Crypto World

$1.28T Erased From Gold & Silver In Lunar New Year Liquidity Crunch

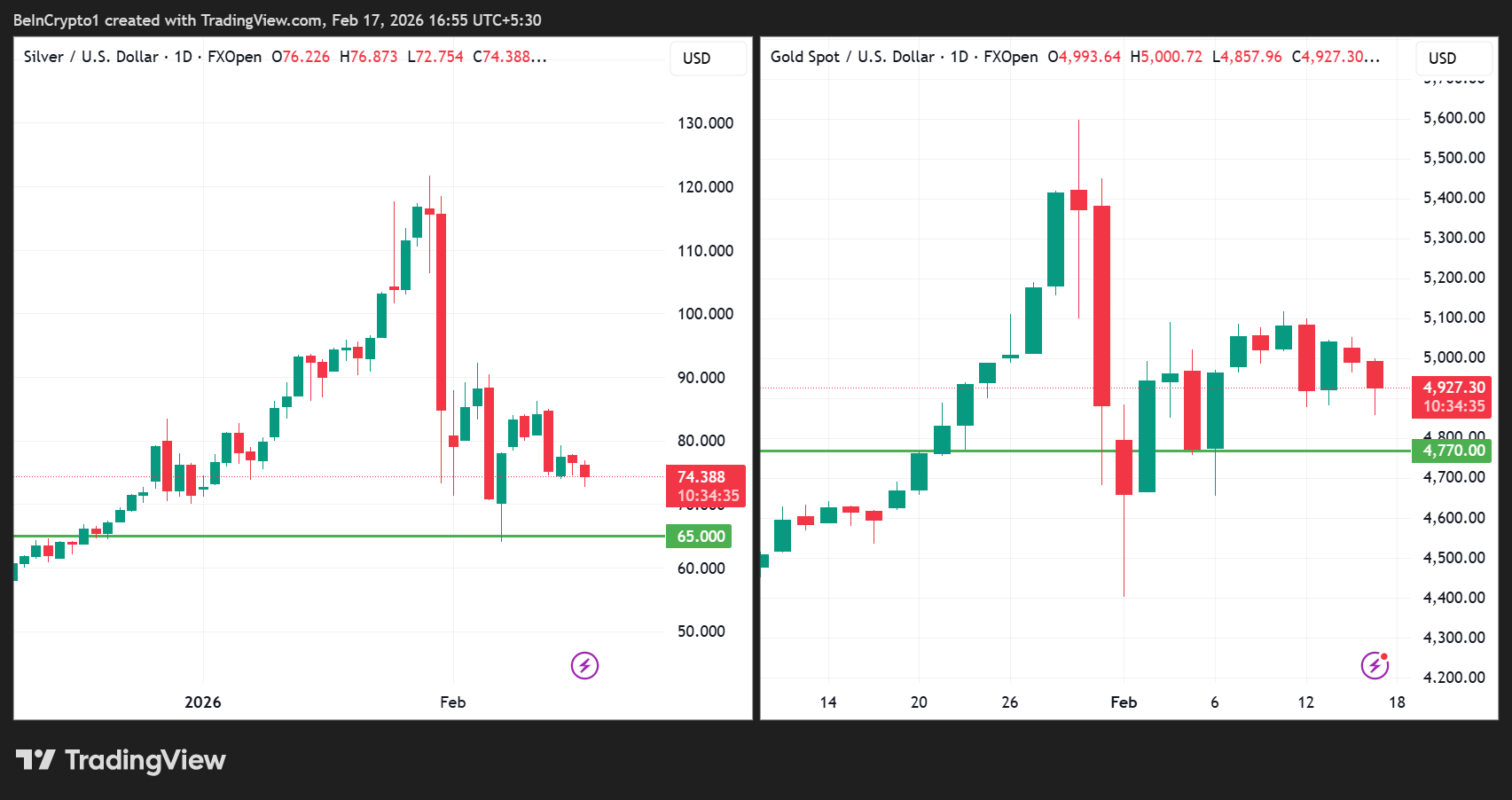

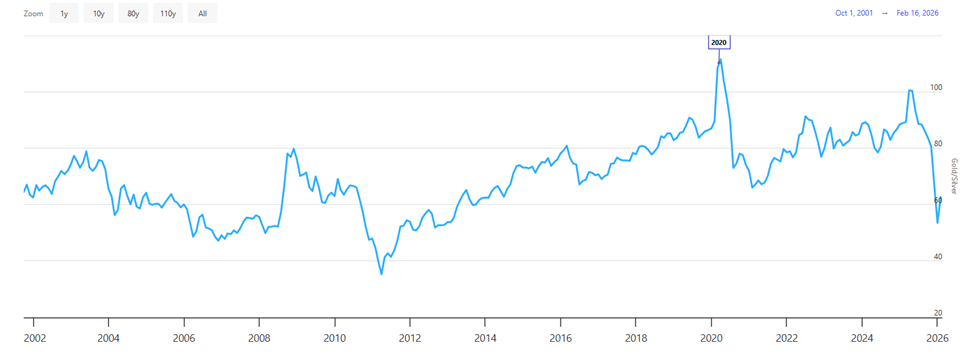

Gold and silver markets are in a sharp correction, with prices falling for a second consecutive session. Commodity-based exchange-traded funds (ETFs) are also declining by as much as 4%.

The sudden downturn has erased an estimated $1.28 trillion in combined market value, reflecting how even traditional safe-haven assets remain vulnerable to macro shocks and liquidity shifts.

Lunar New Year Liquidity and Macro Pressures Fuel Gold and Silver Correction

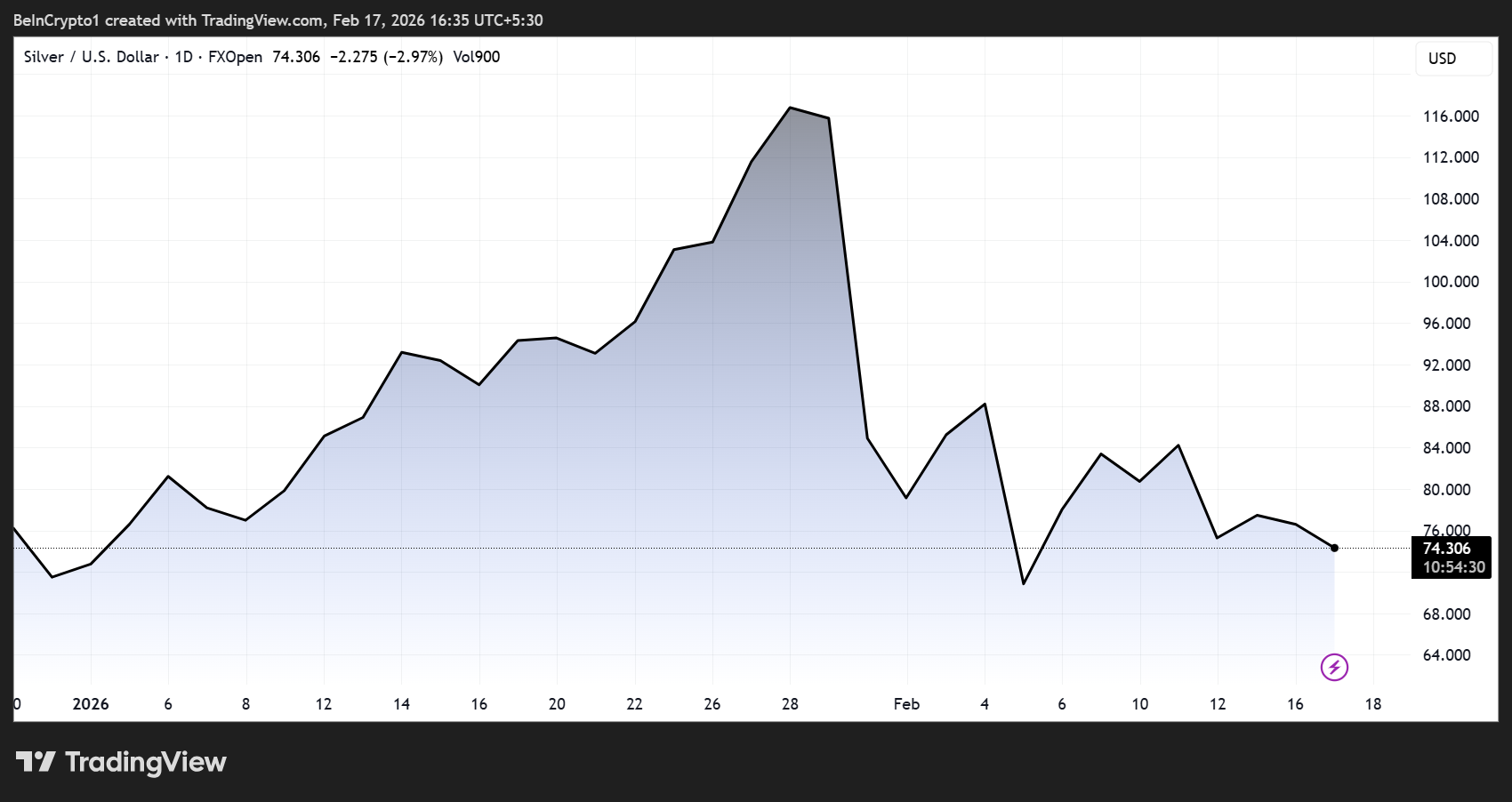

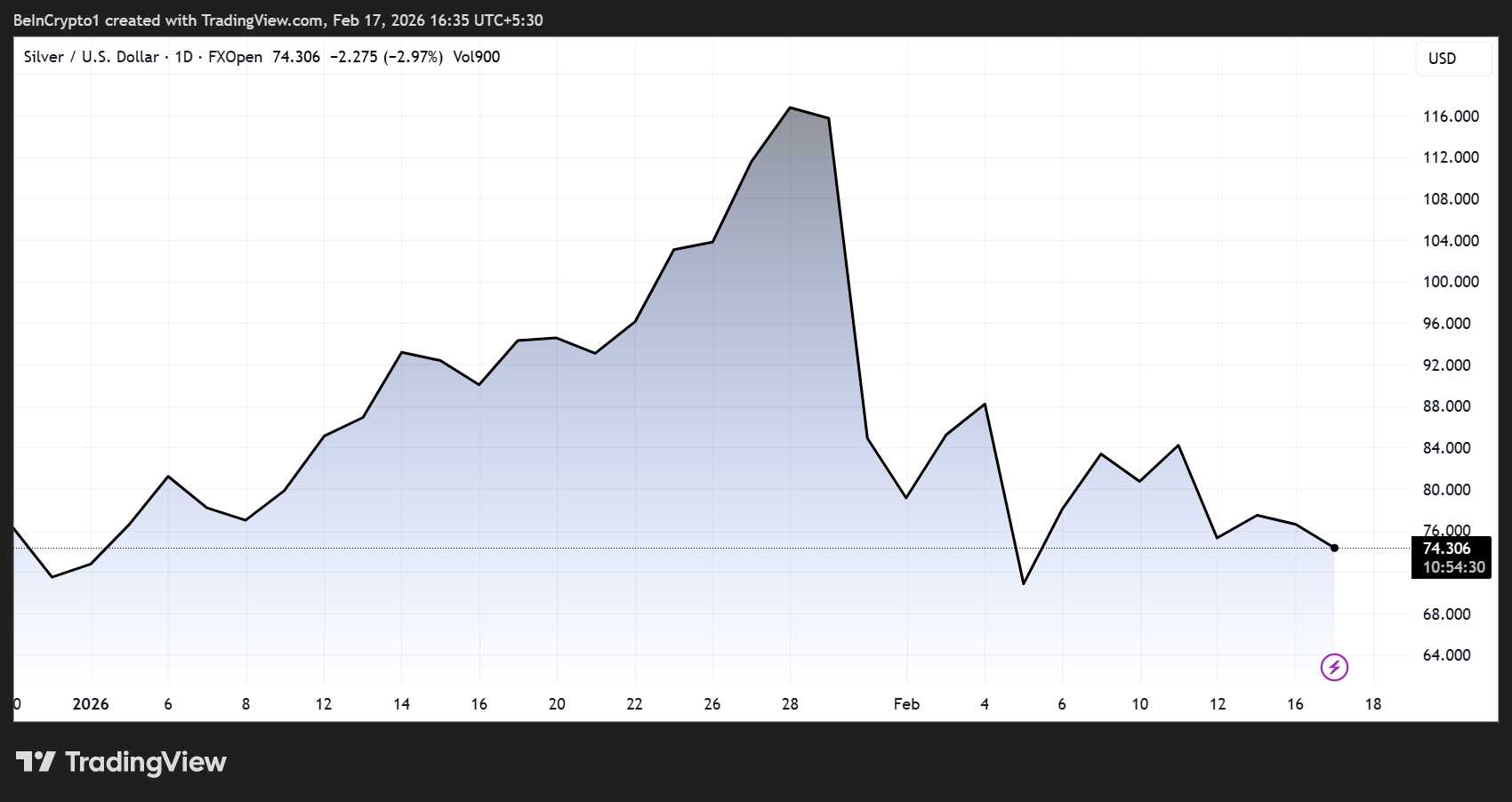

The decline follows a powerful rally earlier in 2026 that pushed gold above $5,000 per ounce and drove silver to record highs.

Sponsored

Sponsored

Analysts now say the pullback reflects a mix of seasonal factors, macroeconomic pressure, and profit-taking after an extended run-up.

Silver has been hit particularly hard, falling nearly 40% from its all-time high (ATH) of $121.646 recorded in late January.

As of this writing, Silver (XAG) was trading at $74.11, reinforcing its reputation as a more volatile counterpart to gold, given its smaller market size and stronger industrial demand.

“Gold and Silver wiped out $1.28 trillion today… even ‘safe havens’ bleed,” wrote one analyst, emphasizing the speed of the decline and the risks of assuming stability in any asset class.

Others pointed to the role of market structure and liquidity, arguing that temporary dislocations may occur when key physical markets slow, particularly in Asia.

Sponsored

Sponsored

Lunar New Year Liquidity Effects Come into Focus

Against this backdrop, one of the most widely cited short-term drivers is the Lunar New Year holiday period, during which trading activity across major Asian financial centers declines sharply.

Mainland China, Hong Kong, Singapore, Taiwan, and South Korea all experience reduced participation as traders, manufacturers, and market makers step away.

Lower liquidity can amplify price movements in global futures markets, especially for commodities like silver, where physical demand from the Chinese industry plays a major role.

Weaker demand during the holiday period could temporarily pressure prices, with physical buying potentially resuming once factories and exchanges return to full activity.

Analysts Warn of Continued Volatility As Macro Pressures Weigh on Bullion

Beyond seasonal factors, broader macroeconomic developments are also contributing to the downturn. Precious metals came under pressure as investors focused on narratives that strengthen the US dollar in the short term. These include:

Sponsored

Sponsored

A firmer dollar typically weighs on bullion by making gold and silver more expensive in other currencies, reducing demand from international buyers.

ETF flows reflect the cautious sentiment. Several gold and silver ETFs declined between 2% and 4%. This mirrors weakness in futures markets and suggests that some investors are locking in profits after the recent rally.

Meanwhile, market strategists say precious metals are now in a “volatile consolidation phase.” After such a strong advance, corrections and sideways trading are common as markets digest gains and rebalance positions.

Therefore, a disciplined approach may be advisable, rather than chasing prices at elevated levels; instead, consider staggered buying during corrections.

Technical analysis also shows key support levels, with estimates placing silver price support near $65 per troy ounce and gold support around $4,770 per ounce on a weekly closing basis.

Sponsored

Sponsored

While these levels could determine whether the current pullback stabilizes or deepens, investors should conduct their own research.

Despite the sharp drop, structural forces such as rising global debt, currency debasement, and historical cycles in ratios, such as the gold–silver ratio, could support a powerful long-term bull market in precious metals.

If historical ratio reversals repeat, silver could experience significant upside over the coming decade, potentially reaching dramatically higher price levels by the early 2030s.

Crypto World

Dutch nominee to oversee crypto tax quits over CV scandal

The prospective nominee for the Netherlands Secretary of Finance, who would’ve overseen the newly approved 36% tax on unrealised crypto gains, has stepped down after lying about her CV’s credentials.

Democrats 66 (D66) member Nathalie van Berkel announced yesterday that she would withdraw her bid to become Secretary of Finance, and today resigned as a member of the House of Representatives, after the news outlet De Volkskrant discovered multiple discrepancies in her resume.

She claimed to have a master’s degree in public administration from Leiden University, to have studied law at Erasmus University, and that she had completed her higher professional education.

De Volkskrant questioned her credentials, and over the course of a week, she reportedly changed her CV three times, with each revision lowering the quality of her educational background.

They discovered that Van Berkel had only applied for a master’s and that she hadn’t completed the admission program for students applying without the right qualifications.

Van Berkel also never finished her first year at Erasmus, and she only has a secondary school diploma and a first-year diploma for a bachelor’s degree in public administration.

Nathalie van Berkel regrets CV mistakes

Van Berkel was the prospective candidate for the coalition government’s upcoming Secretary of Finance cabinet role and was penciled in to start on February 23. She represented the D66 party and was part of the current coalition government alongside the Christian Democrats and the People’s Party for Freedom and Democracy.

In her withdrawal (translated from Dutch), she claims, “It was never my intention to misrepresent my CV. I regret that this impression has been created.”

Read more: Crypto traders in the UK will have data handed to taxman from 2026

“I would have loved to use my knowledge and experience to contribute to a government that works better for people,” she said, adding that her educational background has become a distraction “from the important tasks facing this cabinet. I regret that.”

She previously told De Volkskrant that her CV was “to the best of her knowledge, based on her memory.” D66 reportedly claimed that Van Berkel was transparent “that she did not complete her education” when speaking to the party’s integrity committee.

Netherlands to implement 36% on unrealised crypto gains

Last Thursday, the Netherlands’ House of Representatives approved the “Actual Return in Box 3 Act” that introduces new tax regulations drafted up by the coalition government, which has left crypto holders worked up.

The law seeks to tax unrealized capital gains annually on stocks, bonds, and cryptocurrencies. This means that, if your invested asset goes up in price and you choose not to sell, you will still have to pay tax on that asset’s increase in price.

The new law was required after the Netherlands’ supreme court ruled in 2024 that the old system, which instead assumed the taxes due on capital gains, was discriminatory and had overtaxed citizens.

Read more: Does Ross Ulbricht owe back taxes on crypto donations?

Politicians at the time estimated this would cost the state €4 billion ($4.7 billion) to repay what was owed.

The new regulations are scheduled to come into effect in 2028. There is also pressure from the majority in the Netherlands House of Representatives to remove the unrealised capital gains tax by 2028.

Protos has reached out to Dutch tax firms for comment on the new tax regulations and will update this piece should we hear anything back.

Update February 17, 15:29 UTC: Included Van Berkel’s resignation as a member of the House of Representatives.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Ripple Price Analysis: $1.65 Rejection Shakes XRP

The popular altcoin has been rejected at the long-term channel’s midline, triggering a liquidity sweep. Nevertheless, XRP is in a short-term recovery phase within a broader bearish framework, and a confirmed breakout from the $1.2–$1.8 range will likely determine the next impulsive move.

Ripple Price Analysis: The Daily Chart

On the daily timeframe, the latest impulsive decline drove the price into the major demand zone around the $1.2 region, where a strong bullish reaction emerged. This area has acted as a structural floor, preventing further continuation toward lower levels.

Despite the rebound, the asset is still trading below the channel’s midline and beneath the dynamic resistance formed by the descending structure. The $1.8 region now stands as a critical static resistance level, aligning with prior support turned resistance. As long as XRP remains below this zone and under the channel’s upper half, the broader structure remains corrective.

A decisive daily close above the $1.8 region would shift momentum and open the path toward the next supply area near $2.1–$2.2. Conversely, failure to sustain above the recent higher low increases the probability of another rotation back toward the $1.2 demand zone.

XRP/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the rebound from $1.2 appears more structured, forming a short-term base followed by a bullish push into the $1.8 supply zone. However, the recent move above this level resulted in a false breakout, as indicated on the chart, with the price quickly rejecting and returning below the resistance.

This rejection reinforces the significance of the $1.8 region as a mid-term supply barrier. Currently, XRP is fluctuating between $1.2 and $1.8, forming a local consolidation pattern after a false breakout, with $1.5 mark acting as the internal supply zone.

If buyers manage to reclaim and hold above $1.5 with strong momentum, the next upside target would be the $1.8 daily resistance. On the other hand, continued rejection from this zone could push the price back toward the $1.35 support and potentially retest the major $1.2 demand area.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Analyst Warns of Multi-Year Reset as Bitcoin Liveliness Falls

Bitcoin’s liveliness metric is falling, signaling a potential multi-year reset phase as analysts say accumulation cycles may now be starting.

Bitcoin’s Entity-Adjusted Liveliness metric peaked in December 2025 and has begun reversing downward, signaling the end of the distribution phase and the start of a new accumulation period that historically lasts between 1.1 and 2.5 years.

According to analyst Axel Adler Jr., the on-chain signal means investors should prepare for an extended market reset rather than a quick recovery, although institutional demand through ETFs may alter the traditional cycle pattern.

Shift From Distribution to Accumulation

In a post published on February 17, Adler wrote that Bitcoin’s Entity-Adjusted Liveliness reached 0.02676 in December 2025 and has started to decline. The indicator tracks the ratio of spent coin days to created coin days, which is filtered to remove transfers within the same holder.

According to his chart, past cycles in 2020 and 2022 showed the same structure, where the metric peaked shortly after price highs and then trended lower during accumulation periods lasting 1.1 to 2.5 years.

Adler noted that the price of Bitcoin surpassed $126,000 in October 2025 before falling by about 45%, adding that liveliness tends to lag price because it is cumulative.

Current readings are still below short-term averages, which the market watcher said are a sign of early-stage transition rather than confirmation of a full trend. He added that a further drop in the 90-day average below the 365-day line would strengthen the case for a longer reset phase.

Analysts Weigh Holder Behavior and Macro Backdrop

Despite the on-chain signs, there seems to be no clear agreement about how severe the downturn could be. For example, in a recent interview, Matt Hougan of Bitwise said the current crypto slump is milder than earlier cycles, such as 2018 or 2022. He cited stronger infrastructure, the emergence of crypto exchange-traded funds (ETFs), and institutional participation in digital assets from firms including BlackRock and Apollo to back his stance.

You may also like:

Meanwhile, Coinbase CEO Brian Armstrong said that balances held on the platform by smaller investors in February have matched or exceeded levels recorded in December last year. It means retail investors are actively buying the dip, with crypto’s market cap falling by about 49% from its peak near $4.4 trillion in October 2025. However, the current decline is not as steep as the 88% wipeout seen in 2018 or the 73% drop in 2022.

Still, some commentators are staying cautious, with the likes of analyst Mippo suggesting that current conditions could still develop into a prolonged winter as valuations adjust to clearer regulations and more focus on revenue.

That said, metrics tracking long-term investors can add nuance to the overall picture. Recently, Joao Wedson of Alphractal pointed out that the Net Unrealized Profit/Loss for long-term holders sits around 0.36, meaning that overall, they remain in profit. According to him, major rallies historically kicked off only after that figure turned negative, when even patient holders faced losses.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Hidden Geopolitical Factors are Shocking Bitcoin Markets

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in—markets are shifting, fear is rising, and Bitcoin is dancing to a tense global rhythm. From geopolitical sparks to shadowy traders making millions, the pioneer crypto is on edge, teetering between consolidation and sudden, dramatic moves.

Crypto News of the Day: Geopolitical Tensions and Market Fear Shake Bitcoin

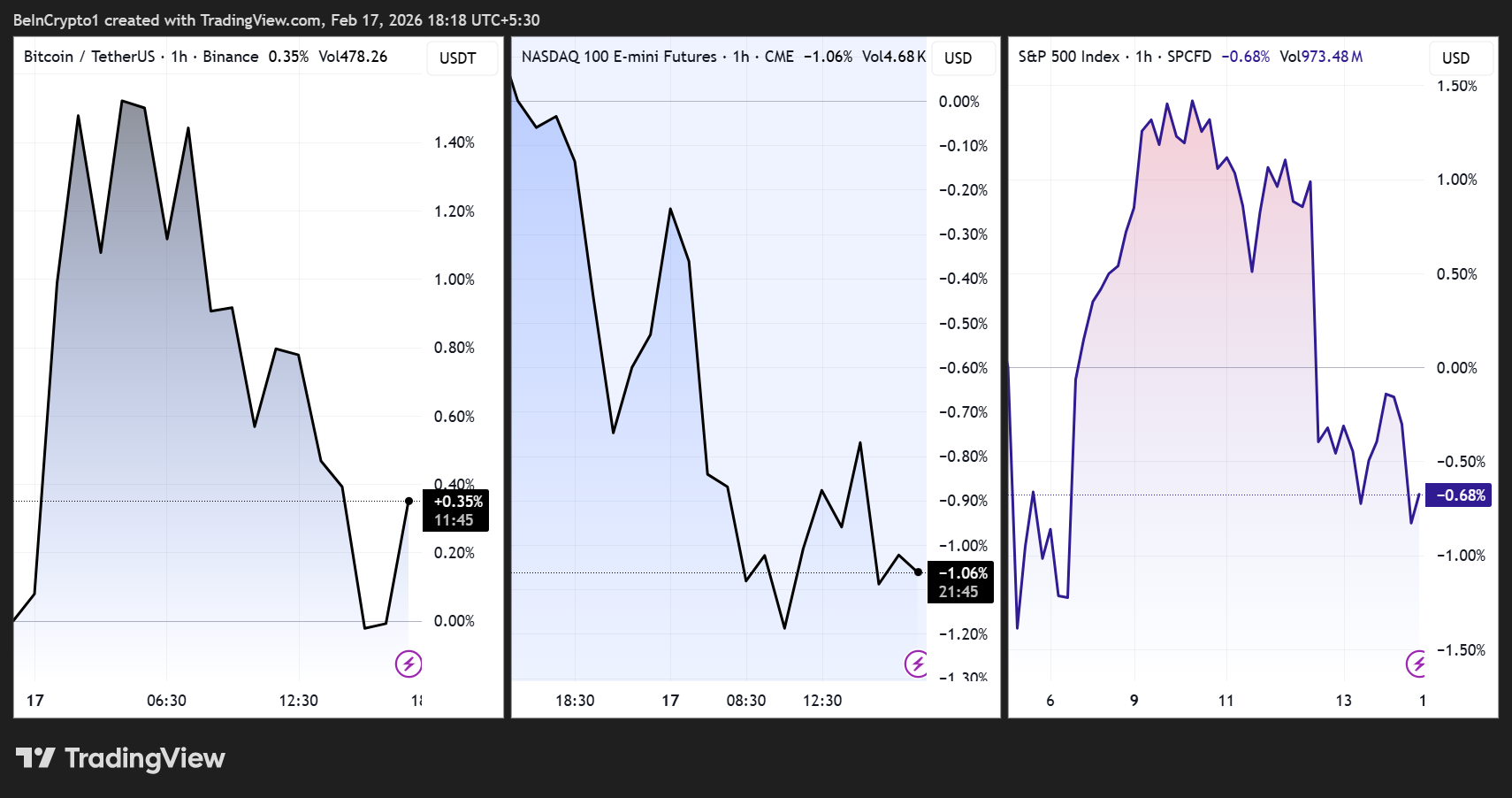

Bitcoin dropped sharply ahead of the US market open on Tuesday, extending a volatile start to 2026 amid geopolitical and macroeconomic concerns.

Sponsored

Sponsored

The pioneer crypto fell 1.7% to roughly $67,600, mirroring weakness in equity futures. The Nasdaq 100 contracts fell 0.9% while the S&P 500 contracts dropped 0.6%, signaling a softer start on Wall Street.

Bitcoin’s correlation with high-beta tech stocks has strengthened in recent months, making the pioneer crypto increasingly sensitive to risk-off sentiment in equities.

“Investors are turning cautious amid rising tensions around Iran, fresh debate over AI’s broader economic impact, and uncertainty over Federal Reserve rate cuts after recent inflation data,” reported Walter Bloomberg on X.

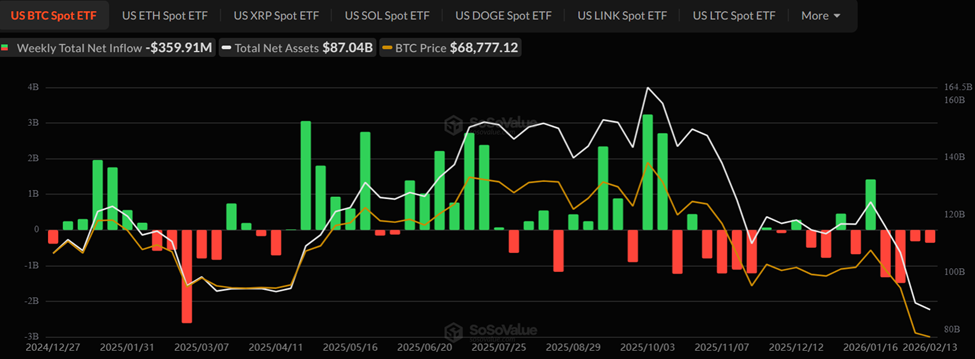

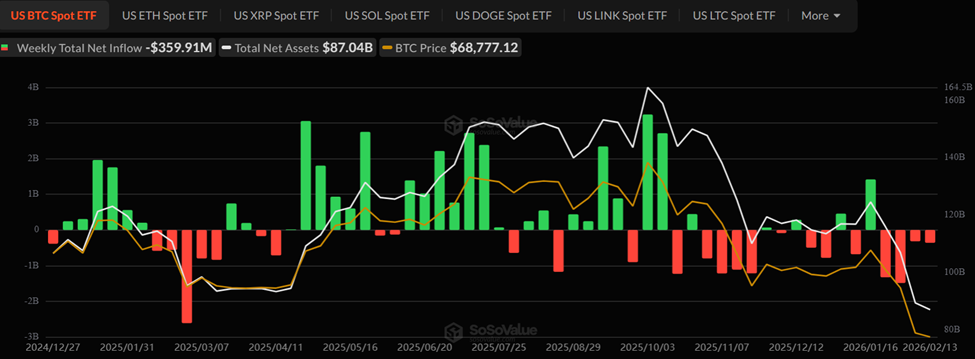

The macro backdrop has contributed to sustained outflows from US-listed Bitcoin ETFs. Last week alone, investors withdrew $360 million, marking the fourth consecutive week of net outflows.

The combination of geopolitical uncertainty, ETF withdrawals, and leverage unwinds has pushed Bitcoin down by more than 50% from its October 2025 peak of $126,000.

“Analysts now view $60,000 as key near-term support, while further macro shocks could see prices revisit the $50,000 range,” Walter added.

It aligns with a recent Galaxy Digital projection, in which head of research Alex Thorn estimated Bitcoin drifting toward the 200-week average near $58,000.

Sponsored

Sponsored

Meanwhile, market sentiment is at levels not seen since the depths of the 2022 bear market, with only 55% of Bitcoin’s supply currently in profit and roughly 10 million BTC held at a loss.

Elsewhere, CryptoQuant’s Fear and Greed Index suggests extreme caution, at 10, firmly in the “extreme fear” zone.

Shadow Shorts and Safe-Haven Bets Highlight Crypto’s Risk-Off Mood

Adding to the market’s nervous undertone is the presence of aggressive short positions. Reports indicate that a not-so-popular trader has made $7 million by shorting multiple crypto assets, including $3.7 million on Ethereum and $1.45 million on ENA.

Sponsored

Sponsored

While largely anonymous, this trader exemplifies the growing sophistication and audacity of market participants betting on downside risk.

Meanwhile, broader investor behavior also reflects a flight toward perceived safety. The February global fund manager survey from Bank of America (BofA) highlighted gold as the most crowded trade, with 50% of managers holding long positions, while top US tech stocks (Nvidia, Alphabet, Apple, Amazon, Microsoft, Meta, and Tesla) ranked second, cited by 20% of respondents.

This preference for traditional hedges reflects heightened risk aversion in financial markets. Despite the current turbulence, investors should not act in panic. Bitcoin’s history suggests it often consolidates after sharp pullbacks before resuming longer-term trends.

However, the combination of geopolitical flashpoints, ETF outflows, concentrated shorting activity, and extreme fear readings suggests that market volatility may persist in the near term.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto World

Nakamoto Secures Acquisition of BTC Inc and UTXO

Editor’s note: In a move that consolidates Bitcoin-native operations across media, asset management, and advisory services, Nakamoto signs definitive agreements to acquire BTC Inc and UTXO Management. The announcement outlines strategic intent, expected closing in early 2026, and how these integrations may reshape Nakamoto’s growth trajectory. The editorial team will monitor how the combined platform expands industry coverage, investor access, and Bitcoin-focused capabilities as the company builds its global brand.

Key points

- Nakamoto signs definitive agreements to acquire BTC Inc and UTXO Management, expanding Bitcoin-native services across media and asset management; closing is targeted for Q1 2026.

- Transaction is expected to close in the first quarter of 2026, subject to customary closing conditions.

- The deal is financed entirely with Nakamoto common stock at $1.12 per share; 363,589,816 shares will be issued, valued at $107,295,354 before adjustments.

- BTC Inc is a global leader in Bitcoin media and events; UTXO provides investment advisory services to Bitcoin-focused opportunities.

- The combined platform aims to strengthen Nakamoto’s balance sheet and accelerate growth initiatives in Bitcoin ecosystems.

Why this matters

Nakamoto’s acquisition broadens its footprint as a diversified Bitcoin operating company with global reach in media, asset management, and advisory services. By integrating BTC Inc’s media assets and UTXO’s investment platform, the company seeks recurring earnings, expanded cross-selling, and stronger market position.

What to watch next

- Closing of the transaction in Q1 2026 and milestones for integration of BTC Inc and UTXO into Nakamoto’s platform.

- Progress on synergies, cross-selling opportunities, and potential additional Bitcoin treasury activities and acquisitions.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Nakamoto Signs Definitive Agreements to Acquire BTC Inc and UTXO Management

Nakamoto Inc. (NASDAQ: NAKA) today announced that it has entered into merger agreements to acquire BTC Inc, the leading provider of Bitcoin-related media and events, and UTXO Management GP, LLC (the “UTXO”), an investment firm focused on private and public Bitcoin companies (collectively, the “Transaction”). The Transaction is expected to close in the first quarter of 2026, subject to customary closing conditions.

The Company’s option to acquire BTC Inc and UTXO, through BTC Inc’s call option with UTXO, was previously disclosed as part of Nakamoto’s proposed merger with Nakamoto Holdings, Inc. (the “Nakamoto Holdings”). The Marketing Services Agreement with BTC Inc (the “MSA”), which the Company assumed from Nakamoto Holdings in the merger last year, outlines the terms of the Company’s option and was publicly filed and approved by the Company’s shareholders in connection with that transaction. Following shareholder approval, Nakamoto, BTC Inc, and UTXO engaged in extensive joint marketing initiatives across BTC Inc’s media and events platforms. Nakamoto exercised its call option with BTC Inc and BTC Inc exercised its call option with UTXO concurrently with signing of the merger agreements. No additional Nakamoto shareholder approval is required to complete the Transaction.

“Bringing BTC Inc and UTXO into Nakamoto has been a part of our vision since day one,” said David Bailey, Chairman and CEO of Nakamoto. “We intend to operate a portfolio of companies across media, asset management, and advisory services that can scale with Bitcoin’s long-term growth. BTC Inc and UTXO are global leaders in Bitcoin media and asset management. This transaction signifies the first step of the company we intend to build, and we’re just getting started.”

UTXO: Investing in Bitcoin Acceleration

UTXO is the adviser to 210k Capital, LP, a hedge fund focused on Bitcoin, Bitcoin-related securities, and derivatives. The investment team leverages extensive experience in the Bitcoin ecosystem to allocate capital across public and private market opportunities.

“UTXO was founded to back the builders and companies shaping the Bitcoin economy,” said Tyler Evans, Chief Investment Officer of Nakamoto and Chief Investment Officer of UTXO. “Leveraging Nakamoto’s public platform and robust treasury, we see a powerful opportunity to compound value across the Bitcoin ecosystem and reinforce Bitcoin’s role as a foundational asset in modern capital markets.”

More information about the transaction can be found on the Nakamoto Investor Relations site: http://investors.nakamoto.com

Additional Transaction Details

A Special Committee of independent directors of Nakamoto’s Board of Directors (the “Special Committee”) was formed to review, evaluate, and negotiate the Transaction. The Special Committee retained B. Riley Securities, Inc. as the independent financial advisor and fairness opinion provider to the Special Committee and Simpson Thacher & Bartlett LLP as independent legal counsel.

Nakamoto was advised by TD Securities (USA) LLC as its financial advisor and Reed Smith LLP as legal counsel in connection with the Transaction. BTC Inc was advised by Bradley Arant Boult Cummings LLP and UTXO was advised by Haynes and Boone, LLP, in each case acting as legal counsel to the respective parties.

About Nakamoto Inc.

Nakamoto Inc. (NASDAQ: NAKA) is a Bitcoin company that owns and operates a global portfolio of Bitcoin-native enterprises spanning media and information, asset management, and advisory services. For more information, please visit nakamoto.com.

Forward Looking Statements All statements, other than statements of historical fact, included in this press release that address activities, events or developments that Nakamoto expects, believes or anticipates will or may occur in the future are forward-looking statements, as defined under U.S. federal securities laws, related to Nakamoto. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts, including, without limitation, statements about expectations regarding anticipated synergies, cross-selling opportunities, operational plans, market expansion, the long-term strategic impact or anticipated effects of the Transaction, financial projections of BTC Inc and/or UTXO, the timing of closing of the Transaction, Bitcoin-related strategies, Bitcoin treasury management activities, and Nakamoto’s anticipated holding of Bitcoin as part of its corporate treasury. Such forward-looking statements are inherently uncertain and involve numerous assumptions and risks. Forward-looking terms used may include, but are not limited to, “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “would,” “may,” “plan,” “will,” “look,” “goal,” “future,” “build,” “focus,” “continue,” “strive,” “allow,” “seek,” “see,” “aim,” “target,” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements and similar expressions. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, the following: descriptions of Nakamoto and its operations, subsidiaries, strategies and plans, expectations regarding anticipated synergies, cross-selling opportunities, operational plans, market expansion, the long-term strategic impact or anticipated effects of the Transaction, financial projections of BTC Inc and/or UTXO, the timing of closing of the Transaction, Bitcoin-related strategies, and Bitcoin treasury management activities. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. Factors that could cause actual results to differ include, but are not limited to, the following: the acquisition of BTC Inc or UTXO may not provide the benefits we anticipate receiving due to any number of factors, including the inability of BTC Inc or UTXO to maintain current level of earnings or to continue to grow its sales to new and existing customers; our inability to successfully cross-sell business between our existing customers and BTC Inc’s or UTXO’s existing products or services, or expand products or services to new customers; the effect of the announcement or pendency of the Transaction on our business relationships, performance, and business generally; the acquisition of BTC Inc or UTXO may not be closed in a timely manner or at all, which may adversely affect the price of our securities; and we may encounter difficulties with integration or unanticipated costs related to the Transaction; Bitcoin market volatility, ; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Nakamoto’s control, including those detailed in Nakamoto’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and such other documents of Nakamoto that are filed, or will filed, with the SEC that are or will be available on Nakamoto’s website at www.nakamoto.com and on the website of the SEC at www.sec.gov. All forward-looking statements are based on assumptions that Nakamoto believes to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and Nakamoto does not undertake any obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Nothing contained herein constitutes an offer to buy or sell securities of Nakamoto or any other party, nor does it constitute a solicitation of any proxy or vote. Past performance is not indicative of future results.

Media Contact

Carissa Felger / Sam Cohen

Gasthalter & Co.

(212) 257-4170

Investor Relations Contact

Steven Lubka

VP of Investor Relations

(615) 701-8889

Crypto World

StarkNet Adds EY Nightfall to Enable Private Payments on Eth Rails

StarkWare’s Starknet is expanding its privacy capabilities by integrating EY’s Nightfall protocol, enabling institutions to run private payments and DeFi activity on public Ethereum-aligned rails, with confidentiality preserved alongside auditability. In a Tuesday release, StarkWare positioned the move as a bridge for enterprises to use a shared, open layer-2 instead of siloed, bank-only networks, while partnering with a Big Four firm that already audits many prospective onboarding clients. Nightfall—EY’s open-source zero-knowledge privacy layer—lets transactions be verified without exposing underlying data, unlocking private B2B and cross-border payments, confidential treasury management, and on-chain transfers of tokenized assets around the clock. The rollout appears staged, focusing on privacy-forward onboarding with selective disclosure for regulators and auditors.

Key takeaways

- StarkWare is integrating EY Nightfall into Starknet to support private transactions on an Ethereum-compatible chain, enabling private payments and DeFi activity at scale.

- The plan emphasizes an open, layer-2 solution rather than siloed, bank-only networks, with a Big Four auditor involved in onboarding.

- Nightfall’s zero-knowledge privacy layer lets verifications occur without revealing private data, while still allowing selective disclosure for compliance and audits.

- The rollout will be staged, starting with compliant private payments and transfers and expanding to additional features as the system scales.

- Starknet has grown to be a major ZK rollup by TVL, but has faced outages in 2025 that prompted post-mortems and reliability enhancements ahead of broader institutional flows.

Market context: The initiative signals a growing emphasis on privacy-preserving rails and interoperable, on-chain workflows for institutions within the expanding Layer-2 ecosystem, as DeFi and cross-border token transfers push for compliance-ready, scalable solutions.

Why it matters

The blending of Nightfall with Starknet is more than a technical upgrade; it represents a strategic attempt to unlock institutional participation in public blockchains without forcing a trade-off between privacy and auditability. By anchoring the privacy layer to a public, open network, StarkWare aims to encourage banks and corporates to explore private payments, treasury management, and cross-border settlement on-chain, while maintaining visibility for regulatory and internal controls. The approach could lower the barriers for traditional financial players who have historically shied away from fully transparent on-chain activity, offering a path to leverage distributed ledger technology within established compliance frameworks.

Eli Ben-Sasson, StarkWare’s co-founder and CEO and a founding scientist of privacy-focused cryptocurrency Zcash (ZEC), described the Nightfall-on-Starknet initiative as paving the way for “the equivalent of a private superhighway for stablecoins and tokenized deposits.” The framing underscores a broader privacy push across Starknet, where institutions could gain confidential access to Ethereum DeFi activities—such as lending, swaps, and yield strategies—without sacrificing auditable records. Alex Gruell, StarkWare’s global head of business development, emphasized that Nightfall’s readiness for KYC-verified onboarding could be a critical differentiator for large organizations entering the blockchain space, aligning privacy with regulatory compliance at scale.[Zcash (CRYPTO: ZEC) is referenced here to reflect Ben-Sasson’s broader background and the privacy ethos behind the technology.]

Gruell also argued that Nightfall, when paired with Starknet, functions as an interoperability layer that could bridge otherwise siloed institutional environments. He contrasted this architecture with permissioned, stand-alone networks such as Canton Network, which he argued are not yet integrated with the Web3 ecosystem. The planned rollout remains permissionless and fully integrated into Starknet, with a staged deployment that starts with private payments and transfers guarded by compliance gates and secure sequencing. Verifier upgrades and expanded functionality will follow as the system scales, aiming to preserve privacy by default while enabling selective disclosure for audits and regulatory checks.

Starknet’s growth and teething trouble

Starknet has established itself as one of the larger ZK rollups by total value locked (TVL), with current estimates hovering around $280 million, driven largely by DeFi protocols and native ecosystem apps. This rapid ascent has not come without challenges. In 2025, Starknet experienced outages tied to sequencer and infrastructure weaknesses, prompting public post-mortems and commitments to harden reliability before courting broader institutional flow. The ongoing efforts to improve resilience are central to appealing to banks and corporates that require robust operational continuity alongside privacy guarantees.

As Starknet matures, proponents argue that a privacy-first path—especially when supported by a reputable auditor—could unlock new capital channels on public rails. The integration with Nightfall is positioned as a concrete step toward that vision, offering institutions a controlled yet verifiable on-chain environment. Yet observers will be watching how the privacy layer handles cross-border compliance challenges, including KYC/AML workflows and data-access requirements, as real-world usage scales beyond pilots and proof-of-concept tests.

What to watch next

- Timeline and milestones for the staged rollout, including the initial private-payments phase and planned expansions of on-chain features.

- Auditing milestones and regulatory reviews tied to the Nightfall integration, especially around KYC verification workflows.

- Verifier upgrades and any announced improvements to sequencing, privacy guarantees, and throughput as adoption grows.

- Real-world usage metrics from early institutional deployments and any interoperability benchmarks with other networks.

Sources & verification

- StarkWare’s announcement detailing the Nightfall integration with Starknet for private payments and DeFi on public rails.

- EY’s Nightfall privacy protocol, describing zero-knowledge privacy for on-chain transactions.

- Cointelegraph coverage of the Nightfall integration and related commentary from StarkWare and EY.

- DefiLlama data showing Starknet’s TVL around $280 million and its DeFi usage drivers.

- Starknet outage post-mortems and reliability commitments published in 2025.

What the story means for users and builders

The integration positions privacy-preserving on-chain activity as a standard feature for institutional users within public blockchain networks. For builders, it creates an opportunity to design DeFi products and treasury solutions that satisfy typical enterprise compliance requirements without sacrificing the openness and composability that characterize open ecosystems. For users and investors, the development signals ongoing maturation of Layer-2 privacy capabilities and a potential shift in how incumbent financial institutions interact with blockchain technologies—moving from isolated pilots to scalable, auditable, and privacy-respecting deployments on public rails.

Key figures and next steps

With Nightfall in tow, Starknet’s roadmap includes extended privacy controls, selective disclosure options for audits, and broader cross-border transaction support. The collaboration’s success will hinge on robust reliability improvements, effective onboarding workflows, and the ability to demonstrate real-world compliance without eroding the user experience. If these elements come together, institutions could begin treating public blockchains as viable platforms for confidential settlement and asset management, painting a more nuanced picture of privacy, scalability, and openness in decentralized finance.

Why it matters for the broader market

Privacy-preserving instrumentation on public blockchains aligns with a broader industry trend toward compliant, enterprise-grade blockchain ecosystems. As institutions weigh the benefits of public networks against privacy and regulatory requirements, solutions like Nightfall could help reconcile these tensions by offering auditable privacy with flexible disclosure. The broader market will be watching how this approach affects competition among Layer-2 providers, the pace of DeFi institutionalization, and the evolution of cross-chain interoperability as the ecosystem grows more interconnected.

Crypto World

BitMine Stock Price Faces 60% Drop Despite Citigroup Support

The BitMine stock price has started showing early signs of recovery. BMNR rose 6% on Feb. 13 before closing and is up 7.32% over the past five days. This rebound comes even as Ethereum, which BitMine closely tracks due to its ETH treasury exposure, has fallen 3.3% over the past week. This divergence suggests BitMine’s stock price may be trying to catch up.

BMNR charts also show that this rebound may be weak despite big players like Citigroup increasing BMNR holdings quarter-on-quarter. The bearish structure is still active, and the next few trading sessions could decide whether BitMine continues recovering or enters another major drop.

Bear Flag Structure Shows Recovery Attempt — But Breakdown Risk Remains

The BitMine stock price has been trading inside a bear flag pattern since early February. A bear flag forms after a sharp decline, followed by a temporary upward consolidation. This pattern often leads to another drop if buyers fail to fully regain control.

Sponsored

Sponsored

Between Dec. 10, 2025, and Feb. 5, 2026, BitMine’s stock price fell nearly 60%. This steep drop created the “pole” phase of the pattern. Since Feb. 5, the stock has rebounded about 26%, forming a bear “flag” pattern, which represents a recovery attempt.

Want more insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, this recovery remains inside the bearish structure. Unless the stock breaks above key resistance levels, this rebound could simply be a temporary pause before another decline.

If the bear flag confirms, BitMine’s stock price could fall by nearly a 60% drop from the lower trendline breach point. This raises a critical question. If the BitMine stock price is recovering, why does the breakdown risk still remain high?

The answer becomes clearer when looking at momentum indicators.

Hidden Bearish Divergence Shows BMNR Sellers Still Maintain Control

Momentum analysis using the Relative Strength Index (RSI) shows signs of underlying weakness. RSI is an indicator that measures buying and selling strength on a scale from 0 to 100. When RSI rises while price struggles, it can signal weakening buyer strength.

Sponsored

Sponsored

The BitMine stock price formed a hidden bearish divergence between Nov. 18, 2025, and Feb. 9, 2026. During this period, the price created a lower high, while RSI formed a higher high. This pattern typically signals that sellers remain in control and further downside may follow.

After this divergence appeared, BitMine’s stock price dropped by over 14%.

Now, a similar setup appears to be forming again. RSI has started rising, but the price still remains below key resistance near $21.57. If the stock fails to break above this level, another bearish divergence could confirm.

This would increase the probability of a breakdown from the bear flag pattern. However, momentum alone does not fully explain price direction. Capital flow data provides another important clue.

Capital Flow Remains Weak Despite Institutional Buying

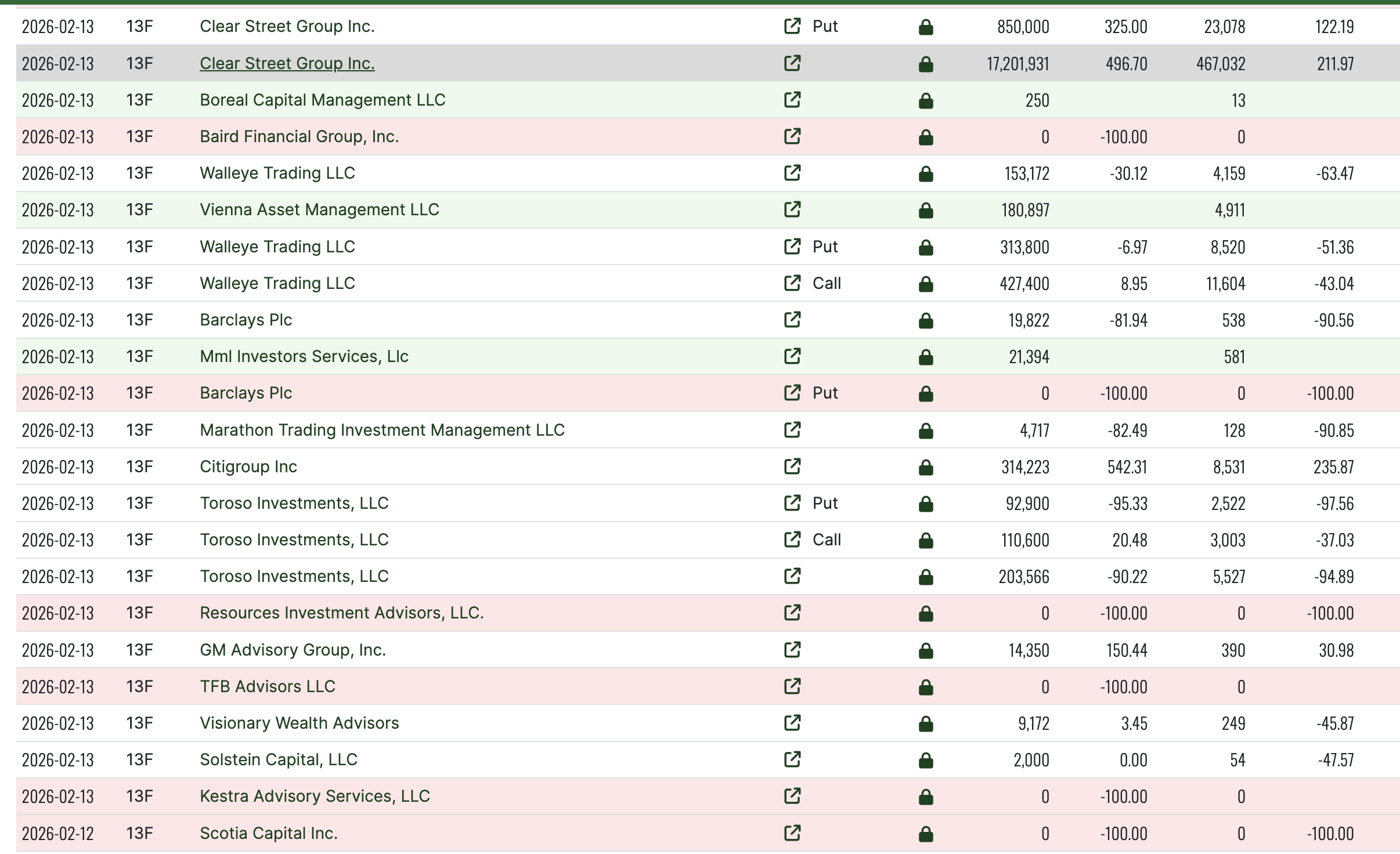

Institutional interest in BitMine has increased significantly. Citigroup raised its ownership stake by over 540%, while firms like BlackRock and BNY Mellon also expanded their exposure. Normally, such buying would support price growth.

Sponsored

Sponsored

The Fintel snapshot shows Citigroup’s addition but also highlights several BMNR dumps by firms like Baird Financial, Resources Investment Advisors, and more, which can be alarming to the price.

The Chaikin Money Flow (CMF) indicator shows a similar picture. CMF measures whether large investors are putting money into or taking money out of an asset. When CMF stays below zero, it signals that overall capital is still leaving the asset.

BitMine’s CMF has started rising gradually, showing that selling pressure is slowing. But the indicator remains below the zero line. This means total institutional buying has not yet fully reversed the broader selling trend. This creates a conflict. While some major firms are increasing exposure, overall, large-scale money flow remains cautious, as highlighted by the earlier snapshot.

Sponsored

Sponsored

This explains why BitMine’s stock price recovery still appears weak.

Price Levels Now Decide Whether BitMine Stock Price Recovers or Breaks Down

The BitMine stock price now sits at a critical level. If BMNR breaks above resistance between $21.57 and $21.74, the bearish structure would weaken for now. This could allow the stock to rise toward $29.60 and potentially $34.03, provided ETH also gains strength.

Such a move would confirm that buyers have regained control. However, downside risk remains significant.

If the BMNR stock price falls below the $20.02 support level, the bear flag breakdown could begin. This may push the stock toward lower support levels at $15.05 and $11.22. A full breakdown could eventually send the stock toward $8.36.

For now, BitMine’s stock price sits at a turning point. Citigroup’s aggressive accumulation shows institutional confidence. But bearish momentum and weak capital inflows still limit recovery strength.

The next few trading sessions will likely decide whether Tom Lee’s BMNR follows institutional optimism higher or confirms the bearish breakdown pattern.

Crypto World

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Surge

TLDR

- Polygon surpassed Ethereum in daily transaction fees for the first time ever, with $407,100 in fees compared to Ethereum’s $211,700.

- The surge in Polygon’s fees was driven by significant activity on Polymarket, especially surrounding Oscar betting.

- Polymarket recorded over $15 million in wagers on a single Oscar category over the weekend, contributing to Polygon’s fee growth.

- Polygon’s average transaction fee is around $0.0026, significantly lower than Ethereum’s fee of about $1.68.

- Ethereum’s recent volatility, driven by large whale movements, created a more favorable environment for Polygon’s fee surge.

Polygon recently surpassed Ethereum in daily transaction fees, marking a significant shift in blockchain activity. This occurred when Polygon’s network recorded $407,100 in transaction fees on Friday, compared to Ethereum’s $211,700. The increase in Polygon’s revenue coincided with the surge in activity on Polymarket, particularly with Oscar betting.

Polymarket Drives Fee Surge

Polymarket, a decentralized prediction market, is behind much of Polygon’s newfound fee dominance. Over the weekend, it recorded more than $15 million in wagers for a single Oscar category, attracting considerable retail interest. This surge in betting activity directly translated into substantial network fees for Polygon, which exceeded $1 million in a single week.

This boost in transaction volume significantly impacted Polygon’s overall fee performance. Polymarket, which is built on Polygon’s blockchain, saw consistent traffic, helping drive up daily revenue. As a result, Polygon briefly overtook Ethereum in daily transaction fees, an outcome few expected given Ethereum’s dominant position.

Lower Transaction Fees Give Polygon an Edge

Polygon’s lower transaction costs have made it an attractive alternative to Ethereum for users engaging in frequent, smaller transactions. The average transaction fee on Polygon is around $0.0026, while Ethereum’s fees average about $1.68. This price difference makes Polygon the clear choice for many users, especially in markets like Polymarket, where multiple small bets are common.

The lower costs allow users to move funds more freely, resulting in a higher transaction volume. This increased volume has contributed to Polygon’s fee surge. According to sources, the majority of Polygon’s recent fee growth is attributed to Polymarket’s activity rather than other apps on the network, solidifying the importance of the prediction market.

Ethereum’s Volatility Adds Pressure

While Ethereum remains the dominant blockchain by many measures, its higher fees and increased volatility have made it less appealing for some users. Recently, large whale movements on Ethereum added to concerns about network stability, creating a sense of uncertainty. This has allowed Polygon to capitalize on the growing demand for lower-cost, more predictable transactions.

Despite Ethereum’s structural advantages, the recent surge in Polymarket’s activity has proven that consumer-driven demand can quickly shift fee dynamics.

Crypto World

Strategy buys 2,486 BTC as a rare pattern points to a Bitcoin price crash

Michael Saylor’s Strategy continued its Bitcoin buying spree last week, even as crypto winter persisted, and the coin formed a rare chart pattern pointing to more near-term downside.

Summary

- Strategy, formerly known as MicroStrategy, acquired 2,486 Bitcoin last week.

- The company now holds over 717,000 coins worth nearly $50 billion.

- Technical analysis suggests that the Bitcoin price is forming a bearish pennant pattern, pointing to a crash.

In an X post, Saylor noted that the company bought 2,496 Bitcoin (BTC) last week for $168 million. This purchase brought its total holdings to 717,131 coins, now valued at nearly $50 billion.

Strategy executed the purchase by selling shares, a move that has continued to dilute its shareholders. Data show that the company still has over $7.8 billion in common shares to sell and an additional $20 billion in preferred STRK.

The company now has over 312 million of outstanding shares, much higher than what it had a few years ago. This dilution will continue, as Michael Saylor has pledged to buy Bitcoin forever. He also revealed that he plans to swap its debt for shares in the future.

Bitcoin price technical analysis points to a crash

The ongoing Strategy acquisition is happening amid concerns that Bitcoin may continue falling in the near term. In a statement last week, Standard Chartered warned that Bitcoin may drop to $50,000 before recovering. The bank reduced its target for the coin from $150,000 to $100,000.

Bitcoin is facing other headwinds, including the tumbling futures open interest, which has moved to $43 billion, down from last year’s high of $95 billion.

At the same time, there are rising odds of a prolonged conflict in the Middle East despite the ongoing talks between Iran and the United States. Donald Trump has sent another carrier to the region, while Iran is conducting drills at the Strait of Hormuz.

A conflict in the Middle East would have a major impact on Bitcoin, which has proven that it is not a safe haven asset.

Technical analysis indicates that the Bitcoin price is slowly forming a bearish pennant pattern, consisting of a vertical line and a symmetrical triangle. The two lines of the triangle are nearing their confluence, meaning that the coin may soon drop to the year-to-date low of $60,000.

The bearish Bitcoin price outlook will become invalid if it moves above the key resistance level at $80,117, its lowest level in November last year.

Crypto World

Starknet Taps EY’s Nightfall for Institutional Privacy on Ethereum Rails

Starknet developer StarkWare has integrated EY’s Nightfall privacy protocol to let institutions run private payments and decentralized finance (DeFi) activity on public Ethereum-aligned rails, targeting banks and corporates that need confidentiality without giving up auditability.

In a Tuesday release shared with Cointelegraph, StarkWare positioned the move as a way for enterprises to use a shared, open layer-2 rather than closed, bank-only networks, while working with a Big Four firm that already audits many of the organizations it wants to onboard.

The integration brings Nightfall, an open-source zero-knowledge (ZK) privacy layer built by EY, that lets transactions be verified without revealing underlying data, onto Starknet to enable private B2B and cross-border payments, confidential treasury management and 24/7 tokenized asset transfers onchain.

StarkWare said that institutions will also be able to access Ethereum DeFi for activities such as lending, swaps and yield strategies, with transactions private by default but supporting selective disclosure, auditability and Know Your Customer (KYC) protocols.

Related: Arbitrum, Optimism and Base weigh in after Vitalik questions L2 scaling model

Starknet and Nightfall target institutional flows

StarkWare frames this as a “major breakthrough” in making public blockchains usable for institutional capital that has so far been deterred by full onchain transparency and the resulting compliance and competitive risks.

Eli Ben-Sasson, StarkWare co-founder and CEO and a founding scientist of privacy-focused cryptocurrency Zcash (ZEC), said in the release that blockchains could give every institution “the equivalent of a private superhighway for stablecoins and tokenized deposits,” positioning Nightfall on Starknet as a concrete step toward that vision.

Alex Gruell, StarkWare’s global head of business development, told Cointelegraph that Nightfall was “particularly useful for institutions requiring ready-to-go KYC verification as part of their onboarding to the blockchain,” and part of a broader privacy push on Starknet.

He said that while crypto native teams had “moved mountains” building ZK infrastructure, the EY-built system added a complementary layer of institutional credibility and “regulatory fluency.”

Related: Vitalik Buterin tempers vision for ETH L2s, pushes native rollups

Gruell also cast Starknet plus Nightfall as an interoperability layer between institutions, contrasting it with what he claimed are “siloed” institutional environments on rival networks, which he said “do not serve as an interoperability infrastructure,” and permissioned models such as Canton Network, which are “not yet integrated with the Web3 ecosystem.”

He stressed that Nightfall would remain permissionless and fully integrated into Starknet, with a staged rollout, where initial deployment focused on “private payments and transfers with compliance gating and secure sequencing in place,” while “verifier upgrades and expanded functionality follow as the system scales.”

Starknet’s growth and teething trouble

Starknet has steadily grown into one of the larger ZK rollups by total value locked (TVL), currently about $280 million, with usage primarily driven by DeFi protocols and native ecosystem apps.

At the same time, Starknet’s rapid scaling push has exposed reliability challenges. In 2025, the network suffered major outages tied to sequencer and infrastructure issues, prompting public post-mortems and commitments to harden reliability before courting more institutional flow.

Magazine: Back to Ethereum — How Synthetix, Ronin and Celo saw the light

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech12 hours ago

Tech12 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video7 hours ago

Video7 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 hours ago

Crypto World6 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports13 hours ago

Sports13 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show