Crypto World

Bitcoin stays volatile while MUFG says stables work better as money

Bitcoin slips ~2% in 7d as MUFG touts stablecoins’ price-stable payments.

Summary

- TC trades near $68k, with a 7d move of about -2.25%, and a 24h range around $66.7k–$69.1k.

- MUFG’s Hardman says stablecoins better meet money’s role via price stability, fast settlement, and low-cost transfers versus BTC’s higher volatility.

- Stablecoins, often fiat-pegged, are gaining attention as digital cash and could see higher adoption in payments while BTC remains mainly a store-of-value asset.

An analyst at Mitsubishi UFJ Financial Group has stated that stablecoins represent a more suitable currency option than Bitcoin for payment purposes, according to recent commentary from the Japanese financial institution.

Lee Hardman, an analyst at MUFG, one of Japan’s three largest banks, said stablecoins have attracted increased attention compared to other digital assets due to their function as digital cash.

Hardman stated that stablecoins better fulfill the requirements of money by offering price stability and fast, low-cost payment services, according to the analyst’s assessment. The analyst noted that Bitcoin’s high price volatility limits its use as a daily payment method.

Stablecoins are pegged to fiat currencies and maintain stable value, making them more likely to be used as a medium of exchange and payment, Hardman said.

The comments come as interest in Bitcoin and cryptocurrencies continues to expand globally, with financial institutions increasingly evaluating various digital asset classes for potential use cases.

Crypto World

Telegram blocks 7.46m channels as Russia mulls April 1 ban

Telegram use in Russia faces rising blocks and slowdown as regulators tighten controls.

Summary

- Telegram blocked 238.8k channels on Feb 15 and 187.3k on Feb 16, taking total blocked groups and channels to over 7.463m since Jan 1.

- Russia fully blocked WhatsApp and removed its domains from DNS, steering users toward the state-backed Max messenger amid broader social-media restrictions.

- Despite throttling and potential April 1 blocking, Russian users increasingly rely on VPNs and alternative apps like imo to keep messaging access.

Telegram has begun blocking illegal content and has sufficient time to meet Russian regulatory requirements, according to a senior parliamentary committee member overseeing the matter.

Andrey Svintsov, deputy chairman of the Committee on Information Policy at the State Duma, told state news agency TASS that the messaging platform has started actively complying with Russian Federation requirements. “Over the past week, Telegram has blocked more than 230,000 channels and pieces of content that violated current legislation,” Svintsov stated. “This indicates that Durov’s company has begun to interact more actively.”

Russian authorities slowed traffic to the messenger earlier this month, citing non-compliance with national regulations. Media reports emerged this week suggesting the platform could be fully blocked on April 1, though Russian officials have neither confirmed nor denied the reports.

Svintsov said Telegram could fulfill Roskomnadzor’s requirements within one to two months and continue operating in Russia. “In my opinion, Telegram will not be blocked before April 1,” he stated, referring to messenger founder and CEO Pavel Durov.

Roskomnadzor, the Federal Service for Supervision of Communications, Information Technology and Mass Media, serves as Russia’s telecommunications regulator and media oversight body. According to Svintsov, the requirements include opening a legal entity, storing data on Russian territory, paying taxes and blocking prohibited content. “Opening a legal entity takes a week at most. Moving personal data processing takes another two or three weeks,” the deputy said.

Last summer, reports that Telegram was preparing to establish an office in Russia under the country’s “landing law” were denied by Durov, either directly or indirectly, according to previous media accounts.

Yulia Dolgova, president of the Russian Association of Bloggers and Agencies, told TASS that determining whether Telegram will be fully blocked remains difficult at this stage. She noted that unlike WhatsApp, Telegram is actively taking measures to maintain service functionality. Roskomnadzor completely removed Meta’s WhatsApp domain from its DNS servers last week, effectively blocking access from Russia. Dolgova also noted widespread VPN usage among Russian users to bypass such restrictions.

Telegram, the government and crypto

The Telegram channel Baza, citing government sources, reported that Roskomnadzor is preparing to “begin a total blocking of the messenger” on April 1. In response to media inquiries, Roskomnadzor said it had “nothing to add” to previous statements threatening “sequential restrictions.”

TASS reported this week that Telegram’s administration blocked 238,800 channels and groups on February 15 and 187,300 channels and groups worldwide on February 16, according to updated statistics on the messenger’s website. As of February 17, more than 7.463 million groups and channels have been blocked on Telegram since the beginning of the year, the agency reported.

Telegram ranks as the second most popular messaging application in Russia with 93.6 million users, trailing WhatsApp, which had 94.5 million monthly users before being blocked. As Russia implements restrictive measures against both platforms while promoting the state-backed Max messenger, Russian citizens have increasingly turned to imo, a U.S.-made messaging alternative, according to reports.

Crypto World

Here’s How Soon US Crypto Market Structure Bill Could Come

US lawmakers may face a narrowing window to pass long-awaited crypto legislation. Speaking at the World Liberty Forum, Senator Bernie Moreno said a comprehensive market structure bill could pass “hopefully by the end of April.”

The Ohio Senator stressed that Congress must act within the next 90 days to maintain momentum.

Sponsored

A Compressed Timeline for Crypto Rules

The remarks, delivered at an event hosted by World Liberty Financial at Mar-a-Lago on February 18, highlighted both urgency and persistent friction between the banking sector and the digital asset industry.

According to live reporting, Bernie Moreno acknowledged the difficulty of negotiations, saying the process had “taken years off my life,” while reiterating that lawmakers “have to get it done in the next 90 days.”

Moreno has been one of the most vocal advocates for federal crypto legislation, particularly measures tied to frameworks such as the Digital Asset Market Clarity Act, which aims to define whether digital tokens fall under securities or commodities law and to establish clearer oversight of trading platforms and stablecoins.

Although elements of crypto legislation have already passed the House, Senate progress has slowed in recent months amid lobbying, technical disagreements, and partisan divisions.

Moreno’s timeline suggests lawmakers are attempting to push negotiations toward a decisive phase before the legislative calendar tightens further.

Sponsored

Stablecoin Yield Debate Remains a Sticking Point

One of the most contentious issues remains whether stablecoin issuers should be allowed to offer yield or rewards to users.

Banks have argued that yield-bearing stablecoins could draw deposits away from the TradFi system. Meanwhile, crypto firms maintain that such features are essential to innovation and competition.

At the forum, Moreno drew applause after vowing not to allow banks to reopen provisions already settled in the GENIUS Act.

“We’re not going to go back and revisit legislation that’s already passed,” Moreno said, adding that he would not permit changes in the digital asset space that could undermine prior agreements.

Sponsored

Sources familiar with negotiations indicated that talks between banks and crypto stakeholders have made little progress in recent weeks. This strengthens concerns that the legislative timetable could slip further.

Political Signals and Industry Pressure

Standing alongside Moreno, Ashley Moody injected a note of humor into the discussion, drawing laughter from the audience.

She also highlighted the intense scrutiny facing lawmakers as they attempt to finalize the bill.

Sponsored

“He’s in Banking. If they don’t get it done, we can blame Bernie,” she quipped.

Meanwhile, a potential White House meeting to advance negotiations may be postponed. One invitee reportedly described the planned gathering as likely to be “just for show,” suggesting that insufficient progress has been made to justify another high-level session.

The World Liberty Forum itself drew roughly 300 to 400 leaders from finance, technology, policy, and media.

This suggests growing institutional interest in how stablecoins, DeFi, and blockchain infrastructure could shape the future of the US dollar and global markets.

Moreno’s 90-day deadline serves less as a guarantee than a signal. After years of debate, the window for decisive US crypto regulation may finally be narrowing.

Crypto World

Lagarde Exit Report Raises Questions Over Digital Euro Timeline and Stablecoin Policy

Christine Lagarde might not stick around until 2027. Reports suggest the ECB president is weighing an early exit.

If that happens, it is not just a personnel change. It could scramble the timeline for the digital euro and stablecoin oversight right as MiCA rules start taking effect.

A leadership shakeup at this stage would inject fresh uncertainty into Europe crypto roadmap.

Key Takeaways

- Early Departure: Lagarde is reportedly weighing an exit before October 2027 to align with French presidential elections.

- Succession Race: Top contenders include Dutch central bank chief Klaas Knot and Spain’s Pablo Hernández de Cos.

- Project Risk: A change in leadership threatens the continuity of the digital euro project and euro-stablecoin oversight.

Why Is The Timing Critical for Crypto?

Lagarde has been the driving force behind the ECB digital push. Since 2019, she moved the digital euro from theory into formal investigation. Now, just as MiCA stablecoin rules are being finalized, her potential exit lands at a sensitive moment.

Without her leading the charge, the sovereign payment narrative weakens. There are also political layers here. Aligning her departure with the April 2027 French election could give President Macron influence over who steps in next.

The bigger concern is policy drift. A new ECB chief could shift focus back to traditional tightening and slow down digital euro efforts. That would leave more room for private stablecoins to fill the gap.

Who Could Take The Reins?

Publicly, the ECB says she is fully focused on her job. But the timing being floated suggests this is more than random chatter. The idea is to step aside before political shifts in France and Germany complicate the process.

Names are already circulating. Spain’s Pablo Hernández de Cos. Dutch central bank chief Klaas Knot. Even Bundesbank head Joachim Nagel is in the conversation.

Officially, nothing is confirmed. ECB executive Piero Cipollone says he has no knowledge of an early exit plan. Still, markets tend to price political risk before headlines become formal announcements.

With 21 eurozone nations needing to approve a successor, whoever takes over could significantly shape Europe’s stance on crypto and the digital euro.

What Happens to the Digital Euro?

A leadership vacuum would leave the digital euro in a fragile spot. The project already faces pushback from banks and privacy advocates. Without Lagarde driving it forward, momentum could fade fast.

And this is happening while stablecoin liquidity is shifting quickly. If the ECB hesitates on building a serious euro alternative to US dollar tokens, private players will not wait.

At the same time, the US and other major economies are accelerating their crypto frameworks. Europe cannot really afford a slowdown. Leadership uncertainty rarely supports long term institutional projects.

Discover: Here are the crypto likely to explode!

The post Lagarde Exit Report Raises Questions Over Digital Euro Timeline and Stablecoin Policy appeared first on Cryptonews.

Crypto World

ECB Targets 2027 Digital Euro Pilot as Provider Bids Open Q1 2026

The European Central Bank is edging closer to a full-fledged digital euro pilot, signaling a shift from exploratory talks to concrete testing. In remarks delivered after an executive committee meeting of the Italian Banking Association, ECB Executive Board member Piero Cipollone outlined a staged timetable that prioritizes the selection of payment service providers (PSPs) in early 2026 and a 12-month pilot during the second half of 2027. The plan envisions a small group of PSPs, merchants and Eurosystem staff participating in the initial phase, with broader involvement contingent on legislative and technical readiness. The remarks underscore the bank’s aim to validate a central bank digital currency in practical settings while preserving the integrity of European card schemes and keeping banks at the core of the payments ecosystem. held

Cipollone stressed that the digital euro would be designed to protect European card schemes and preserve banks’ central role in Europe’s payments system, a framing that aligns with Reuters’ coverage of the central bank’s approach. The pilot is intended to be modest in scope at the outset, focusing on a limited number of PSPs, merchants and Eurosystem staff to test onboarding, settlement and liquidity management in a real-world environment. This phased approach is positioned to give participating PSPs an early-readiness edge should a broader rollout follow, while generating practical data on infrastructure, compliance and staffing costs for planning purposes.

Key takeaways

- PSP selection for the digital euro pilot is scheduled to begin in the first quarter of 2026, setting the stage for a 12-month trial in the latter half of 2027.

- The pilot will involve a limited cohort of PSPs, merchants and Eurosystem staff, enabling hands-on testing of onboarding, settlement and liquidity management within a controlled environment.

- European authorities emphasize that the digital euro is intended to shield domestic payment ecosystems and card schemes, rather than displace them, with a focus on preserving the role of banks in payments.

- Governance and cost visibility are key aims of the pilot, offering participating players clearer insights into future infrastructure, compliance and staffing needs.

- Industry expectations are shaped by a longer-term roadmap that includes potential broader rollout and a 2029 launch target, contingent on legislative progress in 2026 and subsequent regulatory steps.

Market context: The push for a digital euro sits within a broader European effort to modernize payments, reduce dependence on international card networks, and ensure a stable, centrally governed digital currency option for residents and businesses. The central bank’s framing of the pilot as a way to protect domestic systems while engaging with private sector participants mirrors ongoing debates around stablecoins and private payment solutions that could otherwise erode the traditional banking role in payments.

Why it matters

The ECB’s move toward a structured pilot signals a careful balance between innovation and incumbency. By enabling a controlled test environment that includes EU-licensed PSPs and direct Eurosystem involvement, the central bank aims to gather actionable data on how a digital euro could function in real commerce. This includes practical issues around onboarding new users, ensuring seamless settlement between participants, and managing liquidity—areas that have historically proven complex for central bank digital currency platforms to operationalize at scale.

From a banking perspective, the digital euro is envisioned not as a threat to banks, but as a mechanism to preserve their centrality in a payments landscape that increasingly incorporates digital solutions. Cipollone highlighted that the project would aim to protect domestic payment rails and card schemes while offering a more cost-efficient option for merchants. The stated goal is to place a cap on merchant fees for the digital euro network that would be lower than the charges typical of international card networks, yet higher than those charged by domestic schemes. This pricing dynamic is designed to keep EU-based payment ecosystems competitive while ensuring that the digital euro remains attractive to merchants and consumers alike.

European policymakers are also mindful of broader industry shifts. The plan explicitly notes the European Bancomat and Bizum-type networks as areas where the digital euro could help preserve domestic alternatives against private, cross-border payment rails. In this context, the pilot is less about displacing existing networks and more about integrating a central bank digital currency in a way that complements, rather than competes with, established infrastructures. This approach aligns with the broader aim of safeguarding financial stability and ensuring that Europe maintains strategic control over its payments architecture as new digital forms of money emerge.

What to watch next

- First-quarter 2026: Official PSP selection process begins, narrowing the field for the pilot.

- Second half of 2027: Primary 12-month digital euro pilot period commences with participating PSPs and merchants.

- 2026–2027: Legislation and regulatory steps to enable or adjust digital euro deployment, shaping the timeline for broader rollout.

- 2029: Potential full-scale launch if legislative and technical milestones are met and stakeholders achieve sufficient readiness.

- Ongoing infrastructure planning: ECB and Eurosystem continue to map future ecosystem costs, staffing needs and compliance requirements tied to the digital euro’s operation.

Sources & verification

- ECB press release and accompanying document outlining the PSP selection and pilot plans (Sp260218) and related materials.

- Reuters coverage detailing Cipollone’s remarks and the digital euro design goals to protect European banks’ card schemes.

- Cointelegraph reporting on the digital euro trajectory, including references to the 2029 launch plan and next-phase progression.

- Historical reporting on the ECB’s progression toward a digital euro, including discussions around legislation timelines in 2026.

ECB advances digital euro pilot as PSP selection begins in 2026

The European Central Bank is advancing toward a tangible digital euro pilot, signaling a transition from theoretical exploration to real-world testing. The plan, presented in the wake of a meeting with the Italian Banking Association’s executive committee, centers on naming payment service providers (PSPs) in early 2026 and launching a 12-month trial in the second half of 2027. The pilot’s initial footprint will be deliberately modest: a limited cadre of PSPs, a handful of merchants and Eurosystem staff will participate to validate core operational flows, including onboarding, settlement and liquidity management. This approach aims to deliver measurable insights while preserving the primacy of existing European card schemes and banks within the payments system.

In explaining the design philosophy, Cipollone stressed that the digital euro should bolster domestic payment networks rather than replace them. By anchoring the rollout in EU-licensed PSPs, the ECB seeks to ensure merchant access, interoperable settlements and a governance structure that keeps banks at the center of the payments ecosystem. The broader objective is to strike a balance between innovation and stability—allowing the digital euro to co-exist with established rails while mitigating the risk of private, non-government-controlled systems displacing traditional players.

A key element of the planned approach is the potential to test and refine future infrastructure, compliance and staffing costs. The pilot’s visibility into these cost dimensions could inform investment decisions for PSPs and banks, helping them plan capital deployment with greater certainty. Direct Eurosystem involvement is intended to yield practical feedback from participants, shaping both product design and governance arrangements as the project evolves.

Beyond the technical and financial considerations, the ECB’s digital euro initiative is framed as a strategic safeguard for Europe’s payments sovereignty. The project explicitly envisions protecting local networks, such as Italy’s Bancomat and Spain’s Bizum, from losing ground to private, cross-border platforms. In Cipollone’s view, the digital euro should offer an affordable alternative for merchants—pricing that is lower than the typical charges on international networks but higher than the minimums charged by domestic schemes. This pricing nuance reflects a deliberate effort to maintain domestic competitive advantages while embracing the efficiencies associated with central bank money in digital form.

As policymakers weigh the next steps, observers will be watching how the proposed timeline aligns with legislative developments in 2026 and how the pilot’s findings influence the path toward a broader rollout. The ECB’s timeline currently contemplates a 2029 launch under favorable regulatory and technical conditions, with a potential early start to the pilot if legislation is enacted in 2026. This braided timetable underscores the delicate balance the central bank must strike between experimentation, market readiness and fiscal prudence in a rapidly evolving digital payments landscape.

Crypto World

Grayscale and Canary Capital Introduce SUI ETFs for Direct Token Exposure

TLDR

- Canary Capital launched the Canary Stake SUI ETF on Nasdaq, offering exposure to the SUI token and staking rewards.

- Grayscale converted its SUI trust into an ETF, providing investors with direct access to the SUI token through NYSE Arca.

- The new SUI ETFs allow both institutional and retail investors to participate in the growing SUI blockchain ecosystem.

- SUI is a Layer 1 blockchain developed by Mysten Labs, with its token used for transaction fees and smart contract execution.

- The SUI ETFs enable investors to earn rewards through SUI’s proof-of-stake mechanism while tracking the spot price of the token.

Two new exchange-traded funds (ETFs) linked to SUI token launched on Wednesday, offering investors direct exposure to SUI’s price. Canary Capital debuted the Canary Stake SUI ETF on Nasdaq, while Grayscale converted its SUI trust into an ETF on NYSE Arca. Both funds will track SUI’s price, with the added benefit of enabling investors to earn staking rewards.

Canary Capital’s SUI ETF: Canary Stake SUI ETF (SUIS)

Canary Capital launched its Canary Stake SUI ETF, trading under the ticker symbol SUIS on Nasdaq. This new fund tracks the spot price of SUI and allows investors to benefit from staking rewards. SUI operates on a proof-of-stake mechanism, which the ETF integrates into its structure, allowing investors to earn net staking rewards.

Steven McClurg, CEO of Canary Capital, emphasized the importance of this fund, saying, “The Canary Staked SUI spot ETF (SUIS) brings exposure to SUI in a registered, exchange-traded structure, while also enabling investors to benefit from net staking rewards generated through SUI’s proof-of-stake mechanism.” The ETF provides a regulated way for investors to engage with the SUI ecosystem and benefit from staking.

Grayscale Launches SUI Fund as an ETF

Grayscale followed suit, launching its own SUI fund on the same day. The company converted its SUI trust into an ETF, trading under the ticker GSUI on NYSE Arca. This ETF will provide investors with exposure to the SUI token, offering another way to participate in the growing blockchain ecosystem.

Grayscale’s decision to turn its SUI trust into an ETF aims to provide easier access for institutional and retail investors. By offering direct exposure to the SUI token, the fund offers an alternative to buying the token directly on cryptocurrency exchanges.

SUI’s Growing Ecosystem

SUI, developed by Mysten Labs, is a Layer 1 blockchain used to power decentralized applications and smart contracts. The SUI token plays a vital role in the blockchain, serving as a means to pay for transaction fees and support various other network functions. SUI is currently ranked 31st by market capitalization, valued at approximately $3.7 billion.

The launch of these SUI ETFs marks an important milestone for the blockchain’s adoption. It allows a broader range of investors to gain exposure to the SUI ecosystem in a regulated, traditional investment format. The ETFs make it easier for individuals to invest in the blockchain’s native token while also earning rewards through its proof-of-stake mechanism.

Crypto World

How Europe’s Blockchain Sandbox Ties Innovation to Regulation

The European Union, often criticized for prioritizing rulemaking over innovation, is pointing to the European Blockchain Sandbox as an example of how regulation can boost innovation.

After three cohorts of confidential dialogues, the initiative has produced a 230-page best practices report and drawn in nearly 125 regulators and authorities.

The European Commission tapped law firm Bird & Bird and its consortium partners to lead the initiative, which matches blockchain use cases with regulators for confidential dialogues aimed at clearing legal challenges.

Marjolein Geus, a partner at Bird & Bird, told Cointelegraph that the process has shown compliance need not be a deterrent.

“For use case owners, it helps them better understand the relevant regulations and how those rules apply to their projects,” she said. “It allows regulators and authorities to deepen their understanding of how those technologies interact with the regulatory frameworks within their areas of competence.”

In the latest cohort, “mature” use cases were increasingly operational and embedded in sectors such as energy, healthcare and artificial intelligence, bringing along more complex compliance discussions.

How MiCA became a test of regulatory timing for blockchain

When the Markets in Crypto-Assets Regulation (MiCA) was adopted, observers warned that strict obligations would raise barriers for startups. Stablecoin rules drew particular scrutiny as Tether — issuer of the world’s largest stablecoin — ultimately decided against seeking MiCA authorization for USDt (USDT).

The brain drain narrative predates crypto. European founders have often incorporated in jurisdictions perceived as having a lighter touch.

Similar fears surfaced when the General Data Protection Regulation (GDPR) took effect in 2018. Businesses complained of interpretive confusion and administrative burden. Some foreign firms scaled back EU exposure. However, the GDPR has since become a global reference point, with many multinationals aligning operations to its standards.

The criticism that Europe “regulates first and innovates later” rests on the idea that legal certainty follows market development. MiCA was adopted before the crypto sector reached institutional maturity. In theory, that sequencing risks locking rapidly developing tech into rigid categories too early.

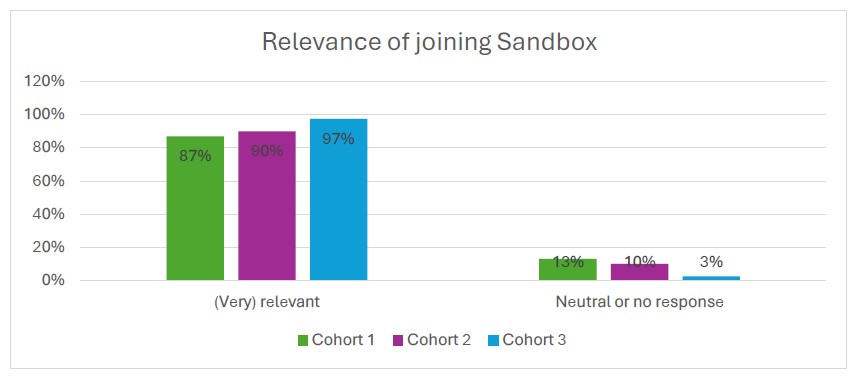

But the sandbox advanced a counterpoint, suggesting that early legislation combined with regulatory dialogue can enhance clarity and accelerate compliance. In the third cohort, 77% of respondents described the sandbox as having a crucial or valuable impact on innovation and regulation, and none reported no impact.

While the EU opted for early codification and dialogue, the world’s largest economy, the US, lacks a comprehensive federal framework for digital assets despite presidential pledges to become a global hub. Its proposed Digital Asset Market Clarity Act has stalled after key industry figures withdrew support over provisions, including restrictions on stablecoin yield.

Related: When will crypto’s CLARITY Act framework pass in the US Senate?

Smart contracts and the limits of decentralization

While the best practices report spans over 20 chapters across multiple regulatory domains, its sections on smart contracts and decentralization focus on how blockchain systems are structured at the code and governance level.

“Virtually all blockchain DLT use cases use smart contracts. They are subject to regulation, with security requirements often relevant, as well as obligations under the GDPR,” Geus said.

The dialogues examined how those contracts interact with existing EU frameworks, not just MiCA. Depending on their function and the degree of control retained by identifiable actors, smart contracts may trigger obligations ranging from cybersecurity source code reviews to operational resilience testing and conformity declarations.

“The question then becomes how to ensure those smart contracts are secure and GDPR compliant and how to test whether they meet the applicable regulatory frameworks. That is an area where further clarification, harmonization and standardization are needed,” Geus said.

Another focal point of the third cohort report is the qualification of services provided “in a fully decentralized manner without any intermediary” under MiCA.

MiCA references the term “fully decentralized” but doesn’t define it.

Like smart contracts, determining full decentralization in Europe requires further clarification. The report did attempt to lay out a checklist within the limits of how MiCA and the Markets in Financial Instruments Directive are structured.

Among those are identifiable fee recipients or entities capable of modifying the protocol, which may suggest the existence of an intermediary. Where such influence exists, MiCA is likely to apply, and authorization as a crypto service provider may be required.

Related: Crypto’s decentralization promise breaks at interoperability

Crypto in Europe’s legal architecture

The European Blockchain Regulatory Sandbox’s participation neither implies legal endorsement or regulatory approval nor does it grant derogations from applicable law.

By the third cohort, dialogues increasingly engaged horizontal legislation such as the GDPR and the Data Act. Projects were assessed not as isolated crypto experiments, but as embedded digital systems interacting with financial, cybersecurity and data governance frameworks.

Johannes Wirtz, partner at Bird & Bird’s finance regulation group, observed that regulators involved in the dialogues demonstrated deeper familiarity with crypto than expected.

“This was actually something which surprised me in certain regards because you always had this assumption that they are more or less bound to the old world, but they have their innovation departments, which are really good at identifying the issues,” Wirtz said.

If the early criticism of European policy assumed that law would constrain experimentation, Bird & Bird representatives claimed that structured dialogue clarifies how that perimeter applies in practice.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

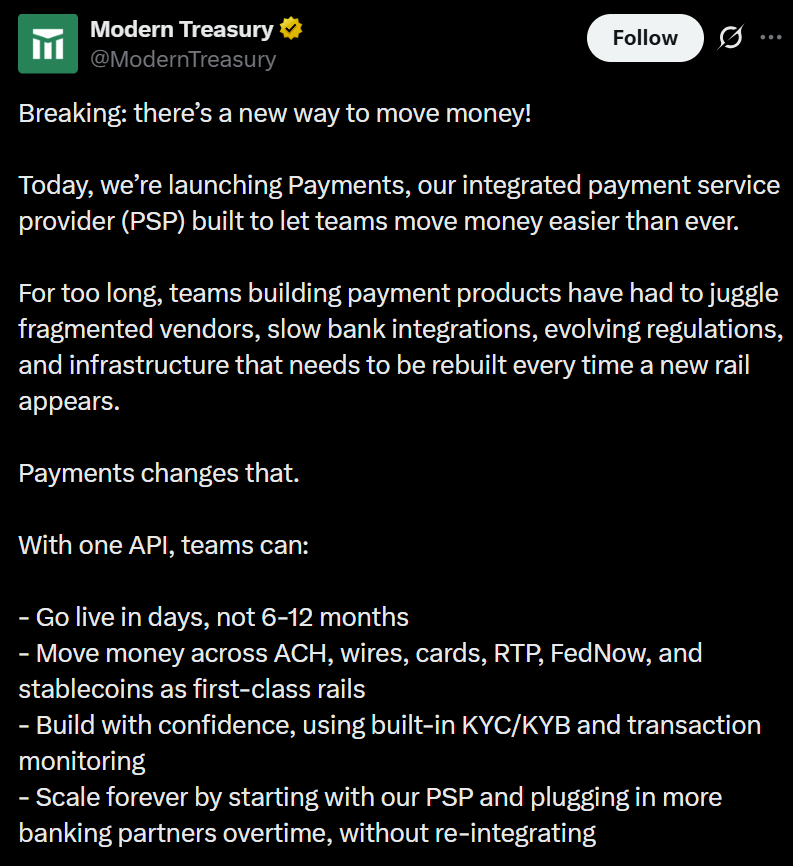

Modern Treasury Adds Stablecoin Settlement to PSP

Modern Treasury, a payments operations software provider that helps companies manage and reconcile money movement, has introduced an integrated payment service provider (PSP) that supports both traditional fiat rails and stablecoins.

On Wednesday, the company announced that it has added stablecoin settlement to the same infrastructure that businesses already use for ACH transfers, wire payments and real-time payment networks. At launch, the platform supports Global Dollar (USDG), Pax Dollar (USDP) and USDC (USDC), with USDt (USDT) expected to be added in the future.

Modern Treasure acquired stablecoin and fiat payment platform Beam in October.

The company has partnered with Paxos to integrate regulated stablecoins and settlement capabilities into its platform and has joined the Global Dollar Network. San Francisco-based Modern Treasury also participates in Circle’s Alliance Program, a partner network that supports the broader use of the USDC stablecoin in payments and financial services.

With the move, stablecoins are incorporated into a single compliance framework alongside traditional banking rails. Companies using Modern Treasury no longer need separate vendors or technical integrations to process crypto-based and fiat payments.

The update effectively makes stablecoins another settlement option within a conventional payment flow, potentially lowering the operational barrier for businesses seeking to integrate blockchain-based payment rails.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Stablecoins move deeper into mainstream financial infrastructure

Modern Treasury’s latest integration comes as stablecoins see broader uptake across the payments industry, particularly following the passage of the US GENIUS Act last July, which established a federal framework for dollar-backed stablecoins.

The total value of stablecoins in circulation grew by nearly 50% last year, surpassing $300 billion for the first time. Growth has slowed in recent months, with supply hovering around that level amid tighter liquidity conditions and a cooling crypto market.

Still, issuance remains near record highs, reflecting sustained demand for dollar-pegged digital assets in trading, cross-border transfers and settlement.

America’s largest banks have also signaled interest in stablecoins and related technology. JPMorgan Chase, Bank of America, Citigroup and Wells Fargo have been reported to be in early discussions about a jointly operated stablecoin initiative, though the plans are still at a conceptual stage.

Last month, Fidelity Investments announced plans to issue a new stablecoin called the Fidelity Digital Dollar. Fidelity Digital Assets president Mike O’Reilly described stablecoins as “foundational payment and settlement services.”

Related: How TradFi banks are advancing new stablecoin models

Crypto World

Peter Thiel Exits ETHZilla, Company Sells $74.5M in ETH Amid Market Pressure

Once holding over 100,000 ETH, ETHZilla liquidated some to cover debt and repurchase stock.

Peter Thiel and his Founders Fund have sold $74.5 million worth of ether (ETH) through ETHZilla Corp., fully exiting the company’s crypto treasury. The SEC filing confirmed Thiel’s entities no longer hold any shares in ETHZilla.

The sale follows a series of ether liquidations by ETHZilla to cover debt and buy back stock. The company previously held over 100,000 ETH at its peak, according to DefiLlama.

ETHZilla Faces Market Pressure

ETHZilla started as a biotech firm, 180 Life Sciences Corp., before making a full pivot to cryptocurrency management in August. The Palm Beach-based company rebranded and shifted its operations entirely to focus on holding ETH, signaling a major change from its original biotech focus.

The timing of this shift coincided with a broader crypto market downturn, which immediately affected the company’s treasury. Ether has fallen nearly 60% from last year’s peak, trading around $2,000 at press time. The decline put pressure on ETHZilla’s newly acquired crypto holdings, making careful financial management a priority.

To stabilize its finances, ETHZilla sold ether in October and December. In late October, it liquidated roughly $40 million to repurchase shares. Two months later, it sold $74.5 million to repay senior secured convertible notes, according to filings.

A Shift to Real-World Assets

ETHZilla has launched a subsidiary, ETHZilla Aerospace, to offer tokenized equity in leased jet engines. The move signals a shift toward real-world, asset-backed offerings beyond its cryptocurrency holdings.

Meanwhile, the company has not publicly commented on Thiel’s exit or its recent ETH sales. However, observers say these actions reflect the financial pressures facing crypto-focused public firms.

You may also like:

Notably, the development underscores the caution high-profile investors are showing amid volatile markets. It also highlights the challenges of maintaining a public ether treasury during rapid price swings.

Looking ahead, market watchers will follow ETHZilla’s aerospace venture and broader strategy for clues about its next steps. The pivot may indicate a new approach for digital asset companies seeking revenue outside of pure crypto holdings. It also shows how quickly corporate strategies can evolve in the crypto space.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

CryptoQuant Founder Proposes Freezing Old Bitcoin Addresses to Prevent Quantum Attacks

Bitcoin may need drastic fix against quantum threats as CryptoQuant founder urges freezing inactive wallets holding billions in BTC.

Ki Young Ju, founder of CryptoQuant, has proposed that a future Bitcoin (BTC) quantum upgrade may require freezing old addresses to protect against potential theft by quantum computers.

He also believes that addressing the risk would be challenging because the crypto community has historically struggled to agree on protocol changes.

Solution to Quantum Risk

In a social media post, Ju explained that anyone holding BTC in old address types faces the same risk. This is because the digital assets could either be frozen by design or stolen if quantum machines evolve enough to break BTC’s cryptography. He added that even securely stored private keys could become useless if owners fail to adopt protocol upgrades in time.

“In simple terms, coins that appear perfectly safe today could become spendable by an attacker tomorrow,” warned Ju.

In response to the threat, the CryptoQuant founder has suggested freezing old addresses, including the one containing Satoshi’s 1 million BTC, to prevent them from being stolen or compromised.

“Would you support freezing dormant coins, including Satoshi’s, to save BTC from quantum attacks?” he asked.

Bitcoin’s security relies on cryptography that is effectively unbreakable by classical computers. However, quantum computers change this assumption. Under certain conditions, a sufficiently powerful machine of this kind could get a private key from an exposed public key.

Once a public key is revealed on-chain, the risk is permanent. Ju estimates that roughly 6.89 million BTC are currently exposed to such attacks. Data shows that about 3.4 million BTC have been dormant for over a decade, including Satoshi’s stash, representing hundreds of billions of dollars in potential value. He explained that with so much value at risk, hackers could be very motivated if the technology becomes cheaper and easier to use.

Social Consensus Challenges

Even if freezing dormant BTC is technically possible, achieving community agreement is still a major challenge. This is because such solutions move quickly, while social consensus happens slowly.

You may also like:

The Bitcoin ecosystem has historically struggled with agreeing on protocol changes. This can be seen in the block size debate, which lasted more than three years and led to hard forks. Another example is the failed SegWit2x upgrade, demonstrating how difficult coming to an agreement can be.

Freezing coins, even to prevent quantum attacks, would likely face similar resistance because it conflicts with the OG cryptocurrency’s core philosophy of decentralization and user control.

Ju cautioned that the lack of full agreement could potentially lead to rival BTC forks as quantum technology progresses. According to him, the real question is not whether the threat will arrive in five or ten years, but whether the crypto community will be united on how to handle it before then.

Elsewhere, Bankless co-founder David Hoffman believes that in the event of a quantum attack, ETH would continue functioning normally even if BTC were to fail because it has been long prepared for these challenges.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

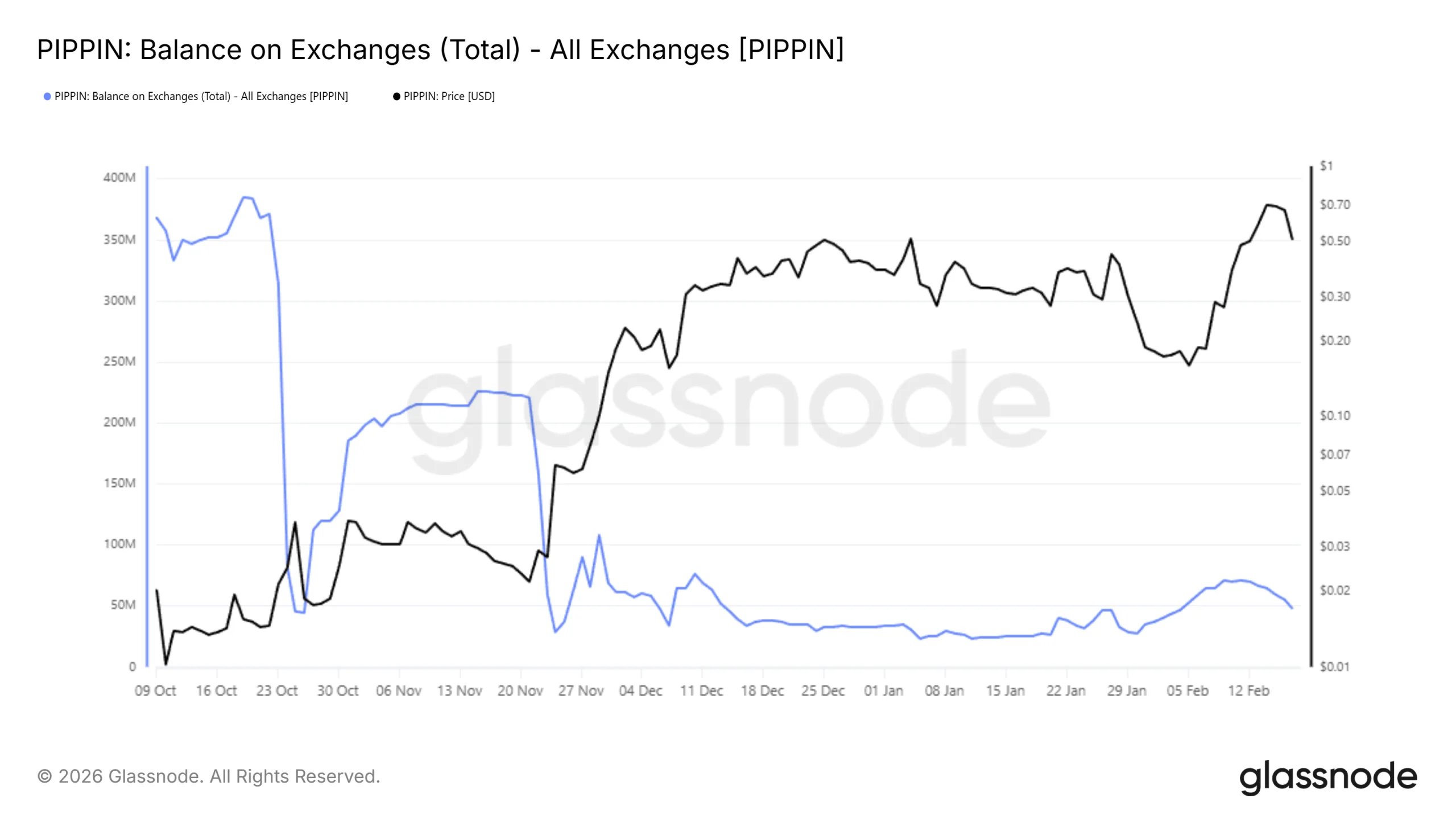

16.6 Million PIPPIN Bought Since ATH Price Now Sits At 40% Loss

PIPPIN has entered a volatile phase after failing to sustain its recent breakout. The altcoin rallied sharply but has since retraced, placing many recent buyers at a loss.

Price action now threatens to invalidate a projected 221% breakout from a broadening descending wedge pattern.

Sponsored

Sponsored

PIPPIN Holders Run To Buy

Exchange balance data reveals notable accumulation following the recent all-time high. Since the peak three days ago, investors have purchased approximately 16.6 million PIPPIN. At current valuations, this represents roughly $7.7 million in buying activity.

This accumulation pattern is not new. Historical data shows that PIPPIN holders often buy aggressively near peaks. As prices decline, panic selling frequently follows. Similar behavior appeared during the late January surge and again during the October 2025 spike.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

These cycles tend to delay sustained recovery. Early buyers accumulate at elevated levels, then exit during pullbacks. If the price weakens further, selling pressure may intensify again. This pattern raises the probability of renewed volatility in the near term.

Momentum indicators signal caution. The Money Flow Index currently sits above 80.0, placing PIPPIN in overbought territory. Elevated readings often precede cooling phases as capital inflows slow.

Broader market indecision compounds the risk. Without strong directional cues from major cryptocurrencies, speculative altcoins often struggle to sustain rallies. Unless holders begin aggressive distribution, however, a full reversal may remain delayed rather than immediate.

Sponsored

Sponsored

Will LTHs Prove To Be Pippin’s Saviour?

The HODLer Net Position Change metric provides a mixed outlook. Long-term holders continue to accumulate, as indicated by persistent green bars. Although the slope has weakened, net buying remains intact.

This ongoing support is critical. If long-term PIPPIN holders shift to distribution, downside risk would escalate quickly. A transition from accumulation to selling could accelerate losses and confirm bearish control over the trend.

PIPPIN Price Faces a Crash

PIPPIN previously broke out of a broadening descending wedge pattern. That formation projected a potential 221% upside move. However, current price action suggests the breakout is at risk of invalidation if support levels fail.

If long-term holder support stabilizes the token, PIPPIN could rebound from the $0.449 support zone. A sustained bounce may drive the price toward $0.600. Strong follow-through could retest the $0.772 all-time high, recovering recent losses.

Conversely, downside risk remains substantial. Many investors who bought at the all-time high are currently facing losses of about 40%. If panic selling resumes, PIPPIN could break below $0.449. A drop toward $0.372 would invalidate the bullish pattern and confirm the breakdown scenario.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business17 hours ago

Business17 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment4 hours ago

Entertainment4 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech8 hours ago

Tech8 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business10 hours ago

Business10 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal