Entertainment

13 Eye-Catching Clothes and Accessory to Channel NYFW 2026

Us Weekly has affiliate partnerships. We receive compensation when you click on a link and make a purchase. Learn more!

New York Fashion Week 2026 has come and gone, but the styles have certainly left a lasting impact on local Manhattanites. As a shopping editor in New York City, you can bet I had my sights set on exciting trends showcased on (and off) the runway. One style I saw over and over again? Patterns on patterns on patterns. Designers and labels by the likes of Carolina Herrera, Anna Sui, Khaite, and more all went headfirst into playful polka dots, wild animal prints and vibrant florals, which is inspiring a newfound 2026 look for all the NYC fashion girlies.

To replicate said high-end style, I’m leaning on affordable retailers that deliver the runway look without ever stepping into the showroom. Like the looks seen during NYFW, these pieces feel bold, unconventional, feminine and even vintage-esque — especially when you layer them together. And although I’m opting for picks under $150, that doesn’t mean you can’t find big brands below. I’m talking about Kate Spade, Free People, Sam Edelman, Banana Republic and more. All these finds transition well from winter to spring, so you can wear ’em now and again when spring really is in bloom.

13 NYFW-Inspired Styles to Add to Your Wardrobe

1. Our Favorite: Deep brown hues and floral prints dominated the runway, and this popular maxi dress makes the trend super wearable. Designed with a muted, inspired tone, this dress can be worn from day to night. All you need to do is swap out your shoes, and you’re ready to go.

2. Everyday Essential: With warm weather on the way, it’s time to grab this polka dot dress for upcoming spring activities. While Christian Siriano played with large spots, I like this minimalistic pattern for everyday wear instead. It still presents a stark contrast against the black backdrop, but is more realistic for errands, brunches and the like.

3. Spring Staple: I’m willing to bet that you’ll throw on this long-sleeved dress every second you can get. It has a billowy fit, a sweetheart neckline and a twirl-worthy skirt that’s perfect for date night. Oh, and the pretty floral print is just chef’s kiss.

4. Wild Side: Animal print pieces have definitely been on my radar before New York Fashion Week, but the shows only confirmed my hunch. It’s safe to say that the style is definitely ‘in,’ and this off-shoulder top is an easy way to incorporate the print. This pick skews more fitted, making it ideal for baggy jeans and trousers.

5. Mix and Match: If you’re unsure how to mix patterns together in your ensemble, I’d say start with your base and then throw on these polka dot slingbacks as the cherry on top. The mesh paneling, pointed toe and kitten heel feel so Hollywood glam, but in 2026.

6. Instant Upgrade: Anyone who lives in the northeast knows that spring takes a while to warm up. This cheetah-print shirt jacket keeps you on trend and cozy warm at the very same time. I also love the idea of wearing this shacket with a basic tee and jeans, with the outerwear as the main statement.

7. Work Warrior: Whether you work in fashion or accounting, this button-down shirt is an essential for every workwear wardrobe. Unlike traditional button-ups, this one does away with the point collar, replacing it with a feminine ruffle for a stand-out approach.

8. Flattering Find: Utility dresses, like this cotton option, work just as hard as you do; this one is customizable, has multiple pockets and a waist-defining belt that won’t let your shape get lost behind the zebra print.

9. Cool-Girl Style: Haven’t you heard? Shoulder bags are the cool ‘It’ girl thing, and this animal-print style nails both trends simultaneously. The purse has just enough space for the essentials, like your phone, key and lip gloss.

10. Dreamy Find: While lace isn’t an actual pattern, I noticed that the delicate style kept showing up on the runway. This pretty Free People layering top is one of my favorite ways to zhuzh up an otherwise boring outfit. The floral design gives it an ethereal appearance while looking lovely under tanks, vests, baggy shirts, and dresses.

11. Instant Upgrade: Upgrade your blouse collection with this long-sleeve number that embodies the runway-approved dark floral style with a workwear twist. The pleats at the neckline give the top a little extra something, too!

12. Pretty in Pink: Puffed sleeves, a flowy fit and a ruffle hem are three details that make this dressy top an instant ‘add to cart.’ Another selling point? It’s marked down to just $15 right now.

13. Cocktail Hour: As soon as I saw this Astr the Label dress, I had to shop it. Made with lightweight materials, ruffled tiers and a safari-like print, this elegant dress looks like something showcased this February. Thankfully, it wasn’t and can be at your front door in a few days.

Entertainment

Hillary Clinton Points Finger at Donald Trump in Epstein Deposition

Hillary Clinton Epstein Deposition

Trump’s Prior Conduct Might Be Relevant!!!

Published

c-span

Hillary Clinton didn’t hold back when asked about President Donald Trump during her Epstein deposition last week … pushing to have him testify under oath, because he’s got a laundry list of bad behavior and past connections with the dead convicted pedophile.

Check out the footage released by the House Committee on Oversight and Government Reform released Monday — Clinton says given that Trump’s all over the Epstein Files and has been found guilty of a myriad of crimes … he should “absolutely” be brought in for questioning.

And she doesn’t let people forget about his past trials and convictions … she reminds the committee that he’s been found civilly liable for sexual assault by a jury of his peers and convicted on 34 counts of falsified business records in relation to covering his relations with an escort … which was election interference.

As you know, Hillary and former President Bill Clinton were deposed separately last week. Bill was adamant he had no idea Epstein was up to no good … claiming if he did know what crimes he was committing, he would have turned him in himself. Hillary, meanwhile, maintains that she never even met him.

Trump has repeatedly washed his hands of Epstein, who died by suicide in 2019 while in custody at the Metropolitan Correctional Center in New York awaiting trial on federal sex trafficking charges. Trump has said he kicked JE out of his circle when he betrayed him by hiring people who had worked for him at Mar-a-Lago in Florida.

Friday, Trump said he did not enjoy seeing former President Clinton deposed, though he added … “But they certainly went after me a lot more than that.”

If you or someone you know is struggling or in crisis, help is available. Call or text 988 or chat 988lifeline.org.

Entertainment

Diddy Prison Release Date Updated Amid Fight To Appeal 4 Years

Diddy‘s prison release date has reportedly been updated amid his fight to appeal his 4-year sentence.

RELATED: Social Media Users Are Sharing Thoughts After Diddy’s Lawyer Revealed His Post-Prison Release Plans (WATCH)

Diddy’s Prison Release Date Reportedly Updated

On Tuesday, March 2, Page Six published an exclusive report asserting that the Federal Bureau of Prisons updated Diddy’s prison release date. Per the outlet, the bureau updated Diddy’s release date from June 4, 2028, to April 25, 2028.

Furthermore, the outlet notes that the update arrived after Diddy was accepted into the drug rehabilitation program at Fort Dix Federal Correctional Institution in November 2025. At the time, it was reportedly noted that his acceptance could lower his time behind bars.

“Mr. Combs is an active participant in the Residential Drug Abuse Program (RDAP) and has taken his rehabilitation process seriously from the start. He is fully engaged in his work, focused on growth, and committed to positive change,” a rep for Diddy reportedly told the press at the time of his acceptance.

Social Media Reacts To His Updated Prison Release Date

Social media users reacted to Diddy’s updated prison release date in TSR’s comment section.

Instagram user @flawednfabulous wrote, “How Can I petition to add another 10 years?”

While Instagram user @shelovecj added, “I have a feeling he’ll be out sooner than that”

Instagram user @flvckor_ wrote, “Keep him”

While Instagram user @gee2srt added, “He might as well stay😭 bro not gonna ever get looked at the same..”

Instagram user @delphine_na18 wrote, “We don’t want him out… He should stay longer”

While Instagram user @attractivebeing added, “This is great news for him and his children and I love that for them! 👏🏽”

Instagram user @dream.ofdessy wrote, “Honestly after viewing these Epstein files, Diddy shouldn’t be nobody’s main concern 😭 it’s waaaaaay more people need to be chained up right next to him !!!”

While Instagram user @_racer.x added, “Another distraction”

Instagram user @lajoyyyy__ wrote, “gone get back out and do the same sht”

While Instagram user @_boysfantasy added, “Needs to be 2078 😂😂😂”

More On Diddy’s Prison Release Updates & His Fight To Appeal His 4-Year Sentence

As The Shade Room previously reported, Diddy’s initial prison release date was announced in October 2025. At the time, it was reported that he would be behind bars until May 8, 2028. However, it was also noted that the date was subject to change and could be altered if he displayed good behavior.

Then, in November 2025, it was reported that Diddy’s prison release date was pushed back until June 4, 2028, per The Shade Room. At the time, Page Six reported that he was involved in an unauthorized three-way phone call and participated in illegal alcohol consumption. However, his rep denied the “rumor.”

“As with any high-profile individual in a new environment, there will be many rumors and exaggerated stories throughout his time there — most of them untrue. We ask that people give him the benefit of the doubt, the privacy to focus on his personal growth,” the rep stated at the time.

In December 2025, Diddy and his legal team filed an appeal against his four-year prison sentence, per The Shade Room. Furthermore, his team reportedly demanded his immediate release and argued that prosecutors failed to prove their case against him. Additionally, they reportedly argued that Judge Arub Subramanian issued a sentence that violated Diddy’s constitutional rights.

Per Page Six, in February, prosecutors opposed Diddy’s appeal. As The Shade Room previously reported, Diddy was convicted of transportation to engage in prostitution charges in July 2025. Furthermore, he was acquitted on sex trafficking and racketeering charges after an eight-week trial.

RELATED: Another One! Diddy Seeks Immediate Release From Prison In Latest Appeal

What Do You Think Roomies?

Entertainment

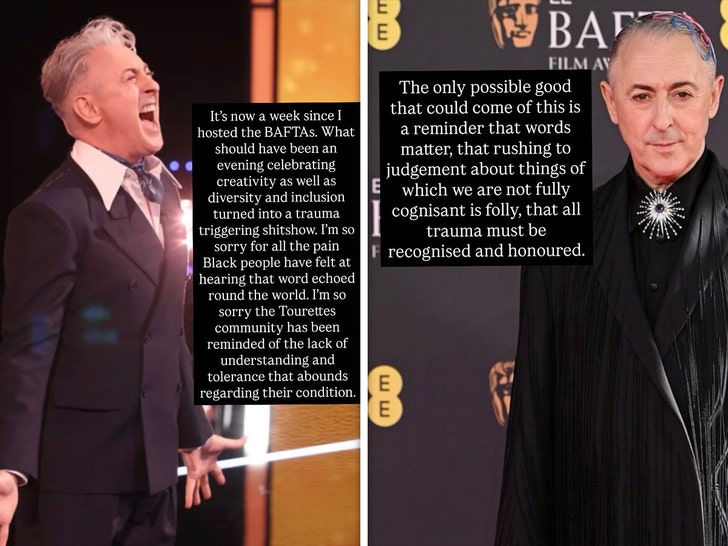

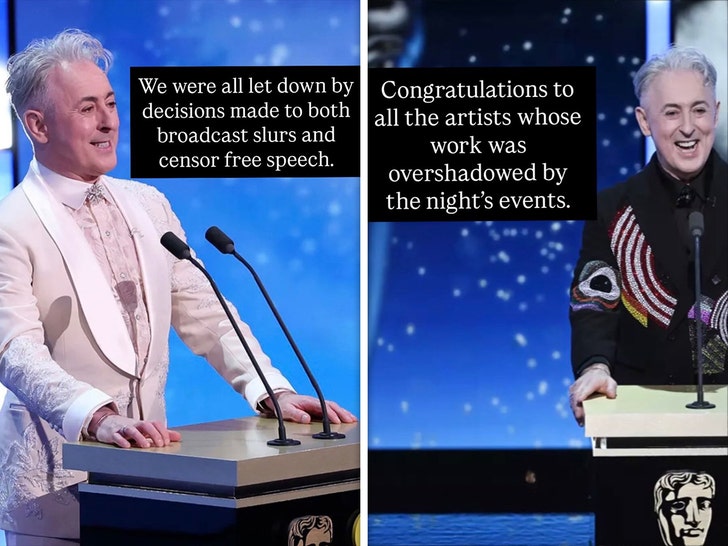

Alan Cumming Posts Detailed Apology Online for BAFTA Racial Slur Incident

Alan Cumming

Sorry for the ‘Trauma-Triggering’ BAFTAs

Published

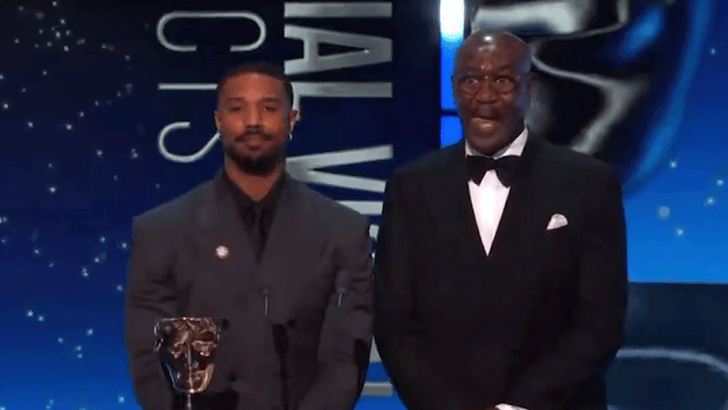

Alan Cumming has officially spoken out about Tourette syndrome activist John Davidson shouting the N-word at The British Academy Film Awards in February … labeling the annual ceremony a “trauma triggering s***show.”

Alan — who hosted the Feb. 22 show — shared his apology on Instagram Tuesday … saying he’s sorry for “all the pain Black people have felt at hearing that word echoed round the world” — and also to the Tourette’s community for the onslaught of negative comments due to the world’s “lack of understanding and tolerance” about the neurological disorder.

He even directed some shade at the BAFTAs and BBC network, noting … “We were all let down by decisions made to both broadcast slurs and censor free speech.” But he acknowledges “all trauma must be recognised and honoured.”

ICYMI … the BAFTAs were pre-recorded, and somehow the racial slur stayed in the final broadcast uncensored. And the BBC apparently decided to axe the “Free Palestine” portion of filmmaker Akinola Davies Jr.’s speech during the show … while leaving in the slur.

The BAFTAs took “full responsibility” for putting black presenters Michael B. Jordan and Delroy Lindo “in a very difficult situation” … and said in a second apology they would learn from the incident as the world laid on the heat.

BBC

Alan had apologized during the show … but that did little to pacify the thousands who watched the incident.

Davidson himself spoke out about the ordeal, saying he was grateful to Alan for taking a moment mid-show to address what happened, adding … “I was heartened by the round of applause that followed this announcement and felt welcomed and understood in an environment that would normally be impossible for me.”

Entertainment

Carrie Underwood Claps Back After Being Booed on American Idol

Carrie Underwood is seemingly relishing in the boos she received on American Idol.

“Boo me. I don’t care. 😂😜🤪,” the Idol judge, 42, clapped back via X on Monday, March 2.

Underwood clashed with the live audience during each of American Idol’s “Hollywood Week: Music City Takeover” episodes on season 24. The Hollywood Week episodes — which were filmed in Nashville this season — made for awkward viewing at times since Underwood’s constructive criticism proved to be unpopular with the crowd.

“They just like to boo me,” Underwood said in Tuesday’s final “Hollywood Week: Music City Takeover” episode.

Fellow American Idol judge Luke Bryan piped up to defend the former Idol winner during one stretch of booing.

“She only won this. She knows,” Bryan, 49, admonished the crowd.

His reference to Underwood’s American Idol season 4 victory did little to quiet the backlash, leading her to warn the booing fans about interfering in the judging process.

“You’re not included in the discussions,” she told them.

The booing was particularly heavy after Idol hopeful Mor performed an original song during his “Music City Takeover” audition. When it came time for his evaluations, Underwood correctly predicted to Bryan that “they are going to boo me.”

“You guys are gonna boo me. You’re gonna boo me,” she told the crowd. “It’s coming. Bring it on. I love it! Your boos are feeding me.”

Carrie Underwood on “American Idol” season 24. Disney/Eric McCandless

In her feedback, she argued that Mor made a mistake by trying out original material during “Hollywood Week: Music City Takeover.”

“In a room like this, for you to bring an original song with that incredible band sitting behind you, twiddling their thumbs, I feel like it was a missed opportunity,” she said.

Mor ultimately still advanced to the next stage of American Idol by the judges despite Underwood’s lukewarm appraisal.

“Singing original music is SUCH a gamble at this stage in the competition. Don’t. Waste. The. Band,” Underwood insisted via X on Monday. “Mor’s voice and previous audition kept him in. I wanna hear his original music after he’s a big star!”

Underwood previously hinted that she was going to have a hostile rapport with the “Hollywood Week: Music City Takeover” crowd before the episodes even aired.

“Spoiler alert…I get booed A LOT from our Hollywood Week audience @AmericanIdol,” Underwood tweeted on February 16.

Underwood joined the American Idol judging panel for season 23 alongside Bryan and Lionel Richie. She replaced Katy Perry, who left after seven seasons in 2024.

“I went from nobody knowing my name to tens of million of people watching the show,” the country singer said at the time. “I’m proud of everything that I was able to accomplish on the show and I’m so proud of everything I’ve accomplished since.”

Underwood received the backing of fellow American Idol winner Kelly Clarkson, who told E! News in September 2024 that the country star was the perfect addition to the judging panel. (Clarkson, 43, has been a coach on rival competition show The Voice for 10 seasons.)

“What better person to have — somebody that’s won that show to come back,” Clarkson said at the time. “To have gone through it all and then had such a huge career like her, that’s invaluable.”

Clarkson called Underwood an “awesome pick” for Idol, adding, “To have somebody to look at and go, ‘OK, they’ve done it and they’re sitting right there. So, that means I am capable of doing it. I can dream that big.’ … I think she’s gonna do great.”

Underwood has sold more than 22.5 million albums and 72.5 million singles, making her the biggest selling female country music star of all time, according to the Recording Industry Association of America.

American Idol season 24 airs on ABC Mondays at 8 p.m. ET.

Entertainment

The Best New Sci-Fi Series of 2025 Gets Official Update Fans Have Been Waiting For

Ridley Scott has plenty of notable sci-fi hits under his belt over the last 40 years, but none have stood the test of time as well as Alien. He directed the 1979 classic on a budget of only $11 million, and it was such a success that it spawned a franchise still going strong to this day. Scott passed off directorial control to James Cameron for the sci-fi sequel, and looking back, there aren’t two directors more suited to handle sci-fi horror than the two who have come to define sci-fi in cinema as we know it. Scott returned to the Alien franchise 13 years ago with the premiere of the Michael Fassbender and Idris Elba-led Prometheus prequel, and he directed what will likely be his final Alien movie with 2017’s Covenant. While Scott hasn’t directed anything Alien-related since 2017, he remains involved in the franchise as a producer who gives creative insight.

The most recent Alien project that Scott was involved in was Alien: Earth, the franchise’s first TV show, which was written and created for TV by Noah Hawley (Fargo). The hit sci-fi series is set two years before the events of the first Alien movie, and it follows a young woman and a group of ragtag soldiers who make a fateful discovery after a vessel full of dangerous species crashes on Earth. It took some time, but FX renewed Alien: Earth for a second season weeks after the Season 1 finale. Updates since the official renewal have been mostly quiet, until recently, when executive producer Dana Gonzales posted a photo from Pinewood Studios on Instagram, the production home of Alien: Earth, with the caption, “Super excited to start the journey of Alien: Earth Season 2. World-building in the Alien universe birthplace.” It sounds like production on Alien: Earth Season 2 will begin any day now.

Are They Making Another ‘Alien’ Movie?

Another Alien movie is in the works, and it will reportedly be a direct sequel to Alien: Romulus, the 2024 hit directed by Fede Alvarez. It’s unclear at this time who will star in the film or when it will be released, but Alvarez has confirmed that he will not direct. He and Ridley Scott are in the process of searching for a new director, and the film will likely not move forward any further until they find someone suitable to helm the sequel.

Check out the first season of Alien: Earth on Hulu and stay tuned to Collider for more updates and coverage of Season 2.

- Release Date

-

August 12, 2025

- Directors

-

Dana Gonzales, Ugla Hauksdóttir, Noah Hawley

- Writers

-

Bob DeLaurentis

Entertainment

Kim K & Lewis Hamilton Share Photos Of their Romantic Arizona Getaway

Kim K & Lewis Hamilton

Lovebirds Share New Photos Of Romantic Vacay

Published

Kim Kardashian and Lewis Hamilton are in total couple’s mode … sharing new photos of their romantic getaway in Arizona over the weekend — but with a little twist.

On Monday, the famous pair uploaded photos and a video of their special vacay in Lake Powell to their Instagram Stories — but there was a catch — the reality star and Formula 1 driver were not seen in any of the footage.

Instead, the couple gave everyone a good look at the beautiful mountainous landscape with orange caves and clear blue water. Lewis also posted a shirtless video of himself going for run.

TMZ broke the story Sunday … Kim and Lewis were caught on video walking back to their SUV after watching the sunset in Lake Powell at dusk on Saturday.

TMZ.com

An eyewitness — who happened to be driving by — filmed the two celebs, who were also seen snapping a selfie together.

Our sources say Kim and Lewis stayed at Amangiri, the ultra-exclusive five-star resort in Utah near the Arizona border. The property is a favorite among A-listers, including the Kardashians.

Kim and Lewis made their first public appearance as a couple at last month’s Super Bowl LX game. Both have known each other for years, hanging out in the same circles. But they’ve only now started to date and things seem to be getting serious.

Entertainment

Josh Duhamel Reflects On His Relationship With Ex-Wife Fergie

Josh Duhamel is looking back on his past relationship with ex-wife Fergie, sharing candid details about the reasons behind their split. The actor has since remarried and is sharing a glimpse of his co-parenting relationship with the singer.

Article continues below advertisement

Josh Duhamel Has ‘No Regrets’

Duhamel sat down for an interview on “The Skinny Confidential Him & Her Podcast” with Michael and Lauryn Bosstick, and the actor dished about what ended his marriage to Fergie.

Duhamel and singer Fergie, born Stacy Ann Ferguson, were together for 13 years, 8 of those years married. Duhamel explained that they were very different people. “She and I just have different views of the world, and that’s okay,” he told the hosts, adding that he has “no regrets.”

The actor also shared the same view in 2023 on “In Depth with Graham Bensinger,” where he said he and Fergie agreed they “had a great time” but “outgrew” each other, per ET Online.

Despite their separation, the former couple has maintained a good relationship throughout the years and co-parent their son.

Article continues below advertisement

Inside Josh Duhamel And Fergie’s Relationship

Duhamel and Fergie met in 2004 while the actor was filming in Las Vegas and Fergie was with the Black Eyed Peas for a cameo appearance. According to the actor, he had a crush on the singer but could only come up with the line, “You’re hot,” as his greeting.

They began dating that same year and were engaged three years later. Duhamel and Fergie wed in 2009 in Malibu, California. They welcomed their son, Axl Jack, in 2013.

In September 2017, the couple announced their separation in a statement, saying, “With absolute love and respect, we decided to separate as a couple earlier this year,” adding that they will always support each other. Their divorce was finalized in 2019.

Article continues below advertisement

The Actor’s Co-Parenting Relationship With His Ex-Wife

Duhamel only had praise for his ex-wife and their current relationship. In regard to co-parenting their son Axl, he said, “She’s a great mom, very kind, very non-confrontational, thank God.”

In 2017, Fergie left her group, the Black Eyed Peas, after more than a decade with them. It was a bittersweet moment, but according to the other members, Fergie had a good reason for her departure.

“We love her, and she’s focusing on being a mom. That’s a hard job, and that’s what she really wants to do, and we’re here for her,” Will.i.am explained.

Duhamel also described his ex as being “wholesome,” saying, “Fergie is also very wholesome, believe it or not, especially since she stepped away from it all,” he shared.

Article continues below advertisement

Fergie Has A Great Relationship With Her Ex’s New Wife

Duhamel married former pageant queen Audra Mari in 2022, and they welcomed their son, Shepherd, in 2024. In 2023, Duhamel shared the family dynamics, saying that his ex-wife has been welcoming of Mari. “She and Audra have a great relationship,” he said.

Again, Duhamel commended Fergie for being supportive. “Fergie’s an amazing woman, she really is. She’s taken Audra in. It could be much worse,” he said. As for finding out that he and Mari were expecting, Duhamel said Fergie was ecstatic about the news, per People.

When the couple announced Mari’s pregnancy on social media, Fergie commented, “I am truly happy for you guys. Axl can’t wait to be a big brother.”

Article continues below advertisement

Josh Duhamel Left LA In 2023

In 2023, Duhamel left LA to move to Minnesota. In an interview with People in 2025, the actor shared that despite his love for his work in entertainment, he wanted to go back to his roots.

“I’m really more of a guy who wants to stay true to my roots, get back to the basics, hone whatever basic skills I need in this world of massive technology,” he explained. As The Blast previously reported, Duhamel’s property even comes with a doomsday cabin.

Fergie still resides in California, and despite the distance, she and Duhamel raise their child together. “This is not for her,” the actor said, referring to his new home base. “But I’ve got no hard feelings… I’m very lucky that she’s a kind human. I really am,” he added.

Entertainment

Karlissa Saffold Says Nevaeh Blocked Her After Gender Reveal

While Blueface celebrates learning his fourth child with Nevaeh Akira is a baby boy, his mother, Karlissa Saffold, took to the net with her own reaction to the gender reveal. She later revealed that after sharing her response, she received some surprising news of her own.

RELATED: New Addition! Karlissa Saffold Harvey Reacts To Blueface & Nevaeh Akira’s Apparent Pregnancy Announcement

Karlissa Saffold Addresses Being Blocked Following Her Gender Reveal Reaction

Late Sunday night, Blueface and Nevaeh were trending after their big gender reveal announcement. Social media users across platforms reacted as they revealed they’re expecting a baby boy and plan to name him Solar Porter. Karlissa shared her thoughts as another grandchild is on the way. She reposted the stream clip with her own reaction. She wrote, “Is it me or did she grab her son like we hit the jackpot lol then grabbed the baby daddy and I’m not mad lol congrats to y’all both.”

However, things seemed to shift shortly after. Karlissa later claimed she was blocked following her reaction, suggesting her comment was meant as a joke.

“Well I’m blocked in the first trimester. This why people [shouldn’t] have babies with strangers. because if she knew me she would have laughed to because her reaction was hilarious. I’m here girl whenever if ever you need me. And congratulations on my bloodline it’s the cream of the crop.”

Nevaeh Akira Is Ignoring the Negativity While Enjoying Her Growing Family

While Karlissa was speaking about being blocked, Nevaeh was over on her Instagram Story with a message for anyone bringing negativity her way.

She shared a video walking with Blueface along with the caption, “For those trying to bring negativity to my life, I wish y’all endlessly blessings! I’m overly blessed, no hatred in my heart, happy with my little family, happy with the man I gave my heart to, happy with the man I’ll be creating all my blessings with, happy is my aspiration!”

Nevaeh also reminded folks not to compare her to anyone else, writing, “We’re all our own individuals, don’t compare me to no one or don’t compare me to other people experiences. I’m my own person. After today, I’m going to ghost for a while and enjoy my boys!” She ended things by reposting a quote that read, “No weirdo energy will prosper against me.”

Social Media Weighs In

Folks gathered under The Shade Room Teens as they tried to keep up with the Blueface family updates. Many expressed that Karlissa should mind her business, saying there was nothing wrong with Nevaeh’s reaction and that she simply looked happy. On the other hand, some urged Nevaeh to “wake up.” Others even pointed out what they believe is a pattern in Blueface’s relationships and questioned how long this one will last.

Instagram user @_shadiamonddd wrote, “I would block you too thinking yo son the damn jackpot and its just blue face”

Instagram user @qt_pie19 added, “Karlissa Be Negative Af Cause What Jackpot 😂Why Not Just Congratulate It Is Ur Grandchild No Matter What!”

While Instagram user @litofromharlem wrote, “Mind you, she grabbed the son like she was happy 😂😂😂😂😂😂😂😂””

@oneakayladshari wrote, “Karlissa be throwing rocks & hiding her hand duh that girl blocked you you talking sh** about her”

@elegant_sha added, “I would hate to have a mother like her all jokes aside”

@bigmamaherworld wrote, “They on good terms and she won’t shut up girl bye. You happy to be that man 3rd baby momma who was dogging you out just a few months ago.”

@only1deshia wrote, “Wheeew chyyy it’s like he have them dckmatized or some, rock was saying the same thing”

@rare_breed_7703 added, “Jaidyn did right by him and he still dogged her!!! What makes her think she different”

@jusstniyy_ wrote, “Mann I still can’t believe chrisean really the one who got away”

RELATED: Wait…What?! Blueface Airs Out Ongoing Tension Over His Mother Karlissa’s Involvement In His Love Life (PHOTO)

What Do You Think Roomies?

Entertainment

20 Most Badass Women in Anime

For a long time, women in anime were simply background characters, eye candy for the male characters, mother figures, or quiet wives waiting on their men. Luckily, most anime have moved on, and now, women are getting the exciting and complex stories they deserve. And while they might still be wives, girlfriends, or mothers, they are no longer defined by those roles.

Now, women in anime have enough agency to defy the stereotypes. A few female characters even stand out because of their daring and outright badass behavior. They don’t take no for an answer or let anyone in their lives make decisions for them; they face challenges head-on and take down the bad guys without hesitation. From Frieren to Nami, the most badass women in anime are independent, fierce, and ready to take on the world with their intelligence and fighting skills.

20

Asuna Yuuki

‘Sword Art Online’ (2012), ‘Sword Art Online II’ (2014), ‘Sword Art Online: Alicization’ (2018)

The main heroine of Sword Art Online, Asuna is one of many players who partook in the Day 1 release of SAO and found herself trapped just like everyone else. Though she felt dismal about it at first, she leveled up rather quickly and secured her own life in the process.

Though not many viewers think much of her thanks to the second half of season one, where she essentially becomes a damsel in distress, in the beginning, Asuna is a powerful foe and a strong asset who works well alongside Kirito. She proved herself to be a strong wielder of the rapier, and she was one of the strongest players in SAO. Nothing after could ever tarnish Asuna’s name, as she has proven that she can take care of herself.

19

Mitsuri Kanroji

‘Demon Slayer’ (2021–2024)

Mitsuri Kanroji is one of the nine Hashira in Demon Slayer, all of whom have developed their own breathing types. Mitsuri is the Love Hashira who established her own breathing style that represents her perfectly. With a great personality, a kind heart, and a colorful demeanor, Mitsuri is one of the gentler demon slayers to exist.

While kindhearted, Mitsuri is also not a Hashira to be messed with, as her strength and prowess know no bounds. She can cut through any demon with ease, and her swiftness allows her to slaughter any demon with efficiency. Looks can be deceiving, and in this timid slayer’s case, Mitsuri is not one to mess around.

18

Akame

‘Akame ga Kill!’ (2016–2017)

Akame from Akame ga Kill! is the silent hitman and mercenary, and the female protagonist of both the manga and anime. She is known as Akame of the Demon Sword Murasame, and she works for the infamous Night Raid.

A silent killer who hides her emotions away, Akame is merciless when it comes to killing and protecting her team. Though her personality doesn’t shine through like other characters in the show, Akame is a badass, plain and simple. With her fighting style and passion, it’s hard to find anyone as good as what they do like Akame.

17

Kobeni Higashiyama

‘Chainsaw Man’ (2022)

Kobeni is a character from Chainsaw Man who has limited appearances. One of Makima’s new recruits for her devil-fighting squad, Kobeni appeared initially like any other ordinary devil hunter. Timid and often easily frightened, Kobeni often gives viewers the wrong impression due to her outward demeanor. However, it turns out, Kobeni is actually a bit of a badass.

At first, Kobeni didn’t seem like much; fans found her to be somewhat of a coward for freaking out all the time and wanting to go home instead of finishing the mission. But when the other devil hunters were taken out during a surprise attack, Kobeni showed her hidden skill set. With an expression of anxiety, Kobeni dodged bullets and attacks with ease, attacking her assailants as if they were nothing. Though she retires during the Public Safety Saga, seeing her skills in action puts her at the top of the list of badass women in anime.

16

Touka Kirishima

‘Tokyo Ghoul’ (2014), ‘Tokyo Ghoul √A’ (2015), ‘Tokyo Ghoul: re’ (2018)

The older sister of Ayato Kirishima and a former waitress at Anteiku, Touka Kirishima is a ghoul who met and helped Kaneki Ken become the ghoul he is today. Though she is often full of anger, rage, and judgment, she is also kind at times and understanding. Her harsh demeanor and attitude are due to a complicated and tough childhood.

She is a tough and determined ghoul who encourages Kaneki Ken to eat human flesh and live, though she does so forcibly. She helps to take care of Kaneki and has even taken on a loving role to care for her younger brother. Not to mention, she is a fierce ghoul who is not to be messed with. Though later on in the must-see anime series she grows a tad bit softer, underneath her quiet and sweet complexion is a ghoul full of carnage. Touka is nothing short of a badass woman who gets what she wants in Tokyo Ghoul.

15

Elizabeth Midford

‘Black Butler’ (2008–2009), ‘Black Butler Season Two’ (2010), ‘Black Butler: Book of Circus’ (2014), ‘Black Butler: Public School Arc’ (2024)

Elizabeth Midford is the heiress of the Midford family and fiancée of Ciel Phantomhive, the protagonist of the Black Butler series. After almost losing Ciel to the manor fire, she has shown herself to be clingy and overly attached to him, visiting him every chance she gets. Even though he appreciates and cares for her, Ciel often considers her presence to be a nuisance, as she can be overbearing and overwhelming, often attempting to dictate Ciel’s life.

Despite these frustrations Ciel may have with Elizabeth, often feeling as though he needs to protect her due to his duty as the queen’s guard dog, Elizabeth later on proves herself to be capable of protecting herself. During the Book of Atlantic film, when Elizabeth was surrounded by the undead and Ciel was injured, she proved her prowess and swordsmanship without hesitation. Hiding her capabilities under the guise of pure femininity, Elizabeth broke her own rules and protected Ciel while defending herself. Though she has often shown herself to be vulnerable and weak, this was all to protect Ciel’s manhood, proving that just because she decides to abide by society’s gender roles does not mean she can not take care of herself when necessary.

14

Sakura Haruno

‘Naruto’ (2002–2007), ‘Naruto Shippuden’ (2007–2017), ‘Boruto: Naruto Next Generations’ (2017–2023)

Sakura Haruno is one of Naruto’s protagonists. She is a kunoichi of Konohagakure and a medical ninja. She is close friends with Naruto and Sasuke, having been part of the same team as them. Currently in Boruto: Naruto Next Generations, she is the wife of Sasuke Uchiha and mother to Sarada Uchiha.

Though Sakura was once considered the weakling of Team 7, she has trained consistently and grown tremendously since her debut in Naruto. Having trained under Sannin Tsunade, Sakura grows to become extremely powerful; this is especially true since she has proven to be incredibly good at chakra control and growing stronger physically. There were even points in time when Sakura was predicted to become stronger and more powerful than Tsunade herself. As a proud and determined mother, Sakura will always be a badass.

13

Bulma

‘Dragon Ball’ (1986–1989), ‘Dragon Ball Z’ (1989–1996), ‘Dragon Ball GT’ (1996–1997), ‘Dragon Ball Super’ (2015–2018)

Bulma is one of the few female characters in the Dragon Ball franchise. She is the daughter of Dr. Briefs, the founder of The Capsule Corporation. When she is sixteen, she meets Goku, and they set out on a quest to gather Dragon Balls. Bulma eventually takes over her father’s company and builds herself a career as an inventor.

Simply put, there is no Dragon Ball without Bulma. Although she is a mother and wife, she doesn’t let this role define who she is. Bulma is, first and foremost, an inventor, but she still indulges her girly side because she doesn’t need to be defined by just one quality. She is able to come up with new inventions, like the Super Dragon Radar, an updated version of the original Dragon Radar, and the Universal Translator. Bulma is among the best Dragon Ball characters, and her contributions to the franchise are too great to ignore.

12

Sailor Jupiter

‘Sailor Moon’ (1992–1997), ‘Sailor Moon Crystal’ (2014–2021)

Sailor Jupiter, whose real name is Makoto Kino, is one of the Sailor Guardians. Makoto transferred from her previous school to Juuban Public Junior because she got in trouble for starting fights. Her parents died when she was young, and she learned how to become independent very quickly. Sailor Jupiter’s powers include the ability to throw thunder and lightning bolts. She is also a skilled martial artist and has incredible strength.

Even when she isn’t fighting alongside the Sailor Guardians, Makoto is extremely loyal to her friends and defends them, no matter what the cost. Sailor Jupiter is the strongest Sailor Guardian. She doesn’t back down from a fight, even when she is by herself. While her strength is impressive, it’s her fierce loyalty to Sailor Moon and the other Guardians that makes her truly badass. If a demon or a high school bully tries to mess with her friends, Sailor Jupiter is there to protect them from harm.

11

Minare Koda

‘Wave, Listen to Me!’ (2020)

Mirane Koda starts as a waitress at a curry soup restaurant. Her life changes when she gets into a deep conversation with Kanetsugu Mato, who is in charge of the local radio station, about her ex-boyfriend, Mitsuo Suga. Mato records this interaction with Mirane and ends up playing it on the radio. Mirane becomes furious with Mato, but he offers her a part-time job as a radio show host. After she is fired from her job at the restaurant, Mirane goes to live with Mizuho Nanba, who works as an assistant director at the radio station.

Mirane stays calm through the chaos in Wave, Listen to Me!. This is exemplified by her ability to continue her radio program on air in the middle of an earthquake. She has great investigative skills, as shown by her trying to determine whether her neighbor, Shinji Oki, murdered his girlfriend. Mirane is ambitious and wants to become the best radio personality in Sapporo. She is the perfect depiction of the modern career woman, driven yet remaining relatable to audiences who empathize with her personal and professional struggles.

Entertainment

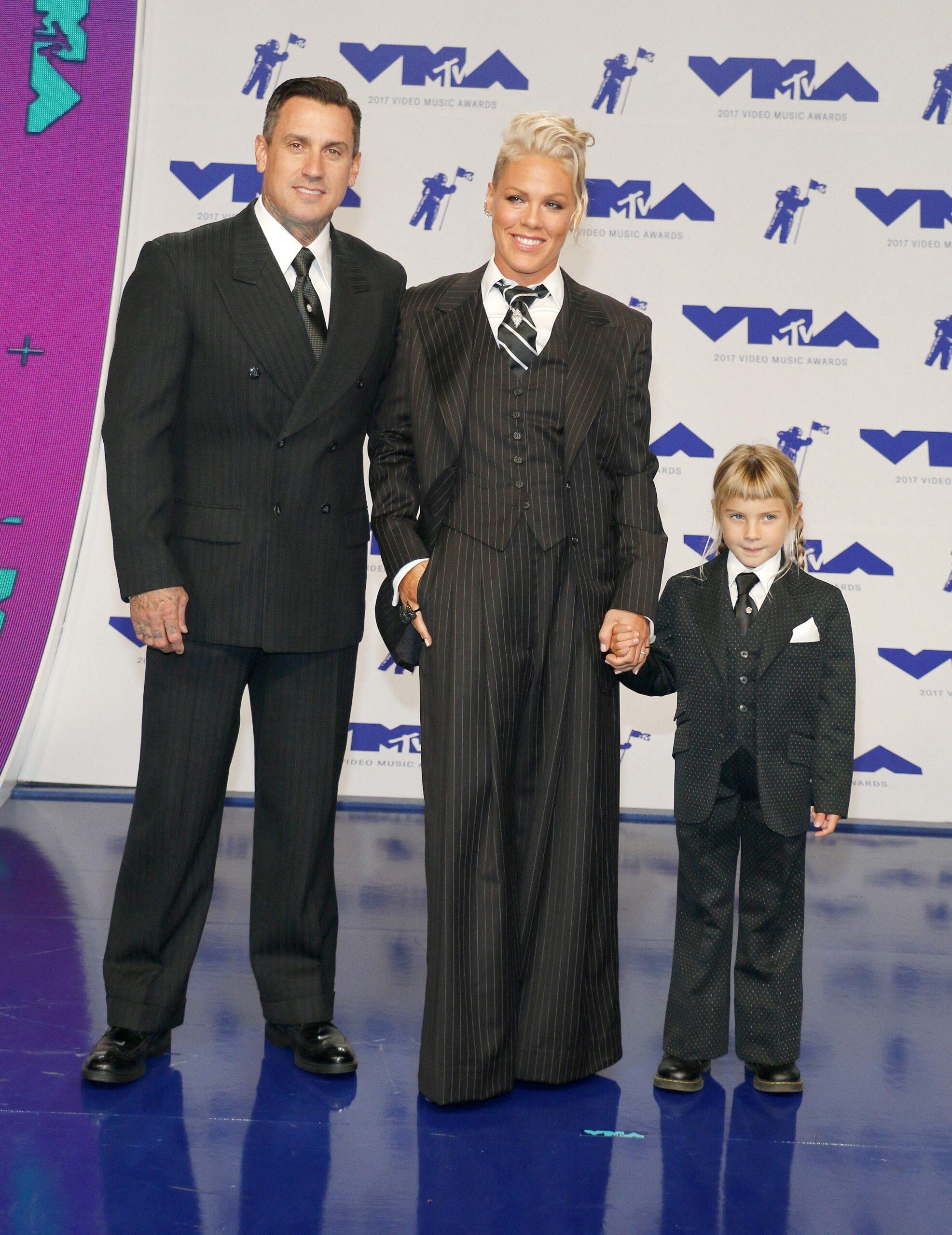

The Strange Reason Pink’s Marriage Never Looks Stable

Rumors of another celebrity breakup recently swirled around Pink, leaving fans bracing for the worst.

Yet what appears to be instability is, according to sources close to the singer and her husband, Carey Hart, something far more complicated.

Their marriage has survived public splits, private grief, and constant speculation, creating a relationship that often looks like it is falling apart even when it is not.

Article continues below advertisement

Pink And Carey Hart’s Marriage Has Always Defied Expectations

From the outside, Pink and Carey Hart’s relationship often appears volatile.

Insiders say that perception is not entirely wrong, but it is also not the full story.

One source described the couple as emotionally intense, explaining to the Daily Mail, “They are always on the cusp of breaking up or head over heels in love. They fight for their relationship because they are soulmates.”

That same source noted that even longtime friends struggle to keep up with the couple’s status, adding that “close friends” had not seen them together “in a while and assumed they had split.”

This constant swing between closeness and conflict has defined their bond for two decades, creating the impression that the marriage is always nearing its end.

Article continues below advertisement

Why Pink’s Silence Fueled Divorce Rumors

Recent speculation gained traction after Pink failed to publicly acknowledge her wedding anniversary in January.

The silence stood out, especially compared to the affectionate tribute she shared the previous year.

Adding to the chatter, she and Hart had not been photographed together since September, when they appeared ring-free during an outing in New York City.

According to a source, this pattern is nothing new. “They are together, but who knows for how long?” the insider said. “They are stubborn and want their own way. For 20 years, it has been the same thing. It’s what makes them tick.”

Article continues below advertisement

The same source summed up the unpredictability bluntly, saying, “No one would be surprised if they break up tomorrow and continue the cycle. They are a very unique couple, and most definitely a surprise a minute.”

Article continues below advertisement

A History Of Breakups That Never Fully Ended

Pink and Hart’s relationship has always followed an unconventional timeline.

They first met in 2001 at the Summer X Games in Philadelphia, where Hart suffered severe injuries after a terrifying fall that left him hospitalized with broken ribs, a shattered foot, and a fractured tailbone. Despite the chaos, the pair began dating soon after.

Their first breakup in 2003 coincided with Pink’s song “Love Song” from her album “Try This,” which explored her fears around commitment.

The split was temporary. By 2005, she proposed to Hart at one of his motocross events, flipping traditional expectations yet again.

They married in Costa Rica in 2006, only to announce a separation two years later.

Article continues below advertisement

What followed was tragedy rather than closure. Hart’s younger brother, Anthony, died at 21 from a traumatic head injury during a motorcycle practice run.

Pink reportedly rushed to Hart’s side, and by 2009, the couple confirmed they were working through their issues together.

Pink Says Therapy Helped Save The Marriage

As their family grew, so did the pressures on their relationship.

Pink and Hart welcomed daughter Willow in 2011 and son Jameson in 2016, milestones that did not magically erase long-standing tensions. Instead, the couple turned inward for solutions.

During a 2020 Instagram livestream with her therapist Vanessa Inn, Pink credited therapy with keeping their marriage intact.

The admission offered rare insight into how much work goes on behind the scenes.

While fans often focus on dramatic moments, the singer has been clear that professional help played a critical role in sustaining their bond through repeated challenges.

Article continues below advertisement

Pink’s Career Timing Made The Rumors Explode

A day after publicly shutting down divorce rumors, Pink appeared on “The Kelly Clarkson Show,” where she is set to guest-host an entire week starting March 2 in honor of Women’s History Month. The timing raised eyebrows.

A source told the Daily Mail that the hosting role could serve as an audition of sorts, explaining, “If all goes well and the ratings are great, it will be her job. She wants it, NBC Universal wants it, all that counts now is if the audience wants it.”

The insider suggested the renewed focus on her marriage came at a strategic moment. The speculation, they said, was “perfect timing” because it allows Pink to be “as real and transparent” as Kelly Clarkson has been with viewers.

The source added, “Pink is such an open book and will be perfect for the role, but the proof will be if she can bring in the audience and keep the audience.”

They went further, saying, “The talk about her relationship issues was perfect timing, as hurtful as that can be. Everyone is waiting for her to talk about it on the show. Everyone wants her to be as real and transparent as Kelly is. She could turn the relationship drama into ratings gold.”

In the end, Pink’s marriage appears less like a slow collapse and more like a cycle of tension, reconciliation, and reinvention.

The very traits that make it look unstable may be the same ones that keep it alive.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Politics7 hours ago

Politics7 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business7 days ago

Business7 days agoTrue Citrus debuts functional drink mix collection

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports3 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoPolice latest as search for missing woman enters day nine

-

Entertainment1 day ago

Entertainment1 day agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World7 days ago

Crypto World7 days agoEntering new markets without increasing payment costs