Crypto World

botim money launches digital silver with fractional access from AED 10

Editor’s note: This editorial perspective highlights a notable step in fintech inclusion. botim money’s expansion into digital silver underscores a growing trend toward accessible, regulated investing within popular UAE apps. By enabling fractional ownership from AED 10 and extending its Invest suite in partnership with OGold, botim aims to broaden asset diversification for millions of users. The move follows botim’s gold investment capability and reflects UAE’s push toward a digital-first, regulated financial ecosystem where everyday people can participate in precious metals markets with ease and security.

Key points

- Digital silver investing is added to botim money’s Invest feature, enabling fractional access from AED 10.

- The launch expands botim’s strategic partnership with OGold to broaden precious metals access in the UAE.

- Gold investment performance (128,000 trades, over AED 100 million) signals strong user demand for expanded metals offerings.

Why this matters

With silver drawing renewed attention as a store of value and industrial metal, botim money’s in-app silver offering lowers entry barriers and provides a regulated, user-friendly path to diversification. The UAE-focused rollout aligns with market demand for digital-first financial tools and broadens access to precious metals for millions of users within a popular fintech ecosystem.

What to watch next

- Uptake of digital silver within botim money’s Invest feature and its impact on user engagement.

- Potential expansion of the precious metals suite to include additional metals or products with partners like OGold.

- Continued alignment with UAE’s digital-first financial ecosystem and regulatory developments.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Press release: botim money launches digital silver with fractional access from AED 10

Dubai, UAE – 18 February 2026 – botim money, the financial services arm of botim, today announced the launch of digital silver investing within its ‘Invest’ feature, enabling eligible users to buy, sell, and manage fractional silver holdings from AED 10. The launch follows the in-app gold investing capability introduced in partnership with OGold, expanding botim’s precious metals suite across the UAE.

The new capability is designed to lower traditional entry barriers tied to bulk purchases and offline handling, giving users a simpler way to access silver through a regulated, in-app experience. It forms part of botim’s broader build-out of practical financial tools across the platform, alongside existing payments and remittance use cases.

Since its launch in August 2025, botim money’s gold investment feature recorded 128,000 in-app gold trades with a total amount exceeding AED 100 million. This rapid adoption signals strong and sustained user demand to expand botim money’s ‘Invest’ offerings beyond gold into silver within the same suite.

Sacha Haider, Chief Operating Officer of Astra Tech | botim, said:

We were the first fintech platform to announce plans for a digital gold investment portfolio within botim’s fintech ecosystem in 2023, in partnership with OGold. Since launch, fractional investing has removed traditional minimum investment thresholds that historically limited participation and driven notable growth in usage. Extended to silver and combined with botim’s ease of use and scale, this creates a seamless and inclusive pathway for users to begin investing with confidence.

Bandar Alothman, Chairman & Founder at OGold,

As an Emirati company, our goal at OGold is to make precious metal ownership simple, accessible, and secure for everyone. Partnering with a platform as widely used as botim allows us to extend these innovative silver-earning solutions to millions of users. This is a game-changer for democratizing access to timeless assets through Silver Wakalah, which ensures your silver is not a stagnant investment. Instead of just sitting in a vault, your silver is put to work to grow your wealth with just a few taps.

The launch comes as silver draws renewed attention globally both as a store-of-value asset and as an industrial metal with structural demand drivers. With the global silver market expected to record a sixth consecutive annual deficit in 2026, and a projected shortfall of around 67 million ounces, while retail investment demand is forecast to rise despite softer demand in some industrial and consumer categories.

By extending botim’s investment offering beyond gold into silver, botim is broadening access to asset diversification for everyday users while continuing to build toward the UAE’s ambition of a mature, digital-first financial ecosystem.

The digital silver feature is now available to eligible users through the botim app.

About botim

botim, part of Astra Tech’s ecosystem, is the MENA region’s leading fintech company headquartered in Abu Dhabi. Botim is a fintech-first, AI-native platform offering inclusive, user-centric solutions for financial services. Built on the foundation of being the UAE’s first free VoIP provider, Botim has evolved into a multi-layered ecosystem serving over 150 million users across 155 countries.

Designed to meet the needs of MENA consumers, businesses, and communities, botim delivers integrated services with innovation, accessibility, and regulatory credibility at its core. botim is building the next generation of everyday finance and connectivity easier, smarter, and more inclusive for everyone.

Crypto World

Pi Network (PI) News Today: February 18

We will also review the latest price performace of the PI token, which has been rather impressive after last week’s crash.

The Core Team issued an important reminder about a deadline that has now past and the community is expecting updates on the nodes front.

We will also take a look at some of the criticism of the project, as well as the PI’s price resurgance.

Pi Network’s Latest Deadline

Recall that at the end of the previous business week, the team behind the protocol issued an important reminder for Pi Network nodes, describing them as the “fourth role” in the ecosystem. The reason for the February 15 deadline is because the team promised a new series of upgrades to be introduced soon. Nodes had to comply by that date; otherwise, they risked being disconnected from the network.

All nodes were prompted to use laptops or desktops instead of mobile phones. Although the deadline has passed now, the team has yet to publish any additional information about the number of nodes that have completed the necessary step or provide any extensions.

Criticism Grows

On the first Friday of February, the Core Team said they celebrated Pi Network moderators. They published a designated video praising this vital part of the overall ecosystem, indicating that moderators are volunteers not employed or paid by the official Pi Network team, who help moderate chats, answer Pioneers’ questions, monitor Pi apps and products, report bugs, and test new features.

The project’s community, though, was not in a celebratory mood. Many criticized the Core Team for a lack of transparency, clear planning, and failure to implement working KYC solutions. Some urged the team to “speed up the progress” and stop messing around with “all that superficial nonsense.” Others said they had been waiting for over seven years to migrate their Pi coins to no avail.

Separately, one user going by the X handle ‘pinetworkmembers’ addressed the PI token’s massive price calamity and drop to new all-time lows of $0.1312 last week. They blamed the team for failing to introduce a “functioning mainnet after years of promises, no real-world utility beyond ‘keep the app open,’ and a whole lot of mobile mining theater.”

You may also like:

PI’s Revival

As mentioned above, the project’s native token was hit hard during the broader market’s correction last week, plunging to a fresh low. However, while the cards were stacked against it, PI went on an impressive run in the following days and rocketed to over $0.20 during the weekend, prompting other Pioneers to celebrate the revival.

One popular analyst predicted a massive 500% surge, and hinted about buying some PI “for the midterm.” As of press time, PI remains the top performer on a weekly basis, having jumped 40% despite retracing to under $0.19.

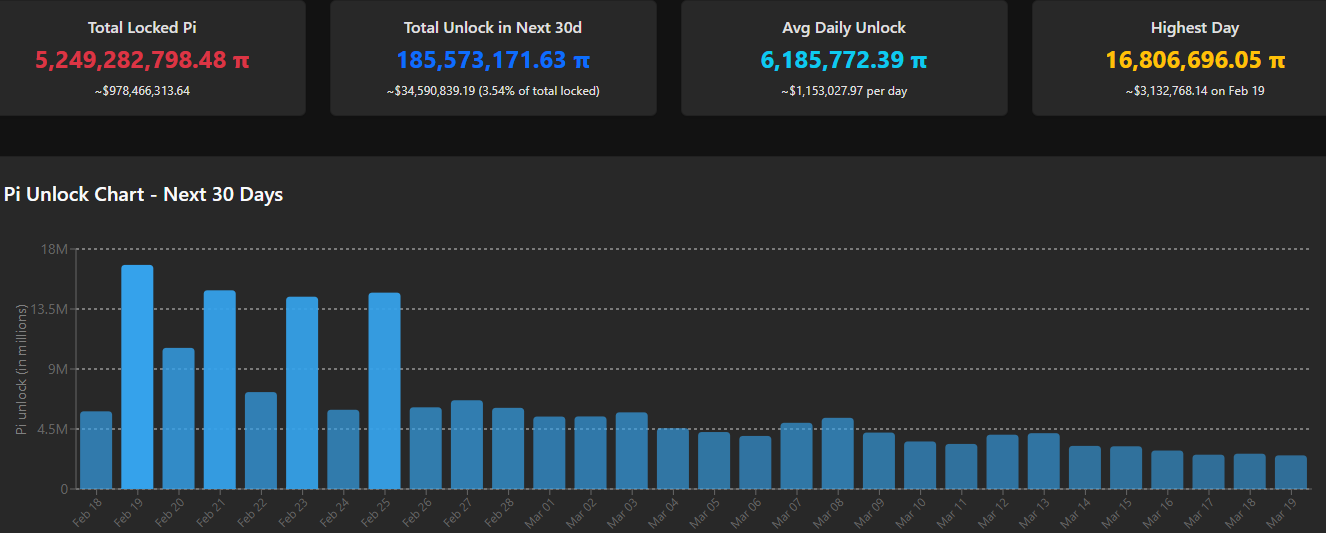

PiScan data shows a sizeable reduction in the number of coins to be unlocked on average in the following month, down to under 6.2 million daily from well over 7.5 million last week. This could further ease the asset’s immediate selling pressure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Brevan Howard’s crypto fund lost 30% in 2025 in worst year since inception: FT

Investment manager Brevan Howard’s cryptocurrency fund fell almost 30% last year as the bitcoin bull run faltered, the Financial Times (FT) reported on Wednesday.

The BH Digital Asset fund lost 29.5% of its value, its worst performance in a calendar year since its inception in 2021, according to the report, which cited people familiar with the fund’s performance. The fund underperformed bitcoin, which lost 6% in the period.

BH Digital Asset, which invests in crypto tokens and digital asset-related companies, enjoyed gains of 43% and 52% in 2023 and 2024, respectively, as the crypto market recovered from the lows of 2022 and the bitcoin price eclipsed $100,000 in December 2024.

“There are a lot of private equity and venture capital type instruments [in BH Digital Asset],” said one hedge fund investor, according to the FT’s report. “They have underperformed bitcoin but to give them credit, last year was terrible for crypto.”

Brevan Howard did not immediately respond to CoinDesk’s request for further comment.

Crypto World

Moonwell’s ‘vibe-coded’ oracle in $1.8M blowup

It was only a matter of time before “vibe-coded” smart contracts led to a significant loss of funds and on Sunday, an oracle misconfiguration led to users of DeFi lending platform Moonwell being liquidated for a total of 1,096 Coinbase Wrapped Staked Ether (cbETH).

The protocol was also saddled with $1.8 million worth of bad debt as a result.

The error was introduced in pull request 578, submitted by Moonwell core contributor “anajuliabit” and co-authored by Claude Opus 4.6.

Including this incident, Moonwell has suffered three oracle malfunctions in the past six months, leading to over $7 million in bad debt.

Read more: Claude AI plugins can now vibe code smart contracts

cbETH = $1.12

Moonwell’s post-mortem report states that, this time, the issue lies in calculating the dollar price of cbETH.

“The oracle used only the raw cbETH/ETH exchange rate. This misconfiguration caused the oracle to report cbETH’s price as approximately $1.12 (reflecting the cbETH/ETH ratio of ~1.12) rather than the intended market value of roughly $2,200,” the report explains.

As a result, the error “wiped out most or all of the cbETH collateral for many borrowers.”

A total of 1,096 cbETH was liquidated. In turn, $1.78 million worth of bad debt was generated for the protocol.

Monitoring systems picked up the discrepancy and strict borrow and supply caps were set to prevent further interaction.

Despite this, liquidation of existing positions continued. Any oracle correction requires “a five-day governance voting and timelock period, which could not be bypassed.”

Trading Strategy’s Mikko Ohtamaa pointed out that “regardless of whether the code is written by an AI or by a human, these kinds of errors are caught in an automated integration test suite.”

He highlights that Claude can even write these tests itself, but that in this case “there was no test case for price sanity.”

Others highlighted the contributor’s GitHub profile which shows an extremely high workrate, over 1,000 commits in the past week.

Read more: Clawdbot creator Peter Steinberger: ‘Crypto folks, stop harassing me’

The dark side of the moon

Moonwell is a lending protocol active on the Base, Optimism, and Moonbeam networks. It holds around $90 million in total value locked (TVL), according to DeFiLlama data, down from a peak of $380 million in August last year.

Since then, the project has suffered a number of hiccups.

DeFi commentary account “Yieldsandmore” details two further incidents in recent months. The first came during last year’s infamous October 10 crash, when a pricing discrepancy between Chainlink feeds and decentralized exchanges on Base led to $12 million in liquidations and $1.7 million of bad debt.

The second came less than a month later, on November 4, when the $129 million Balancer hack had a knock on effect on Moonwell’s market-based wrsETH/ETH oracle, leading to $3.7 million of bad debt.

The two incidents were apparently exploited by the same attacker, who is “clearly constantly scanning Moonwell for extractable value.”

Previously, 2022’s $190 million Nomad Bridge hack devastated the protocol’s Moonbeam deployment, its sole instance at the time.

The incident saw TVL drop 80%, from over $100 million to just $21 million.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Sai Launches Perps Platform Combining CEX Speed with Onchain Settlement

[PRESS RELEASE – Panama City, Republic of Panama, February 18th, 2026]

Sai today launched Sai Perps, a perpetuals trading platform built to be as fast and intuitive as a centralized exchange with the transparency and self-custody of on-chain settlement. The platform features gasless transactions, removing friction for traders while maintaining full on-chain security.

Sai also unveiled Let’s Go Saicho, a one-month on-chain trading competition running from February 18 through March 19, 2026, with $25,000 in total prizes. The campaign is structured in two phases designed to reward both performance and participation: a PNL competition for profitable traders, followed by a first-come, first-serve “Be Early” phase for traders who engage early and hit a minimum volume threshold.

“On-chain markets shouldn’t require traders to compromise between speed and self-custody,” said Matthias Darblade, a Sai contributor. “Sai Perps is designed for active traders who want a clean, CEX-like experience, while still getting the transparency and settlement guarantees that only on-chain infrastructure can provide.”

Why Sai vs. Other Perps DEXs

Sai Perps is built around the premise: trading should be accessible without the usual friction of on-chain perps. Compared to existing perpDEXs, Sai stands out in many ways:

- CEX-like UX, on-chain settlement: A streamlined trading experience designed to be fast and familiar, with trades settling on-chain for transparency and verifiability.

- Infrastructure built for deep, smooth markets: Sai has focused heavily on liquidity, risk systems, and oracle design to support more consistent execution and robust market integrity.

- Accessible to both new and experienced traders: A platform experience optimized for speed and clarity, without sacrificing advanced trading capability.

- Roadmap beyond crypto perps: Sai’s planned expansion includes stocks, commodities, and FX markets, plus user-focused capital efficiency features like Sai Savings (yield on deposits), and cross-chain deposits.

Let’s Go Saicho: $25,000 Trading Competition (Feb 18 – Mar 19, 2026)

Let’s Go Saicho is a one-month competition rewarding trading on Sai across two two-week phases:

- Phase 1 (Feb 18 – Mar 4): PNL Competition | $20,000 prize pool, 50 winners

- Phase 2 (Mar 5 – Mar 19): Be Early (First Come First Serve) | $5,000 prize pool, 50 winners

All markets listed on Sai are eligible in both phases. Traders may go long or short on any listed pair using supported collateral (e.g., USDC and other supported assets such as stNIBI, as available on Sai). For more details on Sai’s Trading Competition, visit here.

About Sai

Sai is a new perpetuals trading platform designed to feel as easy and fast as a centralized exchange, while still settling fully on-chain. Sai’s mission is to make advanced trading accessible without sacrificing transparency or self-custody.

Sai is focused on finalizing its core trading infrastructure and user experience, building liquidity and risk systems for smoother execution, and laying the groundwork for yield features that help users earn on idle collateral. Next on the roadmap: expanded markets (stocks, commodities, FX), Sai Savings, cross-chain deposits, and smart accounts for gasless trading.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

ECB To Launch Payment Provider Selection For Digital Euro

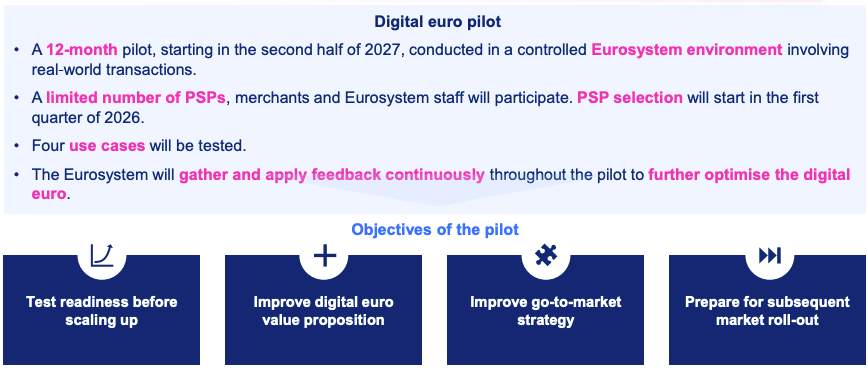

The European Central Bank (ECB) is moving closer to a pilot for a digital euro, with Executive Board Member Piero Cipollone outlining plans to begin selecting payment service providers (PSPs) in early 2026, ahead of a 12-month test scheduled for the second half of 2027.

Cipollone on Wednesday held an executive committee meeting of the Italian Banking Association. He said the pilot would involve a limited number of payment service providers, merchants and Eurosystem staff. Selection of participating providers is expected to start in the first quarter of 2026.

Cipollone said the digital euro will be designed to ensure it protects European card schemes and keeps banks at the core of the Eurozone payments system, according to Reuters.

Pilot could give PSPs an early start

European Union-licensed PSPs will be at the core of digital euro distribution, Cipollone said. For participating PSPs, the pilot offers an early-readiness advantage ahead of a potential broader rollout, including hands-on experience with onboarding, settlement and liquidity management.

He added that it also provides clearer visibility on future infrastructure, compliance and staffing costs, helping companies plan investments more accurately.

With direct Eurosystem support and the ability to feed into the design process, participants should gain both operational insight and influence over how the digital euro ultimately takes shape.

Stablecoins are not the only threat to banks, says Cipollone

The digital euro pilot is also intended to protect domestic European payment projects, such as Italy’s Bancomat card network and Spain’s Bizum peer-to-peer system.

“Banks could lose their role in payments not just because of stablecoins but also due to other private solutions,” Cipollone said, pointing to Europe’s heavy reliance on international card networks like Visa and Mastercard.

He added that the digital euro would be structured to preserve the competitiveness of local systems.

“The cap on the fee that merchants will pay on the digital euro network will be lower than what the international payments network, normally the costlier, charge, but higher than what domestic payments scheme, normally the cheapest, charge,” Cipollone said.

Cointelegraph contacted the ECB for comment on the PSP selection but had not received a response by publication.

Related: Lagarde early exit report puts ECB succession and digital euro in focus

The news marks a milestone in the digital euro pilot after the ECB officially moved to the next phase of the project in October 2025, targeting a launch in 2029.

The central bank then projected that a pilot exercise could start in 2027 if legislation is put in place during the course of 2026.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

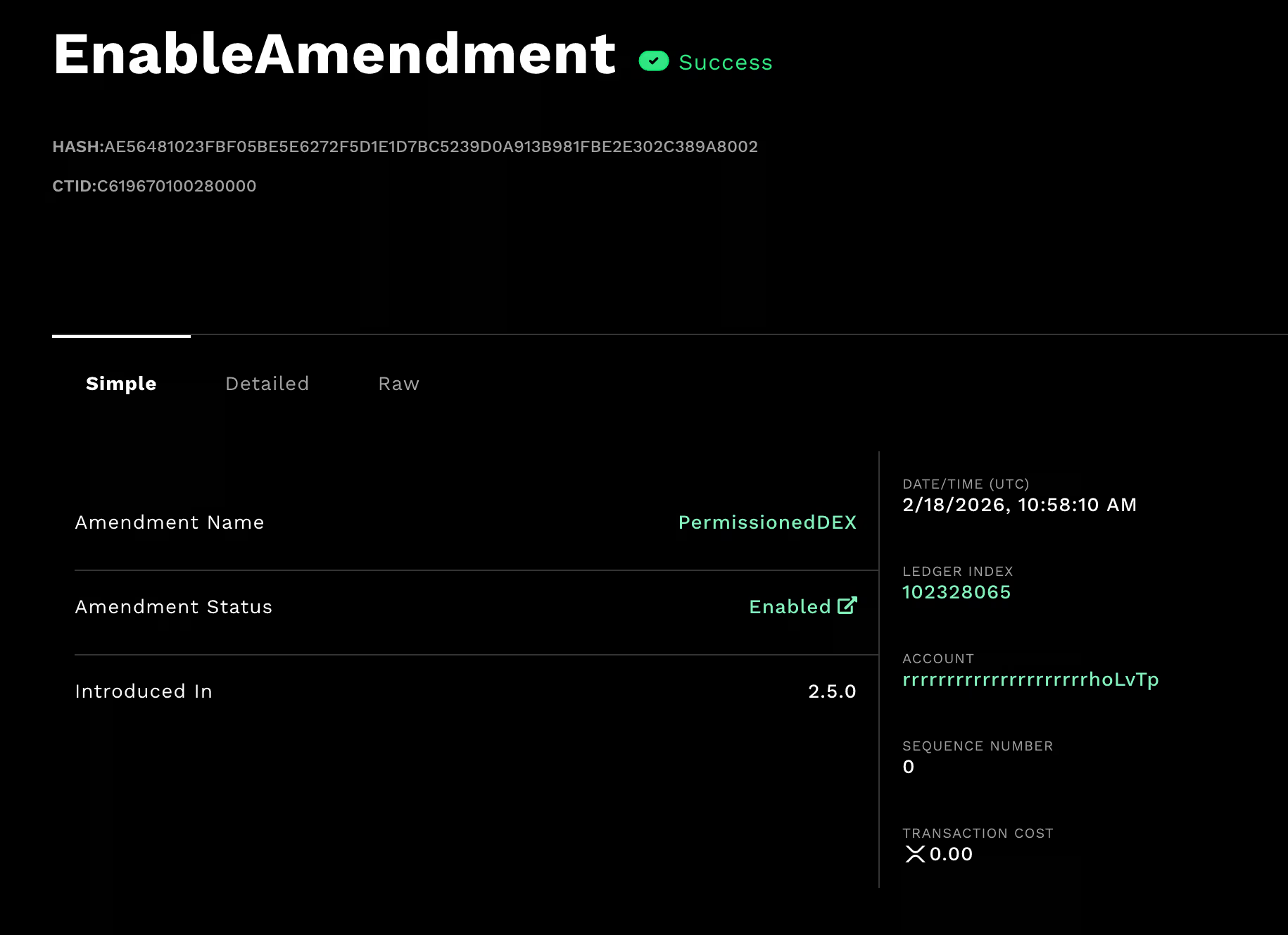

XRP Ledger rolls out members-only DEX for regulated institutions

The XRP Ledger has activated a new “Permissioned DEX” amendment, a technical upgrade designed to let regulated institutions trade on XRPL without opening markets to everyone.

The change, known as XLS-81, allows the creation of permissioned decentralized exchanges that work like XRPL’s existing built-in DEX, but with a key difference.

A permissioned domain can restrict who is allowed to place offers and who is allowed to accept them, creating a gated trading venue where participation can be tied to compliance requirements such as KYC and AML checks.

Think of it as a ‘members only’ marketplace, while still keeping the trading mechanics native to the ledger.

The feature is aimed at banks, brokers and other firms that may want onchain settlement and liquidity but cannot interact with fully open DeFi markets. For these players, the ability to control access is not optional but forms the minimum requirement.

The activation also adds to a growing set of “institutional DeFi” primitives XRPL has been rolling out this month. Token Escrow, or XLS-85, went live last week, extending XRPL’s native escrow system beyond XRP to all trustline-based tokens and Multi-Purpose Tokens, including stablecoins such as RLUSD and tokenized real-world assets.

Together, the two upgrades create a more complete toolkit for regulated finance on XRPL. Token escrow allows conditional settlement for assets issued on the network, while the permissioned DEX provides a controlled venue for trading them.

That combination is central to use cases like tokenized funds, stablecoin FX rails, and regulated secondary markets for tokenized assets.

While the changes are unlikely to matter to most retail traders day to day, they signal XRPL’s direction. It is building infrastructure for institutions first, even if that means leaning into gated markets rather than the fully open DeFi model that defined the last cycle.

Crypto World

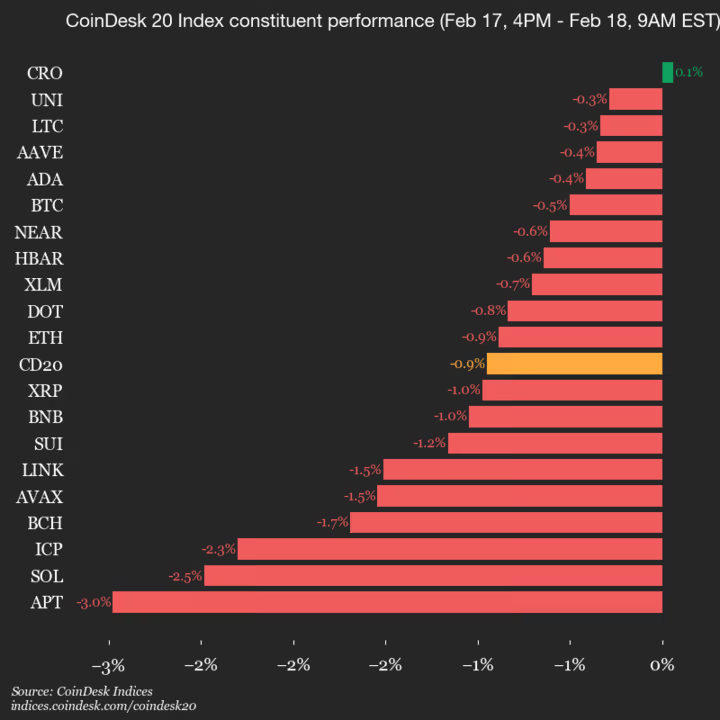

Aptos (APT) declines 3%, leading index lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1962.18, down 0.9% (-18.81) since 4 p.m. ET on Tuesday.

One of the 20 assets is trading higher.

Leaders: CRO (+0.1%) and UNI (-0.3%).

Laggards: APT (-3.0%) and SOL (-2.5%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

MYX closes strategic funding round led by Consensys

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

MYX has completed and closed a strategic funding round led by Consensys ahead of its V2 launch.

Onchain derivatives protocol MYX has completed a strategic funding round led by Consensys, with participation from Consensys Mesh and Systemic Ventures, ahead of the MYX V2 launch. With the closing of this round, Consensys has officially become the largest investor in MYX. The raise supports the rollout of MYX’s Modular Derivative Settlement Engine, marking the platform’s transition into core infrastructure for omnichain derivatives.

MYX V2 represents a structural shift in how onchain derivatives are built and settled. Rather than operating as a vertically integrated dapp, MYX now serves as a modular settlement layer that other products and platforms can build upon.

At the protocol level, MYX V2 integrates account abstraction via EIP-4337 and EIP-7702 alongside Chainlink’s latest permissionless oracle stack. Together, these components are designed to remove long-standing frictions in onchain trading including slow listings for long-tail assets as well as inefficient use of capital and complex transaction flows.

MYX V2 enables gasless, one-click trading while preserving non-custodial control and introduces a Dynamic Margin system that supports up to 50x leverage without relying on traditional order book depth. This architecture allows MYX to offer oracle-anchored pricing that eliminates slippage for large orders, significantly reducing execution risk for professional traders.

By decoupling liquidity depth from execution quality, MYX aims to eliminate the trade-off between access and execution that onchain perps traders deal with every day. MYX states that with this approach, traders no longer need to wait for deep order books, ladder into positions, or eat slippage when trading size, especially in new or volatile markets. Pricing is anchored directly to oracles rather than transient market depth, allowing positions to be opened and closed at predictable prices regardless of local liquidity conditions.

According to the team, the result is materially lower effective trading costs than underlying spot markets, immediate access to newly emerging assets, and consistent execution even during periods of market stress. These mechanics are not discretionary or market-maker dependent; they are enforced by deterministic economic models, robust margin systems, and conservative security assumptions designed to perform under real trading conditions.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin stays volatile while MUFG says stables work better as money

Bitcoin slips ~2% in 7d as MUFG touts stablecoins’ price-stable payments.

Summary

- TC trades near $68k, with a 7d move of about -2.25%, and a 24h range around $66.7k–$69.1k.

- MUFG’s Hardman says stablecoins better meet money’s role via price stability, fast settlement, and low-cost transfers versus BTC’s higher volatility.

- Stablecoins, often fiat-pegged, are gaining attention as digital cash and could see higher adoption in payments while BTC remains mainly a store-of-value asset.

An analyst at Mitsubishi UFJ Financial Group has stated that stablecoins represent a more suitable currency option than Bitcoin for payment purposes, according to recent commentary from the Japanese financial institution.

Lee Hardman, an analyst at MUFG, one of Japan’s three largest banks, said stablecoins have attracted increased attention compared to other digital assets due to their function as digital cash.

Hardman stated that stablecoins better fulfill the requirements of money by offering price stability and fast, low-cost payment services, according to the analyst’s assessment. The analyst noted that Bitcoin’s high price volatility limits its use as a daily payment method.

Stablecoins are pegged to fiat currencies and maintain stable value, making them more likely to be used as a medium of exchange and payment, Hardman said.

The comments come as interest in Bitcoin and cryptocurrencies continues to expand globally, with financial institutions increasingly evaluating various digital asset classes for potential use cases.

Crypto World

What Happens to ETH if $2K Support Is Decisively Lost?

After the aggressive sell-off toward the $1.8K region, the market has transitioned into choppy consolidation, while lower timeframes are now approaching a decisive breakout point. The key question is whether this compression resolves to the upside or results in continuation within the dominant downtrend structure.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, Ethereum is exhibiting clear consolidation behaviour following its sharp decline. The price action has become increasingly choppy, reflecting equilibrium between buyers and sellers. Instead of impulsive continuation, the market is printing overlapping candles with limited directional commitment.

This consolidation is confined between the $1.8K static support base and the channel’s midline acting as dynamic resistance. The mid-boundary of the descending channel continues to cap bullish attempts, preventing a structural trend reversal. Meanwhile, the $1.8K zone remains a strong demand area that has repeatedly absorbed selling pressure.

As long as the price remains trapped between these two boundaries, the primary scenario is range-bound fluctuation. A confirmed breakout above the channel’s midline would open the path toward higher resistance zones, while a breakdown below $1.8K would invalidate the equilibrium and likely trigger another impulsive leg lower.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the market structure becomes more compressed. Ethereum has formed a clear triangle pattern, with descending resistance and rising support squeezing the price into a narrow apex. This pattern reflects volatility contraction and typically precedes an expansion phase.

The asset is now approaching the final portion of the triangle, suggesting that a breakout is imminent. Given the recent higher lows inside the pattern and the improving short-term structure, the probability of an upside breakout is increasing. The targets are clearly defined on the chart, with the first resistance zone aligned with the previously marked supply region above the pattern at the $2.4K area.

However, failure to break upward and a decisive breakdown below the ascending support would shift momentum back in favour of sellers.

Sentiment Analysis

The Binance ETH/USDT liquidation heatmap reveals significant liquidity dynamics around the current range. A dense liquidity cluster is positioned above the current price, indicating a concentration of short liquidation levels. Such clusters often act as magnets, drawing the price upward to trigger liquidations before a potential reaction.

At the same time, a developing liquidity concentration below the market reflects the accumulation of long positions. This suggests that traders are increasingly positioning for upside continuation, building long exposure near the consolidation zone.

The interaction between these liquidity pools increases the likelihood of a volatility expansion. A breakout to the upside could trigger short liquidations above the price, accelerating the move. Conversely, a downside sweep could target the long liquidity cluster before a potential rebound.

Overall, Ethereum is in a compression phase. The daily chart reflects equilibrium within a broader downtrend, the 4-hour chart shows a triangle nearing resolution, and liquidity positioning suggests that a decisive breakout move is approaching.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business15 hours ago

Business15 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech6 hours ago

Tech6 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business7 hours ago

Business7 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show