Entertainment

‘The View’ Welcomes Back Former Cohost Elisabeth Hasselbeck

“The View” has been a staple of daytime television since its premiere on ABC in 1997. In the decades since, the show, which was created by Barbara Walters, had seen many cohosts come and go, with one of the most notable being Elisabeth Hasselbeck, who began her tenure on the series in 2003. She then exited in July 2013. Now, almost 13 years later, she’s returned as a guest cohost.

Article continues below advertisement

Elisabeth Hasselbeck Complimented The Current ‘View’ Co-Hosts

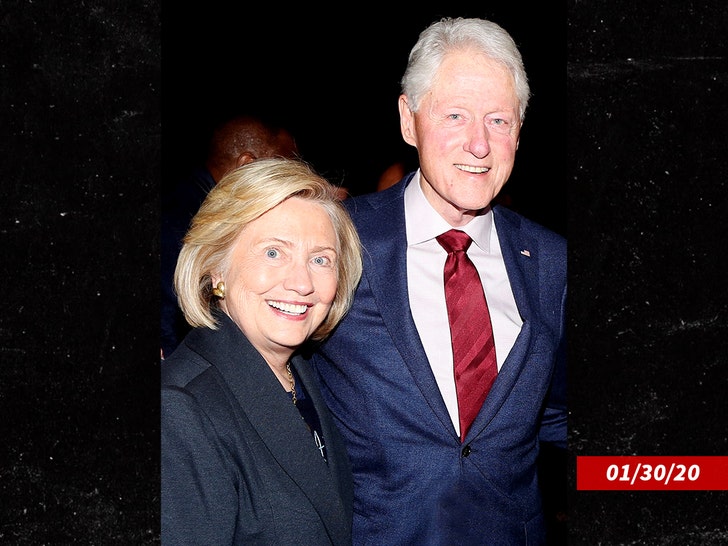

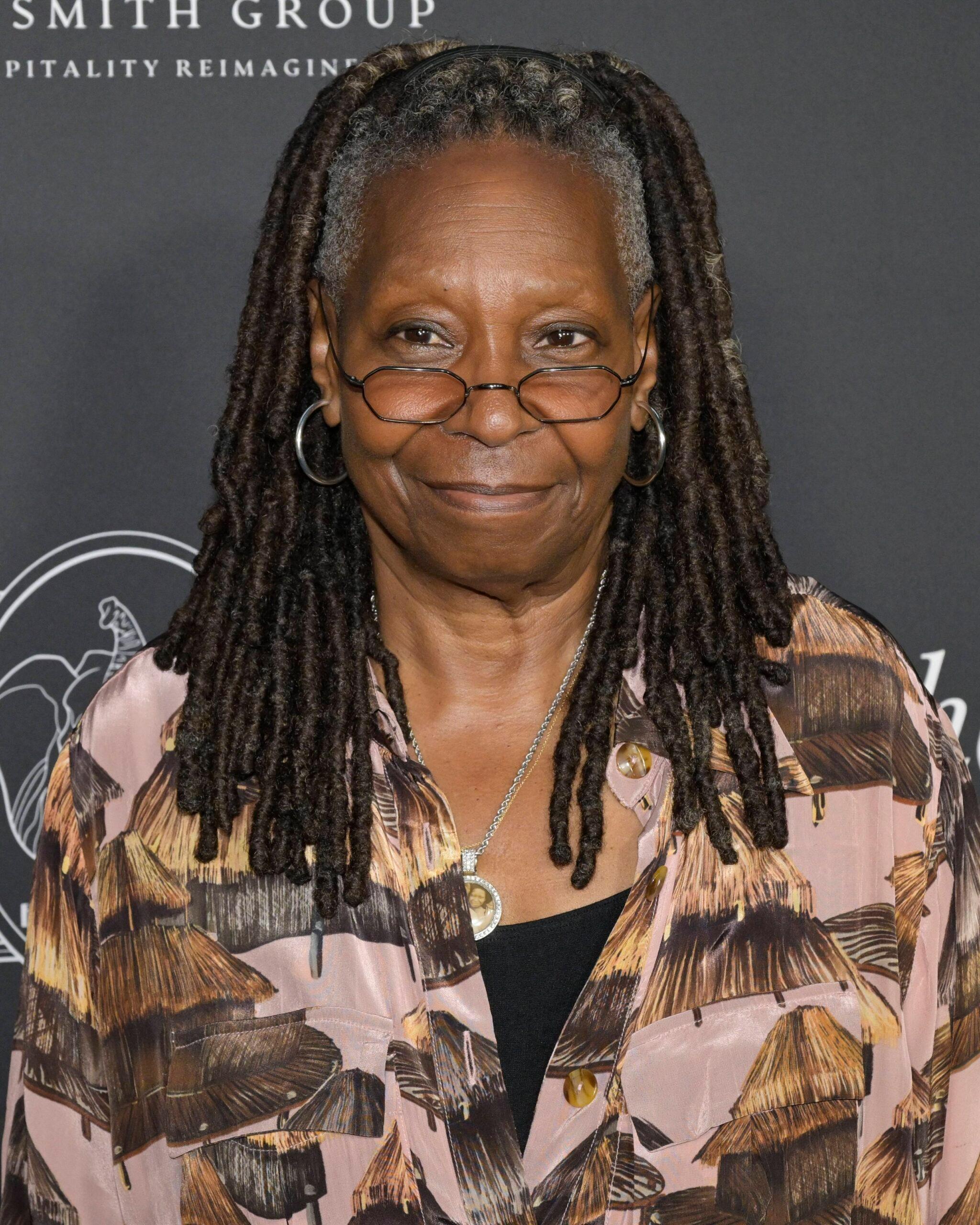

Hasselbeck appeared on the March 2 episode of “The View” as a guest co-host. Whoopi Goldberg introduced her before the former “View” host said, “I’m so thankful to be here with you all. This is really a gift. Whoopi, we go way back. We go way back, and it’s a blessing to be near you anytime that I can, so that is great.”

She went on to highlight the ladies who currently host the show. According to Hasselbeck, “Ya’ll do a great job and significantly so to just have voices as women in the world right now. Forever reminded of the gift of our freedoms particulrlly in light of what’s going on with Iran.”

Hasselbeck went on to say that the cohosts on “The View” prove that “women can be beautiful, voiced, respected.

Article continues below advertisement

The Former Daytime Host Says Civil Discourse Is Not Dead

Hasselbeck drew controversy throughout her years on the show due to some of her more conservative beliefs. She subtly hinted at her opposing beliefs to most of the women on the show during her return to “The View,” saying, “And listen, civil discourse is not dead.”

Hasselbeck went on, “We might have differences of opinion, but we love eachother and we’re stronger for it. I actually think for the young people watching, it’s important to see that you can have, and Whoppi, you’ve said it before, we can hold our positions in one hand, and each other’s in the other.”

She teased her upcoming appearances on the show, saying, “So we get to do that all week. It might get a little spicy at times, but we do not hate each other. We love eachother. We have the freedom to do it.”

Article continues below advertisement

Fans Are Reacting To Hasselbeck’s Return

Fans of “The View” are responding to the show’s official X account after they posted a clip of Hasselbeck’s return. While some fans welcome conservative media personality, others aren’t too fond of seeing her back on the show. One person said, “This woman was on Hannity bashing Joy and The View, and now she’s invited onto the show as a host. What hypocrisy! No thanks!”

Another person wrote, “I’m not welcoming her. As far as I’m concerned, whether she was fired or left the show, that was the best day this show ever had.” In support of Hasselbeck’s return, a different X user said, “Make Elisabeth permanent! She fits in seamlessly and can disagree while being respectful!”

Article continues below advertisement

Someone else said, “Elizabeth Hasselbeck can hold her own, and she is the best guest ever. The witches on the View think they are the only ones with an opinion. Whoopi is so disrespectful, she can’t even say the President, and calls him “you know who.”

Finally, a different “View” fan complained, “Sick of her already! Over-talking everyone and yapping, yapping, yapping!”

Article continues below advertisement

The Former ‘View’ Star Recently Pubished A Best-Selling Book

Hasselbeck has done quite a bit since leaving “The View” in 2013. Immediately after, she joined “Fox & Friends” as one of the cohosts, where she remained until 2015. She has made sporadic guest-hosting appearances on “The View” since her official departure.

However, she also published a book, God’s Masterpiece: An Adventure in Discovering Your Worth,” in 2025. She then announced in April of that year that it had become a New York Times Bestseller. Hasselbeck said on Instagram, “May God be Glorified! GOD’s MASTERPIECE is #4 on the @nytimes best seller list – praying the truth of God’s promise and His message continues to bless little readers with this book that He allowed me to write.”

‘The View’ Guest Cohosts Explained

Many non-regular “View” watchers may wonder why there have been so many guest cohosts on the show recently. This comes after regular cohost, Alyssa Farah Griffin, is on maternity leave after giving birth to her first child in February 2026. Savannah Chrisley was first, with Hasselbeck now following.

Entertainment

Dax Shepard Is Writing a Memoir That Details Childhood Sexual Abuse

Dax Shepard is ready to open up about his childhood sexual abuse in a new memoir.

Shepard, 51, revealed that he’s writing a memoir during the Monday, March 2, episode of his “Armchair Expert” podcast. While he plans to discuss being molested as a child in the book, the Parenthood actor admitted that he struggled for several months to put the story on paper.

“I have, for years on here, been acknowledging that I have been molested. And that was its own hurdle to just say that. And I got quite comfortable being able to say that. That was fine. And now I’m writing a memoir. And last year, really, the whole year was about, ‘Do I have the balls to write down the details of this?’” Shepard told guest Marcus Mumford, who detailed his own experience with childhood sexual abuse on his 2022 single “Cannibal.”

Shepard continued, “The details were always going to be mine. I didn’t want anyone to be envisioning me. It’s weird that that was still some wall between my shame. Like, I can say that happened, but I don’t need you to know anything that actually happened.”

Shepard said it took him “four months” to be able to tell the story in his memoir.

“And when I’m writing it, I cannot help but think of people knowing this about me and how still exposed that feels,” he admitted, adding that he was “emotional” during the months it took him to write the story.

“I was having really weird kind of spikes of emotions and moodiness. And I would forget that’s why I was having that,” Shepard added.

The Zathura star said he felt better once he finally finished that portion of the memoir, but the next challenge will be actually publishing the book.

“I finished it, and something about it existing there feels like a lot of weight is off my shoulders. But for me, there’s still the hurdle of, like, [putting the book out there],” he concluded.

Shepard first opened up about his experience in 2016.

“Yeah, I was molested,” he said on SiriusXM’s The Jason Ellis Show at the time, revealing that he was abused by an 18-year-old “dude in my neighborhood” when he was 7 years old.

Though Shepard called the molestation “minimal,” he added that it likely played a role in his struggles with addiction later in life.

“If you’ve been molested, you only have a 20 percent chance of not being an addict,” Shepard explained, noting that he thought his addiction was a result of heavy partying. “But when you hear a statistic like that, I’m like, ‘Oh, no, I was going to be an addict, period.’”

Shepard said it took him “12 years” to open up to someone about his experience.

“And then all that time, I was like, ‘It’s my fault,’ as generic as that is, I’m like, ‘It’s my fault. And I’m gay, I must have manifested this because I’m secretly gay.’ I had all these insane thoughts for 11 years or 12 years,” he continued.

Shepard’s wife, Kristen Bell, whom he married in 2013, exclusively told Us Weekly at the time why her husband decided to go public with his story.

“Well, in truth, he has dealt with it many, many years ago,” Bell, 45, said at the time. “It wasn’t a moment he revealed. It’s a lifestyle he lives, where he’s honest and brave. The entirety of the radio show, he was relating to the host who had a similar revelation, and they were communicating.”

Bell continued, “I think that, to me, is the more profound thing, that he does talk about it. Anytime someone can admit a vulnerability, and it can be helpful to others, it should be done when said person is ready. That emotion is maybe one of the most profound ones we have. I, particularly, I’m taken with vulnerability when you’re in any sort of conflict. If you come at the other person, come back to the other person with vulnerability, you can never lose. It always makes the situation better.”

If you or anyone you know has been sexually abused, call the National Sexual Assault Hotline at 1-800-656-HOPE (4673). A trained staff member will provide confidential, judgment-free support as well as local resources to assist in healing, recovering and more.

Entertainment

90 Day Fiance: Elise Goes with the Flow Down Under – Before The 90 Days Recap [S08E12]

On 90 Day Fiance, Elise Benson proceeds to Australia to meet Josh Lawson and while they hit it off the circumstances are less than ideal. Forrest stands his ground and stands up for Sheena when Molly attacks their engagement. Aviva Duhamel is wishy washy in the face of hard evidence that Stig Da Artist is unfaithful. And Lisa comes clean after a messy incident with Daniel. Let’s break it all down in this recap of Season 8, Episode 12 Final Boarding Call.

90 Day Fiance: Elise Meets Josh in Australia

Elise Benson packs for her trip to Australia to meet her online boyfriend Josh Lawson on 90 Day Fiance. The late season couple look great on paper. But cracks are already appearing. It seems Josh text Elise about an incident on his job as a yacht broker. He took a yacht on an unauthorized joyride and crashed it. Elise Benson is still going to follow through with the trip. In spite of Josh throwing red flags at every turn.

We get a glimpse of Josh Lawson and his roommate cutting up like 40 something frat boys. And Josh reveals that he really wasn’t living with his parents. He was living with his best gal pal Nat. He admits he left that part out when speaking with Elise Benson. She packs bikini bottoms rating them on the likelihood of getting laid. Josh’s friend and roommate Chris placed a painting of himself above the bed where Josh and Elise will sleep among other things.

Elise Benson confides Josh’s man child antics to her closest friend on 90 Day Fiance. Ultimately her friend has concerns. Elise believes he’s the one. After some glitches with her tourist visa she arrives down under. To find Josh and Chris waiting in sport coats while she’s in a sports bra and leggings. They want to whisk her to a bar to watch a night of racing. Elise and Josh make out while Chris watches. They convince her to change at the airport to go out. She agrees, dons a yellow dress and goes commando.

90 Day Fiance: Forrest Stands up for Sheena

Forrest and Sheena find themselves under attack on Before The 90 Days. Once they told Forrest’s mom Molly of their engagement, she went on the attack. She calls Forrest stupid for being manipulated by Sheena. And tells him he’s more full of ish than a Christmas goose. Sheena encourages Molly to let Forrest make his own decisions. And that only enrages Molly further. She even suggests Forrest would stay with Sheena if she “diddled” someone else.

Forrest has had enough of her nasty attitude and seeks support from his stepfather Dev. Who seems terrified to go against Molly. But Forrest stands his ground. Even going as far to issue an ultimatum to Molly. Accept the engagement or be cut out of their lives. Molly doesn’t take this well. And suggests he not come crawling back to her when this fails. She later cries that she feels she has lost her son.

TLC Couple Aviva and Stig Deal with Rumors

On 90 Day Fiance, Aviva Duhamel also deals with meddling relatives. Her Aunt Spring is on a mission to unsettle Aviva’s relationship with Belizean singing star Stig Da Artist. At the center of the investigation is a photo of Stig laying a smooch on a bikini clad woman. Spring’s niece claims this girl is a friend of hers from way back. And has been casually hooking up with Stig for awhile.

Over tropical drinks, Aviva, Spring and her niece Corrinth decide to call the woman in question to get the truth. Stig was left behind and wonders what kind of conspiracies they will feed Aviva. It was a one sided phone call. You couldn’t hear the other woman’s voice. But Corrinth says her friend didn’t know of Aviva. And later text that she was going to San Pedro with him later in the month.

Aunt Spring is smug. But Aviva Duhamel isn’t sold and is set to meet Stig’s dad that evening. Even Stig’s father admits his son is a bit of a player. Aviva brings Aunt Spring along. Spring suggests a strong round of libations called “panty rippers”. Aviva imbibes and questions Stig about the picture. And Corrinth’s phone call. He swears none of it is true and doubts that girl even has his number. With weak evidence and the help of the panty ripper, she forgives him. But he admits to production he’s not innocent.

Before The 90 Days: Lisa’s Dirty Secret Gets Real

It’s been quite a wild ride for Lisa on this season of 90 Day Fiance. She’s been under the microscope since she arrived. Deprived of her vape, shamed when she appeared without her wig in front of Daniel and placed in front of a “king” wearing a plush lion, it doesn’t seem like it could get worse. But it does. Apparently the Nigerian cuisine caught up to her. And Lisa had an accident and pooped the bed. She is mortified, but Daniel tells her it’s ok while ironically gnawing on a Baby Ruth bar.

But she doesn’t realize it’s about to get worse. Over some wine and a home cooked meal she spills most but not all of the beans to Daniel about her past. She admits to five marriages. And in spite of being separated for 9 years she’s still married to number five. But fails to divulge that it’s a woman. Daniel freaks out over the fact he’s been sleeping with another man’s wife. He fears being banished from his tribe.

Lisa sobs and finishes off the wine while Daniel rants. They ride back to the hotel together in silence on 90 Day Fiance. He won’t even sit by her in the car. Lisa realizes she should get her own room for the night. Once she does she calls her daughter revealing what happened. Her daughter isn’t really surprised. But suggests she must come all the way clean about her life and that she’s actually married to a woman. But Lisa doesn’t think she can.

90 Day Fiance: Rick Bets on a Rumble and Wins Trish Back

In spite of admitting he jetted to Colombia for a tryst with his ex after just a few days of no contact from Trish, Rick Van Vactor manages to win her back. She’s hurting. And doesn’t want him to touch her. But the 90 Day Fiance couple decide to finish out their vacation and watch an outdoor Moraingy match. Rick heckles the bare-knuckled brawlers. And Trish softens a little bit wagering a night of sex. Rick takes the bet and wins. But she suggests she’s not putting out.

Trish admits she isn’t sure if she can trust Rick Van Vactor going forward. But acknowledges he makes her happy and she does love him. But there’s the matter of taking him to meet her father. Rick is nervous about it too. But she doesn’t plan on telling her family about the indiscretion. Rick knows he probably has several strikes against him already. Mainly his age and the fact he’s not thrilled about more children. So, it’s a gamble. Till next time!

Entertainment

Every Stephen King Book That Needs an Adaptation ASAP, Ranked

One day, I wanted to know how many Stephen King novels hadn’t been adapted into TV shows or movies. And so I went through them all, and, at the time of writing, it’s… actually, it’s complicated. The Dark Tower complicates things. Let’s just address that first and foremost. It’s obvious that Salem’s Lot has been adapted as both a miniseries and a movie, while The Stand has had two miniseries, and Pet Sematary has had two movies, and so on, but The Dark Tower only kind of has The Dark Tower (2017).

But then that adaptation isn’t really an adaptation of one specific book. For present purposes, maybe it’s best to say that it kind of lines up with book #1, The Gunslinger, though not really. And so all the other books definitely remain unadapted, but if they were to be adapted, it would make sense to do them as one big adaptation, like a multi-season-long TV show. So, multiple unadapted books = one potential adaptation that’ll hopefully come out one day. Taking those unadapted books as one story, and almost imagining the unadapted Gwendy books as getting one adaptation, there are 22 unadapted stories, not counting novellas or short stories that haven’t been adapted. And if you separate out the Gwendy and Dark Tower books, there are 29 (out of 66) novels that haven’t yet been adapted into a movie or miniseries. That’s a higher number than expected, in all honesty, even if many of those novels are more recent ones that’ll likely get adapted eventually.

There are also some older books mentioned here that might, post-2026, have adaptations. This whole endeavor will likely age faster than most rankings, but for now, it’s accurate and thorough. For now, you can only really experience these Stephen King novels on the page, or as audiobooks, and that’s one of many good reasons why reading every now and then (like, generally) is worthwhile. Those still-to-be-adapted novels are ranked below, starting with the messy/not-so-good ones and ending with those where it’s surprising adaptations don’t yet exist.

22

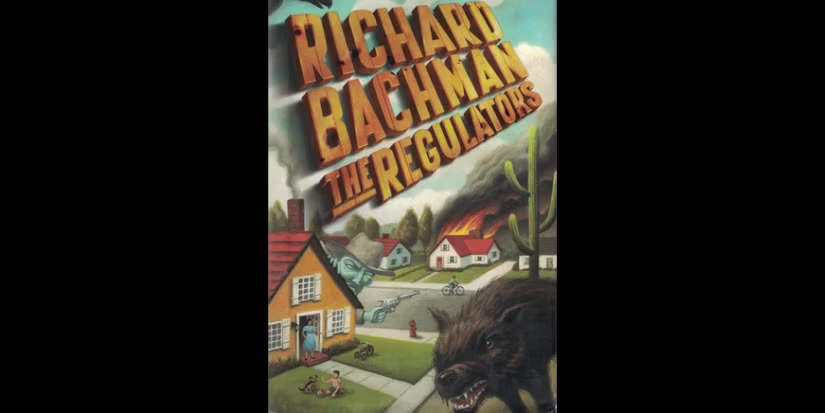

‘The Regulators’ (1996)

It would make the job easier to skim over the Richard Bachman books that Stephen King wrote under his pseudonym, as of the seven, only three have been adapted to film (The Running Man twice, though, for what that’s worth). Still, we know Bachman is King now, and vice versa, and in 1996, people knew that, so King releasing The Regulators as a Bachman novel was sort of him being cute.

And he also did so in order for it to be a companion novel with the slightly better Desperation, which has a TV movie adaptation. The Regulators is an incomprehensible book, though, and so it would likely make for a similarly frustrating movie. Points for trying something weird, and the act of comparing and contrasting The Regulators and Desperation is sort of interesting if you’re a big King fan, but The Regulators on its own is just not a particularly good read (sorry).

21

‘Holly’ (2023)

Even if Holly might not look too long, compared to other very long Stephen King novels, it feels agonizingly drawn out, and is among his weaker books overall. It’s the first novel of his to give Holly Gibney a central role, after she was a supporting player in a handful of other Stephen King books, most of them crime/mystery-focused, but not all without horror elements altogether.

Some of those books have had adaptations, like the Mr. Mercedes TV series that ran for a few seasons, meaning it could also adapt Finders Keepers and End of Watch, and then also The Outsider, which Gibney was a supporting player in. There’s one other Holly book after Holly that’s also unadapted, and is a little better overall (still not perfect, but an improvement nonetheless is still worth appreciating).

20

Two Books in the ‘Gwendy Trilogy’ (2017–2022)

It wouldn’t take much to make the stories in the Gwendy trilogy equal to the books, in terms of quality, were they adapted, though one has to wonder who’d want an adaptation in the first place. This is also a bit of a Dark Tower situation where things get complicated. Here, it’s because there are three books, and no indication of how they’d be adapted if an adaptation were attempted, and also, King didn’t write or co-write the second one, as that was a solo effort by Richard Chizmar.

Honestly, Gwendy’s Button Box is a decent enough read, only really suffering because it’s short and very, very reminiscent of other books by Stephen King. The third book, Gwendy’s Final Task, almost feels like a practical joke, and then the second, written only by Chizmar (and called Gwendy’s Magic Feather) is very forgettable. Judging the series as a whole, it’s not very good, but that first book on its own is just fine (still wouldn’t really ever need an adaptation, though).

19

‘From a Buick 8’ (2002)

You can write about From a Buick 8 multiple times, and it never gets easier. The same can sort of be said for The Tommyknockers and Dreamcatcher, but even those somehow got adaptations (a two-part miniseries and a movie, respectively). From a Buick 8 might well be unadaptable, since it’s even weirder, despite being shorter and so technically not having as many strange directions it can rampage off in.

But just as the characters in Seinfeld have “got to see the baby,” anyone talking about From a Buick 8 has got to try and say what’s more or less about. A spooky car? Alien life? The nature of storytelling? Policing? It’s far more common to come away from a Thomas Pynchon novel not knowing what the hell you read, but for a storyteller like King, who usually lays everything out so smoothly, to deliver something this weird… well, maybe it’s a sign of range? If you really want a silver lining.

18

‘Sleeping Beauties’ (2017)

The idea of Sleeping Beauties is interesting, like, premise-wise. And then it’s also nice that Stephen King wrote a novel with one of his sons, Owen King. As a duo, they made something that wasn’t terrible, and yeah, the premise is good. Sleeping Beauties is about women all being affected by some sort of unknown event that makes them fall into comas, and get cocoons wrapped around them.

The men left conscious all panic, especially because bad things happen whenever someone tries to wake up one of the women. Once answers start being revealed, Sleeping Beauties falls apart a bit, and that’s a problem for obvious reasons. It’s one of those “King started it well, but didn’t really know how to finish it” books. Or, more specifically, “two Kings started things well, but then neither had a great idea of how to finish things.”

17

‘Elevation’ (2018)

Keeping it short when it comes to Elevation, because this book is tiny, it’s basically about a guy who starts becoming lighter and lighter. That also happened in Thinner, which was a Richard Bachman book (the last of King’s Bachman books before people found out the truth), but that had a horror slant to the premise, whereas this one’s kind of trying to be a tearjerker?

It’s weird, how sentimental Elevation tries to be, not because it plays out more like a fantasy story than a horror one, but because it’s really sappy and just absurd at the same time. Is it a novella or a novel? Different sources define it differently, but that length (or lack thereof) does mean it could be adapted pretty directly. Question is, would anyone want it? Is anyone really that much of an Elevation fan?

16

‘The Girl Who Loved Tom Gordon’ (1999)

The Girl Who Loved Tom Gordon is another Stephen King book that keeps things on the shorter side, for better or worse. Or for better and worse? It’s for the better, because it’s about a young girl who gets lost in the woods on her own, and you can only do so much with that premise. But maybe also for the worse, because King’s taken a simple adventure and/or survival story and expanded it in significantly more interesting ways before.

There are also a few more fans of The Girl Who Loved Tom Gordon, it seems, compared to Elevation, but still probably not many girls or boys or women or men who love The Girl Who Loved Tom Gordon. It’s a bit too slight, but it’s not bad. It has its moments. And it would translate well to film (not a TV series, or even a miniseries; there’s just not enough here to adapt).

15

‘Rage’ (1977)

Given how King feels about Rage, and his stance on it being a good thing that it’s out of print, a movie or TV adaptation of it feels like it might well be the least likely unadapted book of the author’s to ever get one. It’s about a student who brings a gun to school, killing two teachers with it before taking his class hostage, and then that whole situation is what most of the story is devoted to.

As for the quality of Rage itself? It’s not terrible for an early work by the author.

It’s understandable why King feels the way he does about Rage, even if movies dealing with similarly upsetting subject matter have been made before (see Polytechnique and Elephant). As for the quality of Rage itself? It’s not terrible for an early work by the author, and you can sort of admire what it’s going for to some extent, but it’s not handled ideally, and even with its relatively short page count, Rage does end up feeling a little drawn-out.

14

‘Roadwork’ (1981)

While not quite as disturbing as Rage, Roadwork is a similarly angry and intense book, and it has some flaws as well, like that other early Bachman book with a single-word title (and that word starts with “R”). It’s also the case that Roadwork would probably work better as a movie, or be a little easier to tackle, even if adapting it, you’d run the risk of making something too similar to Taxi Driver or Falling Down.

That’s because Roadwork is one of those stories about a man pushed to some kind of limit, and then he lashes out because of the injustice he feels in society. Here, he just has a run of very bad luck, and King gets some engaging material out of the whole “How far do you want to go before you start seeing him as a villain more than a victim” kind of thing (see also any number of more recent TV shows about anti-heroes).

13

‘Never Flinch’ (2025)

Two years on from Holly, Holly Gibney herself was also the protagonist of Never Flinch, and it feels a bit silly to include it on this ranking at this present time, since it’s very recent and adaptations usually take time… unless it’s Christine, for whatever reason. That Stephen King book came out in the first half of 1983, and the movie adaptation came out right near the end of the very same year.

But to stay focused on Never Flinch, this one might be difficult to adapt because it’s sort of a messy combination of two ideas that might have been two novellas on their own, or overall neither was long enough to be fleshed out into a novel. So King threw them both together here, and had Holly Gibney tackling two different cases that are interesting on their own, but don’t really cross over or come together in an especially satisfying way. It’s a novel that’s less than the sum of its parts, though at least many parts of it are pretty good.

Entertainment

Ex NHL Star Ron Duguay Posts Update After Revealing Cancer Diagnosis

Former NHL star Ron Duguay gave fans an update about his health journey after revealing he had been diagnosed with stage IV colon cancer.

Duguay, 68, detailed part of his “upgraded” treatment plan in a video via his Instagram Story on Sunday, March 1.

“Most of you are aware of the benefits of Vitamin C. Most people may take a gram a day, maybe two,” Duguay said, showing his arm hooked up to an IV in a doctor’s office.

He continued, “I’m doing as much as 75 grams. I’ve been doing 50. My body has been tolerating it. So now I’m moving it up to 75. I’m going to get to the bottom of this. Get stronger. Build up my immune system so I can get out of here. I want to see the finish line! Let’s go!”

Duguay was diagnosed with colon cancer in December 2024, but kept it private until the ongoing financial burdens led to his family launching a GoFundMe last week.

Shay Thomas, Duguay’s daughter, exclusively told Us Weekly that convincing her father to ask for help was “a fight for many months.”

“His credit card debt was going up and that’s when I told him, ‘Dad, just let me do this. I’m not going to put your name on there. Just let me do this. So many people have asked to help you. You need the help. You’ve helped people. Let them help,’” Thomas said.

She added, “We spoke as a family and we said, ‘We need to make this GoFundMe. We gotta do everything we can. Because if we don’t, it’s going to kill you.’”

Thomas said her father “had nothing left” when the family resorted to launching the fundraiser, which has since raised over $112,000 at the time of this story’s publication.

“He does not like asking for help, even when I have to ask him about his finances,” Thomas said. “I can tell when he’s stressed out. I know he hasn’t been able to work. He was able to work comfortably before he got sick and he was able to provide for himself. He was fine. But once he was sick, he couldn’t even walk. He could barely eat. It was so bad. He wasn’t able to work.”

Thomas also responded to some backlash the GoFundMe has faced, with some critics questioning how Duguay, who played 12 seasons in the NHL, had run out of money.

“I see so many things where people are like, ‘He has millions of dollars from back in the day. I’m like, ‘What are we talking about?’” she said.

Thomas added, “I never understand some of these people with these crazy opinions. Most people don’t make them unless they need to. Who wants to have an illness where you have this financial strain? You’re desperate, in a sense, and that’s where we’re at.”

Duguay’s daughter gushed about the assistance of former Alaska governor Sarah Palin, who has been in a relationship with her father for years.

“She’s been involved and incredibly supportive in my dad’s entire journey,” Thomas told Us. “Their relationship can obviously be challenging because they live long distance. She’s in Alaska, he’s in Florida. But they have always remained close.”

Thomas continued, “If we ever need her for something, she would take a red eye flight on short notice. If we have stuff with our kids and couldn’t make it — for example, my dad had a surgery where they went into his colon and liver — and she stayed with him in the hospital for five days. She’s been a huge source of support. Not only for my dad, but for our entire family.”

Entertainment

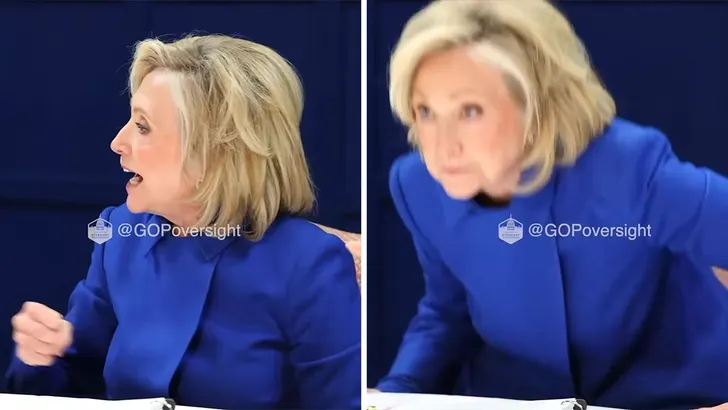

Hillary Clinton Storms Out of Epstein Deposition After Photo Leaks, See Video

Hillary Clinton’s Epstein Depo

Leak My Pic?!? I’m Done With This!!!

Published

Hillary Clinton was pissed when she found out a photo from her deposition on Jeffrey Epstein got leaked from inside what was supposed to be a closed-door session … and video shows the moment she storms off from the podium.

In footage from last week’s testimony, released Monday by the House Oversight Committee, Hillary rips the panel for breaking their own rules and not preventing a leak.

The former First Lady, New York Senator and Secretary of State blasts Republicans in the room, saying … “I’m done with this. If you guys are doing that, I am done. You can hold me in contempt from now until the cows come home. This is just typical behavior.”

The leaked photo was posted on social media by conservative influencer Benny Johnson … and he claimed it was snapped by Colorado Republican Congresswoman Lauren Boebert.

Video cuts off after Hillary gets up from her chair and storms off … and when she comes back, she’s told the photo was snapped before she uttered a word.

Still, Hillary was not pleased with the explanation.

Entertainment

Beyond the Gates Weekly Spoilers March 2-6: Ted Faces Intense Interrogation & Hayley Trapped in Crisis

Beyond the Gates spoilers for March 2 – 6, 2026 see Ted Richardson (Keith D. Robinson) getting grilled and Hayley Lawson (Marquita Goings) cornered.

Beyond the Gates Monday, March 2nd: Anita’s Chemo Struggles and Hayley’s Anniversary Crashers

On Monday, March 2nd, Ashley Morgan (Jen Jacob) helps Anita Dupree (Tamara Tunie) through a tough time. She’s getting another chemo session and looks really annoyed but Ashley’s there for her. Anita is in chemo and then she tells Vernon Dupree (Clifton Davis) she doesn’t know if she’ll win her battle or if she can handle this.

By the way, Anita’s in a blue cap thing during chemo and those are cooling caps that are attached to a little A/C system and cools down the head which can help slow hair loss from chemo. So, Ashley might’ve suggested it, we’ll see.

Naomi Hamilton Hawthorne (Arielle Prepetit) gets a proposition from Katherine “Kat” Richardson (Colby Muhammad). Is it about moving in with her while Jacob Hawthorne (Jibre Hordges) is undercover?

Hayley and Bill Hamilton (Timon Kyle Durrett) celebrate their anniversary but they have several crashers that interrupt. Hayley and Bill are at Fairmont Cross Country Club for dinner and looking awfully annoyed when they get unwanted company.

Dani Dupree (Karla Mosley) wishes Bill and Hayley a happy anniversary but sarcastically. Andre Richardson (Sean Freeman) is there with her. Dani reaches in her purse and says she had to commemorate this occasion and Bill looks worried when Dani digs in her purse. Is he expecting a gun?

BTG Spoilers Tuesday, March 3rd: Izaiah Gets Put on the Spot and Bill Wants a Baby

On Tuesday, March 3rd, someone puts Izaiah Hawthorne (David Lami Friebe) on the spot. Is Ted grilling him about him and Eva Thomas (Ambyr Michelle) and intentions as Dana “Leslie” Thomas (Trisha Mann-Grant) asked him to do?

Hayley’s stunned when Bill presses her about expanding the family. Bill asks Hayley if she’s ready to try again for a baby.

Tomas “Tom” Navarro (Alex Alegria) gives Eva advice. Is it about dealing with Kat?

Leslie says she doesn’t know what Eva’s talking about but she reminds Leslie that she taught her everything she knows about revenge.

Leslie runs into Nicole Dupree Richardson (Daphnee Duplaix). Next week, Vanessa McBride (Lauren Buglioli) tries to keep the peace when things get heated between Leslie and Nicole. Vanessa and Nicole are at Uptown and Leslie plops down being catty and Nicole reminds Leslie that the last time she goaded her, naughty Nicky came out and put her hands on her—she asks does Leslie remember how that turned out? Vanessa reaches for Nicole’s hand before she does anything impulsive.

Beyond the Gates Spoilers Wednesday, March 4th: Ashley Helps Grayson and the Duprees Get a Surprise Visitor

On Wednesday, March 4th, Vernon supports Chelsea Hamilton (RhonniRose Mantilla). Is this about her wedding plans or something else? Bill calls in a favor. Is it from the Duprees? Is this about what he wants from Hayley?

The Dupree family receives a surprising visitor. Kyle gives Vanessa an update that will affect Nicole. Is Kyle house hunting to stick around the DMV because he’s really into Nicole and wants to be around to pursue her?

BTG Thursday, March 5th: Ryland Keeps Hayley on Track and Derek Gets Stuck in the Middle

On Thursday, March 5th, Derek Baldwin (Ben Gavin) is stuck in the middle when Leslie and Vanessa are bickering. Madison and Chelsea notice an unusual couple. Who’s together that stuns them? Joey Armstrong (Jon Lindstrom) doesn’t want to do something but agrees anyway. Does Bill ask him or Vanessa?

Friday, March 6th: Jacob’s New Assignment and the Plasma Ring Reveal on BTG

On Friday, March 6th, Jacob gets a new assignment but it may wreck the undercover op into the plasma ring. Martin tries to connect with Bradley “Smitty” Smith (Mike Manning) and Samantha Richardson (Najah Jackson). Why is he feeling disconnected?

A shocking person is revealed to be involved in the plasma ring. Joey? Izaiah? Leslie? When Vernon’s surprise arrives, Anita doesn’t feel well. These side effects are really starting to take their toll and she’ll need the family to rally around her. That’s your Beyond the Gates weekly spoiler outlook.

Entertainment

Carole Radziwill Rejoining ‘RHONY’ as a ‘Friend’ for Season 16

‘Real Housewives of New York City’

Carole Radziwill’s Back in the Mix for Season 16!!!

Published

Major reality TV shakeup — Carole Radziwill is heading back to “The Real Housewives of New York City” … but pump the brakes, she’s not reclaiming her apple full-time.

TMZ has confirmed Carole — who held court from S5 through 10 — is returning as a “friend” for Season 16, with cameras firing up in NYC this week.

During her OG run, Carole was no wallflower … locking horns with Bethenny Frankel, Ramona Singer, Sonja Morgan and Luann de Lesseps in some of the franchise’s messiest moments.

This time around, she’ll mix it up with Erin Lichy, Sai De Silva and Jessel Taank — the only trio sticking around from the reboot era.

Bottom line? The women from the city that never sleeps are clocking back in … and it’s gonna be bigger and better than ever!

Entertainment

10 21st-Century Oscar Wins That Keep Getting Better

The nominations have been announced, and the stage is almost set for the 98th Academy Awards, which takes place at the Los Angeles Dolby Theatre on March 15. Paul Thomas Anderson’s politically poignant One Battle After Another, Ryan Coogler’s acclaimed vampire flick Sinners, and the quietly stunning Danish-Norwegian drama Sentimental Value lead the way as favorites, although, as the recent BAFTAs have proven, anything can happen on awards night.

Of course, taking home a gold statue is certain to cement someone’s legacy in the annals of cinema history. However, as years pass, the respect and reputation of any given win can fluctuate, with many now being considered to have aged like milk. Instead of focusing on those negatives, here’s a look at ten 21st-century Oscar wins that keep getting better with age, proving the Academy very often gets it really right.

10

Peter Jackson – Best Director for ‘The Lord of the Rings: The Return of the King’ (2003)

Nominated, but not winning, for The Fellowship of the Ring, and being entirely snubbed for The Two Towers, director Peter Jackson went into the 76th Academy Awards in 2004 as the overwhelming favorite to take home the Best Director prize, with many seeing a triumph as collective adulation for the trilogy as a whole.

As one of Return of the King‘s record-tying 11 Academy Awards that night, Jackson’s victory for Best Director was arguably the most deserved, the long-overdue recognition for one of modern cinema’s most impressive visionaries. Over 20 years on, as shown by the trilogy’s recent hugely successful box office re-release, love for the Lord of the Rings franchise hasn’t faltered, making Jackson’s win all the sweeter.

9

Christoph Waltz – Best Supporting Actor for ‘Inglourious Basterds’ (2009)

Twice Christoph Waltz has been nominated for Best Supporting Actor at the Academy Awards, and twice he has won. His first victory, three years before triumphing for Django Unchained, came at the 82nd Academy Awards in 2010, as he swept aside the competition to take home a golden statue for his intelligently deceptive portrayal of S.S. Colonel Hans Landa in Quentin Tarantino‘s revisionist WWII epic, Inglourious Basterds.

Oozing with charisma and frighteningly evil, Hans Landa is one of Tarantino’s best creations. As time has passed, it has become evermore clear that no one could’ve nailed this duplicitous and challenging role quite like Waltz. The Austrian actor’s methodical approach to the art of acting is able to squeeze every last ounce of menace out of an already wicked character.

8

‘Eternal Sunshine of the Spotless Mind’ (2004) – Best Original Screenplay

In the past 27 years of cinema, there’s perhaps no better screenwriter than Charlie Kaufman. Despite being involved in some of the most intriguing philosophical movie musings in modern memory, the genius behind the likes of Being Jon Malkovich and his directorial debut, Synecdoche, New York, has only ever won one Academy Award.

For his simply stunning screenplay for Eternal Sunshine of the Spotless Mind, Kaufman carved a story that was ahead of its time. The film itself has become iconic, a defining piece of 21st-century romance that has inspired waves of creatives and become a masterpiece in the eyes of audiences. It is because of this that the Academy’s choice to declare it as the best in class at the 77th Oscars in 2004 is so impressive, and it has aged like a fine wine.

7

J. K. Simmons – Best Supporting Actor for ‘Whiplash’ (2014)

Few actors could turn a bitter jazz instructor into one of the scariest villains in modern movie history. That’s exactly what J.K. Simmons did with Terence Fletcher in Damien Chazelle‘s pulse-pumping masterpiece Whiplash, as he goes head-to-head with budding young drumming prodigy Andrew Neiman (Miles Teller).

Against a stacked 2015 line-up, Whiplash entered the 87th Academy Awards unsure of victory in any category. However, if anyone deserved a golden statue, it was Simmons, with this most likely his career-best work. A decade on, and no Supporting Actor winner can really come close to this stunning performance from Simmons, and thankfully, the Academy recognized it.

6

‘Spirited Away’ (2001) – Best Animated Feature

The success of an anime at the Academy Awards might not look so surprising today, especially in light of The Boy and the Heron‘s 2024 win, but back in 2003, it was unheard of. Against tough competition in the form of Treasure Planet, Spirit: Stallion of the Cimarron, Ice Age, and Lilo & Stitch, Spirited Away left the 75th Academy Awards as the surprise winner of the Best Animated Feature prize.

Today, anime has boomed from a niche interest to a global phenomenon, and, through that simple fact, this win for Spirited Away back in 2003 is truly one of the best the Academy has ever awarded. It goes without saying that Hayao Miyazaki’s modern fairytale masterpiece is worthy of this Oscar and many other accolades.

5

Charlize Theron – Best Actress for ‘Monster’ (2003)

Of all the 21st century Best Actress victories, none have proven as enduring as Charlize Theron‘s in Patty Jenkins’ 2003 crime drama Monster. Completely unrecognizable as serial killer Aileen Wuornos, Theron’s performance is the epitome of an actor losing themselves to a role, with people still shocked to this day to learn that it is the Bombshell star behind the dental prosthetics.

The best performance in a career stacked with great turns, Theron’s work is simply spectacular. The Academy’s choice to award Theron the victory might’ve been unsurprising given the star’s victories at the Golden Globes, SAG Awards, and Critics’ Choice Awards, but let that take nothing away from how well this has aged. If Roger Ebert calls it “one of the greatest performances in the history of the cinema,” who are we to argue?

4

Bong Joon-ho – Best Director for ‘Parasite’ (2019)

There are few superlatives left to attribute to Parasite. Ever since the genius South Korean thriller debuted in 2019, it has been praised to the highest degree by anyone with even the slightest interest in film. Despite all that acclaim, director Bong Joon-ho‘s win for Best Director in 2020 is an easy choice for this list.

Although Alfonso Cuarón won Best Director for the Spanish-language film Roma in 2019, Joon-ho’s win a year later will forever be heralded for ushering a new Academy appreciation for non-English language filmmaking. There is plenty more to be said about the movie itself, although that should be saved for later in the list.

3

‘Moonlight’ (2016) – Best Picture

For a few moments on February 26, 2017, the winner of the Best Picture Oscar was the colorful, romantic musical La La Land. Thankfully, although La La Land is an excellent movie, the mistake made by Warren Beatty and Faye Dunaway was quickly rectified, Barry Jenkins‘ Moonlight was announced the winner, and the rest is history.

One of the best coming-of-age drama tales of all time, Moonlight won three of its eight Oscar nominations, with Mahershala Ali‘s Best Supporting Actor triumph almost worthy of a place in this list. However, given the film’s minuscule budget of just $4 million and the impressive success of small-budget indie flicks since, it is fair to say that today’s film landscape would look considerably different without Moonlight‘s Best Picture win.

2

Daniel Day-Lewis – Best Actor for ‘There Will Be Blood’ (2007)

Daniel Day-Lewis is undeniably one of the greatest actors of all time, and his Best Actor win for There Will Be Blood is the best of his three Academy Award victories. As the misanthropic oil baron Daniel Plainview, Day-Lewis combines with the genius of Paul Thomas Anderson to craft one of modern cinema’s greatest performances.

Many actors go to extreme, seemingly performative lengths to prove their ability. Day-Lewis’s two-year isolation in Ireland to prepare for this role is one of the only times such radical methods paid off. Earning a plethora of best actor nominations from various award boards for this performance, There Will Be Blood is Day-Lewis’s magnum opus, and his Best Actor win is one of the best decisions the Academy has ever made.

1

‘Parasite’ (2019) — Best Picture

As the first non-English language film to win Best Picture, Parasite‘s win at the 2020 ceremony marked a huge shift in the Academy. Today, the likes of The Secret Agent and I’m Still Here are easy considerations for Best Picture nominations, and the Academy itself now boasts a much more international blend of members.

Whether you believe it is one of the greatest movies of all time or not, the film undeniably changed Western attitudes to international filmmaking for the better. Reported to be the most-logged movie on Letterboxd, Parasite‘s popularity continues to grow thanks to the increase in attention to non-English language films — a movement the movie itself helped propel forward.

Entertainment

Eric Dane’s Official Cause of Death Released

Actor Eric Dane, best known for his roles in “Grey’s Anatomy” and “Euphoria,” passed away on Thursday, February 19. The 53-year-old actor had announced in April 2025 that he had been diagnosed with amyotrophic lateral sclerosis, better known as ALS.

Article continues below advertisement

Eric Dane’s Official Cause Of Death Has Been Confirmed

According to a death certificate obtained by PEOPLE magazine, the actor passed away from respiratory failure. ALS was listed as an underlying cause of death.

The actor is survived by his wife, Rebecca Gayheart, and their two children: Billie Beatrice, 15, and Georgia Geraldine, 13.

Article continues below advertisement

Dane ‘Spent His Final Days Surrounded By Dear Friends’

On February 19, the actor’s family shared a brief statement with the publication confirming his passing. “With heavy hearts, we share that Eric Dane passed on Thursday afternoon following a courageous battle with ALS,” the statement read. “He spent his final days surrounded by dear friends, his devoted wife, and his two beautiful daughters, Billie and Georgia, who were the center of his world.”

Article continues below advertisement

“Throughout his journey with ALS, Eric became a passionate advocate for awareness and research, determined to make a difference for others facing the same fight. He will be deeply missed, and lovingly remembered always,” the statement continued. “Eric adored his fans and is forever grateful for the outpouring of love and support he’s received. The family has asked for privacy as they navigate this impossible time.”

Article continues below advertisement

Eric Dane Announced A Memoir In December 2025

In December 2025, only a few months before his sudden passing, the actor revealed that he would be releasing a memoir containing highlights from his life and legendary acting career. The memoir, set to be titled “Books of Days: A Memoir in Moments,” was set to be published by Maria Shriver’s imprint, The Open Field.

In an Instagram post announcing the memoir, Shriver said that it was “an honor to publish” his story, writing, “It is indeed an honor to publish @realericdane’s new memoir about his account of being diagnosed with ALS and how he is dealing with it. I’m so humbled and honored that he chose @openfieldbooks to publish his important story, an imprint known for publishing bestselling books that rise above the noise and move humanity forward.”

Article continues below advertisement

She continued, “I cannot wait for the world to read his story and learn more about his intention and his goals. Thank you for entrusting me with your story, Eric!”

In his own statement, Dane added, “I want to capture the moments that shaped me — the beautiful days, the hard ones, the ones I never took for granted… If sharing this helps someone find meaning in their own days, then my story is worth telling.”

Patrick Dempsey Paid Tribute To His Late ‘Grey’s Anatomy’ Costar

On February 20, Dempsey had a guest appearance on “The Chris Evans Breakfast Show,” only one day after Dane passed away. The actor said that Dane already had difficulty speaking and that some friends had been visiting him amid his health struggles.

“He was bedridden and it was very hard for him to swallow, so the quality of his life was deteriorating so rapidly,” Dempsey shared. He described Dane as a funny man who was “such a joy to work with” and looked back on their days on “Grey’s Anatomy” fondly.

Article continues below advertisement

“First scene was him in all of his glory coming out of the bathroom with a towel on, looking amazing, making me feel completely out of shape and insignificant,” Dempsey recalled, adding, “There was this wonderful mutual respect. He’s wickedly intelligent, and I’m always going to remember those moments of fun that we had together and celebrate the joy that he did bring to people’s lives.”

‘Grey’s Anatomy’ Creator Shonda Rhimes Pays Tribute

On February 20, “Grey’s Anatomy” creator also took to Instagram to pay tribute to the late actor with a carousel of photos showing the two posing together at various events. “Eric Dane was a beloved member of the Shondaland and Grey’s Anatomy families,” she wrote. “He was truly a gifted actor whose portrayal of Dr. Mark Sloan left an indelible mark on the series and on audiences around the world.”

She went on to say, “We are grateful for the artistry, spirit, friendship and humanity he shared with us for so many years. Our hearts are with his family, loved ones, and all who were touched by his work.”

Rebecca Gayheart commented on the post, writing, “That you Shonda — I am still unable to speak on our loss. Appreciate this.”

Entertainment

How Men Were Destroyed By The Most Popular Movie Of A Generation

By Joshua Tyler

| Updated

During World War 2 millions of American men were forced to march in lockstep to their death. Whether you think the cause was just or not, the truth is that for years these men had no say, no agency, and no independence. When the war was over, those who survived were released from bondage and returned home. They responded by doing what men have always done in those circumstances: by getting away from those who would control them.

The result was the rise of the American suburb, as returning soldiers left the city life of reliance on government apparatuses like public transportation and cramped apartment regulations for a place that promised more breathing room, your own home that you controlled, and the ability to hop in a car and go anywhere you want, anytime you like. The elites who’d been ordering them around during the war were soon unsettled by this shift in American culture and launched a campaign to demonize those returning soldiers and their suburbanite quest to get the hell away from them.

This pushback against suburban flight culminated in a cultural trend that would last for decades, but it first clicked into place with a singular movie that’s still persuading impressionable minds today. This is the story of how The Graduate screenwashed Americans into redefining success as a prison and failure as the real key to happiness.

Sympathy For A Spoiled Brat

The Graduate is about a recent college graduate named Benjamin Braddock. He’s played by a young Dustin Hoffman who, in addition to being a great actor, is also naturally sympathetic. The movie begins as he’s returning home after completing college. Once home, he’s supposed to figure out his next steps, and he hates every minute of it.

We follow Braddock everywhere, and the film makes sure you sympathize with him, even when you shouldn’t. That’s important because Benjamin Braddock acts like an asshole throughout almost the entire movie.

He bails on a party his parents threw to show him how proud they are of him. He mopes around their house, freeloading, and refuses to get a job. He complains when his Dad offers to help him or when his parents say nice things about him. He’s presented with reasonable choices and opportunities, and treats them like an attack on his soul. He stalks and harasses a woman he barely knows, ruins a marriage, and uses everyone around him.

The Graduate excuses Benjamin’s behavior as if it’s everyone else that’s the problem, even though they’re doing nothing to him at all. On paper, Benjamin Braddock is a total tool, but as the Simon & Garfunkel music swells and he slinks through the flatly shot airport, the movie frames him as a victim entering a trap.

The Graduate frames Benjamin as its surrogate, creating a situation where hating him means hating yourself. You won’t do that, so with a little help from creative camera work, your brain assumes Ben’s in the right, even though he’s clearly a passive-aggressive jerk.

How Moral Reframing Turns Bad Into Good

The movie makes that ridiculous flip happen using a persuasion technique called Moral Reframing. Moral Reframing is the persuasive repositioning of behavior, motives, or outcomes so that actions widely seen as harmful, selfish, or unethical are interpreted as virtuous, principled, or necessary by shifting the moral lens through which they are judged.

The Graduate pulls off that reframing because of the way director Mike Nichols shoots and constructs his film. Nichols frequently aligns the camera with Benjamin’s POV, making the audience experience situations from his perspective. Every shot frames him behind glass, water, plastic, or some kind of architecture.

Benjamin often says very little, even when asked questions. In the real world, that behavior would be rude, but Nichols lets pauses linger, making his confusion and anxiety feel authentic and earned rather than what it really is, which is lazy and passive-aggressive.

Affected By Affect Heuristics

Early scenes show adults crowding him, speaking at him rather than to him. The camera stays close to Benjamin, trapping the viewer in his discomfort. Everything Nichols does makes sure you FEEL that he’s trapped by the world around him, and that world is the suburbs. In doing so, he’s taking advantage of something called Affect Heuristics.

Affect Heuristics are a mental shortcut all humans take, in which immediate emotional reactions, such as fear, liking, disgust, or comfort, are substituted for deliberate analysis. That means judgments of things like risk, value, or truth are guided more by feeling than by evidence.

So The Graduate never outright says the suburbs and success are evil. It doesn’t even show most of them (with one big exception, and we’ll get to HER in a minute) doing anything bad. Instead, Nichols uses reframing to make you FEEL his message. And he does it indirectly, so you’ll never notice what he’s doing to you. So while on screen you see nothing but paradise-like suburbs filled with mini mansions, swimming pools, and supportive parents and friends, The Graduate’s director subtly manipulates the audience into FEELING that, despite all evidence, this place of success is actually one of festering rot.

That’s where Mrs. Robinson comes in.

Mrs. Robinson Gets The Blame

Even if you’ve never seen The Graduate, you know who Mrs. Robinson is. An older woman who has known Benjamin since he was a baby decides to seduce him, and she does so aggressively.

She’s played by Anne Bancroft, who was actually only thirty-five at the time. Hoffman, by the way, was twenty-nine. But the movie goes out of its way to age her, while simultaneously de-aging Dustin Hoffman.

Nichols shoots Bancroft in hard, shadow-casting lighting that accentuates cheekbones and facial lines. Heavy eye makeup, dark liner, and sculpted hair add severity rather than youthfulness. In real life, Anne Bancroft was a smokeshow, but in The Graduate, nothing about her is attractive.

I know the movie’s reputation is that she’s some kind of hot MILF seductress, but that’s a marketing distraction. It’s not what the movie wants you to FEEL. The reality is that, compared to Benjamin, she looks much too old, and their entire relationship is a creepy, creepy betrayal.

What’s more, the movie puts all the blame for their creepy relationship on Mrs. Robinson and almost none on Benjamin. The Graduate never says this overtly, but she’s consistently filmed looming over Benjamin, emphasizing power and experience. Low angles and dominant framing make her imposing and authoritative. She’s always placed in adult spaces like dim bars, bedrooms, and cocktail settings that reinforce her status and power as being superior to Benjamin.

The Power Of Symbolic Guilt Transfer

Mrs. Robinson must be creepy, and she must be to blame, because she represents the movie’s true motives. Mrs. Robinson exists in the film to be the chief representative of suburbia, and it’s suburbia that The Graduate is out to destroy. This is Symbolic Guilt Transfer.

Symbolic Guilt Transfer is a persuasion effect in which negative moral judgment or blame attached to a person, image, or symbol is psychologically shifted onto the broader group, place, or idea that the figure is made to represent, causing audiences to condemn the larger target through its symbolic stand-in.

Mrs. Robinson is the rotting, putrid core at the heart of the suburbs. She’s there to make you FEEL negatively about a place, not a person, and it’s all hidden beneath a veneer of smoky-voiced, granny panties seduction.

Boring Is The Worst

But what are the suburbs really? Everyone has a nice house, they have friends, and aside from Mrs. Robinson, they seem happy and well-adjusted. The suburban lifestyle is so obviously superior to the crowded, restrictive, crime-ridden city alternatives people were familiar with in 1967 that there really was no way to attack that honestly.

So instead, The Graduate makes them dull. Boring. It makes you think BORING is the worst. That boring rots the soul, that boring turns you into Mrs. Robinson. The camera lingers on beige walls, manicured lawns, polite smiles. It sells the idea that nice things are inherently empty and creates an inverted morality in which good is bad and bad is good.

Things snowball as the movie goes on, with Benjamin basically going insane. He becomes a full-on stalker, harassing Mrs. Robinson’s daughter, who behaves like a brain-dead zombie and follows his commands for basically no reason.

Through it all, the movie’s groovy Simon & Garfunkel-powered soundtrack blares, and to audiences back then, that music felt hip and cool, a signal that Benjamin is on the right track. Seen through a modern lens, that endless 60s soundtrack sounds haunting and disturbing, and the film takes on the form of a horror movie as Benjamin increasingly acts irrationally, violently, and abusively.

Because the film was stylish, funny, and backed by a soundtrack that felt modern and restless, the teenage Boomers who piled into its audience didn’t see it as a horror movie. It felt edgy, it felt cool. It felt right. And so The Graduate spread a message of insanity and irresponsibility as optimal, based entirely on feeling and vibes. It packaged and sold a ridiculous anti-suburb, anti-responsibility lie that made success look cowardly and respect look like conformity.

Hollywood Provides Impressionable Minds Social Proof That The Graduate Is Right

The Graduate worked, and the Hollywood elite rewarded it for pushing exactly the right message. Mike Nichols won the Academy Award for Best Director, while the film earned additional Oscar nominations, including Best Picture, Best Actor for Dustin Hoffman, and Best Actress for Anne Bancroft.

It exploded into one of the era’s biggest hits, grossing over $100 million worldwide, an extraordinary figure for the late 1960s, and becoming the highest-grossing film of 1967. It’s still regarded by the modern-day press as one of the greatest films of all time, and if you ask most average Boomers about it, they’ll probably tell you The Graduate changed their entire life.

Perhaps more importantly, The Graduate’s runaway success signaled a shift toward youth-oriented propaganda and helped usher in the New Hollywood era, which led to even more manipulative films, like The Stepford Wives, which you can learn more about right here on this channel.

The Ultimate Straw Man

The powers that be couldn’t argue against the Greatest Generation’s post-World War II success, so they constructed a straw man and made people hate it. The Graduate was that straw man, a symbol of everything that stood in opposition to America’s post-War prosperity. You can’t fight a symbol.

Mike Nichols claims his intent was only to show the confusion of youth, but it’s unlikely he’s being honest. That being his only goal doesn’t explain Mrs. Robinson, or the movie’s over-the-top finish, in which Benjamin wards off suburbanites with a giant cross, as if they’re daywalking vampires.

Permanently Implanted With Catharsis

In that finale, by the way, which is the film’s propaganda masterstroke, The Graduate hard-codes all the bad ideas it’s been planting in its audience’s brains by giving them catharsis. Catharsis is an engineered emotional purge that converts built-up tension into relief, binding the audience to whatever action, character, or idea triggered the release.

So when Benjamin storms a wedding, releasing all the tension the movie’s been building up by thumbing his nose at everything, it’s like The Graduate just hit the “save program” button in your brain. It’s why The Graduate still lives rent-free in your Boomer grandparents’ heads, and why there’s no shaking them out of it.

The last we see of Benjamin, he’s boarding a bus with the girl he stalked, Mrs. Robinson’s daughter. He’s abandoned the freedom with responsibility of the suburbs and set out on an uncertain journey into nothingness. For Benjamin, oblivion is better than opportunity.

For the audience, freedom of choice is now a prison, and basic level responsibility is a curse. Congratulations, future welfare moochers, you’ve been Screenwashed.

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports3 days ago

The Vikings Need a Duck

-

Crypto World7 days ago

Crypto World7 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat1 day ago

NewsBeat1 day ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment16 hours ago

Entertainment16 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World6 days ago

Crypto World6 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers