Crypto World

Crypto’s RWA Revolution: $25B Market, 37% Growth & Institutional Flows

TLDR:

- RWA tokenized value soared from $1.2B in 2023 to $25.26B in 2026, marking a structural inflection.

- US Treasuries dominate on‑chain RWA with $10B+, signaling confidence in safe collateral.

- 827,951 holders and 20.35% monthly growth point to broadening adoption beyond whales.

- $378.96B in represented RWAs highlights a massive pipeline yet to be tokenized.

Tokenized real‑world assets (RWAs) have quietly shifted from niche pilots to mainstream on‑chain finance. Growing from $1.2B in January 2023 to $25.26B by early 2026, RWAs are now powered by institutional demand, stablecoin liquidity, and programmable finance rails.

With US treasuries as the structural backbone and diverse asset classes gaining traction, the narrative is no longer “if” tokenization scales, but how fast it reshapes global markets.

Treasuries and Core Asset Growth Drive RWA Adoption

The past three years have witnessed a meteoric rise in tokenized real-world assets. They have grown from $1.2 billion in January 2023 to $25.26 billion by January 2026.

The pace of growth accelerated sharply between 2024 and 2026, demonstrating a structural inflection rather than linear expansion. Initially, early adopters tested infrastructure, regulators circled, and institutions dipped their toes.

By 2025, capital was committed, and by 2026, a 4.4× increase in a single year was recorded. This was a mark that RWAs are moving from pilot programs into mainstream financial operations.

At the heart of this surge are US Treasuries, which now constitute over $10 billion of on-chain RWAs. Leading institutions such as BlackRock (BUIDL), Circle (USYC), and Ondo Finance are driving tokenization, creating compliant, yield-bearing instruments.

This shift shows that institutions are starting with low-risk, high-liquidity assets, turning blockchains into programmable money markets.

Gold and precious metals also follow with $5.9 billion in tokenized value, while private credit reaches over $4 billion.

This reflects growing demand for yield diversification. Tokenized equities, though smaller at $963 million, surged 2,900% YoY, highlighting rapid adoption in emerging segments.

Stablecoins and Pipeline Assets Set the Stage for Expansion

Beyond active distribution, the gap between represented ($378.96 billion) and distributed ($25.26 billion) RWAs reveals a massive, untapped pipeline. The bottleneck lies in execution and compliance, not demand.

Meanwhile, stablecoins act as the backbone of liquidity, with $308.96 billion in supply across 223 million holders, powering transactions and enabling fast, frictionless flows.

Institutional adoption is broadening, with 827,951 on-chain asset holders, up 37% month-over-month, signaling participation beyond whales. This layered infrastructure indicates RWAs are no longer speculative.

They are becoming a mainstream financial layer. If current trends continue, industry projections foresee RWA TVL surpassing $100 billion by the end of 2026.

This is as traditional asset managers tokenize index products, equities, and structured credit.

The story is clear: tokenized RWAs have evolved from theoretical pilots into essential plumbing for global finance.

Liquid assets are leading the charge, and stablecoin liquidity is fueling adoption. The on-chain ecosystem is entering its next stage of rapid, institution-driven growth.

Crypto World

Pudgy Penguins, Known For NFT Toys, Dives Deeper Into Soccer

Join Our Telegram channel to stay up to date on breaking news coverage

Pudgy Penguins, a globally recognized non-fungible token brand known for creating NFT-inspired toys, has expanded into soccer through significant NFT partnerships with two leading football clubs. Pudgy Penguins NFT team, which partnered with Spain’s soccer club CD Castellón last year, has now partnered with England’s Premier League soccer club Manchester City. In this article, we shall explore this expansion journey further.

Pudgy Penguins’ Journey From Toys To Soccer

Over the weekend, the Pudgy Penguins team, via its official X account, confirmed that it has dived deeper into the world of soccer. Launched in July 2021, the Pudgy Penguins is a digital asset incubation studio known for creating Pudgy Penguins, a globally recognized non-fungible token collection featuring a fixed set of 8,888 unique digital penguin characters on the Ethereum blockchain network.

🚨PUDGY PENGUINS PARTNERS WITH MANCHESTER CITY

Pudgy Penguins will release a premium collectibles for 18+ audience and merch line with Manchester City, tapping into the club’s 300M+ global fanbase. pic.twitter.com/B0HtfgNj2q

— Coin Bureau (@coinbureau) January 16, 2026

Pudgy Penguins is also the brainchild behind Lil Pudgy, a non-fungible token series that features a fixed supply of 22,222 smaller NFTs hosted on the Ethereum blockchain network, Pudgy Rod, a companion collection of fishing rod NFTs that were airdropped to original holders in 2021 and are now used as multipliers in the ecosystem and soulbound tokens, a non-transferable tokens such as ‘Opensea x Penguins SBTs’ launched to recognize community engagement, loyalty, and licensing participation.

Pudgy Penguins entered the physical retail space in May 2023 with the release of its first line of toys. Initially launched online through Amazon, the collection sold over 20,000 units in its first 48 hours and generated more than $500,000 USD in sales. This was clear evidence of a strong demand beyond the NFT community. Later that year, the toys were stocked in more than 2,000 Walmart stores across the U.S., and within 12 months of launching, over 1 million plushies had been sold worldwide. These plushies are now available in the United States, Europe, Asia, and Hong Kong.

Pudgy Penguins Dives Deeper Into Soccer

Pudgy Penguins NFT team partnered with the Spanish soccer club CD Castellón in January 2025 to feature their characters on the team’s official jerseys and shorts. As part of the collaboration, an open edition NFT was released, and some holders of that NFT were eligible to be featured in some way related to the partnership. Pudgy Penguins and Lil Pudgys characters appeared directly on CD Castellón’s jerseys.

CD Castellón🇪🇸 x Pudgy Penguins🐧 https://t.co/DgPV0URVMz pic.twitter.com/7jb2Ww8BJ9

— Football Shirt News🌍 (@Footy_ShirtNews) January 24, 2025

In the latest news, the Pudgy Penguins NFT team has announced a “landmark partnership” with English Premier League champions Manchester City to launch a premium co-branded NFT line targeted at an adult audience. This move is considered one of the highest-profile crossovers between a web3-native brand and a global sports giant, aimed at bringing the Pudgy Penguins intellectual property to a massive, mainstream audience. The merchandise drop was scheduled for January 17, 2026.

These ventures are part of the Pudgy Penguins’ broader strategy to evolve beyond their digital origins and toy lines into a mainstream, global intellectual property (IP) through real-world utility and high-profile brand building, bridging the gap between digital assets and traditional markets. This integration will provide tangible ways for NFT holders to feel part of the brand’s journey, reinforcing holder identity and community.

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

XRP Risks Another 23% Drop as Price Slides Below $1.60

XRP (XRP) price dropped below $1.50 over the weekend, its lowest level in over 14 months. Now, a bearish technical setup on the charts suggests that the downtrend may extend throughout February.

Key takeaways:

-

XRP’s bear pennant on the four-hour chart targets $1.22.

-

XRP futures open interest dropped to $2.61 billion, which gives some hope for the bulls.

XRP price chart shows a textbook bear pennant

On Saturday, XRP price fell about 14% from a high of $1.75 to a low of $1.50, losing the $1.60 support level for the first time since November 2024.

The latest drop has put it into the breakdown phase of its bear pennant setup, as shown on the four-hour chart below.

Related: Price predictions 1/30: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

XRP dropped below the pennant’s lower trendline on Tuesday, then rebounded to retest it as support. The price is likely to drop lower if the retest fails and a four-hour candlestick closes below this level at $1.58.

The measured target of the bear pennant, calculated by adding the height of the initial drop to the breakout point, is $1.22, representing a 23% drop from the current price.

XRP’s recovery to $2.40 in January turned out to be a “fakeout” as the price continued to form “price formed a fresh lower lows,” pseudonymous analyst AltCryptoGems said in a recent post on X, adding:

“The downtrend remains intact and we are on the verge of a disastrous collapse in a huge no-support zone.”

Trader and investor Alex Clay said that after breaching the support line of a double bottom pattern at $1.60, the path is now cleared for a drop toward $1 or lower.

As Cointelegraph reported, XRP’s next major support level is near its aggregated realized price at $1.48. If this level is lost, it would put the average holder underwater, a setup that closely matches the 2022 bear phase that ultimately ended in a 50% drawdown toward $0.30.

XRP buyers step back

The 90-day Spot Taker Cumulative Volume Delta (CVD), a metric that tracks whether market orders are driven by buyers or sellers, reveals that buy-orders (taker buy) have been declining sharply since early January.

While demand-side pressure has dominated the order book since November 2025, buy orders have dropped sharply over the last 30 days, according to CryptoQuant.

This indicates waning enthusiasm or exhaustion among XRP investors, signaling reduced bullish momentum and increasing downside risk for the price.

Previous sharp drops in spot CVD have been accompanied by 28%-50% price drawdowns within weeks.

However, in the current downtrend, one hope for the bulls is the declining XRP futures open interest (OI). It has dropped sharply to $2.61 billion on Wednesday, from $4.55 billion on Jan. 6.

When OI declines in combination with falling prices, it indicates a weakening bearish trend or a potential trend reversal.

This could provide some fuel for the bulls to test the important overhead resistance at around $1.85, a level that served as support throughout most of 2025.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

The DAO hacked again, but this time it’s the good guys

Ten years on from the most notorious hack in Ethereum history, The DAO has been exploited once again.

However, this time, far from 2016’s existential crisis, it’s actually good news.

In what a Security Alliance (SEAL) member described as a “long-planned whitehat rescue,” over 50 ether (ETH) were rescued from an insecure contract.

The funds, worth over $100,000 had sat in a vulnerable smart contract for a decade. They currently sit in this recovery address.

Read more: 2025’s biggest crypto hacks: From exchange breaches to DeFi exploits

The 2016 hack of the original DAO saw 3.6 million ETH lost. The sum was worth around $60 million at the time, but would now be valued at close to $8 billion.

Whitehat hackers subsequently sprang into action, racing to reverse engineer the hack and drain the contracts themselves in order to secure funds that blackhats may otherwise have gained.

This bought time until a longer-term solution could be decided on by the community.

The event caused such disruption to the Ethereum community that it collectively took the decision to fork the network, restoring the blockchain to its pre-hack state.

Today’s whitehat rescue was announced by “Giveth,” whose co-founder Griff Green worked on The DAO back in 2016.

It may be surprising that such a high profile codebase, especially from a security standpoint, would still contain an unidentified vulnerability a decade later. But a recent spate of blackhat attacks on older projects show that such hidden weaknesses may be more common than expected.

Read more: Legacy DeFi platforms lose $27M as hacking spree continues into 2026

The rescue mission comes on the back of more good news for the Ethereum security community.

Last week, Green pledged that recovered funds will be returned “to the people who put it there, or if unclaimed, [used] for funding Ethereum Security.”

Any unclaimed funds from today’s rescue will be added to the pot.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Gold Volatility Beats Bitcoin’s Risk Profile

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and brace yourself: markets are moving in ways few expected. One asset is swinging wildly, defying norms, while the other struggles to catch up. Traders and investors are watching closely as volatility reshapes familiar narratives, signaling that nothing is quite as it seems.

Sponsored

Sponsored

Crypto News of the Day: Gold’s Volatility Surges Past Bitcoin Amid Historic Market Swings

Gold has overtaken Bitcoin amid market turbulence. Its recent price swings surpass even Bitcoin’s, highlighting a rare inversion in risk dynamics that few investors expected.

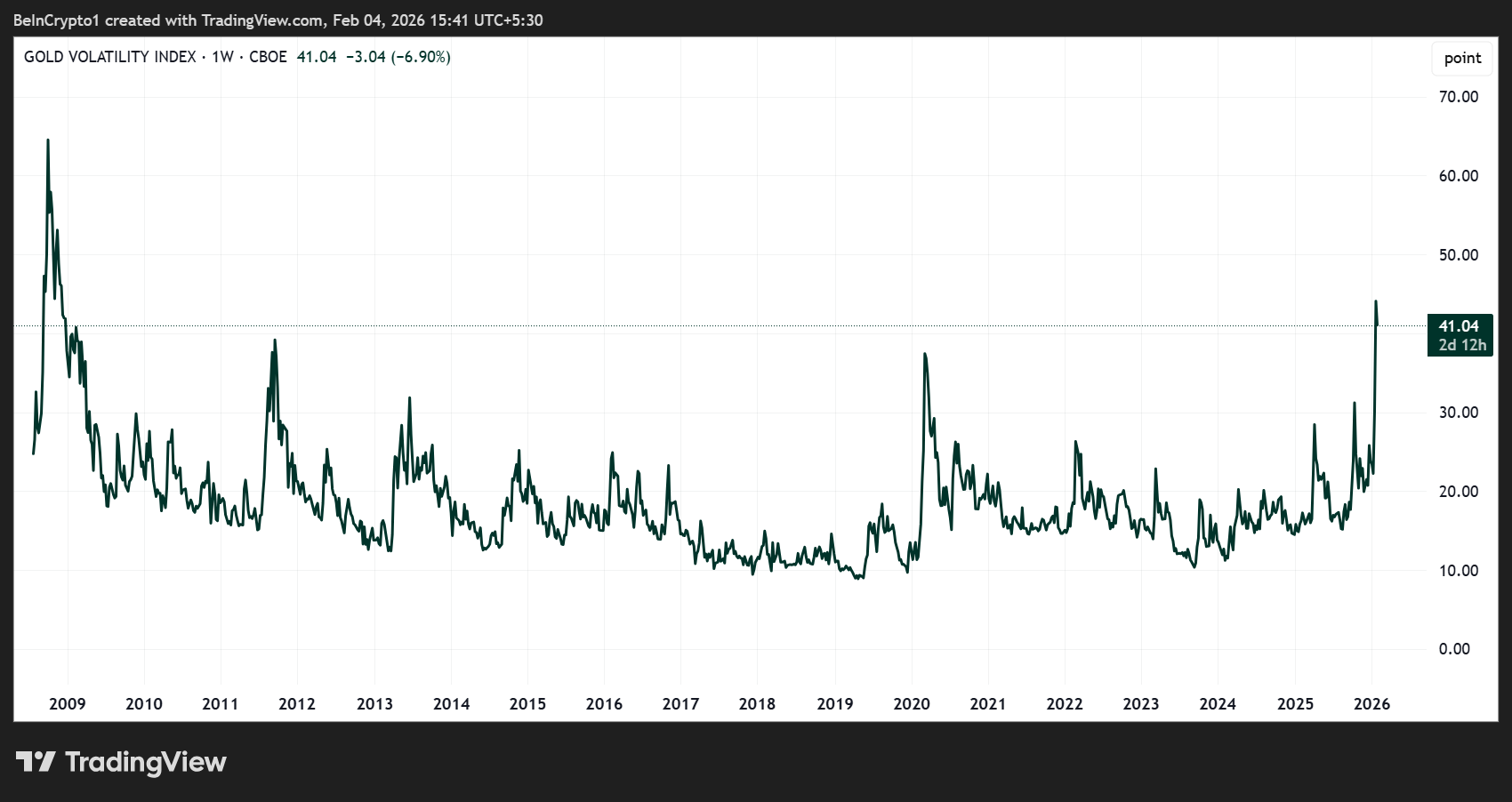

Data shows the 30-day volatility in gold surged to a new peak of 48.68, and stood at 41.04 as of this writing. Notably, this level was not tested since the 2008 financial crisis.

In comparison, Bitcoin’s volatility currently hovers around 39%, despite its reputation as a highly speculative asset.

The surge in gold volatility follows its sharpest plunge in more than a decade, including a single-session drop of nearly 10% from a peak of $5,600 to roughly $4,400 per ounce in Asian trading.

Since Bitcoin’s creation 17 years ago, gold has been more volatile only twice. The most recent was in May 2019 during a flare-up in trade tensions sparked by tariff threats from US President Donald Trump.

The wild swings in gold come amid broader macroeconomic uncertainty. As indicated in a recent US Crypto News publication, renewed fears of geopolitical instability, currency debasement, and questions about the Federal Reserve’s independence drove investors to pile into precious metals.

Sponsored

Sponsored

Gold Rebounds $6 Trillion in Two Days, Leaving Bitcoin Behind

The recovery in gold has been equally dramatic, with XAU prices surging back above $5,000/oz, up 17% in just 48 hours.

During the same period, gold added $4.74 trillion to its market capitalization, while silver gained $1 trillion. This brings the total growth in the precious metals market cap to nearly $6 trillion in two days.

“That’s over 4× Bitcoin’s market cap,” stated analyst Crypto Rover.

Sponsored

Sponsored

The rebound reflects strong accumulation by institutional and high-net-worth investors, with consistent buying on every dip speaking volumes about who’s accumulating the precious metal, regardless of the noise.

“Volatility shouldn’t surprise anyone here—it’s rare for an asset to absorb a hit like last week’s and then move straight back up without a few bumps. Gold remains severely under-owned, and this move has real legs as part of a much larger cycle,” said Otavio in a post.

Even amid volatility, gold has maintained its status as a safe-haven asset, up roughly 66% year-on-year, while Bitcoin remains down more than 20% over the same period.

The contrast mirrors how, in times of macroeconomic stress, traditional precious metals continue to command a premium in investor portfolios, outpacing even high-profile digital assets.

As geopolitical and monetary pressures persist, gold’s newfound volatility is likely to remain in focus, offering both risk and opportunity for traders seeking refuge from broader market swings.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 3 | Pre-Market Overview |

| Strategy (MSTR) | $133.26 | $132.55 (-0.53%) |

| Coinbase (COIN) | $179.66 | $178.89 (-0.43%) |

| Galaxy Digital Holdings (GLXY) | $21.98 | $22.11 (+0.59%) |

| MARA Holdings (MARA) | $9.05 | $8.99 (-0.66%) |

| Riot Platforms (RIOT) | $15.34 | $15.32 (-0.13%) |

| Core Scientific (CORZ) | $17.74 | $17.65 (-0.51%) |

Crypto World

BTC might just be another software name, and that’s bad news

Bitcoin is increasingly behaving like a software stock, with its latest correction unfolding alongside the broader software sell-off.

The relationship between bitcoin and software equities has strengthened notably. On a 30-day rolling basis, bitcoin’s correlation with the iShares Expanded Tech Software ETF, (IGV), stands at a high 0.73, according to ByteTree. The IGV is down around 20% year to date, while bitcoin has fallen 16%.

IGV is heavily weighted toward software and services names such as Microsoft (MSFT), Oracle (ORCL), Salesforce (CRM), Intuit (INTU) and Adobe (ADBE).

While the technology sector appears relatively resilient at the headline level — the Nasdaq 100 (QQQ), is only around 4% below its record high — software stocks have absorbed most of the selling pressure, and bitcoin is increasingly trading in line with this weaker pocket of the market rather than the broader index.

As for why software names are getting hammered, the answer is simple: AI. The rapid progress towards fully functioning artificial general intelligence (AGI) is currently being considered an existential issue for software.

“There can be no doubt that bitcoin has been caught up in the technology selloff,” said ByteTree. “At its heart, bitcoin is an internet stock. Software stocks have been the most recent casualty, and the price of bitcoin has shown similar performance over the past five years, with high correlation.”

ByteTree also notes that the average technology bear market lasts about 14 months. With this current downturn having started in October, this suggests pressure could persist through much of 2026. However, ByteTree notes that a resilient economic backdrop could provide support for bitcoin.

“Bitcoin is just open-source software,” said Van Eck’s Matthew Sigel.

Crypto World

DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER): What Early-Stage Project Reigns Supreme in 2026?

President Donald Trump is expected to sign the bill approved by the US House of Representatives, which will reopen the government after a recent partial shutdown.

While the political tailwinds could push some liquidity into the choppy market, many traders are actually exploring presale opportunities.

The biggest debate pits three projects against each other: DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

Although all entries are the epitome of quality, DeepSnitch AI takes the cake with its upside potential and mass appeal that places it on a path to 100x gains post-launch.

The government may be opening soon

On February 3, the US House of Representatives approved a bill that will largely end a four-day partial government shutdown, voting 217–214 to pass the roughly $1.2 trillion funding package already cleared by the Senate.

The measure funds most government operations through September 30, with some Democratic support despite opposition from many in the party over immigration enforcement provisions included in the bill.

US President Donald Trump is expected to sign the legislation without any changes, which will swiftly reopen affected sectors.

The brief shutdown, which only partially disrupted government functions, was far shorter than the 43-day shutdown in 2025. The quick resolution avoids prolonged disruption, but it’s expected that the immigration-related funding fights will resume shortly

Meanwhile, retail traders are trying to decide on DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

What’s the best presale in Q1?

1. DeepSnitch AI: Is DSNT a mass-adoption coin?

Early-stage sales are back in the limelight as majors keep printing lows. Case in point, DeepSnitch AI raised $1.47M fast, and its $0.03830 price attracted buyers who are eyeing 100x with reasonable investments.

The reason for this conviction is the utility. DeepSnitch AI is powered by five AI agents that help users spot breakout opportunities while dodging common traps like rugs, honeypots, and liquidity issues. The workflow is dead simple: paste any contract address into the LLM-style interface for an instant audit and clear risk assessment.

While that’s certainly a godsend for the retail trader, the ability to predict social sentiment shifts and incoming FUD is another trick that DeepSnitch AI brings to the table that strengthens the mass adoption narrative.

When comparing DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER), many traders highlight DSNT’s broader mass-adoption potential thanks to its retail-first focus and practical daily utility.

Many traders are debating the merits of AI analytics vs payment-focused crypto, but DeepSnitch AI’s approach is certainly more original than most of the popular DeFi projects.

2. LivLive: Is LivLive too niche?

The DeepSnitch AI vs LivLive comparison is common among investors hunting fresh Q1 opportunities. However, the two projects couldn’t be more different.

LivLive is all about the concept of augmented reality, which lets users tokenize daily actions, blending lifestyle posting with blockchain rewards. Users earn LIVE tokens and XP by completing quests, check-ins, business reviews, social challenges, streaks, and AR interactions.

The level of gamification is high, meaning that LivLive could have viral potential (think Pokémon GO meets blockchain impact).

The LIVE presale price sits at $0.02. While the project certainly has a place in your portfolio (especially if you’re sold on the concept, many argue that DeepSnitch AI’s utility for day-to-day trading offers more durable long-term growth and staying power.

3. Bitcoin Hyper: Could Bitcoin L2 outpace the competition?

DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER) debate is tough to call simply because all the projects ooze quality.

Take Bitcoin Hyper as an example. The project delivers genuine innovation with its Bitcoin-native Layer 2 built on the Solana Virtual Machine. This allows it to provide ultra-fast off-chain transactions while opening Bitcoin’s massive ecosystem to Solana dApps.

The Bitcoin Hyper valuation remains speculative at this stage, but the fundamentals are compelling. At the current presale price of $0.013675, HYPER offers an accessible entry point with a solid narrative. While it may not have the day-to-day appeal of DeepSnitch AI or the social angle of LivLive, Bitcoin Hyper still has a strong draw, especially for those looking for quality tech.

Final words: Take your pick

As ICOs attract serious attention, traders are split between DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

While personal taste certainly plays a role in deciding your own personal “winner”, DeepSnitch AI may have the most compelling narrative. Look at it this way: DeepSnitch AI combines mass appeal, real AI utility for everyday traders, explosive upside potential, and a bullish trajectory with $1.47M in the bank.

Moreover, you can get an unreal amount of value by jumping in right now. The largest code, DSNTVIP300, delivers 300% on $30K+ ($90K worth of DSNT tokens), which basically seems like printing money.

Reserve your spot in the DeepSnitch AI presale today and follow the latest community buzz on X or Telegram.

FAQs

1. Which is the best presale? DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER)?

DeepSnitch AI ($DSNT) leads as the next crypto to explode, with $1.47M raised at $0.03830, five AI agents for real-time risk detection and sentiment prediction, plus strong mass-adoption potential and widespread 100x forecasts.

2. What makes DeepSnitch AI stand out in the DSNT vs LIVE vs HYPER comparison?

DeepSnitch AI offers practical daily utility and mass appeal potential that could elevate it above its key competitors.

3. How does the US government reopening impact the market?

The US House passed a $1.2T funding bill to end a partial shutdown, with President Trump expected to sign it quickly. The resolution boosts overall sentiment and liquidity.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

BTC under pressure as U.S. tech sector stumbles

Bitcoin fell back below $74,000 in the early innings of the U.S. session, with the bounce from Tuesday’s lows quickly fading away as weakness in tech stocks weighed on crypto.

The Nasdaq 100 was 1% lower following the previous day’s 1.5% decline. The software sector continued its tumble, with the thematic iShares Expanded Tech-Software ETF (IGV) declining another 4%, now down 17% in a little over a week, amid fears that AI will be severely disruptive.

Crypto miners, increasingly tied to the buildout of AI infrastructure, mirrored the slide, with Cipher Mining (CIFR), IREN, and Hut 8 (HUT) falling by more than 10%. The declines stemmed from chipmaker AMD, which fell 14% after its 2026 outlook missed analysts’ expectations.

Gold was also caught in the selling, with the yellow metal quickly reversing an overnight surge to $5,113 per ounce and sliding back below $5,000.

U.S. economic data is mixed

The ISM Services PMI for January held steady at 53.8, matching December’s revised reading and beating expectations by a hair, pointing to continued expansion in the services sector.

However, private job growth slowed sharply, with just 22,000 jobs added according to an ADP report, well below forecasts for 48,000 and December’s already weak 37,000. The government’s January job report would normally have been released this Friday, but the short government shutdown has delayed it until next week.

“Manufacturing has lost jobs every month since March 2024 (Main Street recession) but this month professional and business services and large employers joined the weakness,” said Lekker Capital CIO Quinn Thompson, who believes markets are underestimating the amount of Fed stimulus that may be coming in 2026.

Crypto World

Bitcoin Dips to $95K as Crypto Funds See Record Inflows

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped 3% in the last 24 hours to trade at $93,324, as crypto investment products continue to attract strong interest from investors with record inflows.

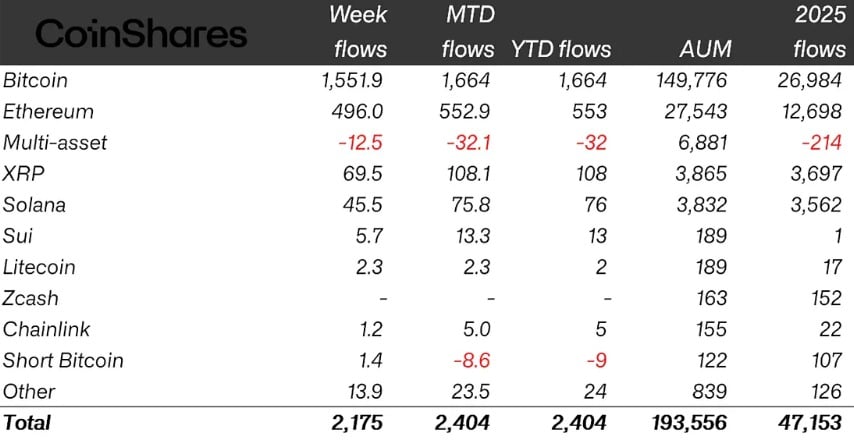

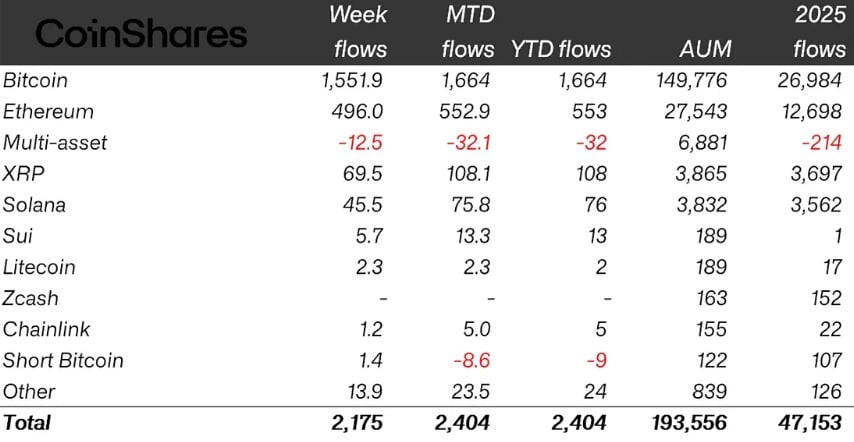

Last week, crypto funds saw inflows of $2.17 billion, the highest in 2026 so far and the largest weekly gain since October, according to European asset manager CoinShares. Most of the money entered the market earlier in the week, but Friday recorded $378 million in outflows due to geopolitical tensions in Greenland and fresh concerns over tariffs.

James Butterfill, CoinShares’ head of research, also noted that sentiment was affected by expectations that Kevin Hassett, a leading contender for US Fed Chair, would likely remain in his current position. Bitcoin dominated last week’s fund inflows, pulling in $1.55 billion, which represented over 70% of the total.

Ether followed with $496 million, while XRP and Solana attracted $70 million and $46 million, respectively. Smaller altcoins such as Sui and Hedera recorded minor inflows of $5.7 million and $2.6 million. Despite proposals under the US Senate’s CLARITY Act that could limit stablecoin yields, Ether and Solana funds held up well.

Among fund types, multi-asset and short Bitcoin products were the only categories to see outflows, totaling $32 million and $8.6 million. On the issuer side, BlackRock’s iShares ETFs led the market with $1.3 billion in inflows, followed by Grayscale Investments at $257 million and Fidelity Investments at $229 million.

Geographically, the US accounted for the majority of inflows at $2 billion, while Sweden and Brazil saw small outflows of $4.3 million and $1 million, respectively. With these gains, total assets under management in crypto funds surpassed $193 billion for the first time since early November, showing renewed investor confidence.

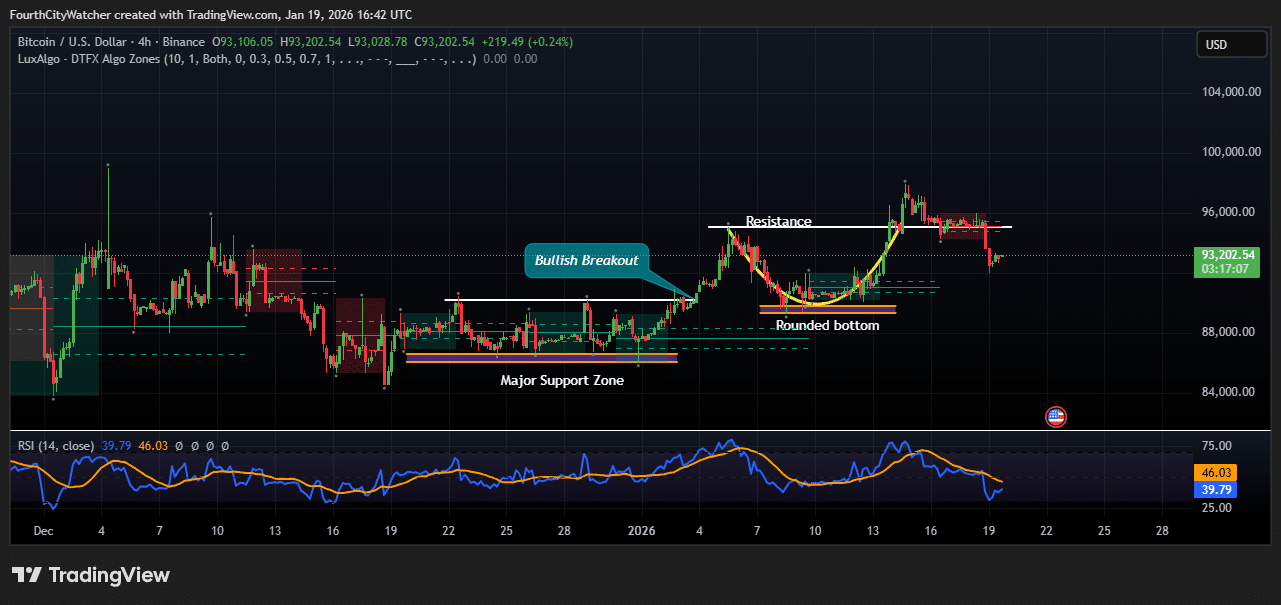

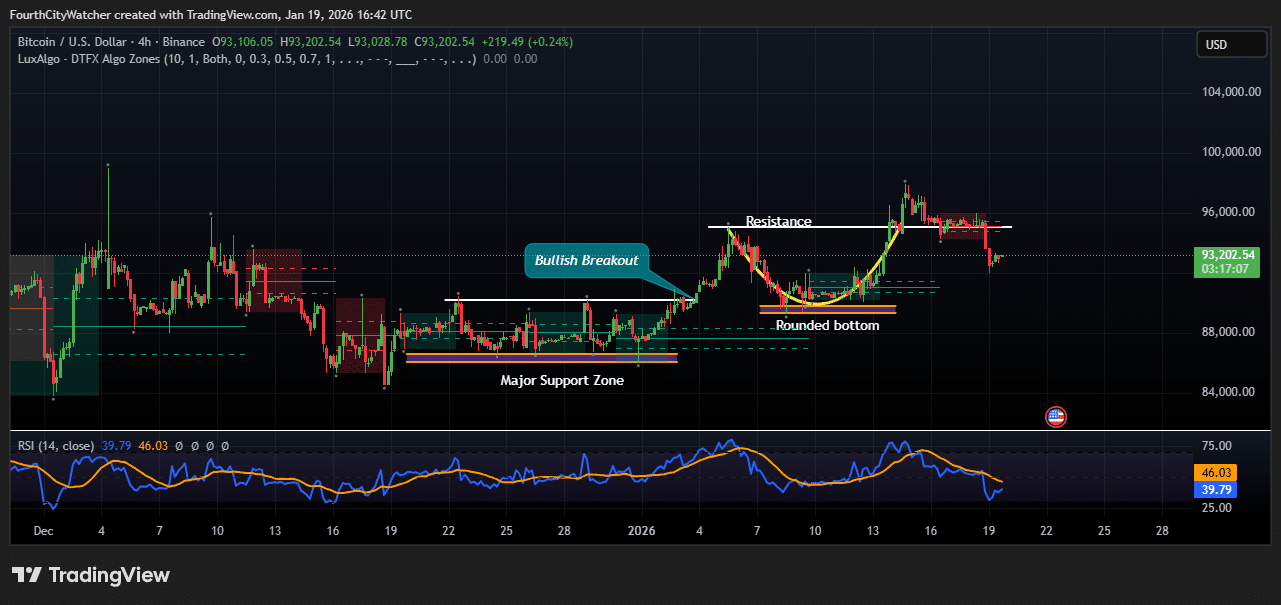

The Bitcoin price 4-hour chart shows a series of bullish developments, though recent price action indicates some short-term consolidation. Price recently rebounded from a major support zone around $87,500–$88,500, which had previously acted as a strong accumulation area. This level has successfully absorbed selling pressure multiple times in the past, providing a solid foundation for higher moves.

Following this support, Bitcoin formed a rounded bottom pattern between January 6 and January 12, signaling a shift from bearish to bullish sentiment. The rounded bottom reflects a gradual loss of selling momentum, allowing buyers to regain control.

A bullish breakout occurred after the rounded bottom, pushing the price above prior resistance levels around $91,000. This breakout was accompanied by strong upward momentum, with the price briefly testing the $96,000 region. The breakout confirms that buyers were willing to step in decisively after the consolidation, signaling potential continuation of the short-term uptrend.

Currently, the price has pulled back slightly after hitting the $96,000 resistance area. The minor retracement appears healthy, as it allows buyers to enter at lower levels without threatening the overall bullish structure. The relative strength index (RSI), currently around 39.8, shows that Bitcoin is not yet oversold, indicating room for further upside once buyers re-enter. The 46-level on the RSI also indicates previous resistance in momentum, now acting as a potential pivot point.

The chart shows a well-defined support and resistance structure, with price respecting the $88,000–$91,000 range before attempting higher levels. The rounded bottom and bullish breakout highlight a transition from accumulation to renewed upward momentum. Traders may watch for a retest of $91,000–$92,000 as a key support level, while the $96,000 area remains a near-term resistance barrier.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Bitcoin-native USDT protocol joins CTDG Dev Hub

Bitcoin has long served a simple purpose: storing and transferring value. The blockchain’s inherent limitations in scalability and programmability prevented use cases like high-frequency payments and smart contracts.

Launched in 2018, the layer-2 solution Lightning Network introduced noticeable improvements in scalability. It takes some of the burden offchain by creating side channels between the sender and receiver.

The model settles transactions faster, with lower fees. Rendering Bitcoin feasible for daily use, the solution spurred the development of many payment apps on the blockchain.

Programmability also arrived in Bitcoin through secondary protocols, such as RGB, an open-source solution designed to expand Bitcoin’s capabilities. The protocol enables the creation of smart contracts and other digital assets on Bitcoin through private, offchain transactions.

RGB powers decentralized applications (DApps) and tokenization, and allows digital assets other than Bitcoin (BTC) to exist on top of the original blockchain.

Bitcoin-native USDT transactions

CTDG Dev Hub, a collaborative platform for blockchain developers working on protocol ideas, has added Utexo as a new participant. The project examines how stablecoin transfers could be represented natively on Bitcoin by combining the Lightning Network’s payment channels with RGB’s client-side asset model. By focusing on interoperability between Bitcoin’s scaling and asset layers, Utexo aligns with DevHub’s goal of supporting experimental infrastructure research and practical developer-driven use cases.

Before the introduction of native solutions, the prevailing practice for using USDT on Bitcoin was utilizing methods like wrapping and bridging, which add intermediaries to the process and increase security risks.

Utexo moves USDT on Bitcoin-native rails instead by combining Lightning’s payment flow with RGB’s asset transfer model. Through RGB, USDT is issued and transferred under a client-side validation model, which keeps most of the transaction details off Bitcoin’s base layer.

Meanwhile, the Lightning Network enables fast and low-cost execution. Bitcoin’s layer-1 only serves as the security anchor that ultimately settles transactions and prevents double-spending.

That combination is meant to avoid the extra trust assumptions that come with wrapping and bridging while still keeping the experience fast. In other words, speed comes from Lightning, asset logic comes from RGB and the security stays tied to Bitcoin.

In Utexo’s design, separating execution from base-layer congestion can make cost behavior less sensitive to Bitcoin’s mempool conditions, since most activity occurs off-chain and Bitcoin is used only for final settlement. This structural decoupling is one reason some implementations aim for more stable cost behavior as throughput grows.

Utilizing the Lightning Network or RGB normally requires a good amount of manual labor. Users have to set up and run a Lightning node, open and manage channels, ensure liquidity, handle routing failures and monitor payment status.

On the RGB side, they also need to manage issuance and transfers, exchange the data needed for client-side validation and keep track of state so balances remain accurate.

The project brings these steps into a single integration flow available via an SDK and REST API. It exposes programmatic access to Lightning execution, routing and failure handling, as well as RGB asset issuance, transfers and state transitions, enabling interaction with both layers through one interface.

Bitcoin developers gain a hub

Cointelegraph has been taking an active role in blockchain governance and development through its initiative, Cointelegraph Decentralization Guardians.

As part of the CTDG ecosystem, CTDG Dev Hub serves as a developer-focused hub alongside CTDG’s validator operations and educational initiatives. The hub offers an open, global public space for developers and other members of the blockchain community to exchange ideas, develop solutions, and submit proposals.

Through its participation in CTDG Dev Hub, Utexo becomes part of a shared development environment where its approach can be reviewed and discussed by other contributors. The Dev Hub serves as a coordination point for developers and community members exploring infrastructure and tooling for Bitcoin-based applications.

Crypto World

Indian investors have matured, buying BTC in shift from speculative tokens

Indian crypto investors have shed the speculative itch and are buying the dip in bitcoin price like seasoned pros, Mumbai-based CoinDCX exchange told CoinDesk.

“Indian investors are maturing. They’re no longer driven purely by sentiment or headlines; instead, they’re focused on fundamentals and the long-term potential of the asset class,” CoinDCX’s CEO Sumit Gupta said in an email.

“We’re seeing it in their behavior: regular bitcoin systematic investment plans (SIPs), deliberate market orders, and thoughtfully placed limit orders,” he added, naming ether , solana and XRP as other favorites.

The latest trend contrasts with the frenzied trading in 2021 when newbies chasing 100x pumps dabbled with clones and other smaller tokens.

“It’s clear that participation is becoming more strategic and measured, rather than reactive. Increasingly, investors are looking at Bitcoin for portfolio diversification and long-term wealth creation,” Gupta said.

Bitcoin’s price has dropped to $75,000 after having hit a high of over $126,000 in October. The broader market has followed suit, with altcoins registering bigger losses. Coincidentally, the Indian national rupee (INR) has depreciated against the U.S. dollar in recent weeks, hitting a record low of 92 per USD.

Yet trading volumes have picked up on the exchange, rising from about $269 million in December to roughly $309 million in January, he said, adding that the activity has been more balanced. “We see profit-taking from short-term traders who bought near recent lows, but at the same time, steady accumulation from long-term investors who view these levels as an opportunity,” he noted.

India, the world’s fastest-growing major economy, maintains a cautious, regulatory-focused stance on digital assets, treating them as taxable Virtual Digital Assets (VDA) rather than legal tender. The annual budget announced over the weekend maintained a 30% tax on crypto gains, with no loss set-offs, and a 1% transaction tax deducted at source.

Regulations issued by the Financial Intelligence Unit also mandate strict KYC requirements, including regular and accurate reporting of user transactions by exchanges. These measures are aimed at bolstering compliance and countering money laundering and terrorist financing.

“The Union Budget 2026 proposes strengthening compliance for crypto platforms over lapses in transaction disclosures, aiming to curb tax evasion in virtual digital assets,” Gupta said.

We remain fully committed to working with policymakers to support the development of a safe, innovative, and globally competitive VDA ecosystem, as the regulatory landscape continues to evolve.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech9 hours ago

Tech9 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World18 hours ago

Crypto World18 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards