchitel” podcast, giving a little background view into her relationship with Zarin.

“I’ve known Jill since 2011, since I joined ‘Housewives’, even though we didn’t work together, we became friendly. I’ve never thought of Jill to be racist, and that was really the thing that stung. That was just the most awful about her tirade,” she stated.

Article continues below advertisement

The reality TV star added that she would not have done the show with Zarin if she felt any nuance of racism, as she draws a hard line on the topic.

Still addressing the matter, Drescher clarified that she was not defending the remarks her fellow Real Housewife made, but stated that she does not think they came from a place of hate. However, she did not hold back in her thoughts about Zarin’s commentary, saying:

“It came off as completely racist, but I don’t think she’s racist. I don’t think it came from a hateful place. It was completely stupid.”

Article continues below advertisement

Why Was The Reality TV Star Labeled A Racist?

In case you missed it, Zarin posted a video analyzing the rapper’s performance where she did not hold back with the criticism. Her words in turn created a firestorm online, which then led to her being kicked off the “Real Housewives” spin-off project.

In the video, she complained that there were no white people in the Puerto Rican artist’s performance, slamming it as the worst halftime show ever. “To me, it looked like a political statement because there were literally no white people in the entire thing,” she said.

Zarin also complained that she could not understand a word of Bad Bunny’s performance, although she would have loved to, since he sang in Spanish. She claimed that the choice of his native language over English was inappropriate.

Article continues below advertisement

She took it down from Instagram shortly after the video was posted, but some fans already reposted it on X. Since then, many fans called her out, claiming her statement was racist, and later, news spread that she was fired from E! ‘s upcoming “RHONHY” reboot show.

Article continues below advertisement

Aviva Drescher Was Not The First To Show Support For The ‘Real Housewives’ Alum

Brandi Glanville previously addressed her pals’ firing from the upcoming reunion show, stating that people should not be punished for their opinions.

In her statement shared in a post on X, she credited the rapper for his performance, writing that she enjoyed it, but as much as she did, she acknowledged that some people like Zarin didn’t, and everyone is free to have a different opinion.

The Blast shared that the former bravolebrity emphasized that “opinions aren’t wrong, they’re subjective,” explaining that firing her as punishment for having a different opinion was not sending the right message.

“I want to watch Jill on TV explain herself & hopefully learn something. Or we can just keep watching ‘yes people’ afraid to share,” she penned.

Zarin Addressed The Network’s Decision

Zarin’s contract with E! for the new “RHONY” spin-off, “The Golden Life,” was cut off shortly after her controversial video went viral. Being one of the OG Housewives, she took the news of her firing to heart.

The producers announced it in a public statement, which read, “In light of recent public comments made by Jill Zarin, Blink49 Studios has decided not to move forward with her involvement in The Golden Life. We remain committed to delivering the series in line with our company standards and values,” as shared by The Blast.

Zarin claims she acknowledged her fault almost immediately, which was why she took the video down, but E! already threw in the towel on her. “[They] didn’t even give me a chance” to rectify the situation.

Article continues below advertisement

“I took it down right away. People make mistakes. I’m human,” the TV star said. She was also fired ahead of season 5 of “RHONY” in September 2011, so this marks her second axing.

Since Jill Zarin Is Out, Who Is In?

E! has announced that another face will be taking Zarin’s place on “The Golden Life” set, which is scheduled to air later in the year. The show was initially set to feature the original cast of “RHONY,” Zarin, Sonja Morgan, Luann de Lesseps, and Ramona Singer.

With the latest developments, Zarin is being replaced by Dorinda Medley, who is not a new face to viewers. She starred on the show previously for six seasons, and fans have since anticipated her return.

The Blast noted in a previous release that the network did not intend to share that Medley was stepping up from being a spare cast member immediately. Instead, they hoped to announce her role closer to the show’s premiere as they wanted to extend the publicity for the show a little longer.

Entertainment

Summer Walker — Fun In Fendi Bikini Beach Babe Pics!

It’s always summer somewhere when Summer Walker steps out … and these pics are living proof she brings the heat wherever she goes!

Check out these scorching shots … Summer’s soaking up the sun in a barely-there Fendi bikini, putting her curves on full display while striking poses that are impossible to ignore.

No surprise here — Summer’s basically made a sport out of blessing fans with next-level bikini moments, and TBH, nobody’s complaining!

We’ve got one more Summer Walker snap in the mix — but you’ll have to piece it together yourself …

So yeah, temperatures might be dropping where you are — but Summer’s keeping things hot all on her own!

Entertainment

Jeffrey Epstein Emails Refer to Toxic ‘Zombie Drug’ Plants He Kept

Jeffrey Epstein may have had a collection of highly poisonous plants known to produce a drug that blocks free will in its victims … according to newly discovered emails in the last document dump of the Epstein Files.

In one of the uncovered messages, Epstein sends an email asking about his “trumpet plants at nursery.”

For background … Angel’s Trumpet plants are extremely toxic and produce a drug called scopolamine, which is known to basically turn humans into zombies, wiping them of memory and eliminating their free will. Severe intoxication reportedly may even cause paralysis and death.

Even more alarming, scopolamine reportedly doesn’t show up on toxicology reports.

And if you’re wondering if Epstein was aware of this … there’s an excellent chance he was. In another email, he was sent an article all about the effects of scopolamine and the plant it comes from.

Epstein died in his cell in 2019 awaiting trial on federal sex-trafficking charges. Lawmakers voted to force President Donald Trump‘s Dept. of Justice to publicly release the Epstein Files last year … they’ve been dropped in batches, the most recent last month … though the DOJ says there won’t be any more forthcoming.

Last week, Ghislaine Maxwell pleaded the Fifth Amendment during a deposition in front of the House Oversight Committee, refusing to answer questions relating to Trump’s association with Epstein. Trump has not been accused of any crime in relation to Epstein … dozens of high-profile figures in entertainment, business, science and academia are featured in the files as friends and confidants.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video17 hours ago

Video17 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech5 hours ago

Tech5 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal