Crypto World

What About the Ethereum 2.0 Roadmap?

The founder of the Ethereum project, Vitalik Buterin, unveiled a new roadmap for Ethereum a few weeks ago. His goal is to fix the weaknesses created by the migration from ETH1.0 (PoW) to ETH2.0 (PoS) regarding security and decentralisation. Vitalik, therefore, acknowledges that Ethereum has become centralised to the point where it can become dangerous, a risk that many people warned The Merge posed.

Ethereum roadmap:

The key to this change lies in whether these new modifications will be enough to make Ethereum a network with guarantees of decentralisation and resistance to censorship. We should wait a while to find out, as the new Ethereum roadmap is extensive and applies technologies that could be a success if well implemented. Without further ado, let’s take a look at the phases of this roadmap one by one:

First Phase: The Surge, truly scaling Ethereum

The Surge is the first phase of this new roadmap and aims to increase Ethereum’s scalability. Its construction relies on a series of improvements. Among them, the following stand out:

1.- The activation of EIP-4844 (Proto-Danksharding): Proposed improvement consisting of enabling a new transaction format for Ethereum. Transactions can have “data BLOBs” that can be transparently integrated into the nodes and their operation. This is similar to how rollups work and could facilitate rollup operations on Ethereum. This way, Ethereum would increase its scalability, leaving behind the ‘PoS = more scalability’ farce sold during the pre-The Merge.

2.- A series of cryptographic improvements focused on offering a ZKP (Zero Knowledge Proof) model. These improvements would enable more private and secure transactions, as well as lay the foundations for the construction of zk-Rollups and zkEVM, which would allow for private smart contracts.

3.- Alongside ZKP would come SLE or Secret Leader Election (SLE). An improvement that seeks to make the election of the PoS validator node an event protected by ZKP cryptography. This is intended to prevent manipulation of the network to some extent.

Second phase: The Scourge, re-centralising the network

In this second phase, there is a need for SLE from the previous phase to be fulfilled. This is because The Scourge needs it to build its significant improvement Proposer / Builder Separation (PBS). PBS is a proposed solution to the problem of censorship and MEV (Maximum Extractable Value) attack on the Ethereum network. The idea lies in making the construction of blocks and the proposal of new blocks to be assigned to different parts of the network, avoiding the validator carrying the weight in both tasks.

The separation of roles also occurs in other blockchains such as Dash, where there is a similar scheme with Dash miners and Masternodes, each with very clear and well-defined roles in the network. Well, Ethereum wants to take this approach to make the network have two roles:

1. Generate the role of Block Proposer, dedicated to proposing blocks to the network, a job for which it could receive rewards. However, this still needs to be clarified in Ethereum, but in other networks, these nodes receive rewards (e.g. Flow).

2. Generate the role of Block Validator, which is in charge of validating the proposed block and receiving rewards for it.

Both roles would be under an SLE type selection, but only the Block Validator could write data to the blockchain. The problem with PBS is that the reward scheme needs to be adjusted, which will directly impact Ethereum tokenomics.

Third Phase: The Verge, speeding up transaction verification

One issue that is a severe problem in Ethereum is transaction verification on the network. On-chain transaction verification is fast. However, the problem lies in the synchronisation and verification of transactions and their entire history.

This is where the third phase aims to make a significant change, making transactions able to include a series of ZKP enhancements using zk-SNARKs cryptography. Ultimately, Buterin wants Ethereum to implement zk-SNARKs as a cryptographic stack to generate the proofs needed to verify new transactions on the network. This has the advantage that zk-SNARKs are more secure than the current system using EdDSA (i.e. zk-SNARKs have higher resistance to quantum computers than EdDSA). Still, it has the disadvantage that

zk-SNARKs are algorithmically more complex. Catastrophic errors can be made, and bugs can be challenging to detect.

Fourth Phase: The Purge

This phase aims to make Ethereum simpler. As such, Buterin seeks to make the network have capabilities that allow for greater portability. These capabilities include:

1.- Enable a Fast sync. In other words, fast synchronisations only require downloading a part of the blockchain to have a functional node. Currently, the entire blockchain has to be downloaded.

2.- With the arrival of zk-SNARKs and verkle trees, unnecessary data could be discarded from the blockchain, which would allow nodes to need less disk space to store the blockchain, enabling small devices to serve as nodes (e.g. a smartphone). This would be another achievement, but it is complex, and the impact on validator nodes (which must have complete data to operate) is unknown.

3.- Further improvements in EVM to reduce gas usage and overhead (overhead on nodes and the network in general).

Fifth phase: The Splurge

In this last phase of the roadmap, the aim is to repair everything that can be repaired in Ethereum. On the one hand, to say goodbye to the manipulation of gas costs with the EIP-1559. This would eliminate the current gas costing scheme and the token burning that currently prevails in Ethereum. On the other hand, activating the VDF (Verifiable Delay Function) is a type of cryptographic function that makes data verification more efficient. It is also intended to move everything from the EVM to the zkEVM.

Another goal is to change the account abstraction scheme in Ethereum, considering EIP-4337, which entails abstracting the wallets and associated accounts to a point away from the consensus because the accounts are no longer related to the consensus, but their operations are.

Conclusion: Relative decentralisation

The design of Ethereum’s roadmap makes us think that its creator is concerned about the degree of decentralisation it shows to the world.

Indeed, some things would make Ethereum advanced and decentralised, such as the use of zk-SNARKs, PBS and SLE. However, its success depends on a reliable setup for the security it provides to be effective.

Crypto World

Three Arrested After Binance France Employee Home Break-In

Three suspects were arrested in France after a reported break-in targeting the home of a senior figure at Binance’s French unit, with the company confirming to Cointelegraph that one of its employees was the victim of a home invasion.

Local outlet RTL, citing anonymous police sources, reported that three hooded individuals attempted to enter an apartment in Val-de-Marne around 7:00 am CET Thursday and were carrying weapons.

RTL said the suspects first forced their way into the apartment of another resident, forcing them to direct them to the home of the head of Binance France. RTL reported the suspects searched the apartment and stole two mobile phones before fleeing.

Two hours later, the three suspects were reportedly arrested during a second home invasion attempt in Hauts-de-Seine after residents alerted authorities, RTL said. Authorities recovered the stolen phones and a vehicle that RTL said linked the suspects to the earlier break-in.

Related: 22 Bitcoin worth $1.5M vanish from Seoul police custody

Binance confirms a break into an employee’s home

Binance confirmed the incident to Cointelegraph but declined to identify the employee involved.

“We are aware of a home break-in involving one of our employees. There is an ongoing investigation with the local police,” a Binance spokesperson said. “The safety and well-being of our employees and their families is our absolute priority. We are working closely with law enforcement and further enhancing appropriate security measures.”

David Prinçay is the President of Binance France, but Cointelegraph was unable to independently verify the identity of the employee targeted in the break-in. Binance declined to provide further details, citing the ongoing investigation and safety concerns.

Related: Binance completes $1B Bitcoin conversion for SAFU emergency fund

Crypto wrench attacks rise 75% in 2025, as France sees most attacks

Physical attacks targeting cryptocurrency investors, also known as “wrench attacks,” have risen over the past year.

Wrench attacks increased by 75% during 2025, to 72 verified cases worldwide recorded last year alone, according to cybersecurity platform CertiK.

Wrench attacks accounted for at least $40.9 million in confirmed losses in 2025, but the value could be much larger due to unreported incidents, according to CertiK.

France recorded the largest number of attacks last year, with 19 confirmed incidents, while Europe accounted for about 40% of all attacks globally in 2025.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

How much does an RWA tokenization platform cost?

The acceleration of blockchain adoption in capital markets has transformed tokenization from a conceptual innovation into a strategic infrastructure decision. Enterprises, asset managers, and fintech startups are increasingly exploring tokenized securities, fractional ownership models, and programmable financial instruments. Yet before initiating development, a critical question arises: what is the true cost to build a tokenization platform?

Costs of developing the tokenization platform include far more than just the basic development time. The tokenization platform development cost are influenced by how complex the asset is, the depth of compliance required, how the product will be secured, how many integrations are required, and what level of scalable solutions will be required for the future. If the asset is a security or a tangible asset in the real world, the real-world asset tokenization cost will also include the costs associated with regulatory compliance, reporting requirements, and custodial obligations.

This blog covers the cost factors associated with tokenization and the various applications of tokenization platforms on several types of assets as well as the timelines of implementing a tokenization project. This guide will provide an extensive continuation of how an organization can effectively build compliant digital asset ecosystems, including some sample vendors (third party organizations) that have designed tokenization platforms.

What Is a Tokenization Platform and How Does It Work?

A tokenization platform development is a blockchain-enabled infrastructure that digitizes ownership rights and represents them as programmable tokens. These tokens can symbolize equity shares, debt instruments, real estate fractions, commodities, funds, or other regulated assets.

Unlike basic crypto token issuance, enterprise tokenization platforms operate within strict financial and legal frameworks. They combine blockchain immutability with compliance automation, investor management systems, and custody safeguards.

The foundational components of a tokenization platform include:

1. Blockchain Infrastructure

This serves as the ledger where token ownership and transactions are recorded. Organizations may choose:

- Public chains (Ethereum, Polygon) for liquidity and ecosystem access

- Private or permissioned chains for enhanced control and compliance

- Hybrid models for balancing transparency and confidentiality

Infrastructure decisions directly influence tokenization software development pricing, as private networks require node setup, governance models, and dedicated maintenance.

2. Smart Contract Engine

Smart contracts govern token issuance, transfer restrictions, dividend distribution, governance voting, and compliance checks. Advanced programmable securities increase the tokenization platform development cost, especially when they include:

- Lock-up periods

- Jurisdiction-based transfer rules

- Corporate action automation

- Automated yield calculations

3. Compliance & Identity Layer

This layer integrates KYC/AML providers, accreditation verification systems, and regulatory screening tools. Since regulated assets demand strict adherence, compliance modules significantly impact the overall real-world asset tokenization cost.

4. Custody & Wallet Systems

Institutional investors require bank-grade custody solutions, including:

- Multi-party computation (MPC) wallets

- Cold storage

- Key recovery systems

- Custodial integrations with regulated entities

Advanced custody frameworks elevate the RWA tokenization platform cost, particularly when insurance-backed storage is involved.

5. Investor Dashboard & Admin Controls

User interfaces manage onboarding, portfolio monitoring, dividend tracking, and reporting. Administrative dashboards handle asset issuance, investor approvals, and regulatory documentation.

Each of these modules contributes cumulatively to the total cost to build a tokenization platform.

Get a Detailed RWA Tokenization Platform Cost Estimate

Key Factors That Influence Tokenization Software Development Pricing

Tokenization software development pricing varies depending on several technical and operational factors:

1. Blockchain Selection

The blockchain framework determines performance, scalability, and cost structure.

- Public chains may reduce setup time but require gas optimization and scalability considerations.

- Enterprise blockchains demand custom node configurations and governance protocols.

- Cross-chain compatibility increases development complexity but improves liquidity access.

Selecting the appropriate blockchain architecture can significantly alter the tokenization platform development cost.

2. Smart Contract Complexity

Basic token contracts are relatively straightforward. However, security token standards with regulatory logic require deeper engineering and testing.

Complex smart contracts often include:

- Dividend automation

- Revenue-sharing logic

- Investor voting rights

- Automated cap table updates

- Compliance-based transfer gating

Extensive testing, formal verification, and third-party audits elevate the RWA tokenization platform cost, but they are essential for institutional trust.

3. Regulatory Framework & Jurisdiction

Compliance obligations differ across countries. Platforms targeting cross-border investors must integrate:

- Multi-jurisdictional accreditation rules

- Transfer restrictions

- Reporting frameworks

- Licensing requirements

Legal structuring often runs parallel to development, increasing the real-world asset tokenization cost. However, ignoring regulatory requirements can lead to costly revisions later.

4. Security Architecture

Security extends beyond smart contracts. It includes:

- API encryption

- Infrastructure firewalls

- DDoS mitigation

- Database protection

- Continuous monitoring tools

For institutional-grade deployments, third-party security audits are mandatory. These measures increase upfront costs but reduce long-term operational risk.

5. Integration Ecosystem

Tokenization platforms rarely operate in isolation. They require integration with:

- Payment gateways

- Banking APIs

- Identity verification providers

- Secondary trading platforms

- Reporting tools

Each integration expands development scope, influencing both the cost to build a tokenization platform and the overall deployment timeline.

How to Choose the Right RWA Tokenization Platform Development Company for Cost Efficiency ?

It is important to choose a qualified RWA tokenization platform development company when you’re considering the cost of developing a tokenization platform and ensuring its sustainability over time. Tokenizations take place at many intersections – Blockchain Engineering, Financial Regulations, Cybersecurity, and Enterprise Architecture.

Choosing a vendor who is not an expert in this area could expose you to compliance issues, security issues, budget overruns, and ultimately an increased total cost to create your RWA tokenization platform.

When making a decision on cost-effectiveness, do not focus so much on the lowest dollar option that you select a Vendor who cannot deliver an infrastructure that is secure, compliant, scalable, all without unnecessary rewriting/rework and/or hidden costs.

Evaluate Proven Domain Expertise

A qualified development partner should demonstrate experience in:

- Real-world asset structuring (real estate, private equity, debt instruments, funds)

- Securities token standards and regulatory mapping

- Smart contract security implementation

- Institutional-grade custody integrations

A vendor unfamiliar with regulated token issuance may underestimate compliance layers, leading to scope changes mid-project. This directly increases the cost to build a tokenization platform through extended development cycles and additional audit requirements.

Assess Technical Architecture Capability

A reliable partner should offer clear documentation on:

- Blockchain framework selection

- Node management architecture

- Scalability models

- Interoperability with exchanges and custodians

Cost efficiency is achieved when the technical foundation is designed for long-term scalability. Poor architecture decisions often require rebuilding components later, drastically inflating tokenization software development pricing.

Examine Security & Audit Readiness

Enterprise tokenization platforms must meet institutional security standards. The development company should have structured processes for:

- Smart contract audits

- Penetration testing

- Infrastructure hardening

- Secure key management

If audit readiness is not embedded in development from the beginning, remediation costs may exceed initial estimates, raising the total real-world asset tokenization cost.

Consider Post-Launch Support & Upgradeability

Tokenization ecosystems require ongoing updates due to:

- Regulatory changes

- Feature expansion

- Security enhancements

- Asset diversification

A development partner offering structured maintenance models reduces long-term uncertainty in tokenization platform development cost and prevents unexpected operational disruptions.

Analyze Transparency in Pricing Structure

An experienced RWA tokenization platform Development company will provide:

- Clear scope documentation

- Defined deliverables

- Milestone-based pricing

- Separate cost allocation for audits and integrations

Transparent pricing avoids ambiguity and stabilizes the projected RWA tokenization platform cost, ensuring alignment between business objectives and budget allocation.

Start Planning Your Tokenization Platform Today

What Is the Typical Tokenization Platform Development Timeline?

The tokenization platform development timeline depends on asset complexity, regulatory jurisdiction, customization level, and integration depth. While smaller MVPs may launch within a few months, institutional-grade ecosystems require structured, multi-phase execution to ensure compliance and scalability.

A realistic timeline typically ranges between 4 to 8 months, with enterprise-scale builds extending further depending on regulatory approvals.

Phase 1: Discovery, Feasibility & Regulatory Assessment (3–6 Weeks)

This foundational phase defines project viability. Activities include:

- Asset class feasibility evaluation

- Regulatory landscape mapping

- Legal structuring coordination

- Technical architecture planning

- Preliminary cost modeling

A well-structured discovery phase reduces scope ambiguity and creates clarity around the expected cost to build a tokenization platform. Skipping this stage often results in timeline extensions later.

Phase 2: Architecture Design & Compliance Framework (4–6 Weeks)

During this stage, the platform blueprint is finalized. Key deliverables include:

- Smart contract logic frameworks

- Compliance automation rules

- Custody integration planning

- Data security architecture

- UI/UX workflow designs

Proper planning at this stage prevents reengineering during development and helps control tokenization software development pricing.

Phase 3: Core Development & System Integration (8–16 Weeks)

This is the most resource-intensive phase. It involves:

- Smart contract coding and internal testing

- Backend system development

- API integration with payment, KYC, and custody providers

- Investor dashboard and admin panel development

Customization requirements significantly affect both the tokenization platform development cost and timeline. Multi-asset support, cross-chain functionality, or multi-jurisdiction compliance layers can extend this phase.

Phase 4: Security Audits & Quality Assurance (4–8 Weeks)

Institutional tokenization platforms require:

- Independent third-party smart contract audits

- Infrastructure penetration testing

- Load and performance testing

- Compliance validation

Audit timelines depend on contract complexity. While this stage adds to the overall real-world asset tokenization cost, it is essential for investor trust and regulatory approval.

Phase 5: Deployment, Launch & Optimization

Once audits are cleared:

- Mainnet deployment occurs

- Monitoring tools are activated

- Operational governance begins

- Performance metrics are analyzed

Post-launch support ensures smooth scaling and prevents unexpected increases in long-term RWA tokenization platform cost.

Building a Future-Ready Tokenization Ecosystem

Building a tokenization platform requires more than estimating the immediate cost to build a tokenization platform—it demands strategic planning for scalability, compliance, and long-term operational resilience. Organizations that prioritize modular architecture, automated regulatory controls, and secure custody frameworks are better positioned to manage evolving asset classes and investor growth without inflating future tokenization platform development cost.

A structured approach to the tokenization platform development timeline, combined with security-first engineering, ensures sustainable deployment and controlled RWA tokenization platform cost over time.

At Antier, as a trusted RWA tokenization platform Development company, the focus is on delivering compliant, scalable ecosystems while optimizing tokenization software development pricing and minimizing overall real-world asset tokenization cost. Through enterprise-grade architecture and regulatory alignment, Antier enables businesses to launch secure, future-ready tokenization platforms with confidence.

Frequently Asked Questions

01. What is a tokenization platform?

A tokenization platform is a blockchain-enabled infrastructure that digitizes ownership rights and represents them as programmable tokens, which can symbolize various assets like equity shares, debt instruments, or real estate fractions.

02. What factors influence the cost of developing a tokenization platform?

The cost of developing a tokenization platform is influenced by the complexity of the asset, compliance requirements, security measures, necessary integrations, and the scalability needed for future growth.

03. How do tokenization platforms ensure compliance and security?

Tokenization platforms ensure compliance and security by operating within strict financial and legal frameworks, utilizing blockchain immutability, automation for compliance, investor management systems, and custody safeguards.

Crypto World

JPMorgan (JPM) cuts Coinbase (COIN) target to $252 after 4Q miss, keeps overweight rating

Wall Street analysts from companies including JPMorgan (JPM) and Cannacord lowered their price targets for Coinbase (COIN) stock after the largest publicly traded crypto exchange missed fourth-quarter earnings estimates.

JPMorgan said weak crypto prices and trading activity weighed on volumes and fees. The bank maintained its overweight rating on the crypto exchange, but cut the price target to $252 from $290 in the Thursday report.

The stock, which is down about 40% so far this year, was priced around $150 at publication time in pre-market trading. It closed yesterday at $141.09.

Crypto-linked equities have had a choppy start to the year, broadly tracking the turbulent digital-asset market. Major companies such as Coinbase have seen share prices pressured as crypto trading volumes weakened and token prices slid. Bitcoin , the largest cryptocurrency, remains well below late-2025 peaks and is now down about 25% year-to-date.

JPMorgan analysts led by Kenneth Worthington said higher operating expenses, up 22% year over year, and a shift toward lower-fee Advanced trading and Coinbase One subscriptions pressured results.

The analysts lowered their forward take-rate assumptions and cited a softer volume and market cap outlook in trimming the price target. The take rate is the percentage of transaction volume the company keeps as revenue.

Coinbase’s scale and profitability stand out in a volatile crypto market, broker Canaccord said, maintaining its buy rating while cutting its price target to $300 from $400 after lowering near-term estimates following the results.

While tumbling spot prices have weighed on the broader industry, the broker said Coinbase remains solidly profitable and is taking incremental market share as it expands its product suite.

Analysts led by Joseph Vafi pointed to progress on the company’s “Everything Exchange,” growth in USDC commerce use cases and expanding decentralized finance (DeFi) applications on Base and Ethereum, in the report published Thursday.

Deribit, the derivatives exchange it bought during the year, was described as a strategic addition helping drive cross-sell activity outside the U.S. across spot and derivatives.

The analysts said global trading volume and market share are up roughly 100% from a year earlier, with recent records in notional volume supported by activity in gold and silver futures.

Canaccord expects a tougher first quarter for the industry, and sees Coinbase gaining market share and stepping up stock buybacks. It views the stock as near cyclical lows, with the new $300 target based on 22 times its 2027 Ebitda estimate.

Read more: Coinbase misses Q4 estimates as transaction revenue falls below $1 billion

Crypto World

BTC long-term rally is ‘broken’ until price reclaims $85,000, Deribit executive says

Bitcoin’s long-term rally is “broken” and will remain so until the price climbs above $85,000, said Jean-David Péquignot, chief commercial officer of derivatives exchange Deribit.

The largest cryptocurrency has settled into the $60,000 to $70,000 range in the past week, some 45% below the record high it hit in October. It’s on track to fall for a fourth straight week, and dropped below $85,000 at the end of January.

“Until the market reclaims $85k, the longer-term chart remains broken, and the path of least resistance technically remains lower,” Péquignot said in an interview during the Consensus Hong Kong conference.

Rising above $85,000 would confirm that buyers have established control, having soaked up all the supply that wrecked the long-term outlook. The bitcoin price was recently near $66,600, well below Péquignot’s make-or-break level, and deep in bear territory with room for more pain.

Speaking of the pain, $60,000 is the next big support, a price that nearly came into play early this month as bitcoin wilted alongside software stocks. According to Péquignot, it is a major psychological level, where large buy walls, or multiple purchase orders, have historically resided.

“If $60k fails to hold on a closing basis, the 200-week MA is the next logical, and possibly final stop for this correction,” he said.

The 200-week simple moving average (SMA) is widely regarded as the holy grail for bottom fishers, or traders hunting bargains at bear-market lows to time their bullish bets. Since 2015, multiple bitcoin bear markets have hit lows near this average, which is why traders now track it closely. The average is currently located at around $58,000.

“Traders would be looking at the $58k–$60k range as the ultimate support,” Péquignot said.

Crypto World

SanDisk (SNDK) Stock Rallies 5% as Memory Shortage Gets Worse – Time to Buy?

TLDR

- SanDisk stock climbed 5.16% Thursday as Kioxia’s strong guidance triggered a rally across memory chip stocks

- Japanese chipmaker Kioxia reported customers booking NAND supply for 2027-2028, two years earlier than typical one-year advance contracts

- Memory chip shortage expected to persist through 2026 as manufacturers prioritize high-bandwidth memory over NAND production

- SanDisk trades at 15x forward P/E despite sitting 14% below February peak, with gross margins expanding to 50.9%

- Micron’s early HBM4 chip shipments reinforce tight supply expectations as AI data center demand continues growing

SanDisk shares jumped 5.16% Thursday after Kioxia issued guidance pointing to an extended memory chip shortage. The rally lifted other memory stocks including Seagate Technology, up 5.87%, and Western Digital, up 3.78%.

Kioxia forecast full-year sales and operating income above analyst expectations. Fourth-quarter revenue is projected at ¥890 billion with adjusted net income of ¥340 billion, both beating estimates.

The Japanese manufacturer revealed customers are securing memory contracts for 2027 and 2028. This represents a major shift from the industry norm of one-year advance bookings.

Early Contract Bookings Signal Supply Crunch

The rush to lock in future supply suggests companies expect shortages to last years, not months. Kioxia CFO Hideki Hanazawa confirmed tight supply is pushing selling prices sharply higher.

Micron started shipping next-generation HBM4 memory chips ahead of schedule. The early rollout reinforces expectations that supply constraints will continue through 2026.

NAND flash memory is used in solid-state drives for cloud servers. As companies build AI infrastructure, they need massive storage capacity for training data and outputs.

The current shortage stems from decisions made after the pandemic. Memory makers overbuilt capacity during strong electronics demand. The resulting oversupply crashed NAND prices and turned gross margins negative.

Why SanDisk Benefits Most

Companies responded by cutting NAND production and shifting capacity to DRAM and high-bandwidth memory. HBM delivers better margins and became essential for AI chip performance.

But AI data centers started buying huge quantities of NAND-based storage. With production slashed and demand surging, prices skyrocketed.

SanDisk led Thursday’s gains because it manufactures NAND chips through a joint venture with Kioxia. The company has direct exposure to rising flash memory prices.

Western Digital and Seagate, which sell data center storage products, typically follow memory pricing trends.

SanDisk stock trades 14% below its February highs despite Thursday’s rally. The pullback has created a potential entry point at attractive valuations.

The stock trades at 15 times forward earnings for fiscal 2026 ending June. That multiple drops to 7.5 times fiscal 2027 estimates.

Last quarter, SanDisk posted 61% revenue growth. Gross margins expanded from 32.3% to 50.9% year-over-year. Adjusted earnings per share jumped fivefold.

The company represents one of the few pure-play investments in flash memory after spinning off from Western Digital about a year ago.

Memory stocks had cooled earlier this year following a strong rally. Kioxia’s guidance reassured investors that elevated chip prices will continue supporting profits.

The NAND market appears to be transitioning from a cyclical business to structural growth driven by AI data center buildouts. Kioxia’s comments about 2027-2028 bookings suggest tight conditions will persist longer than many expected.

Crypto World

Kalshi enters $9B sports insurance market with new brokerage deal

Kalshi is moving deeper into the sports insurance market after announcing a partnership with sports insurance broker Game Point Capital, according to comments from CEO Tarek Mansour.

Summary

- Kalshi has partnered with Game Point Capital to expand into the $9 billion sports insurance and reinsurance market, which is projected to double by 2030.

- Game Point executed two basketball bonus hedges on Kalshi at significantly lower prices (6% and 2%) compared to traditional OTC reinsurance rates of 12–13% and 7–8%.

- Kalshi is positioning its exchange as a cheaper, more transparent alternative to traditional reinsurers like Lloyd’s of London, citing growing liquidity and institutional capacity.

The collaboration targets the fast-growing sports insurance and reinsurance industry, currently valued at around $9 billion annually and projected to double by 2030.

The market covers a range of risks, including brand sponsorship guarantees, game cancellations, player compensation structures, and performance-based bonuses.

Game Point Capital issues hundreds of millions of dollars in sports insurance each year. One of its most in-demand products is team and player performance bonus insurance, which protects teams against large payouts triggered by milestones such as playoff appearances, championship wins, or statistical achievements.

Kalshi undercuts traditional reinsurance pricing

Last week, Game Point executed two basketball-related performance bonus hedges on Kalshi’s exchange. One contract covered a bonus tied to a team making the postseason, priced at 6% on Kalshi compared with roughly 12–13% in the over-the-counter (OTC) market.

Another hedge, linked to advancing to the second round, was priced at 2% on Kalshi versus approximately 7–8% OTC.

Traditionally, insurers seeking to offload risk negotiate directly with reinsurance providers such as Lloyd’s of London. These OTC arrangements often involve bilateral negotiations, limited transparency, and higher pricing, particularly for volatile or higher-risk contracts.

Mansour argued that exchanges offer a competitive alternative by expanding liquidity and allowing multiple counterparties to bid in an open market, improving price discovery and lowering costs.

Kalshi’s pitch hinges on liquidity. During the recent Super Bowl, the exchange could have processed a $22 million trade without significantly moving market prices, according to the CEO.

With that depth, Kalshi expects to handle tens of millions of dollars in similar hedging transactions from Game Point in the coming months, positioning prediction markets as an emerging tool in institutional sports risk management.

Crypto World

Crypto market wobbles as investors ignore good news, look for the ‘exit ramp’: Crypto Daybook Americas

Crypto Daybook Americas will not be published on Monday, Feb. 16 due to the Presidents’ Day holiday in the U.S. We will be back on Feb. 17.

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin is on track for a fourth straight weekly decline in its longest negative streak since mid-November. The largest cryptocurrency has lost 1.7% in the past 24 hours and 4.8% since Monday morning.

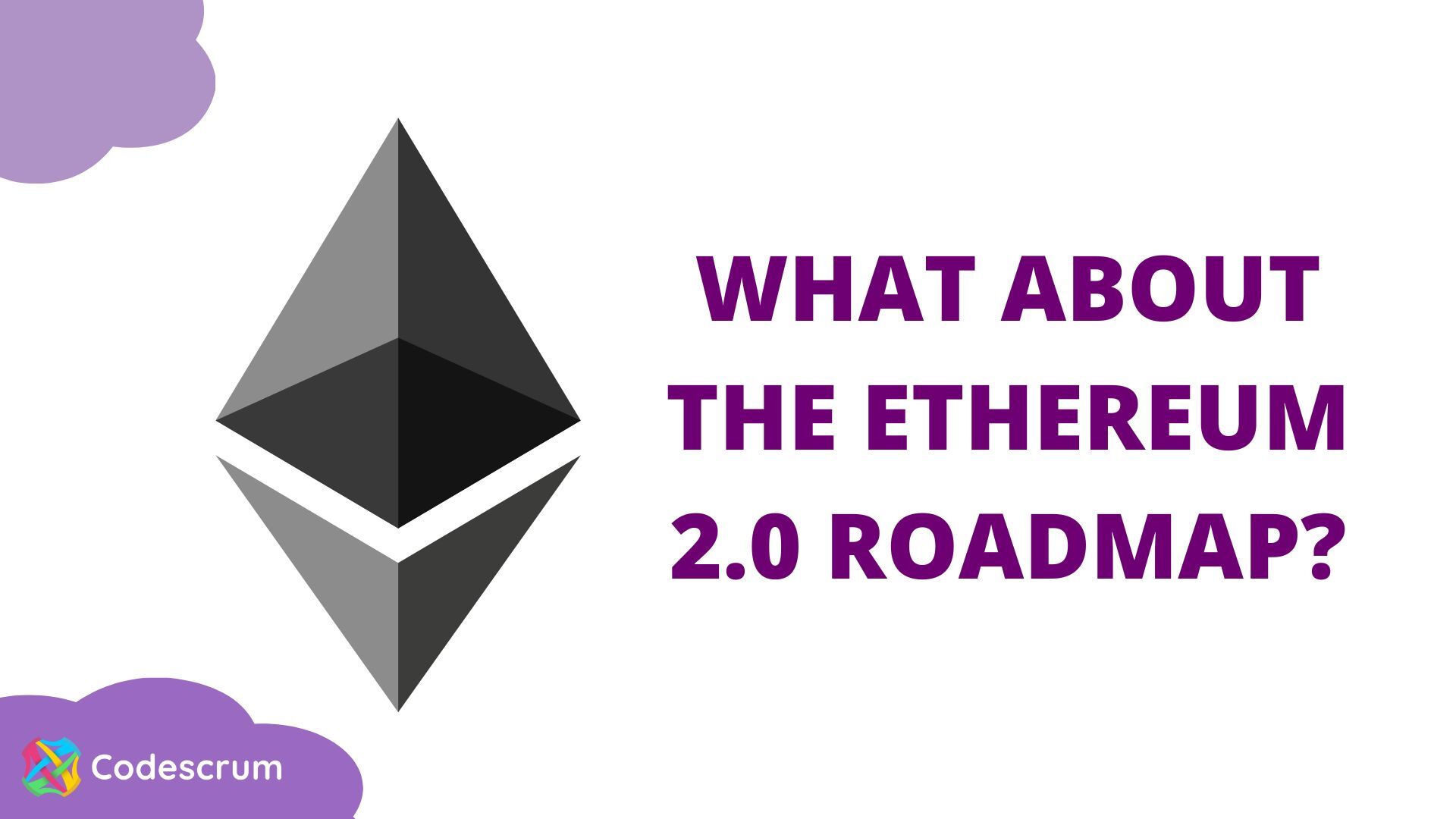

The broader CoinDesk 20 Index (CD20) fell 2% in a market that, according to Bitwise research analyst Danny Nelson, is mostly driven by fear. Indeed, the Crypto Fear and Greed Index has now been in “extreme fear” territory for almost two weeks.

“The market’s main driver right now is fear. Fear that we’ll go lower,” Nelson told CoinDesk. “In a market like this, good news doesn’t register with investors. If they see an exit ramp, they’re taking it.”

To illustrate his point, Nelson pointed to the reaction to Uniswap’s 25% increase after the world’s largest asset manager, BlackRock (BLK), said it was making shares of its $2.2 billion tokenized U.S. treasury fund BUIDL tradable on the decentralized exchange. The token has now given back the gains made after that announcement.

“Sellers bearish on the market’s short-term direction overwhelmed the bulls betting that institutional adoption will drive value long-term,” he said.

Earlier this week, stronger U.S. payroll data and a falling unemployment rate prompted traders to rethink rate-cut expectations for the year. Further guidance may come later today in the form of inflation figures for the world’s largest economy.

The U.S. Consumer Price Index (CPI) for January is forecast to show 2.5% year-over-year inflation.

Adding to that uncertainty is concern over a partial U.S. government shutdown. Odds of that occurring tomorrow are now around 90% on prediction market Kalshi. If one materializes, expect even more volatility amid thin trading. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 13, 8:30 a.m.: U.S. core inflation rate YoY for January (Prev. 2.6%); MoM Est. 0.3% (Prev. 0.2%)

- Feb. 13, 8:30 a.m.: U.S. inflation rate YoY for January (Prev. 2.7%); MoM Est. 0.3% (Prev. 0.3%)

- Earnings (Estimates based on FactSet data)

- Feb. 13: Trump Media & Tech Group (DJT), post-market

- Feb. 13: HIVE Digital Technologies (HIVE), post-market, -$0.07

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Unlocks

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 1.75% from 4 p.m. ET Thursday at $66,933.65 (24hrs: -0.83%)

- ETH is up 2.05% at $1,961.15 (24hrs: -0.97%)

- CoinDesk 20 is up 1.48% at 1,913.46 (24hrs: -1.96%)

- Ether CESR Composite Staking Rate is down 15 bps at 2.85%

- BTC funding rate is at 0.0019% (2.0947% annualized) on Binance

- DXY is up 0.13% at 97.05

- Gold futures are up 1.41% at $4,993.10

- Silver futures are up 3.65% at $78.30

- Nikkei 225 closed down 1.21% at 56,941.97

- Hang Seng closed down 1.72% at 26,567.12

- FTSE 100 is up 0.12% at 10,414.44

- Euro Stoxx 50 is down 0.16% at 6,001.38

- DJIA closed on Thursday down 1.34% at 49,451.98

- S&P 500 closed down 1.57% at 6,832.76

- Nasdaq Composite closed down 2.03% at 22,597.15

- S&P/TSX Composite closed down 2.37% at 32,465.30

- S&P 40 Latin America closed down 1.71% at 3,741.30

- U.S. 10-Year Treasury rate is down 7 bps at 4.10%

- E-mini S&P 500 futures are down 0.27% at 6,832.50

- E-mini Nasdaq-100 futures are down 0.29% at 24,696.00

- E-mini Dow Jones Industrial Average Index futures are down 0.33% at 49,358.00

Bitcoin Stats

- BTC Dominance: 59.01% (+0.41%)

- Ether-bitcoin ratio: 0.02923 (-0.55%)

- Hashrate (seven-day moving average): 1,027 EH/s

- Hashprice (spot): $33.55

- Total fees: 2.55 BTC / $170,716

- CME Futures Open Interest: 116,875 BTC

- BTC priced in gold: 13.5 oz.

- BTC vs gold market cap: 4.48%

Technical Analysis

- Bitcoin remains pressured below the 200-week exponential moving average of $68,324.

- A confirmed weekly close below this level historically signals a further 20%-25% capitulation.

- The would take it toward the $51,000–$54,000 range before a bottom forms

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $141.09 (-7.90%), +5.87% at $149.37 in pre-market

- Circle Internet (CRCL): closed at $56.63 (-2.13%), +1.71% at $57.60

- Galaxy Digital (GLXY): closed at $20.15 (-1.23%)

- Bullish (BLSH): closed at $31.71 (-0.53%), +0.28% at $31.80

- MARA Holdings (MARA): closed at $7.25 (-4.10%), +1.10% at $7.33

- Riot Platforms (RIOT): closed at $14.20 (-4.05%), +0.85% at $14.32

- Core Scientific (CORZ): closed at $17.48 (-3.37%), +0.11% at $17.50

- CleanSpark (CLSK): closed at $9.31 (-3.22%), +1.18% at $9.42

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.10 (-3.70%)

- Exodus Movement (EXOD): closed at $10.19 (+1.09%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $123.00 (-2.44%), +1.54% at $124.89

- Strive (ASST): closed at $7.70 (-4.82%), +0.52% at $7.74

- SharpLink Gaming (SBET): closed at $6.54 (-1.21%), +1.07% at $6.61

- Upexi (UPXI): closed at $0.74 (-8.82%)

- Lite Strategy (LITS): closed at $1.03 (-3.74%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$410.2 million

- Cumulative net flows: $54.3 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$113.1 million

- Cumulative net flows: $11.67 billion

- Total ETH holdings ~5.8 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Is Crypto Becoming a Tool for Human Trafficking Networks?

Cryptocurrency flows to services linked with suspected human trafficking surged 85% year over year in 2025.

The findings come from a new report by blockchain analytics firm Chainalysis, which highlighted that the intersection of cryptocurrency and suspected human trafficking expanded markedly last year.

Sponsored

Sponsored

Which Crypto Assets Are Most Used in Suspected Human Trafficking Networks?

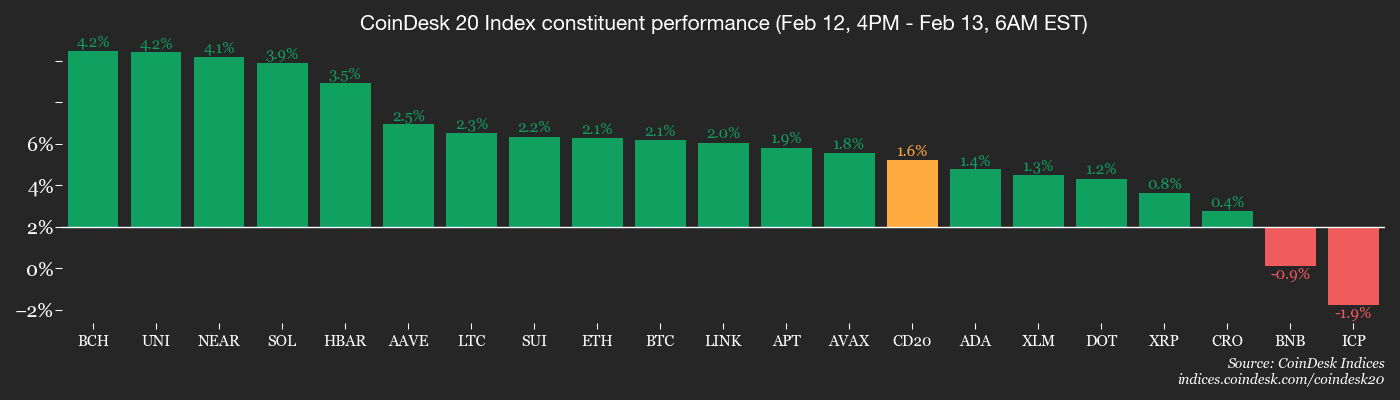

The report outlined four primary categories of suspected crypto-facilitated human trafficking. This includes Telegram-based “international escort” services, forced labor recruitment linked to scam compounds, prostitution networks, and child sexual abuse material vendors (CSAM).

“The intersection of cryptocurrency and suspected human trafficking intensified in 2025, with total transaction volume reaching hundreds of millions of dollars across identified services, an 85% year-over-year (YoY) increase. The dollar amounts significantly understate the human toll of these crimes, where the true cost is measured in lives impacted rather than money transferred,” Chainalysis wrote.

According to the report, payment methods varied across categories. International escort services and prostitution networks used stablecoins.

“The ‘international escort services are tightly integrated with Chinese-language money laundering networks. These networks rapidly facilitate the conversion of USD stablecoins into local currencies, potentially blunting concerns that assets held in stablecoins might be frozen,” Chainalysis noted.

CSAM vendors have historically relied more heavily on Bitcoin (BTC). However, Bitcoin’s dominance has declined with the rise of alternative Layer 1 networks.

Sponsored

Sponsored

In 2025, while these networks continue to accept mainstream cryptocurrencies for payments, they increasingly turn to Monero (XMR) to launder proceeds. According to Chainalysis,

“Instant exchangers, which provide rapid and anonymous cryptocurrency swapping without KYC requirements, play a crucial role in this process.”

The Dual Role of Crypto in Human Trafficking-Linked Transactions

Chainalysis noted that the surge in cryptocurrency flows to services linked with suspected human trafficking is not occurring in isolation. Instead, it mirrors the rapid expansion of Southeast Asia–based scam compounds, online casinos and gambling platforms, and Chinese-language money laundering (CMLN) and guarantee networks operating primarily through Telegram.

Together, these entities form a fast-growing regional illicit ecosystem with global reach. According to the report, Chinese-language services operating across mainland China, Hong Kong, Taiwan, and multiple Southeast Asian countries exhibit advanced payment processing capabilities and extensive cross-border networks.

Furthermore, geographic analysis reveals that while many trafficking-linked services are based in Southeast Asia, cryptocurrency inflows originate globally. Significant transaction flows were traced to countries including the United States, Brazil, the United Kingdom, Spain, and Australia.

“While traditional trafficking routes and patterns persist, these Southeast Asian services exemplify how cryptocurrency technology enables trafficking operations to facilitate payments and obscure money flows across borders more efficiently than ever before. The diversity of destination countries suggests these networks have developed sophisticated infrastructure for global operations,” the report read.

At the same time, Chainalysis stressed that blockchain transparency offers investigators deeper visibility into trafficking-related financial activity.

Unlike cash transactions, which leave little to no audit trail, blockchain-based transfers generate permanent, traceable records. This creates new opportunities for detection and disruption that are not possible with traditional payment systems.

Crypto World

The New Digital Human for Crypto

Bitget, the world’s largest Universal Exchange (UEX), has launched Gracy AI, the first animated digital human in crypto designed to bring real leadership thinking into one-on-one conversations with users.

Built around the experience and decision-making approach of Bitget CEO Gracy Chen, Gracy AI moves beyond charts and short-term signals. Instead, it gives users a space to talk through market cycles, strategy, career questions, and mindset with an AI that reflects how a real industry leader thinks about growth, risk, and long-term direction.

The launch marks a shift in how exchanges use AI. Rather than acting as another data layer, Gracy AI focuses on interpretation and context. Users can ask about where the industry is heading, how to think through uncertainty, or how to approach decision-making when markets are noisy. The goal is not to predict prices, but to help users think more clearly about them.

“Honestly, I still find it a little funny to see an AI avatar of me on screen,” said Gracy Chen, CEO at Bitget. She added:

“But a big part of my job is listening to user concerns, getting close to the details, and helping people understand what’s really happening in the market. The team built Gracy AI around that same approach so more users can connect, learn and grow feeling supported by me and the team.”

Gracy AI is part of Bitget’s broader AI roadmap as part of its UEX transformation. After GetAgent established Bitget’s AI capability in analytics and decision support, Gracy AI represents the more human-facing side of that strategy, where technology supports understanding rather than just execution.

To mark the launch, Bitget is rolling out themed Gracy AI conversations tied to moments of reflection and renewal. Valentine’s Day introduces self-care-focused chats, while Chinese New Year features guided conversations around goals, perspective, and new beginnings. These campaigns are designed to make AI interaction feel personal, timely, and useful, rather than transactional.

The Gracy AI launch builds on Bitget’s broader push to make AI genuinely useful for everyday traders. From AI-powered market insights and smart trading tools to products like GetAgent, which helps users navigate volatility with clearer signals and context,

Bitget has steadily integrated AI to reduce friction and improve decision-making. Gracy AI extends that approach by putting experience, perspective, and real-time intelligence into a more accessible, conversational layer for users. As Bitget continues to evolve into a Universal Exchange, Gracy AI reflects a simple idea: better tools matter, but better thinking matters more.

Experience Gracy AI here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Crypto World

10% Bounce Hope Rise As Whales Buy

Ethereum is trying to stabilize after weeks of heavy selling. The price is holding near the $1,950 zone, up around 6% from its recent low. At the same time, the biggest Ethereum whales have started accumulating aggressively.

But short-term sellers and derivatives traders remain cautious, creating a growing tug-of-war around the next move.

Biggest Ethereum Whales Accumulate as Bullish Divergence Stays Intact

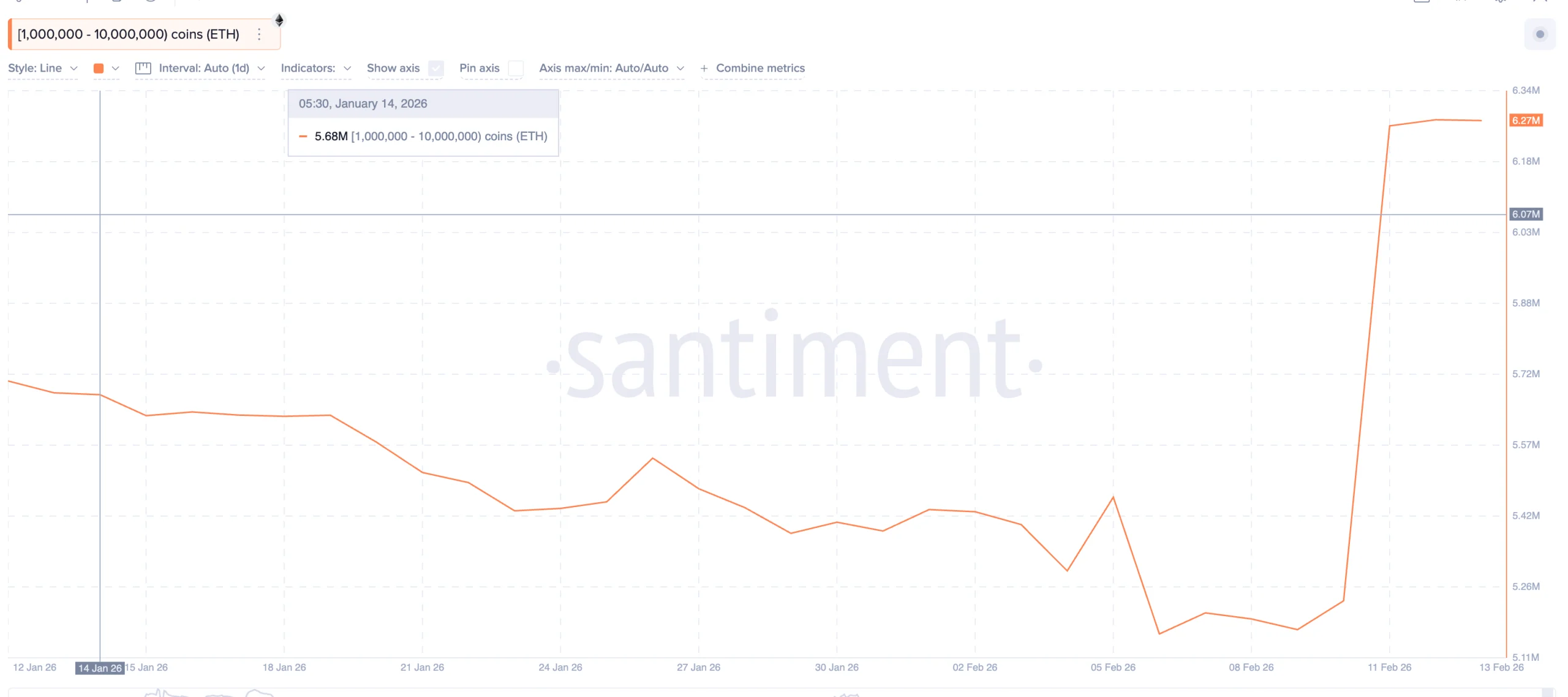

On-chain data shows that the largest Ethereum holders are positioning for a rebound. Since February 9, addresses holding between 1 million and 10 million ETH have increased their holdings from around 5.17 million ETH to nearly 6.27 million ETH. That is an addition of more than 1.1 million ETH, worth roughly $2 billion at current prices.

Sponsored

Sponsored

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This accumulation aligns with a bullish technical signal on the 12-hour chart.

Between January 25 and February 12, Ethereum’s price made a lower low, while the Relative Strength Index, or RSI, formed a higher low. RSI measures momentum by comparing recent gains and losses. When price falls, but RSI rises, it often signals weakening selling pressure.

This bullish divergence suggests downside momentum is fading.

The structure remains valid as long as Ethereum holds above $1,890, as the same signal flashed even on February 11 and still seems to be holding. A breakdown below this level would invalidate the divergence for now and weaken the rebound case.

For now, whales appear to be betting that this support will hold.

Sponsored

Sponsored

Short-Term Holders Are Selling?

While large investors are accumulating, short-term holders are behaving very differently.

The Spent Coins Age Band for the 7-day to 30-day cohort has surged sharply. Since February 9 (the same time when the whale pickup started), this metric has risen from around 14,000 to nearly 107,000, an increase of more than 660%. This indicator tracks how many recently acquired coins are being moved. Rising values usually signal possible profit-taking and distribution.

In simple terms, short-term traders are exiting positions. This pattern appeared earlier in February as well. On February 5, a spike in short-term coin activity occurred near $2,140. Within one day, Ethereum dropped by around 13%.

That history shows how aggressive selling from this group can quickly reverse moves. As long as short-term holders remain active sellers, upside moves are likely to face resistance.

Sponsored

Sponsored

Derivatives Data Shows Heavy Bearish Positioning

Derivatives markets are reinforcing this cautious outlook. Current liquidation data shows nearly $3.06 billion in short positions stacked against only about $755 million in long leverage. This creates a heavily bearish imbalance with almost 80% of the market betting on the short side.

On one hand, this setup creates fuel for a potential short squeeze if prices rise. On the other hand, it shows that most traders still expect further weakness. This keeps momentum muted but keeps the bounce hope alive if the whale buying pushes the prices up, even a little bit, crossing past key clusters.

On-chain cost basis data helps explain why Ethereum struggles to break higher. Around $1,980, roughly 1.58% of the circulating supply, was acquired. Near $2,020, another 1.23% of supply sits at breakeven. These zones represent large groups of holders waiting to exit without losses.

Sponsored

Sponsored

When price approaches these levels, selling pressure increases as investors try to recover capital. This has repeatedly capped recent bounces. Only a strong leverage-driven move or short squeeze would likely be powerful enough to push through these supply clusters.

Until then, these zones remain major barriers.

Key Ethereum Price Levels To Track Now

With whales buying and sellers resisting, Ethereum price levels now matter more than narratives.

On the upside, the first major resistance sits near $2,010. A clean 12-hour close above this level would increase the probability of short liquidations. And it sits near the key supply cluster.

If that happens, Ethereum could target $2,140 next, a strong resistance zone with multiple touchpoints. It also sits around 10% from the current levels. On the downside, $1,890 remains the critical support. A break below this level would invalidate the bullish divergence and signal renewed downside pressure. Below that, the next major support sits near $1,740.

As long as Ethereum holds above $1,890 and continues testing $2,010, the rebound structure remains intact. A sustained breakdown below support would cancel the current recovery attempt.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video2 hours ago

Video2 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’