Video

Does Money Buy Happiness? Munger’s Brutal Answer #shorts

Charlie Munger shares a blunt take on simple living: despite having the means for more, he chose a modest life and stayed in the same house for decades, just like Warren Buffett.

After watching rich friends build fancy houses and spend excessively without becoming happier, he raises the real question: does money buy happiness? The lesson is clear: frugal living and a minimalist lifestyle often deliver more peace than upgrading everything just because you can.

Take care.

#charliemunger #investing #valueinvesting #money #stockmarket #stocks #motivation #financialeducation

source

Video

BITCOIN: We’re Being Played! (here’s proof) – BTC, ETH, XRP Price Prediction Today

Want a free $30,000 bonus + $20 just for signing up? Go here: https://www.bybit.com/en/sign-up?affiliate_id=9187&group_id=881614&&group_type=1

Or if you prefer a free $8,560 bonus + no KYC: https://www.bitunix.com/register?vipCode=BitcoinHyper

Use my trading bots for free

1. Sign up here: https://www.pionex.com/en/activities/common/1273924944/Bitcoinhyper?referral=j7J3lFqt

2. Deploy here: https://www.pionex.com/en/activities/kol-follow-order?share_code=j7J3lFqt

Join my free VIP group here: https://discord.gg/EN2SYAVkUt

I’m a full-time crypto trader and investor since 2017, but not a financial adviser. The content in this video, including Bitcoin price prediction today, Bitcoin price prediction 2025, Bitcoin technical analysis, crypto news today, and cryptocurrency topics, is for educational and entertainment purposes only and reflects my personal opinions. Always do your own research and consult a professional before making financial decisions.

source

Video

Where are The Men With Money….. I’m F**king Serious

🎙️ Red Leather Podcast Clips Channel

📺 Main Channel: @JackMorgan_RLP

📧 Business Inquiries: RLPQNA@GMAIL.COM

@hoe_math

Thank you for all of your support. Seriously, I love you guys. ♥️

🔥 Support the Channel 🔥

👕 Buy a Caddy Daddy T-Shirt: https://jackmorganrlp.sellfy.store/

👾 Join the The Red Leather Club Discord: https://discord.gg/cGGaNFF9Kp

🎥 Exclusive Content on Patreon: https://www.patreon.com/cw/JackMorganRLP

📞 Ask Me Anything — Call anytime ($5/min): 561-589-4009

💸 PayPal: @JackmorganRLP

💵 Cash App: $Johnnylongcoat

🎬 The No BS Guide to YouTube: Everything you NEED to Learn to be Successful on YouTube. https://jackmorganrlp.sellfy.store/youtube-guide/

💼 Sponsors

📱 ConnectWithMe – Download in the App Store — Turn conversations into cash.

This is a Bill per minute phone service so your fans can support you and connect with you. https://www.connectwithme.com/?uaid=4286937

⏰ Time Stamps

0:00 – The “Equal Pay” Paradox & Ho Math’s Logic

2:08 – Why Men Still Pay For Everything (The Social Custom)

5:32 – Dating in Your 40s: “Pathetic” or Just Realistic?

11:00 – Why We Actually Ask “What Do You Do For A Living?”

14:30 – The Truth About Shared Bills & Financial Stability

Any support is much appreciated Like, Comment, Subscribe all that Jazz

#dating #women #mgtow #genz #millennials

source

Video

BITCOIN DEATH CROSS – TIME TO ACT !!!!

🟧 BYBIT: http://themoon.co/Bybit 👉 10% DISCOUNT & $30,000 BONUS

🔥 Coinflare: https://themoon.co/Coinflare 👉 Earn Up to $5,050 in Rewards

🟠 BloFin: https://themoon.co/blofinexclusive 👉 Deposit $2,000, Get $300 Futures Bonus

🟨 WEEX: https://themoon.co/WEEX50usdt 👉 $50 cashback on first $100 deposit

Carl Moon Music Channel: https://www.youtube.com/@CarlMoon_Music

⚔ Play Medieval Empires: https://themoon.co/MedievalEmpires

🔥 *EXCHANGE TUTORIALS* 🔥

📺 BloFin: https://youtu.be/WwWwp2miv0E

📺 Binance: https://youtu.be/80zosJeVhU4

📺 Bybit: https://youtu.be/_1M5gag_Zm0

📺 Coinflare: https://youtu.be/Xn-Ptvt1eeI

📺 Phemex: https://youtu.be/AJbYFEOn02Q

📺 MEXC: https://youtu.be/QN2NzpCQ2G0

📺 Bitget: https://youtu.be/726Vrm03ZMc

*FAVOURITE EXCHANGES RIGHT NOW FULL LIST*

⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇

🔥 *Coinflare is the fastest growing alternative to Bybit, with LOWER FEES!*

_Click this link to Earn Up to $5,050 in Rewards_

Sign up here 👉 https://themoon.co/Coinflare

🟨 *WEEX is available in ALL COUNTRIES with NO KYC:*

_Click this link to get $500 bonus each to Weekly 100 winners + Deposit $100, Get $50 bonus_

Sign up here 👉 https://themoon.co/WEEXwelcome

🟠 *BloFin offers best liquidity:*

_Click this link to get $100,000 Deposit & Trade Rewards_

Sign up here 👉 https://themoon.co/blofin100k

✳️ *SwissBorg is secure and reliable crypto app:*

_Click this link to get up to €100 in Crypto Rewards_

Sign up here 👉 https://themoon.co/swissborgmoon

🟦 *MEXC requires NO KYC:*

_Click this link to get $30,000 in welcome rewards!_

Sign up here 👉 https://themoon.co/MEXC

❎ *LeveX is a Social Crypto Exchange:*

_Click this link to get 20% Deposit Bonus + VIP5 Benefits + Exclusive Content (NO KYC)_

Sign up here 👉 https://themoon.co/LeveX

🟢 *Bitunix requires NO KYC and is highly liquid:*

_Click this link to get a free $100 after your first $500 deposit!_

Sign up here 👉 https://themoon.co/Bitunix

🟧 *Bybit is the MOST TRUSTED and liquid exchange for leverage trading in crypto:*

_Click this link to get 10% fee reduction & $30,000 BONUS_

Sign up here 👉 https://themoon.co/Bybit

🔸 *Binance is the best exchange for SPOT TRADING:*

_Click this link to get a permanent 20% fee reduction!_

Sign up here 👉 https://themoon.co/Binance

Want to earn passive income from Bybit? Become my sub-affiliate with this link: https://affiliates.bybit.com/v2/en/apply?affiliate_id=1205

*FOLLOW CARL MOON ONLINE*

⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇

Vlog channel: https://www.youtube.com/@Carl

Instagram: https://www.instagram.com/carlmoon

Twitter: https://www.twitter.com/TheMoonCarl

Tik-Tok: https://www.tiktok.com/@carlmoon

Tik-Tok: https://www.tiktok.com/@moon

Facebook: https://www.facebook.com/TheMoon

Website 1: https://carlrunefelt.com

Website 2: https://carlmoon.com

🗣️ Join The Moon Show Community:

Website: https://themoonshow.com

Twitter: https://x.com/TheMoonShow

Telegram Group: https://t.me/TheMoonGroup

Telegram Alerts: https://t.me/TheMoonOfficial

🌙 BUY BITCOIN WITH FIAT ($ €):

⭕️ Swissborg Win up to $100: https://swissborg.com/r/themoon

⭕️ Binance $1,000 cashback: https://themoon.co/Binance

🌙 EVERY BITCOIN INVESTOR NEEDS:

⭕️ Tradingview: https://themoon.co/Tradingview

⭕️ Ngrave Hardware Wallet: https://themoon.co/Ngrave

⭕️ GET NORDVPN UP TO 72% OFF + 4 EXTRA months: https://nordvpn.com/themoon

⭕️ Ledger Wallet: http://ledger.com/?r=f988

⚠️ I don’t accept donations, use that money to invest in yourself or buy Bitcoin! If you want to support me, use any of the affiliate links above and leave a like & subscribe! THANK YOU!

#Coinflare #WEEX #Bybit #Bitunix #Crypto #Bitcoin #Binance #MEXC #LeveX

DISCLAIMER: By accessing this channel, you agree to the following: Content is for general information and entertainment only—not financial, legal, or professional advice. No guarantee is made regarding accuracy; use at your own risk. Views are my personal. Investing involves risk—do your own research. Not intended for users in the UK, US, India, China, or other restricted jurisdictions.

PROMOTIONS & AFFILIATES: Ads and links may appear but do not imply endorsement in any way. Sponsored content reflects personal views. Compensation may be received—verify third-party services independently.

source

Video

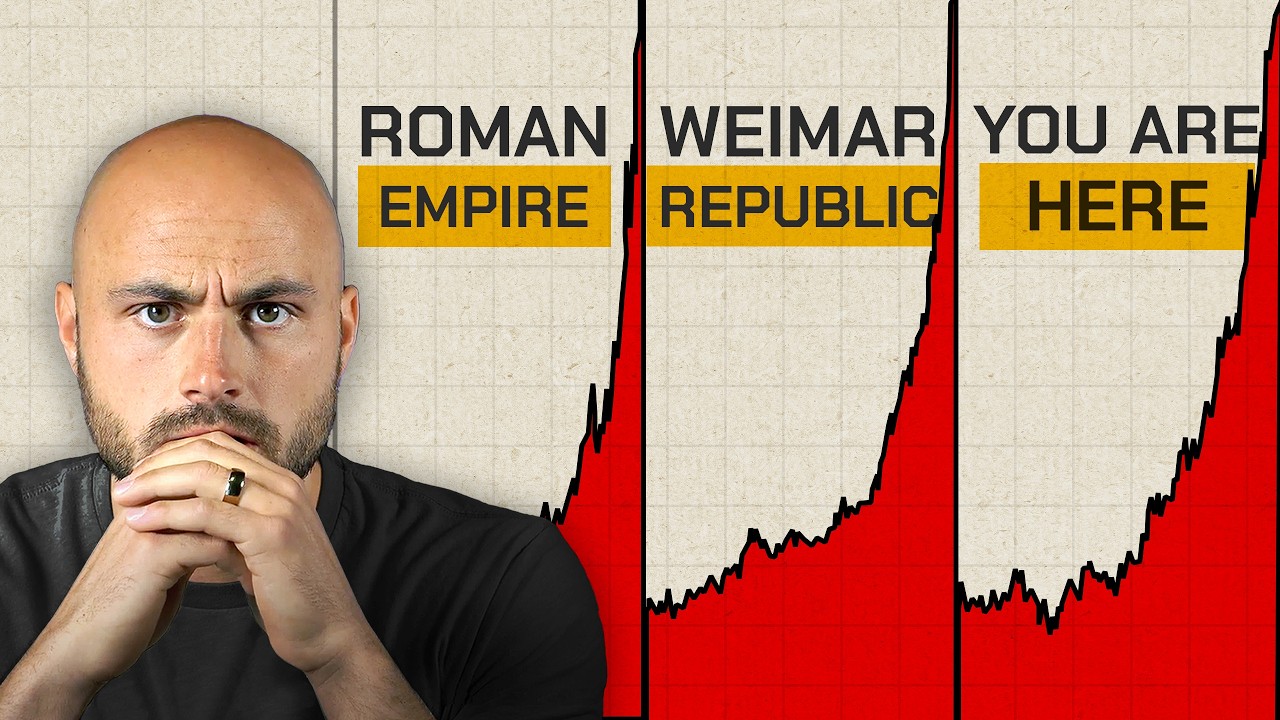

When Gold Does This, Empires Fall

Get the Replay of my Traders Wanted event: https://go.heresy.financial/traders-wanted

TIMECODES

0:00 Gold Has Doubled in Two Years

0:08 When Gold Moves Like This Empires Fall

0:23 Central Banks Are Buying Gold

0:41 Gold Now Larger Than Treasuries in Foreign Reserves

0:55 Gold Broke Out in 2019 Before the Money Printing

1:15 Gold Sniffs Out Future Monetary Policy

1:33 Central Banks Make Policy and Buy Gold

1:53 Weimar Republic Gold Chart

2:17 Our Gold Chart Has the Same Shape

2:30 Governments Inflate Money Empires Fall

2:49 Commodities Follow Gold

4:08 Weimar Is Not the Only Example

4:30 Dollar Lost Over 90% Purchasing Power

4:48 Roman Empire Debased Their Coins

5:20 Same Story Different Emperor

5:37 Debasing Money Is Short Term Pain Free

6:10 Governments Promise Free Things Then Debase

6:27 US Government Is in the Same Situation

6:44 National Debt Could Hit $60 Trillion

6:59 $120 Trillion in Unfunded Liabilities

7:30 You Cannot Borrow Out of Debt

7:53 Inflation Like Rome and Weimar

8:08 Gold Up 150% Central Banks Know

8:22 Kevin Warsh Will Deregulate Banks

8:56 Supplementary Leverage Ratio Explained

9:17 2020 They Removed the Restriction

9:40 Prepare for Prices to Run Hot

9:53 Gold Runs Ahead of Policy Decisions

My Important Links:

Get my FREE newsletter Letters From a Heretic: https://go.heresy.financial/letters-from-a-heretic

Get my Hedged Hyper Growth Portfolio Blueprint for its lowest price ever: https://go.heresy.financial/hypergrowth

Affiliate Partners:

Monetary Metals (earn yield on gold) https://monetary-metals.com/heresy-financial/

Miles Franklin (buy gold, best price) https://milesfranklin.com/heresy-financial/

Swan Bitcoin (stack bitcoin) http://bit.ly/swnhrsy

M1 Finance (invest in stocks) https://m1.finance/MNoCZwlvGStC

Socials @HeresyFinancial

Twitter: https://www.twitter.com/heresyfinancial

Insta: https://www.instagram.com/heresyfinancial

TikTok: https://www.tiktok.com/@heresyfinancial

Reddit: https://www.reddit.com/user/heresyfinancial/

Rumble: https://rumble.com/c/HeresyFinancial

My name is Joe Brown, and I’m a former stock broker who spent years advising the top 1% on how to manage their wealth. After making enough money to leave the corporate world behind, I turned my attention to teaching regular people financial strategies that exist outside the mainstream – things you’ll never hear from your traditional fiancial advisor.

I am not a CPA, attorney, or licensed financial advisor and the information in these videos shall not be construed as tax, legal, or financial advice. Information shared here is for educational purposes only. It is not financial advice or a recommendation to buy or sell any security. Investors are responsible for evaluating their own financial objectives and identifying potential risks before making any investment decisions. Your results are not guaranteed, and all investing involves substantial risk of loss. Your results may vary. Linked items may create a financial benefit for Heresy Financial. Copyright Heresy Financial 2025.

source

Video

BREAKING: Bitcoin Price Suppression & Crypto Market Manipulation LIFTED!

Bitcoin Price Suppression & Crypto Market Manipulation LIFTED!

⭐ Follow Altcoin Daily on 𝕏: https://twitter.com/AltcoinDaily

🟠 Become a channel member & get access to perks:

https://www.youtube.com/channel/UCbLhGKVY-bJPcawebgtNfbw/join

🎁 Altcoin Daily Merch: https://m046hz-bk.myshopify.com

🟡 50% deposit bonus on first $100 on WEEX: https://www.weex.com/events/welcome-event?vipCode=oz5p&qrType=activity

🟣 Best Crypto Exchange To Trade ($12,000 Bonus): https://www.coinw.com/en_US/register?r=ALTCOINDAILY

✅ Bitunix (no kyc, $10,000 bonus): https://www.bitunix.com/register?vipCode=AltcoinDaily

🔴 $30k USDT bonus with Phemex with our link: https://phemex.com/a/k/ALTCOINDAILY30

🔵 $30k bonuses with our link – Buy & Trade Crypto on Bybit: https://partner.bybit.com/b/altcoindaily

🟢 $8k bonus on Bitget Exchange with our link: https://bonus.bitget.com/AltcoinDaily

Altcoin Daily in Spanish: www.youtube.com/@AltcoinDailyenEspanol

Follow Altcoin Daily:

www.twitter.com/AltcoinDaily

www.instagram.com/thealtcoindaily/

Join Altcoin Daily on Telegram: https://t.me/AltcoinDailyANN

Hit Like, Share, and Subscribe for more daily cryptocurrency news

Altcoin Daily, the best cryptocurrency news media online!

Video by Aaron:

www.instagram.com/aarontarnold/

www.twitter.com/aarontarnold

For business inquires email: info.altcoindailyio@gmail.com

Timestamps:

0:00 – Bitcoin suppression LIFTED!?

0:34 – Jane Street Manipulation REVEALED

1:55 – Clarity Act gets boost

4:21 – What comes next?

5:57 – short term predictions

7:39 – Michael Saylor bullish on Ethereum & Solana?

8:48 – You aren’t bullish enough?

10:40 – final thoughts

**Note: My overall opinion is that the name of the game is to accumulate as much Bitcoin as possible. Alts are interesting but a lot more speculative. I use them to accumulate more Bitcoin & Ethereum.

***********************************************************************

🏺Support The Channel!!🏺(We Get A Kickback From Affiliate Links)

Protect and store your crypto with a Ledger Nano:

https://shop.ledger.com/?r=4b0f6c5711dc

Robinhood exchange has crypto & stocks:

https://join.robinhood.com/aarona-78df3a8

***********************************************************************

Altcoin Daily, the best cryptocurrency news media online!

#bitcoin #cryptocurrency #news #btc #ethereum #eth #cryptocurrency #litecoin #altcoin #altcoins #forex #money #best #trading #bitcoinmining #invest #trader #cryptocurrencies #top #investing #business #success #investment #finance #coinbase #binance #stocks #wallstreet #investor #wealth #bullish #crash #collapse #economy #cnbc #cryptolive #altcoindaily

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT! USE ALTCOIN DAILY AS A STARTING OFF POINT!

This is NOT an offer to buy or sell securities.

Investing and trading in cryptocurrencies is very risky, as anything can happen at any time.

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander, harm or defame any of the actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

*The channel is not responsible for the performance of sponsors and affiliates.

Most of my crypto portfolio is Bitcoin, then Ethereum, but I hold many cryptocurrencies, possibly ones discussed in this video.

cryptocurrency, crypto, altcoin, altcoin daily, news, best investment, top altcoins, best crypto investment, ethereum, xrp, crash, crash, price, prediction, podcast, interview, finance, stock, investment, too late, bitcoin, cryptocurrency news, bitcoin news, cryptocurrency news media online, best crypto investments, 2026 prediction, should I buy ethereum?, blackrock, donald trump, coin bureau, binance, coinbase, trading crypto, trade, make money, cryptosrus, bitcoin today, bitcoin cnbc, altcoin news,

source

Video

THIS IS WHY BITCOIN IS DUMPING…

🟨WEEX: https://www.weex.com/events/welcome-event?vipCode=00dt&qrType=activity 👉 25% FEE DISCOUNT & GET FREE $25

✅My Private Group: https://t.me/alphacartelsetup

Best DEX:

🟧APEX: https://join.omni.apex.exchange/CRYPTOROVER

✅Exchange Tier List: https://www.signupforbonus.com

🟧BYBIT: https://www.bybit.eu/sign-up?affiliate_id=16210 👉 $30,000 BONUS

💹BTTC: https://www.btcc.com/market-promotion/bonus2/s/cryptorover

🟧BLOFIN: https://partner.blofin.com/d/Rover 👉($100K deposit Bonus)

Do not use exchanges which are not allowed in your REGION!

CRYPTOSEA TRADING TOOLS:👇

🚀 SMART BOT: https://cryptosea.com/smart-bot

🔥 PREMIUM INDICATOR: https://cryptosea.com/premium-indicator

BUY & SELL CRYPTO

🎖 BYBIT: $30,050 FREE BTC BONUS!

↳ https://partner.bybit.com/b/CR

MORE CRYPTO ROVER

Second channel about altcoins!

↳ https://www.youtube.com/@AltcoinRover

Twitter for more updates on the market!

↳ https://twitter.com/rovercrc

Instagram if you are interested in my lifestyle!

↳ https://www.instagram.com/cryptorover

Telegram for business inquires!

↳ @cryptoroveryt

DISCLAIMERS

1. High Risk: Bitcoin trading is very risky, with 80% of traders losing money. It is advised primarily for experienced traders.

2. Disclosure: I own a diverse cryptocurrency portfolio for transparency. The content here is for general information and not financial advice.

3. No Professional Advice: Opinions expressed are personal and not from a licensed financial advisor. Investing in cryptocurrencies involves a high risk of loss.

4. Public Information: The information presented is publicly sourced and reflects personal viewpoints. Viewers should conduct their own research before making decisions.

#Bitcoin #BTC #Cryptocurrency #Altcoins #Blockchain

source

Video

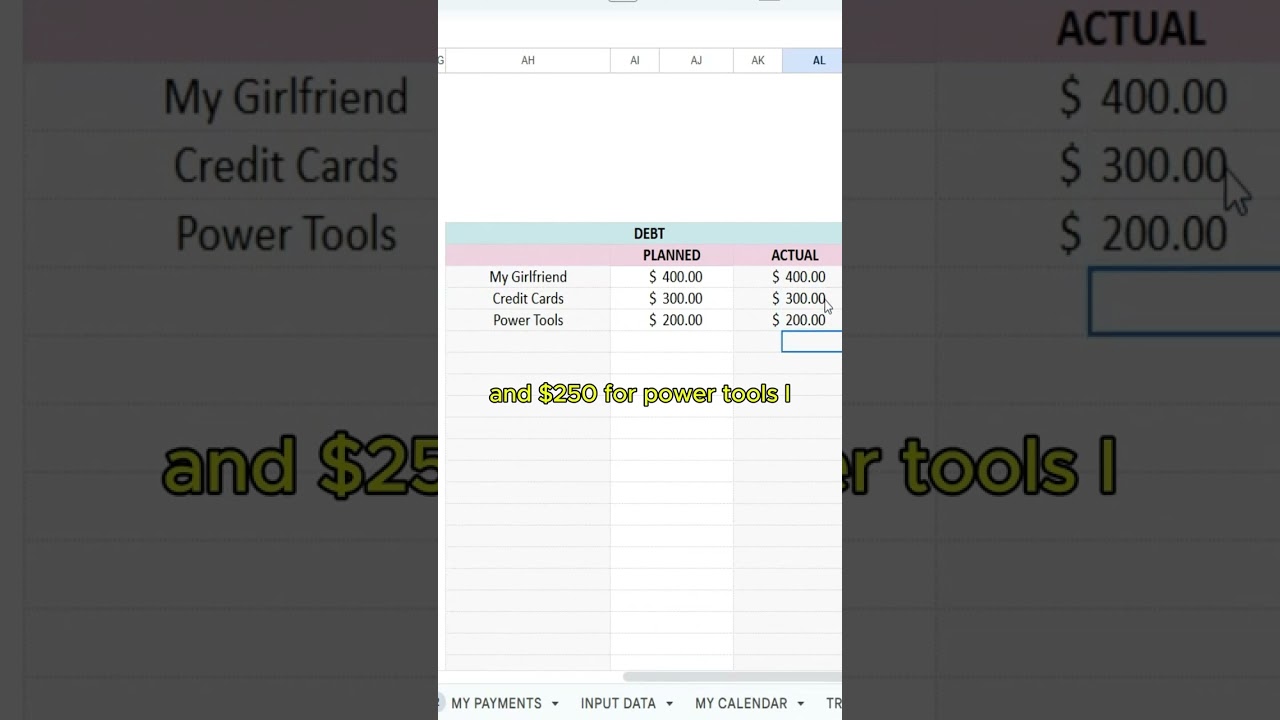

Financial Planner #money #expenses #savings

Subscribe & Comment “Budget” and I’ll send you the link or check in my bio.

#finance

#money

#savings

#expenses

#life

source

Video

The Blueprint to Using AI for Finance in 2026 (ft. Shawn Kanungo)

Join 1,500+ AI CFOs in the AI Finance Club ➡️ https://ai-finance.club/?utm_source=youtube&utm_medium=33&utm_id=1&utm_content=shawn-kanungo

Become an AI CFO through live masterclasses, hands-on video courses and the best network of AI finance experts.

In this video, I interview Shawn Kanungo, and talk all about how to use AI for finance in 2026.

CONNECT WITH ME:

https://www.linkedin.com/in/bouchernicolas/

https://www.instagram.com/nicolasboucherfinance/

https://x.com/BoucherNicolas

CONNECT WITH Shawn:

https://www.linkedin.com/in/shawnkanungo/

source

Video

XRP RIPPLE GARLINGHOUSE GOOD REGS UPDATE

#xrp #bitcoin #hbar #xlm #eth

Ripple CEO Brad Garlinghouse says we are close to a deal and all the banks have to do is walk through the door. The passive yield for crypto is all but gone, but so is the volume and interest LOL. XRP ADA n NIGHT along with the altcoin market are seeing a brief rebound following the US IRAN escalation. Charles Hoskinson is hoping night will do something, or else this is 2 projects in a row with dumpster style results. BTC and Ethereum are soft as well, but are seeing some green today after the Friday and Saturday meltdown. Let’s talk altcoin action, Clarity Act odds and everything else that affects the crypto market.

🚨ARTICLE LINKS🚨

read://https_decrypt.co/?url=https%3A%2F%2Fdecrypt.co%2F359528%2Fbitcoin-recovers-following-plunge-as-us-israel-begin-bombing-iran

read://https_zycrypto.com/?url=https%3A%2F%2Fzycrypto.com%2Fcharles-hoskinson-fires-back-cardanos-not-done-yet-despite-5-years-of-losses%2F

https://x.com/gnarleyjs/status/2026948212565889115?s=20

read://https_coinpaper.com/?url=https%3A%2F%2Fcoinpaper.com%2F15049%2Fclarity-act-breakthrough-ripple-ceo-brad-garlinghouse-says-deal-may-be-imminent

read://https_u.today/?url=https%3A%2F%2Fu.today%2Fripple-ceo-urges-banks-to-act-in-good-faith

https://x.com/bgarlinghouse/status/2027885213016072301?from=article-links

read://https_36crypto.com/?url=https%3A%2F%2F36crypto.com%2Fripple-ceo-sends-urgent-warning-as-clarity-act-hangs-by-a-thread%2F

https://coinmarketcap.com/currencies/xrp/

XRP news today

XLM news today

best trading strategy for crypto

how to make crypto coin and earn money

crypto arbitrage strategy

source

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports3 days ago

The Vikings Need a Duck

-

Crypto World7 days ago

Crypto World7 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat1 day ago

NewsBeat1 day ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment13 hours ago

Entertainment13 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech3 days ago

Tech3 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World6 days ago

Crypto World6 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers