Business

Goldman Sachs to remove DEI board hiring standards amid policy shift

Cornell University law professor William Jacobson discusses rooting racism out of the high education system as well as an op-ed that college students are becoming less woke.

Goldman Sachs plans to remove DEI hiring standards for its board of directors, The Wall Street Journal reported Monday.

The company had removed a requirement for board diversity on companies it was taking public last year, but now plans to remove DEI language in the criteria for its own board members this month. The board’s governing committee evaluates potential candidates based on four criteria, one of which is a more traditional understanding of diversity, encapsulating viewpoints, background, work and military service.

That section also has “other demographics” tagged on to the end, referring to race, gender identity, ethnicity and sexual orientation, according to the Journal. The board now reportedly plans to remove reference to “other demographics.”

The expected change comes after the National Legal and Policy Center, a conservative nonprofit that owns a small stake in the bank, requested the change in September, according to the Journal.

Goldman Sachs is rolling back its DEI hiring standards for its board of directors. (Getty Images / Getty Images)

Goldman Sachs struck a deal with the group under which the board would make the change of its own accord and the NLPC would not submit a formal request circulated to shareholders ahead of the company’s annual shareholder meeting later this year, people familiar with the matter told the outlet.

The change comes as part of a wider rejection of DEI policies thanks in large part to President Donald Trump‘s return to the White House last year.

Trump moved quickly to drop the hammer on DEI, signing an executive order on day one titled “Ending Radical and Wasteful Government DEI Programs and Preferencing,” which directed federal agencies to stamp out DEI-style programs across the federal government. The following day, Trump signed a second order aimed at “restoring merit-based opportunity,” including changes for federal contracting and related compliance.

CORPORATE AMERICA HAS DECIDED THAT DEI NEEDS TO DIE

A view of the Goldman Sachs stall on the floor of the New York Stock Exchange.

“We’ve ended the tyranny of so-called Diversity, Equity and Inclusion policies all across the entire federal government and indeed the private sector and our military. And our country will be woke no longer,” Trump said in March.

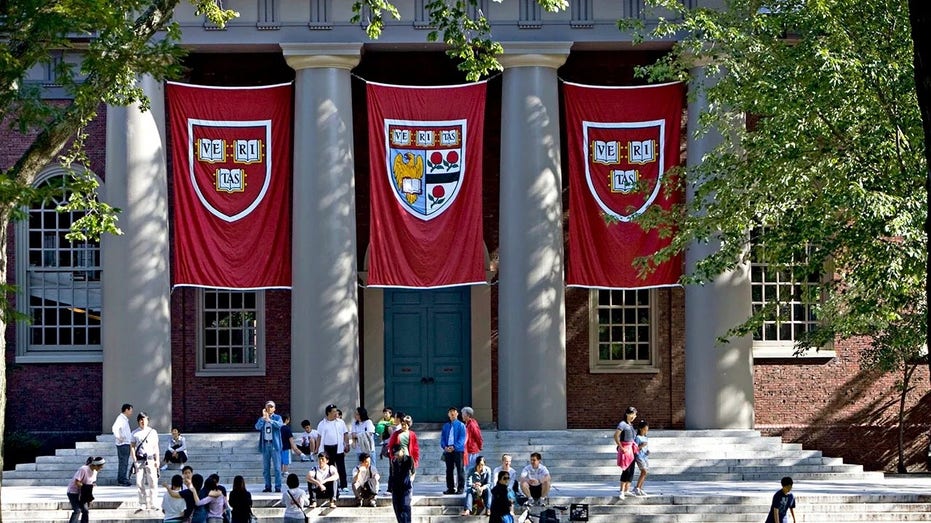

The administration has also targeted DEI initiatives at America’s elite universities, seeking new funding agreements with Columbia University, Harvard and others.

Harvard has been a main target of the Trump administration’s attempt to leverage federal funding in order to crack down on antisemitism and “woke” ideology.

In December, lawyers for the Trump administration appealed a judge’s order to restore $2.7 billion in frozen federal research funding to Harvard University.

Harvard banners hang outside Memorial Church on the Harvard University campus in Cambridge, Massachusetts. (Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Harvard sued the administration in April over its attempt to freeze the federal funding and argued in court that the actions amounted to an unconstitutional “pressure campaign” to influence and exert control over elite academic institutions.

Fox News’ Emma Colton contributed to this report.

Business

Ford to follow Tesla Cybertruck with electrical tech in new EV pickup

A Ford F-150 Lightning next to a Tesla Cybertruck.

Michael Wayland / CNBC

DETROIT — Ford Motor‘s $5 billion “bet” on its next generation of all-electric vehicles will feature a budding technology that Tesla commercialized in the U.S. on its Cybertruck, the Detroit automaker said Tuesday.

The system, known as a 48-volt electrical architecture, had been discussed in the automotive industry for decades but Tesla was the first to bring it to consumers in 2023.

The auto industry has historically used a 12-volt system with a lead-acid battery for all vehicles to power the car’s accessories — but that’s been problematic and caused recalls for many EVs. The new architecture instead uses the EV’s high-voltage battery to power everything.

The 48-volt system improves efficiency, allows for additional electrical bandwidth and saves weight through the reduction of wiring, officials have said. The power also can be “stepped down” to 12 volts, when needed, through the use of new electronic control units, or ECUs, that handle different groups of an EV’s architecture.

The new electrical system is one of many innovations that Ford believes will allow its next-generation EVs — starting with a $30,000 small electric pickup truck in 2027 — to compete against Tesla as well as rapidly expanding Chinese brands in global markets.

“At Ford, we took on the challenge many others have stopped doing. We’re taking the fight to our competition, including the Chinese,” Ford CEO Jim Farley said during an August event at a plant in Kentucky that will produce the unnamed electric pickup. “For too long, legacy automakers played it safe.”

Farley has called it a “Model T moment” for the company, referring to the company’s flagship vehicle that came out more than a century ago and led to the mass adoption of vehicles during the early 1900s. He’s also called it a “bet” for Ford given the amount of changes it will make to the EVs as well as the company and its processes.

Ford expects the new EVs, which will be based on a common “Universal Electric Vehicle,” or UEV, to have comparable costs to gas-powered vehicles through new technologies and efficiencies. Currently, the massive batteries that power EVs have made them far more expensive to produce and have been infamously unprofitable.

The Detroit automaker has said the new EVs will reduce parts by 20% versus a typical vehicle, with 25% fewer fasteners, 40% fewer workstations dock-to-dock in the plant and 15% faster assembly time.

“It represents the most radical change on how we design and how we build vehicles at Ford since the Model T,” Farley said at the plant. “Now is time to change the game once again.”

Ford CEO Jim Farley speaks at the Louisville Assembly Plant as the company shares its plans to design and assemble breakthrough electric vehicles in the United States, Aug. 11, 2025.

Courtesy: Ford

Ford said those improvements, as well as price points that are more similar to gas-powered models, will lead to greater adoption of EVs. That’s despite a significant slowdown in U.S. EV sales amid changes to federal support by the Trump administration as well as less-than-expected consumer adoption.

U.S. EV sales peaked in September, ahead of the federal incentives ending, at 10.3% of the new vehicle market, according to Cox Automotive. That demand plummeted to preliminary estimates of 5.8% during the fourth quarter.

Those market conditions recently led Ford to announce $19.5 billion in write-downs, largely related to a pullback in EV plans, but the company said it will continue to invest $5 billion for its new UEV platform through 2027.

“Our focus has been on giving them everything they would get in a nice vehicle and more, and we think that that will allow us to ultimately not just make an affordable vehicle, but make one that’s extremely desirable,” Alan Clarke, Ford’s executive director of advanced EV development, said during a media briefing.

48-volt system

The 48-volt system provides significant benefits to other parts of the vehicle aside from just the battery and is expected to continue to do so as the bandwidth of 12-volt batteries gets maxed out, according Clarke, a former Tesla executive.

“It’s less expensive, has smaller wires and is the future of automotive,” he said. “So, if you want to future-protect this platform to exist for more than a decade … it’s very clear that 48 made the most sense.”

Alan Clarke, Ford’s executive director of advanced EV development, during a video presentation on Ford’s Universal Electric Vehicle platform.

Courtesy Ford

Ford said the wiring harness in the new midsize truck will be more than 4,000 feet shorter and 22 pounds lighter than the wiring harness used in Ford’s first-generation electric SUV.

Tesla CEO Elon Musk sent competitors such as Ford and General Motors a “how-to” guide on developing a 48-volt system in 2023.

Clarke said Ford had already decided on a 48-volt platform before getting the letter but that it “certainly added fuel to the fire” and was a “helpful starting point to see how they thought about” it. It also helped suppliers get ready to assist with 48-volt systems, he added.

Gigacastings

In addition to the 48-volt system, the company on Tuesday released additional details on how it’s achieving its targets with the new EV through aerodynamics, team “bounties” to increase vehicle efficiency and turning to Tesla-pioneered “gigacastings.”

Gigacasting is a manufacturing process that can replace dozens of traditionally small, stamped parts with larger pieces. The process requires massive machines to pressurize large sheets of metal into parts such as a vehicle’s facia or underlying structure.

Ford said the new pickup will only have two structural front and rear parts compared with 146 such components on its current gas-powered Maverick small pickup.

Ford also said its aluminum castings for the upcoming EV are more than 27% lighter than those features on a Tesla Model Y.

“We’re still on a really steep decline of EV costs, and you can only get that by innovating, and you can only get that by system level, optimizing into what eventually becomes a product that a customer wants,” Clarke said.

Business

Fortescue lodges plans for Wyloo North iron ore mine

A new mine submitted to the EPA would be among the first in Fortescue’s stable to run on renewable energy from the get-go, should the miner’s plans come off.

Business

Halozyme earnings in focus: Can royalty momentum carry into 2026?

Halozyme earnings in focus: Can royalty momentum carry into 2026?

Business

TPG Mortgage Investment Trust, Inc. 2025 Q4 – Results – Earnings Call Presentation (NYSE:MITT) 2026-02-17

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Howard Porter boss buys into Bibra Lake

An entity owned by Roy Lombardi has purchased four lots from St John Ambulance for $9.57 million.

Business

Flowserve at Citi Conference: Strategic Growth and Operational Excellence

Flowserve at Citi Conference: Strategic Growth and Operational Excellence

Business

(VIDEO) Netflix Enters MMA Arena With Historic Ronda Rousey vs. Gina Carano Superfight Set for May

Netflix is diving into mixed martial arts with its first-ever live MMA event, headlined by a long-awaited dream matchup between pioneers Ronda Rousey and Gina Carano on May 16 at the Intuit Dome in Inglewood, California.

The announcement, made Feb. 17, 2026, by Most Valuable Promotions (MVP) — Jake Paul’s combat sports company — and Netflix marks a major expansion for the streaming giant beyond its previous boxing ventures, such as the Jake Paul-Mike Tyson bout. The card will stream exclusively live on Netflix worldwide, with no pay-per-view required for subscribers.

Rousey (12-2, 9 submissions, 3 KOs), the former UFC women’s bantamweight champion and Olympic judo medalist, returns after a nearly 10-year retirement from MMA. Her last professional fight was a loss to Amanda Nunes in December 2016. Carano (7-1, 1 submission, 3 KOs), often credited as one of the earliest stars of women’s MMA through her Strikeforce bouts, has not competed professionally since 2009 but has remained active in training and acting.

The bout will be contested at featherweight (145 pounds) over five five-minute rounds inside a hexagon cage. Both fighters, now 39 (Rousey) and 43 (Carano), are un-retiring specifically for this superfight, billed as the biggest in women’s combat sports history.

“Been waiting so long to announce this: Me and Gina Carano are gonna throw down in the biggest super fight in women’s combat sport history,” Rousey said in a statement. “We’re partnering with the fighter-first promotion MVP as well as the biggest and baddest streamer on the planet Netflix. This is for all MMA fans past, present and future.”

Carano echoed the sentiment, noting Rousey approached her as the only opponent worth a comeback. The matchup, often discussed as a “what if” since the mid-2010s, arrives more than a decade after both were at their peaks.

The event is MVP’s inaugural MMA card, following its successes in boxing. Additional undercard fights will be announced in the coming weeks. Tickets go on sale March 5 via Ticketmaster, with a pre-sale signup already available. A press conference is scheduled for March 5 at the Intuit Dome, hosted by combat sports journalist Ariel Helwani.

Netflix promoted the fight aggressively on social media Feb. 17 with a video declaring “Two MMA legends are coming to Netflix. RONDA ROUSEY vs. GINA CARANO Saturday May 16 LIVE only on Netflix #RouseyCarano.” Fan reactions exploded across platforms, with excitement over the historic clash mixed with skepticism about ring rust — Carano’s 17-year absence and Rousey’s decade-long hiatus — and debates on competitiveness.

Some fans called it a “wild ride” and “dream fight,” while others joked about it being “10 years too late” or questioned outcomes. The announcement also drew attention to Carano’s controversial exit from “The Mandalorian” in 2021, with headlines noting Netflix’s move as an effective “un-canceling” for the actress-fighter.

The Intuit Dome, home to the NBA’s Los Angeles Clippers, provides a modern venue for the event. Netflix’s live sports push continues to grow, capitalizing on massive viewership from prior combat events.

No undercard details or additional streaming requirements have been released beyond a standard Netflix subscription. The fight streams live May 16, with timing to be confirmed closer to the date.

This landmark card positions Netflix as a player in live MMA broadcasting, potentially setting the stage for more events if viewership proves strong.

Business

(VIDEO) Netflix’s ‘His & Hers’ Limited Series Tops Charts with Twisty Murder Mystery

Netflix’s psychological thriller limited series “His & Hers” has surged to the top of streaming charts since its Jan. 8, 2026, premiere, captivating audiences with its unreliable narrators, multiple twists and intense performances from leads Tessa Thompson and Jon Bernthal.

The six-episode series, an adaptation of Alice Feeney’s 2020 bestselling novel of the same name, follows estranged spouses Anna Andrews (Thompson), a once-prominent Atlanta news anchor returning to her small Georgia hometown of Dahlonega, and Jack Harper (Bernthal), the lead detective on a high-profile murder case. As Anna covers the story for her struggling career comeback, she and Jack each suspect the other of involvement in the killing of a wealthy local woman, leading to a tense battle of wits amid buried secrets from their shared past.

All episodes dropped simultaneously on Netflix, allowing viewers to binge the slow-burn suspense that builds to a shocking finale. The official trailer, released Dec. 11, 2025, teased the core conflict with the tagline “Two sides. One truth,” highlighting heated confrontations and the question of who is lying. Netflix promoted the series as a seductive mind game exploring trust, betrayal and small-town secrets.

Supporting cast includes Pablo Schreiber, Rebecca Rittenhouse as ambitious coworker Lexy Jones, Sunita Mani, Marin Ireland, Crystal Fox and Poppy Liu, adding layers to the ensemble of suspects and allies. Created by William Oldroyd (“Lady Macbeth”) and showrun by Dee Johnson (“ER”), the production emphasizes atmospheric tension in the sweltering Georgia setting.

Viewership has been explosive: Nielsen data for Jan. 12-18, 2026, showed “His & Hers” leading with 2.24 billion viewing minutes, dethroning “Stranger Things” from its seven-week No. 1 run. The series claimed the top spot on Netflix’s English TV list with 29.5 million views in its debut week, drawing praise for its bingeable pacing and star power.

Critics have offered mixed but engaged responses. Rotten Tomatoes gives it a 69% Tomatometer score based on reviews, with a 62% Popcornmeter from audiences. Some outlets hailed the chemistry between Thompson and Bernthal and the addictive twists, while others critiqued plot holes, overreliance on melodrama and handling of heavy themes like sexual assault and bullying. RogerEbert.com called it frustrating yet indicative of the thriller miniseries boom, while fans on social media and Reddit lauded it as a “wild ride” perfect for one-sitting viewing.

Thompson, who also executive produces, brings emotional depth to Anna’s unraveling life, while Bernthal’s intense portrayal of the rogue detective adds grit. The adaptation stays faithful to Feeney’s novel, preserving its unreliable perspectives and final revelations.

As a limited series, “His & Hers” concludes its story in one season, though its success has sparked discussions about potential anthology-style follow-ups in the thriller space. Netflix continues to invest heavily in book-to-screen adaptations, with “His & Hers” joining recent hits in the genre.

Fans can stream all six episodes exclusively on Netflix, rated TV-MA for mature themes, violence and language. With ongoing buzz nearly six weeks post-premiere, the series remains a dominant conversation piece in streaming entertainment.

Business

Cinemark earnings on deck: Can box office momentum offset concerns?

Cinemark earnings on deck: Can box office momentum offset concerns?

Business

Mutual funds slash stakes in 9 of 10 IT stocks but Rs 4 lakh crore still at play

Mutual funds held Rs 395,404 crore worth of IT stocks as of January 2026, down from their December exposure of Rs 397,310 crore, as relentless selling gripped the sector, according to data from Prime Database. Oracle Financial Services Software (OFSS), Wipro, TCS and Coforge have all crashed at least 30% from 52-week highs, while Infosys is down 27% and HCL Tech has shed 18%.

ICICI Prudential Asset Management Company led the exodus, offloading an estimated Rs 1,953 crore in Infosys alone during the month, according to the data. The fund house also dumped Rs 783 crore in Tata Consultancy Services (TCS) and Rs 623 crore in HCL Tech. Only Wipro saw buying interest, with both ICICI Prudential Mutual Fund and Quant Mutual Fund adding to their positions.

According to estimates, net selling by all mutual funds in TCS reached Rs 302.53 crore in January, while Tech Mahindra saw Rs 966.71 crore in net outflows and HCL Tech Rs 817.35 crore.

“We expect continued relevance for IT Services, but their position in the tech value chain is softening,” said Ruchi Mukhija of ICICI Securities. “As AI-driven capital shifts toward infrastructure and AI software, services are losing their share of new tech spend. This prolonged period of subdued growth could drive a further derating in valuation multiples.”

Large-cap IT stocks currently trade at 18 times fiscal 2027 estimated earnings, well above historical troughs like the 11-12 times seen during the global financial crisis and initial Covid-19 outbreak, or the 15-17 times average of the fiscal 2013-2017 slowdown, Mukhija noted.

Also Read | Beyond Rs 6 lakh crore selloff: How TCS, Infosys, other IT giants are reinventing to outlast AI disruption fears

AI’s deflationary grip

The structural threat is stark as generative and agentic AI are delivering immediate productivity gains of 20-40% across core tasks like coding, testing, support, maintenance, and business process outsourcing. This efficiency is eroding IT services’ share of global tech spending, with ICICI Securities projecting an 8 percentage point contraction between calendar 2023-2026 as capital flows toward AI infrastructure and platforms.

Pure-play AI leaders are scaling at “unprecedented rates,” the brokerage said, with OpenAI and Anthropic reaching annual revenue run-rates of $20 billion and $14 billion respectively, backed by over 1 million and 300,000-plus enterprise customers.

“While we believe that these platforms do not replace IT service providers, they are essentially weakening their bargaining power and relevance within the modern tech value chain,” ICICI Securities said.

“IT services may see a growth surge once AI-driven demand outpaces its deflationary effects—but even three years into the AI wave, that tipping point remains elusive,” Mukhija added. “Key monitorables include improvement in profitability per employee, share of new billing models and net new deal TCV.”

Kodak moment for Indian IT?

Motilal Oswal struck a more measured tone, arguing that current valuations may already reflect dire scenarios. The firm’s reverse discounted cash flow analysis suggests the market is pricing in an average 10-year free cash flow compound annual growth rate of just 6.5% which is “among the lowest in the past two decades.”

“This compares to a 40% FCF CAGR in crisis eras such as GFC; a 13% FCF CAGR over FY16-19, when the sector decelerated sharply; and an 8.5% FCF CAGR during FY23-FY26, the latest period of deceleration,” the brokerage said.

On a free cash flow yield basis, large-caps are trading at 5.8% for fiscal 2027 and 6.2% for fiscal 2028 — “levels approaching prior cyclical troughs.”

“The core question is whether AI represents a structural break to terminal growth assumptions or merely compresses growth/margins temporarily,” Motilal Oswal said. “If this is a Kodak moment, then the quantum of downside from here is moot. If it is not, the market is currently pricing an FCF CAGR that is among the lowest in the past two decades.”

Both brokerages acknowledged IT services providers retain critical roles despite AI headwinds. According to ISG, 65% of IT leaders say managing existing data complexity hinders AI progress more than lack of innovation, creating demand for “AI-ready” data architecture that IT services firms can provide.

“New AI tools have accelerated productivity gains but cannot entirely replace the need for IT services,” ICICI Securities said, citing unavailability of AI-ready data at enterprise scale, need for data governance and accountability, and client reluctance to overhaul smoothly running core systems with probabilistic AI platforms.

The brokerage sees potential for a “surge in net-new demand for ERP and legacy code transformations” as AI speeds up refactoring of mission-critical tech stacks. Key areas include legacy code modernization, ERP transformation, replacing point-solution SaaS with AI agents, building AI-ready data foundations, cybersecurity, and physical AI.

“In the long term, answers to whether the industry goes extinct, thrives, or just survives won’t come by easily,” Motilal Oswal said. “In the short term, we stick to forecasting earnings growth for the next two years, which, as shown earlier, seems to be improving.”

JP Morgan analysts argue that it’s overly simplistic to assume that AI can automatically generate enterprise grade software and replace the value IT services firms create across the cycle.

“Indeed, IT Services companies remain the plumbers in the tech world, and if enterprise software/SaaS is rewritten on a bespoke basis by agents – it will need significant services plumbing to work in enterprise context and minimise AI slop,” it said in a recent note.

The brokerage is taking a barbell approach to buy deep value in largecaps like Infosys and TCS, along with growth champions such as Persistent and Sagility.

Sensex, Nifty today: Catch all the LIVE stock market action here

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video24 hours ago

Video24 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech12 hours ago

Tech12 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video7 hours ago

Video7 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 hours ago

Crypto World6 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports13 hours ago

Sports13 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show