Crypto World

Trump’s Fed chair nominee’s return sparks bitcoin jitters over rates, balance sheet cuts

The market was initially jolted by the sudden news of President Donald Trump naming Kevin Warsh as his choice for the next Federal Reserve chair, ending a month-long saga of guessing game.

The U.S. dollar rallied, bitcoin fell, and the equity market became volatile when the news broke; while the market might have stabilized a bit for now, the uncertainty is still gripping the traders across all asset classes.

So who is Kevin Warsh, and more importantly, how will his leadership shape the future of monetary policy and crypto?

Former Fed governor

Kevin Maxwell Warsh is a former U.S. Federal Reserve governor who served from 2006 to 2011 and played a senior role during the 2008 global financial crisis, including acting as a key liaison between the Fed and financial markets.

Before joining the central bank, Warsh worked at Morgan Stanley and served in the George W. Bush administration as Special Assistant to the President for Economic Policy and Executive Secretary of the National Economic Council, giving him experience spanning Wall Street and Washington.

After leaving the Fed, Warsh became a visiting fellow at Stanford University’s Hoover Institution, where he has written extensively on monetary policy, central bank credibility and what he views as the long-term risks of prolonged balance-sheet expansion by central banks.

It’s worth noting here that while the nomination spooked the market and bitcoin, Federal Reserve Chair Jerome Powell — whose second four-year term expires on May 15, 2026 — is eligible to remain on the Fed’s Board of Governors until Jan. 31, 2028. Warsh must still be confirmed by the Senate before assuming the role, but a vacancy created by Governor Stephen Miran’s expiring temporary term on Jan. 31, 2026 could allow him to join the board ahead of May.

The bitcoin view

Warsh’s appointment has drawn particular scrutiny from digital-asset investors — at least initially — given his long-held views on monetary discipline and skepticism toward bitcoin’s role as money.

While the concern is not with Warsh personally, his background has led many market participants to view him as potentially bearish for bitcoin and other risk assets. He is broadly viewed as favoring monetary discipline, higher real rates, and a smaller Fed balance sheet, all of which oppose a liquidity-heavy environment that has historically backed risk assets.

So what are his ties to crypto?

First, let’s take a look at what he said about bitcoin previously.

In public commentary in 2015, Warsh approached bitcoin and cryptocurrencies primarily through a monetary-policy lens, expressing skepticism about their use as stable mediums of exchange while acknowledging the potential of blockchain technology.

“The underlying technology in that white paper, it’s just software,” Warsh said during a video conversation with Stanley Drukenmiller. “It’s just the newest, coolest software that will provide us the opportunity to do things we could never have done before.”

While acknowledging all software can be used for good and for evil, Warsh said that by building it here in the U.S., that gives us the opportunity to be more productive and create something very special over the next decade…”

At one point in the conversation with the billionaire hedge fund manager and his former colleague, Warsh told Drukenmiller, “You made reference to Bitcoin and I thought I heard a little condescension in your voice, that people are buying bitcoin.”

He went on to make a case in favour of bitcoin, saying “it could provide market discipline, it could tell the world that things need to be fixed.” He also said he thinks of “bitcoin as a lot of things, but certainly with every passing day it’s getting new life as an alternative currency.”

While the interview is from 2015, when bitcoin was still seen as dangerous and mostly used for illegal activities, a lot has changed in the last eleven years. Now, the U.S. has a pro-crypto government, there is legislation in the works to create a legal framework for digital assets, and, most importantly, crypto has become too big to ignore, even for Wall Street giants.

The potential future Fed chair has argued that central banks must engage with digital money, including considering a U.S. central bank digital currency (CBDC) to counter bitcoin and rival China’s digital yuan. Worth noting that CBDC is a hotly debated topic in the crypto community due to privacy concerns.

He also said cryptocurrency was nothing more than “software pretending to be money.” He categorized cryptocurrencies as a symptom of “speculative excess” driven by loose monetary policy and argued that Bitcoin’s rise was largely a derivative of the “global dollar flood” and that, as liquidity tightens, such assets are likely to lose their appeal.

‘Not hostile to crypto’

Warsh also had close ties with crypto in general.

Warsh has drawn attention in crypto circles for his early involvement with digital-asset firms, including Bitwise Asset Management, a crypto index fund provider. Warsh was an investor in a cryptocurrency project called Basis, an algorithmic central bank. He also served as an adviser for Electric Capital, a VC firm focused on crypto, blockchain and fintech.

Market analysts covering crypto have said Warsh’s policy outlook, which emphasizes institutional credibility and monetary discipline, could matter for liquidity conditions affecting risk assets such as bitcoin.

Warsh is not a crypto evangelist, but has expressed a nuanced, pragmatic stance on innovation and regulation. Analysts view him as cautious about private crypto volatility and as more focused on systemic financial stability than on championing unregulated markets.

While criticizing its use as money, Warsh has conceded that bitcoin could potentially serve as a “sustainable store of value, like gold.” However, he maintains that its boom-and-bust cycles are speculative and may foretell “heightened market volatility” across broader financial assets.

“Warsh is not viewed as hostile to crypto, and the prospect of a new Fed Chair perceived as more inclined toward rate cuts could trigger a short-term relief rally across risk assets,” Market analyst and Adlunam founder Jason Fernandes said.

“However, without a genuine macroeconomic justification for easing, any such move will be met with skepticism and sold into,” Fernandes added.

Crypto World

How to Fix Cross-Border Delays at Scale

“Every hour a payment is delayed is capital that cannot be reinvested, scaled, or compounded.” Cross-border payments remain one of the most complex challenges in global finance. Despite advances in digital banking and fintech infrastructure, many international transactions still take days to settle. Multiple intermediaries, fragmented regulations, and inefficient reconciliation systems continue to slow down money movement.

For fintech founders, payment service providers, and institutional investors, these delays translate into higher costs, liquidity constraints, and lost customer trust. A TRON-enabled stablecoin payment platform offers a modern alternative. Businesses can enable near-instant, low-cost, and transparent international payments by combining blockchain settlement with fiat-pegged digital assets.

This guide explains how such platforms work, why TRON plays a critical role, and how organizations can implement scalable systems to eliminate cross-border payment delays.

Understanding the Real Problem Behind Cross-Border Payment Delays

Cross-border payment delays are not caused by a single technical limitation. They are the result of structural inefficiencies embedded in traditional banking systems. Even with digital interfaces, most international transactions still depend on fragmented infrastructure, multiple intermediaries, and manual verification processes.

For scaling fintech companies and global payment operators, these frictions directly impact liquidity management, customer satisfaction, and operational margins. Without a modern stablecoin payment platform, businesses remain dependent on slow settlement rails that limit their ability to compete in real-time financial markets.

Key Friction Points in Traditional Cross-Border Payments

| Friction Point | Key Data Point | The Real Problem |

|---|---|---|

| Speed | 80% of delays occur in the last mile | Local bank processing and legacy systems slow final settlement |

| Availability | Systems operate ~66 hours per week | Financial dead zones during weekends and holidays |

| Success Rate | Only 35% meet the 1-hour target | Fragmented AML and KYC regulations |

| Cost | 6.49% global average fee | Too many correspondent banks and intermediaries |

What does this mean for payment leaders?

- Speed Remains Unreliable

- Availability Is Limited

- Compliance Slows Execution

- Intermediaries Inflate Costs

The root issue is continued dependence on legacy rails and intermediary-heavy models. Incremental upgrades rarely solve these problems without comprehensive stablecoin payment platform development. Sustainable improvement requires rebuilding settlement workflows at the infrastructure level.

See How Modern Payment Platforms Reduce Delays

Why TRON Is a Preferred Network for Stablecoin Payment Platform Development

When evaluating blockchain networks for stablecoin payment platform development, real-world usage and performance matter most. TRON offers a blend of high throughput, low fees, and strong adoption, making it a practical choice for payment infrastructure.

TRON’s technical characteristics support reliable payment orchestration:

- High transaction speed helps reduce settlement time compared to traditional rails.

- Low network costs make stablecoin transfers more economical, improving margins.

- Mature ecosystem adoption means wider developer support and integration options.

- Stablecoin compatibility ensures seamless settlement workflows for USDT and other assets.

These traits have contributed to TRON’s growth and positioned it as a strong foundation for building a Stablecoin Payment Platform that meets enterprise performance and scalability needs.

How a TRON-Enabled Stablecoin Payment Platform Works

- Payment initiation: Customers trigger transactions through wallets or integrated apps. The system validates identity and balance before processing.

- Merchant and gateway processing: Merchant systems connect via APIs. The payment gateway applies routing rules, fees, and compliance checks.

- Transaction orchestration: The platform prepares, signs, and routes transactions while managing fallback and risk controls.

- TRON settlement layer: Stablecoin transfers are executed on the TRON network, enabling near-real-time settlement and transparent records.

- Liquidity and on/off ramps: Integrated exchanges and custodians convert between fiat and stablecoins for local payouts and treasury management.

- Security and custody management: Multi-signature wallets, cold storage, and access controls protect digital assets.

- Compliance and monitoring: Automated KYC, AML, and transaction screening ensure regulatory alignment.

- Reconciliation and reporting: On-chain data and system logs enable automated accounting and settlement reporting.

- Integration and scalability: APIs connect with banking systems, ERPs, and marketplaces, supporting long-term growth.

When these components operate together, they form a unified, secure, and high-performance Stablecoin payment system, making professional stablecoin payment platform development essential for building scalable, compliant, and future-ready global settlement systems.

Business Benefits of Adopting Stablecoin Payment Infrastructure

For fintech operators, payment platforms, and global enterprises, implementing a TRON-enabled solution delivers measurable and long-term business value. Beyond technical efficiency, it directly improves financial performance, operational resilience, and market competitiveness.

- Faster Settlement Cycles: TRON-based settlement enables funds to move within minutes instead of days. This accelerates cash flow, reduces working capital pressure, and improves treasury visibility. For high-volume platforms, faster settlements supported by a modern stablecoin payment platform translate into better liquidity planning and reduced dependency on credit lines.

- Lower Operating Costs: Traditional cross-border payments involve multiple intermediaries, each charging processing and reconciliation fees. A blockchain-based settlement layer removes many of these cost centers. Combined with automated workflows, this significantly lowers per-transaction expenses and improves margin sustainability.

- Improved Customer Experience: End users increasingly expect instant and transparent payments. Delayed settlements and unclear fee structures lead to churn and reputational risk. A reliable stablecoin payment system enables faster transfers, real-time status updates, and predictable pricing, strengthening user trust and platform retention.

- Global Market Expansion: TRON-enabled platforms allow businesses to operate in regions with limited banking infrastructure. This enables payment providers to serve underbanked populations and emerging markets without establishing local correspondent relationships.

- Better Risk Control and Compliance: On-chain transaction records provide immutable audit trails, while integrated compliance tools support automated monitoring and reporting. This improves governance, reduces fraud exposure, and simplifies regulatory engagement. For institutional clients, these features are essential for long-term adoption.

- Stronger Investor and Partner Confidence: Transparent settlement logic, predictable costs, and scalable infrastructure make payment platforms more attractive to investors and strategic partners. Platforms built through structured payment system development demonstrate operational maturity and long-term viability, which support fundraising and partnership negotiations.

For founders, executives, and investors, TRON-based stablecoin infrastructure is not merely a technology upgrade. It is a strategic lever for improving profitability, reducing operational risk, and accelerating market entry.

Request a Detailed Platform Architecture Review

Key Considerations Before Implementation

While the technology is mature, successful deployment requires careful planning.

1. Regulatory Compliance

A production-ready platform must support:

- Know Your Customer procedures.

- Anti-Money Laundering screening

- Transaction monitoring

- Regulatory reporting

2. Security Framework

Security must include:

- Multi-signature wallets

- Cold storage mechanisms

- Secure API authentication

- Disaster recovery systems

3. Scalability Planning

- Systems must handle future transaction growth without latency or failures.

4. Integration Capability

- Compatibility with ERP systems, accounting tools, and partner platforms is critical.

Professional stablecoin payment platform development teams design these elements from the start.

Practical Roadmap to Building a TRON-Based Payment System

For organizations considering implementation, the following phased approach works best for successful stablecoin payment platform development:

Phase 1: Business and Technical Assessment

Define transaction volumes, target markets, regulatory exposure, and operational requirements to align the platform with business goals.

Phase 2: Architecture Design

Develop wallet models, compliance workflows, API structures, and settlement logic to create a scalable foundation.

Phase 3: Platform Development

Build and test core modules for transaction processing, monitoring, and reporting to ensure operational reliability.

Phase 4: Compliance and Security Validation

Conduct audits, regulatory reviews, and penetration testing to meet institutional security and regulatory standards.

Phase 5: Deployment and Optimization

Launch in controlled environments, analyze performance data, and continuously optimize workflows for long-term stability.

Evaluating ROI: Is It Worth the Investment?

For decision-makers, return on investment is a critical factor when adopting new payment infrastructure. Implementing a solution on the TRON network offers both technical efficiency and measurable financial returns.

Well-designed stablecoin platforms built on TRON typically deliver:

- 40-70% reduction in processing costs by minimizing intermediaries and automating settlement workflows

- Significant improvement in settlement speed, enabling near-real-time fund availability

- Lower customer churn through faster transfers and transparent pricing

- Increased transaction volumes driven by improved user trust and operational reliability

In addition, the low transaction fees and high throughput of the TRON network help payment providers maintain profitability even at scale. When aligned with a long-term growth strategy, a well-implemented stablecoin payment platform becomes a revenue enabler rather than a cost center. It supports stronger cash flow management, higher platform adoption, and greater investor confidence, making it a strategic asset for fintech and enterprise payment leaders.

Final Takeaway

Cross-border delays are no longer acceptable in a real-time global economy. Fintech leaders and payment providers that continue relying on legacy rails risk losing customers, margins, and market relevance. A TRON-enabled settlement infrastructure offers speed, transparency, and scalability. However, realizing these benefits requires expert execution. This is why professional stablecoin payment platform development is essential.

Antier brings deep technical expertise, regulatory understanding, and proven delivery capabilities to help organizations build secure, high-performance payment platforms. With Antier, businesses reduce implementation risk and accelerate time-to-market. Now is the time to modernize your payment infrastructure.

Partner with Antier to Launch Your TRON-Enabled stablecoin platform. Start building a faster, compliant, and future-ready global payment system today!

Frequently Asked Questions

01. What are the main challenges of cross-border payments?

The main challenges include delays caused by multiple intermediaries, fragmented regulations, and inefficient reconciliation systems, which lead to higher costs and liquidity constraints.

02. How does a TRON-enabled stablecoin payment platform improve cross-border payments?

A TRON-enabled stablecoin payment platform enables near-instant, low-cost, and transparent international payments by combining blockchain settlement with fiat-pegged digital assets.

03. What are the key friction points in traditional cross-border payment systems?

Key friction points include unreliable speed, limited availability, compliance issues that slow execution, and inflated costs due to too many intermediaries.

Crypto World

Polymarket Partners with Circle to Integrate Native USDC

The move comes as crypto prediction markets continue to rise in popularity, seeing record volumes.

Circle announced on Thursday, Feb. 5, that it has partnered with Polymarket, the largest on-chain prediction market by trading volume, to provide its U.S. dollar stablecoin settlement infrastructure.

The partnership focuses on integrating Circle’s stablecoin USDC as the primary collateral currency for trading on Polymarket. The prediction market, which operates on Polygon, currently uses Polygon Bridged USDC (USDC.E), but will move to native USDC “in the coming months.”

With a supply of $70.77 billion, Circle’s USDC is the second-largest stablecoin by market capitalization after Tether’s USDT.

Circle said the partnership is focused on making settlement on Polymarket more “institutionally aligned” as trading activity increases. Over the past 24 hours, Polymarket processed $113 million in trades, with total value locked on the platform at $337.5 million, according to DefiLlama.

“Circle has built some of the most critical infrastructure in crypto, and partnering with them is an important step in strengthening prediction markets,” said Shayne Coplan, founder and CEO of Polymarket. “Using USDC supports a consistent, dollar-denominated settlement standard that enhances market integrity and reliability as participation on the platform continues to grow.”

Record-Breaking Growth

The partnership comes as the prediction market sector continues to grow, attracting more users and liquidity. The top-three prediction marketplaces, Polymarket, Kalshi and Opinion, have all seen record-breaking monthly volumes over the past three months. In January, total TVL across crypto-focused prediction markets reached a new high of more than $550 million, The Defiant reported.

The news comes after Polymarket began rolling out trading fees for the first time earlier this year. That same week Polymarket also expanded its institutional reach, becoming the exclusive prediction market partner of the Wall Street Journal and Dow Jones.

Last month, the platform generated about $2.6 million in fees and $1.6 million in revenue, according to DefiLlama. In the first few days of February, fees and revenue have already reached roughly $708,000 and $459,000, respectively.

Crypto World

Apocalypse now? Top economist says crypto market looks bleak

The crypto market continued its recent crash today, Feb. 5, with Bitcoin falling below the key support at $70,000 and the valuation of all coins moving to $2.3 trillion from a record high of over $4.2 trillion.

Summary

- The crypto market crash accelerated on Thursday, with Bitcoin moving below $70,000.

- Nouriel Roubini, a top economist, has warned of an impending crypto apocalypse.

- On the positive side, Bitcoin and most altcoins have become highly oversold.

Roubini is ready for a crypto market apocalypse

The Bitcoin (BTC) sell-off accelerated. And Nouriel Roubini, a top economist popularly known as “Dr. Doom,” expects the top cryptocurrency and most altcoins to continue falling. Why? Not enough people use them.

Bitcoin remains in a bear market, while gold hovers near its all-time high, despite many proponents calling it a safe-haven asset.

Roubini, who accurately predicted the Global Financial Crisis, also warned that most cryptocurrencies were blockchain in name only. He said:

“95% of ‘blockchain’ monies and digital services are blockchain in name only. They are private rather than public, centralized rather than decentralized, permissioned rather than permissionless, and validated by a small group of trusted authenticators.”

Doom isn’t alone

Other popular analysts have warned about the crypto industry.

For example, Peter Schiff, a top gold bull has continued to predict that the coin will continue falling over time.

However, other crypto proponents have argued that the ongoing crypto crash is a normal part of the process, citing other crypto crashes in the past. For example, Bitcoin dropped by over 70% in 2022 as companies like Terra and FTX crashed. In a statement, Michael Novogratz said:

“I do think we are at the lower end of the range. What I would say is we have been here before. Anyone who has been in crypto for more than five years realizes that part of the ethos of this whole industry is pain.”

There are a few reasons why the crypto market may recover in the coming weeks or months. First, the Federal Reserve will likely continue cutting interest rates, which will make risky assets more attractive

Second, the Crypto Fear and Greed Index has moved to the extreme fear zone of 11. In most cases, crypto prices normally rebound when the index moves to the extreme fear zone as we saw in December last year.

Additionally, the Relative Strength Index of most coins, including Bitcoin and Ethereum, has moved to the extreme fear zone. Other oscillators, like the Stochastics have also moved to the oversold level, where rebounds normally happen.

Crypto World

Fidelity Launches Digital Dollar Stablecoin FIDD

Fidelity Investments has entered the stablecoin market with the launch of Fidelity Digital Dollar (FIDD), marking a significant step by one of the world’s largest asset managers into on-chain dollar instruments. Announced on February 4, 2026, the new stablecoin is issued by Fidelity Digital Assets, National Association, and is available to both retail and institutional clients. Each token is redeemable at a 1:1 ratio with the U.S. dollar, positioning FIDD as a regulated, institutionally managed alternative in a stablecoin market that now exceeds $316 billion in total capitalization.

Key takeaways

- Fidelity has launched its first U.S. dollar-backed stablecoin, Fidelity Digital Dollar (FIDD), available to retail and institutional clients.

- FIDD can be purchased or redeemed directly through Fidelity platforms at a fixed rate of $1 per token.

- Reserve assets are managed internally, leveraging Fidelity’s long-standing asset management infrastructure.

- The stablecoin operates on the Ethereum mainnet and can be transferred to any compatible address.

- Daily disclosures provide transparency on circulating supply and reserve net asset value.

- The launch follows new U.S. regulatory clarity for payment stablecoins.

Sentiment: Neutral

Market context: The launch comes as regulatory clarity in the United States improves and traditional financial institutions increase their participation in tokenized cash, custody, and blockchain-based settlement infrastructure.

Why it matters

Fidelity’s move into stablecoin issuance signals a broader shift in how traditional asset managers approach blockchain-based financial infrastructure. Rather than relying solely on third-party stablecoins, Fidelity is now offering a proprietary digital dollar backed by its own balance sheet processes and operational standards.

For institutional investors, the availability of a stablecoin issued and managed by a globally recognized financial institution may reduce counterparty concerns that have historically limited stablecoin adoption in regulated environments. Retail users, meanwhile, gain access to an on-chain dollar that integrates directly with existing Fidelity platforms.

More broadly, the launch highlights how stablecoins are increasingly viewed as foundational financial plumbing rather than speculative crypto assets. As asset managers, banks, and payment firms adopt similar models, competition may shift toward transparency, reserve management, and regulatory alignment.

What to watch next

- Whether FIDD expands beyond Ethereum to additional blockchain networks.

- Potential exchange listings and liquidity growth outside Fidelity platforms.

- Regulatory reporting standards applied to Fidelity-issued stablecoins.

- Adoption by wealth managers and institutional treasury operations.

Sources & verification

- Fidelity’s official announcement dated February 4, 2026.

- Daily reserve and supply disclosures published on Fidelity’s website.

- Statements from Fidelity Digital Assets leadership regarding regulatory alignment.

Fidelity Digital Dollar enters the regulated stablecoin landscape

Fidelity Investments’ decision to issue a proprietary stablecoin represents a notable evolution in the firm’s digital asset strategy. The new token, Fidelity Digital Dollar (FIDD), is designed to function as a blockchain-based representation of the U.S. dollar while remaining closely integrated with Fidelity’s existing financial infrastructure.

Issued by Fidelity Digital Assets, National Association, FIDD is available to eligible retail and institutional investors through Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers. Clients can purchase or redeem the stablecoin directly with Fidelity at a fixed price of one U.S. dollar per token, a structure intended to mirror the operational simplicity of traditional cash balances.

Unlike many stablecoins that rely on external reserve managers or opaque custodial arrangements, FIDD’s reserve assets are managed by Fidelity Management & Research Company LLC. This internal structure allows Fidelity to apply the same portfolio oversight, risk controls, and compliance standards used across its traditional asset management business.

Transparency is a central component of the product’s design. Fidelity publishes daily disclosures detailing FIDD’s circulating supply and the net asset value of its reserves as of each business day’s close. This approach aligns with growing regulatory expectations for stablecoin issuers and aims to address long-standing concerns around reserve sufficiency and disclosure practices in the sector.

From a technical perspective, FIDD is issued on the Ethereum mainnet, enabling holders to transfer tokens to any compatible Ethereum address. This design choice allows the stablecoin to integrate with existing decentralized finance infrastructure while remaining accessible through centralized platforms.

Fidelity Digital Assets President Mike O’Reilly described the launch as the result of years of internal research into stablecoins and blockchain-based financial systems. According to the firm, the goal is to provide investors with on-chain utility without sacrificing the stability and operational rigor associated with traditional financial products.

The timing of the launch is closely tied to regulatory developments in the United States. Recent legislation establishing clearer rules for payment stablecoins has reduced legal uncertainty for large financial institutions considering issuance. Fidelity has positioned FIDD as a response to this evolving framework, emphasizing compliance and investor protection alongside technological innovation.

Stablecoins have become a critical component of digital asset markets, facilitating trading, settlement, and cross-border transfers. With total market capitalization now exceeding $316 billion, the sector has attracted increasing scrutiny from regulators and policymakers. Fidelity’s entry reflects a broader trend of established financial firms seeking to bring stablecoin activity within regulated, institutionally managed environments.

Fidelity’s broader digital asset strategy provides important context for the move. The firm has been building blockchain-related infrastructure since 2014, long before digital assets became mainstream. Its offerings now include custody, trading, research, and investment products tailored to institutional clients, intermediaries, and retail investors.

By adding a proprietary stablecoin to this lineup, Fidelity is effectively extending its ecosystem into on-chain cash management. For wealth managers and institutional clients already using Fidelity’s digital asset services, FIDD may serve as a settlement layer that reduces reliance on external stablecoin issuers.

The launch also raises questions about how competition in the stablecoin market may evolve. As more traditional financial institutions issue their own tokens, differentiation may increasingly depend on regulatory status, transparency, and integration with existing financial services rather than yield incentives or aggressive growth strategies.

While Fidelity has not disclosed immediate plans for expanding FIDD beyond Ethereum or adding advanced programmable features, the infrastructure chosen leaves room for future development. Potential use cases could include on-chain settlement for tokenized securities, collateral management, or integration with institutional payment systems.

For now, Fidelity Digital Dollar stands as a signal that stablecoins are moving deeper into the core of traditional finance. Rather than operating at the margins of the financial system, regulated digital dollars issued by major asset managers may become standard tools for both crypto-native and traditional investors navigating an increasingly hybrid financial landscape.

Crypto World

How to Choose the Right AI Development Partner for Enterprises in 2026

Key Takeaways:

- Enterprises need production-ready, scalable AI systems to drive real business impact.

- Clarify business problems, workflows, and success metrics before choosing a partner.

- Look for technical expertise, domain knowledge, and co-development capabilities.

- Ensure data protection, governance, and ongoing support are built in.

- Evaluate use cases, conduct technical assessments, run PoCs, and finalize IP and support models.

The landscape of enterprise technology has shifted. In 2026, artificial intelligence is no longer an experimental feature; it is the core engine of corporate strategy. According to Gartner, by 2026, more than 80% of enterprises will have moved from basic generative AI pilots to production-grade systems, including multi-agent architectures and domain-specific models.

As the global AI market is projected to reach $312 billion in 2026, the pressure to choose a capable AI development partner has never been higher. This guide provides a strategic framework for identifying, evaluating, and onboarding the right AI development company to lead your digital transformation.

Understanding Your AI Requirements Before Engaging a Partner

Before evaluating any AI development company, enterprises must clearly define their internal objectives and constraints. As AI systems become more complex, success increasingly depends on aligning technical architecture with measurable business outcomes.

1. Clarify the Business Problem

Enterprises should begin by identifying the exact problem AI is expected to solve. This may include reducing operational inefficiencies, improving decision accuracy, automating high-volume workflows, or enabling new revenue models. Leading organizations are shifting away from bottom-up experimentation toward targeted, high-impact transformations aligned with strategic priorities.

2. Identify the Type of AI Solution Required

Different business goals require different AI approaches. Common enterprise-grade solutions in 2026 include:

- Multi-Agent Systems (MAS): Autonomous agents that collaborate to execute complex, multi-step workflows.

- Domain-Specific Language Models (DSLMs): Models trained or fine-tuned on industry-specific data to improve reliability and contextual understanding.

- Recommendation and Personalization Engines: AI systems that drive individualized experiences across marketing, sales, and digital platforms.

3. Define Success Metrics Early

Traditional metrics such as model accuracy are no longer sufficient. Enterprises increasingly track performance through operational and financial indicators, including decision latency reduction, inference cost relative to business value, risk mitigation, and employee productivity gains.

Choose a Trusted AI Development Partner

The Enterprise AI Partner Landscape in 2026

The market for custom AI development services has matured and diversified. Selecting the right AI development partner depends heavily on an organization’s scale, regulatory environment, and technical maturity.

Common Types of AI Service Providers

- Global Consulting Firms: Suitable for large-scale digital transformation initiatives, though often slower and more expensive to execute.

- Niche AI Specialists: Strong in advanced R&D and complex model development but may face challenges scaling enterprise-wide deployments.

- Product-Led AI Firms: Offer faster deployment using pre-built platforms, with potential limitations in customization and IP ownership.

1. Co-Development and IP Ownership

- Global Consulting Firms: Suitable for large-scale digital transformation initiatives, though often slower and more expensive to execute.

- Niche AI Specialists: Strong in advanced R&D and complex model development but may face challenges scaling enterprise-wide deployments.

- Product-Led AI Firms: Offer faster deployment using pre-built platforms, with potential limitations in customization and IP ownership.

2. Co-Development and IP Ownership

Enterprises are increasingly favoring co-development models that allow them to build proprietary intellectual property alongside their AI solutions provider. This approach reduces dependency on vendor-controlled platforms and supports long-term strategic flexibility.

3. Local vs. Distributed Delivery Models

While distributed teams offer cost efficiencies, enterprises in regulated industries often prioritize providers with a strong regional presence to address data residency, compliance, and governance requirements.

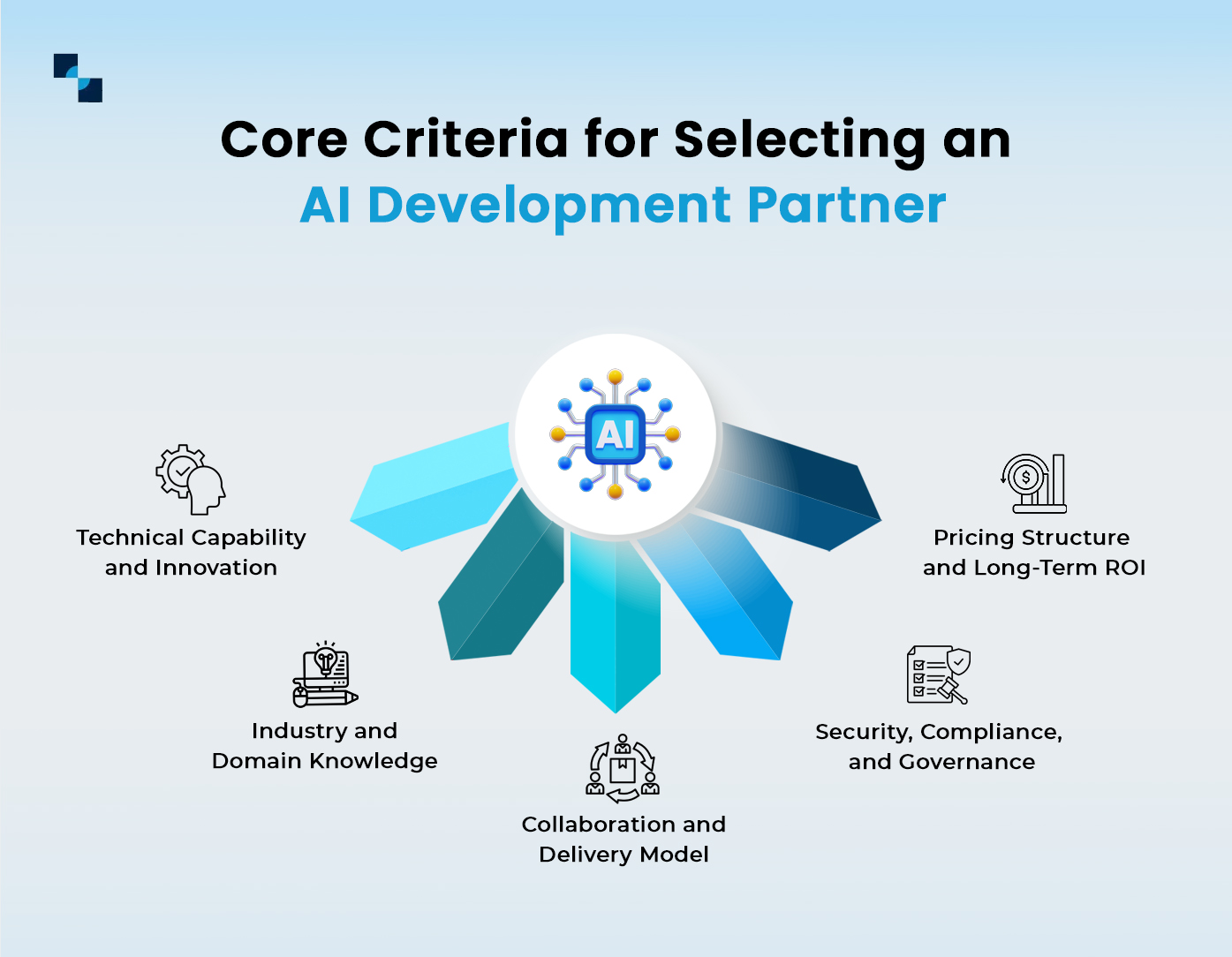

Core Criteria for Selecting an AI Development Partner

1. Technical Capability and Innovation

An enterprise AI development partner must demonstrate hands-on expertise with modern AI architectures, including agent-based systems, retrieval-augmented generation (RAG), and vector databases. Equally important is a commitment to continuous research and experimentation with evolving open-source and commercial AI frameworks.

2. Industry and Domain Knowledge

Domain familiarity significantly accelerates development timelines and reduces operational risk. Partners with experience in regulated industries such as finance, healthcare, or logistics are better equipped to handle domain-specific data structures, compliance obligations, and validation requirements.

3. Collaboration and Delivery Model

AI development is inherently iterative. Enterprises should look for transparent governance structures, clearly defined roles across data science and engineering teams, and agile delivery processes that emphasize frequent validation over long development cycles.

4. Security, Compliance, and Governance

In 2026, AI security and governance are non-negotiable. A qualified AI solutions provider for enterprises must demonstrate adherence to regional regulations, provide explainability mechanisms, and maintain full data lineage across training and deployment pipelines.

5. Pricing Structure and Long-Term ROI

Enterprise AI investments typically extend beyond initial development. Organizations should assess the total cost of ownership, including infrastructure usage, ongoing monitoring, retraining, and performance optimization. Flexible pricing models—such as dedicated teams or hybrid engagement structures—often provide better long-term value than rigid fixed-price contracts.

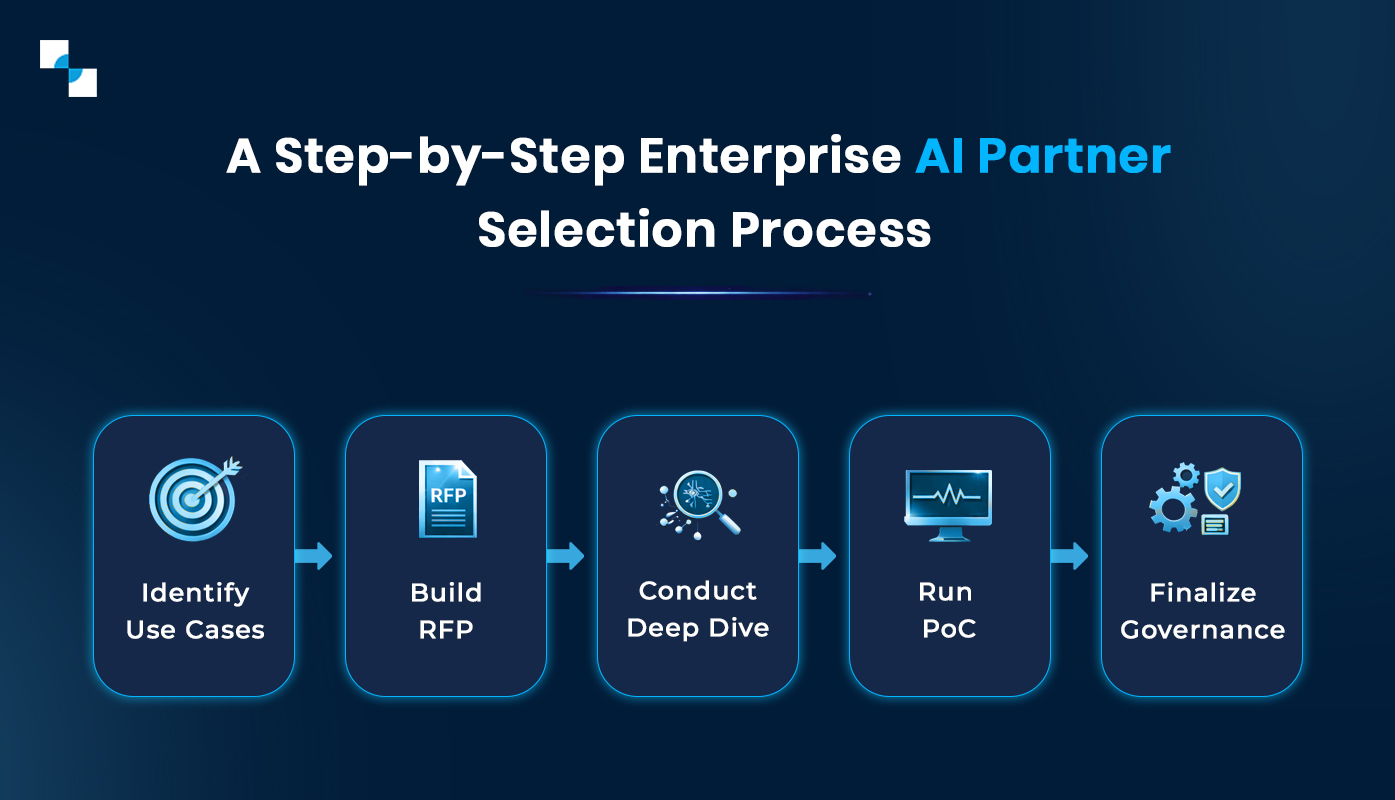

A Step-by-Step Enterprise AI Partner Selection Process

Step 1: Identify High-Value Use Cases

Rather than pursuing broad AI initiatives, enterprises should prioritize workflows where AI can deliver measurable operational impact. High-value use cases often involve decision automation, exception handling, or high-volume manual processes.

Step 2: Design a Future-Ready RFP

Modern RFPs should assess more than cost and timelines. Enterprises should evaluate a partner’s MLOps maturity, approach to model monitoring, explainability frameworks, and ability to support agentic workflows.

Step 3: Conduct a Technical Deep Dive

Involving senior technical stakeholders is essential. Enterprises should assess architecture design, data handling strategies, and cloud-native deployment approaches to ensure scalability and avoid vendor lock-in.

Step 4: Run a Production-Oriented PoC

A proof of concept should reflect real-world conditions. Using unrefined enterprise data allows organizations to evaluate a partner’s ability to manage data complexity, deliver reliable performance, and meet defined KPIs within a limited timeframe.

Step 5: Finalize Governance, IP, and Support Models

Before onboarding, enterprises should clearly define IP ownership, model maintenance responsibilities, performance SLAs, and post-deployment support mechanisms to ensure long-term alignment.

Critical Warning Signs When Evaluating an AI Development Partner

- Unclear System Architecture: If a provider cannot clearly explain how their AI system works end to end—including data flow, decision logic, and integration points—it’s a sign the solution may not be production-ready.

- No Plan for Post-Deployment Maintenance: AI models require continuous monitoring, retraining, and performance evaluation. A partner that treats deployment as the finish line is likely to deliver a system that degrades quickly over time.

- Lack of Cost Transparency: Be cautious of vendors who provide high-level estimates without detailing infrastructure usage, cloud compute requirements, data preparation costs, or long-term operational expenses.

- Generic or Reused Demonstrations: If the same demo or example is used across industries and use cases, it suggests limited customization capability. Enterprise AI solutions should be designed around specific business and domain requirements.

- Limited Accountability After Delivery: A weak or undefined support model—such as unclear SLAs, response times, or ownership boundaries—can create operational risk once the solution is live.

Positive Indicators When Evaluating an AI Development Partner

- Clearly Documented Development Processes: A strong AI development partner follows well-defined, repeatable frameworks for data ingestion, model training, validation, deployment, and monitoring. This signals maturity and reduces delivery risk.

- Deep Focus on Data Quality and Validation: Instead of starting with tools or timelines, the right partner spends time understanding your data sources, data integrity, labeling standards, and validation methods. This focus on ground truth is critical for reliable AI outcomes.

- Security Built into the Design Phase: Trusted enterprise AI partners address data protection, access controls, and model security early in the design process—often recommending secure execution environments and governance measures without being prompted.

- Strong Alignment with Business Objectives: A capable AI development company consistently connects technical decisions to business impact, ensuring models are designed to support measurable outcomes rather than theoretical performance.

- Clear Ownership and Long-Term Support Model: Reliable partners define responsibilities for maintenance, updates, monitoring, and issue resolution upfront, demonstrating accountability beyond initial delivery.

Build Future-Ready AI Solutions with Us

Building Long-Term AI Capability Through the Right Partnership

Choosing the right AI development partner is no longer just a procurement decision—it’s a strategic pivot. By 2026, the gap between AI leaders and laggards will be defined by the quality of their technical partnerships.

At Antier, we help enterprises build robust, scalable, and ethically grounded AI solutions. Whether you are looking for custom AI development services or need an enterprise AI solutions provider to overhaul your operations, our team is ready to bridge the gap between vision and production.

Crypto World

Here’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

Bitcoin (BTC) sellers resumed their activity on Thursday as the BTC price dropped below $69,000, the lowest since Nov. 6, 2024.

Analysts said that Bitcoin showed signs of “full capitulation” and a potential bottom forming, due to extreme market fear, panic selling by short-term holders and the relative strength index (RSI).

Key takeaways:

-

Short-term Bitcoin holders have sold nearly 60,000 BTC in 24 hours.

-

The Crypto Fear & Greed index shows “extreme fear,” signaling a potential bottom.

-

Bitcoin’s “most oversold” RSI points to seller exhaustion.

Short-term holder capitulation deepens

Nearly 60,000 BTC, worth about $4.2 billion at current rates, held by short-term holders (STHs), or investors who have held the asset for less than 155 days, were moved to exchanges at a loss over the last 24 hours, according to data from CryptoQuant.

This was the largest exchange inflow year-to-date, which is contributing to selling pressure.

“The correction is so severe that no BTC in profit is being moved by LTHs,” CryptoQuant analyst Darkfost said in a post on X, adding:

“This is a full capitulation.”

When analyzing the volume of coins spent at a loss, Glassnode found that the 7-day SMA of realized losses has risen above $1.26 billion per day.

This reflects a “marked increase in fear,” Glassnode said, adding:

“Historically, spikes in realized losses often coincide with moments of acute seller exhaustion, where marginal sell pressure begins to fade.”

Bitcoin’s capitulation metric has also “printed its second-largest spike in two years,” occurrences that have previously coincided with accelerated de-risking and elevated volatility as market participants reset positioning,” Glassnode said.

“Extreme fear” could signal market bottom

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, posted an “extreme fear” score of 12 on Thursday.

These levels were last seen on July 22, a few months before the BTC price bottomed at $15,500 and then embarked on a bull run.

Data reveals that in all capitulation events where the index hit this extreme level, short-term weakness was common, but almost every event produced a rebound.

“We are at an ‘extreme fear’ level with a Crypto Fear and Greed Index of 11,” said analyst Davie Satoshi in an X post on Thursday, adding:

“History has shown this is the time to buy and accumulate more!”

Crypto sentiment platform Santiment said in an X post on Thursday that the investor sentiment has “turned extremely bearish toward Bitcoin.”

“This remains a strong argument for a short-term relief rally as long as the small trader crowd continues to show disbelief toward cryptocurrency as a whole.”

Bitcoin “most oversold” RSI signals seller exhaustion

CoinGlass‘ heatmap shows that BTC’s RSI is displaying oversold conditions on five out of six time frames.

Bitcoin’s RSI is now at 18 on the 12-hour chart, 20 on the daily chart and 23 on the four-hour chart. Other intervals also display oversold or near-oversold RSI values, such as 30 and 31 on the weekly and hourly time frames, respectively.

In fact, data from TradingView shows that the weekly RSI is at 29 on Thursday, the “most oversold” since the 2022 bear market, according to analysts.

“Bitcoin is now the MOST oversold since the FTX crash,” CryptoXLARGE said in an X post on Wednesday, adding that it reflects panic selling among investors.

“Historically, this is where fear peaks and opportunity begins,” the analyst added.

Bitcoin’s RSI is at the same oversold levels last seen around $16K in 2022, which marked the “last major capitulation,” phase, said analyst HodlFM in a recent post on X, adding:

“Not a timing signal by itself, but historically, this is where risk/reward favors the buyers.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Cardano faces deeper plunge as Bitcoin breaches $70K amid bear-cycle fears

- Cardano price dropped to near $0.26 as cryptocurrencies continued to struggle.

- ADA bulls face further pain if the price breaks below $0.25.

- Bitcoin’s crash to under $70,000 amid bear cycle fears is a major trigger.

Cardano price fell more than 9% to extend its downturn, with this coming as Bitcoin tumbled to below the $70,000 support level.

With BTC dragging the broader crypto market into turmoil, Cardano (ADA) dropped to lows of $0.26, signaling prolonged downside risks in this bear cycle.

Other altcoins had it even rougher, with XRP plummeting 14% to under $1.40 and Solana breaching support at $90.

Altcoins slide as BTC tanks amid market panic

Bitcoin sank further on Thursday, with bears breaking below $70,000 to plunge the whole sector into fresh turmoil.

The 8% drop from a retest of $73,000 came as Strategy, the world’s largest corporate holder of Bitcoin, sank into unrealized losses worth billions of dollars.

Treasury Secretary Scott Bessent had also noted on Wednesday that the government would not “bail out” Bitcoin.

However, despite confirmation that the US will not sell its BTC holdings, Cardano, alongside all the top altcoins, nosedived as BTC touched lows of $69,500.

Analysts at Glassnode pointed out that forced selling is escalating.

The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling.

These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning.… pic.twitter.com/mcvVqXJcYq— glassnode (@glassnode) February 5, 2026

Cardano ADA price dives to $0.26

Cardano traded at $0.27 at the time of writing on February 5, 2026, down nearly 9% on the day.

Recent declines mean Cardano price has dived 21% in the past week and 36% in the past month.

The plunge from the $0.8 peak in October 2025 has only accelerated in the past month, with bulls failing to hold onto notable bounces above the $0.30 level.

ADA’s move aligns with bear cycle indicators, including a Fear & Greed Index in extreme fear territory and negative funding rates across exchanges.

Retail and institutional outflows have also amplified the slide, with macroeconomic conditions fueling further pain in a brutal start to the year for buyers.

Given Bitcoin’s outlook, analysts see the current support level of $0.26 as a fragile one for Cardano.

Bearish technicals signal further ADA downtrend

ADA’s daily chart gives a largely bearish outlook after the token’s dip below $0.30 and $0.28.

The dump across risk assets saw buyers fail to hold the 50-day moving average mark, while daily RSI hovers near oversold but lacks bullish divergence.

Data from Coinglass also shows a sharp decline in open interest, and negative funding rates reinforce the outlook.

If the altcoin carnage accelerates amid a broader bear cycle crash, ADA could revisit $0.20 or lower.

On the upside, a shift in macro conditions and regulatory tailwinds could spark bullish bets.

Catalysts like network upgrades or ETF approvals also favour bulls, with short-term targets at $0.50 and $1.

Crypto World

Can It Pump Even More?

Will HYPE continue its uptrend or will it follow the broader market downtrend?

It’s quite difficult to spot a popular cryptocurrency whose price hasn’t tumbled by 20% or even more in the last few weeks.

Hyperliquid (HYPE), though, is an evident exception, and its solid performance has caused analysts to envision further gains in the near future.

The Lone Survivor

Bitcoin (BTC) has crashed to a 14-month low of around $69,000, Ethereum (ETH) is struggling to keep the $2,000 level, while Ripple’s XRP and Solana (SOL) have plummeted by 27% in the past seven days. However, Hyperliquid (HYPE) has somehow defied the ongoing massacre and currently trades at around $32, representing a 50% increase on a two-week scale.

Its strong performance comes amid a string of positive developments surrounding the ecosystem. Earlier this week, Ripple announced that its institutional prime brokerage platform (called Ripple Prime) enabled support for Hyperliquid. Meanwhile, Grayscale recently revealed that it was encouraged by the rise in perpetual futures trading for non-crypto assets on the decentralized exchange.

Before that, on-chain data revealed growing interest in HIP-3 activity amid skyrocketing trading volume and open interest. These metrics continued to increase as the market tumbled in the past few days, reaching new peaks of $1B in OI and $4.8B in 24-hour volume.

HYPE has been the subject of numerous optimistic predictions, and many analysts believe there’s fuel left for additional gains. The analyst, using the X moniker Crypto General, expects volatility ahead and an eventual explosion above $100 later this year. Speaking on the matter was also Zach, who argued there are “so many reasons to buy and hold HYPE.”

There are so many reasons to buy and hold $HYPE.

The more it takes over market share and volume, the bigger the buybacks are, which is one of the reasons it’s so strong.

Really would love to get a spot entry around yearly open of $25 but who knows if it’ll come

— Zach (@CryptoZachLA) February 4, 2026

You may also like:

The popular analyst Crypto Tony chipped in, too, suggesting that HYPE could do “magical things when the market conditions are right.” Those interested in additional bullish forecasts for the token can read our dedicated article here.

Can It Follow the Pack?

It is important to note that the broader crypto market remains shaky, and sustained bearish conditions could eventually weigh in on HYPE as well.

Some analysts believe this is a likely outcome. The one using the X handle, Greeny, predicted that the native token of Hyperliquid could plummet to $20 later in 2026.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Cosmos Powers Real World Asset Tokenization for Institutional Capital Markets

TLDR:

- Tokenized U.S. Treasuries reached $5.6 billion by April 2025, growing five times year over year.

- Cosmos powers 150+ blockchains including Provenance, Progmat, and institutional RWA platforms.

- Ondo Finance moved $95 million into BlackRock’s BUIDL fund, enabling continuous redemptions.

- Lombard’s LBTC token surpassed $1 billion in three months with Franklin Templeton backing.

Capital markets are shifting toward blockchain infrastructure as tokenization gains traction across traditional finance.

Asset managers and banks now issue tokenized treasuries, credit instruments, and securities through distributed ledgers.

Stablecoins represent $250 billion in circulating value, while tokenized U.S. Treasuries reached $5.6 billion in assets under management by April 2025.

Citi analysts project tokenized assets could reach $4 to $5 trillion by 2030. Cosmos has emerged as preferred infrastructure for institutions seeking on-chain capital markets solutions.

Cosmos Architecture Addresses Institutional Requirements

Cosmos provides institutions with blockchain infrastructure that balances operational control and market connectivity.

The framework allows financial firms to build custom chains with internal governance, security protocols, and compliance automation.

Over 150 interoperable blockchains currently operate on Cosmos technology, with regulated institutions increasingly adopting the stack for capital markets applications.

Provenance powers Figure’s non-bank home equity lending platform, which leads the U.S. market in this segment. Progmat, a joint venture of Japan’s MUFG, Mizuho, and SMB, operates the country’s largest regulated tokenization platform on Cosmos infrastructure.

These deployments validate the technology for high-stakes financial operations requiring regulatory compliance and institutional-grade security.

The Inter-Blockchain Communication protocol enables asset distribution across networks while preserving issuer sovereignty.

Institutions can issue securities on proprietary chains and connect to external liquidity venues without surrendering control over core asset rules.

This separation of governance and distribution resolves a fundamental tension in institutional blockchain adoption.

Ledger-based settlement reduces reconciliation costs across custodians, transfer agents, and clearing systems. Asset managers achieve faster liquidity access, while banks minimize counterparty exposure.

Tokenization expands distribution by enabling asset fractionalization across regions without reconstructing product structures for each venue.

These operational benefits have accelerated adoption in cash equivalents, credit products, and exchange-traded instruments.

Production-Scale Implementations Demonstrate Market Readiness

Injective addresses digital securities market fragmentation through purpose-built financial infrastructure. The platform provides native primitives for tokenized asset issuance and trading at institutional scale.

DigiShares and publicly listed Valereum deployed their digital securities platform on Injective using the ERC-7943 interoperability standard for single-asset tokenization.

The integration supports real estate, pre-IPO equity, and alternative assets with institutional-grade settlement. Valereum’s secondary trading platform leverages Injective’s on-chain order book and cross-chain capabilities.

Institutions can perform due diligence, execute investments, and trade digital securities through a unified interface built on Cosmos-compatible infrastructure.

Ondo Finance solves liquidity constraints that limited early tokenized markets. The platform connects tokenized assets to public exchange liquidity through direct acquisition mechanisms.

Users fund purchases with stablecoins, Ondo acquires underlying securities on regulated venues, and redemption processes maintain price alignment.

In March 2024, Ondo moved $95 million into BlackRock’s BUIDL tokenized money market fund. This enabled continuous redemptions instead of T+2 settlement delays.

Ondo Global Markets, built on the Cosmos Stack, now offers hundreds of tokenized equities and ETFs. Partnerships with Franklin Templeton and BlackRock position the platform as a bridge between traditional finance and on-chain markets.

Lombard Finance demonstrates Bitcoin’s evolution as capital markets collateral through its liquid-staked LBTC token.

The product surpassed $1 billion in total value locked within three months, with supply actively deployed across on-chain financial markets.

Franklin Templeton participated in the $16 million seed round, while Wintermute, Galaxy, and DCG provide security oversight.

ZIGChain combines brokerage rails with blockchain settlement to extend retail access to global tokenized equities.

Announced in 2024 with a $100 million ecosystem fund, the platform recently partnered with Apex Group to launch regulated on-chain fund structures.

The $3.4 trillion fund administrator collaboration demonstrates institutional confidence in Cosmos infrastructure for real-world asset tokenization at scale.

Crypto World

Bitcoin’s $70,000 Support Shatters as ‘Warsh Shock’ Triggers Massive Liquidity Exodus

Bitcoin collapsed below the psychological $70,000 support level Thursday, marking a 15-month low as markets aggressively repriced the liquidity outlook under incoming Federal Reserve Chair Kevin Warsh.

The world’s largest cryptocurrency fell as low as $67,619. The rout erased $40 billion from open interest in under 48 hours, showing a capitulation of leveraged longs.

The catalyst? The market’s digestion of President Trump’s nomination of Kevin Warsh. While Warsh is historically pro-crypto, calling Bitcoin “new gold,” traders are fleeing his well-known stance on balance sheet reduction.

The Liquidity Vacuum

Spot ETF flows exacerbated the decline, with total assets under management sinking below $100 billion for the first time in Q1.

The technical damage is severe, as the $70,000 level had served as a fortress for bulls throughout 2025. Its failure has exposed the lack of bid depth below, with order books thinning out toward the mid-$60k range.

The divergence is stark: Gold shattered records Thursday, crossing $5,100/oz. Investors are rotating from “risk-on” stores of value (BTC) to “safety” stores of value (Gold), anticipating that Warsh’s restrictive monetary policy will strengthen the dollar and drain the excess liquidity that fuels crypto rallies.

The Warsh Paradox: Pro-Bitcoin, Anti-Liquidity

This sell-off represents a sophisticated pricing of the “Warsh Paradox.” Retail sees a pro-Bitcoin nominee; institutions see a hawk who despises quantitative easing.

Warsh has explicitly argued that the Fed’s swollen balance sheet distorts asset prices. The desk view? The “Fed Put” is dead. Warsh may support Bitcoin’s legality, but he will not print the dollars required to pump it. Expect volatility to persist until the market finds a price floor based on utility rather than liquidity overflow.

The post Bitcoin’s $70,000 Support Shatters as ‘Warsh Shock’ Triggers Massive Liquidity Exodus appeared first on Cryptonews.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 hours ago

NewsBeat7 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Business33 minutes ago

Business33 minutes agoQuiz enters administration for third time

Trump nominates Kevin Warsh to be the new head of the federal reserve.

Trump nominates Kevin Warsh to be the new head of the federal reserve.