Crypto World

Ripple CEO Expects CLARITY Act to Pass by April, Boosting Crypto Clarity

Ripple CEO Brad Garlinghouse has expressed confidence that the CLARITY Act, a landmark piece of legislation for the crypto industry, is likely to pass by the end of April.

Ripple CEO Brad Garlinghouse remains optimistic about the Clarity Act, giving it an 👀 80% chance of being signed by the end of April. 🏛️

While XRP has its legal clarity, the rest of the industry is still waiting. Progress over perfection is the goal. 🤝 pic.twitter.com/7DqQezE3U2

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) February 16, 2026

According to Garlinghouse, there is now an 80% chance of the bill being approved, especially after continued negotiations between banks and crypto firms. The CEO has urged the industry to embrace compromise, suggesting that waiting for a perfect bill could stall progress.

In recent weeks, discussions surrounding the CLARITY Act have seen significant developments, especially following a long-standing deadlock in the Senate Banking Committee. This delay occurred just before the bill was initially expected to pass. Ripple’s Chief Legal Officer, Stuart Alderoty, also remains optimistic, noting that talks between banks and crypto firms have made significant strides.

The potential passage of the CLARITY Act would offer much-needed regulatory clarity for the crypto space, which has long struggled with uncertain legislation. This clarity, according to Garlinghouse, would be a step toward stabilizing the market, benefiting both crypto firms and investors. However, despite its positive potential, the bill still faces challenges that could delay its passage further.

Crypto Bill Stalemate and Progress in Negotiations

The road to the CLARITY Act’s passage has not been smooth. Earlier this year, Coinbase, one of the largest cryptocurrency exchanges in the United States, pulled its support for the legislation. The company cited its inability to reach a compromise on the issue of stablecoin yield. This setback delayed momentum in the Senate Banking Committee, creating further uncertainty for the bill’s future.

While there is some frustration over the stalled negotiations, there is still hope that a breakthrough is imminent. The White House has set a February deadline for crypto and banking leaders to agree on stablecoin yield provisions within the bill. This deadline aligns with Garlinghouse’s predictions, as he has consistently emphasized that compromise rather than perfection is necessary to move the legislation forward.

As talks continue this week, stakeholders in the crypto sector remain hopeful that the final version of the bill will be sufficiently beneficial to all parties involved. The current focus is on balancing regulatory clarity with the needs of both traditional banks and the emerging crypto economy. A resolution could bring much-needed stability and restore confidence in the market, especially as the crypto industry struggles through a bearish phase.

White House Involvement and Potential Market Impact

The involvement of the White House in the negotiation process highlights the importance of the CLARITY Act to the future of the crypto industry. A key upcoming meeting later this week could serve as a turning point in the discussions. With the backing of influential parties, such as the White House and major financial institutions, the chances of the bill’s successful passage by April appear to be increasing.

Market speculation suggests that the CLARITY Act’s passage could lead to significant liquidity returning to the crypto space. If the bill succeeds, many analysts believe it could reinvigorate the market, which has been experiencing a downturn for some time. Increased stability from clearer regulations may prompt a resurgence of interest in crypto assets, driving investment and innovation within the sector.

Despite the uncertainty, many in the industry are holding out hope that the passage of the CLARITY Act will bring much-needed regulatory certainty. This could pave the way for future growth and opportunities in the crypto market. With discussions heating up and potential progress on the horizon, the crypto community will be watching closely as April approaches.

Crypto World

Ki Young Ju Says Bitcoin May Need to Hit $55K Before True Recovery Begins

Selling pressure overwhelms new capital inflows; institutional unwinding and the absence of buying interest define the current cycle.

CryptoQuant CEO Ki Young Ju has declared the current bitcoin market a definitive bear cycle, warning that a genuine recovery could take months and may require prices to fall further before a sustainable rebound materializes.

Sponsored

Sponsored

Capital Inflows Failing to Move the Needle

In an interview with a South Korean crypto outlet, Ju laid out a data-driven case for extended weakness. He pointed to a fundamental imbalance between capital inflows and selling pressure.

“Hundreds of billions of dollars have entered the market, yet the overall market capitalization has either stagnated or declined,” Ju said. “That means selling pressure is overwhelming new capital.”

He noted that past deep corrections have typically required at least three months of consolidation before investment sentiment recovered. Ju emphasized that any short-term bounces should not be mistaken for the start of a new bull cycle.

Two Paths to Recovery

Ju outlined two scenarios for Bitcoin’s eventual recovery. The first involves prices dropping toward the realized price of approximately $55,000. The price is the average cost basis of all bitcoin holders, calculated from on-chain transaction data, before rebounding. Historically, bitcoin has needed to revisit this level to generate fresh upward momentum.

The second scenario envisions a prolonged sideways consolidation in the $60,000 to $70,000 range. The prices would grind through months of range-bound trading before the next leg up.

Sponsored

Sponsored

In either case, Ki stressed that the preconditions for a sustained rally are not currently in place. ETF inflows have stalled, over-the-counter demand has dried up, and both realized and standard market capitalizations are either flat or declining.

Institutional Exodus Behind the Decline

Ju attributed much of the recent selling to institutional players unwinding positions. As bitcoin’s volatility contracted over the past year, institutions that had entered the market to capture volatility through beta-delta-neutral strategies found better opportunities in assets such as the Nasdaq and gold.

“When bitcoin stopped moving, there was no reason for institutions to keep those positions,” Ju explained. Data from the CME show that institutions have significantly reduced their short positions—not a bullish signal, but evidence of capital withdrawal.

Ju also flagged aggressive selling patterns where large volumes of bitcoin were dumped at market price within very short timeframes. He believes this suggests either forced liquidations or deliberate institutional selling to manipulate derivative positions.

Altcoin Outlook Even Bleaker

The picture for altcoins is grimmer still. Ju noted that while altcoin trading volume appeared robust throughout 2024, actual fresh capital inflows were limited to a handful of tokens with ETF listing prospects. The broader altcoin market cap never significantly surpassed its previous all-time high, indicating that funds were merely rotating among existing participants rather than expanding the market.

“The era of a single narrative lifting the entire altcoin market is over,” Ki said. He acknowledged that structural innovations such as AI agent economies could eventually create new value-driven models for altcoins, but dismissed the likelihood of simple narrative-driven rallies returning.

“Short-term altcoin upside is limited. The damage to investor sentiment from this downturn will take considerable time to heal,” he concluded.

Crypto World

XRP Ledger Introduces Permissioned DEX, Boosting Institutional Access

TLDR

- The Permissioned DEX amendment on the XRP Ledger will activate in 24 hours.

- This upgrade introduces controlled environments for trading within the decentralized exchange.

- The amendment allows regulated financial institutions to participate while adhering to compliance requirements.

- XRP’s demand remains strong, with nearly $4.5 million flowing into XRP-focused products in the last 24 hours.

- The Permissioned DEX amendment builds on the previous XLS-80, enhancing the platform’s functionality for permissioned domains.

The Permissioned DEX amendment is set to go live on the XRP Ledger within 24 hours, marking a key milestone for the platform. This upgrade will introduce controlled environments for trading within the XRP Ledger’s decentralized exchange (DEX). The development is expected to facilitate broader participation, especially from regulated financial institutions.

XRP Ledger’s Permissioned DEX Amendment Activation

The Permissioned DEX amendment, also known as XLS 81, is set to activate on the XRP Ledger tomorrow. This amendment will create controlled trading environments, allowing only authorized users to place and accept offers. By integrating permissioning directly into the DEX protocol, it is designed to offer a secure space for regulated entities to trade.

According to XRPScan, the countdown to activation stands at just 23 hours. This feature builds upon the previous XLS-80, which focuses on Permissioned Domains. As part of this upgrade, users within these domains will have the ability to trade freely but only within a pre-approved group.

XRP’s Continued Demand Despite Market Shifts

XRP remains in strong demand, even as the broader cryptocurrency market experiences fluctuations. Rayhaneh Sharif Askary, the head of product and research at Grayscale, spoke about the consistent interest in XRP at a recent community event. “Advisors are constantly asked by their clients about XRP,” said Sharif Askary, underlining its continued relevance.

In fact, XRP has become one of the most talked-about assets, trailing only behind Bitcoin in some circles. This increasing interest is reflected in the recent data compiled by SoSoValue, showing XRP funds receiving nearly $4.5 million in the last 24 hours. Despite a market drop, the demand for XRP shows no signs of slowing down.

At the time of writing, XRP had fallen by 1.78% in the last 24 hours to $1.45. However, it had gained 3.59% over the past week. This indicates that, while it may face short-term volatility, XRP continues to attract attention from investors.

The introduction of the Permissioned DEX amendment is seen as a crucial step in XRP’s journey toward broader institutional adoption. By offering a controlled environment for trading, the XRP Ledger aims to cater to the needs of regulated financial institutions.

The integration of permissioning features within the DEX protocol allows these institutions to participate without violating compliance requirements. In the long term, this move could play a pivotal role in attracting more institutional investors to the XRP ecosystem.

Crypto World

Bitwise And GraniteShares File Election Prediction ETFs

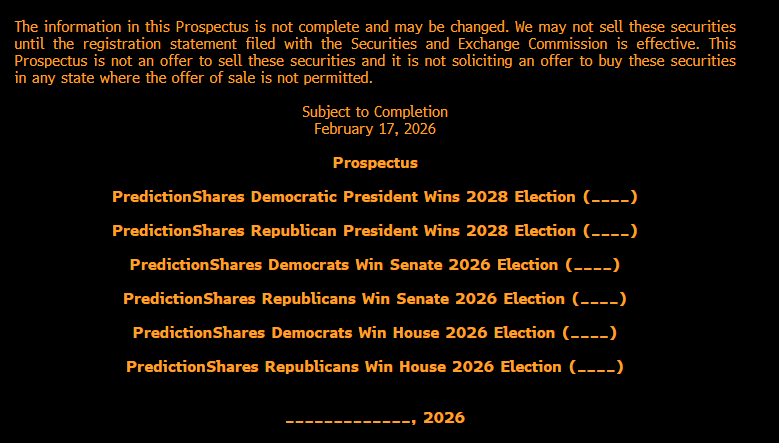

Exchange-traded fund issuers Bitwise and GraniteShares have filed with the US Securities and Exchange Commission to launch funds tied to event contracts on the outcome of US elections.

Bitwise filed a prospectus on Tuesday for a new lineup of ETFs branded as PredictionShares, with six prediction market-style ETFs on NYSE Arca.

The first two funds will pay out if either a Democrat or a Republican wins the U.S. presidential election in November 2028. The next two will pay out if either Democrats or Republicans win the Senate in November 2026, and the final two if either party wins the House.

“The fund’s investment objective is to provide capital appreciation to investors in the event that a member of the Democratic Party is the winner of the US Presidential election taking place on November 7, 2028,” read the prospectus.

Each fund invests at least 80% of its net assets in binary event contracts, or political prediction market derivatives traded on CFTC-regulated exchanges. These contracts settle at $1 if the referenced outcome occurs and $0 if it doesn’t.

“In the event that a member of the Democratic Party is not the winner of the 2028 Presidential election, the fund will lose substantially all of its value,” it explained.

Betting on a prediction market wrapped in an ETF

In essence, Bitwise is offering separate ETFs for each race — one for each party — and investors can choose which one to buy into.

The price of each fund’s shares on any given day reflects the market’s implied probability of that outcome, fluctuating between $0 and $1 based on polling, news, and sentiment.

Related: Prediction markets are the new open-source spycraft

ETF issuer GraniteShares also filed a prospectus on Tuesday offering six similar funds with the same structures based on US election outcomes.

“The financialization and ETF-ization of everything continues,” commented Bloomberg ETF analyst James Seyffart.

Not the first prediction market-style ETF filings

“This is not the first filing of this kind, and I think it’s extremely unlikely that these will be the last,” added Seyffart, in reference to the Roundhill filing for similar funds on Feb. 14.

The Roundhill prospectus also offers six prediction market-style ETFs based on the outcomes of the presidential, Senate, and House elections.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Bitcoin improvement proposal to block spam draws heat from heavyweights

By Omkar Godbole (All times ET unless indicated otherwise)

A new Bitcoin Improvement Proposal, BIP-110, which seeks to curb spam-like data clogging the blockchain, is facing backlash from some industry leaders who argue it risks damaging the network’s reputation more than the spam itself.

BIP-110 is a “soft fork,” a type of upgrade that works smoothly with existing Bitcoin setups without breaking the blockchain. It seeks to set strict temporary limits on non-money data in transactions, particularly Ordinals inscriptions that jam images, videos or tokens into Bitcoin blocks.

Implementing the same could help fight “spam” and unclog the network, making it cheaper for regular people to use, keeping the blockchain focused on payments. The onchain activity has been close to negligible in recent months.

However, Blockstream’s CEO, Adam Back, disagrees, calling the proposal an attack on Bitcoin’s reputation as reliable money.

“It’s worse as it is an attack on bitcoin’s credibility as a store of value, it’s security credibility, and a lynch mob attempt to push changes there is not consensus for. spam is just an annoyance, it all definitionally fits within the block-size. the op returns are 4x smaller,” Back said on X.

Several others echoed this, arguing the fix might hurt trust more than spam does.

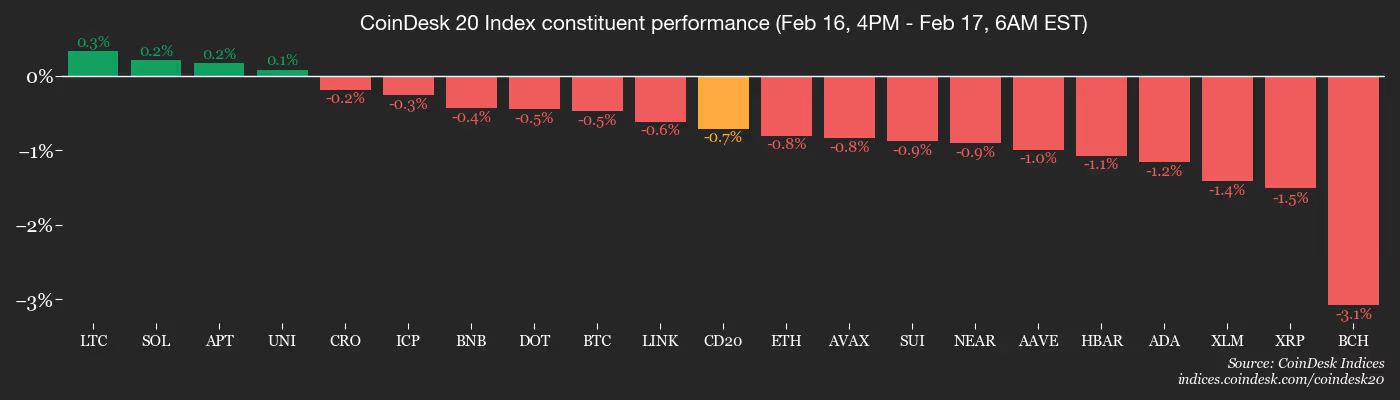

In the meantime, markets offer little excitement, as bitcoin continues to trade back and forth between $67,000 and $70,000, with prices approaching the lower end of the range as of writing. The CoinDesk Memecoin Index (CDMEME) is down 3% over 24 hours alongside 1% declines in other major tokens such as ether and BNB.

“The decline of the largest coins is an ominous sign for smaller ones, as it may soon pull them down with it at an accelerated pace,” Alex Kuptsikevich, senior market analyst at The FxPro, said in an email.

He added that the market has entered a “stress zone” but has not yet reached the final capitulation stage. “To form a ‘true bottom,’ a peak in loss-taking and a complete exhaustion of selling pressure are necessary,” he noted.

In traditional markets, dollar shorts hit their highest level in over a decade, while the recent decline in the inflation-adjusted yield on the U.S. 10-year note offered hope to battered bitcoin bulls. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 17, 7 p.m.: Rocket Pool to launch its Saturn One upgrade.

- Macro

- Feb. 17, 8:30 a.m.: Canada inflation rate YoY for January (Prev. 2.4%); Core rate YoY (Prev. 2.8%)

- Feb. 17, 8:30 a.m.: NY Empire State manufacturing index for February est. 7.1 (Prev. 7.7)

- Feb. 17, 6:50 p.m.: Japan balance of trade for January est.-2.142bn yen (Prev.105.7bn yen)

- Earnings (Estimates based on FactSet data)

- Feb. 17: HIVE Digital Technologies (HIVE), pre-market, -$0.07

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 17: Jito to host an X Spaces session with Hush Protocol.

- Feb. 17: Basic Attention Token to host a Brave Talk session on X Spaces.

- Balancer is voting to swap a signer on the Emergency subDAO multisigs to improve operational responsiveness and security coverage. Voting ends Feb. 17.

- Unlocks

- Feb. 17: YZY (YZY) to unlock 17.24% of its circulating supply worth $20.84 million.

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 1.03% from 4 p.m. ET Monday at $68,131.79 (24hrs: -1.28%)

- ETH is down 1.11% at $1,976.32 (24hrs: -0.57%)

- CoinDesk 20 is down 1.28% at 1,978.56 (24hrs: -1.03%)

- Ether CESR Composite Staking Rate is up 6 bps at 2.84%

- BTC funding rate is at 0.002% (2.2119% annualized) on Binance

- DXY is up 0.21% at 97.12

- Gold futures are down 1.87% at $4,952.10

- Silver futures are down 4.19% at $74.70

- Nikkei 225 closed down 0.42% at 56,566.49

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 0.37% at 10,512.50

- Euro Stoxx 50 is up 0.15% at 5,987.94

- DJIA closed on Friday up 0.10% at 49,500.93

- S&P 500 closed up 0.05% at 6,836.17

- Nasdaq Composite closed down 0.22% at 22,546.67

- S&P/TSX Composite closed up 1.87% at 33,073.71

- S&P 40 Latin America closed on Monday down 0.64% at 3,717.23

- U.S. 10-Year Treasury rate is down 2.7 bps at 4.029%

- E-mini S&P 500 futures are down 0.20% at 6,836.50

- E-mini Nasdaq-100 futures are down 0.58% at 24,658.75

- E-mini Dow Jones Industrial Average Index futures are down 0.02% at 49,560.00

Bitcoin Stats

- BTC Dominance: 58.81% (-0.16%)

- Ether-bitcoin ratio: 0.02897 (-0.14%)

- Hashrate (seven-day moving average): 1,043 EH/s

- Hashprice (spot): $34.08

- Total fees: 2.22 BTC / $151,829

- CME Futures Open Interest: 118,450 BTC

- BTC priced in gold: 13.8 oz.

- BTC vs gold market cap: 4.53%

Technical Analysis

- The chart shows swings in bitcoin’s 30-day implied volatility index in candlestick format.

- Volatility has cooled significantly, reversing the early month pop to nearly 100%.

- The reversal indicates that panic has ebbed and traders are no longer frantically chasing options or hedging bets as in the first six days of the month.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $164.32 (+16.46%), -0.94% at $162.78 in pre-market

- Circle Internet (CRCL): closed at $60.04 (+6.02%), -0.35% at $59.83

- Galaxy Digital (GLXY): closed at $21.66 (+7.49%), -1.66% at $21.30

- Bullish (BLSH): closed at $31.73 (+0.06%), -0.66% at $31.52

- MARA Holdings (MARA): closed at $7.92 (+9.24%), -1.14% at $7.83

- Riot Platforms (RIOT): closed at $15.22 (+7.18%), -1.18% at $15.04

- Core Scientific (CORZ): closed at $17.84 (+2.06%)

- CleanSpark (CLSK): closed at $9.85 (+5.80%), -0.81% at $9.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $41.34 (+3.09%)

- Exodus Movement (EXOD): closed at $11.27 (+10.60%), -3.02% at $10.93

Crypto Treasury Companies

- Strategy (MSTR): closed at $133.88 (+8.85%), -1.60% at $131.74

- Strive (ASST): closed at $8.33 (+8.18%), -0.12% at $8.32

- SharpLink Gaming (SBET): closed at $6.85 (+4.74%), -2.34% at $6.69

- Upexi (UPXI): closed at $0.77 (+3.36%), +5.76% at $0.81

- Lite Strategy (LITS): closed at $1.12 (+8.74%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $15.1 million

- Cumulative net flows: $54.31 billion

- Total BTC holdings ~ 1.26 million

Spot ETH ETFs

- Daily net flow: $10.2 million

- Cumulative net flows: $11.67 billion

- Total ETH holdings ~ 5.71 million

Source: Farside Investors

While You Were Sleeping

Bitcoin remains under pressure near $68,000 even as panic ebbs (CoinDesk): Bitcoin is struggling to build any upward momentum, even as the key panic gauge pulls back from its early-month high and hints at renewed stability.

BofA survey flags dollar bearish bets at over a decade high. Here’s what it means for bitcoin (CoinDesk): Investors are most bearish on the dollar in over a decade, per Bank of America’s latest survey and that extreme bet could breed bitcoin volatility, just not the way crypto bulls have become used to.

Pound and bond yields Fall as weak data Cements rate-cut bets (Bloomberg): The pound is falling below $1.36 after data showed wage growth slowed more than expected to 4.2% in December, while unemployment ticked up.

US and Iran begin nuclear talks in Geneva as threat of war looms (Reuters): Iran’s supreme leader warned that U.S. attempts to depose his government would fail, as Washington and Tehran began nuclear talks amid a U.S. military buildup in the Middle East.

Crypto World

Bitcoin Hovers Around $67,000 as Crypto Markets Drift Lower

Experts say volatility is cooling as investors await macro catalysts.

Crypto markets edged lower on Tuesday, Feb. 17, as traders remain cautious ahead of new economic data.

Bitcoin (BTC) is trading at about $67,500, down 0.5% over the past 24 hours, while Ethereum (ETH) is up 1% at $1,995. Other large-cap tokens are largely unchanged, with BNB trading at $618, XRP at $1.48, and Solana (SOL) at $85.

Meanwhile, the total cryptocurrency market capitalization stood near $2.39 trillion, down about 0.5% on the day, while 24-hour trading volume was $93.1 billion, according to CoinGecko.

Among top gainers, MemeCore (M) rose about 9%, Pi Network (PI) climbed 6%, and World Liberty Financial (WLFI) advanced around 4.2%.

On the downside, Quant (QNT) fell 3.7%, Worldcoin (WLD) dropped 2.7%, and Sky (SKY) slipped 2.3%.

Paul Howard, senior director at Wincent, noted in comments shared with The Defiant that volatility has cooled after the Feb. 6 spike, with markets now in a holding pattern as institutions hedge rather than take new directional bets.

Howard added that prices are likely to remain rangebound until a clear catalyst emerges, such as major macro or policy headlines. In the meantime, investors are watching this week’s initial jobless claims report.

Liquidations and ETF Flows

Roughly $193.7 million in leveraged crypto positions were liquidated over the past 24 hours, according to CoinGlass. Long liquidations accounted for $126.2 million, while shorts made up $67.5 million.

Bitcoin accounted for $77 million, while Ethereum followed with $44.9 million. More than 83,000 traders were liquidated during the same period.

In the exchange-traded fund (ETF) space, Bitcoin spot ETFs recorded $15.2 million in inflows on Feb. 13, while Ethereum spot ETFs posted $10.26 million in inflows.

Moreover, XRP spot ETFs added $4.5 million on the day, and U.S. Solana spot ETFs recorded $1.57 million in inflows.

Elsewhere

In traditional markets, precious metals were also lower on the day. Gold traded around $4,900, down 2.2%, while silver fell 4% to $74.20. Platinum slipped 1.4% to $2,033, and palladium declined 2.6% to $1,710.

Geopolitics were also in focus as U.S. officials said talks with Iran in Geneva made progress, CNN reported. Negotiations over Russia’s war in Ukraine also continued, with delegations set to resume talks after the initial meetings conclude.

Meanwhile, in Washington, the Department of Homeland Security remained shut down amid an ongoing policy standoff. Experts say this adds to both political and economic uncertainty.

Crypto World

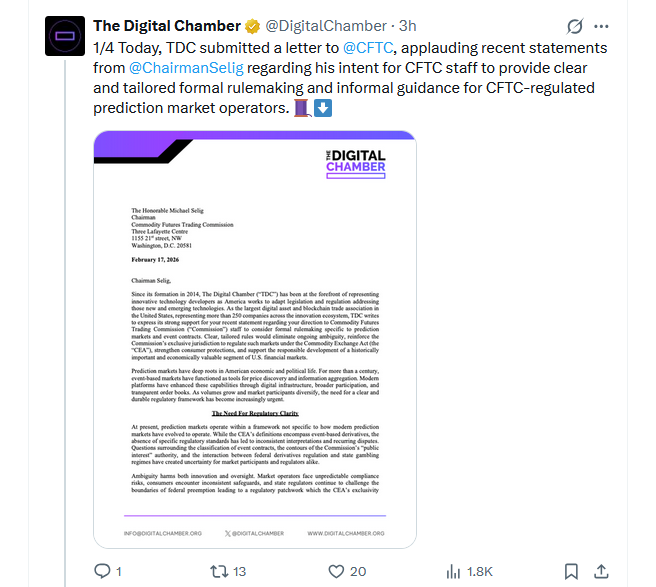

Prediction Markets Working Group Will Support Push For Regulatory Clarity

Blockchain advocacy group The Digital Chamber has launched a new unit focused on supporting prediction markets and helping gain regulatory clarity for the sector in the US.

In an announcement via X on Tuesday, The Digital Chamber unveiled the Prediction Markets Working Group, outlining a multi-year plan to bring clarity to what it called a “misunderstood segment of finance.”

The Digital Chamber said the first course of action was sending a letter to Commodity Futures Trading Commission (CFTC) chairman Mike Selig praising his efforts to maintain federal jurisdiction over prediction markets, while also calling for an end to regulation by enforcement.

“In our letter, we applauded Chair Selig’s recent statements regarding the intent for CFTC staff to provide tailored rulemaking and guidance for this rapidly growing segment of the financial and digital asset industries,” The Digital Chamber said.

“For too long, operators in this space have navigated a maze of regulatory ambiguity including unclear overlaps between federal and state regulators,” it added.

Moving forward, the group plans to continue engaging with the CFTC, develop policy principles, submit policy recommendations, publish research and build a coalition of industry stakeholders and participants.

It also mentioned “participating in litigation” via friend-of-the-court briefings to educate courts on what it deems the “CFTC’s historic regulatory exclusivity” over the sector.

Prediction markets are heading to court

The move comes amid intense scrutiny of the sector from state governments and regulators.

Kalshi, one of the leading prediction market platforms, was hit with a civil enforcement action by the Nevada Gaming Control Board on Tuesday. The gaming board is calling for an injunction to stop Kalshi from offering “unlicensed wagering” in the state.

Both Kalshi and competitor Polymarket have seen multiple state regulators push to stop them from offering markets such as sports contracts in their respective states, arguing that they are offering unlicensed gambling products.

Last week, Polymarket filed a federal lawsuit against the state of Massachusetts to preemptively block any potential enforcement action, arguing that the CFTC has primary oversight over the sector, not state governments.

Related: Prediction markets should become hedging platforms, says Buterin

The CFTC chair has also been echoing such sentiments recently, urging state governments to respect the CFTC’s authority and oversight over the sector or risk facing them in court.

“Prediction markets aren’t new — the CFTC has regulated these markets for over two decades,” Selig emphasized in a video posted to X on Monday.

Responding to Selig on Tuesday, Utah Governor Spencer Cox welcomed any possible legal stoushes with the CFTC, labeling prediction markets as a form of gambling, which is “destroying the lives” of Americans.

“Mike, I appreciate you attempting this with a straight face, but I don’t remember the CFTC having authority over the ‘derivative market’ of LeBron James rebounds. These prediction markets you are breathlessly defending are gambling—pure and simple.”

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Italian banking giant Intesa Sanapolo discloses near $100 million bitcoin ETF holdings, along with Strategy hedge

Italian banking giant Intesa Sanpaolo disclosed $96 million in bitcoin ETF holdings and a substantial options position tied to Strategy shares, along with smaller crypto-linked exposure.

In a 13F filing for the quarter ending December 2025, the bank lists five spot bitcoin ETF positions, including $72.6 million in the ARK 21Shares Bitcoin ETF and $23.4 million in the iShares Bitcoin Trust, for a total exposure of just over $96 million.

It also includes a $4.3 million stake in the Bitwise Solana Staking ETF, which tracks the value of solana (SOL) and captures staking rewards.

The bank also posted a large put option position on Strategy, the largest corporate holder of bitcoin with 714,644 BTC on its balance sheet, valued at approximately $184.6 million.

That put option gives the firm the opportunity, but not the obligation, to sell MSTR shares at a specific price in the future. The position, coupled with the directionally long position on bitcoin ETFs, could reflect a trade capitalizing on the company trading above the value of its BTC holdings, as measured by the multiple of net asset value (mNAV), which compares enterprise value to bitcoin value.

Strategy was trading at 2.9 mNAV at one point and is now at 1.21 mNAV, according to its website. That gap closing would see the position make a profit as the stock price falls back to the level of its bitcoin holdings.

The filing also shows equity stakes in crypto-linked companies, including Coinbase, Robinhood, BitMine, and ETHZilla. These are minor positions, with the largest one of around $4.4 million being on Circle.

The filing uses the “DFND” (Shared-Defined) designation, indicating that investment decisions were made jointly by Intesa Sanpaolo S.p.A. and affiliated asset managers. Whether those asset managers are Intesa’s own trading desk or institutional clients remains unclear.

This structure is common when the parent bank exercises oversight or centralized strategy while subsidiaries execute trades. CoinDesk has reached out to Intesa Sanapolo for comment but hasn’t heard back at the time of writing.

The bank’s U.S. wealth management arm filed a separate 13F with no digital asset exposure.

Early last year, Intesa Sanapolo bought 11 bitcoin for over $1 million. The firm has had a proprietary trading desk in place for years, which also handles cryptocurrency trading.

Crypto World

Senate Asked to Not Axe Crypto Developer Protection Bill

Crypto industry lobby Coin Center has sent a letter to the US Senate Banking Committee urging it to follow through with a bill that seeks to prevent well-intended crypto developers from being prosecuted.

The Blockchain Regulatory Certainty Act (BRCA) was first introduced by House Representative Tom Emmer in September 2018, with a new version of the bill written last month by Senators Cynthia Lummis and Ron Wyden to clarify that software developers and infrastructure providers who do not control user funds are not money transmitters under federal law.

Coin Center policy director Jason Somensatto’s letter to the Senate Banking Committee, which he shared on Tuesday, further stated that blockchain innovation cannot thrive in the US when developers face constant threats of prosecution and that they deserve the same legal protections as ordinary internet developers.

“This is the same type of activity conducted every day by internet service providers, cloud hosting services, router manufacturers, browser developers, and email providers,” he said, adding that “we do not threaten those actors with prison when a criminal uses the internet, sends an email, routes traffic, or uploads files.”

“The same principle must apply to blockchain developers.”

Somensatto added that the “BRCA ensures that the next Satoshi Nakamoto, Vitalik Buterin, or Hayden Adams is able to develop the very systems that a market structure bill is designed to promote and protect.”

Coin Center is a Washington, DC-based non-profit think tank and advocacy center that focuses on public policy issues related to crypto and decentralized technologies.

Several crypto developers convicted in the US last year

Its push for crypto developer protections to coincide with the CLARITY Act comes amid several high-profile convictions of crypto developers last year.

Those convictions include Tornado Cash developer Roman Storm and Samourai Wallet founders Keonne Rodriguez and Will Lonergan Hill.

Related: When will crypto’s CLARITY Act framework pass in the US Senate?

All three were convicted of conspiracy to operate an unlicensed money-transmitting business in 2025. Rodriguez and Lonergan Hill were sentenced to five years and four years in prison, respectively, in November, while Storm is awaiting his sentencing date.

Weakening BRCA provisions could deter developers

The Senate Banking Committee is still reviewing the latest BRCA draft. It has not been marked up or voted on yet.

Somensatto said removing or even weakening provisions of the BRCA would lead to legal uncertainty for crypto developers, potentially deterring well-intended developers from operating in the US and pushing them offshore.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

company added 2,486 bitcoin last week

Strategy (MSTR) continued with its customary bitcoin purchases in the last week, adding 2,486 BTC for $168.4 million.

The company’s holdings are now 717,131 bitcoin acquired for $54.52 billion, or an average of $76,027 per coin. Bitcoin’s current price sits at $68,000, putting the company at a loss of about $8,000 per coin, or a total of about $5.7 billion.

Last week’s buys were funded via $90.5 million in common stock sales and $78.4 million in sales of the company’s STRC preferred series of stock, according to a Tuesday morning filing.

MSTR shares are lower by 3.2% in premarket trading and down more than 60% year-over-year.

Crypto World

Elemental Royalty Corporation Offers Dividends in Tether Gold

Elemental Royalty Corporation becomes the first publicly listed gold company to offer dividends in Tether Gold (XAU₮)

Elemental Royalty Corporation plans to offer dividends in Tether Gold (XAU₮), making it the first publicly listed gold company to embrace this financial model. According to the company, this move showcases the potential of tokenized assets in modern finance by integrating traditional gold with digital financial infrastructure.

Tether Gold (XAU₮) is a digital asset representing ownership of one troy ounce of gold on a London Good Delivery bar. It is available as an ERC-20 token on Ethereum and a TRC20 token on TRON, bridging the gap between conventional gold value and digital finance.

“Gold has always been one of the most trusted stores of value in the world, yet integrating it directly into modern financial distribution models has been difficult,” said Paolo Ardoino, CEO of Tether. “Using XAU₮ for shareholder dividends changes that dynamic completely. This marks a major step forward for the gold industry and shows how tokenized assets can unlock new financial models that were previously out of reach.”

Elemental Royalty Corporation specializes in acquiring royalties from gold mining companies, providing investors with exposure to gold without the direct risks associated with mining. This new dividend initiative is expected to offer investors more direct exposure to gold, rather than cash equivalents.

This article was generated with the assistance of AI workflows.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech24 hours ago

Tech24 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 hours ago

Business4 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video19 hours ago

Video19 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World18 hours ago

Crypto World18 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery