Entertainment

What Is President Donald Trump’s Neck Rash? Doctor Details Cause

Donald Trump’s doctor gave some insight into the neck rash that has been spotted on the back of the president’s neck in recent weeks.

“President Trump is using a very common cream on the right side of his neck, which is a preventative skin treatment,” Dr. Sean Barbabella said in a statement to CNN on Monday, March 2. “The President is using the treatment for one week, and the redness is expected to last for a few weeks.”

The medical professional did not reveal the reason why Trump, 79, needed the cream. The White House has not addressed the president’s skin issue.

Earlier on Monday, Trump participated in the Medal of Honor Ceremony at the White House. During the event, Trump was seen with what appeared to be a red rash with scabs on the back right side of his neck. The skin issue could be seen near the president’s hairline and extended to the collar of his shirt.

This isn’t the first time Trump has been seen with skin issues. He has previously been photographed with bruises on his hand that sometimes have been covered by makeup. White House press secretary Karoline Leavitt addressed Trump’s bruising in a February 2025 press conference.

“President Trump has bruises on his hand because he’s constantly working and shaking hands all day every day,” Leavitt said at the time. “President Trump is a man of the people. His commitment is unwavering, and he proves that every single day.”

Later that year, Barbabella revealed that Trump, who is the oldest president to take the oath of office, was diagnosed with chronic venous insufficiency. The condition is a form of venous disease that occurs when veins in a person’s legs are damaged, per the Cleveland Clinic.

“In recent weeks, President Trump noted mild swelling in his lower legs,” Barbabella wrote in a note read by Leavitt in a July 2025 press conference. “In keeping with routine medical care and out of an abundance of caution, this concern was thoroughly evaluated by the White House Medical Unit.”

Barbabella’s note added that the chronic venous insufficiency is a “benign and common condition, particularly in individuals over the age of 70.” He reiterated that Trump is in “excellent overall health.”

Earlier this year, Trump shared that his bruising was a result of the amount of aspirin he takes. In a January 2026 interview with the Wall Street Journal, Trump revealed he takes 325mg of aspirin a day (According to the Mayo Clinic, the typical daily dose for aspirin therapy ranges between 75 mg and 325 mg.)

“They say aspirin is good for thinning out the blood, and I don’t want thick blood pouring through my heart,” he told the outlet. “I want nice, thin blood pouring through my heart. Does that make sense?”

Later that month, Trump was seen with a bruise on his left hand instead of his right. (Trump shakes hands with his right.)

Leavitt revealed that the left-handed bruise was caused by Trump hitting his hand into the corner of a table.

Entertainment

Hillary Clinton Argues With Nancy Mace During Epstein Deposition, Video Shows

Hillary Clinton & Nancy Mace

New Video Shows Wild On Camera Confrontation

Published

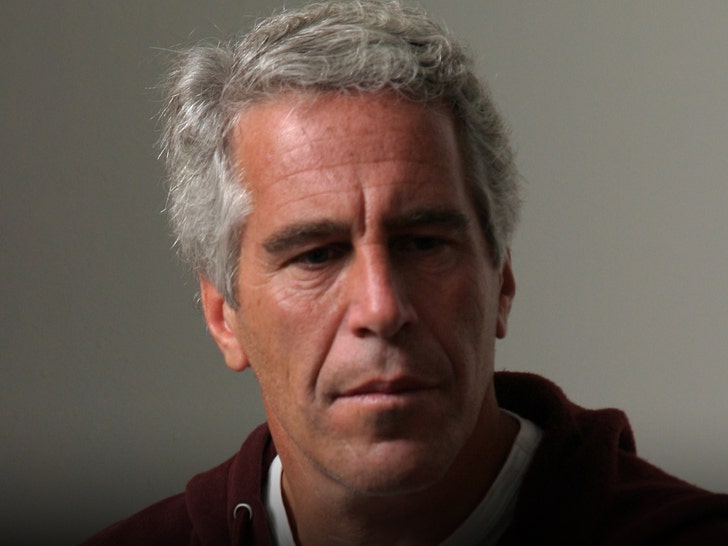

Hillary Clinton locked horns with Nancy Mace while the former secretary of state was deposed about Jeffrey Epstein last week — and their heated back and forth was caught on newly released video.

The GOP-led House Oversight Committee grilled Clinton for hours during her February 26 deposition over her alleged ties to Epstein, which Hillary said did not exist.

Things turned ugly when Mace, a republican South Carolina congresswoman, started questioning Clinton about how she knew Commerce Secretary Howard Lutnick. Recently, Lutnick has come under intense scrutiny over his past association with Epstein, who was convicted in 2008 for soliciting a minor for prostitution in Florida.

Waiting for your permission to load the Twitter Tweet.

Check out the clip, released Monday by the oversight committee … Hillary responded that she met Lutnick after 650 of his employees at Cantor Fitzgerald — a financial services firm in the World Trade Center — were killed during the 9/11 attacks in 2001 while Clinton was a New York senator.

At one point, Mace interrupted Clinton, claiming the ex-senator was trying to dance around the question while the congresswoman pointed out she’s a survivor of rape just like Epstein’s numerous victims.

Mace then cited an email from Lutnick to Epstein, which asked the convicted pedophile to donate money to Hillary for a political event at Cantor Fitzgerald.

That’s when Hillary fought back, shouting at Mace to allow her to finish answering the question. Hillary also tried to sympathize with Mace over her being sexually assaulted … but that didn’t soften Mace one bit.

The two clearly couldn’t stand each other. See for yourself and watch the clip.

Entertainment

Todd Meadows, “Deadliest Catch ”deckhand, dies at 25

:max_bytes(150000):strip_icc():format(jpeg)/Todd-Meadows-030226-b657c942f34441c8a585c631ed171d40.jpg)

A spokesperson for Discovery Channel described the loss of Meadows as “devastating.”

Entertainment

Dax Shepard prepares for invasive medical procedure as wife Kristen Bell hosts Actor Awards 2026

:max_bytes(150000):strip_icc():format(jpeg)/Dax-Shepard-Kristen-Bell-030126-17b42082a1d5489889456f1c61127949.jpg)

Sunday’s ceremony marked Bell’s third time hosting the event formerly known as the SAG Awards.

Entertainment

Savannah Guthrie embraces family members while visiting memorial at missing mother Nancy's house

:max_bytes(150000):strip_icc():format(jpeg)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-05-4a37602367524c8c8fb644ae5f95f3de.jpg)

The “Today” cohost wrote on Instagram that the family felt “the love and prayers” from around the world, adding, “Please don’t stop praying and hoping with us.”

Entertainment

Netflix Is Quietly Adding All 205 Episodes of This Controversial Sitcom

There’s a certain kind of TV lightning that only strikes once. The sort of show that doesn’t just entertain viewers but reshapes what the medium is allowed to say out loud. This is great news for All in the Family, as Netflix is set to release all 205 episodes of the show as part of its upcoming release of two major parts and two minor parts. New viewers will be able to discover a sitcom that played an important part in changing television forever.

For old fans, it brings back many memories of what was sure to be an unforgettable moment in television history for many years to come. A 30-year-old program has left an indelible mark on the comedy landscape; almost anyone who has ever watched an episode can give a detailed rundown of the show from start to finish. Although there are some very serious political and social overtones present throughout much of the series, these elements are all treated with a humorous tone.

The 1971 premiere of All in the Family on CBS had a significant impact on television comedy because, instead of bending the rules of comedy, it steamrolled them. The series was developed by Norman Lear and Bud Yorkin and was based on the British comedy Till Death Us Do Part, but it developed into a uniquely American television series. At the time of its premiere, sitcoms were primarily made for escapism, and All in the Family placed the viewer in the Queens apartment of working-class family man Archie Bunker (Carroll O’Connor), who held an array of non-complimentary opinions that caused constant strife with his family.

Throughout its run, All in the Family examined topics that very few primetime comedies did: racism, sexism, the Vietnam War, women’s liberation, and the generations of people who differ in many ways. The gamble paid off. The series didn’t just become a hit; it dominated the ratings for five consecutive years in the early 1970s. More importantly, it proved that audiences would show up for comedy that didn’t pretend the real world wasn’t happening outside the living room window.

Archie Bunker Remains One of TV’s Most Complicated Leads

At the center of the show’s staying power is Archie Bunker, who is often described as a “lovable bigot,” and the contradiction is the point. He’s stubborn, frequently wrong, and often offensive — but he’s also human, vulnerable, and occasionally capable of growth.

The show’s genius was in surrounding him with people who constantly challenged his worldview: his warm but sharper-than-she-seems wife, Edith (Jean Stapleton), his increasingly independent daughter, Gloria (Sally Struthers), and his progressive son-in-law, Michael, better known as Meathead (Rob Reiner).

What followed were arguments that felt ripped from actual American households. Lear’s formula was deceptively simple: put clashing worldviews in the same room and let them talk — loudly. The result was a sitcom that functioned as both comedy and cultural mirror.

Why the Show Still Feels Uncomfortably Relevant

One of the best reasons to revisit this series in 2026 is that the core conflicts face many of the same challenges they did when originally aired. Throughout its history, the series dealt openly and honestly with many of the same hard-hitting issues that were hard-hitting for network television at the time; among them were homophobia, reproductive rights, mental illness, and class conflict. The fact that an episode from very early in the run (Season 1, Episode 6) contained one of the first openly gay characters (played by Philip Carey) to appear on an American network television show (albeit by the standards of today, it’s not the greatest representation) demonstrates how groundbreaking this particular series was during its original run.

In addition, the series portrayed many elements that comedies often struggle to show: it maintained sufficient levels of censure to remain funny while also providing a great deal of character development. The family scene in the series also included emotional moments; this was evident when the family mourned the loss of their father, dealt with financial issues, and adjusted to changing cultural standards.

Many current television series that push boundaries, whether cartoons or prestige dramas, owe a tremendous debt to this show’s ability to deliver a large audience with entertaining and controversial characters, events, and storylines. It provided the viewer with evidence that increasing levels of controversy and viewer acceptance do not preclude a series from being a success.

Streaming Gives a New Generation a Chance to Reevaluate

The arrival of all nine seasons on Netflix is more than a nostalgia play because streaming changes how the show is experienced. What once unfolded weekly — and sometimes contentiously — can now be watched in rapid succession, making the character evolution and thematic through-lines easier to track.

It also invites a fresh conversation about what “controversial” TV looks like today. Plenty of modern comedies are edgier on paper, but few operate with the same combination of mainstream reach and willingness to make viewers genuinely uncomfortable.

Not every joke lands the same way in 2026, and the series is undeniably a product of its time, but that friction is part of the value. The show was designed to provoke discussion — and, ideally, reflection. With its full run finally easy to binge, the sitcom’s legacy is likely to spark debate all over again. And honestly, that feels exactly in the spirit of the Bunker household.

Entertainment

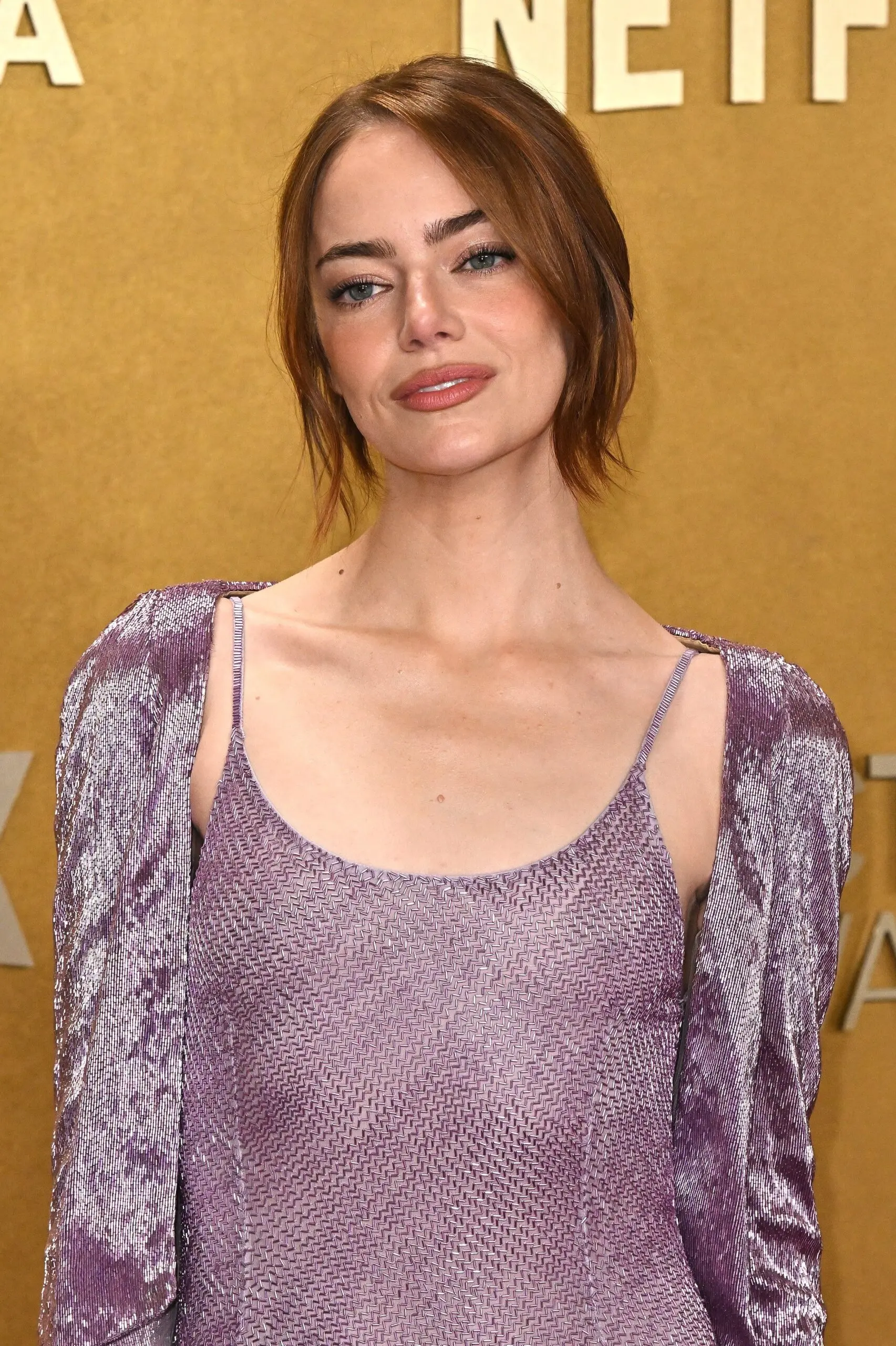

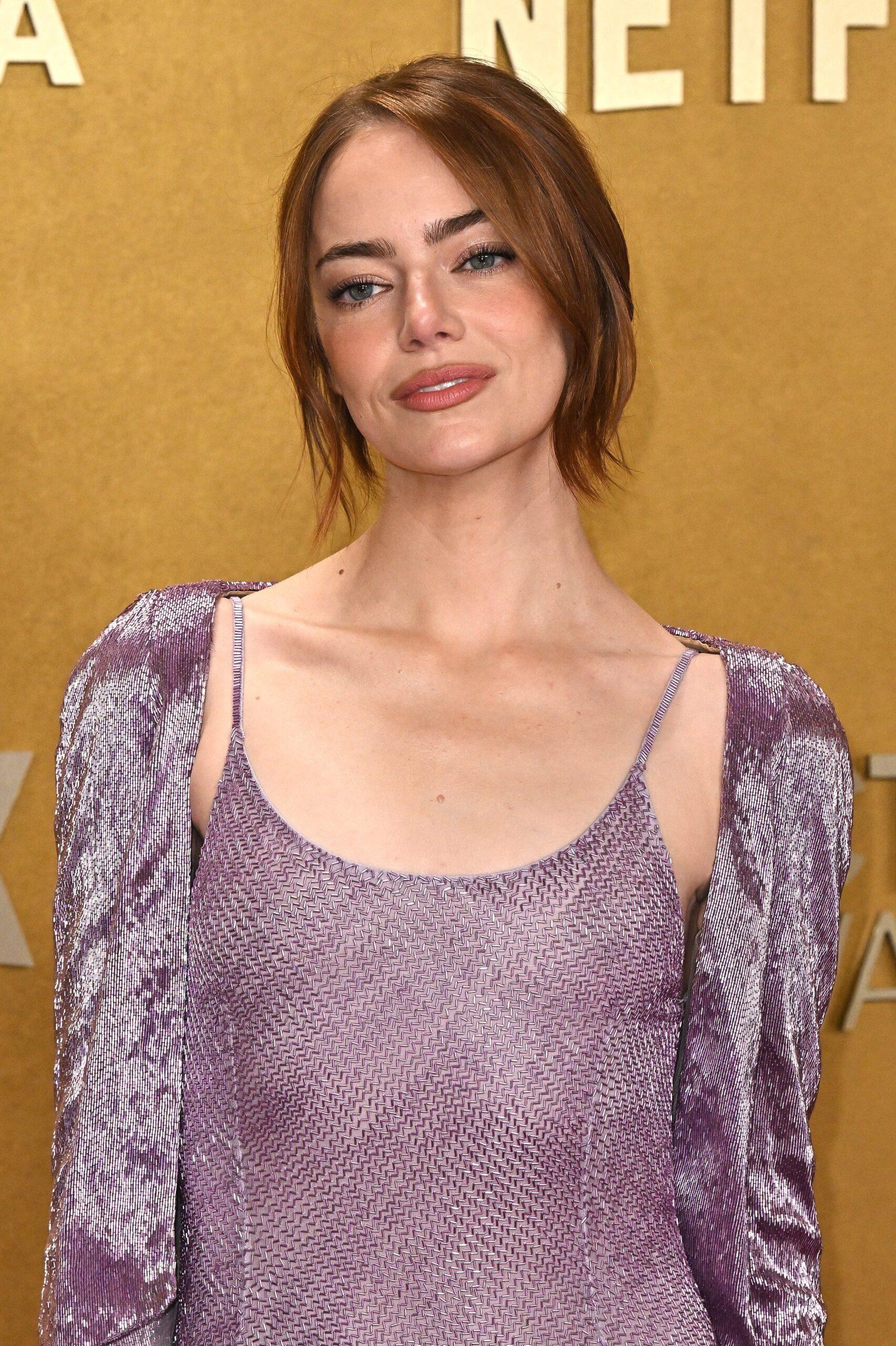

Emma Stone’s ‘New Face’ At Actor Awards Surprises Fans

Emma Stone has recently sparked online debate, with fans questioning why her appearance seems subtly different.

The conversation began at Paris Fashion Week and resurfaced at the Screen Actors Guild Awards, where her red carpet look drew comparisons and speculation.

As social media buzz grew, cosmetic experts began weighing in with their theories, fueling even more curiosity about what, if anything, may have changed with Emma Stone’s face.

Article continues below advertisement

Emma Stone’s Evolving Looks Spark Online Buzz At Paris Fashion Week Qatar SAG Awards

Stone’s changing look has become a hot topic online, with many fans admitting they are puzzled by what seems different about her appearance. As one social media user put it, she “looks so different,” yet it’s hard to pinpoint exactly why.

Speculation first intensified during Paris Fashion Week last year, when photos of the “Bugonia” star alongside BLACKPINK’s Lisa began circulating.

Some commenters described Stone as a more glam version of herself, while others compared her features to a Bratz doll aesthetic.

The conversation picked up again at the Screen Actors Guild Awards (now known as the Actor Awards), where the 37-year-old wore a purple Louis Vuitton gown paired with a coordinating cardigan, and styled her hair in a refined updo and chose soft, warm-toned makeup.

Article continues below advertisement

Fans Have Mixed Reactions To The Actress’s ‘New Face’

Despite the elegant look Stone wore to the event, fans once again debated her appearance.

Some joked that she looks like “if Lindsay Lohan and the OG Emma Stone had a child,” while others likened her to a red-haired Margot Robbie.

One person on TikTok wrote, “IDC if it’s a new face it’s gorgeous,” while another said, “Idk what she did to her face but she looks soooo gooood.”

A third person commented, “She looks incredible, but I get a slight uncanny valley look just in her gaze.”

Another noted, “She’s done something to her face. Looks good tho.”

An unsure fan stated, “I’m torn between oh no, Emma, and oh yes, she looks amazing,” while another said, “She looks amazing, but that’s a whole new face.”

Article continues below advertisement

Experts Weigh In On Emma Stone’s Changing Appearance

As the conversation intensified, several cosmetics professionals publicly offered their opinions on Stone’s “new face.”

According to BoredPanda, Dr. Hazan suggested in an interview with Daily Express that Stone’s lifted, cat-eye effect could potentially be the result of Botox or a brow lift.

Similarly, Beverly Hills plastic surgeon Dr. Babak Dadvand told The Sun that her features might align with procedures such as a brow lift, upper blepharoplasty (eyelid surgery), or lower eyelid surgery.

Just last year, London-based aesthetics doctor Dr. Jonny Betteridge also shared a TikTok video analyzing Stone’s look, suggesting the changes could align with procedures such as an upper blepharoplasty, an endoscopic temporal brow lift, or a mid-face lift.

Article continues below advertisement

According to Dr. Betteridge, a mid-face lift is designed to elevate and tighten the central portion of the face. He added that the incisions “are well hidden in the hairline, temporal area, or inside the mouth, which helps to reduce visible scarring.”

Article continues below advertisement

Emma Stone Reflects On Body Image And Urges Kindness

Meanwhile, at the BAFTAs earlier this year, discussion about Stone revolved around her slim figure, with some fans pointing to visible collarbones and sunken cheeks, as well as her slender frame, as signs that she may be underweight.

However, the “La La Land” actress has previously spoken about her complicated relationship with body image, saying she felt “disgusted” with her appearance.

In a 2012 interview with S Magazine, she admitted to moments of insecurity, recalling times she felt self-conscious about eating or her appearance. The actress emphasized that such feelings are common and part of being human.

Stone later attributed her slim frame to genetics and stress during a 2014 interview with Seventeen Magazine.

“I’ve seen articles or comments that have addressed my weight of ‘caving to pressure to be thin,’” the actress said at the time. “Keeping weight on is a struggle for me, especially when I’m under stress and especially as I’ve gotten older.”

Stone continued, “That’s the way my genes have decided to go, and things will change as time goes on, as does everything. So when completely untrue statements are made about me or my health, of course, a part of me wants to defend.”

Article continues below advertisement

Emma Stone Reveals Why She Changed Her Name Before Finding Fame

Amid the renewed attention, Stone has also recently shared a lesser-known detail about her career. Despite spending more than two decades in Hollywood, “Emma Stone” isn’t the name she was born with.

The actress, nominated at the Screen Actors Guild Awards presented by SAG-AFTRA on March 1 for her role in a Yorgos Lanthimos film, revealed that her real name is Emily Stone.

When she applied for her SAG card at 16, however, she discovered the name was already taken and had to choose a stage name.

During an October 2025 appearance on “The Late Show” with Stephen Colbert, the actress explained that her first stage name wasn’t “Emma” at all. “I actually adopted a stage name for six months,” she said. “I was 16, and I decided I wanted to be Riley. For like six months, I was Riley Stone.”

That choice, however, didn’t last long. While guest-starring on “Malcolm in the Middle,” the sitcom led by Frankie Muniz, she quickly realized the name didn’t feel natural.

“They kept going, ‘Riley, Riley!’ and I had no idea who they were talking to. Truly,” she recalled.

The confusion made her rethink the decision. “So I was like, ‘I cannot be Riley.’ It came out of nowhere,” she joked. Eventually, she settled on “Emma,” a name she felt was close enough to Emily to feel authentic.”

Entertainment

John Oliver Roasts Potential New ‘Business Daddy’ Paramount

On Sunday, March 1, John Oliver took aim at his possible new “business daddy.” Last week, Netflix backed out of the bidding war for Warner Bros., which means that David Ellison’s Paramount Skydance seems all but certain to take over HBO, the home of his late-night show, “Last Week Tonight.”

Article continues below advertisement

John Oliver Slams His New ‘Business Daddy’ Amid HBO Takeover Drama

Although Hollywood had plenty of concerns when Netflix was poised to take over the studio, Oliver seemed more perplexed by the thought of Paramount becoming his new boss.

“It turns out we might be getting a new business daddy,” he said on the March 1 episode of “Last Week Tonight,” as per The Hollywood Reporter.

He went on to say, “Yeah, not great news. In fact, if I may quote anyone who’s ever accidentally sat on their Roku remote, ‘Oh sh-t, I’m in Paramount now, how the f-ck do I get out of this?’”

Article continues below advertisement

John Oliver Previously Slammed AT&T

In 2022, Discovery and WarnerMedia combined to create Warner Bros. Discovery, and AT&T ceded control of HBO. At the time, Oliver reflected on the merger, saying, “Interestingly, as of Friday, AT&T officially no longer owns us, so it is goodbye from me, Business Daddy. Let me just say this.”

He then proceeded to hold up two middle fingers, adding, “which is frankly two more bars than you have ever had.”

Article continues below advertisement

Netflix Called The Deal ‘No Longer Financially Attractive’

In a joint statement, Netflix co-CEOs Ted Sarandos and Greg Peters called the deal “no longer financially attractive.” He went on to say that it “was always a ‘nice to have’ at the right price, not a ‘must have’ at any price.”

“The transaction we negotiated would have created shareholder value with a clear path to regulatory approval,” the statement continued. “However, we’ve always been disciplined, and at the price required to match Paramount Skydance’s latest offer, the deal is no longer financially attractive, so we are declining to match the Paramount Skydance bid.”

Article continues below advertisement

David Ellison Is Focused On ‘Reinventing The Business’

A day after John Oliver’s statement, the CEO of Paramount, David Ellison, spoke at length about the $110 billion megadeal that will not only include streaming services like HBO Max and Paramount+, but also TV channels like CBS, TNT, CNN, MTV, Nickelodeon, HGTV, and many more.

“By uniting our iconic studios complimentary streaming platforms with a global footprint, our cable and linear networks, and our world-class IP, we have the opportunity to help shape the future and build a next generation media and entertainment company. This has been our goal since day one,” Ellison said, as per The Hollywood Reporter.

Article continues below advertisement

“This is not about consolidation, it’s about reinventing the business,” he continued. “We want to expand our reach and enhance our ability to create the world’s most compelling stories and experiences. And we’re incredibly excited about this transaction, and it will accelerate that ambition.”

Ellison confirmed that HBO Max and Paramount+ will be combined into one major streaming platform once the deal closes and committed to 45-day theatrical windows, before sending films to premium video on demand (PVOD).

John Oliver Fans Want To See Him Head Over To Netflix

With John Oliver voicing his distaste for Paramount and “The Late Show with Stephen Colbert” wrapping up later this year, one fan took to Reddit to suggest that both Oliver and Colbert should make deals with Netflix.

“Netflix has been trying to make talk shows work for them. Picking up Oliver and Colbert would be a much better way to manage it,” one user offered. “It seems like they’ve built up the goodwill in the industry, so I don’t know why they wouldn’t do it.”

“If there’s a world where I can see a late-night lineup of John Mulaney, Oliver, and Colbert on one platform, I’d be sooo happy,” another fan agreed. “The Netflix Is A Joke festival is massive. I’m sure they’d be interested in Colbert and Oliver when the opportunity comes.”

Entertainment

St. Patrick’s Day T-Shirts

Pinch-Proof ☘️

St. Paddy’s Day Fits

Published

TMZ may collect a share of sales or other compensation from links on this page.

St. Patrick’s Day comes with a dress code … and you definitely don’t want to risk getting caught not wearing green.

So it’s best to plan ahead. This year, go all out with your St. Paddy’s Day wardrobe, whether you’re Irish or just looking to feel (and get) lucky.

These tees will guarantee you won’t be getting pinched by a leprechaun … although we can’t say the same for everyone else at the bar.

St. Patrick’s Day Shenanigans T-Shirt

What is St. Patrick’s Day for if not shenanigans? If you know things are bound to get a little crazy, then this St. Patrick’s Day Shenanigans T-Shirt is for you.

Whether you’re pounding beers or searching for a pot of gold, let this tee be the pop of green you need for everyone’s favorite Irish holiday.

Sassy Lassie T-Shirt

This tee couldn’t be more you. Starbucks? Check. A pop of cheetah print? Check.Your signature peace sign pose you’ve been using since 2011? Check.

This St. Patrick’s Day Sassy Lassie T-Shirt has got it all. It’s the only shirt you need to bring your iconic Irish vibes this March.

If you’ve got a teenage boy in your life that’s all about that skibidi toilet rizz, then this St. Patrick’s Day Bruh Leprechaun T-Shirt was probably made for them.

Featuring a leprechaun that’s dabbing (because what else would he be doing?), this tee is guaranteed to turn heads in the hallway on St. Paddy’s Day.

Hearts, stars and horseshoes! What better way to celebrate than with the world’s most famous leprechaun?

This nostalgic St. Patrick’s Day Lucky Charms T-Shirt features a vintage print of Lucky the Leprechaun and his iconic rainbow. And after a day of drinking, it’ll surely inspire a late night run to the supermarket for your own magically delicious box of cereal.

Pinch Me & I’ll Punch You T-Shirt

Honesty is the best policy. This St. Patrick’s Day Pinch Me & I’ll Punch You T-Shirt tells it like it is … and comes with a warning to anyone who thinks they’re going to give you a pinch.

But since this tee has you covered with your mandated St. Paddy’s day green, getting pinched shouldn’t be a big problem anyway.

Kiss Me I’m Irish T-Shirt

Can’t go wrong with a classic. This tried and true St. Patrick’s Day Kiss Me I’m Irish T-Shirt is perfect for parades, bar hopping and whatever other shenanigans you have in store for the big day.

Whether you’re Irish or just pretending to be, this tee is guaranteed to get you a lot of attention.

Celebrate your heritage all year long with this Pinch Me I’m Irish Magnet. Reminisce on your Irish pride every time you pull a Guinness out of the fridge or grab your ingredients for your famous corned beef. We’re fairly certain this will earn you some pinches … even if you are wearing green.

Sign up for Amazon Prime to get the best deals!

All prices subject to change.

Entertainment

‘The Rookie’s Newest Partnership Takes the Spotlight Over a Flashy ‘Game Changers’ Cameo

One of the best things about ABC’s The Rookie is its ability to pair up characters in a way that feels comfortable, but also exciting and new. The procedural has been incredibly successful even after moving on from its original premise of John Nolan (Nathan Fillion) being a rookie officer in the Los Angeles Police Department. There have been several rookies that have joined the force and become skilled police because of the tutelage they have received from their training officers. This week’s episode switches things up by allowing one of its detectives to go back into the field with a rookie that still needs a lot of help. This creates a new partnership that feels familiar, yet still fresh.

‘The Rookie’ Throws Nyla and Miles Together on a Bank Robbery Case

We learned last week that Nyla Harper (Mekia Cox) has been demoted from detective because of her inappropriate conduct with serial killer Liam Glasser (Seth Gabel) last season. She is now being required to head back into uniform as a patrol cop, but to add insult to injury, she discovers at the beginning of Episode 9 that she’ll be working as a training officer once again. Her new rookie will be Miles Penn (Deric Augustine), who’s also fresh off disciplinary action from the department. Things are a bit uncomfortable from the start, as Nyla’s strategy to train Miles is to have him act as the training officer and offer guidance to her as if she were a rookie. Soon, they’re assigned to intercept two bank robbers, and this is when things get interesting.

The two bank robbers happen to be young women, both of whom have been shot. At the hospital, they learn one of the women has died from her injuries. Her girlfriend is in recovery, and Miles thoughtfully interrogates her (based on Nyla’s advice). She confesses that they robbed the bank because she’s over $200,000 in debt from student loans from Stanford. Miles and Nyla know there was a third robber, but aren’t sure who they are. The grandmother of the young woman arrives at the hospital when the police put the pieces together.

Meanwhile, a criminal we’re sick of returns for another heart-pounding episode.

The grandmother had actually robbed a bank back in 1983, and helped her granddaughter plan and execute this new heist. The elderly woman is arrested in front of her hysterical granddaughter, all the while insisting that the fact that the two girls couldn’t simply get ahead in life isn’t right. This is a fascinating case because the suspects aren’t your average bank robbers, and it’s even more entertaining because of Nyla and Miles’ new partnership. At the end of the day, Nyla accepts that Miles is her new rookie, and I’m excited to see even more scenes with these two characters working together.

‘The Rookie’ Season 8, Episode 9 Provides a Crossover with ‘Game Changers’

Episode 9 sees Nolan back with his old rookie, Celina Juarez (Lisseth Chavez). They head to the site of a different robbery, where they discover an improv comedy group has been robbed. This episode then becomes a crossover with Dropout’s Game Changer game show series, including an appearance by Sam Reich. The case actually offers plenty of comic relief for the episode, because the characters involved are intent on cracking non-stop jokes instead of helping Nolan and Celina solve the case. The cops discover that the criminal left his wallet while fleeing which jump-starts their investigation. Eventually, they learn that the wallet was lost inadvertently by an innocent man, and that Reich’s character actually set up a fake robbery for his show, which unsurprisingly turned into a real one. As someone who hasn’t seen Game Changer, these scenes were still silly and fun because of the actors’ commitment to the bit. The only loose end to appear in the episode is that Dash (Beckett Hawley), the drone kid from Season 7, shows up with the Game Changer crew. I don’t really have any idea why he’d appear in the episode, unless there’s a further storyline developing down the line.

There’s one other crime that gets investigated by the gang in this episode. Two people come into the hospital having been accidentally glued to each other. Lieutenant Wade Grey (Richard T. Jones) notices that they have firing pins from a handgun glued to their bodies, which leads the police to discover that they’ve been producing ghost guns. Celina and Lucy Chen (Melissa O’Neil) locate the criminals working on the ghost guns, as well as the epoxy that the couple used that led to their adhesion. They’re subsequently arrested, but it turns out that this extra case is not all that necessary to the episode’s overall narrative.

There’s More Relationship Drama in This Week’s Episode of ‘The Rookie’

Chenford does have a minor storyline in this week’s episode, where Lucy is chastising Tim Bradford (Eric Winter) about his failure to respond to his mom in their group chat. I’m not loving that Lucy basically comes across as a nagging girlfriend throughout this episode, and the conflict does feel a bit repetitive. I do appreciate that Tim’s mother is a callback to the prior episode.

The main relationship drama in The Rookie this week has to do with Wade and his wife, Luna (Angel Parker). Wade discovers that his wife is flirting with a new doctor at the hospital named Oliver Ashton (Charles Michael Davis). Wade even finds Oliver’s sunglasses in Luna’s car, which immediately raises his suspicions that his wife is cheating on him. Wade eventually asks Luna what’s going on, and she admits that while nothing has happened so far between her and Oliver, she does have feelings for him. This is a heartbreaking turn of events, but it is a nice change of pace to see Wade not completely in control of a situation like he usually is.

The episode wraps up with Nolan heading to comfort Wade, even though Bailey (Jenna Dewan) has come home from Washington D.C. for a quick 34-hour trip. I’m not excited to see Bailey back, and this split-second scene just furthers my opinion that her character doesn’t fit into the show’s narrative anymore. Despite this, the episode creates a nice balance of building up new partnerships while also still threatening some formerly solid ones.

New episodes of The Rookie air on Monday nights on ABC, with episodes available to stream on Hulu in the U.S.

Entertainment

Ryan Gosling pauses interview to check on journalist stranded in the desert: 'Do you have help on the way?'

:max_bytes(150000):strip_icc():format(jpeg)/Ryan-Gosling-Fall-Guy-premiere-2024-030226-a78c5f0014234e09949c4710ec87581e.jpg)

Despite promoting his upcoming sci-fi adventure “Project Hail Mary,” Gosling was more concerned for a journalist stuck on the side of the road.

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business7 days ago

Business7 days agoTrue Citrus debuts functional drink mix collection

-

Politics2 hours ago

Politics2 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Sports3 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment1 day ago

Entertainment1 day agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World6 days ago

Crypto World6 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers