Crypto World

Iran Crypto Outflows Rose 700% After US-Israel Attack

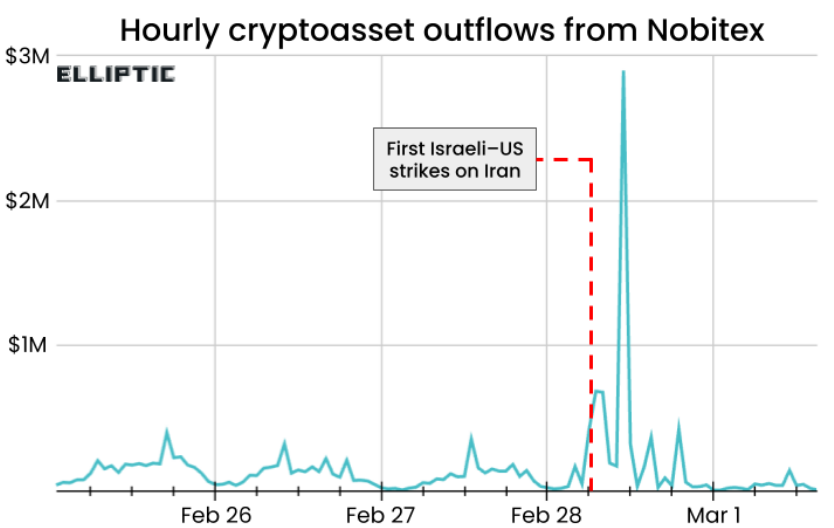

Iran’s top crypto exchange saw a significant spike in crypto withdrawals within minutes of the US and Israel launching strikes in Tehran on Saturday. However, a widespread internet outage curbed additional outflows.

In a post on Monday, Elliptic said crypto outflows from the Nobitex exchange surged by more than 700% to over $500,000 within minutes of the first airstrikes, with a chart showing that outflows reached nearly $3 million in a single hour later that day.

Elliptic said the sharp rise in outflows “potentially represents capital flight from Iran,” with its initial tracing showing that many of those funds were sent to foreign crypto exchanges.

“This allows funds to be moved out of Iran while avoiding some of the scrutiny of the global banking system,” Elliptic said.

However, crypto outflows from Nobitex fell sharply after Saturday, which fellow crypto forensics platform TRM Labs attributed to the Iranian regime enforcing strict internet blackouts.

Iran’s internet connectivity reportedly fell by approximately 99% shortly after the conflict unfolded, TRM noted.

TRM also opposed Elliptic’s conclusion that capital flight is leaving Iran, stating:

“It appears that the country’s crypto ecosystem is not showing signs of acceleration or capital flight, but instead experiencing a downturn in both transactions and volume as the regime enforces strict internet blackouts.”

The crypto outflows come as the US and Israel seek to topple the current Iranian regime and wipe out its nuclear and missile programs. Iran responded with airstrikes of its own on neighboring countries, creating further instability in the region.

Nobitex is Iran’s largest crypto exchange, handling roughly 87% of the country’s crypto transaction volume. In 2025, it processed about $7.2 billion in trades for more than 11 million users.

Millions of Iranians impacted by recent banking collapse

Iranians continue to rely on crypto to store and move funds as a solution to navigate Iran’s fragile banking system and the widespread sanctions imposed on the country.

Related: Will Bitcoin crash if oil prices hit $100 per barrel?

In October, one of Iran’s largest private banks, Ayandeh Bank, went bankrupt after accumulating $5.1 billion in losses and nearly $3 billion in debt, impacting more than 42 million customers.

Iran’s central bank warned last year that eight other local banks were at risk of dissolution unless they implement reforms.

Iranian crypto exchanges haven’t been without problems either, as Nobitex suffered an $81 million hack in June.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Paxful Founder Indicted Days After Company’s Guilty Plea

NoOnes founder Ray Youssef is being investigated by the US Department of Justice (DOJ). The probe centers on allegations that Youssef’s peer-to-peer crypto marketplace, Paxful, operated without proper licensing and failed to implement effective anti-money laundering (AML) controls before it shut down in 2025.

Prosecutors also claimed Paxful facilitated transactions linked to unlawful activities, including payments tied to commercial sex advertising platforms. Youssef disputed the allegations, arguing the move represents a further continuation of the war on crypto.

Prosecutors Cite Years Of Compliance Gaps

Federal prosecutors have charged Youssef in the US District Court for the Eastern District of California. The indictment focuses on his role as co-founder and former CEO of Paxful.

According to court documents obtained by BeInCrypto, prosecutors alleged that Paxful lacked adequate Know Your Customer procedures and meaningful internal compliance controls. Authorities further alleged the platform did not timely file Suspicious Activity Reports as required under federal law.

Authorities also claimed Paxful facilitated transactions linked to unlawful online enterprises, including commercial sex advertising platforms.

The indictment cited specific, dated Bitcoin transfers that prosecutors say were sent from Paxful wallets to addresses linked to Backpage, an online platform accused of facilitating illegal commercial sex advertising.

Youssef has strongly rejected the charges in a series of social media posts.

Youssef Publicly Rejects Criminal Allegations

In a video uploaded to his X account, Youssef claimed that he was in Mexico when authorities deported him to Los Angeles, under orders from the DOJ. He was subsequently arrested and sent to a prison in Santa Ana until a judge ordered his release under supervision following his arraignment. Until the case’s resolution, Youssef cannot leave the United States.

Youssef described the charges as “bogus” and claimed that the case largely rests on approximately $240 worth of Bitcoin transactions.

According to the indictment, Paxful embedded a “Pay with Paxful” button directly on Backpage, allowing users to buy Bitcoin through Paxful and use it to pay for ads on the site.

It further stated that undercover federal agents opened Paxful accounts and successfully completed these transactions, which prosecutors cited as evidence that the payment system actively facilitated related activity.

For Youssef, the situation reinforced his belief that the war on crypto never stopped existing. Instead, it just became more selective.

“If you were doing a token like our president, and retail lost a couple billion, well that’s fine. If you’re like CZ and sold a couple of hundred billion by liquidations and price manipulation, well that’s fine. If you just stole money from retail, no one cares. Go ahead,” Youssef said in an X video.

The latest events come at a difficult time for Youssef’s role in different crypto projects.

Paxful To Pay Million-Dollar Fine

Last week, NoOnes announced on social media that Youssef was no longer the company’s CEO. It also clarified that the legal matters he currently faces are “personal and unrelated to” the company’s decision.

Four days before the DOJ indicted Youssef, Paxful pleaded guilty to three federal criminal charges related to Backpage.

According to court documents, Paxful admitted it conspired to promote illegal prostitution through interstate commerce, operated as an unlicensed money transfer business, and failed to put proper anti-AML controls in place.

In July 2024, Paxful co-founder Artur Schaback pleaded guilty to conspiracy to fail to maintain an effective AML program in relation to the same scheme.

Although federal guidelines suggested a much higher penalty, Paxful will pay $4 million based on its financial condition. The company is scheduled to be sentenced in February 2026.

Crypto World

Saylor’s Strategy Spends Over $200 Million to Acquire 3,015 BTC: Details

Some of the comments below the company’s post said this purchase shows “conviction, not hesitation.”

After hinting about another purchase on Sunday, Strategy’s co-founder and former CEO, Michael Saylor, has made it official, indicating that his firm has splashed $204.1 million to acqure additional 3,015 BTC.

The average cost for the latest transaction was $67,700, and the company’s stash has grown to 720,737 BTC. It was purchased at an average price of just under $76,000, which means that the NASDAQ-listed firm continues to be deep in the red on its bitcoin position.

With the cryptocurrency’s price trading at around $66,000 as of press time, Strategy’s fortune is worth around $47.5 billion, which represents an unrealized net loss of over $7 billion.

Strategy has acquired 3,015 BTC for ~$204.1 million at ~$67,700 per bitcoin. As of 3/1/2026, we hodl 720,737 $BTC acquired for ~$54.77 billion at ~$75,985 per bitcoin. $MSTR $STRC https://t.co/rqDIhlUDNx

— Michael Saylor (@saylor) March 2, 2026

Most comments below Saylor’s posts outlined their support for the move, with one user calling the purchase of 3,015 BTC during the current macro conditions a show of “conviction” and not hesitation.

Strategy’s stock price has not opened for trading yet after the weekend events in the Middle East, but is down by 0.5% in pre-market trading. More volatility is expected when Wall Street opens in a few hours.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Real-World Assets on Ethereum Top $15 Billion

The tokenized gold market has surged past $4 billion, significantly contributing to Ethereum’s Real-World Asset (RWA) market, which now exceeds $15 billion.

Ethereum’s real-world asset (RWA) market has grown significantly, reaching $15 billion and accounting for 58% of the global RWA market. This expansion is largely driven by the increasing popularity of tokenized gold.

“Tokenized gold, such as PAX Gold (PAXG) or Tether Gold (XAUT), offers investors the security of owning fully backed physical bullion while enjoying the liquidity and portability of digital assets,” according to ARKM Research. This blend of traditional and digital finance facilitates a seamless transition for investors seeking stability and growth.

Gold-backed tokens are now competing directly with leading crypto derivatives, shedding their niche status. Tether Gold (XAUT) is the largest tokenized gold token by market capitalization, backed by physical gold stored in Swiss vaults. Meanwhile, Paxos Gold (PAXG) is regulated by the New York Department of Financial Services (NYDFS), with each token backed by one troy ounce of gold.

In addition to gold, the on-chain perpetual futures trading market for gold and silver, exemplified by platforms like TradeXYZ, has seen record levels of interest and volume in recent months, further indicating the growing appetite for tokenized commodities.

This article was generated with the assistance of AI workflows.

Crypto World

How Gold, Bitcoin, and Oil Have Performed Since Trump Took Office

The past year’s price action shows how politics, inflation concerns, and a weaker dollar reshaped market trends.

Gold has surged to new record highs, Bitcoin (BTC) has swung sharply, and oil keeps reacting to headlines since U.S. President Donald Trump began his second term in January 2025.

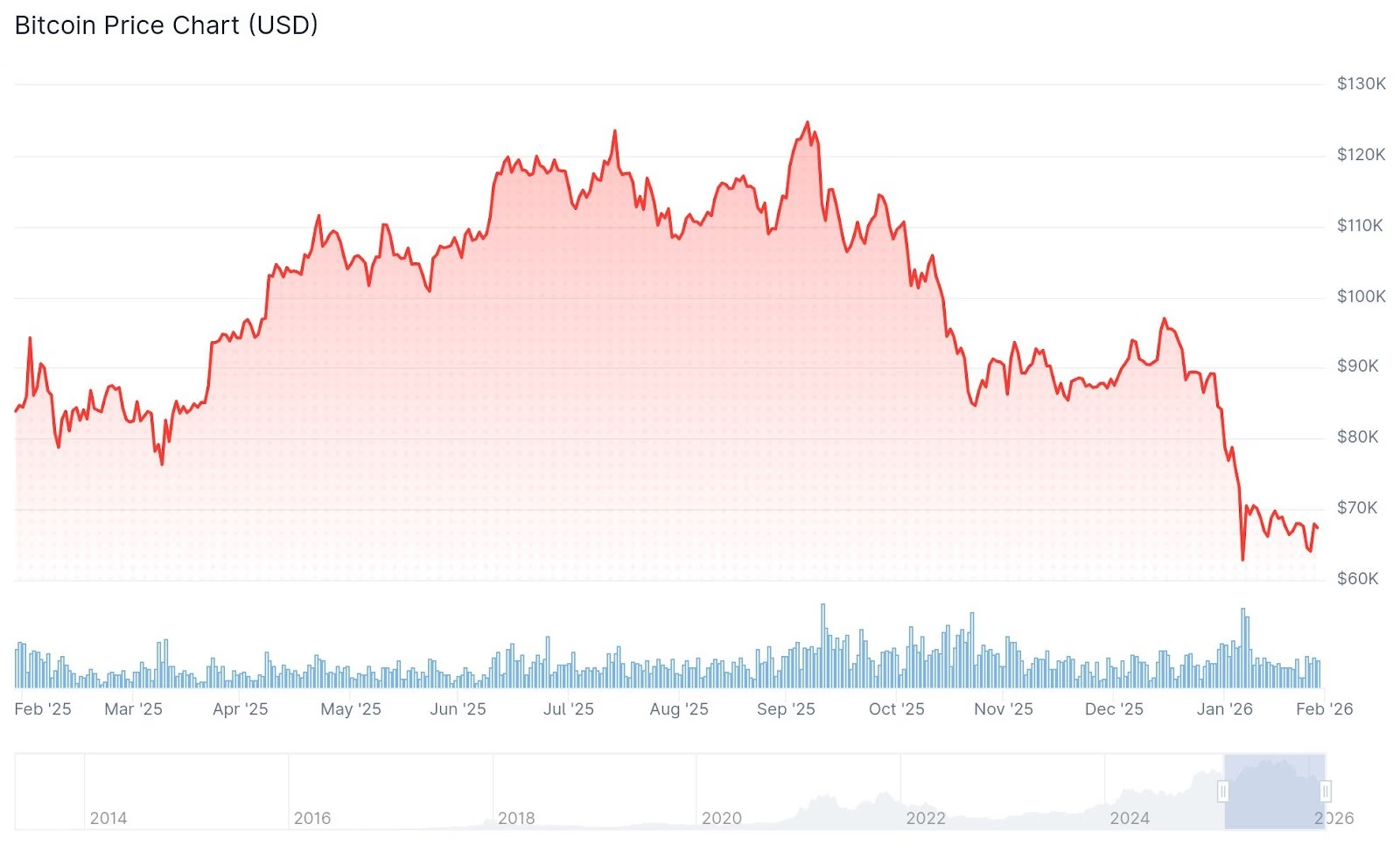

Over the past year, gold has jumped roughly 80%, while Bitcoin is down over 25% despite trading as high as $124,000 last October. Oil, on the other hand, has hovered near recent highs but continues to move on geopolitical developments.

Together, the moves show how less predictable markets have become. Instead of following cycles, assets are increasingly reacting to politics, inflation worries, and shifting expectations for growth, forcing investors to rethink what counts as a safe haven, a risky trade, or a macro signal.

Gold: The Classic Hedge

Gold has been one of the clearest winners of the past year, rising about 80%. The metal traded near $2,941 per ounce a year ago and now sits around $5,300, as investors increasingly turned to it for protection against inflation, geopolitical tensions, and general uncertainty.

During the year, gold fell as low as $2,857 and hit an all-time high above $5,500. Jonathan Rose, CEO of BlockTrust IRA, said the rally shows how investors tend to return to fundamentals when uncertainty rises.

“If there’s one thing the current administration’s ‘America First ‘ agenda has proven, it’s that the market eventually stops trading on ‘vibes’ and starts trading on plumbing,” Rose said. He added that gold’s resilience stems from its role as an asset not dependent on leverage or liquidity cycles.

“It’s held by central banks and ‘old money’ that doesn’t panic-sell to meet a 4:00 PM margin call,” Rose said. “While the digital world was reeling from the largest leveraged liquidation event on record ($20 billion wiped out in a single cascade), gold acted as the asset of last resort.”

Meanwhile, Sid Powell, CEO of Maple, said the metal’s performance reflects a familiar pattern during uncertain periods.

“In uncertain political and macro environments, gold has done what it always does – steadily attracting demand as investors look for protection against inflation risk, policy shifts, and instability,” Powell explained.

And this interest in gold has also shown up on-chain, with tokenized gold assets surpassing $4 billion in market value earlier this year as investors sought exposure to the metal through digital rails.

Bitcoin: The Volatile One

If gold has delivered steady gains, Bitcoin has delivered volatility. In the year since Trump took office again, Bitcoin has fallen around 25%. It traded near $95,740 a year ago and now sits around $69,000 – a far choppier performance than gold.

And the path has been anything but linear. Over the past year, BTC rallied to an all-time high on Inauguration Day, reaching $108,500, dropped to a low of $74,000 in April 2025, and then rallied to a new high of $124,773 in October. This solidified its status as a highly volatile asset after being touted as a “safe” hedge against inflation for the first half of 2025.

For much of the year, BTC and gold traded closely together, both benefiting from inflation concerns and political uncertainty. But that correlation weakened in recent months. While gold continued climbing to record highs, Bitcoin pulled back sharply from its peak.

The divergence only accelerated after the Oct. 10 crash, when roughly $20 billion in leveraged positions were liquidated – the largest derivatives wipeout in crypto history. The event not only drained liquidity but also marked a turning point for crypto market structure.

Marissa Kim, Head of Asset Management at Abra, said the shift reflects broader macro dynamics rather than crypto-specific factors. “Since Trump took office, asset performance has been shaped less by traditional fundamentals and more by a breakdown in old monetary and market cycles.”

She said Bitcoin initially moved in tandem with gold and other assets as investors piled into what she described as the broader “debasement trade,” driven by inflation fears and uncertainty about the future monetary order.

“While many ‘debasement trade’ assets have performed extremely well… BTC and crypto performance has lagged,” Kim said.

Oil

Unlike gold’s steady rise or Bitcoin’s volatility, oil has mostly been moving on geopolitical news, experts said, making it a bit more predictable.

Prices have stayed near recent highs, with U.S. crude trading in the low-to-mid $60s per barrel and Brent crude hovering around the upper-$60s to around $70, as markets weighed the likelihood of a U.S.-Iran nuclear deal and the risk of supply disruptions in the Middle East.

“Oil’s a different story, as it’s been a mix of geopolitics, supply constraints, and growth expectations,” Arrash Yasavolian, founder and CEO of Vanta, told The Defiant. “However, it got swept into the same reflation tape at different points.”

He said the recent swings show how investors are once again treating assets based on their specific roles rather than broad macro narratives. “And now with unrest in Venezuela and Iran, oil feels much more volatile and less safe than gold,” Yasavolian added.

Meanwhile, President Donald Trump’s recent proposal to raise tariffs to 15% after the U.S. Supreme Court ruled his emergency tariffs illegal has added new concerns about global growth.

USD: The Silent Influencer

While gold, Bitcoin, and oil have drawn most of the attention, the U.S. dollar has quietly shaped the environment behind their moves.

The U.S. Dollar Index is down around 8% over the past year, falling from above 106 last February to around 97.7, and earlier this year touched its lowest level in about four years. A weaker dollar tends to support commodities like gold and oil and can also make alternative assets like Bitcoin look more attractive.

Analysts have tied the decline to a mix of tariff threats, fiscal concerns, and expectations that interest rates could move lower, factors that have also coincided with investors rotating into hard assets.

In that sense, the dollar hasn’t been the headline story, but it has influenced how other markets behave.

When looking at the entire picture, the moves across gold, Bitcoin, oil, and the dollar suggest markets are becoming more fragmented. It also highlights how each asset is increasingly reacting to its own drivers rather than a single macro narrative.

Crypto World

Clarity Act Fails March 1 Deadline as Stablecoin Yield Dispute Stalls Progress

The White House’s self-imposed deadline for banks and crypto to resolve their stablecoin standoff has come and gone.

With no deal in sight, trillions in institutional capital now hang in the balance.

Why it matters:

- Stablecoin legislation is widely seen as the gateway to mainstream crypto adoption in the US.

- Without it, regulatory uncertainty persists, enforcement risk rises, and innovation continues migrating to friendlier jurisdictions in Europe and Asia.

The details:

- The March 1 deadline set by White House Crypto Council Executive Director Patrick Witt has passed without a compromise on stablecoin yield.

- Crypto firms are pushing for the legal right to offer regulated rewards on stablecoins like USDC.

- Meanwhile, banks, fearing deposit flight if users chase 4–5% stablecoin returns over 0.01% savings rates, are lobbying for strict limits or an outright ban.

- A banking source told Crypto In America that while there’s broad agreement stablecoin balances shouldn’t earn direct interest, crypto firms are still attempting to engineer yield through “membership programs, rewards, and staking” — a workaround banks say is holding up the deal.

- The OCC may have bolstered the banks’ position, signaling in its latest GENIUS Act rulemaking that stablecoin rewards could face tighter limits than the crypto industry anticipated.

The big picture:

- Senate Banking Committee markup is now expected in mid-to-late March, with breakout negotiations penciled in for April and a soft July deadline before election-year paralysis sets in.

- If no compromise is reached, the SEC and OCC could resort to enforcement actions to fill the policy vacuum.

- Such a move could delay what JPMorgan has projected could be a massive institutional inflow wave by late 2026.

The post Clarity Act Fails March 1 Deadline as Stablecoin Yield Dispute Stalls Progress appeared first on BeInCrypto.

Crypto World

US Authorities Target $327K USDt in Romance Fraud Scheme

The U.S. Department of Justice has filed a civil forfeiture action to recover more than 327,829 USDT (CRYPTO: USDT), Tether’s widely used stablecoin, in connection with a money-laundering scheme tied to an online romance scam that targeted a Massachusetts resident beginning in 2024. Prosecutors say portions of the funds were traced to unhosted wallets and were seized in August 2025, with the complaint arguing that all cryptocurrency tied to those wallets constitutes property involved in money laundering. The case underscores ongoing regulatory attention on illicit activity tied to crypto payments and stablecoins. It follows a February disclosure that Tether had frozen about $4.2 billion worth of USDT since 2023 due to suspected criminal activity, a figure reported by Reuters and referenced in coverage linked to the broader crackdown on illicit flows within the sector. The action reflects intensified scrutiny of how stablecoins can be used in fraud and money-laundering schemes, as authorities pursue on-chain traces and wallet seizures alongside traditional law-enforcement methods.

Key takeaways

- The U.S. Attorney’s Office for the District of Massachusetts filed a civil forfeiture action to recover over 327,829 USDT tied to an online romance scam, with authorities noting funds traced to unhosted wallets seized in August 2025.

- A separate February report cited that Tether had frozen roughly US$4.2 billion of USDT since 2023 due to suspected illicit activity, highlighting the government’s ability to blacklist addresses and restrict transfers.

- Past actions show Tether’s capacity to freeze funds—such as a February case involving about $544 million linked to Turkish illicit betting and money laundering at the request of Turkish authorities—illustrating that stablecoin controls can intersect with law enforcement requests.

- The romance-scam case is part of broader enforcement patterns around crypto-enabled fraud, as U.S. authorities continually map on-chain activity to real-world schemes—an area that remains a focal point for regulatory clarity and compliance standards.

- The developments come ahead of Valentine’s Day cross-border awareness campaigns about online scams and guideposts from prosecutors warning the public against sending money or crypto to people met online.

Tickers mentioned: $USDT

Market context: The action sits at the intersection of enforcement and stablecoin use, where regulators are increasingly focused on tracing funds and the on-chain footprints of criminals. As stablecoins anchor more crypto payments, authorities are tightening oversight and emphasizing the need for transparent governance, auditable reserves, and robust compliance programs to curb misuse.

Why it matters

The Massachusetts forfeiture filing shines a light on the practical steps law enforcement takes to recover digital assets linked to crime. By tying the seizure to a romance scam—an increasingly common vector for crypto-related fraud—prosecutors illustrate how traditional schemes can migrate to blockchain rails. The case also underscores the dual-edged nature of stablecoins: while USDT provides liquidity and smoother fiat-crypto exchanges, it also creates an additional channel for illicit activity unless effective controls are in place. The ability to freeze specific wallets reflects a level of centralized control that, for some observers, raises questions about the boundary between policing crimes and the freedom of decentralized finance.

For users and investors, the episode serves as a reminder to exercise caution in online interactions and to remain vigilant about requests for cryptocurrency transfers, even when the sender appears credible or emotionally persuasive. It also contextualizes ongoing policy debates around stablecoin regulation, reserve transparency, and how authorities should balance innovation with consumer protection and financial crime prevention. The public record—the civil-forfeiture notice and related government statements—retains value as a verifyable basis for understanding how on-chain activity maps to real-world illicit networks, a critical element as the ecosystem scales and evolves.

From a market perspective, these enforcement actions can influence sentiment around stablecoins and crypto liquidity. While one case does not erase the overall growth of legitimate use cases for USDT, it reinforces the perception that regulators are actively pursuing avenues to disrupt or unwind illicit flows, potentially shaping future compliance expectations for issuers and exchanges alike.

For researchers and practitioners, the affair underscores the importance of on-chain analytics and the availability of publicly auditable data to corroborate law-enforcement claims. It also spotlights the role of unhosted wallets and the challenges of tracing activity across varying wallet types, including noncustodial solutions that complicate asset-recovery processes. In parallel, the broader narrative around Valentine’s Day-related scams—highlighted by public warnings from U.S. prosecutors—serves as a reminder that fraud can take multiple forms, with crypto merely one instrument among many in a criminal playbook.

Watchers should note that the case is not isolated. It follows previously reported actions where Tether disclosed freezing a substantial amount of USDT in response to illicit activity, and it aligns with a wider trend of authorities pursuing criminal funds that flow through digital assets. The landscape continues to evolve as regulators seek greater interoperability between traditional anti-money-laundering frameworks and the evolving mechanics of blockchain finance. For readers tracking regulatory risk, the developing civil-forfeiture action offers a concrete example of how enforcement agencies intersect with stablecoins, wallets, and on-chain tracing to disrupt criminal networks.

To contextualize the discussion for a broader audience, a related video discussion is available here: Watch on YouTube.

What to watch next

- Upcoming court filings in the civil forfeiture case, including any claims by Tether or other parties and the timeline for resolution.

- Details on which unhosted wallets were seized and whether the assets will be returned, forfeited, or subject to further legal action.

- Any subsequent government statements clarifying the scope of the recovery and the role of USDT in the underlying scheme.

- Broader regulatory developments around stablecoins and on-chain asset tracing, including potential guidance or new rules affecting issuers and exchanges.

Sources & verification

- United States Attorney’s Office for the District of Massachusetts. United States Attorneys Office files civil forfeiture action to recover cryptocurrency. https://www.justice.gov/usao-ma/pr/united-states-attorneys-office-files-civil-forfeiture-action-recover-cryptocurrency

- Cointelegraph. Tether freezes $4.2B USDT illicit-activity report. https://cointelegraph.com/news/tether-freezes-4-2b-usdt-illicit-activity-report

- Cointelegraph. Tether freezes $544M crypto Turkey illegal betting. https://cointelegraph.com/news/tether-freezes-544m-crypto-turkey-illegal-betting

- Cointelegraph. Gen Z crypto Valentine’s date payments OKX survey. https://cointelegraph.com/news/gen-z-crypto-valentines-date-payments-okx-survey

Case details and implications for stablecoin enforcement

The core of the action is a civil forfeiture filing that targets a specific tranche of digital assets—327,829 USDT—linked to a scheme described by prosecutors as money laundering via an online romance scam. The defendant in the public filing is described by authorities as an individual operating a deception that began in 2024, culminating in the seizure of funds tied to on-chain wallets that could not be accessed through standard custodial services. The authorities emphasize that the cryptocurrency associated with those wallets is property involved in money laundering, an assertion that aligns with the broader legal framework that permits asset forfeiture in cases where crypto assets are proven to have been used to facilitate crime.

The broader narrative includes a February report indicating that Tether had frozen roughly $4.2 billion of USDT since 2023 in connection with suspected illicit activity. This points to the ongoing capability of stablecoin issuers and law enforcement agencies to respond to suspicious activity by blacklisting addresses and effectively controlling the flow of funds within the ecosystem. The fact that a separate action involving nearly half a billion dollars in USDT linked to Turkish authorities’ requests illustrates the practical, real-world reach of these controls—even within a largely decentralized, permissionless network. Critics may view such actions as necessary enforcement tools, while supporters may argue they reflect appropriate risk management by on-chain participants and stablecoin issuers alike.

As enforcement patterns evolve, market participants will be watching for how such cases influence liquidity, regulatory expectations, and the willingness of exchanges to list or delist certain assets in response to tethered enforcement actions. The romance-scam case also underscores the importance of consumer education and awareness campaigns, especially around Valentine’s Day, when online dating scams tend to spike. Authorities have repeatedly warned the public against sending funds or crypto to individuals met online, highlighting that the speed and anonymity of digital assets can complicate traditional fraud prevention measures.

Crypto World

Bitfinex Resumes USDt Tokenized Bonds on Liquid

Bitfinex Securities said on Monday it will resume issuing tokenized bonds for Luxembourg-based securitization fund ALTERNATIVE, with future sales expected to exceed $10 million.

The USDt-denominated bonds will be issued and settled on the Liquid Network, a Bitcoin sidechain, with fundraising, coupon payments and principal repayments executed fully onchain.

The move follows four prior tokenized bond issuances since 2023 totaling $6.2 million, three of which have matured and been fully repaid, representing about $1 million in principal returned to investors.

Across those offerings, investors received 20 onchain coupon payments worth more than $1.1 million by the completion of their first full tokenized bond cycle in 2025, according to the companies. The bonds give investors exposure to emerging-market private credit, including financing for small and medium-sized businesses and women-led enterprises.

Bitfinex Securities operates under licenses in the Astana International Financial Centre in Kazakhstan and in El Salvador, and handles issuance, listing and secondary trading, while Tether’s Hadron platform supports token management. The platform says it now lists about $250 million in regulated tokenized securities.

Jesse Knutson, head of operations at Bitfinex, told Cointelegraph that buyers have primarily been high-net-worth crypto investors and crypto-focused institutions from Europe and Asia seeking yield on their USDt (USDT) holdings.

The tokenized bonds operate alongside the issuer’s conventional monthly bond program and typically carry an 11-month duration. Transactions are recorded on the Liquid Network, though key settlement details are shielded by its confidential transaction features.

He added, “There’s been a lot of discussion this year around yield-generating stablecoins. This product offers a solution with an easy, regulated and established vehicle for earning yield on USDt balances.”

Related: Bitcoin exposes the structural weaknesses that banks refuse to admit

Yield vs. no yield debate rages on

The relaunch comes as debate continues over whether stablecoins should be allowed to offer yield and how such products should be regulated in the United States.

With the passage of the US GENIUS Act in July 2025, stablecoin issuers were barred from paying yield, but the law did not explicitly prohibit third parties from offering returns through separate products. The “loophole” allowed exchanges or other third-party platforms to structure securities or lending instruments that generate yield in stablecoins without the issuer itself distributing interest.

Banks have warned that high-yielding stablecoin products could pull deposits away from the traditional financial system. In January, Bank of America CEO Brian Moynihan said interest-bearing stablecoins could drain as much as $6 trillion in deposits from US banks, arguing that large-scale migration into digital dollar products could reduce lending capacity and increase funding costs.

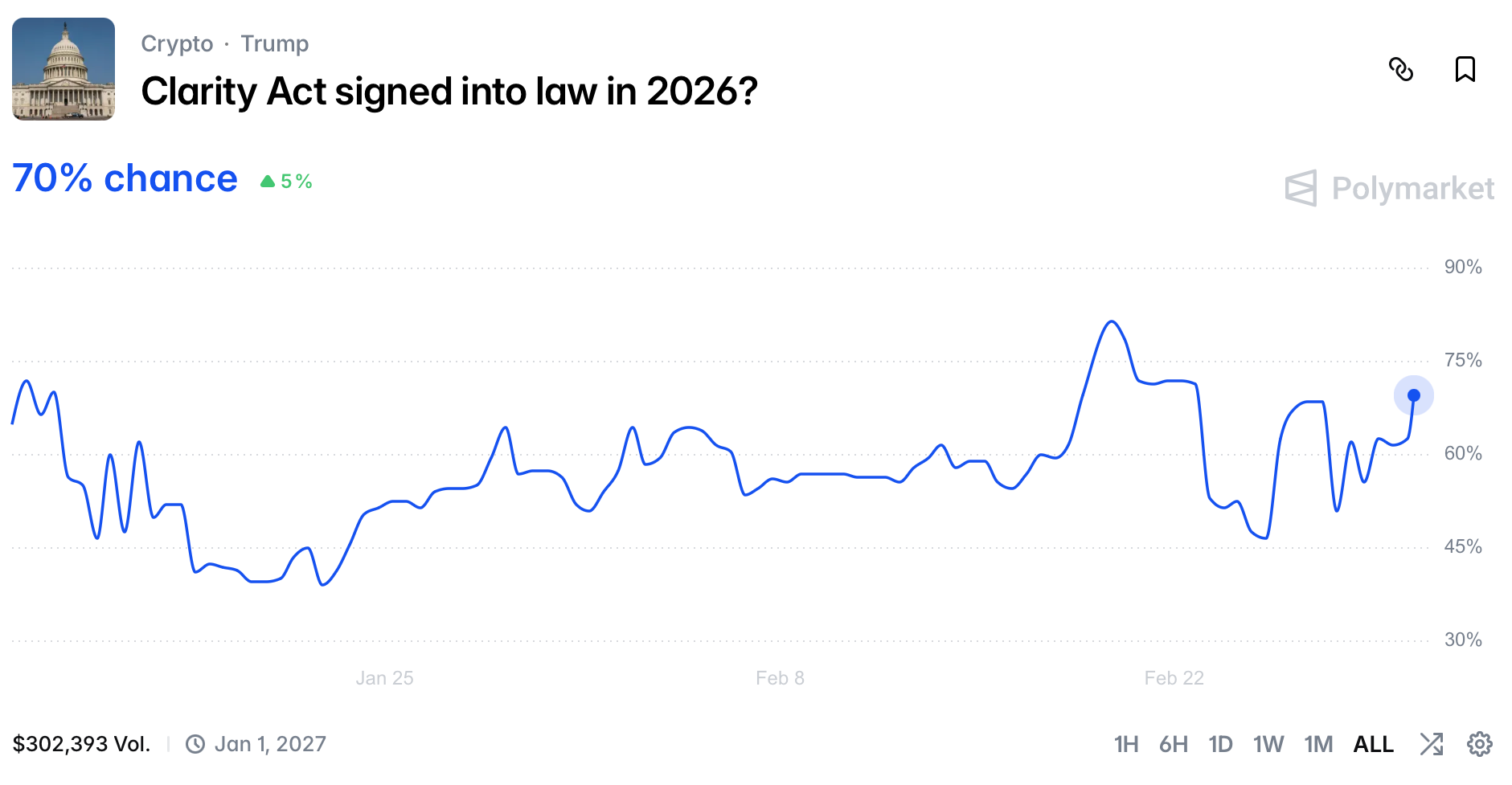

The debate has become one of the most contentious issues surrounding the CLARITY Act, proposed US legislation aimed at establishing a broader regulatory framework for digital assets. On Jan. 14, Coinbase CEO Brian Armstrong withdrew his support for the bill, citing stablecoin yield as one of the key sticking points.

Still, some lawmakers remain optimistic. On Feb. 18, US Senator Bernie Moreno said he hopes Congress can move forward on market structure legislation by April, speaking to CNBC at US President Donald Trump’s Mar-a-Lago property in Florida. Armstrong, who joined Moreno in the interview, also said he believes there is a path forward “where we can get a win-win-win outcome here.”

Prediction market data from Polymarket currently assigns a 70% probability that the Clarity Act will be signed into law in 2026.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

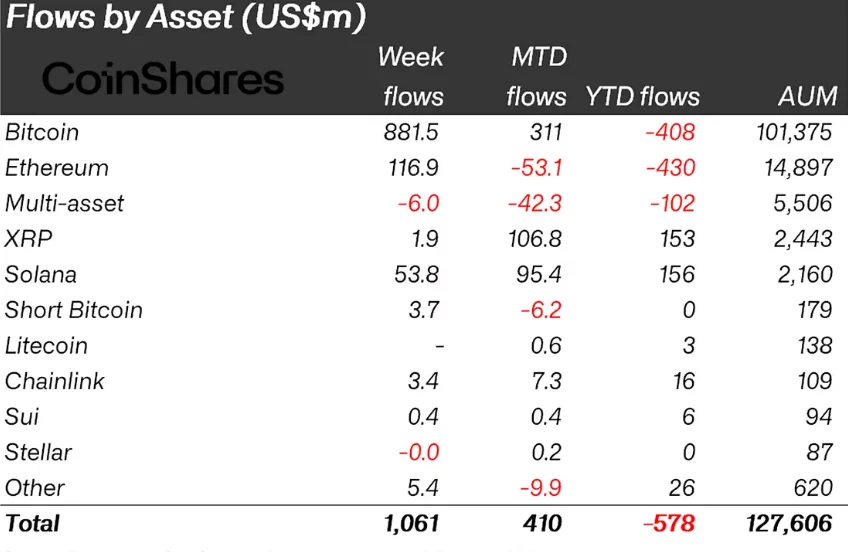

Crypto funds snap outflow streak with $1bn inflows amid Middle East strikes

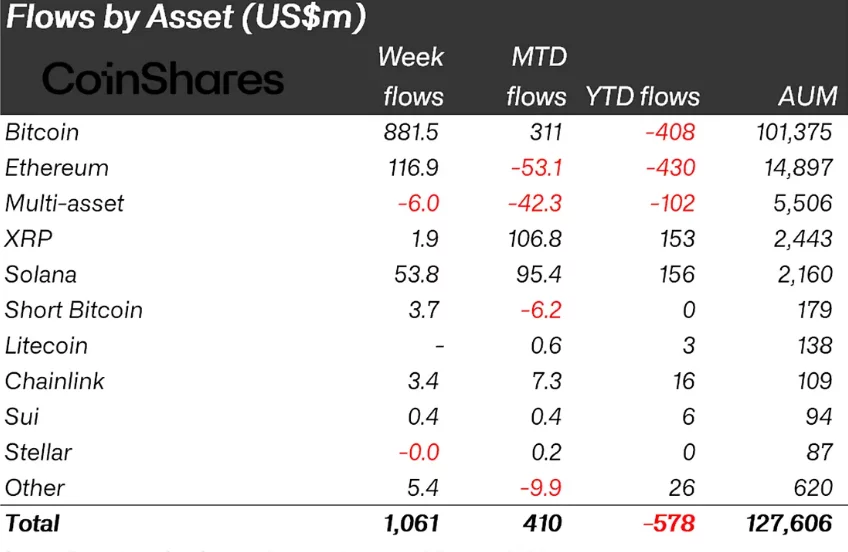

Crypto funds demonstrated remarkable resilience this week as investment products recorded $1.06 billion in net inflows, effectively terminating a grueling five-week stretch of $4.0 billion in outflows.

Summary

- Despite the US-Iran conflict, $1.06 billion in inflows ended a month-long $4.0 billion outflow streak as institutions bought the technical reset.

- Bitcoin led the recovery with $881.5 million in inflows, though $3.7 million in short-BTC positions highlights lingering caution over regional instability.

- Solana remains the year-to-date leader in altcoin inflows at $156 million, while Ethereum posted its best weekly performance in nearly two months.

Crypto funds see $1 billion resurgence

This pivot comes at a critical juncture for global markets as the escalating US-Iran conflict has introduced severe geopolitical instability following military strikes in late February 2026.

While the broader market context remains defensive due to these tensions, institutional sentiment was buoyed by recent price weakness and technical resets, which large-scale holders interpreted as an attractive entry window.

Regional participation was overwhelmingly positive, with the United States accounting for $957 million of the total inflows despite the geopolitical headwinds. Other key markets including Canada, Germany, and Switzerland also saw continued interest, contributing a combined $94.2 million.

Bitcoin (BTC) remained the primary beneficiary of this trend, capturing $881.5 million in weekly inflows.

However, the market remains polarized as evidenced by $3.7 million flowing into short-bitcoin products, suggesting that a segment of investors is still hedging against potential downside risks linked to the ongoing conflict in the Middle East.

Ethereum saw a significant resurgence with $116.9 million in inflows, its strongest performance since mid-January, indicating that institutions are looking past short-term volatility toward long-term value.

In the altcoin sector, Solana continues its dominant streak, attracting $53.8 million last week and bringing its year-to-date inflows to $156 million. Chainlink also recorded minor interest with $3.4 million in inflows.

The strong institutional activity suggests that while geopolitical events like the US-Iran strikes create short-term fear, the “smart money” is utilizing the resulting price resets to rebuild positions in core digital assets.

Crypto World

Iranian Crypto Outflows Jump 700% After US-Israeli Airstrikes

Crypto Breaking News is a fast-growing digital media platform focused on the latest developments in cryptocurrency, blockchain, and Web3 technologies. Our goal is to provide fast, reliable, and insightful content that helps our readers stay ahead in the ever-evolving digital asset space.

Web3 Digital L.L.C-FZ

License Number: 2527596

📞 +971 50 449 2025

✉️ info@cryptobreaking.com

📍Meydan Grandstand, 6th floor, Meydan Road, Nad Al Sheba, Dubai, United Arab Emirates

Crypto World

Ethereum Price Prediction March 2026: Bearish, But With Hope

The Ethereum price enters March after a brutal February that delivered close to 20% losses. ETH has now posted six consecutive red months starting from September 2025, a streak unprecedented in the token’s history. If March finishes in the red, it would extend to seven months, further cementing this as the longest sustained decline Ethereum has ever seen.

While March historically carries a median return of nearly 9% for ETH, the current setup suggests history may offer little guidance. Here is what the data shows.

The Weekly Chart Has Already Broken Down

Even February 2025, which saw a 32% decline, immediately saw a recovery attempt over the next few months. This time, the selling has been relentless, and the weekly chart explains why. Six straight months of red, excluding March (just formed), is no mean bearish feat.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Since April 7, 2025, the Ethereum price has been trading within a head-and-shoulders pattern. It is a bearish reversal structure in which a central peak (the head) is flanked by two lower peaks (the shoulders). The breakdown confirmed in early January 2026, and it was not a minor dip. It was a structural break.

The measured move from this pattern projects a roughly 53% decline from the breakdown line, targeting approximately $1,320. While that level has not yet been reached, the pattern remains active and unresolved.

Making matters worse, two additional bearish crossovers are forming on the weekly Exponential Moving Averages (EMAs), which smooth price data to highlight trend direction.

The 50-period EMA is closing in on the 100-period EMA, and the 20-period EMA is approaching the 200-period EMA. The last confirmed crossover — when the 20 EMA crossed below the 50 EMA in early January — preceded a 46% correction.

If these new crossovers confirm, they would reinforce the bearish trend on the higher timeframe.

Ethereum ETF Outflows Offer No Institutional Floor

Unlike Bitcoin, where spot ETF outflows have been steadily declining, Ethereum’s ETF picture is deteriorating. February recorded $369.87 million in net outflows — higher than January’s $353.20 million. This reversed the improving trend that had briefly offered hope when January’s outflows shrank compared to December’s $616.82 million.

This marks four consecutive months of outflows since November 2025, when $1.42 billion exited. The last positive inflow month was October 2025 at $569.92 million.

For the Ethereum price, this means there is no institutional demand floor forming heading into March. The capital that once supported ETH through ETF channels is withdrawing, and unlike Bitcoin, the bleeding is not slowing down.

HODLers Are Buying, But The Plot Thickens

Against this bearish backdrop, one on-chain metric stands out. Ethereum hodlers — wallets that have held ETH for 155 days or more — have sharply increased their buying. On February 21, the hodler net position change metric was a modest +6,829 ETH. By March 1, it surged to +252,142 ETH, a massive 3,500% spike that on the surface looks like strong conviction.

But context complicates this signal. The last major hodler buying spell began on December 26, 2025, when the Ethereum price was around $2,920. They kept accumulating as the price climbed to $3,350 by January 14. Then the weekly EMA crossover triggered, and the price began falling sharply. Hodlers continued buying through the decline. Their net position only turned negative on February 2, when the price had already dropped to $2,340.

Many of these hodlers are therefore likely trapped between $2,340 and $3,350. The current buying surge may not represent fresh bullish conviction but rather an attempt to average down and break even. Retail investors should be cautious about following this signal blindly — the motivation behind the buying may be survival, not strategy.

But There Is a Reason They Are Buying; And the Key Ethereum Price Levels to Watch

If hodlers are trapped, why are they increasing exposure now, in a weak market? The 12-hour chart may hold the answer.

Between February 12 and February 28, the Ethereum price printed a lower low while the Relative Strength Index (RSI) — a momentum oscillator — printed a higher low. This forms a bullish divergence, a signal that selling momentum is weakening even as the price drops. That divergence has already triggered a bounce, with the Ethereum price rallying approximately 11.7% from the lows.

More importantly, this bounce is shaping an inverse head and shoulders pattern on the 12-hour chart; a bullish reversal structure. This is likely what hodlers are positioning for — a short-term breakout that could help them recover losses from the January trap. The technical setup is real, and the RSI divergence has already been validated by the initial bounce.

The neckline sits around $2,160–$2,180. If the Ethereum price closes above this level, the measured move projects a roughly 19% rally, targeting approximately $2,590. Before that, the Fibonacci extension levels at $2,050 and $2,400 would serve as intermediate resistance zones.

On the downside, a drop below $1,830 weakens the inverse head and shoulders. A close below $1,790 invalidates the bounce thesis entirely, and the weekly head and shoulders reasserts dominance — placing the $1,320 target back in focus.

The most probable path for March mirrors Bitcoin’s setup: a bounce attempt driven by the 12-hour structure and hodler accumulation, followed by renewed pressure as the weekly trend remains firmly bearish.

The bounce is real, but it is fighting against a much larger breakdown.

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Sports3 days ago

The Vikings Need a Duck

-

Crypto World7 days ago

Crypto World7 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment19 hours ago

Entertainment19 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World6 days ago

Crypto World6 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers