Entertainment

Kristen Bell, Connor Storrie and More Stars Inside the 32nd Actors Award

32nd Actors Awards

Inside the Ceremony …

Timothée Chalamet and More Stars

Published

The 32nd annual Actors Awards are underway … and, we’ve got pics from inside the event — with numerous moments shown on the broadcast and a few that weren’t.

From Kristen Bell opening the show with a song-and-dance number to Connor Storrie and Kathryn Hahn cracking jokes together while presenting an award.

“Marty Supreme” cast members Timothée Chalamet and Gwyneth Paltrow flashed some huge grins while sitting at a table together.

On the other hand, Jenna Ortega watched the show in true “Wednesday” fashion … a serious expression dotting her face.

While the ceremony itself has had a ton of hot moments, the stars really brought the heat on the red carpet … just click through our gallery to see for yourself!

Entertainment

Justin Bieber Celebrates 32nd Birthday With Wife Hailey by His Side

Justin Bieber’s 32nd Birthday

Celebrates With Hailey …

‘No One I’d Rather Be With’!!!

Published

|

Updated

Justin Bieber is celebrating his b’day …. marking the big day with the most important person in his life glued to his side.

The Biebs turned the big 3-2 on Sunday, sharing two photos on IG of his small, intimate dinner at what appears to be a restaurant, with wife Hailey right beside him.

Waiting for your permission to load the Instagram Media.

The Biebers — who have been married for 7 years — are parked at a cozy table with a cake in front of Justin as he blows out the candles. Both are dressed casually and look happy as clams.

Justin captioned the post, “no one id rather spend my birthday withhh.. :)) 💋”

Hailey couldn’t resist sharing the love, reposting the pics to her Instagram Stories and adding a sweet nod to their baby, Jack Blues, writing, “Dada mama, dada mama.”

Waiting for your permission to load the Instagram Media.

Justin’s mom, Pattie, also took to IG to wish her son happy birthday, posting a series of throwback pics of Justin through the years. Pattie wrote a heartfelt message, calling him “one of the greatest gifts God has ever given me.”

Happy birthday, JB!

Entertainment

Most Shocking TV Deaths: Yellowstone’s Marshals, Chicago Fire and More

Whether it’s drama, comedy or something in between, TV show writers have never been afraid to surprise audiences with a memorable character death.

Back in March 1975, M*A*S*H became a TV death pioneer when Lieutenant Colonel Henry Blake (McLean Stevenson) died in the season 3 finale. The character was headed home after being honorably discharged from the army, but before he could make it, he was killed by enemy fire.

Some 21st-century shows, however, make M*A*S*H‘s surprise death look tame.

Lost, which ran from 2004 to 2010, became known for its shocking twists before the first season was even finished. In the April 2005 episode “Do No Harm,” viewers were devastated when Boone (Ian Somerhalder) died after a plane fell on him in the jungle, and his passing was just the beginning.

Manifest, You, Game of Thrones and more hit series have also thrown fans for a loop by killing off fan favorites.

Scroll down for a look back at some of the most shocking deaths in TV history — and remember, spoilers ahead!

Entertainment

Michelle Williams Breaks Silence on Costar James Van Der Beek’s Death

Michelle Williams broke her silence on the death of her former Dawson’s Creek costar James Van Der Beek.

During an interview with Entertainment Tonight, recorded on Sunday, March 1, at SAG’s 2026 Actor Awards in Los Angeles, Williams, 45, spoke candidly about how Van Der Beek’s death has impacted her.

“I’m thinking about him and I’m thinking about his family constantly,” she told the outlet. Van Der Beek died at the age of 48 on February 11 following a battle with cancer.

Williams, who played Jen Lindley opposite Van Der Beek’s Dawson Leery on the WB coming-of-age drama which ran from 1998 to 2003, also shared a message with the people who have contributed to the GoFundMe launched by Van Der Beek’s family in the wake of his death.

“I also just want to say, like, it’s been such an amazing thing as James’ friend and a friend of the family to see the response in the wake of his passing and I just really want to say thank you to each and every person who contributed to sustaining their life and their children’s lives,” she told the outlet, who shared the interview via its X account. “It’s an incredibly meaningful thing to witness.”

Van Der Beek’s wife, Kimberly Van Der Beek, confirmed his death via social media on February 11. “Our beloved James David Van Der Beek passed peacefully this morning. He met his final days with courage, faith, and grace,” she said in a statement shared via Van Der Beek’s Instagram at the time. “There is much to share regarding his wishes, love for humanity and the sacredness of time. Those days will come. For now we ask for peaceful privacy as we grieve our loving husband, father, son, brother, and friend.”

Michelle Williams Neilson Barnard/Getty Images

Later that day, the GoFundMe was launched in an effort to support Kimberley and her six children. “James Van Der Beek was a beloved husband, father, and friend who touched the lives of everyone around him,” a description on the GoFundMe page read. “After a long and courageous battle with cancer, James passed away on February 11, 2026 leaving behind his devoted wife, Kimberly, and their six wonderful children. Throughout his illness, the family faced not only emotional challenges but also significant financial strain as they did everything possible to support James and provide for his care.”

At the time of publication, $2.75 million had been raised for the family, far surpassing the original listed goal of $1.5 million.

Williams’ Actor Awards appearance marked her first public outing since Van Der Beek’s death. She won the Actor award of Best Actress in a Limited Series for her work in FX’s Dying For Sex.

James Van Der Beek Tommaso Boddi/Getty Images for Prime Video

After Van Der Beek shared publicly in November 2024 that he had been diagnosed with stage 3 colorectal cancer, Williams told Entertainment Tonight in April 2025 that she was “in contact” with Van Der Beek and was there for him “in every and all ways.”

She later organised a Dawson’s Creek reunion, which Van Der Beek was unable to attend due to a stomach virus, in an effort to raise money for F Cancer. The actress shared via an August 2025 statement, “We grew up in Capeside and that’s a bond that will last a lifetime. We wanted to gather around our dear friend James and remind him that we are all here. We always have been and we always will be. And I know the fans of Dawson’s Creek feel the same way.”

Entertainment

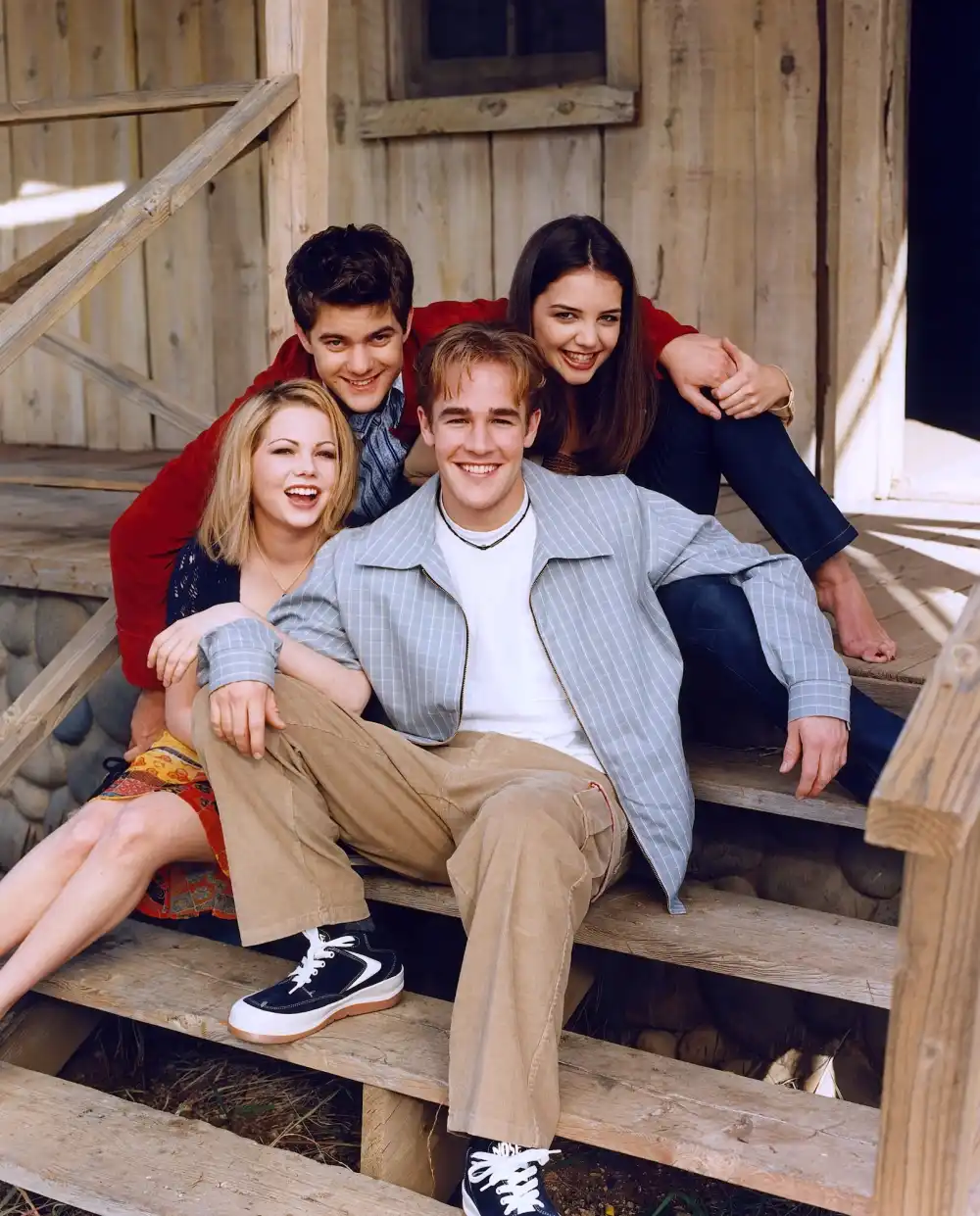

Dawson’s Creek Cast Reacts to James Van Der Beek’s Death at Age 48

The Dawson’s Creek cast is mourning the death of their costar James Van Der Beek following his death at age 48.

Van Der Beek’s family confirmed on Wednesday, February 11, that the actor, who portrayed the titular character on the hit ‘90s teen drama, had died following a battle with colorectal cancer.

“Our beloved James David Van Der Beek passed peacefully this morning. He met his final days with courage, faith, and grace,” James’ wife, Kimberly Van Der Beek, shared in a statement shared via his Instagram at the time. “There is much to share regarding his wishes, love for humanity and the sacredness of time. Those days will come. For now we ask for peaceful privacy as we grieve our loving husband, father, son, brother, and friend.”

Van Der Beek announced his stage III colorectal cancer in November 2024. His Capeside Crew — including Joshua Jackson, Katie Holmes, Michelle Williams, Kerr Smith and more — came together one year later in September 2025 for a one-night only Dawson’s Creek reunion to help raise money for F Cancer and Van Der Beek, performing a live reading of the show’s pilot at the Richard Rodgers Theatre in New York City.

“James and I were actually talking about [a reunion] back in April or May. We were doing a convention together out in, I think it was Pittsburgh, and he had mentioned that Michelle wanted to do this and put it together,” Smith, 53, exclusively told Us Weekly in September 2025 about how the reunion first came together. “So it’s Michelle’s baby, as far as I’m aware. She gets the credit. And I’m just glad she’s doing it, because it’s going to be fun to see all those guys. And when I was pitched, I’m like, ‘Of course, I’m in. This is fantastic.’ I mean, it helps, James.”

While Van Der Beek was ultimately not in attendance for the event, as he was forced to drop out last minute due to a stomach flu, Lin-Manuel Miranda stepped in to read the part of Dawson in his absence. The reunion sold out in 12 minutes, with tickets priced from $199 to $1,200, raising thousands of dollars for the cause.

Dawson’s Creek ran on The WB from 1998 to 2003 and followed Van Der Beek’s Dawson Leery as he navigated the ups and downs of teenagehood alongside his on-and-off love interest Joey Potter (Holmes), best friend Pacey Witter (Jackson) and mysterious new neighbor Jen Lindley (Williams). Smith, Meredith Monroe, Busy Philipps, John Wesley Shipp and Mary-Margaret Humes also starred.

Following his death, the cast took to social media to honor the life of their longtime friend. Keep scrolling for every heartfelt tribute about Van Der Beek from the Dawson’s Creek cast:

Michelle Williams

“I’m thinking about him and I’m thinking about his family constantly,” Michelle Williams, who played Jen Lindley on the show, said during an interview with Entertainment Tonight on March 1.

Williams also expressed her gratitude to fans who had donated to the Van Der Beek family’s GoFundMe. “I also just want to say, like, it’s been such an amazing thing as James’ friend and a friend of the family to see the response in the wake of his passing and I just really want to say thank you to each and every person who contributed to sustaining their life and their children’s lives,” she told the outlet. “It’s an incredibly meaningful thing to witness.”

Katie Holmes

“James, thank you. To share space with your imagination is sacred — breathing the same air in the land of make-believe and trusting that each other’s hearts are safe in their expression…,” Holmes, 47, shared in an emotional handwritten letter posted via Instagram on Thursday, February 12. “These are some of the memories, along with laughter, conversations about life, James Taylor songs — adventures of a unique youth…”

“Bravery. Compassion. Selflessness. Strength. An appreciation for life and the action taken to live life with the integrity that life is art — creating a beautiful marriage, six loving children — the journey of a hero,” she wrote.

“I mourn this loss with a heart holding the reality of his absence and deep gratitude for his imprint on it,” said the actress. “To Kimberly and the children, we are here for you always. And will always be there to shower you with love and compassion,” Holmes concluded.

Kerr Smith

“I’m so grateful for being able to call James a brother,” Kerr Smith, who portrayed Jack McPhee on seasons 2 through 6 of the show, wrote via Instagram. I’ll miss him deeply. Rest easy.”

In another tribute shared via Instagram, Smith wrote, “To Kimberly and your beautiful children, James was so many things…brilliant, creative, wildly original, and completely himself in every room he walked into. Being around him meant thinking more deeply, laughing more freely, and feeling more awake to the world. He didn’t just create work. He created connection. He created laughter. He created moments that stay with you.”

He continued, “I cherish being his friend. For twenty-seven years, through different seasons of life, through different versions of ourselves. Our early years shaped me in ways I still carry, and now as adults gave that friendship even more depth and meaning. Sharing a life alongside his, in all its chapters, is something I will forever be grateful for.”

Smith also penned a message to Van Der Beek’s wife, Kimberly.

“Kimberly, he loved you deeply. And to his children…your father was extraordinary not only in what he accomplished, but in who he was. His mind, his heart, his generosity,” he concluded. “Rest easy James.”

Chad Michael Murray

“Sending love and light to your beautiful family,” Chad Michael Murray, who played Charlie during Dawson’s Creek’s college years, wrote in the comments section of James’ Instagram. “James was a giant. We’re so so so sorry for what you’re going through. His words, art and humanity inspired all of us- he inspired us to be better in all ways. God bless you guys🙏.”

Busy Philipps

Philipps, who portrayed Joey’s roommate Audrey on Dawson’s Creek, shared an emotional tribute via Instagram. “My heart is deeply hurting for all of us today…every person who knew James and loved him, anyone who loved his work or had the pleasure of meeting him, all of his dear friends and community that surrounded him as he battled this illness, especially his parents and brother and sister,” she wrote alongside throwback photos of the pair through the years. “But I am profoundly heartbroken for his incredible wife Kimberly and their six magical children. There is a go fund me for them to help out and i’ll put the link in my stories. James Van Der Beek was one in a billion and he will be forever missed and i don’t know what else to say. i am just so so sad. He was my friend and i loved him and i’m so grateful for our friendship all these years.❤️.”

Mary-Margaret Humes

James Van Der Beek and Mary-Margaret Humes on ‘Dawson’s Creek.’ Columbia TriStar Television/ Courtesy: Everett Collection

Mary-Margaret Humes, who played James’ mother on Dawson’s Creek, issued a social media tribute in honor of her late costar on February 11.

“Rarely am I at a loss for words … today would be the exception. James, my gracious warrior, you fought a hard battle against all odds with such quiet strength and dignity,” Humes wrote via Instagram. “I will always love and admire you for that. Our last conversations … merely a few days ago … are forever sitting softly in my heart for safe keeping. To our extended Dawson’s Creek family of friends, please be respectful of our silences at the moment as Beautiful Kimberly and family have asked for peaceful privacy for now.”

‘Dawson’s Creek’

The official Instagram page for Dawson’s Creek issued a tribute following James’ death at 48.

“We are deeply saddened by the passing of James Van Der Beek,” the social media statement read. “His iconic portrayal of Dawson Leery helped define a generation of television for fans and continues to resonate with audiences today. Our thoughts are with his family and loved ones.”

Sasha Alexander

Sasha Alexander played Pacey Witter’s older sister, Gretchen Witter, on season 4 of Dawson’s Creek, who eventually becomes Dawson’s girlfriend. “Just heartbroken,” she wrote in the comments section of Mary-Margaret Humes’ Instagram post. “I am so sorry for all of our losses. James was a beautiful soul and kind human. Prayers for his whole family.”

Alexander later shared an emotional tribute to Van Der Beek, uploading an Instagram post with a carousel of photos of the actor over the years, including ones from his time on Dawson’s Creek.

“It feels like yesterday that we were sitting beneath those pink Wilmington sunsets, filming during the beautiful Dawson’s Creek years. What made Dawson special was the man who played him,” she wrote. “James was a deep, thoughtful soul. He took his work seriously, not out of ego, but out of care. He cared about being a good actor. He cared about doing things well and he never took any of it for granted. But more than anything, he cared about people. He cared about his family. He cared about showing up fully.”

Alexander shared that she was “heartbroken for everyone who loved him, especially his beautiful family” and added that she was holding them in her prayers.

“I will always be grateful that I got to stand in his light for a little while. That I got to laugh with him, go to prom with Dawson and grow up alongside him. He will live on in our memories, and in the kindness he left behind,” she concluded. “Rest in Peace, my friend. 🤍”

Hal Ozsan

Hal Ozsan appeared on the final season of Dawson’s Creek as Todd Car, a film director mentor of James Van Der Beek’s character, Dawson.

“This morning my brother, James passed in his sleep. I do not have the words to express the grief. There will be a James sized hole in my heart for the rest of my life and I will never meet his like again,” Ozsan wrote via Instagram alongside a photo of his former costar. “James… there are so many things I could say about you, brother, but the truest, is that you always lived your life heart-first in everything you did. Which is why, when the time came, you left in a home that you built, surrounded by the love you made. We should all be so lucky. What a life. What a man. What a friend. No notes, brother. No notes.”

Kevin Williamson

Kevin Williamson, who created Dawson’s Creek and served as showrunner for seasons 1 and 2 before returning to write the series finale, shared an emotional message to James Van Der Beek and his family.

“With much love, we are here for you. Your Dawson’s Creek family will always be here for you and your beautiful family,” Williamson wrote via Instagram alongside photos with Van Der Beek over the years. “To everyone, thank you for your outpouring of love. It has been felt. Several times today, from my heart, I’ve tried to form the words to express the beautiful brilliance of James and what his presence has meant to my life. But I am truly at a loss for words. I will have to trust that one day those words will come… But today, all I can think about is Kimberly and the entire Van Der Beek family. My heart is with you. K.”

John Wesley Smith

John Wesley Smith, who played Dawson’s dad, penned a lengthy tribute via Instagram.

“I try to pause before commenting when a painful event occurs in the lives of people to whom I have been close, out of an abundance of caution not to co-opt their personal pain and make it my own,” he wrote. “I am so glad to have met James Van Der Beek’s beautiful family at his DANCING WITH THE STARS competition in LA and most recently at the spectacular event, DAWSON’S CREEK ON BROADWAY last Fall. It is to them that my heart goes out at this moment, his beautiful wife, Kimberly, and family and their families and circle of closest friends.”

Meredith Monroe

Meredith Monroe, who played Andie McPhee, paid tribute to James Van Der Beek via a touching Instagram tribute and shared that “nothing seems right” after the actor’s death.

Explaining that she had been “flooded with fond memories” of her friendship with Van Der Beek over the years, Monroe praised the actor, listing several of his positive traits.

“Your legacy is your light. Whether 1 on 1, at a party, an event, or in your art you’ve always shared your light through: your humor & laughter, your curiosity, time & energy both in others & the world around you,” Monroe wrote alongside a carousel of throwback photos. She added, “Your ability to be completely present & make others feel welcome & comfortable, your sincerity, friendship, compassion & love.”

Entertainment

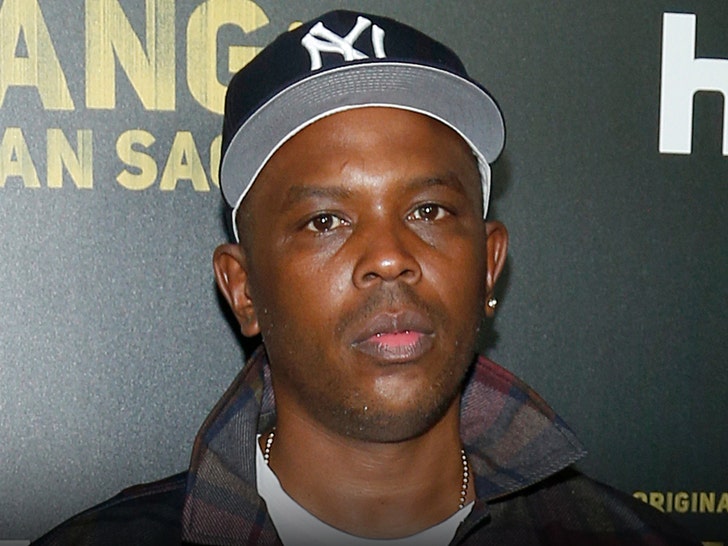

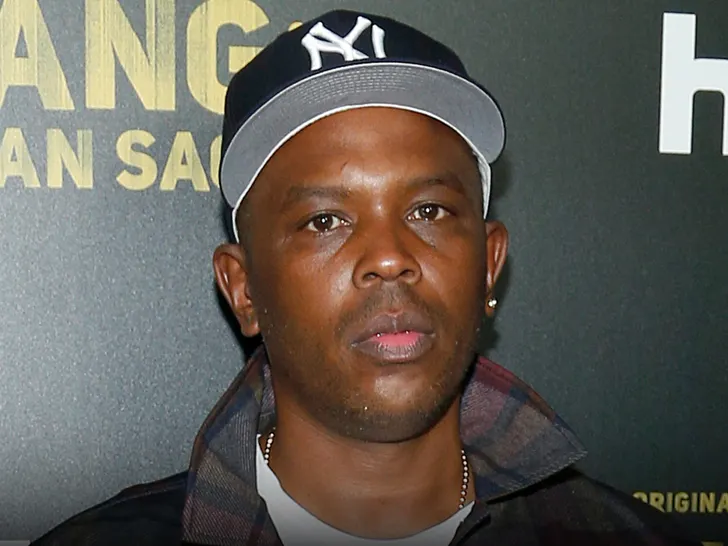

Eugene Thomas King Jr.’s, Who Held Paula Deen at Gunpoint, Cause of Death Revealed

The man who held Paula Deen at gunpoint died from cardiovascular disease, a natural cause … TMZ has learned.

Eugene Thomas King Jr. died from hypertensive and arteriosclerotic cardiovascular disease, the New York City Medical Examiner’s Officer tells us.

According to the Mayo Clinic, hypertensive and arteriosclerotic cardiovascular disease is caused when high-blood pressure damages the arteries and causes plaque to build up. This is considered a natural cause of death by the M.E.

We broke the story … King was found unresponsive in his Brooklyn apartment just after 5 PM on Thursday. Emergency Medical Service personnel pronounced him dead at the scene.

Back in 1987, King committed armed robbery … and Deen, who was working as a bank teller at the time, says he held a gun to her head. He was caught and sentenced to 25 years in prison for that crime and another robbery.

In 2013 — after Deen used a racial slur — King came to her defense … claiming she was being “persecuted” for making one small mistake in judgment and reacting out of anger. In the same Inside Edition interview, he apologized once again for holding her at gunpoint.

Eugene was 75.

Entertainment

Wu-Tang Clan Cofounder Oliver ‘Power’ Grant Cause of Death Revealed

Wu-Tang Clan cofounder Oliver “Power” Grant died after a “courageous” battle with pancreatic cancer … his family said on Saturday.

In a joint statement given to Rolling Stone, Grant’s family and his rap group revealed his illness — telling the outlet he was a “true fighter until the end.”

Oliver will be remembered as a “global architect of culture” whose legacy will continue on forever.

Wu-Tang Clan announced Grant’s death earlier this week … and popular members like Method Man and GZA jumped on social media to shout out their longtime friend — with the latter even saying the group wouldn’t have succeeded without him.

While Grant wasn’t a performing member of WTC, he helped the group achieve stardom in their early years … helping finance their first single, “Protect Ya Neck.”

He was also an executive producer on “Enter the Wu-Tang (36 Chambers)” … which Rolling Stone ranked as the 27th greatest album ever in 2023.

Waiting for your permission to load the Instagram Media.

Grant also helped create “Wu Wear” … the collective’s streetwear brand, which influenced fashion and funded the group during their first few years.

Oliver was just 52 years old.

RIP

Entertainment

Michael J. Fox Says His Role in ‘Shrinking’ Was More Than Just Acting Job

Michael J. Fox

Role in ‘Shrinking’ Bigger than Just a Job …

Reveals Inspiration

Published

@LionsShareNews / Backgrid

Michael J. Fox says his part in the hit TV show “Shrinking” wasn’t just a small little acting gig … but something much more.

Photographers caught up with the movie and TV star at LAX Saturday … and he was asked what it was like playing Jerry on the show — a man with Parkinson’s disease, just like himself.

Take a listen for yourself … Michael says this part was more than just a TV role to him — though he also added it’s nice to go to set and do the work.

Fox was also asked about his legacy … to which he responded he’s not worried what people think about him after he’s dead.

MJF dove into who inspires him, too … especially since he’s an inspiration to so many — and, he points to Freddie Roach, a well-known boxing trainer who also has Parkinson’s.

Basically, don’t try to shrink the importance of this role, Michael says … it’s an important one.

Entertainment

Kylie Kelce Shares Rare Insight Into Raising Children With Jason Kelce

Kylie Kelce offered rare insight into her family life with husband, Jason Kelce, as the pair raise four daughters together.

During an appearance in Jennifer Garner’s Instagram video series “Naptime Cook Club,” shared by the actress on Sunday, March 1, Kylie, 33, was quizzed by Garner, 53, about how she copes day-to-day with “so many” children.

“Yeah, they just keep multiplying,” joked Kylie, who was dressed casually in denim jeans and a gray T-shirt. Garner, whose lighthearted social media series offers simple meal ideas for parents to prepare at home while their “kid is down for a nap,” then asked whether Kylie had any children of her own who still took a daily nap.

“We still have one napper,” Kylie said, pinpointing her youngest child, Finnley, 11 months. Kylie and Jason, 38, also share Bennett, 2, Elliotte, 4, and Wyatt, 5.

A surprised Garner then confirmed with Kylie, “Your two-year-old doesn’t nap?” to which the “Not Gonna Lie” podcast host replied, “No, she’s busy. She’s got things to do.”

Kylie also joked about her kitchen skills, revealing that she isn’t entirely polished with a knife in hand. “I watch so many cooking shows, including yours [Garner’s], that I am afraid that someone will see me with a knife,” Kylie said.

As the cooking tutorial continued, Garner noted that parents may like to get up in the morning and marinade meat for extended periods of time if they have their “act together,” which drew another humorous response from Kylie.

“I’ve never felt that in my whole life [but] go on, hypothetically,” she quipped before discussing the challenges she’s faced due to Wyatt’s fussy eating habits.

“I have one child who will, actually that’s a lie, two because one can’t talk, two children who will voluntarily eat something that is green,” Kylie began. “Our toughest eater was our oldest. Once Upon a Farm pouches were great because they are not a green color. They’re beautiful colors. I tried to explain to her, like, ‘You ate veggies. You used to’ and she’s like, ‘No I didn’t.’ I’m like, ‘No, I watched it, I actually bought it.’

While Kylie had previously kept her personal and family life out of the spotlight for the most part, her “Not Gonna Lie” interviews are allowing more frequent peeks into non-professional elements of her day-to-day activities and headspace.

During the February 12 episode, she even shared that she hoped to undergo breast augmentation surgery one day. “Really, my plan is, we’re gonna end up doing this,” Kylie said to a former college roommate during the show. “To be clear, there is a rough plan that eventually I will put my boobs back where they belong. Because four kids. That’s all I have to say about that.”

Kylie, who gave birth to Finnley in March 2025, continued at the time, “I’m gonna wait until they settle because if I did [a reveal] fresh out of surgery, [my friend] would be like, ‘I don’t know why they’re at your neck.’”

Entertainment

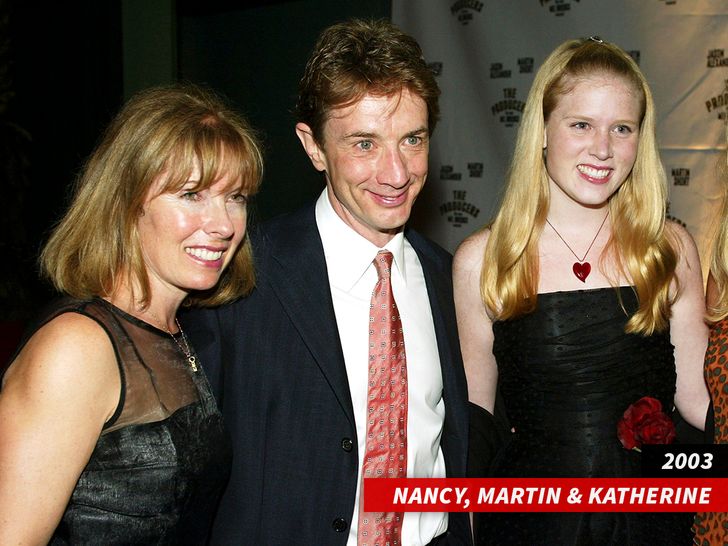

Martin Short Skips Actors Awards Days After Daughter Katherine’s Death

Martin Short

Doesn’t Attend Actors Awards After Daughter’s Death

Published

Martin Short had a difficult last week … and decided it was best if he didn’t attend the Actors Awards Sunday.

The veteran actor was up for the Outstanding Performance by a Male Actor in a Comedy Series — an award he won last year — for “Only Murders in the Building … but, he was the only one of the five nominees not at the ceremony in Los Angeles.

Seth Rogen ended up taking the trophy anyway … but, it seems clear Martin skipped the ceremony because his daughter, Katherine, passed away last week.

We broke the story … Short’s daughter died by self-inflicted gunshot wound, law enforcement sources told us. She previously revealed she suffered from mental health issues.

We spoke with a friend who remembered her as a “beautiful empathetic soul” … who said there were no indications that Katherine was suffering as she was.

Broadcastify.com

She was found behind a locked door … and a note was found at the scene.

Short had several comedy shows scheduled for this weekend … but, he postponed those shortly after Katherine was found dead.

She was 42.

RIP

If you or someone you know is struggling or in crisis, help is available. Call or text 988 or chat 988lifeline.org.

Entertainment

Zendaya and Tom Holland Are Married, Her Longtime Stylist Claims

Law Roach

Zendaya and Tom’s Wedding Already Happened …

Y’all Missed It!!!

Published

Zendaya and Tom Holland are married … so claims her longtime stylist, Law Roach.

Here’s the deal … the celebrity stylist — who started styling Zendaya way back in 2011 — spoke to Access Hollywood on the Actors Awards red carpet where he sang out “The wedding has already happened, you missed it.”

Waiting for your permission to load the Instagram Media.

The AH reporter asks in shock if that’s true … and, Law responds by saying it’s “very true” before walking off.

This isn’t the first time Tom and Zendaya’s relationship status has made headlines on a red carpet … remember at the Golden Globes in 2025, Zendaya had a ring on that finger — and, the next day, we found out the two were engaged.

TMZ.com

Zendaya and Tom met on the set of “Spider-Man: Homecoming” in 2016, started dating a couple years later and went public with their relationship in 2021.

We’ve reached out to Tom and Zendaya’s teams … so far, no word back.

-

Sports7 days ago

Sports7 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics7 days ago

Politics7 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech1 day ago

Tech1 day agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat24 hours ago

NewsBeat24 hours ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment6 hours ago

Entertainment6 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech3 days ago

Tech3 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS