Crypto World

Strategy and Bitmine Expand BTC, ETH Holdings Amid Market Slump

The two largest publicly traded crypto treasury companies expanded their digital asset holdings this week, with Strategy adding 2,486 Bitcoin and Bitmine Immersion Technologies buying 45,759 Ether, deploying about $260 million combined.

Strategy said it spent $168.4 million on Bitcoin (BTC) purchases Feb. 9-16, bringing total holdings to 717,131 BTC. The acquisitions were funded through share sales under its at-the-market program, including 785,354 shares of STRC preferred stock for $78.4 million in net proceeds and 660,000 shares of Class A common stock for $90.5 million.

As of Monday, Strategy reported an aggregate purchase price of $54.52 billion for its Bitcoin holdings, implying an average acquisition cost of $76,027 per BTC. The latest purchases were made at an average price of $67,710 apiece.

Bitmine, the largest Ether treasury company, said its Ether (ETH) holdings now total 4,371,497 ETH, representing 3.62% of the 120.7 million ETH supply. Of that amount, 3,040,483 ETH are staked, valued at about $6.1 billion at $1,998 per ETH, with annualized staking revenue estimated at $176 million.

The company also reported total crypto, cash and other investments of $9.6 billion, including $670 million in cash, 193 BTC, a $200 million stake in Beast Industries and a $17 million stake in Eightco Holdings.

The purchases came as both Bitcoin and Ether continued to slide. At the time of writing, Bitcoin was trading near $66,700, down about 30% over the past 30 days.

Ether was hovering around $1,990, off more than 40% over the same period, according to CoinGecko data.

Related: MrBeast buys Gen Z bank just weeks after BitMine’s $200M bet

Crypto treasury stocks tumble as Bitcoin retreats from October peak

As the broader crypto market retreats from Bitcoin’s October peak above $126,000, digital asset treasury companies, publicly traded companies that accumulate and hold cryptocurrencies as primary reserve assets, have also experienced sharp declines in their share prices.

Strategy is currently trading around $129, down about 72% from its July 16, 2025, high of $455.90, according to Yahoo Finance data. Bitmine shares have seen an even sharper decline. The stock is trading around $20, down about 85% from its July 3 high of $135. However, the stock remains up nearly 175% over the past year.

SharpLink Gaming, the second-largest Ether treasury holder with 864,840 ETH, about 0.72% of total supply, has also seen its shares decline sharply. At the time of writing, the stock is trading near $6.55, down from $79.21 on May 29.

MARA Holdings, which holds 53,250 BTC and ranks as the second-largest publicly traded Bitcoin holder, is trading near $7.48, down from $22.84 on Oct. 15, a decline of around 67%.

According to BitcoinTreasuries.NET data, 194 publicly traded companies collectively hold 1.136 million Bitcoin valued at around $76 billion.

By comparison, 28 entities hold 6,301,185 Ether valued at about $12.5 billion, based on CoinGecko data.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Monad (MON) price slips after profit-taking as traders eye $0.030 resistance

- Monad price moved within the $0.020 and $0.23 range on Tuesday.

- The layer 1 project eyes traction as $100 million in private credit becomes verifiable on-chain.

- MON price could retest resistance at $0.030.

Monad’s native token, MON, was trading near $0.021 after falling about 7% over the past 24 hours.

Data from CoinMarketCap showed the decline followed renewed profit-taking after prices revisited the $0.025 level.

Continued weakness in Bitcoin and other major altcoins could add further pressure on MON in the near term.

However, some analysts see potential for a rebound as Monad positions itself as a platform for institutional-grade decentralised finance.

Recent developments include a network milestone that enables $100 million in private credit to be fully verifiable on-chain, as well as leadership changes at the Monad Foundation, which have renewed interest in the project’s longer-term prospects.

Monad’s growth amid Valos $100 million private credit launch

Monad’s public mainnet went live in November 2025, with the team unveiling a token sale on Coinbase.

In the few months since, the L1 project has seen nearly $480 million in stablecoin market cap, and DeFiLlama shows total value locked (TVL) currently sits at over $250 million.

Growth along these metrics suggests the native MON token could benefit as adoption ramps up.

On Tuesday, Valos announced the launch of a $100 million private‑credit vault on Accountable’s Yield App.

Notably, the private credit is now fully verifiable on‑chain via Monad. On-chain private credit effectively bridges traditional finance and DeFi, adding to adoption potential.

In parallel, the Monad Foundation has strengthened its institutional‑facing leadership by appointing three senior executives.

Urvit Goel joins from the Optimism Foundation as VP of go-to market, Joanita Titan assumes the role of head of institutional growth from FalconX, and Sagar Sarbhai, formerly of BVNK, is the new head of institutions for Asia‑Pacific.

The hires target institutional investors of the L1, which in turn could support higher demand for MON within an expanding ecosystem.

Monad price forecast

At the time of writing, MON trades in the $0.020-$0.023 range, with daily trading volume down 30% to suggest seller dominance is waning.

From a short‑term perspective, protocol adoption and shifts in macro conditions could help bulls hold $0.020 as they target a breakout to $0.030.

This outlook has been helped by the bounce from all-time lows of $0.016 in early February.

If momentum flips bullish, the all-time high near $0.05 will be a fresh short-term target.

On the downside, negative sentiment around new layer 1 tokens could scuttle bulls’ ambitions.

That outlook has hindered ZetaChain, Berachain, and Aster in recent weeks. Monad’s token could thus revisit lows of $0.016-$0.010 as support levels.

Crypto World

Centrifuge and Pharos partner to expand onchain distribution infrastructure for institutional assets

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Centrifuge and Pharos team up to enable tokenized U.S. Treasuries and AAA-rated credit products via shared onchain infrastructure.

Summary

- Centrifuge and Pharos partner to enable onchain distribution of institutional assets like tokenized Treasuries.

- The collaboration targets tokenized JTRSY and AAA-rated credit products, improving institutional asset accessibility.

- Partnership aims to make tokenized U.S. dollar assets actively usable onchain, overcoming fragmentation and custody limits.

Centrifuge and Pharos have announced a partnership focused on enabling institutional assets to be distributed and operated onchain through a shared infrastructure framework.

The deal targets assets, such as tokenized U.S. Treasuries (JTRSY) and AAA-rated structured credit products (JAAA).

The collaboration aims to solve the issue of distribution, which is one of the challenges faced by institutional onchain finance. A major concern is that many institutional assets remain difficult to access, fragmented across platforms, or passive once issued, despite the progress made by tokenization over the years. This partnership focuses on enabling institutional assets to move beyond issuance and remain usable within live onchain financial systems.

Across many markets outside the U.S. and Western Europe, access to U.S. dollar-denominated credit and treasury products continues to face regulatory, onboarding, custody, and operational constraints. Even when these products are tokenized, distribution is often indirect and fragmented, limiting their ability to reach new participants or be actively deployed once onchain.

The deal will see Pharos serving as a liquidity and distribution layer for assets issued through Pharos, providing the needed infrastructure and ecosystem connectivity to facilitate broader capital entry and a deeper onchain liquidity pathway.

Commenting on the matter, Bhaji Illuminati, CEO of Centrifuge Labs, said that the partnership will focus on building the distribution and infrastructure layer that allows institutional assets to function within real onchain financial environments.

According to Wish Wu, CEO of Pharos, the collaboration will focus on creating an environment where institutional assets can move onchain and remain active within open, composable financial systems.

The partnership is an early step toward what proponents describe as operational on-chain finance, in which institutional assets are not only represented on blockchain networks but are also supported by infrastructure intended to enable distribution, execution, and longer-term participation.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

5 memecoins crypto experts are watching to grow in 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

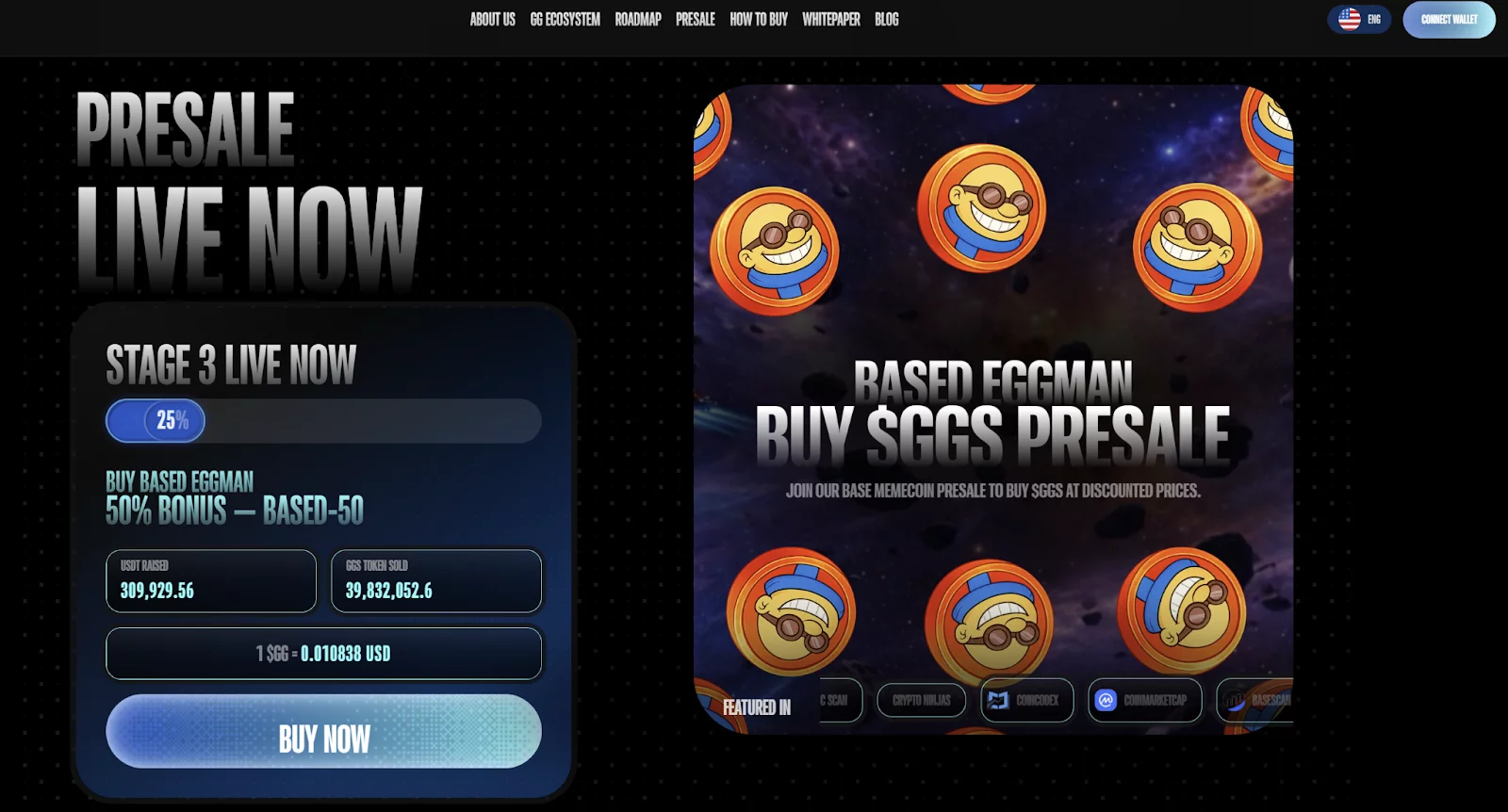

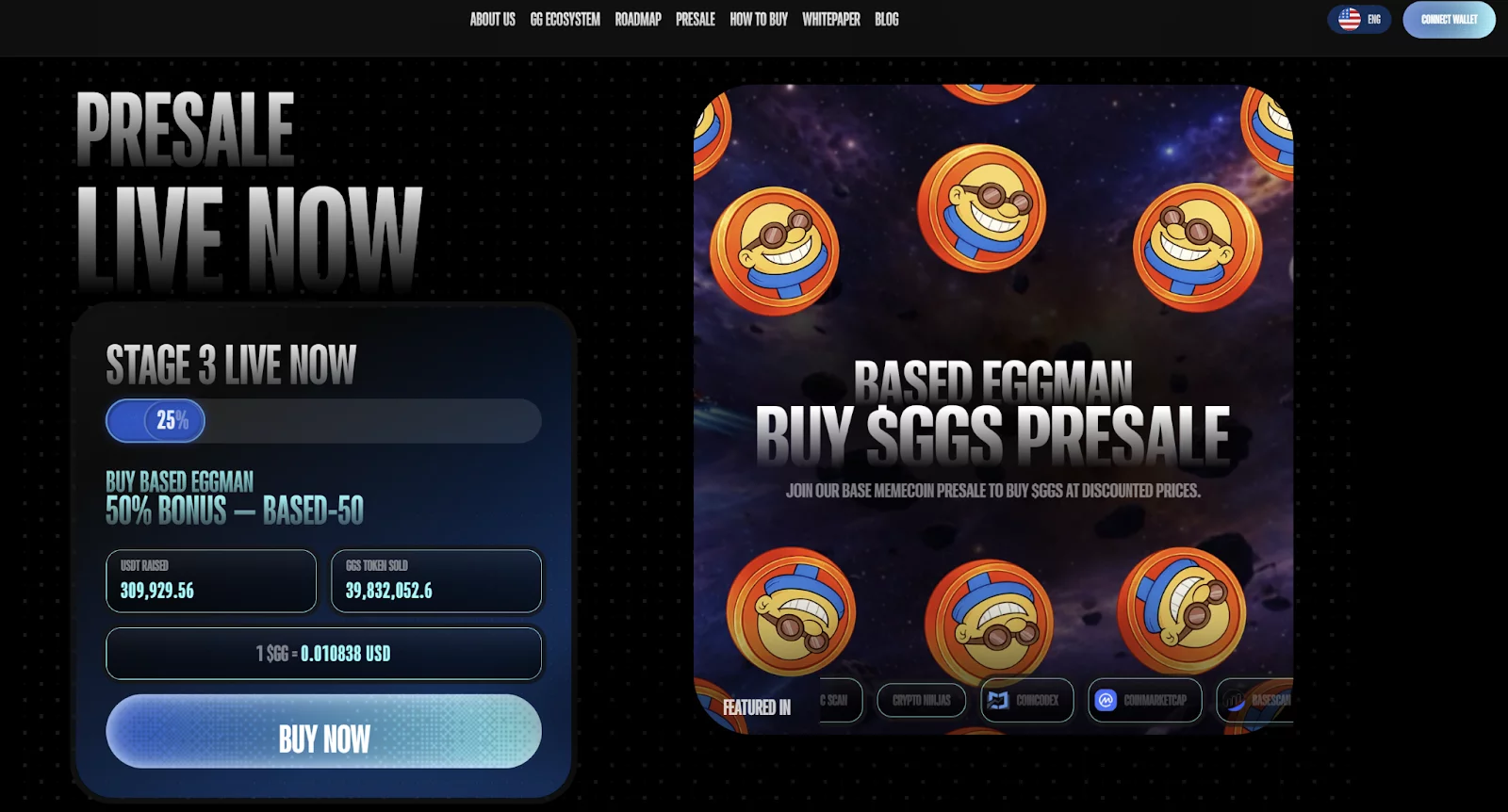

Based Eggman (GGs) tops investor watchlists as the 2026 bull market shifts toward utility-driven memecoins with real traction.

Summary

- Experts say 2026 crypto gains may favor practical, pre-viral projects over hype, with utility memecoins gaining attention.

- Analysts highlight Based Eggman’s presale model, utility focus, and planned exchange listing as key factors driving 2026 interest.

- Market watchers note CEX listings can boost token access and prices, positioning early presale buyers ahead of potential demand.

Every cryptocurrency investor has a strong question after witnessing the fabled, transformative profits from early investments in Dogecoin and Shiba Inu: Can someone get rich with memecoins?

The answer is unquestionably yes, but there is one important requirement. In the 2026 bull market, following the current viral trends won’t make someone wealthy. Rather, the focus will be on identifying the upcoming projects that have the potential to become viral, are practical, and have a strategy for their success.

Hype-driven currencies are no longer of interest to those who are well-versed in cryptocurrency. Rather, they are searching for a novel type of “utility meme.” The most significant item on their watchlists is Based Eggman (GGs). At the top of this list of the top five memecoins that are set to soar is the presale project that experts believe has the best chance of succeeding.

The top 5 memecoins to watch in 2026, per experts

1. The engineered presale giant, Based Eggman (GGs)

Based Eggman is not a luck-seeking memecoin. At every stage of its use, this planned ecosystem will provide value. Experts are closely monitoring it because it addresses issues with earlier memecoins, including their lack of usefulness, inadequate liquidity at launch, and lack of incentives for long-term investment.

The advantage of the presale and the upcoming listing catalyst

Right now, the most important option is the Based Eggman Presale. Investing now will put someone ahead of a significant event that will take place in the second quarter of 2026: a listing on a centralised exchange (CEX). An announcement will be made during Presale Stage 4, and the team is in advanced negotiations with Tier-2 exchanges.

In the past, a token’s price has been most reliably affected by a CEX listing. Because millions of new users can access it all at once, it frequently causes a 5x to 20x spike. Purchasing during the presale entitles you to a discount before the market goes crazy.

Constructed to last: Use and stake immediately

Unlike other memecoins that don’t function at all when they launch, Based Eggman operates right away:

- During the third stage of the presale, the “HODL Furnace” staking mechanism goes live. Early backers benefit from receiving large sums of money up front, which encourages them to stick around and contribute to the development of a vibrant community prior to the official launch.

- Real-World Usefulness of Base: Based on Coinbase’s Layer-2, Base offers fast performance and cheap fees. The gaming and social layer are powered by the GGs token (CA: 0x7f23e5fc401bdfcdc9ad3970ff52f65de73ba8ed). Petrol prices, in-game purchases, leaderboards, and broadcasting all use it. There are only 389 million of them, which is insufficient to meet the actual demand from traders and gamers.

- Professional Execution: The launch of a new, user-friendly website on February 12 shows that the initiative is serious about being ready for the mainstream.

Based Eggman is a good illustration of a successful memecoin for 2026, according to experts. It has long-term use that will sustain it after the initial pump, as well as a presale with a clear, high-probability exit catalyst (CEX listing).

2. The Pepe Dollar (PEPD): A stablecoin hybrid test

PEPD presale is attempting to accomplish a very difficult goal: make a dollar-tied asset both stable and well-liked, similar to the Pepe meme. Experts are keeping an eye on it to see if it can retain its value despite fluctuations in the price of bitcoin. It could create a new form of “spendable meme” currency if it succeeds. But there’s always a chance that the peg will shatter and people will lose faith in it.

3. Maxi Doge: Direct tribute as a game

As a direct descendant of the Dogecoin story, Maxi Doge aims to replicate the fervour and community of the original. It could bring the committed DOGE soldiers together under a new banner with a lower market cap. However, experts predict that Dogecoin will struggle to differentiate itself and provide something unique beyond its moniker. This implies that the general perception of Dogecoin will have a significant impact on its success.

4. Bitcoin hyper presale: The unpredictable variable

As its name implies, people are aware that Bitcoin Hyper plans to create a Bitcoin scaling platform utilizing Solana blockchain technology. In the memecoin market, experts use it to determine how much risk and profit people are willing to take. Because it lacks a developed ecology, it typically attracts more day traders and those seeking volatility than long-term holders.

5. The new storyteller, Pippin

Pippin is a community-driven memecoin, most commonly associated with the Solana blockchain ecosystem and Pump.Fun. Like many meme tokens, it is primarily culture-driven rather than utility-driven — meaning its value is heavily influenced by:

- Social media momentum

- Meme virality

- Community engagement

- Speculative trading cycles

It does not typically position itself as a deep-tech or utility token.

Pippin memecoin is a new project that aims to create its own narrative and sense of community. One of these new stories has the potential to grow to the size of Dogecoin, so experts are closely monitoring them. Because it depends on whether the project gains traction and cultural significance, the investment is highly risky.

The final figure for Memecoin’s value in 2026 is

Strategic Launch + Defined Catalyst + Sustainable Utility is the new formula for profitable memecoins in 2026. Although all of the coins on this list show promise, Based Eggman is currently the only one that meets all three criteria.

It has the long-lasting demand of a genuine gaming and social ecosystem, the guaranteed high-impact event of a CEX IPO, and the organised, low-risk entry of a presale. One of the best ways to respond to the question, “Can memecoins make me rich?” is through the Based Eggman presale, which allows someone to enter the market ahead of the competition. The experts are monitoring everything, and the smart money is moving swiftly.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

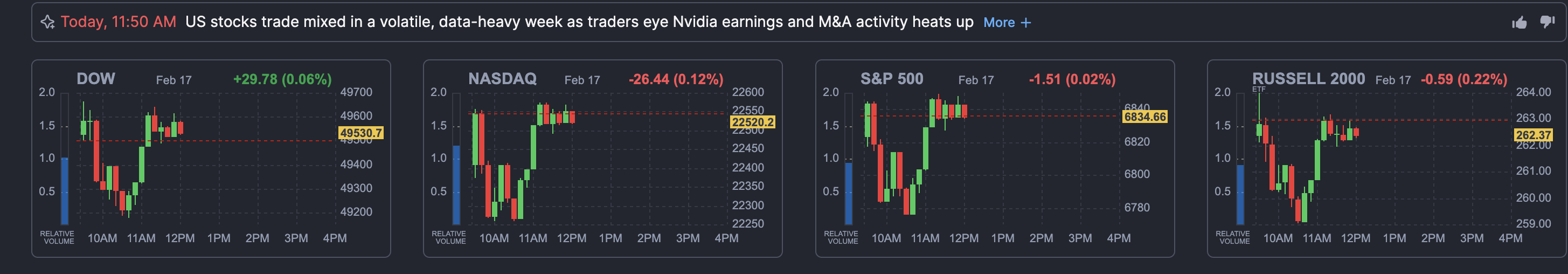

Why Is the US Stock Market Down Today?

The US stock market opened lower on February 17, 2026. It is the first session after Presidents’ Day, with the S&P 500 trading around 6,840 at press time. The Index is down approximately 0.65% (around 44 points) from Friday’s high, but up almost 0.58% since today’s open. This hints at buyers stepping in across sectors.

Persistent “SaaSpocalypse” fears that AI will disrupt traditional software and tech models continue to pressure the market. This makes Information Technology the weakest sector, down 1.5% intraday. Synopsys, Inc. (SNPS) leads the top laggards, falling 1.6% amid broader AI anxiety.

Top US Stock Market News:

• Empire State Manufacturing Index: The New York Fed’s survey showed modest regional expansion in February at +7.1. It is slightly below January’s +7.7 but above forecasts. This leading gauge for US factory activity offers some reassurance against slowdown fears.

• Canadian CPI Cools: January headline inflation eased to 2.3% YoY (from 2.4%), driven by lower gasoline prices. The softer print strengthens the disinflation narrative and could preview similar trends in US data, supporting Fed rate-cut hopes.

Sponsored

Sponsored

• US-Iran Indirect Talks Resume: Discussions in Geneva today focused on nuclear issues and de-escalation. Progress could help stabilize oil markets and reduce volatility in the energy and global trade sectors.

S&P 500 Tests Key Level As AI Disruption Fears Weigh on Wall Street

Wall Street remains cautious on February 17, 2026, with the US stock market trading mixed but overall subdued amid persistent SaaSpocalypse fears. The S&P 500 opened weaker, briefly dipping below its 100-day EMA before reclaiming it.

The index stabilized around 6,834–6,841 mid-session, down 0.65% intraday from its February 13 high.

The trend suggests the market might recover mildly, but the key to a broader recovery lies above the highs set on February 13 (Friday).

This echoes the late-November 2025 scenario. The index lost the 100-day EMA on November 28 but reclaimed it quickly the next session, triggering a strong rally. The S&P 500 gained approximately 7.38% from late November into late January.

The 100-day EMA has acted as strong support since then. Key support now sits around this zone, at around 6,819. A close below could invite broader weakness toward 6,762 and 6,705. A decisive push above 6,889 (above Friday’s high) could target the psychological 7,000 level.

However, stagflation-like concerns (sticky inflation, growth slowdown) and AI disruption anxiety limit upside conviction.

Sponsored

Sponsored

Nasdaq Composite trades deeper in the red, highlighting tech’s drag. Tech’s 33% S&P 500 weight amplifies the impact on the broader index.

VIX, the Volatility Index, eased 1.08% to 20.97 (from higher early-session levels), signaling reduced volatility as the day progressed, though still elevated relative to recent lows and reflecting caution.

The US 10-year Treasury yield is 4.05% (down modestly today, near 2.5-month lows).

It reflects flight-to-safety flows and softer inflation expectations; supportive for bonds but pressuring growth stocks and crypto amid delayed rate-cut bets.

Sponsored

Sponsored

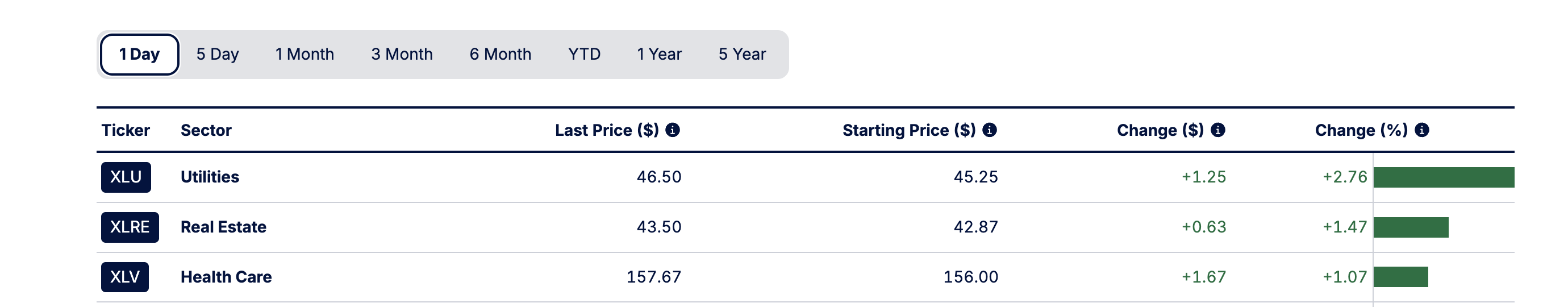

Sector Rotation in Focus: Defensives Shine While Tech Drags

The US stock market’s mixed tone on February 17, 2026, reveals pronounced sector rotation. Technology (XLK) is the standout laggard, down approximately 1.24% from February 13 highs (currently trading -0.37% on the day).

XLK is the Technology Select Sector SPDR Fund, managed by State Street Global Advisors, one of the flagship sector ETFs that slices the S&P 500 into its 11 GICS sectors for targeted exposure.

It tracks major tech names (Nvidia, Microsoft, Apple) and software/semiconductor companies. This makes XLK sensitive to growth sentiment and AI-related developments.

The XLK chart shows a developing head-and-shoulders pattern, a bearish structure. The neckline holds steady near 133; a decisive break below could confirm the pattern and trigger a 10% downside move (measured from head to neckline), potentially pushing toward 129 or even 120 in a deeper correction if broader market conditions or AI concerns worsen.

Utilities (XLU) continues to show relative strength after rallying 2.5% on Friday. While it’s down 0.40% today in line with broader weakness, the sector remains the strongest performer on a weekly basis.

This flow, from growth/tech into defensives and value, explains why the S&P 500 can trade flat-to-lower despite green pockets: tech’s 33% index weight magnifies XLK weakness, overshadowing gains elsewhere.

Sponsored

Sponsored

The bearish setup invalidates on a reclaim of 141–144; a move above 150 would fully negate the threat.

Synopsys (SNPS) Drops 4.4% As AI Anxiety Hammers Software Stocks

Synopsys (SNPS) is one of the standout US stock market laggards. It is trading at approximately 419 after dropping 4.43% intraday, at press time.

As a leading EDA software and semiconductor IP provider, SNPS is closely tied to the software infrastructure subsector. This leaves it vulnerable to ongoing concerns that AI may reshape chip-design workflows.

In the Technology Select Sector SPDR Fund (XLK), SNPS carries a modest weight of 0.72%. This limits its direct ETF impact but serves as a strong proxy for software weakness (e.g., ORCL -3.85%, CRWD -5.12%, FTNT -4.11%).

The daily chart shows SNPS trading inside a bear flag pattern following a 24% correction that began January 12, 2026, with the February 4 rebound/consolidation keeping price contained within the flag. It attempted a breakdown today, but buyers defended so far.

A confirmed break below 416 could activate the pattern, projecting downside toward 322 (over 20% from current levels). Intermediate support levels sit at 402 and 371.

The bearish setup invalidates on a reclaim of 451. This reinforces rotation away from software/growth names into defensives, adding to Nasdaq’s relative pressure.

Crypto World

Bitcoin is down, but could bear market be nearing its end?

Bitcoin slid more than 2% to $67,000 on Tuesday, reflecting broader risk aversion across markets as Wall Street reopened after the Presidents’ Day holiday.

Summary

- Tech and crypto remain under pressure, while defensives are mixed, with selective strength emerging in activist-driven and travel names.

- Bitcoin has fallen about 29% over the past month, sparking debate over whether the downturn is nearing a bottom or has further to run.

- “I believe that bitcoin has already capitulated with that big move from 100k-> 60k,” one analyst says.

Crypto weakness coincided with renewed pressure on technology and software shares, where investors continued to grapple with the potential for AI-driven disruption. The Nasdaq-100 underperformed, slipping 0.3%, while the iShares Expanded Tech-Software Sector ETF dropped more than 2.7% in midday New York trading. The software-focused fund has now declined in 11 of the past 15 sessions, pushing its year-to-date losses to nearly 25%.

Broader equity indices were largely flat, masking sharp divergences beneath the surface. Financial stocks rebounded after weeks of weakness, while consumer staples lagged.

Travel Tickers

Travel-linked shares stood out as a pocket of strength. Norwegian Cruise Line Holdings surged 11% after Elliott Investment Management disclosed a stake exceeding 10% and signaled plans to push for strategic changes following the cruise operator’s prolonged underperformance.

Peers rallied in sympathy, with Carnival Corp. rising about 4% and Royal Caribbean Group gaining 3%.

In travel and leisure, Airbnb Inc. added 3.7%, extending momentum from last week’s earnings report. Southwest Airlines Co. jumped more than 6% following a wave of analyst upgrades from Susquehanna and UBS.

But what about Bitcoin?

The top cryptocurrency has fallen about 29% over the past month, sparking debate over whether the downturn is nearing a bottom or has further to run.

Trader Altcoin Sherpa pointed to past cycles for comparison, noting that both the 2017–2018 and 2021–2022 bear markets saw steep 75–85% drawdowns and took roughly a year from all-time high to final bottom. Each cycle ended with a sharp capitulation event — including the 2018 plunge from $6,000 to $3,000 and the 2022 crash tied to FTX — followed by several months of accumulation.

However, Sherpa argues the current cycle may differ. The 2024–2025 rally was slower and more consolidation-heavy than prior vertical surges, and structural factors such as spot ETFs, reduced speculative excess, stronger support in the $50,000–$70,000 range, and already-flushed altcoin froth could shorten the bear market timeline, potentially avoiding a full 365-day decline.

“I believe that bitcoin has already capitulated with that big move from 100k-> 60k,” Sherpa says. “I believe we are now in the ACCUMULATION phase of the cycle. Accumulation can last anywhere from a few weeks to several months.”

See the full post via the link below.

Crypto World

Binance Whale Inflows Surge as Bitcoin Tests Critical Support

Key Insights:

- Binance whale inflow ratio surged, showing growing dominance of large BTC transactions.

- Bitcoin’s 22% YTD decline has pushed sentiment into extreme fear territory.

- Falling stablecoin liquidity makes whale moves more influential on price action.

Market Weakness Deepens Across Crypto

The larger crypto market is still under intense pressure with Binance registering a massive increase in whale activity. Bitcoin is trading around $68,000, dropping over 22% in the year, the lowest first-quarter performance since 2018.

The month of January ended with a sharp loss of 10% and February has been unable to provide relief yet. This decline is reflected in investor sentiment, where the Crypto Fear & Greed Index is solidly in the extreme fear zone. The range of $60,000 to $65,000 has been cited by analysts as one of the key support zones that might dictate the direction in the near future.

Whale Inflows on Binance Spike Suddenly

Despite bearish price action, on-chain data points to a notable shift in large-holder behavior. According to CryptoQuant, Binance’s whale inflow ratio jumped from 0.40 to 0.62 between February 2 and February 15, indicating that a large portion of exchange inflows is currently taken over by large holders.

A single large holder, known as the Hyperunit whale, allegedly transferred close to 10,000 BTC to Binance as the volatility increased. A number of other high-value transfers occurred in their turn, indicating that institutional-scale players are actively repositioning as prices get weaker.

🐳 Whale Inflow ratio surges on Binance amid market correction.

This correction is testing all types of investors, from retail participants to whales and even institutions.

According to the whale inflow ratio, we are seeing a clear surge in whale activity on Binance,… pic.twitter.com/TVJiUAWy1O

— Darkfost (@Darkfost_Coc) February 17, 2026

In the past, increasing numbers of whales may cause sell-side pressure. They can, however, reflect tactical actions in times when deep liquidity on the major exchanges becomes crucial.

Liquidity Tightens as Capital Pulls Back

Binance has seen declining stablecoin liquidity. The exchange has registered three consecutive months of negative netflows of stablecoins, with almost $3 billion leaving the platform this month. Since November, the total stablecoin reserves have been decreasing by nearly $9 billion.

This tightening of liquidity increases the effect of the whale movement since big transfers can more readily influence the short-term price action.

Selling Pressure or Strategic Accumulation?

The statistics provide a varied picture. The low liquidity and risk-off flows suggest caution, but the rise in whale activity implies that the large players are finding opportunities at these levels. It remains unclear whether this signals distribution, hedging, or silent accumulation.

Crypto World

AAVE Drops 86% From ATH; Can This Key Support Zone Trigger a $1,000 Rally?

TLDR:

- AAVE is trading around $124, sitting above a major support zone between $90 and $110 on the weekly chart.

- A multi-year ascending trendline active since 2021 converges with the 0.618 Fibonacci level at current prices.

- Price is compressing between descending resistance and rising support, signaling a potential breakout is approaching.

- Upside targets range from $190 to $1,000, representing a 10x return from the base of the accumulation zone.

AAVE is currently sitting at a critical support zone following an 86% decline from its all-time high. The DeFi token is trading around $124, holding above a major weekly trendline that has remained intact since 2021.

Analysts are now watching whether this level can sustain buying pressure and trigger a larger recovery. Crypto analyst CryptoPatel has outlined a detailed technical case suggesting a potential 10x move from the current accumulation range.

Price Holds Above Key Support as Accumulation Signs Emerge

AAVE is trading above a high-timeframe support zone between $90 and $110. This range has attracted considerable attention from technical analysts tracking the asset’s long-term structure.

The zone aligns with a multi-year ascending trendline, adding weight to its relevance as a demand area.

CryptoPatel flagged the setup on social media, stating that price is showing a “liquidity sweep and reaction from a multi-year ascending trendline that has held since 2021.”

That trendline converges with the 0.618 Fibonacci retracement level, forming a strong area of technical confluence. Together, these factors point to a historically significant support region for the asset.

Beyond the trendline, price action is compressing between a descending resistance level and rising support. This type of compression pattern often builds tension before a directional move. Traders are watching closely to see which side resolves first.

10x Targets in Focus as Breakout Conditions Take Shape

The $74 level stands as the line in the sand for bulls. A weekly close below that price would cancel the bullish scenario outlined in the analysis. As long as AAVE holds above that threshold, the setup remains technically intact.

CryptoPatel mapped out a series of upside targets starting at $190, followed by $345, then $579, and eventually $1,000 or more.

These levels represent roughly a 10x return calculated from the base of the accumulation zone near $90. Each target corresponds to a technical resistance level identified on higher timeframes.

The analyst described the current range as trading between the 0.618 and 0.786 Fibonacci support levels, calling it a “generational accumulation range before massive expansion.”

This Fibonacci band is commonly associated with deep retracements that precede strong recoveries in trending assets.

Whether AAVE confirms this pattern depends on price holding current support and broader market momentum supporting a DeFi recovery.

Crypto World

Brutal Collapse on the Way?

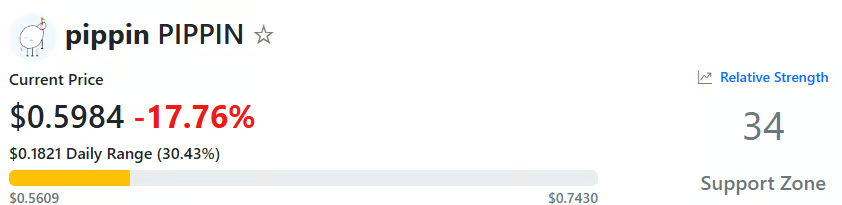

Is PIPPIN headed for a collapse below $0.10?

The meme coin pippin (PIPPIN) is deep in red territory today (February 17) after posting substantial gains over the past few weeks.

The question now is whether this will be a temporary correction or the beginning of a major collapse.

What Comes Next?

The asset’s price has retraced by nearly 20% on a daily scale and now trades at around $0.59 (per CoinGecko’s data). PIPPIN’s market capitalization has tumbled below $600 million, putting it at risk of losing its prestigious spot among the 100 largest cryptocurrencies.

Several analysts have recently warned that the meme coin could be a high-stakes gamble, advising traders to stay away from it. Earlier this week, X user Ted said he doesn’t know a single person who holds PIPPIN and wondered what might have driven the rally.

He thinks the whole thing is “a CEX cabal play,” similar to Mantra (OM). In crypto slang, “cabal” refers to a small, coordinated group of insiders who are believed to manipulate a token’s price with their actions. Recall that just a year ago, OM was worth almost $9, whereas its market cap briefly exceeded $8 billion. Since then, the asset has crashed by staggering 99%.

Crypto Rug Muncher shared a similar thesis. The X user argued that the only people still active in the PIPPIN ecosystem are “the cabal members who crimed it to $700 million MC in the first place.”

“This isn’t a project holding the active interest of the space; it’s organized manipulation designed to bait in naive retail for exit liquidity. The project is a hollow, abandoned shell with no fundamentals, and as soon as the insiders manipulating this get bored, it’s headed straight back to shitcoin hell where it belongs,” they added.

Crypto GVR and ALTSTEIN TRADE also gave their two cents. The former spotted the price reversal that occurred in the past hours to forecast that a major collapse to $0.10 may be coming next. The latter argued that PIPPIN’s “top is in,” predicting that all the gains will be lost and that the valuation will tumble below $0.10.

You may also like:

Something for the Bulls

Despite the grim forecasts from the aforementioned analysts, the meme coin’s Relative Strength Index (RSI) suggests a short-term rebound could be on the horizon.

The technical analysis tool tracks the speed and magnitude of recent price changes and helps traders spot potential turning points. It runs on a scale from 0 to 100, and ratios below 30 indicate that PIPPIN is oversold and might be on the verge of a resurgence. On the contrary, readings above 70 are considered precursors of a correction. Currently, the RSI stands just north of the bullish zone.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum Staking Breaks New Highs as Price Slumps

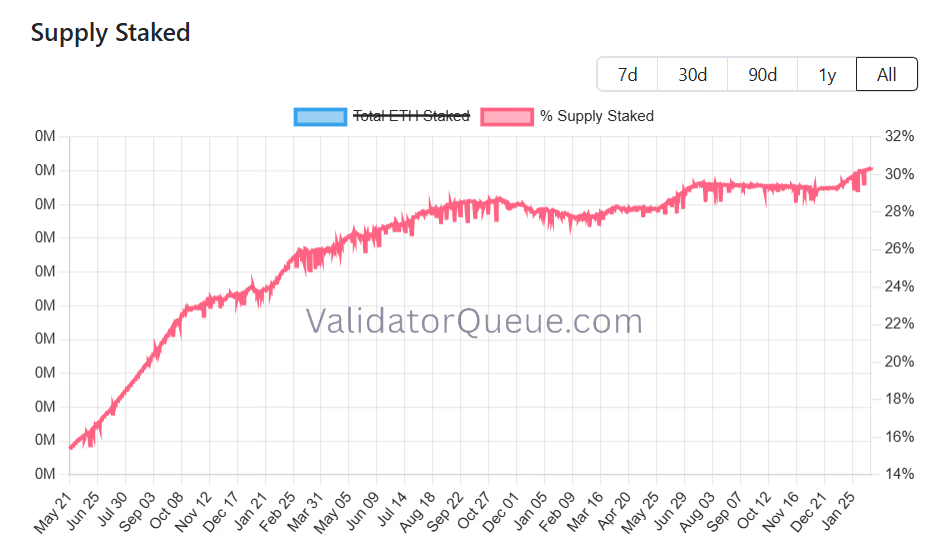

The amount of ETH that’s being used to secure the network recently crossed 30% of Ethereum’s circulating supply for the first time.

More than 30% of ETH’s circulating supply is now locked in staking contracts, per data from Validator Queue. The percent of supply staked continues to break new highs this month, climbing over 30% for the first time at the end of January.

As of today, Feb. 17, data shows that about 36.9 million ETH, or roughly 30.4% of total supply, is currently staked across nearly 967,000 active validators.

Meanwhile, the price of ETH rallied to new highs this summer, reaching nearly $5,000 in late August, but has since given back much of those gains, and is currently struggling to stay around $2,000.

The jump in staking, however, has also created a clear backlog for new validators. About 3.92 million ETH is currently sitting in the validator entry queue, waiting to be staked, and the wait time for staking has reached nearly 68 days.

Getting out of staking, however, is finally far easier. The exit queue is empty, although withdrawals still face an additional eight-day sweep delay before funds reach withdrawal addresses. This fall, the validator exit queue also faced congestion, and in September it took more than 45 days to exit Ethereum staking.

The network APR, or annual staking rewards, currently sits at around 2.84%. As for players, Lido remains the largest staking entity, controlling roughly 24% of all staked ETH, or about 8.7 million tokens, according to data from Dune Analytics. Centralized exchanges and centralized staking providers also account for a sizable share.

The data shows staking inflows rising through 2024 and early 2025, before turning negative later in 2025 as some participants began pulling ETH back out.

Last summer, alongside ETH’s price, the total value locked across liquid staking protocols — which let ETH holders stake their tokens while keeping funds liquid — rose to record highs above $85 billion, which extended through early October.

But after the Oct. 10 crash, liquid staking TVL began to drop and is currently sitting just below $40 billion.

Crypto World

Crypto VC firm Dragonfly raises $650 million despite ‘gloom of a bear market’

Crypto venture firm Dragonfly Capital completed a $650 million fourth fund, marking one of the largest raises in the sector at a time when many blockchain-focused VCs are struggling, Managing Partner Haseeb Qureshi said.

“It’s a weird time to celebrate,” Qureshi wrote on a social media post on Tuesday, describing low spirits and “the gloom of a bear market” for crypto. However, he noted that Dragonfly has historically raised capital during downturns, including the 2018 ICO crash and just before the 2022 Terra collapse, ‘vintages,’ he said, ultimately became the firm’s best performers.

In September, the firm said it was aiming to raise $500 million for its fourth fund, which would target early-stage projects. It has not yet identified any of them. In May 2023, Dragonfly Capital raised $650 million for its third crypto fund for later-stage companies.

‘Biggest bet yet’

The new vehicle comes as token prices slumped this year and fundraising across crypto ventures has slowed sharply. Bitcoin has lost roughly 46% of its value since its all-time high of more than $126,000 in October of last year, and the crypto downtrend has wiped out more than $1.4 trillion in market cap.

While market sentiment remains bearish, Qureshi is bullish on crypto’s financial use cases, saying the sector “is exploding,” while other non-financial use cases are failing. In fact, Dragonfly has increasingly leaned into crypto-financial infrastructure, from stablecoins to tokenization and on-chain payments, reflecting a broader shift away from speculative Web3 applications and toward blockchain-based financial services.

“Stablecoins are eating the world. DeFi has grown so big it’s rivaling CeFi. Financial institutions around the world are racing to build out their crypto strategies. And prediction markets are becoming the most trusted source of truth on the internet,” he wrote.

Qureshi also noted the growth in Dragonfly’s recent investments, including Polymarket, Ethena, Rain, and Mesh, as examples of his thesis that crypto’s financial use cases are having a moment.

His comments come after VC firms at Consensus Hong Kong 2026 struck a cautious tone about the state of the crypto market amid prevailing bearish sentiment. The crypto VCs that included Qureshi, Maximum Frequency Ventures’ Mo Shaikh and Pantera Capital’s Paul Veradittakit all echoed the same sentiment: invest in what’s working, like stablecoins and tokenizations, while selectively betting on sectors such as AI and prediction markets.

Qureshi seems to be doubling down on the idea that the crypto industry isn’t dead, despite the gloom, but just realigning and noted that the new fund is his firm’s “biggest bet yet that the crypto revolution is still early in its exponential.”

Fortune was first to report Dragonfly’s recent raise.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech17 hours ago

Tech17 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video12 hours ago

Video12 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World11 hours ago

Crypto World11 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports18 hours ago

Sports18 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery