Business

ETMarkets PMS Talk | Gold allocation and dynamic hedging helped QAW beat Nifty in January selloff: Rishabh Nahar of Qode Advisors

In this edition of ETMarkets PMS Talk, Rishabh Nahar, Partner and Fund Manager at Qode Advisors, explains how a higher allocation to gold and a dynamically managed derivative hedge helped cushion downside risk and generate alpha.

He also shares insights into the strategy’s asset allocation framework, risk-adjusted return focus, and why an “all weather” approach may be particularly relevant in today’s uncertain macro environment. Edited Excerpts –

Q) QAW delivered nearly 7% return in January 2026 versus a 3% decline in the Nifty50. What led to the outperformance?

A) The outperformance in January was primarily driven by two factors: our higher allocation to gold and the effective deployment of dynamic derivative hedges.

Gold acted as a strong diversifier during the equity drawdown, while our hedging framework protected the equity portion of the portfolio during market weakness.

The combination of asset diversification and tactical hedging enabled QAW to deliver positive returns despite a challenging equity environment.

Q) QAW positions itself as a diversified, low-volatility strategy with a derivative hedge. How is the hedge structured and how dynamic is it across cycles?

A) The derivative hedge is designed to protect the equity component of the portfolio during medium- to long-term downtrends. It is not static – it adjusts dynamically based on market direction and trend signals.

When markets exhibit sustained weakness, hedges are activated to reduce downside risk. Conversely, during strong uptrends, hedges are scaled down or removed to avoid unnecessary cost drag.

This dynamic structure allows us to balance protection and participation efficiently across market cycles.

Q) How do you determine asset allocation between equity, gold, and cash?

A) The asset allocation framework is the result of rigorous testing and correlation analysis across asset classes. Gold and equities historically exhibit complementary behavior, especially during periods of stress.

Within equities, we blend momentum and low-volatility strategies, which themselves tend to complement each other across market regimes.

While the core allocation is strategic and not frequently altered, we conduct regular portfolio reviews and may make measured adjustments based on prevailing market conditions and macro positioning.

Q) Since inception in November 2024, what has been the biggest contributor to alpha – asset allocation, stock selection, or derivatives?

A) The largest contributor to alpha so far has been asset allocation – particularly our higher allocation to gold – along with the timely and effective execution of our derivative hedges.

The interplay between diversified asset allocation and well-calibrated hedging has been instrumental in generating excess returns.

Q) The Sharpe ratio stands at 1.59 versus 0.03 for the benchmark. How sustainable is this risk-adjusted outperformance?

A) The portfolio is specifically designed to optimize risk-adjusted returns rather than maximize raw returns. A higher Sharpe ratio is a structural objective of the strategy.

By combining uncorrelated assets and disciplined hedging, we aim to deliver stable and consistent performance across market cycles. While short-term metrics can fluctuate, the design philosophy of the portfolio supports sustainable risk-adjusted outperformance over the long term.

Q) With standard deviation slightly higher than the Nifty (13.42% vs 12.95%), how do you define “low volatility” in this context?

A) While our standard deviation has been comparable to the Nifty over the past year and since inception, an also meaningful measure is drawdown.

QAW has experienced significantly lower maximum drawdowns compared to the Nifty 50 during the same period. Over longer time frames, we expect volatility to moderate further.

The strategy’s objective is not only to minimize short-term fluctuations, but also to reduce downside severity and improve return consistency over time.

Q) How actively do you rebalance between equity and gold based on macro signals?

A) The portfolio undergoes a structured rebalance annually to maintain strategic alignment. However, we continuously monitor macroeconomic signals and market conditions.

If warranted, we may make measured tactical adjustments during the year, though changes are incremental rather than aggressive. The framework prioritizes stability while remaining responsive to evolving macro trends.

Q) In the current macro environment, what risks justify an “all weather” approach?

A) The current environment is characterized by geopolitical uncertainty, inflationary pressures, shifting interest rate cycles, and periodic equity volatility.

An “All Weather” approach is designed to navigate such uncertainties without requiring precise market timing.

While the strategy may not capture the full upside during strong equity bull runs due to diversification into gold and hedges, it aims to deliver smoother and more consistent returns across cycles – which is particularly valuable in uncertain macro conditions.

Q) Who is the ideal investor for QAW?

A) QAW is suitable for investors seeking stability, consistency, and lower drawdowns in their portfolios.

It can serve equity-heavy HNIs looking to smooth overall portfolio volatility, as well as conservative investors who want equity participation with downside protection.

In fact, most diversified portfolios can benefit from some allocation to strategies like QAW, given its focus on uncorrelated return streams and disciplined risk management.

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)

Business

Thailand Futures Exchange announces TFEX Best Award 2025 for outstanding derivatives brokers

TFEX announced the “TFEX Best Award 2025” to recognize broker excellence. Awards went to MTSGF, PI, KGI, KKPS, YUANTA, CAF, and INVX for outstanding performance and market contributions.

KEY POINTS

- TFEX announced the “TFEX Best Award 2025”, recognizing member companies for excellence in the areas of investor base expansion, market maker performance and active trading.

- Seven awarded brokers were MTSGF, PI, KGI, KKPS, YUANTA, CAF, and INVX

BANGKOK, February 16, 2026 – Thailand Futures Exchange pcl (TFEX) announced the recipients of the TFEX Best Award 2025, an annual recognition program honoring member companies for their excellence and outstanding performance across key areas of the derivatives market. TFEX Managing Director Triwit Wangvorawudhi emphasized that the strong cooperation and continued support from all members have been instrumental in driving the development and growth of Thailand’s derivatives market.

The “TFEX Best Award of Honor 2025” was presented to brokers that have demonstrated exceptional and consistent excellence for at least three consecutive years. The following companies received this distinction:

- MTS Capital Co., Ltd. (MTSGF) – Market Maker Best Performance

- Pi Securities pcl (PI) – Active Agent

- KGI Securities (Thailand) pcl (KGI) – Most Active House and Active Prop-Trading

For the “Best of the Year Award 2025”, the following brokers were recognized for their outstanding achievements based on trading performance and investor base expansion in each category:

- Kiatnakin Phatra Securities pcl (KKPS) – Most Active House Award

- Yuanta Securities (Thailand) Co., Ltd. (YUANTA) – Active Agent Award

- Classic Ausiris Investment Advisory Securities Co., Ltd. (CAF) – Active Prop-Trading Award

- InnovestX Securities Co., Ltd. (INVX) – Popular Agent Award

- KGI Securities (Thailand) pcl (KGI) – Market Maker Best Performance Award

Source : Thailand Futures Exchange announces TFEX Best Award 2025 for outstanding derivatives brokers

Other People are Reading

Business

City of Perth policy limits councillor’s emails

The City of Perth has started to implement suggestions from the psychosocial risk assessment, including addressing a councillor’s “inappropriate communication to staff”.

Business

Dilip Buildcon shares rally 4% as lowest bidder for Rs 702 crore Gujarat flood control project

The company has been declared the L-1 bidder for a tender issued by the Narmada Water Resources, Water Supply & Kalpasar Department, Government of Gujarat. The project entails the construction of a flood protection embankment along the Narmada River in Bharuch district.

Execution will follow an EPC (Engineering, Procurement, and Construction) model, with a total project cost of Rs 702 crore, excluding GST. The project is expected to be completed over a 24-month period.

This initiative forms part of Gujarat’s broader efforts to enhance flood protection infrastructure. Being a domestic EPC contract, it is a standard engineering and construction project with no involvement of the company’s promoters or promoter group in the awarding authority, and no related-party transactions are associated with this order.

On Tuesday, Dilip Buildcon shares closed at Rs 434.95 on the NSE, registering a modest gain of 1.02% for the day.

In terms of valuation, the stock price-to-earnings (P/E) ratio of 5.01, a price-to-sales (P/S) ratio of 0.62, and the price-to-book (P/B) ratio of 1.34. These metrics suggest that the market is valuing the company at relatively low multiples compared to its earnings, sales, and book value.

From a technical perspective, the daily Relative Strength Index (RSI) stood at 39.7. Since an RSI below 30 generally indicates that a stock is oversold and above 70 signals overbought conditions, the current level points to a neutral-to-slightly-oversold territory. Additionally, the stock is trading below all eight of its simple moving averages (SMAs), suggesting short-term bearish momentum and caution for traders relying on trend-following strategies.Looking at recent financial performance, Dilip Buildcon reported a revenue of Rs 2,308 crore in the December 2025 quarter, which represents a 12.4% decline year-on-year. However, the company’s net profit saw a substantial increase of 619.9% YoY, reaching Rs 830 crore, highlighting strong profitability improvements despite the dip in top-line revenue.

The company’s strong order wins and robust profitability in the last quarter could keep investor interest high, despite some short-term technical weakness in stock movement.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)

Business

Alcoa to pay "unprecedented" $55m enforceable undertaking

Alcoa Australia has made an unprecedented commitment to pay $55 million to support remediation of its mine sites as it strives for environmental approval for its South West operations.

Business

PSU banks and capex stocks leading market gains: Dipan Mehta

PSU Banks Gain Ground

“Plenty happening within Indian markets. PSU banks are doing very well for themselves. In fact, the Nifty Bank has outperformed in the last couple of days,” Mehta said in an interview to ET Now. He highlighted that PSU banks are closing a multi-decade gap with private sector banks in both valuations and performance.

“There was a time when private sector banks were gaining market share. Their growth rates were far superior, anywhere from double the growth rates of the industry, and the PSU banks’ NPA levels were well below. But now many PSU banks are giving private sector banks a run for their money, and investors recognize that. Balance sheet qualities are far better, they are back into growth mode, and that is reflected in the stock prices. Still, there is a lot of gap between the two segments within the banking industry,” he added.

Mehta believes the rerating of PSU banks is likely to continue, but cautions that sustaining current NIMs in an increasingly competitive banking sector will be challenging.

Capital Goods Sector on an Upward Trajectory

On capital goods companies like BHEL, Mehta emphasized the significance of execution. “Execution is the biggest risk in capital goods manufacturing companies, and sometimes execution is not only at their end but also at the customer end because sometimes the customer is not ready to let the project go ahead.”

Despite execution risks, Mehta sees strong potential due to robust order books and capex cycles. “We are in a nice upward cycle as far as capex is concerned, and across the board, capital goods, engineering, procurement, and construction companies are sitting on record order book positions, great earning visibility for the next two to three years, and reasonable valuations.” He also favors companies with overseas orders such as L&T and KEC International, which benefit from diversified revenue streams.

FMCG Leadership and Investment Caution

Mehta expressed caution on FMCG stocks like Dabur. “Frankly, Dabur has just gone off the grid, and so is the case with a lot of FMCG stocks. We just do not track them anymore because, for us, the benchmark to evaluate a company is at least it should grow more than the nominal GDP growth rate, which is 11% or thereabouts. If a business is not growing topline growth of more than 11%, it just kind of falls through our grid. I do not have any view on Dabur or FMCG for that matter, or rather I have a view, and that is negative. Investors who are there in this stock need to diversify out of FMCG.”Infrastructure and Engineering Opportunities

Mehta highlighted the enduring strength of companies with large and diversified order books. “You must have a large proportion of your portfolio in all these engineering, procurement, and construction companies, and the best bet still remains L&T. It is hitting an all-time high, and as I said earlier, we prefer companies which have a diversified order base. L&T has almost 40-50% revenues on order books from outside India, and those order books are at reasonable margins. Certain projects within India can only be executed by L&T, putting them in a different league altogether.”

Other firms of interest include VA Tech Wabag, focused on water projects, as well as various power equipment companies covering solar, wind, and electric distribution equipment.

Wires and Cable Sector

On the wires and cable space, Mehta noted strong quarterly performance despite rising copper prices. “The numbers coming from the cable industry certainly seem to surprise us quarter after quarter. Despite increases in copper prices, they have been able to pass on the price increases and improve their margins. A lot of these companies have built solid brands, which is difficult for new entrants to replicate. The industry is doing well because of investment in renewable energy, which requires more transmission and copper cables, and also due to industrialization and data centres, all of which improve demand for cables.”

However, he cautioned on valuations. “I would remain invested, only reason it is not a buy for us is because the valuations are very rich. They are trading anywhere from 40 to 60 times, which is expensive considering it is largely a B2B business and there is no real product differentiation over there.”

Business

McCormick & Company, Incorporated (MKC) Presents at Consumer Analyst Group of New York Conference 2026 – Slideshow

McCormick & Company, Incorporated (MKC) Presents at Consumer Analyst Group of New York Conference 2026 – Slideshow

Business

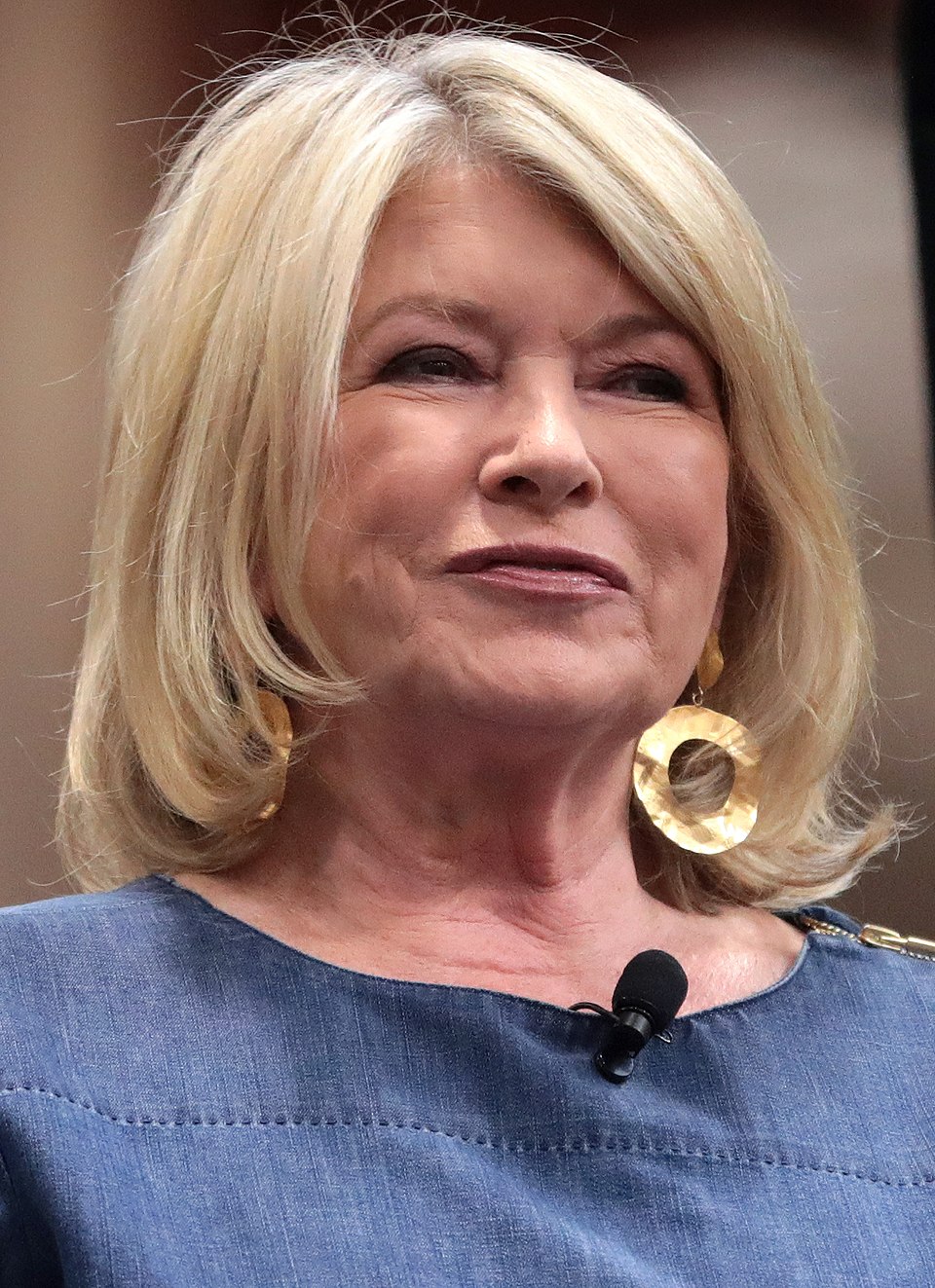

The Timeless Lifestyle Icon Still Thriving at 84

At 84, Martha Stewart remains one of America’s most influential lifestyle authorities, blending timeless domestic expertise with modern ventures in gardening, skincare and media. From her early days as a stockbroker to her current role as Chief Gardening Officer for Scotts Miracle-Gro and her upcoming coverage of the 2026 Winter Olympics in Milan, Stewart continues to captivate audiences with her perfectionist approach to living well.

Here are 10 key things to know about the entrepreneur, author and television personality whose brand has shaped generations of home cooks, gardeners and entertainers.

- Born to Build a Legacy Martha Helen Kostyra was born Aug. 3, 1941, in Jersey City, New Jersey, the second of six children in a Polish-American family. Raised in Nutley, New Jersey, she learned cooking, sewing, canning and gardening from her mother and father, skills that became the foundation of her empire. A straight-A student, she earned a partial scholarship to Barnard College, where she studied history and architectural history while modeling to cover expenses.

- From Wall Street to Homemaking After graduating, Stewart worked as a stockbroker on Wall Street, gaining sharp business acumen. In the 1970s, she shifted focus, launching a catering business in Westport, Connecticut, that emphasized fresh, elegant entertaining. Her first book, “Entertaining,” published in 1982, became a bestseller and launched her media career.

- America’s First Self-Made Female Billionaire Stewart built Martha Stewart Living Omnimedia into a powerhouse, encompassing magazines, television shows, books, merchandise and licensing deals. She became the first self-made female billionaire in the United States, though her net worth fluctuated after legal challenges. Her brand remains synonymous with aspirational domesticity.

- A Landmark Legal Battle and Comeback In 2004, Stewart served five months in federal prison following a conviction for obstruction of justice and lying to investigators in an insider trading case involving ImClone stock. She never wavered publicly, emerging stronger with new ventures and maintaining her audience’s loyalty through resilience and transparency.

- Enduring Media Presence Stewart hosted “Martha Stewart Living” and other programs, earning multiple Daytime Emmy Awards. She has authored dozens of bestselling books on cooking, crafts and holidays. Today, she remains active on social media, sharing glimpses of her daily life, from farm animals to travel, with millions of followers.

- Gardening as Lifelong Passion and New Role A dedicated gardener, Stewart tends extensive gardens at her Bedford, New York, estate and elsewhere. In 2025, Scotts Miracle-Gro named her Chief Gardening Officer. In a February 2026 interview with People, she revealed prizing dendrobium orchids more than 50 years old, calling gardening her ultimate self-care ritual. She recently announced plans for “Martha Stewart’s Gardening Handbook.”

- Skincare Venture and Ageless Appearance In recent years, Stewart launched Elm Biosciences, a science-backed skincare line with dermatologist Dr. Dhaval Bhanusali. She frequently addresses rumors about her youthful look, emphasizing routines of fitness, diet and skincare. In February 2026 interviews, she detailed getting only 3-4 hours of sleep nightly yet maintaining energy through green juices, exercise and disciplined habits.

- Travel and Adventure at 84 Stewart embraces a “maximalist” travel style, recently sharing on Instagram her packing hack: clothes on hangers in plastic bags to prevent wrinkles during trips to Milan. Ahead of the 2026 Winter Olympics, where she serves as a special correspondent for NBC alongside Snoop Dogg, she joked about seeking an “Italian prince” while covering figure skating and other events.

- Advocacy and Personal Views Stewart has spoken on issues including immigration, expressing concern during Super Bowl weekend interviews in February 2026. An animal lover with horses, dogs and other pets, she shares winter enrichment activities for her stable animals on her blog. She also promotes philanthropy through the Martha Stewart Center for Living at Mount Sinai.

- Unstoppable at Every Age Defying expectations, Stewart appeared on the cover of Sports Illustrated Swimsuit Issue at 81 in 2023. In 2026, she continues innovating — from hosting events for her skincare line to offering hosting tips at Pepsi-sponsored gatherings. Her Instagram and blog posts celebrate everything from Valentine’s Day crafts to silver polishing, proving her influence endures.

As Stewart prepares for more Olympic coverage and seasonal projects, her blend of tradition and reinvention keeps her relevant in an ever-changing world.

Business

Friday flights now cheapest day to book and fly, new Expedia report finds

Travelers at El Paso, Texas’ airport called it a “shock” that the Federal Aviation Administration closed the city airspace Wednesday, before lifting the travel restrictions. (KFOX)

The days of booking your flights six months in advance to save a buck are officially over.

According to Expedia’s 2026 Air Hacks Report, the early bird is now getting stuck with the bill, while a new wave of Friday flyers is reaping the rewards.

As domestic airfares tick up 3% this year, a massive shift in travel data reveals that Friday has dethroned the weekend as the cheapest day to both book and fly — saving savvy travelers hundreds on everything from quick trips to Las Vegas to international treks to Tokyo.

“Flight trends are constantly evolving and with Friday emerging as both the busiest day for air travel and also the most affordable, this leads us to believe it is a shift in business class behaviors driving this,” Expedia told Fox News Digital in a statement. “This opens up a great opportunity for leisure travelers [though] to start their weekend trips a day earlier, with Friday more affordable than Saturday departures.”

A NEW WAY OF COMMUTING IS CLOSER TO TAKING OFF IN THE U.S.

The report found that booking a flight on a Friday saves 3% versus booking during the weekend rush. Meanwhile, flying on a Friday versus Sunday can save travelers up to 8%.

The departure gate of Terminal 1 at JFK International Airport is seen in New York on August 15, 2025. (Getty Images)

August reigns as the most affordable month to fly, saving airline travelers an average of $120 per ticket – 29% cheaper than flying at the same time in December. Flights to Morelia, Mexico, Tokyo, Japan and Honduras are seeing 30%+ year-over-year price declines.

“This is the second year in a row where August has been the most affordable month to fly,” Expedia said. “It seems to be here to stay, so that offers American vacationers a great opportunity to take an affordable, big annual vacation during peak season.”

Domestic first-class fares have plummeted 27% year-over-year, as the report also signals a “micro-cation” boom with 25% of Gen Z and Millennials skipping hotels entirely and opting for 24-hour extreme day trips.

“Business travelers head home earlier in the week these days, so new opportunities are opening up for leisure travelers to save by choosing smarter travel days, like Friday for the best prices or Tuesday for fewer crowds,” Expedia Group Brands public relations head Melanie Fish said in a press release.

Evercore ISI senior managing director Mark Mahaney joins ‘Varney & Co.’ to break down why he’s upgrading Airbnb and Expedia while downgrading Pinterest amid growing AI competition and slowing growth.

“With a year of data from Expedia’s Flight Deals now in – which highlights routes and dates priced at least 20% lower than the norm – July and October are emerging as two of the best months to travel to secure these high-quality fares,” she continued.

Additionally, the online travel agency broke down how to time the flying market and when to book as opposed to when to fly. The alleged “Goldilocks” booking window opens for domestic flights 15 to 30 days out and saves $130 compared to booking six months earlier.

If you’re trying to avoid crowds altogether, per Expedia’s data, Tuesday is the least busy day of the week to fly — with the slowest travel dates in 2026 predicted to be Feb. 25, March 4 and Nov. 18. On the other hand, the busiest dates to fly this year are predicted to be May 22, July 3 and Aug. 29.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Motley Fool Asset Management portfolio manager Shelby McFaddin discusses how rising U.S.-Canada tensions could impact travel demand and which travel stock she favors right now on ‘The Claman Countdown.’

“September is still the second most affordable month, so we may see ‘big vacations’ extend into September for those budget-conscious travelers. With December being the most expensive month to fly, that could also lead travelers to shifting their trip types during that month to focus more on domestic stays, road trips or breaks close to home, versus hopping on a plane,” Expedia said.

Airports including Fort Lauderdale, Las Vegas and Orlando were hailed as the affordability kings for having ticket prices 25% below the national average. At Washington Dulles, San Francisco and New York-JFK, you could break your budget by spending 25% or more than national average prices.

Business

ECB’s Lagarde focused on job, not taken decision on leaving, ECB says

ECB’s Lagarde focused on job, not taken decision on leaving, ECB says

Business

Hottest housing markets shift to affordable Midwest, South cities

The Corcoran Group broker Noble Black joins ‘Varney & Co.’ to discuss homebuilder confidence, mortgage rates and Congress’ actions to address the housing crisis.

America’s hottest housing markets aren’t in flashy coastal cities — they’re in communities across the Midwest and South.

Even as the national market cools, areas in states like Missouri and Kentucky are seeing double-digit price growth while remaining within reach for middle-income buyers.

Recent data from the National Association of Realtors (NAR) ranked the top five single-family metro areas with the highest home price appreciation last quarter.

Missouri’s Cape Girardeau held the top spot with a nearly 20% yearly increase and a $275,000 median home price, followed by Cumberland, Maryland, up 17.1% with a $174,900 median home price; Owensboro, Kentucky, up 15% with a $264,000 median home price; Anniston-Oxford, Alabama, with a 14.9% increase and $175,103 median home price; and Mobile, Alabama, which appreciated 13.7% at a median home price of $216,235.

‘WALL STREET TO Y’ALL STREET’: WHY AMERICA’S WEALTHY TRADES CITY LUXURY FOR ACRES OF TEXAS FREEDOM

The numbers signal strength in smaller, more affordable pockets of American cities and that housing opportunities remain highest outside expensive urban cores. Migration toward lower-cost regions also continues to shape market dynamics.

A for sale sign sits in front of a vacant lot near completed homes in a Missouri subdivision. (Getty Images)

In contrast, the bottom five single-family metro areas that had the slowest price appreciation were Elmira, New York; Farmington, New Mexico; Boulder, Colorado; Pueblo, Colorado; and Cleveland, Tennessee, with NAR noting that some overheated markets are correcting and higher-cost Western markets show pressure.

Additionally, America’s national median home prices rose 1.2% year-over-year to $414,900, signaling market resilience despite economic headwinds, while monthly mortgage payments fell 5.7% – to $2,057 – from the previous year.

‘The Big Money Show’ panel discusses Congress’s plan to tackle the nation’s housing crisis.

The housing market has cooled this winter with the annual pace of home price growth easing to levels unseen since the nation was recovering from the Great Recession. While some areas continue to see strong price growth, others, like Hawaii, California, Texas and Florida, have seen notable declines.

As of last week, mortgage affordability was at a four-year high after rates fell in January, with the White House touting President Donald Trump’s economic policies and maintaining his promise to “unlock” the opportunity of homeownership for American families.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

PMG Affordable principal Dan Coakley speaks to Fox News Digital about what it may take to make housing affordable again across the country.

As of Tuesday afternoon, the 30-year fixed-rate mortgage averaged 6.09%, down from last week’s 6.11%, Freddie Mac reports. This time last year, the 30-year rate was at 6.87%.

“Joe Biden’s inflation crisis crushed the dream of homeownership for millions of Americans — but President Trump is bringing it back,” White House press secretary Karoline Leavitt previously told Fox News Digital. “Thanks to the President’s successful economic policies, unnecessary red tape is being cut at a historic pace, borrowing costs are easing, and income growth is outpacing home price gains — finally making housing more affordable again.”

FOX Business’ Eric Revell and Brooke Singman contributed to this report.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business7 hours ago

Business7 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video22 hours ago

Video22 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World21 hours ago

Crypto World21 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

Business6 days ago

Business6 days agoAn Activist Investor Enters Wall Street Banks’ Cozy Club