Business

Coca-Cola Europacific Partners PLC 2025 Q4 – Results – Earnings Call Presentation (NASDAQ:CCEP) 2026-02-18

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Disney’s Leadership Change Is Exciting, But Think Very Long-Term On The Shares (NYSE:DIS)

I have previously written articles for The Motley Fool, TheStreet, and AOLs BloggingStocks.I also write fiction. I have stories published at Nikki Finke’s Hollywood Dementia site, including “The Streaming Service,” “The Screenwriterman,” “Mygalomorph” and “Spielberg’s Last Film.”Here is a link to my YA book, “Abner Wilcox Thornberry and The Witch of Wall Street.”This is a collection of short horror stories: Tales From Salem, Mass.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

In addition to long-term positions in the above, I separately trade the same names in a shorter-term account to capture volatility gains, and may buy/sell them at any time.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

UK inflation falls to 3% as rate cut hopes build

UK inflation slowed more sharply than many had feared in January, falling to 3 per cent and bolstering expectations that the Bank of England could resume cutting interest rates as early as next month.

Data from the Office for National Statistics showed consumer price index (CPI) inflation eased from 3.4 per cent in December to 3 per cent in January, the lowest annual rate since March 2025. The reading was in line with analysts’ forecasts.

The decline was driven by lower airfares, falling petrol prices and easing food costs. Food inflation slowed to 3.6 per cent year-on-year, down from 4.5 per cent in December and its lowest level since last April. Services inflation edged down to 4.4 per cent from 4.5 per cent, while core inflation, which strips out volatile elements such as energy and food, fell to 3.1 per cent.

However, higher prices for hotel stays and takeaway food partly offset the broader slowdown.

Grant Fitzner, chief economist at the ONS, said: “Inflation fell markedly in January, driven in part by a drop in petrol prices and airfares following December’s increases. Lower food prices also contributed, particularly for bread, cereals and meat.”

The easing in price pressures comes amid signs of weakness in the labour market. Earlier this week, figures showed unemployment had climbed to 5.2 per cent, its highest level in five years, while youth joblessness reached a decade high.

Taken together, softer inflation, rising unemployment and sluggish growth have increased market expectations of a rate cut when policymakers meet on 19 March. Financial markets are now pricing in a strong likelihood that rates will be reduced from 3.75 per cent to 3.5 per cent. The Bank lowered rates four times in 2025.

Rachel Reeves said cutting the cost of living remained her “number one priority”, pointing to measures in the November budget such as energy bill adjustments and the first rail fare freeze in 30 years as helping to ease pressure on households.

At its most recent meeting, the Bank’s monetary policy committee voted narrowly, by 5-4, to hold rates steady. Governor Andrew Bailey indicated there was scope for further easing this year if inflation continued to moderate.

Yael Selfin, chief economist at KPMG UK, said the latest figures “pave the path for a March rate cut” and suggested there could be up to three reductions over the course of 2026.

Markets reacted modestly. Sterling dipped 0.06 per cent against the dollar to $1.35, while the yield on the ten-year UK government bond fell to 4.38 per cent, its lowest level in around a month.

With inflation edging closer to the Bank’s 2 per cent target and economic momentum slowing, attention will now turn to whether policymakers judge the cooling trend sufficiently durable to justify renewed monetary easing.

Business

New York Times Stock Slips Despite Berkshire Hathaway Stake-Building

Berkshire bought 5.1 million shares of the New York Times during the December quarter, Warren Buffett’s last few months as chief executive.

It sold stock in Apple, marking the third-straight period it cut its stake in the iPhone maker.

Berkshire slashed its stake in Amazon by 77%.

It also unloaded shares of Bank of America.

Business

Dutch Bros delivers ‘record-breaking year’

Income surges 126% to nearly $80 million.

Business

Mamdani pushes for New York tax hike on the wealthy and corporations

New York City Mayor Zohran Mamdani called for the state to increase taxes on corporations and the wealthy to help address city’s budget deficit Tuesday, warning that the alternative option will be for the city to raise property taxes.

New York City Mayor Zohran Mamdani is calling for the Empire State to hike taxes on corporations and wealthy individuals in order to address the Big Apple’s budget deficit, warning that the alternative would involve the city increasing property taxes and dipping into its reserves.

Mamdani has issued a preliminary fiscal year 2027 budget that involves a property tax hike, a prospect he has described as a “last resort.”

“Today, I’m releasing the City’s preliminary budget. After years of fiscal mismanagement, we’re staring at a $5.4 billion budget gap — and two paths. One: Albany can raise taxes on the ultra-wealthy and the most profitable corporations and address the fiscal imbalance between our city and state. The other, a last resort: balance the budget on the backs of working people using the only tools at the City’s disposal,” Mamdani noted in a Tuesday post on X.

FREE BUSES, REAL COSTS. INSIDE MAMDANI’S SOCIALIST DREAM TO SHAKEUP TRANSIT FOR NEW YORKERS

New York City Mayor Zohran Mamdani during a Bloomberg Television interview at City Hall in New York, on Thursday, Jan. 29, 2026. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

The city council needs to green-light city budgets, according to the New York Times.

“As the mayor of New York City, I have a legal obligation to balance the budget. I will meet that obligation,” he said during remarks on Tuesday.

The sun sets on the Statue of Liberty and the Empire State Building in New York City on July 28, 2025, as seen from Bayonne, N.J. (Gary Hershorn/Getty Images / Getty Images)

“Faced with no other choice, the city would have to exercise the only revenue lever fully within our own control. We would have to raise property taxes. We would also be forced to raid our reserves,” he said.

“This would effectively be a tax on working and middle class New Yorkers, who have a median income of $122,000,” said Mamdani, a self-described Democratic socialist who ran on a platform that promised to tackle rent costs.

HOUSE GOP LEADER RIPS ‘SOCIALIST’ ZOHRAN MAMDANI AFTER 18 PEOPLE FREEZE TO DEATH IN NYC

New York City Mayor Zohran Mamdani during an announcement on junk fees in the Susan and John Hess Family Theater at The Whitney Museum of American Art in New York, on Wednesday, Jan. 21, 2026. (Adam Gray/Bloomberg via Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Mamdani said the “preliminary budget takes the only path within our control,” but added that the city will only go that route if there is no other way to achieve a balanced budget.

Business

Bank of Hawaii stock hits 52-week high at 80.25 USD

Bank of Hawaii stock hits 52-week high at 80.25 USD

Business

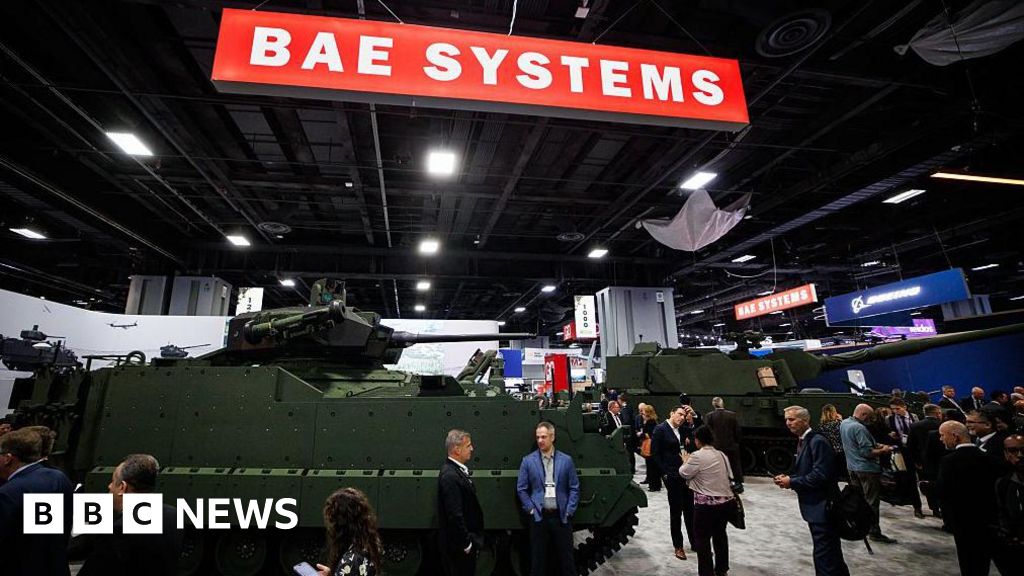

Defence giant BAE hails record sales as workers remain on strike

Speaking after the company’s record results, Woodburn, who has run BAE since 2017, said: “In a new era of defence spending, driven by escalating security challenges, we’re well-positioned to provide both the advanced conventional systems and disruptive technologies needed to protect the nations we serve now and into the future.”

Business

Lagarde’s possible early departure leaves investors pondering replacements

Lagarde’s possible early departure leaves investors pondering replacements

Business

Upstart’s Technology Has Taken The Next Step (Rating Upgrade) (NASDAQ:UPST)

I am an individual investor, working at a global technology company. I have an academic background in engineering and business economics and am currently pursuing a PhD in economics. I started investing while attending university in 2012 and have a focus in technology-based growth stocks, particularly in the fields of renewable energy, hydrogen, new mobility and space. As I aim to identify growth stocks for a diversified portfolio early on, the companies I invest in are usually small or micro caps which are not covered by a lot of analysts and SA contributors. I will thus share my thoughts from time to time with articles if I feel there are interesting yet under-evaluated investment ideas to contribute. My investment style is long only and I invest to hold for the long-term. In my analyses, I focus on fundamental topics such as technology, business model and valuation relative to the addressed market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UPST, PGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

General Mills reduces forecast for fiscal 2026

“Challenging consumer environment” cited for guidance adjustment.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business15 hours ago

Business15 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech6 hours ago

Tech6 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business8 hours ago

Business8 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment2 hours ago

Entertainment2 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion