Crypto World

MicroStrategy Raises STRC Dividend as MSTR Share Dips 14.77%

Strategy, formerly MicroStrategy, raised its STRC preferred stock dividend by 25 basis points for March 2026, as Bitcoin (BTC) drawdown continues to push MSTR shares down.

Strategy is the largest corporate holder of Bitcoin (BTC). The STRC dividend rate is set monthly to keep shares trading near their $100 par value, limiting price volatility.

Why it matters:

- Bitcoin’s drawdown has impacted both MicroStrategy’s Class A shares, MSTR, and its balance sheet.

- MSTR has declined 14.77% year-to-date (YTD) amid BTC’s drawdown. The largest cryptocurrency itself has dropped nearly 24% in the same time frame.

- STRC’s stability near $100 par contrasts with MSTR’s volatility.

The details:

- Executive Chairman Michael Saylor announced the 11.50% STRC dividend rate on X (formerly Twitter), up from 11.25% in February.

- The March increase marks the seventh STRC dividend hike since the shares began trading in July 2025.

- Strategy prices STRC dividends monthly to anchor shares near $100 par value.

- CEO Phong Le stated in February that the company plans to shift toward preferred share issuance over common stock for BTC purchases.

The big picture:

- Strategy holds the largest corporate BTC reserve globally and continues to purchase BTC despite $6.6 billion in paper losses.

- The pivot to preferred shares offers a lower-volatility capital raise vehicle compared to MSTR equity dilution.

- BTC’s current drawdown tests whether the Strategy’s accumulation model holds under prolonged price pressure.

Crypto World

Kyber Network Crystal cryptocurrency up over 23%: here’s why the KNC price is rising

- Kyber Network Crystal (KNC) has surged on a 900% volume spike.

- Recent Kyber product upgrades have improved market sentiment.

- Traders should closely watch the support at $0.148 support and the resistance at $0.175.

Kyber Network Crystal (KNC) has jumped by nearly 24% to trade around the $0.16 level at press time.

This move stands out in a market that has otherwise struggled for direction.

While many large-cap cryptocurrencies, including Bitcoin (BTC), posted losses, KNC moved higher with strong conviction, and the rally has drawn attention from traders who are now asking what is really driving the price higher.

Heavy trading activity fueling KNC’s price rally

One of the clearest drivers behind the surge is a dramatic increase in trading activity.

KNC’s 24-hour trading volume has exploded by more than 900%, pushing turnover to levels rarely seen in recent months.

Such a sharp rise in volume often signals aggressive short-term participation from traders looking to capitalise on momentum.

This also explains why the price moved largely independently of BTC, which has declined over the same period.

When volume expands this quickly, even modest buying pressure can translate into outsized price moves, and that appears to be exactly what happened with KNC.

Product updates add to positive sentiment

Although no single announcement directly triggered today’s price spike, Kyber Network has been quietly rolling out updates that have helped improve sentiment around the project.

Kyber Network recently highlighted expanded cross-chain functionality on its flagship product, KyberSwap.

As a result, users can now swap assets across 25 different blockchains using liquidity from eight providers in a single transaction.

This kind of convenience strengthens Kyber’s position in an increasingly competitive DeFi landscape.

The team has also introduced a new feature called Smart Exit on Kyber Earn.

Smart Exit allows liquidity providers to automate how and when they exit positions.

Instead of constantly monitoring charts, users can set predefined conditions for profit-taking, risk management, or time-based exits.

The feature is already live on Base and BNB Chain, with more networks expected to follow.

In parallel, Kyber has continued to form new ecosystem partnerships.

A recent integration with Vaultedge brought the USDVE asset onto KyberSwap, unlocking deeper liquidity and improved routing.

Another upcoming integration with Supernova is expected to further expand Kyber’s liquidity reach.

While these updates did not directly cause today’s spike, they help explain why traders are willing to speculate on upside.

Kyber Network Crystal price forecast

From a technical analysis standpoint, the KNC price has broken above its 30-day simple moving average near $0.148.

This level had acted as a cap for weeks, and clearing it helps reinforce bullish sentiment.

Moving ahead, the $0.148 zone has now become the most important support to watch in the near term.

Holding above this level would suggest that the recent breakout remains intact.

If buyers maintain control, KNC could attempt a push toward resistance around $0.175, and a clean break above that area may open the door to further upside.

On the downside, failure to hold $0.148, especially if trading volume contracts sharply, could trigger a quick pullback.

In that scenario, the next area of interest sits near $0.135, where buyers may look to step back in.

Crypto World

Market Analysis: GBP/USD Weakens Again, EUR/GBP Shows Signs of Stability

GBP/USD failed to climb above 1.3575 and corrected some gains. EUR/GBP started a decent increase and might aim for more gains above 0.8800.

Important Takeaways for GBP/USD and EUR/GBP Analysis Today

· The British Pound is showing bearish signs below the 1.3500 support.

· There is a key bearish trend line forming with resistance near 1.3440 on the hourly chart of GBP/USD at FXOpen.

· EUR/GBP is gaining pace and trading above the 0.8750 pivot level.

· There is a connecting bullish trend line forming with support at 0.8755 on the hourly chart at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the pair failed to stay above the 1.3535 pivot level. As a result, the British Pound started a fresh decline below 1.3500 against the US Dollar.

There was a clear move below 1.3485 and the 50-hour simple moving average. The bears pushed the pair below 1.3440. Finally, there was a spike toward the 1.3400 handle. A low was formed near 1.3400, and the pair is now consolidating losses.

There was a minor move above 1.3425 and the 23.6% Fib retracement level of the downward move from the 1.3575 swing high to the 1.3400 low. On the upside, the GBP/USD chart indicates that the pair is facing resistance near a key bearish trend line at 1.3440.

A close above the trend line might send the pair toward the 50% Fib retracement at 1.3485 and the 50-hour simple moving average. If the bulls remain in action, they could aim for more gains.

In the stated case, the pair might rise toward 1.3535. The next major hurdle for GBP/USD sits at 1.3575. On the downside, there is a key support forming near 1.3400. If there is a downside break below 1.3400, the pair could accelerate lower. The next key interest area might be 1.3360, below which the pair could test 1.3320. Any more downside could lead the pair toward 1.3250.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP at FXOpen, the pair started a decent increase from 0.8700. The Euro traded above 0.8750 to enter a positive zone against the British Pound.

The pair settled above the 50-hour simple moving average and 0.8760. The pair traded as high as 0.8789 before there was a downside correction. There was a move below the 23.6% Fib retracement level of the upward move from the 0.8702 swing low to the 0.8790 high.

However, the pair is stable above 0.8750 and the 50% Fib retracement. Besides, there is a connecting bullish trend line forming with support at 0.8755.

A downside break below 0.8755 might call for more downsides. In the stated case, the pair could drop toward 0.8745. Any more losses might call for an extended drop toward the 0.8730 pivot zone.

If there is another increase, the EUR/GBP chart suggests that the pair is facing hurdles near 0.8775. A close above 0.8775 might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8800. Any more gains might send the pair to 0.8840.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

X allows crypto promotion under new paid partnership policy

Elon Musk-owned X will allow crypto-related promotional content under an updated paid partnership policy.

Summary

- X has lifted its ban on paid crypto promotions, allowing influencers to publish sponsored content under a revised paid partnership framework.

- The update excludes jurisdictions such as the European Union, the United Kingdom and Australia.

According to X’s updated paid partnership policy, influencers will be allowed to publish promotional content related to cryptocurrencies, as long as it is in compliance with the platform’s disclosure rules and all applicable advertising and financial promotion laws.

However, the feature will not be available in regions where local regulations impose stricter requirements on crypto-related promotions, such as the European Union, the United Kingdom and Australia.

For instance, the U.K. Advertising Standards Authority has cracked down on crypto advertisements that downplay risks, recently banning a Coinbase ad campaign. Australian regulators have also taken a similar stance and have previously sued Meta over misleading crypto ads.

X first imposed restrictions on crypto advertising back in 2018, just weeks after similar crackdowns were introduced by other tech giants like Google and Meta, which was still operating as Facebook at the time.

Under the X branding, the social network in June 2024 moved the entire Financial Products category into Prohibited status for paid promotions and influencer partnerships as a means to combat undisclosed crypto endorsements and aggressive shilling by influencers who were not revealing their paid deals.

Commenting about the latest update, X’s head of product Nikita Bier said the feature will help creators build and grow their businesses on the platform while, at the same time, remaining transparent to their follower base.

Over the past months, X has announced plans to launch new products, including X Money and X TV, as part of Musk’s vision of an “everything app” that combines social networking, media, and financial services under one platform.

Last year, X partnered with Visa to enable digital transactions directly within the platform. Rumors have suggested that X Money could also include cryptocurrencies, but these claims have not been officially confirmed by the company.

However, X has confirmed plans for “Smart Cashtags,” a feature that will allow users to see real-time price charts and access buy and sell buttons for major assets, including cryptocurrencies, directly from their timelines.

Crypto World

Sundial CEO on Institutional Crypto Strategy and Flight to Quality

After reaching an all-time high of roughly $4 trillion in total market value in October, crypto markets have entered one of their sharpest corrections in years.

Bitcoin, which peaked near $126,000 during the rally, has since retraced to the low $60,000 range. Billions of dollars in leveraged positions have been liquidated, open interest has contracted sharply from late-year highs, and liquidity across trading venues has thinned. ETF flows have turned negative, reinforcing a broader phase of institutional de-risking.

The speed of the unwind has revived a familiar question: when volatility spikes and liquidity compresses, how do institutions actually respond?

How Institutional Capital Responds to Volatility

For Sheldon Hunt, the pullback tells a different story than the headlines suggest. As founder and CEO of Sundial, a Bitcoin Layer-2 protocol targeting institutional participation, he sees institutions simplifying their exposure instead of abandoning it.

“When you see volatility like this, what pulls back first is risk, exposure, and complexity,” Hunt told BeInCrypto during our conversation at Liquidity Summit 2026 in Hong Kong, further adding:

“Institutions are not necessarily cutting all exposure. They are consolidating. They go back to basics.”

That return to basics, Hunt says, is best understood as a flight to quality.

When volatility spikes, institutions tend to reduce exposure to more complex or risk-centric applications. Rather than chasing new strategies, they narrow their focus. He added:

“You can pull back on some of these complexities, variants like DeFi. You want to get back to something like the basics.”

Wallet Activity as a Market Barometer

In addition to allocation shifts, Hunt also watches on-chain behavior for early signs of stress.

“Wallets generally don’t lie,” he said, describing wallet activity as one of the clearest barometers of market health.

During volatile periods, he observes assets moving off exchanges and DeFi platforms and reconsolidating into fewer wallets. That movement, he argues, reflects caution rather than capitulation.

Hunt does not view the current shift as a brief pause. In his assessment, the market is operating under real liquidity strain.

“We’re living in it right now,” he said. “There are certainly constraints around liquidity these days. People are quite nervous.”

He points to volatility across broader markets and tightening financial conditions as reinforcing that caution. For institutional capital, that environment changes the tempo of decision-making.

Hunt believes that capital allocators are likely to proceed more cautiously under current liquidity constraints.

“There’s still a real possibility that this is the beginning of a fairly nasty bear market that could go on for potentially two or more years,” he said.

If the downturn extends, timing matters less than resilience. Allocators focus on maintaining exposure without introducing additional fragility. He described the current phase as “minimizing risk exposure and looking to be in it for the long run.”

Evaluating Yield Through an Institutional Lens

That framing also informs how institutions approach Bitcoin yield.

Hunt said one of the most common misconceptions is that institutions are primarily focused on maximizing returns. In practice, he argued, that assumption does not reflect how professional allocators operate.

According to Hunt, professional allocators are unlikely to pursue 20% or 30% yields on their Bitcoin if those returns depend on layered complexity or unclear counterparty structures.

“The reality is that institutions are focused on minimizing risk,” he said. “Stable and secure yield over the long run, even 1% or 2%, is far more aligned with their mandates.”

In practical terms, that shapes how products are evaluated. Yield levels alone are not the deciding factor. Custody arrangements, settlement mechanics, and downside scenarios tend to carry more weight in internal reviews.

Despite the growing conversation around Bitcoin-native finance, Hunt believes meaningful institutional deployment remains limited. Hunt added:

“There’s this idea that there’s all of this Bitcoin out there, it’s all sloshing around. The reality is that we have seen very little Bitcoin being put to work on DeFi or being put to work in either the protocols or layer-2s.”

A large share of BTC continues to sit in long-term custody. For Hunt, that signals that the infrastructure layer is still developing rather than saturated.

“It’s still early days,” he said. “The best days of Bitcoin are very much ahead of it. The best days of DeFi are ahead of it. There’s still so much more to be untapped.”

The slower pace of institutional participation, in his view, reflects how risk is assessed. Before capital moves into structured yield environments, questions around custody control, settlement assurance, and exposure concentration must be addressed in ways that align with existing mandates.

Custody, Control, and the Next Cycle

Looking toward the next cycle, Hunt expects architecture to matter more than surface-level features.

“I’m of the very firm belief that in this next cycle, a big priority is going to be around non-custodial options,” he said, pointing specifically to non-custodial staking and settlement models that account for custodial risk.

In his view, institutions want clarity over who controls assets at every stage of the process. In practice, that means retaining unilateral authority over settlement and custody. The crypto industry has long championed the idea of being one’s own bank. For institutional allocators, that principle shows up less as ideology and more as governance architecture. The next phase of adoption will depend on whether that architecture can satisfy traditional risk frameworks.

Crypto World

How Is Gold’s Rally Extending Into Crypto Markets in March 2026?

Physical gold prices climbed to their highest level in a month as safe-haven demand spiked amid escalating geopolitical tensions.

At the same time, the move into bullion is spilling into digital markets. On-chain data shows a surge in the accumulation of tokenized gold assets.

Gold Prices Advance as Investors Seek Safety

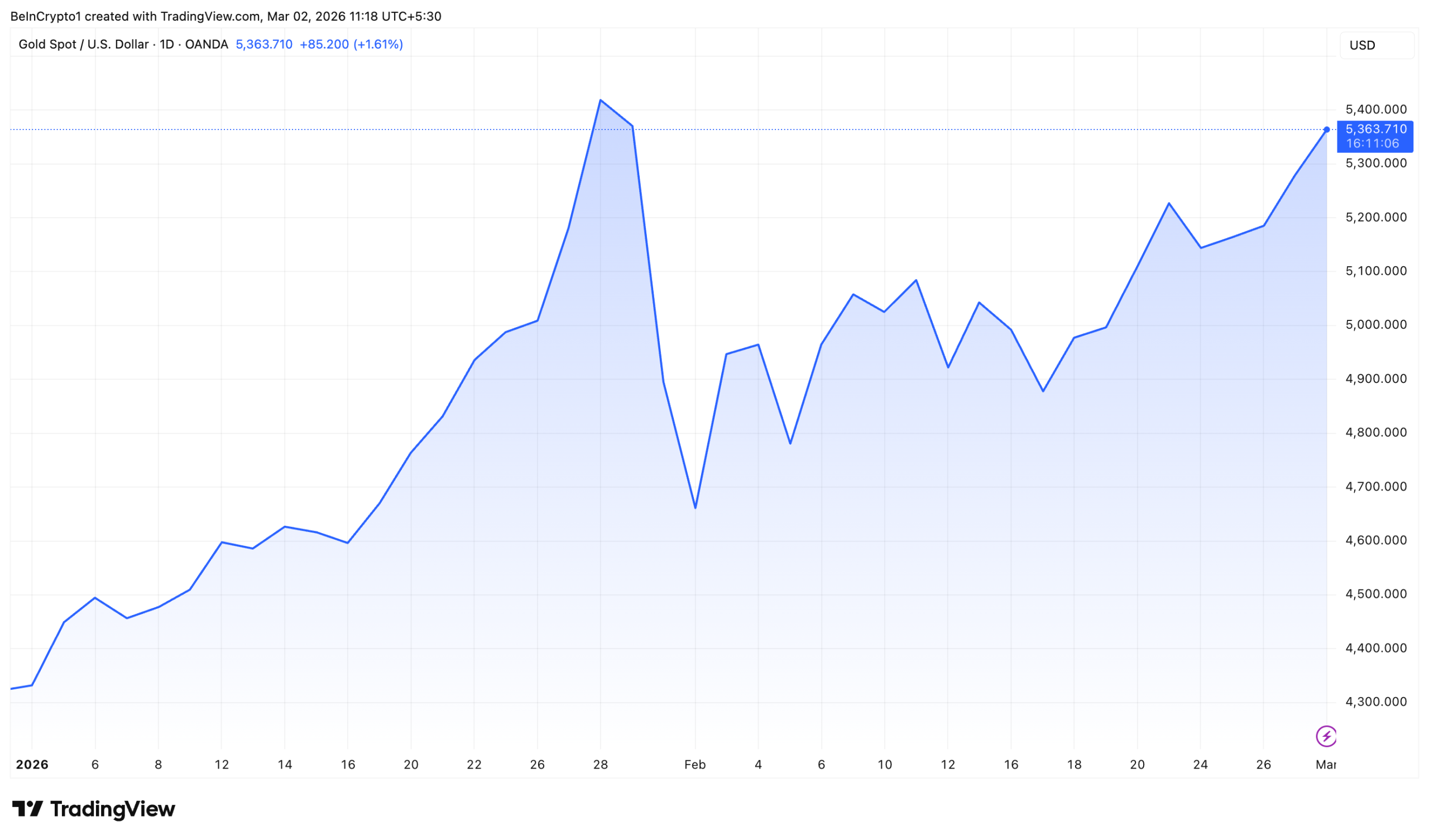

Gold rose 2% on March 2, reaching an intraday high of $5,394 per ounce, its highest level since January 30. At press time, the price had adjusted to $5,363.7.

Follow us on X to get the latest news as it happens

The catalyst was direct: US and Israeli strikes on Iran sparked safe-haven flows into precious metals across global markets. Monday’s flare-up injected additional momentum into the precious metal’s broader rally. Gold has delivered notable returns, rising approximately 65% in 2025 alone.

For crypto participants, the timing mattered. With digital asset markets simultaneously experiencing renewed volatility, tokenized gold offered a path to preserve gold exposure without relying on traditional finance rails.

Major Purchases Highlight Tokenized Gold Demand

On-chain analytics firm Lookonchain identified an inactive wallet that spent $1 million USDC to buy PAX Gold (PAXG) and Tether Gold (XAUT) tokens. The address, labeled 0x1C70, performed multiple swaps over several hours and still holds $4 million USDC.

“The wallet still holds 4M USDC and may buy more,” Lookonchain said.

Additionally, an Ethereum whale rotated holdings from ETH into XAUT while accepting a realized loss. OnchainLens reported that the wallet (0x744b) swapped 1,000 ETH, valued at $1.94 million, for 358.49 XAUT at $5,413, incurring a loss of over $60,000.

“Over the past 2 years, the whale received 1,645 ETH for $3.26 million and still holds 645 ETH ($1.25 million),” the post read.

Meanwhile, London-based asset manager Abraxas Capital Management’s gold holdings also rose. An on-chain analyst, citing data from blockchain intelligence platform Arkham Intelligence, reported that the firm received 28,723 XAUT tokens, valued at $151 million, from Tether’s treasury. The transfer marked the largest XAUT transaction recorded in the past three weeks.

“Interesting fact: Heka Funds (Abraxas Capital) is one of Tether’s largest and most important institutional clients. At one point, it held 1.5% of the total USDT supply. Among Tether’s publicly disclosed on-chain address clusters, it currently ranks as the second-largest entity by interaction volume,” the analyst added.

The increase in tokenized gold accumulation corresponds with greater interest in alternative stores of value within crypto. Investors may favor gold-backed tokens for price stability and potential gains linked to metals markets, while risking less from the volatility typical of many digital assets.

BeInCrypto recently reported that the tokenized gold sector has recorded significant expansion, with its market capitalization now exceeding $6 billion. Furthermore, according to CoinGecko, daily trading volumes for both XAUT and PAXG surpassed $1 billion yesterday, signaling strong investor demand.

Whether this is a temporary flight to safety or marks a sustained move toward commodity-backed digital tokens remains a question as March 2026 progresses and more on-chain data emerges.

Subscribe to our YouTube channel to watch leaders and journalists provide expert insights

Crypto World

Arthur Hayes Explains How US-Iran Conflict Could Boost Bitcoin

Arthur Hayes argues that Middle East wars often trigger Federal Reserve rate cuts, boosting Bitcoin over time.

In a March 1 essay, BitMEX co-founder Arthur Hayes argued that the U.S. military escalation in Iran fits a four-decade pattern of American intervention in the Middle East that ultimately leads to Federal Reserve easing.

According to Hayes, the longer the U.S. engages in this conflict, the higher the likelihood the Fed cuts rates or prints money to finance the war effort, a move he believes will drive the price of Bitcoin (BTC) higher.

Hayes Draws a Line From Gulf Wars to Fed Rate Cuts

In his analysis, Hayes pointed to the 1990 Gulf War, where FOMC minutes from August of that year noted that “events in the Middle East had greatly complicated the formulation of an effective monetary policy,” leading to rate cuts later that year.

He also cited the Federal Reserve’s emergency meeting after the September 11, 2001, attacks, where then-Chair Alan Greenspan cut rates by 50 basis points, explicitly pointing to a “heightened degree of fear and uncertainty” impacting asset prices.

The crypto market has already reacted to the unfolding geopolitical news, showcasing its role as the only financial market open during the weekend turmoil. Bitcoin, the most prominent asset in the sector, initially plummeted from $66,000 to around $63,600 within minutes of the first reports of strikes on February 28.

However, the asset just as quickly reversed course, jumping to $67,000 later that evening following reports of the death of Iranian Supreme Leader Ayatollah Ali Khamenei. At the time of writing, BTC was trading at around $66,800, slipping by less than 1% on the day and up 2.8% over the past week, although it remains down more than 20% across the last month.

Hayes Advises Waiting for the Fed Before Buying

While the immediate market reaction has been chaotic, Hayes is urging investors to look past the initial volatility and focus on the anticipated policy response. He noted that every U.S. president since 1985 has engaged militarily in the Middle East, and the financial fallout has consistently been managed with cheaper money.

You may also like:

For the former BitMEX CEO, the “simple heuristic” for Bitcoin’s rise or fall is that the cost of “nation-building” invariably leads to monetary easing.

“The longer Trump engages in the extremely costly activity of Iranian nation-building, the higher the likelihood the Fed lowers the price and increases the quantity of money to support Pax Americana’s latest bout of Middle Eastern adventurism,” he wrote.

Considering that Bitcoin has just suffered through its fifth consecutive month of losses, a streak not seen since 2018, with the asset shedding nearly 15% in February, Hayes has provided a specific trading tactic for the current environment. Given the uncertainty over how long the U.S. will remain engaged and how much financial market pain it can tolerate, he advises a patient approach.

“The prudent action is to wait and see,” said the crypto trader.

He also suggests that the optimal time to “back up the truck and buy Bitcoin and high-quality shitcoins” is not during the initial conflict but immediately after the Fed actually cuts rates or resumes money printing to support the government’s objectives in Iran.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

February 2026 Records Lowest Crypto Theft Activity in Almost 12 Months

TLDR

- February recorded crypto security breaches totaling $26.5M to $35.7M, marking the lowest monthly figure since March 2025

- A $10M oracle manipulation attack on YieldBlox’s Stellar-based lending platform represented the month’s largest single exploit

- Private key compromise led to approximately $8.9M in losses for IoTeX on February 21

- Compared to January’s $86M in losses, February saw a dramatic 69%+ decline, and remained far below the $1.5B Bybit breach from February 2025

- Phishing scams persisted as a major vulnerability, responsible for $8.5M in February theft

February witnessed a dramatic downturn in cryptocurrency theft, with blockchain security experts reporting the lowest monthly losses in nearly a year. Leading security platforms PeckShield and CertiK documented total losses between $26.5 million and $35.7 million throughout the month.

This represents a significant improvement from January’s $86 million figure, marking a decline exceeding 69% in just one month. The contrast becomes even starker when compared to February 2025, when the massive $1.5 billion Bybit exchange compromise dominated the statistics.

While February recorded 15 separate security incidents, two major attacks drove the majority of financial damage. The most significant breach targeted YieldBlox, a decentralized autonomous organization operating a lending protocol on the Stellar blockchain, resulting in $10 million in stolen assets.

On February 22, an exploiter took advantage of low liquidity conditions within the USTRY/USDC trading pair. Through a strategically executed abnormal transaction, the attacker artificially pumped the token’s valuation by 100x, manipulating the system into permitting massive undercollateralized loan withdrawals.

The month’s second-largest security failure struck IoTeX, a blockchain platform focused on Internet-of-Things applications, on February 21. Unauthorized access to a compromised private key granted the attacker entry to the project’s token safe.

The perpetrator rapidly converted stolen tokens into ETH before moving funds through multiple cross-chain bridges toward Bitcoin. While CertiK’s analysis estimated damages near $9 million, IoTeX representatives contested this figure, claiming actual losses were closer to $2 million.

Foom.Cash, a privacy-focused protocol, suffered the third-largest attack with $2.2 million in losses. The exploit leveraged a cryptographic vulnerability to manufacture fraudulent zkSNARK proofs, generating fake authentication credentials that bypassed protocol security measures.

What Drove the Drop

According to PeckShield’s analysis, February’s reduced numbers stem largely from the absence of any catastrophic “mega-hack” comparable to previous incidents like the Bybit breach. Additionally, a significant Bitcoin price downturn early in the month, with values falling beneath $70,000, redirected market focus away from protocol vulnerabilities.

Kronos Research’s Dominick John attributed the improvement to enhanced risk management protocols, elevated counterparty vetting standards, and superior real-time security monitoring deployed across major cryptocurrency platforms. He highlighted that artificial intelligence-powered code auditing tools and automated vulnerability detection systems are identifying weaknesses before exploitation occurs.

Phishing Still a Problem

Despite encouraging overall trends, phishing schemes continue plaguing the crypto ecosystem. These social engineering attacks claimed $8.5 million during February.

The proliferation of “drainer-as-a-service” operations, including platforms like Angel Drainer and Inferno Drainer, has democratized sophisticated phishing campaigns. These services supply turnkey solutions including replica websites, counterfeit social media profiles, and pre-built malicious smart contracts, requiring only a revenue-sharing agreement with operators.

PeckShield recommended that both institutional players and high-value individual wallet holders implement multi-signature cold storage solutions while maintaining rigorous private key security protocols.

Notably, wallet drainer-related losses have shown substantial year-over-year improvement, declining from $494 million throughout 2024 to $83.85 million across 2025.

Crypto World

Bitcoin to Ride Tailwinds If AI Drives Easier Monetary Policy, NYDIG

Bitcoin could gain ground if artificial intelligence reshapes labor markets or creates volatility that nudges central banks toward looser monetary policy, according to Greg Cipolaro, research lead at NYDIG. In a Friday note, he argued that AI may emerge as a general‑purpose technology on par with electricity, with macro effects on employment, economic growth and risk appetite that feed into the crypto market. The implications for Bitcoin (CRYPTO: BTC) hinge on the broader policy and liquidity backdrop: AI‑driven growth paired with ample liquidity and low real yields could be supportive, while a scenario of rising real yields and tighter policy would introduce headwinds. Conversely, if AI triggers labor disruption or market volatility that prompts fiscal expansion and looser policy, the liquidity impulse could again favor Bitcoin.

Key takeaways

- AI could act as a broad macro catalyst, influencing employment, growth, risk appetite, and ultimately Bitcoin (CRYPTO: BTC) through shifts in liquidity and policy expectations.

- Bitcoin’s direction depends on the interplay between AI‑driven growth, liquidity conditions, and the path of real interest rates; sustained expansion with accommodative policy may support BTC, while tighter real rates could weigh on it.

- Disruptive AI adoption may trigger fiscal expansion and easier monetary policy in some scenarios, delivering a liquidity impulse that tends to benefit Bitcoin (CRYPTO: BTC).

- Corporate AI ambitions are already reshaping corporate workforces, as seen in high‑visibility restructuring plans, signaling broader macro and market implications for risk assets.

- Regulatory and policy signals surrounding AI’s impact on employment could influence risk sentiment and crypto flows in the near term, alongside traditional equity and fixed income markets.

Tickers mentioned: $BTC, $SQ, $COIN, $GS

Market context: The AI wave is converging with ongoing liquidity dynamics and risk‑on sentiment in crypto markets. As institutions assess AI’s productivity gains and potential disruptions, macro data releases and central bank guidance will help determine whether crypto assets like Bitcoin can sustain a bid amid shifting policy expectations.

AI adoption is already altering corporate strategy and labor markets, a trend that crypto markets are watching closely. The broader narrative suggests that the technology could be a catalyst for both growth and volatility, depending on how fiscal and monetary authorities respond to changes in productivity and demand. In the near term, investors are parsing whether AI‑led productivity will accompany a period of loose financial conditions or whether the opposite dynamic—tightening policy in response to stronger growth—will prevail.

Why it matters

The intersection of AI and crypto sits at a critical juncture for investors and developers. If AI accelerates productive capacity while liquidity remains ample and real yields stay subdued, Bitcoin could benefit from a favorable risk environment and higher risk tolerance among investors seeking alternative stores of value. Conversely, if AI boosts output and real yields rise, policy normalization could reduce the appeal of risk assets, including BTC, even as the technology broadens the toolkit available to market participants.

From a labor‑market perspective, the outlook is nuanced. Goldman Sachs’ research arm suggested that widespread AI adoption could displace a portion of the workforce, even as it creates new opportunities. That tension—displacement alongside new roles—has historically been resolved through gradual adaptation and retraining rather than abrupt obsolescence. The practical implication for Bitcoin is not merely a price impulse but a shift in macro conditions that shape liquidity, risk appetite, and the relative attractiveness of crypto as an inflation‑hedge or diversification instrument.

Within the crypto industry, the AI rollout is not purely theoretical. Coinbase introduced a Payments MCP tool that enables AI agents to access on‑chain financial tools—an innovation that tests how AI can operate safely within decentralized systems while highlighting new risk vectors for security and market integrity. As AI agents gain more autonomy over financial actions, the ecosystem will need robust risk management, auditing, and compliance frameworks to avert unintended consequences.

The narrative is further complicated by corporate actions tied to AI. Block, the payments company co‑founded by Jack Dorsey, announced plans to cut roughly 40% of its staff as part of an AI‑driven restructuring, signaling that major tech and fintech firms are recalibrating cost structures in response to automation. That kind of market‑moving news underscores how AI may trigger both productivity gains and near‑term volatility as companies realign their workforces and investment priorities.

Looking ahead, the balance of macro forces—central bank policy, fiscal responses to AI‑enabled growth, and the pace of AI deployment—will shape how BTC trades in the coming quarters. If AI‑led productivity collapses into broader liquidity, Bitcoin could find a receptive environment; if not, the path of least resistance for BTC could be more challenging. The ongoing debate about AI’s macro impact is not just about employment; it’s about how money, policy, and risk assets interact in a world where automation and data drive more decision‑making than ever before.

What to watch next

- Upcoming macro data and central bank guidance to gauge whether AI‑driven growth translates into a more accommodative or restrictive policy environment.

- Details on Coinbase’s Payments MCP rollout, including any updates on safety assessments and the practical adoption by institutions and retail users.

- Further AI‑related restructurings or earnings commentary from major tech and fintech firms, and their impact on liquidity in crypto markets.

- New research updates from Goldman Sachs or other institutions outlining the labor market implications of AI and potential knock‑on effects for risk sentiment.

- BTC price responses to macro shocks linked to AI developments, providing a test of Bitcoin’s sensitivity to shifts in liquidity and policy expectations.

Sources & verification

- NYDIG research note by Greg Cipolaro on AI as a potential general‑purpose technology and its macro effects on BTC.

- Reports on Block’s planned staff reductions tied to AI‑driven restructuring.

- Goldman Sachs research on the potential displacement and creation of jobs due to AI adoption.

- Coinbase announcement of Payments MCP enabling AI agents to access on‑chain tools.

- Related coverage on AI, crypto funding, and industry developments referenced in the original reporting.

What the announcement changes

What to watch next

Rewritten Article Body: AI as a macro catalyst for Bitcoin

Bitcoin (CRYPTO: BTC) stands at the intersection of two transformative trends: artificial intelligence’s runaway potential and the evolving policy stance of global central banks. In a forward‑looking view, Greg Cipolaro, the research lead at NYDIG, framed AI as a “general‑purpose technology” whose macro effects—on employment, growth, and risk appetite—could materially influence the path for BTC. The core argument is simple but consequential: if AI‑driven growth is accompanied by expanding liquidity and low real rates, BTC could benefit from a more favorable macro backdrop. But if that growth pushes real yields higher and policy becomes more restrictive, Bitcoin could face headwinds that temper enthusiasm for risk‑sensitive assets.

Cipolaro’s logic rests on a classic macro equation: technology boosts productivity, which should lift demand for assets that function as stores of value or hedges against inflation and uncertainty. Yet the tech boom is not a guarantee of perpetual ease. In practice, the same AI adoption that accelerates growth can also provoke shifts in the labor market and in fiscal and monetary policy. If AI growth translates into higher real activity without overheating inflation, central banks might tolerate looser financial conditions longer. In such a scenario, Bitcoin could ride a liquidity tailwind as investors search for non‑traditional diversifiers amid rising risk appetite.

Conversely, Cipolaro warned that if AI‑driven productivity pushes the economy toward higher real yields, or if policymakers tighten to cool overheating, BTC’s path could weaken. The idea is not that Bitcoin is inherently fragile, but that its performance is increasingly tethered to the broader policy environment and the velocity of liquidity. In other words, BTC’s fate may be decided as much by macro policy reactions to AI‑enabled growth as by the technology’s direct impact on the crypto market. The takeaway is nuanced: the same technology that could lift BTC through liquidity cycles can also dampen it if it prompts policy normalization that drains speculative capital from risk assets.

The conversation around AI’s macro impact gains realism when considering how the labor market might respond. Goldman Sachs’ research arm, in August, noted that widespread AI adoption could displace a portion of the US workforce, even as it promises to create new opportunities. The report underscored a familiar theme in technology transitions: disruption and opportunity often coexist, with the net effect dependent on policy choices, retraining, and the speed at which new jobs emerge. For the crypto market, the implication is not a single directional move but a spectrum of outcomes shaped by policy signals and the pace of AI integration into the real economy.

Within the crypto ecosystem, the AI narrative is already producing tangible experiments. Coinbase announced a new tool, Payments MCP, designed to grant AI agents access to the same on‑chain financial tools used by humans. The development marks a significant step in integrating AI capabilities with decentralized finance, while also highlighting new risk vectors—from misfired automation to security vulnerabilities in autonomous actions. Industry executives stressed that safety must be a priority as AI agents operate in on‑chain environments, posing questions for risk management and compliance frameworks that will shape adoption trajectories.

Beyond wallets and protocols, AI is reshaping corporate strategy. Block, the payments company co‑founded by Jack Dorsey, disclosed plans to cut roughly 40% of its staff as part of a broader AI‑driven restructuring. The move is a vivid reminder that AI’s productivity gains can come with sharp adjustments to workforce composition and cost structures across the tech landscape. While such actions carry near‑term volatility for equities and tech‑driven liquidity, they also reflect the broader reallocation of resources toward more automated workflows and AI‑enabled platforms. For Bitcoin, these corporate shifts may contribute to liquidity dynamics and risk sentiment that influence price behavior in the months ahead.

As the AI‑era unfolds, Bitcoin’s trajectory will likely reflect a balance between macro stability and disruption. If AI accelerates growth without triggering aggressive tightening, BTC could benefit from an environment of ample liquidity and restrained inflation. If AI unlocks rapid productivity but also prompts policy normalization, risk assets—including Bitcoin—may face a more challenging climate. The overarching theme is that Bitcoin’s sensitivity to macro conditions is intensifying, driven not solely by on‑chain fundamentals but by the interconnected web of technology, labor markets, and policy responses that define the macro landscape.

In this evolving context, investors and builders alike should monitor the evolving AI policy narrative, corporate restructuring trends, and the practical rollout of AI‑driven financial tools within crypto ecosystems. The convergence of AI adoption, liquidity cycles, and central bank dynamics will play a decisive role in BTC’s direction in the near term, with the potential for both periods of outperformance and retracements depending on how policy and market sentiment respond to the AI shift.

Crypto World

Is crypto market crash deepening after Trump confirms more strikes on Iran?

Crypto markets remain under pressure after U.S. President Donald Trump confirmed that military operations against Iran will continue following joint U.S.–Israeli strikes that killed Iran’s Supreme Leader, Ayatollah Ali Khamenei.

Summary

- Total crypto market cap has fallen from roughly $3.3 trillion in January to around $2.26 trillion, with key support now near $2.1 trillion.

- BTC trades near $66,200, well below its 50-day ($77K) and 100-day ($83K) moving averages, signaling continued bearish momentum.

- Trump’s confirmation of continued U.S. military operations against Iran has added uncertainty, keeping risk assets like crypto under pressure.

Trump said combat operations are ongoing and will persist until U.S. strategic objectives are achieved, warning Tehran of further consequences as the conflict escalates.

Total crypto market cap analysis

The total crypto market capitalization has fallen sharply from January highs near $3.3 trillion to around $2.26 trillion at press time, marking a drawdown of more than $1 trillion at the peak of the selloff.

February saw an accelerated breakdown, with a large capitulation candle pushing the market toward the $2.1–$2.2 trillion support zone.

Currently, total market cap is consolidating near $2.26 trillion, showing mild stabilization but no clear reversal. Immediate support sits around $2.1 trillion, the recent wick low.

A break below that could open the door toward the psychological $2.0 trillion level. On the upside, resistance stands near $2.35–$2.4 trillion, where previous breakdown consolidation occurred.

Momentum suggests a bearish structure remains intact, though volatility has compressed, indicating markets are waiting for further geopolitical clarity.

Crypto market crash continues: Bitcoin struggles

Bitcoin (BTC) mirrors the broader market weakness. After topping near $96,000 in early January, BTC plunged below $70,000, briefly wicking toward the low $60,000s during February’s panic selling.

At the time of writing, BTC trades around $66,200.

Technically, Bitcoin remains below both its 50-day SMA (~$77,277) and 100-day SMA (~$83,408) — a bearish alignment that confirms downward momentum. The 50-day moving average is trending lower and approaching a potential bearish crossover configuration.

Immediate support lies around $64,000–$65,000, with stronger structural support near $60,000. Resistance remains heavy at $70,000, followed by the 50-day SMA near $77,000.

While markets have not made new lows since the initial strike shock, Trump’s confirmation of continued military operations adds uncertainty that could keep risk assets under pressure. For now, crypto appears to be stabilizing, but the broader downtrend remains intact unless key resistance levels are reclaimed.

Crypto World

South Korea to review crypto seizure practices after security lapses

South Korea’s finance minister has pledged reforms to strengthen how government agencies manage seized cryptocurrency, following a digital asset information leak involving the National Tax Service.

Summary

- South Korea’s finance minister announced a full inspection of digital assets held by public institutions through seizure and tax enforcement.

- The review follows a National Tax Service data leak and past incidents where police lost access to seized Bitcoin due to custody failures.

- Authorities plan to strengthen digital asset security management and implement safeguards to prevent future breaches.

Seized Bitcoin under scrutiny as South Korea tightens digital asset controls

In a statement posted on social media, the minister said the government will work with the Financial Services Commission and the Financial Supervisory Service to conduct a full inspection of digital assets held by public institutions through legal enforcement measures such as seizures from tax delinquents.

The review will assess the current status and management practices of those holdings and introduce measures to prevent future incidents, including tighter digital asset security controls.

“Together with relevant agencies such as the Financial Services Commission and the Financial Supervisory Service, the government will inspect the current status and management practices of digital assets held and managed by government and public institutions through seizure and other enforcement measures,” Koo said on X.

The minister clarified that the government does not actively invest in or hold cryptocurrency beyond assets acquired through legal enforcement processes.

The move comes after past security lapses raised concerns about how authorities safeguard confiscated crypto. South Korean police lost access to Bitcoin seized in 2021 after relying on a third-party custodian without maintaining control of private keys, exposing weaknesses in custody oversight.

The issue only came to light following an internal probe, drawing criticism over law enforcement’s digital asset handling procedures.

Authorities later arrested two suspects accused of stealing Bitcoin from wallets linked to seized assets, further highlighting vulnerabilities in state-managed crypto storage.

With digital asset seizures becoming more common in tax enforcement and criminal investigations, the latest review signals an effort to standardize custody practices and reinforce accountability. The government’s inspection is expected to evaluate storage methods, access controls, and inter-agency coordination to reduce operational risks tied to holding volatile and technically complex assets.

The finance minister said reforms would be implemented promptly once the review is complete, aiming to restore confidence in the state’s ability to securely manage seized digital assets.

-

Sports7 days ago

Sports7 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Politics7 days ago

Politics7 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Politics3 days ago

Politics3 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech1 day ago

Tech1 day agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat18 hours ago

NewsBeat18 hours ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat7 days ago

NewsBeat7 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat1 day ago

NewsBeat1 day agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoPolice latest as search for missing woman enters day nine

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Sports7 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Business3 days ago

Business3 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality